f0120d9a128ca4e0de164ebd22203254.ppt

- Количество слайдов: 26

Working Capital Options for small, mid-sized, and large companies San Antonio Veteran’s Business Summit 2014 Presented by Ron Edinger October 30, 2014

Working Capital Options for small, mid-sized, and large companies San Antonio Veteran’s Business Summit 2014 Presented by Ron Edinger October 30, 2014

The Squeeze on Small Business Working Capital 65. 3% of small business say that the limited business lending environment is affecting their growth. Small firms with big customers are slow to pay. Large companies are hoarding cash, squeezing small businesses who have less access to capital. Wall Street Journal 6/7/2012

The Squeeze on Small Business Working Capital 65. 3% of small business say that the limited business lending environment is affecting their growth. Small firms with big customers are slow to pay. Large companies are hoarding cash, squeezing small businesses who have less access to capital. Wall Street Journal 6/7/2012

Fixed Capital vs. Working Capital Frac-Sand Transloading Operation Cost to build: $14 mm Working capital: $21 mm

Fixed Capital vs. Working Capital Frac-Sand Transloading Operation Cost to build: $14 mm Working capital: $21 mm

Traditional financing for small companies v Conventional lending v Personal, credit-based v Selling equity v Collateral (asset-based) lending

Traditional financing for small companies v Conventional lending v Personal, credit-based v Selling equity v Collateral (asset-based) lending

Conventional Lending Historical cash flow, credit-score based Bank loans and Lines of Credit SBA Loans: Bank financing with an SBA (Small Business Administration) guarantee Micro-Lenders: e. g. , (Acción, People Fund, CRA Funds)

Conventional Lending Historical cash flow, credit-score based Bank loans and Lines of Credit SBA Loans: Bank financing with an SBA (Small Business Administration) guarantee Micro-Lenders: e. g. , (Acción, People Fund, CRA Funds)

Personal Credit-Based Methods Personal credit cards (61% of small businesses) Personal loans and savings Family and friends Peer to peer lending Home equity loans

Personal Credit-Based Methods Personal credit cards (61% of small businesses) Personal loans and savings Family and friends Peer to peer lending Home equity loans

Selling Equity Based on past performance and business idea/management Private equity funds Venture capital funds “Angel” private lenders Today largely for companies with proprietary technology needing >$2 million

Selling Equity Based on past performance and business idea/management Private equity funds Venture capital funds “Angel” private lenders Today largely for companies with proprietary technology needing >$2 million

Collateral (Asset-Based) Lending • • Home equity loans Equipment leasing Commercial real estate loans – e. g. SBA 504 loans Hard money real estate lenders ( ((

Collateral (Asset-Based) Lending • • Home equity loans Equipment leasing Commercial real estate loans – e. g. SBA 504 loans Hard money real estate lenders ( ((

