0efd3be666b85c7c6a3bf52b6fafda4e.ppt

- Количество слайдов: 140

交通银行 UCP 600培训 Monday, March 19, 2018·南宁 1

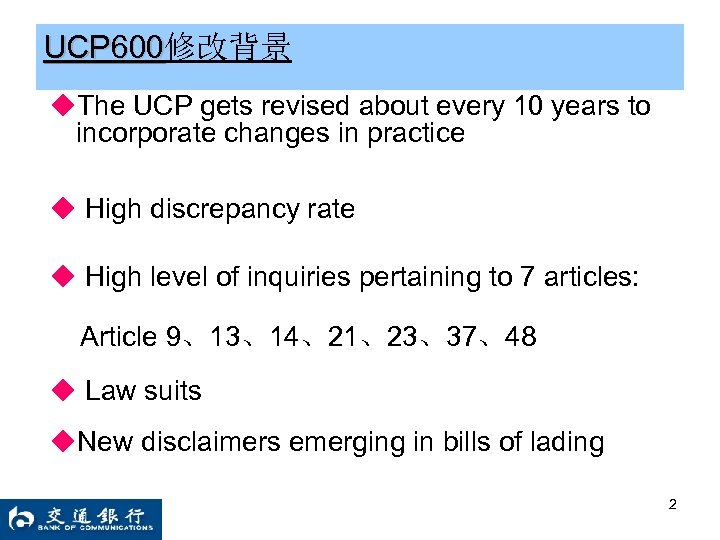

UCP 600修改背景 UCP 600 ◆The UCP gets revised about every 10 years to incorporate changes in practice ◆ High discrepancy rate ◆ High level of inquiries pertaining to 7 articles: Article 9、13、14、21、23、37、48 ◆ Law suits ◆New disclaimers emerging in bills of lading 2

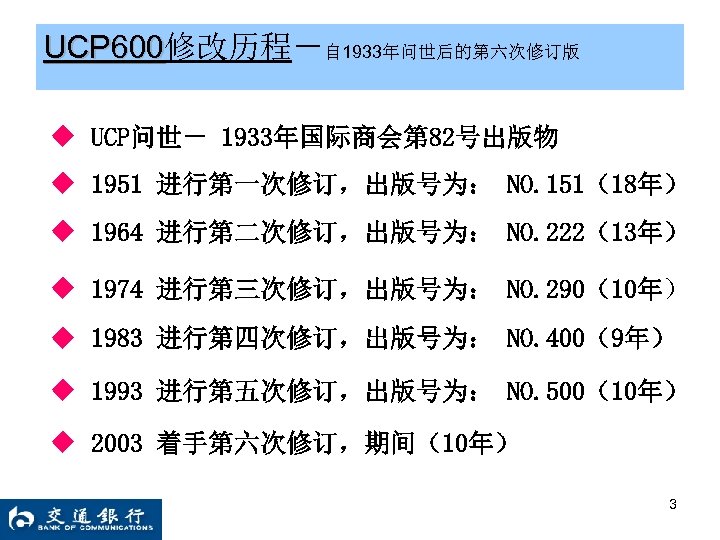

UCP 600修改历程-自 1933年问世后的第六次修订版 UCP 600 ◆ UCP问世- 1933年国际商会第 82号出版物 ◆ 1951 进行第一次修订,出版号为: NO. 151(18年) ◆ 1964 进行第二次修订,出版号为: NO. 222(13年) ◆ 1974 进行第三次修订,出版号为: NO. 290(10年) ◆ 1983 进行第四次修订,出版号为: NO. 400(9年) ◆ 1993 进行第五次修订,出版号为: NO. 500(10年) ◆ 2003 着手第六次修订,期间(10年) 3

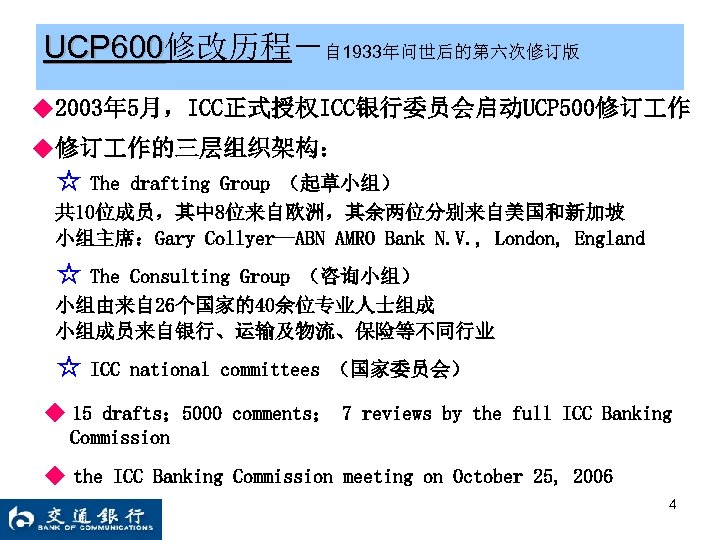

UCP 600修改历程-自 1933年问世后的第六次修订版 UCP 600 ◆2003年 5月,ICC正式授权ICC银行委员会启动UCP 500修订 作 ◆修订 作的三层组织架构: ☆ The drafting Group (起草小组) 共 10位成员,其中 8位来自欧洲,其余两位分别来自美国和新加坡 小组主席:Gary Collyer--ABN AMRO Bank N. V. , London, England ☆ The Consulting Group (咨询小组) 小组由来自 26个国家的40余位专业人士组成 小组成员来自银行、运输及物流、保险等不同行业 ☆ ICC national committees (国家委员会) ◆ 15 drafts; 5000 comments; 7 reviews by the full ICC Banking Commission ◆ the ICC Banking Commission meeting on October 25, 2006 4

UCP 600-主要修改内容 ◆结构上的变化 ◆增加了新的概念 ◆重大的条款改变 ◆删除了部分内容 5

UCP 600-主要修改内容 1) Given 14 definitions at first and 12 interpretations to clarify the meaning of ambiguous terms, refer to Art 2 & 3. And we need pay attention to the change about ‘negotiation’. 2)Agreed that the issuing bank must reimburse the nominated bank even though the documents are lost in the transmitting however, the presentation must be complying. 3) Denied the practice that banks stipulate the clause about which the amendment should be accepted by beneficiary who did not send any rejected advice in certain time, refer to sub-article 10 f. 4) Five banking days replaced reasonable time and seven banking days, refer to sub-article 14 b. 5) Two kinds of form about refusing have been added in UCP 600, refer to sub-article 16 c iii. 6

UCP 600-主要修改内容 6) Banks can now accept an insurance document that contains reference to any exclusion clause, refer to sub-article 28 i. 7) The insurance document could be issued by proxies, refer subarticle 28 a. 8) The clause for transport documents issued by Freight Forwarders has been deleted. 9) The clause about carrying vessel propelled by sail only has been deleted since that kind of sailboat has dropped out of ocean transport. 10) The expression is straightaway, precise and compact, for example, the wording for ‘unless the credit expressly stipulates…’ is not used in UCP 600. 7

UCP 600-主要修改内容 11) Transpot docs: master’s name, issuance by charterer, refer to article 19 -23. 12) Canceled the blocking frame about the form of clauses. 13)The number of the clauses has decreased to 39 from original 49. 14) Financing under deferred payment credit and acceptance credits, refer to article 12 b. 15) Added the acts of terrorism as a kind of Force Majeure, refer to Art 36. 16) Confirmed that the issuing bank may be a transferring bank, refer to sub-article 38 b. 8

UCP 600-Article 1 ◆ ☆when the text of the credit expressly indicates that it is subject to ucp 600. ◆ ☆Since 11/18/2006, MT 700 s have been no longer automatically subject to ucp latest edition. ◆Does UCP 600 apply to standby LCs? ☆…including, to the extent to which they may be applicable, any standby LCs. 9

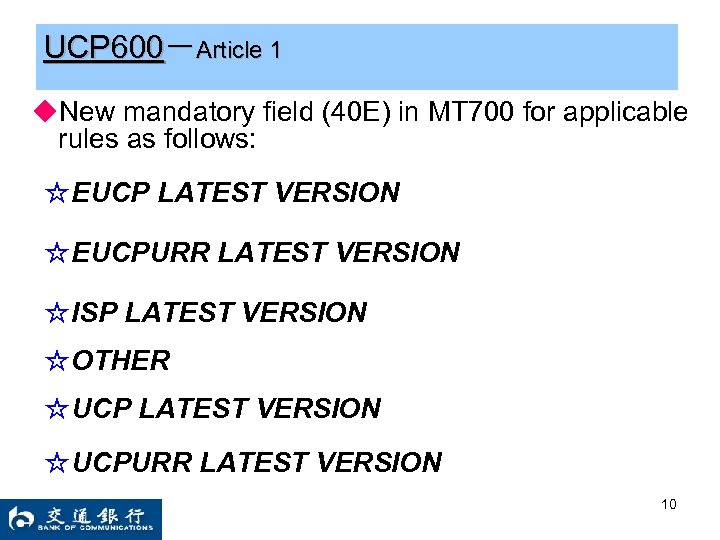

UCP 600-Article 1 ◆New mandatory field (40 E) in MT 700 for applicable rules as follows: ☆EUCP LATEST VERSION ☆EUCPURR LATEST VERSION ☆ISP LATEST VERSION ☆OTHER ☆UCP LATEST VERSION ☆UCPURR LATEST VERSION 10

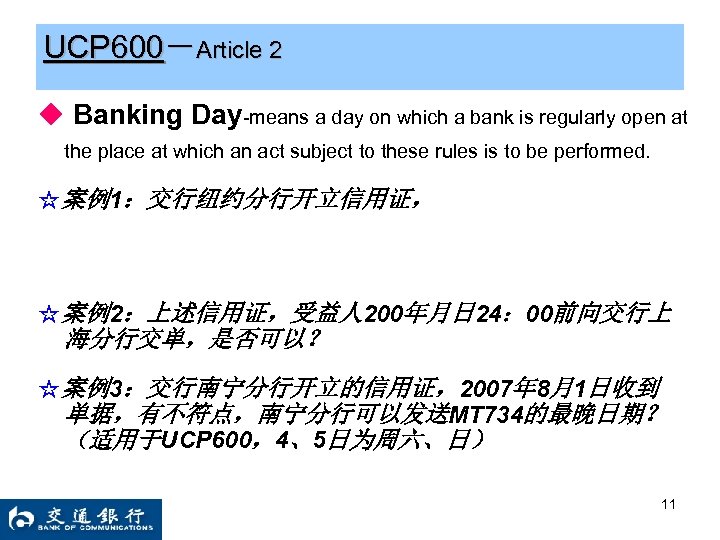

UCP 600-Article 2 ◆ Banking Day-means a day on which a bank is regularly open at the place at which an act subject to these rules is to be performed. ☆案例1:交行纽约分行开立信用证, ☆案例2:上述信用证,受益人 200年月日 24: 00前向交行上 海分行交单,是否可以? ☆案例3:交行南宁分行开立的信用证,2007年 8月1日收到 单据,有不符点,南宁分行可以发送MT 734的最晚日期? (适用于UCP 600,4、5日为周六、日) 11

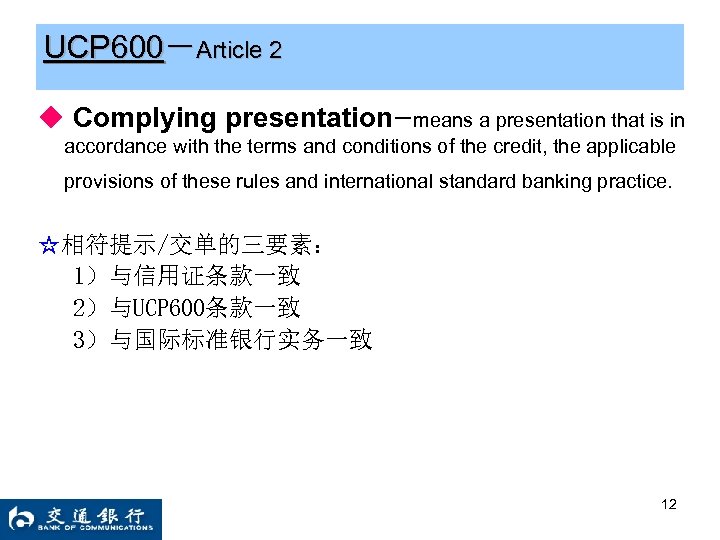

UCP 600-Article 2 ◆ Complying presentation-means a presentation that is in accordance with the terms and conditions of the credit, the applicable provisions of these rules and international standard banking practice. ☆相符提示/交单的三要素: 1)与信用证条款一致 2)与UCP 600条款一致 3)与国际标准银行实务一致 12

