07447d958a7b0244e4c18268fcffe503.ppt

- Количество слайдов: 26

World Savings Banks Institute (WSBI) European Savings Banks Group (ESBG) Payments in the Americas Comparing Experiences: « PE-ACH » Norbert Bielefeld Deputy Director Atlanta – 8 Oct. 2004

Foreword n Purpose of « Panel 2 » : « …focus on the experiences of building cross-border exchanges in Asia and Europe, with particular emphasis on their lessons for the Americas…. » n Europe The experience goes beyond « remittances » , and is broader and deeper than « PE-ACH »

Agenda n A vision n Defining SEPA n How it is being built n Baseline n Dimensions, constraints n Interim status n Lessons for the Americas n Remittances, more specifically

Imagine… n A geographical area… n … where any customer could step onto any plane, paying the same price, getting the same service, regardless of the destination, … n Or: …make and receive any phone call, regardless of the distance, with the same convenience, and at the same price, … n Or: n …make and receive any payment with the same convenience, and at the same price…

For payments… n Such an area will exist by 2010 at the latest n In the Single Euro Payments Area (SEPA): « Customers will be able to make and receive retail and commercial payments in euro with the same level of security, ease and convenience, than they do in their hometown » n Note: precise perimeter of « SEPA » is function of payment instrument considered (credit transfer, direct debit, cards, cash) n Can be: eurozone, EU +EEA, +CH

How banks build SEPA n A phased programme, n First to deliver pan-European instruments and schemes, n To be subsequently adopted by national systems, n At a pace determined by communities and supported by regulators, n This reflects customer demand rather than a pure « push » approach n EPC (European Payments Council) schemes to be attractive to operators, other market actors and their communities: market forces dictate the evolving landscape

The banks’ focus n Continuation of plans to establish a genuine euro-cash area n During next 2 years, formulation of 3 pan-European « schemes » (rule books with data formats, rules, liabilities, …) for pan-European: - Credit transfers - Direct debits - Debit and credit cards n For voluntary adoption by market operators, and migration of national solution as decided by national communities, and required by customers n Delivery: 2008 - 2010

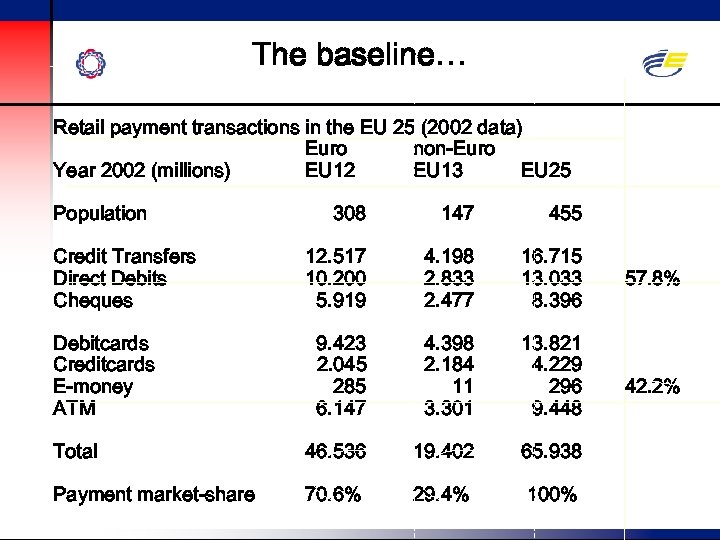

The baseline… Retail payment transactions in the EU 25 (2002 data) Euro non-Euro Year 2002 (millions) EU 12 EU 13 EU 25 Population 308 147 455 12. 517 10. 200 5. 919 4. 198 2. 833 2. 477 16. 715 13. 033 8. 396 9. 423 2. 045 285 6. 147 4. 398 2. 184 11 3. 301 13. 821 4. 229 296 9. 448 Total 46. 536 19. 402 65. 938 Payment market-share 70. 6% 29. 4% 100% Credit Transfers Direct Debits Cheques Debitcards Creditcards E-money ATM 57. 8% 42. 2%

