f8ed7ea6ef6cee3b7239cfb701b56aea.ppt

- Количество слайдов: 37

World Trends in EWP Presentation to Joint ECE Timber Committee & FAO European Forestry Commission October 10, 2000 Rome, Italy Al Schuler – USDA Forest Service Craig Adair – APA – The Engineered Wood Association Ed Elias – APA – The Engineered Wood Association

World Trends in EWP Presentation to Joint ECE Timber Committee & FAO European Forestry Commission October 10, 2000 Rome, Italy Al Schuler – USDA Forest Service Craig Adair – APA – The Engineered Wood Association Ed Elias – APA – The Engineered Wood Association

Outline 1. Definition of EWP 2. Compare/contrast world demand/end use applications 3. Demand drivers and outlook for next few years

Outline 1. Definition of EWP 2. Compare/contrast world demand/end use applications 3. Demand drivers and outlook for next few years

1. EWP Definitions • 1. Structural Composite Lumber (SCL) – Laminated Veneer Lumber (LVL) – Parallel Strand Lumber (PSL) – Oriented Strand Lumber (OSL) • 2. Wood I-Beams • 3. Glued Laminated Timber (Glulam)

1. EWP Definitions • 1. Structural Composite Lumber (SCL) – Laminated Veneer Lumber (LVL) – Parallel Strand Lumber (PSL) – Oriented Strand Lumber (OSL) • 2. Wood I-Beams • 3. Glued Laminated Timber (Glulam)

2. World Demand Trends for EWP · EWP versus conventional wood products · Compare & contrast demand in North America vs Europe vs Asia · Why the major differences? ?

2. World Demand Trends for EWP · EWP versus conventional wood products · Compare & contrast demand in North America vs Europe vs Asia · Why the major differences? ?

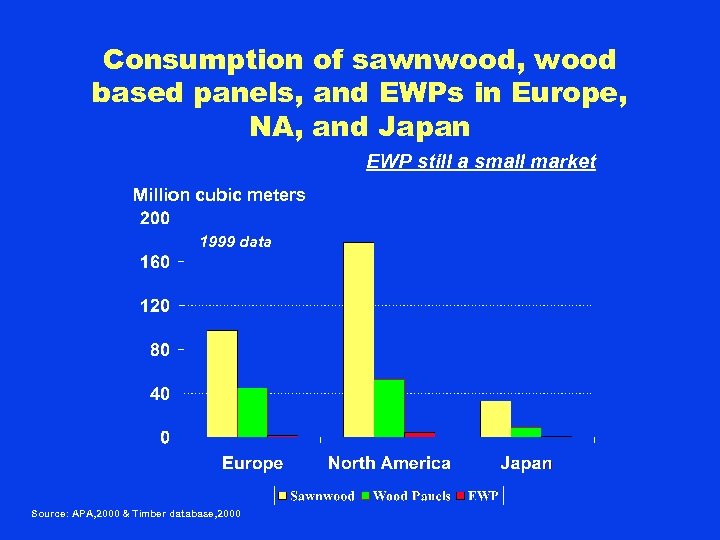

Consumption of sawnwood, wood based panels, and EWPs in Europe, NA, and Japan EWP still a small market Million cubic meters 1999 data Source: APA, 2000 & Timber database, 2000

Consumption of sawnwood, wood based panels, and EWPs in Europe, NA, and Japan EWP still a small market Million cubic meters 1999 data Source: APA, 2000 & Timber database, 2000

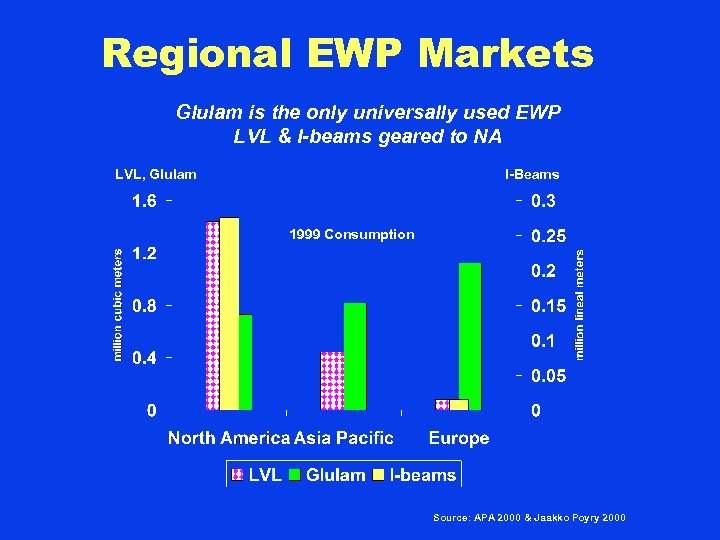

Regional EWP Markets Glulam is the only universally used EWP LVL & I-beams geared to NA LVL, Glulam I-Beams 1999 Consumption Source: APA 2000 & Jaakko Poyry 2000

Regional EWP Markets Glulam is the only universally used EWP LVL & I-beams geared to NA LVL, Glulam I-Beams 1999 Consumption Source: APA 2000 & Jaakko Poyry 2000

