8e9e23540e1191102ede038bc1d20a1f.ppt

- Количество слайдов: 54

Wrist Watch 1

Wrist Watch 1

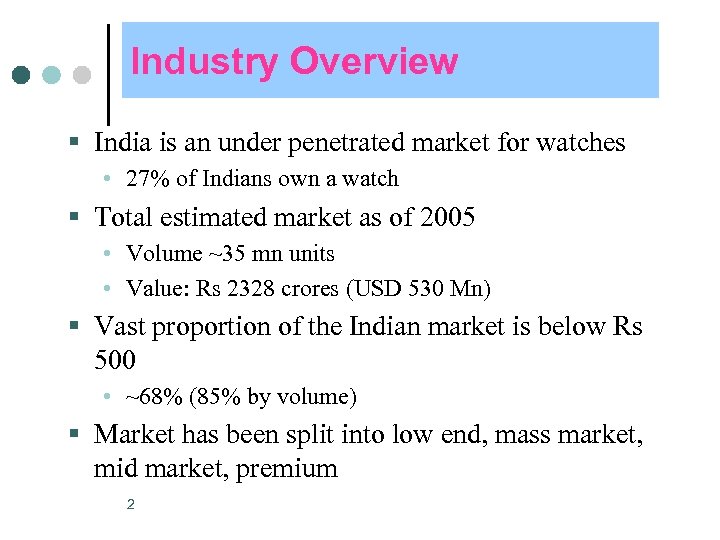

Industry Overview § India is an under penetrated market for watches • 27% of Indians own a watch § Total estimated market as of 2005 • Volume ~35 mn units • Value: Rs 2328 crores (USD 530 Mn) § Vast proportion of the Indian market is below Rs 500 • ~68% (85% by volume) § Market has been split into low end, mass market, mid market, premium 2

Industry Overview § India is an under penetrated market for watches • 27% of Indians own a watch § Total estimated market as of 2005 • Volume ~35 mn units • Value: Rs 2328 crores (USD 530 Mn) § Vast proportion of the Indian market is below Rs 500 • ~68% (85% by volume) § Market has been split into low end, mass market, mid market, premium 2

Major Players 3

Major Players 3

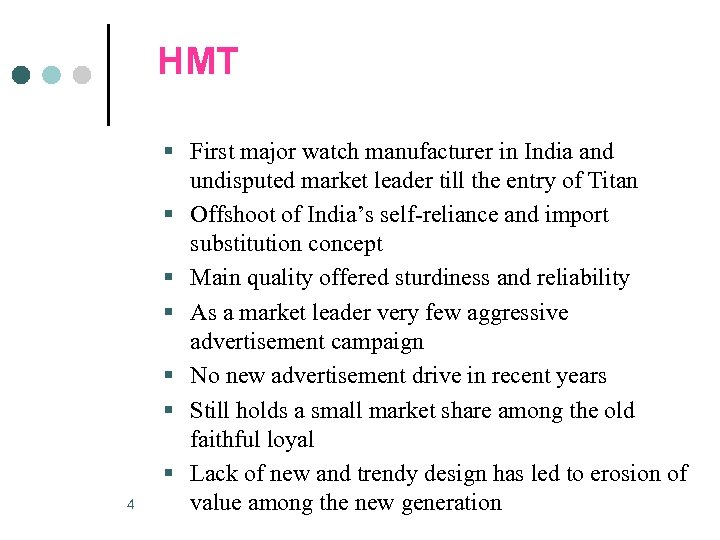

HMT 4 § First major watch manufacturer in India and undisputed market leader till the entry of Titan § Offshoot of India’s self reliance and import substitution concept § Main quality offered sturdiness and reliability § As a market leader very few aggressive advertisement campaign § No new advertisement drive in recent years § Still holds a small market share among the old faithful loyal § Lack of new and trendy design has led to erosion of value among the new generation

HMT 4 § First major watch manufacturer in India and undisputed market leader till the entry of Titan § Offshoot of India’s self reliance and import substitution concept § Main quality offered sturdiness and reliability § As a market leader very few aggressive advertisement campaign § No new advertisement drive in recent years § Still holds a small market share among the old faithful loyal § Lack of new and trendy design has led to erosion of value among the new generation

Titan § A joint venture between the Tata group and the Tamil Nadu Industrial Development Corporation § Launched in 1984 § Titan is today world’s sixth largest, integrated watch manufacturer and India’s largest § 4 factories main watch and jewellery plants in Hosur near Bangalore ( India’s ‘Silicon valley’), Watch Assembly plants at Dehradun and in Himachal Pradesh, with an ECB plant in Goa § Investment of over US$130 million. A 450, 000 sq. ft. state of the art facility 5

Titan § A joint venture between the Tata group and the Tamil Nadu Industrial Development Corporation § Launched in 1984 § Titan is today world’s sixth largest, integrated watch manufacturer and India’s largest § 4 factories main watch and jewellery plants in Hosur near Bangalore ( India’s ‘Silicon valley’), Watch Assembly plants at Dehradun and in Himachal Pradesh, with an ECB plant in Goa § Investment of over US$130 million. A 450, 000 sq. ft. state of the art facility 5

Titan § Leader in the watch and jewellery businesses in India • First and largest branded player in the jewellery (Tanishq) • >50% share of the organized watch market • Over 60 million watches sold across 30 countries § Brands offered: Steel, Edge, Raga, Sonata, Fasttrack, Regalia, Bandhan, Sonata, Nebula, Flip § Recently Titan has taken a drive to improve its image as a maker of contemporary style and design in wrist watches § Titan is trying to offer international quality/style at an affordable price 6

Titan § Leader in the watch and jewellery businesses in India • First and largest branded player in the jewellery (Tanishq) • >50% share of the organized watch market • Over 60 million watches sold across 30 countries § Brands offered: Steel, Edge, Raga, Sonata, Fasttrack, Regalia, Bandhan, Sonata, Nebula, Flip § Recently Titan has taken a drive to improve its image as a maker of contemporary style and design in wrist watches § Titan is trying to offer international quality/style at an affordable price 6

Time Products Division § Market leader • Only profitable watch company in India • 50% of volume, 65% of value of organized industry • Most admired consumer durable company (A&M magazine), Superbrand 2003, Brand Equity Award (PHDCCI), Images Fashion Award • Established two brands – Titan and Sonata Business § Enviable network • Widespread, visible and profitable retail and customer service chains (~7250 retail outlets in 1800 towns, 165 exclusive showrooms, 600 service centres) • Distributed in 30 countries Financial 7 § Large customer base more than 60 million consumers § Efficient support system integrated manufacturing facilities, strong vendor base (~800 strong vendor base)

Time Products Division § Market leader • Only profitable watch company in India • 50% of volume, 65% of value of organized industry • Most admired consumer durable company (A&M magazine), Superbrand 2003, Brand Equity Award (PHDCCI), Images Fashion Award • Established two brands – Titan and Sonata Business § Enviable network • Widespread, visible and profitable retail and customer service chains (~7250 retail outlets in 1800 towns, 165 exclusive showrooms, 600 service centres) • Distributed in 30 countries Financial 7 § Large customer base more than 60 million consumers § Efficient support system integrated manufacturing facilities, strong vendor base (~800 strong vendor base)

