03d171b63e22df11706129794a9ee708.ppt

- Количество слайдов: 17

Y On to 2016 -2017… Main Street “Bailout” of Wall Street February 29, 2016 Dennis P. Yeskey Managing Partner/Founder dennis@yeskeyrealestate. com 203 -832 -7197 “Keeping Clients & Investors Ahead of the Market”

Outline • Predictions • Product Life Cycle • Macro Actions; 2015 -2016 • Top Issues; 2015 & 2016 • Some Interesting Exhibits www. yeskeyrealestate. com

Source: Townhall. com, Glenn Mc. Coy 3

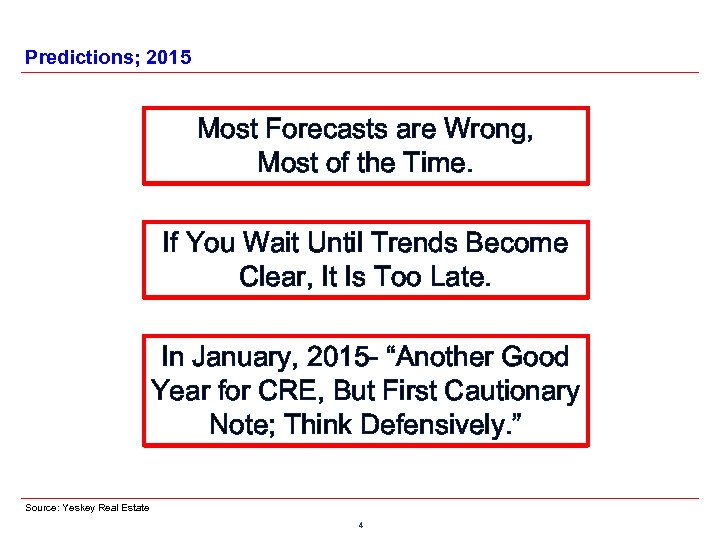

Predictions; 2015 Most Forecasts are Wrong, Most of the Time. If You Wait Until Trends Become Clear, It Is Too Late. In January, 2015 - “Another Good Year for CRE, But First Cautionary Note; Think Defensively. ” Source: Yeskey Real Estate 4

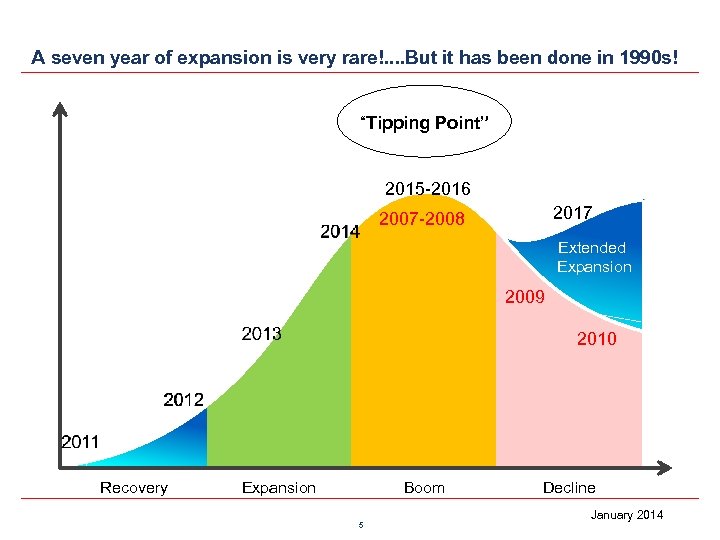

A seven year of expansion is very rare!. . But it has been done in 1990 s! “Tipping Point” 2015 -2016 2017 2007 -2008 Extended Expansion 2009 2010 Recovery Expansion Boom 5 Decline January 2014

