ZSX Medical Financing Questions Given the “total” amount of money ZSX needs to reach FDA clearance, are they best served by: 1. Seeking the money as proposed ($1. 35 MM, then $6 MM)? 2. Seek a single raise of $7. 5 MM? 3. Seek two raises differently divided? PCCI Monthly Group Meeting, December 13, 2010 Vidal F. de la Cruz, Vice President Business Development, Cytokine Pharma. Sciences, Inc.

ZSX Medical Financing Questions Given the “total” amount of money ZSX needs to reach FDA clearance, are they best served by: 1. Seeking the money as proposed ($1. 35 MM, then $6 MM)? 2. Seek a single raise of $7. 5 MM? 3. Seek two raises differently divided? PCCI Monthly Group Meeting, December 13, 2010 Vidal F. de la Cruz, Vice President Business Development, Cytokine Pharma. Sciences, Inc.

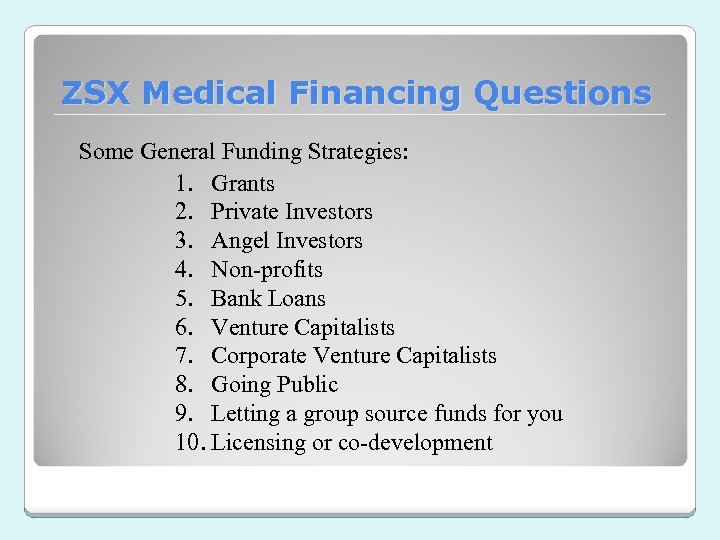

ZSX Medical Financing Questions Some General Funding Strategies: 1. Grants 2. Private Investors 3. Angel Investors 4. Non-profits 5. Bank Loans 6. Venture Capitalists 7. Corporate Venture Capitalists 8. Going Public 9. Letting a group source funds for you 10. Licensing or co-development

ZSX Medical Financing Questions Some General Funding Strategies: 1. Grants 2. Private Investors 3. Angel Investors 4. Non-profits 5. Bank Loans 6. Venture Capitalists 7. Corporate Venture Capitalists 8. Going Public 9. Letting a group source funds for you 10. Licensing or co-development

ZSX Medical Financing Questions Grants: NIH, e. g. , SBIR or the Office of Minority Health SBIR Phase I is for $150 k total costs over 6 months SBIR Phase II is for up to $1 mm over 12 months Can apply for combined Phase 1 with Phase II preapproved Phase III possible if possible U. S. Government use

ZSX Medical Financing Questions Grants: NIH, e. g. , SBIR or the Office of Minority Health SBIR Phase I is for $150 k total costs over 6 months SBIR Phase II is for up to $1 mm over 12 months Can apply for combined Phase 1 with Phase II preapproved Phase III possible if possible U. S. Government use

ZSX Medical Financing Questions Private Investors: Self, Friends & Family; sufficient for first tranche of ~$1 mm? Angel Investors: Too variable to comment on specifics; sufficient for first tranche? Non-Profits: E. g. Gates Foundation, Genesis Research Foundation, others Bank loans: An option, if you’re willing to mortgage your home(s)!

ZSX Medical Financing Questions Private Investors: Self, Friends & Family; sufficient for first tranche of ~$1 mm? Angel Investors: Too variable to comment on specifics; sufficient for first tranche? Non-Profits: E. g. Gates Foundation, Genesis Research Foundation, others Bank loans: An option, if you’re willing to mortgage your home(s)!

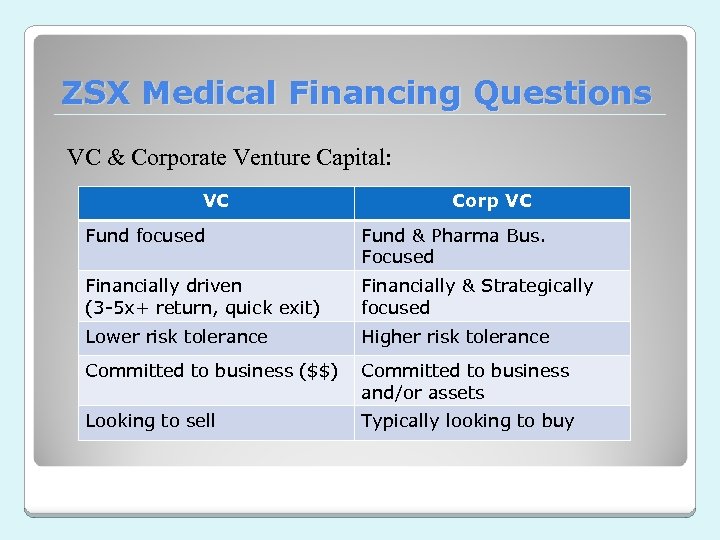

ZSX Medical Financing Questions VC & Corporate Venture Capital: VC Corp VC Fund focused Fund & Pharma Bus. Focused Financially driven (3 -5 x+ return, quick exit) Financially & Strategically focused Lower risk tolerance Higher risk tolerance Committed to business ($$) Committed to business and/or assets Looking to sell Typically looking to buy

