608283725f56391ba29246063afc418a.ppt

- Количество слайдов: 19

XBRL in the UK Peter Calvert XBRL European Technical Meeting 5 October 2006

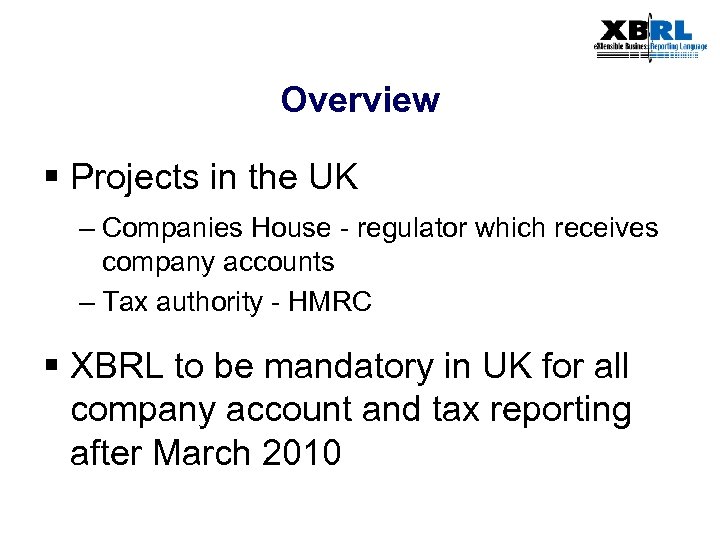

Overview § Projects in the UK – Companies House - regulator which receives company accounts – Tax authority - HMRC § XBRL to be mandatory in UK for all company account and tax reporting after March 2010

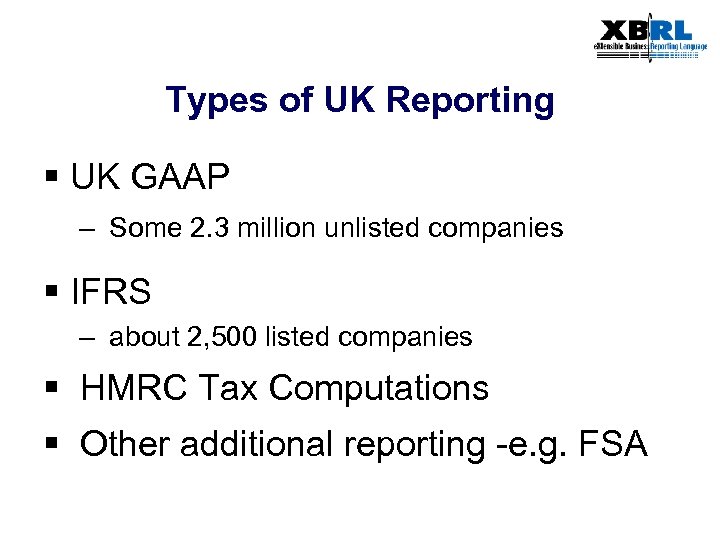

Types of UK Reporting § UK GAAP – Some 2. 3 million unlisted companies § IFRS – about 2, 500 listed companies § HMRC Tax Computations § Other additional reporting -e. g. FSA