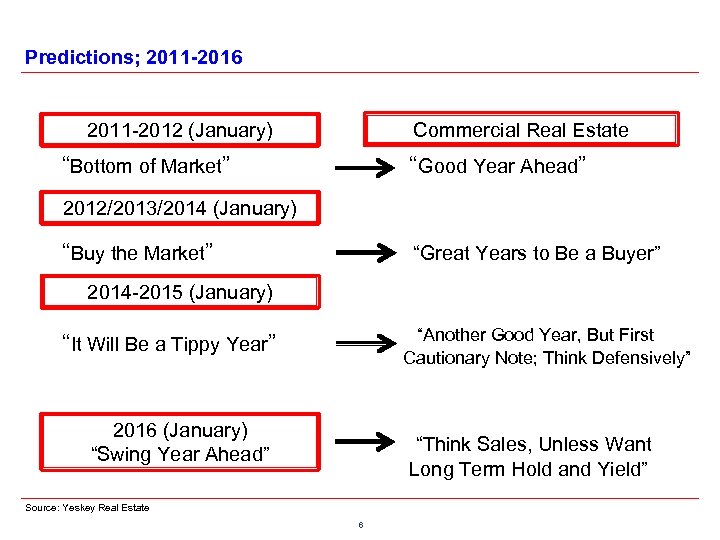

Predictions; 2011 -2016 Commercial Real Estate 2011 -2012 (January) “Bottom of Market” “Good Year Ahead” 2012/2013/2014 (January) “Buy the Market” “Great Years to Be a Buyer” 2014 -2015 (January) “Another Good Year, But First Cautionary Note; Think Defensively” “It Will Be a Tippy Year” 2016 (January) “Swing Year Ahead” “Think Sales, Unless Want Long Term Hold and Yield” Source: Yeskey Real Estate 6

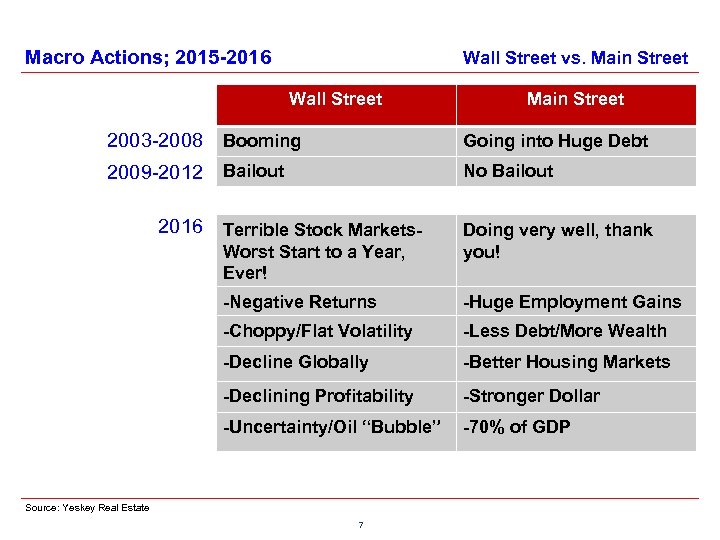

Macro Actions; 2015 -2016 Wall Street vs. Main Street Wall Street Main Street 2003 -2008 Booming Going into Huge Debt 2009 -2012 Bailout No Bailout Terrible Stock Markets. Worst Start to a Year, Ever! Doing very well, thank you! -Negative Returns -Huge Employment Gains -Choppy/Flat Volatility -Less Debt/More Wealth -Decline Globally -Better Housing Markets -Declining Profitability -Stronger Dollar -Uncertainty/Oil “Bubble” -70% of GDP 2016 Source: Yeskey Real Estate 7

