f77f1da1f183026a96f58e350b1e3c16.ppt

- Количество слайдов: 35

XI. Open economy in Keynesian models

XI. Open economy in Keynesian models

Reminder- Lecture III • Definitions: floating and fixed Ex. R • Asset approach to Ex. R determination • Monetary approach and purchasing power parity • Real Ex. R and price level

Reminder- Lecture III • Definitions: floating and fixed Ex. R • Asset approach to Ex. R determination • Monetary approach and purchasing power parity • Real Ex. R and price level

Rationale for this Lecture • Important component of macroeconomic policy: aggregate demand management • Previous semester: model of closed economy mainly, factors influencing – Household consumption (C) – Private investment (I) – Policy tools: government expenditures (G) or taxes (T) • This semester: open economy models, i. e. what are the factors influencing exports and imports – The role of nominal and (especially) real Ex. R

Rationale for this Lecture • Important component of macroeconomic policy: aggregate demand management • Previous semester: model of closed economy mainly, factors influencing – Household consumption (C) – Private investment (I) – Policy tools: government expenditures (G) or taxes (T) • This semester: open economy models, i. e. what are the factors influencing exports and imports – The role of nominal and (especially) real Ex. R

XI. 1 Money and the exchange rate • Equilibrium on forex market determined by: – Domestic and foreign interest rate – Expectations about future Ex. R • Interest rates determined on money markets → link between money markets and forex market • Expectations: may be considered as covering all other aspects, namely short run risk perception

XI. 1 Money and the exchange rate • Equilibrium on forex market determined by: – Domestic and foreign interest rate – Expectations about future Ex. R • Interest rates determined on money markets → link between money markets and forex market • Expectations: may be considered as covering all other aspects, namely short run risk perception

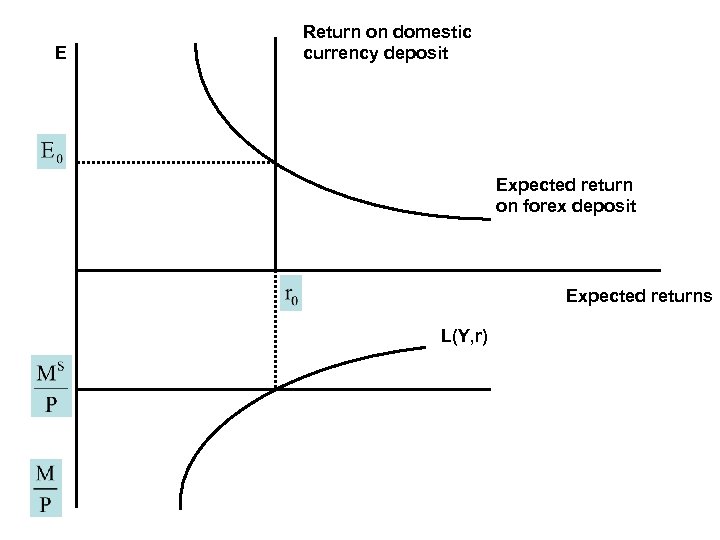

XI. 1. 1 Short term • Price is fixed, conceptually imagine, e. g. , ISLM framework • Demand for money depends on real income and interest rate, L(Y, r) – Keynesian demand for money • Supply of money determined by central authorities • This applies both for domestic and foreign market • Graphical explanation – next slide

XI. 1. 1 Short term • Price is fixed, conceptually imagine, e. g. , ISLM framework • Demand for money depends on real income and interest rate, L(Y, r) – Keynesian demand for money • Supply of money determined by central authorities • This applies both for domestic and foreign market • Graphical explanation – next slide

E Return on domestic currency deposit Expected return on forex deposit Expected returns L(Y, r)

E Return on domestic currency deposit Expected return on forex deposit Expected returns L(Y, r)