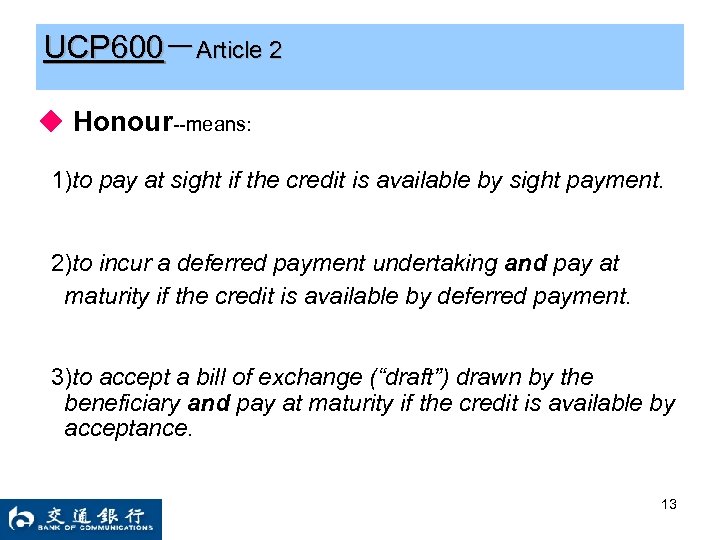

UCP 600-Article 2 ◆ Honour--means: 1)to pay at sight if the credit is available by sight payment. 2)to incur a deferred payment undertaking and pay at maturity if the credit is available by deferred payment. 3)to accept a bill of exchange (“draft”) drawn by the beneficiary and pay at maturity if the credit is available by acceptance. 13

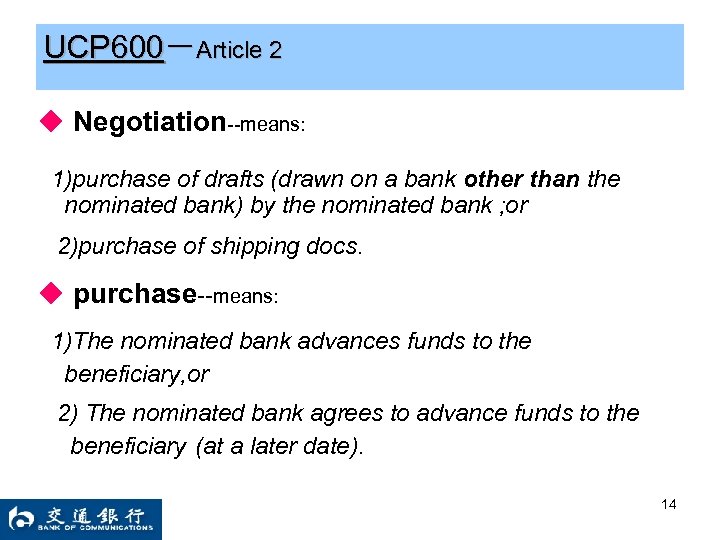

UCP 600-Article 2 ◆ Negotiation--means: 1)purchase of drafts (drawn on a bank other than the nominated bank) by the nominated bank ; or 2)purchase of shipping docs. ◆ purchase--means: 1)The nominated bank advances funds to the beneficiary, or 2) The nominated bank agrees to advance funds to the beneficiary (at a later date). 14

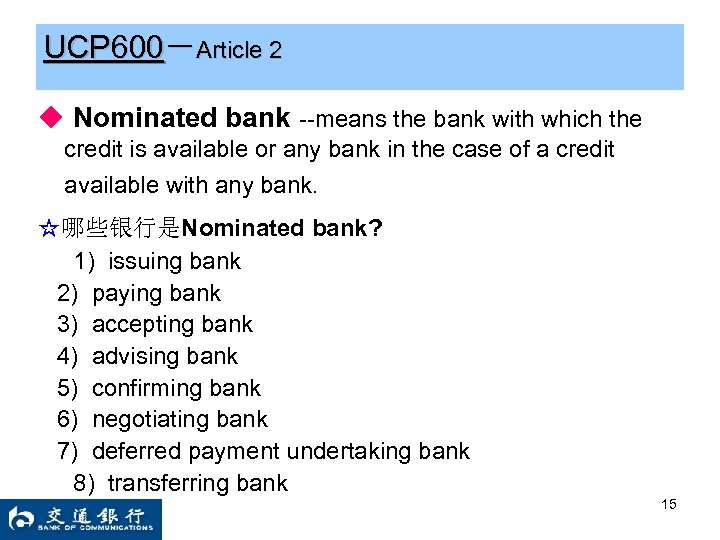

UCP 600-Article 2 ◆ Nominated bank --means the bank with which the credit is available or any bank in the case of a credit available with any bank. ☆哪些银行是Nominated bank? 1) issuing bank 2) paying bank 3) accepting bank 4) advising bank 5) confirming bank 6) negotiating bank 7) deferred payment undertaking bank 8) transferring bank 15

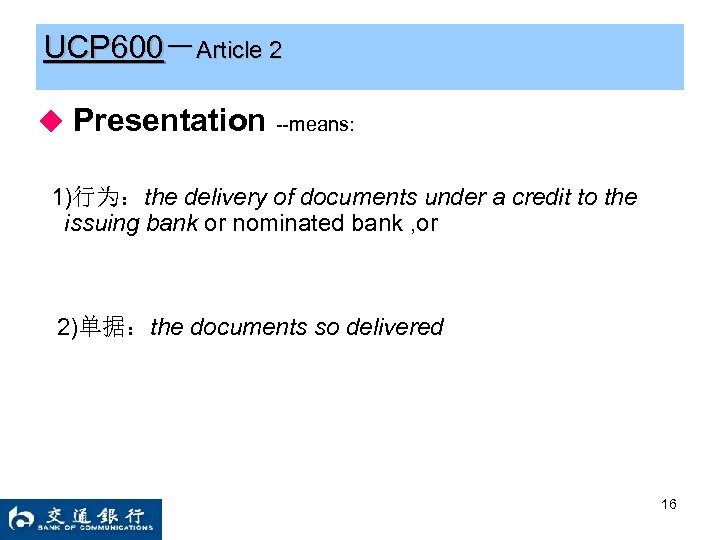

UCP 600-Article 2 ◆ Presentation --means: 1)行为:the delivery of documents under a credit to the issuing bank or nominated bank , or 2)单据:the documents so delivered 16

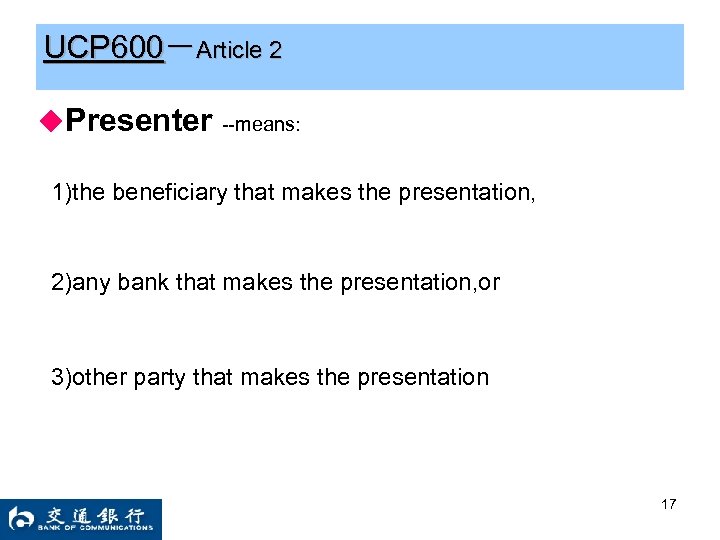

UCP 600-Article 2 ◆Presenter --means: 1)the beneficiary that makes the presentation, 2)any bank that makes the presentation, or 3)other party that makes the presentation 17

UCP 600-Article 3 ◆ If an LC does not indicate whether it is irrevocable or revocable, what should we do? 不可撤销。 ◆ How can a document be signed? 1)handwriting 2)facsimile signature 3)perforated signature 4)stamp 5)symbol 6)any other mechanical method of authentication, or 7)any other electronic method of authentication 18

UCP 600-Article 3 ◆ 案例:南宁分行开立的信用证,46 A单据要求为: certified commercial invoice。受益人提交一份 signed invoice,但没有其它注明。问是否构成不符 ? ☆不是不符点。any signature, mark, stamp or label on the document which appears to satisfy that requirement. 19

UCP 600-Article 3 ◆ 案例:南宁分行开立的信用证,46 A单据要 求为:official ………。问是否构成不符? ☆不是不符点。 …to allow any issuer except the beneficiary to issue that document. 20

UCP 600-Article 3 ◆ 案例:信用证要求为:……………. . 如何理解? ☆不予理会。 words such as "prompt", "immediately" or "as soon as possible" will be disregarded. . 21

UCP 600-Article 3 ◆ 案例:信用证要求为: ……………………………. . ” 如何处理? ☆ “immediately”需要出现在单据Beneficiary certificate. 22

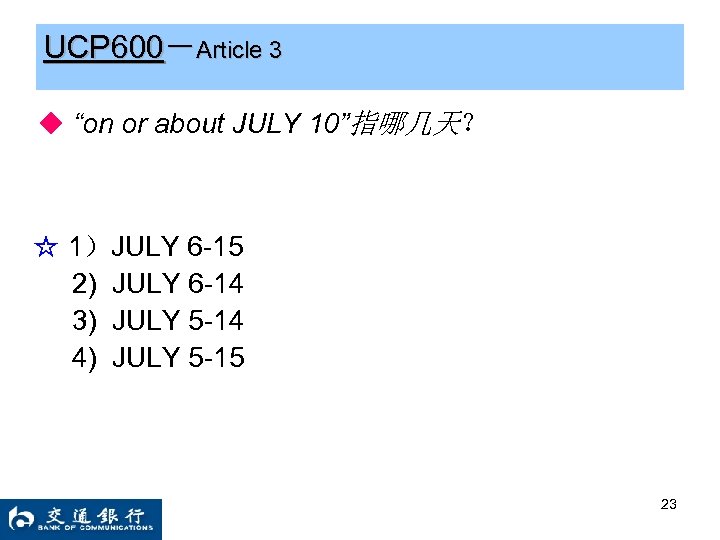

UCP 600-Article 3 ◆ “on or about JULY 10”指哪几天? ☆ 1)JULY 6 -15 2) JULY 6 -14 3) JULY 5 -14 4) JULY 5 -15 23

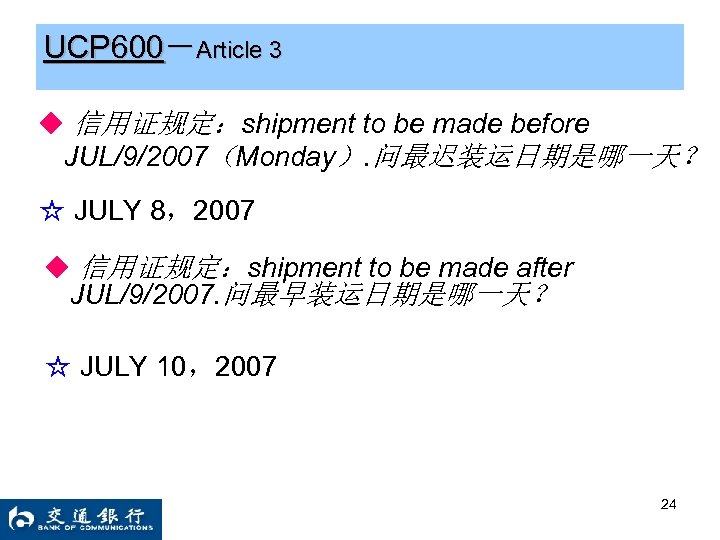

UCP 600-Article 3 ◆ 信用证规定:shipment to be made before JUL/9/2007(Monday). 问最迟装运日期是哪一天? ☆ JULY 8,2007 ◆ 信用证规定:shipment to be made after JUL/9/2007. 问最早装运日期是哪一天? ☆ JULY 10,2007 24