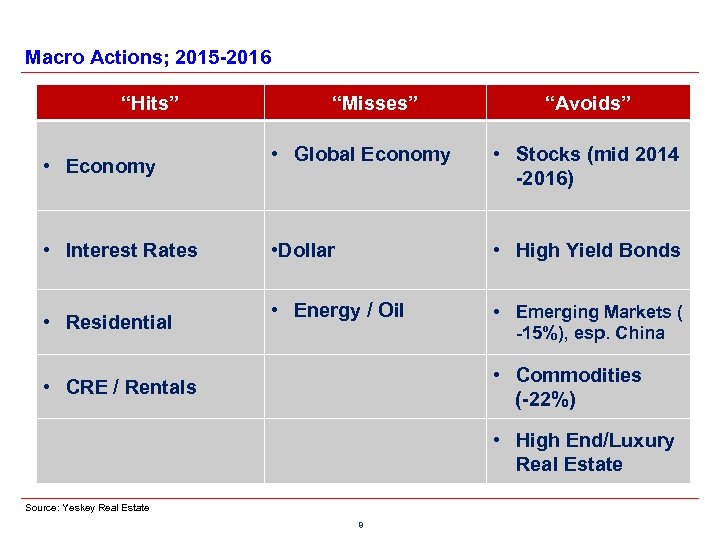

Macro Actions; 2015 -2016 “Hits” • Economy • Interest Rates • Residential “Misses” “Avoids” • Global Economy • Stocks (mid 2014 -2016) • Dollar • High Yield Bonds • Energy / Oil • Emerging Markets ( -15%), esp. China • Commodities (-22%) • CRE / Rentals • High End/Luxury Real Estate Source: Yeskey Real Estate 8

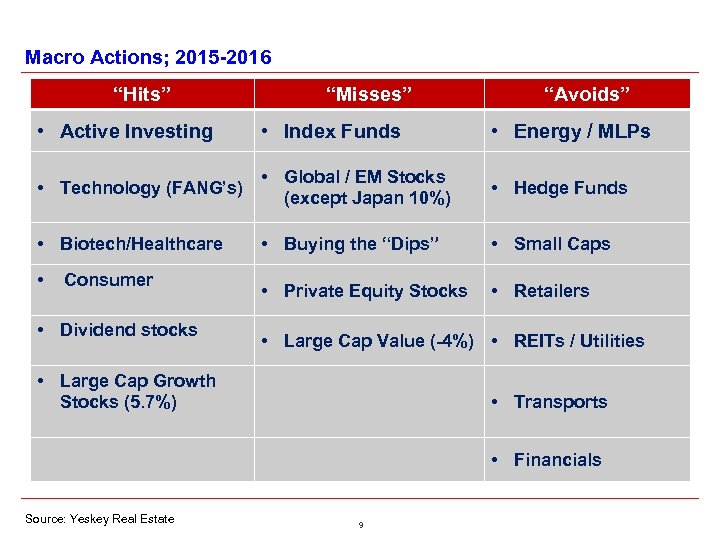

Macro Actions; 2015 -2016 “Hits” “Misses” “Avoids” • Active Investing • Index Funds • Energy / MLPs • Technology (FANG’s) • Global / EM Stocks (except Japan 10%) • Hedge Funds • Biotech/Healthcare • Buying the “Dips” • Small Caps • Private Equity Stocks • Retailers • Consumer • Dividend stocks • Large Cap Value (-4%) • REITs / Utilities • Large Cap Growth Stocks (5. 7%) • Transports • Financials Source: Yeskey Real Estate 9

