2. TPA GUBKIN BOOK 2_OIL.ppt

- Количество слайдов: 14

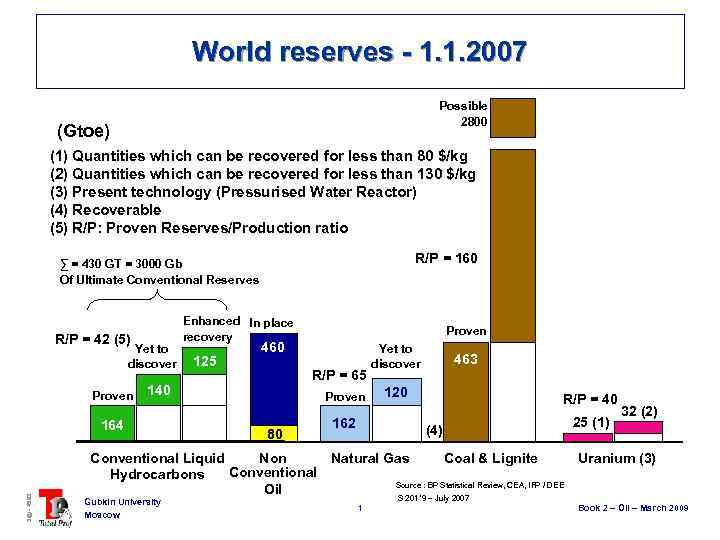

World reserves - 1. 1. 2007 Possible 2800 (Gtoe) (1) Quantities which can be recovered for less than 80 $/kg (2) Quantities which can be recovered for less than 130 $/kg (3) Present technology (Pressurised Water Reactor) (4) Recoverable (5) R/P: Proven Reserves/Production ratio R/P = 160 ∑ = 430 GT = 3000 Gb Of Ultimate Conventional Reserves R/P = 42 (5) Yet to discover Proven 125 Proven 460 R/P = 65 140 164 3@ - 4593 Enhanced In place recovery Proven 80 162 Yet to discover 463 120 R/P = 40 (4) Conventional Liquid Non Natural Gas Coal & Lignite Conventional Hydrocarbons Source : BP Statistical Review, CEA, IFP / DEE Oil Gubkin University Moscow 1 S 201*9 – July 2007 25 (1) 32 (2) Uranium (3) Book 2 – Oil – March 2009

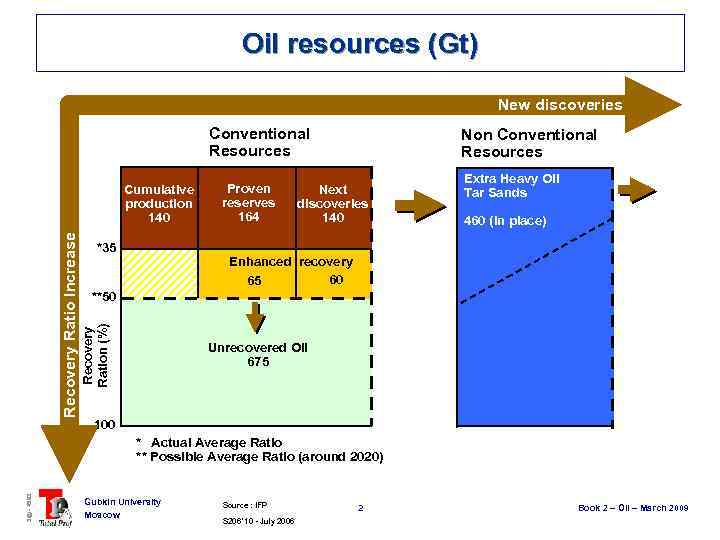

Oil resources (Gt) New discoveries Conventional Resources *35 Proven reserves 164 Next discoveries 140 Extra Heavy Oil Tar Sands 460 (in place) Enhanced recovery 60 65 **50 Recovery Ration (%) Recovery Ratio Increase Cumulative production 140 Non Conventional Resources Unrecovered Oil 675 100 3@ - 4593 * Actual Average Ratio ** Possible Average Ratio (around 2020) Gubkin University Moscow Source : IFP S 206*10 - July 2006 2 Book 2 – Oil – March 2009