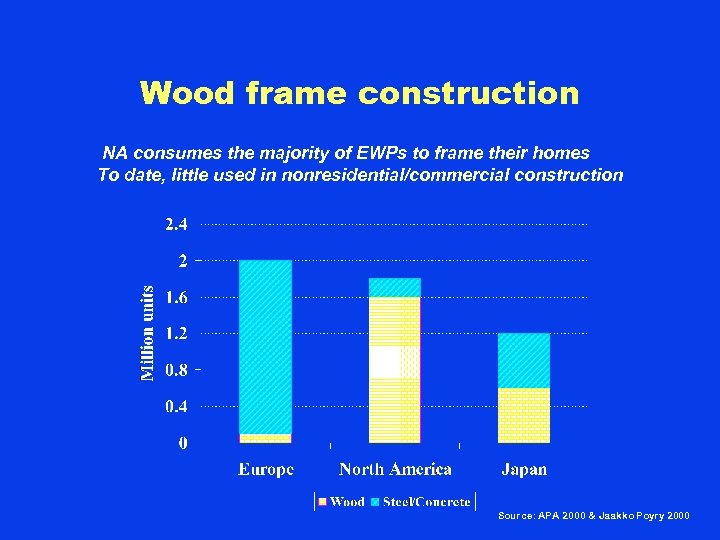

Wood frame construction NA consumes the majority of EWPs to frame their homes To date, little used in nonresidential/commercial construction Source: APA 2000 & Jaakko Poyry 2000

Wood frame construction NA consumes the majority of EWPs to frame their homes To date, little used in nonresidential/commercial construction Source: APA 2000 & Jaakko Poyry 2000

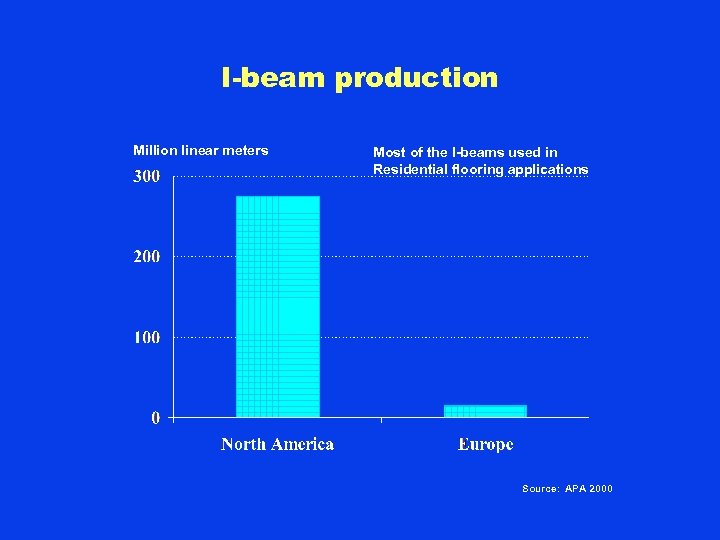

I-beam production Million linear meters Most of the I-beams used in Residential flooring applications Source: APA 2000

I-beam production Million linear meters Most of the I-beams used in Residential flooring applications Source: APA 2000

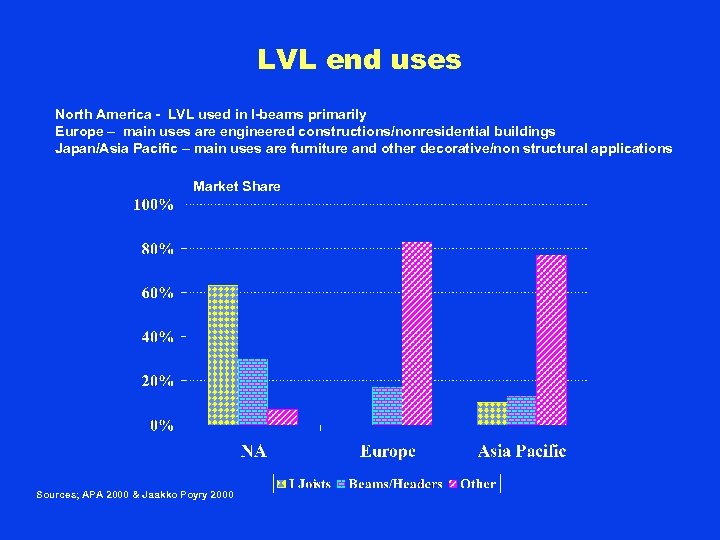

LVL end uses North America - LVL used in I-beams primarily Europe – main uses are engineered constructions/nonresidential buildings Japan/Asia Pacific – main uses are furniture and other decorative/non structural applications Market Share Sources; APA 2000 & Jaakko Poyry 2000

LVL end uses North America - LVL used in I-beams primarily Europe – main uses are engineered constructions/nonresidential buildings Japan/Asia Pacific – main uses are furniture and other decorative/non structural applications Market Share Sources; APA 2000 & Jaakko Poyry 2000

North American EWP Markets Glulam I-beams SCL* New Homes 52%38% 83% 7% 60%20% Nonres. Buildings 10% = 20% = Renovation Export/Other 100% * Structural composite lumber products not used to make Ijoists.

North American EWP Markets Glulam I-beams SCL* New Homes 52%38% 83% 7% 60%20% Nonres. Buildings 10% = 20% = Renovation Export/Other 100% * Structural composite lumber products not used to make Ijoists.