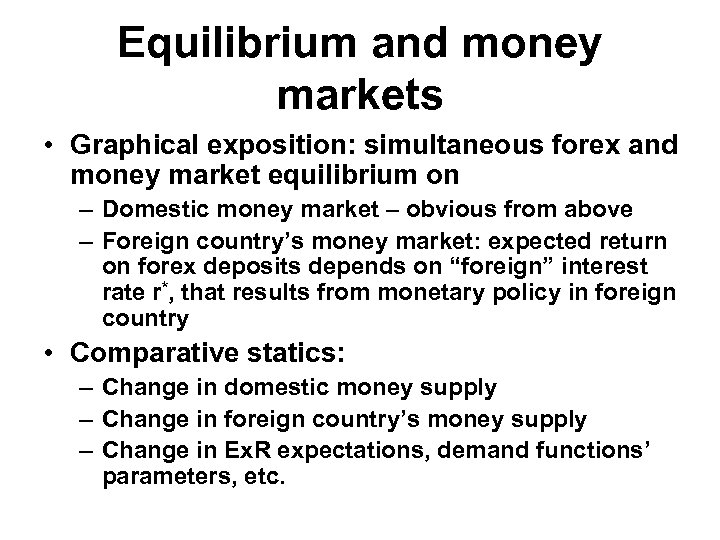

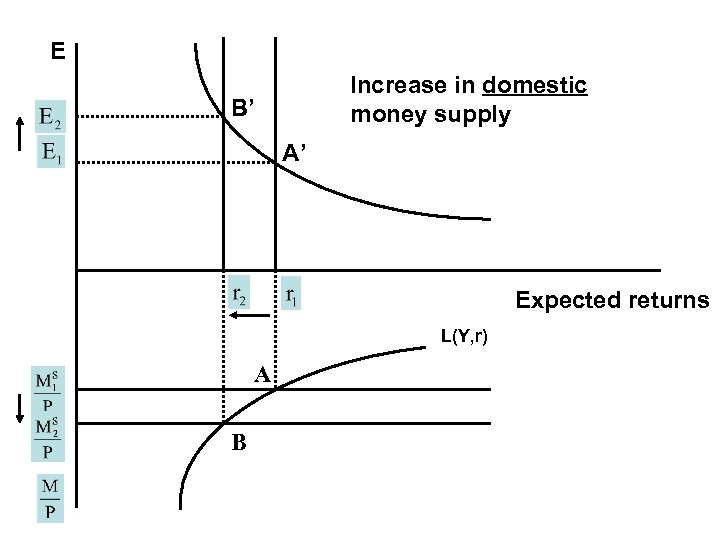

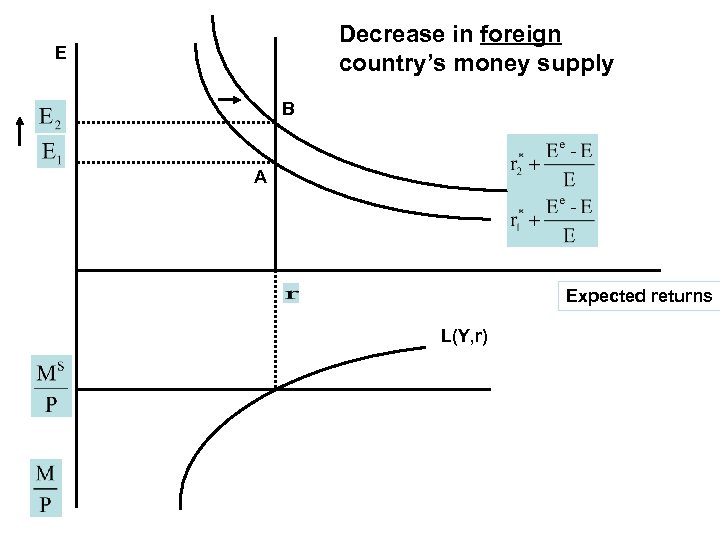

Equilibrium and money markets • Graphical exposition: simultaneous forex and money market equilibrium on – Domestic money market – obvious from above – Foreign country’s money market: expected return on forex deposits depends on “foreign” interest rate r*, that results from monetary policy in foreign country • Comparative statics: – Change in domestic money supply – Change in foreign country’s money supply – Change in Ex. R expectations, demand functions’ parameters, etc.

Equilibrium and money markets • Graphical exposition: simultaneous forex and money market equilibrium on – Domestic money market – obvious from above – Foreign country’s money market: expected return on forex deposits depends on “foreign” interest rate r*, that results from monetary policy in foreign country • Comparative statics: – Change in domestic money supply – Change in foreign country’s money supply – Change in Ex. R expectations, demand functions’ parameters, etc.

E Increase in domestic money supply B’ A’ Expected returns L(Y, r) A B

E Increase in domestic money supply B’ A’ Expected returns L(Y, r) A B

Decrease in foreign country’s money supply E B A Expected returns L(Y, r)

Decrease in foreign country’s money supply E B A Expected returns L(Y, r)

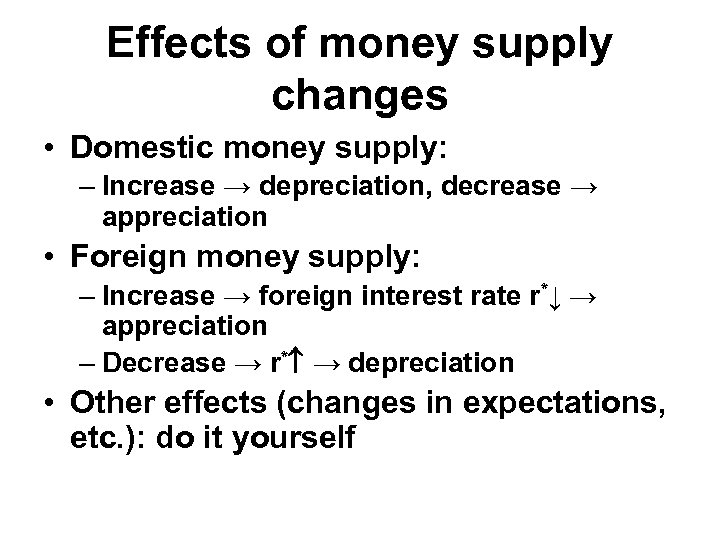

Effects of money supply changes • Domestic money supply: – Increase → depreciation, decrease → appreciation • Foreign money supply: – Increase → foreign interest rate r*↓ → appreciation – Decrease → r* → depreciation • Other effects (changes in expectations, etc. ): do it yourself

Effects of money supply changes • Domestic money supply: – Increase → depreciation, decrease → appreciation • Foreign money supply: – Increase → foreign interest rate r*↓ → appreciation – Decrease → r* → depreciation • Other effects (changes in expectations, etc. ): do it yourself

