85d20d0ca8eaf73729e7e6637274be73.ppt

- Количество слайдов: 46

www. naftamx. org/ohio. html www. naftamexico. org/ohio. html Columbus, Ohio May, 2006

www. naftamx. org/ohio. html www. naftamexico. org/ohio. html Columbus, Ohio May, 2006

Mexico’s Market Mexico is an attractive market of over 105 million consumers with annual foreign purchases that exceed 231 billion dollars, making it the 8 th* largest importer globally. Mexico’s consumers spend more than five out of every ten dollars on U. S. goods. Share in Mexico’s Imports by Selected Countries 2005 Source: Banxico *Source: WTO 2006, excluding intra-EU (25) imports

Mexico’s Market Mexico is an attractive market of over 105 million consumers with annual foreign purchases that exceed 231 billion dollars, making it the 8 th* largest importer globally. Mexico’s consumers spend more than five out of every ten dollars on U. S. goods. Share in Mexico’s Imports by Selected Countries 2005 Source: Banxico *Source: WTO 2006, excluding intra-EU (25) imports

U. S. Exports to Mexico has become the U. S. ’ second largest export market buying more products from the U. S. than countries such as: Source: USDOC *Source: Banxico

U. S. Exports to Mexico has become the U. S. ’ second largest export market buying more products from the U. S. than countries such as: Source: USDOC *Source: Banxico

U. S. Exports to Mexico’s market share of total U. S. exports increased more than any other country’s in the last twelve years Share in U. S. Exports by Selected Countries Percentage Source: USDOC

U. S. Exports to Mexico’s market share of total U. S. exports increased more than any other country’s in the last twelve years Share in U. S. Exports by Selected Countries Percentage Source: USDOC

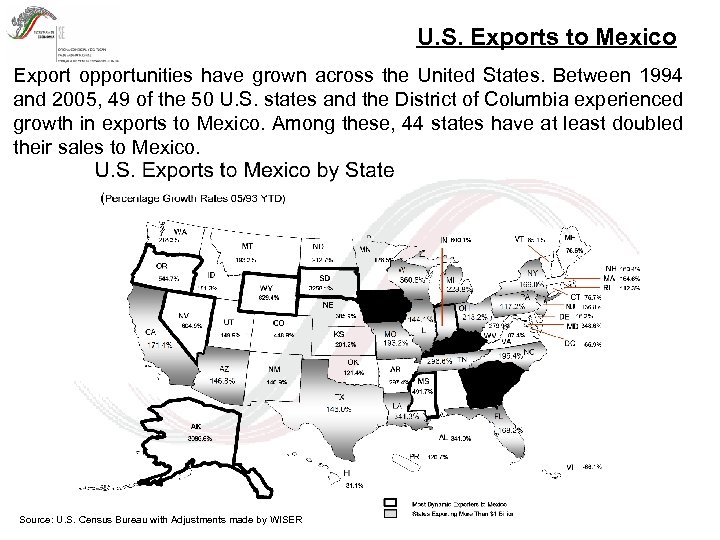

U. S. Exports to Mexico Export opportunities have grown across the United States. Between 1994 and 2005, 49 of the 50 U. S. states and the District of Columbia experienced growth in exports to Mexico. Among these, 44 states have at least doubled their sales to Mexico. Source: U. S. Census Bureau with Adjustments made by WISER

U. S. Exports to Mexico Export opportunities have grown across the United States. Between 1994 and 2005, 49 of the 50 U. S. states and the District of Columbia experienced growth in exports to Mexico. Among these, 44 states have at least doubled their sales to Mexico. Source: U. S. Census Bureau with Adjustments made by WISER

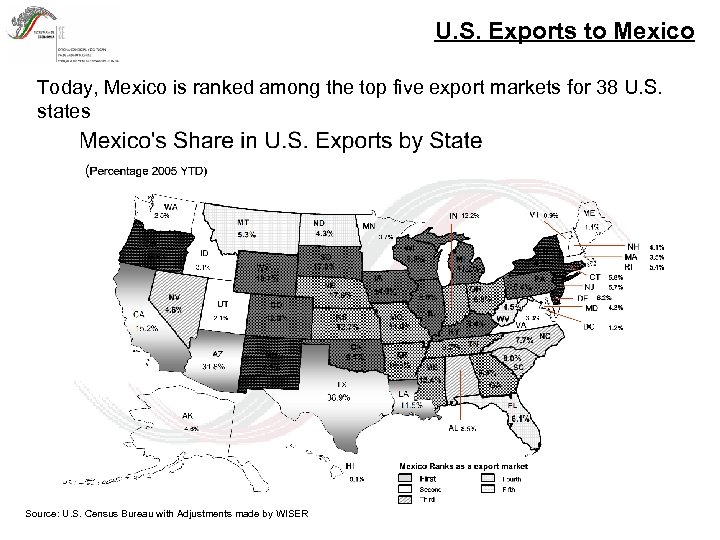

U. S. Exports to Mexico Today, Mexico is ranked among the top five export markets for 38 U. S. states Source: U. S. Census Bureau with Adjustments made by WISER

U. S. Exports to Mexico Today, Mexico is ranked among the top five export markets for 38 U. S. states Source: U. S. Census Bureau with Adjustments made by WISER

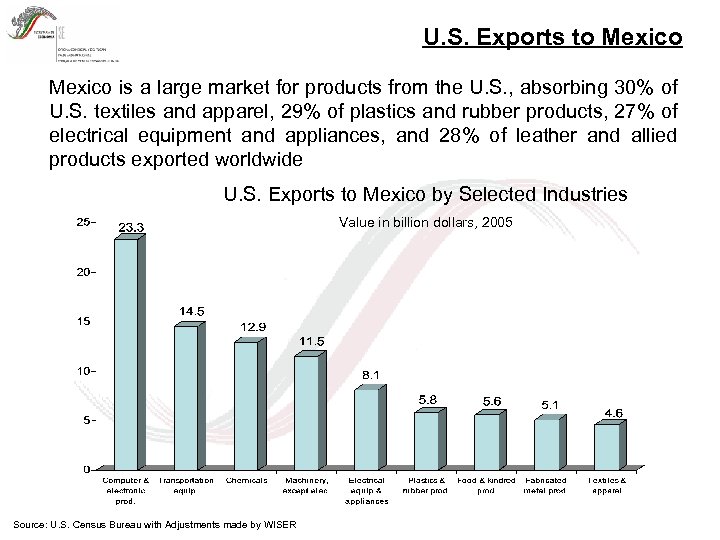

U. S. Exports to Mexico is a large market for products from the U. S. , absorbing 30% of U. S. textiles and apparel, 29% of plastics and rubber products, 27% of electrical equipment and appliances, and 28% of leather and allied products exported worldwide U. S. Exports to Mexico by Selected Industries Value in billion dollars, 2005 Source: U. S. Census Bureau with Adjustments made by WISER