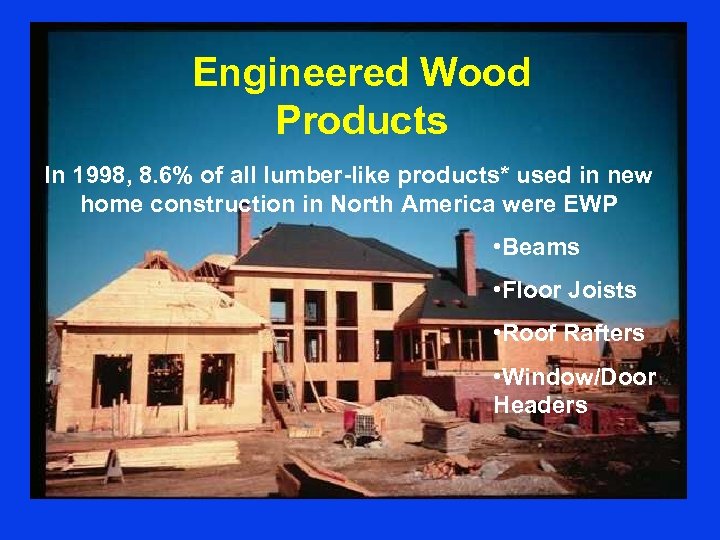

Engineered Wood Products In 1998, 8. 6% of all lumber-like products* used in new home construction in North America were EWP • Beams • Floor Joists • Roof Rafters • Window/Door Headers * Lumber products only. Panels excluded.

Engineered Wood Products In 1998, 8. 6% of all lumber-like products* used in new home construction in North America were EWP • Beams • Floor Joists • Roof Rafters • Window/Door Headers * Lumber products only. Panels excluded.

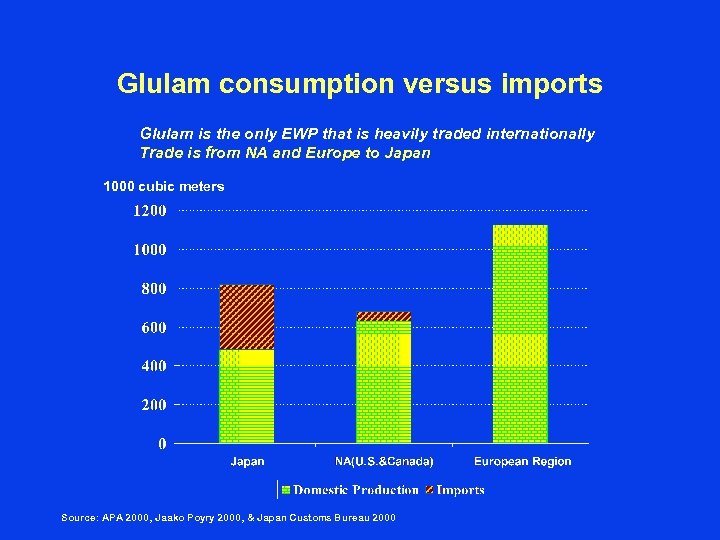

Glulam consumption versus imports Glulam is the only EWP that is heavily traded internationally Trade is from NA and Europe to Japan 1000 cubic meters Source: APA 2000, Jaako Poyry 2000, & Japan Customs Bureau 2000

Glulam consumption versus imports Glulam is the only EWP that is heavily traded internationally Trade is from NA and Europe to Japan 1000 cubic meters Source: APA 2000, Jaako Poyry 2000, & Japan Customs Bureau 2000

3. Outlook

3. Outlook

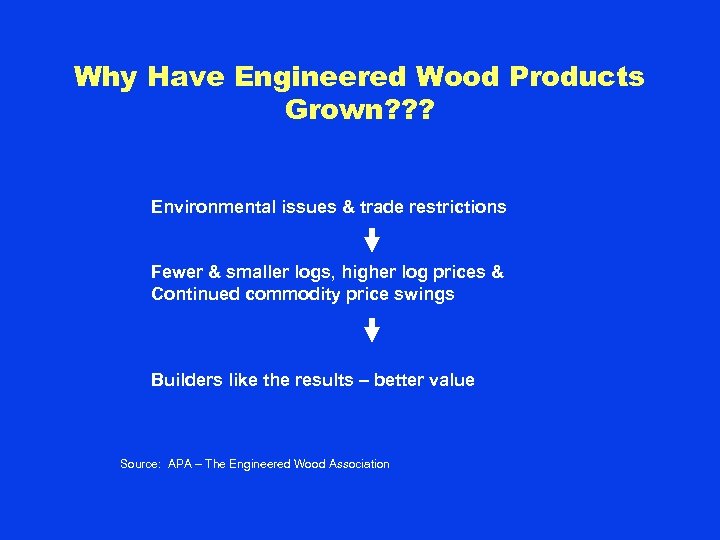

Why Have Engineered Wood Products Grown? ? ? Environmental issues & trade restrictions Fewer & smaller logs, higher log prices & Continued commodity price swings Builders like the results – better value Source: APA – The Engineered Wood Association

Why Have Engineered Wood Products Grown? ? ? Environmental issues & trade restrictions Fewer & smaller logs, higher log prices & Continued commodity price swings Builders like the results – better value Source: APA – The Engineered Wood Association

