f0e4b8ab5b462398ceb26763c4d2687e.ppt

- Количество слайдов: 87

Working with the IRS Chapter Twelve

Working with the IRS Chapter Twelve

Organization of IRS Ø IRS Oversight Board (RRA’ 98) President appoints Ø Six members from private sector, staggered 5 year terms Ø Commissioner is standing member Ø NTEU (IRS employee union) appoints one standing member Ø Recommends to President candidates for Commissioner Ø

Organization of IRS Ø IRS Oversight Board (RRA’ 98) President appoints Ø Six members from private sector, staggered 5 year terms Ø Commissioner is standing member Ø NTEU (IRS employee union) appoints one standing member Ø Recommends to President candidates for Commissioner Ø

Organization of IRS (cont’d) Ø IRS Oversight Board (cont’d) Develops long term strategy Ø Reviews and approves mission, strategic plans, annual budget request Ø As name implies, oversight of IRS Ø No authority to affect tax policy of intervene into IRS personnel or procurement matters Ø

Organization of IRS (cont’d) Ø IRS Oversight Board (cont’d) Develops long term strategy Ø Reviews and approves mission, strategic plans, annual budget request Ø As name implies, oversight of IRS Ø No authority to affect tax policy of intervene into IRS personnel or procurement matters Ø

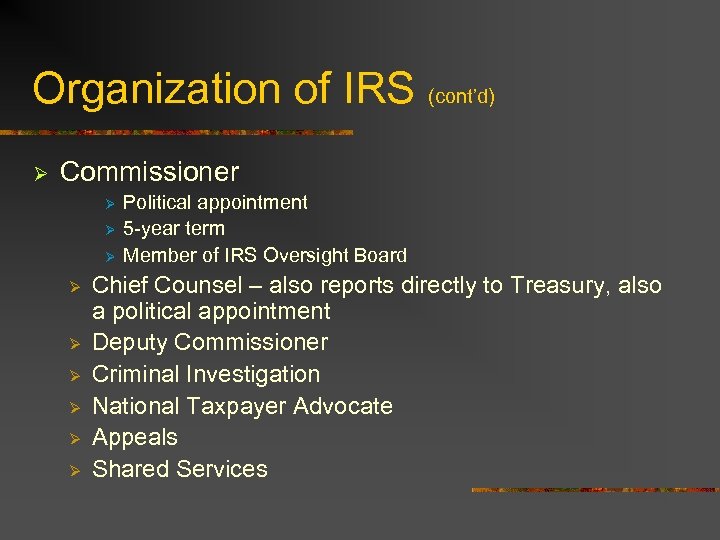

Organization of IRS (cont’d) Ø Commissioner Ø Ø Ø Ø Ø Political appointment 5 -year term Member of IRS Oversight Board Chief Counsel – also reports directly to Treasury, also a political appointment Deputy Commissioner Criminal Investigation National Taxpayer Advocate Appeals Shared Services

Organization of IRS (cont’d) Ø Commissioner Ø Ø Ø Ø Ø Political appointment 5 -year term Member of IRS Oversight Board Chief Counsel – also reports directly to Treasury, also a political appointment Deputy Commissioner Criminal Investigation National Taxpayer Advocate Appeals Shared Services

IRS Mission Statement Provide America’s taxpayers top quality service by helping them understand meet their tax responsibilities and by applying the tax law with integrity and fairness to all

IRS Mission Statement Provide America’s taxpayers top quality service by helping them understand meet their tax responsibilities and by applying the tax law with integrity and fairness to all

IRS Organization (cont’d) n Chief Counsel n n n Political appointment Commissioner’s lawyer - agency’s highest ranking legal advisor Reports to the Commissioner in. re. n n Enforcement and administration of the tax laws Litigates disputed tax issues cases not otherwise resolvable

IRS Organization (cont’d) n Chief Counsel n n n Political appointment Commissioner’s lawyer - agency’s highest ranking legal advisor Reports to the Commissioner in. re. n n Enforcement and administration of the tax laws Litigates disputed tax issues cases not otherwise resolvable

IRS Organization (cont’d) n Chief Counsel (cont’d) n Writes Regs n Proposed legislation n Tax Treaties n Executive orders n Revenue Rulings n Private Letter Rulings n n Etc.

IRS Organization (cont’d) n Chief Counsel (cont’d) n Writes Regs n Proposed legislation n Tax Treaties n Executive orders n Revenue Rulings n Private Letter Rulings n n Etc.

IRS Organization (cont’d) n Deputy Commissioner n Operating Divisions Large and Mid-Size Business – D. C. ($$) n Small Business/Self-Employed – Atlanta ($$) n Wage and Investment Income – D. C. ($$) n Exempt-Organization and Government Entities – D. C. ($$) n

IRS Organization (cont’d) n Deputy Commissioner n Operating Divisions Large and Mid-Size Business – D. C. ($$) n Small Business/Self-Employed – Atlanta ($$) n Wage and Investment Income – D. C. ($$) n Exempt-Organization and Government Entities – D. C. ($$) n

IRS Organization (cont’d) n Note: The following no longer exist n n Regional offices / Regional Commissioner District offices – District Director

IRS Organization (cont’d) n Note: The following no longer exist n n Regional offices / Regional Commissioner District offices – District Director

Taxpayer Advocate n National Taxpayer Advocate n n n Taxpayer intervention system Local Taxpayer Advocates Taxpayer Bill of Rights Form 911 - Taxpayer Assistance Order (TAO) On page 391, last paragraph under Taxpayer Rights re. “confidentiality privilege, ”

Taxpayer Advocate n National Taxpayer Advocate n n n Taxpayer intervention system Local Taxpayer Advocates Taxpayer Bill of Rights Form 911 - Taxpayer Assistance Order (TAO) On page 391, last paragraph under Taxpayer Rights re. “confidentiality privilege, ”

Taxpayer Bill of Rights n Taxpayers guaranteed certain rights n n n A recording of any administrative proceeding, after a 10 -day request notice Transcript of administrative proceeding interview (at TP’s expense) An explanation of IRS position on any administrative matter it initiates May be represented by attorney, CPA, or other person permitted to practice before IRS Etc.

Taxpayer Bill of Rights n Taxpayers guaranteed certain rights n n n A recording of any administrative proceeding, after a 10 -day request notice Transcript of administrative proceeding interview (at TP’s expense) An explanation of IRS position on any administrative matter it initiates May be represented by attorney, CPA, or other person permitted to practice before IRS Etc.

SEC. 7525. CONFIDENTIALITY PRIVILEGES n 7525(a)(1) GENERAL RULE. --With respect to tax advice, the same common law protections of confidentiality which apply to a communication between a taxpayer and an attorney shall also apply to a communication between a taxpayer and any federally authorized tax practitioner to the extent the communication would be considered a privileged communication if it were between a taxpayer and an attorney.

