f474398c8afcabdd12c15d4aa9c5a983.ppt

- Количество слайдов: 69

XBRL: The Extensible Business Reporting Language 14 th Biennial Forum of Government Auditors 20 -May-2002 Neal J. Hannon Chair, XBRL International Education Work Group Co-Founder, XBRL Center at Bryant College nhannon@bryant. edu

Agenda • • • XBRL – US and Worldwide Making the Case for XBRL Government XBRL Applications Inside XBRL The Future of Digital Reporting

XBRL UPDATE • FDIC to run pilot program for Call Sheets – Proof of concept is complete – RFQ in second quarter of 2002 – Pilot program for 2003 • APRA: XBRL in use for all required filings in banking and insurance industry in Australia • Microsoft and Reuters publish in XBRL

XBRL Update • • The Bank of America/ Moody’s Connection Dresner and Deutsche Bank GE Financial (tax consolidations) Inland Revenue • 260 people attended Berlin, Germany conference • Over 50 Japanese companies members of XBRLJapan • Total consortium membership projected to exceed 200 by 2003

XBRL – The Technology – Specification v 2 • XML Schema • XML Linking Language (“XLink”) • Computation, Version Control, Mapping, Entity, and other Linkbases are Works in Progress – Interoperability • Summits I & II • Learn more @ http: //www. omg. org/interop/

XBRL – The Organization – History • Founded by the AICPA in 1998 (13) • Spin Out into International Organization in 2002 (>140) – Organizational Matters • Structure of XBRL • Liaison work • Next International Meeting in Toronto June 17 – 21, 2002 – Jurisdictional Growth • Active: Australia, Canada, Germany, IASB, Japan, UK, US, Singapore • Development: Belgium, Hong Kong, India, Ireland, Netherlands, New Zealand, South Africa, Spain, Sweden, Taiwan

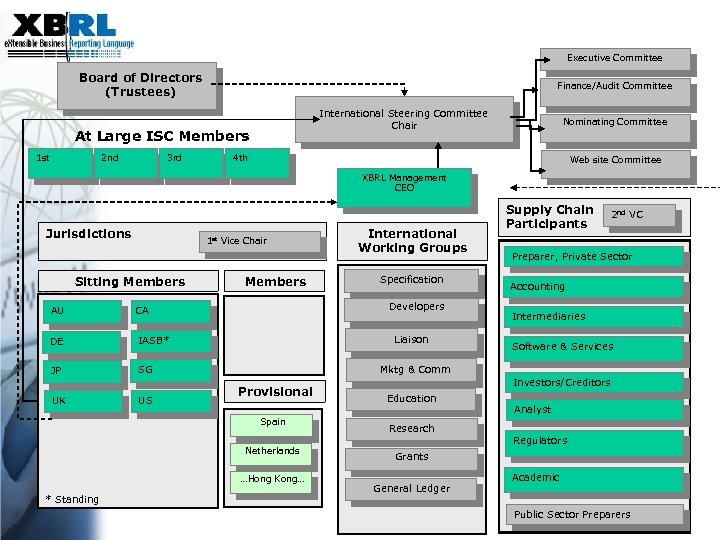

Executive Committee Board of Directors (Trustees) Finance/Audit Committee International Steering Committee Chair At Large ISC Members 1 st 3 rd 2 nd Nominating Committee 4 th Web site Committee XBRL Management CEO Jurisdictions 1 st Vice Chair Sitting Members AU Members Liaison IASB* JP SG UK US 2 nd VC Preparer, Private Sector Accounting Intermediaries Software & Services Mktg & Comm Provisional Spain Netherlands …Hong Kong… * Standing Specification Developers CA DE International Working Groups Supply Chain Participants Investors/Creditors Education Analyst Research Regulators Grants General Ledger Academic Public Sector Preparers

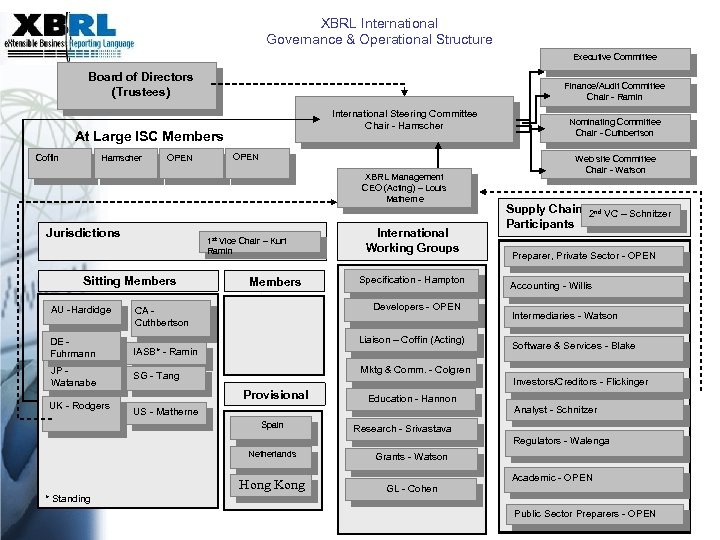

XBRL International Governance & Operational Structure Executive Committee Board of Directors (Trustees) Finance/Audit Committee Chair - Ramin International Steering Committee Chair - Hamscher At Large ISC Members Coffin Hamscher OPEN XBRL Management CEO (Acting) – Louis Matherne Jurisdictions 1 st Vice Chair – Kurt Ramin Sitting Members AU -Hardidge Members International Working Groups Specification - Hampton Developers - OPEN CA Cuthbertson Liaison – Coffin (Acting) DE Fuhrmann IASB* - Ramin JP Watanabe SG - Tang UK - Rodgers Nominating Committee Chair - Cuthbertson Web site Committee Chair - Watson Supply Chain 2 nd VC – Schnitzer Participants Preparer, Private Sector - OPEN Accounting - Willis Intermediaries - Watson Software & Services - Blake Mktg & Comm. - Colgren Investors/Creditors - Flickinger Provisional Education - Hannon US - Matherne Spain Analyst - Schnitzer Research - Srivastava Regulators - Walenga Netherlands Hong Kong * Standing Grants - Watson GL - Cohen Academic - OPEN Public Sector Preparers - OPEN

XBRL – Taxonomies • IASB Commercial & Industrial for AU, NZ, SG, UK, HK, • Japan Statutory Accounts • Germany Statutory Accounts • International General Ledger • U. S. Commercial & Industrial • U. S. Investment Management • U. S. Federal Government General Ledger (KPMG developed) • U. S. Non-Profit Form 990 • Other specific sector based taxonomies under development.

XBRL Support “I would like to see you develop valuation models that result in consistent, comparable and fair values of assets and liabilities. I would like to see you hone specific, but plain English definitions for the types of information you believe should be included in public disclosure. I would like to see you take your XBRL project a step further, providing account classifications for companies in common industries. In short, I challenge you to turn all of this data into meaningful information for investors. ” - Arthur Levitt, Chairman, U. S. Securities & Exchange Commission October 24, 2000, at the Fall Council of the AICPA (Las Vegas, Nevada)

Microsoft CFO on XBRL • "Through Internet delivery, XBRL will also provide analysts and investors with extensible financial data to make informed decisions about the company. We see XBRL as not only the future standard for publishing, delivery and use of financial information over the Web, but also as a logical business choice. " John Connors, Chief Financial Officer, Microsoft

The Capital Markets • “NASDAQ joins shoulder to shoulder in the effort of the XBRL Consortium to adopt this new, freely available technology because it feels that improving the distribution and analysis of corporate results, especially for the 10, 000 companies not covered by Wall Street analysts will broaden the market for NASDAQ’s own trading services” Michael Sanderson, CEO NASDAQ Europe

Transparency in Financial Reporting • “Reuters’ reputation stands on its ability to communicate and the extensible business reporting language standard it has employed this week to publish accounts online is amongst the most significant of developments in promoting transparency in financial information” Accountancy Age, 1 November 2001

Message to Congress on Post Enron Environment • “One large scale and potentially revolutionary private sector initiative that already is underway is a collaboration of growing companies, accounting firms and the AICPA to develop a common “tagging” system for various financial accounts, which goes under the acronym “XBRL”. … I would urge the SEC (and if necessary, urge the Committee to urge the SEC) to encourage this project… One possibility: require EDGAR submissions to be in XBRL by a specific date. ” • Bob Litan, Brookings Institution & Bear Stearns testimony to U. S. Senate Banking Committee on post-Enron, March 14, 2002

Implementations/Vendors • APRA • FDIC • UK Inland § Revenue • GRE – Credit§ § & RM § • General § Electric Morgan Stanley Reuters Microsoft Edgar-On. Line Moody’s § Edgarscan § ACCPAC § Caseware § Creative Solutions § Enumerate § FRSolutions § MSFT/Great Plains/Navision § Fujitsu § Hitachi § Hyperion § KPMG § Moody’s § New. Tec § SAP § Semansys § Software AG § UBMatrix

Agenda • XBRL – US and Worldwide • Making the Case for XBRL • Government XBRL Applications • Inside XBRL • The Future of Digital Reporting

e. Xtensible Markup Language (XML) • ……is a meta markup language the World Wide Web Consortium (W 3 C) considers a universal standard for describing both structured data and the behavior of applications that process the language.