Timex § The main focus is on reflecting a sporty and fashionable look for the men § In the ladies segment it is offering highly stylized bangle bracelet watch that are sleek and sophisticated § The advertising campaign aims at focusing on power, precision and timing § Used Brett Lee as brand ambassador 8

Timex § The main focus is on reflecting a sporty and fashionable look for the men § In the ladies segment it is offering highly stylized bangle bracelet watch that are sleek and sophisticated § The advertising campaign aims at focusing on power, precision and timing § Used Brett Lee as brand ambassador 8

Other Players § Mainly Rado, Tommy Hilfiger and Evidenza from Longines § Tommy Hilfiger is positioned in the mid and premium segment while the other two players are in the luxury segment § Trying to catch the upmarket, urban, western minded youth § Also offer a sense of exclusivity and style as their products are distributed through some selected outlets § Using high society and stylish brand ambassadors such as Shahrukh Khan, Aishwarya Rai, Yana Gupta, Lisa Ray 9

Other Players § Mainly Rado, Tommy Hilfiger and Evidenza from Longines § Tommy Hilfiger is positioned in the mid and premium segment while the other two players are in the luxury segment § Trying to catch the upmarket, urban, western minded youth § Also offer a sense of exclusivity and style as their products are distributed through some selected outlets § Using high society and stylish brand ambassadors such as Shahrukh Khan, Aishwarya Rai, Yana Gupta, Lisa Ray 9

Segmentation 10

Segmentation 10

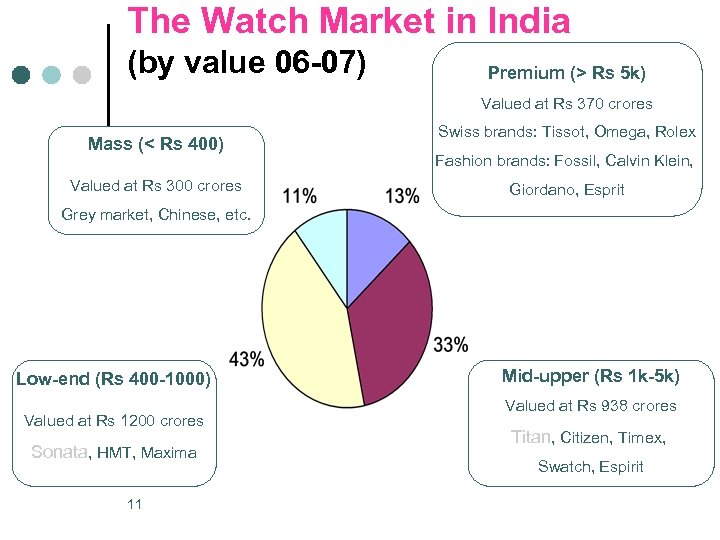

The Watch Market in India (by value 06 -07) Premium (> Rs 5 k) Valued at Rs 370 crores Mass (< Rs 400) Valued at Rs 300 crores Swiss brands: Tissot, Omega, Rolex Fashion brands: Fossil, Calvin Klein, Giordano, Esprit Grey market, Chinese, etc. Low-end (Rs 400 -1000) Valued at Rs 1200 crores Sonata, HMT, Maxima 11 Mid-upper (Rs 1 k-5 k) Valued at Rs 938 crores Titan, Citizen, Timex, Swatch, Espirit

The Watch Market in India (by value 06 -07) Premium (> Rs 5 k) Valued at Rs 370 crores Mass (< Rs 400) Valued at Rs 300 crores Swiss brands: Tissot, Omega, Rolex Fashion brands: Fossil, Calvin Klein, Giordano, Esprit Grey market, Chinese, etc. Low-end (Rs 400 -1000) Valued at Rs 1200 crores Sonata, HMT, Maxima 11 Mid-upper (Rs 1 k-5 k) Valued at Rs 938 crores Titan, Citizen, Timex, Swatch, Espirit

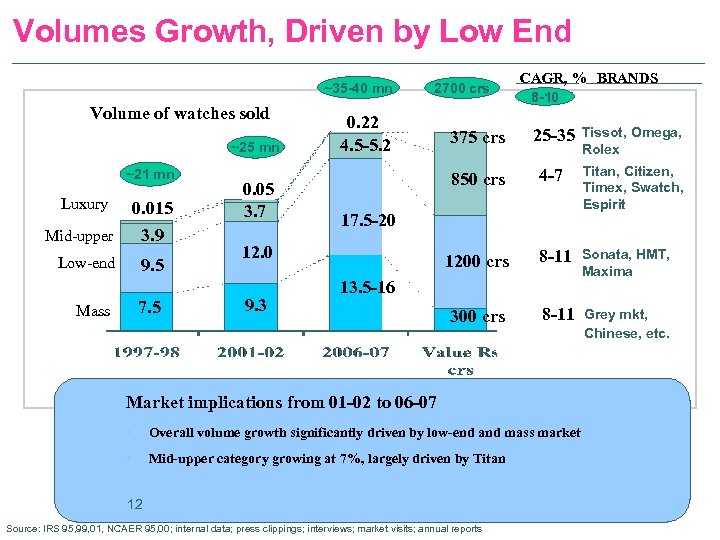

Volumes Growth, Driven by Low End ~35 -40 mn Volume of watches sold ~25 mn ~21 mn Luxury 0. 015 3. 9 Mid upper Low end 9. 5 7. 5 Mass 0. 05 3. 7 2700 crs 0. 22 4. 5 -5. 2 8 -10 375 crs 25 -35 Tissot, Omega, Rolex 850 crs 4 -7 Titan, Citizen, Timex, Swatch, Espirit 1200 crs 8 -11 Sonata, HMT, Maxima 300 crs 8 -11 Grey mkt, Chinese, etc. 17. 5 -20 12. 0 9. 3 CAGR, % BRANDS 13. 5 -16 Market implications from 01 -02 to 06 -07 • Overall volume growth significantly driven by low-end and mass market • Mid-upper category growing at 7%, largely driven by Titan 12 Source: IRS 95, 99, 01, NCAER 95, 00; internal data; press clippings; interviews; market visits; annual reports

Volumes Growth, Driven by Low End ~35 -40 mn Volume of watches sold ~25 mn ~21 mn Luxury 0. 015 3. 9 Mid upper Low end 9. 5 7. 5 Mass 0. 05 3. 7 2700 crs 0. 22 4. 5 -5. 2 8 -10 375 crs 25 -35 Tissot, Omega, Rolex 850 crs 4 -7 Titan, Citizen, Timex, Swatch, Espirit 1200 crs 8 -11 Sonata, HMT, Maxima 300 crs 8 -11 Grey mkt, Chinese, etc. 17. 5 -20 12. 0 9. 3 CAGR, % BRANDS 13. 5 -16 Market implications from 01 -02 to 06 -07 • Overall volume growth significantly driven by low-end and mass market • Mid-upper category growing at 7%, largely driven by Titan 12 Source: IRS 95, 99, 01, NCAER 95, 00; internal data; press clippings; interviews; market visits; annual reports

