dce44fadb2a7bd3ad4ff380c67a1f208.ppt

- Количество слайдов: 44

WTO Workshop on Technical Assistance and Capacity Building in Trade Facilitation 10 -11 May 2001, Geneva Overview of Technical Assistance Activities by Japan Customs Kunio Mikuriya Director, International Affairs and Research, Customs and Tariff Bureau, Ministry of Finance, Japan

Objectives • Assistance in modernization of customs administrations to fulfill their three main missions at national borders - Collection of revenue - Trade facilitation to promote trade & industry - Protection of society from the inflow and outflow of hazardous goods

Collection of revenue • Secure the national revenue -- Important source of national revenue in the developing countries -- Example of US Customs; Predominance in the national revenue (1789 -1914) before the introduction of income tax • Trade policy tool - Protection of domestic industry

Attention of Trade Community Has Been Shifted to Trade Facilitation • Lowering of tariffs across the globe (WTO tariff negotiations) • Cost of complying customs formalities exceeds • Cost of duties to be paid

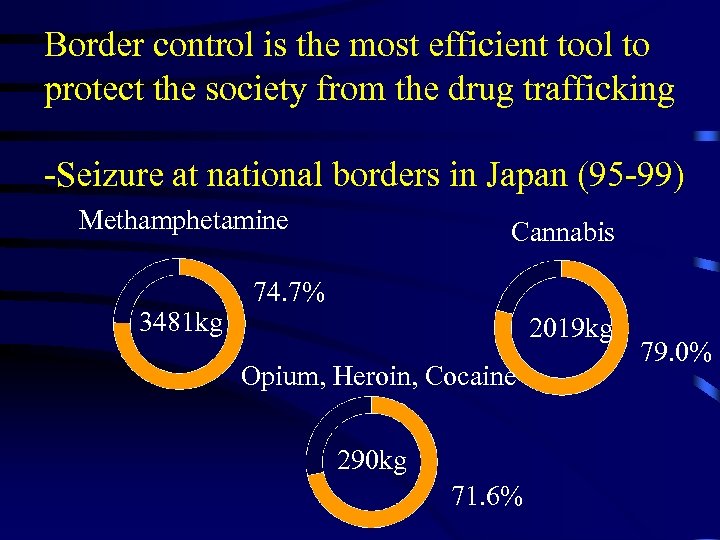

Border control is the most efficient tool to protect the society from the drug trafficking -Seizure at national borders in Japan (95 -99) Methamphetamine 3481 kg Cannabis 74. 7% 2019 kg Opium, Heroin, Cocaine 290 kg 71. 6% 79. 0%

Sharing Japan’s experience on modern customs techniques • Risk management to strike a balance between the facilitation and border control requirements • Post-clearance audit • Pre-arrival declaration • Paperless trade and one-stop service • Mutual customs cooperation including information exchange

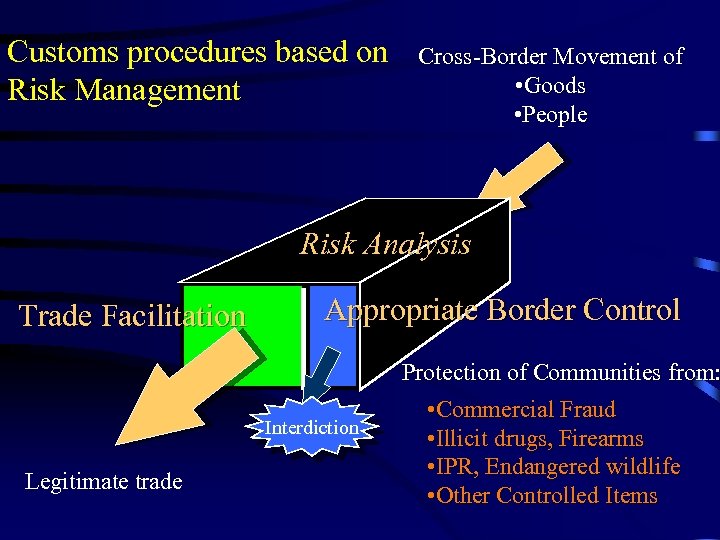

Customs procedures based on Risk Management Cross-Border Movement of • Goods • People Risk Analysis Trade Facilitation Appropriate Border Control Protection of Communities from: Interdiction Legitimate trade • Commercial Fraud • Illicit drugs, Firearms • IPR, Endangered wildlife • Other Controlled Items

