b5d1f3e9b22f894b39f87d3282abae22.ppt

- Количество слайдов: 15

WTO Doha round Andres Oopkaup

WTO Doha round Andres Oopkaup

Estonian Government policy at glance • • Extremely liberal Total and fast privatisation Low or non existent support level Modest rural support including some for agriculture • Emphases on green box type support • FTA-s • Little support for marketing

Estonian Government policy at glance • • Extremely liberal Total and fast privatisation Low or non existent support level Modest rural support including some for agriculture • Emphases on green box type support • FTA-s • Little support for marketing

Estonian trade conditions before joining EU • Competitiveness, comparative advantage – price level (farm gate, inputs) – quality and product range – structures (primary, processing, trade) • Outside conditions – tariffs (economical and political) – non tariff measures (hygiene and technical requirements)

Estonian trade conditions before joining EU • Competitiveness, comparative advantage – price level (farm gate, inputs) – quality and product range – structures (primary, processing, trade) • Outside conditions – tariffs (economical and political) – non tariff measures (hygiene and technical requirements)

OECD-s view to global trade development. • Significant reduction of import tariffs • Abolition of export subsidies • Abolition of trade distorting domestic support (amber box) • Direct payments - fully decoupled

OECD-s view to global trade development. • Significant reduction of import tariffs • Abolition of export subsidies • Abolition of trade distorting domestic support (amber box) • Direct payments - fully decoupled

WISH to CHANGE TRADING ENVIRONMENT; URA commitment SEATTLE MINISTERIAL 1999 FAILURE MODALITIES TARGETS, AMBITIONS DOHA MINISTERIAL 2001 DECLARATION Precise numbers and formulas for commitments CANCUN 2003 FAILURE HONG-KONG (december 2005) Partial agreement that confirms willingness to move forward "SCHEDULES" Fixing commitment that were agreed and surveiliance 2006 July modalities FAILURE Time 2000 BERLIN AGENDA BUDGET enlargement DIRECT PAYMENTS vs PRICE SUPPORT 2007 New Budget for 20072013 2003 LUXEMBOURG CAP reform Decoupling GENF 2004, July agreement, EC conditional willingness to abolish ES 2007 EC Proposals for “health check” MODALITIES To be agreed by 2008

WISH to CHANGE TRADING ENVIRONMENT; URA commitment SEATTLE MINISTERIAL 1999 FAILURE MODALITIES TARGETS, AMBITIONS DOHA MINISTERIAL 2001 DECLARATION Precise numbers and formulas for commitments CANCUN 2003 FAILURE HONG-KONG (december 2005) Partial agreement that confirms willingness to move forward "SCHEDULES" Fixing commitment that were agreed and surveiliance 2006 July modalities FAILURE Time 2000 BERLIN AGENDA BUDGET enlargement DIRECT PAYMENTS vs PRICE SUPPORT 2007 New Budget for 20072013 2003 LUXEMBOURG CAP reform Decoupling GENF 2004, July agreement, EC conditional willingness to abolish ES 2007 EC Proposals for “health check” MODALITIES To be agreed by 2008

Topic’s to be negotiated (single undertaking) • • Agriculture (MA, ES, DS); Non-agricultural products trade (NAMA); Trade in services; Rules (incl fisheries); Development agenda (package); Trade and Environment; Trade simplification;

Topic’s to be negotiated (single undertaking) • • Agriculture (MA, ES, DS); Non-agricultural products trade (NAMA); Trade in services; Rules (incl fisheries); Development agenda (package); Trade and Environment; Trade simplification;