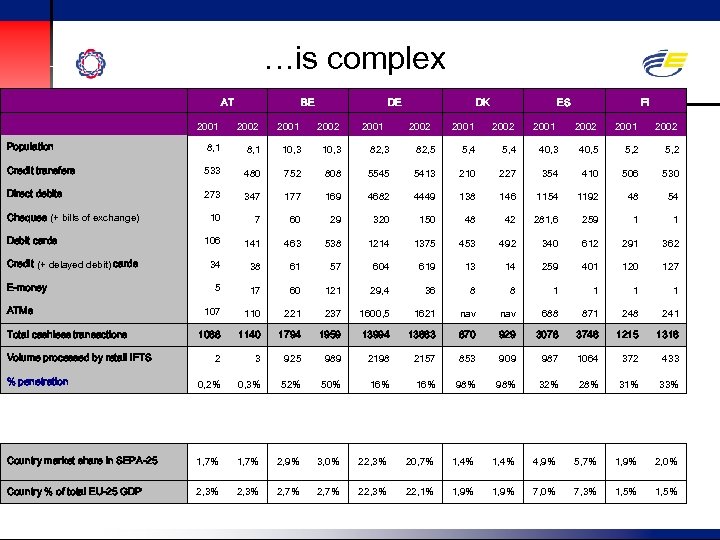

…is complex AT BE DE 2001 2002 Population 8, 1 10, 3 82, 3 Credit transfers 533 480 752 808 Direct debits 273 347 177 10 7 2002 40, 3 40, 5 5, 2 227 354 410 506 530 138 146 1154 1192 48 54 150 48 42 281, 6 259 1 1 106 1214 1375 453 492 340 612 291 362 57 604 619 13 14 259 401 120 127 60 121 29, 4 36 8 8 1 1 110 221 237 1600, 5 1621 nav 688 871 248 241 1068 1140 1794 1959 13994 13663 870 929 3078 3746 1215 1316 2 3 925 989 2198 2157 853 909 987 1064 372 433 0, 2% 0, 3% 52% 50% 16% 98% 32% 28% 31% 33% Country market share in SEPA-25 1, 7% 2, 9% 3, 0% 22, 3% 20, 7% 1, 4% 4, 9% 5, 7% 1, 9% 2, 0% Country % of total EU-25 GDP 2, 3% 2, 7% 22, 3% 22, 1% 1, 9% 7, 0% 7, 3% 1, 5% Credit (+ delayed debit) cards E-money ATMs Total cashless transactions Volume processed by retail IFTS % penetration 2001 2002 82, 5 5, 4 5545 5413 210 169 4682 4449 60 29 320 141 463 538 34 38 61 5 17 107 2001 FI 2001 Debit cards 2002 ES 2002 Cheques (+ bills of exchange) 2001 DK