XML is Platform Independent Self-Describing • • • Example: Windows Unix Macintosh Mainframe Linux – <DATE>July 26, 1998</DATE> • Describes the information, not the presentation • Format neutral

Content and Context • Thousands of companies release financial results quarterly • The contents are not organized. The data must be re-entered into computer applications for interpretation. • What if financial documents included both – Content (75, 044, 453) and – Context (¥ 75, 044, 453=net income for Q 1/2001)

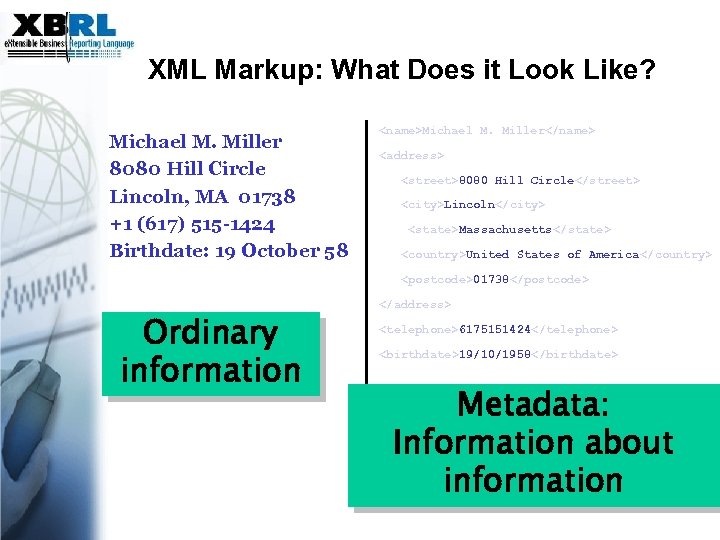

XML Markup: What Does it Look Like? Michael M. Miller 8080 Hill Circle Lincoln, MA 01738 +1 (617) 515 -1424 Birthdate: 19 October 58 <name>Michael M. Miller</name> <address> <street>8080 Hill Circle</street> <city>Lincoln</city> <state>Massachusetts</state> <country>United States of America </country> <postcode>01738</postcode> Ordinary information </address> <telephone>6175151424</telephone> <birthdate>19/10/1958</birthdate> Metadata: Information about information

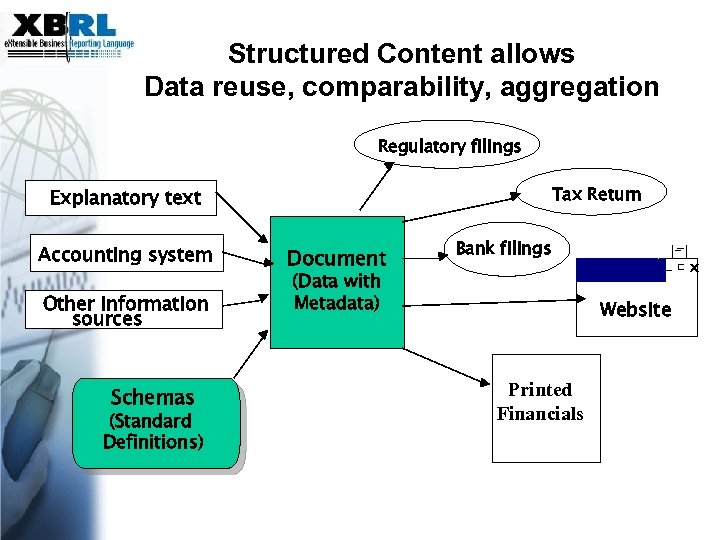

Structured Content allows Data reuse, comparability, aggregation Regulatory filings Tax Return Explanatory text Accounting system Other information sources Schemas (Standard Definitions) Document Bank filings (Data with Metadata) Website Printed Financials

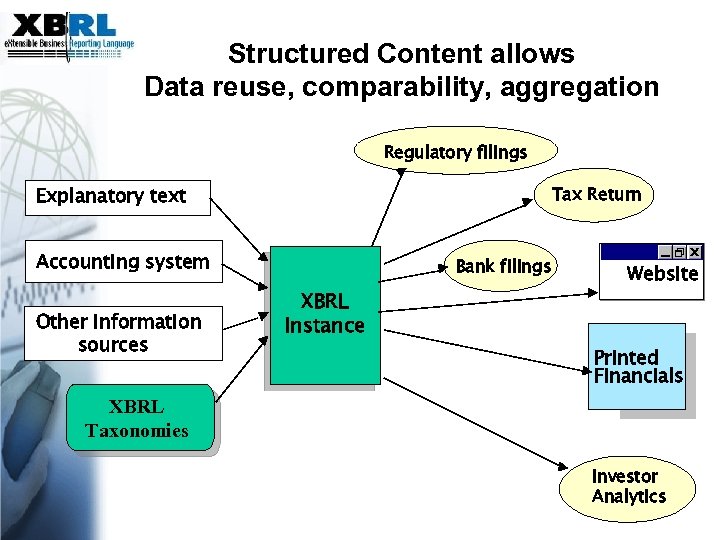

Structured Content allows Data reuse, comparability, aggregation Regulatory filings Explanatory text Tax Return Accounting system Other information sources Bank filings XBRL Instance Website Printed Financials XBRL Taxonomies Investor Analytics

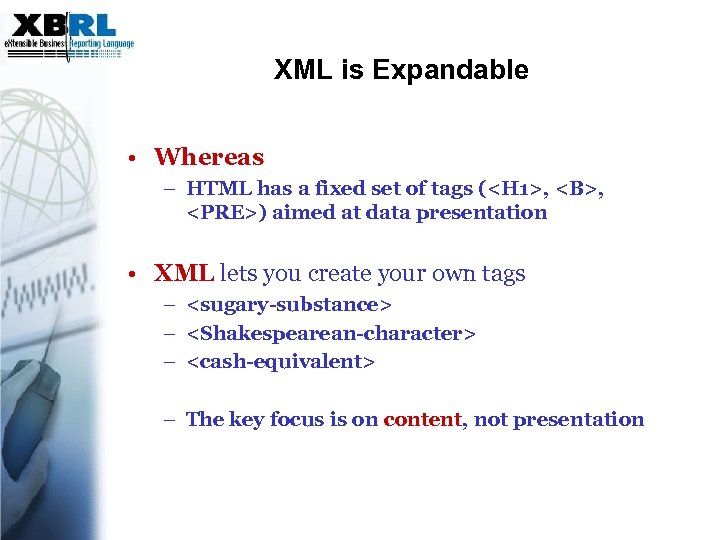

XML is Expandable • Whereas – HTML has a fixed set of tags (<H 1>, <B>, <PRE>) aimed at data presentation • XML lets you create your own tags – <sugary-substance> – <Shakespearean-character> – <cash-equivalent> – The key focus is on content, not presentation

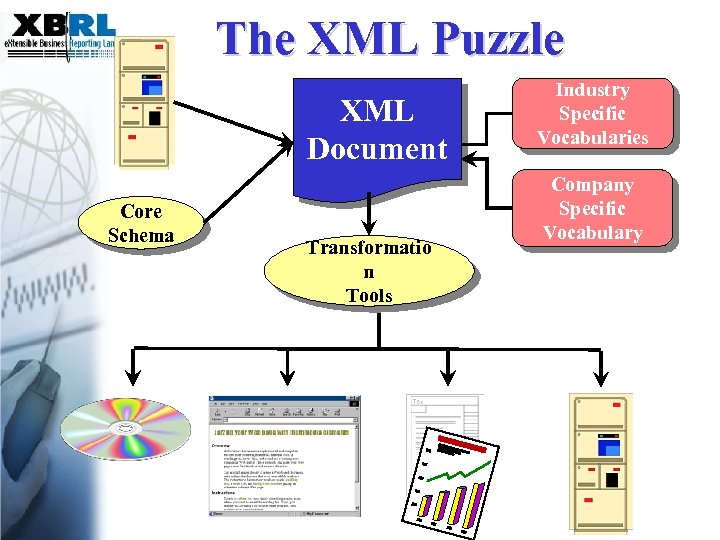

The XML Puzzle XML Document Core Schema Transformatio n Tools Industry Specific Vocabularies Company Specific Vocabulary

