26b84af85bcf4e6be481a4594c99da40.ppt

- Количество слайдов: 52

WORLD BANK GROUP LOGISTICS PERFORMANCE INDEX AND DOING BUSINESS INDICATORS Souleymane COULIBALY LAC Trade Training Peruvian Delegation October 21, 2010 ECA Regional Trade Coordinator Geneva, June 14 th, 2011

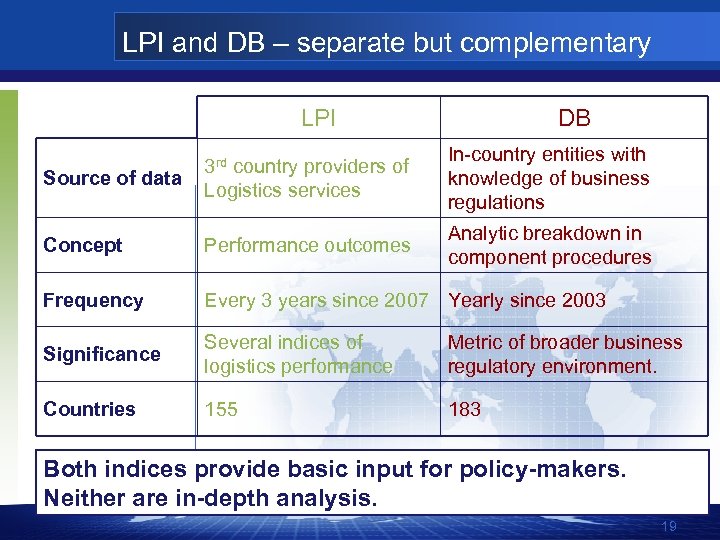

The Logistics Performance Index and Doing Business Report Two separate but complementary reports 2

The Logistics Performance Index • Measures the trade logistics efficiency of a country • Fundamental premise: Efficient logistics drives economic performance 3

The Doing Business Report • Provides measures of the ease of doing business (regulations) for local firms in a given country • Fundamental premise: economic activity requires effective regulations in all areas of setting up and operating a business 4

Agenda 1. Overview of LPI 2010 2. Overview of Doing Business 2011 3. LPI Results: CIS countries 4. DB Results: CIS Countries 5. Want to Learn More?

1. Overview LPI 2010 6

The Logistics Performance Index • First report in 2007, every three years • Source of data is suppliers of logistics services (freight forwarders, express carriers) • Rates logistical performance on a scale of 1 to 5 7

LPI: Key messages • • • Trade logistics is an important element of national competitiveness A country’s performance is only as good as its weakest link The LPI dataset can be used to identify key bottlenecks in your own country 8

What are efficient logistics? The LPI measures six dimensions of country performance: Efficiency of the clearance process Quality of trade and transport infrastructure Ease of arranging competitively priced shipments Logistics competence and quality of logistics services Ability to track and trace shipments Timeliness of shipment delivery 9

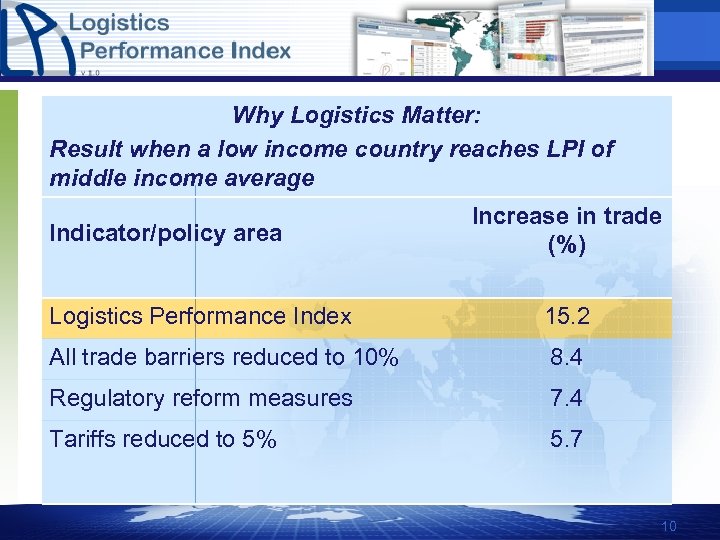

Why Logistics Matter: Result when a low income country reaches LPI of middle income average Indicator/policy area Increase in trade (%) Logistics Performance Index 15. 2 All trade barriers reduced to 10% 8. 4 Regulatory reform measures 7. 4 Tariffs reduced to 5% 5. 7 10

Key Policy Implications: • Expand the traditional development agenda beyond customs reform and infrastructure to be comprehensive—processes, services, and infrastructure. • Increase border agency coordination • Partner with the private sector • Reform must be tailored to each country’s circumstances 11

The Logistics Performance Index 12

2. Overview Doing Business 2011 13

The Doing Business Report • First report in Sept 2003, yearly • Covers 183 countries • Surveys in-country specialists with knowledge of regulatory system • Provides a basis for measuring, understanding and improving the regulatory environment for business • creates methodology and a database for policy makers 14

