2015-09-27 WTO Law - Market access.pptx

- Количество слайдов: 23

WTO Law Fernando Piérola Market Access (goods)

WTO Law Fernando Piérola Market Access (goods)

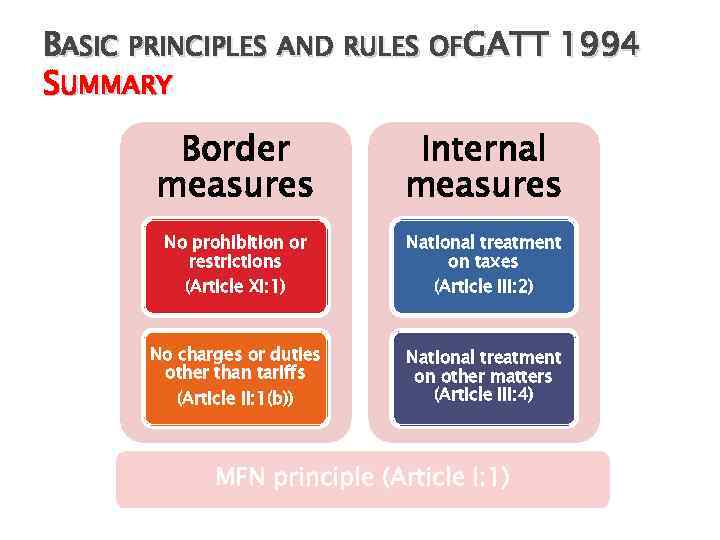

BASIC PRINCIPLES AND RULES OFGATT 1994 SUMMARY Border measures Internal measures No prohibition or restrictions (Article XI: 1) National treatment on taxes (Article III: 2) No charges or duties other than tariffs (Article II: 1(b)) National treatment on other matters (Article III: 4) MFN principle (Article I: 1)

BASIC PRINCIPLES AND RULES OFGATT 1994 SUMMARY Border measures Internal measures No prohibition or restrictions (Article XI: 1) National treatment on taxes (Article III: 2) No charges or duties other than tariffs (Article II: 1(b)) National treatment on other matters (Article III: 4) MFN principle (Article I: 1)

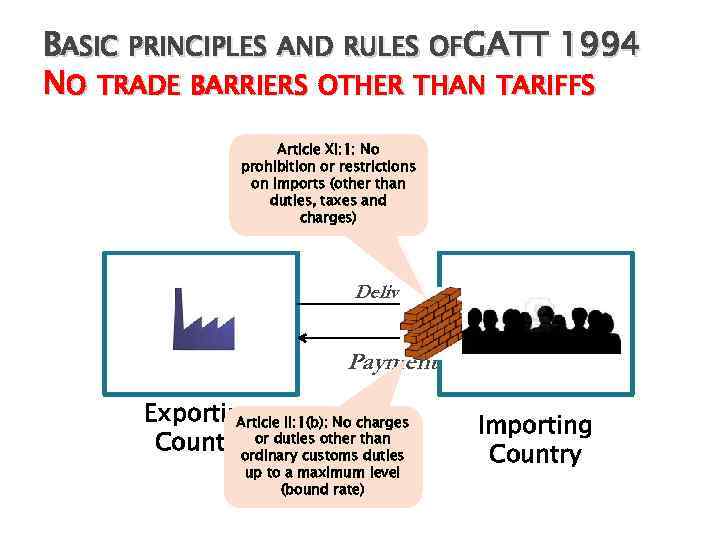

BASIC PRINCIPLES AND RULES OFGATT 1994 NO TRADE BARRIERS OTHER THAN TARIFFS Article XI: 1: No prohibition or restrictions on imports (other than duties, taxes and charges) Delivery Payment Exporting II: 1(b): No charges Article Country or duties other than ordinary customs duties up to a maximum level (bound rate) Importing Country

BASIC PRINCIPLES AND RULES OFGATT 1994 NO TRADE BARRIERS OTHER THAN TARIFFS Article XI: 1: No prohibition or restrictions on imports (other than duties, taxes and charges) Delivery Payment Exporting II: 1(b): No charges Article Country or duties other than ordinary customs duties up to a maximum level (bound rate) Importing Country