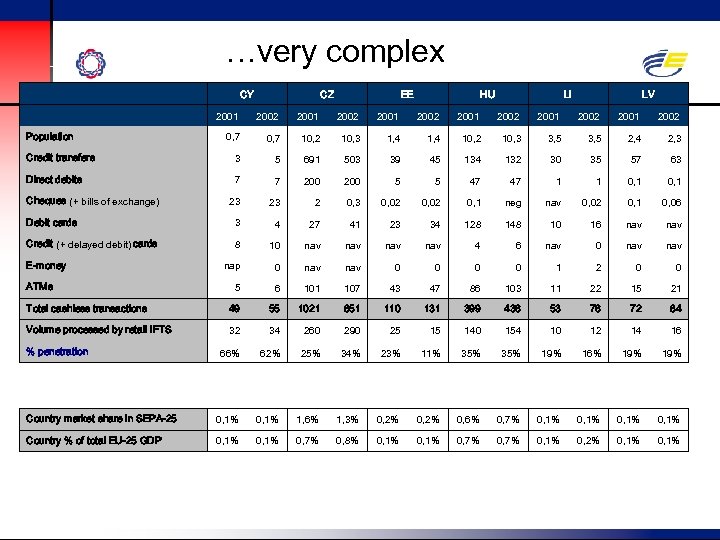

…very complex CY CZ EE HU LI LV 2001 2002 2001 2002 0, 7 10, 2 10, 3 1, 4 10, 2 10, 3 3, 5 2, 4 2, 3 Credit transfers 3 5 691 503 39 45 134 132 30 35 57 63 Direct debits 7 7 200 5 5 47 47 1 1 0, 1 23 23 2 0, 3 0, 02 0, 1 neg nav 0, 02 0, 1 0, 06 Debit cards 3 4 27 41 23 34 128 148 10 16 nav Credit (+ delayed debit) cards 8 10 nav nav 4 6 nav 0 nav nap 0 nav 0 0 1 2 0 0 5 6 101 107 43 47 86 103 11 22 15 21 Total cashless transactions 49 55 1021 851 110 131 399 436 53 76 72 84 Volume processed by retail IFTS 32 34 260 290 25 15 140 154 10 12 14 16 66% 62% 25% 34% 23% 11% 35% 19% 16% 19% Country market share in SEPA-25 0, 1% 1, 6% 1, 3% 0, 2% 0, 6% 0, 7% 0, 1% Country % of total EU-25 GDP 0, 1% 0, 7% 0, 8% 0, 1% 0, 7% 0, 1% 0, 2% 0, 1% Population Cheques (+ bills of exchange) E-money ATMs % penetration

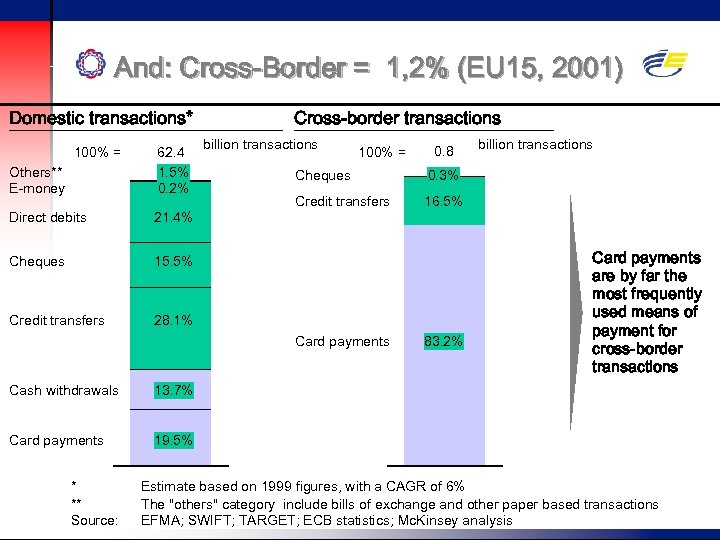

And: Cross-Border = 1, 2% (EU 15, 2001) Domestic transactions* 100% = Others** E-money 62. 4 1. 5% 0. 2% Direct debits 21. 4% Cheques billion transactions 100% = 0. 8 15. 5% Credit transfers Cross-border transactions 28. 1% Cheques 0. 3% Credit transfers 16. 5% Card payments Cash withdrawals 83. 2% Card payments are by far the most frequently used means of payment for cross-border transactions 13. 7% Card payments billion transactions 19. 5% n n n * ** Source: Estimate based on 1999 figures, with a CAGR of 6% The "others" category include bills of exchange and other paper based transactions EFMA; SWIFT; TARGET; ECB statistics; Mc. Kinsey analysis

Dimensions, constraints n Multi-payment instrument approach: credit transfers, direct debits, debit/credit cards n Highly efficient, existing non-cash payment systems n « cross-border » solutions in operation for over 15 years n Any new solution to be full STP, end-to-end from the beginning n Profound re-engineering of payment systems to ensue n Standardization (different levels): significant work item n Technology is not a barrier n There is no obvious business case!

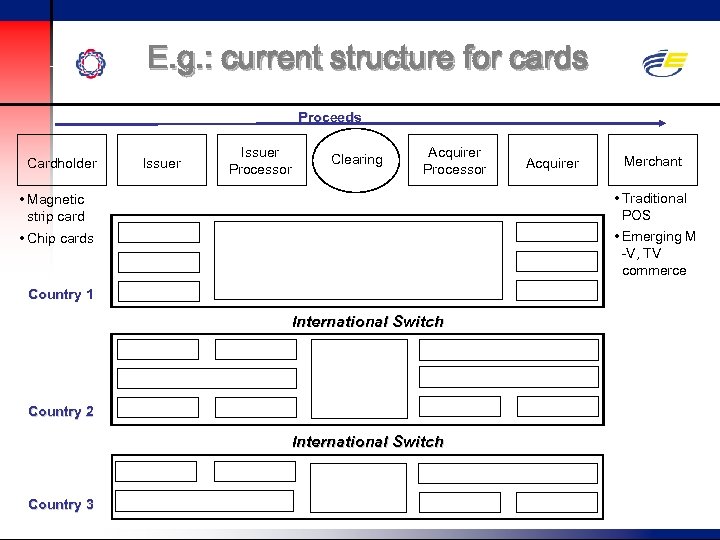

E. g. : current structure for cards Proceeds Cardholder Issuer Processor Clearing Acquirer Processor Merchant • Traditional POS • Emerging M -V, TV commerce • Magnetic strip card • Chip cards Country 1 International Switch Country 2 International Switch Country 3 Acquirer

