4a6cdb934b0eeceb739cf3af86401756.ppt

- Количество слайдов: 50

www. eu-skladi. si Smart Specialisation Strategy of Slovenia - S 4 Gorazd Jenko, GODC, Slovenia November 4, 2015, Brussels

www. eu-skladi. si Smart Specialisation Strategy of Slovenia - S 4 Gorazd Jenko, GODC, Slovenia November 4, 2015, Brussels

Why? Growth. Vision. Energy. What? Document Platform Leverage How? Priority areas. Strategic (Development) Partnerships. When? 2015 Who? All S 4? – 1) SI

Why? Growth. Vision. Energy. What? Document Platform Leverage How? Priority areas. Strategic (Development) Partnerships. When? 2015 Who? All S 4? – 1) SI

Context, Structure, Vision, Goals Finance Priority areas Policy mix Governance

Context, Structure, Vision, Goals Finance Priority areas Policy mix Governance

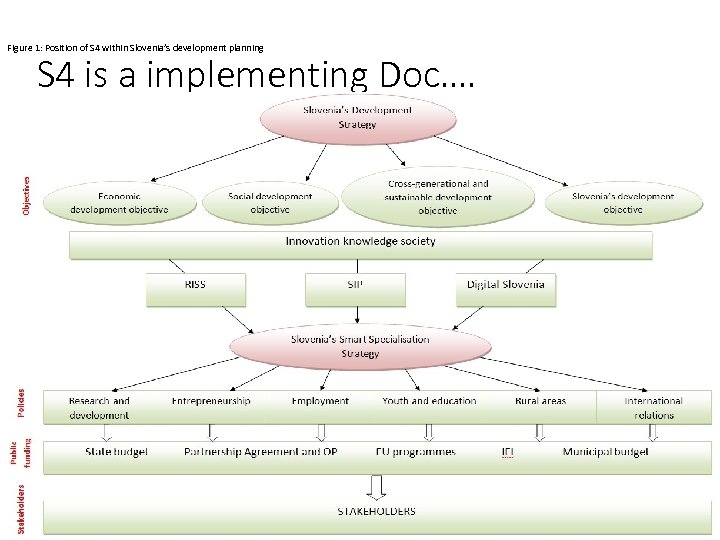

Figure 1: Position of S 4 within Slovenia’s development planning S 4 is a implementing Doc…. 4

Figure 1: Position of S 4 within Slovenia’s development planning S 4 is a implementing Doc…. 4

Vision SUSTAINABLE TECHNOLOGIES AND SERVICES FOR A HEALTHY LIFE on the basis of which Slovenia will become a green, active, healthy and digital region with top-level conditions fostering creativity and innovation focused on the development of medium- and high-level technological solutions in niche areas.

Vision SUSTAINABLE TECHNOLOGIES AND SERVICES FOR A HEALTHY LIFE on the basis of which Slovenia will become a green, active, healthy and digital region with top-level conditions fostering creativity and innovation focused on the development of medium- and high-level technological solutions in niche areas.

Goals 1. Rise of the VA per employee measured at the level of the individual areas of application. 2. Increased share of high-tech intensive products in export from 22. 3% to EU-15 average of 26. 5% 3. increased share of export of knowledge-intensive services in total export from 21. 4% to 33% which will reduce Slovenia’s below-EU-average rate by a half 4. increased overall entrepreneurial activity from the current 11% to at least the EU average of 12. 8% ******************* SI Ambition – from a follower to co-creator of global trends in niche areas 7

Goals 1. Rise of the VA per employee measured at the level of the individual areas of application. 2. Increased share of high-tech intensive products in export from 22. 3% to EU-15 average of 26. 5% 3. increased share of export of knowledge-intensive services in total export from 21. 4% to 33% which will reduce Slovenia’s below-EU-average rate by a half 4. increased overall entrepreneurial activity from the current 11% to at least the EU average of 12. 8% ******************* SI Ambition – from a follower to co-creator of global trends in niche areas 7

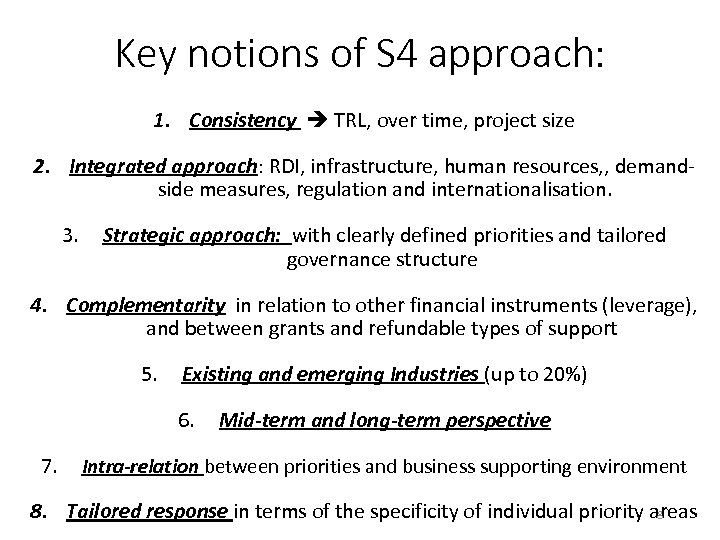

Key notions of S 4 approach: 1. Consistency TRL, over time, project size 2. Integrated approach: RDI, infrastructure, human resources, , demandside measures, regulation and internationalisation. 3. Strategic approach: with clearly defined priorities and tailored governance structure 4. Complementarity in relation to other financial instruments (leverage), and between grants and refundable types of support 5. Existing and emerging Industries (up to 20%) 6. Mid-term and long-term perspective 7. Intra-relation between priorities and business supporting environment 8. Tailored response in terms of the specificity of individual priority areas 8

Key notions of S 4 approach: 1. Consistency TRL, over time, project size 2. Integrated approach: RDI, infrastructure, human resources, , demandside measures, regulation and internationalisation. 3. Strategic approach: with clearly defined priorities and tailored governance structure 4. Complementarity in relation to other financial instruments (leverage), and between grants and refundable types of support 5. Existing and emerging Industries (up to 20%) 6. Mid-term and long-term perspective 7. Intra-relation between priorities and business supporting environment 8. Tailored response in terms of the specificity of individual priority areas 8

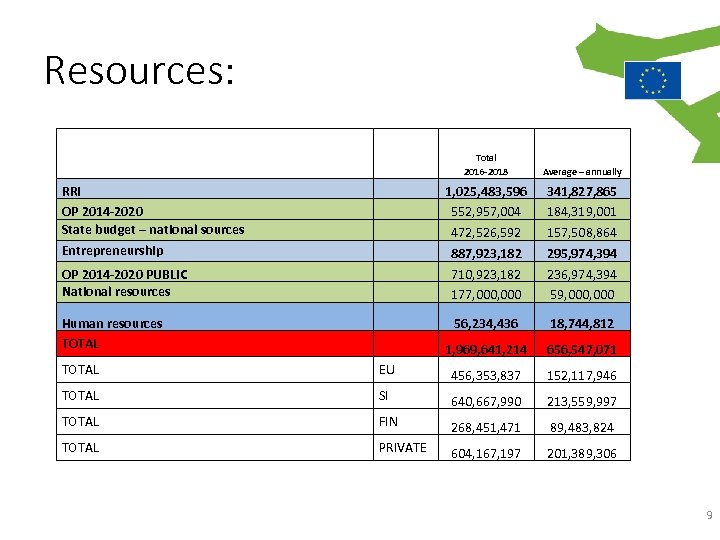

Resources: RRI OP 2014 -2020 State budget – national sources Entrepreneurship Total 2016 -2018 Average – annually 1, 025, 483, 596 552, 957, 004 472, 526, 592 887, 923, 182 710, 923, 182 177, 000 341, 827, 865 184, 319, 001 157, 508, 864 295, 974, 394 236, 974, 394 59, 000 56, 234, 436 18, 744, 812 1, 969, 641, 214 656, 547, 071 OP 2014 -2020 PUBLIC National resources Human resources TOTAL EU 456, 353, 837 152, 117, 946 TOTAL SI 640, 667, 990 213, 559, 997 TOTAL FIN 268, 451, 471 89, 483, 824 TOTAL PRIVATE 604, 167, 197 201, 389, 306 9

