ebcf75623833197825b0380df85d33da.ppt

- Количество слайдов: 18

www. duni. com Q 3 2008 Presentation 1

www. duni. com Q 3 2008 Presentation 1

Disclaimer § This presentation has been prepared by Duni AB (the “Company”) solely for use at this investor presentation and is furnished to you solely for your information and may not be reproduced or redistributed, in whole or in part, to any other person. By attending the meeting where this presentation is made, or by reading the presentation slides, you agree to be bound by the following limitations. § This presentation is not for presentation or transmission into the United States or to any U. S. person, as that term is defined under Regulation S promulgated under the Securities Act of 1933, as amended. § This presentation contains various forward-looking statements that reflect management’s current views with respect to future events and financial and operational performance. The words “believe, ” “expect, ” “anticipate, ” “intend, ” “may, ” “plan, ” “estimate, ” “should, ” “could, ” “aim, ” “target, ” “might, ” or, in each case, their negative, or similar expressions identify certain of these forward-looking statements. Others can be identified from the context in which the statements are made. These forward-looking statements involve known and unknown risks, uncertainties and other factors, which are in some cases beyond the Company’s control and may cause actual results or performance to differ materially from those expressed or implied from such forward-looking statements. These risks include but are not limited to the Company’s ability to operate profitably, maintain its competitive position, to promote and improve its reputation and the awareness of the brands in its portfolio, to successfully operate its growth strategy and the impact of changes in pricing policies, political and regulatory developments in the markets in which the Company operates, and other risks. § The information and opinions contained in this document are provided as at the date of this presentation and are subject to change without notice. § No representation or warranty (expressed or implied) is made as to, and no reliance should be placed on, the fairness, accuracy or completeness of the information contained herein. Accordingly, none of the Company, or any of its principal shareholders or subsidiary undertakings or any of such person’s officers or employees accepts any liability whatsoever arising directly or indirectly from the use of this document 2

Disclaimer § This presentation has been prepared by Duni AB (the “Company”) solely for use at this investor presentation and is furnished to you solely for your information and may not be reproduced or redistributed, in whole or in part, to any other person. By attending the meeting where this presentation is made, or by reading the presentation slides, you agree to be bound by the following limitations. § This presentation is not for presentation or transmission into the United States or to any U. S. person, as that term is defined under Regulation S promulgated under the Securities Act of 1933, as amended. § This presentation contains various forward-looking statements that reflect management’s current views with respect to future events and financial and operational performance. The words “believe, ” “expect, ” “anticipate, ” “intend, ” “may, ” “plan, ” “estimate, ” “should, ” “could, ” “aim, ” “target, ” “might, ” or, in each case, their negative, or similar expressions identify certain of these forward-looking statements. Others can be identified from the context in which the statements are made. These forward-looking statements involve known and unknown risks, uncertainties and other factors, which are in some cases beyond the Company’s control and may cause actual results or performance to differ materially from those expressed or implied from such forward-looking statements. These risks include but are not limited to the Company’s ability to operate profitably, maintain its competitive position, to promote and improve its reputation and the awareness of the brands in its portfolio, to successfully operate its growth strategy and the impact of changes in pricing policies, political and regulatory developments in the markets in which the Company operates, and other risks. § The information and opinions contained in this document are provided as at the date of this presentation and are subject to change without notice. § No representation or warranty (expressed or implied) is made as to, and no reliance should be placed on, the fairness, accuracy or completeness of the information contained herein. Accordingly, none of the Company, or any of its principal shareholders or subsidiary undertakings or any of such person’s officers or employees accepts any liability whatsoever arising directly or indirectly from the use of this document 2

Contents § 2008 Q 3 highlights § Business areas § Financials 3

Contents § 2008 Q 3 highlights § Business areas § Financials 3

2008 Q 3 Highlights • Net sales increased with 0. 7% to SEK 973 m • Operating profit amounted to SEK 83 m (97) • Includes market valuation of derivatives SEK -18 m • Operating margin amounted to 8. 5% (10. 0%) • Underlying margin amounted to 10. 4% (9. 6%) • Continued growth in Professional and improved underlying margins - Good development in Central Europe - Strong growth in Duni Food. Solutions • Continued improvement of Retail’s underlying profit margin • Sales in Tissue of airlaid material still phased towards first quarter, year-to-date growth is stable 4