Control method • Change from all documentary and physical inspection to selected inspection based on risk management • Importance of information gathering and intelligence

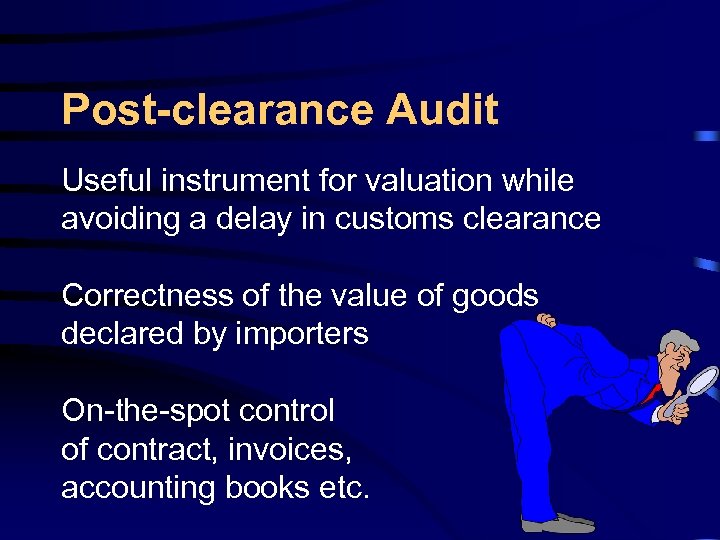

Post-clearance Audit Useful instrument for valuation while avoiding a delay in customs clearance Correctness of the value of goods declared by importers On-the-spot control of contract, invoices, accounting books etc.

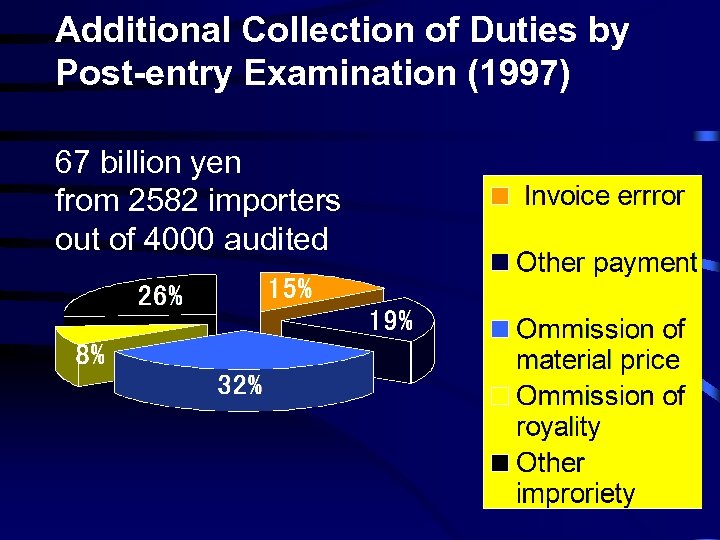

Additional Collection of Duties by Post-entry Examination (1997) 67 billion yen from 2582 importers out of 4000 audited

Automation of customs procedures • Sharing experience on automation towards paperless trade in collaboration with the private sector • Automated risk management and buildingup of database • Pre-arrival declaration • Coordination with other government agencies