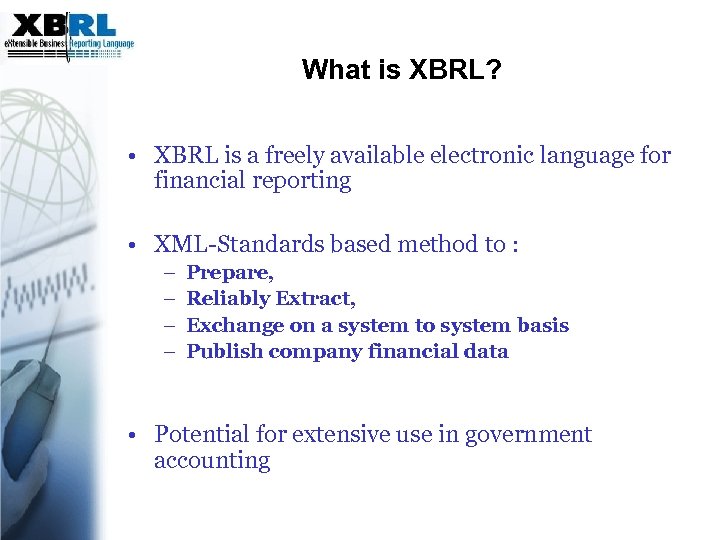

What is XBRL? • XBRL is a freely available electronic language for financial reporting • XML-Standards based method to : – – Prepare, Reliably Extract, Exchange on a system to system basis Publish company financial data • Potential for extensive use in government accounting

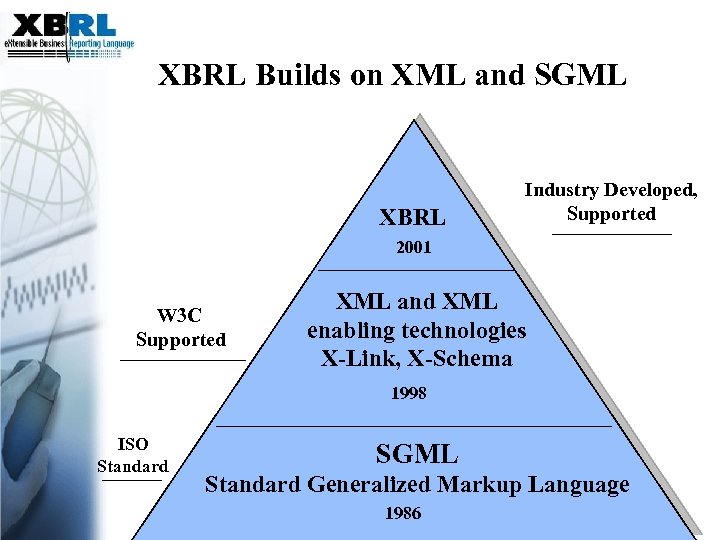

XBRL Builds on XML and SGML XBRL Industry Developed, Supported 2001 W 3 C Supported XML and XML enabling technologies X-Link, X-Schema 1998 ISO Standard SGML Standard Generalized Markup Language 1986

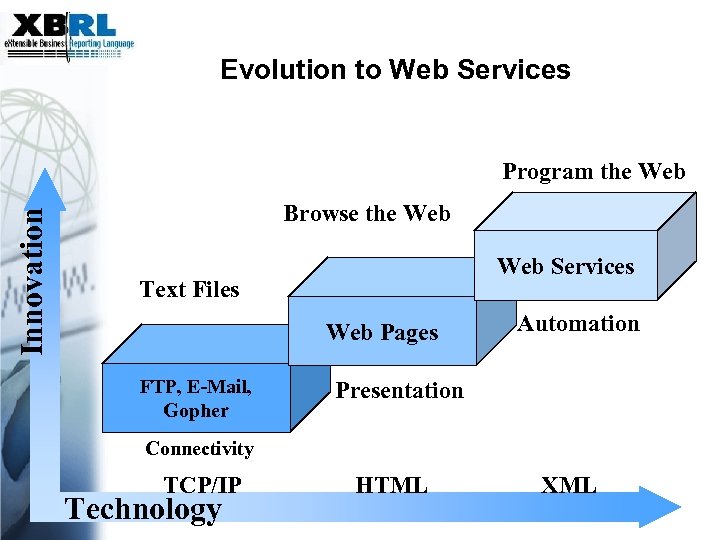

Evolution to Web Services Innovation Program the Web Browse the Web Services Text Files Web Pages FTP, E-Mail, Gopher Automation Presentation Connectivity TCP/IP Technology HTML XML

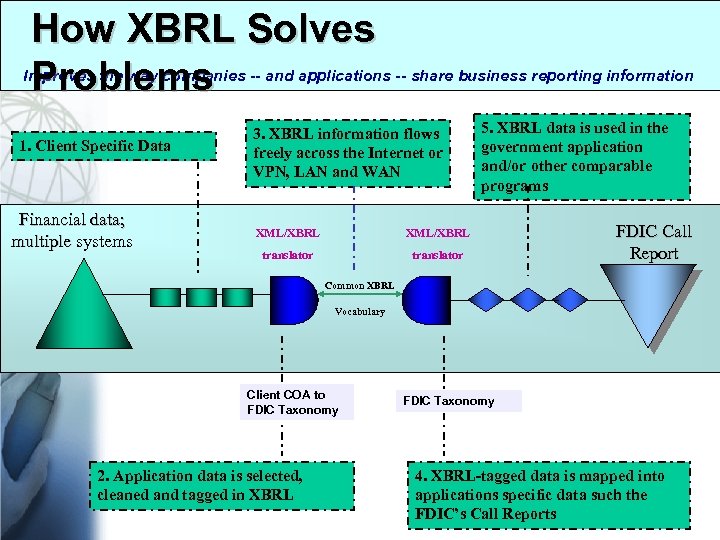

How XBRL Solves Problems Improves the way companies -- and applications -- share business reporting information 1. Client Specific Data Financial data; multiple systems 3. XBRL information flows freely across the Internet or VPN, LAN and WAN XML/XBRL translator 5. XBRL data is used in the government application and/or other comparable programs translator FDIC Call Report Common XBRL Vocabulary Client COA to FDIC Taxonomy 2. Application data is selected, cleaned and tagged in XBRL FDIC Taxonomy 4. XBRL-tagged data is mapped into applications specific data such the FDIC’s Call Reports

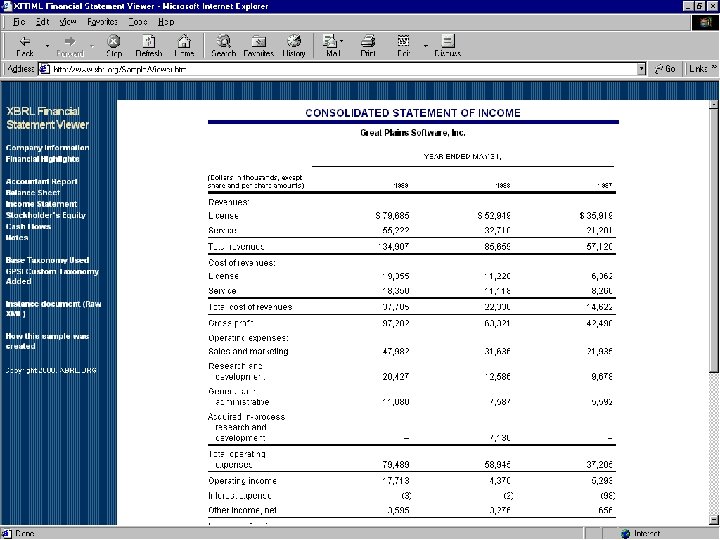

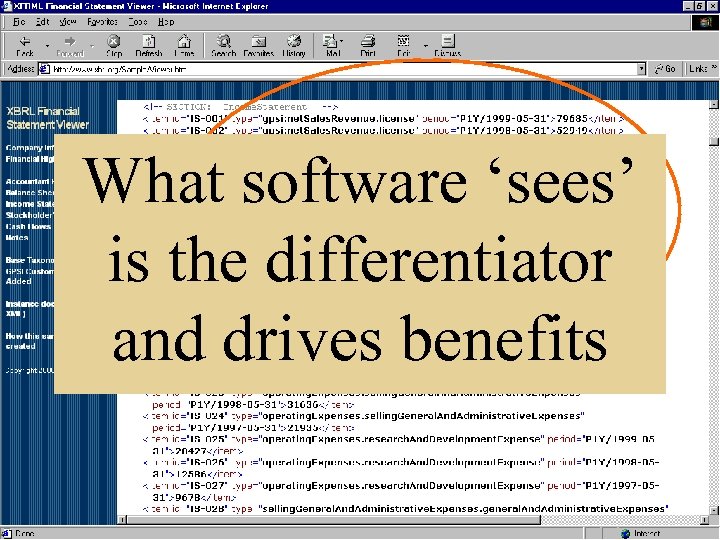

What software ‘sees’ is the differentiator and drives benefits

Benefits • XBRL is: – NOT a new accounting standards but enhances the distribution and usability of existing financial statement information – Enabler and an extension for native-XML database functionality* for all financial statement information • *Can be stored as a form or a separate financial fact