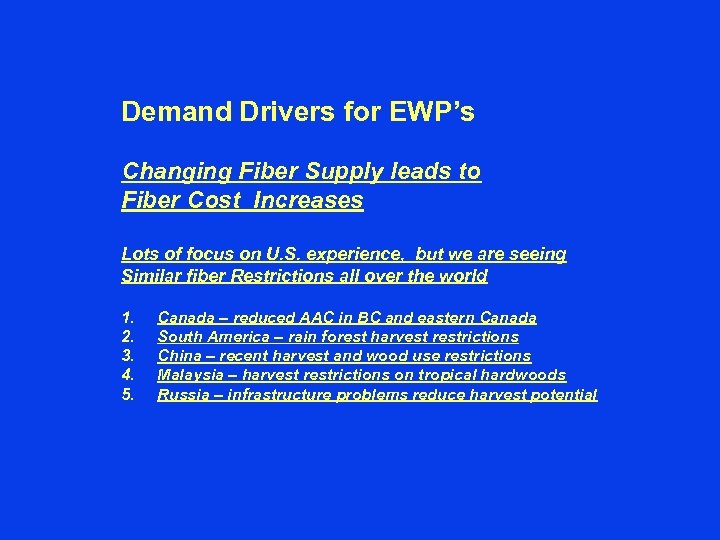

Demand Drivers for EWP’s Changing Fiber Supply leads to Fiber Cost Increases Lots of focus on U. S. experience, but we are seeing Similar fiber Restrictions all over the world 1. 2. 3. 4. 5. Canada – reduced AAC in BC and eastern Canada South America – rain forest harvest restrictions China – recent harvest and wood use restrictions Malaysia – harvest restrictions on tropical hardwoods Russia – infrastructure problems reduce harvest potential

Demand Drivers for EWP’s Changing Fiber Supply leads to Fiber Cost Increases Lots of focus on U. S. experience, but we are seeing Similar fiber Restrictions all over the world 1. 2. 3. 4. 5. Canada – reduced AAC in BC and eastern Canada South America – rain forest harvest restrictions China – recent harvest and wood use restrictions Malaysia – harvest restrictions on tropical hardwoods Russia – infrastructure problems reduce harvest potential

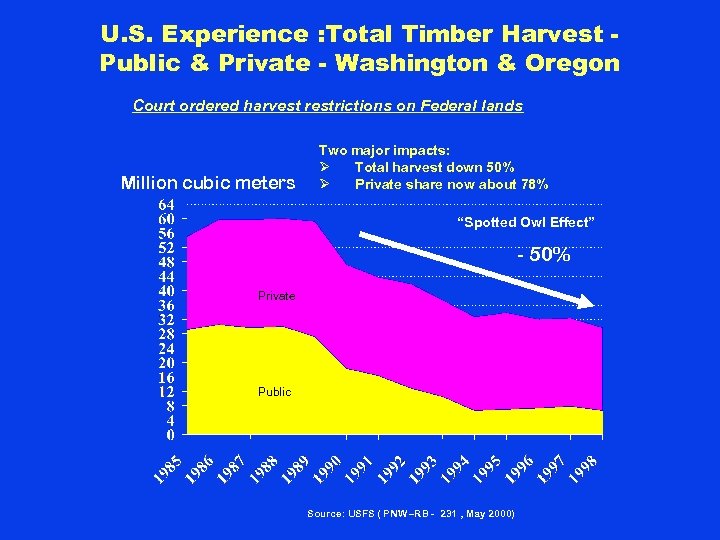

U. S. Experience : Total Timber Harvest Public & Private - Washington & Oregon Court ordered harvest restrictions on Federal lands Million cubic meters Two major impacts: Ø Total harvest down 50% Ø Private share now about 78% “Spotted Owl Effect” - 50% Private Public Source: USFS ( PNW –RB - 231 , May 2000)

U. S. Experience : Total Timber Harvest Public & Private - Washington & Oregon Court ordered harvest restrictions on Federal lands Million cubic meters Two major impacts: Ø Total harvest down 50% Ø Private share now about 78% “Spotted Owl Effect” - 50% Private Public Source: USFS ( PNW –RB - 231 , May 2000)

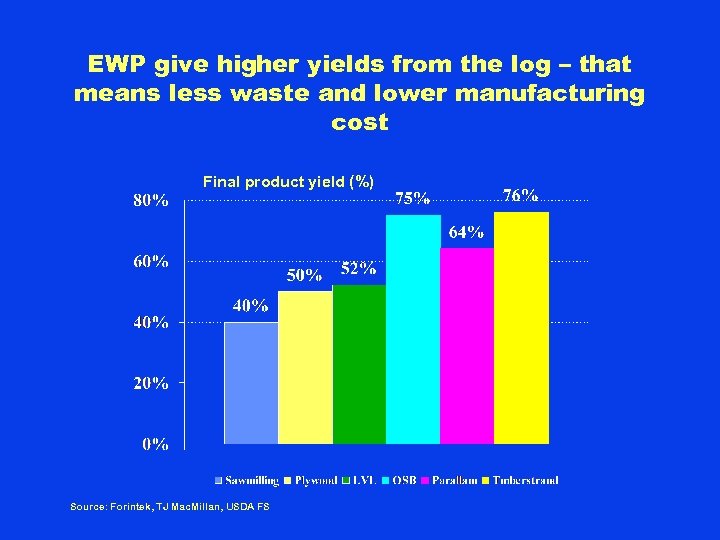

EWP give higher yields from the log – that means less waste and lower manufacturing cost Final product yield (%) Source: Forintek, TJ Mac. Millan, USDA FS

EWP give higher yields from the log – that means less waste and lower manufacturing cost Final product yield (%) Source: Forintek, TJ Mac. Millan, USDA FS