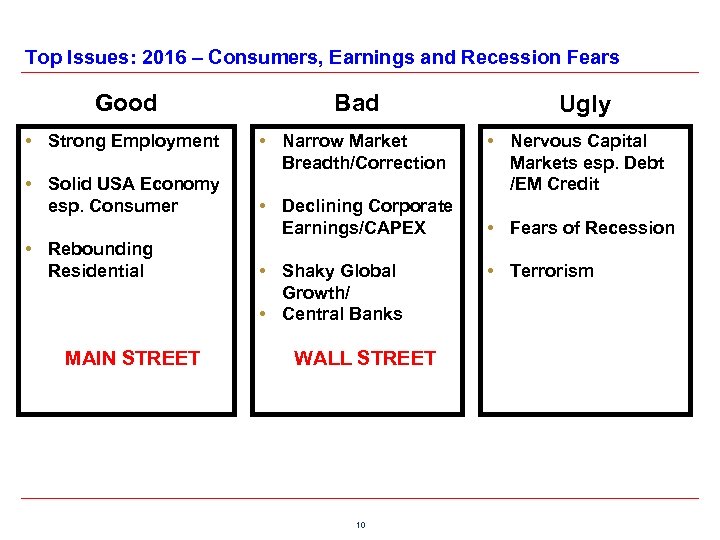

Top Issues: 2016 – Consumers, Earnings and Recession Fears Good Bad • Strong Employment • Narrow Market Breadth/Correction • Solid USA Economy esp. Consumer • Rebounding Residential MAIN STREET • Declining Corporate Earnings/CAPEX • Shaky Global Growth/ • Central Banks WALL STREET 10 Ugly • Nervous Capital Markets esp. Debt /EM Credit • Fears of Recession • Terrorism

Summary - Top Ten Issues 2016 1. Domestic Economy- Continued Growth? 2. Global Economy- Return to Growth? 3. Global Capital Flows- More Trade and Transparency 4. Capital Markets (USA)- Reactions to “Bear” Stock/Bond Markets? 5. Capital Flows Into Alternatives- Continuation of Abundant Flows? ______________________________ 6. CRE Arena – Pre-Bust or Continued Growth? 7. CRE Fundamentals- Demand Continues to Grow? 8. Government Intervention- Are Regulations “Watered Down? ” 9. Tax Reform- Any Changes Coming Due to Elections? 10. CRE Debt/Equity- Do Good Times Continue? 11

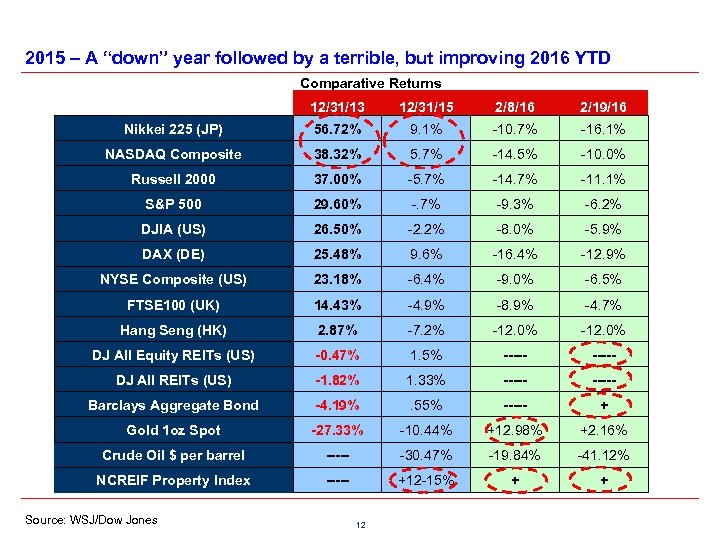

2015 – A “down” year followed by a terrible, but improving 2016 YTD Comparative Returns 12/31/13 12/31/15 2/8/16 2/19/16 Nikkei 225 (JP) 56. 72% 9. 1% -10. 7% -16. 1% NASDAQ Composite 38. 32% 5. 7% -14. 5% -10. 0% Russell 2000 37. 00% -5. 7% -14. 7% -11. 1% S&P 500 29. 60% -. 7% -9. 3% -6. 2% DJIA (US) 26. 50% -2. 2% -8. 0% -5. 9% DAX (DE) 25. 48% 9. 6% -16. 4% -12. 9% NYSE Composite (US) 23. 18% -6. 4% -9. 0% -6. 5% FTSE 100 (UK) 14. 43% -4. 9% -8. 9% -4. 7% Hang Seng (HK) 2. 87% -7. 2% -12. 0% DJ All Equity REITs (US) -0. 47% 1. 5% ----- DJ All REITs (US) -1. 82% 1. 33% ----- Barclays Aggregate Bond -4. 19% . 55% ----- + Gold 1 oz Spot -27. 33% -10. 44% +12. 98% +2. 16% Crude Oil $ per barrel ----- -30. 47% -19. 84% -41. 12% NCREIF Property Index ----- +12 -15% + + Source: WSJ/Dow Jones 12