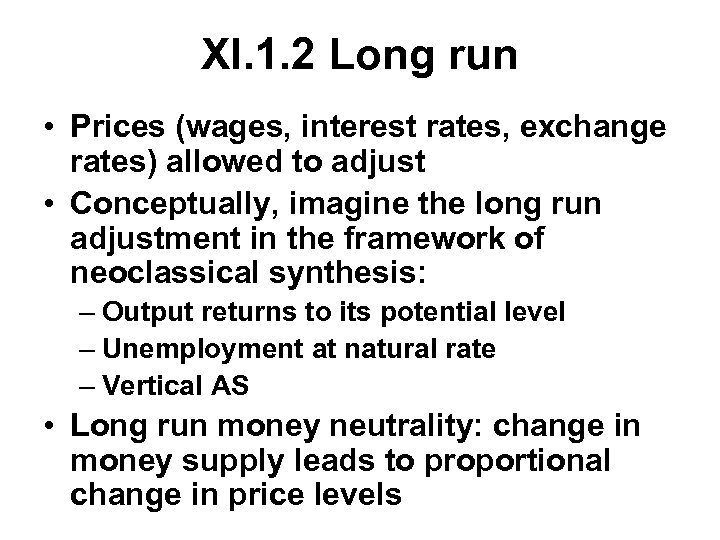

XI. 1. 2 Long run • Prices (wages, interest rates, exchange rates) allowed to adjust • Conceptually, imagine the long run adjustment in the framework of neoclassical synthesis: – Output returns to its potential level – Unemployment at natural rate – Vertical AS • Long run money neutrality: change in money supply leads to proportional change in price levels

XI. 1. 2 Long run • Prices (wages, interest rates, exchange rates) allowed to adjust • Conceptually, imagine the long run adjustment in the framework of neoclassical synthesis: – Output returns to its potential level – Unemployment at natural rate – Vertical AS • Long run money neutrality: change in money supply leads to proportional change in price levels

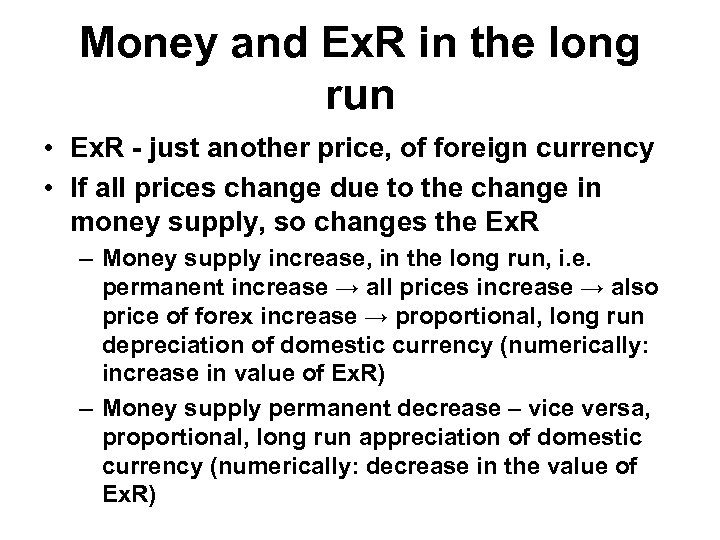

Money and Ex. R in the long run • Ex. R - just another price, of foreign currency • If all prices change due to the change in money supply, so changes the Ex. R – Money supply increase, in the long run, i. e. permanent increase → all prices increase → also price of forex increase → proportional, long run depreciation of domestic currency (numerically: increase in value of Ex. R) – Money supply permanent decrease – vice versa, proportional, long run appreciation of domestic currency (numerically: decrease in the value of Ex. R)

Money and Ex. R in the long run • Ex. R - just another price, of foreign currency • If all prices change due to the change in money supply, so changes the Ex. R – Money supply increase, in the long run, i. e. permanent increase → all prices increase → also price of forex increase → proportional, long run depreciation of domestic currency (numerically: increase in value of Ex. R) – Money supply permanent decrease – vice versa, proportional, long run appreciation of domestic currency (numerically: decrease in the value of Ex. R)

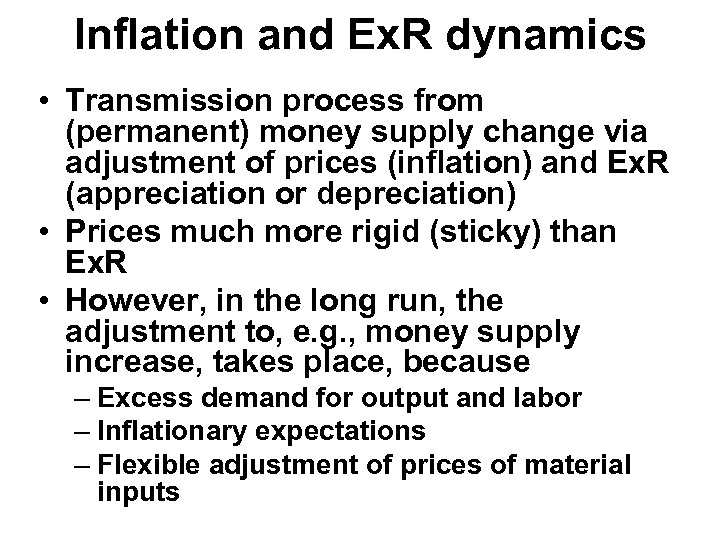

Inflation and Ex. R dynamics • Transmission process from (permanent) money supply change via adjustment of prices (inflation) and Ex. R (appreciation or depreciation) • Prices much more rigid (sticky) than Ex. R • However, in the long run, the adjustment to, e. g. , money supply increase, takes place, because – Excess demand for output and labor – Inflationary expectations – Flexible adjustment of prices of material inputs