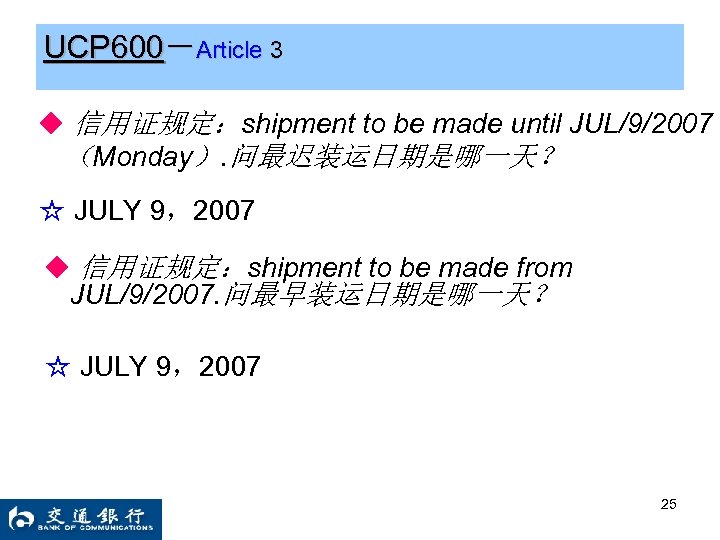

UCP 600-Article 3 ◆ 信用证规定:shipment to be made until JUL/9/2007 (Monday). 问最迟装运日期是哪一天? ☆ JULY 9,2007 ◆ 信用证规定:shipment to be made from JUL/9/2007. 问最早装运日期是哪一天? ☆ JULY 9,2007 25

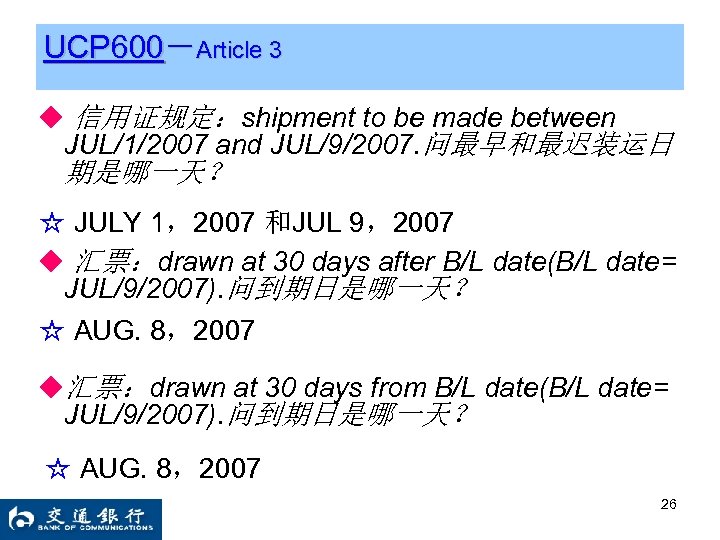

UCP 600-Article 3 ◆ 信用证规定:shipment to be made between JUL/1/2007 and JUL/9/2007. 问最早和最迟装运日 期是哪一天? ☆ JULY 1,2007 和JUL 9,2007 ◆ 汇票:drawn at 30 days after B/L date(B/L date= JUL/9/2007). 问到期日是哪一天? ☆ AUG. 8,2007 ◆汇票:drawn at 30 days from B/L date(B/L date= JUL/9/2007). 问到期日是哪一天? ☆ AUG. 8,2007 26

UCP 600-Article 4 a ◆1. A credit by its nature is a separate transaction from the sale or other contract. Although an LC may mention a certain sale contract, banks are not concerned with or bound by such contract. ◆2. the undertaking of a bank to honour, to negotiate is not subject to claims or defences by the applicant resulting from its relationships with the issuing bank or the beneficiary. 27

UCP 600-Article 4 a ◆ 案例:南宁分行在对外进行开证时,收 取申请人A开证费………………问:受益 人是否可以要求我行按照向申请人A收取 开证费的标准向其收取费用? ◆3. A beneficiary can in no case avail itself of the contractual relationships existing between banks or between the applicant and the issuing bank. 28

UCP 600-Article 4 b ◆ 案例:为保险起见,开证申请人在开证申请书中 附上了合同,作为开证申请书的一部分。问:申请 人这种做法是否妥当?开证行应如何处理? ☆ 1)prohibit. 2) include it as an integral part of the credit. 3) discourage. 4) disregard. ◆ 4 b. An issuing bank should discourage any attempt by the applicant to include, as an integral part of the credit, copies of the underlying contract, proforma invoice and the like. 29

UCP 600-Article 5 ◆ 案例:南宁分行收到单据后,经审核单证相 符,通知开证申请人 …………………问:南宁分 行是否应该退款? ◆ 5. Banks deal with documents and not with goods, services or performance to which the documents may relate. 30

UCP 600-Article 6 a ◆ 案例:南宁分行对外开立了一份信用证,规定: This credit is available with BOCOMM H. K. BRANCH. 问:哪家银行是兑用银行? ☆ 1) BOCOMM H. K. BRANCH 2)NANNING BRANCH ◆ a. A credit must state the bank with which it is available or whether it is available with any bank. A credit available with a nominated bank is also available with the issuing bank. 31

UCP 600-Article 6 b ◆ b. A credit must state whether it is available by: ☆ 1)sight payment 2)deferred payment 3) acceptance or 4) negotiation. 32

UCP 600-Article 6 c ◆ Drafts on the applicant: ☆ 1)Credits should not be issued requiring that drafts be drawn on the applicant. 2)Credits must not be issued available by a draft drawn on the applicant. ◆ c. A credit must not be issued available by a draft drawn on the applicant. ☆ Credits may be issued requiring a draft drawn on the applicant, but must not be issued available by drafts drawn on the applicant. (ISBP-UCP 600 P 54) 33

UCP 600-Article 6 di. ◆ 南宁分行开立了一份信用证,规定:the expiry date for payment on ……………问:受益人是否晚交单 ?付款行是否迟付款? ☆不是。 ◆ d. i. An expiry date for honour or negotiation = an expiry date for presentation. 34

UCP 600-Article 6 dii ◆ 案例:南宁分行对外开立了一份信用证,规定: This credit is available with BOCOMM H. K. BRANCH. 问:where is the place for presentation? ☆ 1) HONG KONG 2) QING DAO ◆ 6 dii. The place of the bank with which the credit is available is the place for presentation. The place for presentation under a credit available with any bank is that of any bank. A place for presentation other than that of the issuing bank is in addition to the place of the issuing bank. 35

UCP 600-Article 7 a ◆ 案例:南宁分行开立的信用证,单证相符,但指定 行拒绝议付,问:南宁分行应如何处理? ☆ NANNING BR. must honour. ◆ 两个条件构成开证行的承付(honour)责任: ☆ 1) the documents are presented to the nominated bank or to the issuing bank; 2) a complying presentation ☆7 a…… if the credit is available by: i. sight payment, deferred payment or acceptance with the issuing bank; 36

UCP 600-Article 7 b ◆ 信用证何时生效? ☆1) ………………. . ◆ b. An issuing bank is irrevocably bound to honour as of the time it issues the credit. 37

UCP 600-Article 7 c ◆ 两个条件构成开证行偿付(reimburse)指定行责任: ☆ 1) a nominated bank has honoured or negotiated a complying presentation, and 2) forwarded the documents to the issuing bank. ◆ 开证行偿付指定行的责任独立于开证行对受益人的 责任: An issuing bank's undertaking to reimburse a nominated bank is independent of the issuing bank’s undertaking to the beneficiary. 38

UCP 600-Article 7 c ◆ 案例:…………………. 问:开证行是否可 以拒付? ☆ 开证行不能拒付。 ◆ Reimbursement for the amount of a complying presentation under a credit available by acceptance or deferred payment is due at maturity, whether or not the nominated bank prepaid or purchased before maturity. 39

UCP 600-Article 8 a ◆ 两个条件构成保兑行的承付/议付(honour/negotiate)责任: ☆ 1) the documents are presented to the confirming bank or to any other nominated bank 2) a complying presentation ◆ 即使 1)其他指定行拒绝承担责任; 2)开证行破产 保兑行也必须承付或议付。 ◆ 8 aii. (the confirming bank must) negotiate, without recourse, if the credit is available by negotiation with the confirming bank. 40

UCP 600-Article 8 b ◆ 何时起保兑行承担承付/议付的责任? ☆ 8 b. A confirming bank is irrevocably bound to honour or negotiate as of the time it adds its confirmation to the credit. 自对信用证加具保兑之时起 41

UCP 600-Article 8 d ◆ If the issuing bank request a advising bank to confirm a credit but the advising bank is not prepared to do so. 1)What must the advising bank do? 2)What can the advising bank do? ☆8 d. ……it must inform the issuing bank without delay and may advise the credit without confirmation. 42

UCP 600-Article 9 a ◆ 某开证行通知完信用证后,是否对于相符交单也承 担承付/议付责任? ☆9 a. An advising bank that is not a confirming bank advises the credit and any amendment without any undertaking to honour or negotiate. . 43

UCP 600-Article 9 b ◆ 通知行的责任是什么? ☆9 b. …… the advising bank signifies 1) that it has satisfied itself as to the apparent authenticity of the credit or amendment and 2)that the advice accurately reflects the terms and conditions of the credit or amendment received. 44

UCP 600-Article 9 e ◆ 如一银行被要求通知某信用证,该银行能拒绝通知吗? ☆可以拒绝通知。. ◆ 然后,该银行应如何处理? ☆it must so inform, without delay, the issuing bank or the first advising bank. 45

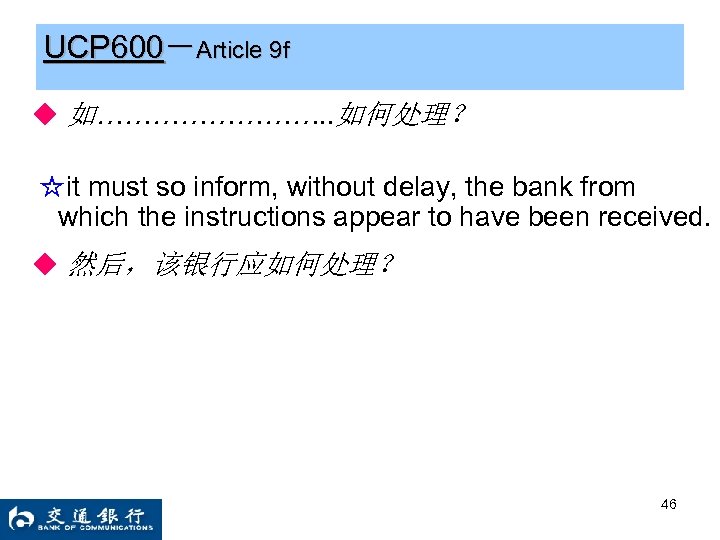

UCP 600-Article 9 f ◆ 如…………. . 如何处理? ☆it must so inform, without delay, the bank from which the instructions appear to have been received. ◆ 然后,该银行应如何处理? 46

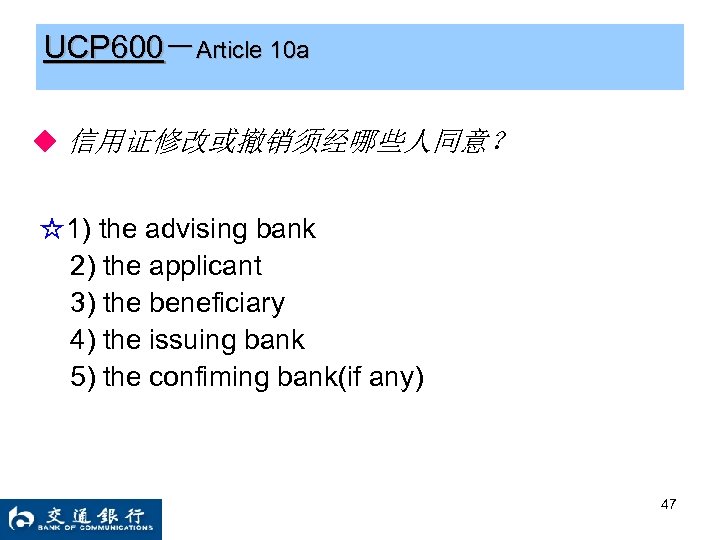

UCP 600-Article 10 a ◆ 信用证修改或撤销须经哪些人同意? ☆1) the advising bank 2) the applicant 3) the beneficiary 4) the issuing bank 5) the confiming bank(if any) 47

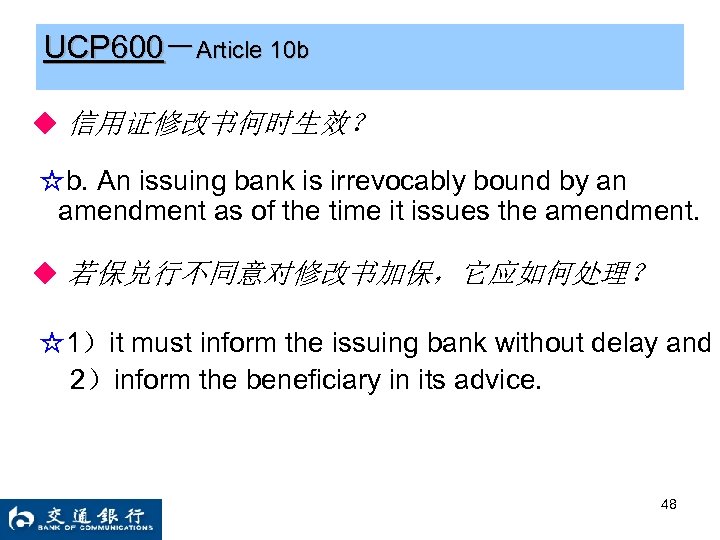

UCP 600-Article 10 b ◆ 信用证修改书何时生效? ☆b. An issuing bank is irrevocably bound by an amendment as of the time it issues the amendment. ◆ 若保兑行不同意对修改书加保,它应如何处理? ☆1)it must inform the issuing bank without delay and 2)inform the beneficiary in its advice. 48

