b54a0a02b89d08ea89d84ed9a1c55273.ppt

- Количество слайдов: 24

Workshop on Innovative Options for Financing the Development and Transfer of Technologies Montreal, 27 -29 September 2004 “Financing Renewable Energy in Emerging Markets – Opportunities & Approaches” Frank Joshua Montreal, 28 September 2004

Workshop on Innovative Options for Financing the Development and Transfer of Technologies Montreal, 27 -29 September 2004 “Financing Renewable Energy in Emerging Markets – Opportunities & Approaches” Frank Joshua Montreal, 28 September 2004

Contents w Investor Expectations in Emerging Markets w Returns on Investment & Impact of Carbon Finance w Assessing Risks & Rewards in Emerging Markets w Opportunities for Private Equity Funds & Debt Providers w Role of Climate Investment Partnership (“C. I. P. ”) I 2

Contents w Investor Expectations in Emerging Markets w Returns on Investment & Impact of Carbon Finance w Assessing Risks & Rewards in Emerging Markets w Opportunities for Private Equity Funds & Debt Providers w Role of Climate Investment Partnership (“C. I. P. ”) I 2

1 Investor Expectations in Emerging Markets I 3

1 Investor Expectations in Emerging Markets I 3

Rationale for Investing in Renewable Energy Projects in Emerging Markets w Emerging markets offer major opportunities for Renewable Energy projects w In the best markets (for example: China, India, Brazil, Chile, Mexico, Korea, Thailand, Philippines) common characteristics of good potential include: § Huge and growing energy demand (e. g. China recently announced that it plans to invest USD 120 billion to double generation capacity by 2010) § Centralized power sector (need for re-organization) § Good wind speeds and/or small scale hydro resources § Healthy “start up” growth rates and returns § Increasing environmental awareness § Relevant national and/or local policies in place § Ability to utilize CDM benefits w Emerging markets have significant long term potential compared to North America and Europe w However, until recently, lack of reliable local developers, regulatory risk, and wind data risk have tended to depress investments. I 4

Rationale for Investing in Renewable Energy Projects in Emerging Markets w Emerging markets offer major opportunities for Renewable Energy projects w In the best markets (for example: China, India, Brazil, Chile, Mexico, Korea, Thailand, Philippines) common characteristics of good potential include: § Huge and growing energy demand (e. g. China recently announced that it plans to invest USD 120 billion to double generation capacity by 2010) § Centralized power sector (need for re-organization) § Good wind speeds and/or small scale hydro resources § Healthy “start up” growth rates and returns § Increasing environmental awareness § Relevant national and/or local policies in place § Ability to utilize CDM benefits w Emerging markets have significant long term potential compared to North America and Europe w However, until recently, lack of reliable local developers, regulatory risk, and wind data risk have tended to depress investments. I 4

Investor Expectations & Opportunity for Strong Emerging Market Returns w Equity investment IRR: § India 15 – 25% § China 10 – 15% § Korea 10 – 15% § Brazil 15 – 20% § Chile 10 – 15% w + 2. 5 – 5% from carbon credits w Expected IRR of individual wind farms: +/- 15% + carbon + country risk premium w Expected IRR of Landfill gas: >15%, + carbon + country risk premium w Exit Strategy: Possible Sale of Equity to local utility or through IPO ü If equity is sold after 3 – 5 years of operating history a significant capital gain can be made ü IPOs of bundled RE projects have been successful in mature markets (Europe) but have yet to be tried in emerging markets I 5

Investor Expectations & Opportunity for Strong Emerging Market Returns w Equity investment IRR: § India 15 – 25% § China 10 – 15% § Korea 10 – 15% § Brazil 15 – 20% § Chile 10 – 15% w + 2. 5 – 5% from carbon credits w Expected IRR of individual wind farms: +/- 15% + carbon + country risk premium w Expected IRR of Landfill gas: >15%, + carbon + country risk premium w Exit Strategy: Possible Sale of Equity to local utility or through IPO ü If equity is sold after 3 – 5 years of operating history a significant capital gain can be made ü IPOs of bundled RE projects have been successful in mature markets (Europe) but have yet to be tried in emerging markets I 5