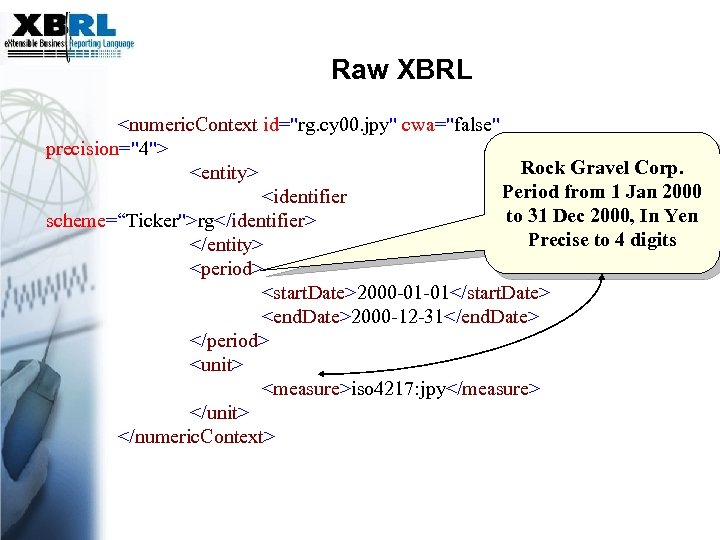

Raw XBRL <numeric. Context id="rg. cy 00. jpy" cwa="false" precision="4"> Rock Gravel Corp. <entity> Period from 1 Jan 2000 <identifier to 31 Dec 2000, In Yen scheme=“Ticker">rg</identifier> Precise to 4 digits </entity> <period> <start. Date>2000 -01 -01</start. Date> <end. Date>2000 -12 -31</end. Date> </period> <unit> <measure>iso 4217: jpy</measure> </unit> </numeric. Context>

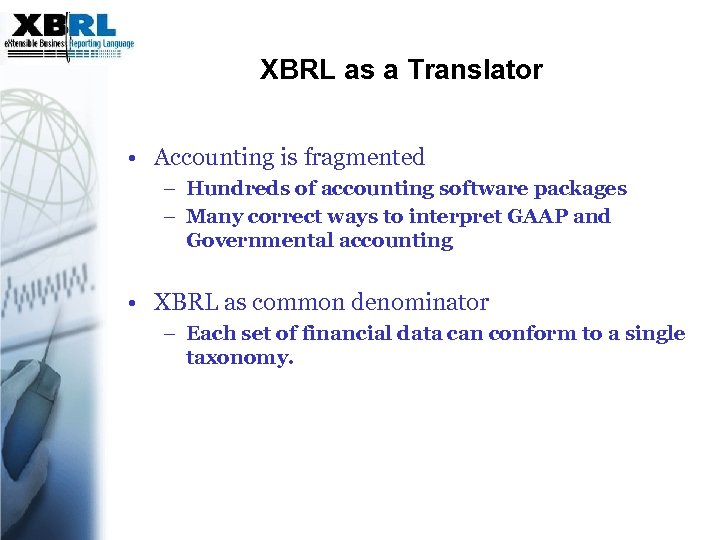

XBRL as a Translator • Accounting is fragmented – Hundreds of accounting software packages – Many correct ways to interpret GAAP and Governmental accounting • XBRL as common denominator – Each set of financial data can conform to a single taxonomy.

Who defines the tags? • Tags are defined by industry consortiums • Each industry’s standard tags are commonly referred to as a taxonomy

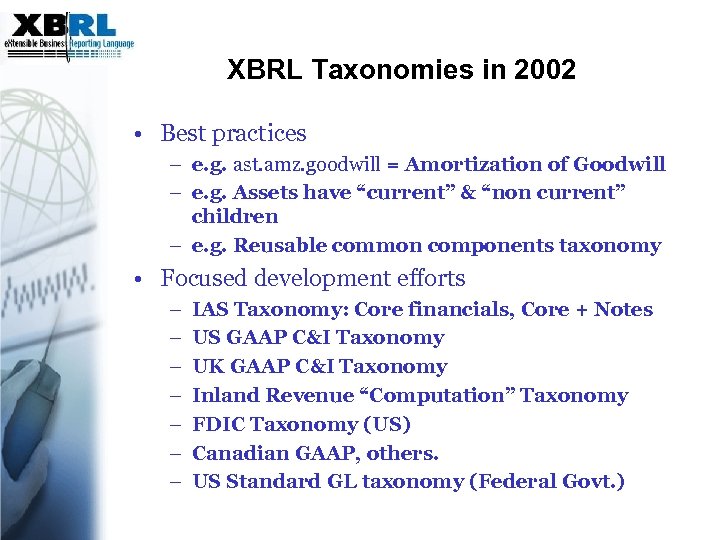

XBRL Taxonomies in 2002 • Best practices – e. g. ast. amz. goodwill = Amortization of Goodwill – e. g. Assets have “current” & “non current” children – e. g. Reusable common components taxonomy • Focused development efforts – – – – IAS Taxonomy: Core financials, Core + Notes US GAAP C&I Taxonomy UK GAAP C&I Taxonomy Inland Revenue “Computation” Taxonomy FDIC Taxonomy (US) Canadian GAAP, others. US Standard GL taxonomy (Federal Govt. )

XBRL for General Ledger Developing an international core for reporting general ledger transactions

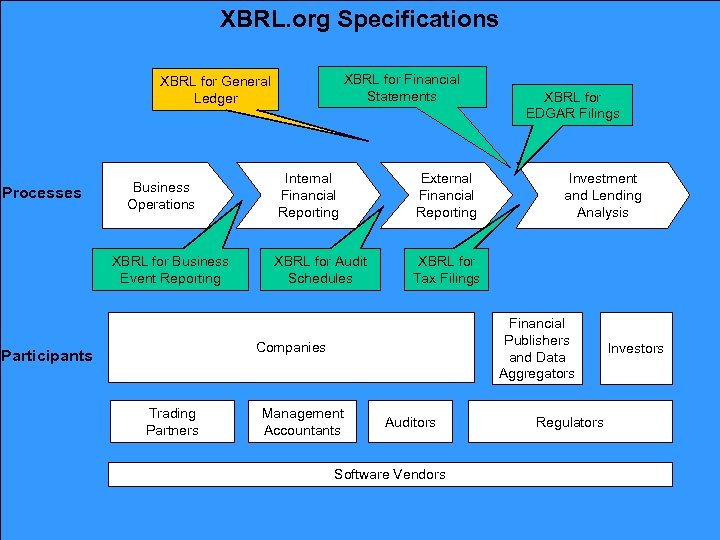

XBRL. org Specifications XBRL for Financial Statements XBRL for General Ledger Processes Business Operations XBRL for Business Event Reporting Internal Financial Reporting External Financial Reporting XBRL for Audit Schedules XBRL for Tax Filings Trading Partners Investment and Lending Analysis Financial Publishers and Data Aggregators Companies Participants XBRL for EDGAR Filings Management Accountants Auditors Software Vendors Regulators Investors

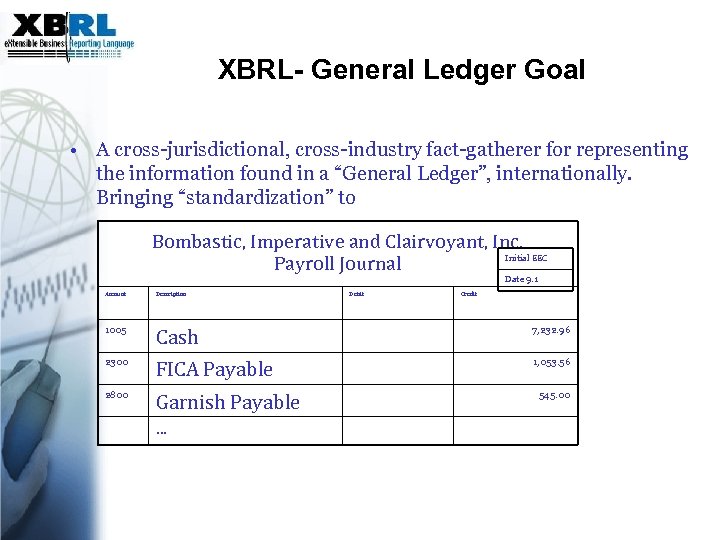

XBRL- General Ledger Goal • A cross-jurisdictional, cross-industry fact-gatherer for representing the information found in a “General Ledger”, internationally. Bringing “standardization” to Bombastic, Imperative and Clairvoyant, Inc. Initial EEC Payroll Journal Date 9. 1 Account Description 1005 Cash 7, 232. 96 2300 FICA Payable 1, 053. 56 2800 Garnish Payable … Debit Credit 545. 00

Requirements for XBRL GL A Standard Format for: • 3 rd party software to create journal entries to pull into client GL system • To move unposted and posted GL information from divisions to consolidating systems, budgeting , forecasting, reporting tools, and back • To upload general ledger information, payables, receivable files and open balances for system migration or interfacing with Internet ASP

Requirements for XBRL GL Standard Format to move information • From client's systems to CPA • From one CPA system (eg, write-up) to another (eg, tax) in an international context. Standard Format to Represent • Open receivables, open payables, inventory balances, and other asset-based measures for sharing with banks • Detail drill-down for performance measurement reporting items

Requirements for XBRL GL • Extensible for any type of mandatory audit trail • Extensible for meeting any "sub-ledger" need • Designed as XBRL spec-compliant but for easy translation to other uses • Cannot assume that XBRL period, entity, unit and other context (numeric, nonnumeric) will automatically be there.

