9a58cdba8c38a4c6b5f964b19e788cf7.ppt

- Количество слайдов: 20

XBRL Module Part 1: Introduction to XBRL Credits Prepared by: Sponsored by: Rajendra P. Srivastava Ernst & Young Professor University of Kansas Ernst & Young, LLP (August 2005) 1

Outline l l Current and Future Reporting Process l Primary Use Cases l XBRL Information Chain and XBRL GL l XBRL Consortium and Evolution of XBRL l Current Usage and First Adopters of XBRL l Potential Usage of XBRL l 2 Definition and Value of XBRL Some Examples

XBRL Definition* l l 3 XBRL is the specification for the e. Xtensible Business Reporting Language. XBRL allows software vendors, programmers and end users to enhance the creation, exchange, and comparison of business reporting information. Business reporting includes, but is not limited to, financial statements, financial information, non-financial information and regulatory filings such as annual and quarterly financial statements. XBRL defines a syntax in which a fact can be reported as the value of a well defined reporting concept within a particular context. The syntax enables software to efficiently and reliably find, extract and interpret those facts. The XBRL framework splits business reporting information into two components: XBRL instances and taxonomies. * The above definition is provided by XBRL. org in “Extensible Business Reporting Language (XBRL) 2. 1 RECOMMENDATION - 2003 -12 -31 + Corrected Errata 2005 -04 -25. ”

Value of XBRL l 4 Video Clip

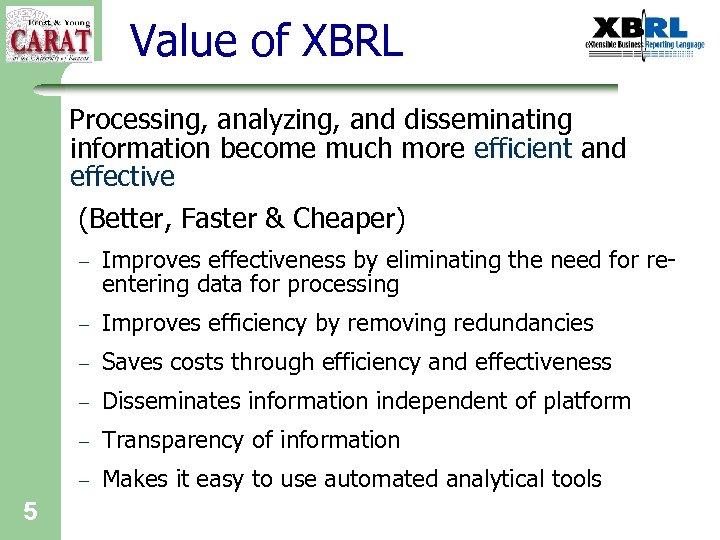

Value of XBRL Processing, analyzing, and disseminating information become much more efficient and effective (Better, Faster & Cheaper) – – Improves efficiency by removing redundancies – Saves costs through efficiency and effectiveness – Disseminates information independent of platform – Transparency of information – 5 Improves effectiveness by eliminating the need for reentering data for processing Makes it easy to use automated analytical tools

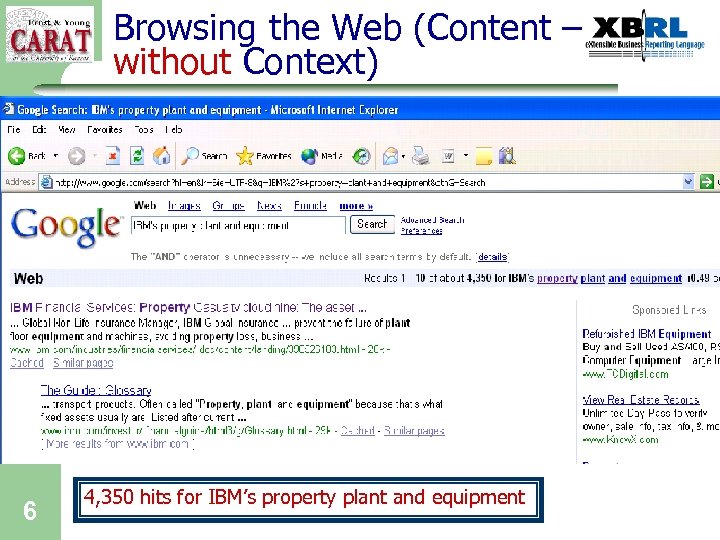

Browsing the Web (Content – without Context) 6 4, 350 hits for IBM’s property plant and equipment

