04cacd3f6c9d1e969a7b7310705e99db.ppt

- Количество слайдов: 33

XBRL: A Step forward for e-Filings Everywhere Walter Hamscher (walter@hamscher. com) Executive Committee, XBRL International Consultant to Pricewaterhouse. Coopers

XBRL: A Step forward for e-Filings § § XBRL Review E-Filing and US Federal financial system Overview of the processes and systems Points of view § § FFIEC and public – data sharing efficiency Bank – improved compatibility platform Vendor – differentiation opportunities Consortium – proves that collaboration works § Lessons for other data collection systems

Prudential Equities says: “The Impact Of XBRL Will Be Pervasive And Positive, We Believe. In his classic film, Brazil, former Monty Python comicturned-director Terry Gilliam presents a nightmare technological dystopian vision of a world where sophisticated computers exist, but humans copy information from sleek glass screens onto paper by manually hammering the keys of ancient Smith. Coronas. To a surprising extent, in our opinion, we still live that nightmare today. ”

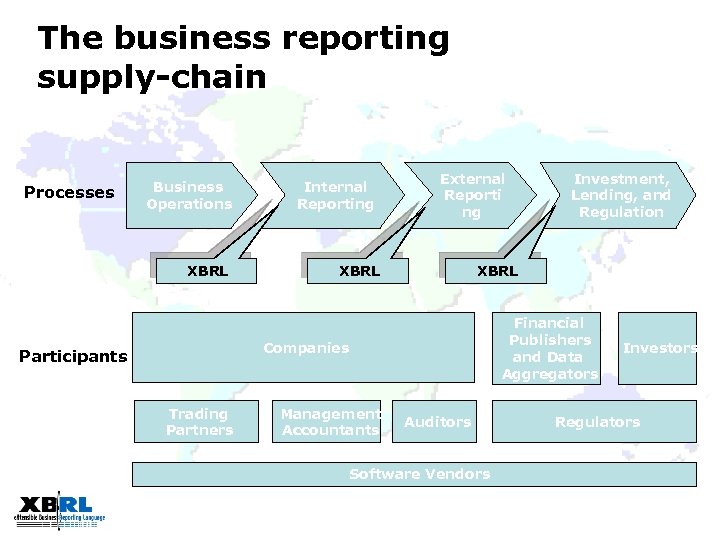

The business reporting supply-chain Processes Business Operations XBRL Internal Reporting External Reporti ng XBRL Financial Publishers and Data Aggregators Companies Participants Trading Partners Investment, Lending, and Regulation Management Accountants Auditors Software Vendors Investors Regulators

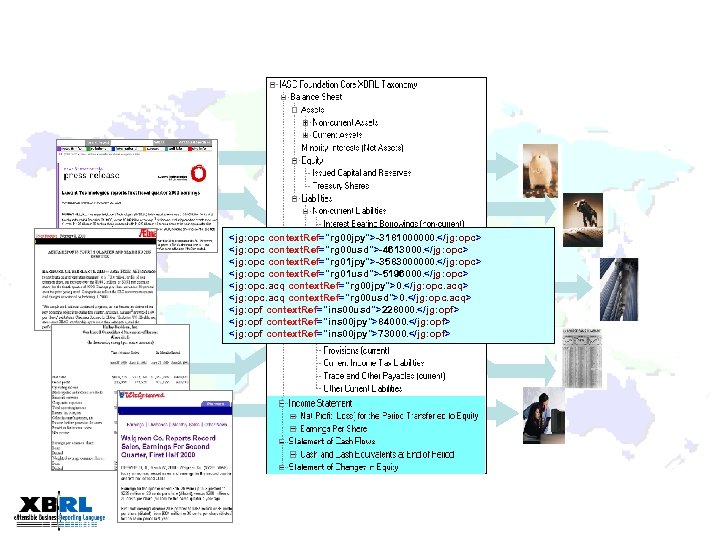

<jg: opc context. Ref="rg 00 jpy">-3181000000. </jg: opc> <jg: opc context. Ref="rg 00 usd">-4613000. </jg: opc> <jg: opc context. Ref="rg 01 jpy">-3583000000. </jg: opc> <jg: opc context. Ref="rg 01 usd">-5196000. </jg: opc> <jg: opc. acq context. Ref="rg 00 jpy">0. </jg: opc. acq> <jg: opc. acq context. Ref="rg 00 usd">0. </jg: opc. acq> <jg: opf context. Ref="ins 00 usd">228000. </jg: opf> <jg: opf context. Ref="ins 00 jpy">84000. </jg: opf> <jg: opf context. Ref="ins 00 jpy">73000. </jg: opf> ?

