d35bf748f4a58312264739ba739332f8.ppt

- Количество слайдов: 25

Working with New Life Distribution Channels Steve Parrish, JD, CLU, Ch. FC, RHU National Advanced Solutions Consultant February 23, 2007 For Continuing Education Only. Not for use with the Public.

Before • The market: – “The right thing to do” – Vertically integrated • Money – Savings regulated; no money market – Mutual funds limited • Life Insurance – Rate book whole life – Term For Continuing Education Only. Not for use with the Public.

Before • Distribution: – Debit – Career – Other: multiline, Fraternals, and brokerage • Commissions: – 50%; 12%; 5% renewals – Limited Bonuses For Continuing Education Only. Not for use with the Public.

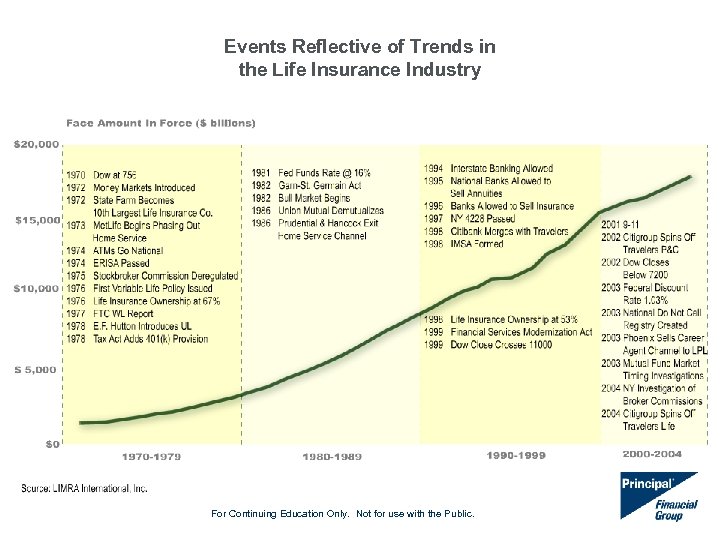

Events Reflective of Trends in the Life Insurance Industry For Continuing Education Only. Not for use with the Public.

Now • Underinsured middle class • Open investment markets • Policies – UL, VUL, Private Placement – Traditional – Term – Hybrids For Continuing Education Only. Not for use with the Public.

Now - Distribution • Career • Brokerage – Rollups – IMOs • Other – Banks – Wirehouses – Worksite – Financial Planners For Continuing Education Only. Not for use with the Public.

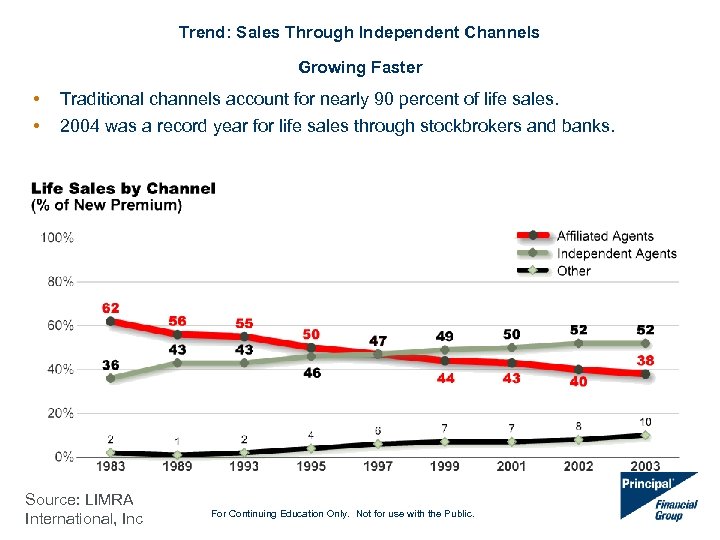

Trend: Sales Through Independent Channels Growing Faster • • Traditional channels account for nearly 90 percent of life sales. 2004 was a record year for life sales through stockbrokers and banks. Source: LIMRA International, Inc For Continuing Education Only. Not for use with the Public.

Key Trend: Recruiting inexperienced agents continues to be critical to the sale of insurance products. And if recent trends continue the industry is heading into a very challenging period. • More than four out of five independent agents started their career as an affiliated agent (career or multi-line). • More than half of independent agents are age 54 or older. • Career agents on average broker 24 percent of their business. Source: LIMRA International, Inc For Continuing Education Only. Not for use with the Public.

Home Office / Manufacturing • Varied Integration (product, distribution, processing) • Stock versus Mutual • Regulation (State, NY, OFC, NASD) • Accounting (Stat, GAAP, RBC, etc) • Distribution (owned, separated, mixed) For Continuing Education Only. Not for use with the Public.

