RM_Sensitivity_Fall2012.ppt

- Количество слайдов: 20

WIUU BBA RM Sensitivity. Tornado chart. DOL. DFL. DTL. Study materials: Slides RWJ: Ch 8. 3. BM: Ch 10. 1. WIUU BBA RM, Fall 2012, A. Zaporozhetz 1

Sensitivity Analysis - The study of how variations of outcome are due to changes in variables. It is used to see how a dependent variable reacts to changes in an independent variable. A method of predicting how changes in a particular factor will change the outcome. Usually performed by creating a range of change for an independent variable and predicting an outcome range. (SMA 2 A) “The effect of a change in a variable (such as sales) on the risk or profitability of an investment. ” (Barron’s Dictionary of Finance and Investment Terms) WIUU BBA RM, Fall 2012, A. Zaporozhetz 2

Sensitivity: cases in Finance 1. Beta as indicator of market risk 2. Modified Duration (MD) 3. RRR in Capital budgeting analysis; NPV profile NB: The higher the value of a sensitivity factor, the higher (some particular, type of) risk. WIUU BBA RM, Fall 2012, A. Zaporozhetz 3

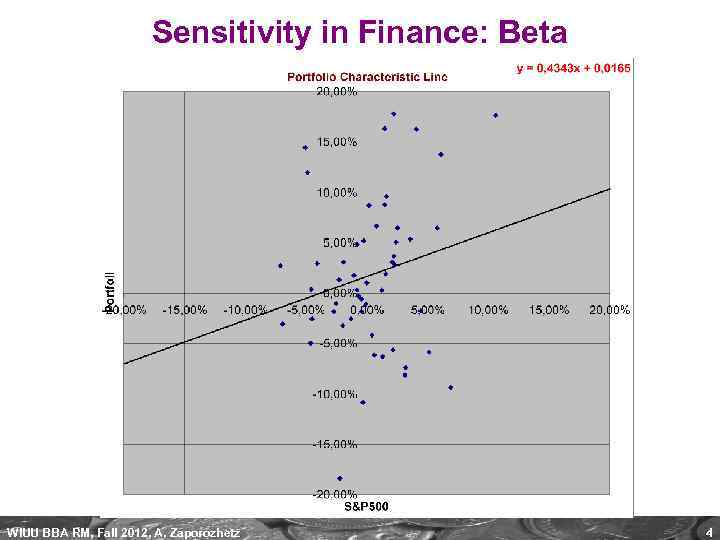

Sensitivity in Finance: Beta WIUU BBA RM, Fall 2012, A. Zaporozhetz 4

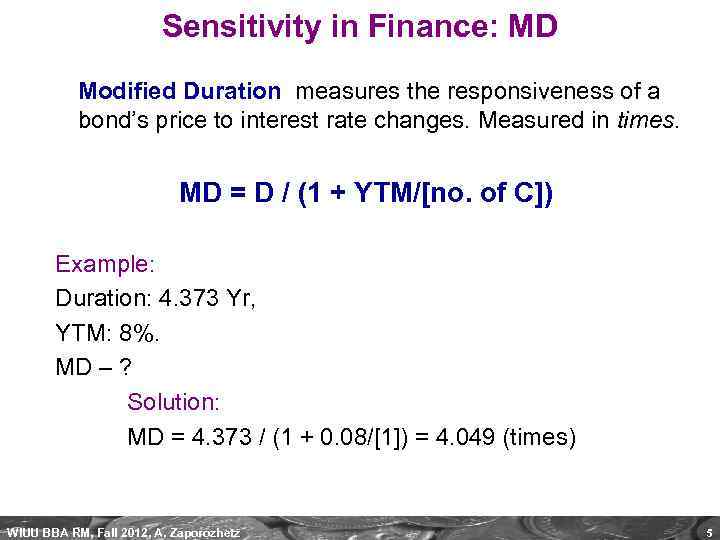

Sensitivity in Finance: MD Modified Duration measures the responsiveness of a bond’s price to interest rate changes. Measured in times. MD = D / (1 + YTM/[no. of C]) Example: Duration: 4. 373 Yr, YTM: 8%. MD – ? Solution: MD = 4. 373 / (1 + 0. 08/[1]) = 4. 049 (times) WIUU BBA RM, Fall 2012, A. Zaporozhetz 5