U. S. Exports to Mexico is a large market for products from the U. S. , absorbing 30% of U. S. textiles and apparel, 29% of plastics and rubber products, 27% of electrical equipment and appliances, and 28% of leather and allied products exported worldwide U. S. Exports to Mexico by Selected Industries Value in billion dollars, 2005 Source: U. S. Census Bureau with Adjustments made by WISER

U. S. Exports to Mexico Among products exported by the U. S. worldwide, Mexico purchases: üOne out of every four feet of copper wire üOne in every two office boxes of carton or paper üNearly half of electric motor and generator parts, and some articles of iron and steel ü 44% of some articles of plastics ü 41% of electric capacitors üTwo of every five containers of plastic ü 35% of printed circuits üOne out of every four parts for TV’s and radios ü 24% of new pneumatic tires üOne out of every five parts and accessories for vehicles üNearly one in every five of control instrument parts üMore than one out of every ten vehicles

U. S. Exports to Mexico Among products exported by the U. S. worldwide, Mexico purchases: üOne out of every four feet of copper wire üOne in every two office boxes of carton or paper üNearly half of electric motor and generator parts, and some articles of iron and steel ü 44% of some articles of plastics ü 41% of electric capacitors üTwo of every five containers of plastic ü 35% of printed circuits üOne out of every four parts for TV’s and radios ü 24% of new pneumatic tires üOne out of every five parts and accessories for vehicles üNearly one in every five of control instrument parts üMore than one out of every ten vehicles

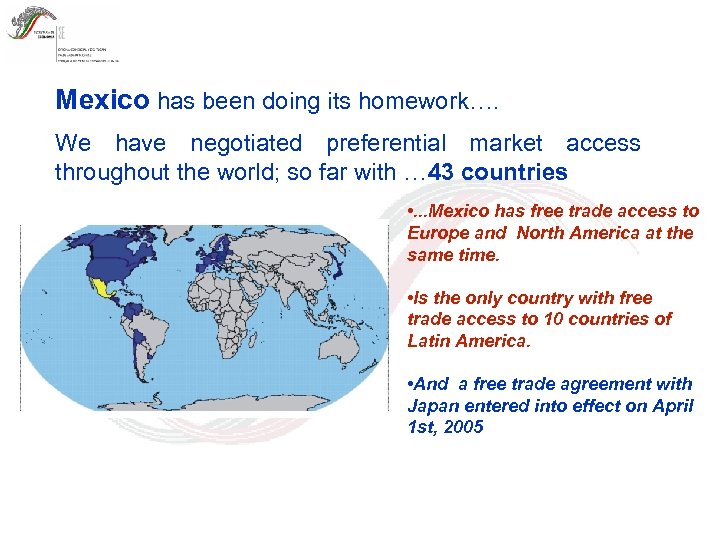

Mexico has been doing its homework…. We have negotiated preferential market access throughout the world; so far with … 43 countries • . . . Mexico has free trade access to Europe and North America at the same time. • Is the only country with free trade access to 10 countries of Latin America. • And a free trade agreement with Japan entered into effect on April 1 st, 2005

Mexico has been doing its homework…. We have negotiated preferential market access throughout the world; so far with … 43 countries • . . . Mexico has free trade access to Europe and North America at the same time. • Is the only country with free trade access to 10 countries of Latin America. • And a free trade agreement with Japan entered into effect on April 1 st, 2005

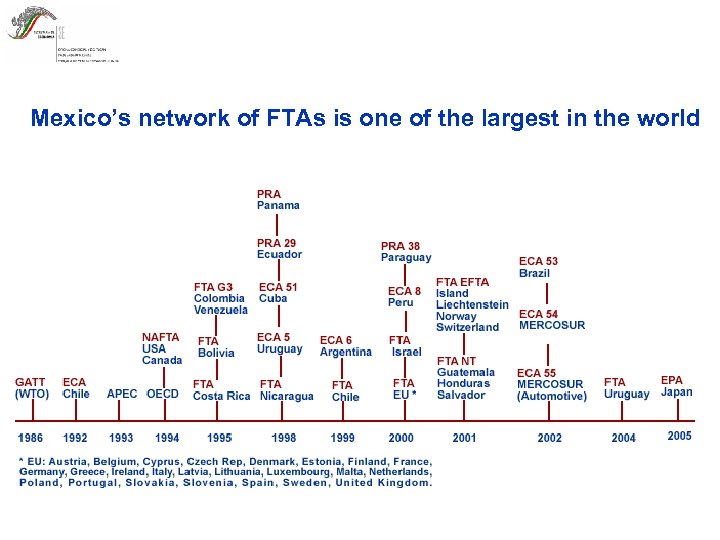

Mexico’s network of FTAs is one of the largest in the world Sweeden 12 FTAs Canadá Norway Finland Denmark 20 BITs United States Iceland United Kingdom 6 CEAs Netherlands Germany Cuba Ireland Honduras Belgium Nicaragua Guatemala Liechtenstein Czech Rep. Austria Luxembourg Switzerland Portugal Costa Rica El Salvador Spain Venezuela Colombia Mercosur France Italy Greece Australia South Korea Peru Bolivia Chile Brazil Uruguay Argentina Israel Japan

Mexico’s network of FTAs is one of the largest in the world Sweeden 12 FTAs Canadá Norway Finland Denmark 20 BITs United States Iceland United Kingdom 6 CEAs Netherlands Germany Cuba Ireland Honduras Belgium Nicaragua Guatemala Liechtenstein Czech Rep. Austria Luxembourg Switzerland Portugal Costa Rica El Salvador Spain Venezuela Colombia Mercosur France Italy Greece Australia South Korea Peru Bolivia Chile Brazil Uruguay Argentina Israel Japan

Mexico’s network of FTAs is one of the largest in the world

Mexico’s network of FTAs is one of the largest in the world

As a result of its 12 free trade agreements with 43 countries, Mexico is by far, the leading exporter of the Latin American region. The eight exporter in the world and the second largest partner of the United States. Exports of Mexico account for almost twice the total exports of Brazil and Argentina and almost equal to all Latin America. Mexico is the 13 th economy in the world. In terms of Sq. Miles is the 14 th (equals to France, Spain, Germany, Italy and UK all together)

As a result of its 12 free trade agreements with 43 countries, Mexico is by far, the leading exporter of the Latin American region. The eight exporter in the world and the second largest partner of the United States. Exports of Mexico account for almost twice the total exports of Brazil and Argentina and almost equal to all Latin America. Mexico is the 13 th economy in the world. In terms of Sq. Miles is the 14 th (equals to France, Spain, Germany, Italy and UK all together)