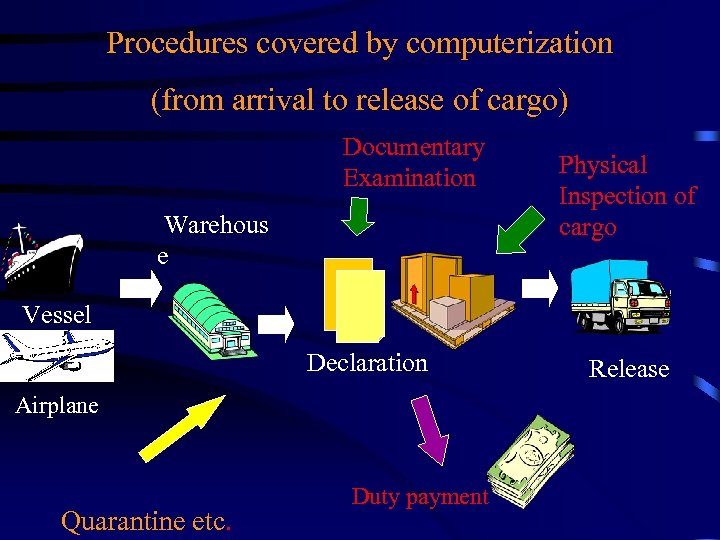

Procedures covered by computerization (from arrival to release of cargo) Documentary Examination Warehous e Physical Inspection of cargo Vessel Declaration Airplane Quarantine etc. Duty payment Release

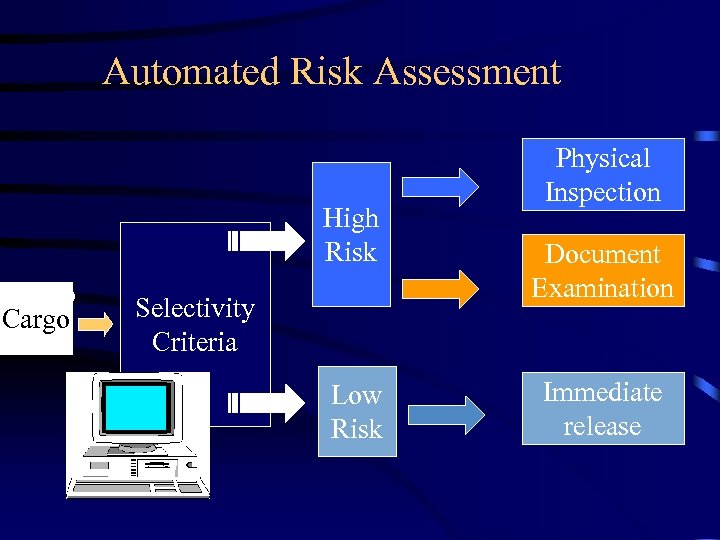

Automated Risk Assessment High Risk Cargo Selectivity Criteria Low Risk Physical Inspection Documentary Examination Immediate release Release