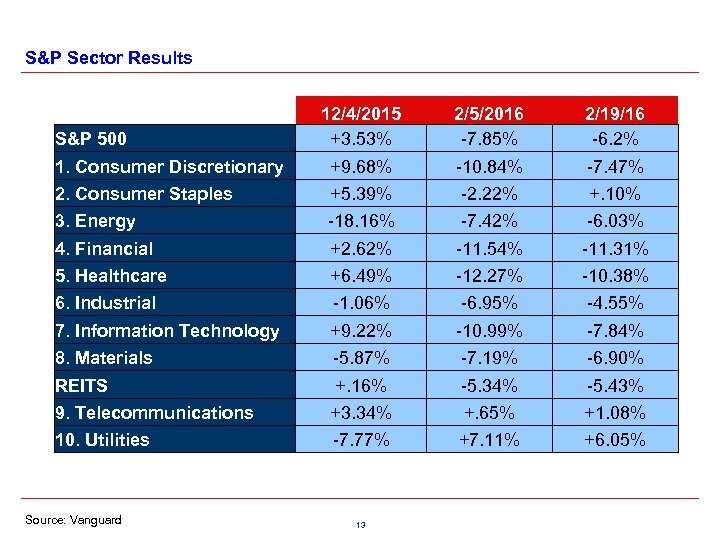

S&P Sector Results S&P 500 12/4/2015 +3. 53% 2/5/2016 -7. 85% 2/19/16 -6. 2% 1. Consumer Discretionary +9. 68% -10. 84% -7. 47% 2. Consumer Staples +5. 39% -2. 22% +. 10% 3. Energy -18. 16% -7. 42% -6. 03% 4. Financial +2. 62% -11. 54% -11. 31% 5. Healthcare +6. 49% -12. 27% -10. 38% 6. Industrial -1. 06% -6. 95% -4. 55% 7. Information Technology +9. 22% -10. 99% -7. 84% 8. Materials -5. 87% -7. 19% -6. 90% REITS +. 16% -5. 34% -5. 43% 9. Telecommunications +3. 34% +. 65% +1. 08% 10. Utilities -7. 77% +7. 11% +6. 05% Source: Vanguard 13