SEC. 7525. CONFIDENTIALITY PRIVILEGES n 7525(a)(1) GENERAL RULE. --With respect to tax advice, the same common law protections of confidentiality which apply to a communication between a taxpayer and an attorney shall also apply to a communication between a taxpayer and any federally authorized tax practitioner to the extent the communication would be considered a privileged communication if it were between a taxpayer and an attorney.

SEC. 7525. CONFIDENTIALITY PRIVILEGES (cont’d) n n n 7525(a)(2) LIMITATIONS. --Paragraph (1) may only be asserted in-(A) any noncriminal tax matter before the Internal Revenue Service; and (B) any noncriminal tax proceeding in Federal court brought by or against the United States.

SEC. 7525. CONFIDENTIALITY PRIVILEGES (cont’d) n n n 7525(a)(2) LIMITATIONS. --Paragraph (1) may only be asserted in-(A) any noncriminal tax matter before the Internal Revenue Service; and (B) any noncriminal tax proceeding in Federal court brought by or against the United States.

SEC. 7525. CONFIDENTIALITY PRIVILEGES (cont’d) n 7525(a)(3)(A) FEDERALLY AUTHORIZED TAX PRACTITIONER. --The term "federally authorized tax practitioner" means any individual who is authorized under Federal law to practice before the Internal Revenue Service if such practice is subject to Federal regulation under section 330 of title 31, United States Code.

SEC. 7525. CONFIDENTIALITY PRIVILEGES (cont’d) n 7525(a)(3)(A) FEDERALLY AUTHORIZED TAX PRACTITIONER. --The term "federally authorized tax practitioner" means any individual who is authorized under Federal law to practice before the Internal Revenue Service if such practice is subject to Federal regulation under section 330 of title 31, United States Code.

SEC. 7525. CONFIDENTIALITY PRIVILEGES (cont’d) n 7525(a)(3)(B) TAX ADVICE. --The term "tax advice" means advice given by an individual with respect to a matter which is within the scope of the individual's authority to practice described in subparagraph (A).

SEC. 7525. CONFIDENTIALITY PRIVILEGES (cont’d) n 7525(a)(3)(B) TAX ADVICE. --The term "tax advice" means advice given by an individual with respect to a matter which is within the scope of the individual's authority to practice described in subparagraph (A).

SEC. 7525. CONFIDENTIALITY PRIVILEGES (cont’d) n n 7525(b) SECTION NOT TO APPLY TO COMMUNICATIONS REGARDING CORPORATE TAX SHELTERS. -The privilege under subsection (a) shall not apply to any written communication between a federally authorized tax practitioner and a director, shareholder, officer, or employee, agent, or representative of a corporation in connection with the promotion of the direct or indirect participation of such corporation in any tax shelter (as defined in section 6662(d)(2)(C)(iii) ).

SEC. 7525. CONFIDENTIALITY PRIVILEGES (cont’d) n n 7525(b) SECTION NOT TO APPLY TO COMMUNICATIONS REGARDING CORPORATE TAX SHELTERS. -The privilege under subsection (a) shall not apply to any written communication between a federally authorized tax practitioner and a director, shareholder, officer, or employee, agent, or representative of a corporation in connection with the promotion of the direct or indirect participation of such corporation in any tax shelter (as defined in section 6662(d)(2)(C)(iii) ).

Tax Practitioner Confidentiality Privilege n n n RRA’ 98 Extends attorney-client confidentiality privilege in tax matters to non-attorney’s authorized to practice before the IRS May be asserted only in noncriminal proceedings

Tax Practitioner Confidentiality Privilege n n n RRA’ 98 Extends attorney-client confidentiality privilege in tax matters to non-attorney’s authorized to practice before the IRS May be asserted only in noncriminal proceedings

Tax Practitioner Confidientality Privilege (cont’d) n Confidentiality Privilege does not extend to: n n Preparation of tax returns Giving accounting or business advice Tax accrual workpapers Be aware of it, use it with discretion

Tax Practitioner Confidientality Privilege (cont’d) n Confidentiality Privilege does not extend to: n n Preparation of tax returns Giving accounting or business advice Tax accrual workpapers Be aware of it, use it with discretion

Returns / Examination Division n n Preliminary Review of Filed Returns Handled from service centers n Mathematical errors Not an examination n “Deficiency procedure” not required n No administrative remedy n IRC § 6213(b)(1) n n Unallowable items n Same as above

Returns / Examination Division n n Preliminary Review of Filed Returns Handled from service centers n Mathematical errors Not an examination n “Deficiency procedure” not required n No administrative remedy n IRC § 6213(b)(1) n n Unallowable items n Same as above

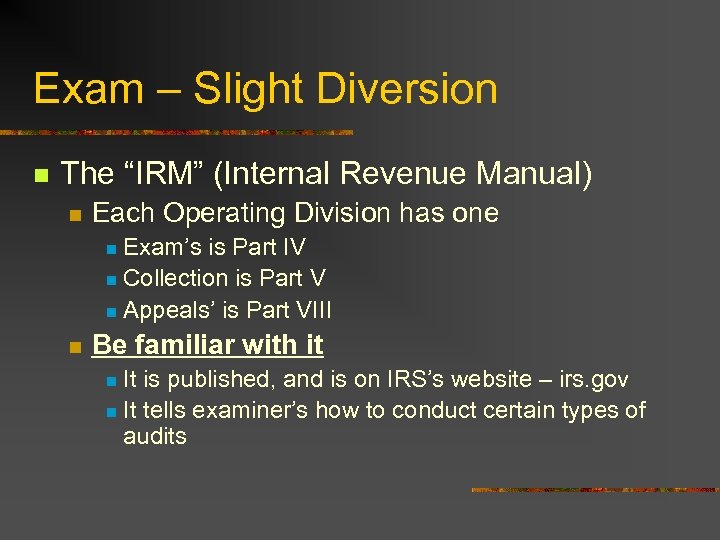

Exam – Slight Diversion n The “IRM” (Internal Revenue Manual) n Each Operating Division has one Exam’s is Part IV n Collection is Part V n Appeals’ is Part VIII n n Be familiar with it It is published, and is on IRS’s website – irs. gov n It tells examiner’s how to conduct certain types of audits n

Exam – Slight Diversion n The “IRM” (Internal Revenue Manual) n Each Operating Division has one Exam’s is Part IV n Collection is Part V n Appeals’ is Part VIII n n Be familiar with it It is published, and is on IRS’s website – irs. gov n It tells examiner’s how to conduct certain types of audits n