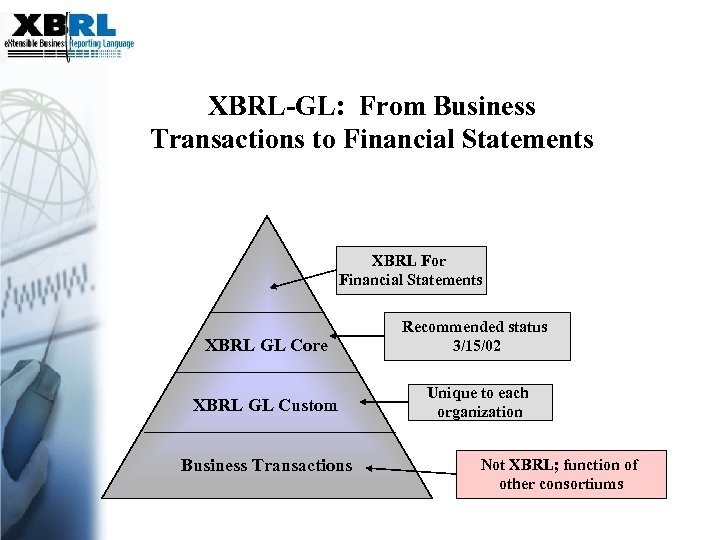

XBRL-GL: From Business Transactions to Financial Statements XBRL For Financial Statements XBRL GL Core Recommended status 3/15/02 XBRL GL Custom Unique to each organization Business Transactions Not XBRL; function of other consortiums

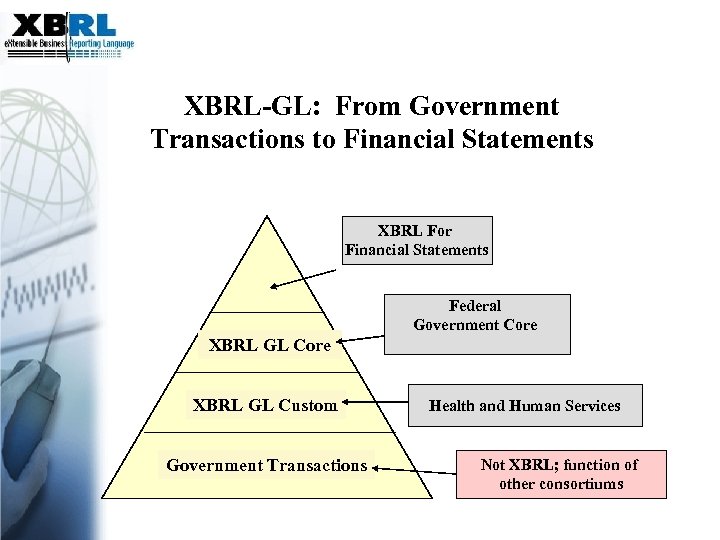

XBRL-GL: From Government Transactions to Financial Statements XBRL For Financial Statements Federal Government Core XBRL GL Custom Government Transactions Health and Human Services Not XBRL; function of other consortiums

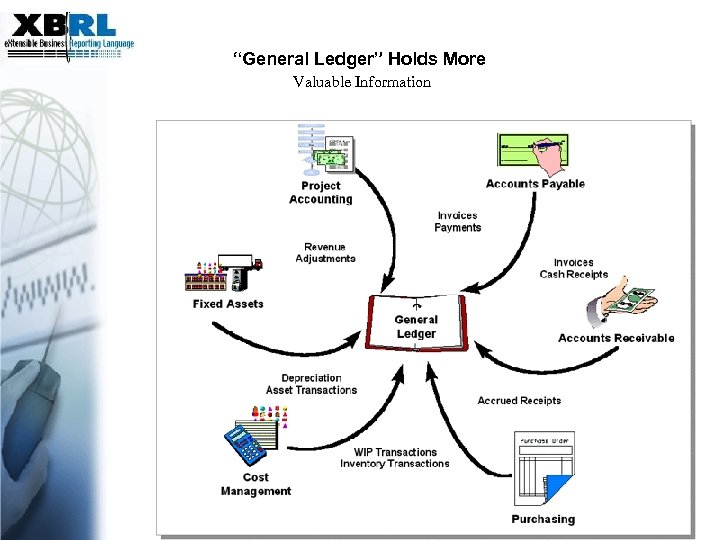

“General Ledger” Holds More Valuable Information

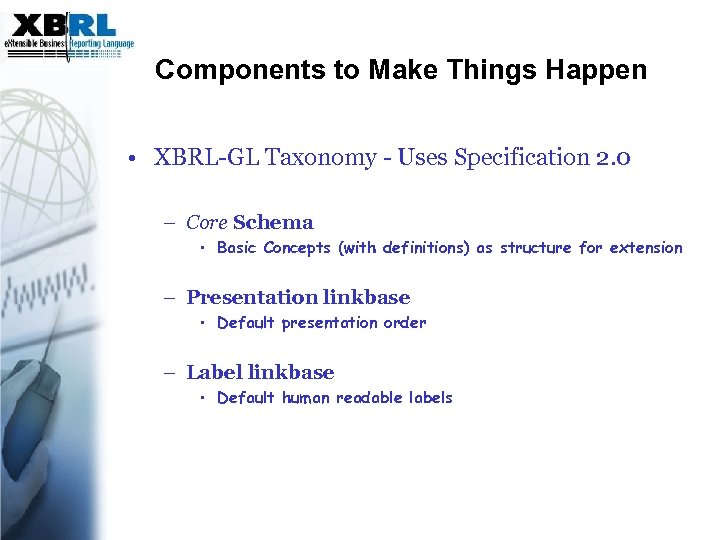

Components to Make Things Happen • XBRL-GL Taxonomy - Uses Specification 2. 0 – Core Schema • Basic Concepts (with definitions) as structure for extension – Presentation linkbase • Default presentation order – Label linkbase • Default human readable labels

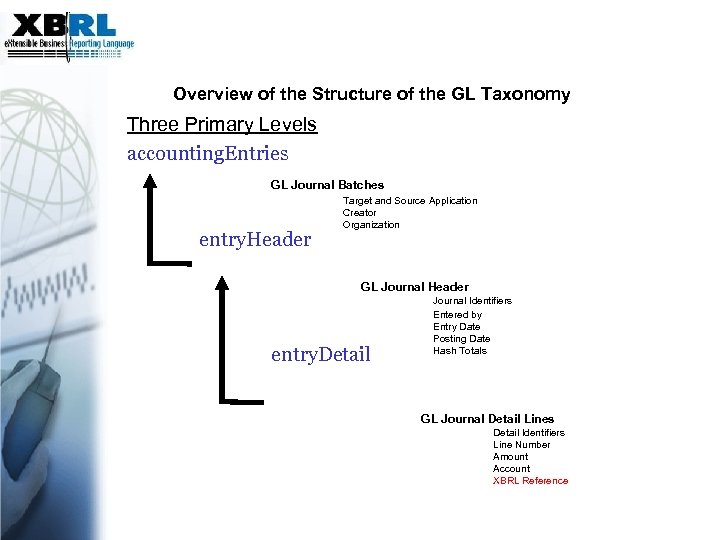

Overview of the Structure of the GL Taxonomy Three Primary Levels accounting. Entries GL Journal Batches entry. Header Target and Source Application Creator Organization GL Journal Header entry. Detail Journal Identifiers Entered by Entry Date Posting Date Hash Totals GL Journal Detail Lines Detail Identifiers Line Number Amount Account XBRL Reference