The Doing Business Report Doing Business does not measure all aspects such as: • • • macroeconomic stability corruption level of labor skills proximity to markets, regulations specific to foreign investment or financial markets 15

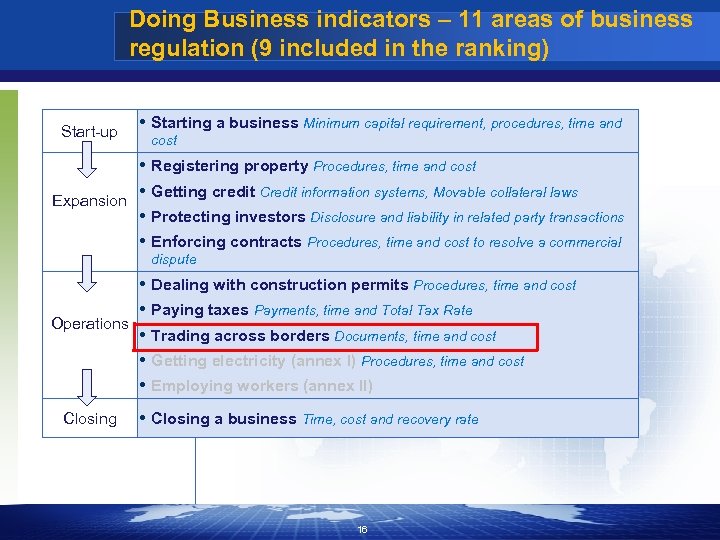

Doing Business indicators – 11 areas of business regulation (9 included in the ranking) Start-up Starting a business Minimum capital requirement, procedures, time and cost Registering property Procedures, time and cost Getting credit Credit information systems, Movable collateral laws Expansion Protecting investors Disclosure and liability in related party transactions Enforcing contracts Procedures, time and cost to resolve a commercial dispute Dealing with construction permits Procedures, time and cost Paying taxes Payments, time and Total Tax Rate Operations Trading across borders Documents, time and cost Getting electricity (annex I) Procedures, time and cost Employing workers (annex II) Closing a business Time, cost and recovery rate 16

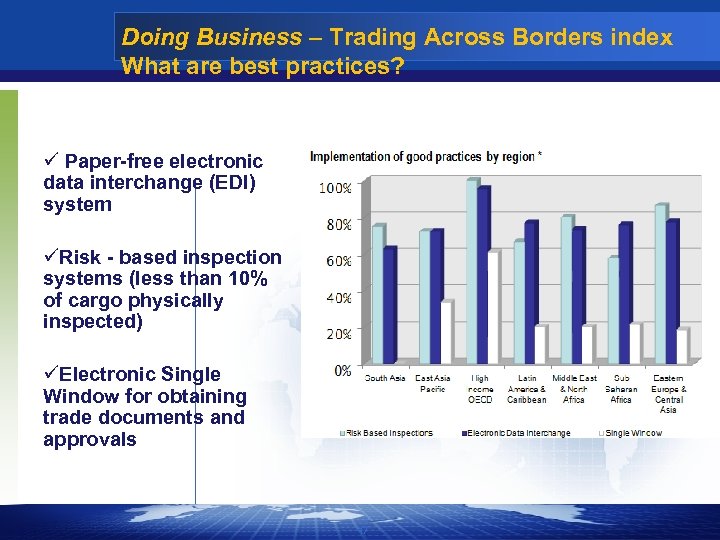

Doing Business – Trading Across Borders index What are best practices? ü Paper-free electronic data interchange (EDI) system üRisk - based inspection systems (less than 10% of cargo physically inspected) üElectronic Single Window for obtaining trade documents and approvals 17

The Doing Business Report 18

LPI and DB – separate but complementary LPI DB Source of data 3 rd country providers of Logistics services In-country entities with knowledge of business regulations Concept Performance outcomes Analytic breakdown in component procedures Frequency Every 3 years since 2007 Yearly since 2003 Significance Several indices of logistics performance Metric of broader business regulatory environment. Countries 155 183 Both indices provide basic input for policy-makers. Neither are in-depth analysis. 19

3. LPI Results: CIS countries 20

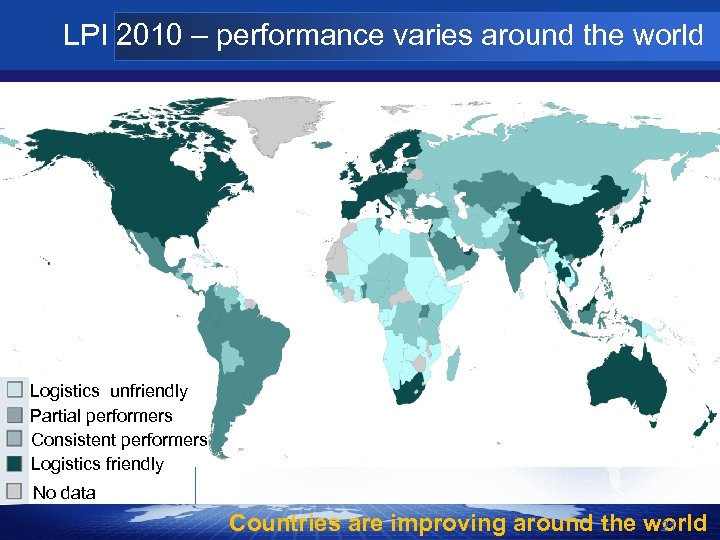

LPI 2010 – performance varies around the world Logistics unfriendly Partial performers Consistent performers Logistics friendly No data Countries are improving around the world 21