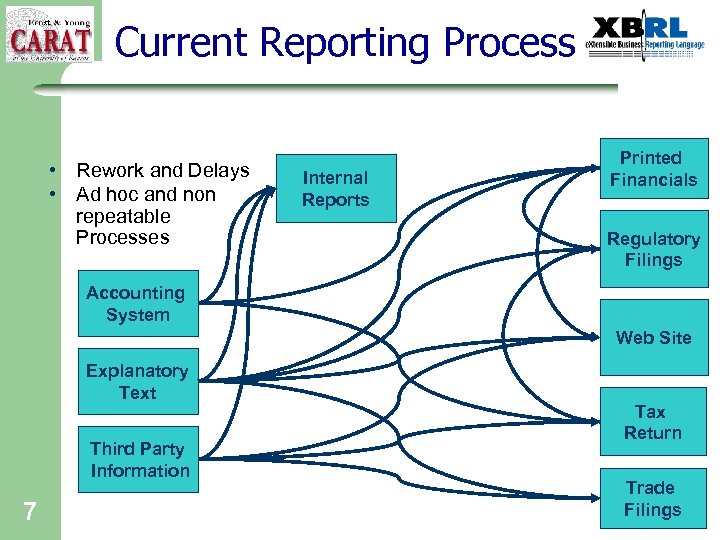

Current Reporting Process • Rework and Delays • Ad hoc and non repeatable Processes Internal Reports Printed Financials Regulatory Filings Accounting System Web Site Explanatory Text Third Party Information 7 Tax Return Trade Filings

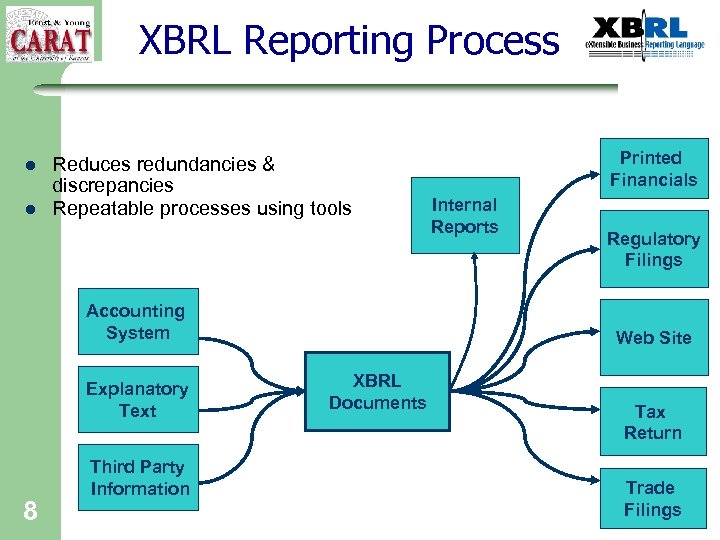

XBRL Reporting Process l l Reduces redundancies & discrepancies Repeatable processes using tools Accounting System Explanatory Text 8 Third Party Information Printed Financials Internal Reports Regulatory Filings Web Site XBRL Documents Tax Return Trade Filings