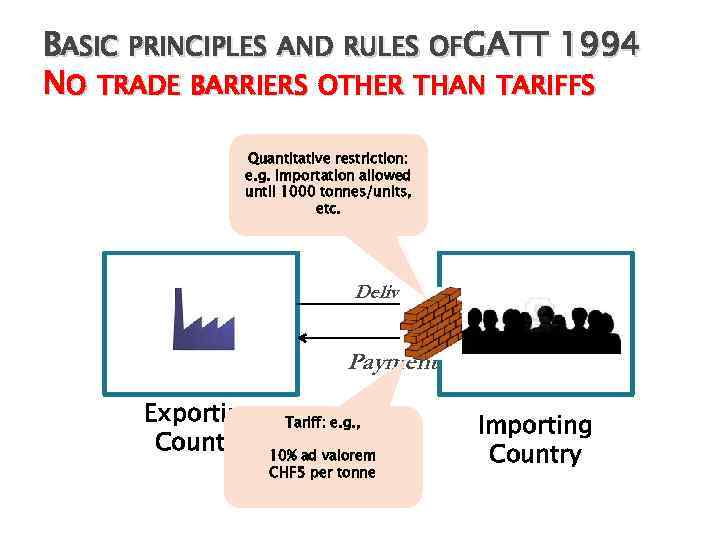

BASIC PRINCIPLES AND RULES OFGATT 1994 NO TRADE BARRIERS OTHER THAN TARIFFS Quantitative restriction: e. g. importation allowed until 1000 tonnes/units, etc. Delivery Payment Exporting Country Tariff: e. g. , 10% ad valorem CHF 5 per tonne Importing Country

BASIC PRINCIPLES AND RULES OFGATT 1994 NO TRADE BARRIERS OTHER THAN TARIFFS Quantitative restriction: e. g. importation allowed until 1000 tonnes/units, etc. Delivery Payment Exporting Country Tariff: e. g. , 10% ad valorem CHF 5 per tonne Importing Country

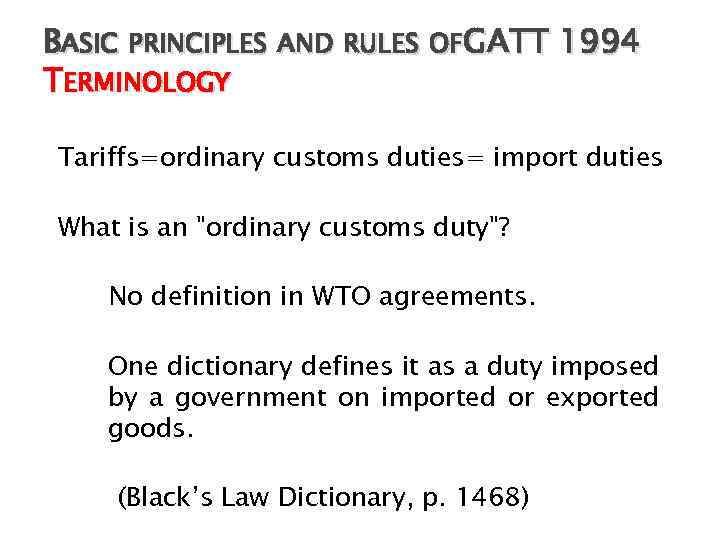

BASIC PRINCIPLES AND RULES OFGATT 1994 TERMINOLOGY Tariffs=ordinary customs duties= import duties What is an "ordinary customs duty"? No definition in WTO agreements. One dictionary defines it as a duty imposed by a government on imported or exported goods. (Black’s Law Dictionary, p. 1468)

BASIC PRINCIPLES AND RULES OFGATT 1994 TERMINOLOGY Tariffs=ordinary customs duties= import duties What is an "ordinary customs duty"? No definition in WTO agreements. One dictionary defines it as a duty imposed by a government on imported or exported goods. (Black’s Law Dictionary, p. 1468)

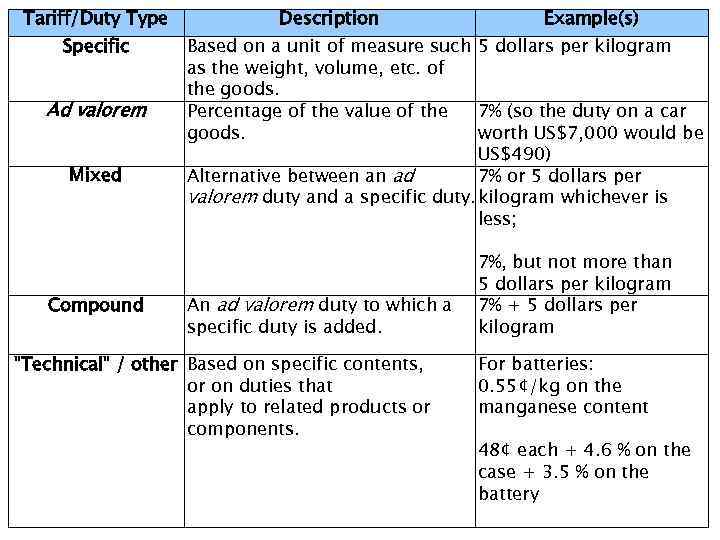

Tariff/Duty Type Description Example(s) Specific Based on unit of measure such 5 dollars 1994 BASIC PRINCIPLES a. AND RULES OFGATT per kilogram as the weight, volume, etc. of TYPE OF TARIFFS the goods. Ad valorem Percentage of the value of the goods. Mixed Compound 7% (so the duty on a car worth US$7, 000 would be US$490) Alternative between an ad 7% or 5 dollars per valorem duty and a specific duty. kilogram whichever is less; 7%, but not more than 5 dollars per kilogram An ad valorem duty to which a 7% + 5 dollars per specific duty is added. kilogram "Technical" / other Based on specific contents, or on duties that apply to related products or components. For batteries: 0. 55¢/kg on the manganese content 48¢ each + 4. 6 % on the case + 3. 5 % on the battery