2 Returns on Investment & Impact of Carbon Finance I 6

2 Returns on Investment & Impact of Carbon Finance I 6

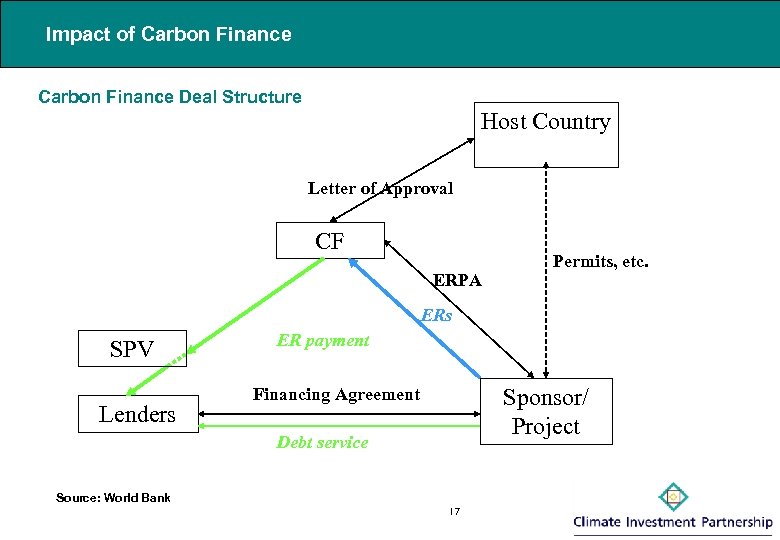

Impact of Carbon Finance Deal Structure Host Country Letter of Approval CF ERPA Permits, etc. ERs SPV Lenders ER payment Sponsor/ Project Financing Agreement Debt service Source: World Bank I 7

Impact of Carbon Finance Deal Structure Host Country Letter of Approval CF ERPA Permits, etc. ERs SPV Lenders ER payment Sponsor/ Project Financing Agreement Debt service Source: World Bank I 7

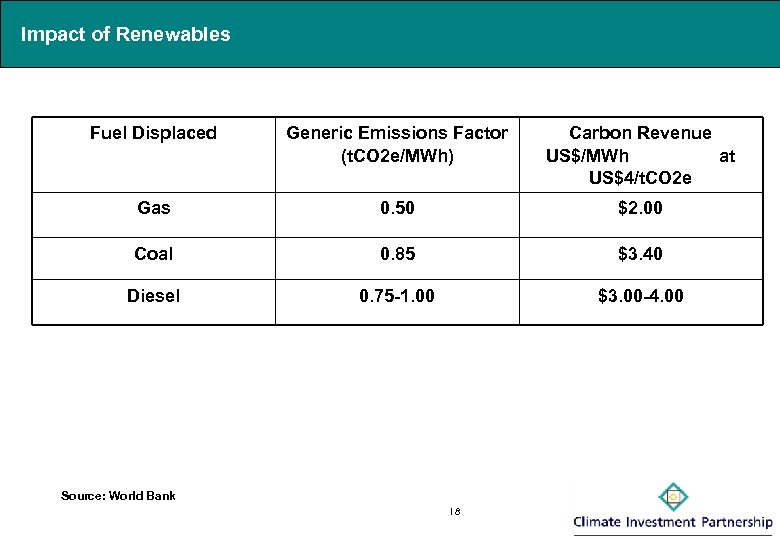

Impact of Renewables Fuel Displaced Generic Emissions Factor (t. CO 2 e/MWh) Carbon Revenue US$/MWh at US$4/t. CO 2 e Gas 0. 50 $2. 00 Coal 0. 85 $3. 40 Diesel 0. 75 -1. 00 $3. 00 -4. 00 Source: World Bank I 8

Impact of Renewables Fuel Displaced Generic Emissions Factor (t. CO 2 e/MWh) Carbon Revenue US$/MWh at US$4/t. CO 2 e Gas 0. 50 $2. 00 Coal 0. 85 $3. 40 Diesel 0. 75 -1. 00 $3. 00 -4. 00 Source: World Bank I 8