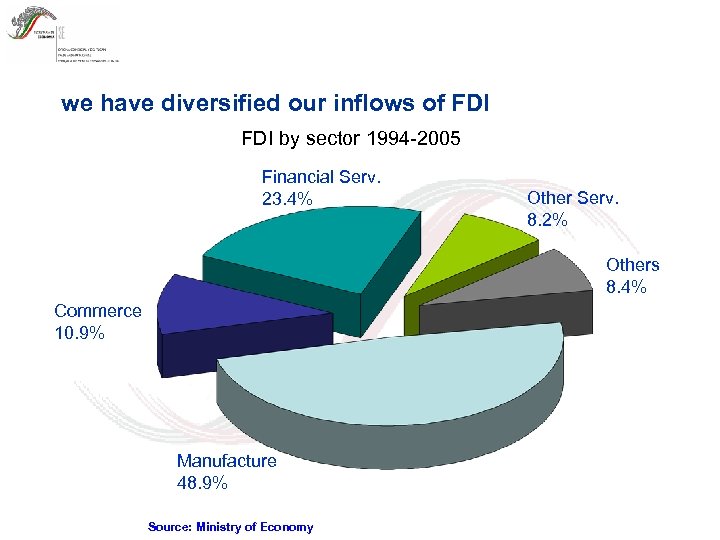

we have diversified our inflows of FDI by sector 1994 -2005 Financial Serv. 23. 4% Other Serv. 8. 2% Others 8. 4% Commerce 10. 9% Manufacture 48. 9% Source: Ministry of Economy

we have diversified our inflows of FDI by sector 1994 -2005 Financial Serv. 23. 4% Other Serv. 8. 2% Others 8. 4% Commerce 10. 9% Manufacture 48. 9% Source: Ministry of Economy

Electronic Industry location ……(700 + companies) Tijuana SANYO SONY HITACHI MATSUSHITA JVC SAMSUNG PIONNER MITSUBISHI SHARP SANYO ELECTRODOMÉSTICOS PHILIPS CASIO KODAK CANON KIOCERA INTERNACIONAL RECTIFIER Aguascalientes WHITE WESTINGHOUSE MEX* TEXAS INTS. XEROX SIEMENS Guadalajara I. B. M H. P. NEC LUCENT TECHNOLOGIES MOTOROLA KODAK CUMEX SIEMENS SOLECTRON DE MEXICO FLEXTRONICS JABIL CIRCUIT MTI ELECTRONICS SCI SANMINA Mexicali Juárez Chihuahua SONY TOSHIBA (SLRC) MOTOROLA PHILIPS DAEWOO ALTEL THOMSON MITSUBISHI KIOCERA KENWOOD GOLDSTAR JABIL ELECTROLUX Saltillo ACER MABE ELAMEX HAMILTON PLEXUS BEACH* Torreón THOMSON San Luis Potosí MABE GE MABE SANYO Querétaro VISTAR VITROMATIC (2) Reynosa DELCO (Automotriz) PHILIPS SONY MATSUSHITA (Automotriz) VITROMATIC NOKIA LUCENT TECHNOLOGIES FUJITSU (Automotriz) CONDURA (Automotriz) DELNOSA (Automotriz) Monterrey PIONNER DANFOSS COMPRESSORS VITROMATIC (3) MABE (2) KODAK NIPPON DENSO (Automotriz) AXA YAZAKI (Automotriz) Cuernavaca NEC Querétaro CLARION Estado de Mexico Me DAEWOO BLACK & DECKER MABE BRAUN MABE (2) ELECTROLUX SINGER SUNBEAM SIEMENS KOBLENZ ERICSSON ALCATEL/INDETEL AMP Puebla GESTAR SINGER VITROMATIC AUDIO & VIDEO HOUSEHOLD APP. COMPUTERS TELECOMUNICATIONS OTHERS Estado de México Mé PANASONIC ELECTROLUX FILTER QUEEN HOOVER IMAN KOBLENZ MABE PHILIPS SUNBEAM OLIVETTI OLIMPIA

Electronic Industry location ……(700 + companies) Tijuana SANYO SONY HITACHI MATSUSHITA JVC SAMSUNG PIONNER MITSUBISHI SHARP SANYO ELECTRODOMÉSTICOS PHILIPS CASIO KODAK CANON KIOCERA INTERNACIONAL RECTIFIER Aguascalientes WHITE WESTINGHOUSE MEX* TEXAS INTS. XEROX SIEMENS Guadalajara I. B. M H. P. NEC LUCENT TECHNOLOGIES MOTOROLA KODAK CUMEX SIEMENS SOLECTRON DE MEXICO FLEXTRONICS JABIL CIRCUIT MTI ELECTRONICS SCI SANMINA Mexicali Juárez Chihuahua SONY TOSHIBA (SLRC) MOTOROLA PHILIPS DAEWOO ALTEL THOMSON MITSUBISHI KIOCERA KENWOOD GOLDSTAR JABIL ELECTROLUX Saltillo ACER MABE ELAMEX HAMILTON PLEXUS BEACH* Torreón THOMSON San Luis Potosí MABE GE MABE SANYO Querétaro VISTAR VITROMATIC (2) Reynosa DELCO (Automotriz) PHILIPS SONY MATSUSHITA (Automotriz) VITROMATIC NOKIA LUCENT TECHNOLOGIES FUJITSU (Automotriz) CONDURA (Automotriz) DELNOSA (Automotriz) Monterrey PIONNER DANFOSS COMPRESSORS VITROMATIC (3) MABE (2) KODAK NIPPON DENSO (Automotriz) AXA YAZAKI (Automotriz) Cuernavaca NEC Querétaro CLARION Estado de Mexico Me DAEWOO BLACK & DECKER MABE BRAUN MABE (2) ELECTROLUX SINGER SUNBEAM SIEMENS KOBLENZ ERICSSON ALCATEL/INDETEL AMP Puebla GESTAR SINGER VITROMATIC AUDIO & VIDEO HOUSEHOLD APP. COMPUTERS TELECOMUNICATIONS OTHERS Estado de México Mé PANASONIC ELECTROLUX FILTER QUEEN HOOVER IMAN KOBLENZ MABE PHILIPS SUNBEAM OLIVETTI OLIMPIA