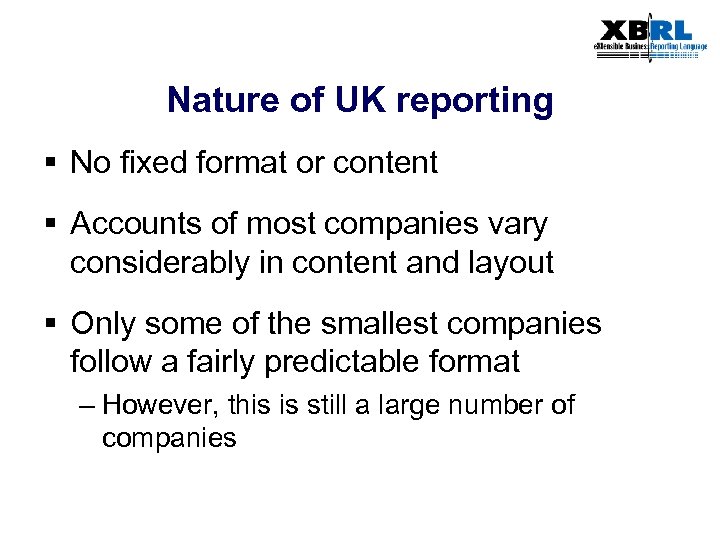

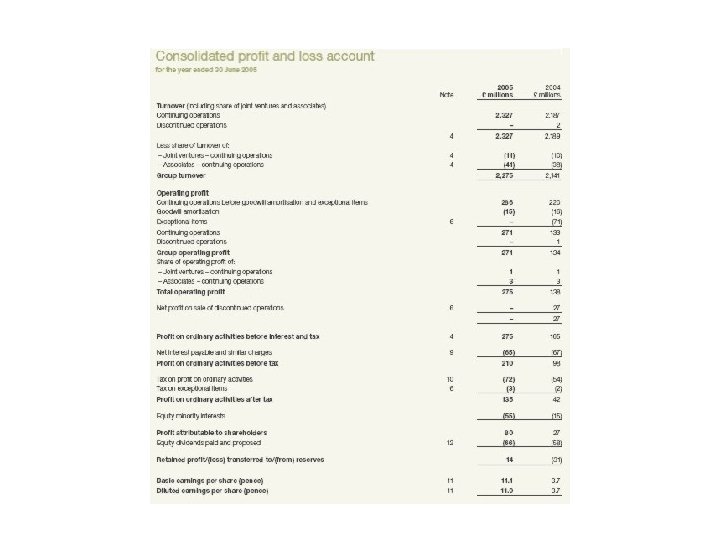

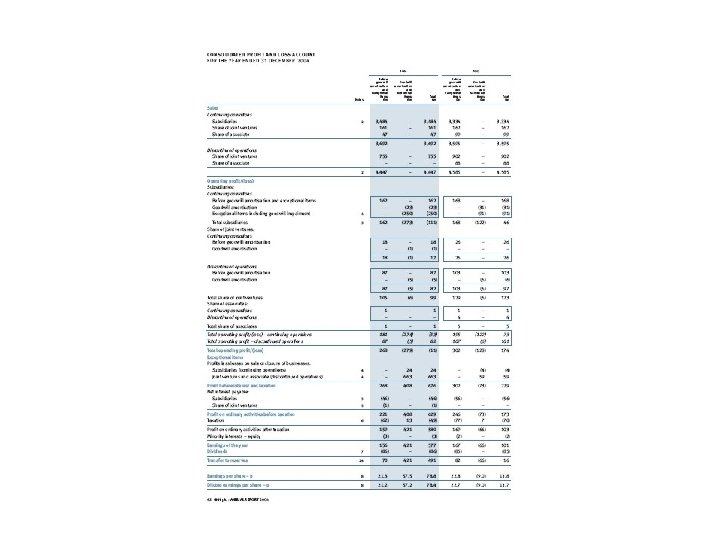

Nature of UK reporting § No fixed format or content § Accounts of most companies vary considerably in content and layout § Only some of the smallest companies follow a fairly predictable format – However, this is still a large number of companies

Consequences § Large and complex GAAP taxonomy § Need to support company extensions § Need to support varying formats => requirements for rendering § Various issues arise with calculations, handling of text etc.

Plans in the UK § Start with small companies, then move to more complex cases. § Companies House project for XBRL filing by audit exempt companies § HMRC tax computations and accounts for audit exempt companies § Expand to larger companies

Taxonomy development § Full UK GAAP taxonomy § Extend for small companies § HMRC tax computations taxonomy § (Use stylesheets for rendering) § Revise full UK GAAP taxonomy – Issue to software vendors for feedback and implementation