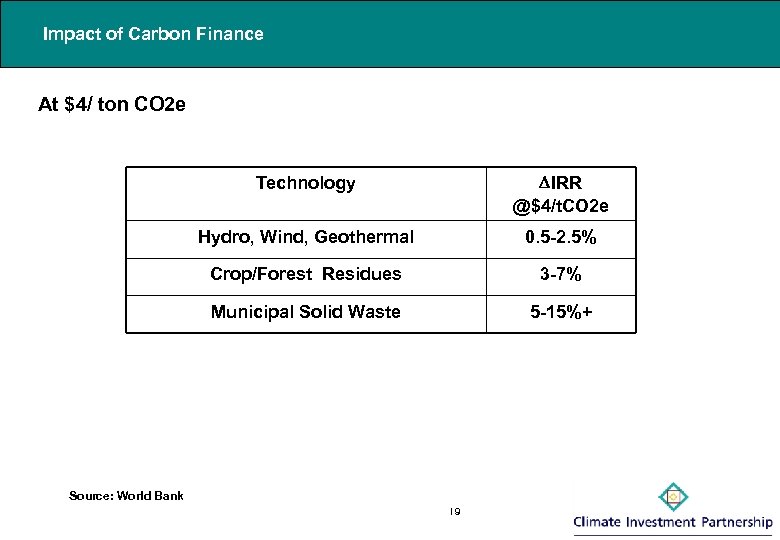

Impact of Carbon Finance At $4/ ton CO 2 e Technology DIRR @$4/t. CO 2 e Hydro, Wind, Geothermal 0. 5 -2. 5% Crop/Forest Residues 3 -7% Municipal Solid Waste 5 -15%+ Source: World Bank I 9

Impact of Carbon Finance At $4/ ton CO 2 e Technology DIRR @$4/t. CO 2 e Hydro, Wind, Geothermal 0. 5 -2. 5% Crop/Forest Residues 3 -7% Municipal Solid Waste 5 -15%+ Source: World Bank I 9

Profitability of a Subset of CIP Projects Source: Climate Investment Partnership (CIP) I 10

Profitability of a Subset of CIP Projects Source: Climate Investment Partnership (CIP) I 10

Impact of Carbon Finance w Increased cash flow boosts IRRs § ~0. 5% to 2. 5% for renewables/EE § 5 -15% for CH 4 w High quality cash flow reduces risk § OECD - sourced § $- or €- denominated § Investment-grade payer ØEliminate currency convertibility or transfer risk w Financial engineering helps access capital markets I 11

Impact of Carbon Finance w Increased cash flow boosts IRRs § ~0. 5% to 2. 5% for renewables/EE § 5 -15% for CH 4 w High quality cash flow reduces risk § OECD - sourced § $- or €- denominated § Investment-grade payer ØEliminate currency convertibility or transfer risk w Financial engineering helps access capital markets I 11

3 Assessing Risks & Rewards in Emerging Markets I 12

3 Assessing Risks & Rewards in Emerging Markets I 12

Understanding Carbon Risk (1) w The GHG business involves many poorly understood but widely perceived risks: § Regulatory risk § Performance risk § Delivery risk § Counterparty Credit risk § Price risk § Etc. w Proposition: Investors’ inability to accurately assess “Carbon Risks & Rewards” will drive resources towards “Carbon Trading” instead of “Project Finance” I 13

Understanding Carbon Risk (1) w The GHG business involves many poorly understood but widely perceived risks: § Regulatory risk § Performance risk § Delivery risk § Counterparty Credit risk § Price risk § Etc. w Proposition: Investors’ inability to accurately assess “Carbon Risks & Rewards” will drive resources towards “Carbon Trading” instead of “Project Finance” I 13

Understanding Carbon Risk (2) The Evidence: ü Volume of carbon reductions traded since 2001 has doubled year-on-year to over 100 mt. CO 2 e per year ü Yet most carbon projects (CDM) have not achieved financial close. Why? Perceived Risks will: ü Discourage investment in RE & GHG Projects by major financial institutions, and ü Drive resources towards “Carbon Trading” instead of “Project Finance”… § Carbon is not their core business § Hedge trading via Forward Contracts with “payment-on-delivery” terms § Governments & Multilateral Financial Institutions as Investors (e. g. Dutch, UK, PCF, etc) § Missing: Investment Banks; Fund Managers; Debt Providers I 14

Understanding Carbon Risk (2) The Evidence: ü Volume of carbon reductions traded since 2001 has doubled year-on-year to over 100 mt. CO 2 e per year ü Yet most carbon projects (CDM) have not achieved financial close. Why? Perceived Risks will: ü Discourage investment in RE & GHG Projects by major financial institutions, and ü Drive resources towards “Carbon Trading” instead of “Project Finance”… § Carbon is not their core business § Hedge trading via Forward Contracts with “payment-on-delivery” terms § Governments & Multilateral Financial Institutions as Investors (e. g. Dutch, UK, PCF, etc) § Missing: Investment Banks; Fund Managers; Debt Providers I 14