2008 Q 3 Highlights • Net sales increased with 0. 7% to SEK 973 m • Operating profit amounted to SEK 83 m (97) • Includes market valuation of derivatives SEK -18 m • Operating margin amounted to 8. 5% (10. 0%) • Underlying margin amounted to 10. 4% (9. 6%) • Continued growth in Professional and improved underlying margins - Good development in Central Europe - Strong growth in Duni Food. Solutions • Continued improvement of Retail’s underlying profit margin • Sales in Tissue of airlaid material still phased towards first quarter, year-to-date growth is stable 4

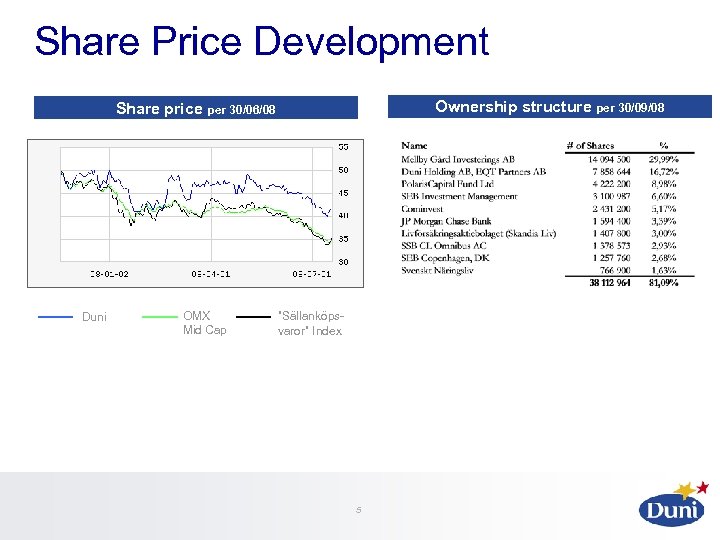

Share Price Development Ownership structure per 30/09/08 Share price per 30/06/08 Duni OMX Mid Cap ”Sällanköpsvaror” Index 5

Share Price Development Ownership structure per 30/09/08 Share price per 30/06/08 Duni OMX Mid Cap ”Sällanköpsvaror” Index 5

Duni – the European Market Leader for Table Top Solutions Duni Key financials Full year 2007 Table Top Professional 66% Tissue 14% Retail 20% ∙ Sales: SEK 4. 0 billion (+5. 9%) ∙ EBIT: SEK 394 million (277) Manufactured ∙ EBIT margin: 9. 9% (8. 7%) ¹ Traded Napkins Candles Plates Eating & Drinking (glasses, cups, plates, cutlery) ¹ Excluding non-recurring items Jan – Sep 2008 Table coverings ∙ ∙ 6 EBIT: SEK 260 million (248) ∙ Meal service Sales: SEK 3. 0 billion (+3. 3%) EBIT margin: 8. 8% (8. 7%)

Duni – the European Market Leader for Table Top Solutions Duni Key financials Full year 2007 Table Top Professional 66% Tissue 14% Retail 20% ∙ Sales: SEK 4. 0 billion (+5. 9%) ∙ EBIT: SEK 394 million (277) Manufactured ∙ EBIT margin: 9. 9% (8. 7%) ¹ Traded Napkins Candles Plates Eating & Drinking (glasses, cups, plates, cutlery) ¹ Excluding non-recurring items Jan – Sep 2008 Table coverings ∙ ∙ 6 EBIT: SEK 260 million (248) ∙ Meal service Sales: SEK 3. 0 billion (+3. 3%) EBIT margin: 8. 8% (8. 7%)

2008 Market Outlook HORECA market growing in line or slightly above GDP • Positive eating out trend • Continued strong growth in take-away sector Retail growth in line with GDP • Private label stagnating Higher uncertainty • GDP forecasts revised downward since Q 1 Raw material prices and costs of certain traded goods continue to increase • Energy • Transport • Pulp (stabilizing) 7 Changing eating habits