Tariff/Duty Type Description Example(s) Specific Based on unit of measure such 5 dollars 1994 BASIC PRINCIPLES a. AND RULES OFGATT per kilogram as the weight, volume, etc. of TYPE OF TARIFFS the goods. Ad valorem Percentage of the value of the goods. Mixed Compound 7% (so the duty on a car worth US$7, 000 would be US$490) Alternative between an ad 7% or 5 dollars per valorem duty and a specific duty. kilogram whichever is less; 7%, but not more than 5 dollars per kilogram An ad valorem duty to which a 7% + 5 dollars per specific duty is added. kilogram "Technical" / other Based on specific contents, or on duties that apply to related products or components. For batteries: 0. 55¢/kg on the manganese content 48¢ each + 4. 6 % on the case + 3. 5 % on the battery

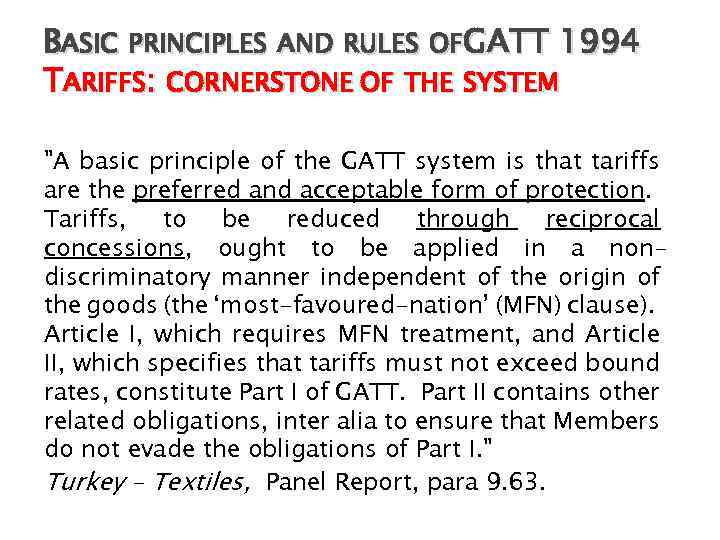

BASIC PRINCIPLES AND RULES OFGATT 1994 TARIFFS: CORNERSTONE OF THE SYSTEM "A basic principle of the GATT system is that tariffs are the preferred and acceptable form of protection. Tariffs, to be reduced through reciprocal concessions, ought to be applied in a nondiscriminatory manner independent of the origin of the goods (the ‘most-favoured-nation’ (MFN) clause). Article I, which requires MFN treatment, and Article II, which specifies that tariffs must not exceed bound rates, constitute Part I of GATT. Part II contains other related obligations, inter alia to ensure that Members do not evade the obligations of Part I. " Turkey – Textiles, Panel Report, para 9. 63.

BASIC PRINCIPLES AND RULES OFGATT 1994 TARIFFS: CORNERSTONE OF THE SYSTEM "A basic principle of the GATT system is that tariffs are the preferred and acceptable form of protection. Tariffs, to be reduced through reciprocal concessions, ought to be applied in a nondiscriminatory manner independent of the origin of the goods (the ‘most-favoured-nation’ (MFN) clause). Article I, which requires MFN treatment, and Article II, which specifies that tariffs must not exceed bound rates, constitute Part I of GATT. Part II contains other related obligations, inter alia to ensure that Members do not evade the obligations of Part I. " Turkey – Textiles, Panel Report, para 9. 63.

BASIC PRINCIPLES AND RULES OFGATT 1994 TARIFF NEGOTIATIONS AND TARIFF CONCESSIONS Article XXVIII: 1 bis of GATT: Members… “recognize that customs duties often constitute serious obstacles to trade; thus negotiations on a reciprocal and mutually advantageous basis, directed to the substantial reduction of the general level of tariffs and other charges on imports and exports and in particular to the reduction of such high tariffs as discourage the importation … are of great importance to the expansion of international trade. [Members] may therefore sponsor such negotiations from time to time.

BASIC PRINCIPLES AND RULES OFGATT 1994 TARIFF NEGOTIATIONS AND TARIFF CONCESSIONS Article XXVIII: 1 bis of GATT: Members… “recognize that customs duties often constitute serious obstacles to trade; thus negotiations on a reciprocal and mutually advantageous basis, directed to the substantial reduction of the general level of tariffs and other charges on imports and exports and in particular to the reduction of such high tariffs as discourage the importation … are of great importance to the expansion of international trade. [Members] may therefore sponsor such negotiations from time to time.