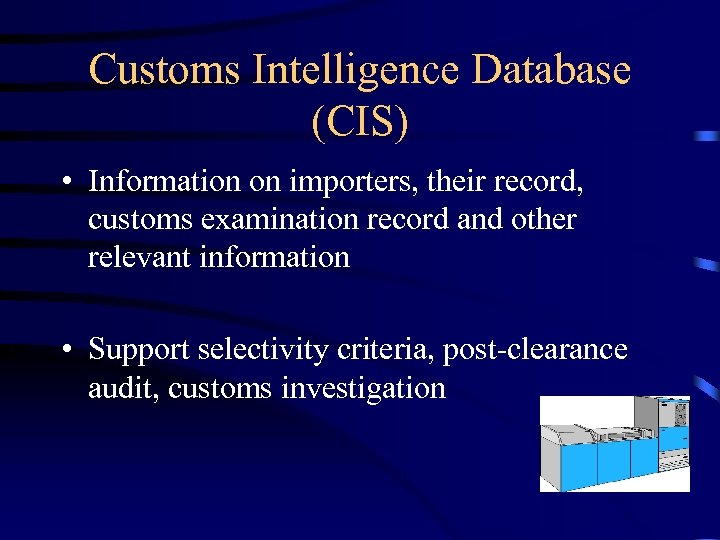

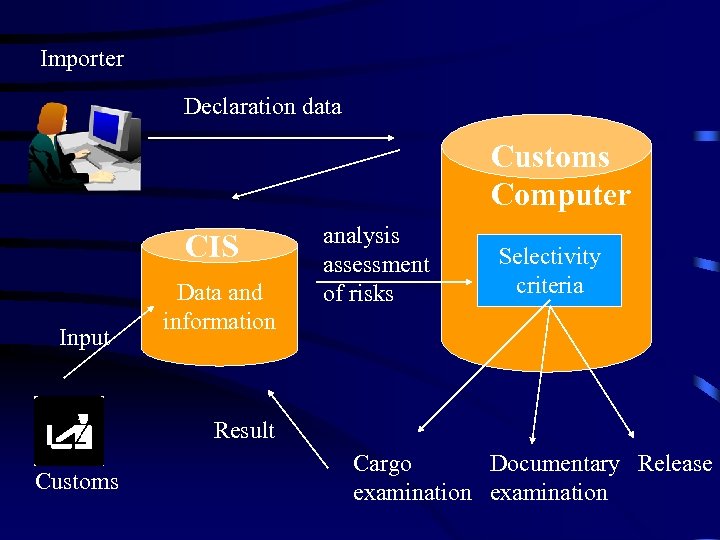

Customs Intelligence Database (CIS) • Information on importers, their record, customs examination record and other relevant information • Support selectivity criteria, post-clearance audit, customs investigation

Importer Declaration data Customs Computer CIS Input Data and information analysis assessment of risks Selectivity criteria Result Customs Cargo Documentary Release examination

Pre-arrival declaration • Advanced examination based on pre-arrival declaration • Immediate release upon arrival of cargo • Further acceleration of trade flow

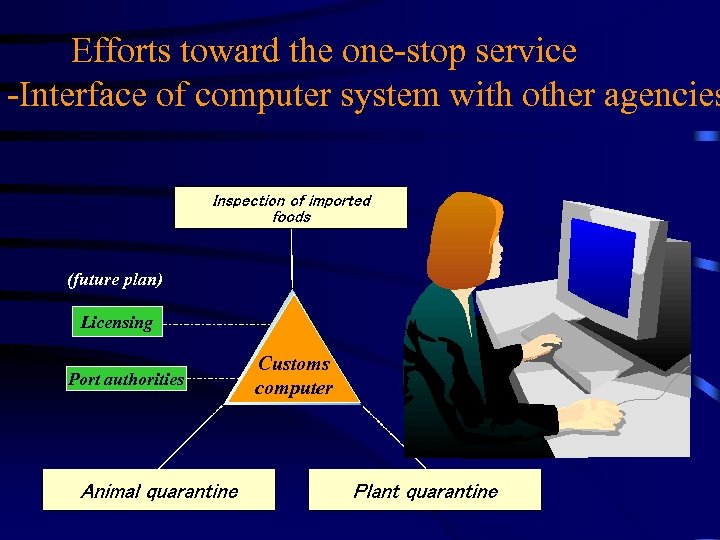

Efforts toward the one-stop service -Interface of computer system with other agencies (future plan) Licensing Port authorities Customs computer