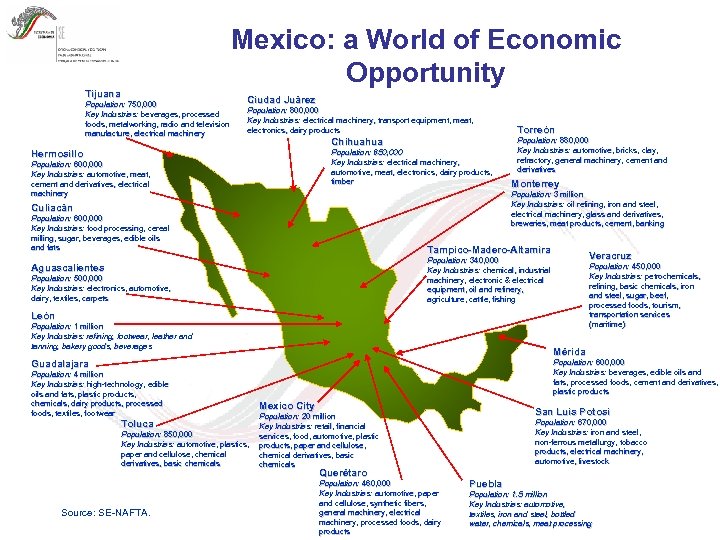

Mexico: a World of Economic Opportunity Tijuana Population: 750, 000 Key Industries: beverages, processed foods, metalworking, radio and television manufacture, electrical machinery Ciudad Juárez Population: 800, 000 Key Industries: electrical machinery, transport equipment, meat, electronics, dairy products Chihuahua Population: 650, 000 Key Industries: electrical machinery, automotive, meat, electronics, dairy products, timber Hermosillo Population: 600, 000 Key Industries: automotive, meat, cement and derivatives, electrical machinery Torreón Population: 880, 000 Key Industries: automotive, bricks, clay, refractory, general machinery, cement and derivatives Monterrey Population: 3 million Key Industries: oil refining, iron and steel, electrical machinery, glass and derivatives, breweries, meat products, cement, banking Culiacán Population: 600, 000 Key Industries: food processing, cereal milling, sugar, beverages, edible oils and fats Tampico-Madero-Altamira Veracruz Population: 340, 000 Key Industries: chemical, industrial machinery, electronic & electrical equipment, oil and refinery, agriculture, cattle, fishing Aguascalientes Population: 500, 000 Key Industries: electronics, automotive, dairy, textiles, carpets Population: 450, 000 Key Industries: petrochemicals, refining, basic chemicals, iron and steel, sugar, beef, processed foods, tourism, transportation services (maritime) León Population: 1 million Key Industries: refining, footwear, leather and tanning, bakery goods, beverages Mérida Population: 600, 000 Key Industries: beverages, edible oils and fats, processed foods, cement and derivatives, plastic products Guadalajara Population: 4 million Key Industries: high-technology, edible oils and fats, plastic products, chemicals, dairy products, processed foods, textiles, footwear Toluca Population: 850, 000 Key Industries: automotive, plastics, paper and cellulose, chemical derivatives, basic chemicals Source: SE-NAFTA. Mexico City San Luis Potosí Population: 20 million Key Industries: retail, financial services, food, automotive, plastic products, paper and cellulose, chemical derivatives, basic chemicals Querétaro Population: 460, 000 Key Industries: automotive, paper and cellulose, synthetic fibers, general machinery, electrical machinery, processed foods, dairy products Population: 670, 000 Key Industries: iron and steel, non-ferrous metallurgy, tobacco products, electrical machinery, automotive, livestock Puebla Population: 1. 5 million Key Industries: automotive, textiles, iron and steel, bottled water, chemicals, meat processing

Mexico: a World of Economic Opportunity Tijuana Population: 750, 000 Key Industries: beverages, processed foods, metalworking, radio and television manufacture, electrical machinery Ciudad Juárez Population: 800, 000 Key Industries: electrical machinery, transport equipment, meat, electronics, dairy products Chihuahua Population: 650, 000 Key Industries: electrical machinery, automotive, meat, electronics, dairy products, timber Hermosillo Population: 600, 000 Key Industries: automotive, meat, cement and derivatives, electrical machinery Torreón Population: 880, 000 Key Industries: automotive, bricks, clay, refractory, general machinery, cement and derivatives Monterrey Population: 3 million Key Industries: oil refining, iron and steel, electrical machinery, glass and derivatives, breweries, meat products, cement, banking Culiacán Population: 600, 000 Key Industries: food processing, cereal milling, sugar, beverages, edible oils and fats Tampico-Madero-Altamira Veracruz Population: 340, 000 Key Industries: chemical, industrial machinery, electronic & electrical equipment, oil and refinery, agriculture, cattle, fishing Aguascalientes Population: 500, 000 Key Industries: electronics, automotive, dairy, textiles, carpets Population: 450, 000 Key Industries: petrochemicals, refining, basic chemicals, iron and steel, sugar, beef, processed foods, tourism, transportation services (maritime) León Population: 1 million Key Industries: refining, footwear, leather and tanning, bakery goods, beverages Mérida Population: 600, 000 Key Industries: beverages, edible oils and fats, processed foods, cement and derivatives, plastic products Guadalajara Population: 4 million Key Industries: high-technology, edible oils and fats, plastic products, chemicals, dairy products, processed foods, textiles, footwear Toluca Population: 850, 000 Key Industries: automotive, plastics, paper and cellulose, chemical derivatives, basic chemicals Source: SE-NAFTA. Mexico City San Luis Potosí Population: 20 million Key Industries: retail, financial services, food, automotive, plastic products, paper and cellulose, chemical derivatives, basic chemicals Querétaro Population: 460, 000 Key Industries: automotive, paper and cellulose, synthetic fibers, general machinery, electrical machinery, processed foods, dairy products Population: 670, 000 Key Industries: iron and steel, non-ferrous metallurgy, tobacco products, electrical machinery, automotive, livestock Puebla Population: 1. 5 million Key Industries: automotive, textiles, iron and steel, bottled water, chemicals, meat processing

Ohio’s Exports to Mexico 1993 -2005* (Billions of US Dollars) Source: US Census, WISER and SE-NAFTA Series. * 2000 -2005, NAICS series.

Ohio’s Exports to Mexico 1993 -2005* (Billions of US Dollars) Source: US Census, WISER and SE-NAFTA Series. * 2000 -2005, NAICS series.

Ohio’s Exports to Mexico by Sector (NAICS) 2005 Source: US Census, WISER and SE-NAFTA Series.

Ohio’s Exports to Mexico by Sector (NAICS) 2005 Source: US Census, WISER and SE-NAFTA Series.

Ohio’s Exports to Mexico – 2005 (Millions of US Dollars) Source: US Census, WISER and SE-NAFTA Series.

Ohio’s Exports to Mexico – 2005 (Millions of US Dollars) Source: US Census, WISER and SE-NAFTA Series.

U. S. ’ Exports to Mexico 1993 -2005* (Billions of US Dollars) Source: US Census, WISER and SE-NAFTA Series. * 2000 -2005, NAICS series.

U. S. ’ Exports to Mexico 1993 -2005* (Billions of US Dollars) Source: US Census, WISER and SE-NAFTA Series. * 2000 -2005, NAICS series.