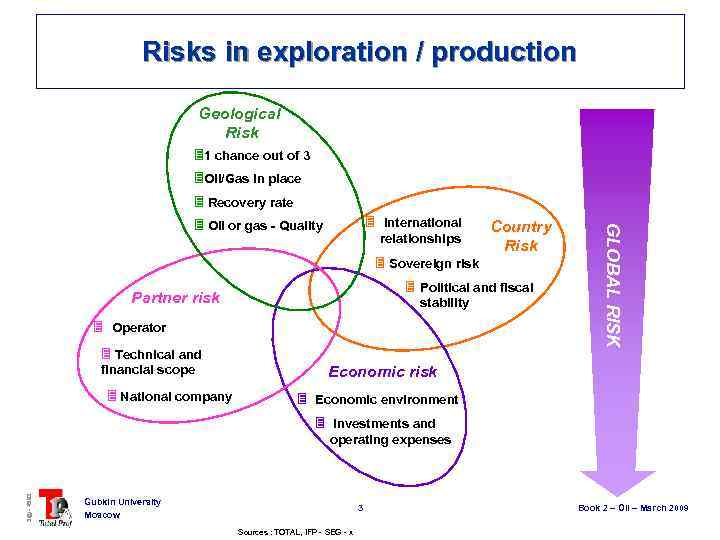

Risks in exploration / production Geological Risk 31 chance out of 3 3 Oil/Gas in place 3 Recovery rate relationships Country Risk 3 Sovereign risk 3 Political and fiscal Partner risk stability 3 Operator 3 Technical and financial scope 3 National company GLOBAL RISK 3 International 3 Oil or gas - Quality Economic risk 3 Economic environment 3 Investments and 3@ - 4593 operating expenses Gubkin University Moscow 3 Sources : TOTAL, IFP - SEG - x Book 2 – Oil – March 2009

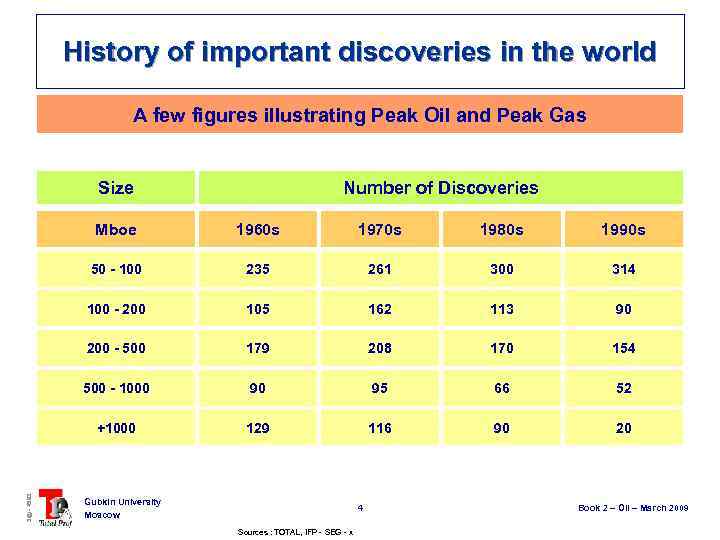

History of important discoveries in the world A few figures illustrating Peak Oil and Peak Gas Size Number of Discoveries 1960 s 1970 s 1980 s 1990 s 50 - 100 235 261 300 314 100 - 200 105 162 113 90 200 - 500 179 208 170 154 500 - 1000 90 95 66 52 +1000 3@ - 4593 Mboe 129 116 90 20 Gubkin University Moscow 4 Sources : TOTAL, IFP - SEG - x Book 2 – Oil – March 2009