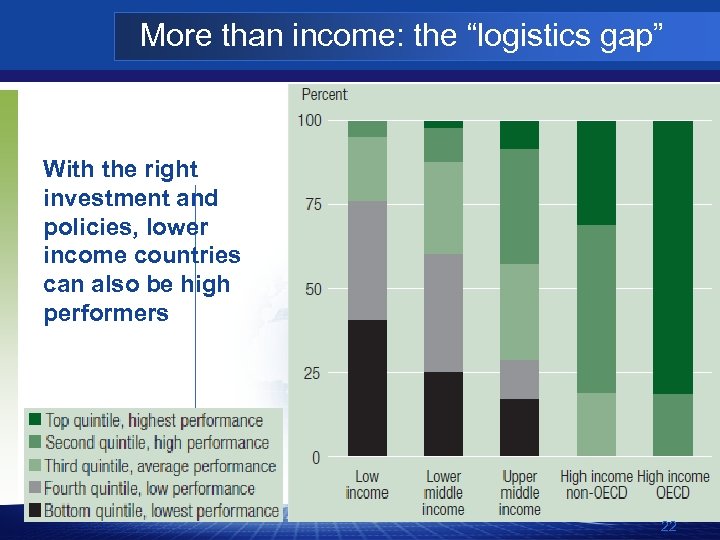

More than income: the “logistics gap” With the right investment and policies, lower income countries can also be high performers 22

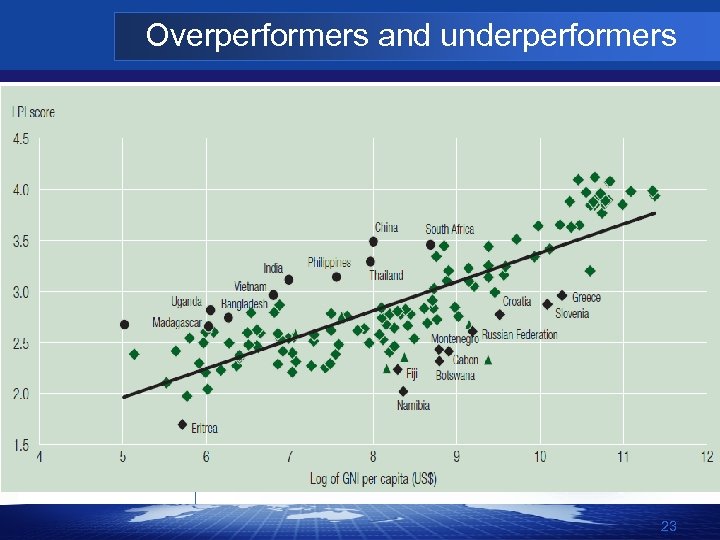

Overperformers and underperformers 23

LPI 2010 Ranks TOP 10 COUNTRIES UPPER MIDDLE INCOME LOW INCOME Country South Africa Malaysia Poland Lebanon Latvia Turkey Brazil Lithuania Argentina Chile LPI Rank 28 29 30 33 37 39 41 45 48 49 Country China Thailand Philippines India Tunisia Honduras Ecuador Indonesia Paraguay Syrian Arab Republic LPI Rank 27 35 44 47 61 70 71 75 76 Country Vietnam Senegal Uganda Uzbekistan Benin Bangladesh Congo, Dem. Rep. Madagascar Kyrgyz Republic Tanzania LPI Rank 53 58 66 68 69 79 85 88 91 95 80 24