Inflation and Ex. R dynamics • Transmission process from (permanent) money supply change via adjustment of prices (inflation) and Ex. R (appreciation or depreciation) • Prices much more rigid (sticky) than Ex. R • However, in the long run, the adjustment to, e. g. , money supply increase, takes place, because – Excess demand for output and labor – Inflationary expectations – Flexible adjustment of prices of material inputs

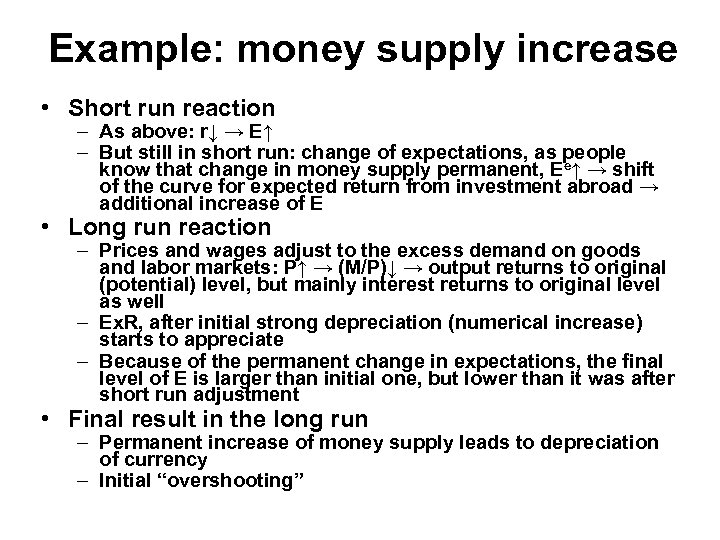

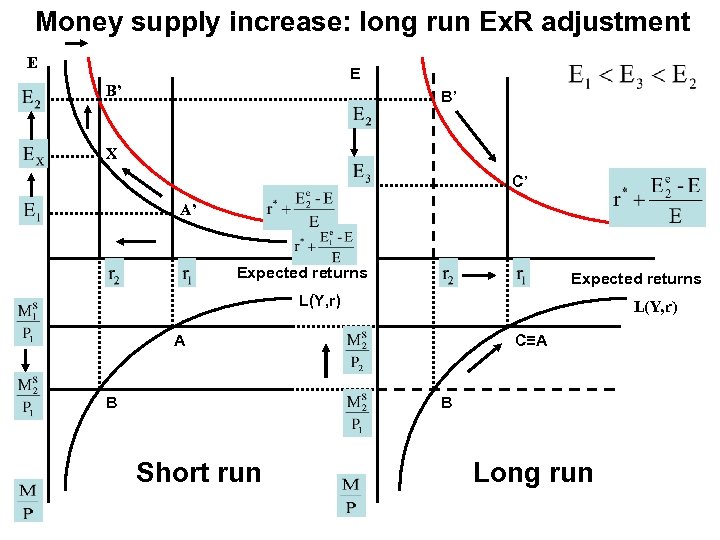

Example: money supply increase • Short run reaction – As above: r↓ → E↑ – But still in short run: change of expectations, as people know that change in money supply permanent, Ee↑ → shift of the curve for expected return from investment abroad → additional increase of E • Long run reaction – Prices and wages adjust to the excess demand on goods and labor markets: P↑ → (M/P)↓ → output returns to original (potential) level, but mainly interest returns to original level as well – Ex. R, after initial strong depreciation (numerical increase) starts to appreciate – Because of the permanent change in expectations, the final level of E is larger than initial one, but lower than it was after short run adjustment • Final result in the long run – Permanent increase of money supply leads to depreciation of currency – Initial “overshooting”

Example: money supply increase • Short run reaction – As above: r↓ → E↑ – But still in short run: change of expectations, as people know that change in money supply permanent, Ee↑ → shift of the curve for expected return from investment abroad → additional increase of E • Long run reaction – Prices and wages adjust to the excess demand on goods and labor markets: P↑ → (M/P)↓ → output returns to original (potential) level, but mainly interest returns to original level as well – Ex. R, after initial strong depreciation (numerical increase) starts to appreciate – Because of the permanent change in expectations, the final level of E is larger than initial one, but lower than it was after short run adjustment • Final result in the long run – Permanent increase of money supply leads to depreciation of currency – Initial “overshooting”

Money supply increase: long run Ex. R adjustment E E B’ B’ X C’ A’ Expected returns L(Y, r) A B C≡A B Short run Long run

Money supply increase: long run Ex. R adjustment E E B’ B’ X C’ A’ Expected returns L(Y, r) A B C≡A B Short run Long run

Exchange Rate Overshooting Different dynamics of different variables • Money supply: one time jump • Interest rate: immediate adjustment (decrease), then gradual return to original level • Price: no immediate reaction, then gradual increase • Ex. R: immediate sharp depreciation (overshooting), then gradual appreciation, the final outcome – depreciation compared to original level, but less than immediate reaction

Exchange Rate Overshooting Different dynamics of different variables • Money supply: one time jump • Interest rate: immediate adjustment (decrease), then gradual return to original level • Price: no immediate reaction, then gradual increase • Ex. R: immediate sharp depreciation (overshooting), then gradual appreciation, the final outcome – depreciation compared to original level, but less than immediate reaction