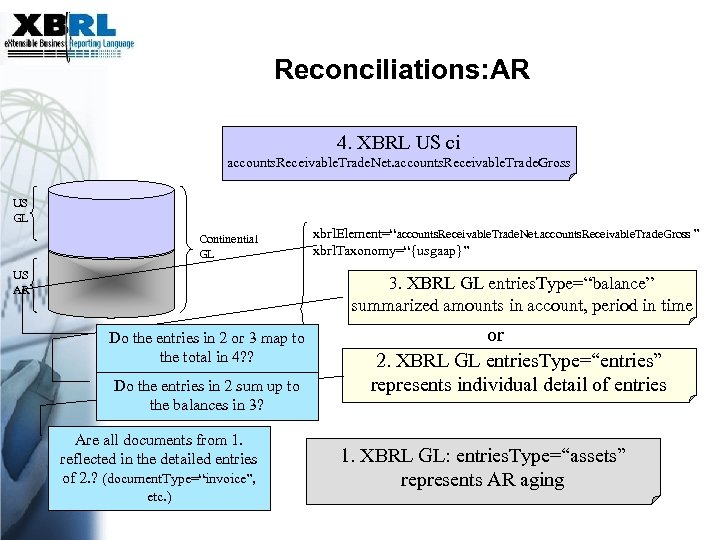

Reconciliations: AR 4. XBRL US ci accounts. Receivable. Trade. Net. accounts. Receivable. Trade. Gross US GL Continential GL US AR xbrl. Element=“accounts. Receivable. Trade. Net. accounts. Receivable. Trade. Gross ” xbrl. Taxonomy=“{usgaap}” 3. XBRL GL entries. Type=“balance” summarized amounts in account, period in time Do the entries in 2 or 3 map to the total in 4? ? Do the entries in 2 sum up to the balances in 3? Are all documents from 1. reflected in the detailed entries of 2. ? (document. Type=“invoice”, etc. ) or 2. XBRL GL entries. Type=“entries” represents individual detail of entries 1. XBRL GL: entries. Type=“assets” represents AR aging

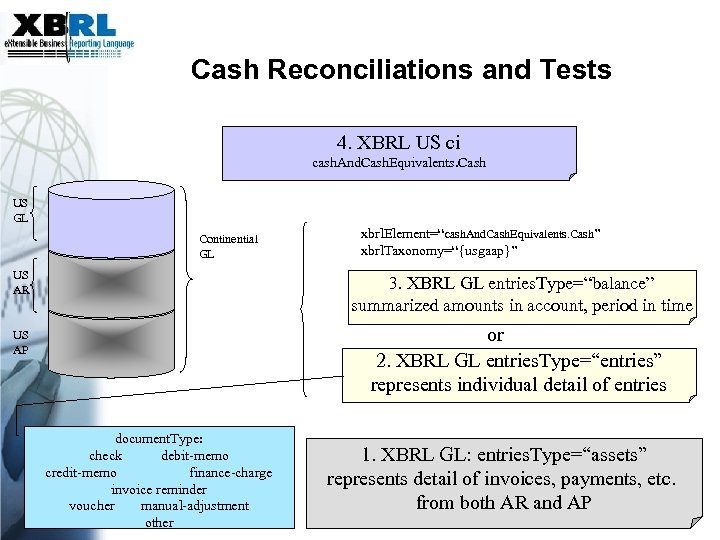

Cash Reconciliations and Tests 4. XBRL US ci cash. And. Cash. Equivalents. Cash US GL Continential GL xbrl. Element=“cash. And. Cash. Equivalents. Cash” xbrl. Taxonomy=“{usgaap}” US AR 3. XBRL GL entries. Type=“balance” summarized amounts in account, period in time US AP or 2. XBRL GL entries. Type=“entries” represents individual detail of entries document. Type: check debit-memo credit-memo finance-charge invoice reminder voucher manual-adjustment other 1. XBRL GL: entries. Type=“assets” represents detail of invoices, payments, etc. from both AR and AP

XBRL-GL • Files and more information can be found at: www. xbrl. org/gl/gl. htm

Agenda • XBRL – US and Worldwide • Making the Case for XBRL • Government XBRL Applications • Inside XBRL • The Future of Digital Reporting

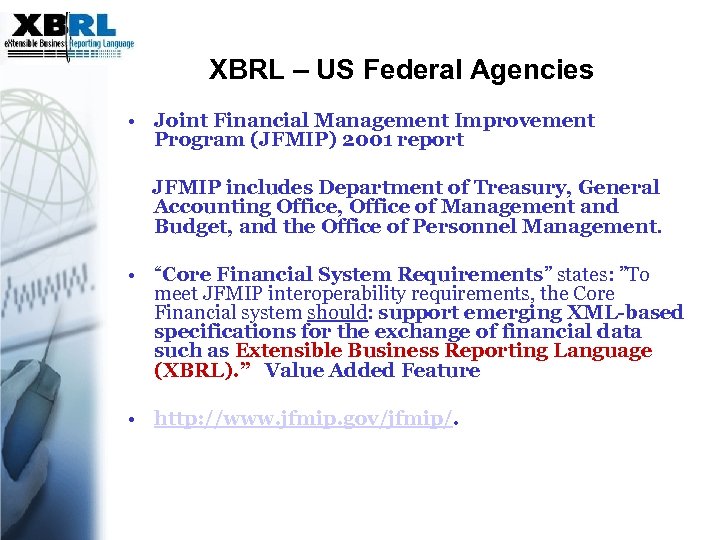

XBRL – US Federal Agencies • Joint Financial Management Improvement Program (JFMIP) 2001 report JFMIP includes Department of Treasury, General Accounting Office, Office of Management and Budget, and the Office of Personnel Management. • “Core Financial System Requirements” states: ”To meet JFMIP interoperability requirements, the Core Financial system should: support emerging XML-based specifications for the exchange of financial data such as Extensible Business Reporting Language (XBRL). ” Value Added Feature • http: //www. jfmip. gov/jfmip/.

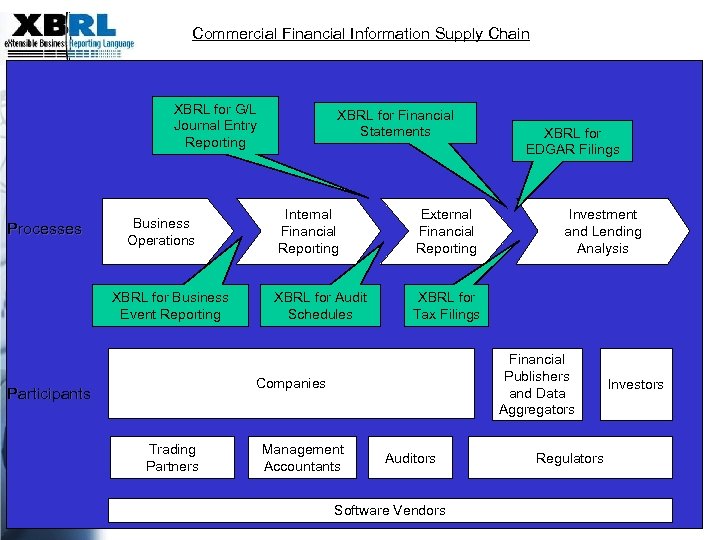

Commercial Financial Information Supply Chain XBRL for G/L Journal Entry Reporting Processes Business Operations XBRL for Business Event Reporting XBRL for Financial Statements Internal Financial Reporting External Financial Reporting XBRL for Audit Schedules XBRL for Tax Filings Trading Partners Investment and Lending Analysis Financial Publishers and Data Aggregators Companies Participants XBRL for EDGAR Filings Management Accountants Auditors Software Vendors Regulators Investors

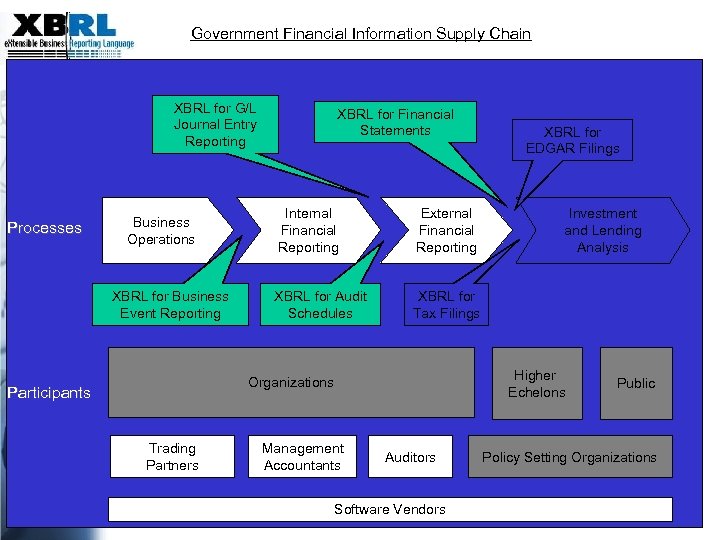

Government Financial Information Supply Chain XBRL for G/L Journal Entry Reporting Processes Business Operations XBRL for Business Event Reporting XBRL for Financial Statements Internal Financial Reporting External Financial Reporting XBRL for Audit Schedules XBRL for Tax Filings Trading Partners Investment and Lending Analysis Higher Echelons Organizations Participants XBRL for EDGAR Filings Management Accountants Auditors Software Vendors Public Policy Setting Organizations