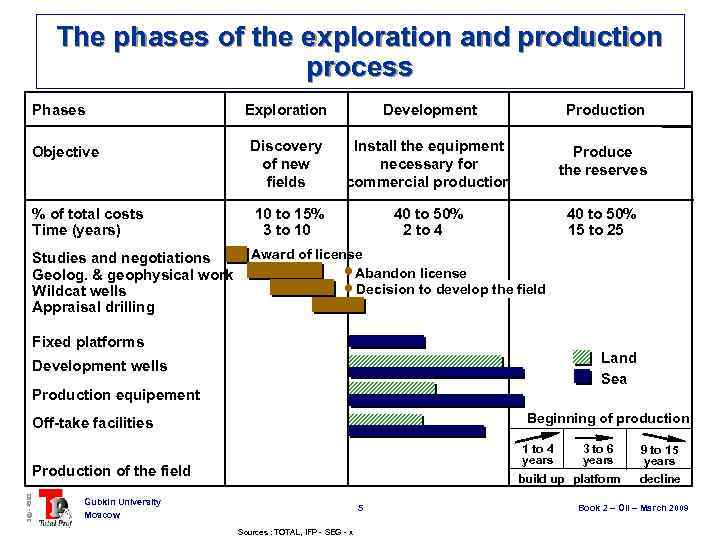

The phases of the exploration and production process Phases Exploration Development Production Discovery of new fields Install the equipment necessary for commercial production Produce the reserves % of total costs Time (years) 10 to 15% 3 to 10 40 to 50% 2 to 4 40 to 50% 15 to 25 Studies and negotiations Geolog. & geophysical work Wildcat wells Appraisal drilling Award of license Abandon license Decision to develop the field Objective Fixed platforms Land Sea Development wells Production equipement Beginning of production Off-take facilities 1 to 4 years 3@ - 4593 Production of the field 3 to 6 years build up platform Gubkin University Moscow 5 Sources : TOTAL, IFP - SEG - x 9 to 15 years decline Book 2 – Oil – March 2009

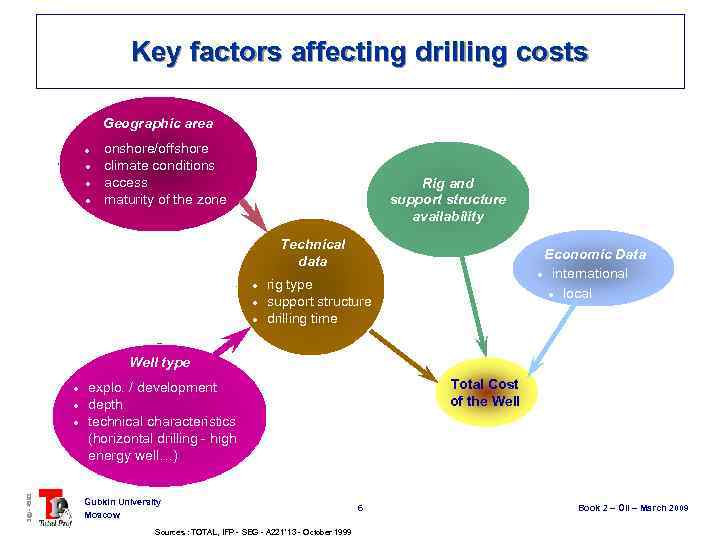

Key factors affecting drilling costs Geographic area l l onshore/offshore climate conditions access maturity of the zone Rig and support structure availability Technical data l l l Economic Data l international l local rig type support structure drilling time Well type l l 3@ - 4593 l Total Cost of the Well explo. / development depth technical characteristics (horizontal drilling - high energy well…) Gubkin University Moscow Sources : TOTAL, IFP - SEG - A 221*13 - October 1999 6 Book 2 – Oil – March 2009