U. S. ’ Exports to Mexico by Sector (NAICS) 2005 Source: US Census, WISER and SE-NAFTA Series.

U. S. ’ Exports to Mexico by Sector (NAICS) 2005 Source: US Census, WISER and SE-NAFTA Series.

U. S. ’ Exports to Mexico – 2005 (Billions of US Dollars) Source: US Census, WISER and SE-NAFTA Series.

U. S. ’ Exports to Mexico – 2005 (Billions of US Dollars) Source: US Census, WISER and SE-NAFTA Series.

Selling in Mexico Directly to the Final Importer üNegotiations take less time üNo distributor mark-up üUS firm know directly client requirements üUS firm must know Mexican trade environmental üSeveral travels to Mexico Through a Mexican Manufacturer üUsually products of the same industrial sector üTo complement product line üClear contract to avoid misunderstandings

Selling in Mexico Directly to the Final Importer üNegotiations take less time üNo distributor mark-up üUS firm know directly client requirements üUS firm must know Mexican trade environmental üSeveral travels to Mexico Through a Mexican Manufacturer üUsually products of the same industrial sector üTo complement product line üClear contract to avoid misunderstandings

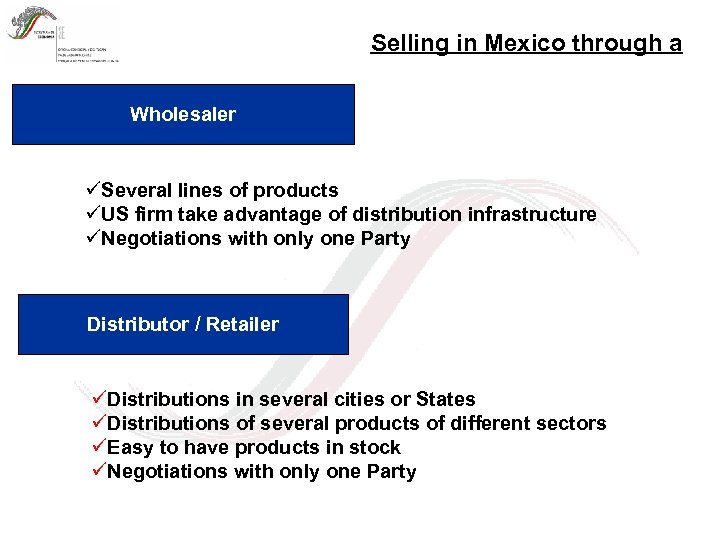

Selling in Mexico through a Wholesaler üSeveral lines of products üUS firm take advantage of distribution infrastructure üNegotiations with only one Party Distributor / Retailer üDistributions in several cities or States üDistributions of several products of different sectors üEasy to have products in stock üNegotiations with only one Party

Selling in Mexico through a Wholesaler üSeveral lines of products üUS firm take advantage of distribution infrastructure üNegotiations with only one Party Distributor / Retailer üDistributions in several cities or States üDistributions of several products of different sectors üEasy to have products in stock üNegotiations with only one Party

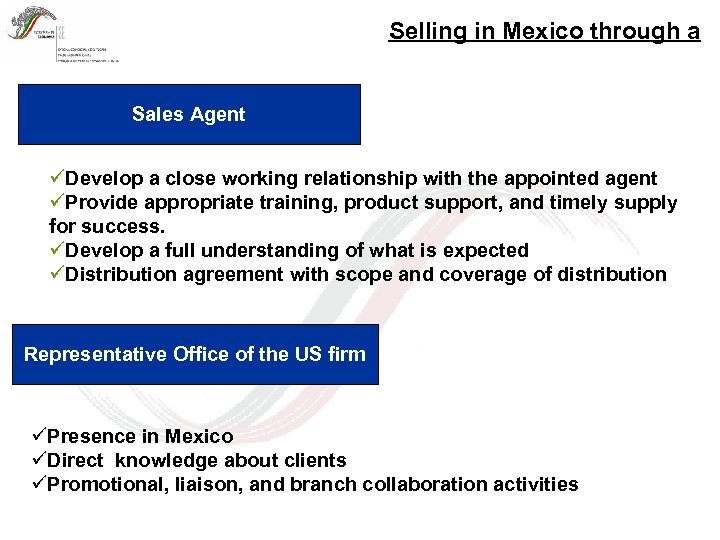

Selling in Mexico through a Sales Agent üDevelop a close working relationship with the appointed agent üProvide appropriate training, product support, and timely supply for success. üDevelop a full understanding of what is expected üDistribution agreement with scope and coverage of distribution Representative Office of the US firm üPresence in Mexico üDirect knowledge about clients üPromotional, liaison, and branch collaboration activities

Selling in Mexico through a Sales Agent üDevelop a close working relationship with the appointed agent üProvide appropriate training, product support, and timely supply for success. üDevelop a full understanding of what is expected üDistribution agreement with scope and coverage of distribution Representative Office of the US firm üPresence in Mexico üDirect knowledge about clients üPromotional, liaison, and branch collaboration activities

Opening an Office in Mexico Most common initial corporate and administrative steps 1. Acquisition of a corporate name 2. Formation of the Company before a Public Notary 3. Inscription on the Public Registry 4. Obtain a Tax Paying Registry Number 5. Registration on the Foreign Investment Registry 6. Local or State Licenses (when applicable) 7. Labor contracts (individual, IMSS registry) 8. Inscription on the General Importers Registry 9. Visa and immigration process foreign employees (when applicable)

Opening an Office in Mexico Most common initial corporate and administrative steps 1. Acquisition of a corporate name 2. Formation of the Company before a Public Notary 3. Inscription on the Public Registry 4. Obtain a Tax Paying Registry Number 5. Registration on the Foreign Investment Registry 6. Local or State Licenses (when applicable) 7. Labor contracts (individual, IMSS registry) 8. Inscription on the General Importers Registry 9. Visa and immigration process foreign employees (when applicable)

Opening an Office in Mexico The General Commercial Law (Ley Federal de Sociedades Mercantiles) allows the establishment of several kinds of companies in Mexico, generally: Sociedad Anónima (SA) or Sociedad Anónima de Capital Variable (SA de CV) Sociedad de Responsabilidad Limitada (S de RL) (Limited Liability Company) Sociedad Civil (SC) (Civil Partnership) Mexican Branch

Opening an Office in Mexico The General Commercial Law (Ley Federal de Sociedades Mercantiles) allows the establishment of several kinds of companies in Mexico, generally: Sociedad Anónima (SA) or Sociedad Anónima de Capital Variable (SA de CV) Sociedad de Responsabilidad Limitada (S de RL) (Limited Liability Company) Sociedad Civil (SC) (Civil Partnership) Mexican Branch

Opening an Office in Mexico Sociedad Anónima (SA) or Sociedad Anónima de Capital Variable (SA de CV) Usually recommended to incorporate a limited liability stock corporation. Shareholder’s liability is limited to their stock interest in the company Minimum amount of paid-in capital One of the advantages of the latter is that the minimum fixed capital can be changed subsequent to the initial formation. Sociedad de Responsabilidad Limitada (S de RL) (Limited Liability Company) Minimum amount of paid- in capital Maximum of 50 partners Partners’ liability is limited to their partnership interest in the company It has the option of having a variable capital

Opening an Office in Mexico Sociedad Anónima (SA) or Sociedad Anónima de Capital Variable (SA de CV) Usually recommended to incorporate a limited liability stock corporation. Shareholder’s liability is limited to their stock interest in the company Minimum amount of paid-in capital One of the advantages of the latter is that the minimum fixed capital can be changed subsequent to the initial formation. Sociedad de Responsabilidad Limitada (S de RL) (Limited Liability Company) Minimum amount of paid- in capital Maximum of 50 partners Partners’ liability is limited to their partnership interest in the company It has the option of having a variable capital