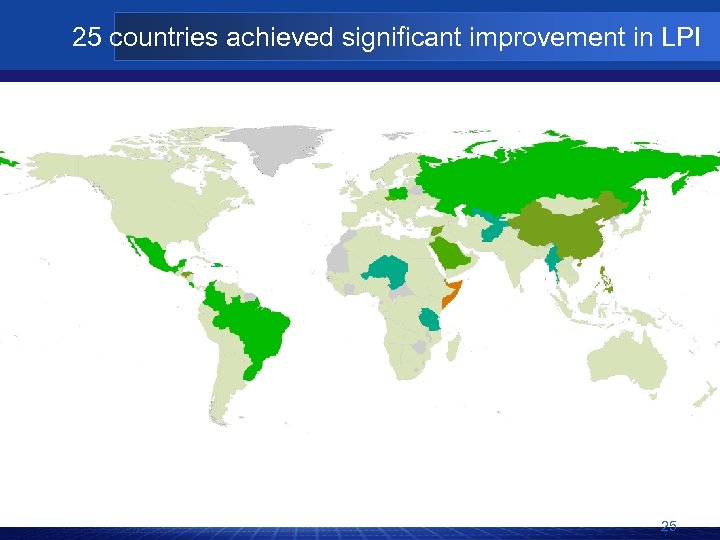

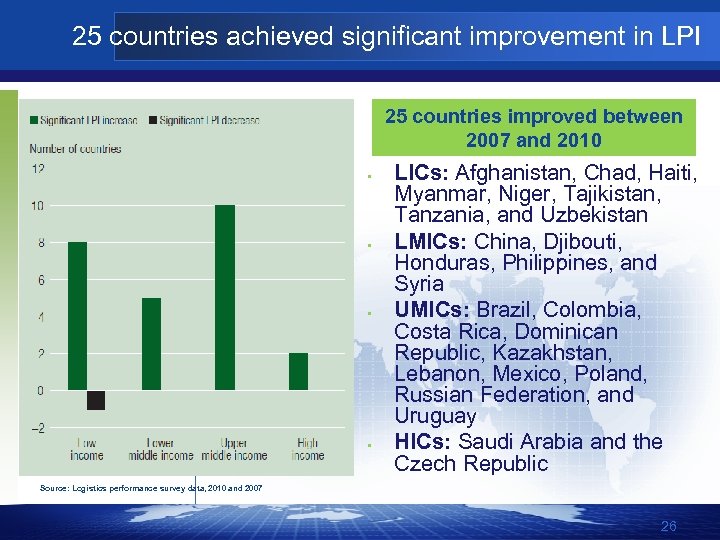

25 countries achieved significant improvement in LPI 25

25 countries achieved significant improvement in LPI 25 countries improved between 2007 and 2010 § § LICs: Afghanistan, Chad, Haiti, Myanmar, Niger, Tajikistan, Tanzania, and Uzbekistan LMICs: China, Djibouti, Honduras, Philippines, and Syria UMICs: Brazil, Colombia, Costa Rica, Dominican Republic, Kazakhstan, Lebanon, Mexico, Poland, Russian Federation, and Uruguay HICs: Saudi Arabia and the Czech Republic Source: Logistics performance survey data, 2010 and 2007 26

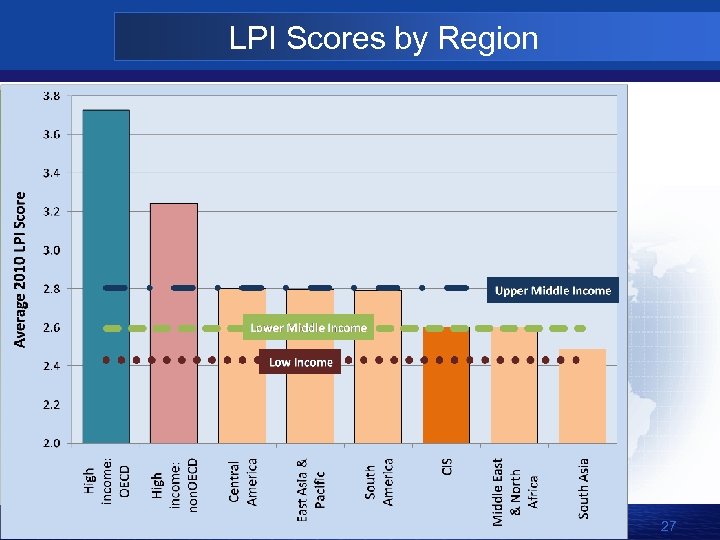

LPI Scores by Region 27

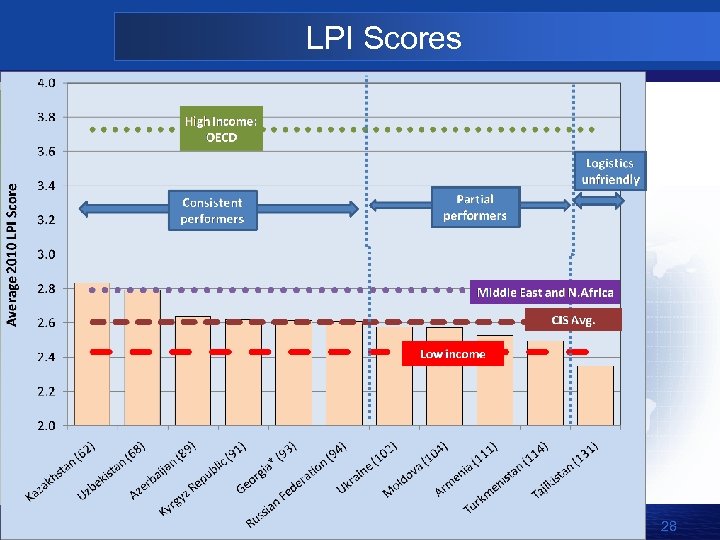

LPI Scores 28

% of the highest performer LPI 2010 Highest performer Germany 100% Lowest performer Somalia 11% LPI 2007 Highest performer Singapore 100 Lowest performer Afghanistan 7% 29

