56359b7665b391012f42e7acbb490075.ppt

- Количество слайдов: 20

Workshop Session III – Part 2 The Challenge of Management Succession in Family Enterprises Professor Alden G. Lank UBC X 1 Alden G. Lank

Workshop Session III – Part 2 The Challenge of Management Succession in Family Enterprises Professor Alden G. Lank UBC X 1 Alden G. Lank

A Significant Challenge: BMO Harris Private Banking 2003 Outstanding Workshop 40% of U. S. family businesses will see a leadership change at the top in the next 5 years UBC X 2 Alden G. Lank Session III Part 2

A Significant Challenge: BMO Harris Private Banking 2003 Outstanding Workshop 40% of U. S. family businesses will see a leadership change at the top in the next 5 years UBC X 2 Alden G. Lank Session III Part 2

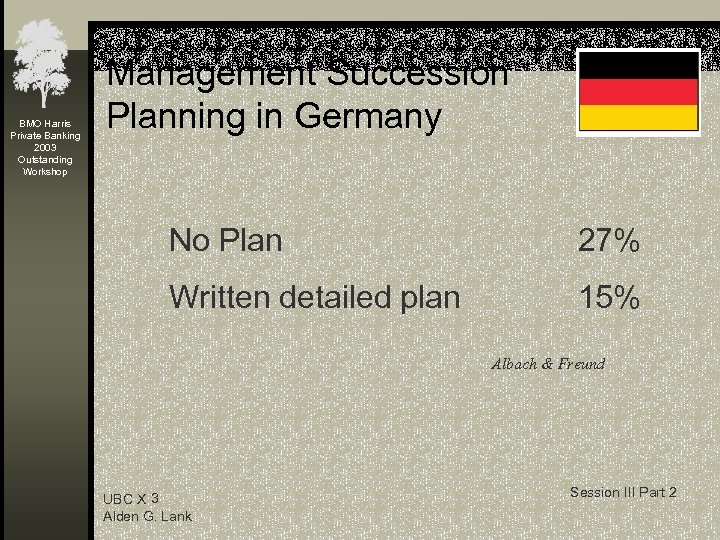

BMO Harris Private Banking 2003 Outstanding Workshop Management Succession Planning in Germany No Plan 27% Written detailed plan 15% Albach & Freund UBC X 3 Alden G. Lank Session III Part 2

BMO Harris Private Banking 2003 Outstanding Workshop Management Succession Planning in Germany No Plan 27% Written detailed plan 15% Albach & Freund UBC X 3 Alden G. Lank Session III Part 2

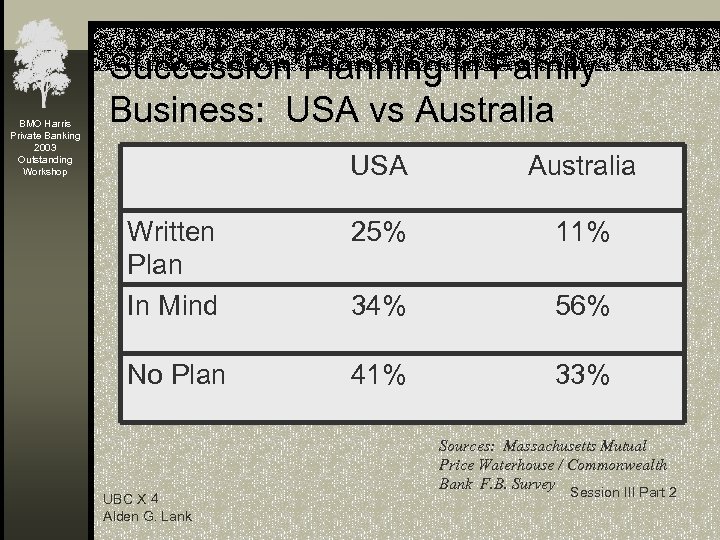

BMO Harris Private Banking 2003 Outstanding Workshop Succession Planning in Family Business: USA vs Australia USA Australia Written Plan In Mind 25% 11% 34% 56% No Plan 41% 33% UBC X 4 Alden G. Lank Sources: Massachusetts Mutual Price Waterhouse / Commonwealth Bank F. B. Survey Session III Part 2