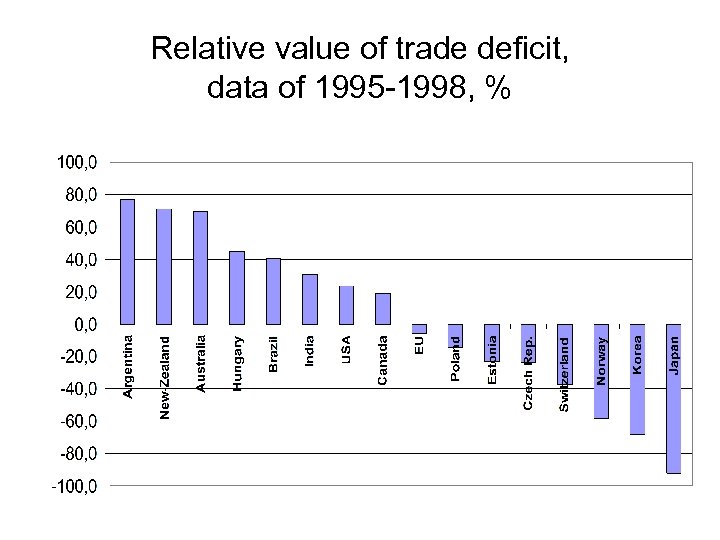

Relative value of trade deficit, data of 1995 -1998, %

Relative value of trade deficit, data of 1995 -1998, %

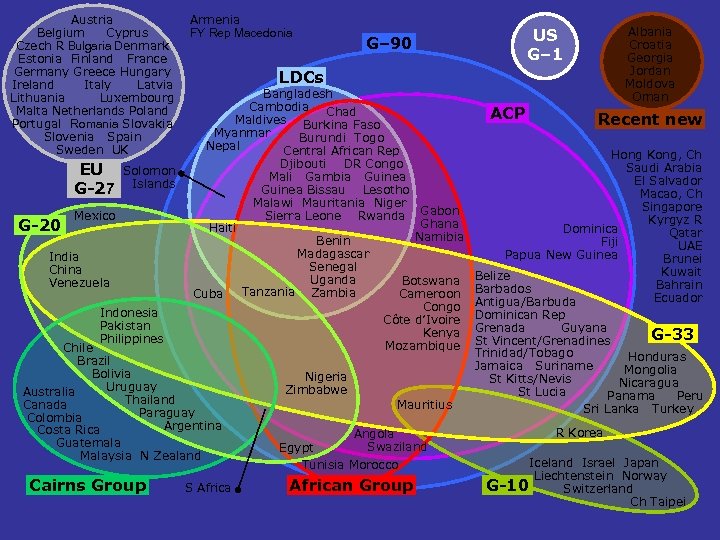

Armenia Austria FY Rep Macedonia Belgium Cyprus G– 90 Czech R Bulgaria Denmark Estonia Finland France Germany Greece Hungary LDCs Ireland Italy Latvia Bangladesh Lithuania Luxembourg Cambodia Chad Malta Netherlands Poland Maldives Burkina Faso Portugal Romania Slovakia Myanmar Slovenia Spain Burundi Togo Nepal Sweden UK Central African Rep Djibouti DR Congo EU Solomon Mali Gambia Guinea G-27 Islands Guinea Bissau Lesotho Malawi Mauritania Niger Mexico Sierra Leone Rwanda Gabon Ghana G-20 Haiti Namibia Benin Madagascar India Senegal China Uganda Botswana Venezuela Tanzania Zambia Cuba Cameroon Congo Indonesia Côte d’Ivoire Pakistan Kenya Philippines Mozambique Chile Brazil Bolivia Nigeria Uruguay Zimbabwe Australia Thailand Canada Mauritius Paraguay Colombia Argentina Costa Rica Angola Guatemala Swaziland Egypt Malaysia N Zealand Tunisia Morocco Cairns Group S African Group Albania Croatia Georgia Jordan Moldova Oman US G– 1 ACP Recent new Hong Kong, Ch Saudi Arabia El Salvador Macao, Ch Singapore Kyrgyz R Dominica Qatar Fiji UAE Papua New Guinea Brunei Kuwait Belize Bahrain Barbados Ecuador Antigua/Barbuda Dominican Rep Grenada Guyana G-33 St Vincent/Grenadines Trinidad/Tobago Honduras Jamaica Suriname Mongolia St Kitts/Nevis Nicaragua St Lucia Panama Peru Sri Lanka Turkey R Korea Iceland Israel Japan Liechtenstein Norway G-10 Switzerland Ch Taipei

Armenia Austria FY Rep Macedonia Belgium Cyprus G– 90 Czech R Bulgaria Denmark Estonia Finland France Germany Greece Hungary LDCs Ireland Italy Latvia Bangladesh Lithuania Luxembourg Cambodia Chad Malta Netherlands Poland Maldives Burkina Faso Portugal Romania Slovakia Myanmar Slovenia Spain Burundi Togo Nepal Sweden UK Central African Rep Djibouti DR Congo EU Solomon Mali Gambia Guinea G-27 Islands Guinea Bissau Lesotho Malawi Mauritania Niger Mexico Sierra Leone Rwanda Gabon Ghana G-20 Haiti Namibia Benin Madagascar India Senegal China Uganda Botswana Venezuela Tanzania Zambia Cuba Cameroon Congo Indonesia Côte d’Ivoire Pakistan Kenya Philippines Mozambique Chile Brazil Bolivia Nigeria Uruguay Zimbabwe Australia Thailand Canada Mauritius Paraguay Colombia Argentina Costa Rica Angola Guatemala Swaziland Egypt Malaysia N Zealand Tunisia Morocco Cairns Group S African Group Albania Croatia Georgia Jordan Moldova Oman US G– 1 ACP Recent new Hong Kong, Ch Saudi Arabia El Salvador Macao, Ch Singapore Kyrgyz R Dominica Qatar Fiji UAE Papua New Guinea Brunei Kuwait Belize Bahrain Barbados Ecuador Antigua/Barbuda Dominican Rep Grenada Guyana G-33 St Vincent/Grenadines Trinidad/Tobago Honduras Jamaica Suriname Mongolia St Kitts/Nevis Nicaragua St Lucia Panama Peru Sri Lanka Turkey R Korea Iceland Israel Japan Liechtenstein Norway G-10 Switzerland Ch Taipei