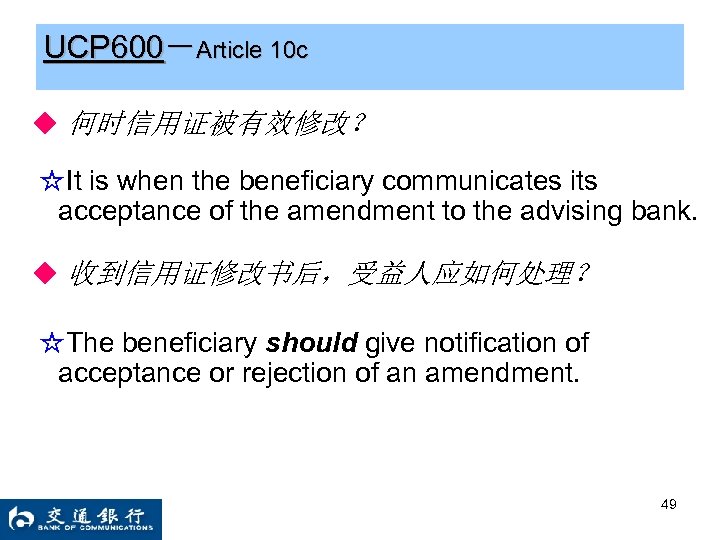

UCP 600-Article 10 c ◆ 何时信用证被有效修改? ☆It is when the beneficiary communicates its acceptance of the amendment to the advising bank. ◆ 收到信用证修改书后,受益人应如何处理? ☆The beneficiary should give notification of acceptance or rejection of an amendment. 49

UCP 600-Article 10 c ◆ If the beneficiary fails to give such notification? 拒绝 接受 不明 不明 50

UCP 600-Article 10 e ◆ 案例:某MT 707主要内容有两项: 1)信用证增额USD 1000. 00 2)开证行以外的费用改由受益人承担。 受益人收到该MT 707后,告知通知行其只接受增额修改,不 接受费用承担。 问:该MT 707结果如何? ☆It means that the beneficiary has rejected the whole amendment. 51

UCP 600-Article 10 f ◆ 案例:某MT 707规定:This amendment shall enter into force unless rejected by the beneficiary within 5 banking days after the issuance date of this amendment. 5个银行 作日后没有收到任何通知,该MT 707自 动生效? ☆This clause shall be disregarded. 52

UCP 600-Article 11 ◆ 案例:某通知行收到一份已证实表面真实性的 MT 700后,又收到一份邮寄确认书,问通知行应如 何处理该确认书? ☆It shall be disregarded. ◆ 案例:某开证行开立一份MT 705(pre-advice)后, 随后应如何处理? ☆The issuing bank must then issue the operative credit or amendment without delay in terms not inconsistent with the teletransmission. 53

UCP 600-Article 12 a 某指定行(非保兑行)是否有义务进行承付 或议付? ◆ ☆12 a……. an authorization to honour or negotiate does not impose any obligation on that nominated bank to honour or negotiate, except 1)when expressly agreed to by that nominated bank and 2)so communicated to the beneficiary. 54

UCP 600-Article 12 b ◆ 12 b. By nominating a bank to accept a draft or incur a deferred payment undertaking, an issuing bank authorizes that nominated bank to prepay or purchase a draft accepted or a deferred payment undertaking incurred by that nominated bank. 55

UCP 600-Article 12 c ◆ 案例:……………. 问:受益人是否 应该得到赔偿? ☆12 c. Receipt or examination and forwarding of documents by a nominated bank that is not a confirming bank does not make that nominated bank liable to honour or negotiate, nor does it constitute honour or negotiation. 56

UCP 600-Article 13 a ◆通过SWIFT开立的MT 700中,规定由第三方银行作 为偿付行(reimbursing bank )。问:根据最新 SWIFT规则,该信用证是否自动适用与URR 525? ☆不是。必须在信用证中明确该偿付适用于URR 525。 2006年 11月18日后,必须在MT 700的40 E中选择: UCPURR LATEST VERSION ☆13 a……. the credit must state if the reimbursement is subject to the ICC rules for bank-to-bank reimbursements in effect on the date of issuance of the credit. 57

UCP 600-Article 13 c ◆如果某偿付行(reimbursing bank )未能在索偿行 (claiming bank )首次索偿时偿付该索偿行,那么 谁应对该索偿行负责? ☆The issuing bank is obligated to reimburse the claiming bank. ☆13 c. An issuing bank is not relieved of any of its obligations to provide reimbursement if reimbursement is not made by a reimbursing bank on first demand. 58

UCP 600-Article 14 a ◆案例:银行A是某信用证下的议付行(非保兑行)。 银行A收到受益人提交的单据后,未审核单据,也 未议付该套单据,直接向开证行寄单。问:根据 UCP 600银行A是否承担责任(必须审核单据)? ☆14 a. A nominated bank acting on its nomination, a confirming bank, if any, and the issuing bank must examine a presentation…… ◆审单: 1)仅基于单据本身(on the basis of the documents alone ) 2)在单据表面上(the documents appear on their face ) 59

UCP 600-Article 14 b ◆案例:……………. . 该指定行审核单据是否 相符的天数还有几天? ☆1)3 banking days 2) a reasonable time not to exceed 7 banking days 3) a reasonable time not to exceed 5 banking days 4) a maximum of 5 banking days 60

UCP 600-Article 14 c ◆案例:某MT 700信用证,…………………. . 问:该信用证下单据应该在何时提交指定行 ? ☆1)装运日后21个日历日内 2) 装运日后21个日历日内及信用证效期内 3) 装运日后21个银行 作日内及信用证效期内 4) 信用证效期内 61

UCP 600-Article 14 d ◆what are ‘compliance’ ? ☆14 d. Data in a document, ……, need not be identical to, but must not conflict with, data in that document, any other stipulated document or the credit. 62

UCP 600-Article 14 e ◆案例:某信用证中货物描述为: …………… 问:上述装箱单中货物描述 是否为不符点 ? ☆不是。 14 e. In documents other than the commercial invoice, the description of the goods, services or performance, if stated, may be in general terms not conflicting with their description in the credit. 63

UCP 600-Article 14 e ◆案例:某信用证中货物描述为: …………………… 问:上述重量单中货物描述是否为不符点 ? ☆不是不符点,如果在重量单中注明“参见发票 №XXX”。 64

UCP 600-Article 14 f ◆案例:某信用证中规定: Weight List in 3 copies. 问:谁能出立该Weight List?内容如何? ☆任何人可以出立该单据。 内容应符合以下条件: 1)its content appears to fulfil the function as Weight List. 2) its content must not conflict with the other docs or LC. 3) It must not have conflicting data(in its content) 65

UCP 600-Article 14 g ◆案例:某信用证中没有要求提交………………但受益人交单 时提交了,问指定行应如何处理该份单据? ☆14 g. A document presented but not required by the credit 1)will be disregarded and 2)may be returned to the presenter. ☆指定行是否可以把该份单据随其它单据一起寄交开 证行? 66

UCP 600-Article 14 h ◆案例:某信用证中要求: “THE GOODS ARE TO BE GERMAN ORIGIN ” ,问:银行应如何处理该条款? ☆14 h. ……banks will deem such condition as not stated and will disregard it. 67

UCP 600-Article 14 i ◆案例: 1)Can a document be dated prior to the issuance date of the credit? 2)Can a document be dated after its date of presentation? ☆14 i. A document may be dated prior to the issuance date of the credit, but must not be dated later than its date of presentation. 68

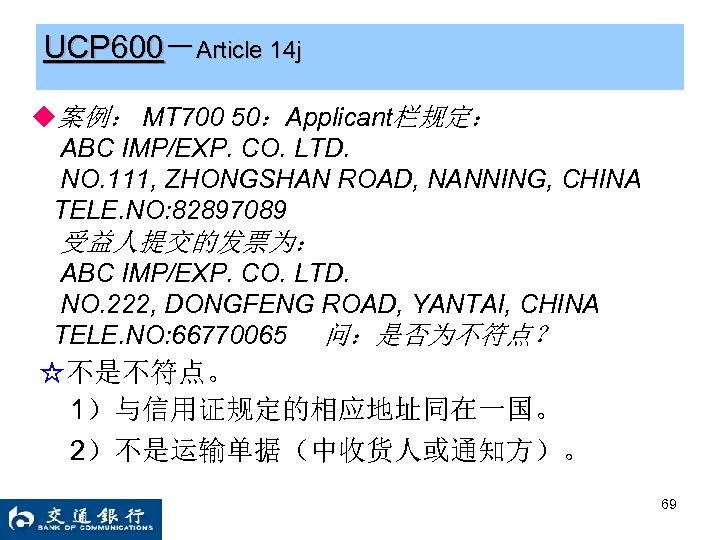

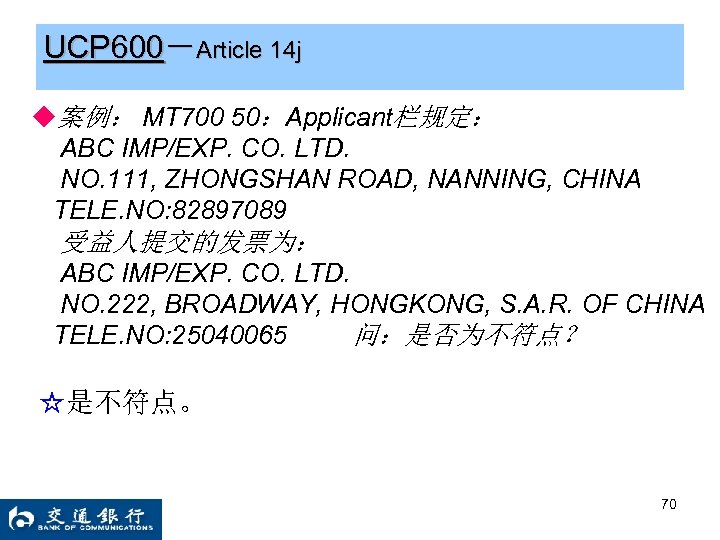

UCP 600-Article 14 j ◆案例: MT 700 50:Applicant栏规定: ABC IMP/EXP. CO. LTD. NO. 111, ZHONGSHAN ROAD, NANNING, CHINA TELE. NO: 82897089 受益人提交的发票为: ABC IMP/EXP. CO. LTD. NO. 222, DONGFENG ROAD, YANTAI, CHINA TELE. NO: 66770065 问:是否为不符点? ☆不是不符点。 1)与信用证规定的相应地址同在一国。 2)不是运输单据(中收货人或通知方)。 69

UCP 600-Article 14 j ◆案例: MT 700 50:Applicant栏规定: ABC IMP/EXP. CO. LTD. NO. 111, ZHONGSHAN ROAD, NANNING, CHINA TELE. NO: 82897089 受益人提交的发票为: ABC IMP/EXP. CO. LTD. NO. 222, BROADWAY, HONGKONG, S. A. R. OF CHINA TELE. NO: 25040065 问:是否为不符点? ☆是不符点。 70

UCP 600-Article 14 k ◆案例: 谁可以做…. . 中的“shipper”? ☆任何人。 ◆案例: 谁可以做…. . 中的“consignor”? ☆任何人。 ◆案例: 谁可以做…………. . 中的“shipper”? ☆任何人。 ☆14 k. The shipper or consignor of the goods indicated on any document need not be the beneficiary of the credit. 71