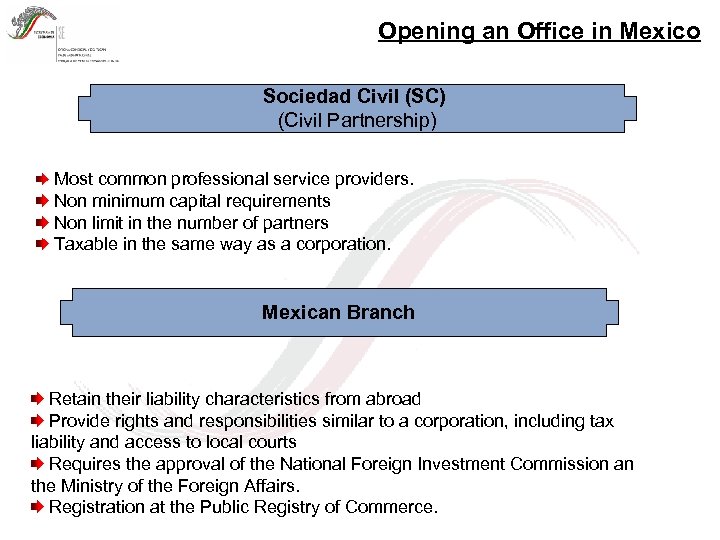

Opening an Office in Mexico Sociedad Civil (SC) (Civil Partnership) Most common professional service providers. Non minimum capital requirements Non limit in the number of partners Taxable in the same way as a corporation. Mexican Branch Retain their liability characteristics from abroad Provide rights and responsibilities similar to a corporation, including tax liability and access to local courts Requires the approval of the National Foreign Investment Commission an the Ministry of the Foreign Affairs. Registration at the Public Registry of Commerce.

Opening an Office in Mexico Sociedad Civil (SC) (Civil Partnership) Most common professional service providers. Non minimum capital requirements Non limit in the number of partners Taxable in the same way as a corporation. Mexican Branch Retain their liability characteristics from abroad Provide rights and responsibilities similar to a corporation, including tax liability and access to local courts Requires the approval of the National Foreign Investment Commission an the Ministry of the Foreign Affairs. Registration at the Public Registry of Commerce.

Mexican importer is responsible for the import process, so he must be registered in the General Import Registry (Padrón General de Importadores), and for certain merchandises they also need to be incorporated in the Sectoral Import Registry (Padrón de Importadores Sectorial) In accordance to the Customs Law, all export and import operations must be done by a Custom Broker, so importers require to use the Services of any authorized Customs Broker

Mexican importer is responsible for the import process, so he must be registered in the General Import Registry (Padrón General de Importadores), and for certain merchandises they also need to be incorporated in the Sectoral Import Registry (Padrón de Importadores Sectorial) In accordance to the Customs Law, all export and import operations must be done by a Custom Broker, so importers require to use the Services of any authorized Customs Broker

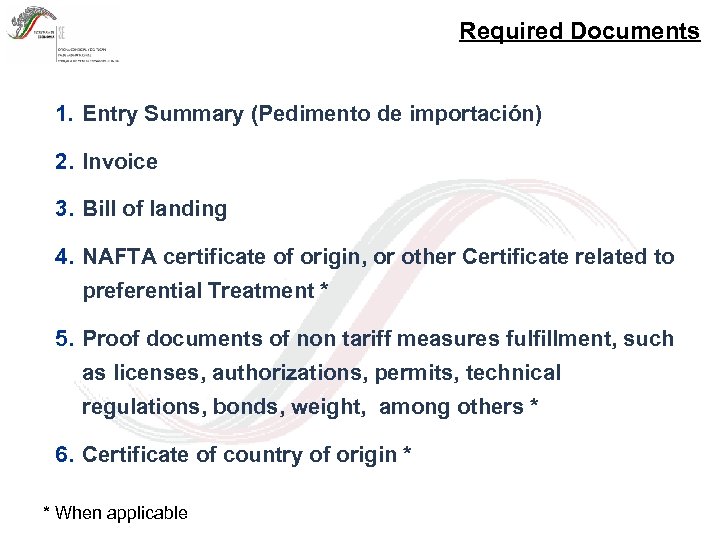

Required Documents 1. Entry Summary (Pedimento de importación) 2. Invoice 3. Bill of landing 4. NAFTA certificate of origin, or other Certificate related to preferential Treatment * 5. Proof documents of non tariff measures fulfillment, such as licenses, authorizations, permits, technical regulations, bonds, weight, among others * 6. Certificate of country of origin * * When applicable

Required Documents 1. Entry Summary (Pedimento de importación) 2. Invoice 3. Bill of landing 4. NAFTA certificate of origin, or other Certificate related to preferential Treatment * 5. Proof documents of non tariff measures fulfillment, such as licenses, authorizations, permits, technical regulations, bonds, weight, among others * 6. Certificate of country of origin * * When applicable

Import Taxes Currently, most of the NAFTA originating goods enter Mexico duty – free. On January 2008 all products will be duty free, in accordance to the NAFTA tariff phase out. Non-NAFTA originating goods are subject to the General Import Rate (MFN rate), which is between zero and 35 per cent ad valorem for industrial goods

Import Taxes Currently, most of the NAFTA originating goods enter Mexico duty – free. On January 2008 all products will be duty free, in accordance to the NAFTA tariff phase out. Non-NAFTA originating goods are subject to the General Import Rate (MFN rate), which is between zero and 35 per cent ad valorem for industrial goods

Import Taxes Mexico also has implemented Sectoral Promotion Programs (PROSEC) and a mechanism called Rule 8 th to reduce MFN tariffs on a wide range of important inputs needed by Mexico's manufacturing sector. In addition, Maquiladora and Pitex programs facilitate the import of raw materials to be used by Mexico's export manufacturing sector. It is important to know the tariff classification of the exported good, in accordance to the Harmonized System (HS code) to determine the applicable import rate http: //www. economia. gob. mx/index. jsp? P=2262

Import Taxes Mexico also has implemented Sectoral Promotion Programs (PROSEC) and a mechanism called Rule 8 th to reduce MFN tariffs on a wide range of important inputs needed by Mexico's manufacturing sector. In addition, Maquiladora and Pitex programs facilitate the import of raw materials to be used by Mexico's export manufacturing sector. It is important to know the tariff classification of the exported good, in accordance to the Harmonized System (HS code) to determine the applicable import rate http: //www. economia. gob. mx/index. jsp? P=2262

Other Taxes Antidumping or Countervailing Duties. Applied on certain products originating from some countries http: //www. economia. gob. mx/index. jsp? P=392 Value Added Tax (Impuesto al Valor Agregado / IVA) Tax on New Vehicles (Impuesto Sobre Automóviles Nuevos / ISAN) Special Tax on Production and Services (Impuesto Especial sobre Producción y Servicios / IEPS) Custom Processing Fee (Derecho de Trámite Aduanero / DTA). Goods originating from certain free trade areas are exempt. Storage Fee (Derecho de Almacenaje)