Enabling Carbon-linked Project Finance w But as the GHG market matures “Carbon Procurement” will face supply constraints § And rising carbon prices § Companies and governments could face serious financial exposure w RE & CDM project developers need early upfront financing § In the form of Equity, Debt, & Mezzanine Finance, & Risk Mitigation § Carbon as Collateral: i. e. utilizing the market value of emission reductions to enable projects to proceed w Carbon as financial security (€, $, £) w Carbon as risk mitigation asset w Renewable Energy Certificates (RECs & ROCs) I 15

Enabling Carbon-linked Project Finance w But as the GHG market matures “Carbon Procurement” will face supply constraints § And rising carbon prices § Companies and governments could face serious financial exposure w RE & CDM project developers need early upfront financing § In the form of Equity, Debt, & Mezzanine Finance, & Risk Mitigation § Carbon as Collateral: i. e. utilizing the market value of emission reductions to enable projects to proceed w Carbon as financial security (€, $, £) w Carbon as risk mitigation asset w Renewable Energy Certificates (RECs & ROCs) I 15

4 Opportunities for Private Equity Funds & Debt Providers I 16

4 Opportunities for Private Equity Funds & Debt Providers I 16

Attracting Private Equity & Debt Providers The Problem: w Strong market interest exists in emerging markets (private equity and debt) but bundling opportunities are lacking w Investors often lack resources to find, screen, and evaluate projects w And few RE & GHG projects are well structured from a technical, financial and risk point of view; hence access to project debt and equity is poor w Risk perceptions: Investors often see RE & GHG projects as combining: (i) a risky sectors with (ii) high risk markets & (iii) a risky commodity… I 17

Attracting Private Equity & Debt Providers The Problem: w Strong market interest exists in emerging markets (private equity and debt) but bundling opportunities are lacking w Investors often lack resources to find, screen, and evaluate projects w And few RE & GHG projects are well structured from a technical, financial and risk point of view; hence access to project debt and equity is poor w Risk perceptions: Investors often see RE & GHG projects as combining: (i) a risky sectors with (ii) high risk markets & (iii) a risky commodity… I 17

Opportunities for Private Equity Funds Solution: Renewable Energy Equity Funds ü Create commercially attractive diversified investment opportunity by bundling replicable high quality projects ü Stick to proven replicable cost competitive technologies, mainly on-grid, and mostly Wind Power, Hydro Power, and Landfill Gas Projects ü Work with strong developers to reduce risk of investment delays ü Raise equity mainly in the private sector & look to increase returns through soft debt ü Lock in advantageous pricing and future cash flow for carbon ü ROI of Funds expected to exceed that of individual project investments (i. e. 15 – 20%, plus carbon) ü Benefit from opportunity for early exit through bundling and sale of investments after construction and safe operating period. I 18

Opportunities for Private Equity Funds Solution: Renewable Energy Equity Funds ü Create commercially attractive diversified investment opportunity by bundling replicable high quality projects ü Stick to proven replicable cost competitive technologies, mainly on-grid, and mostly Wind Power, Hydro Power, and Landfill Gas Projects ü Work with strong developers to reduce risk of investment delays ü Raise equity mainly in the private sector & look to increase returns through soft debt ü Lock in advantageous pricing and future cash flow for carbon ü ROI of Funds expected to exceed that of individual project investments (i. e. 15 – 20%, plus carbon) ü Benefit from opportunity for early exit through bundling and sale of investments after construction and safe operating period. I 18

Where’s the Money? Some Examples: w European Investment Bank (EIB) renewable energy investments in 2003: € 500 m w EIB Climate Change Facility: € 500 m w EIB/EDFI Cotonou Investment Facility: € 2. 2 billion w World Bank Carbon Finance Business: $450 m w Citigroup (Renewables, private equity): US$500 m w Government of Netherlands: € 500 m w Japan Carbon Fund § Development Bank of Japan: US$100 m § Japan Bank for International Cooperation: US$100 m w Government of Austria: € 360 m (€ 36 million per year for 10 years) w Government of Canada: C$50 m (C$10 million per year for 5 years) w Other possible sources of funds: § Fortis Bank… World’s largest investor in wind power § Rabobank… § ABN AMRO… § Others… I 19