Performance in the 6 areas of the LPI 2010 Average LPI Score 30

Infrastructure quality 31

Quality of services I TRANSPORT SERVICES 32

Quality of services II 33

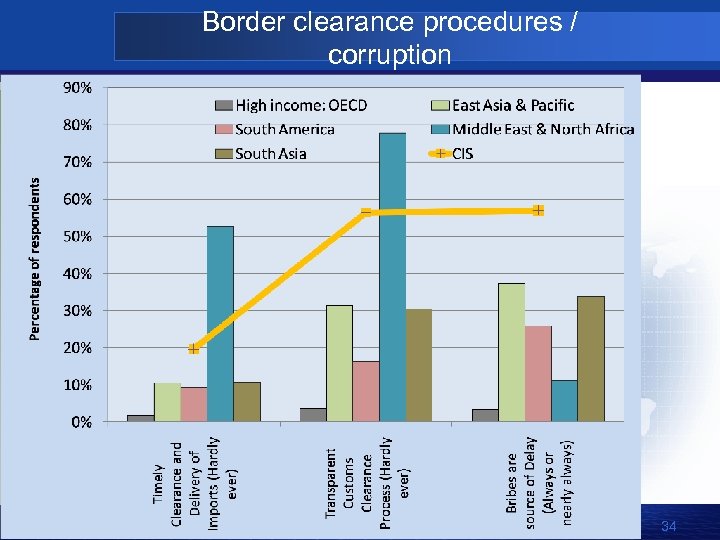

Border clearance procedures / corruption 34

Positive trends in logistics performance since 2005 35

4. Doing Business Results: CIS Countries 36

Top 30 economies on the ease of Doing Business 2009/10 1. Singapore 16. Korea, Rep. 2. Hong Kong SAR, China 17. Estonia 3. New Zealand 18. Japan 4. United Kingdom 19. Thailand 5. United States 20. Mauritius 6. Denmark 21. Malaysia 7. Canada 22. Germany 8. Norway 23. Lithuania 9. Ireland 24. Latvia 10. Australia 25. Belgium 11. Saudi Arabia 26. France 12. Georgia 27. Switzerland 13. Finland 28. Bahrain 14. Sweden 29. Israel 15. Iceland 30. Netherlands 37

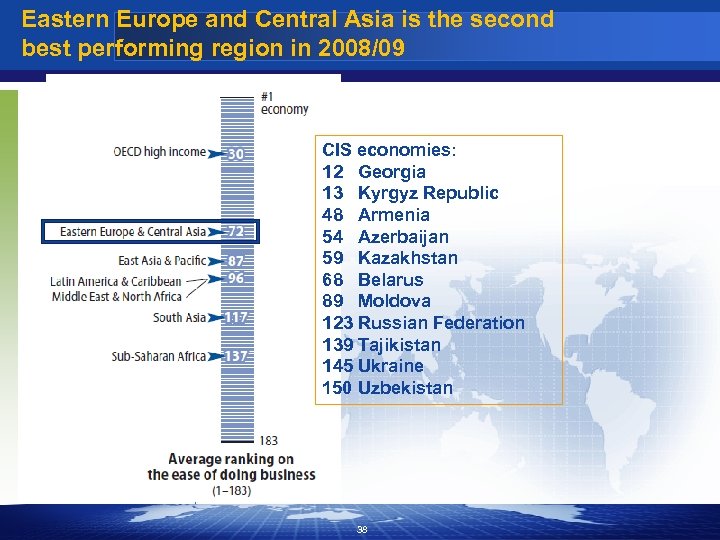

Eastern Europe and Central Asia is the second best performing region in 2008/09 CIS economies: 12 Georgia 13 Kyrgyz Republic 48 Armenia 54 Azerbaijan 59 Kazakhstan 68 Belarus 89 Moldova 123 Russian Federation 139 Tajikistan 145 Ukraine 150 Uzbekistan 38

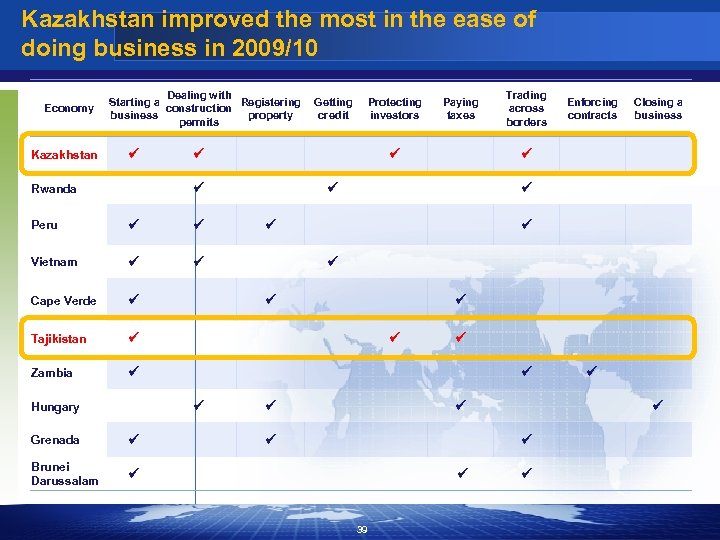

Kazakhstan improved the most in the ease of doing business in 2009/10 Economy Kazakhstan Dealing with Starting a Registering construction business property permits Protecting investors Peru Vietnam Tajikistan Closing a business Hungary Enforcing contracts Zambia Trading across borders Cape Verde Paying taxes Rwanda Getting credit Grenada Brunei Darussalam 39