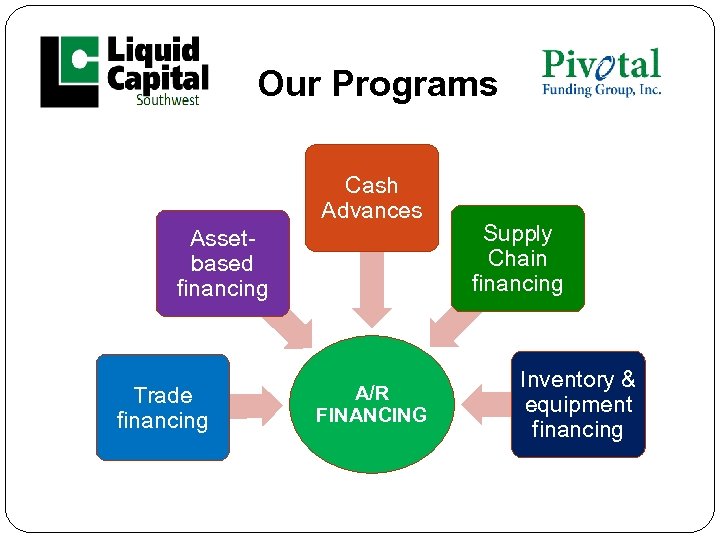

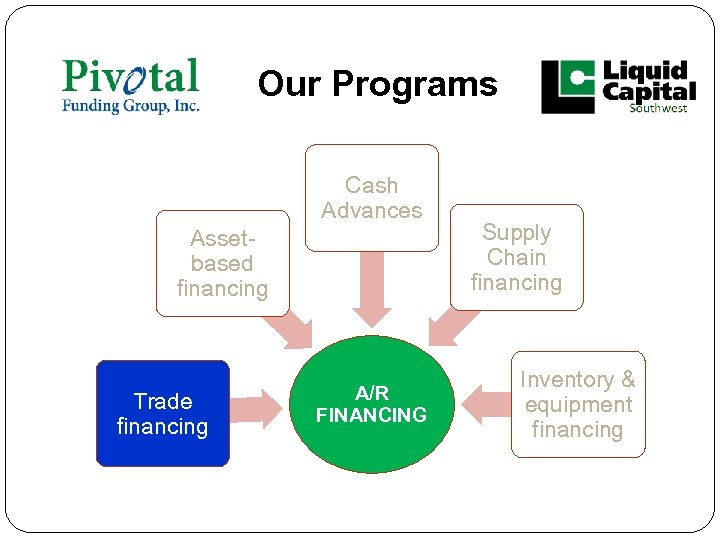

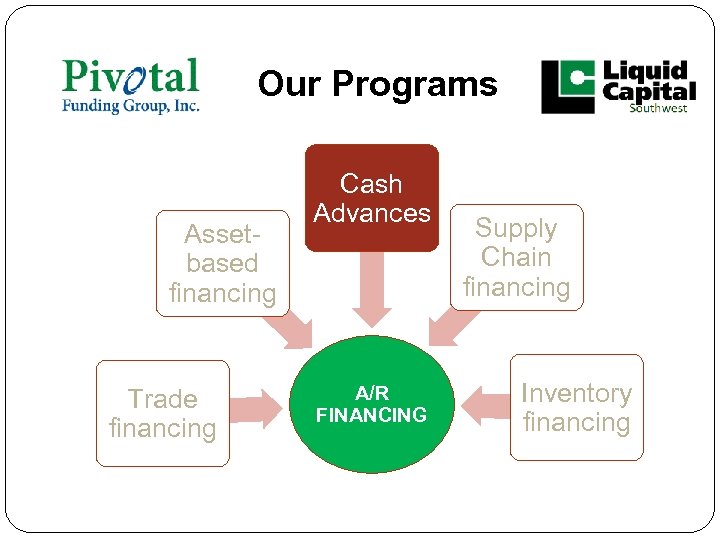

Our Programs Cash Advances Assetbased financing Trade financing A/R FINANCING Supply Chain financing Inventory & equipment financing

Our Programs Cash Advances Assetbased financing Trade financing A/R FINANCING Supply Chain financing Inventory & equipment financing

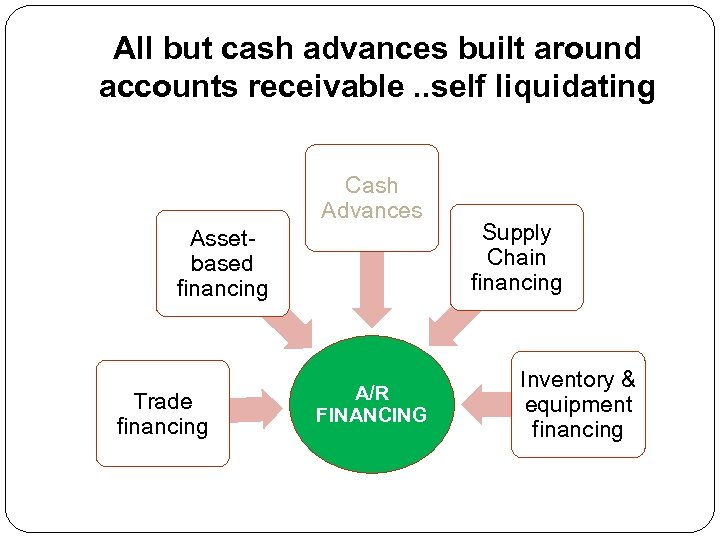

All but cash advances built around accounts receivable. . self liquidating Cash Advances Assetbased financing Trade financing A/R FINANCING Supply Chain financing Inventory & equipment financing

All but cash advances built around accounts receivable. . self liquidating Cash Advances Assetbased financing Trade financing A/R FINANCING Supply Chain financing Inventory & equipment financing