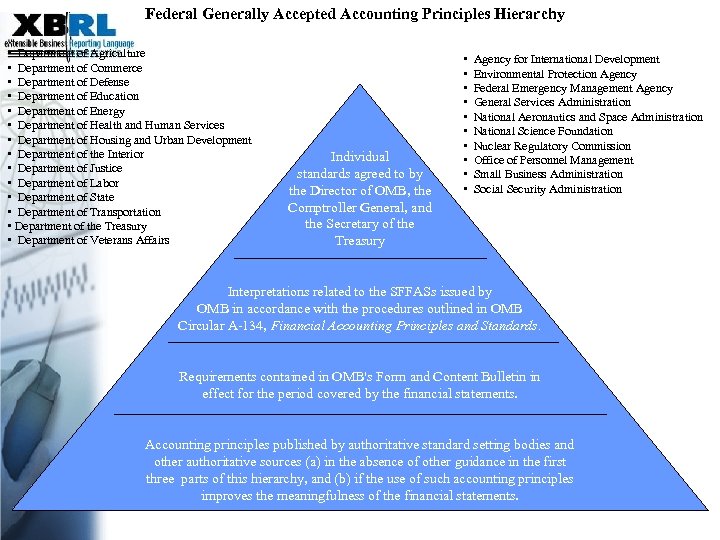

Federal Generally Accepted Accounting Principles Hierarchy • Department of Agriculture • Department of Commerce • Department of Defense • Department of Education • Department of Energy • Department of Health and Human Services • Department of Housing and Urban Development • Department of the Interior • Department of Justice • Department of Labor • Department of State • Department of Transportation • Department of the Treasury • Department of Veterans Affairs Individual standards agreed to by the Director of OMB, the Comptroller General, and the Secretary of the Treasury • • • Agency for International Development Environmental Protection Agency Federal Emergency Management Agency General Services Administration National Aeronautics and Space Administration National Science Foundation Nuclear Regulatory Commission Office of Personnel Management Small Business Administration Social Security Administration Interpretations related to the SFFASs issued by OMB in accordance with the procedures outlined in OMB Circular A-134, Financial Accounting Principles and Standards. Requirements contained in OMB's Form and Content Bulletin in effect for the period covered by the financial statements. Accounting principles published by authoritative standard setting bodies and other authoritative sources (a) in the absence of other guidance in the first three parts of this hierarchy, and (b) if the use of such accounting principles improves the meaningfulness of the financial statements.

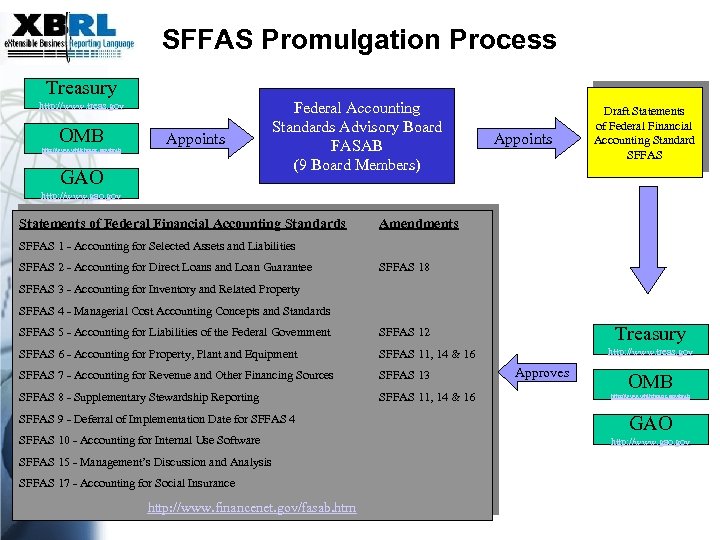

SFFAS Promulgation Process Treasury http: //www. treas. gov OMB http: //www. whitehouse. gov/omb Appoints GAO Federal Accounting Standards Advisory Board FASAB (9 Board Members) Appoints Draft Statements of Federal Financial Accounting Standard SFFAS http: //www. gao. gov Statements of Federal Financial Accounting Standards Amendments SFFAS 1 - Accounting for Selected Assets and Liabilities SFFAS 2 - Accounting for Direct Loans and Loan Guarantee SFFAS 18 SFFAS 3 - Accounting for Inventory and Related Property SFFAS 4 - Managerial Cost Accounting Concepts and Standards SFFAS 5 - Accounting for Liabilities of the Federal Government Treasury SFFAS 12 SFFAS 6 - Accounting for Property, Plant and Equipment SFFAS 11, 14 & 16 SFFAS 7 - Accounting for Revenue and Other Financing Sources SFFAS 13 SFFAS 8 - Supplementary Stewardship Reporting SFFAS 11, 14 & 16 http: //www. treas. gov SFFAS 9 - Deferral of Implementation Date for SFFAS 4 SFFAS 10 - Accounting for Internal Use Software SFFAS 15 - Management’s Discussion and Analysis SFFAS 17 - Accounting for Social Insurance http: //www. financenet. gov/fasab. htm Approves OMB http: //www. whitehouse. gov/omb GAO http: //www. gao. gov

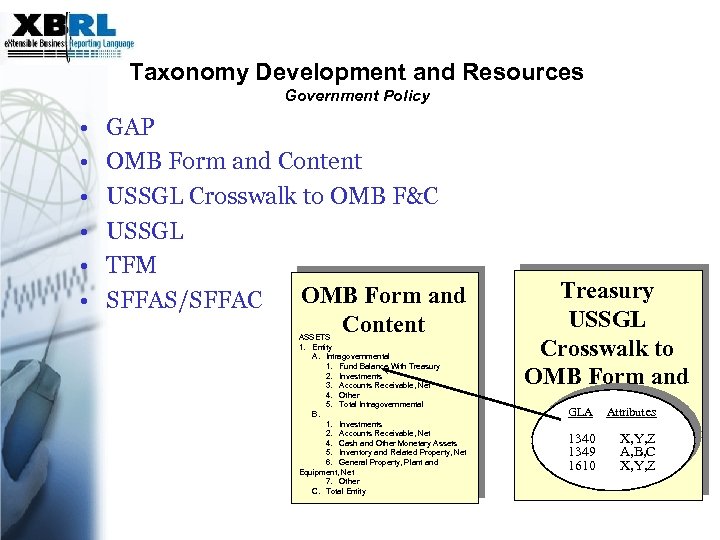

Taxonomy Development and Resources Government Policy • • • GAP OMB Form and Content USSGL Crosswalk to OMB F&C USSGL TFM OMB Form and SFFAS/SFFAC Content ASSETS 1. Entity A. Intragovernmental 1. Fund Balance With Treasury 2. Investments 3. Accounts Receivable, Net 4. Other 5. Total Intragovernmental B. 1. Investments 2. Accounts Receivable, Net 4. Cash and Other Monetary Assets 5. Inventory and Related Property, Net 6. General Property, Plant and Equipment, Net 7. Other C. Total Entity Treasury USSGL Crosswalk to OMB Form and Contentes GLA Attribut 1340 1349 1610 X, Y, Z A, B, C X, Y, Z

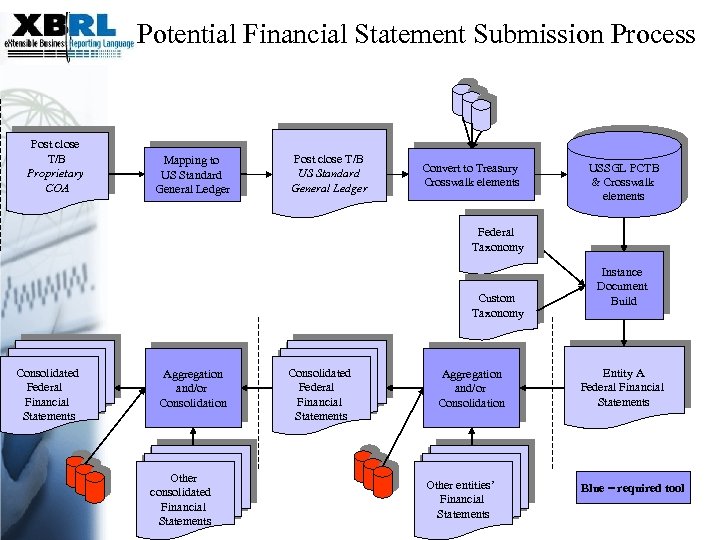

Potential Financial Statement Submission Process Post close T/B Proprietary COA Mapping to US Standard General Ledger Post close T/B US Standard General Ledger Convert to Treasury Crosswalk elements USSGL PCTB & Crosswalk elements Federal Taxonomy Custom Taxonomy Consolidated Federal Financial Statements Aggregation and/or Consolidation Other consolidated Financial Statements Consolidated Federal Financial Statements Aggregation and/or Consolidation Other entities’ Financial Statements Instance Document Build Entity A Federal Financial Statements Blue = required tool