Independent Channels Key Trends: • Independent channels (independent agents, wirehouses, regional BDs, IFAs/IFPs, bank reps) are growing faster than career channels and taking share. • Intermediaries (e. g. , BGAs) consolidating market power and displacing carriers from large parts of the value chain by offering value-added services to third party reps. • Independent channels forcing carriers to compete for shelf space and sales with more attractive commissions, pricing, and product features. • Independent channels generally offer lower quality business (e. g. , persistency, non-taken rates) and are quick to exploit errors in product design (e. g. , mispricing, product features. ) Key Imperatives: • Align incentives to carrier profitability. • Tier service and wholesaling support. • Find ways to add distinctive value to channels. Source: LIMRA International, Inc For Continuing Education Only. Not for use with the Public.

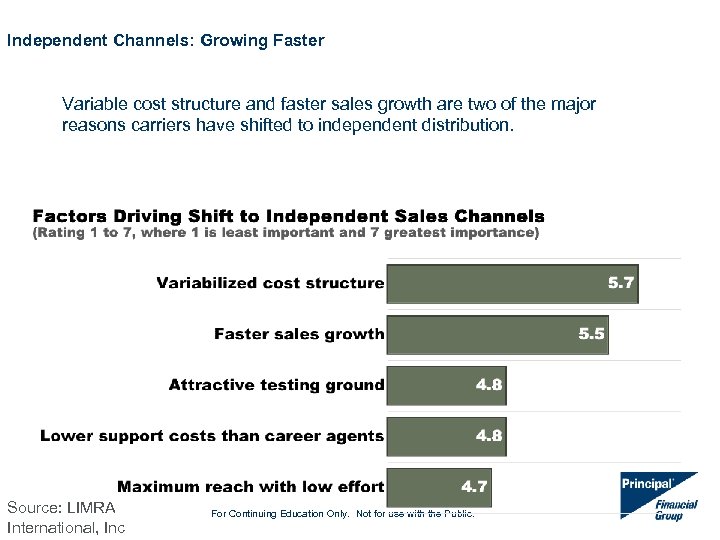

Independent Channels: Growing Faster Variable cost structure and faster sales growth are two of the major reasons carriers have shifted to independent distribution. Source: LIMRA International, Inc For Continuing Education Only. Not for use with the Public.

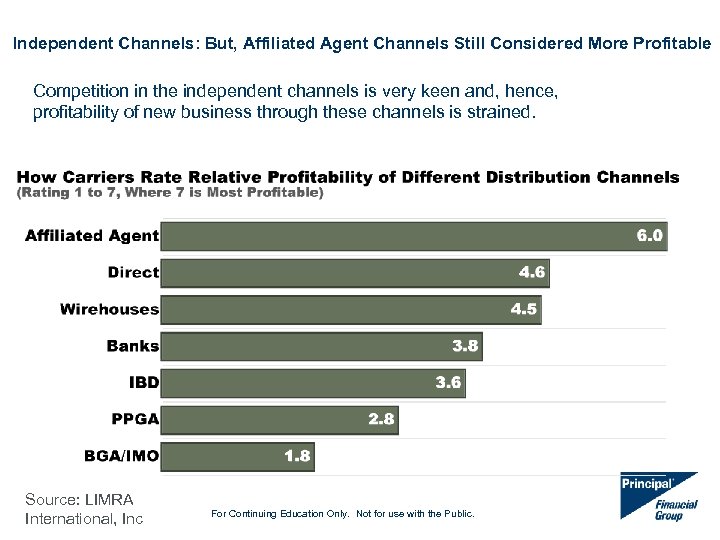

Independent Channels: But, Affiliated Agent Channels Still Considered More Profitable Competition in the independent channels is very keen and, hence, profitability of new business through these channels is strained. Source: LIMRA International, Inc For Continuing Education Only. Not for use with the Public.

Life in the Field • Field Management – Owned versus managed – Wholesaling • Agents and Brokers – Compensation – Office – Internet For Continuing Education Only. Not for use with the Public.

Marketing • To the Producer – The wholesaling revolution • To the Advisor • To the Consumer – Producer versus institutional marketing – Advertising – Other: geodemographics, cobranding For Continuing Education Only. Not for use with the Public.

Sales NEEDS • Death benefit versus living benefits SALES PROCESS • Location • Taxes • Submission, underwriting, delivery, etc • Gimmicks and garbage • Compliance For Continuing Education Only. Not for use with the Public.

Some Thoughts : Primary Challenges in the Marketplace • Delivery (particularly middle markets) • Process • Training • Regulatory For Continuing Education Only. Not for use with the Public.

Some Thoughts : What’s Your Model? • Who is your primary Customer? • Productivity (primarily Career) • Shelf-space (primarily Brokerage) • Training, Promotion, Support services For Continuing Education Only. Not for use with the Public.