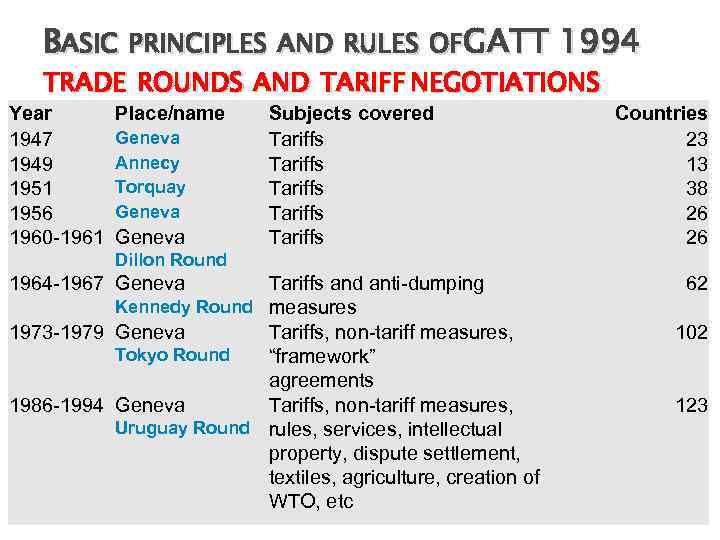

BASIC PRINCIPLES AND RULES OFGATT 1994 TRADE ROUNDS AND TARIFF NEGOTIATIONS Year 1947 1949 1951 1956 1960 -1961 Place/name Geneva Annecy Torquay Geneva Subjects covered Tariffs Tariffs Countries 23 13 38 26 26 Dillon Round 1964 -1967 Geneva Tariffs and anti-dumping Kennedy Round measures 1973 -1979 Geneva Tariffs, non-tariff measures, Tokyo Round “framework” agreements 1986 -1994 Geneva Tariffs, non-tariff measures, Uruguay Round rules, services, intellectual property, dispute settlement, textiles, agriculture, creation of WTO, etc 62 102 123

BASIC PRINCIPLES AND RULES OFGATT 1994 TRADE ROUNDS AND TARIFF NEGOTIATIONS Year 1947 1949 1951 1956 1960 -1961 Place/name Geneva Annecy Torquay Geneva Subjects covered Tariffs Tariffs Countries 23 13 38 26 26 Dillon Round 1964 -1967 Geneva Tariffs and anti-dumping Kennedy Round measures 1973 -1979 Geneva Tariffs, non-tariff measures, Tokyo Round “framework” agreements 1986 -1994 Geneva Tariffs, non-tariff measures, Uruguay Round rules, services, intellectual property, dispute settlement, textiles, agriculture, creation of WTO, etc 62 102 123

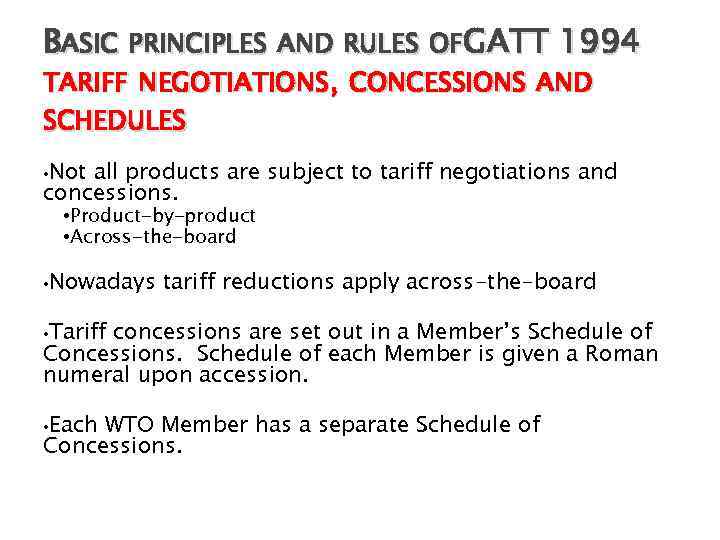

BASIC PRINCIPLES AND RULES OFGATT 1994 TARIFF NEGOTIATIONS, CONCESSIONS AND SCHEDULES • Not all products are subject to tariff negotiations and concessions. • Product-by-product • Across-the-board • Nowadays tariff reductions apply across-the-board • Tariff concessions are set out in a Member’s Schedule of Concessions. Schedule of each Member is given a Roman numeral upon accession. • Each WTO Member has a separate Schedule of Concessions.

BASIC PRINCIPLES AND RULES OFGATT 1994 TARIFF NEGOTIATIONS, CONCESSIONS AND SCHEDULES • Not all products are subject to tariff negotiations and concessions. • Product-by-product • Across-the-board • Nowadays tariff reductions apply across-the-board • Tariff concessions are set out in a Member’s Schedule of Concessions. Schedule of each Member is given a Roman numeral upon accession. • Each WTO Member has a separate Schedule of Concessions.