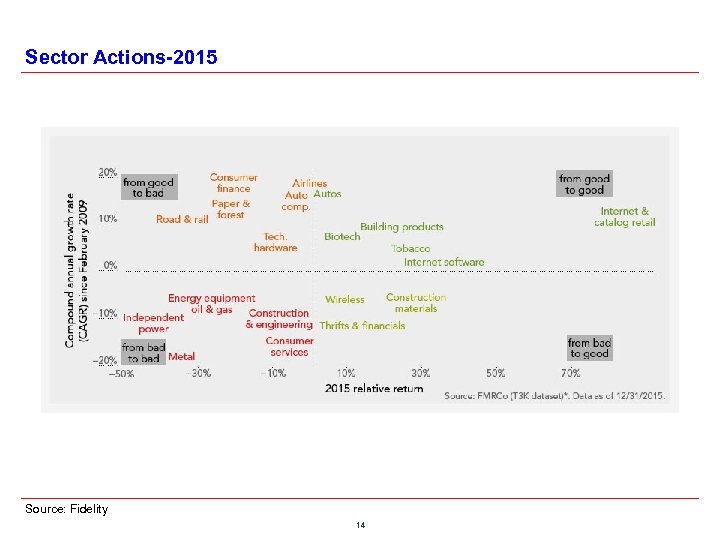

Sector Actions-2015 Source: Fidelity 14

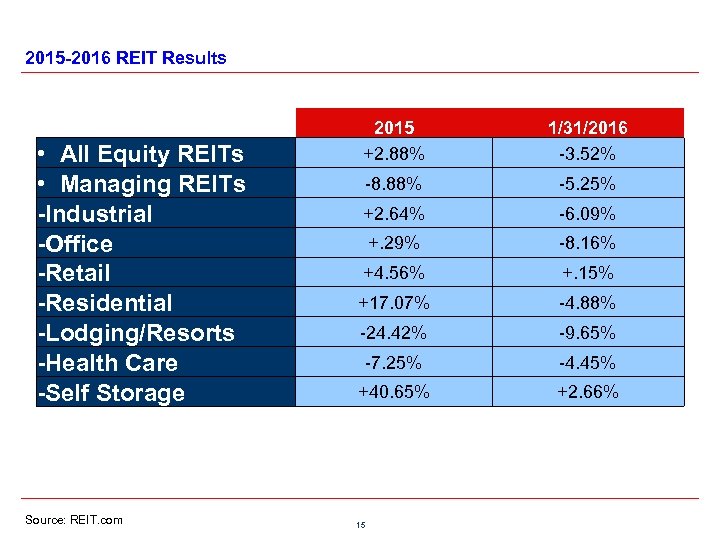

2015 -2016 REIT Results • All Equity REITs • Managing REITs -Industrial -Office -Retail -Residential -Lodging/Resorts -Health Care -Self Storage Source: REIT. com 2015 +2. 88% 1/31/2016 -3. 52% -8. 88% -5. 25% +2. 64% -6. 09% +. 29% -8. 16% +4. 56% +. 15% +17. 07% -4. 88% -24. 42% -9. 65% -7. 25% -4. 45% +40. 65% +2. 66% 15

Y Yeskey Real Estate Consulting and Investments www. Yeskey. Real. Estate. com 16

Dennis P. Yeskey Consulting (Yc) and Investments (Yi) Mr. Yeskey is the Founder and Managing Partner for two firms: Yeskey Consulting (Yc) and Yeskey Investments (Yi). Yc is a unique company formed 6 years ago after Dennis’s retirement from Deloitte as the Senior National Partner in charge of Real Estate Capital Markets, and after over 40 years in the business world. Yc accepts a limited number of consulting and research assignments which are mostly focused on developing new business strategies, debt restructurings and operational improvements. Mr. Yeskey is also the Managing Partner of Yi which involves managing a family office and a series of private investments, along with developing new research boutique operation. He is well known for his re-structuring skills. While at Deloitte, Mr. Yeskey was recognized as the senior leader of Deloitte’s Real Estate, Financial Services and Capital Markets Practices both domestically and globally. Initially, recruited by Deloitte’s Chairman to head the NYC office’s real estate services practice, he successfully restructured the practice and achieved annual growth exceeding 25% with a staff of over 250 professionals. Promoted to the Group Managing Partner at Deloitte, he led a practice of over 1000 professionals focused on the real estate, investment management, private equity, hedge fund and insurance industries. He served on the New York Executive Committee, the firm’s National and Global Financial Services Practices and directed the financial services marketing and eminence building activities. Before joining Deloitte, he was a partner and practice leader at Kenneth Leventhal and Co. from 1987 -1995 where he initiated a new practice focused on institutional real estate, specifically, insurance based real estate. He is a long time member and Governor of ULI, as well as being very active on the Real Estate Round Table. He is a frequent speaker at numerous real estate industry events and author of industry publications. He received his MBA from Columbia University Business School along with an MS and BS from the Swanson School of Engineering at the University of Pittsburgh. www. yeskeyrealestate. com 17

03d171b63e22df11706129794a9ee708.ppt