![The IRM n n Preparing for an IRS Audit Handbook [4. 2]3. 2. 1 The IRM n n Preparing for an IRS Audit Handbook [4. 2]3. 2. 1](https://present5.com/presentation/f0e4b8ab5b462398ceb26763c4d2687e/image-22.jpg) The IRM n n Preparing for an IRS Audit Handbook [4. 2]3. 2. 1 “IRC § 7521(c) states that an examiner cannot require a taxpayer to accompany an authorized representative to an examination interview in the absence of an administrative summons. However, the taxpayer’s voluntary presence at the interview can be requested through the representative as a means to expedite the examination process. ”

The IRM n n Preparing for an IRS Audit Handbook [4. 2]3. 2. 1 “IRC § 7521(c) states that an examiner cannot require a taxpayer to accompany an authorized representative to an examination interview in the absence of an administrative summons. However, the taxpayer’s voluntary presence at the interview can be requested through the representative as a means to expedite the examination process. ”

![The IRM n n Handbook [4. 2]3. 2. 1. 4 2. “IRC § 7602 The IRM n n Handbook [4. 2]3. 2. 1. 4 2. “IRC § 7602](https://present5.com/presentation/f0e4b8ab5b462398ceb26763c4d2687e/image-23.jpg) The IRM n n Handbook [4. 2]3. 2. 1. 4 2. “IRC § 7602 allows examiners to obtain testimony from third parties who can provide relevant information to determine the correct liability for a taxpayer. “ 3. Caution should be taken to not disclose any tax information of a confidential nature when contacts are made with third parties. ”

The IRM n n Handbook [4. 2]3. 2. 1. 4 2. “IRC § 7602 allows examiners to obtain testimony from third parties who can provide relevant information to determine the correct liability for a taxpayer. “ 3. Caution should be taken to not disclose any tax information of a confidential nature when contacts are made with third parties. ”

![Preparing for an IRS Audit n Handbook [4. 2]3. 3. 5 “ 1. An Preparing for an IRS Audit n Handbook [4. 2]3. 3. 5 “ 1. An](https://present5.com/presentation/f0e4b8ab5b462398ceb26763c4d2687e/image-24.jpg) Preparing for an IRS Audit n Handbook [4. 2]3. 3. 5 “ 1. An examiner may consider inspecting the taxpayer’s residence. Due to privacy issues and the intrusiveness of such inspections, their use should be limited. The purpose … includes (but is not limited to): n B. Determining the taxpayer’s financial status. ”

Preparing for an IRS Audit n Handbook [4. 2]3. 3. 5 “ 1. An examiner may consider inspecting the taxpayer’s residence. Due to privacy issues and the intrusiveness of such inspections, their use should be limited. The purpose … includes (but is not limited to): n B. Determining the taxpayer’s financial status. ”

![Preparing for an IRS Audit n Handbook [4. 2]3. 3 1. “The physical observation Preparing for an IRS Audit n Handbook [4. 2]3. 3 1. “The physical observation](https://present5.com/presentation/f0e4b8ab5b462398ceb26763c4d2687e/image-25.jpg) Preparing for an IRS Audit n Handbook [4. 2]3. 3 1. “The physical observation of the taxpayer’s operation, or tour of business site, is an integral part of the examination process.

Preparing for an IRS Audit n Handbook [4. 2]3. 3 1. “The physical observation of the taxpayer’s operation, or tour of business site, is an integral part of the examination process.

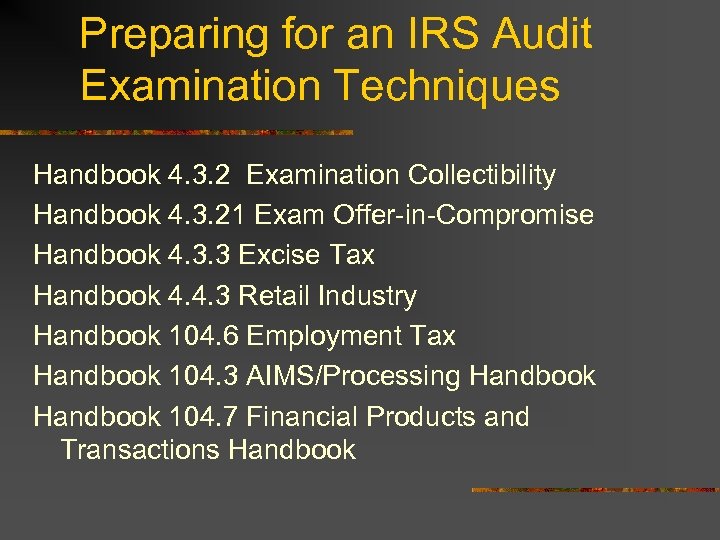

Preparing for an IRS Audit Examination Techniques Handbook 4. 3. 2 Examination Collectibility Handbook 4. 3. 21 Exam Offer-in-Compromise Handbook 4. 3. 3 Excise Tax Handbook 4. 4. 3 Retail Industry Handbook 104. 6 Employment Tax Handbook 104. 3 AIMS/Processing Handbook 104. 7 Financial Products and Transactions Handbook

Preparing for an IRS Audit Examination Techniques Handbook 4. 3. 2 Examination Collectibility Handbook 4. 3. 21 Exam Offer-in-Compromise Handbook 4. 3. 3 Excise Tax Handbook 4. 4. 3 Retail Industry Handbook 104. 6 Employment Tax Handbook 104. 3 AIMS/Processing Handbook 104. 7 Financial Products and Transactions Handbook

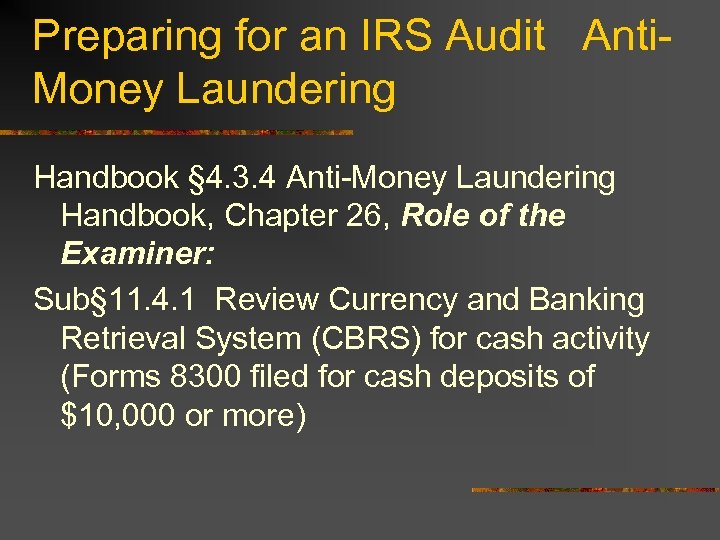

Preparing for an IRS Audit Anti. Money Laundering Handbook § 4. 3. 4 Anti-Money Laundering Handbook, Chapter 26, Role of the Examiner: Sub§ 11. 4. 1 Review Currency and Banking Retrieval System (CBRS) for cash activity (Forms 8300 filed for cash deposits of $10, 000 or more)