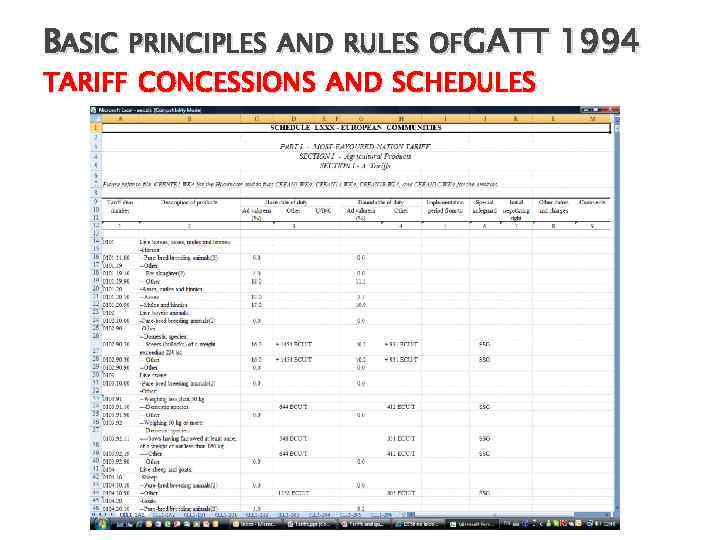

BASIC PRINCIPLES AND RULES OFGATT 1994 TARIFF CONCESSIONS AND SCHEDULES

BASIC PRINCIPLES AND RULES OFGATT 1994 TARIFF CONCESSIONS AND SCHEDULES

BASIC PRINCIPLES AND RULES OFGATT 1994 TARIFF CONCESSIONS AND SCHEDULES GATT Article II: 7 provides that the Schedules are an integral part of the agreement to which they are annexed. A Member's Schedule binds that one Member, but, as a result of the verification or certification process, the Schedule becomes "multilateralised" and accepted by the entire WTO membership as a part of the WTO Agreement.

BASIC PRINCIPLES AND RULES OFGATT 1994 TARIFF CONCESSIONS AND SCHEDULES GATT Article II: 7 provides that the Schedules are an integral part of the agreement to which they are annexed. A Member's Schedule binds that one Member, but, as a result of the verification or certification process, the Schedule becomes "multilateralised" and accepted by the entire WTO membership as a part of the WTO Agreement.

BASIC PRINCIPLES AND RULES OFGATT 1994 PROTECTION OF TARIFF CONCESSIONS/SCHEDULES • Article II: 1(a) : No less favourable treatment than Schedule • Article II: 1(b), 1 st sentence: Not in excess of bound tariff rates • Article II: 1(b), 2 nd sentence: No duties and charges other than tariffs (with exceptions)

BASIC PRINCIPLES AND RULES OFGATT 1994 PROTECTION OF TARIFF CONCESSIONS/SCHEDULES • Article II: 1(a) : No less favourable treatment than Schedule • Article II: 1(b), 1 st sentence: Not in excess of bound tariff rates • Article II: 1(b), 2 nd sentence: No duties and charges other than tariffs (with exceptions)

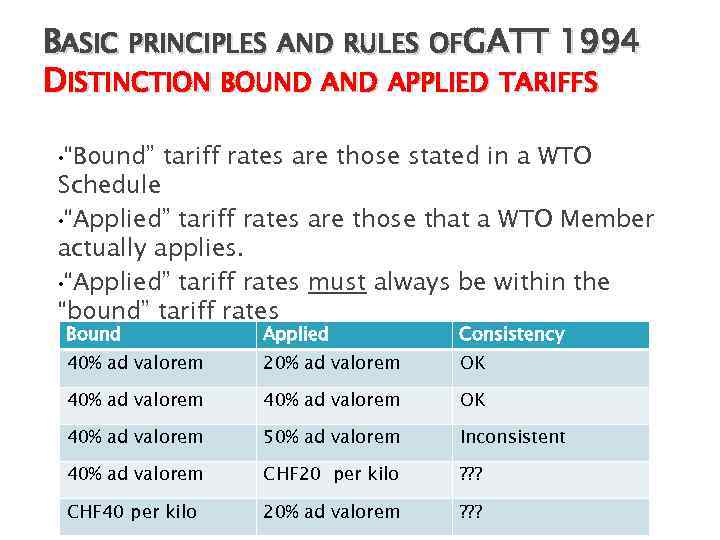

BASIC PRINCIPLES AND RULES OFGATT 1994 DISTINCTION BOUND APPLIED TARIFFS • “Bound” tariff rates are those stated in a WTO Schedule • “Applied” tariff rates are those that a WTO Member actually applies. • “Applied” tariff rates must always be within the “bound” tariff rates Bound Applied Consistency 40% ad valorem 20% ad valorem OK 40% ad valorem 50% ad valorem Inconsistent 40% ad valorem CHF 20 per kilo ? ? ? CHF 40 per kilo 20% ad valorem ? ? ?