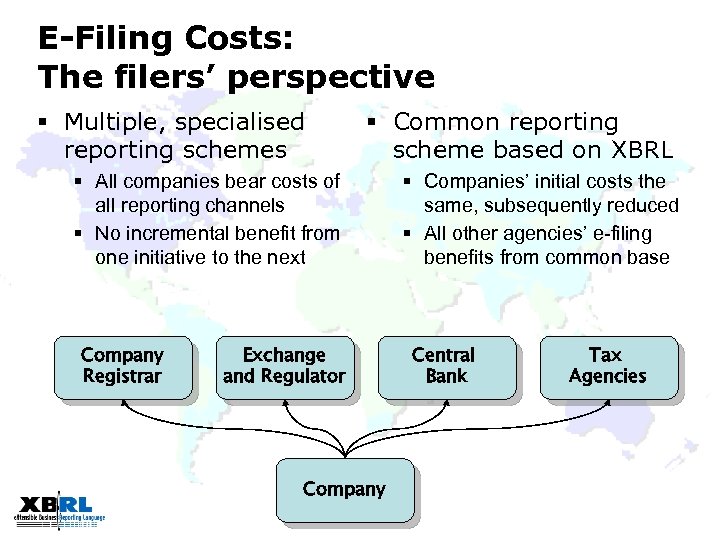

E-Filing Costs: The filers’ perspective § Multiple, specialised reporting schemes § Common reporting scheme based on XBRL § All companies bear costs of all reporting channels § No incremental benefit from one initiative to the next Company Registrar Exchange and Regulator Company § Companies’ initial costs the same, subsequently reduced § All other agencies’ e-filing benefits from common base Central Bank Tax Agencies

XBRL Theory

XBRL Practice

XBRL: A Step forward for e-Filings § Over 8, 300 banks’ data § Up to 1200 data points per filing bank § Virtually all based on GAAP § XML-based e-Filing adds value § Common interface for filings via the Internet § XBRL adds value to XML-based e-Filing § Taxonomy (data dictionary) sharing § Portable and higher level of validation § 1 st live XBRL filing will be for period 3 Q ‘ 04

XBRL: A Step forward for e-Filings § § XBRL: a step forward for e-filings E-Filing and US Federal financial system Overview of the processes and systems Points of view § § FFIEC and public – data sharing efficiency Bank – improved compatibility platform Vendor – differentiation opportunities Consortium – proves that collaboration works § Lessons for other data collectors

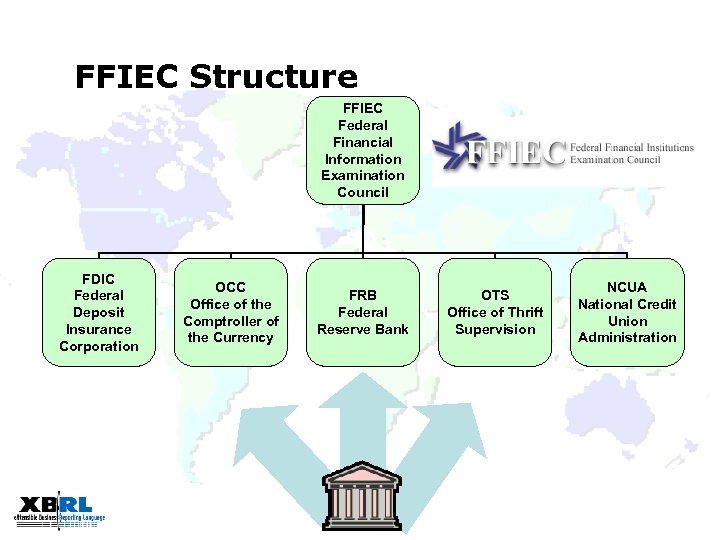

FFIEC Structure FFIEC Federal Financial Information Examination Council FDIC Federal Deposit Insurance Corporation OCC Office of the Comptroller of the Currency FRB Federal Reserve Bank OTS Office of Thrift Supervision NCUA National Credit Union Administration