Preparing for an IRS Audit Anti. Money Laundering Handbook § 4. 3. 4 Anti-Money Laundering Handbook, Chapter 26, Role of the Examiner: Sub§ 11. 4. 1 Review Currency and Banking Retrieval System (CBRS) for cash activity (Forms 8300 filed for cash deposits of $10, 000 or more)

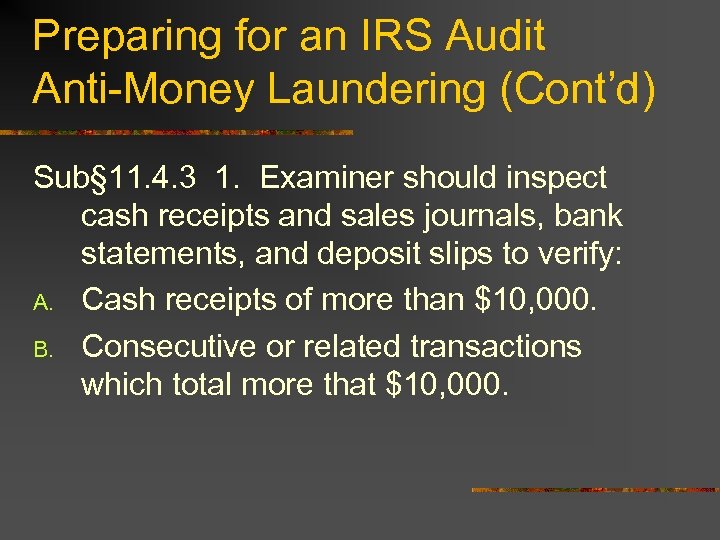

Preparing for an IRS Audit Anti-Money Laundering (Cont’d) Sub§ 11. 4. 3 1. Examiner should inspect cash receipts and sales journals, bank statements, and deposit slips to verify: A. Cash receipts of more than $10, 000. B. Consecutive or related transactions which total more that $10, 000.

Preparing for an IRS Audit Anti-Money Laundering (Cont’d) Sub§ 11. 4. 3 1. Examiner should inspect cash receipts and sales journals, bank statements, and deposit slips to verify: A. Cash receipts of more than $10, 000. B. Consecutive or related transactions which total more that $10, 000.

Preparing for an IRS Audit Anti Money Laundering (Cont’d) Sub§ 11. 4. 3 2. The examiner should be alert to identify transactions that attempt to avoid the reporting requirements of IRC § 6050 I (Form 8300 requirements) by A. (combining cash and non-cash to appear to avoid filing requirements) B. (structuring a single transaction into multiple transactions).

Preparing for an IRS Audit Anti Money Laundering (Cont’d) Sub§ 11. 4. 3 2. The examiner should be alert to identify transactions that attempt to avoid the reporting requirements of IRC § 6050 I (Form 8300 requirements) by A. (combining cash and non-cash to appear to avoid filing requirements) B. (structuring a single transaction into multiple transactions).

Market Segment Specialization Program (MSSP)

Market Segment Specialization Program (MSSP)

MSSP – Pizza Restaurants n “Because pizza restaurants are basically cash businesses, the potential for skimming exists. The type of entities discussed in this guide are the family owned mom and pop types of establishments. ” (Not chains or franchises)

MSSP – Pizza Restaurants n “Because pizza restaurants are basically cash businesses, the potential for skimming exists. The type of entities discussed in this guide are the family owned mom and pop types of establishments. ” (Not chains or franchises)

MSSP – Pizza Restaurants n “Overall, documentation of income and expenses in this industry has been found to be lacking. … cash register tapes are not retained and income is not deposited intact. There is generally little or no documentation to verify gross receipts…… Purchases are often paid in cash … invoices are not kept. Employees are often paid in cash ……”

MSSP – Pizza Restaurants n “Overall, documentation of income and expenses in this industry has been found to be lacking. … cash register tapes are not retained and income is not deposited intact. There is generally little or no documentation to verify gross receipts…… Purchases are often paid in cash … invoices are not kept. Employees are often paid in cash ……”

MSSP - Ministers (Totally changing gears) MSSP Ministers

MSSP - Ministers (Totally changing gears) MSSP Ministers

MSSP - Ministers n Although overall potential examination issues are prevalent, the guidelines consist more of a recitation of those potential issues resulting from the law applicable to ministers that differ from other individual taxpayers.

MSSP - Ministers n Although overall potential examination issues are prevalent, the guidelines consist more of a recitation of those potential issues resulting from the law applicable to ministers that differ from other individual taxpayers.

MSSP - Attorneys (Changing gears again) MSSP Attorneys

MSSP - Attorneys (Changing gears again) MSSP Attorneys

MSSP - Attorneys n Purposes: n “ 2. To increase voluntary compliance in an area in which compliance was poor. ”

MSSP - Attorneys n Purposes: n “ 2. To increase voluntary compliance in an area in which compliance was poor. ”

MSSP - Attorneys n Attorney-Client Privilege n n Attorneys may refuse to provide any documents which contain client’s name. This can include a client list, general ledger, client ledger cards, cancelled checks, and client trust accounts. Osterhoudt v. U. S. , 722 f. 2 d 591 (9 th Cir. 1983): “Thus, the general rule is that disclosure of client identity is not an infringement of the attorney-client privilege.

MSSP - Attorneys n Attorney-Client Privilege n n Attorneys may refuse to provide any documents which contain client’s name. This can include a client list, general ledger, client ledger cards, cancelled checks, and client trust accounts. Osterhoudt v. U. S. , 722 f. 2 d 591 (9 th Cir. 1983): “Thus, the general rule is that disclosure of client identity is not an infringement of the attorney-client privilege.