BASIC PRINCIPLES AND RULES OFGATT 1994 DISTINCTION BOUND APPLIED TARIFFS • “Bound” tariff rates are those stated in a WTO Schedule • “Applied” tariff rates are those that a WTO Member actually applies. • “Applied” tariff rates must always be within the “bound” tariff rates Bound Applied Consistency 40% ad valorem 20% ad valorem OK 40% ad valorem 50% ad valorem Inconsistent 40% ad valorem CHF 20 per kilo ? ? ? CHF 40 per kilo 20% ad valorem ? ? ?

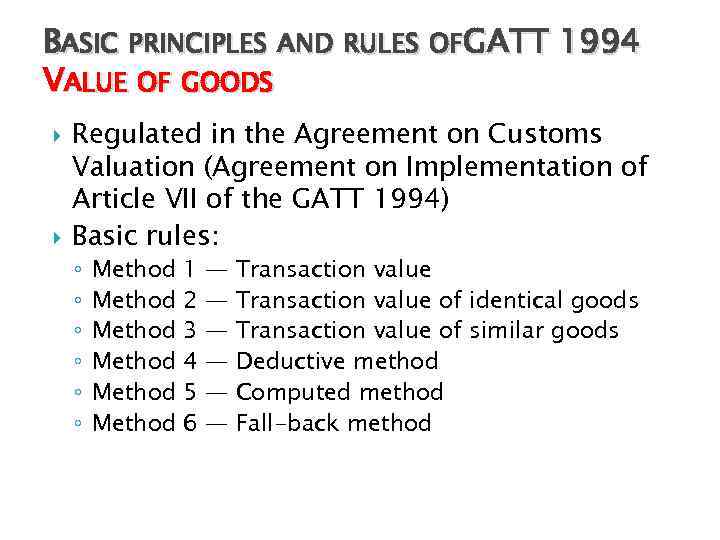

BASIC PRINCIPLES AND RULES OFGATT 1994 VALUE OF GOODS Regulated in the Agreement on Customs Valuation (Agreement on Implementation of Article VII of the GATT 1994) Basic rules: ◦ ◦ ◦ Method 1 Method 2 Method 3 Method 4 Method 5 Method 6 — — — Transaction value of identical goods Transaction value of similar goods Deductive method Computed method Fall-back method

BASIC PRINCIPLES AND RULES OFGATT 1994 VALUE OF GOODS Regulated in the Agreement on Customs Valuation (Agreement on Implementation of Article VII of the GATT 1994) Basic rules: ◦ ◦ ◦ Method 1 Method 2 Method 3 Method 4 Method 5 Method 6 — — — Transaction value of identical goods Transaction value of similar goods Deductive method Computed method Fall-back method

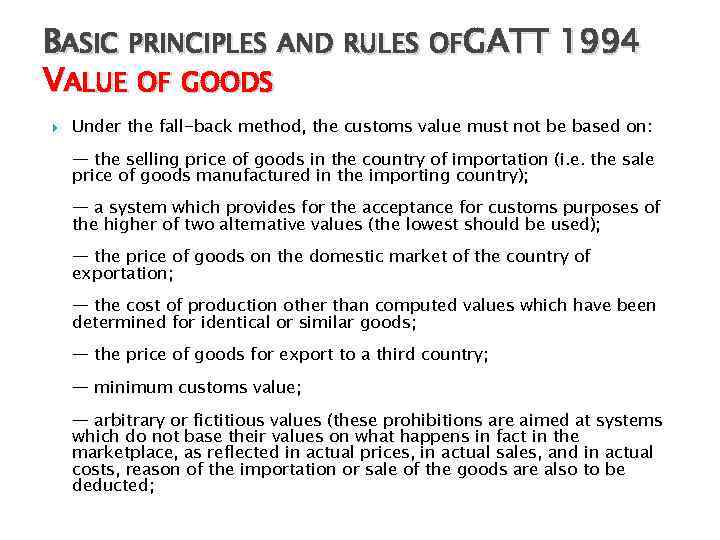

BASIC PRINCIPLES AND RULES OFGATT 1994 VALUE OF GOODS Under the fall-back method, the customs value must not be based on: — the selling price of goods in the country of importation (i. e. the sale price of goods manufactured in the importing country); — a system which provides for the acceptance for customs purposes of the higher of two alternative values (the lowest should be used); — the price of goods on the domestic market of the country of exportation; — the cost of production other than computed values which have been determined for identical or similar goods; — the price of goods for export to a third country; — minimum customs value; — arbitrary or fictitious values (these prohibitions are aimed at systems which do not base their values on what happens in fact in the marketplace, as reflected in actual prices, in actual sales, and in actual costs, reason of the importation or sale of the goods are also to be deducted;

BASIC PRINCIPLES AND RULES OFGATT 1994 VALUE OF GOODS Under the fall-back method, the customs value must not be based on: — the selling price of goods in the country of importation (i. e. the sale price of goods manufactured in the importing country); — a system which provides for the acceptance for customs purposes of the higher of two alternative values (the lowest should be used); — the price of goods on the domestic market of the country of exportation; — the cost of production other than computed values which have been determined for identical or similar goods; — the price of goods for export to a third country; — minimum customs value; — arbitrary or fictitious values (these prohibitions are aimed at systems which do not base their values on what happens in fact in the marketplace, as reflected in actual prices, in actual sales, and in actual costs, reason of the importation or sale of the goods are also to be deducted;