Call Reports § Call Report content determined by the inter -agency FFIEC (Federal Financial Institutions Examination Council) § Forms and instructions are available on www. FDIC. gov

Call Reports § The Call Report filed by banks with foreign offices includes: § 25 schedules § 1, 200+ items § Instructions: 450 pages plus GAAP references § Validations = 1, 200

Call Reports § Call Reports use GAAP for recognition and measurement purposes § Structured to require that all banks report details consistently § Ensures comparability among reporters

Call Reports § Public is downloading about 1 million Call Report pages per year from www. FDIC. gov § Data is distributed to analytical systems that allow customization and acquisition of databases

XBRL: A Step forward for e-Filings § § XBRL Review E-Filing and US Federal financial system Overview of the processes and systems Points of view § § FFIEC and the public – data sharing efficiency Banks – improved compatibility platform Vendor – differentiation opportunities Consortium – proves that collaboration works § Lessons for other data collection systems

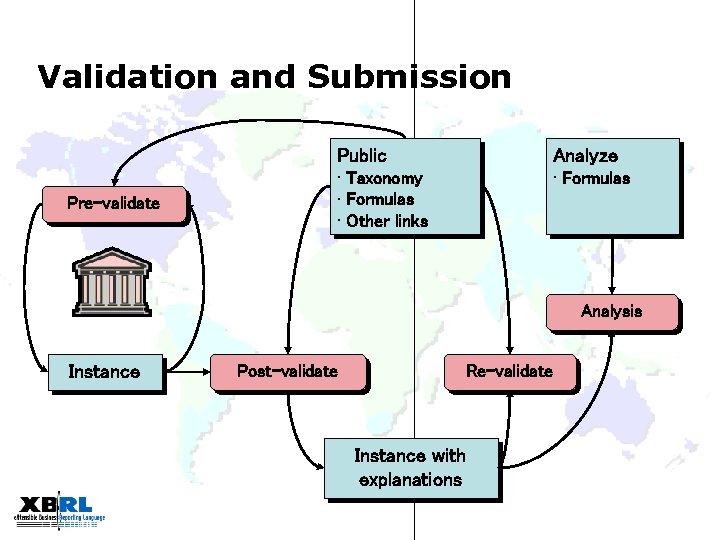

Validation and Submission Public Pre-validate Analyze • Taxonomy • Formulas • Other links • Formulas Analysis Instance Post-validate Re-validate Instance with explanations

Validation Levels § Data elements § “Five year residential loans” is represented by fdic: riad 0348 § Primitive data types § The value of riad 0348 must be nine digits and not negative § Compound data structures § A Maturity Breakdown must contain Loans, Securities and Derivatives § Calculated data values § RIAC 4410 = RIAC 4411 + RIAC 4412, plus or minus 10, 000 § Co-Constraints among data values: Formulas § Box 27 is True if and only if Box 28 is the same as Box 29 § Cross-document constraints § Var 50 is True if Box 28 is larger than any value ever reported.

XBRL: A Step forward for e-Filings § § XBRL Overview E-Filing and US Federal financial system Overview of the processes and systems Points of view § § FFIEC and the public – data sharing efficiency Banks – improved compatibility platform Vendor – differentiation opportunities Consortium – proves that collaboration works § Lessons for other data collectors