2008 Market Outlook HORECA market growing in line or slightly above GDP • Positive eating out trend • Continued strong growth in take-away sector Retail growth in line with GDP • Private label stagnating Higher uncertainty • GDP forecasts revised downward since Q 1 Raw material prices and costs of certain traded goods continue to increase • Energy • Transport • Pulp (stabilizing) 7 Changing eating habits

Business Areas 8

Business Areas 8

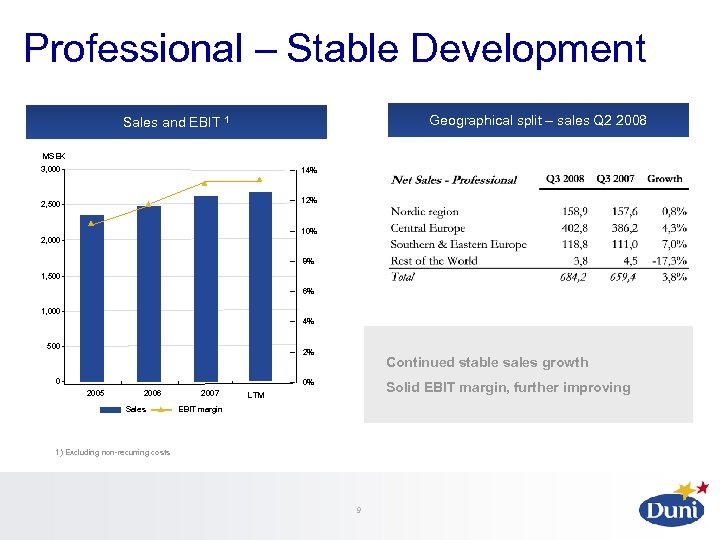

Professional – Stable Development Geographical split – sales Q 2 2008 Sales and EBIT 1 MSEK 3, 000 14% 12% 2, 500 10% 2, 000 8% 1, 500 6% 1, 000 4% 500 2% 0 Continued stable sales growth 0% 2005 2006 Sales 2007 Solid EBIT margin, further improving LTM EBIT margin 1) Excluding non-recurring costs 9

Professional – Stable Development Geographical split – sales Q 2 2008 Sales and EBIT 1 MSEK 3, 000 14% 12% 2, 500 10% 2, 000 8% 1, 500 6% 1, 000 4% 500 2% 0 Continued stable sales growth 0% 2005 2006 Sales 2007 Solid EBIT margin, further improving LTM EBIT margin 1) Excluding non-recurring costs 9

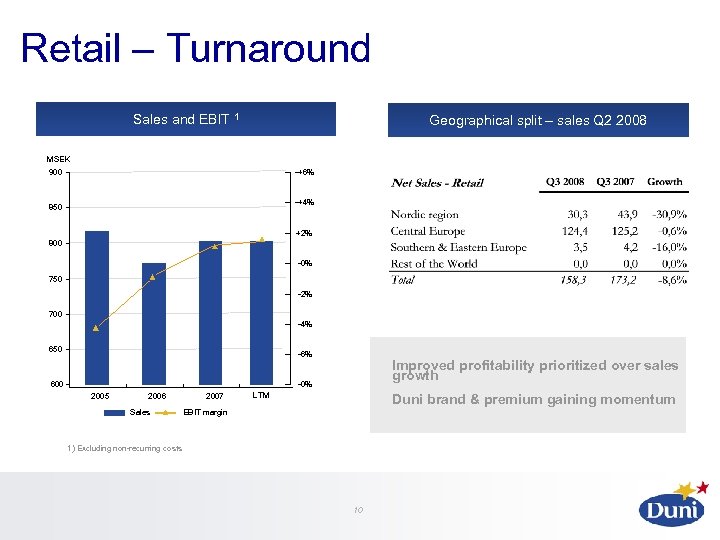

Retail – Turnaround Sales and EBIT 1 Geographical split – sales Q 2 2008 MSEK -+6% 900 -+4% 850 +2% 800 -0% 750 -2% 700 -4% 650 -6% Improved profitability prioritized over sales growth -0% 600 2005 2006 Sales 2007 LTM Duni brand & premium gaining momentum EBIT margin 1) Excluding non-recurring costs 10