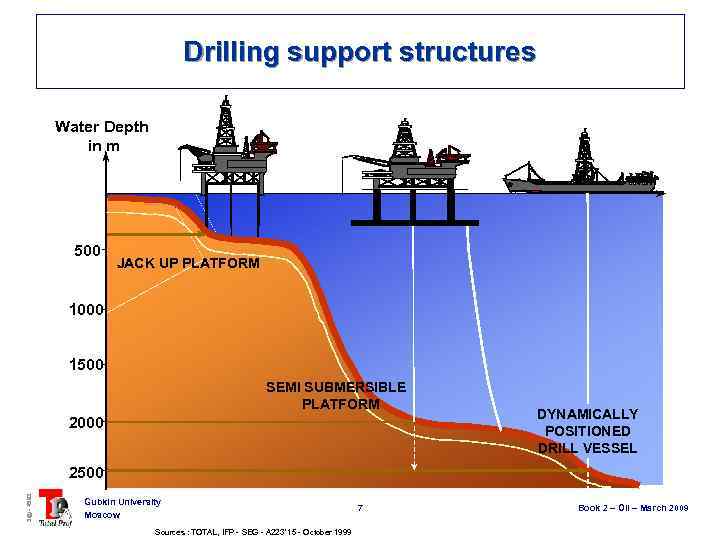

Drilling support structures Water Depth in m 500 JACK UP PLATFORM 1000 1500 SEMI SUBMERSIBLE PLATFORM 2000 DYNAMICALLY POSITIONED DRILL VESSEL 3@ - 4593 2500 Gubkin University Moscow Sources : TOTAL, IFP - SEG - A 223*15 - October 1999 7 Book 2 – Oil – March 2009

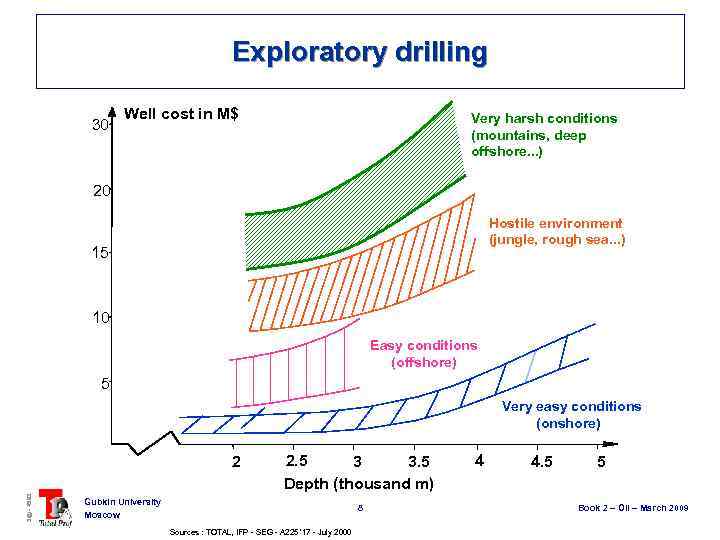

Exploratory drilling 30 Well cost in M$ Very harsh conditions (mountains, deep offshore. . . ) 20 Hostile environment (jungle, rough sea. . . ) 15 10 Easy conditions (offshore) 5 Very easy conditions (onshore) 3@ - 4593 2 2. 5 3 3. 5 Depth (thousand m) Gubkin University Moscow 8 Sources : TOTAL, IFP - SEG - A 225*17 - July 2000 4 4. 5 5 Book 2 – Oil – March 2009