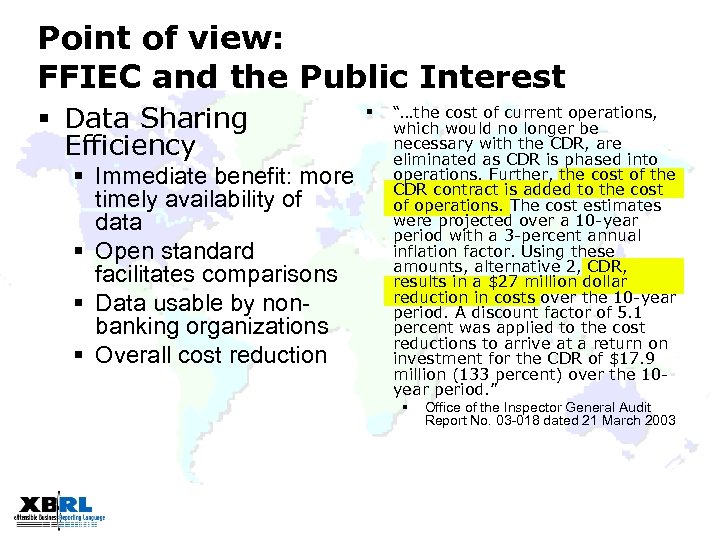

Point of view: FFIEC and the Public Interest § Data Sharing Efficiency § Immediate benefit: more timely availability of data § Open standard facilitates comparisons § Data usable by nonbanking organizations § Overall cost reduction § “…the cost of current operations, which would no longer be necessary with the CDR, are eliminated as CDR is phased into operations. Further, the cost of the CDR contract is added to the cost of operations. The cost estimates were projected over a 10 -year period with a 3 -percent annual inflation factor. Using these amounts, alternative 2, CDR, results in a $27 million dollar reduction in costs over the 10 -year period. A discount factor of 5. 1 percent was applied to the cost reductions to arrive at a return on investment for the CDR of $17. 9 million (133 percent) over the 10 year period. ” § Office of the Inspector General Audit Report No. 03 -018 dated 21 March 2003

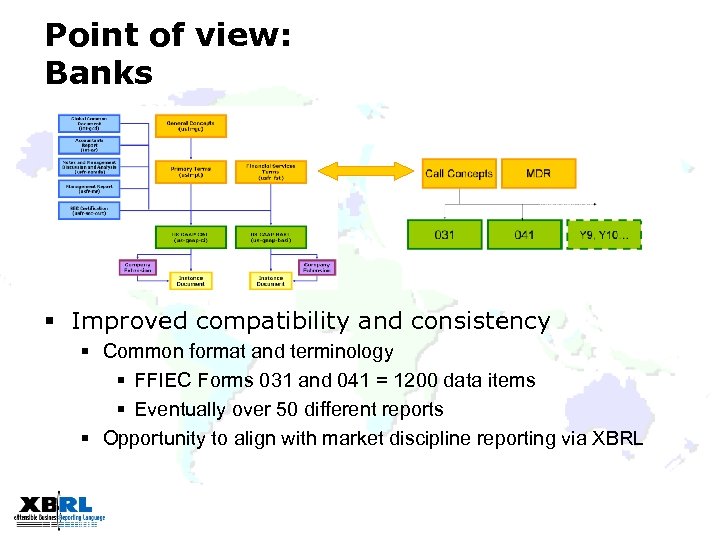

Point of view: Banks § Improved compatibility and consistency § Common format and terminology § FFIEC Forms 031 and 041 = 1200 data items § Eventually over 50 different reports § Opportunity to align with market discipline reporting via XBRL

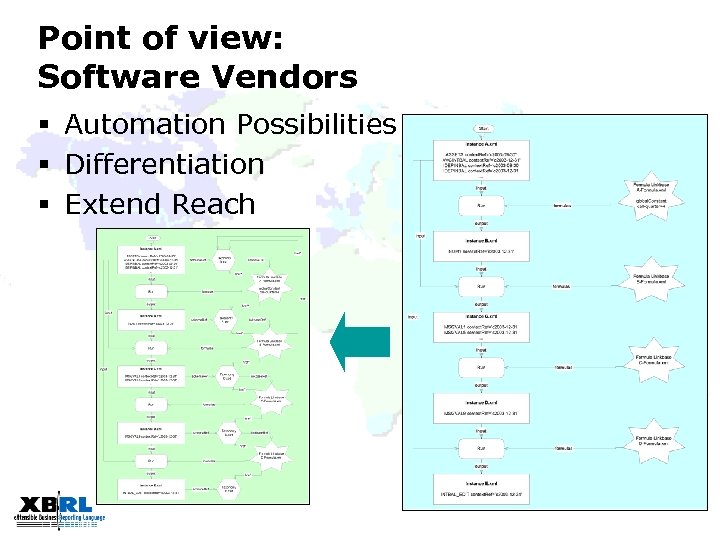

Point of view: Software Vendors § Automation Possibilities § Differentiation § Extend Reach