Retail – Turnaround Sales and EBIT 1 Geographical split – sales Q 2 2008 MSEK -+6% 900 -+4% 850 +2% 800 -0% 750 -2% 700 -4% 650 -6% Improved profitability prioritized over sales growth -0% 600 2005 2006 Sales 2007 LTM Duni brand & premium gaining momentum EBIT margin 1) Excluding non-recurring costs 10

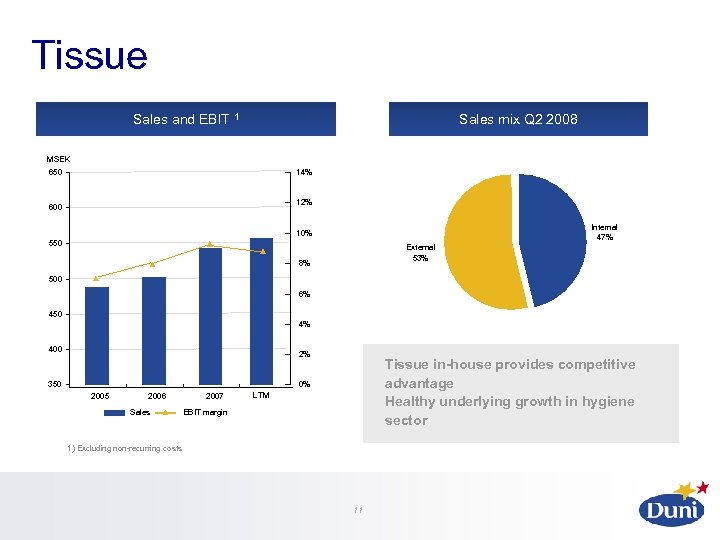

Tissue Sales mix Q 2 2008 Sales and EBIT 1 MSEK 650 14% 12% 600 Internal 47% 10% 550 External 53% 8% 500 6% 450 4% 400 2% 350 Tissue in-house provides competitive advantage Healthy underlying growth in hygiene sector 0% 2005 2006 Sales 2007 LTM EBIT margin 1) Excluding non-recurring costs 11

Tissue Sales mix Q 2 2008 Sales and EBIT 1 MSEK 650 14% 12% 600 Internal 47% 10% 550 External 53% 8% 500 6% 450 4% 400 2% 350 Tissue in-house provides competitive advantage Healthy underlying growth in hygiene sector 0% 2005 2006 Sales 2007 LTM EBIT margin 1) Excluding non-recurring costs 11

Financials 12

Financials 12

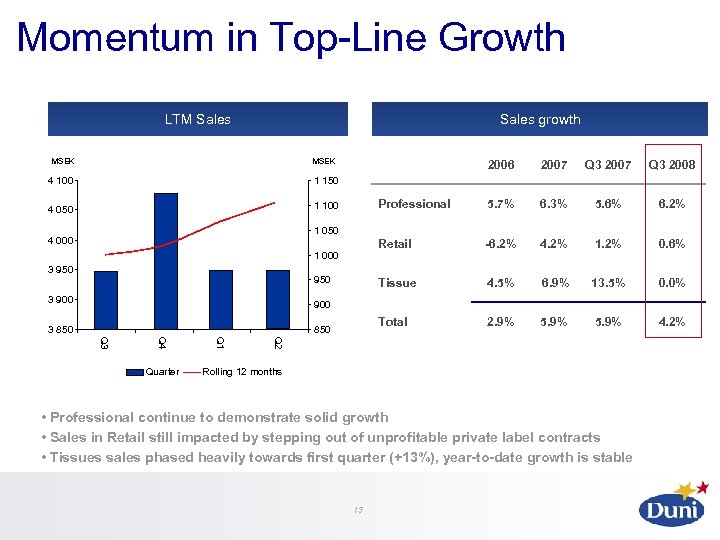

Momentum in Top-Line Growth LTM Sales growth MSEK 4 100 Q 3 2007 Q 3 2008 Professional 5. 7% 6. 3% 5. 6% 6. 2% Retail -6. 2% 4. 2% 1. 2% 0. 6% Tissue 4. 5% 6. 9% 13. 5% 0. 0% Total 1 100 2007 2. 9% 5. 9% 4. 2% 1 150 4 050 2006 1 050 4 000 1 000 3 950 3 900 3 850 Q 2 Q 1 Q 4 Q 3 Quarter Rolling 12 months • Professional continue to demonstrate solid growth • Sales in Retail still impacted by stepping out of unprofitable private label contracts • Tissues sales phased heavily towards first quarter (+13%), year-to-date growth is stable 13