Resources: RRI OP 2014 -2020 State budget – national sources Entrepreneurship Total 2016 -2018 Average – annually 1, 025, 483, 596 552, 957, 004 472, 526, 592 887, 923, 182 710, 923, 182 177, 000 341, 827, 865 184, 319, 001 157, 508, 864 295, 974, 394 236, 974, 394 59, 000 56, 234, 436 18, 744, 812 1, 969, 641, 214 656, 547, 071 OP 2014 -2020 PUBLIC National resources Human resources TOTAL EU 456, 353, 837 152, 117, 946 TOTAL SI 640, 667, 990 213, 559, 997 TOTAL FIN 268, 451, 471 89, 483, 824 TOTAL PRIVATE 604, 167, 197 201, 389, 306 9

S 4 in few words? Ø We do need S 4 for concentration of development resources on areas where SI has critical mass of knowledge, capacities and competences and where innovation potential it is to be unleashed to position SI on a global markets and fostering its visibility PRIORITISATION setting PRIORITY AREAS ØS 4 as a platform for COOPERATION AND COLLABORATION GOVERNANCE and STRATEGIC DEVELOPMENT INNOVATION PARTNERSHIPS ØHuman Resources, fostering Entrepreneurial behaviour, Creativity, Business environment

S 4 in few words? Ø We do need S 4 for concentration of development resources on areas where SI has critical mass of knowledge, capacities and competences and where innovation potential it is to be unleashed to position SI on a global markets and fostering its visibility PRIORITISATION setting PRIORITY AREAS ØS 4 as a platform for COOPERATION AND COLLABORATION GOVERNANCE and STRATEGIC DEVELOPMENT INNOVATION PARTNERSHIPS ØHuman Resources, fostering Entrepreneurial behaviour, Creativity, Business environment

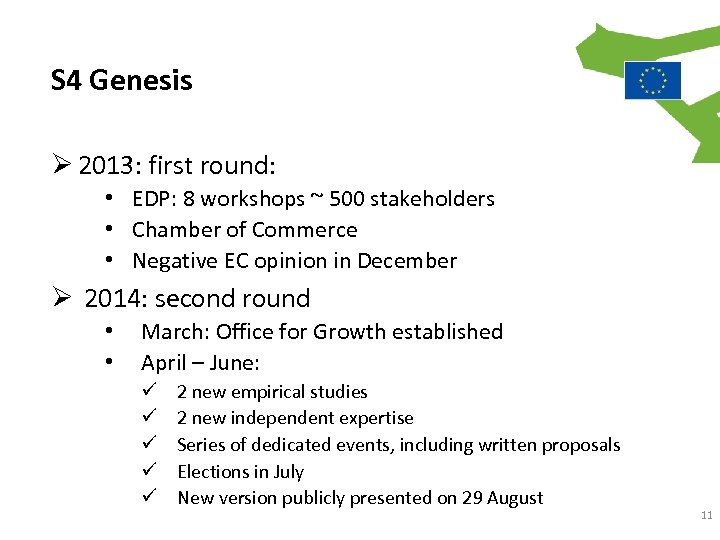

S 4 Genesis Ø 2013: first round: • EDP: 8 workshops ~ 500 stakeholders • Chamber of Commerce • Negative EC opinion in December Ø 2014: second round • • March: Office for Growth established April – June: 2 new empirical studies 2 new independent expertise Series of dedicated events, including written proposals Elections in July New version publicly presented on 29 August 11

S 4 Genesis Ø 2013: first round: • EDP: 8 workshops ~ 500 stakeholders • Chamber of Commerce • Negative EC opinion in December Ø 2014: second round • • March: Office for Growth established April – June: 2 new empirical studies 2 new independent expertise Series of dedicated events, including written proposals Elections in July New version publicly presented on 29 August 11

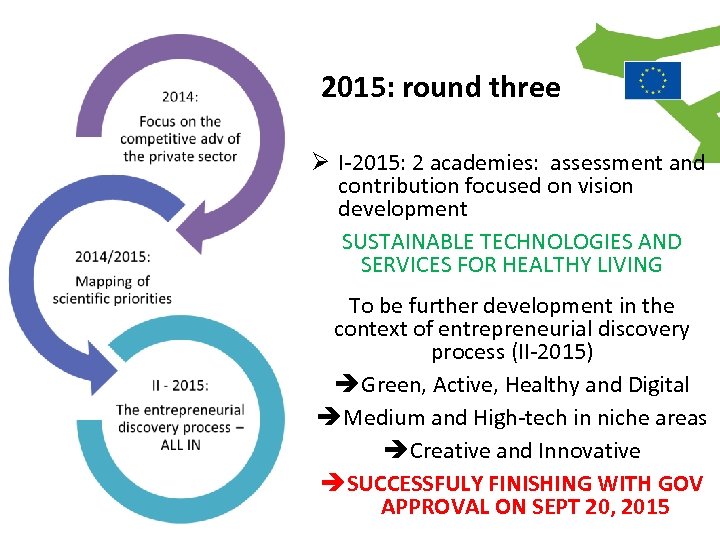

2015: round three Ø I-2015: 2 academies: assessment and contribution focused on vision development SUSTAINABLE TECHNOLOGIES AND SERVICES FOR HEALTHY LIVING To be further development in the context of entrepreneurial discovery process (II-2015) Green, Active, Healthy and Digital Medium and High-tech in niche areas Creative and Innovative SUCCESSFULY FINISHING WITH GOV APPROVAL ON SEPT 20, 2015

2015: round three Ø I-2015: 2 academies: assessment and contribution focused on vision development SUSTAINABLE TECHNOLOGIES AND SERVICES FOR HEALTHY LIVING To be further development in the context of entrepreneurial discovery process (II-2015) Green, Active, Healthy and Digital Medium and High-tech in niche areas Creative and Innovative SUCCESSFULY FINISHING WITH GOV APPROVAL ON SEPT 20, 2015

April-May 2015: PUBLIC CALL FOR EXPRESSION OF INTEREST Ø Further focusing of priorities and elimination process Ø Thus focus on identification of perspective • Technology fields (TRL 4 -6) • Fields of application – product groups (TRL 6 -9) v JOINTLY!!! v WITHING PREDEFINED SET OF PRIORITY DOMAINS Structured according to complementarities and by common characteristics from policy perspective v Including international dimension!

April-May 2015: PUBLIC CALL FOR EXPRESSION OF INTEREST Ø Further focusing of priorities and elimination process Ø Thus focus on identification of perspective • Technology fields (TRL 4 -6) • Fields of application – product groups (TRL 6 -9) v JOINTLY!!! v WITHING PREDEFINED SET OF PRIORITY DOMAINS Structured according to complementarities and by common characteristics from policy perspective v Including international dimension!