XI. 2 Real Exchange Rate

XI. 2 Real Exchange Rate

XI. 2. 1 Reminder – Lecture III next 4 slides review relative Ex. R

XI. 2. 1 Reminder – Lecture III next 4 slides review relative Ex. R

Relative prices of goods • Nominal Ex. R: relative price of two currencies, its level on the forex market • International trade: people make decisions, comparing relative prices of comparable goods, that can be purchased either on domestic market or in a foreign country, provided that prices are allowed to adjust • Problem on macroeconomic level, when comparing two countries: each country has different basket of commodities that are purchased • Back to starting example: suppose that CZ and D produce only Octavias and Passats

Relative prices of goods • Nominal Ex. R: relative price of two currencies, its level on the forex market • International trade: people make decisions, comparing relative prices of comparable goods, that can be purchased either on domestic market or in a foreign country, provided that prices are allowed to adjust • Problem on macroeconomic level, when comparing two countries: each country has different basket of commodities that are purchased • Back to starting example: suppose that CZ and D produce only Octavias and Passats

Octavia vs. Passat Again • Price of foreign goods in terms of domestic goods, how to construct? • Example (nom. ex. rate 1 € = 24 CZK): • CZ Octavia 552, 000 CZK • D Passat 25, 000 € • Price of Passat in terms of Octavia? – Price of Passat in CZK: 25, 000 x 24=600, 000 CZK – In terms of 1 Octavia: 600, 000/552, 000=1. 09 – “Real ex. rate” between Passat and Octavia: 1 P =1. 09 O, or, 1 O = 0. 917 P

Octavia vs. Passat Again • Price of foreign goods in terms of domestic goods, how to construct? • Example (nom. ex. rate 1 € = 24 CZK): • CZ Octavia 552, 000 CZK • D Passat 25, 000 € • Price of Passat in terms of Octavia? – Price of Passat in CZK: 25, 000 x 24=600, 000 CZK – In terms of 1 Octavia: 600, 000/552, 000=1. 09 – “Real ex. rate” between Passat and Octavia: 1 P =1. 09 O, or, 1 O = 0. 917 P

Real Ex. R - Definition • Generalization to the economy-wide level – Problem of “comparable good”: price over standard (reference, typically purchased) basket of purchases in both countries in a given period of time (e. g. a week, months, year, etc. ) – Important: when constructing price indexes, relatively larger weight on commodities, produced (and consumed) domestically • Formally (see example on Octavia and Passat above): e=(E. P*)/P – Direct quotation again: price (expressed in domestic currency) of a reference basket (considered as one unit) in a foreign country relative to the reference basket in domestic country (again considered as one unit) • Real appreciation, e decreases • Real depreciation, e increases

Real Ex. R - Definition • Generalization to the economy-wide level – Problem of “comparable good”: price over standard (reference, typically purchased) basket of purchases in both countries in a given period of time (e. g. a week, months, year, etc. ) – Important: when constructing price indexes, relatively larger weight on commodities, produced (and consumed) domestically • Formally (see example on Octavia and Passat above): e=(E. P*)/P – Direct quotation again: price (expressed in domestic currency) of a reference basket (considered as one unit) in a foreign country relative to the reference basket in domestic country (again considered as one unit) • Real appreciation, e decreases • Real depreciation, e increases

Real exchange rate and price level (1) • Alternative interpretation: e = E. (P*/P) - ratio of foreign and domestic price levels, when both expressed in domestic currency – Real Ex. R evaluates the purchasing power of domestic currency over foreign goods • If e < 1, then foreign price level relatively lower than domestic one, domestic goods relatively more expensive, so less competitive • if e > 1, then foreign price level relatively higher than domestic one, domestic goods relatively cheaper, so more competitive • Real depreciation: fall of purchasing power of domestic currency over the goods in foreign country • Real appreciation: increase of purchasing power over foreign goods

Real exchange rate and price level (1) • Alternative interpretation: e = E. (P*/P) - ratio of foreign and domestic price levels, when both expressed in domestic currency – Real Ex. R evaluates the purchasing power of domestic currency over foreign goods • If e < 1, then foreign price level relatively lower than domestic one, domestic goods relatively more expensive, so less competitive • if e > 1, then foreign price level relatively higher than domestic one, domestic goods relatively cheaper, so more competitive • Real depreciation: fall of purchasing power of domestic currency over the goods in foreign country • Real appreciation: increase of purchasing power over foreign goods

XI. 2. 2 Long –Run Real Ex. R, relative demand supply

XI. 2. 2 Long –Run Real Ex. R, relative demand supply

Long-Run Equilibrium (1) • Real Ex. R – relative price, i. e. determined by supply and demand conditions, but both in domestic and foreign country • Many factors influence domestic/foreign demands and supply, two of them decisive: – Relative demand for domestic output – Relative output supply • Long-run: prices clear the markets • In the same logic: definition of long-run real Ex. R – e is relative price, depends on long-run settlement of relative (domestic vs. foreign) demand supply

Long-Run Equilibrium (1) • Real Ex. R – relative price, i. e. determined by supply and demand conditions, but both in domestic and foreign country • Many factors influence domestic/foreign demands and supply, two of them decisive: – Relative demand for domestic output – Relative output supply • Long-run: prices clear the markets • In the same logic: definition of long-run real Ex. R – e is relative price, depends on long-run settlement of relative (domestic vs. foreign) demand supply