Factoring Two Common Situations: 1. Start up and not yet bankable 2. “Insufficiently bankable” • Very Rapid Growth • Seasonal Sales Pattern

Factoring Two Common Situations: 1. Start up and not yet bankable 2. “Insufficiently bankable” • Very Rapid Growth • Seasonal Sales Pattern

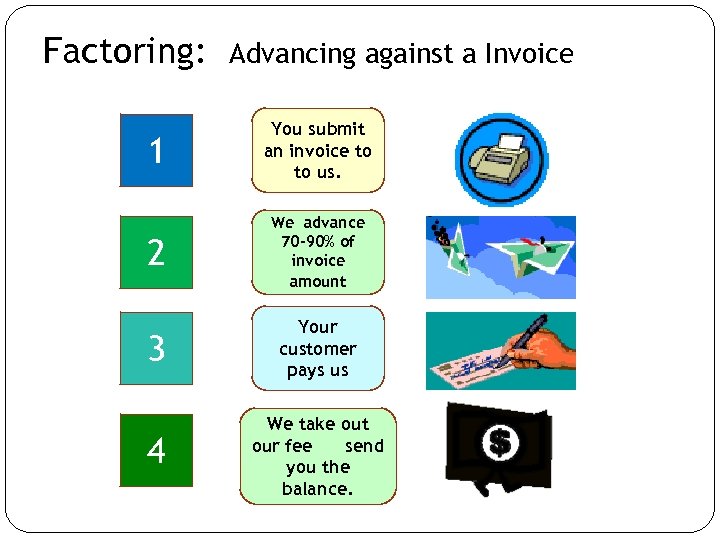

Factoring: Advancing against a Invoice 1 You submit an invoice to to us. 2 We advance 70 -90% of invoice amount 3 Your customer pays us 4 We take out our fee send you the balance.

Factoring: Advancing against a Invoice 1 You submit an invoice to to us. 2 We advance 70 -90% of invoice amount 3 Your customer pays us 4 We take out our fee send you the balance.

Factoring: The only form of financing that grows with sales Dates to medieval times Very common in Europe and Canada Accepting credit cards is a form of factoring Fees range from 1. 8% to 5% depending on size of A/R, industry, time it takes your customers to pay

Factoring: The only form of financing that grows with sales Dates to medieval times Very common in Europe and Canada Accepting credit cards is a form of factoring Fees range from 1. 8% to 5% depending on size of A/R, industry, time it takes your customers to pay

OUR APPROACH No long term contracts Simple, straightforward fees All assets not tied up Available to new and established companies Advances based on your customers’ likelihood of paying - not your credit history, collateral, or cash flow Quick

OUR APPROACH No long term contracts Simple, straightforward fees All assets not tied up Available to new and established companies Advances based on your customers’ likelihood of paying - not your credit history, collateral, or cash flow Quick

Factoring’s Immediate Benefits We provide proof of funding allowing you to bid on very large contracts We open up new (growth) opportunities which pay at 45 -60 days…Oil companies, Lowe’s We provide professional credit management NO debt (self-liquidating)

Factoring’s Immediate Benefits We provide proof of funding allowing you to bid on very large contracts We open up new (growth) opportunities which pay at 45 -60 days…Oil companies, Lowe’s We provide professional credit management NO debt (self-liquidating)

Another option for a small established business: Purchase Order Financing Allows small companies to accept large orders when adequate trade credit is unavailable. For finished product that is pre-sold FLEXIBILITY, CREATIVITY UNLIMITED POSSIBILITIES

Another option for a small established business: Purchase Order Financing Allows small companies to accept large orders when adequate trade credit is unavailable. For finished product that is pre-sold FLEXIBILITY, CREATIVITY UNLIMITED POSSIBILITIES

Our Programs Cash Advances Assetbased financing Trade financing A/R FINANCING Supply Chain financing Inventory & equipment financing

Our Programs Cash Advances Assetbased financing Trade financing A/R FINANCING Supply Chain financing Inventory & equipment financing