Main subjectc for AG negociatrions • Export Subsidies – “all types of Export Subsidies scrapped by 2013” • Domestic Support • Market Access

Main subjectc for AG negociatrions • Export Subsidies – “all types of Export Subsidies scrapped by 2013” • Domestic Support • Market Access

Different MA formulas

Different MA formulas

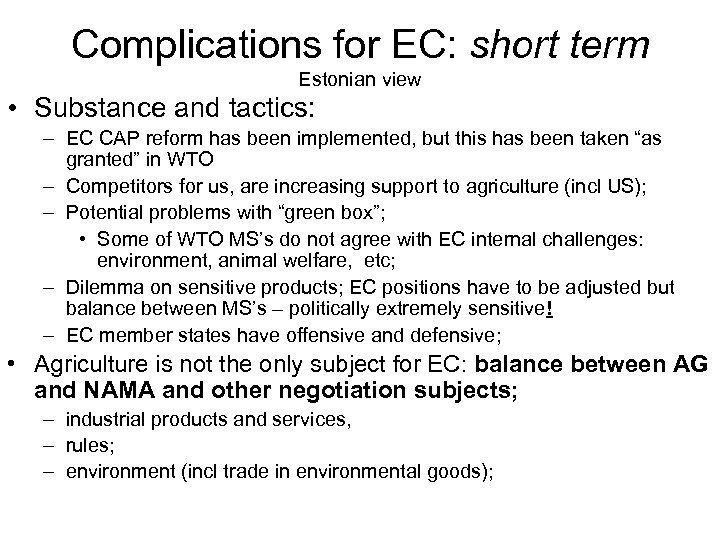

Complications for EC: short term Estonian view • Substance and tactics: – EC CAP reform has been implemented, but this has been taken “as granted” in WTO – Competitors for us, are increasing support to agriculture (incl US); – Potential problems with “green box”; • Some of WTO MS’s do not agree with EC internal challenges: environment, animal welfare, etc; – Dilemma on sensitive products; EC positions have to be adjusted but balance between MS’s – politically extremely sensitive! – EC member states have offensive and defensive; • Agriculture is not the only subject for EC: balance between AG and NAMA and other negotiation subjects; – industrial products and services, – rules; – environment (incl trade in environmental goods);

Complications for EC: short term Estonian view • Substance and tactics: – EC CAP reform has been implemented, but this has been taken “as granted” in WTO – Competitors for us, are increasing support to agriculture (incl US); – Potential problems with “green box”; • Some of WTO MS’s do not agree with EC internal challenges: environment, animal welfare, etc; – Dilemma on sensitive products; EC positions have to be adjusted but balance between MS’s – politically extremely sensitive! – EC member states have offensive and defensive; • Agriculture is not the only subject for EC: balance between AG and NAMA and other negotiation subjects; – industrial products and services, – rules; – environment (incl trade in environmental goods);

DDA development: possible implications in case of negative results • Globally: DDA negotiations will continue in XX years; – Multilateral trading environment in crisis (incl the whole WTO); – Increase in bilateral trade development (back in local and regional preference system); – Increase of protective attitude in trade; – Development will slow down; – New tensions in regional trade; • For EC and Estonia: internal reforms will not contribute to negotiating power; – – EC farmers will have to “pay” more; Increasing pressure through WTO DSB: sugar, bananas etc. ; CAP reform will slow down: old- vs. new MS “situation is remaining; EC internal competitive trade environment is getting worse;

DDA development: possible implications in case of negative results • Globally: DDA negotiations will continue in XX years; – Multilateral trading environment in crisis (incl the whole WTO); – Increase in bilateral trade development (back in local and regional preference system); – Increase of protective attitude in trade; – Development will slow down; – New tensions in regional trade; • For EC and Estonia: internal reforms will not contribute to negotiating power; – – EC farmers will have to “pay” more; Increasing pressure through WTO DSB: sugar, bananas etc. ; CAP reform will slow down: old- vs. new MS “situation is remaining; EC internal competitive trade environment is getting worse;

DDA development: possible implications in case of positive results • Globally: – – Multilateral vs. bilateral; Global (single) rules; Development: increase in trade and incomes; Increase in some food products price: i. e. milk, sugar; • EC and Estonia: – EC farmer will “contribute” but other’s are in similar conditions; – Opportunities in trade to third countries markets will increase; – Pressure to develop flexible internal agricultural policy across the EC; – No need administratively regulate trade;

DDA development: possible implications in case of positive results • Globally: – – Multilateral vs. bilateral; Global (single) rules; Development: increase in trade and incomes; Increase in some food products price: i. e. milk, sugar; • EC and Estonia: – EC farmer will “contribute” but other’s are in similar conditions; – Opportunities in trade to third countries markets will increase; – Pressure to develop flexible internal agricultural policy across the EC; – No need administratively regulate trade;

New challenges!? • Bio- energy and trade in energyproducts • General food shortage – need for different policies

New challenges!? • Bio- energy and trade in energyproducts • General food shortage – need for different policies