BMO Harris Private Banking 2003 Outstanding Workshop Succession Planning in Family Business: USA vs Australia USA Australia Written Plan In Mind 25% 11% 34% 56% No Plan 41% 33% UBC X 4 Alden G. Lank Sources: Massachusetts Mutual Price Waterhouse / Commonwealth Bank F. B. Survey Session III Part 2

BMO Harris Private Banking 2003 Outstanding Workshop The Imminent Succession Challenge: Italy 7% of entrepreneurs in an Italian survey have formalized in a written plan how they want to pass on their leadership responsibilities G. Corbetta & D. Montemerlo F. B. N. Newsletter, May 1998 UBC X 5 Alden G. Lank Session III Part 2

BMO Harris Private Banking 2003 Outstanding Workshop The Imminent Succession Challenge: Italy 7% of entrepreneurs in an Italian survey have formalized in a written plan how they want to pass on their leadership responsibilities G. Corbetta & D. Montemerlo F. B. N. Newsletter, May 1998 UBC X 5 Alden G. Lank Session III Part 2

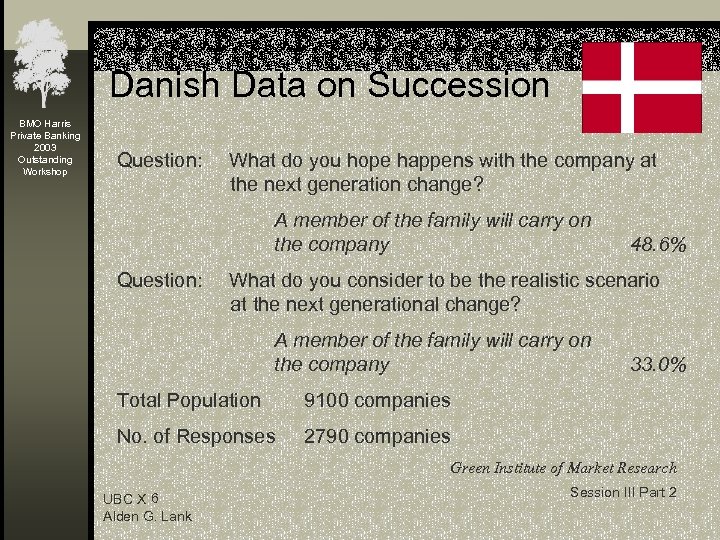

Danish Data on Succession BMO Harris Private Banking 2003 Outstanding Workshop Question: What do you hope happens with the company at the next generation change? A member of the family will carry on the company Question: 48. 6% What do you consider to be the realistic scenario at the next generational change? A member of the family will carry on the company Total Population 9100 companies No. of Responses 33. 0% 2790 companies Green Institute of Market Research UBC X 6 Alden G. Lank Session III Part 2

Danish Data on Succession BMO Harris Private Banking 2003 Outstanding Workshop Question: What do you hope happens with the company at the next generation change? A member of the family will carry on the company Question: 48. 6% What do you consider to be the realistic scenario at the next generational change? A member of the family will carry on the company Total Population 9100 companies No. of Responses 33. 0% 2790 companies Green Institute of Market Research UBC X 6 Alden G. Lank Session III Part 2