Other Taxes Antidumping or Countervailing Duties. Applied on certain products originating from some countries http: //www. economia. gob. mx/index. jsp? P=392 Value Added Tax (Impuesto al Valor Agregado / IVA) Tax on New Vehicles (Impuesto Sobre Automóviles Nuevos / ISAN) Special Tax on Production and Services (Impuesto Especial sobre Producción y Servicios / IEPS) Custom Processing Fee (Derecho de Trámite Aduanero / DTA). Goods originating from certain free trade areas are exempt. Storage Fee (Derecho de Almacenaje)

Import Trade Regulations Estimated prices. Established for certain goods (including tools, wood materials, appliances, textiles, apparel, footwear). If the transaction value of the good is lower than the estimated price, the importer may be required to guarantee payment of the difference in duties. Individual information of goods (Anexo 18). Import of certain goods requires disclosing detailed specification information for identification, analysis or control purposes, and customs enforcement efforts. This requirement may apply to more than 100 types of goods (wines and liquors, textiles and apparel, footwear, etc)

Import Trade Regulations Estimated prices. Established for certain goods (including tools, wood materials, appliances, textiles, apparel, footwear). If the transaction value of the good is lower than the estimated price, the importer may be required to guarantee payment of the difference in duties. Individual information of goods (Anexo 18). Import of certain goods requires disclosing detailed specification information for identification, analysis or control purposes, and customs enforcement efforts. This requirement may apply to more than 100 types of goods (wines and liquors, textiles and apparel, footwear, etc)

Import Trade Regulations Import Licenses. Established for sensitive products, Periodically, Mexico publishes in the Official Gazette lists that identify the different items that have a specific import control. Items are identified according to their Harmonized System (HS) code number; Import Notices. the importer requires to notify the import of certain goods to Mexican authorities prior their arrival to customs. (i. e. medical products and equipment, toiletries, processed food, some chemicals, among other)

Import Trade Regulations Import Licenses. Established for sensitive products, Periodically, Mexico publishes in the Official Gazette lists that identify the different items that have a specific import control. Items are identified according to their Harmonized System (HS) code number; Import Notices. the importer requires to notify the import of certain goods to Mexican authorities prior their arrival to customs. (i. e. medical products and equipment, toiletries, processed food, some chemicals, among other)

Import Trade Regulations Exclusive ports of entry. Various goods are defined to enter into Mexico through a specific Mexican ports, in order that customs authorities strengthen compliance in relevant customs matters, such as tariff classification or valuation. Some products subject to this requirement are: meat of poultry in brine, fats and oils, beer, cigars and cigarettes, matches, bicycles’ tires, footwear, bicycles, CD’s, and textiles.

Import Trade Regulations Exclusive ports of entry. Various goods are defined to enter into Mexico through a specific Mexican ports, in order that customs authorities strengthen compliance in relevant customs matters, such as tariff classification or valuation. Some products subject to this requirement are: meat of poultry in brine, fats and oils, beer, cigars and cigarettes, matches, bicycles’ tires, footwear, bicycles, CD’s, and textiles.

Standards and Technical Regulations Voluntary Standards Normas Mexicanas (NMX’s) Mandatory Technical Regulations Normas Oficiales Mexicanas (NOM’s) NOM’s apply to imported products as well as domestically produced goods. Many of these are enforced at the border. http: //www. economia. gob. mx/index. jsp? P=144

Standards and Technical Regulations Voluntary Standards Normas Mexicanas (NMX’s) Mandatory Technical Regulations Normas Oficiales Mexicanas (NOM’s) NOM’s apply to imported products as well as domestically produced goods. Many of these are enforced at the border. http: //www. economia. gob. mx/index. jsp? P=144

Standards and Technical Regulations NOM’s are issue by several Ministries, for example: ? Ministry of Agriculture (Sagarpa). Plant, animal and fish products, also to prevent the introduction of diseases ? Ministry of Health (SSA). Processed food, beverages, medical devices, and medicines. ? Ministry of Economy (SE). Commercial information (i. e. labeling), industrial safety, and consumer protection ? Ministry of the Environment (SEMARNAT). Forestry products, energy efficiency, emissions and pollution control

Standards and Technical Regulations NOM’s are issue by several Ministries, for example: ? Ministry of Agriculture (Sagarpa). Plant, animal and fish products, also to prevent the introduction of diseases ? Ministry of Health (SSA). Processed food, beverages, medical devices, and medicines. ? Ministry of Economy (SE). Commercial information (i. e. labeling), industrial safety, and consumer protection ? Ministry of the Environment (SEMARNAT). Forestry products, energy efficiency, emissions and pollution control

Standards and Technical Regulations Labelling requirements. There are two main technical regulations in force for labelling of consumer goods: ØNOM-050 -SCFI-1994, establishing general packaging and labelling requirements, and ØNOM-051 -SCFI-1994, establishing specific labelling requirements for food and non-alcoholic beverages. In addition, specific labelling requirements apply to products such as: Ø Alcoholic beverages, (NOM-142 -SSA), Ø Textile and apparel (NOM-004 -SCFI-1993), Ø Leather products (NOM-020 -SCFI-1993), Ø Second-hand products (NOM-017 -SCFI-1993) Ø Electrical domestic appliances (NOM-024 -SCFI-1994)

Standards and Technical Regulations Labelling requirements. There are two main technical regulations in force for labelling of consumer goods: ØNOM-050 -SCFI-1994, establishing general packaging and labelling requirements, and ØNOM-051 -SCFI-1994, establishing specific labelling requirements for food and non-alcoholic beverages. In addition, specific labelling requirements apply to products such as: Ø Alcoholic beverages, (NOM-142 -SSA), Ø Textile and apparel (NOM-004 -SCFI-1993), Ø Leather products (NOM-020 -SCFI-1993), Ø Second-hand products (NOM-017 -SCFI-1993) Ø Electrical domestic appliances (NOM-024 -SCFI-1994)

Standards and Technical Regulations Accredited label verification units exist in Mexico, where companies can obtain an evaluation of their labels prior to export to Mexico Some NOM’s required testing and Third Party certification in accordance to NOM’s and conformity assessment procedures of each Agency ü Lab test must be conducted in approved and accredited laboratories ü Certification must be made by approved and accredited Certification bodies

Standards and Technical Regulations Accredited label verification units exist in Mexico, where companies can obtain an evaluation of their labels prior to export to Mexico Some NOM’s required testing and Third Party certification in accordance to NOM’s and conformity assessment procedures of each Agency ü Lab test must be conducted in approved and accredited laboratories ü Certification must be made by approved and accredited Certification bodies

Noncompliance with regulatory requirements can result in import shipments being held by Mexican Customs, monetary penalties assessed against the importer and, when applicable loss of import privileges

Noncompliance with regulatory requirements can result in import shipments being held by Mexican Customs, monetary penalties assessed against the importer and, when applicable loss of import privileges

Government Procurement Market is divided into federal and subfederal levels > The federal levels comprises government agencies and parastatal companies > The subfederal levels comprises state governments and municipal authorities > The subfederal level is autonomous Constitution and therefore sets its own rules under the > Most public procurement is carried out by the federal government.