Some Thoughts : Common Myths • Agents are dumb • Agents are rich • Agents are unethical • Agents don’t work hard For Continuing Education Only. Not for use with the Public.

Some Thoughts : Working with Producers • Remember how they are paid !!!! • Yes • No • Maybe For Continuing Education Only. Not for use with the Public.

Some Thoughts : How to Learn More • Shadowing • Interviewing • Buy something For Continuing Education Only. Not for use with the Public.

From Theory to Practice Source: LIMRA International, Inc For Continuing Education Only. Not for use with the Public.

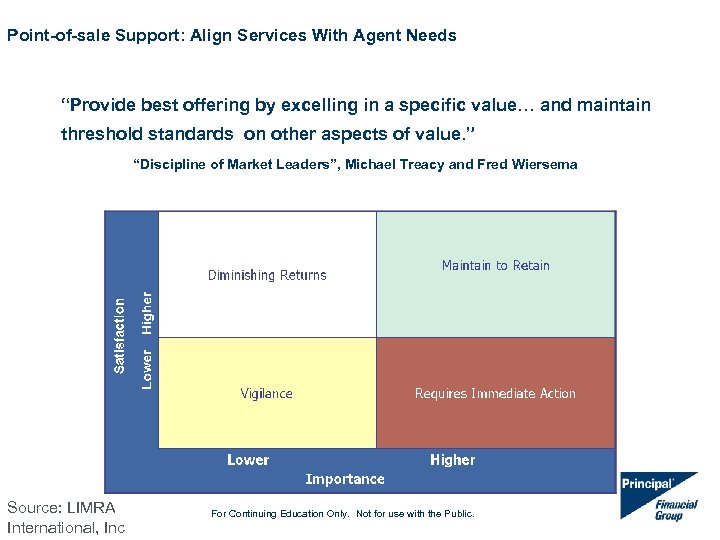

Point-of-sale Support: Align Services With Agent Needs “Provide best offering by excelling in a specific value… and maintain threshold standards on other aspects of value. ” “Discipline of Market Leaders”, Michael Treacy and Fred Wiersema Source: LIMRA International, Inc For Continuing Education Only. Not for use with the Public.

Point-of-sale Support: Align Services With Agent Needs (cont. ) A. B. C. D. E. F. G. H. I. J. K. L. M. N. O. Advanced sales support in specific areas such as tax advice, estate planning Administrative support to help you with processing sales Administrative support to help you with servicing your clients Consolidated statement reporting for each of your clients Contact management software or systems Electronic submission of applications (other than fax or e-mail) Lead generation support On-line access to client records On-line or automated access to application status On-line access to commission reporting Product training Practice management training Sales training Support in leading client seminars Sales and marketing material Source: LIMRA International, Inc For Continuing Education Only. Not for use with the Public.

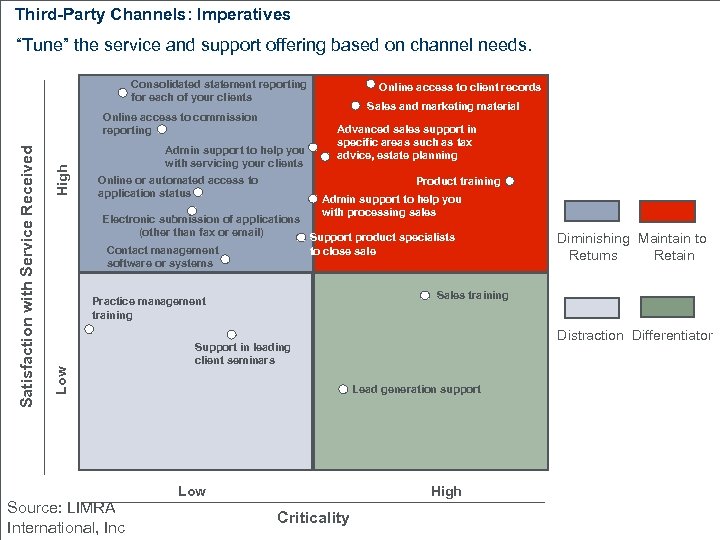

Third-Party Channels: Imperatives “Tune” the service and support offering based on channel needs. Consolidated statement reporting for each of your clients High Admin support to help you with servicing your clients Online or automated access to application status Sales and marketing material Advanced sales support in specific areas such as tax advice, estate planning Product training Admin support to help you with processing sales Electronic submission of applications (other than fax or email) Support product specialists Contact management to close sale software or systems Distraction Differentiator Support in leading client seminars Lead generation support High Low Source: LIMRA International, Inc Diminishing Maintain to Retain Returns Sales training Practice management training Low Satisfaction with Service Received Online access to commission reporting Online access to client records Criticality For Continuing Education Only. Not for use with the Public.

Thank you Questions? For Continuing Education Only. Not for use with the Public.

d35bf748f4a58312264739ba739332f8.ppt