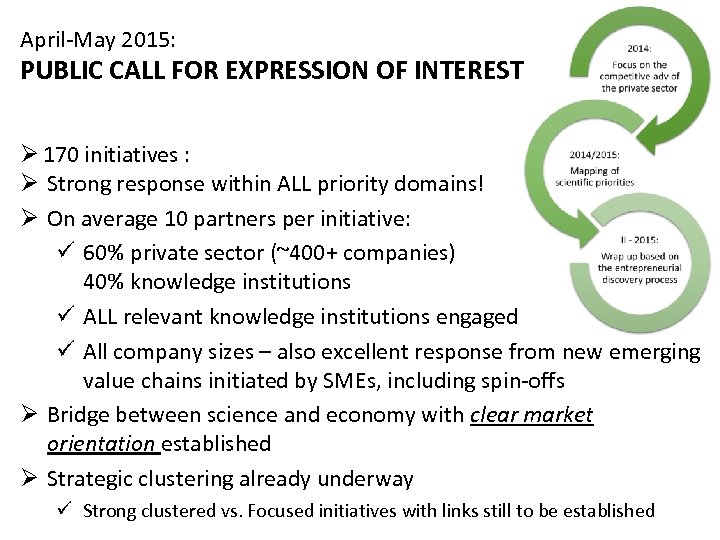

April-May 2015: PUBLIC CALL FOR EXPRESSION OF INTEREST Ø 170 initiatives : Ø Strong response within ALL priority domains! Ø On average 10 partners per initiative: 60% private sector (~400+ companies) 40% knowledge institutions ALL relevant knowledge institutions engaged All company sizes – also excellent response from new emerging value chains initiated by SMEs, including spin-offs Ø Bridge between science and economy with clear market orientation established Ø Strategic clustering already underway Strong clustered vs. Focused initiatives with links still to be established

April-May 2015: PUBLIC CALL FOR EXPRESSION OF INTEREST Ø 170 initiatives : Ø Strong response within ALL priority domains! Ø On average 10 partners per initiative: 60% private sector (~400+ companies) 40% knowledge institutions ALL relevant knowledge institutions engaged All company sizes – also excellent response from new emerging value chains initiated by SMEs, including spin-offs Ø Bridge between science and economy with clear market orientation established Ø Strategic clustering already underway Strong clustered vs. Focused initiatives with links still to be established

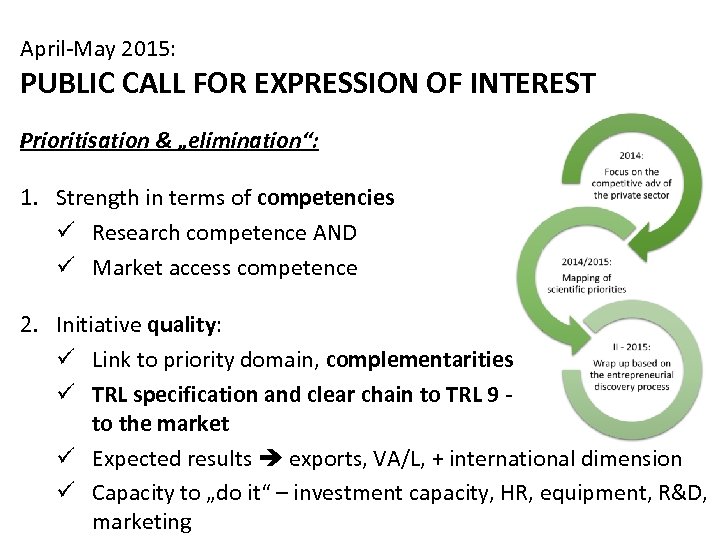

April-May 2015: PUBLIC CALL FOR EXPRESSION OF INTEREST Prioritisation & „elimination“: 1. Strength in terms of competencies Research competence AND Market access competence 2. Initiative quality: Link to priority domain, complementarities TRL specification and clear chain to TRL 9 - to the market Expected results exports, VA/L, + international dimension Capacity to „do it“ – investment capacity, HR, equipment, R&D, marketing

April-May 2015: PUBLIC CALL FOR EXPRESSION OF INTEREST Prioritisation & „elimination“: 1. Strength in terms of competencies Research competence AND Market access competence 2. Initiative quality: Link to priority domain, complementarities TRL specification and clear chain to TRL 9 - to the market Expected results exports, VA/L, + international dimension Capacity to „do it“ – investment capacity, HR, equipment, R&D, marketing

PRIORITY AREAS PRIORITISATION 16

PRIORITY AREAS PRIORITISATION 16

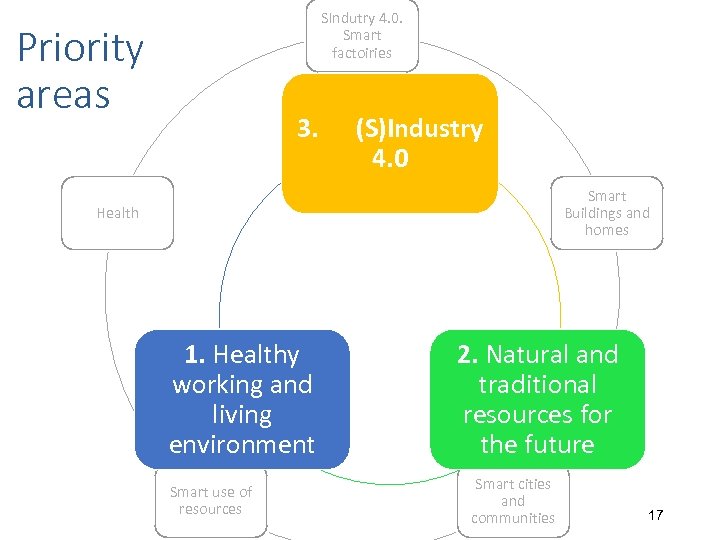

SIndutry 4. 0. Smart factoiries Priority areas 3. (S)Industry 4. 0 Smart Buildings and homes Health 1. Healthy working and living environment Smart use of resources 2. Natural and traditional resources for the future Smart cities and communities 17

SIndutry 4. 0. Smart factoiries Priority areas 3. (S)Industry 4. 0 Smart Buildings and homes Health 1. Healthy working and living environment Smart use of resources 2. Natural and traditional resources for the future Smart cities and communities 17

Defining the priority areas Empirical basis Source of comparative advantages Response received in the framework of the entrepreneurial discovery process Healthy living and working environment STRONG Knowledge, economy and tradition/heritage VERY STRONG Natural and traditional resources for the future MEDIUM Nature, values and economic potential STRONG (S)Industry 4. 0 STRONG Knowledge, economy and tradition/heritage EXCEPTIONALLY STRONG 18

Defining the priority areas Empirical basis Source of comparative advantages Response received in the framework of the entrepreneurial discovery process Healthy living and working environment STRONG Knowledge, economy and tradition/heritage VERY STRONG Natural and traditional resources for the future MEDIUM Nature, values and economic potential STRONG (S)Industry 4. 0 STRONG Knowledge, economy and tradition/heritage EXCEPTIONALLY STRONG 18

Complementarities & policy relevance 1. HEALTHY living and working Environment: Ø Systems solutions Ø R&D + clustering Ø Supply and demand side 2. NATURAL and TRADITIONAL resources for the FUTURE Ø Large no of stakeholders without obvious key player Ø Problem of critical mass Ø Facilitation 3. (S)Industry 4. 0 Ø Strong players Ø Joint approach for more comprehensive products and solutions Ø Longer term perspective needed Ø Strengthening links to SMEs (embedding) & new business creation Ø R&D, clustering & internationalisation 19

Complementarities & policy relevance 1. HEALTHY living and working Environment: Ø Systems solutions Ø R&D + clustering Ø Supply and demand side 2. NATURAL and TRADITIONAL resources for the FUTURE Ø Large no of stakeholders without obvious key player Ø Problem of critical mass Ø Facilitation 3. (S)Industry 4. 0 Ø Strong players Ø Joint approach for more comprehensive products and solutions Ø Longer term perspective needed Ø Strengthening links to SMEs (embedding) & new business creation Ø R&D, clustering & internationalisation 19

3 priority domains with 9 usage domains Health medicine Factories of the Future Mobility Materials as final products (S)INDUSTRY 4. 0 Networks for the transition to Circular economy NATURAL AND TRADITIONAL RESOURCES Sustainable tourism Sustainable food production HEALTHY LIVING AND WORKING ENVIRONMENT Smart Cities & Communities Smart Buildings & Home with Wood chain 20