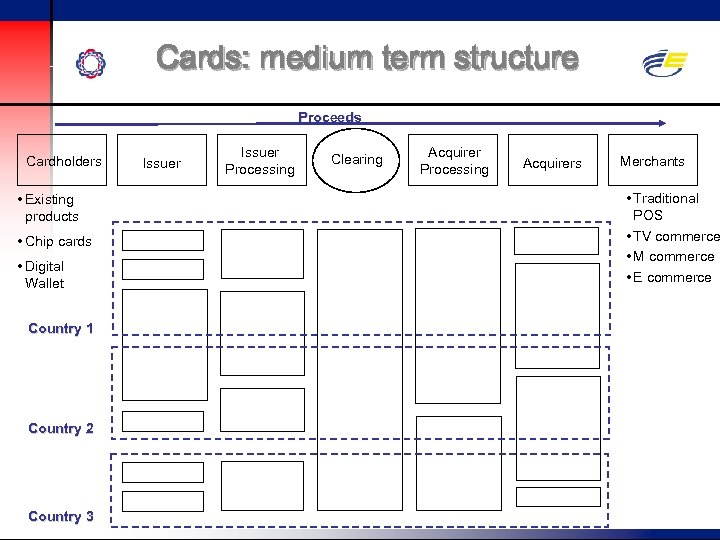

Cards: medium term structure Proceeds Cardholders • Existing products • Chip cards • Digital Wallet Country 1 Country 2 Country 3 Issuer Processing Clearing Acquirer Processing Acquirers Merchants • Traditional POS • TV commerce • M commerce • E commerce

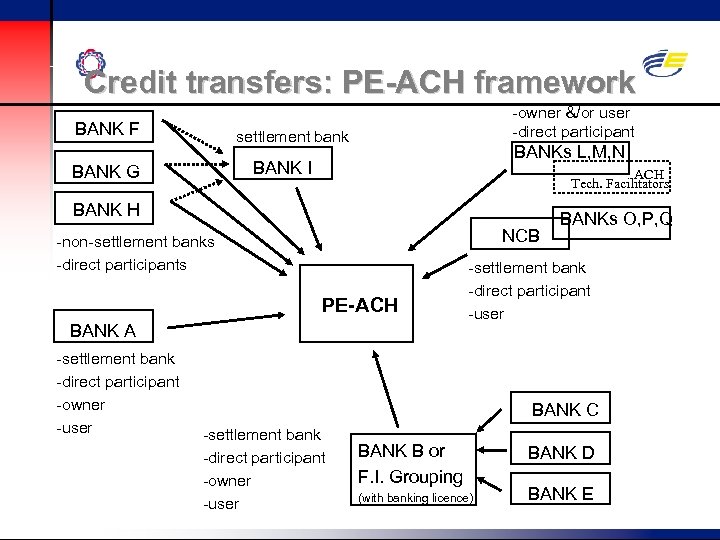

Credit transfers: PE-ACH framework BANK F -owner &/or user -direct participant settlement bank BANKs L, M, N BANK I BANK G ACH Tech. Facilitators BANK H NCB -non-settlement banks -direct participants PE-ACH BANK A -settlement bank -direct participant -owner -user BANKs O, P, Q -settlement bank -direct participant -user BANK C -settlement bank -direct participant -owner -user BANK B or F. I. Grouping (with banking licence) BANK D BANK E