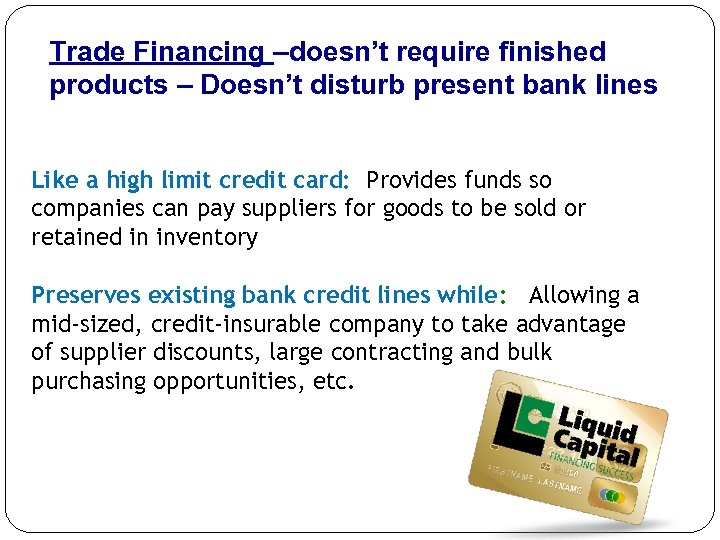

Trade Financing –doesn’t require finished products – Doesn’t disturb present bank lines Like a high limit credit card: Provides funds so companies can pay suppliers for goods to be sold or retained in inventory Preserves existing bank credit lines while: Allowing a mid-sized, credit-insurable company to take advantage of supplier discounts, large contracting and bulk purchasing opportunities, etc.

Trade Financing –doesn’t require finished products – Doesn’t disturb present bank lines Like a high limit credit card: Provides funds so companies can pay suppliers for goods to be sold or retained in inventory Preserves existing bank credit lines while: Allowing a mid-sized, credit-insurable company to take advantage of supplier discounts, large contracting and bulk purchasing opportunities, etc.

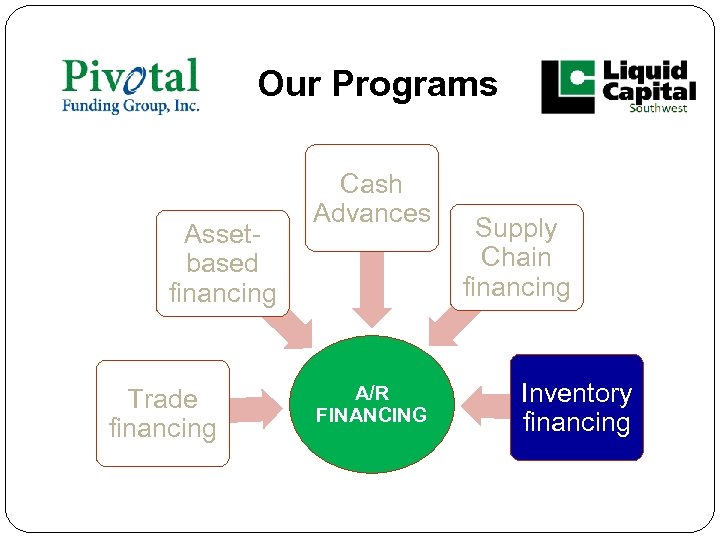

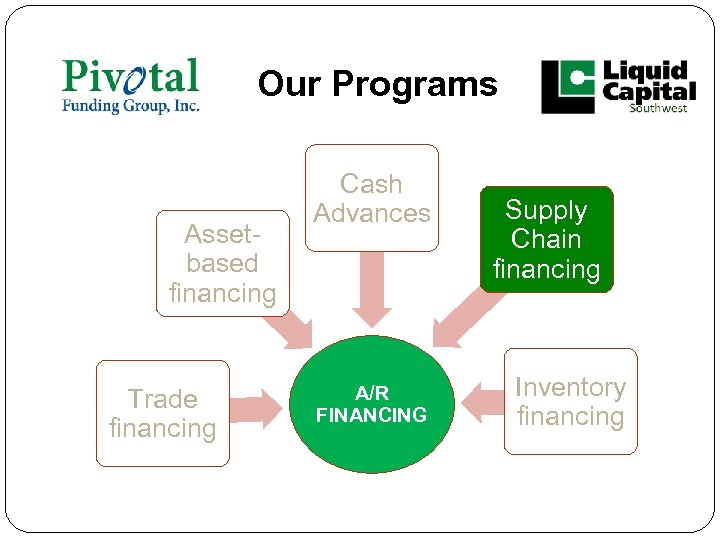

Our Programs Assetbased financing Trade financing Cash Advances A/R FINANCING Supply Chain financing Inventory financing