Preparing for an IRS Audit MSSP n n n n Example of other MSSP Papers: Architect Artists and Art Galleries Auto Body and Repair Bail Bond Bars and Restaurants Child Care Providers

Preparing for an IRS Audit MSSP n n n n Example of other MSSP Papers: Architect Artists and Art Galleries Auto Body and Repair Bail Bond Bars and Restaurants Child Care Providers

Preparing for an IRS Audit MSSP n n n n Drywallers Garment Contractors Lawsuit Awards and Settlements Mortuaries Retail Liquor Taxicabs Veterinary Medicine

Preparing for an IRS Audit MSSP n n n n Drywallers Garment Contractors Lawsuit Awards and Settlements Mortuaries Retail Liquor Taxicabs Veterinary Medicine

MSSP n The MSSP papers also are all available online, on IRS’s web page: irs. gov

MSSP n The MSSP papers also are all available online, on IRS’s web page: irs. gov

Exam n Selection of returns for audit n n Discriminant function (DIF) National Research Program, formerly Taxpayer Compliance Measurement Program (TCMP) (“outlawed” by Congress) Informant Economic Reality (also outlawed by Congress)

Exam n Selection of returns for audit n n Discriminant function (DIF) National Research Program, formerly Taxpayer Compliance Measurement Program (TCMP) (“outlawed” by Congress) Informant Economic Reality (also outlawed by Congress)

Exam – selection of returns (cont’d) n n n Tax shelters Cash operations Abnormal deductions

Exam – selection of returns (cont’d) n n n Tax shelters Cash operations Abnormal deductions

Exam Audits – > Correspondence examinations > Office examination (generally being discontinued) > Field examinations (Dealing with the Internal Revenue Agent)

Exam Audits – > Correspondence examinations > Office examination (generally being discontinued) > Field examinations (Dealing with the Internal Revenue Agent)

Audits (cont’d) n Conclusion of Audit Ø Discussion of adjustments Make sure the RA clearly explains the proposed adjustments and you understand Ø Don’t be reluctant to request a meeting with the Agent’s Manager if necessary – this is an acceptable procedure Ø Thirty-day letter / “Preliminary Notice” (also called a Revenue Agent’s Report (RAR) Ø Administrative procedure – not statutory Ø

Audits (cont’d) n Conclusion of Audit Ø Discussion of adjustments Make sure the RA clearly explains the proposed adjustments and you understand Ø Don’t be reluctant to request a meeting with the Agent’s Manager if necessary – this is an acceptable procedure Ø Thirty-day letter / “Preliminary Notice” (also called a Revenue Agent’s Report (RAR) Ø Administrative procedure – not statutory Ø

Audits (cont’d) Ø Options 1. Agree Ø 2. File a protest (w/in 30 days, or request extension), request administrative appeal Ø 3. Ignore, bypass Appeals, accept “Deficiency Procedure” Ø Then Ø Default SND, pay tax, file suit in DC or CFC Ø Petition Tax Court – w/in 90 -Days (§ 6213) – NOT THREE MONTHS Ø

Audits (cont’d) Ø Options 1. Agree Ø 2. File a protest (w/in 30 days, or request extension), request administrative appeal Ø 3. Ignore, bypass Appeals, accept “Deficiency Procedure” Ø Then Ø Default SND, pay tax, file suit in DC or CFC Ø Petition Tax Court – w/in 90 -Days (§ 6213) – NOT THREE MONTHS Ø

Audits (cont’d) n Appeals Protests May be made orally or simple written request if tax and penalties are under $2, 500 per year Ø Otherwise, must be in writing Ø If proposed tax and penalties are over $10, 000, protest must be formal, setting out Ø Ø Specific facts, Applicable law, and/or Other authority, in support of position

Audits (cont’d) n Appeals Protests May be made orally or simple written request if tax and penalties are under $2, 500 per year Ø Otherwise, must be in writing Ø If proposed tax and penalties are over $10, 000, protest must be formal, setting out Ø Ø Specific facts, Applicable law, and/or Other authority, in support of position

Audits (cont’d) n n Remember, can request a hearing with TC’s Small Case Division if the deficiency and penalty (not interest) does not exceed $50, 000 (per year). TP can appear pro se. (Ceiling amount is statutory, but is increased occasionally by Congress)

Audits (cont’d) n n Remember, can request a hearing with TC’s Small Case Division if the deficiency and penalty (not interest) does not exceed $50, 000 (per year). TP can appear pro se. (Ceiling amount is statutory, but is increased occasionally by Congress)

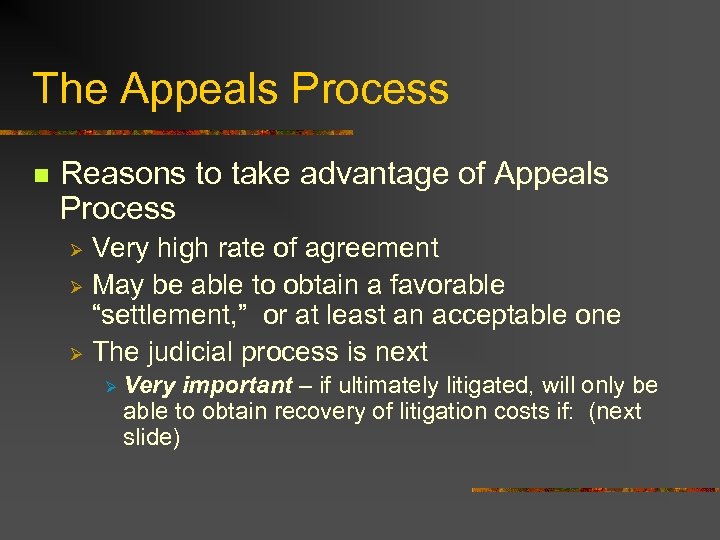

The Appeals Process n Reasons to take advantage of Appeals Process Very high rate of agreement Ø May be able to obtain a favorable “settlement, ” or at least an acceptable one Ø The judicial process is next Ø Ø Very important – if ultimately litigated, will only be able to obtain recovery of litigation costs if: (next slide)

The Appeals Process n Reasons to take advantage of Appeals Process Very high rate of agreement Ø May be able to obtain a favorable “settlement, ” or at least an acceptable one Ø The judicial process is next Ø Ø Very important – if ultimately litigated, will only be able to obtain recovery of litigation costs if: (next slide)

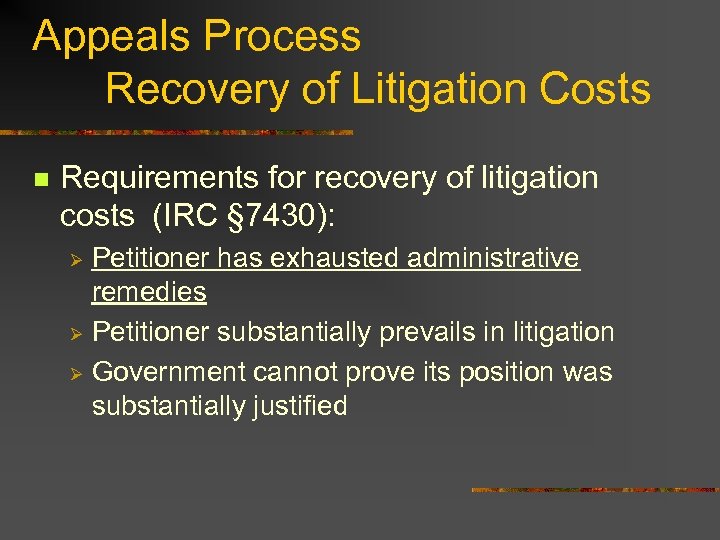

Appeals Process Recovery of Litigation Costs n Requirements for recovery of litigation costs (IRC § 7430): Petitioner has exhausted administrative remedies Ø Petitioner substantially prevails in litigation Ø Government cannot prove its position was substantially justified Ø