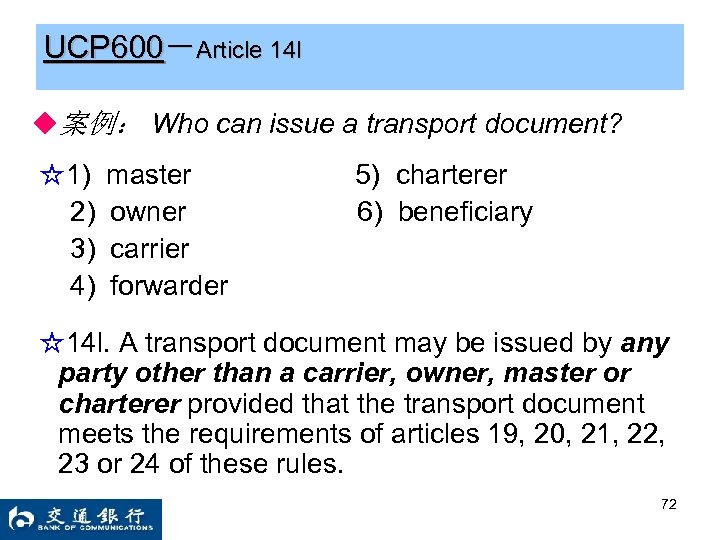

UCP 600-Article 14 l ◆案例: Who can issue a transport document? ☆1) 2) 3) 4) master owner carrier forwarder 5) charterer 6) beneficiary ☆14 l. A transport document may be issued by any party other than a carrier, owner, master or charterer provided that the transport document meets the requirements of articles 19, 20, 21, 22, 23 or 24 of these rules. 72

UCP 600-Article 15 a ◆When an issuing bank determines that a presentation is complying, what must it do? ☆15 a. When an issuing bank determines that a presentation is complying, it must honour. 73

UCP 600-Article 15 b ◆When a confirming bank determines that a presentation is complying, what must it do? ☆15 b. When a confirming bank determines that a presentation is complying, it must 1)honour or negotiate and 2)forward the documents to the issuing bank. 74

UCP 600-Article 15 c ◆When a nominated bank determines that a presentation is complying, what must it do? ☆When a nominated bank determines that a presentation is complying, it must forward the documents to the confirming bank or the issuing bank after it has honoured or negotiated. (acting on its nomination) 75

UCP 600-Article 16 b ◆If the issuing bank chooses to contact the applicant for a waiver …………. days? ☆0 banking day. 16 b……. This does not, however, extend the period mentioned in sub-article 14 (b). 76

UCP 600-Article 16 c ◆When a nominated bank, a confirming bank, if any, or the issuing bank decides to refuse to honour or negotiate, how many refusal notice must it give to the presenter? ☆a single notice. ◆拒付通知的构成是什么? ☆1)the bank is refusing to honour or negotiate; and 2)each discrepancy; and 3)Documents disposal instruction. 77

UCP 600-Article 16 c ◆ Documents disposal instruction: ☆16 ciii. 1) that the bank is holding the documents pending further instructions from the presenter; or 2) that the issuing bank is holding the documents until it receives a waiver from the applicant and agrees to accept it, or receives further instructions from the presenter prior to agreeing to accept a waiver; or 3) that the bank is returning the documents; or 4) that the bank is acting in accordance with instructions previously received from the presenter. 78

UCP 600-Article 16 d ◆How must the refusal notice be given? ☆1)by telecommunications (swift/tlx/fax/telephone) 2)by other expeditious means (courier service) ◆If a nominated bank, a confirming bank, or the issuing bank decides to refuse to honour or negotiate, when must it give a refusal notice? ☆……no later than the close of the fifth banking day following the day of presentation. 79

UCP 600-Article 16 e ◆案例:开证行在…………………. 。问:开证行的行为 是否妥当? ☆开证行可以退单。 16 e. A nominated bank acting on its nomination, a confirming bank, if any, or the issuing bank may, after providing notice required by sub-article 16 (c) (iii) (a) or (b), return the documents to the presenter at any time. 80

UCP 600-Article 16 f ◆案例:If an issuing bank or a confirming bank fails to give the refusal notice as required by this article, what would happen? ☆开证行或保兑行必须承付或议付该不符提示。 16 f. …… it shall be precluded from claiming that the documents do not constitute a complying presentation. 81

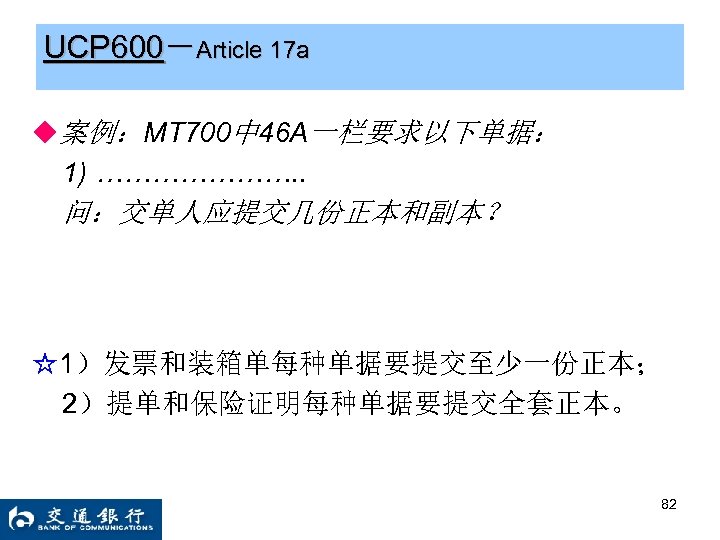

UCP 600-Article 17 a ◆案例:MT 700中 46 A一栏要求以下单据: 1) …………………. . 问:交单人应提交几份正本和副本? ☆1)发票和装箱单每种单据要提交至少一份正本; 2)提单和保险证明每种单据要提交全套正本。 82

UCP 600-Article 17 b ◆17 b. A bank shall treat as an original any document bearing an apparently original signature, mark, stamp, or label of the issuer of the document, unless the document itself indicates that it is not an original. 83

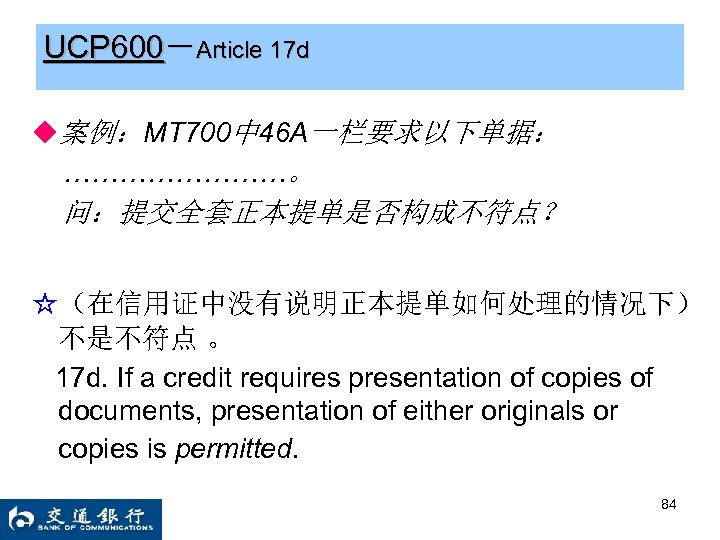

UCP 600-Article 17 d ◆案例:MT 700中 46 A一栏要求以下单据: …………。 问:提交全套正本提单是否构成不符点? ☆(在信用证中没有说明正本提单如何处理的情况下) 不是不符点 。 17 d. If a credit requires presentation of copies of documents, presentation of either originals or copies is permitted. 84

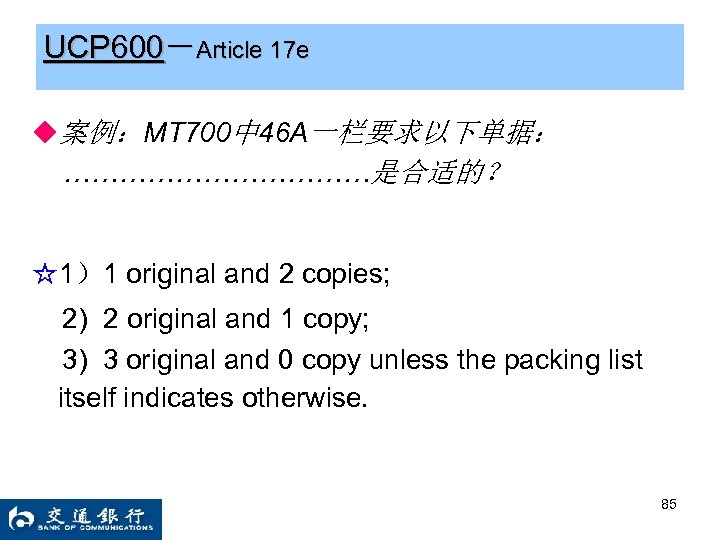

UCP 600-Article 17 e ◆案例:MT 700中 46 A一栏要求以下单据: ………………是合适的? ☆1)1 original and 2 copies; 2) 2 original and 1 copy; 3) 3 original and 0 copy unless the packing list itself indicates otherwise. 85

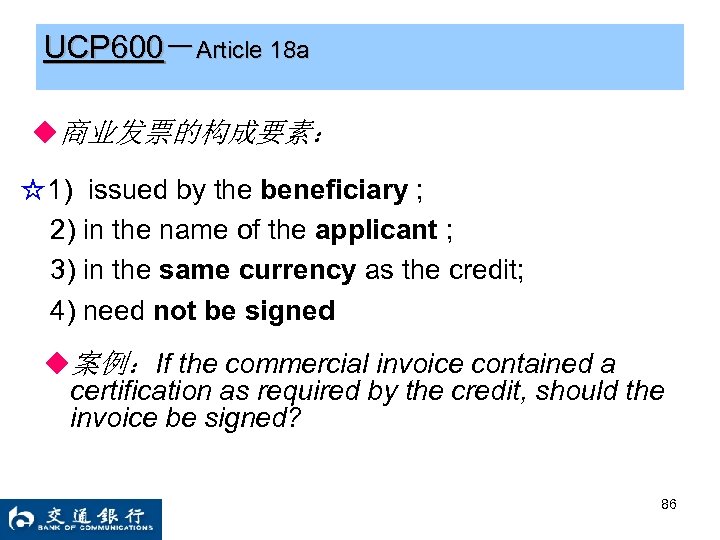

UCP 600-Article 18 a ◆商业发票的构成要素: ☆1) issued by the beneficiary ; 2) in the name of the applicant ; 3) in the same currency as the credit; 4) need not be signed ◆案例:If the commercial invoice contained a certification as required by the credit, should the invoice be signed? 86

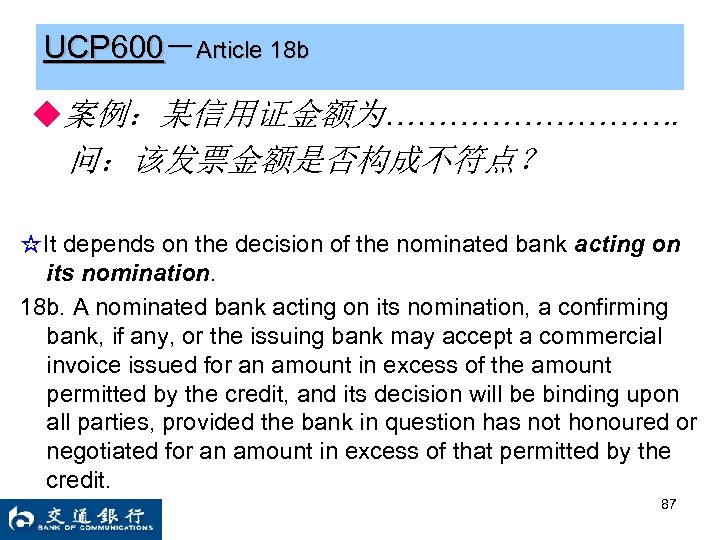

UCP 600-Article 18 b ◆案例:某信用证金额为……………. 问:该发票金额是否构成不符点? ☆It depends on the decision of the nominated bank acting on its nomination. 18 b. A nominated bank acting on its nomination, a confirming bank, if any, or the issuing bank may accept a commercial invoice issued for an amount in excess of the amount permitted by the credit, and its decision will be binding upon all parties, provided the bank in question has not honoured or negotiated for an amount in excess of that permitted by the credit. 87

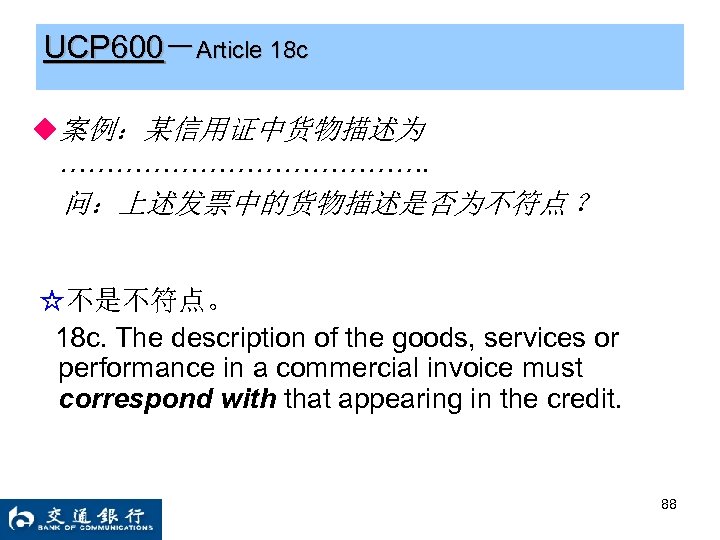

UCP 600-Article 18 c ◆案例:某信用证中货物描述为 …………………. 问:上述发票中的货物描述是否为不符点 ? ☆不是不符点。 18 c. The description of the goods, services or performance in a commercial invoice must correspond with that appearing in the credit. 88