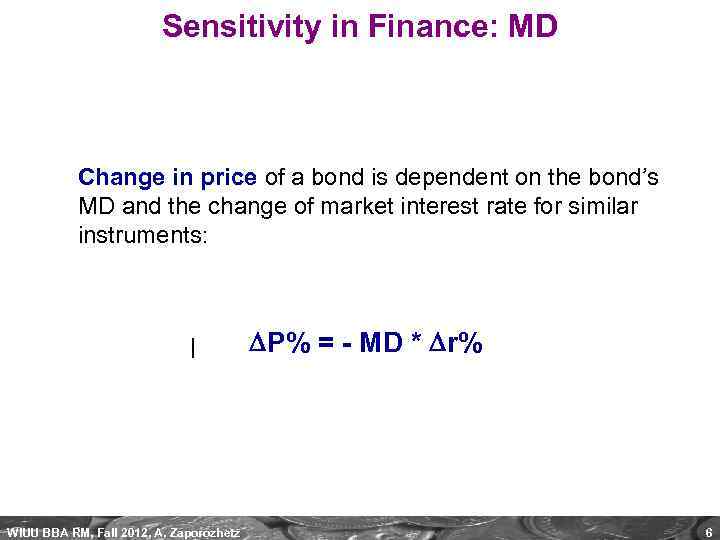

Sensitivity in Finance: MD Change in price of a bond is dependent on the bond’s MD and the change of market interest rate for similar instruments: P% = - MD * r% WIUU BBA RM, Fall 2012, A. Zaporozhetz 6

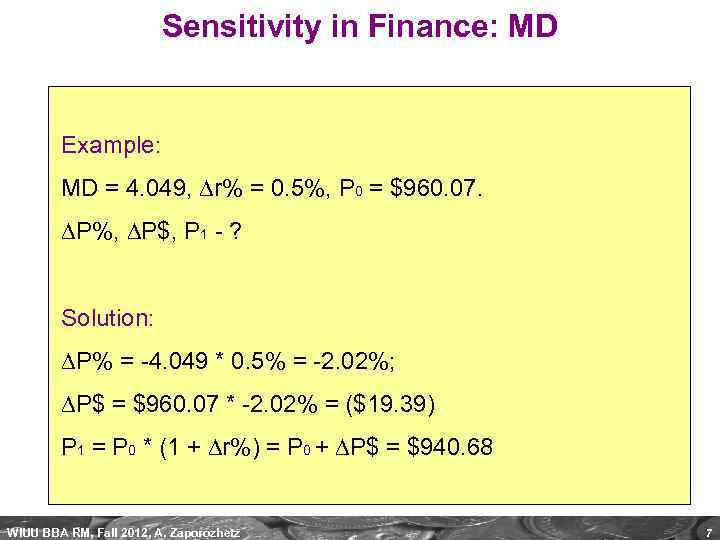

Sensitivity in Finance: MD Example: MD = 4. 049, r% = 0. 5%, P 0 = $960. 07. P%, P$, P 1 - ? Solution: P% = -4. 049 * 0. 5% = -2. 02%; P$ = $960. 07 * -2. 02% = ($19. 39) P 1 = P 0 * (1 + r%) = P 0 + P$ = $940. 68 WIUU BBA RM, Fall 2012, A. Zaporozhetz 7

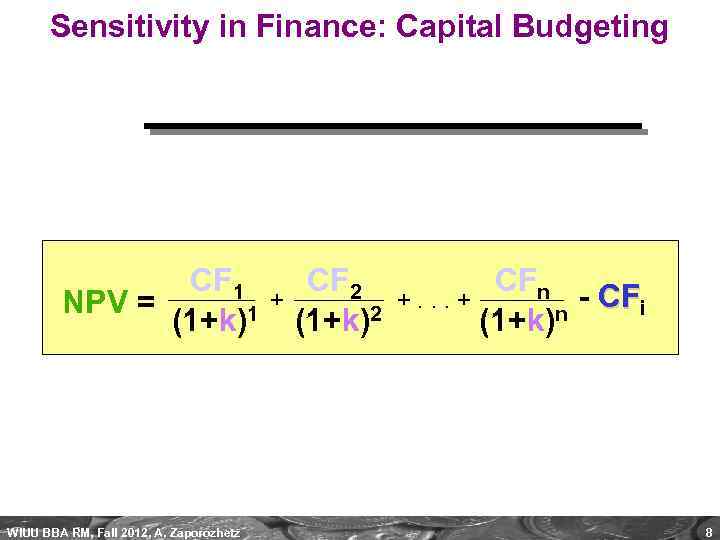

Sensitivity in Finance: Capital Budgeting CF 1 NPV = (1+k)1 WIUU BBA RM, Fall 2012, A. Zaporozhetz + CF 2 (1+k)2 CFn - CFi +. . . + (1+k)n 8