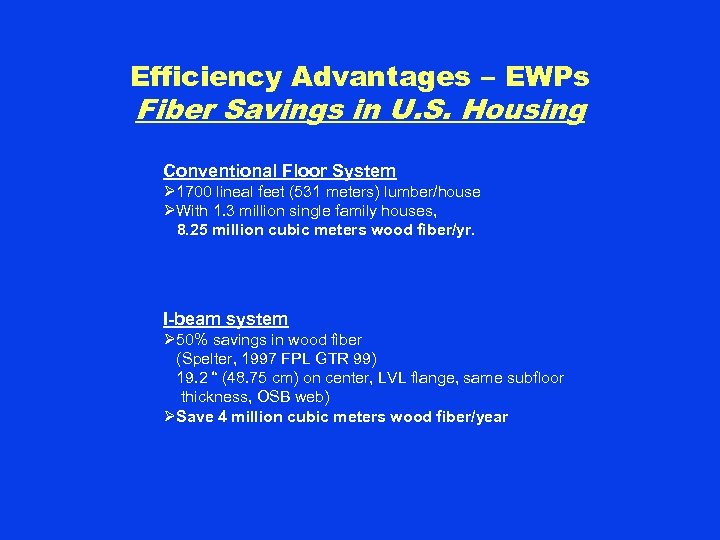

Efficiency Advantages – EWPs Fiber Savings in U. S. Housing Conventional Floor System Ø 1700 lineal feet (531 meters) lumber/house ØWith 1. 3 million single family houses, 8. 25 million cubic meters wood fiber/yr. I-beam system Ø 50% savings in wood fiber (Spelter, 1997 FPL GTR 99) 19. 2 “ (48. 75 cm) on center, LVL flange, same subfloor thickness, OSB web) ØSave 4 million cubic meters wood fiber/year

Efficiency Advantages – EWPs Fiber Savings in U. S. Housing Conventional Floor System Ø 1700 lineal feet (531 meters) lumber/house ØWith 1. 3 million single family houses, 8. 25 million cubic meters wood fiber/yr. I-beam system Ø 50% savings in wood fiber (Spelter, 1997 FPL GTR 99) 19. 2 “ (48. 75 cm) on center, LVL flange, same subfloor thickness, OSB web) ØSave 4 million cubic meters wood fiber/year

Demand Drivers for EWP’s Builders/customers like the product due to Better Quality and less Price Volatility

Demand Drivers for EWP’s Builders/customers like the product due to Better Quality and less Price Volatility

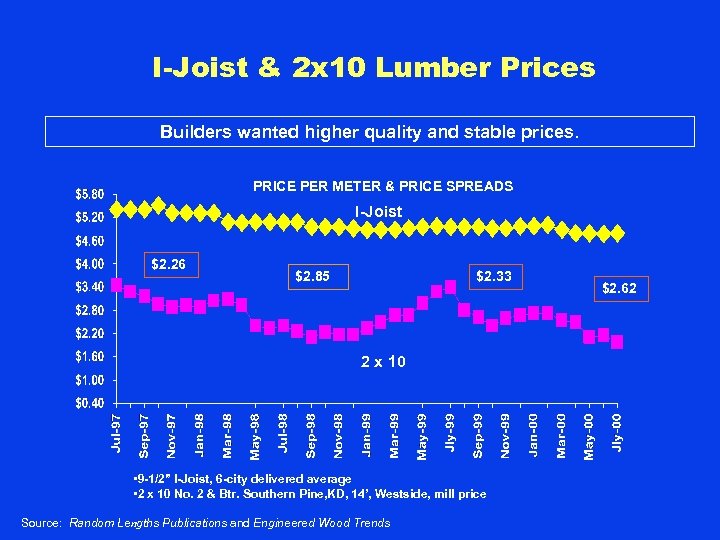

I-Joist & 2 x 10 Lumber Prices Builders wanted higher quality and stable prices. PRICE PER METER & PRICE SPREADS I-Joist $2. 26 $2. 85 $2. 33 2 x 10 • 9 -1/2” I-Joist, 6 -city delivered average • 2 x 10 No. 2 & Btr. Southern Pine, KD, 14’, Westside, mill price Source: Random Lengths Publications and Engineered Wood Trends $2. 62

I-Joist & 2 x 10 Lumber Prices Builders wanted higher quality and stable prices. PRICE PER METER & PRICE SPREADS I-Joist $2. 26 $2. 85 $2. 33 2 x 10 • 9 -1/2” I-Joist, 6 -city delivered average • 2 x 10 No. 2 & Btr. Southern Pine, KD, 14’, Westside, mill price Source: Random Lengths Publications and Engineered Wood Trends $2. 62

Demand Drivers for EWP’s Demographics – aging population favors labor saving construction techniques

Demand Drivers for EWP’s Demographics – aging population favors labor saving construction techniques

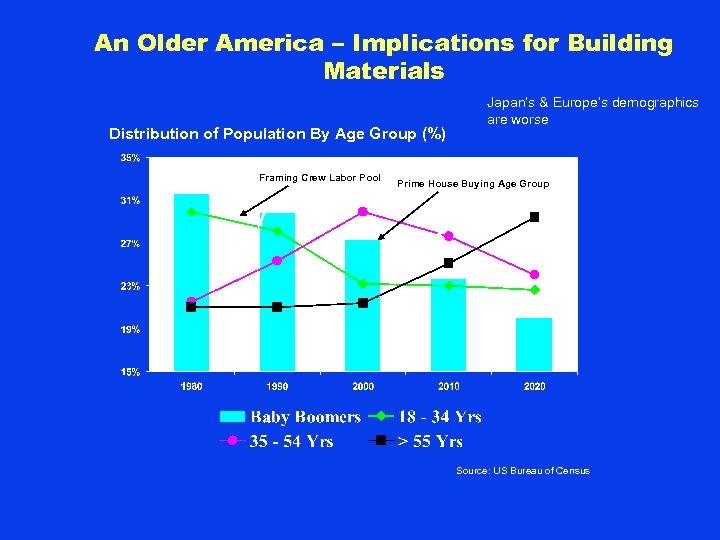

An Older America – Implications for Building Materials Distribution of Population By Age Group (%) Framing Crew Labor Pool Japan’s & Europe’s demographics are worse Prime House Buying Age Group Source: US Bureau of Census