BASIC PRINCIPLES AND RULES OFGATT 1994 EXEMPTIONS FROM ARTICLE II Article II: 2 exempts certain measures from the obligations contained in Articles II: 1(a) and (b): a) a charge equivalent to an internal tax imposed consistently with the provisions of paragraph 2 of Article III in respect of the like domestic product or in respect of an article from which the imported product has been manufactured or produced in whole or in part; (b) any anti-dumping or countervailing duty applied consistently with the provisions of Article VI; (c) fees or other charges commensurate with the cost of services rendered.

BASIC PRINCIPLES AND RULES OFGATT 1994 EXEMPTIONS FROM ARTICLE II Article II: 2 exempts certain measures from the obligations contained in Articles II: 1(a) and (b): a) a charge equivalent to an internal tax imposed consistently with the provisions of paragraph 2 of Article III in respect of the like domestic product or in respect of an article from which the imported product has been manufactured or produced in whole or in part; (b) any anti-dumping or countervailing duty applied consistently with the provisions of Article VI; (c) fees or other charges commensurate with the cost of services rendered.

BASIC PRINCIPLES AND RULES OFGATT 1994 MODIFICATION OF SCHEDULES AND CONCESSIONS Article XXVIII of the GATT Member A may modify or withdraw a concession in a Schedule • • by negotiation and agreement with (i)a Member with initial negotiating rights (INRs), (ii) a Member that has a principal supplying interest, and (iii) subject to consultation with a Member that has a substantial interest (defined as 10% or more of trade share) In the negotiations, Member A may provide compensatory adjustments for other products. unilaterally if no agreement is reached, but others can retaliate - withdraw substantially equivalent concessions on INR lines.

BASIC PRINCIPLES AND RULES OFGATT 1994 MODIFICATION OF SCHEDULES AND CONCESSIONS Article XXVIII of the GATT Member A may modify or withdraw a concession in a Schedule • • by negotiation and agreement with (i)a Member with initial negotiating rights (INRs), (ii) a Member that has a principal supplying interest, and (iii) subject to consultation with a Member that has a substantial interest (defined as 10% or more of trade share) In the negotiations, Member A may provide compensatory adjustments for other products. unilaterally if no agreement is reached, but others can retaliate - withdraw substantially equivalent concessions on INR lines.

BASIC PRINCIPLES AND RULES OFGATT 1994 MODIFICATION OF SCHEDULES AND CONCESSIONS Article XXVIII of the GATT Three procedures in place: • • • Every 3 years At any time (subject to approval of the other WTO Members) At any time through reservation of rights (every 3 years) Procedures are secret. If no compensatory agreement is reached, Members affected may “re-balance” concessions. Rebalancing must be done on a MFN basis.

BASIC PRINCIPLES AND RULES OFGATT 1994 MODIFICATION OF SCHEDULES AND CONCESSIONS Article XXVIII of the GATT Three procedures in place: • • • Every 3 years At any time (subject to approval of the other WTO Members) At any time through reservation of rights (every 3 years) Procedures are secret. If no compensatory agreement is reached, Members affected may “re-balance” concessions. Rebalancing must be done on a MFN basis.

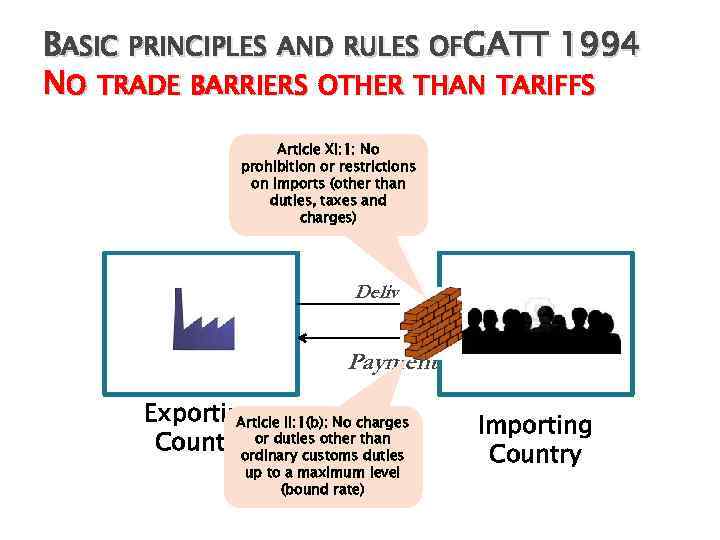

BASIC PRINCIPLES AND RULES OFGATT 1994 NO TRADE BARRIERS OTHER THAN TARIFFS Article XI: 1: No prohibition or restrictions on imports (other than duties, taxes and charges) Delivery Payment Exporting II: 1(b): No charges Article Country or duties other than ordinary customs duties up to a maximum level (bound rate) Importing Country

