17cf5b4416c2fc543618a5bc95ae5c97.ppt

- Количество слайдов: 13

Working for pensions in Europe Ms. Chris VERHAEGEN , Secretary General EFRP FIAP International Conference 31 May 2007, Varna

Working for pensions in Europe Ms. Chris VERHAEGEN , Secretary General EFRP FIAP International Conference 31 May 2007, Varna

Key messages 1. EFRP is the European industry representative focussing on funded and workplace pension provision 2. EU-enlargement with 12 MS has increased diversity in EU pension systems 3. Europe should reflect on a “European pension model” combining EU-15 and EU-12 systems 2

Key messages 1. EFRP is the European industry representative focussing on funded and workplace pension provision 2. EU-enlargement with 12 MS has increased diversity in EU pension systems 3. Europe should reflect on a “European pension model” combining EU-15 and EU-12 systems 2

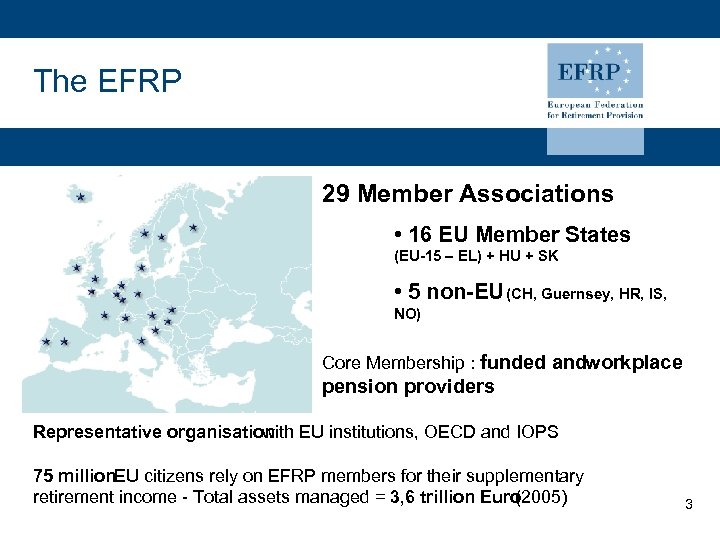

The EFRP 29 Member Associations • 16 EU Member States (EU-15 – EL) + HU + SK • 5 non-EU (CH, Guernsey, HR, IS, NO) Core Membership : funded andworkplace pension providers Representative organisation EU institutions, OECD and IOPS with 75 million. EU citizens rely on EFRP members for their supplementary retirement income - Total assets managed = 3, 6 trillion Euro (2005) 3

The EFRP 29 Member Associations • 16 EU Member States (EU-15 – EL) + HU + SK • 5 non-EU (CH, Guernsey, HR, IS, NO) Core Membership : funded andworkplace pension providers Representative organisation EU institutions, OECD and IOPS with 75 million. EU citizens rely on EFRP members for their supplementary retirement income - Total assets managed = 3, 6 trillion Euro (2005) 3

EFRP Mission Statement EFRP stands for: • Affordablepensions for large sections of the population • helping to maintain living standards in retirement • that provide a degree of intra- and inter-generational solidarity and, which are • administered through funding institutions • which can benefit from a European passport taking into account: • the principles of subsidiarity national diversity and 4

EFRP Mission Statement EFRP stands for: • Affordablepensions for large sections of the population • helping to maintain living standards in retirement • that provide a degree of intra- and inter-generational solidarity and, which are • administered through funding institutions • which can benefit from a European passport taking into account: • the principles of subsidiarity national diversity and 4

EFRP key partner in EU A partner for: • contacts with industry representatives across EU • influencing EU decision making • obtaining selected EU-level information • delivery of in depth analysis on some key issues for private pension providers 5

EFRP key partner in EU A partner for: • contacts with industry representatives across EU • influencing EU decision making • obtaining selected EU-level information • delivery of in depth analysis on some key issues for private pension providers 5