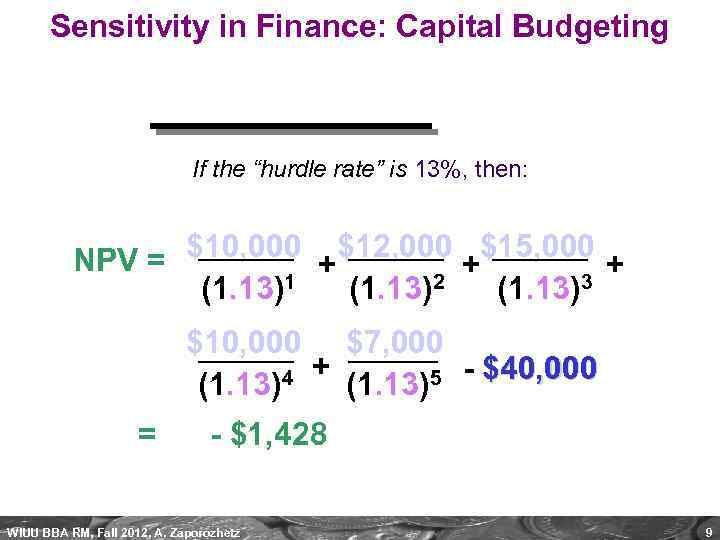

Sensitivity in Finance: Capital Budgeting If the “hurdle rate” is 13%, then: NPV = $10, 000 +$12, 000 +$15, 000 + (1. 13)1 (1. 13)2 (1. 13)3 $10, 000 $7, 000 4 + (1. 13)5 - $40, 000 (1. 13) = - $1, 428 WIUU BBA RM, Fall 2012, A. Zaporozhetz 9

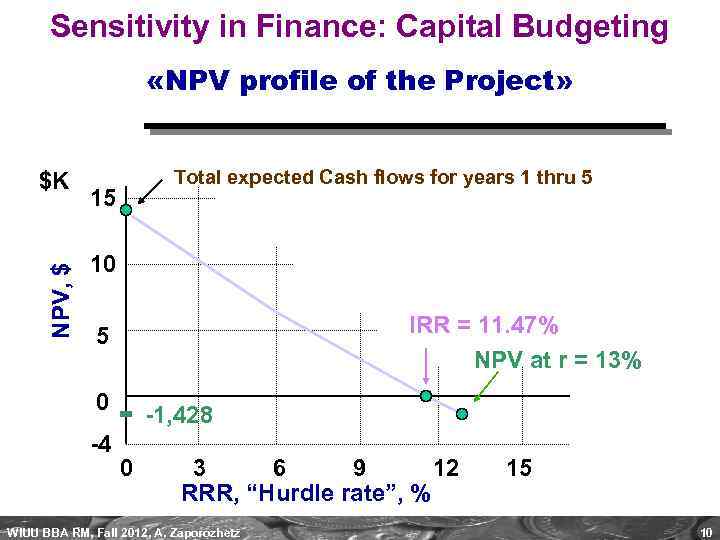

Sensitivity in Finance: Capital Budgeting «NPV profile of the Project» NPV, $ $K Total expected Cash flows for years 1 thru 5 15 10 IRR = 11. 47% NPV at r = 13% 5 0 -4 -1, 428 0 3 6 9 12 RRR, “Hurdle rate”, % WIUU BBA RM, Fall 2012, A. Zaporozhetz 15 10