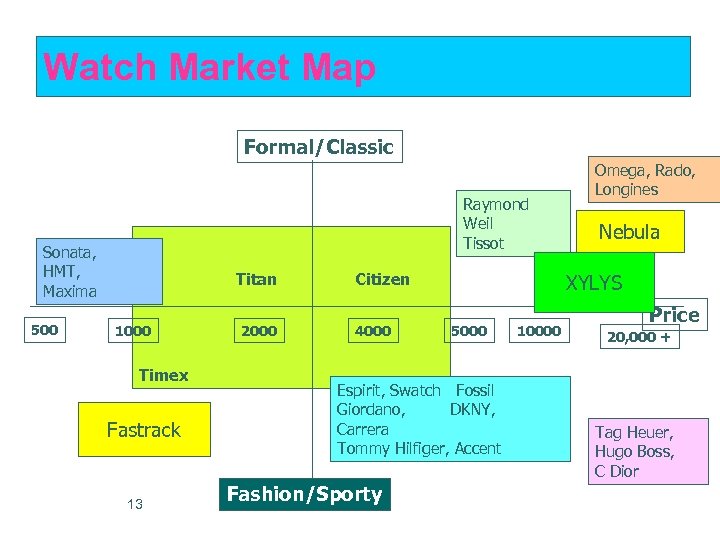

Watch Market Map Formal/Classic Raymond Weil Tissot Sonata, HMT, Maxima 500 Titan 1000 Timex Fastrack 13 2000 Citizen 4000 Nebula XYLYS 5000 Espirit, Swatch Fossil Giordano, DKNY, Carrera Tommy Hilfiger, Accent Fashion/Sporty Omega, Rado, Longines 10000 Price 20, 000 + Tag Heuer, Hugo Boss, C Dior

Watch Market Map Formal/Classic Raymond Weil Tissot Sonata, HMT, Maxima 500 Titan 1000 Timex Fastrack 13 2000 Citizen 4000 Nebula XYLYS 5000 Espirit, Swatch Fossil Giordano, DKNY, Carrera Tommy Hilfiger, Accent Fashion/Sporty Omega, Rado, Longines 10000 Price 20, 000 + Tag Heuer, Hugo Boss, C Dior

The Emerging Trends 14

The Emerging Trends 14

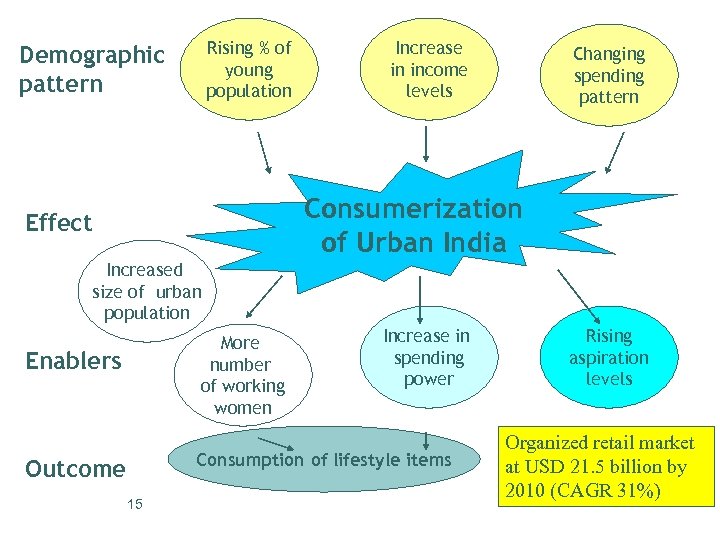

Rising % of young population Demographic pattern Increase in income levels Changing spending pattern Consumerization of Urban India Effect Increased size of urban population More number of working women Enablers Increase in spending power Consumption of lifestyle items Outcome 15 Rising aspiration levels Organized retail market at USD 21. 5 billion by 2010 (CAGR 31%)

Rising % of young population Demographic pattern Increase in income levels Changing spending pattern Consumerization of Urban India Effect Increased size of urban population More number of working women Enablers Increase in spending power Consumption of lifestyle items Outcome 15 Rising aspiration levels Organized retail market at USD 21. 5 billion by 2010 (CAGR 31%)

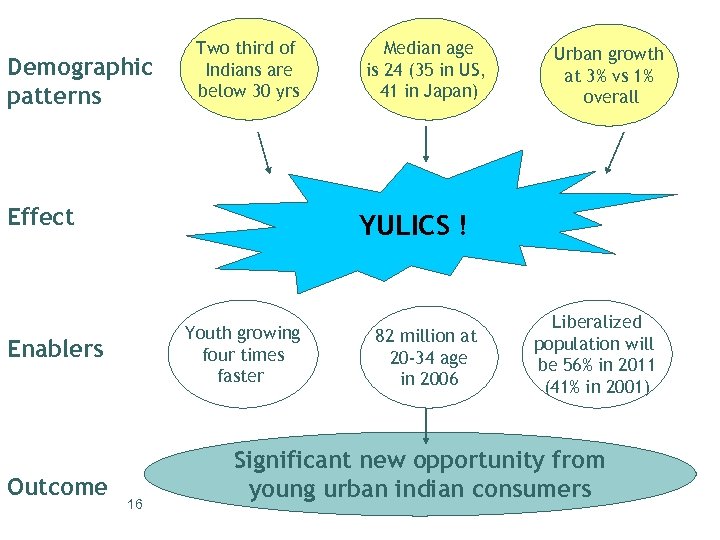

Demographic patterns Two third of Indians are below 30 yrs Effect Urban growth at 3% vs 1% overall YULICS ! Youth growing four times faster Enablers Outcome Median age is 24 (35 in US, 41 in Japan) 16 82 million at 20 -34 age in 2006 Liberalized population will be 56% in 2011 (41% in 2001) Significant new opportunity from young urban indian consumers

Demographic patterns Two third of Indians are below 30 yrs Effect Urban growth at 3% vs 1% overall YULICS ! Youth growing four times faster Enablers Outcome Median age is 24 (35 in US, 41 in Japan) 16 82 million at 20 -34 age in 2006 Liberalized population will be 56% in 2011 (41% in 2001) Significant new opportunity from young urban indian consumers

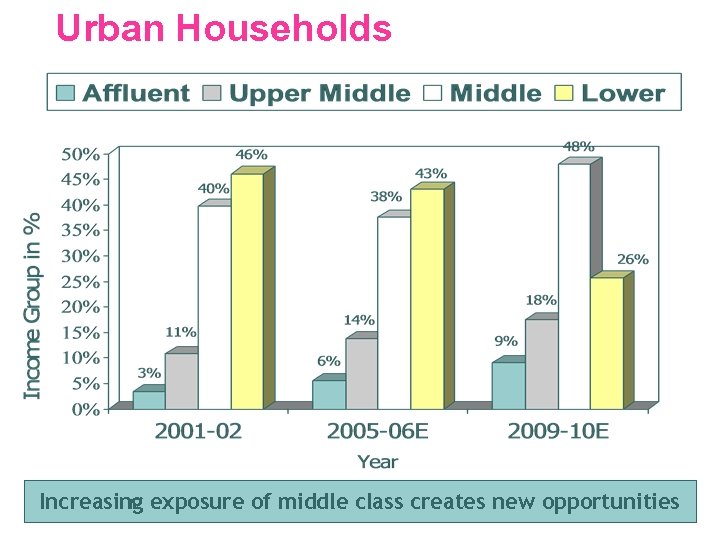

Urban Households Increasing exposure of middle class creates new opportunities 17