3 priority domains with 9 usage domains Health medicine Factories of the Future Mobility Materials as final products (S)INDUSTRY 4. 0 Networks for the transition to Circular economy NATURAL AND TRADITIONAL RESOURCES Sustainable tourism Sustainable food production HEALTHY LIVING AND WORKING ENVIRONMENT Smart Cities & Communities Smart Buildings & Home with Wood chain 20

Priority domains: Each priority area of application is described by: Ø Objectives (including quantification of % AV) Ø Focus areas and Ø Technologies Ø Empirical bases and SI competitive advantage Ø International dimension 21

Priority domains: Each priority area of application is described by: Ø Objectives (including quantification of % AV) Ø Focus areas and Ø Technologies Ø Empirical bases and SI competitive advantage Ø International dimension 21

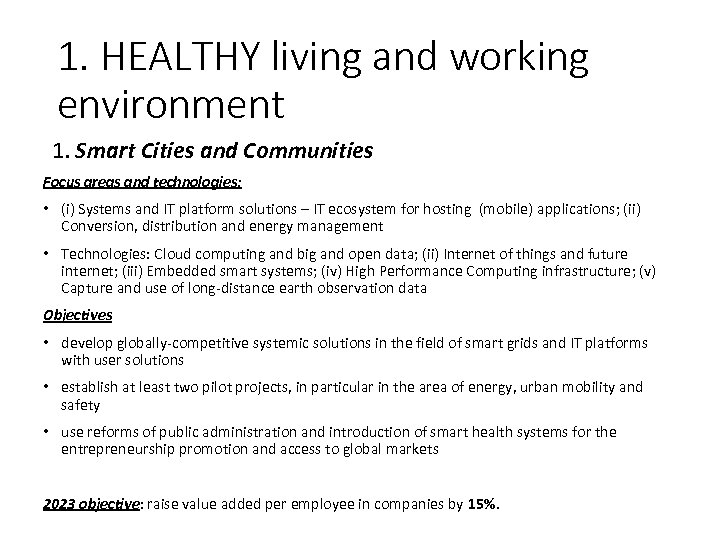

1. HEALTHY living and working environment 1. Smart Cities and Communities Focus areas and technologies: • (i) Systems and IT platform solutions – IT ecosystem for hosting (mobile) applications; (ii) Conversion, distribution and energy management • Technologies: Cloud computing and big and open data; (ii) Internet of things and future internet; (iii) Embedded smart systems; (iv) High Performance Computing infrastructure; (v) Capture and use of long-distance earth observation data Objectives • develop globally-competitive systemic solutions in the field of smart grids and IT platforms with user solutions • establish at least two pilot projects, in particular in the area of energy, urban mobility and safety • use reforms of public administration and introduction of smart health systems for the entrepreneurship promotion and access to global markets 2023 objective: raise value added per employee in companies by 15%.

1. HEALTHY living and working environment 1. Smart Cities and Communities Focus areas and technologies: • (i) Systems and IT platform solutions – IT ecosystem for hosting (mobile) applications; (ii) Conversion, distribution and energy management • Technologies: Cloud computing and big and open data; (ii) Internet of things and future internet; (iii) Embedded smart systems; (iv) High Performance Computing infrastructure; (v) Capture and use of long-distance earth observation data Objectives • develop globally-competitive systemic solutions in the field of smart grids and IT platforms with user solutions • establish at least two pilot projects, in particular in the area of energy, urban mobility and safety • use reforms of public administration and introduction of smart health systems for the entrepreneurship promotion and access to global markets 2023 objective: raise value added per employee in companies by 15%.

1. HEALTHY living and working environment 2. Smart buildings and homes, including wood chain Focus areas and technologies • Smart housing units • Smart environment using intelligent building management systems • Smart appliances • Advanced materials and products, including wood composites Objectives • develop integrated management systems for buildings, homes and the working environment of the future, and smart appliances for energy efficiency and self-sufficiency of buildings and Internet of things as a horizontal orientation • inter-sectoral networking and integration of the wood chain in the design of homes and working environment of the future by also promoting research and innovation deriving from traditional knowledge and skills of the use of wood and wood-compatible natural materials 2023 objective: raise value added and export of companies by 15%.

1. HEALTHY living and working environment 2. Smart buildings and homes, including wood chain Focus areas and technologies • Smart housing units • Smart environment using intelligent building management systems • Smart appliances • Advanced materials and products, including wood composites Objectives • develop integrated management systems for buildings, homes and the working environment of the future, and smart appliances for energy efficiency and self-sufficiency of buildings and Internet of things as a horizontal orientation • inter-sectoral networking and integration of the wood chain in the design of homes and working environment of the future by also promoting research and innovation deriving from traditional knowledge and skills of the use of wood and wood-compatible natural materials 2023 objective: raise value added and export of companies by 15%.

2. NATURAL and TRADITIONAL sources for THE FUTURE 3. Networks for the transition to circular economy Focus areas and technologies • Technologies for sustainable biomass transformation and new bio-based materials • Technologies for use of secondary and raw-materials and reuse of waste • Production of energy based on alternative sources Objective • Connecting stakeholders – business entities, educational and research system, non-governmental organisations, the state and individuals – into value chains according to the principle “economy of closed material cycles” to development new business models for the transition to circular economy 2023 objectives: • raise the material efficiency index of 1. 07 (2011) to 1. 50 (2020) • establish 5 new value chains with closed material cycles 24

2. NATURAL and TRADITIONAL sources for THE FUTURE 3. Networks for the transition to circular economy Focus areas and technologies • Technologies for sustainable biomass transformation and new bio-based materials • Technologies for use of secondary and raw-materials and reuse of waste • Production of energy based on alternative sources Objective • Connecting stakeholders – business entities, educational and research system, non-governmental organisations, the state and individuals – into value chains according to the principle “economy of closed material cycles” to development new business models for the transition to circular economy 2023 objectives: • raise the material efficiency index of 1. 07 (2011) to 1. 50 (2020) • establish 5 new value chains with closed material cycles 24

2. NATURAL and TRADITIONAL sources for THE FUTURE 4 Sustainable food production Focus areas and technologies • Sustainable production and processing of food products into functional foods • Technologies for sustainable agricultural production (livestock and plants) Objectives • promote sustainable production of high-quality food in relation to a business model that will integrate knowledge institutions with manufacturers and economic entities along the value chain • establish an innovative and short supply chains for locally and organically produced foods with a guaranteed and recognised traceability from the field to the table • ensure long-term sustainable conditions for the development of the varieties and farming practices adapted to Slovenian territory and to climate change 2023 objectives: • establish at least 3 value chains which will provide a critical mass of consumption and which will be supported by long-term contractual partnership based on economic initiative • raise value added per employee in companies by 20% 25

2. NATURAL and TRADITIONAL sources for THE FUTURE 4 Sustainable food production Focus areas and technologies • Sustainable production and processing of food products into functional foods • Technologies for sustainable agricultural production (livestock and plants) Objectives • promote sustainable production of high-quality food in relation to a business model that will integrate knowledge institutions with manufacturers and economic entities along the value chain • establish an innovative and short supply chains for locally and organically produced foods with a guaranteed and recognised traceability from the field to the table • ensure long-term sustainable conditions for the development of the varieties and farming practices adapted to Slovenian territory and to climate change 2023 objectives: • establish at least 3 value chains which will provide a critical mass of consumption and which will be supported by long-term contractual partnership based on economic initiative • raise value added per employee in companies by 20% 25