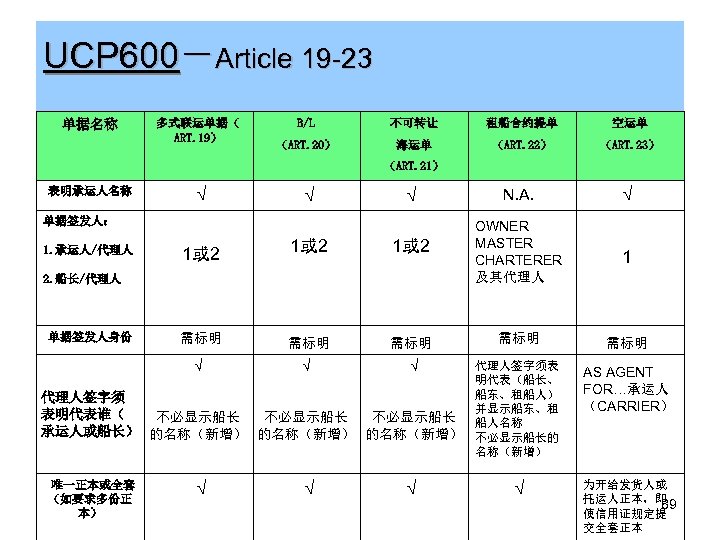

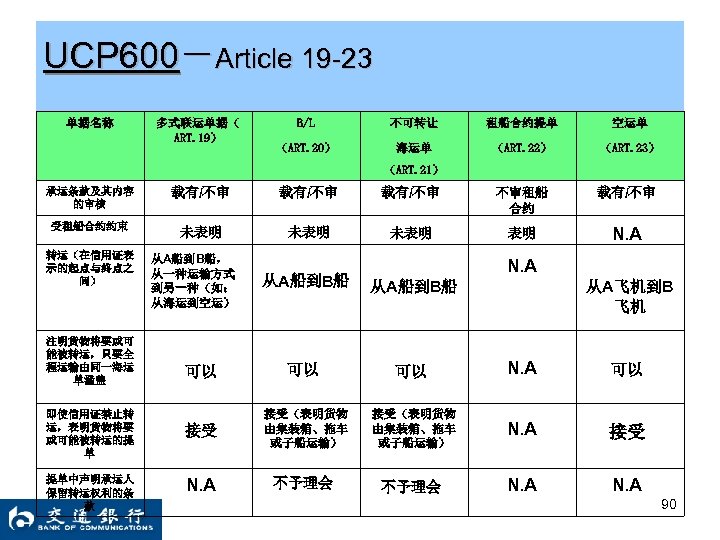

UCP 600-Article 19 -23 不可转让 租船合约提单 空运单 (ART. 20) 海运单 (ART. 22) (ART. 23) (ART. 21) √ √ N. A. √ 1或 2 OWNER MASTER CHARTERER 及其代理人 1 需标明 需标明 需标明 √ 表明承运人名称 B/L 单据名称 多式联运单据( ART. 19) √ √ 代理人签字须表 明代表(船长、 船东、租船人) 并显示船东、租 船人名称 不必显示船长的 名称(新增) AS AGENT FOR…承运人 (CARRIER) √ 为开给发货人或 托运人正本,即 89 使信用证规定提 交全套正本 √ 单据签发人: 1. 承运人/代理人 1或 2 2. 船长/代理人 单据签发人身份 代理人签字须 表明代表谁( 不必显示船长 承运人或船长) 的名称(新增) 唯一正本或全套 (如要求多份正 本) √ √ √

UCP 600-Article 19 -23 单据名称 多式联运单据( ART. 19) B/L 不可转让 租船合约提单 空运单 (ART. 20) 海运单 (ART. 22) (ART. 23) (ART. 21) 承运条款及其内容 的审核 载有/不审 不审租船 合约 载有/不审 受租船合约约束 未表明 未表明 表明 N. A 转运(在信用证表 示的起点与终点之 间) 注明货物将要或可 能被转运,只要全 程运输由同一海运 单涵盖 即使信用证禁止转 运,表明货物将要 或可能被转运的提 单 提单中声明承运人 保留转运权利的条 款 从A船到B船, 从一种运输方式 到另一种(如: 从海运到空运) N. A 从A船到B船 可以 可以 可以 N. A 可以 接受 接受(表明货物 由集装箱、拖车 或子船运输) N. A 接受 N. A 不予理会 N. A 从A飞机到B 飞机 90

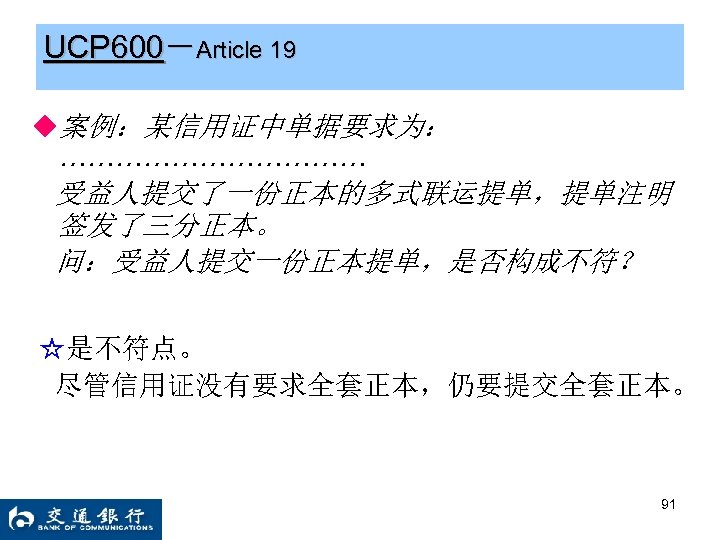

UCP 600-Article 19 ◆案例:某信用证中单据要求为: ……………… 受益人提交了一份正本的多式联运提单,提单注明 签发了三分正本。 问:受益人提交一份正本提单,是否构成不符? ☆是不符点。 尽管信用证没有要求全套正本,仍要提交全套正本。 91

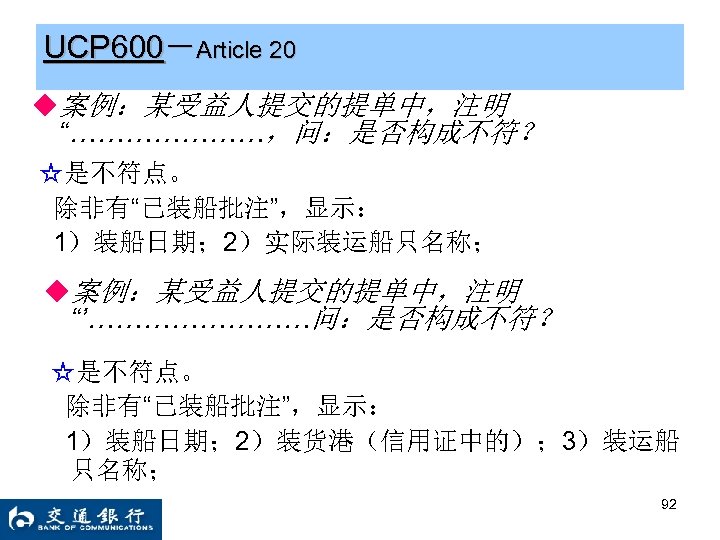

UCP 600-Article 20 ◆案例:某受益人提交的提单中,注明 “…………………,问:是否构成不符? ☆是不符点。 除非有“已装船批注”,显示: 1)装船日期; 2)实际装运船只名称; ◆案例:某受益人提交的提单中,注明 “’…………问:是否构成不符? ☆是不符点。 除非有“已装船批注”,显示: 1)装船日期; 2)装货港(信用证中的); 3)装运船 只名称; 92

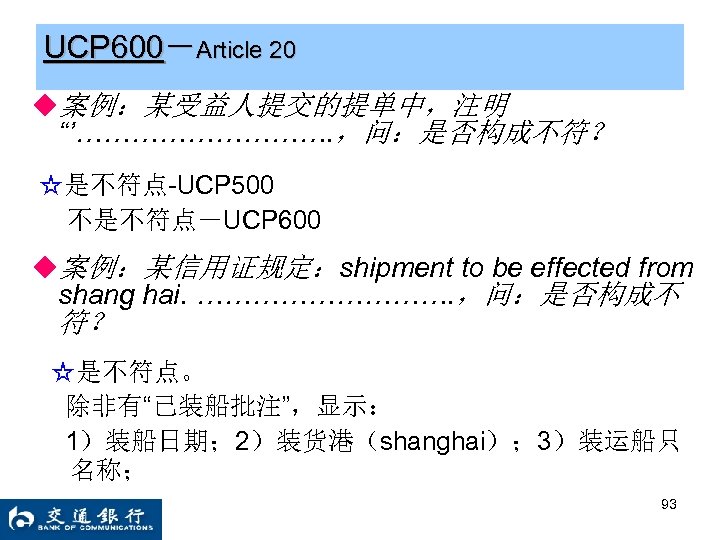

UCP 600-Article 20 ◆案例:某受益人提交的提单中,注明 “’……………. ,问:是否构成不符? ☆是不符点-UCP 500 不是不符点-UCP 600 ◆案例:某信用证规定:shipment to be effected from shang hai. ……………. ,问:是否构成不 符? ☆是不符点。 除非有“已装船批注”,显示: 1)装船日期; 2)装货港(shanghai); 3)装运船只 名称; 93

UCP 600-Article 21 ◆案例:某信用证单据要求为: ………………。问:是否构成不符? ☆不符点。 不可转让海运提单仍要提供全套正本。 94

UCP 600-Article 22 ◆案例:某信用证单据要求为: “…………,问:是否构成不符? ☆22 aiii. …… The port of discharge may also be shown as a range of ports or a geographical area, as stated in the credit. 95

UCP 600-Article 23 ◆案例: 某受益人提交的空运单(AWB)如下所示,问: 装运日期是哪一天? ☆23 aiii. indicate the date of issuance. This date will be deemed to be the date of shipment unless the air transport document contains a specific notation of the actual date of shipment, in which case the date stated in the notation will be deemed to be the date of shipment. 96

UCP 600-Article 25 ◆案例:某信用证单据要求为: ………………………. . 问:是否构成不符? ☆不是不符点。 24 b. A requirement that courier charges are to be paid or prepaid may be satisfied by a transport document issued by a courier service evidencing that courier charges are for the account of a party other than the consignee. 97

UCP 600-Article 26 a ◆案例:某信用证要求: ……………. . ? 若提单中显示:The containers may be loaded on deck. 问:是否为不符点? ☆26 a. A transport document must not indicate that the goods are or will be loaded on deck. A clause on a transport document stating that the goods may be loaded on deck is acceptable 98

UCP 600-Article 27 ◆27. A bank will only accept a clean transport document. A clean transport document is one bearing no clause or notation expressly declaring a defective condition of the goods or their packaging. The word “clean” need not appear on a transport document, even if a credit has a requirement for that transport document to be “clean on board”. 99

UCP 600-Article 28 a ◆谁可以开立并签署保险单据? ☆1)an insurance 2) an underwriter 3) their agents 4) proxies of 1) and 2) ☆28 a……. Any signature by an agent or proxy must indicate whether the agent or proxy has signed for or on behalf of the insurance company or underwriter. 100

UCP 600-Article 28 d ◆案例:信用证规定: ………………… 问:是否构成不符? ☆不是不符。 28 d. An insurance policy is acceptable in lieu of an insurance certificate or a declaration under an open cover. 101

UCP 600-Article 28 e ☆28 e. The date of the insurance document must be no later than the date of shipment, unless it appears from the insurance document that the cover is effective from a date not later than the date of shipment. 102

UCP 600-Article 28 f ii ◆案例:信用证规定:-………………. 问:是否构成不符? ☆不是不符。 28 fii. A requirement in the credit for insurance coverage to be for a percentage of the value of the goods, of the invoice value or similar is deemed to be the minimum amount of coverage required 103

UCP 600-Article 28 f ii ◆案例:信用证金额为 ……………………. 问:是否构成不符? 104

UCP 600-Article 28 f iii UCP 600-Article iii ◆案例:信用证规定: ……………… ……. 问:保险证明是否构成不 符? ☆不是不符。28 fiii. The insurance document must indicate that risks are covered at least between the place of taking in charge or shipment and the place of discharge or final destination as stated in the credit. 105