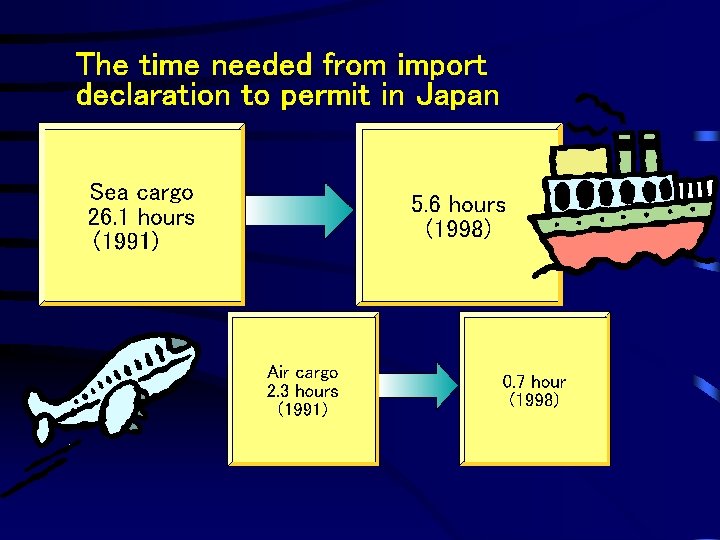

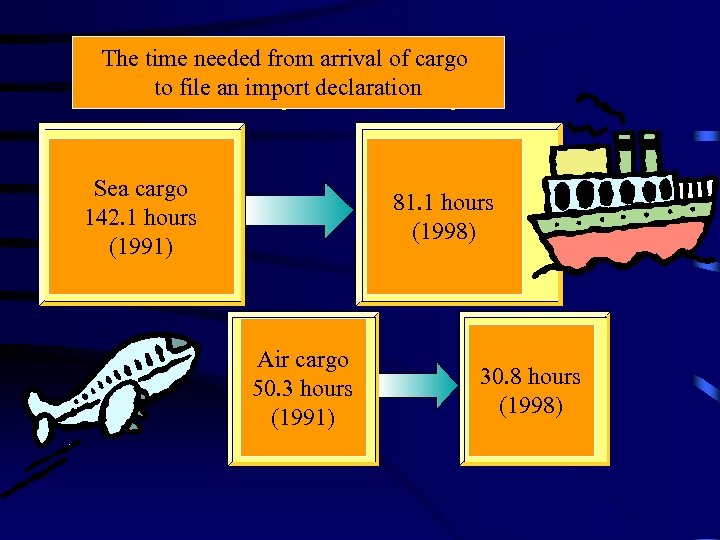

The time needed from arrival of cargo to file an import declaration Sea cargo 142. 1 hours (1991) 81. 1 hours (1998) Air cargo 50. 3 hours (1991) 30. 8 hours (1998)

Information exchange between customs • Key to speed up customs control for revenue purpose (commercial fraud) and protection of society (drug trafficking etc. ) • Bilateral basis – Customs Mutual Assistance Agreement or Memoranda of Understanding • Regional basis – Regional Intelligence Liaison Office (RILO)

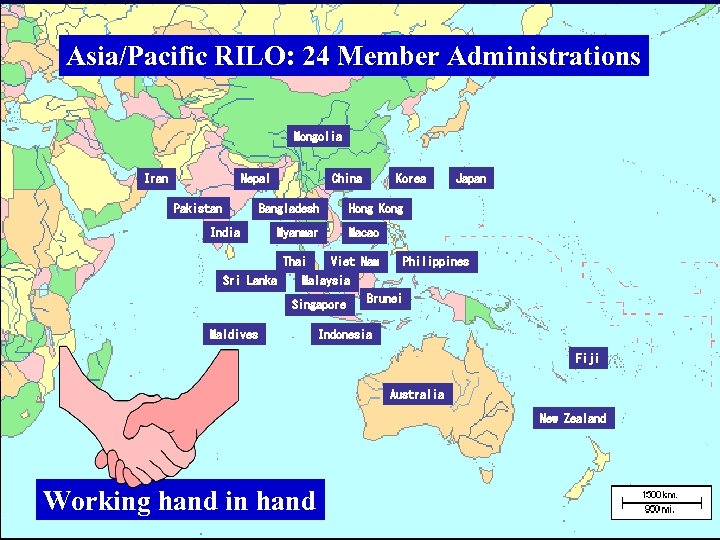

Asia-pacific RILO covers 24 WCO regional members (Tokyo Customs).