Urban Households Increasing exposure of middle class creates new opportunities 17

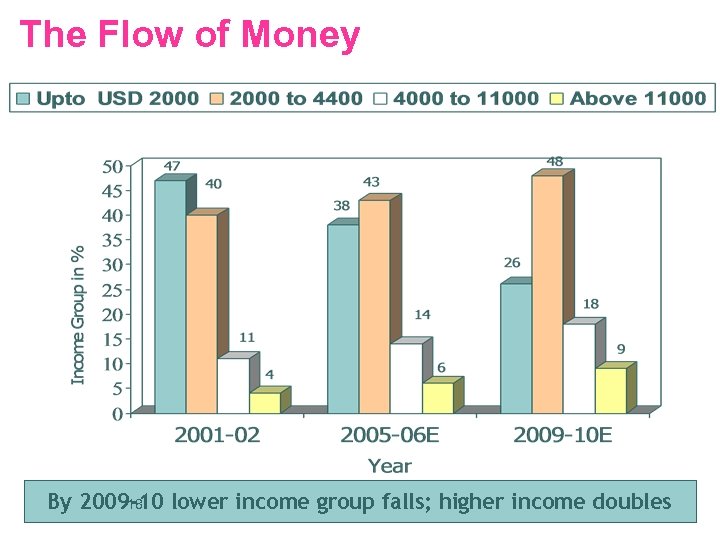

The Flow of Money By 2009 -10 lower income group falls; higher income doubles 18

The Flow of Money By 2009 -10 lower income group falls; higher income doubles 18

Watch Industry in India: Where is it heading? 19

Watch Industry in India: Where is it heading? 19

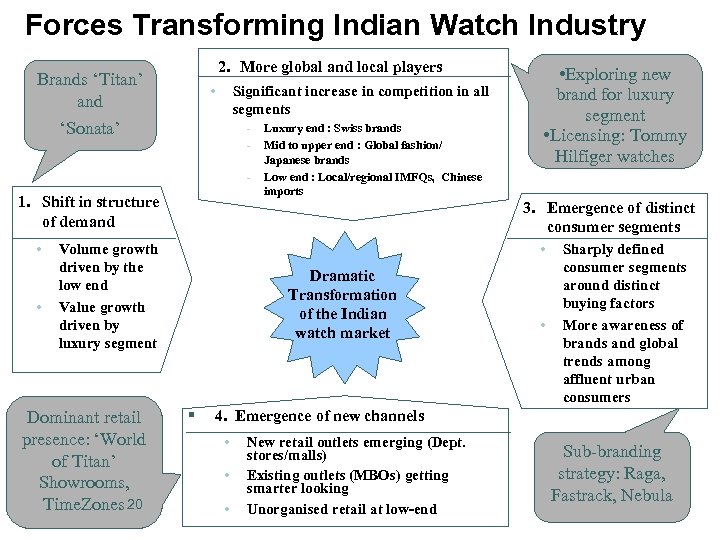

Forces Transforming Indian Watch Industry 2. More global and local players Brands ‘Titan’ and • Significant increase in competition in all segments ‘Sonata’ 1. Shift in structure of demand • • 3. Emergence of distinct consumer segments • Volume growth driven by the low end Value growth driven by luxury segment Dominant retail presence: ‘World of Titan’ Showrooms, Time. Zones 20 Luxury end : Swiss brands Mid to upper end : Global fashion/ Japanese brands Low end : Local/regional IMFQs, Chinese imports • Exploring new brand for luxury segment • Licensing: Tommy Hilfiger watches Dramatic Transformation of the Indian watch market § • Sharply defined consumer segments around distinct buying factors More awareness of brands and global trends among affluent urban consumers 4. Emergence of new channels • • • New retail outlets emerging (Dept. stores/malls) Existing outlets (MBOs) getting smarter looking Unorganised retail at low-end Sub branding strategy: Raga, Fastrack, Nebula

Forces Transforming Indian Watch Industry 2. More global and local players Brands ‘Titan’ and • Significant increase in competition in all segments ‘Sonata’ 1. Shift in structure of demand • • 3. Emergence of distinct consumer segments • Volume growth driven by the low end Value growth driven by luxury segment Dominant retail presence: ‘World of Titan’ Showrooms, Time. Zones 20 Luxury end : Swiss brands Mid to upper end : Global fashion/ Japanese brands Low end : Local/regional IMFQs, Chinese imports • Exploring new brand for luxury segment • Licensing: Tommy Hilfiger watches Dramatic Transformation of the Indian watch market § • Sharply defined consumer segments around distinct buying factors More awareness of brands and global trends among affluent urban consumers 4. Emergence of new channels • • • New retail outlets emerging (Dept. stores/malls) Existing outlets (MBOs) getting smarter looking Unorganised retail at low-end Sub branding strategy: Raga, Fastrack, Nebula

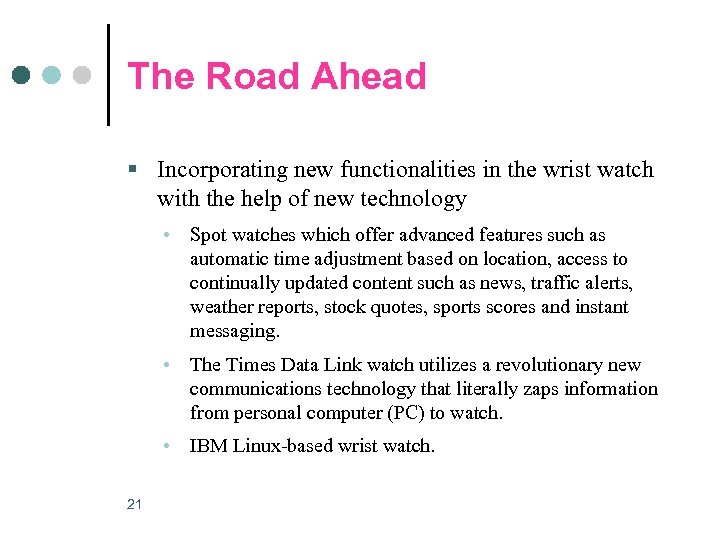

The Road Ahead § Incorporating new functionalities in the wrist watch with the help of new technology • Spot watches which offer advanced features such as automatic time adjustment based on location, access to continually updated content such as news, traffic alerts, weather reports, stock quotes, sports scores and instant messaging. • The Times Data Link watch utilizes a revolutionary new communications technology that literally zaps information from personal computer (PC) to watch. • IBM Linux based wrist watch. 21