Appeals Process Recovery of Litigation Costs n Requirements for recovery of litigation costs (IRC § 7430): Petitioner has exhausted administrative remedies Ø Petitioner substantially prevails in litigation Ø Government cannot prove its position was substantially justified Ø

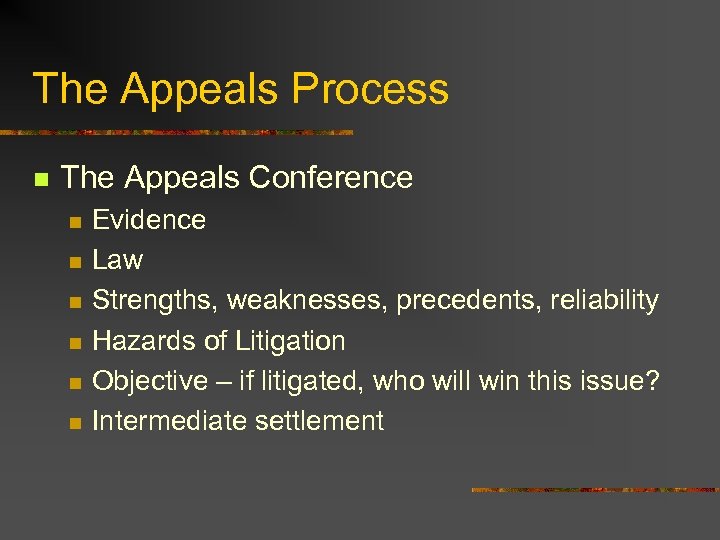

The Appeals Process n The Appeals Conference n n n Evidence Law Strengths, weaknesses, precedents, reliability Hazards of Litigation Objective – if litigated, who will win this issue? Intermediate settlement

The Appeals Process n The Appeals Conference n n n Evidence Law Strengths, weaknesses, precedents, reliability Hazards of Litigation Objective – if litigated, who will win this issue? Intermediate settlement

The Appeals Process n In the absence of agreement here, Appeals will initiate the Deficiency Procedure n And then - the judicial process

The Appeals Process n In the absence of agreement here, Appeals will initiate the Deficiency Procedure n And then - the judicial process

Appeals Process (cont’d) n n Deficiency Procedure – Again, this is The Ninety -Day Letter – be aware, this is the Statutory Notice of Deficiency Options – NOTE: Options are the same as before, except now you have exhausted your administrative remedies n n Agree Ignore – default the SND, pay tax, file suit in DC of CFC Petition Tax Court

Appeals Process (cont’d) n n Deficiency Procedure – Again, this is The Ninety -Day Letter – be aware, this is the Statutory Notice of Deficiency Options – NOTE: Options are the same as before, except now you have exhausted your administrative remedies n n Agree Ignore – default the SND, pay tax, file suit in DC of CFC Petition Tax Court

Assessment of Tax n Verify proper assessment n n n Timely? Assessment Official Authority? Amount correct?

Assessment of Tax n Verify proper assessment n n n Timely? Assessment Official Authority? Amount correct?

The Collection Process If you think the amount being collected is incorrect Ø Discuss with Revenue Officer, then don’t be reluctant to request meeting with RO’s Manager Ø Most Collection matters now may be appealed administratively n

The Collection Process If you think the amount being collected is incorrect Ø Discuss with Revenue Officer, then don’t be reluctant to request meeting with RO’s Manager Ø Most Collection matters now may be appealed administratively n

Collection (cont’d) n Administrative Appeals: > Liens on property > Levies of wages or bank account > Seizures or property

Collection (cont’d) n Administrative Appeals: > Liens on property > Levies of wages or bank account > Seizures or property

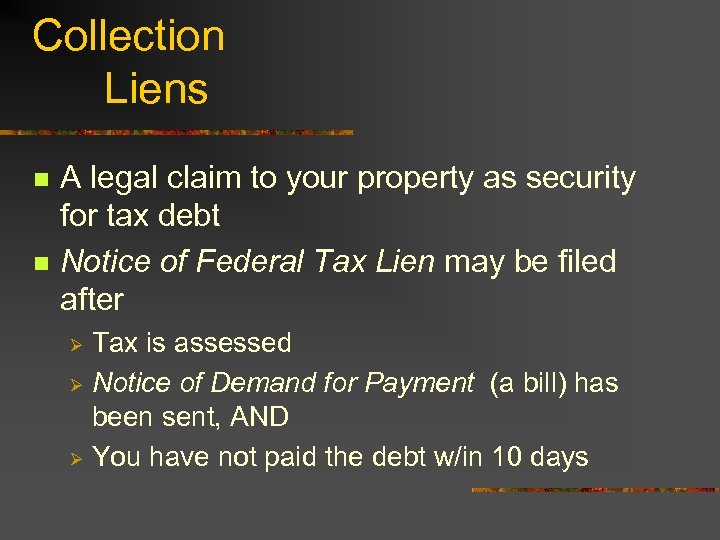

Collection Liens n n A legal claim to your property as security for tax debt Notice of Federal Tax Lien may be filed after Tax is assessed Ø Notice of Demand for Payment (a bill) has been sent, AND Ø You have not paid the debt w/in 10 days Ø

Collection Liens n n A legal claim to your property as security for tax debt Notice of Federal Tax Lien may be filed after Tax is assessed Ø Notice of Demand for Payment (a bill) has been sent, AND Ø You have not paid the debt w/in 10 days Ø

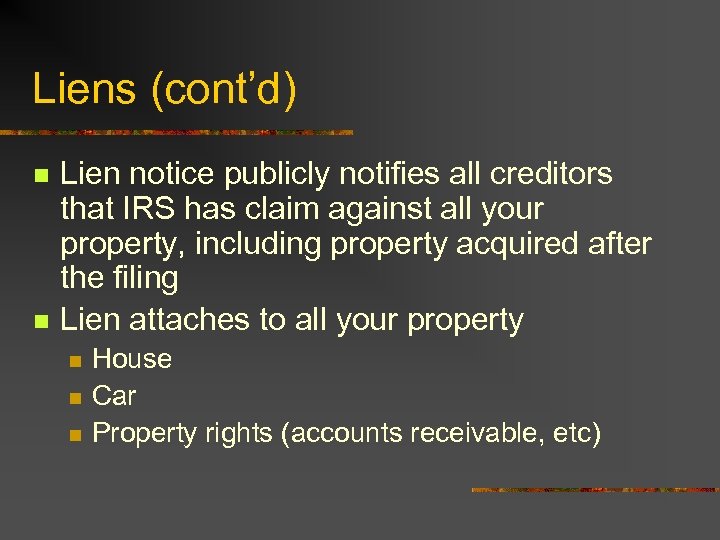

Liens (cont’d) n n Lien notice publicly notifies all creditors that IRS has claim against all your property, including property acquired after the filing Lien attaches to all your property n n n House Car Property rights (accounts receivable, etc)