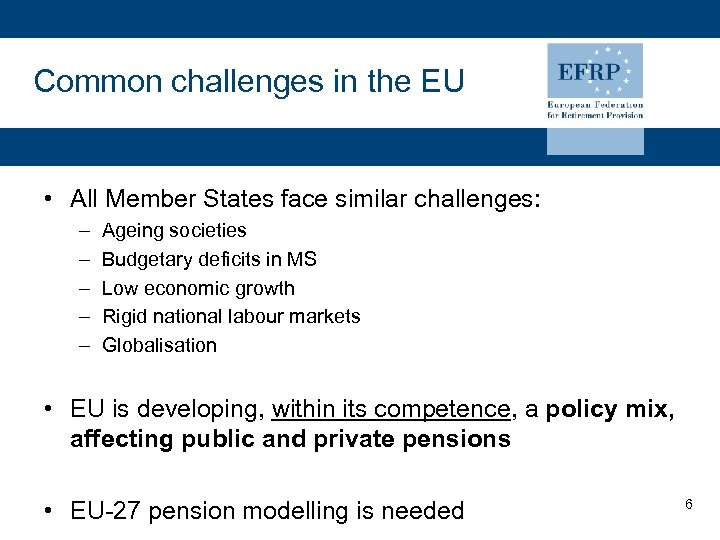

Common challenges in the EU • All Member States face similar challenges: – – – Ageing societies Budgetary deficits in MS Low economic growth Rigid national labour markets Globalisation • EU is developing, within its competence, a policy mix, affecting public and private pensions • EU-27 pension modelling is needed 6

Common challenges in the EU • All Member States face similar challenges: – – – Ageing societies Budgetary deficits in MS Low economic growth Rigid national labour markets Globalisation • EU is developing, within its competence, a policy mix, affecting public and private pensions • EU-27 pension modelling is needed 6

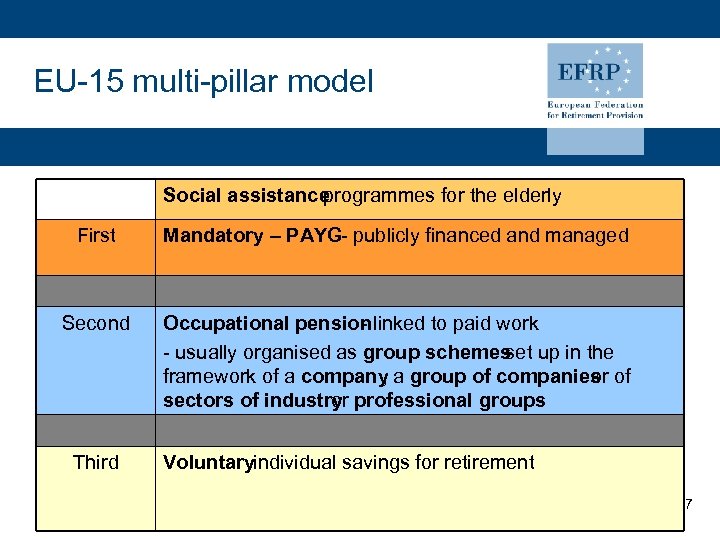

EU-15 multi-pillar model Social assistance programmes for the elderly First Mandatory – PAYG- publicly financed and managed Second Occupational pension linked to paid work - usually organised as group schemes up in the set framework of a company a group of companies of , or sectors of industry professional groups or Third Voluntaryindividual savings for retirement 7

EU-15 multi-pillar model Social assistance programmes for the elderly First Mandatory – PAYG- publicly financed and managed Second Occupational pension linked to paid work - usually organised as group schemes up in the set framework of a company a group of companies of , or sectors of industry professional groups or Third Voluntaryindividual savings for retirement 7