Asia/Pacific RILO: 24 Member Administrations Mongolia Iran Nepal Pakistan Bangladesh India Korea China Hong Kong Myanmar Thai Sri Lanka Japan Macao Viet Nam Philippines Malaysia Singapore Maldives Brunei Indonesia Fiji Australia New Zealand Working hand in hand

WCO - RILO NETWORK WCO Brussels (Belgium) Eastern & Central Europe Warsaw (Poland) Western Europe Cologne (Germany) Caribbean San Juan (Puerto Rico) North Africa Casablanca (Morocco) West Africa Dakar (Senegal) South America Valparaiso (Chile) Middle East Riyadh (Saudi Arabia) East & Southern Africa Nairobi (Kenya) Central Africa Douala (Cameroon) Asia/Pacific Tokyo (Japan)

Integration of the customs procedures into the international standards • WTO Valuation • HS Nomenclature • Kyoto Convention (simplification and harmonization of customs procedures) • TRIPs • Rules of Origin, etc. Standards

WTO Valuation Agreement (1995) • Acceptance obligatory for WTO members - Acceptance of GATT Valuation Agreement was optional before the establishment of WTO • Implementation for developing countries Need for preparation including introduction of post-entry examination

Principles adopted by the revised Kyoto Convention • • Automation and use of information technology Risk assessment and selectivity of control Pre-arrival information Audit based control Coordination with other agencies Transparency of customs regulations Partnership approach between customs and trade

The Revised Kyoto Convention • Adopted in June 1999 at WCO Council • A new instrument adapted to the challenge of trade facilitation • Need an early ratification by the existing Members to put in force

Technical assistance strategy • Asia Pacific Region • WCO member countries based on regional approach • Needs oriented

Training courses in Japan (6 -8 weeks) • • 1199 participants from 83 economies since 1970 Customs clearance (including automation and Kyoto Convention) HS classification Valuation & post-clearance audit Enforcement & intelligence analysis Executive seminar Chemical analysis Information technology, etc.

Expert missions • Long term experts specialized in training, post-clearance audit (ASEAN) and computerization etc. • Short term experts in chemical analysis (customs laboratory), conducting seminars in various areas

Cooperation with international organizations • Financial contribution to WCO Customs Cooperation Fund (JPY 130 million in 2001) • Human contribution (dispatching experts) to WCO CCF seminars

APEC Trade and Investment Liberalization and Facilitation • TILF special account; Japan’s annual contribution of JPY 500 million • Capacity Building to implement WTO agreements (2001 -2005) • Regional seminars & national workshops in valuation, TRIPs and Rules of Origin

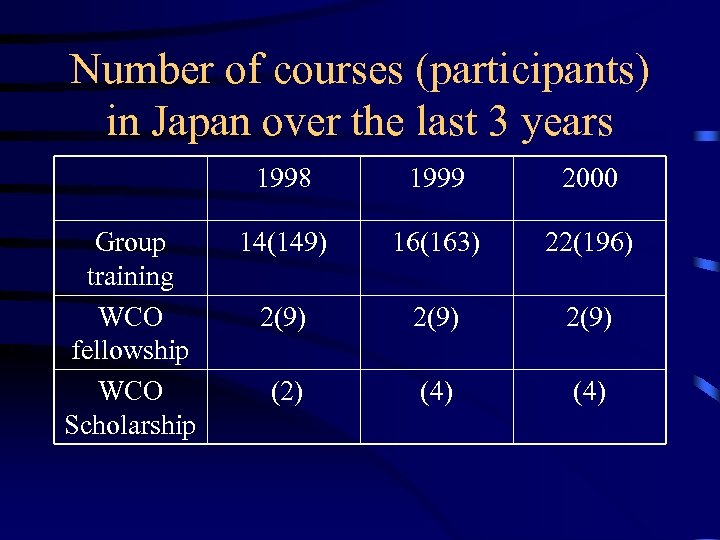

Number of courses (participants) in Japan over the last 3 years 1998 Group training WCO fellowship WCO Scholarship 1999 2000 14(149) 16(163) 22(196) 2(9) (2) (4)