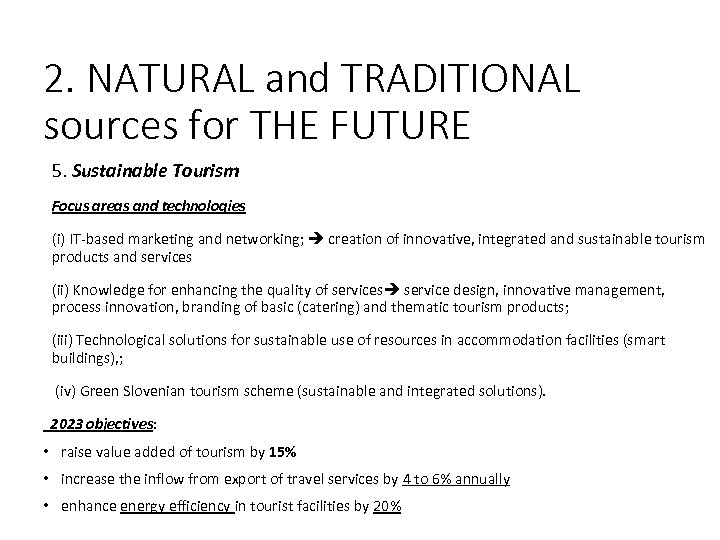

2. NATURAL and TRADITIONAL sources for THE FUTURE 5. Sustainable Tourism Focus areas and technologies (i) IT-based marketing and networking; creation of innovative, integrated and sustainable tourism products and services (ii) Knowledge for enhancing the quality of services service design, innovative management, process innovation, branding of basic (catering) and thematic tourism products; (iii) Technological solutions for sustainable use of resources in accommodation facilities (smart buildings), ; (iv) Green Slovenian tourism scheme (sustainable and integrated solutions). 2023 objectives: • raise value added of tourism by 15% • increase the inflow from export of travel services by 4 to 6% annually • enhance energy efficiency in tourist facilities by 20% 26

2. NATURAL and TRADITIONAL sources for THE FUTURE 5. Sustainable Tourism Focus areas and technologies (i) IT-based marketing and networking; creation of innovative, integrated and sustainable tourism products and services (ii) Knowledge for enhancing the quality of services service design, innovative management, process innovation, branding of basic (catering) and thematic tourism products; (iii) Technological solutions for sustainable use of resources in accommodation facilities (smart buildings), ; (iv) Green Slovenian tourism scheme (sustainable and integrated solutions). 2023 objectives: • raise value added of tourism by 15% • increase the inflow from export of travel services by 4 to 6% annually • enhance energy efficiency in tourist facilities by 20% 26

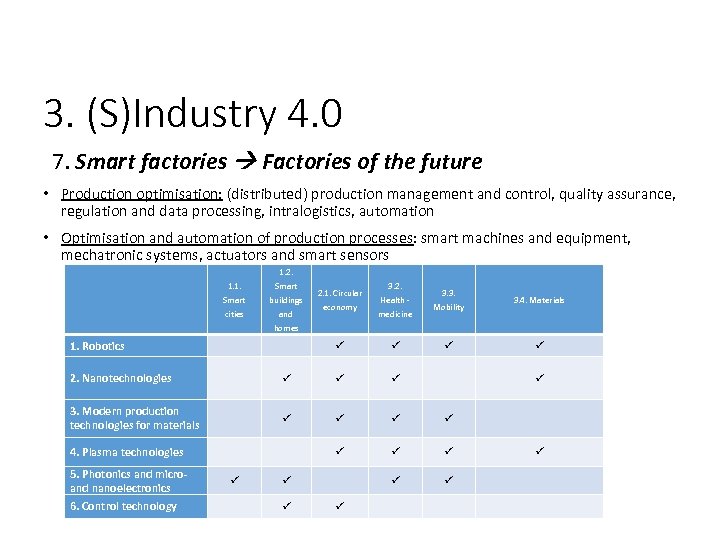

3. (S)Industry 4. 0 7. Smart factories Factories of the future • Production optimisation: (distributed) production management and control, quality assurance, regulation and data processing, intralogistics, automation • Optimisation and automation of production processes: smart machines and equipment, mechatronic systems, actuators and smart sensors 1. 2. 1. 1. Smart buildings cities and 2. 1. Circular economy 3. 2. Health - medicine 3. 3. Mobility 3. 4. Materials homes 1. Robotics 2. Nanotechnologies 3. Modern production technologies for materials 4. Plasma technologies 5. Photonics and micro- and nanoelectronics 6. Control technology 27

3. (S)Industry 4. 0 7. Smart factories Factories of the future • Production optimisation: (distributed) production management and control, quality assurance, regulation and data processing, intralogistics, automation • Optimisation and automation of production processes: smart machines and equipment, mechatronic systems, actuators and smart sensors 1. 2. 1. 1. Smart buildings cities and 2. 1. Circular economy 3. 2. Health - medicine 3. 3. Mobility 3. 4. Materials homes 1. Robotics 2. Nanotechnologies 3. Modern production technologies for materials 4. Plasma technologies 5. Photonics and micro- and nanoelectronics 6. Control technology 27

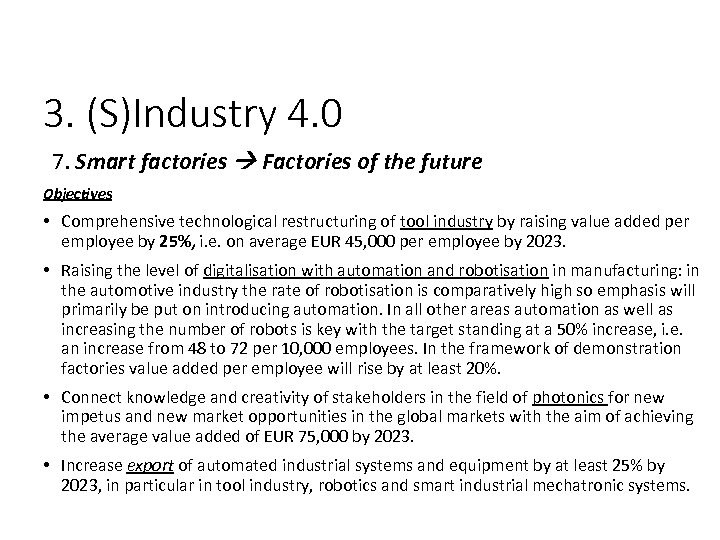

3. (S)Industry 4. 0 7. Smart factories Factories of the future Objectives • Comprehensive technological restructuring of tool industry by raising value added per employee by 25%, i. e. on average EUR 45, 000 per employee by 2023. • Raising the level of digitalisation with automation and robotisation in manufacturing: in the automotive industry the rate of robotisation is comparatively high so emphasis will primarily be put on introducing automation. In all other areas automation as well as increasing the number of robots is key with the target standing at a 50% increase, i. e. an increase from 48 to 72 per 10, 000 employees. In the framework of demonstration factories value added per employee will rise by at least 20%. • Connect knowledge and creativity of stakeholders in the field of photonics for new impetus and new market opportunities in the global markets with the aim of achieving the average value added of EUR 75, 000 by 2023. • Increase export of automated industrial systems and equipment by at least 25% by 2023, in particular in tool industry, robotics and smart industrial mechatronic systems. 28

3. (S)Industry 4. 0 7. Smart factories Factories of the future Objectives • Comprehensive technological restructuring of tool industry by raising value added per employee by 25%, i. e. on average EUR 45, 000 per employee by 2023. • Raising the level of digitalisation with automation and robotisation in manufacturing: in the automotive industry the rate of robotisation is comparatively high so emphasis will primarily be put on introducing automation. In all other areas automation as well as increasing the number of robots is key with the target standing at a 50% increase, i. e. an increase from 48 to 72 per 10, 000 employees. In the framework of demonstration factories value added per employee will rise by at least 20%. • Connect knowledge and creativity of stakeholders in the field of photonics for new impetus and new market opportunities in the global markets with the aim of achieving the average value added of EUR 75, 000 by 2023. • Increase export of automated industrial systems and equipment by at least 25% by 2023, in particular in tool industry, robotics and smart industrial mechatronic systems. 28