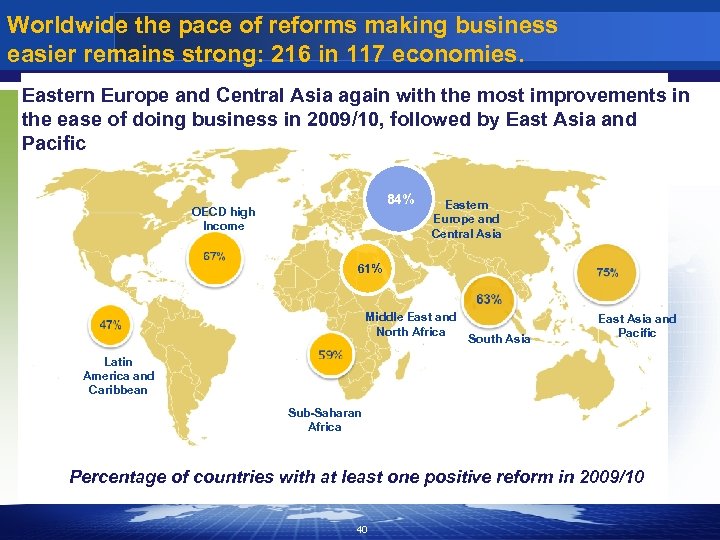

Worldwide the pace of reforms making business easier remains strong: 216 in 117 economies. Eastern Europe and Central Asia again with the most improvements in the ease of doing business in 2009/10, followed by East Asia and Pacific 84% OECD high Income Eastern Europe and Central Asia 61% Middle East and North Africa South Asia East Asia and Pacific Latin America and Caribbean Sub-Saharan Africa Percentage of countries with at least one positive reform in 2009/10 40

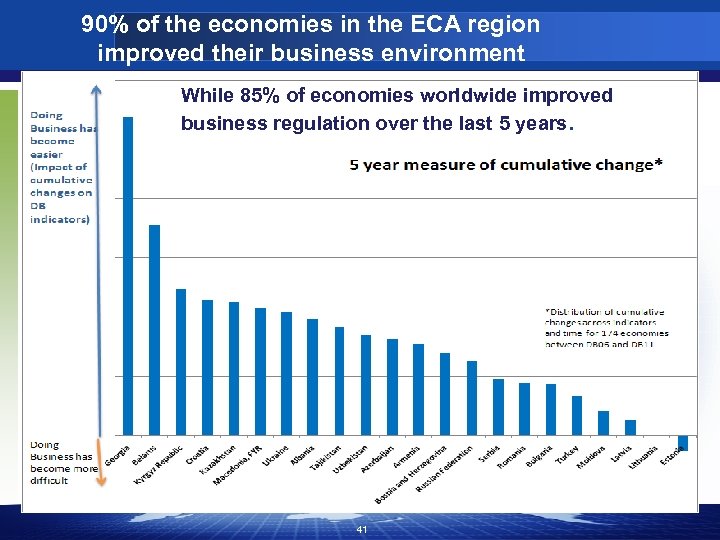

90% of the economies in the ECA region improved their business environment While 85% of economies worldwide improved business regulation over the last 5 years. 41

21 of 25 economies in Eastern Europe & Central Asia improved business regulations this year 6 economies eased trading across borders in the region 11 9 8 6 5 5 3 1 Paying taxes Starting a business Closing a business Trading across borders Dealing with construction permits 42 Getting credit Protecting investors 1 Enforcing Contracts Registering property