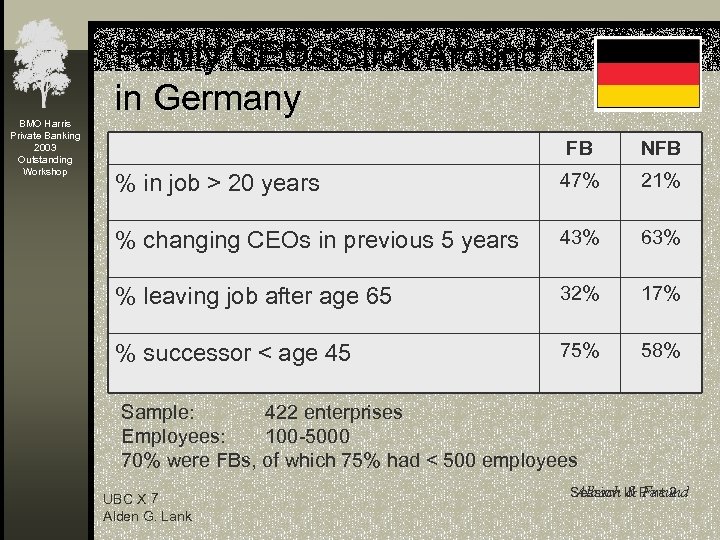

Family CEOs Stick Around in Germany BMO Harris Private Banking 2003 Outstanding Workshop FB NFB % in job > 20 years 47% 21% % changing CEOs in previous 5 years 43% 63% % leaving job after age 65 32% 17% % successor < age 45 75% 58% Sample: 422 enterprises Employees: 100 -5000 70% were FBs, of which 75% had < 500 employees UBC X 7 Alden G. Lank Albach & Freund Session III Part 2

Family CEOs Stick Around in Germany BMO Harris Private Banking 2003 Outstanding Workshop FB NFB % in job > 20 years 47% 21% % changing CEOs in previous 5 years 43% 63% % leaving job after age 65 32% 17% % successor < age 45 75% 58% Sample: 422 enterprises Employees: 100 -5000 70% were FBs, of which 75% had < 500 employees UBC X 7 Alden G. Lank Albach & Freund Session III Part 2

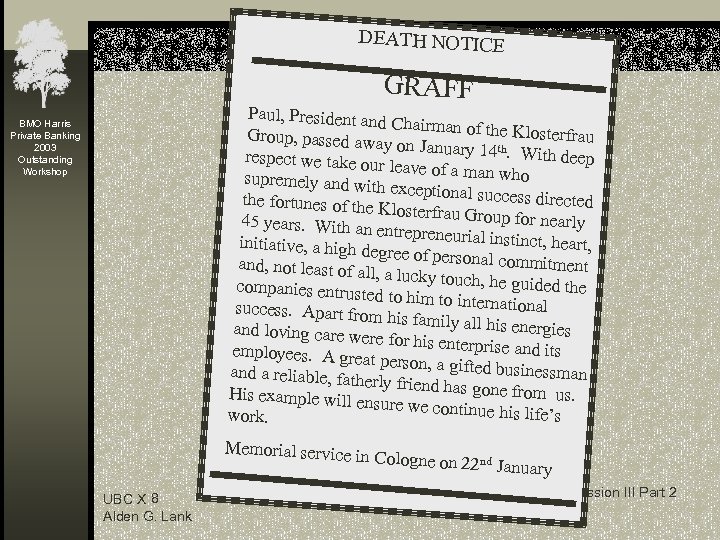

DEATH NOTICE GRÄFF Paul, President an d Chairman of the Klosterfrau Group, passed awa y on January 14 th. With deep respect we take ou r leave of a man w ho supremely and wit h exceptional succ ess directed the fortunes of the Klosterfrau Group for nearly 45 years. With an entrepreneurial inst inct, heart, initiative, a high d egree of personal c ommitment and, not least of all , a lucky touch, he guided the companies entrust ed to him to intern ational success. Apart fro m his family all his energies and loving care we re for his enterprise and its employees. A gre at person, a gifted businessman and a reliable, fath erly friend has gon e from us. His example will e nsure we continue his life’s work. BMO Harris Private Banking 2003 Outstanding Workshop Memorial service UBC X 8 Alden G. Lank in Cologne on 22 nd January Session III Part 2

DEATH NOTICE GRÄFF Paul, President an d Chairman of the Klosterfrau Group, passed awa y on January 14 th. With deep respect we take ou r leave of a man w ho supremely and wit h exceptional succ ess directed the fortunes of the Klosterfrau Group for nearly 45 years. With an entrepreneurial inst inct, heart, initiative, a high d egree of personal c ommitment and, not least of all , a lucky touch, he guided the companies entrust ed to him to intern ational success. Apart fro m his family all his energies and loving care we re for his enterprise and its employees. A gre at person, a gifted businessman and a reliable, fath erly friend has gon e from us. His example will e nsure we continue his life’s work. BMO Harris Private Banking 2003 Outstanding Workshop Memorial service UBC X 8 Alden G. Lank in Cologne on 22 nd January Session III Part 2