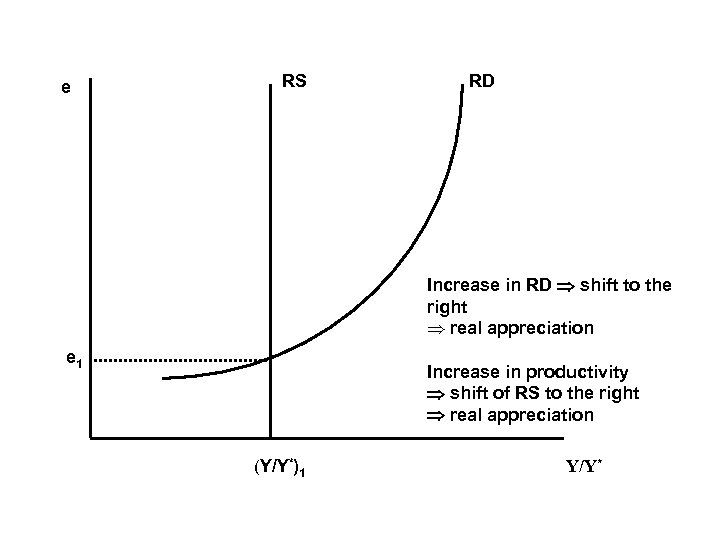

Long-run real Ex. R equilibirum • Real Ex. R e – relative price • Long-run equilibrium: how long term settlement of relative demands and supplies (i. e. ratio of demand for domestic output to foreign output, respectively, ratio of supply of domestic output to foreign output) determines real Ex. R • Useful graphical representation (see Krugman, Obstfeld, Ch. 15): relation between ratio Y/Y* and e – If Y/Y* is ratio of demands for domestic and foreign output, then there is a positive correlation: if e rises, demand for domestic products rises (it is cheaper), i. e. ratio Y/Y* rises (and vice versa) – If Y/Y* is ratio of supplies of domestic and foreign outputs, there is no correlation between real Ex. R and supplies (output supply is determined by respective production functions, where real Ex. R does not have any impact) • See next slide (RD – relation between ratios of relative demand e, RS – the same for ratio of relative supplies)

Long-run real Ex. R equilibirum • Real Ex. R e – relative price • Long-run equilibrium: how long term settlement of relative demands and supplies (i. e. ratio of demand for domestic output to foreign output, respectively, ratio of supply of domestic output to foreign output) determines real Ex. R • Useful graphical representation (see Krugman, Obstfeld, Ch. 15): relation between ratio Y/Y* and e – If Y/Y* is ratio of demands for domestic and foreign output, then there is a positive correlation: if e rises, demand for domestic products rises (it is cheaper), i. e. ratio Y/Y* rises (and vice versa) – If Y/Y* is ratio of supplies of domestic and foreign outputs, there is no correlation between real Ex. R and supplies (output supply is determined by respective production functions, where real Ex. R does not have any impact) • See next slide (RD – relation between ratios of relative demand e, RS – the same for ratio of relative supplies)

e RS RD Increase in RD shift to the right Þ real appreciation e 1 Increase in productivity shift of RS to the right real appreciation (Y/Y*)1 Y/Y*

e RS RD Increase in RD shift to the right Þ real appreciation e 1 Increase in productivity shift of RS to the right real appreciation (Y/Y*)1 Y/Y*