The Road Ahead § Incorporating new functionalities in the wrist watch with the help of new technology • Spot watches which offer advanced features such as automatic time adjustment based on location, access to continually updated content such as news, traffic alerts, weather reports, stock quotes, sports scores and instant messaging. • The Times Data Link watch utilizes a revolutionary new communications technology that literally zaps information from personal computer (PC) to watch. • IBM Linux based wrist watch. 21

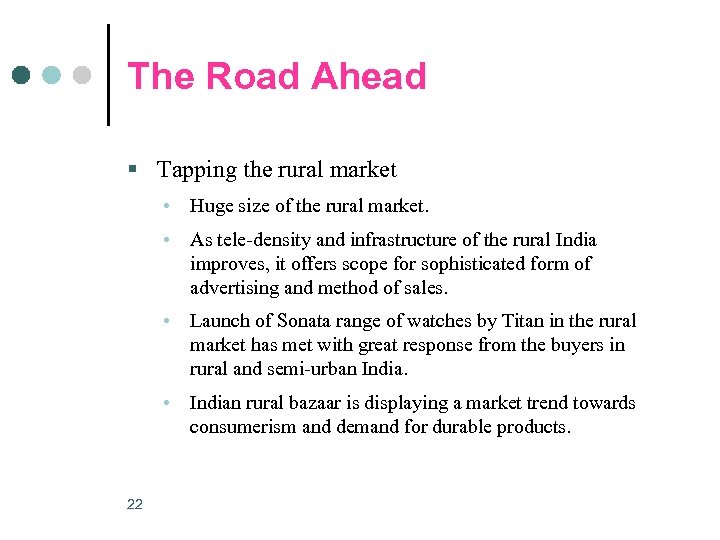

The Road Ahead § Tapping the rural market • Huge size of the rural market. • As tele density and infrastructure of the rural India improves, it offers scope for sophisticated form of advertising and method of sales. • Launch of Sonata range of watches by Titan in the rural market has met with great response from the buyers in rural and semi urban India. • Indian rural bazaar is displaying a market trend towards consumerism and demand for durable products. 22

The Road Ahead § Tapping the rural market • Huge size of the rural market. • As tele density and infrastructure of the rural India improves, it offers scope for sophisticated form of advertising and method of sales. • Launch of Sonata range of watches by Titan in the rural market has met with great response from the buyers in rural and semi urban India. • Indian rural bazaar is displaying a market trend towards consumerism and demand for durable products. 22

Agenda § The Watch Industry • Evolution • Global perspective § Indian Watch Market • Evolution • Trends • Price segmentation § Consumer Behaviour § Major Players • HMT Watches Ltd. • Titan Industries Ltd. • Timex Watches Ltd. § Industry Analysis • • 23 Positioning Advertising Distribution Branding § Future Trends

Agenda § The Watch Industry • Evolution • Global perspective § Indian Watch Market • Evolution • Trends • Price segmentation § Consumer Behaviour § Major Players • HMT Watches Ltd. • Titan Industries Ltd. • Timex Watches Ltd. § Industry Analysis • • 23 Positioning Advertising Distribution Branding § Future Trends

The Watch Industry – Evolution § Conventional watches – standard spring powered watch § Conventional watch evolved into electronic watch § Varieties: • Jewelled lever watches (complex and expensive) • Pin lever watches (recent development) § New generation watches evolved from electric watch to Tuning Fork watch and ultimately settle at Quartz Crystal electronic watch § Major players Switzerland, Japan and United States § 60% Quartz, 27% Digital, 13% Mechanical Source : Segmentation of the Indian Watch Market – Y. L. R. Moorthi, IIMB 24

The Watch Industry – Evolution § Conventional watches – standard spring powered watch § Conventional watch evolved into electronic watch § Varieties: • Jewelled lever watches (complex and expensive) • Pin lever watches (recent development) § New generation watches evolved from electric watch to Tuning Fork watch and ultimately settle at Quartz Crystal electronic watch § Major players Switzerland, Japan and United States § 60% Quartz, 27% Digital, 13% Mechanical Source : Segmentation of the Indian Watch Market – Y. L. R. Moorthi, IIMB 24

The Watch Industry – Global Perspective § Swiss Watch Industry • • Specialization in component manufacturing and watch assembling Competitive advantage – mechanical watches Undisputed leaders till ’ 70 s (42% volume share and 78% value share) First electronic watch invented by Max Hetzel, a Swiss Engineer in 1954 § Japanese Watch Industry • Took advantage of the quartz and digital technology • Carved out a strong position in the world watch industry • Competitive Advantage: Brand image based on quartz technology and accuracy Mass production which led to lower prices 25

The Watch Industry – Global Perspective § Swiss Watch Industry • • Specialization in component manufacturing and watch assembling Competitive advantage – mechanical watches Undisputed leaders till ’ 70 s (42% volume share and 78% value share) First electronic watch invented by Max Hetzel, a Swiss Engineer in 1954 § Japanese Watch Industry • Took advantage of the quartz and digital technology • Carved out a strong position in the world watch industry • Competitive Advantage: Brand image based on quartz technology and accuracy Mass production which led to lower prices 25

The Watch Industry – Global Perspective (Contd. ) § US Watch Industry • Had some presence till 1970 • Post 1970, some chip manufacturers entered as suppliers of components • By 1980 s most of them disappeared due to fierce competition from Japan and Hong Kong • Major player is Timex § Hong Kong Watch Industry • Entered the world watch scene in 1976 • Assembly type production • Japan biggest supplier of movements • Competitive Advantage: Cheap Labour Low Prices 26

The Watch Industry – Global Perspective (Contd. ) § US Watch Industry • Had some presence till 1970 • Post 1970, some chip manufacturers entered as suppliers of components • By 1980 s most of them disappeared due to fierce competition from Japan and Hong Kong • Major player is Timex § Hong Kong Watch Industry • Entered the world watch scene in 1976 • Assembly type production • Japan biggest supplier of movements • Competitive Advantage: Cheap Labour Low Prices 26

Indian Watch Industry – Evolution § 1960: Indian Watch Industry came into being. Govt. took the decision to set up the country’s first watch factory § 1961: HMT set up India’s first watch factory at Bangalore in collaboration with Citizen of Japan § 1981: Hyderabad Allwyn Limited entered the watch industry in collaboration with Seiko of Japan § 1984: The beginning of a new era entry of Titan, the Tata –TIDCO joint sector company § 1990: Timex enters the Indian market in partnership with Titan, targeting the lower price segment § 1997: Timex breaks away from Titan increasing the already fierce competition 27

Indian Watch Industry – Evolution § 1960: Indian Watch Industry came into being. Govt. took the decision to set up the country’s first watch factory § 1961: HMT set up India’s first watch factory at Bangalore in collaboration with Citizen of Japan § 1981: Hyderabad Allwyn Limited entered the watch industry in collaboration with Seiko of Japan § 1984: The beginning of a new era entry of Titan, the Tata –TIDCO joint sector company § 1990: Timex enters the Indian market in partnership with Titan, targeting the lower price segment § 1997: Timex breaks away from Titan increasing the already fierce competition 27