Momentum in Top-Line Growth LTM Sales growth MSEK 4 100 Q 3 2007 Q 3 2008 Professional 5. 7% 6. 3% 5. 6% 6. 2% Retail -6. 2% 4. 2% 1. 2% 0. 6% Tissue 4. 5% 6. 9% 13. 5% 0. 0% Total 1 100 2007 2. 9% 5. 9% 4. 2% 1 150 4 050 2006 1 050 4 000 1 000 3 950 3 900 3 850 Q 2 Q 1 Q 4 Q 3 Quarter Rolling 12 months • Professional continue to demonstrate solid growth • Sales in Retail still impacted by stepping out of unprofitable private label contracts • Tissues sales phased heavily towards first quarter (+13%), year-to-date growth is stable 13

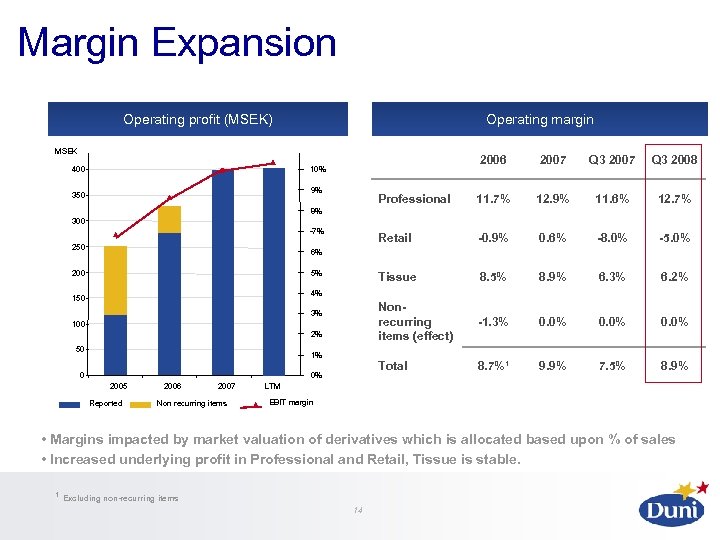

Margin Expansion Operating profit (MSEK) Operating margin MSEK 400 2006 2007 Q 3 2008 Professional 11. 7% 12. 9% 11. 6% 12. 7% Retail -0. 9% 0. 6% -8. 0% -5. 0% Tissue 8. 5% 8. 9% 6. 3% 6. 2% Nonrecurring items (effect) -1. 3% 0. 0% Total 8. 7%¹ 9. 9% 7. 5% 8. 9% 10% 9% 350 8% 300 -7% 250 6% 200 5% 4% 150 3% 100 2% 50 1% 0 0% 2005 Reported 2006 2007 Non recurring items LTM EBIT margin • Margins impacted by market valuation of derivatives which is allocated based upon % of sales • Increased underlying profit in Professional and Retail, Tissue is stable. ¹ Excluding non-recurring items 14

Margin Expansion Operating profit (MSEK) Operating margin MSEK 400 2006 2007 Q 3 2008 Professional 11. 7% 12. 9% 11. 6% 12. 7% Retail -0. 9% 0. 6% -8. 0% -5. 0% Tissue 8. 5% 8. 9% 6. 3% 6. 2% Nonrecurring items (effect) -1. 3% 0. 0% Total 8. 7%¹ 9. 9% 7. 5% 8. 9% 10% 9% 350 8% 300 -7% 250 6% 200 5% 4% 150 3% 100 2% 50 1% 0 0% 2005 Reported 2006 2007 Non recurring items LTM EBIT margin • Margins impacted by market valuation of derivatives which is allocated based upon % of sales • Increased underlying profit in Professional and Retail, Tissue is stable. ¹ Excluding non-recurring items 14