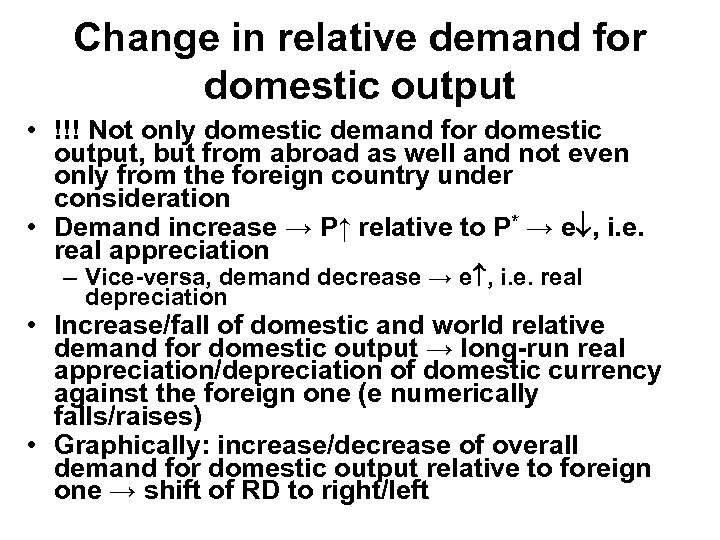

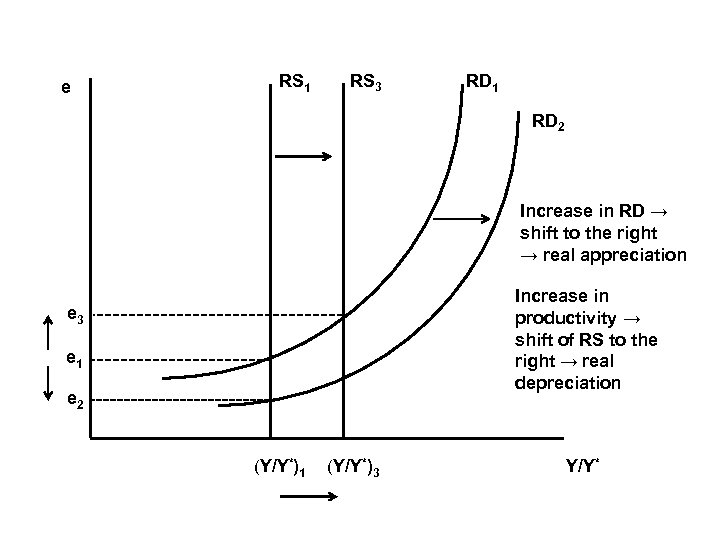

Change in relative demand for domestic output • !!! Not only domestic demand for domestic output, but from abroad as well and not even only from the foreign country under consideration • Demand increase → P↑ relative to P* → e , i. e. real appreciation – Vice-versa, demand decrease → e , i. e. real depreciation • Increase/fall of domestic and world relative demand for domestic output → long-run real appreciation/depreciation of domestic currency against the foreign one (e numerically falls/raises) • Graphically: increase/decrease of overall demand for domestic output relative to foreign one → shift of RD to right/left

Change in relative demand for domestic output • !!! Not only domestic demand for domestic output, but from abroad as well and not even only from the foreign country under consideration • Demand increase → P↑ relative to P* → e , i. e. real appreciation – Vice-versa, demand decrease → e , i. e. real depreciation • Increase/fall of domestic and world relative demand for domestic output → long-run real appreciation/depreciation of domestic currency against the foreign one (e numerically falls/raises) • Graphically: increase/decrease of overall demand for domestic output relative to foreign one → shift of RD to right/left

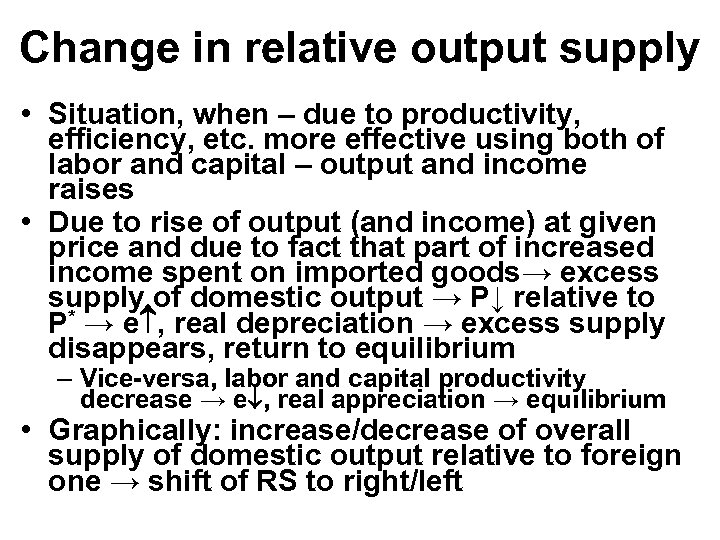

Change in relative output supply • Situation, when – due to productivity, efficiency, etc. more effective using both of labor and capital – output and income raises • Due to rise of output (and income) at given price and due to fact that part of increased income spent on imported goods→ excess supply of domestic output → P↓ relative to P* → e , real depreciation → excess supply disappears, return to equilibrium – Vice-versa, labor and capital productivity decrease → e , real appreciation → equilibrium • Graphically: increase/decrease of overall supply of domestic output relative to foreign one → shift of RS to right/left

Change in relative output supply • Situation, when – due to productivity, efficiency, etc. more effective using both of labor and capital – output and income raises • Due to rise of output (and income) at given price and due to fact that part of increased income spent on imported goods→ excess supply of domestic output → P↓ relative to P* → e , real depreciation → excess supply disappears, return to equilibrium – Vice-versa, labor and capital productivity decrease → e , real appreciation → equilibrium • Graphically: increase/decrease of overall supply of domestic output relative to foreign one → shift of RS to right/left

e RS 1 RS 3 RD 1 RD 2 Increase in RD → shift to the right → real appreciation Increase in productivity → shift of RS to the right → real depreciation e 3 e 1 e 2 (Y/Y*)1 (Y/Y*)3 Y/Y*

e RS 1 RS 3 RD 1 RD 2 Increase in RD → shift to the right → real appreciation Increase in productivity → shift of RS to the right → real depreciation e 3 e 1 e 2 (Y/Y*)1 (Y/Y*)3 Y/Y*

XI. 3 Long run nominal Ex. R again • In 1997, after CZK was floated, Ex. R to USD was 32 CZK, in 2000 it was above 40 CZK, today it is around 19 CZK (but few years ago, attacked 15 CZK) • The same applies for Ex. R to EUR, albeit here the CZK appreciation is not so fast • Strong daily fluctuations, but the trend is clear (see LIII) – Why it is so? • We will not discuss CZK case in particular now (but see case studies later), but determinants of long run nominal Ex. R movements in general

XI. 3 Long run nominal Ex. R again • In 1997, after CZK was floated, Ex. R to USD was 32 CZK, in 2000 it was above 40 CZK, today it is around 19 CZK (but few years ago, attacked 15 CZK) • The same applies for Ex. R to EUR, albeit here the CZK appreciation is not so fast • Strong daily fluctuations, but the trend is clear (see LIII) – Why it is so? • We will not discuss CZK case in particular now (but see case studies later), but determinants of long run nominal Ex. R movements in general