Indian Watch Industry – Evolution (Contd. ) § Government Policies • Reserved the manufacture of straps and dials to the small scale industry • Imposed restrictions on import & manufacture of ECBs § Results • Until the mid 1980 s the industry was predominantly producing mechanical watches. • Total demand for watches greater than supply – the gap in demand being met by smuggled watches unorganized sector 28

Indian Watch Industry – Evolution (Contd. ) § Government Policies • Reserved the manufacture of straps and dials to the small scale industry • Imposed restrictions on import & manufacture of ECBs § Results • Until the mid 1980 s the industry was predominantly producing mechanical watches. • Total demand for watches greater than supply – the gap in demand being met by smuggled watches unorganized sector 28

Indian Watch Industry – Trends § Rapid increase in target audience § Rise of consumerism and purchasing power of the middle class § Bulk of the demand exists in lower and middle segments § Newer segments – jewellery segment, etc. § Rise of demand of trendy watches 29

Indian Watch Industry – Trends § Rapid increase in target audience § Rise of consumerism and purchasing power of the middle class § Bulk of the demand exists in lower and middle segments § Newer segments – jewellery segment, etc. § Rise of demand of trendy watches 29

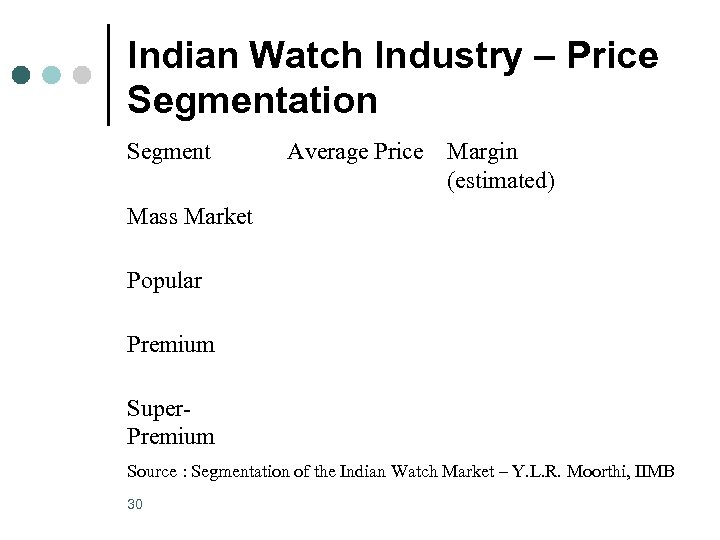

Indian Watch Industry – Price Segmentation Segment Average Price Margin (estimated) Mass Market Rs 450 11% Popular Rs 750 15% Premium Rs 1200 18% Super Premium Rs 3000 22% Source : Segmentation of the Indian Watch Market – Y. L. R. Moorthi, IIMB 30

Indian Watch Industry – Price Segmentation Segment Average Price Margin (estimated) Mass Market Rs 450 11% Popular Rs 750 15% Premium Rs 1200 18% Super Premium Rs 3000 22% Source : Segmentation of the Indian Watch Market – Y. L. R. Moorthi, IIMB 30

Consumer Behaviour § Transition from mere time keeping device with functional benefits like durability, toughness and economy to a personal wear reflecting people’s lifestyle and aspirations • Multiple ownership § Price sensitive § Durability and utility are important aspects § Aesthetic appeal and trendy designs are very important § Brand Name continues to be an important driver in the customer’s mind § Availability in different segments and for different occasions makes the watch a suitable gift item 31

Consumer Behaviour § Transition from mere time keeping device with functional benefits like durability, toughness and economy to a personal wear reflecting people’s lifestyle and aspirations • Multiple ownership § Price sensitive § Durability and utility are important aspects § Aesthetic appeal and trendy designs are very important § Brand Name continues to be an important driver in the customer’s mind § Availability in different segments and for different occasions makes the watch a suitable gift item 31

Major Players § HMT Watches Ltd. (34%) • Titan Industries Ltd. – (39%) • Timex Watches Ltd. – (23%) 32

Major Players § HMT Watches Ltd. (34%) • Titan Industries Ltd. – (39%) • Timex Watches Ltd. – (23%) 32

HMT Ltd. § HMT Limited was established in 1953 in technical collaboration with M/s. Oerlikon of Switzerland § Product range includes Machine Tools, Watches, Tractors, Printing Machines among others § HMT started manufacturing Wrist Watches since 1962 § Technical collaboration with Citizen, Japan § 4 integrated manufacturing units § More than 7 million high quality watches/watch movements per annum § Mechanical and Quartz watches § HMT Watch manufacturing units ISO 9001 certified Source: http: //www. indiainfoline. com 33

HMT Ltd. § HMT Limited was established in 1953 in technical collaboration with M/s. Oerlikon of Switzerland § Product range includes Machine Tools, Watches, Tractors, Printing Machines among others § HMT started manufacturing Wrist Watches since 1962 § Technical collaboration with Citizen, Japan § 4 integrated manufacturing units § More than 7 million high quality watches/watch movements per annum § Mechanical and Quartz watches § HMT Watch manufacturing units ISO 9001 certified Source: http: //www. indiainfoline. com 33

HMT Ltd. - Brands § Mechanical Watches Environment friendly • • • § Automatic Hand wound: Ladies, Gents Shakti: Ladies, Gents Quartz Analog Watches • Roman • Alarm Watches EL Night Watches Multi Dial Watches Dater Watches Plain Watches Elegance Gold Line Bracelet Slim Line 34 • • • Tennmax Utsav Gem Lalit: Ladies, Gents, Pairs Sangam Swarna: Ladies, Gents § Special Watches • • Freedom Braille Nurse Watches Fragrance Watch

HMT Ltd. - Brands § Mechanical Watches Environment friendly • • • § Automatic Hand wound: Ladies, Gents Shakti: Ladies, Gents Quartz Analog Watches • Roman • Alarm Watches EL Night Watches Multi Dial Watches Dater Watches Plain Watches Elegance Gold Line Bracelet Slim Line 34 • • • Tennmax Utsav Gem Lalit: Ladies, Gents, Pairs Sangam Swarna: Ladies, Gents § Special Watches • • Freedom Braille Nurse Watches Fragrance Watch

HMT Ltd. – Strategies § Targeted the global market § State of the art technologies – IT Infrastructure § Collaboration with ISA Quartz, France and Fraporlux, France apart from Citizen, Japan 35

HMT Ltd. – Strategies § Targeted the global market § State of the art technologies – IT Infrastructure § Collaboration with ISA Quartz, France and Fraporlux, France apart from Citizen, Japan 35

HMT Ltd. – Positioning § Positioning based on age, sex, competition § Teenagers • Pace § Older customers • Astra § The male segment • Roman § First watch company to launch watches for children • Zap § Utsav – to compete with Titan Raga • Bracelets, Jewellery and Bangles 36

HMT Ltd. – Positioning § Positioning based on age, sex, competition § Teenagers • Pace § Older customers • Astra § The male segment • Roman § First watch company to launch watches for children • Zap § Utsav – to compete with Titan Raga • Bracelets, Jewellery and Bangles 36