3. (S)Industry 4. 0 8. Medicine Focus areas and technologies • (i) Biopharmaceuticals; (ii) Translational medicine: diagnostics and therapeutics; (iii) Cancer treatment – diagnosis and therapy, (iv) Resistant bacteria; (v) Natural medicines and cosmetics Objective: Establish a strong partnership in the area of health – medicine which will: • position Slovenia as one of the global pillars of development in the field of biopharmaceuticals in symbiosis with large, medium-sized and small enterprises and newly established enterprises • establish Slovenia as a top-level research centre for translational research in the field of pharmacy and therapeutics • enhance the development of new product directions related to natural substances and spa tourism (natural medicines, dermatological cosmetics and cell therapeutics and rehabilitation) • link pharmaceutical industry in terms of human resources development 2023 objective: increase export of companies by over 30% of which small and medium-sized enterprises should increase export by at least EUR 250 million. In addition to promoting the establishment of at least 20 new companies the objective is also to attract at least one foreign direct investment which will employ over 50 people. 29

3. (S)Industry 4. 0 8. Medicine Focus areas and technologies • (i) Biopharmaceuticals; (ii) Translational medicine: diagnostics and therapeutics; (iii) Cancer treatment – diagnosis and therapy, (iv) Resistant bacteria; (v) Natural medicines and cosmetics Objective: Establish a strong partnership in the area of health – medicine which will: • position Slovenia as one of the global pillars of development in the field of biopharmaceuticals in symbiosis with large, medium-sized and small enterprises and newly established enterprises • establish Slovenia as a top-level research centre for translational research in the field of pharmacy and therapeutics • enhance the development of new product directions related to natural substances and spa tourism (natural medicines, dermatological cosmetics and cell therapeutics and rehabilitation) • link pharmaceutical industry in terms of human resources development 2023 objective: increase export of companies by over 30% of which small and medium-sized enterprises should increase export by at least EUR 250 million. In addition to promoting the establishment of at least 20 new companies the objective is also to attract at least one foreign direct investment which will employ over 50 people. 29

3. (S)Industry 4. 0 9. Mobility Focus areas and technologies • (i) Niche components and systems for internal combustion engines; (ii) E-mobility and energy storage systems; (iii) Systems and components for security and comfort (interior and exterior); (iv) Materials for the automotive industry Objective • transition from developing individual components and materials to developing demanding and complex energy-efficient products with higher value added, consistent with the new EU standards in the field of emission reductions (EURO 6 c, EURO 7) and in the field of security (EURO NCAP) • strengthen Slovenian manufactures as pre-development suppliers 2023 objectives: • raise value added of companies by 20% • increase the number of pre-development suppliers from 15 to 22 (45% increase) 30

3. (S)Industry 4. 0 9. Mobility Focus areas and technologies • (i) Niche components and systems for internal combustion engines; (ii) E-mobility and energy storage systems; (iii) Systems and components for security and comfort (interior and exterior); (iv) Materials for the automotive industry Objective • transition from developing individual components and materials to developing demanding and complex energy-efficient products with higher value added, consistent with the new EU standards in the field of emission reductions (EURO 6 c, EURO 7) and in the field of security (EURO NCAP) • strengthen Slovenian manufactures as pre-development suppliers 2023 objectives: • raise value added of companies by 20% • increase the number of pre-development suppliers from 15 to 22 (45% increase) 30

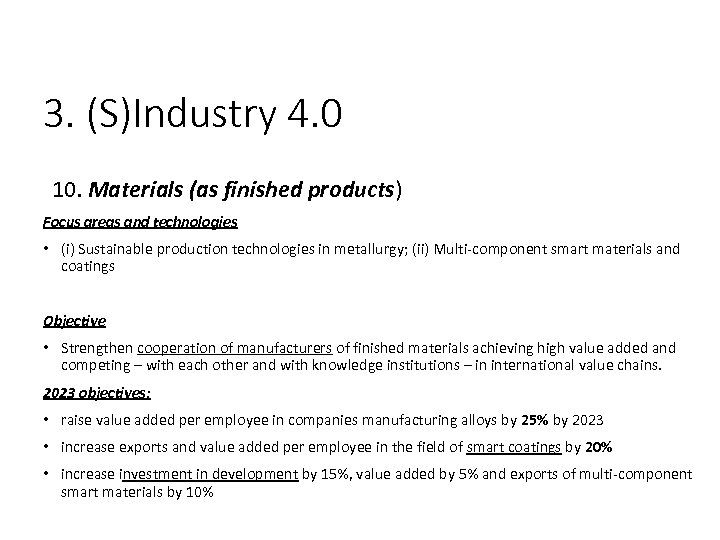

3. (S)Industry 4. 0 10. Materials (as finished products) Focus areas and technologies • (i) Sustainable production technologies in metallurgy; (ii) Multi-component smart materials and coatings Objective • Strengthen cooperation of manufacturers of finished materials achieving high value added and competing – with each other and with knowledge institutions – in international value chains. 2023 objectives: • raise value added per employee in companies manufacturing alloys by 25% by 2023 • increase exports and value added per employee in the field of smart coatings by 20% • increase investment in development by 15%, value added by 5% and exports of multi-component smart materials by 10% 31

3. (S)Industry 4. 0 10. Materials (as finished products) Focus areas and technologies • (i) Sustainable production technologies in metallurgy; (ii) Multi-component smart materials and coatings Objective • Strengthen cooperation of manufacturers of finished materials achieving high value added and competing – with each other and with knowledge institutions – in international value chains. 2023 objectives: • raise value added per employee in companies manufacturing alloys by 25% by 2023 • increase exports and value added per employee in the field of smart coatings by 20% • increase investment in development by 15%, value added by 5% and exports of multi-component smart materials by 10% 31

POLICY MIX RDI, CREATIVITY, ENTREPRENEURSHIP 32

POLICY MIX RDI, CREATIVITY, ENTREPRENEURSHIP 32

Policy mix (1): RDI: • Basic science • Research, development and innovation in value chains and networks (international competitiveness and excellence in research + support to RDI process) • Support to investments • Complementarity with Horizon 2020 and international initiatives • Better utilisation and development of research infrastructure • Specific measures (sustainable food production and sustainable tourism)

Policy mix (1): RDI: • Basic science • Research, development and innovation in value chains and networks (international competitiveness and excellence in research + support to RDI process) • Support to investments • Complementarity with Horizon 2020 and international initiatives • Better utilisation and development of research infrastructure • Specific measures (sustainable food production and sustainable tourism)

Policy mix (2): HR: • Research potential of researchers and international mobility • Strengthening development competences and innovation potentials • Employee knowledge and competences: (i) Competence centres for human resources development 2. 0 , (ii) scholarships for selected priorities, (iii) Life long guidance, 8 iv) mentoring…. • Young and creative Slovenia; creativity and entrepreneurship throughout whole educational system)

Policy mix (2): HR: • Research potential of researchers and international mobility • Strengthening development competences and innovation potentials • Employee knowledge and competences: (i) Competence centres for human resources development 2. 0 , (ii) scholarships for selected priorities, (iii) Life long guidance, 8 iv) mentoring…. • Young and creative Slovenia; creativity and entrepreneurship throughout whole educational system)

Policy mix (3): ENTREPRENEURSHIP AND INNOVATION - Optimisation of business-supporting environment with special attention to: • Newly established enterprises and knowledge transfer • Growth and development of SMEs • Internationalisation and FDI

Policy mix (3): ENTREPRENEURSHIP AND INNOVATION - Optimisation of business-supporting environment with special attention to: • Newly established enterprises and knowledge transfer • Growth and development of SMEs • Internationalisation and FDI