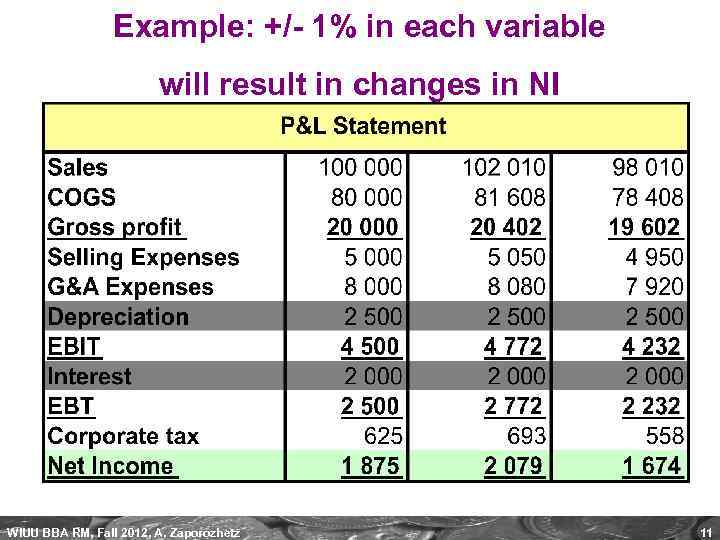

Example: +/- 1% in each variable will result in changes in NI WIUU BBA RM, Fall 2012, A. Zaporozhetz 11

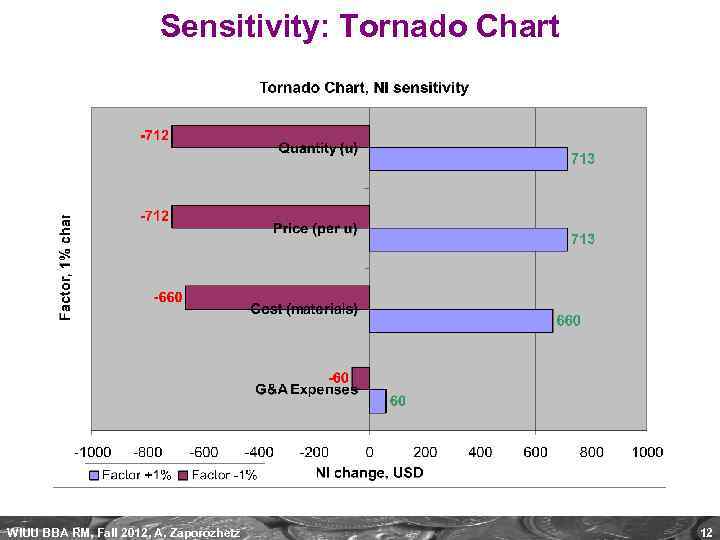

Sensitivity: Tornado Chart WIUU BBA RM, Fall 2012, A. Zaporozhetz 12

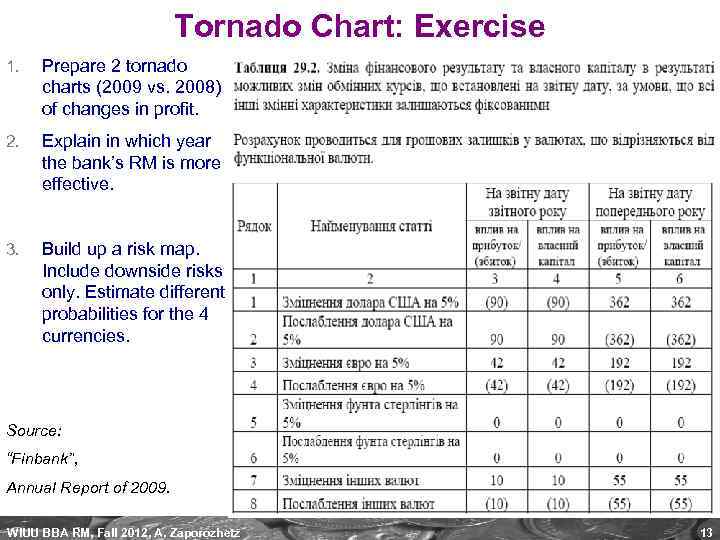

Tornado Chart: Exercise 1. Prepare 2 tornado charts (2009 vs. 2008) of changes in profit. 2. Explain in which year the bank’s RM is more effective. 3. Build up a risk map. Include downside risks only. Estimate different probabilities for the 4 currencies. Source: “Finbank”, Annual Report of 2009. WIUU BBA RM, Fall 2012, A. Zaporozhetz 13