HMT Ltd. – Distribution § Manufacturer – Dealer – Retailer – Customer § Established a strong distributor network of 10, 000 distributors and 50, 000 retail outlets § 1990: Followed Titan in introducing C&F Agents 37

HMT Ltd. – Distribution § Manufacturer – Dealer – Retailer – Customer § Established a strong distributor network of 10, 000 distributors and 50, 000 retail outlets § 1990: Followed Titan in introducing C&F Agents 37

HMT Ltd. – Advertising § Huge early investments § Catchy slogan “If you have the inclination, we have the Time” § Portrayed nationalistic instincts • “Timekeepers to the Nation” 38

HMT Ltd. – Advertising § Huge early investments § Catchy slogan “If you have the inclination, we have the Time” § Portrayed nationalistic instincts • “Timekeepers to the Nation” 38

Titan Industries Ltd. § Titan Industries Ltd. set up in 1987 § Joint venture of the Tata Group and TIDCO § 1 st factory at Hosur • Manufactured quartz analog electronic watches § Financial and technical collaboration with Ebauches, France § 1988: Estd. a component manufacturing facility § 1990: Estd. a case manufacturing plant § 1992: Integrated backwards to manufacture step motors § JV with EDC 2 • To manufacture electronic circuit blocks § Annually markets over 7 million watches 39 • 6 th largest globally in the category of “manufacturer brands”

Titan Industries Ltd. § Titan Industries Ltd. set up in 1987 § Joint venture of the Tata Group and TIDCO § 1 st factory at Hosur • Manufactured quartz analog electronic watches § Financial and technical collaboration with Ebauches, France § 1988: Estd. a component manufacturing facility § 1990: Estd. a case manufacturing plant § 1992: Integrated backwards to manufacture step motors § JV with EDC 2 • To manufacture electronic circuit blocks § Annually markets over 7 million watches 39 • 6 th largest globally in the category of “manufacturer brands”

Titan Industries Ltd. – Brands § Insignia • § Psi 2000, Technology • § § Contemporary styles for the young Dash! • 40 Exclusive watches for women Fastrack • § The “Everyday Watch” Raga • § Combines the sturdiness of steel with the richness of gold Exacta • § Elegant corporate wear Spectra • § Magic in gold and unique futuristic material Classique • § Sports & Multi functional watches Regalia, Royale • § Made with high grade anti allergenic steel, scratch resistant sapphire crystal and special hard gold plating For young boys and girls Bandhan • Watches for him and her

Titan Industries Ltd. – Brands § Insignia • § Psi 2000, Technology • § § Contemporary styles for the young Dash! • 40 Exclusive watches for women Fastrack • § The “Everyday Watch” Raga • § Combines the sturdiness of steel with the richness of gold Exacta • § Elegant corporate wear Spectra • § Magic in gold and unique futuristic material Classique • § Sports & Multi functional watches Regalia, Royale • § Made with high grade anti allergenic steel, scratch resistant sapphire crystal and special hard gold plating For young boys and girls Bandhan • Watches for him and her

Titan Industries Ltd. – Strategies § Early to manufacture watches targeted at US and European markets • The “Insignia Collection” • Also makes watches for international labels § Roping in the crème of designers • Pierre Ludwig (Cartier) • Francis Humbertdiz (Omega) § Diversification into jewellery – Tanishq § Very wide range of products in terms of looks, function and price points § Noted for their workmanship and reliability • Reputation of being excellent value for money § The Titan Signet Club • Customer loyalty programme 41

Titan Industries Ltd. – Strategies § Early to manufacture watches targeted at US and European markets • The “Insignia Collection” • Also makes watches for international labels § Roping in the crème of designers • Pierre Ludwig (Cartier) • Francis Humbertdiz (Omega) § Diversification into jewellery – Tanishq § Very wide range of products in terms of looks, function and price points § Noted for their workmanship and reliability • Reputation of being excellent value for money § The Titan Signet Club • Customer loyalty programme 41

Titan Industries Ltd. – Positioning § Market Segmentation • The young and teenagers, who are looking for their first watch • The low ownership segment like women • Middle and upper segments of society Price range of Rs 500 – Rs 5000 § International watch at Indian prices § A watch that builds your image § A brand which represents style, status and technology • A “Good Looking Watch” § First watch company to brand its showrooms • Titania Titan watch boutiques in Bangalore • Time. Zone • The World of Titan 42

Titan Industries Ltd. – Positioning § Market Segmentation • The young and teenagers, who are looking for their first watch • The low ownership segment like women • Middle and upper segments of society Price range of Rs 500 – Rs 5000 § International watch at Indian prices § A watch that builds your image § A brand which represents style, status and technology • A “Good Looking Watch” § First watch company to brand its showrooms • Titania Titan watch boutiques in Bangalore • Time. Zone • The World of Titan 42

Titan Industries Ltd. – Distribution § Manufacturer – Retailer – Customer § First to go for exclusive showrooms • Did away with retailers • Wholeseller’s importance reduced § Set up a chain of service centres, with close proximity to the marketplace § Innovative planning of showrooms • Watch buying a pleasurable experience § Extensive use of C&F agents to reduce distribution costs 43

Titan Industries Ltd. – Distribution § Manufacturer – Retailer – Customer § First to go for exclusive showrooms • Did away with retailers • Wholeseller’s importance reduced § Set up a chain of service centres, with close proximity to the marketplace § Innovative planning of showrooms • Watch buying a pleasurable experience § Extensive use of C&F agents to reduce distribution costs 43

Titan Industries Ltd. – Advertising § Targeted the typically price sensitive yet discerning Indian customer • “International watch you can pay for in rupees” • “You don’t need to pay in dollars, pounds or dirhams to buy a Titan watch” § Targeted the premium segment of “look and fashion conscious” customers • “To find watches like these you don’t have to go to Europe, Japan, America or a duty free shop” § Promoted the concept of a watch being the ideal gift • “Next time your husband wants to buy you a saree, ask for a Titan watch instead” § The rationale behind their ads being constant bombardment if the “Titan” brand name § Ads are a blend of sophistication and simplicity 44

Titan Industries Ltd. – Advertising § Targeted the typically price sensitive yet discerning Indian customer • “International watch you can pay for in rupees” • “You don’t need to pay in dollars, pounds or dirhams to buy a Titan watch” § Targeted the premium segment of “look and fashion conscious” customers • “To find watches like these you don’t have to go to Europe, Japan, America or a duty free shop” § Promoted the concept of a watch being the ideal gift • “Next time your husband wants to buy you a saree, ask for a Titan watch instead” § The rationale behind their ads being constant bombardment if the “Titan” brand name § Ads are a blend of sophistication and simplicity 44

Timex Watches Ltd. § 1854: Started as the Waterbury Company, in Connecticut's Naugatuck's Valley (the Switzerland of America) § 1990: Tied up with Titan to launch in India § Broke up with the Tata group in '97 § Heart of the watches imported from America § Assembled in Timex factories in Noida § Launched the Indiglo technology • First electroluminescent watch face in 1992 45

Timex Watches Ltd. § 1854: Started as the Waterbury Company, in Connecticut's Naugatuck's Valley (the Switzerland of America) § 1990: Tied up with Titan to launch in India § Broke up with the Tata group in '97 § Heart of the watches imported from America § Assembled in Timex factories in Noida § Launched the Indiglo technology • First electroluminescent watch face in 1992 45