Government Procurement Market is divided into federal and subfederal levels > The federal levels comprises government agencies and parastatal companies > The subfederal levels comprises state governments and municipal authorities > The subfederal level is autonomous Constitution and therefore sets its own rules under the > Most public procurement is carried out by the federal government.

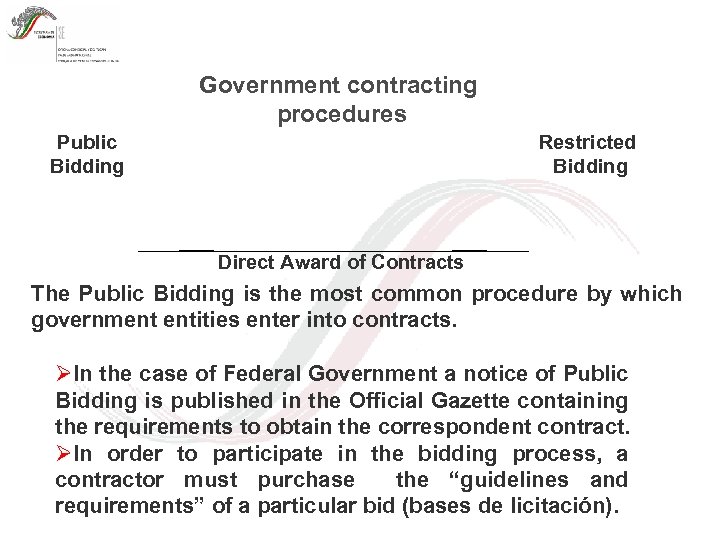

Government contracting procedures Public Bidding Restricted Bidding Direct Award of Contracts The Public Bidding is the most common procedure by which government entities enter into contracts. ØIn the case of Federal Government a notice of Public Bidding is published in the Official Gazette containing the requirements to obtain the correspondent contract. ØIn order to participate in the bidding process, a contractor must purchase the “guidelines and requirements” of a particular bid (bases de licitación).

Government contracting procedures Public Bidding Restricted Bidding Direct Award of Contracts The Public Bidding is the most common procedure by which government entities enter into contracts. ØIn the case of Federal Government a notice of Public Bidding is published in the Official Gazette containing the requirements to obtain the correspondent contract. ØIn order to participate in the bidding process, a contractor must purchase the “guidelines and requirements” of a particular bid (bases de licitación).

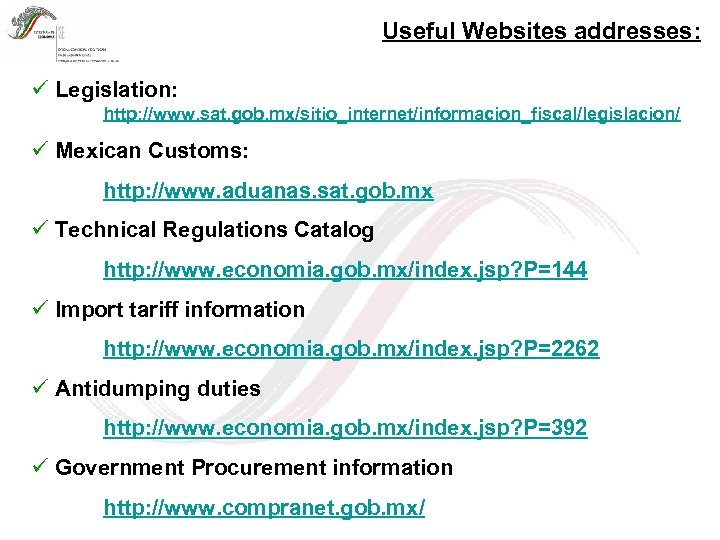

Useful Websites addresses: ü Legislation: http: //www. sat. gob. mx/sitio_internet/informacion_fiscal/legislacion/ ü Mexican Customs: http: //www. aduanas. sat. gob. mx ü Technical Regulations Catalog http: //www. economia. gob. mx/index. jsp? P=144 ü Import tariff information http: //www. economia. gob. mx/index. jsp? P=2262 ü Antidumping duties http: //www. economia. gob. mx/index. jsp? P=392 ü Government Procurement information http: //www. compranet. gob. mx/

Useful Websites addresses: ü Legislation: http: //www. sat. gob. mx/sitio_internet/informacion_fiscal/legislacion/ ü Mexican Customs: http: //www. aduanas. sat. gob. mx ü Technical Regulations Catalog http: //www. economia. gob. mx/index. jsp? P=144 ü Import tariff information http: //www. economia. gob. mx/index. jsp? P=2262 ü Antidumping duties http: //www. economia. gob. mx/index. jsp? P=392 ü Government Procurement information http: //www. compranet. gob. mx/

Useful Websites addresses: ü U. S. Embassy in Mexico: http: //mexico. usembassy. gov/mexico/econ. html ü Distributors / Producers http: //www. cosmos. com. mx http: //www. buyinmexico. com. mx/Bancomext/portal. jsp? parent=141 ü ITA’s Portal with useful information of Mexico & NAFTA http: //web. ita. doc. gov/ticwebsite/naftaweb. nsf!Open. Database&Start=1&Count=500&Expand=2. 1 ü U. S. Government’s Export Portal http: //www. export. gov ü American Chamber / Mexico http: //www. amcham. com. mx ü Industrial Cost in Mexico 2006 http: //www. investinmexico. com. mx/pied/cds/pied_bancomext/homepied/

Useful Websites addresses: ü U. S. Embassy in Mexico: http: //mexico. usembassy. gov/mexico/econ. html ü Distributors / Producers http: //www. cosmos. com. mx http: //www. buyinmexico. com. mx/Bancomext/portal. jsp? parent=141 ü ITA’s Portal with useful information of Mexico & NAFTA http: //web. ita. doc. gov/ticwebsite/naftaweb. nsf!Open. Database&Start=1&Count=500&Expand=2. 1 ü U. S. Government’s Export Portal http: //www. export. gov ü American Chamber / Mexico http: //www. amcham. com. mx ü Industrial Cost in Mexico 2006 http: //www. investinmexico. com. mx/pied/cds/pied_bancomext/homepied/

If you required additional information or further assistance, contact: NAFTA and Trade Office 1911 Pennsylvania Ave. N. W. 8 th. Floor Washington, D. C. 20006 Phone: 202. 728. 17. 00 / 202. 728. 1705 Fax: 202. 728. 1712 E-mail: nafta@naftamexico. net

If you required additional information or further assistance, contact: NAFTA and Trade Office 1911 Pennsylvania Ave. N. W. 8 th. Floor Washington, D. C. 20006 Phone: 202. 728. 17. 00 / 202. 728. 1705 Fax: 202. 728. 1712 E-mail: nafta@naftamexico. net