Liens (cont’d) n n Lien notice publicly notifies all creditors that IRS has claim against all your property, including property acquired after the filing Lien attaches to all your property n n n House Car Property rights (accounts receivable, etc)

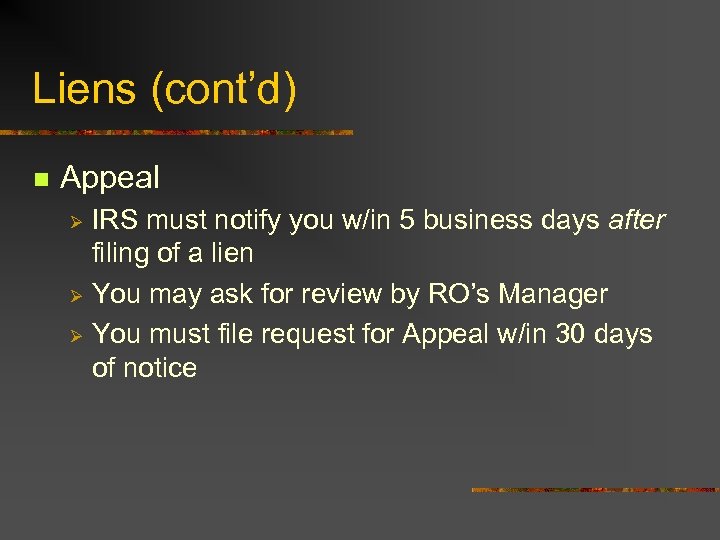

Liens (cont’d) n Appeal IRS must notify you w/in 5 business days after filing of a lien Ø You may ask for review by RO’s Manager Ø You must file request for Appeal w/in 30 days of notice Ø

Liens (cont’d) n Appeal IRS must notify you w/in 5 business days after filing of a lien Ø You may ask for review by RO’s Manager Ø You must file request for Appeal w/in 30 days of notice Ø

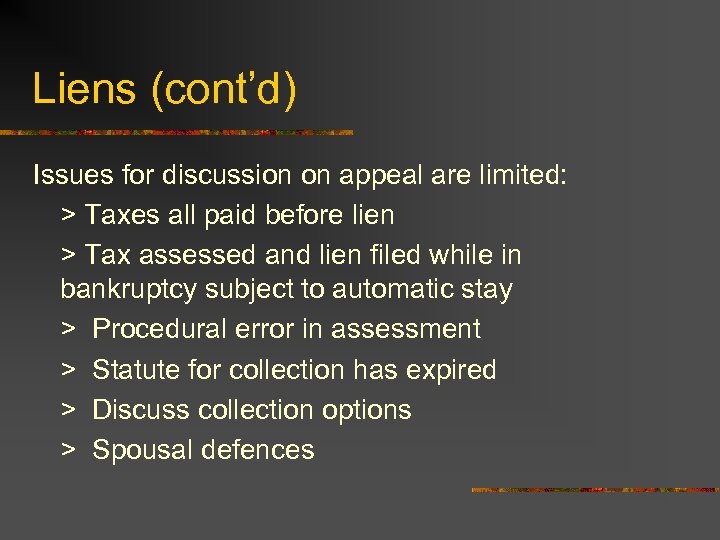

Liens (cont’d) Issues for discussion on appeal are limited: > Taxes all paid before lien > Tax assessed and lien filed while in bankruptcy subject to automatic stay > Procedural error in assessment > Statute for collection has expired > Discuss collection options > Spousal defences

Liens (cont’d) Issues for discussion on appeal are limited: > Taxes all paid before lien > Tax assessed and lien filed while in bankruptcy subject to automatic stay > Procedural error in assessment > Statute for collection has expired > Discuss collection options > Spousal defences

Liens (cont’d) n Release of the Notice of Federal Tax Lien will be (should be) issued n n n Within 30 days after the debt is satisfied, or Within 30 days after IRS accepts a bond you submit guaranteeing payment of the debt TP will have to pay state and/or other jurisdictional fees n will be added to amount owed

Liens (cont’d) n Release of the Notice of Federal Tax Lien will be (should be) issued n n n Within 30 days after the debt is satisfied, or Within 30 days after IRS accepts a bond you submit guaranteeing payment of the debt TP will have to pay state and/or other jurisdictional fees n will be added to amount owed

Collection Levies n Levy – a legal seizure of property to satisfy a tax debt n n n Distinguished from lien in that property is actually taken Property subject – car, boat, house, etc. , or Property owned by TP but held by someone else (wages, retirement account, bank account, licenses, CSV of life insurance, etc.

Collection Levies n Levy – a legal seizure of property to satisfy a tax debt n n n Distinguished from lien in that property is actually taken Property subject – car, boat, house, etc. , or Property owned by TP but held by someone else (wages, retirement account, bank account, licenses, CSV of life insurance, etc.

Levies (cont’d) n Levy may take place after n n Tax is assessed and Notice and Demand for Payment sent Tax not paid, and Final Notice of Intent to Levy and Notice of Right to Hearing + 30 days

Levies (cont’d) n Levy may take place after n n Tax is assessed and Notice and Demand for Payment sent Tax not paid, and Final Notice of Intent to Levy and Notice of Right to Hearing + 30 days

Levies (cont’d) n Topics for discussion on appeal is same as for Liens.

Levies (cont’d) n Topics for discussion on appeal is same as for Liens.

Levies (cont’d) n Levy on a bank account n n The bank must hold the money for 21 days to give TP a chance to make other arrangements After 21 days, the bank must send the money to IRS

Levies (cont’d) n Levy on a bank account n n The bank must hold the money for 21 days to give TP a chance to make other arrangements After 21 days, the bank must send the money to IRS

Levies (cont’d) n Release of Levy will be when/if n n Debt is paid Collection statute expired before levy was filed Installment agreement approved, unless levy is included Expense of selling the property would be more than the tax debt

Levies (cont’d) n Release of Levy will be when/if n n Debt is paid Collection statute expired before levy was filed Installment agreement approved, unless levy is included Expense of selling the property would be more than the tax debt

Levies (cont’d) n Property will be released when/if n n n Amount of government’s interest in property is paid New escrow agreement Acceptable bond Acceptable agreement for paying tax Expense of selling the property is more than debt

Levies (cont’d) n Property will be released when/if n n n Amount of government’s interest in property is paid New escrow agreement Acceptable bond Acceptable agreement for paying tax Expense of selling the property is more than debt