Timex Watches Ltd. – Brands § § § § § 46 Aqura Indiglo Basics Datalink Timex Sportz Lextra Vista Mariner Gimmix Source : Segmentation of the Indian Watch Market – Y. L. R. Moorthi, IIMB

Timex Watches Ltd. – Brands § § § § § 46 Aqura Indiglo Basics Datalink Timex Sportz Lextra Vista Mariner Gimmix Source : Segmentation of the Indian Watch Market – Y. L. R. Moorthi, IIMB

Timex Watches Ltd. – Strategies § Delivering quality products at affordable prices § Basic objective: Change the mechanical watch user to a quartz watch user • Tap the untapped § Transition from plastic to metal • To become market leader § Launched Vista brand in Rs 475 – Rs 900 range • To appeal to small town customers 47

Timex Watches Ltd. – Strategies § Delivering quality products at affordable prices § Basic objective: Change the mechanical watch user to a quartz watch user • Tap the untapped § Transition from plastic to metal • To become market leader § Launched Vista brand in Rs 475 – Rs 900 range • To appeal to small town customers 47

Timex Watches Ltd. – Positioning § Initial understanding with Titan • Titan keeps out of Plastic – High Price Segment • Timex keeps out of Metal – Low Price Segment § “You don't have to be rich to afford a Timex” § Lower price segments • Basics, Lextra, Vista § Youthful and trendy • Aqura § For the discerning Sportsman • Timex Sportz § For the children • Gimmix § Premium segment 48 • Technologically superior multifunctional brands like Datalink, Indiglo

Timex Watches Ltd. – Positioning § Initial understanding with Titan • Titan keeps out of Plastic – High Price Segment • Timex keeps out of Metal – Low Price Segment § “You don't have to be rich to afford a Timex” § Lower price segments • Basics, Lextra, Vista § Youthful and trendy • Aqura § For the discerning Sportsman • Timex Sportz § For the children • Gimmix § Premium segment 48 • Technologically superior multifunctional brands like Datalink, Indiglo

Timex Watches Ltd. –Distribution § Initially followed the Titan distribution channel § Post ’ 97, set up their own showrooms 49

Timex Watches Ltd. –Distribution § Initially followed the Titan distribution channel § Post ’ 97, set up their own showrooms 49

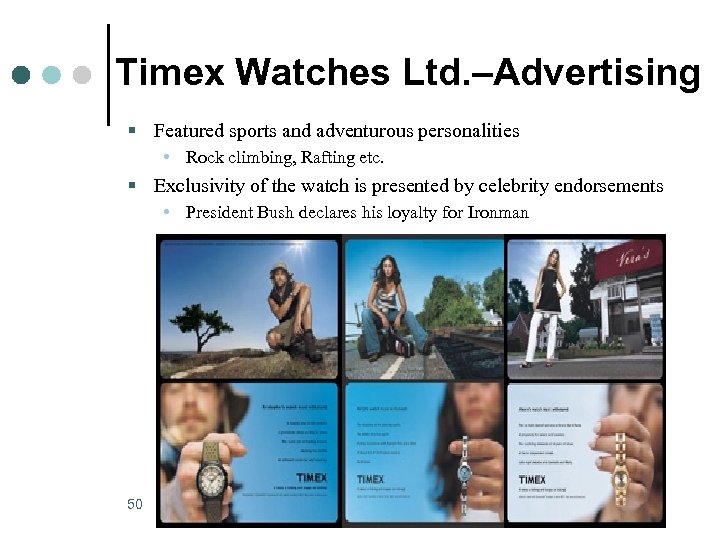

Timex Watches Ltd. –Advertising § Featured sports and adventurous personalities • Rock climbing, Rafting etc. § Exclusivity of the watch is presented by celebrity endorsements • President Bush declares his loyalty for Ironman 50

Timex Watches Ltd. –Advertising § Featured sports and adventurous personalities • Rock climbing, Rafting etc. § Exclusivity of the watch is presented by celebrity endorsements • President Bush declares his loyalty for Ironman 50

Other Players § Westar • • § Shivaki • • § 51 Assembled watch Water proof watch – Rs 350 Failed with the launch of lower priced Titan and HMT products SITCO • • • § Launched in 1996 Southern and Western markets Fashion accessory In problem Maxima • • • § Almost closed down No Brand Equity Upper segment cluttered Lack of distribution strength Analog and digital watches (branded “IQ”) Failed due to lack of sustained promotion and marketing Now planning to cut prices Hyderabad Allwyn Ltd. • • • Launched in 1981 Sourced watch movements from Seiko Lost out due to Organizational problems (PSUs)

Other Players § Westar • • § Shivaki • • § 51 Assembled watch Water proof watch – Rs 350 Failed with the launch of lower priced Titan and HMT products SITCO • • • § Launched in 1996 Southern and Western markets Fashion accessory In problem Maxima • • • § Almost closed down No Brand Equity Upper segment cluttered Lack of distribution strength Analog and digital watches (branded “IQ”) Failed due to lack of sustained promotion and marketing Now planning to cut prices Hyderabad Allwyn Ltd. • • • Launched in 1981 Sourced watch movements from Seiko Lost out due to Organizational problems (PSUs)

The Road Ahead … § More and more focus on new technology and multi functional utility • Timex are the leaders in this area with watches like Internet Messenger Digital Heart Rate Fitness System § Watch consumption in India – 20 units/1000 people as opposed to China – 50/1000 • Scope for increasing the demand of watches § Top 23 cities: 80% of Watch market • The focus should increase on spreading the market to rural areas § Greater price segmentation, sp. lower end • 2 fold advantage: Demand, Market spread § Greater competition from invisible sector and foreign 52 brands

The Road Ahead … § More and more focus on new technology and multi functional utility • Timex are the leaders in this area with watches like Internet Messenger Digital Heart Rate Fitness System § Watch consumption in India – 20 units/1000 people as opposed to China – 50/1000 • Scope for increasing the demand of watches § Top 23 cities: 80% of Watch market • The focus should increase on spreading the market to rural areas § Greater price segmentation, sp. lower end • 2 fold advantage: Demand, Market spread § Greater competition from invisible sector and foreign 52 brands

Sources and Bibliography § Product Management in India, 2 nd Ed. • Ramanuj Majumdar § Segmentation of the Indian Watch Market • Y. L. R. Moorthi, IIMB (http: //www. fba. nus. edu. sg/qm/journals/acrj/India. Watch. M arket. pdf) § http: //www. indiainfoline. com § http: //www. titanworld. com § http: //www. timex. com 53

Sources and Bibliography § Product Management in India, 2 nd Ed. • Ramanuj Majumdar § Segmentation of the Indian Watch Market • Y. L. R. Moorthi, IIMB (http: //www. fba. nus. edu. sg/qm/journals/acrj/India. Watch. M arket. pdf) § http: //www. indiainfoline. com § http: //www. titanworld. com § http: //www. timex. com 53

Thank you 54

Thank you 54