Where’s the Money? Some Examples: w European Investment Bank (EIB) renewable energy investments in 2003: € 500 m w EIB Climate Change Facility: € 500 m w EIB/EDFI Cotonou Investment Facility: € 2. 2 billion w World Bank Carbon Finance Business: $450 m w Citigroup (Renewables, private equity): US$500 m w Government of Netherlands: € 500 m w Japan Carbon Fund § Development Bank of Japan: US$100 m § Japan Bank for International Cooperation: US$100 m w Government of Austria: € 360 m (€ 36 million per year for 10 years) w Government of Canada: C$50 m (C$10 million per year for 5 years) w Other possible sources of funds: § Fortis Bank… World’s largest investor in wind power § Rabobank… § ABN AMRO… § Others… I 19

5 Role of Climate Investment Partnership (“C. I. P. ”) I 20

5 Role of Climate Investment Partnership (“C. I. P. ”) I 20

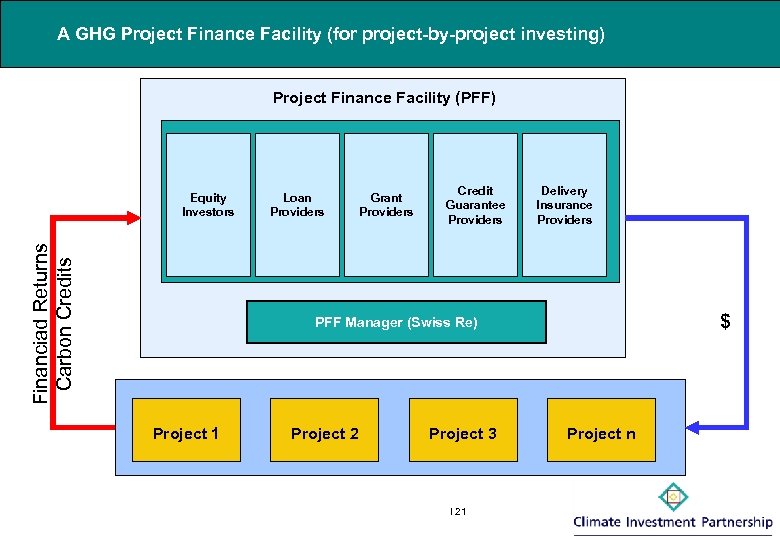

A GHG Project Finance Facility (for project-by-project investing) Project Finance Facility (PFF) Financiad Returns Carbon Credits Equity Investors Loan Providers Grant Providers Credit Guarantee Providers Delivery Insurance Providers $ PFF Manager (Swiss Re) Project 1 Project 2 Project 3 I 21 Project n

A GHG Project Finance Facility (for project-by-project investing) Project Finance Facility (PFF) Financiad Returns Carbon Credits Equity Investors Loan Providers Grant Providers Credit Guarantee Providers Delivery Insurance Providers $ PFF Manager (Swiss Re) Project 1 Project 2 Project 3 I 21 Project n

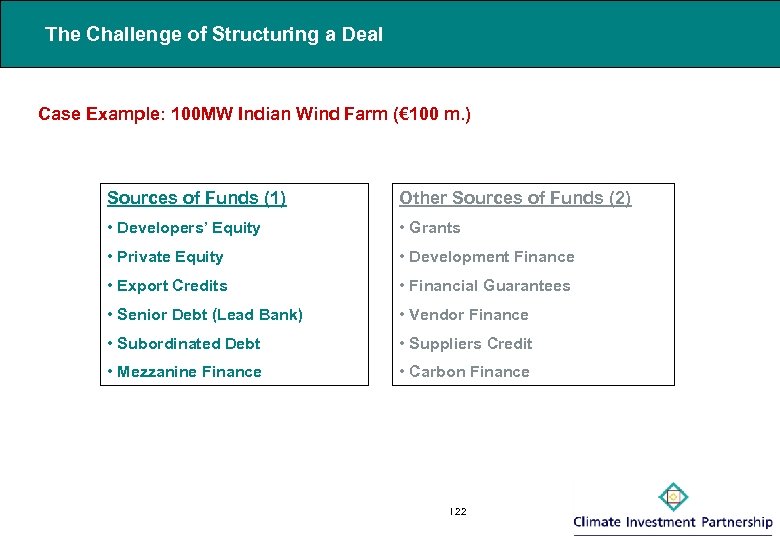

The Challenge of Structuring a Deal Case Example: 100 MW Indian Wind Farm (€ 100 m. ) Sources of Funds (1) Other Sources of Funds (2) • Developers’ Equity • Grants • Private Equity • Development Finance • Export Credits • Financial Guarantees • Senior Debt (Lead Bank) • Vendor Finance • Subordinated Debt • Suppliers Credit • Mezzanine Finance • Carbon Finance I 22