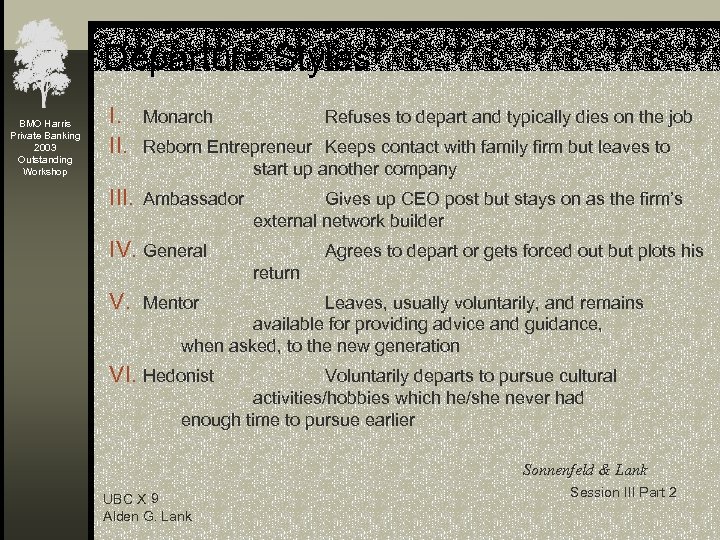

Departure Styles BMO Harris Private Banking 2003 Outstanding Workshop I. II. Monarch III. Ambassador Refuses to depart and typically dies on the job Reborn Entrepreneur Keeps contact with family firm but leaves to start up another company Gives up CEO post but stays on as the firm’s external network builder IV. General Agrees to depart or gets forced out but plots his return V. Mentor Leaves, usually voluntarily, and remains available for providing advice and guidance, when asked, to the new generation VI. Hedonist Voluntarily departs to pursue cultural activities/hobbies which he/she never had enough time to pursue earlier Sonnenfeld & Lank UBC X 9 Alden G. Lank Session III Part 2

Departure Styles BMO Harris Private Banking 2003 Outstanding Workshop I. II. Monarch III. Ambassador Refuses to depart and typically dies on the job Reborn Entrepreneur Keeps contact with family firm but leaves to start up another company Gives up CEO post but stays on as the firm’s external network builder IV. General Agrees to depart or gets forced out but plots his return V. Mentor Leaves, usually voluntarily, and remains available for providing advice and guidance, when asked, to the new generation VI. Hedonist Voluntarily departs to pursue cultural activities/hobbies which he/she never had enough time to pursue earlier Sonnenfeld & Lank UBC X 9 Alden G. Lank Session III Part 2

BMO Harris Private Banking 2003 Outstanding Workshop “Le jour où je m’arrêterai, c’est que je serai mort. Ce sera d’ailleurs une surprise pour tout le monde, y comris pour moi. ” Jacques-Yves Cousteau UBC X 10 Alden G. Lank Jacques-Yves Cousteau “The day that I stop it will be because I am dead. Moreover, that will surprise everyone, including me. ” Session III Part 2

BMO Harris Private Banking 2003 Outstanding Workshop “Le jour où je m’arrêterai, c’est que je serai mort. Ce sera d’ailleurs une surprise pour tout le monde, y comris pour moi. ” Jacques-Yves Cousteau UBC X 10 Alden G. Lank Jacques-Yves Cousteau “The day that I stop it will be because I am dead. Moreover, that will surprise everyone, including me. ” Session III Part 2

BMO Harris Private Banking 2003 Outstanding Workshop “Ce n’est pas parce qu’un gosse est né de votre sperme qu’il a les qualités nécessaires pour vous remplacer. ” Jacques-Yves Cousteau about his son Jean-Philippe Cousteau UBC X 11 Alden G. Lank Jacques-Yves Cousteau à propos de son fils Jean-Philippe Cousteau “It is not because a kid is born from your sperm that he has the necessary qualities to replace you. ” Session III Part 2