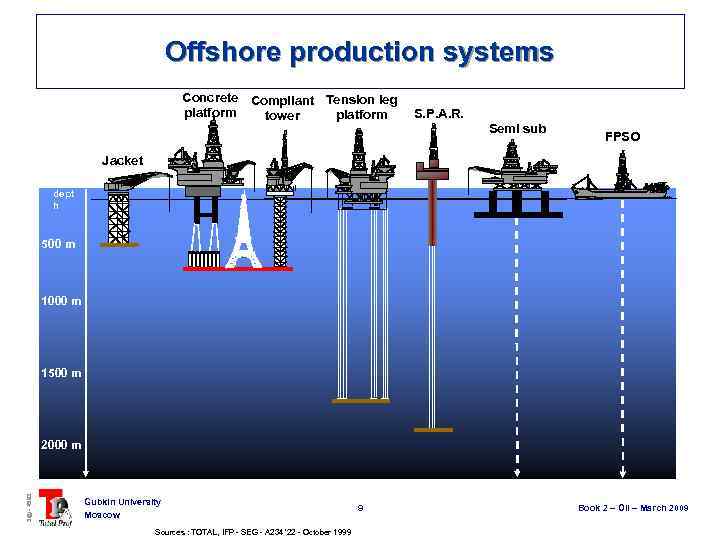

Offshore production systems Concrete Compliant Tension leg platform tower Wat er dept h S. P. A. R. Semi sub FPSO Jacket 500 m 1000 m 1500 m 3@ - 4593 2000 m Gubkin University Moscow Sources : TOTAL, IFP - SEG - A 234*22 - October 1999 9 Book 2 – Oil – March 2009

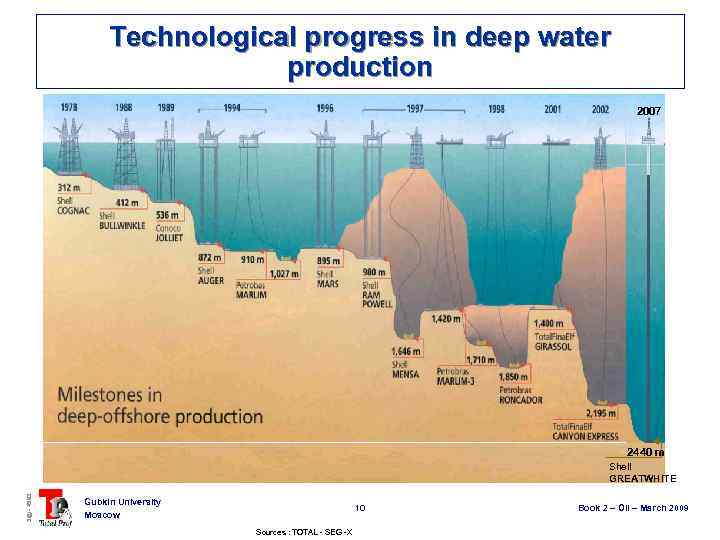

Technological progress in deep water production 2007 2440 m 3@ - 4593 Shell GREATWHITE Gubkin University Moscow 10 Sources : TOTAL - SEG -X Book 2 – Oil – March 2009

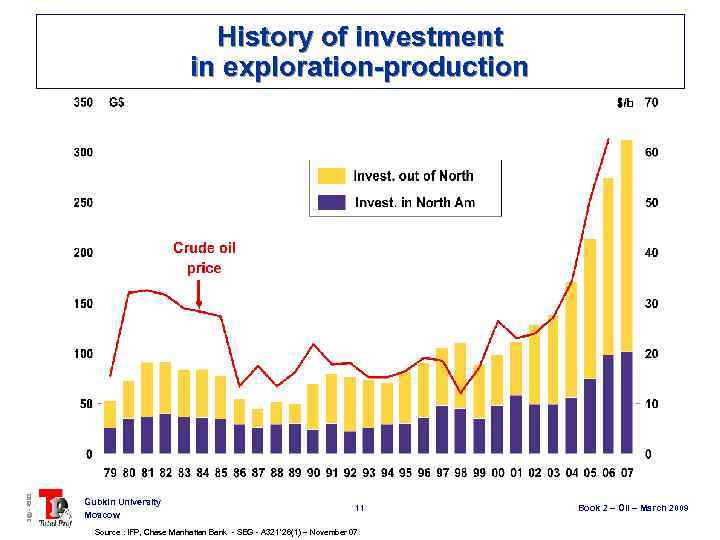

3@ - 4593 History of investment in exploration-production Gubkin University Moscow 11 Source : IFP, Chase Manhattan Bank - SEG - A 321*26(1) – November 07 Book 2 – Oil – March 2009