An Older America – Implications for Building Materials Distribution of Population By Age Group (%) Framing Crew Labor Pool Japan’s & Europe’s demographics are worse Prime House Buying Age Group Source: US Bureau of Census

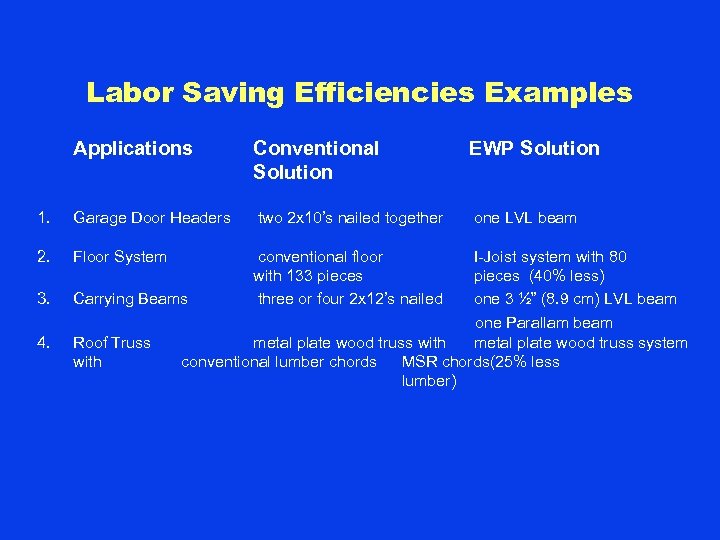

Labor Saving Efficiencies Examples Applications Conventional Solution EWP Solution 1. Garage Door Headers two 2 x 10’s nailed together one LVL beam 2. Floor System conventional floor with 133 pieces three or four 2 x 12’s nailed 3. 4. I-Joist system with 80 pieces (40% less) Carrying Beams one 3 ½” (8. 9 cm) LVL beam one Parallam beam Roof Truss metal plate wood truss with metal plate wood truss system with conventional lumber chords MSR chords(25% less lumber)

Labor Saving Efficiencies Examples Applications Conventional Solution EWP Solution 1. Garage Door Headers two 2 x 10’s nailed together one LVL beam 2. Floor System conventional floor with 133 pieces three or four 2 x 12’s nailed 3. 4. I-Joist system with 80 pieces (40% less) Carrying Beams one 3 ½” (8. 9 cm) LVL beam one Parallam beam Roof Truss metal plate wood truss with metal plate wood truss system with conventional lumber chords MSR chords(25% less lumber)

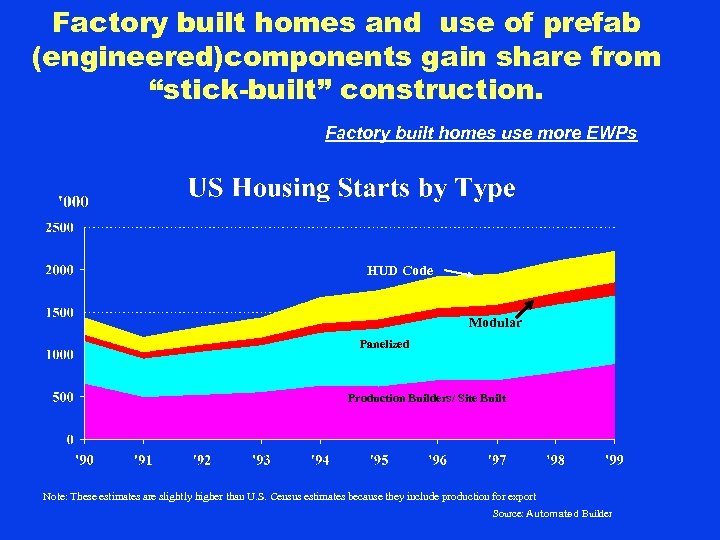

Factory built homes and use of prefab (engineered)components gain share from “stick-built” construction. Factory built homes use more EWPs HUD Code Modular Panelized Production Builders/ Site Built Note: These estimates are slightly higher than U. S. Census estimates because they include production for export Source: Automated Builder

Factory built homes and use of prefab (engineered)components gain share from “stick-built” construction. Factory built homes use more EWPs HUD Code Modular Panelized Production Builders/ Site Built Note: These estimates are slightly higher than U. S. Census estimates because they include production for export Source: Automated Builder

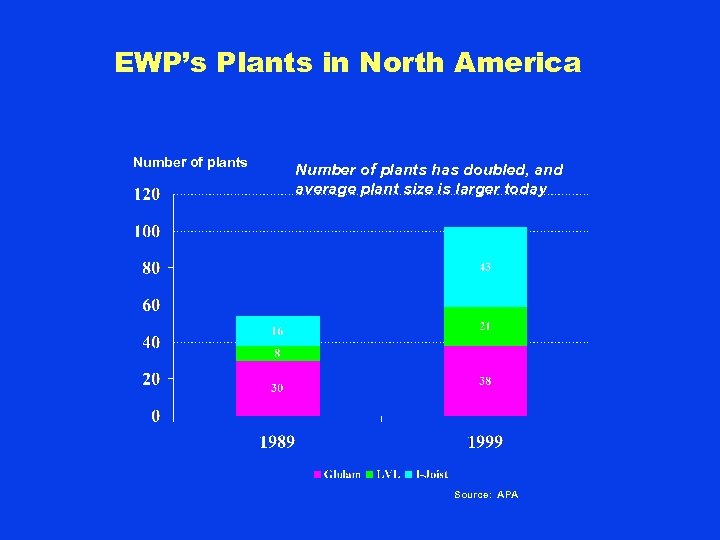

EWP’s Plants in North America Number of plants has doubled, and average plant size is larger today Source: APA