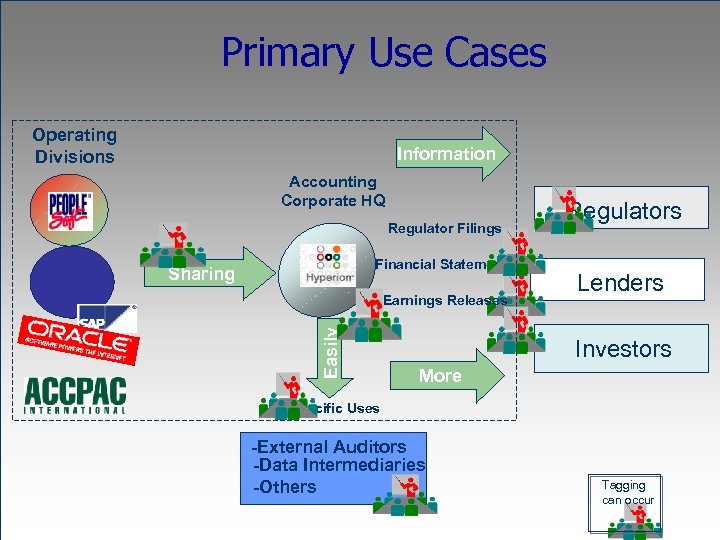

Primary Use Cases Operating Divisions Information Accounting Corporate HQ Regulator Filings Financial Statements Sharing Easily Earnings Releases Regulators Lenders Investors More Specific Uses -External Auditors -Data Intermediaries -Others 9 Tagging can occur

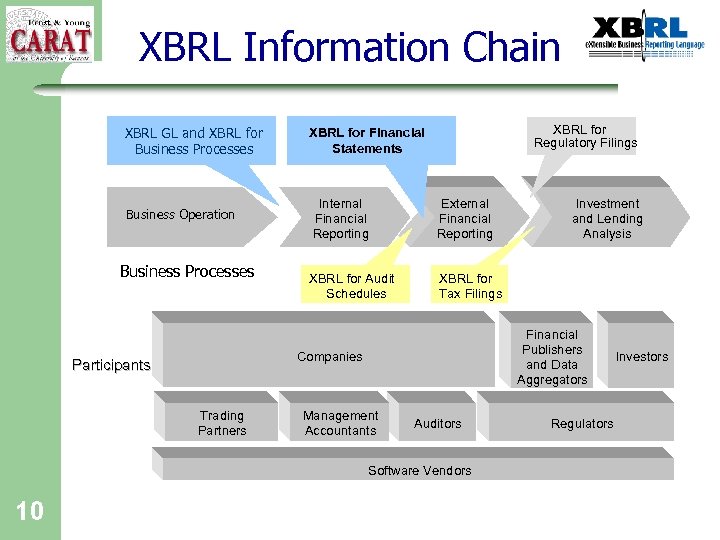

XBRL Information Chain XBRL for Regulatory Filings XBRL GL and XBRL for Business Processes XBRL for Financial Statements Business Operation Internal Financial Reporting External Financial Reporting XBRL for Audit Schedules XBRL for Tax Filings Business Processes Financial Publishers and Data Aggregators Companies Participants Trading Partners Management Accountants Auditors Software Vendors 10 Investment and Lending Analysis Regulators Investors

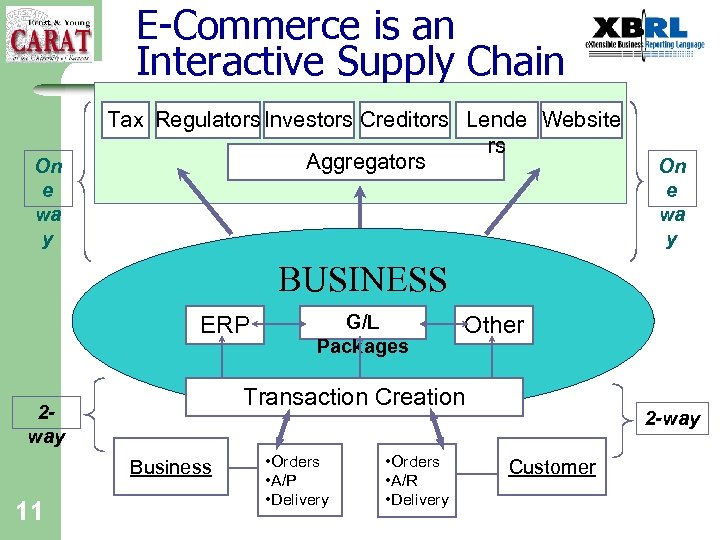

E-Commerce is an Interactive Supply Chain On e wa y Tax Regulators Investors Creditors Lende Website rs Aggregators On e wa y BUSINESS ERP Other Transaction Creation 2 way Business 11 G/L Packages • Orders • A/P • Delivery • Orders • A/R • Delivery 2 -way Customer