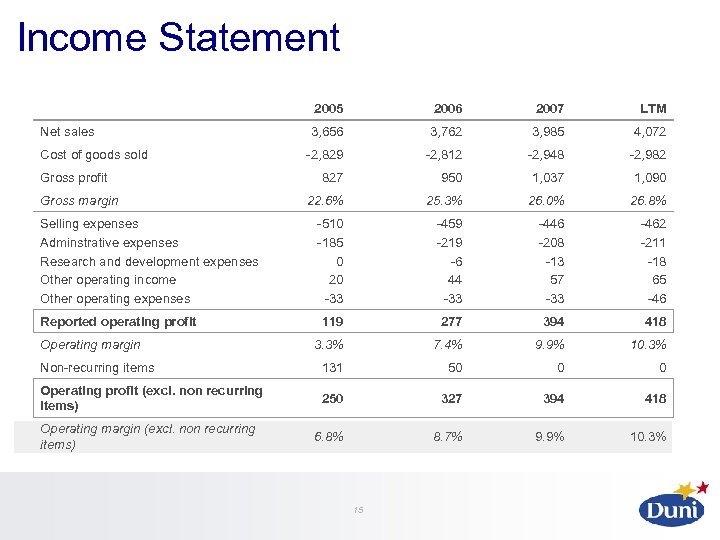

Income Statement 2005 2006 2007 LTM 3, 656 3, 762 3, 985 4, 072 -2, 829 -2, 812 -2, 948 -2, 982 827 950 1, 037 1, 090 22. 6% 25. 3% 26. 0% 26. 8% -510 -185 0 20 -33 -459 -219 -6 44 -33 -446 -208 -13 57 -33 -462 -211 -18 65 -46 119 277 394 418 3. 3% 7. 4% 9. 9% 10. 3% Non-recurring items 131 50 0 0 Operating profit (excl. non recurring items) 250 327 394 418 6. 8% 8. 7% 9. 9% 10. 3% Net sales Cost of goods sold Gross profit Gross margin Selling expenses Adminstrative expenses Research and development expenses Other operating income Other operating expenses Reported operating profit Operating margin (excl. non recurring items) 15

Income Statement 2005 2006 2007 LTM 3, 656 3, 762 3, 985 4, 072 -2, 829 -2, 812 -2, 948 -2, 982 827 950 1, 037 1, 090 22. 6% 25. 3% 26. 0% 26. 8% -510 -185 0 20 -33 -459 -219 -6 44 -33 -446 -208 -13 57 -33 -462 -211 -18 65 -46 119 277 394 418 3. 3% 7. 4% 9. 9% 10. 3% Non-recurring items 131 50 0 0 Operating profit (excl. non recurring items) 250 327 394 418 6. 8% 8. 7% 9. 9% 10. 3% Net sales Cost of goods sold Gross profit Gross margin Selling expenses Adminstrative expenses Research and development expenses Other operating income Other operating expenses Reported operating profit Operating margin (excl. non recurring items) 15

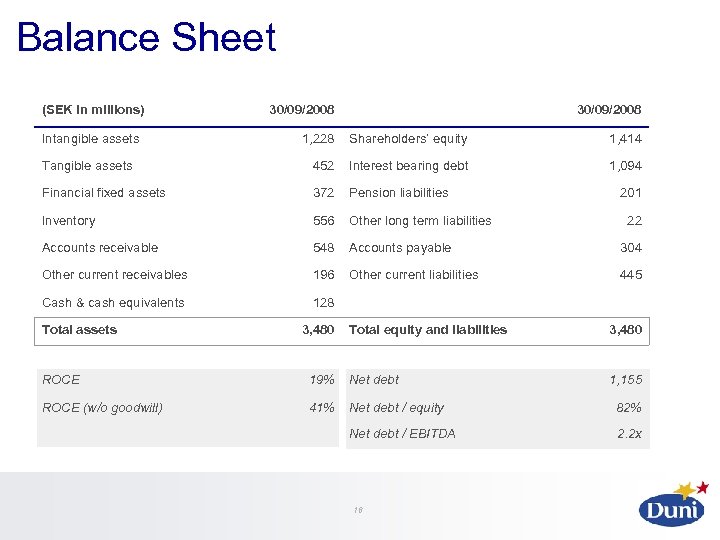

Balance Sheet (SEK in millions) Intangible assets 30/09/2008 1, 228 Shareholders’ equity 1, 414 Tangible assets 452 Interest bearing debt 1, 094 Financial fixed assets 372 Pension liabilities Inventory 556 Other long term liabilities Accounts receivable 548 Accounts payable 304 Other current receivables 196 Other current liabilities 445 Cash & cash equivalents 128 Total assets 3, 480 201 22 Total equity and liabilities 3, 480 1, 155 ROCE 19% Net debt ROCE (w/o goodwill) 41% Net debt / equity 82% Net debt / EBITDA 2. 2 x 16

