Zarika Alexandra, the 4 th full time student of the faculty of Public Administration of the National Research University – Higher School of Economics PUBLIC FINANCE

Zarika Alexandra, the 4 th full time student of the faculty of Public Administration of the National Research University – Higher School of Economics PUBLIC FINANCE

Plan. 1. The essence of public finance. 2. The functions of public finance. 3. Government expenditures. 4. The distribution of government expenditure. 5. Government revenue.

Plan. 1. The essence of public finance. 2. The functions of public finance. 3. Government expenditures. 4. The distribution of government expenditure. 5. Government revenue.

Public finance. A set of economic relations, the education system and the distribution of funds necessary to maintain its State bodies and perform its functions.

Public finance. A set of economic relations, the education system and the distribution of funds necessary to maintain its State bodies and perform its functions.

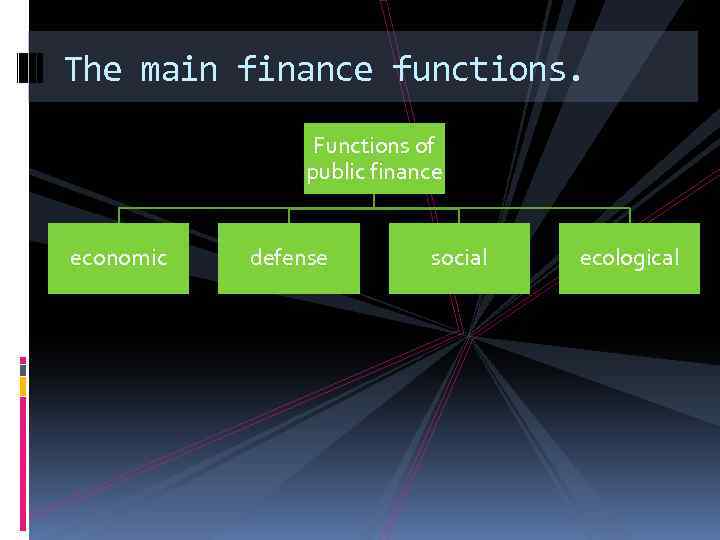

The main finance functions. Functions of public finance economic defense social ecological

The main finance functions. Functions of public finance economic defense social ecological

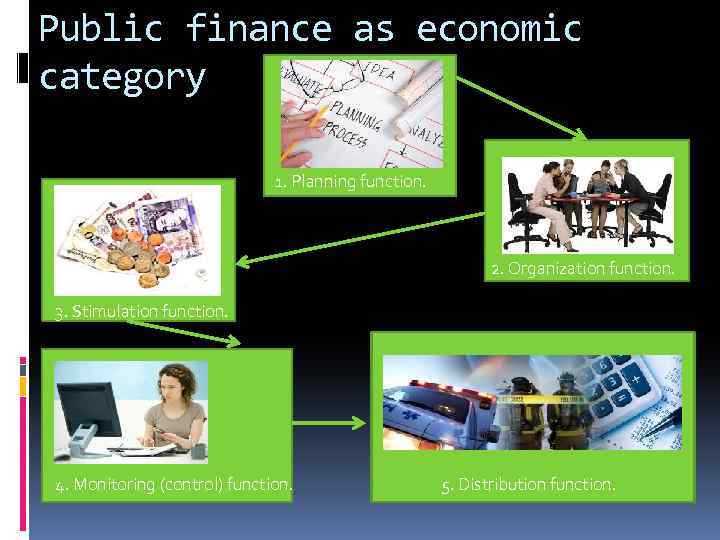

Public finance as economic category 1. Planning function. 2. Organization function. 3. Stimulation function. 4. Monitoring (control) function. 5. Distribution function.

Public finance as economic category 1. Planning function. 2. Organization function. 3. Stimulation function. 4. Monitoring (control) function. 5. Distribution function.

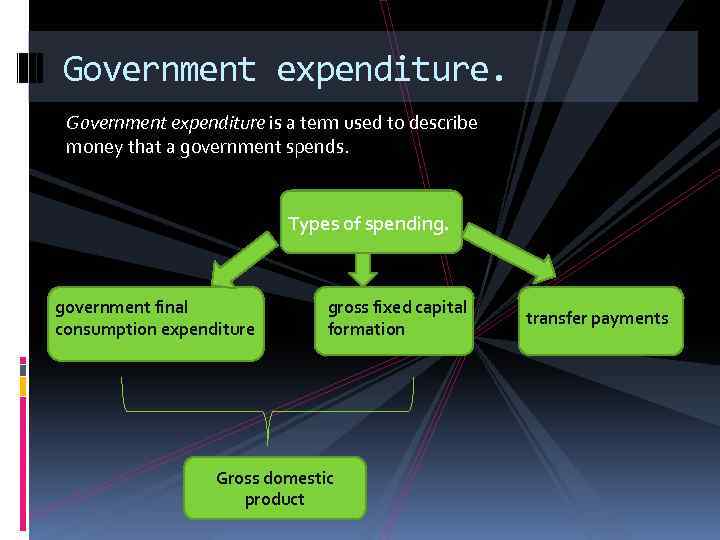

Government expenditure is a term used to describe money that a government spends. Types of spending. government final consumption expenditure gross fixed capital formation Gross domestic product transfer payments