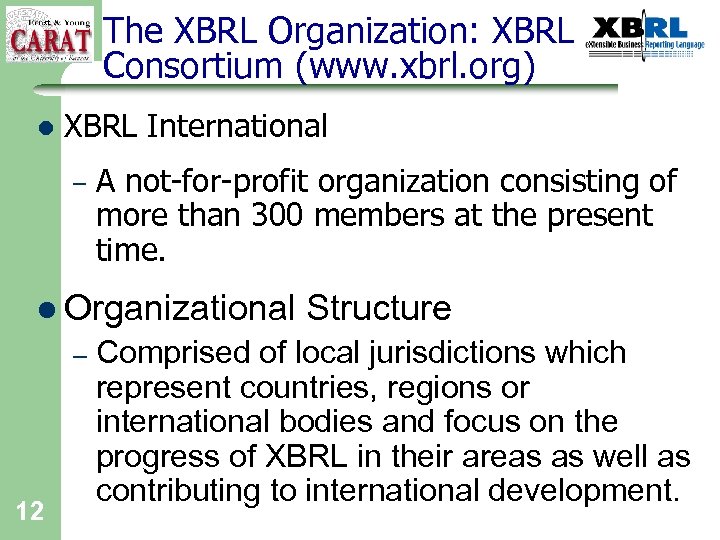

The XBRL Organization: XBRL Consortium (www. xbrl. org) l XBRL International – A not-for-profit organization consisting of more than 300 members at the present time. l Organizational – 12 Structure Comprised of local jurisdictions which represent countries, regions or international bodies and focus on the progress of XBRL in their areas as well as contributing to international development.

13

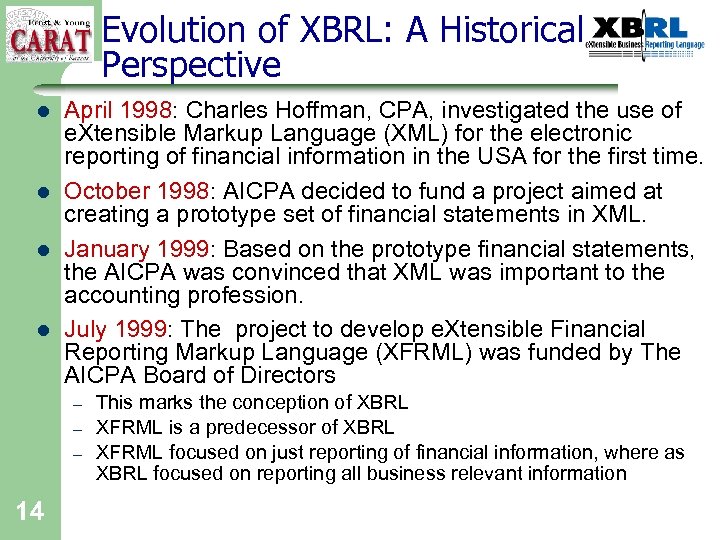

Evolution of XBRL: A Historical Perspective l l April 1998: Charles Hoffman, CPA, investigated the use of e. Xtensible Markup Language (XML) for the electronic reporting of financial information in the USA for the first time. October 1998: AICPA decided to fund a project aimed at creating a prototype set of financial statements in XML. January 1999: Based on the prototype financial statements, the AICPA was convinced that XML was important to the accounting profession. July 1999: The project to develop e. Xtensible Financial Reporting Markup Language (XFRML) was funded by The AICPA Board of Directors – – – 14 This marks the conception of XBRL XFRML is a predecessor of XBRL XFRML focused on just reporting of financial information, where as XBRL focused on reporting all business relevant information