ZSX Medical Financing Questions VC & Corporate Venture Capital: VC Corp VC Fund focused Fund & Pharma Bus. Focused Financially driven (3 -5 x+ return, quick exit) Financially & Strategically focused Lower risk tolerance Higher risk tolerance Committed to business ($$) Committed to business and/or assets Looking to sell Typically looking to buy

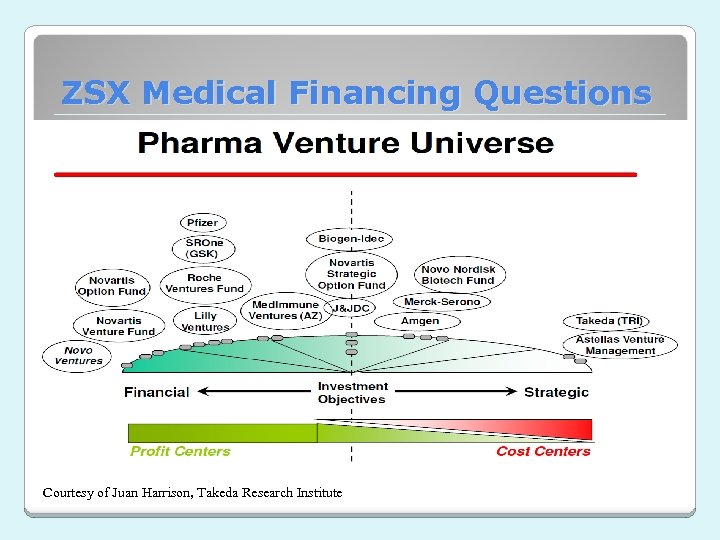

ZSX Medical Financing Questions Courtesy of Juan Harrison, Takeda Research Institute

ZSX Medical Financing Questions Courtesy of Juan Harrison, Takeda Research Institute

ZSX Medical Financing Questions Going Public: • Public offerings getting better, but still uncertain: • Levels in 2010 about half that prior to crisis in 2007 ($1. 2 billion versus $2. 9 billion). • Early stage financing also off ($4. 8 billion/$6. 8 billion for 2010 YTDNov/2007). • Licensing deals down too, as are M&A deals (302 agreements in 2010 (11 YTD) vs 540 in 2007, and M&A 29 deals vs 55 during the fire sales in 2008). • Significant cost to going public. • Costs of operation are very high.

ZSX Medical Financing Questions Going Public: • Public offerings getting better, but still uncertain: • Levels in 2010 about half that prior to crisis in 2007 ($1. 2 billion versus $2. 9 billion). • Early stage financing also off ($4. 8 billion/$6. 8 billion for 2010 YTDNov/2007). • Licensing deals down too, as are M&A deals (302 agreements in 2010 (11 YTD) vs 540 in 2007, and M&A 29 deals vs 55 during the fire sales in 2008). • Significant cost to going public. • Costs of operation are very high.

ZSX Medical Financing Questions Letting Group Source Funds: • Costly, but will allow you to focus on technology Licensing: • Will be competing with Pharma. Some mergers, e. g. , Merck. Schering, are resulting in the shedding of many programs. • Niche play (seek expansion or broadening of technology) • Fear of change in landscape

ZSX Medical Financing Questions Letting Group Source Funds: • Costly, but will allow you to focus on technology Licensing: • Will be competing with Pharma. Some mergers, e. g. , Merck. Schering, are resulting in the shedding of many programs. • Niche play (seek expansion or broadening of technology) • Fear of change in landscape

ZSX Medical Financing Questions Codevelopment: • Seek companies in OB/Gyn space • Don’t focus on their present products; consider their sales force (pharma company may have better access to OB/Gyn physicians than device/supplies company) • Consider foreign markets and offering preferred licensing terms for co-development • Consider services companies

ZSX Medical Financing Questions Codevelopment: • Seek companies in OB/Gyn space • Don’t focus on their present products; consider their sales force (pharma company may have better access to OB/Gyn physicians than device/supplies company) • Consider foreign markets and offering preferred licensing terms for co-development • Consider services companies

ZSX Medical Financing Questions Given the “total” amount of money ZSX needs to reach FDA clearance, Should they: 1. Seek the money as proposed ($1. 35 MM, then $6 MM)? 2. Seek a single raise of $7. 5 MM? 3. Seek two raises differently divided?

ZSX Medical Financing Questions Given the “total” amount of money ZSX needs to reach FDA clearance, Should they: 1. Seek the money as proposed ($1. 35 MM, then $6 MM)? 2. Seek a single raise of $7. 5 MM? 3. Seek two raises differently divided?