EWP’s Plants in North America Number of plants has doubled, and average plant size is larger today Source: APA

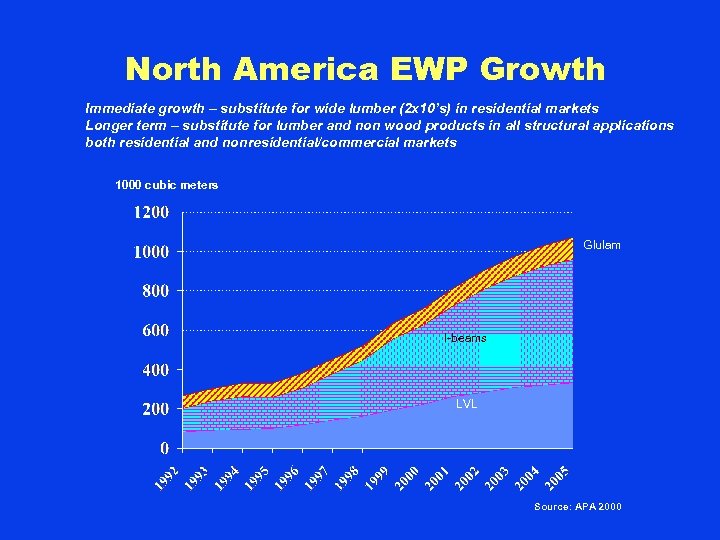

North America EWP Growth Immediate growth – substitute for wide lumber (2 x 10’s) in residential markets Longer term – substitute for lumber and non wood products in all structural applications both residential and nonresidential/commercial markets 1000 cubic meters Glulam I-beams LVL Source: APA 2000

North America EWP Growth Immediate growth – substitute for wide lumber (2 x 10’s) in residential markets Longer term – substitute for lumber and non wood products in all structural applications both residential and nonresidential/commercial markets 1000 cubic meters Glulam I-beams LVL Source: APA 2000

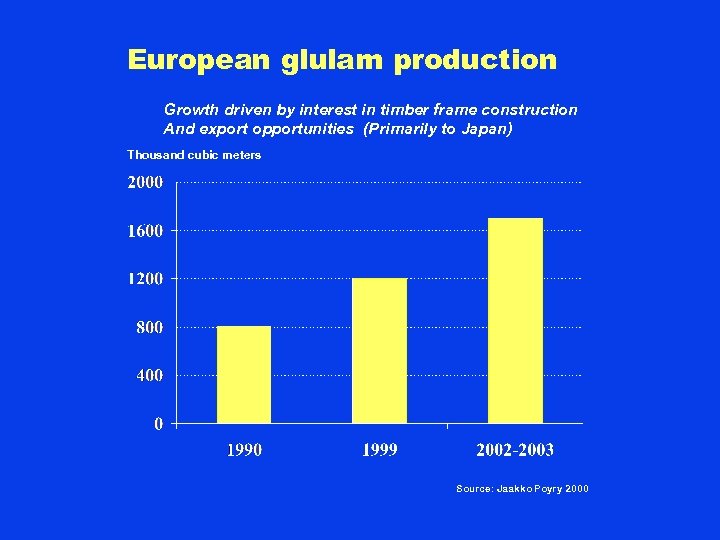

European glulam production Growth driven by interest in timber frame construction And export opportunities (Primarily to Japan) Thousand cubic meters Source: Jaakko Poyry 2000

European glulam production Growth driven by interest in timber frame construction And export opportunities (Primarily to Japan) Thousand cubic meters Source: Jaakko Poyry 2000

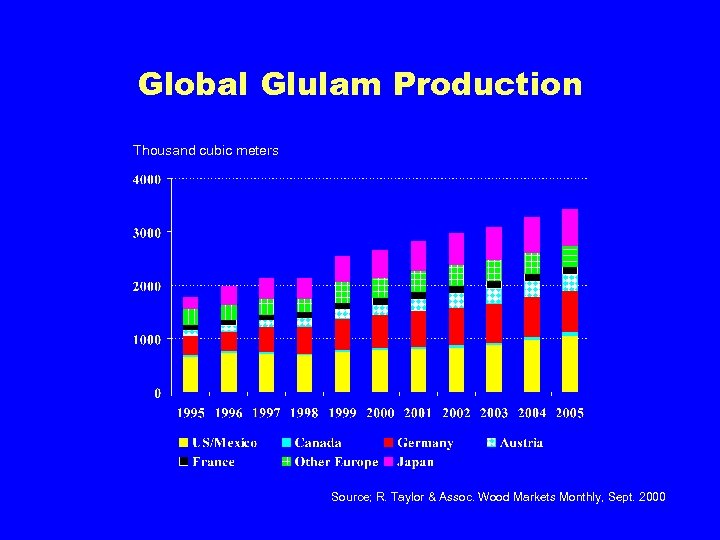

Global Glulam Production Thousand cubic meters Source; R. Taylor & Assoc. Wood Markets Monthly, Sept. 2000

Global Glulam Production Thousand cubic meters Source; R. Taylor & Assoc. Wood Markets Monthly, Sept. 2000