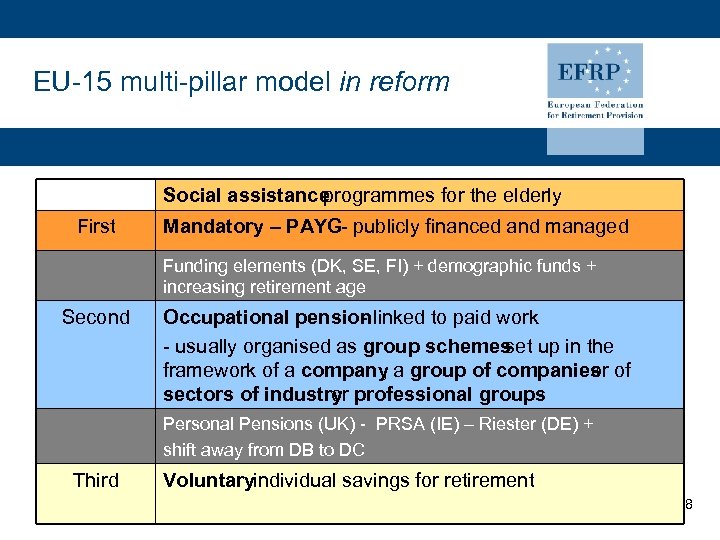

EU-15 multi-pillar model in reform Social assistance programmes for the elderly First Mandatory – PAYG- publicly financed and managed Funding elements (DK, SE, FI) + demographic funds + increasing retirement age Second Occupational pension linked to paid work - usually organised as group schemes up in the set framework of a company a group of companies of , or sectors of industry professional groups or Personal Pensions (UK) - PRSA (IE) – Riester (DE) + shift away from DB to DC Third Voluntaryindividual savings for retirement 8

EU-15 multi-pillar model in reform Social assistance programmes for the elderly First Mandatory – PAYG- publicly financed and managed Funding elements (DK, SE, FI) + demographic funds + increasing retirement age Second Occupational pension linked to paid work - usually organised as group schemes up in the set framework of a company a group of companies of , or sectors of industry professional groups or Personal Pensions (UK) - PRSA (IE) – Riester (DE) + shift away from DB to DC Third Voluntaryindividual savings for retirement 8

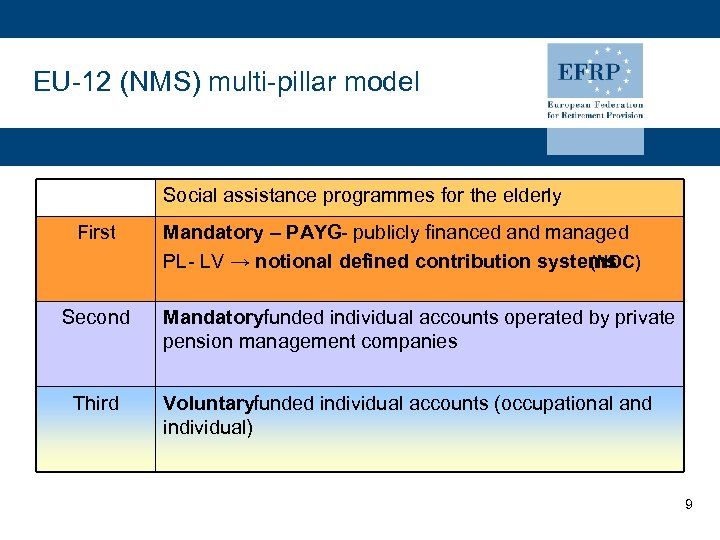

EU-12 (NMS) multi-pillar model Social assistance programmes for the elderly First Second Third Mandatory – PAYG- publicly financed and managed PL- LV → notional defined contribution systems (NDC) Mandatoryfunded individual accounts operated by private pension management companies Voluntaryfunded individual accounts (occupational and individual) 9

EU-12 (NMS) multi-pillar model Social assistance programmes for the elderly First Second Third Mandatory – PAYG- publicly financed and managed PL- LV → notional defined contribution systems (NDC) Mandatoryfunded individual accounts operated by private pension management companies Voluntaryfunded individual accounts (occupational and individual) 9