BMO Harris Private Banking 2003 Outstanding Workshop “Ce n’est pas parce qu’un gosse est né de votre sperme qu’il a les qualités nécessaires pour vous remplacer. ” Jacques-Yves Cousteau about his son Jean-Philippe Cousteau UBC X 11 Alden G. Lank Jacques-Yves Cousteau à propos de son fils Jean-Philippe Cousteau “It is not because a kid is born from your sperm that he has the necessary qualities to replace you. ” Session III Part 2

A Founder Looks at Work BMO Harris Private Banking 2003 Outstanding Workshop “Thinking men know that work is the salvation of the race, morally, physically, socially. Work does more than get us our living, it gets us our life. I do not think that man can ever leave his business. You think of it by day and dream of it by night. ” Henry Ford UBC X 12 Alden G. Lank Session III Part 2

A Founder Looks at Work BMO Harris Private Banking 2003 Outstanding Workshop “Thinking men know that work is the salvation of the race, morally, physically, socially. Work does more than get us our living, it gets us our life. I do not think that man can ever leave his business. You think of it by day and dream of it by night. ” Henry Ford UBC X 12 Alden G. Lank Session III Part 2

Letting Go: It Can Be Difficult BMO Harris Private Banking 2003 Outstanding Workshop Each of us in his own unconscious way seeks omnipotence and immortality. To varying degrees, each wants his achievements to stand as an enduring monument to himself; each wants to demonstrate that he was necessary to his organization, that it cannot do without him. This pressure is particularly strong for entrepreneurs and those who hold their positions for long periods of time. Harry Levinson (1971) UBC X 13 Alden G. Lank Session III Part 2

Letting Go: It Can Be Difficult BMO Harris Private Banking 2003 Outstanding Workshop Each of us in his own unconscious way seeks omnipotence and immortality. To varying degrees, each wants his achievements to stand as an enduring monument to himself; each wants to demonstrate that he was necessary to his organization, that it cannot do without him. This pressure is particularly strong for entrepreneurs and those who hold their positions for long periods of time. Harry Levinson (1971) UBC X 13 Alden G. Lank Session III Part 2

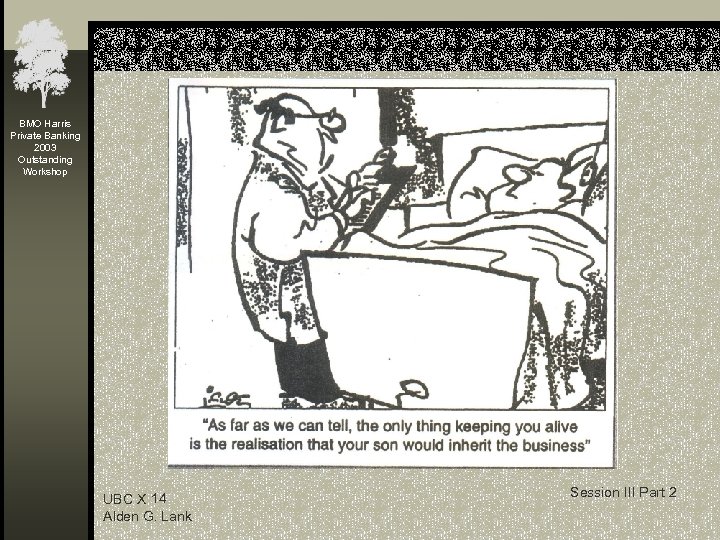

BMO Harris Private Banking 2003 Outstanding Workshop UBC X 14 Alden G. Lank Session III Part 2

BMO Harris Private Banking 2003 Outstanding Workshop UBC X 14 Alden G. Lank Session III Part 2

A Message for the Successee BMO Harris Private Banking 2003 Outstanding Workshop “The final test of greatness for a business manager is to know how and when to let go. ” Peter Drucker UBC X 15 Alden G. Lank Session III Part 2