The Challenge of Structuring a Deal Case Example: 100 MW Indian Wind Farm (€ 100 m. ) Sources of Funds (1) Other Sources of Funds (2) • Developers’ Equity • Grants • Private Equity • Development Finance • Export Credits • Financial Guarantees • Senior Debt (Lead Bank) • Vendor Finance • Subordinated Debt • Suppliers Credit • Mezzanine Finance • Carbon Finance I 22

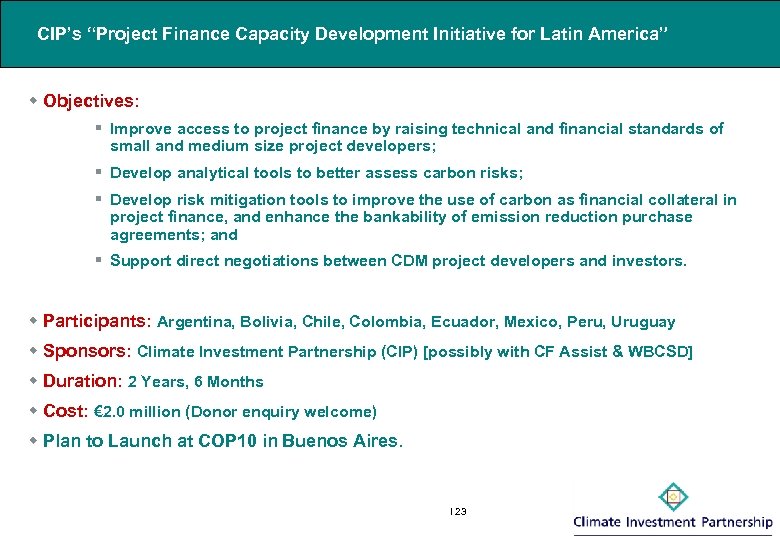

CIP’s “Project Finance Capacity Development Initiative for Latin America” w Objectives: § Improve access to project finance by raising technical and financial standards of small and medium size project developers; § Develop analytical tools to better assess carbon risks; § Develop risk mitigation tools to improve the use of carbon as financial collateral in project finance, and enhance the bankability of emission reduction purchase agreements; and § Support direct negotiations between CDM project developers and investors. w Participants: Argentina, Bolivia, Chile, Colombia, Ecuador, Mexico, Peru, Uruguay w Sponsors: Climate Investment Partnership (CIP) [possibly with CF Assist & WBCSD] w Duration: 2 Years, 6 Months w Cost: € 2. 0 million (Donor enquiry welcome) w Plan to Launch at COP 10 in Buenos Aires. I 23

CIP’s “Project Finance Capacity Development Initiative for Latin America” w Objectives: § Improve access to project finance by raising technical and financial standards of small and medium size project developers; § Develop analytical tools to better assess carbon risks; § Develop risk mitigation tools to improve the use of carbon as financial collateral in project finance, and enhance the bankability of emission reduction purchase agreements; and § Support direct negotiations between CDM project developers and investors. w Participants: Argentina, Bolivia, Chile, Colombia, Ecuador, Mexico, Peru, Uruguay w Sponsors: Climate Investment Partnership (CIP) [possibly with CF Assist & WBCSD] w Duration: 2 Years, 6 Months w Cost: € 2. 0 million (Donor enquiry welcome) w Plan to Launch at COP 10 in Buenos Aires. I 23

Contact Details: Frank Joshua, Chief Executive Officer, CIP Karen Mc. Clellan, Director, Investment, CIP 7 -9 Chemin des Balexert, 1219 Châteleine, Geneva, Switzerland. Tel. (Frank): +41 78 772 4183; (Karen): +44 77 9250 1109 Tel/Fax. +41 22 776 5078 Email: frank. joshua@climateinvestors. com karen. mcclellan@climateinvestors. com I 24

Contact Details: Frank Joshua, Chief Executive Officer, CIP Karen Mc. Clellan, Director, Investment, CIP 7 -9 Chemin des Balexert, 1219 Châteleine, Geneva, Switzerland. Tel. (Frank): +41 78 772 4183; (Karen): +44 77 9250 1109 Tel/Fax. +41 22 776 5078 Email: frank. joshua@climateinvestors. com karen. mcclellan@climateinvestors. com I 24