Our Programs Assetbased financing Trade financing Cash Advances A/R FINANCING Supply Chain financing Inventory financing

Inventory Financing We purchase inventory for you When you sell it we factor the invoice, pay ourselves back and the rest goes proto you. Works best for products that require little additional processing e. g. produce, LED lights, frac sand

Inventory Financing We purchase inventory for you When you sell it we factor the invoice, pay ourselves back and the rest goes proto you. Works best for products that require little additional processing e. g. produce, LED lights, frac sand

Our Programs Assetbased financing Trade financing Cash Advances A/R FINANCING Supply Chain financing Inventory financing

Our Programs Assetbased financing Trade financing Cash Advances A/R FINANCING Supply Chain financing Inventory financing

Our Programs Assetbased financing Trade financing Cash Advances A/R FINANCING Supply Chain financing Inventory financing

Our Programs Assetbased financing Trade financing Cash Advances A/R FINANCING Supply Chain financing Inventory financing

Supply Chain Financing An outsourced accounts payable service: Suppliers of goods and services can elect early payment on approved invoices at known cost. Allows large (Fortune 1000) companies to standardize payment terms; enhance supplier relations; save on staff, clerical, check-writing, wire costs; perhaps share in the supplier’s discount.

Supply Chain Financing An outsourced accounts payable service: Suppliers of goods and services can elect early payment on approved invoices at known cost. Allows large (Fortune 1000) companies to standardize payment terms; enhance supplier relations; save on staff, clerical, check-writing, wire costs; perhaps share in the supplier’s discount.

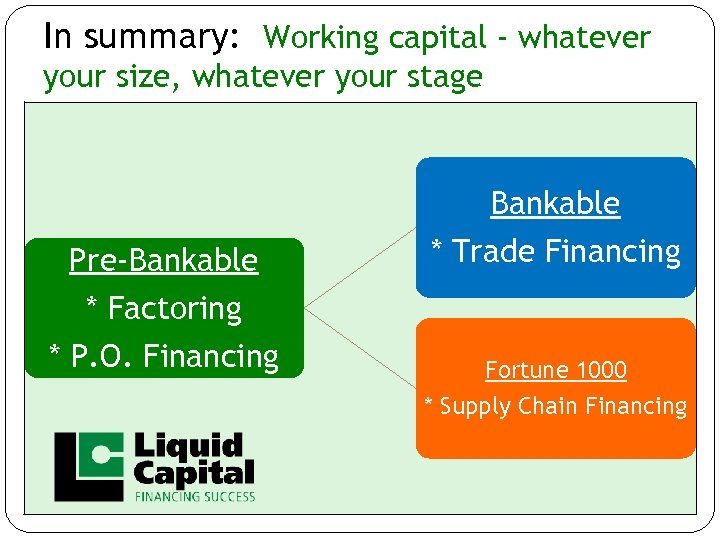

In summary: Working capital - whatever your size, whatever your stage Pre-Bankable * Trade Financing * Factoring * P. O. Financing Fortune 1000 * Supply Chain Financing

In summary: Working capital - whatever your size, whatever your stage Pre-Bankable * Trade Financing * Factoring * P. O. Financing Fortune 1000 * Supply Chain Financing

We are financing specialists Accredited and award-winning • No long-term contract; all inclusive fee • Flexibility; unlimited capital resources • Select those customers you want us to deal with • Family-owned and operated 2010 & 2011: Regional Access to Capital Award 2014 Largest of 84 Liquid Capital companies 2008: Banking & Finance Advocate of the Year A+ Rating

We are financing specialists Accredited and award-winning • No long-term contract; all inclusive fee • Flexibility; unlimited capital resources • Select those customers you want us to deal with • Family-owned and operated 2010 & 2011: Regional Access to Capital Award 2014 Largest of 84 Liquid Capital companies 2008: Banking & Finance Advocate of the Year A+ Rating

Thanks for your time. Ron Edinger Ron. Edinger@My. Liquid. C apital. com (210) 587 -7267

Thanks for your time. Ron Edinger Ron. Edinger@My. Liquid. C apital. com (210) 587 -7267