Nominal and Real Ex. R (1) • Real Ex. R: e=(E. P*)/P • Nominal Ex. R: E=e. (P/P*), i. e. nominal Ex. R equals real Ex. R, multiplied of domestic and foreign price levels • Important remark: ratio P/P* - purchasing power parity, i. e. monetary approach to Ex. R determination – Open economy versions of classical model assumed that nominal Ex. R is equal to PPP, i. e. E= P/P * – In this approach, Ex. R is only determined by monetary factors (that – in classical model – affect only prices) – Even in the very long run, this is not (and never was) consistent with reality – However, by definition, nominal Ex. R implies that it is equal to PPP, but multiplied by real Ex. R

Nominal and Real Ex. R (1) • Real Ex. R: e=(E. P*)/P • Nominal Ex. R: E=e. (P/P*), i. e. nominal Ex. R equals real Ex. R, multiplied of domestic and foreign price levels • Important remark: ratio P/P* - purchasing power parity, i. e. monetary approach to Ex. R determination – Open economy versions of classical model assumed that nominal Ex. R is equal to PPP, i. e. E= P/P * – In this approach, Ex. R is only determined by monetary factors (that – in classical model – affect only prices) – Even in the very long run, this is not (and never was) consistent with reality – However, by definition, nominal Ex. R implies that it is equal to PPP, but multiplied by real Ex. R

Nominal and Real Ex. R (2) Conclusions from previous slide on what determines (nominal) Ex. R in the long run: • Monetary disturbances affect only prices, not real Ex. R, so – Shift in relative money supply (relative to money supply in foreign country), e. g. permanent one time increase of MS → after adjustment, output and unemployment back to potential levels, but P , real Ex. R does not change → E (depreciation) – Shift in relative money supply growth rates → larger long run inflation and increase of interest rates (relative to interest in foreign country) → P , no effect on real Ex. R → E (depreciation again)

Nominal and Real Ex. R (2) Conclusions from previous slide on what determines (nominal) Ex. R in the long run: • Monetary disturbances affect only prices, not real Ex. R, so – Shift in relative money supply (relative to money supply in foreign country), e. g. permanent one time increase of MS → after adjustment, output and unemployment back to potential levels, but P , real Ex. R does not change → E (depreciation) – Shift in relative money supply growth rates → larger long run inflation and increase of interest rates (relative to interest in foreign country) → P , no effect on real Ex. R → E (depreciation again)

Nominal and Real Ex. R (3) • Changes in relative output demand or supply; in the long run, prices (both in domestic and foreign countries) determined only by demand supply of money, so in this case it is only real Ex. R that matters: – Change in relative output demand (e. g. increase, see XI. 3 above): e (real appreciation) → E , nominal appreciation – Change in relative output supply (e. g. increase due to the productivity increases, again see above): e (real depreciation) → E , nominal depreciation

Nominal and Real Ex. R (3) • Changes in relative output demand or supply; in the long run, prices (both in domestic and foreign countries) determined only by demand supply of money, so in this case it is only real Ex. R that matters: – Change in relative output demand (e. g. increase, see XI. 3 above): e (real appreciation) → E , nominal appreciation – Change in relative output supply (e. g. increase due to the productivity increases, again see above): e (real depreciation) → E , nominal depreciation

XI. 4 Conclusions • Asset approach to nominal Ex. R • In the short run: link between money and forex markets, in combination with expectations about future Ex. R (that contains also other factors like risk, etc. ), determines equilibrium Ex. R – Comparative statics • Long run adjustment of nominal Ex. R – Ex. R overshooting • Real Ex. R and its determinants – Link to monetary approach and PPPs • More accurate explanation of long term nominal Ex. R – Separation of monetary and real effects

XI. 4 Conclusions • Asset approach to nominal Ex. R • In the short run: link between money and forex markets, in combination with expectations about future Ex. R (that contains also other factors like risk, etc. ), determines equilibrium Ex. R – Comparative statics • Long run adjustment of nominal Ex. R – Ex. R overshooting • Real Ex. R and its determinants – Link to monetary approach and PPPs • More accurate explanation of long term nominal Ex. R – Separation of monetary and real effects

Literature to Chapter XI Basic text: • Krugman, P. R. , Obstfeld, M. : International Economics, Theory and Policy, Pearson, Addison Wesley, Boston 2006 (7 th ed. ), Ch. 13 -15. In Ch. 15, try to learn a bit more about monetary approach and PPPs. Recommended: • On overshooting: Dornbusch, R. Expectations and Exchange Rate Dynamics, Journal of Political Economy 84 (December 1976), pp. 1161 -1176. • On real Ex. R: Devereaux, M. B. Real Exchange Rates and Macroeconomics: Evidence and Theory. Canadian Journal of Economics 30 (November 1977), pp. 773 -808

Literature to Chapter XI Basic text: • Krugman, P. R. , Obstfeld, M. : International Economics, Theory and Policy, Pearson, Addison Wesley, Boston 2006 (7 th ed. ), Ch. 13 -15. In Ch. 15, try to learn a bit more about monetary approach and PPPs. Recommended: • On overshooting: Dornbusch, R. Expectations and Exchange Rate Dynamics, Journal of Political Economy 84 (December 1976), pp. 1161 -1176. • On real Ex. R: Devereaux, M. B. Real Exchange Rates and Macroeconomics: Evidence and Theory. Canadian Journal of Economics 30 (November 1977), pp. 773 -808