Policy mix (4): NON FIINANCIAL PART / MEASURES – Development State: • • • Innovative and green public procurement Tax relief Economic diplomacy and promotion Issuing permits and eliminating regulatory barriers Efficient justice administration

Policy mix (4): NON FIINANCIAL PART / MEASURES – Development State: • • • Innovative and green public procurement Tax relief Economic diplomacy and promotion Issuing permits and eliminating regulatory barriers Efficient justice administration

Complementarities with Horizon 2020: (Teaming, ERC, Twinning…) 1 -3 PROOF OF CONCEPT Basic science Better utilisation and further development of research infrastructure 3 -6 PROTOTYPE RDI: from research to the market Improvement of international competitiveness and research excellence to participate in value chains International initiatives and programmes (EUREKA) Support to RDI proccesses: 6 -9 • Smaller innovation projects • SME Instr. Plus projects • Bigger RDI projects MARKET Innovative Public Procurement 9+ Revolving sources only! 37 Internationalisation

Complementarities with Horizon 2020: (Teaming, ERC, Twinning…) 1 -3 PROOF OF CONCEPT Basic science Better utilisation and further development of research infrastructure 3 -6 PROTOTYPE RDI: from research to the market Improvement of international competitiveness and research excellence to participate in value chains International initiatives and programmes (EUREKA) Support to RDI proccesses: 6 -9 • Smaller innovation projects • SME Instr. Plus projects • Bigger RDI projects MARKET Innovative Public Procurement 9+ Revolving sources only! 37 Internationalisation

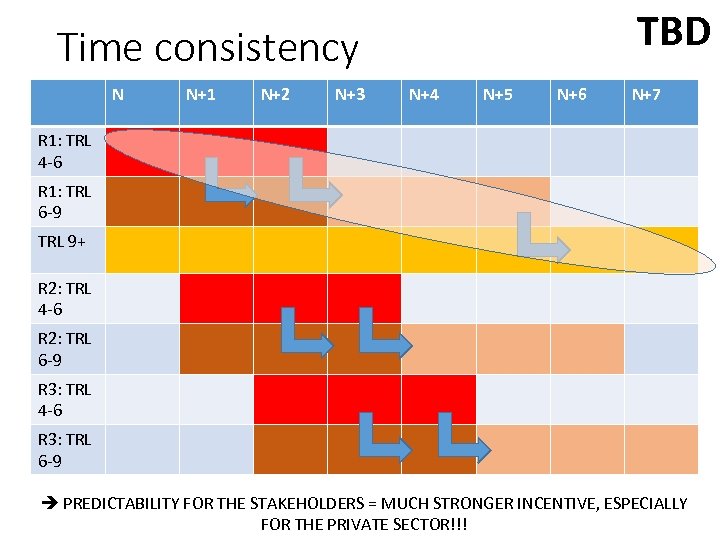

TBD Time consistency N N+1 N+2 N+3 N+4 N+5 N+6 N+7 R 1: TRL 4 -6 R 1: TRL 6 -9 TRL 9+ R 2: TRL 4 -6 R 2: TRL 6 -9 R 3: TRL 4 -6 R 3: TRL 6 -9 38 PREDICTABILITY FOR THE STAKEHOLDERS = MUCH STRONGER INCENTIVE, ESPECIALLY FOR THE PRIVATE SECTOR!!!

TBD Time consistency N N+1 N+2 N+3 N+4 N+5 N+6 N+7 R 1: TRL 4 -6 R 1: TRL 6 -9 TRL 9+ R 2: TRL 4 -6 R 2: TRL 6 -9 R 3: TRL 4 -6 R 3: TRL 6 -9 38 PREDICTABILITY FOR THE STAKEHOLDERS = MUCH STRONGER INCENTIVE, ESPECIALLY FOR THE PRIVATE SECTOR!!!

GOVERNANCE COOPERATION AND COLLABORATION 39

GOVERNANCE COOPERATION AND COLLABORATION 39

State level National Innovation Platform SDIP-STRATEGIC PARTNERSHIPS SP 1 SP 2 SP 3 SP 4 SP 5 SP 6 SP 7 SP 8 SP 9 SP 10 40

State level National Innovation Platform SDIP-STRATEGIC PARTNERSHIPS SP 1 SP 2 SP 3 SP 4 SP 5 SP 6 SP 7 SP 8 SP 9 SP 10 40

MESS GODC MEDT Mf. I MAFF MPA MC MFA ARRS SPIRIT SID Sz. RR Sz. RK Mo. LFSA ZRSZZ National innovation Platform SP 1 SP 2 SP 3 SP 4 SP 5 SP 6 SP 7 SP 8 SP 9 SP 10 41

MESS GODC MEDT Mf. I MAFF MPA MC MFA ARRS SPIRIT SID Sz. RR Sz. RK Mo. LFSA ZRSZZ National innovation Platform SP 1 SP 2 SP 3 SP 4 SP 5 SP 6 SP 7 SP 8 SP 9 SP 10 41

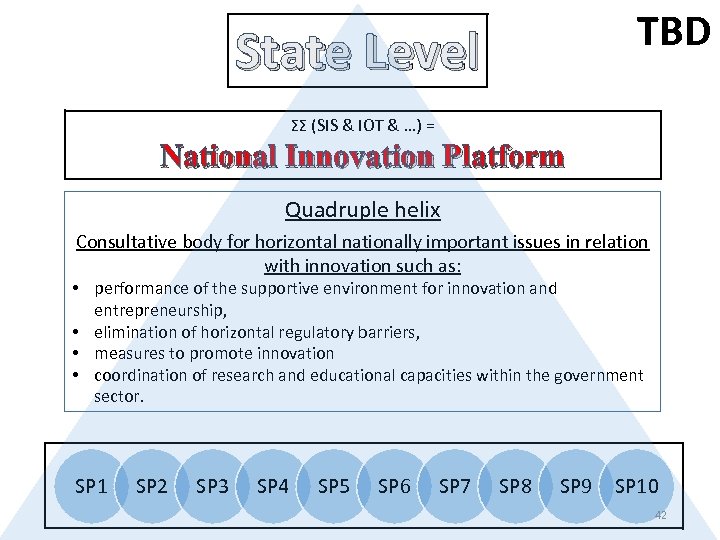

TBD State Level ƩƩ (SIS & IOT & …) = National Innovation Platform Quadruple helix Consultative body for horizontal nationally important issues in relation with innovation such as: • performance of the supportive environment for innovation and entrepreneurship, • elimination of horizontal regulatory barriers, • measures to promote innovation • coordination of research and educational capacities within the government sector. SP 1 SP 2 SP 3 SP 4 SP 5 SP 6 SP 7 SP 8 SP 9 SP 10 42

TBD State Level ƩƩ (SIS & IOT & …) = National Innovation Platform Quadruple helix Consultative body for horizontal nationally important issues in relation with innovation such as: • performance of the supportive environment for innovation and entrepreneurship, • elimination of horizontal regulatory barriers, • measures to promote innovation • coordination of research and educational capacities within the government sector. SP 1 SP 2 SP 3 SP 4 SP 5 SP 6 SP 7 SP 8 SP 9 SP 10 42

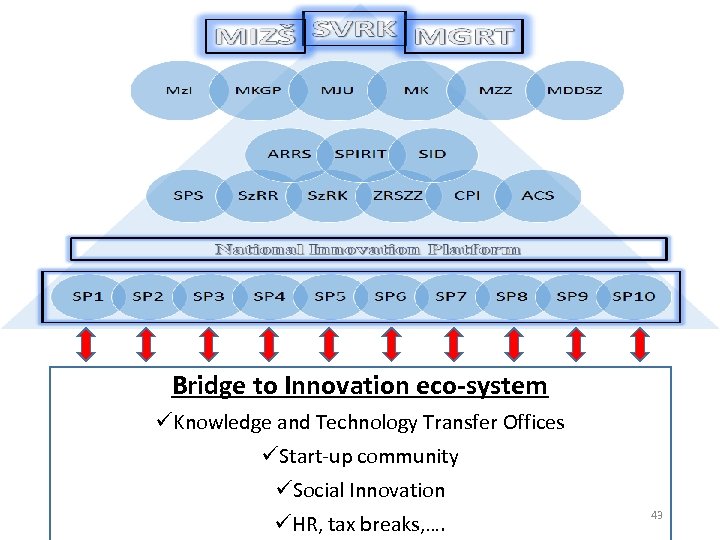

Bridge to Innovation eco-system Knowledge and Technology Transfer Offices Start-up community Social Innovation HR, tax breaks, …. 43