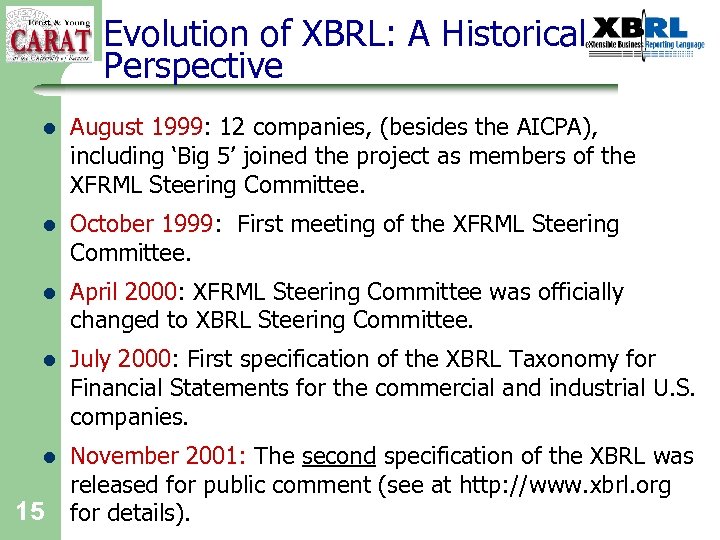

Evolution of XBRL: A Historical Perspective l August 1999: 12 companies, (besides the AICPA), including ‘Big 5’ joined the project as members of the XFRML Steering Committee. l October 1999: First meeting of the XFRML Steering Committee. l April 2000: XFRML Steering Committee was officially changed to XBRL Steering Committee. l July 2000: First specification of the XBRL Taxonomy for Financial Statements for the commercial and industrial U. S. companies. l November 2001: The second specification of the XBRL was released for public comment (see at http: //www. xbrl. org for details). 15

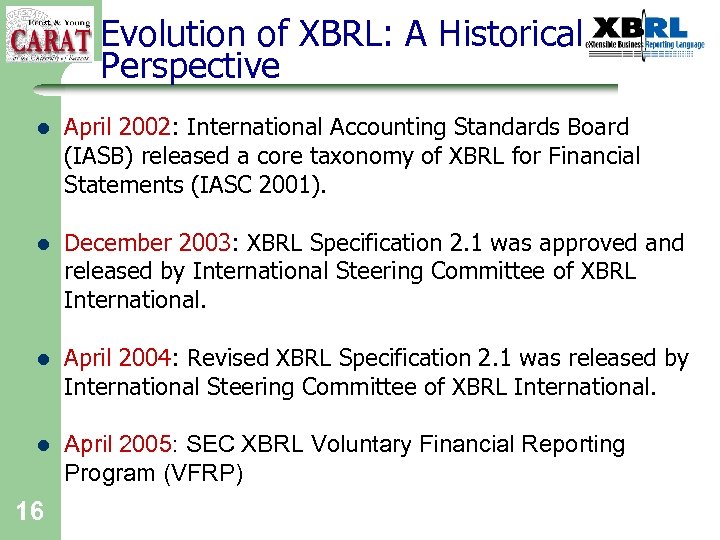

Evolution of XBRL: A Historical Perspective l April 2002: International Accounting Standards Board (IASB) released a core taxonomy of XBRL for Financial Statements (IASC 2001). l December 2003: XBRL Specification 2. 1 was approved and released by International Steering Committee of XBRL International. l April 2004: Revised XBRL Specification 2. 1 was released by International Steering Committee of XBRL International. l April 2005: SEC XBRL Voluntary Financial Reporting Program (VFRP) 16