UCP 600-Article 28 g ◆案例:信用证规定:- ……………… 问:是否构成不符? ☆不是不符。 28 g. A credit should state the type of insurance required and, if any, the additional risks to be covered. An insurance document will be accepted without regard to any risks that are not covered, if the credit uses imprecise terms such as “usual risks” or “customary risks”. 106

UCP 600-Article 28 i ◆28 i. An insurance document may contain reference to any exclusion clause. ☆应记住保险单据显示下列除外责任是现今保险业标准要求, • • 可予接受: Institute Classification Clause, Cargo ISM Endorsement Clause, Institute Radioactive Contamination, Chemical, Biological, Biochemical and Electromagnetic Weapons Exclusion Clause, Institute Cyber Attack Exclusion Clause • Termination of Transit Clause (Terrorism). 107

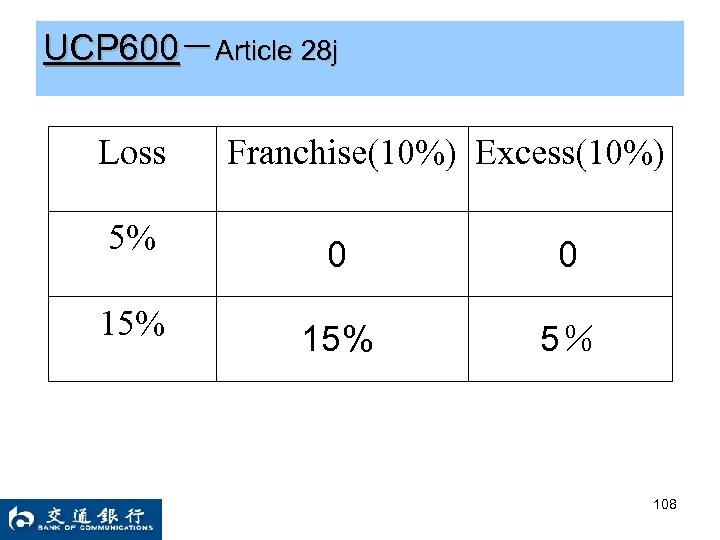

UCP 600-Article 28 j Loss Franchise(10%) Excess(10%) 5% 0 0 15% 5% 108

UCP 600-Article 29 ◆案例:某国外开来的信用证规定: LC效期-Oct. /1/2007; 最后装运日期:空白 问: 1)信用证截至日期是哪一天? 2)最后装运日期是哪一天? ☆ 1)信用证截至日期顺延至下一个银行 作日; 2)最后装运日期为Oct. /1/2007; 109

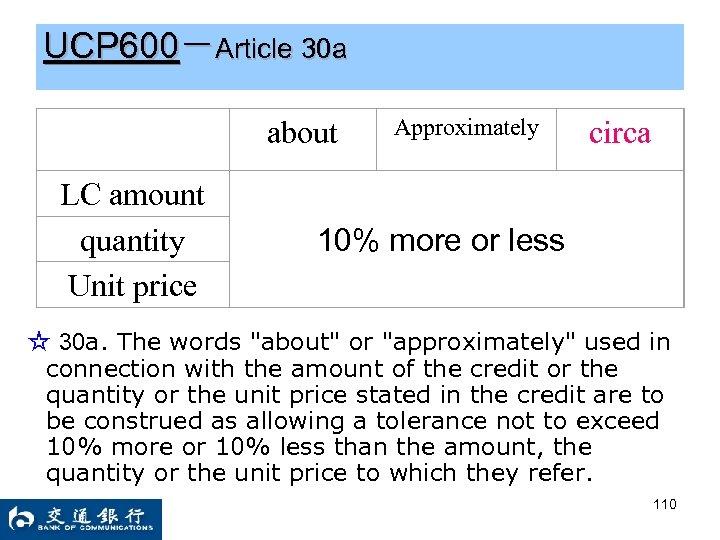

UCP 600-Article 30 a LC amount quantity Unit price about Approximately circa 10% more or less ☆ 30 a. The words "about" or "approximately" used in connection with the amount of the credit or the quantity or the unit price stated in the credit are to be construed as allowing a tolerance not to exceed 10% more or 10% less than the amount, the quantity or the unit price to which they refer. 110

UCP 600-Article 30 b ◆案例:某信用证金额为:………. 问:是否为不符点? ◆案例:某信用证金额为:………………… 问:是否为不符点? ☆ 30 b. 适用条件: 1)不是以包装单位/个数表示; 2)支取金额不超过信用证金额; 货物数量允许有5%的增减。 111

UCP 600-Article 30 c ◆案例:某信用证金额为:…………………. . 问:是否为不符点? ☆ 30 c. 适用条件: 1)信用证规定了货物数量,该数量已全部装运; 2)信用证规定了货物单价,该单价未降低; 3)UCP 600 30 b不适用时 即使在禁止分批的情况下,也允许支取金额有5%减幅; 排除:信用证规定了特定的增减幅度,或适用了30 a,则 该减幅不适用。 112

UCP 600-Article 31 b ◆案例:某信用证规定: -…………………. . 问:上述情况是否构成分批装运? 该套单据的装运日期是哪一天? 113

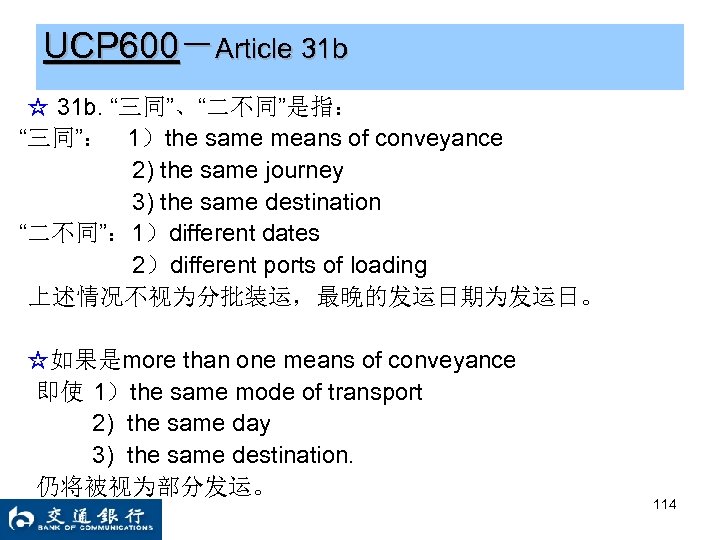

UCP 600-Article 31 b ☆ 31 b. “三同”、“二不同”是指: “三同”: 1)the same means of conveyance 2) the same journey 3) the same destination “二不同”: 1)different dates 2)different ports of loading 上述情况不视为分批装运,最晚的发运日期为发运日。 ☆如果是more than one means of conveyance 即使 1)the same mode of transport 2) the same day 3) the same destination. 仍将被视为部分发运。 114

UCP 600-Article 31 c ◆案例:某信用证规定: ……………. . 问:上述交单是否构成部分发运? ☆ 31 c. 适用条件: 1) the same courier or postal service (stamped/signed) 2) the same place 3) the same date 4) the same destination 将不视为部分发运 115

UCP 600-Article 32 ◆案例:上述信用证的装运安排,哪份信用证可以适用于 ART. 32? 116

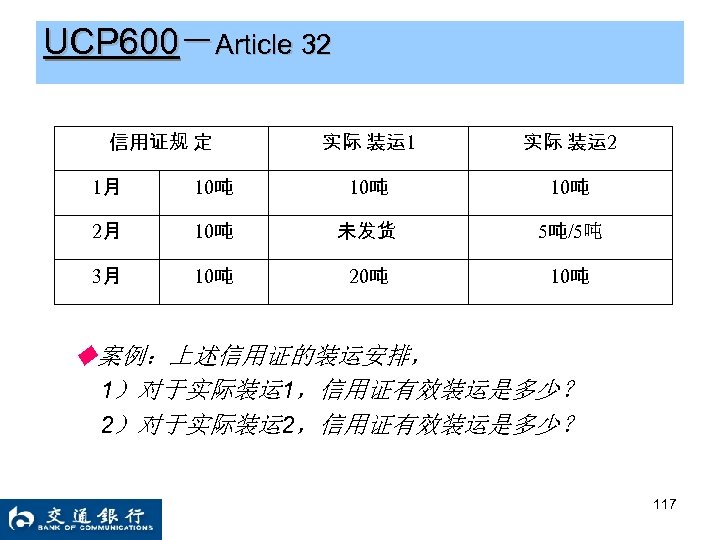

UCP 600-Article 32 信用证规 定 实际 装运 1 实际 装运 2 1月 10吨 10吨 2月 10吨 未发货 5吨/5吨 3月 10吨 20吨 10吨 ◆案例:上述信用证的装运安排, 1)对于实际装运 1,信用证有效装运是多少? 2)对于实际装运 2,信用证有效装运是多少? 117

UCP 600-Article 33 ◆Article 33 Hours of Presentation A bank has no obligation to accept a presentation outside of its banking hours. 118

UCP 600-Article 34 ◆Article 34 Disclaimer on Effectiveness of Documents A bank assumes no liability or responsibility for the form, sufficiency, accuracy, genuineness, falsification or legal effect of any document, or for the general or particular conditions stipulated in a document or superimposed thereon; nor does it assume any liability or responsibility for the description, quantity, weight, quality, condition, packing, delivery, value or existence of the goods, services or other performance represented by any document, or for the good faith or acts or omissions, solvency, performance or standing of the consignor, the carrier, the forwarder, the consignee or the insurer of the goods or any other person. 119

UCP 600-Article 35 ◆案例:以下情况下,银行是否负责? 1)………………. ☆ 根据art. 35, 银行不承担责任,但要采取合理谨慎( reasonable care) 120

UCP 600-Article 35 ◆案例:某议付行审核完受益人提交的单据后,确定 交单相符,议付了该套单据,并根据信用证中的要 求,将单据寄往开证行。单据在快递公司的传送过 程中发生遗失。 问: 1)开证行是否应该偿付该议付行? 2)如果该议付行未议付单据,仅完成了寄单, 开证行是否应该付款? ☆ 根据art. 35, 开证行承担承付责任的条件: 1)交单相符; 2)指定行按照信用证的要求寄出了单据; 121

UCP 600-Article 36 ◆Article 36 Force Majeure A bank assumes no liability or responsibility for the consequences arising out of the interruption of its business by Acts of God, riots, civil commotions, insurrections, wars, acts of terrorism, or by any strikes or lockouts or any other causes beyond its control. A bank will not, upon resumption of its business, honour or negotiate under a credit that expired during such interruption of its business. ☆什么是“acts of terrorism”?给恐怖主义下一个世界各国都认 同的定义,是一件颇费周折的事情。联合国就恐怖主义的定义 组织讨论过多次,至今仍无一致的意见。但通过联合国的多次 讨论,基本形成了一种倾向性的意见,即承认恐怖主义定义有 三要素:非法暴力、具有政治动机、滥杀无辜。 122

UCP 600-Article 37 b ◆案例:申请人A向开证行B申请开立信用证。 ……………. . 问:该申请人A是否可以起诉开证行B并要求 赔偿? ☆37 b. An issuing bank or advising bank assumes no liability or responsibility should the instructions it transmits to another bank not be carried out, even if it has taken the initiative in the choice of that other bank. 123

UCP 600-Article 37 c ◆案例: 某信用证规定:All banking charges outside the issuing bank’s country are for the account of the beneficiary. 通知行通知了该信用证后,要求受益人支付通知费用,但受 益人一直未付。 问:谁应承担通知行的通知费用? ☆37 c. ……If a credit states that charges are for the account of the beneficiary and charges cannot be collected or deducted from proceeds, the issuing bank remains liable for payment of charges. . ◆案例: 某转让的信用证规定:The LC transfer charges are for the account of the 2 nd beneficiary. 转让行通知该信用证后,第二受益人未提交任何单据,也没有 支付转让费用 问:谁应承担转让行的费用? 124

UCP 600-Article 37 c ◆案例: 某信用证规定:. . …………………. 问:这种做法是否合适? ☆37 c. ……A credit or amendment should not stipulate that the advising to a beneficiary is conditional upon the receipt by the advising bank or second advising bank of its charges. • TA 574 -ICC结论:上述……实务作法是ICC银行委员会既不支 持也不希望看到继续下去的。费用收取的负担经常会导致管理 事务的增加,信用证通知的延迟及其相关风险,其结果给受益 人增加了不应产生的费用。这些费用都是开证行行为和需求造 成的,而这已超出信用证正常处理范围。通知行有权选择谢绝 或拒绝处理写明这类条款的业务。 125

UCP 600-Article 37 d ☆37 d. The applicant shall be bound by and liable to indemnify a bank against all obligations and responsibilities imposed by foreign laws and usages. 126