Government expenditure is a term used to describe money that a government spends. Types of spending. government final consumption expenditure gross fixed capital formation Gross domestic product transfer payments

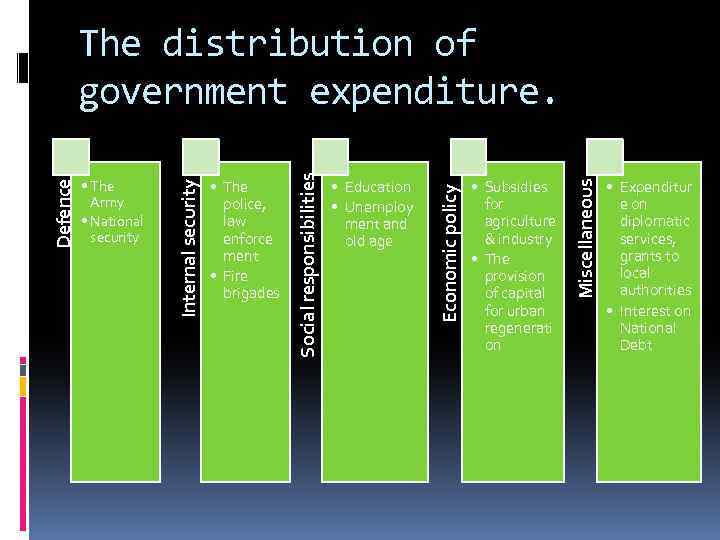

• Subsidies for agriculture & industry • The provision of capital for urban regenerati on Miscellaneous • Education • Unemploy ment and old age Economic policy • The police, law enforce ment • Fire brigades Social responsibilities • The Army • National security Internal security Defence The distribution of government expenditure. • Expenditur e on diplomatic services, grants to local authorities • Interest on National Debt

• Subsidies for agriculture & industry • The provision of capital for urban regenerati on Miscellaneous • Education • Unemploy ment and old age Economic policy • The police, law enforce ment • Fire brigades Social responsibilities • The Army • National security Internal security Defence The distribution of government expenditure. • Expenditur e on diplomatic services, grants to local authorities • Interest on National Debt

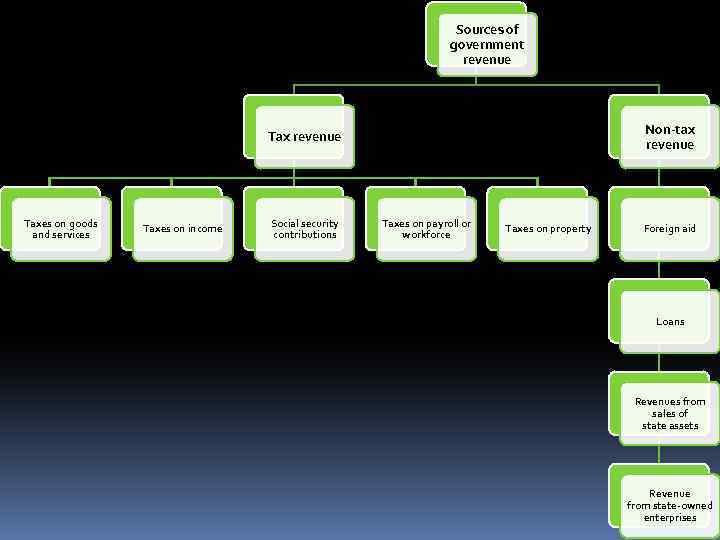

Government revenue. Governments acquire the resources to finance their expenditures through a number of different methods.

Government revenue. Governments acquire the resources to finance their expenditures through a number of different methods.

Sources of government revenue Non-tax revenue Taxes on goods and services Taxes on income Social security contributions Taxes on payroll or workforce Taxes on property Foreign aid Loans Revenues from sales of state assets Revenue from state-owned enterprises

Sources of government revenue Non-tax revenue Taxes on goods and services Taxes on income Social security contributions Taxes on payroll or workforce Taxes on property Foreign aid Loans Revenues from sales of state assets Revenue from state-owned enterprises