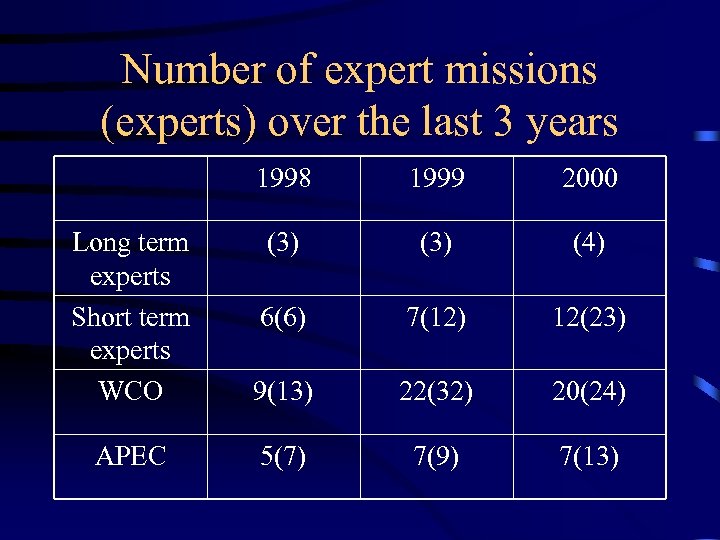

Number of expert missions (experts) over the last 3 years 1998 1999 2000 (3) (4) Long term experts Short term experts WCO 6(6) 7(12) 12(23) 9(13) 22(32) 20(24) APEC 5(7) 7(9) 7(13)

Needs inventory & planning • Needs inventory to Asia-Pacific WCO members in September by WCO regional training coordinator (Japan) • Evaluation & follow-up missions • Plan training courses in April (Japan’s FY: April. March) • Consultation with WCO in June (FY: July-June) • Avoid overlap of technical assistance

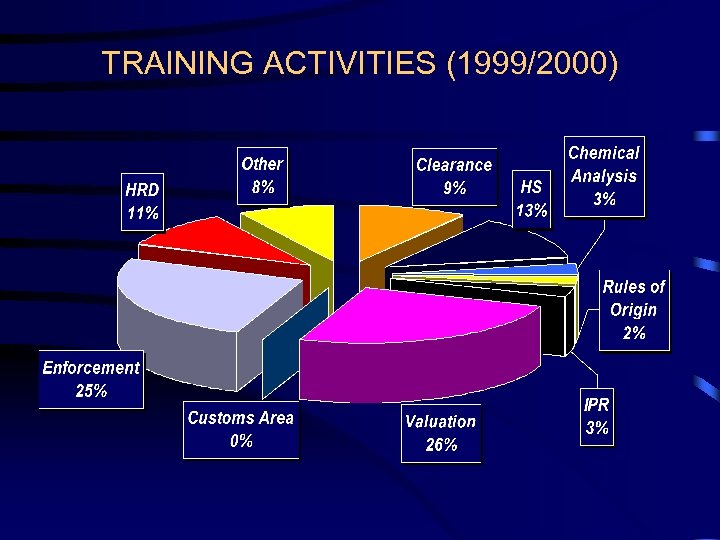

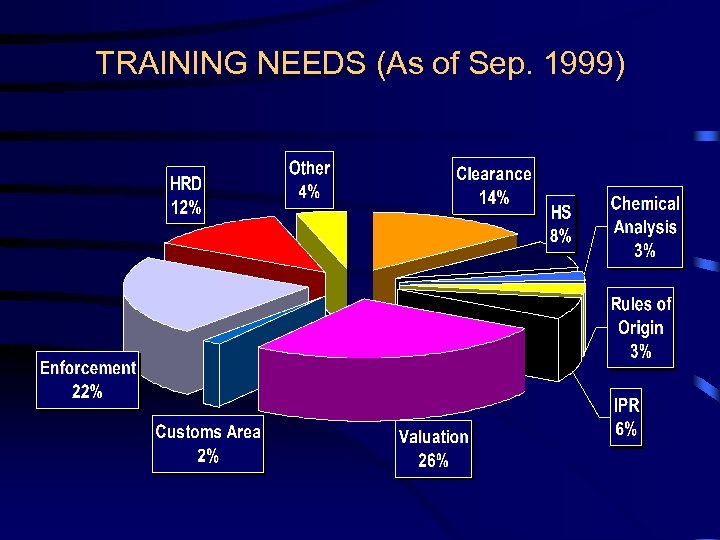

Asia-Pacific Customs Training Needs Inventory • International Training / Technical Co-operation Activities in 1999/2000 (Table 1) • Training Needs in 1999 (Table 2) • International Training / Technical Co-operation Activities Projected (Table 3) • Training Needs in 2000 (Table 4)