Balance Sheet (SEK in millions) Intangible assets 30/09/2008 1, 228 Shareholders’ equity 1, 414 Tangible assets 452 Interest bearing debt 1, 094 Financial fixed assets 372 Pension liabilities Inventory 556 Other long term liabilities Accounts receivable 548 Accounts payable 304 Other current receivables 196 Other current liabilities 445 Cash & cash equivalents 128 Total assets 3, 480 201 22 Total equity and liabilities 3, 480 1, 155 ROCE 19% Net debt ROCE (w/o goodwill) 41% Net debt / equity 82% Net debt / EBITDA 2. 2 x 16

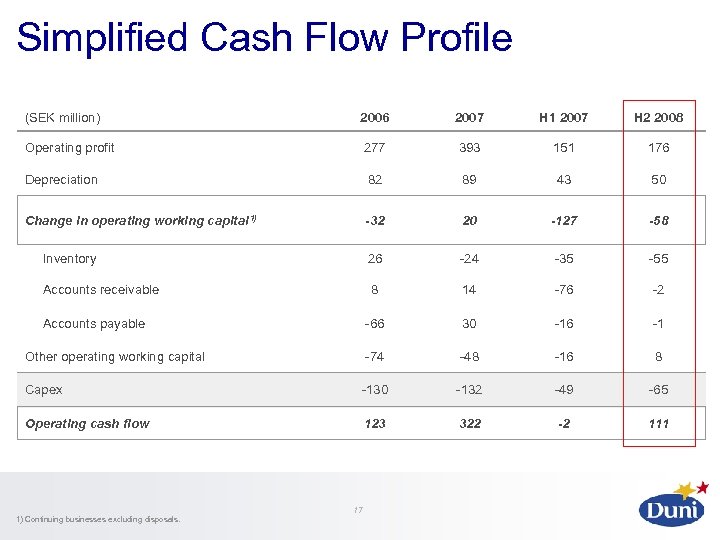

Simplified Cash Flow Profile (SEK million) 2006 2007 H 1 2007 H 2 2008 Operating profit 277 393 151 176 Depreciation 82 89 43 50 Change in operating working capital 1) -32 20 -127 -58 Inventory 26 -24 -35 -55 Accounts receivable 8 14 -76 -2 -66 30 -16 -1 Other operating working capital -74 -48 -16 8 Capex -130 -132 -49 -65 Operating cash flow 123 322 -2 111 Accounts payable 17 1) Continuing businesses excluding disposals.

Simplified Cash Flow Profile (SEK million) 2006 2007 H 1 2007 H 2 2008 Operating profit 277 393 151 176 Depreciation 82 89 43 50 Change in operating working capital 1) -32 20 -127 -58 Inventory 26 -24 -35 -55 Accounts receivable 8 14 -76 -2 -66 30 -16 -1 Other operating working capital -74 -48 -16 8 Capex -130 -132 -49 -65 Operating cash flow 123 322 -2 111 Accounts payable 17 1) Continuing businesses excluding disposals.

Financial Targets LTM Sales growth > 5% EBIT margin > 10% ∙ Organic growth of 5% over a business cycle ∙ Consider acquisitions to reach new markets or to strengthen current market positions ∙ Top-line growth 4. 7% - 10. 3% ∙ Improvements in manufacturing and sourcing Dividend payout ratio 40+% ∙ Board target at least 40% of net profit 18 1, 80 kr/share

Financial Targets LTM Sales growth > 5% EBIT margin > 10% ∙ Organic growth of 5% over a business cycle ∙ Consider acquisitions to reach new markets or to strengthen current market positions ∙ Top-line growth 4. 7% - 10. 3% ∙ Improvements in manufacturing and sourcing Dividend payout ratio 40+% ∙ Board target at least 40% of net profit 18 1, 80 kr/share