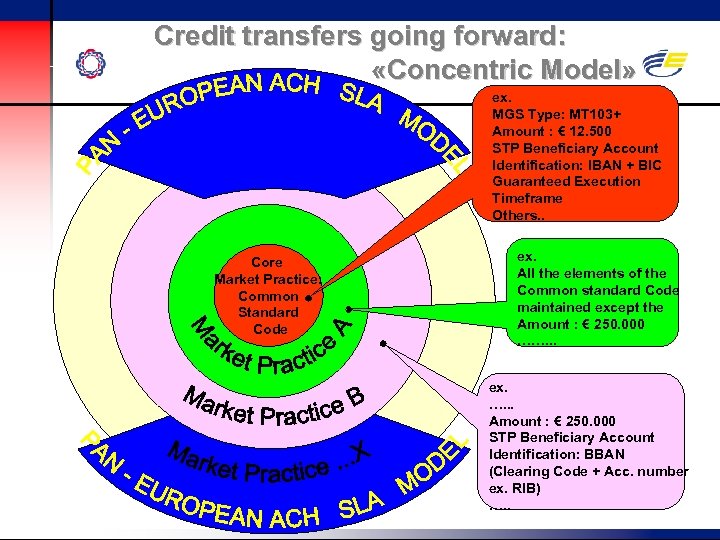

Credit transfers going forward: «Concentric Model» ex. MGS Type: MT 103+ Amount : € 12. 500 STP Beneficiary Account Identification: IBAN + BIC Guaranteed Execution Timeframe Others. . Core Market Practice: Common Standard Code ex. All the elements of the Common standard Code maintained except the Amount : € 250. 000 ……. . . ex. …. . . Amount : € 250. 000 STP Beneficiary Account Identification: BBAN (Clearing Code + Acc. number ex. RIB) …. .

An essential component n Pan-European settlement systems n TARGET 1: interlinking of national RTGS systems n EBA Euro 1: Lamfalussy-compliant net settlement system (settling in TARGET) n General Functional Specifications of TARGET 2 debated and agreed (although this goes beyond retail and commercial payments) n Planned deployment of TARGET 2 as Single Shared Platform: 2007

Interim status n n n Conventions for basic credit transfers (Credeuro) and their interbank handling (ICP) implemented, architecture for clearing defined (PE-ACH), 1 st operator active (STEP 2) Cards: conditions for SEPA- wide issuing and acquiring, and dissociation of branding and processing, spelled out. Under implementation with schemes Significant work underway in Card Fraud Prevention A high level description of a pan European Direct Debit agreed Conditions for re-engineering of cash handling and distribution spelled out

Lessons for the Americas? n (this is a quote from the programme!) n What is comparable, and less so n Scope, approach: priority to self-regulation? n Going forward: need for catalyst, dialogue

What is comparable, and less so n Multi-country requirement n Multi-currency n Heterogeneous payment systems n Political, society-level vision, ambition? n Multi-country implementation: legislative, regulatory, selfregulatory capabilities? n Multi-payment instrument? n End-to-end, full STP initiation and delivery? n Cohabitation, or migration of national schemes?

Scope, approach n Pre-condition: remove any ambiguity about scope, objectives n Who are the drivers? Who are the stakeholders? n Originators and beneficiaries: should be equal partners n Identifying and removing obstacles n Making the most of existing systems n Technology: an enabler, yet not a constraint

Going forward n « Public » , « private » : what balance? n Regulation can have perverse effects: lessons from Regulation 2560/2001 n There are business cases and business cases n Structured dialogue: a necessity

Remittances: key hurdles n For « customers » - Access to market information - Access to banking services - Access to transaction information - Access to redress procedures n The macro-economic questions - Untapped lever for economic development - Potential feeder for criminal activities - Unrecognized opportunity for social integration

Remittances: challenging regulators n Should the remittance business be regulated? n Who should bear that burden (related costs)? n What balance of public and private initiatives to enhance conditions in the market? n How to foster competition, motivate financial institutions to play a more active role? n Should public intervention foster the infrastructure? n How to move away from cash (without putting the burden on remitters and their recipients)? n How to move beyond remittances?

The WSBI action plan in remittances n Contributing to formulation and implementation of policy: overseeing market structure evolution and monitoring performance, enhancing the legal and regulatory framework, setting standards and defining infrastructure, encouraging and facilitating n Motivating players: working closely with Members to identify and qualify opportunities, creating partnerships, setting best practice n Delivering the value: establishing a SLA framework as the benchmark, facilitating redress and dispute resolution, developing a toolkit for Members

For further information: www. savings-banks. com e-mail: info@savings-banks. com

07447d958a7b0244e4c18268fcffe503.ppt