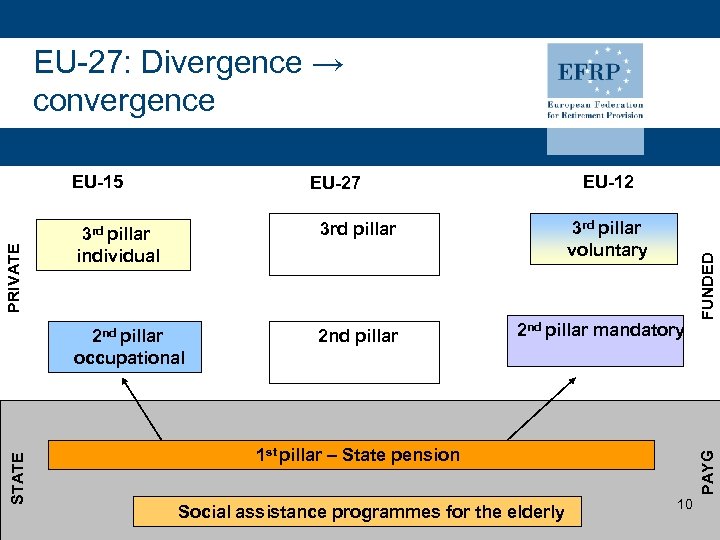

EU-27: Divergence → convergence 2 nd pillar 3 rd pillar voluntary 3 rd pillar 2 nd pillar mandatory 1 st pillar – State pension Social assistance programmes for the elderly PAYG PRIVATE 3 rd pillar individual 2 nd pillar occupational STATE EU-12 EU-27 FUNDED EU-15 10

EU-27: Divergence → convergence 2 nd pillar 3 rd pillar voluntary 3 rd pillar 2 nd pillar mandatory 1 st pillar – State pension Social assistance programmes for the elderly PAYG PRIVATE 3 rd pillar individual 2 nd pillar occupational STATE EU-12 EU-27 FUNDED EU-15 10

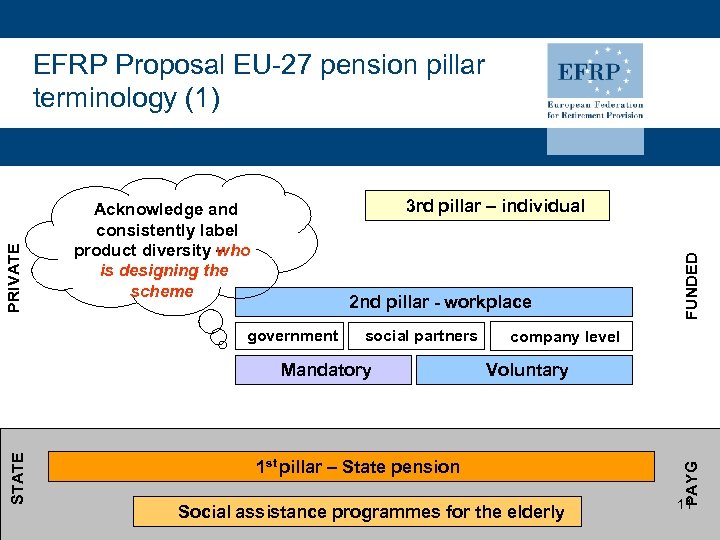

2 nd pillar - workplace government social partners STATE Mandatory FUNDED 3 rd pillar – individual Acknowledge and consistently label product diversity – who is designing the scheme company level Voluntary 1 st pillar – State pension Social assistance programmes for the elderly PAYG PRIVATE EFRP Proposal EU-27 pension pillar terminology (1) 11

2 nd pillar - workplace government social partners STATE Mandatory FUNDED 3 rd pillar – individual Acknowledge and consistently label product diversity – who is designing the scheme company level Voluntary 1 st pillar – State pension Social assistance programmes for the elderly PAYG PRIVATE EFRP Proposal EU-27 pension pillar terminology (1) 11

Key messages 1. EFRP is the European industry representative focussing on funded and workplace pension provision 2. EU-enlargement with 12 MS has increased diversity in EU pension systems 3. Europe should reflect on a “European pension model” combining EU-15 and EU-12 systems 12

Key messages 1. EFRP is the European industry representative focussing on funded and workplace pension provision 2. EU-enlargement with 12 MS has increased diversity in EU pension systems 3. Europe should reflect on a “European pension model” combining EU-15 and EU-12 systems 12

Contact EFRP Koningsstraat 97 rue Royale 1000 Brussels Belgium Tel. : +32 2 289 14 14 Fax: +32 2 289 14 15 efrp@efrp. org www. efrp. org 13

Contact EFRP Koningsstraat 97 rue Royale 1000 Brussels Belgium Tel. : +32 2 289 14 14 Fax: +32 2 289 14 15 efrp@efrp. org www. efrp. org 13