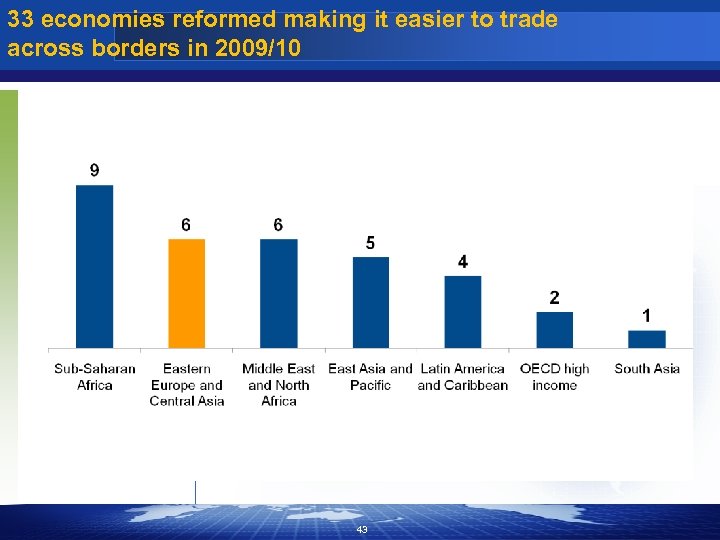

33 economies reformed making it easier to trade across borders in 2009/10 43

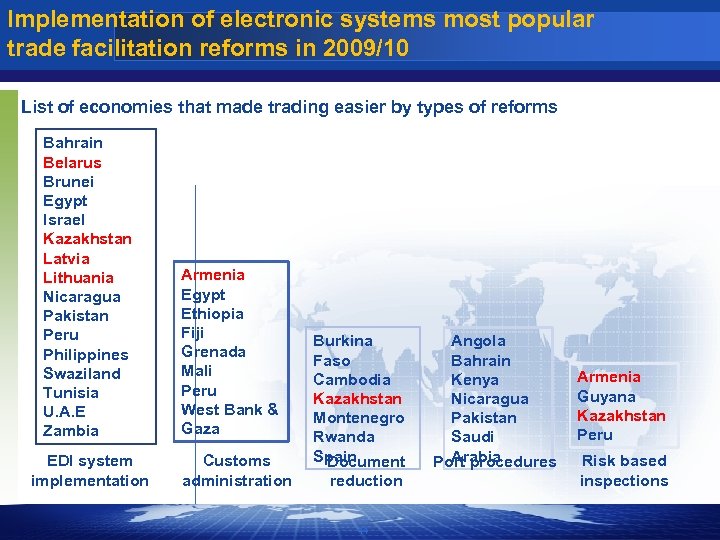

Implementation of electronic systems most popular trade facilitation reforms in 2009/10 List of economies that made trading easier by types of reforms Bahrain Belarus Brunei Egypt Israel Kazakhstan Latvia Lithuania Nicaragua Pakistan Peru Philippines Swaziland Tunisia U. A. E Zambia EDI system implementation Armenia Egypt Ethiopia Fiji Grenada Mali Peru West Bank & Gaza Customs administration Burkina Faso Cambodia Kazakhstan Montenegro Rwanda Spain Document reduction 44 Angola Bahrain Kenya Nicaragua Pakistan Saudi Arabia Port procedures Armenia Guyana Kazakhstan Peru Risk based inspections

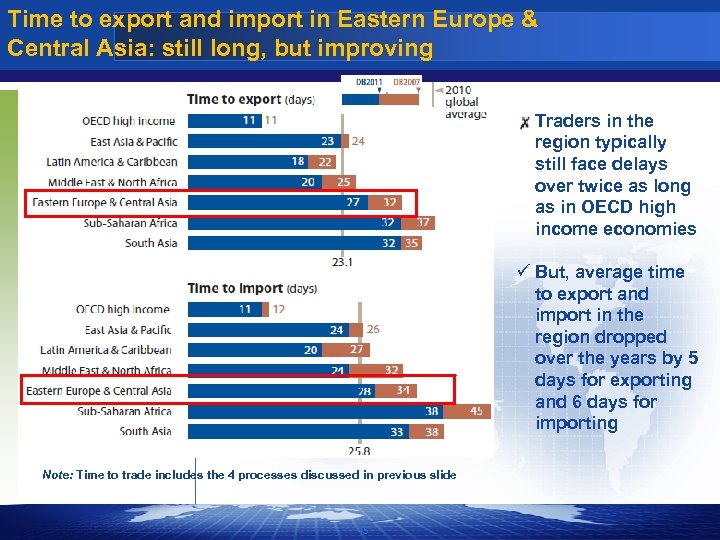

Time to export and import in Eastern Europe & Central Asia: still long, but improving Traders in the region typically still face delays over twice as long as in OECD high income economies ü But, average time to export and import in the region dropped over the years by 5 days for exporting and 6 days for importing Note: Time to trade includes the 4 processes discussed in previous slide 45

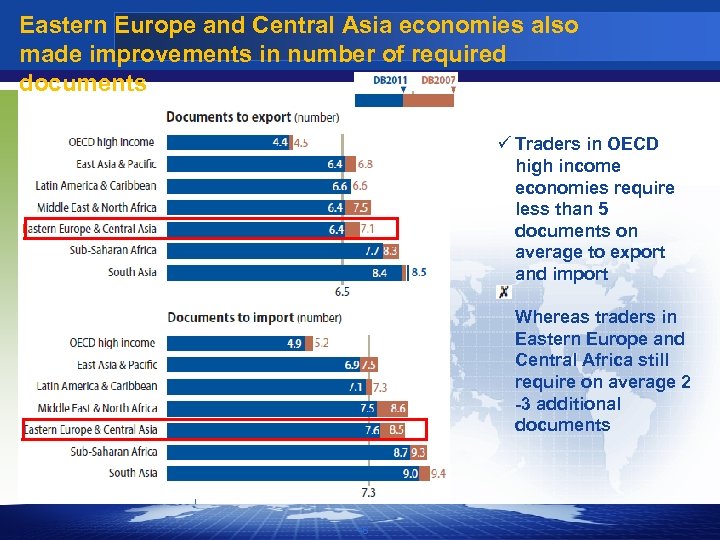

Eastern Europe and Central Asia economies also made improvements in number of required documents ü Traders in OECD high income economies require less than 5 documents on average to export and import Whereas traders in Eastern Europe and Central Africa still require on average 2 -3 additional documents 46