Agenda • XBRL – US and Worldwide • Making the Case for XBRL • Government XBRL Applications • Inside XBRL • The Future of Digital Reporting

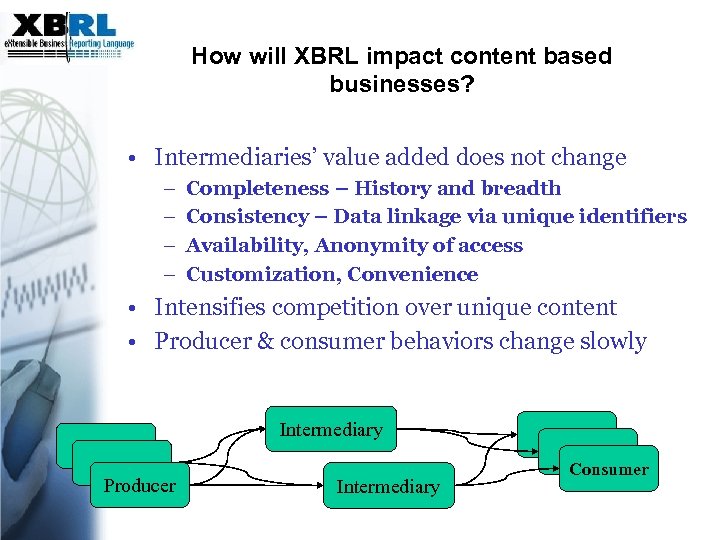

How will XBRL impact content based businesses? • Intermediaries’ value added does not change – – Completeness – History and breadth Consistency – Data linkage via unique identifiers Availability, Anonymity of access Customization, Convenience • Intensifies competition over unique content • Producer & consumer behaviors change slowly Intermediary Producer Intermediary Consumer

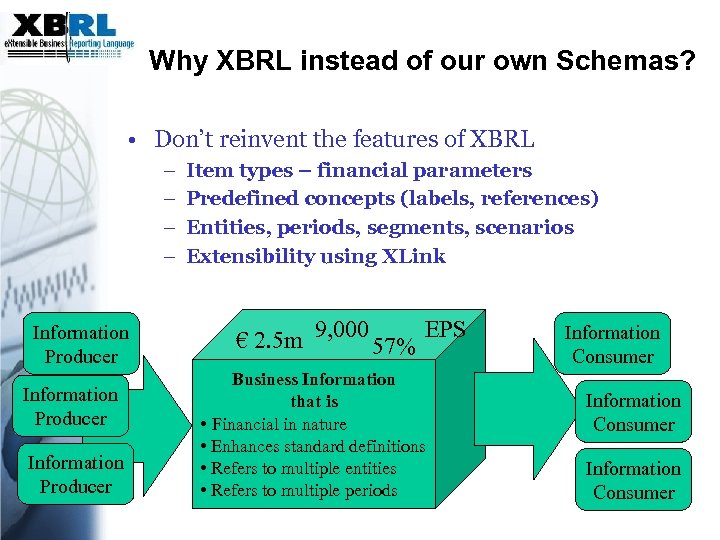

Why XBRL instead of our own Schemas? • Don’t reinvent the features of XBRL – – Information Producer Item types – financial parameters Predefined concepts (labels, references) Entities, periods, segments, scenarios Extensibility using XLink € 2. 5 m 9, 000 57% EPS Business Information that is • Financial in nature • Enhances standard definitions • Refers to multiple entities • Refers to multiple periods Information Consumer

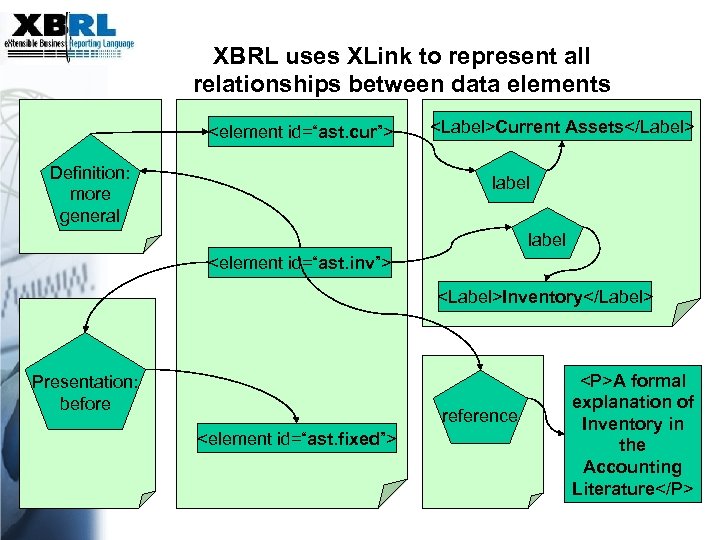

XBRL uses XLink to represent all relationships between data elements <element id=“ast. cur”> Definition: more general <Label>Current Assets</Label> label <element id=“ast. inv”> <Label>Inventory</Label> Presentation: before reference <element id=“ast. fixed”> <P>A formal explanation of Inventory in the Accounting Literature</P>

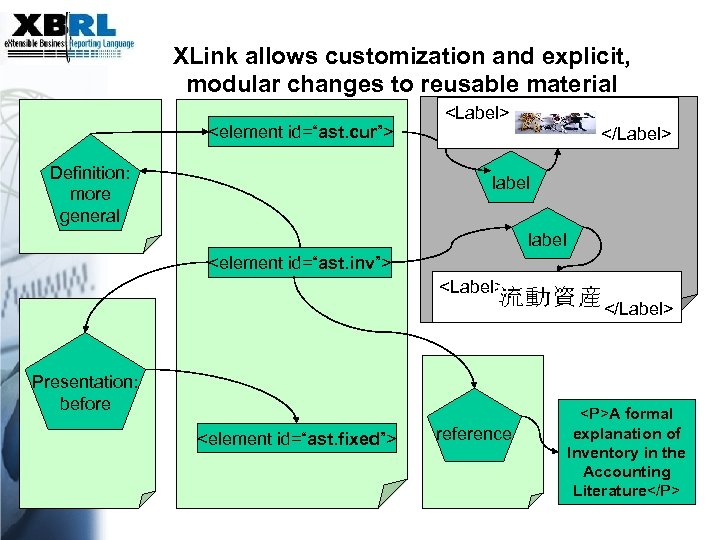

XLink allows customization and explicit, modular changes to reusable material <element id=“ast. cur”> Definition: more general <Label> </Label> label <element id=“ast. inv”> <Label> </Label> Presentation: before <element id=“ast. fixed”> reference <P>A formal explanation of Inventory in the Accounting Literature</P>

Agenda • • XBRL – US and Worldwide Making the Case for XBRL Government XBRL Applications Inside XBRL • The Future of Digital Reporting

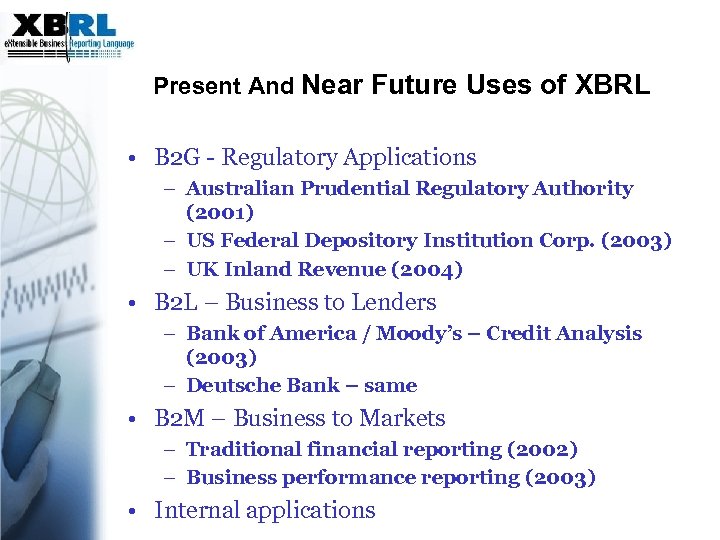

Present And Near Future Uses of XBRL • B 2 G - Regulatory Applications – Australian Prudential Regulatory Authority (2001) – US Federal Depository Institution Corp. (2003) – UK Inland Revenue (2004) • B 2 L – Business to Lenders – Bank of America / Moody’s – Credit Analysis (2003) – Deutsche Bank – same • B 2 M – Business to Markets – Traditional financial reporting (2002) – Business performance reporting (2003) • Internal applications

Questions? Neal J. Hannon, CMA Chair, Education Work Group, XBRL International nhannon@cox. net Photo Credit: Dave Garbutt, FRS, South Africa

f474398c8afcabdd12c15d4aa9c5a983.ppt