BASIC PRINCIPLES AND RULES OFGATT 1994 NO TRADE BARRIERS OTHER THAN TARIFFS Article XI: 1: No prohibition or restrictions on imports (other than duties, taxes and charges) Delivery Payment Exporting II: 1(b): No charges Article Country or duties other than ordinary customs duties up to a maximum level (bound rate) Importing Country

BASIC PRINCIPLES AND RULES OFGATT 1994 NO TRADE BARRIERS OTHER THAN TARIFFS Article XI: 1 of the GATT 1994 General Elimination of Quantitative Restrictions No prohibitions or restrictions other than duties, taxes or other charges, whether made effective through quotas, import or export licences or other measures, shall be instituted or maintained by any [Member] on the importation of any product of the territory of any other [Member] or on the exportation or sale for export of any product destined for the territory of any other [Member].

BASIC PRINCIPLES AND RULES OFGATT 1994 NO TRADE BARRIERS OTHER THAN TARIFFS Article XI: 1 of the GATT 1994 General Elimination of Quantitative Restrictions No prohibitions or restrictions other than duties, taxes or other charges, whether made effective through quotas, import or export licences or other measures, shall be instituted or maintained by any [Member] on the importation of any product of the territory of any other [Member] or on the exportation or sale for export of any product destined for the territory of any other [Member].

BASIC PRINCIPLES AND RULES OFGATT 1994 NO TRADE BARRIERS OTHER THAN TARIFFS ◦ ◦ ◦ All forms of prohibition or restriction, including: quotas; import or export licences; or other measures Only exceptions: taxes, duties and other charges (covered by Articles II and III of GATT 1994). Expansive scope through case law. Described as "broad" and "comprehensive". All measures; it does not say “laws, regulations or requirements” Distinction between “importation” and “entry into the market” (Dominican Republic – Cigarettes). ©ACWL

BASIC PRINCIPLES AND RULES OFGATT 1994 NO TRADE BARRIERS OTHER THAN TARIFFS ◦ ◦ ◦ All forms of prohibition or restriction, including: quotas; import or export licences; or other measures Only exceptions: taxes, duties and other charges (covered by Articles II and III of GATT 1994). Expansive scope through case law. Described as "broad" and "comprehensive". All measures; it does not say “laws, regulations or requirements” Distinction between “importation” and “entry into the market” (Dominican Republic – Cigarettes). ©ACWL

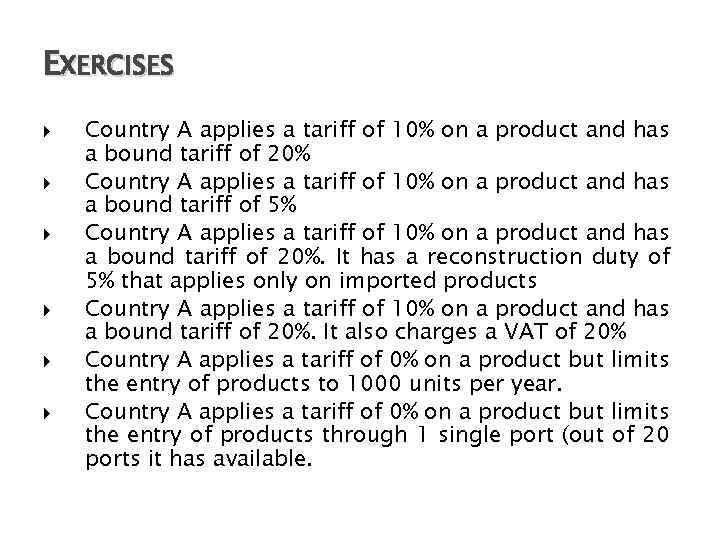

EXERCISES Country A applies a tariff of 10% on a product and has a bound tariff of 20% Country A applies a tariff of 10% on a product and has a bound tariff of 5% Country A applies a tariff of 10% on a product and has a bound tariff of 20%. It has a reconstruction duty of 5% that applies only on imported products Country A applies a tariff of 10% on a product and has a bound tariff of 20%. It also charges a VAT of 20% Country A applies a tariff of 0% on a product but limits the entry of products to 1000 units per year. Country A applies a tariff of 0% on a product but limits the entry of products through 1 single port (out of 20 ports it has available.

EXERCISES Country A applies a tariff of 10% on a product and has a bound tariff of 20% Country A applies a tariff of 10% on a product and has a bound tariff of 5% Country A applies a tariff of 10% on a product and has a bound tariff of 20%. It has a reconstruction duty of 5% that applies only on imported products Country A applies a tariff of 10% on a product and has a bound tariff of 20%. It also charges a VAT of 20% Country A applies a tariff of 0% on a product but limits the entry of products to 1000 units per year. Country A applies a tariff of 0% on a product but limits the entry of products through 1 single port (out of 20 ports it has available.