UCP 600-Article 38 a ◆案例: 某可转让信用证指定南宁分行为转让行,在第 一受益人请求转让该信用证时, 问:南宁分行是否有义务进行转让? ☆38 a. A bank is under no obligation to transfer a credit except to the extent and in the manner expressly consented to by that bank. 127

UCP 600-Article 38 b ◆案例: 信用证有如下规定: …………………. 问:上述信用证是否可以转让? ☆38 b. ……Transferable credit means a credit that specifically states it is “transferable”. 128

UCP 600-Article 38 c ◆案例: 某可转让信用证指定南宁分行为转让行,第一 受益人请求转让该信用证,在转让申请书中规定: 转让费用由第二受益人承担。 问:南宁分行是否可以坚持在第一受益人付清转让 费用的情况下再进行转让? ☆38 c. Unless otherwise agreed at the time of transfer, all charges (such as commissions, fees, costs or expenses) incurred in respect of a transfer must be paid by the first beneficiary. 129

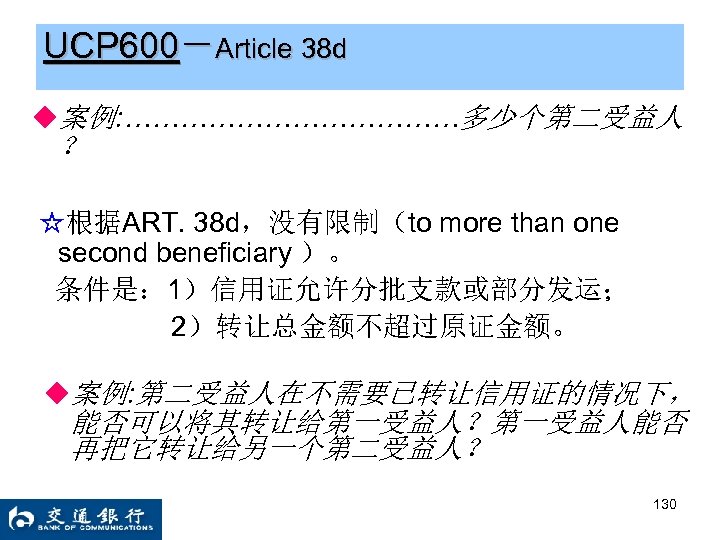

UCP 600-Article 38 d ◆案例: ………………多少个第二受益人 ? ☆根据ART. 38 d,没有限制(to more than one second beneficiary )。 条件是: 1)信用证允许分批支款或部分发运; 2)转让总金额不超过原证金额。 ◆案例: 第二受益人在不需要已转让信用证的情况下, 能否可以将其转让给第一受益人?第一受益人能否 再把它转让给另一个第二受益人? 130

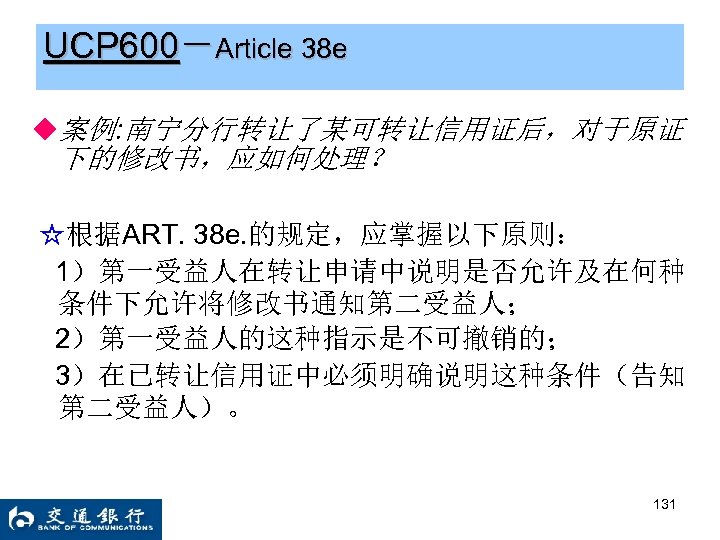

UCP 600-Article 38 e ◆案例: 南宁分行转让了某可转让信用证后,对于原证 下的修改书,应如何处理? ☆根据ART. 38 e. 的规定,应掌握以下原则: 1)第一受益人在转让申请中说明是否允许及在何种 条件下允许将修改书通知第二受益人; 2)第一受益人的这种指示是不可撤销的; 3)在已转让信用证中必须明确说明这种条件(告知 第二受益人)。 131

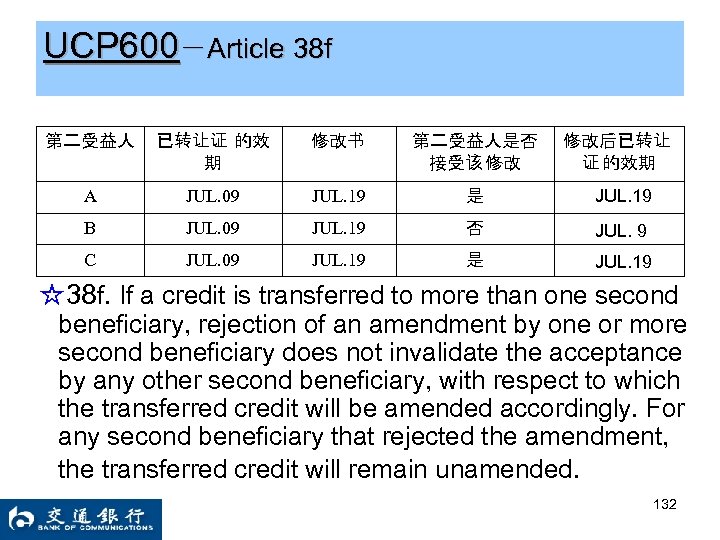

UCP 600-Article 38 f 第二受益人 已转让证 的效 期 修改书 第二受益人是否 接受该 修改 修改后已转让 证 的效期 A JUL. 09 JUL. 19 是 JUL. 19 B JUL. 09 JUL. 19 否 JUL. 9 C JUL. 09 JUL. 19 是 JUL. 19 ☆38 f. If a credit is transferred to more than one second beneficiary, rejection of an amendment by one or more second beneficiary does not invalidate the acceptance by any other second beneficiary, with respect to which the transferred credit will be amended accordingly. For any second beneficiary that rejected the amendment, the transferred credit will remain unamended. 132

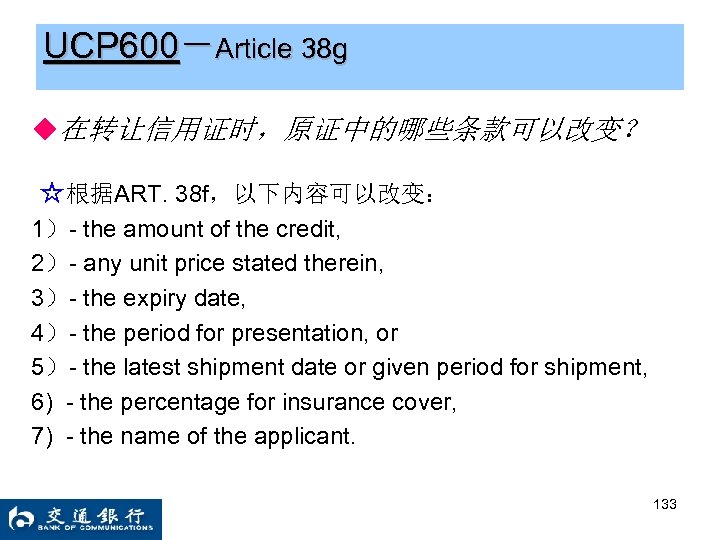

UCP 600-Article 38 g ◆在转让信用证时,原证中的哪些条款可以改变? ☆根据ART. 38 f,以下内容可以改变: 1)- the amount of the credit, 2)- any unit price stated therein, 3)- the expiry date, 4)- the period for presentation, or 5)- the latest shipment date or given period for shipment, 6) - the percentage for insurance cover, 7) - the name of the applicant. 133

UCP 600-Article 38 h ◆第一受益人有权力替换第二受益人的哪些单据? ☆38 h. The first beneficiary has the right to substitute its own invoice and draft, if any, for those of a second beneficiary for an amount not in excess of that stipulated in the credit, and upon such substitution the first beneficiary can draw under the credit for the difference, if any, between its invoice and the invoice of a second beneficiary. 134

UCP 600-Article 38 i ◆对于已转让信用证,………………证行应如何处理? ☆38 i. If the first beneficiary is to present its own invoice and draft, if any, but fails to do so on first demand, or if the invoices presented by the first beneficiary create discrepancies that did not exist in the presentation made by the second beneficiary and the first beneficiary fails to correct them on first demand, the transferring bank has the right to present the documents as received from the second beneficiary to the issuing bank, without further responsibility to the first beneficiary. 135

UCP 600-Article 38 j ◆案例:A transferable LC: -………………… SINGAPORE 问:上述转让是否可以? ☆38 j. The first beneficiary may, in its request for transfer, indicate that honour or negotiation is to be effected to a second beneficiary at the place to which the credit has been transferred, up to and including the expiry date of the credit. This is without prejudice to the right of the first beneficiary in accordance with sub-article 38 (h). . 136

UCP 600-Article 38 k ◆案例:第二受益人可否把单据直接寄给开证行? ☆38 k. Presentation of documents by or on behalf of a second beneficiary must be made to the transferring bank. 137

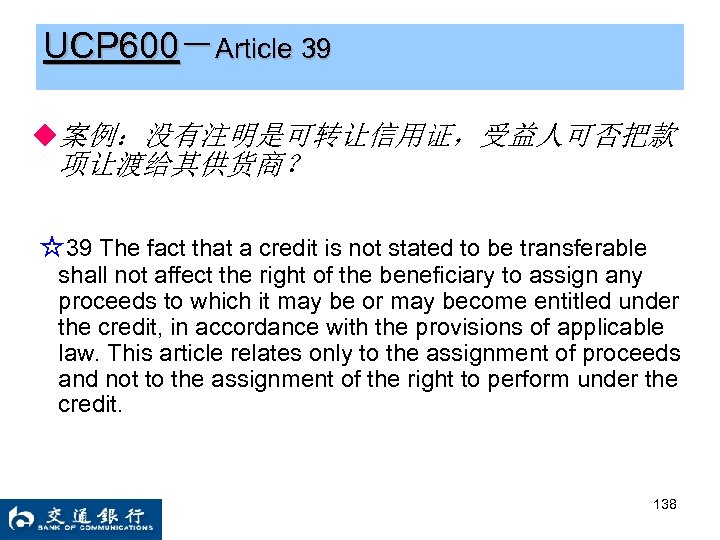

UCP 600-Article 39 ◆案例:没有注明是可转让信用证,受益人可否把款 项让渡给其供货商? ☆39 The fact that a credit is not stated to be transferable shall not affect the right of the beneficiary to assign any proceeds to which it may be or may become entitled under the credit, in accordance with the provisions of applicable law. This article relates only to the assignment of proceeds and not to the assignment of the right to perform under the credit. 138

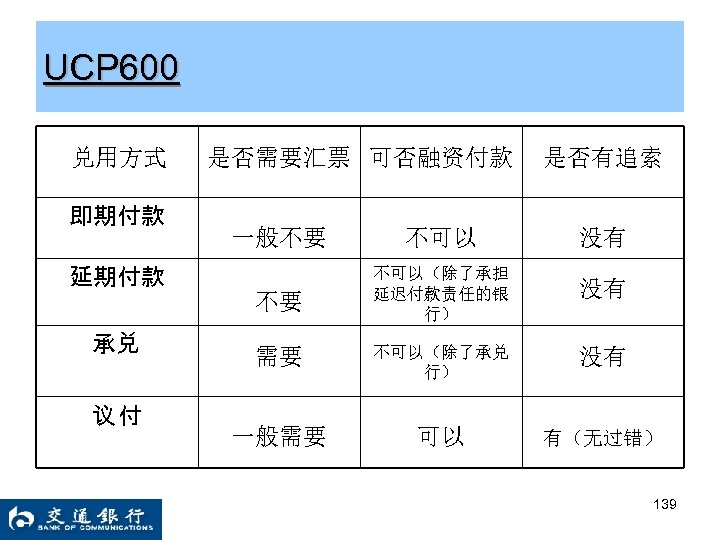

UCP 600 兑用方式 即期付款 是否需要汇票 可否融资付款 是否有追索 一般不要 不可以 没有 不要 不可以(除了承担 延迟付款责任的银 行) 没有 需要 不可以(除了承兑 行) 没有 一般需要 可以 有(无过错) 延期付款 承兑 议付 139

THANK YOU 140

0efd3be666b85c7c6a3bf52b6fafda4e.ppt