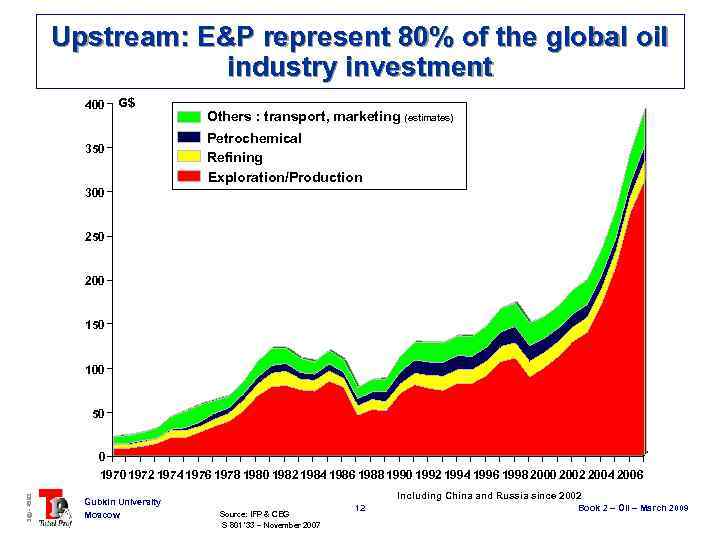

Upstream: E&P represent 80% of the global oil industry investment 400 G$ 350 Others : transport, marketing (estimates) Petrochemical Refining Exploration/Production 300 250 200 150 100 50 3@ - 4593 0 1972 1974 1976 1978 1980 1982 1984 1986 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 Gubkin University Moscow Including China and Russia since 2002 Source: IFP & CEG S 801*33 – November 2007 12 Book 2 – Oil – March 2009

The key paradoxes of the oil industry At 100 $/b crude oil, the upstream worlwide average technical costs represent 15% (10% for the producing companies and around 75% for the producing countries « government take » ). u 3@ - 4593 u At the 100 $/b this « crude oil cost » represent an average 30% of the pumps prices in the E. U. (10% downstream costs for refining and distribution and around 60% for the consumming countries « government take » ). Gubkin University Moscow 13 Book 2 – Oil – March 2009

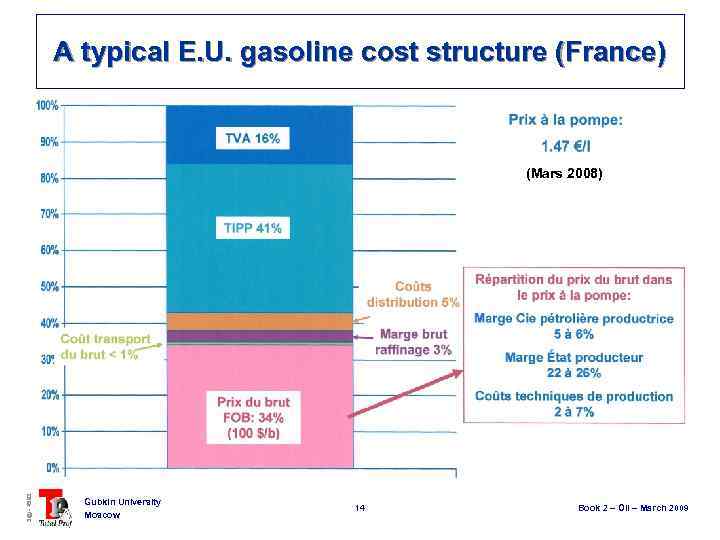

A typical E. U. gasoline cost structure (France) 3@ - 4593 (Mars 2008) Gubkin University Moscow 14 Book 2 – Oil – March 2009

2. TPA GUBKIN BOOK 2_OIL.ppt