TRAINING ACTIVITIES (1999/2000)

TRAINING NEEDS (As of Sep. 1999)

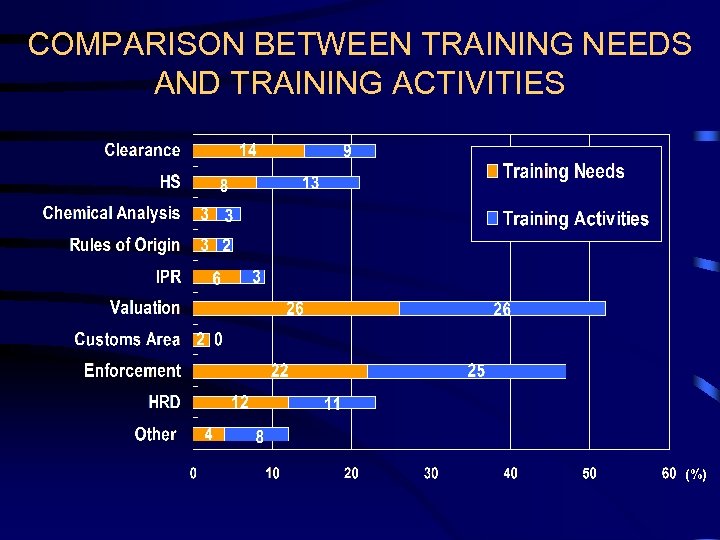

COMPARISON BETWEEN TRAINING NEEDS AND TRAINING ACTIVITIES (%)

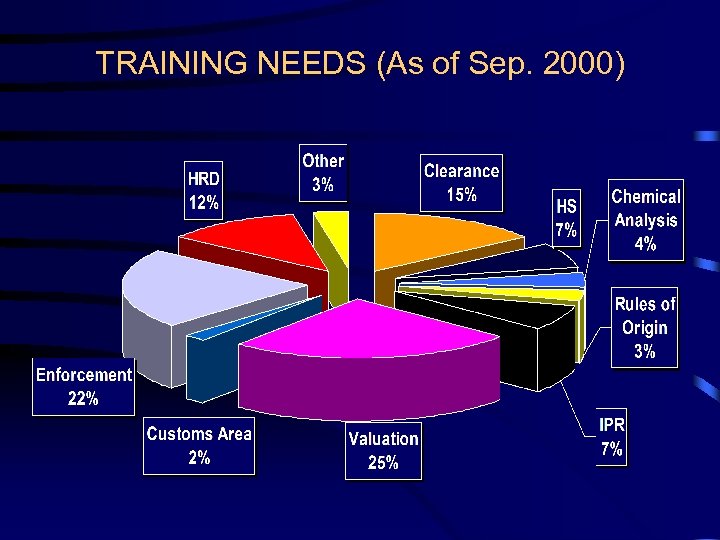

TRAINING NEEDS (As of Sep. 2000)

Success & failure • Focus on practical application of agreement rather than its theoretical explanation • Selection of participants • Usefulness of regional seminar for exchange of information/experience • Human network

Challenges in the coming years • Needs for WTO/WCO instruments related training in a practical manner • Information technology • Exchange of information • Human resources development • Integrity

Maintenance & monitoring of projects • Evaluation after each training course to improve the service • Follow-up missions to 6 -8 countries annually (interview with former participants & senior management)

Coordination between bilateral donors & international organizations • Avoid duplication for recipients • Efficient use of limited human resources • Coherence and synergy desirable from the planning stage • More information sharing on technical assistance

dce44fadb2a7bd3ad4ff380c67a1f208.ppt