A Message for the Successee BMO Harris Private Banking 2003 Outstanding Workshop “The final test of greatness for a business manager is to know how and when to let go. ” Peter Drucker UBC X 15 Alden G. Lank Session III Part 2

Mandate No. 1 BMO Harris Private Banking 2003 Outstanding Workshop You have been asked to address a group of highly competent, new university graduates – all of whom aspire to reach the very top level of your family company. What advice do you give them to maximize the probability that the eventual transition of management power is as efficient and effective as possible. Assume that there a couple of your family members in the group? UBC X 16 Alden G. Lank Session III Part 2

Mandate No. 1 BMO Harris Private Banking 2003 Outstanding Workshop You have been asked to address a group of highly competent, new university graduates – all of whom aspire to reach the very top level of your family company. What advice do you give them to maximize the probability that the eventual transition of management power is as efficient and effective as possible. Assume that there a couple of your family members in the group? UBC X 16 Alden G. Lank Session III Part 2

Mandate No. 2 BMO Harris Private Banking 2003 Outstanding Workshop Assume you are addressing a group of CEOs of family companies most of whom are members of the owning family. They range in age from 55 to 75. What advice do you give them to maximize the probability that the eventual transition of power is as efficient and effective as possible? UBC X 17 Alden G. Lank Session III Part 2

Mandate No. 2 BMO Harris Private Banking 2003 Outstanding Workshop Assume you are addressing a group of CEOs of family companies most of whom are members of the owning family. They range in age from 55 to 75. What advice do you give them to maximize the probability that the eventual transition of power is as efficient and effective as possible? UBC X 17 Alden G. Lank Session III Part 2

Advice to Potential Successors BMO Harris Private Banking 2003 Outstanding Workshop n Relevant education n Outside experience n Examine motivation n Be prepared to live in a fish bowl n Insist on clarity of role expectations and performance n n n standards Demand honest, constructive feedback on performance Actively search out developmental opportunities Build alliances with key stakeholders including the family Get to know the successee and top management team Clarify successee’s plans UBC X 18 Alden G. Lank Session III Part 2

Advice to Potential Successors BMO Harris Private Banking 2003 Outstanding Workshop n Relevant education n Outside experience n Examine motivation n Be prepared to live in a fish bowl n Insist on clarity of role expectations and performance n n n standards Demand honest, constructive feedback on performance Actively search out developmental opportunities Build alliances with key stakeholders including the family Get to know the successee and top management team Clarify successee’s plans UBC X 18 Alden G. Lank Session III Part 2

Successee: Caveats BMO Harris Private Banking 2003 Outstanding Workshop 1. Don’t force potential successors to enter or stay against their will 2. Create systems for: • • • Challenging assignments Diverse experiences Realistic objectives and standards Quality feedback on performance Opportunities for education and training 3. Manifest interest and concern 4. Start the process early 5. Share your values but do not expect that successor will buy all UBC X 19 Alden G. Lank Session III Part 2

Successee: Caveats BMO Harris Private Banking 2003 Outstanding Workshop 1. Don’t force potential successors to enter or stay against their will 2. Create systems for: • • • Challenging assignments Diverse experiences Realistic objectives and standards Quality feedback on performance Opportunities for education and training 3. Manifest interest and concern 4. Start the process early 5. Share your values but do not expect that successor will buy all UBC X 19 Alden G. Lank Session III Part 2

Successee: Caveats BMO Harris Private Banking 2003 Outstanding Workshop 1. 2. 3. 4. 5. Interact with stakeholders Build consensus Clarify intentions on phasing out process Stick to your intentions Develop game plan for retirement N. B. : The name of the game: Go for competence!!! UBC X 19 a Alden G. Lank Session III Part 2

Successee: Caveats BMO Harris Private Banking 2003 Outstanding Workshop 1. 2. 3. 4. 5. Interact with stakeholders Build consensus Clarify intentions on phasing out process Stick to your intentions Develop game plan for retirement N. B. : The name of the game: Go for competence!!! UBC X 19 a Alden G. Lank Session III Part 2