Levies (cont’d) n Sale of Seized Property n IRS must wait 60 days, during which n n TP may ask that it be sold w/in 60 days Public Notice will be posted (local newspaper, flyer, etc. ) Original of Notice to TP After the Notice is placed, IRS must wait 10 days before sale (unless property is perishable) n n IRS will compute a minimum bid price (generally 80% of forced sale value) You may appeal the minimum bid price

Levies (cont’d) n Sale of Seized Property n IRS must wait 60 days, during which n n TP may ask that it be sold w/in 60 days Public Notice will be posted (local newspaper, flyer, etc. ) Original of Notice to TP After the Notice is placed, IRS must wait 10 days before sale (unless property is perishable) n n IRS will compute a minimum bid price (generally 80% of forced sale value) You may appeal the minimum bid price

Levies (cont’d) n Proceeds of the sale n n If less than the tax bill and expenses of levy and sale, you will still have to pay the unpaid tax If more than the tax bill and expenses, surplus will be refunded

Levies (cont’d) n Proceeds of the sale n n If less than the tax bill and expenses of levy and sale, you will still have to pay the unpaid tax If more than the tax bill and expenses, surplus will be refunded

Levies (cont’d) n Real Estate n n TP may redeem real estate w/in 180 days of the sale Must pay purchaser the amount paid for the property, plus interest at 20% annually (interest on the funds paid to the government by the purchaser)

Levies (cont’d) n Real Estate n n TP may redeem real estate w/in 180 days of the sale Must pay purchaser the amount paid for the property, plus interest at 20% annually (interest on the funds paid to the government by the purchaser)

Levies (cont’d) n Property that cannot be seized: n n n School books, certain clothing Personal and household effects, up to $6, 250 Tools of trade, up to $3, 125 Unemployment benefits Certain annuity and pension benefits Certain disability payments

Levies (cont’d) n Property that cannot be seized: n n n School books, certain clothing Personal and household effects, up to $6, 250 Tools of trade, up to $3, 125 Unemployment benefits Certain annuity and pension benefits Certain disability payments

Levies - Property that Cannot be Seized (cont’d) n n n Salary, wages, or income included in a judgment for court-ordered child support Certain public assistance payments Minimum weekly exemption for wages, salary, and other income

Levies - Property that Cannot be Seized (cont’d) n n n Salary, wages, or income included in a judgment for court-ordered child support Certain public assistance payments Minimum weekly exemption for wages, salary, and other income

Collection (cont’d) n Opportunities for Relief Installment Agreement Ø Offer in Compromise Ø Temporary Delay in Collection Process Ø

Collection (cont’d) n Opportunities for Relief Installment Agreement Ø Offer in Compromise Ø Temporary Delay in Collection Process Ø

Installment Agreement n n n < $10, 000 - Automatic upon request > $10, 000 – more troublesome, but is doable Will be an up front user fee (now $43) Interest and penalties will continue Beware – if miss payment, will be interest on interest May be better to attempt loan at bank or by CC, if available

Installment Agreement n n n < $10, 000 - Automatic upon request > $10, 000 – more troublesome, but is doable Will be an up front user fee (now $43) Interest and penalties will continue Beware – if miss payment, will be interest on interest May be better to attempt loan at bank or by CC, if available

Installment Agreement n Note: If under threat of levy, upon application for installment, cannot levy n n While request for installment agreement is being considered While appeal of rejection of installment agreement is being evaluated For 30 days after rejection While installment agreement is in effect (assuming payments are current)

Installment Agreement n Note: If under threat of levy, upon application for installment, cannot levy n n While request for installment agreement is being considered While appeal of rejection of installment agreement is being evaluated For 30 days after rejection While installment agreement is in effect (assuming payments are current)

Offer in Compromise n May apply to n n Taxes Interest Penalties Additions to tax

Offer in Compromise n May apply to n n Taxes Interest Penalties Additions to tax

Offer in Compromise (cont’d) n Grounds for an offer n n n Doubt as to liability (similar to establishing liability amount under Exam or Appeals processes) Doubt as to collectibility (does TP have ability to pay) “promote effective tax administration” (assessed tax is correct, but TP under economic hardship or other special circumstance)

Offer in Compromise (cont’d) n Grounds for an offer n n n Doubt as to liability (similar to establishing liability amount under Exam or Appeals processes) Doubt as to collectibility (does TP have ability to pay) “promote effective tax administration” (assessed tax is correct, but TP under economic hardship or other special circumstance)

Temporary Delay in Collection n Temporary delay because of inability to pay currently n n Be aware that interest/penalties will continue During the delay, IRS may file a Notice of Federal Tax Lien to “protect the government’s interest in your assets

Temporary Delay in Collection n Temporary delay because of inability to pay currently n n Be aware that interest/penalties will continue During the delay, IRS may file a Notice of Federal Tax Lien to “protect the government’s interest in your assets

Trust Fund Recovery Penalty § 6672 Also commonly known as n n 100% Penalty § 6672 Penalty

Trust Fund Recovery Penalty § 6672 Also commonly known as n n 100% Penalty § 6672 Penalty

§ 6672 Penalty (cont’d) n n n Trust Fund Taxes – taxes withheld and held for employees until employer makes a federal tax deposit of them Trust Fund Recovery Penalty – 100% of the trust fund taxes not paid over to government Responsible person – person responsible for paying over the trust fund taxes to the government

§ 6672 Penalty (cont’d) n n n Trust Fund Taxes – taxes withheld and held for employees until employer makes a federal tax deposit of them Trust Fund Recovery Penalty – 100% of the trust fund taxes not paid over to government Responsible person – person responsible for paying over the trust fund taxes to the government

§ 6672 Penalty Responsible Person (cont’d) n n If IRS determines you are the Responsible Person, they will issue you a Notice and Demand for Payment Party determined responsible has 60 days to appeal

§ 6672 Penalty Responsible Person (cont’d) n n If IRS determines you are the Responsible Person, they will issue you a Notice and Demand for Payment Party determined responsible has 60 days to appeal

§ 6672 Penalty Responsible Person (cont’d) n n n Officer or employee of the company Member or employee of a partnership Corporate director or shareholder Member of board of trustees of a nonprofit organization Another person having authority and control over funds to direct their disbursement

§ 6672 Penalty Responsible Person (cont’d) n n n Officer or employee of the company Member or employee of a partnership Corporate director or shareholder Member of board of trustees of a nonprofit organization Another person having authority and control over funds to direct their disbursement

§ 6672 Penalty Responsible Person (cont’d) n n Responsible Person – willfully fails to collect or pay trust fund taxes. Willfulness – n n Must have known about the unpaid taxes Must have used the funds for other purposes

§ 6672 Penalty Responsible Person (cont’d) n n Responsible Person – willfully fails to collect or pay trust fund taxes. Willfulness – n n Must have known about the unpaid taxes Must have used the funds for other purposes

n. Questions?

n. Questions?