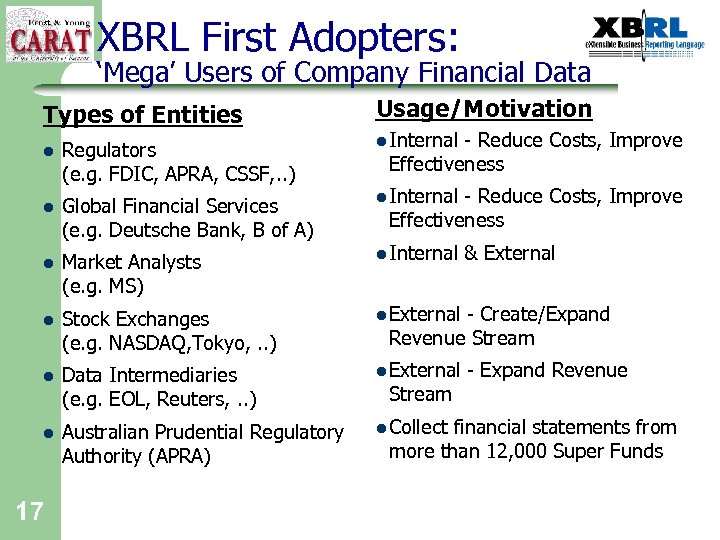

XBRL First Adopters: ‘Mega’ Users of Company Financial Data Types of Entities Usage/Motivation l Internal - Reduce Costs, Improve Effectiveness l Regulators (e. g. FDIC, APRA, CSSF, . . ) l Global Financial Services (e. g. Deutsche Bank, B of A) l Market Analysts (e. g. MS) l Stock Exchanges (e. g. NASDAQ, Tokyo, . . ) l External l Data Intermediaries (e. g. EOL, Reuters, . . ) l External l Australian Prudential Regulatory Authority (APRA) l Collect 17 l Internal - Reduce Costs, Improve Effectiveness l Internal & External - Create/Expand Revenue Stream - Expand Revenue financial statements from more than 12, 000 Super Funds

Potential Usage of XBRL l Managerial Reporting – – – l Internal Auditing – – l 18 Efficient and effective evaluation of internal controls, and documentation of material weaknesses Effective compliance to Sarbanes-Oxley Act External Auditing – l Enhance internal reporting of financial and non-financial production related information XBRL can lead to effective and efficient management of supply value chain XBRL can provide timely feedback on personnel performance Efficient and effective use of analytical tools for risk assessments, industry comparisons, benchmarking, trend analysis, etc. from remote locations Others: Loan approval, Credit rating, Mergers & acquisitions, Investment Decisions, etc.

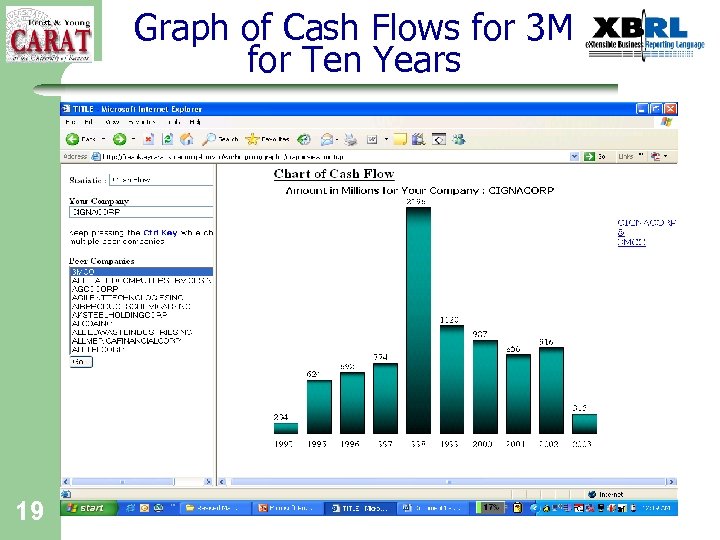

Graph of Cash Flows for 3 M for Ten Years 19

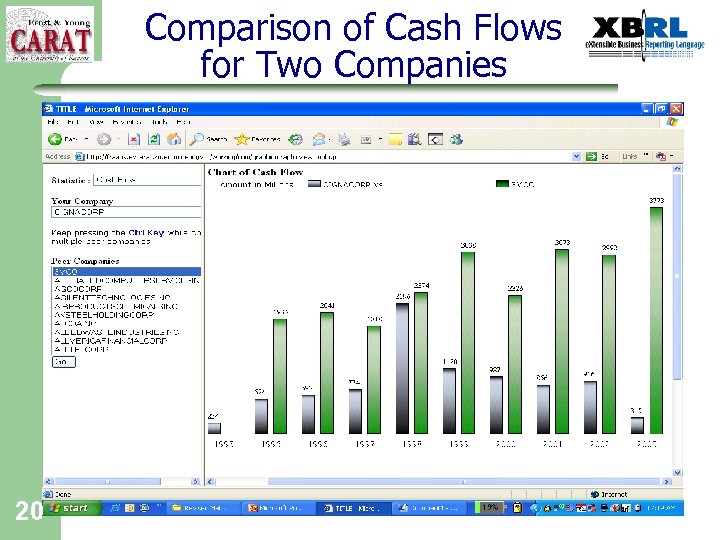

Comparison of Cash Flows for Two Companies 20

9a58cdba8c38a4c6b5f964b19e788cf7.ppt