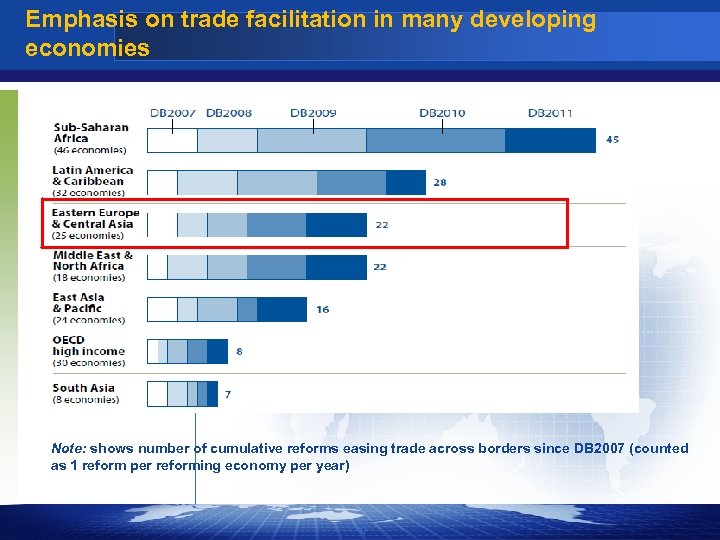

Emphasis on trade facilitation in many developing economies Note: shows number of cumulative reforms easing trade across borders since DB 2007 (counted as 1 reform per reforming economy per year) 47

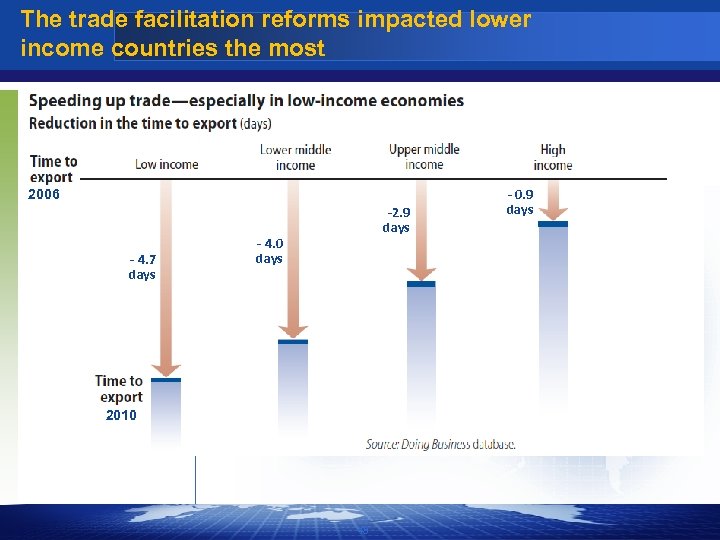

The trade facilitation reforms impacted lower income countries the most 2006 - 4. 7 days -2. 9 days - 4. 0 days 2010 48 - 0. 9 days

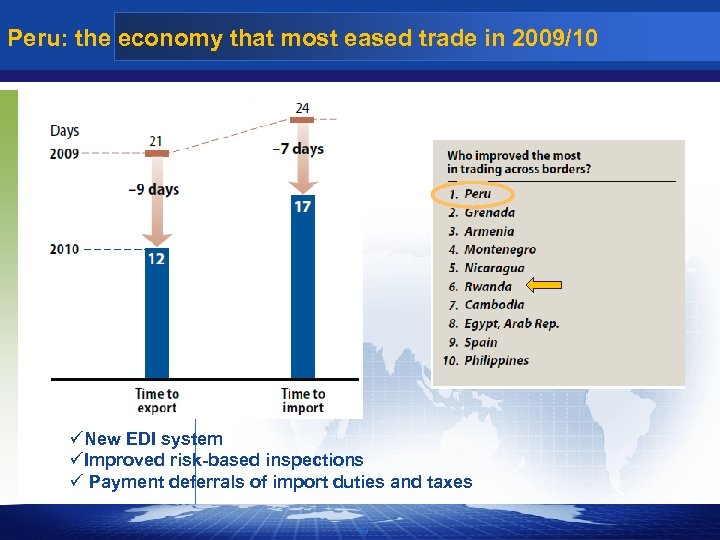

Peru: the economy that most eased trade in 2009/10 üNew EDI system üImproved risk-based inspections ü Payment deferrals of import duties and taxes 49

5. Want to Learn More? 50

Contact Us The World Bank Group International Trade Department www. worldbank. org/tradefacilitation www. worldbank. org/tradelogistics www. worldbank. org/lpi www. worldbank. org/tradestrategy Washington Office 1818 H Street NW Washington DC 20433 Contact: tradefacilitation@worldbank. org 51

Thank you. For more information: www. doingbusiness. org 52

26b84af85bcf4e6be481a4594c99da40.ppt