Global LVL Production Thousand cubic meters Source: R. Taylor & Assoc. , Wood Markets Monthly, Sept. 2000

Global LVL Production Thousand cubic meters Source: R. Taylor & Assoc. , Wood Markets Monthly, Sept. 2000

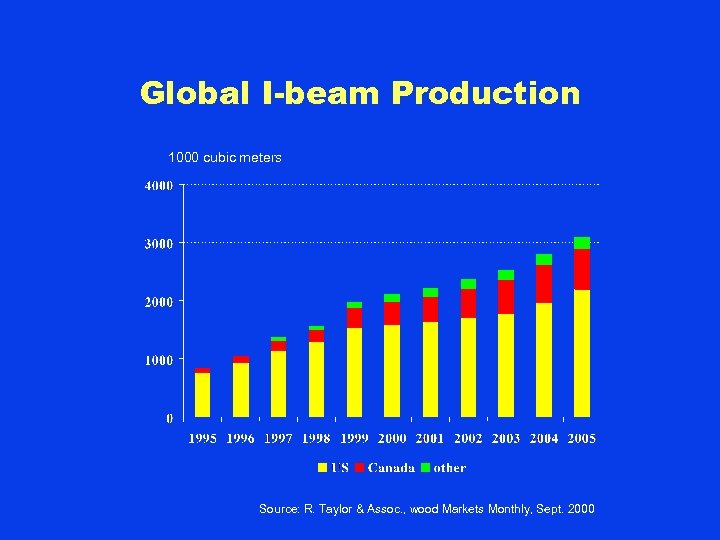

Global I-beam Production 1000 cubic meters Source: R. Taylor & Assoc. , wood Markets Monthly, Sept. 2000

Global I-beam Production 1000 cubic meters Source: R. Taylor & Assoc. , wood Markets Monthly, Sept. 2000

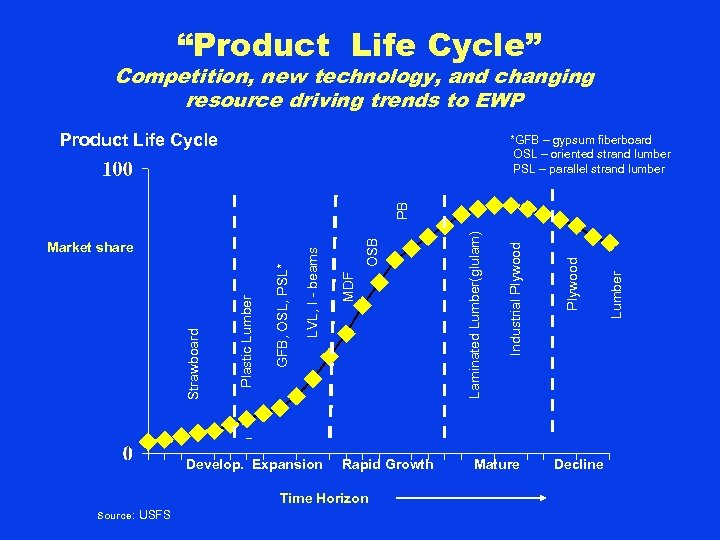

“Product Life Cycle” Competition, new technology, and changing resource driving trends to EWP Product Life Cycle Develop. Expansion Rapid Growth Time Horizon Source: USFS Mature Decline Lumber Plywood Industrial Plywood Laminated Lumber(glulam) OSB MDF GFB, OSL, PSL* Plastic Lumber Strawboard Market share LVL, I - beams PB *GFB – gypsum fiberboard OSL – oriented strand lumber PSL – parallel strand lumber

“Product Life Cycle” Competition, new technology, and changing resource driving trends to EWP Product Life Cycle Develop. Expansion Rapid Growth Time Horizon Source: USFS Mature Decline Lumber Plywood Industrial Plywood Laminated Lumber(glulam) OSB MDF GFB, OSL, PSL* Plastic Lumber Strawboard Market share LVL, I - beams PB *GFB – gypsum fiberboard OSL – oriented strand lumber PSL – parallel strand lumber

Potential Problems for EWPs Adding capacity too quickly easy to do with new markets

Potential Problems for EWPs Adding capacity too quickly easy to do with new markets

MSR Premiums Shrink as Production Soars Premium to #1&2 Million BF Source: Random Lengths, MSR Lbr. Producer’s Council

MSR Premiums Shrink as Production Soars Premium to #1&2 Million BF Source: Random Lengths, MSR Lbr. Producer’s Council

Future Fiber Supply Uncertain? ? ? EWPs offer additional flexibility to use whatever fiber is available Why? ? Here are two reasons!!!! > New conversion systems focused on small log resource e. g. flaking machines for SCL (LVL, OSL, PSL) > New resin technology/systems let us use more species

Future Fiber Supply Uncertain? ? ? EWPs offer additional flexibility to use whatever fiber is available Why? ? Here are two reasons!!!! > New conversion systems focused on small log resource e. g. flaking machines for SCL (LVL, OSL, PSL) > New resin technology/systems let us use more species

Facts: 1. We don’t use the majority of the species available to us 2. Now, old growth is becoming “off limits” 3. Plantation forests offer opportunities to grow “pulpwood” size trees in a fraction of the time required to grow “conventional size” fiber 4. EWPs technology allows us to use a wider range of available fiber

Facts: 1. We don’t use the majority of the species available to us 2. Now, old growth is becoming “off limits” 3. Plantation forests offer opportunities to grow “pulpwood” size trees in a fraction of the time required to grow “conventional size” fiber 4. EWPs technology allows us to use a wider range of available fiber