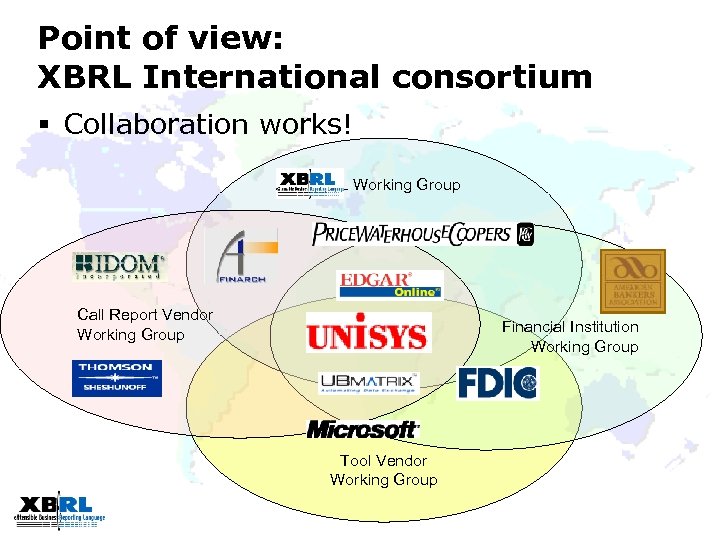

Point of view: XBRL International consortium § Collaboration works! XBRL Working Group Call Report Vendor Working Group Financial Institution Working Group Tool Vendor Working Group

XBRL: A step forward for e-Filings § § XBRL Overview E-Filing and US Federal financial system Overview of the processes and systems Points of view § § FFIEC and the public – data sharing efficiency Banks – improved compatibility platform Vendors – differentiation opportunities Consortium – proves that collaboration works § Lessons for other data collectors

Accelerating Positive Change § The type and timing of validation processing impacts the filers’ work flow. § Validations are essential in order to improve the overall processing of filings – so collaborate with other agencies § Multiple validation environments and stages take place; that becomes visible to filers but is unfamiliar – make it worthwhile! § Whether or not to have official “forms” will be a key decision. § Selective data collection is good regulation strategy § Banks’ filing preparation processes are tied to forms § Maintenance of many dependent modules is key § Without setting expectations, filers prefer for regulators to use less flexible technology - all lose!

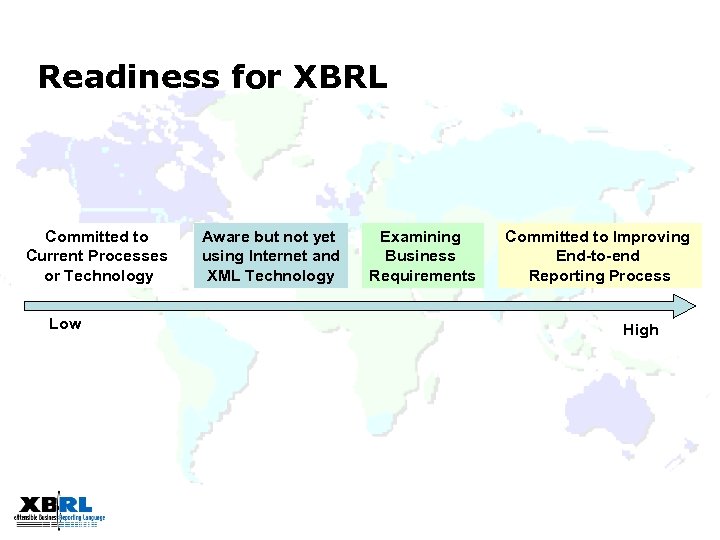

Readiness for XBRL Committed to Current Processes or Technology Low Aware but not yet using Internet and XML Technology Examining Business Requirements Committed to Improving End-to-end Reporting Process High

An XBRL reporting system will disseminate relevant information in a flexible, usable format to markets on an almost real-time basis… Too much damage has occurred to the U. S. economy and the capital markets because of the lack of timely and transparent financial information. I have confidence that XBRL will eliminate those deficiencies. The Hon. Richard H. Baker Chairman, House Capital Markets Subcommittee

From www. fsa. uk. gov/regulatory_reporting The Integrated Regulatory Return… will combine all of the data we request from firms into one return, helping us monitor them more effectively and reducing costs for firms and us. …we have decided to use the Extensible Business Reporting Language (XBRL) to collect, validate and distribute the data in the Integrated Regulatory Return.

XBRL: A Step forward for e-Filings Everywhere Walter Hamscher (walter@hamscher. com) Executive Committee, XBRL International Consultant to Pricewaterhouse. Coopers

04cacd3f6c9d1e969a7b7310705e99db.ppt