Bridge to Innovation eco-system Knowledge and Technology Transfer Offices Start-up community Social Innovation HR, tax breaks, …. 43

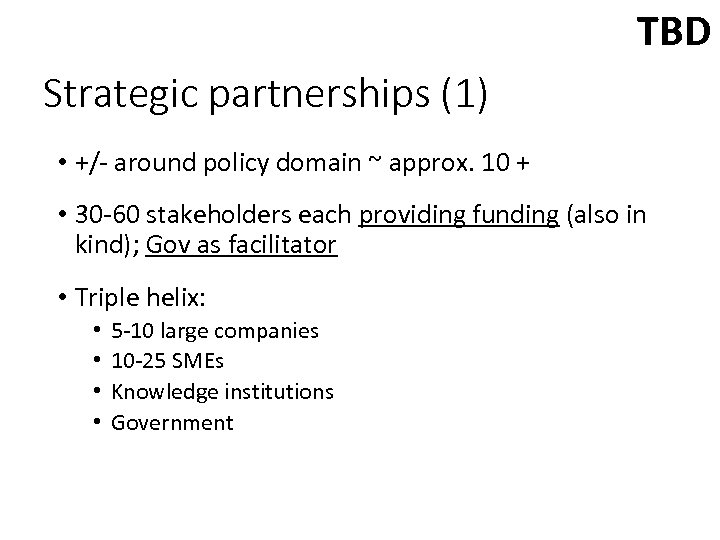

TBD Strategic partnerships (1) • +/- around policy domain ~ approx. 10 + • 30 -60 stakeholders each providing funding (also in kind); Gov as facilitator • Triple helix: • • 5 -10 large companies 10 -25 SMEs Knowledge institutions Government 44

TBD Strategic partnerships (1) • +/- around policy domain ~ approx. 10 + • 30 -60 stakeholders each providing funding (also in kind); Gov as facilitator • Triple helix: • • 5 -10 large companies 10 -25 SMEs Knowledge institutions Government 44

TBD Strategic partnerships (2) • What do they do: 1. Joining RTDI initiatives towards more demanding, comprehensive and integrated products and services 2. Joint global trend analysis technologies, value chains, … 3. Development of business models balancing push and pull 4. Internationalisation (e. g. technology bridges, value chain development, FDIs) and international cooperation (e. g. Horizon 2020, COSME, ETC, international networks) + promotion 5. Knowledge transfer + promoting open innovation 45

TBD Strategic partnerships (2) • What do they do: 1. Joining RTDI initiatives towards more demanding, comprehensive and integrated products and services 2. Joint global trend analysis technologies, value chains, … 3. Development of business models balancing push and pull 4. Internationalisation (e. g. technology bridges, value chain development, FDIs) and international cooperation (e. g. Horizon 2020, COSME, ETC, international networks) + promotion 5. Knowledge transfer + promoting open innovation 45

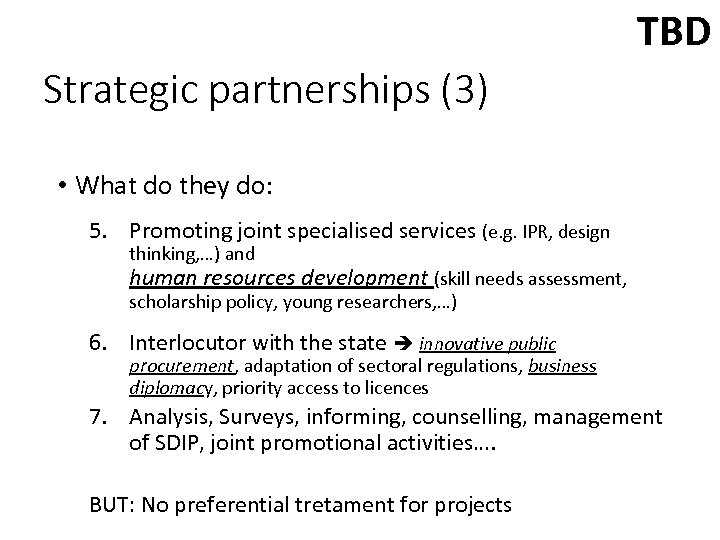

TBD Strategic partnerships (3) • What do they do: 5. Promoting joint specialised services (e. g. IPR, design thinking, …) and human resources development (skill needs assessment, scholarship policy, young researchers, …) 6. Interlocutor with the state innovative public procurement, adaptation of sectoral regulations, business diplomacy, priority access to licences 7. Analysis, Surveys, informing, counselling, management of SDIP, joint promotional activities…. BUT: No preferential tretament for projects 46

TBD Strategic partnerships (3) • What do they do: 5. Promoting joint specialised services (e. g. IPR, design thinking, …) and human resources development (skill needs assessment, scholarship policy, young researchers, …) 6. Interlocutor with the state innovative public procurement, adaptation of sectoral regulations, business diplomacy, priority access to licences 7. Analysis, Surveys, informing, counselling, management of SDIP, joint promotional activities…. BUT: No preferential tretament for projects 46

TBD Strategic partnerships (4) • Organisation forms: up to stakeholders Ø Allows flexibility Ø + strengthening capacity where it already exists Ø But it needs to be open: for newcomers v. Consortium / Contract v. Economic Interest Group v. European Economic Interest Group (yes, also foreign entities) v. Other new legal form 47

TBD Strategic partnerships (4) • Organisation forms: up to stakeholders Ø Allows flexibility Ø + strengthening capacity where it already exists Ø But it needs to be open: for newcomers v. Consortium / Contract v. Economic Interest Group v. European Economic Interest Group (yes, also foreign entities) v. Other new legal form 47

Summary Main Lessons learnt: - Strong analytical part isn‘t enough – need for EDP - Not only RDI (HR, Non tech, social innovation, creative industries…) - Need cooperation between science and economy (SI: ministries), stability - Involvement of all (S 4 is not a „room doc“) - EU cooperation (JRC. Peer review, EC, Smart Spec) - Finish (20. 9. ; 3. 11. ) Start (Continuous exercise) S 4 shortly: Focus - priorities Collaboration – SDIP, NIP Creativity and Entrepreneurship S 4? - 2) Ambitious Me, Active Ambassador

Summary Main Lessons learnt: - Strong analytical part isn‘t enough – need for EDP - Not only RDI (HR, Non tech, social innovation, creative industries…) - Need cooperation between science and economy (SI: ministries), stability - Involvement of all (S 4 is not a „room doc“) - EU cooperation (JRC. Peer review, EC, Smart Spec) - Finish (20. 9. ; 3. 11. ) Start (Continuous exercise) S 4 shortly: Focus - priorities Collaboration – SDIP, NIP Creativity and Entrepreneurship S 4? - 2) Ambitious Me, Active Ambassador

SI: Healthy, Green, Active, Digital and… Successful 49

SI: Healthy, Green, Active, Digital and… Successful 49

THANK YOU peter. wostner@gov. si S 4 Team gorazd. jenko@gov. si simona. hocevar@gov. si 50 marko. hren@gov. si

THANK YOU peter. wostner@gov. si S 4 Team gorazd. jenko@gov. si simona. hocevar@gov. si 50 marko. hren@gov. si