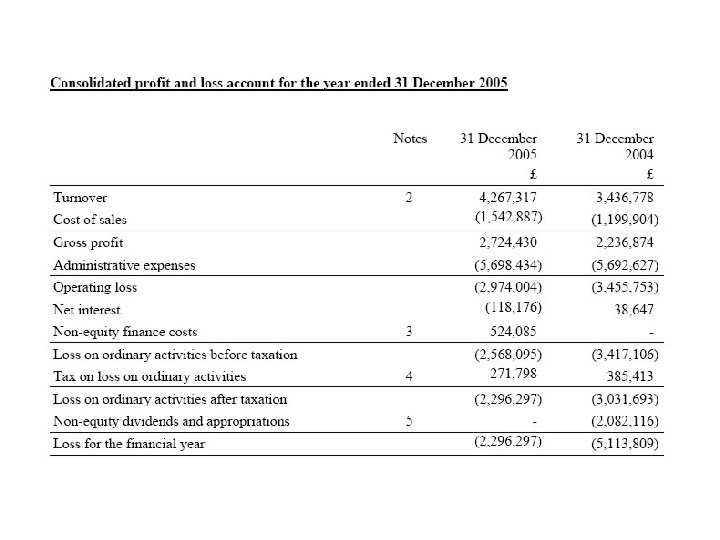

Companies House small company project § Went live in December 2005 § Filing by accounting software packages and by web interface § About 40, 000 accounts filed so far § Significant increase in quality and saving of resources

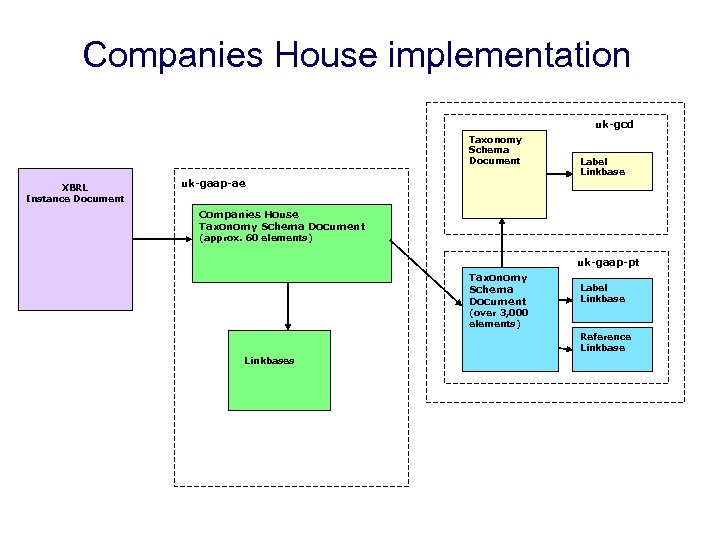

Companies House implementation uk-gcd Taxonomy Schema Document XBRL Instance Document uk-gaap-ae Label Linkbase Companies House Taxonomy Schema Document (approx. 60 elements) uk-gaap-pt Taxonomy Schema Document Label Linkbase (over 3, 000 elements) Reference Linkbases

HMRC, Next Steps and UK GAAP § HMRC filing of tax computations just gone live § Revision of small companies extension => broader range of smaller company filing in early 2007 § Revision of UK GAAP taxonomy now in final stages

Revision of UK GAAP taxonomy and expansion of XBRL filing § Revised version incorporates dimensions (and new GCD) § Now under internal review § Release to accounting software companies in November § Important implementation stage: challenge for companies and XBRL

Issues - Dimensions § Important addition - much more effective representation of data § Reduction in number of elements § BUT complex to implement – Statistics: 34 dimensions, 22 hypercubes – Use of inheritance to simplify extension – Feedback from review and early implementation

Issues - Rendering § Standard mechanism to make instances readable by humans § Required by data providers for efficient instance creation and assurance § Needed by regulators for efficient consumption and publication of data

Other Issues (1) § Text: what text to represent and at what level of granularity § Versioning: – Phased approach – Standard way of documenting typical changes – Human commentary – We should limit initial expectations

Other Issues (2) § Formulae – Not a high priority for the UK – Accept limitations of calculations – Practical application and extensibility § GCD – Use and reaction so far – Duplicate activity and loss of interoperability – Effort required - put on agenda for future consideration

SUMMARY OF XBRL IN THE UK § Successful implementation for fixed format and simple accounts § Now face challenge of implementing for large, variable format accounts with company extensions § Deadlines; requirements for international deliverables

608283725f56391ba29246063afc418a.ppt