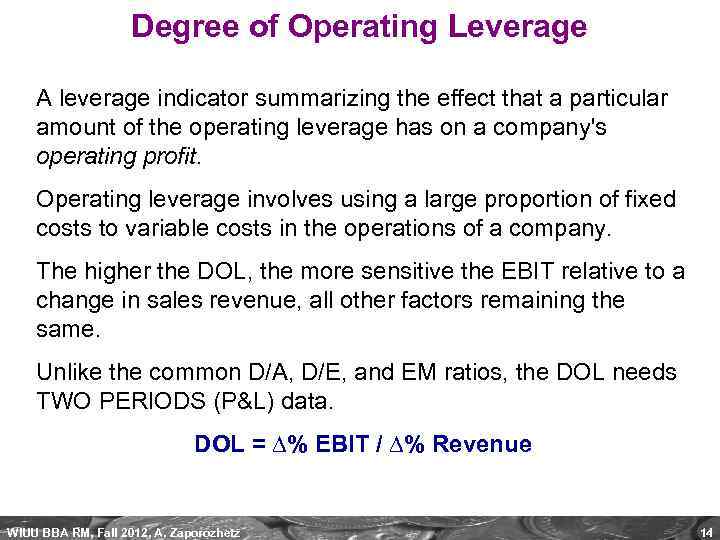

Degree of Operating Leverage A leverage indicator summarizing the effect that a particular amount of the operating leverage has on a company's operating profit. Operating leverage involves using a large proportion of fixed costs to variable costs in the operations of a company. The higher the DOL, the more sensitive the EBIT relative to a change in sales revenue, all other factors remaining the same. Unlike the common D/A, D/E, and EM ratios, the DOL needs TWO PERIODS (P&L) data. DOL = ∆% EBIT / ∆% Revenue WIUU BBA RM, Fall 2012, A. Zaporozhetz 14

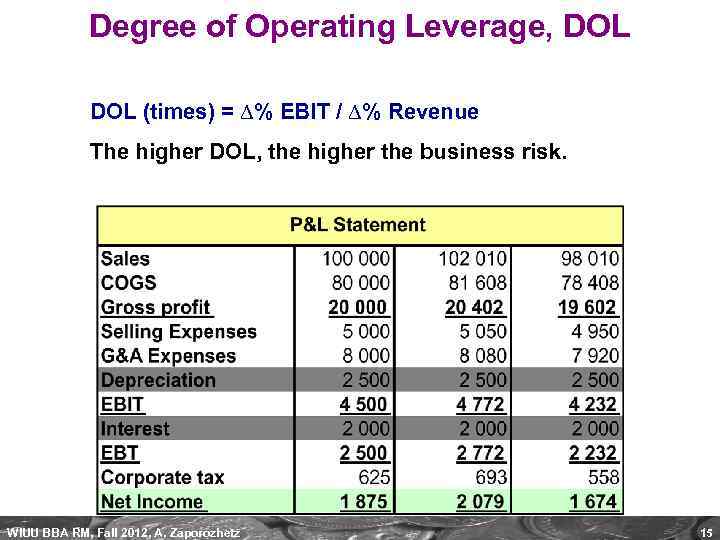

Degree of Operating Leverage, DOL (times) = ∆% EBIT / ∆% Revenue The higher DOL, the higher the business risk. WIUU BBA RM, Fall 2012, A. Zaporozhetz 15

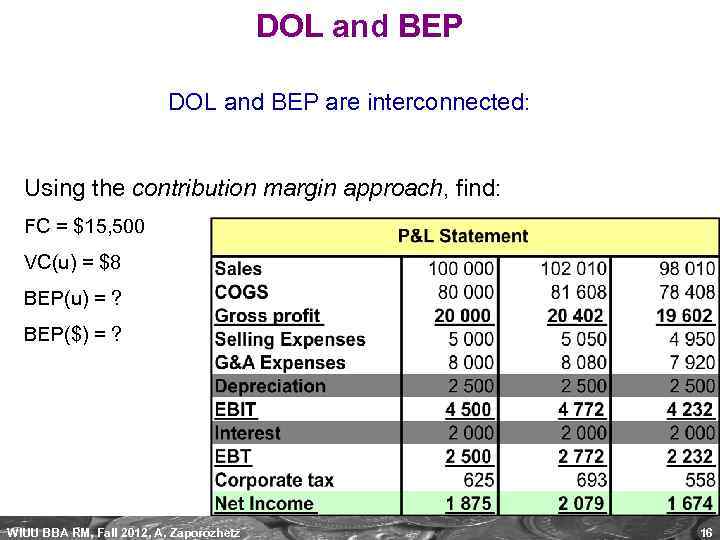

DOL and BEP are interconnected: Using the contribution margin approach, find: FC = $15, 500 VC(u) = $8 BEP(u) = ? BEP($) = ? WIUU BBA RM, Fall 2012, A. Zaporozhetz 16

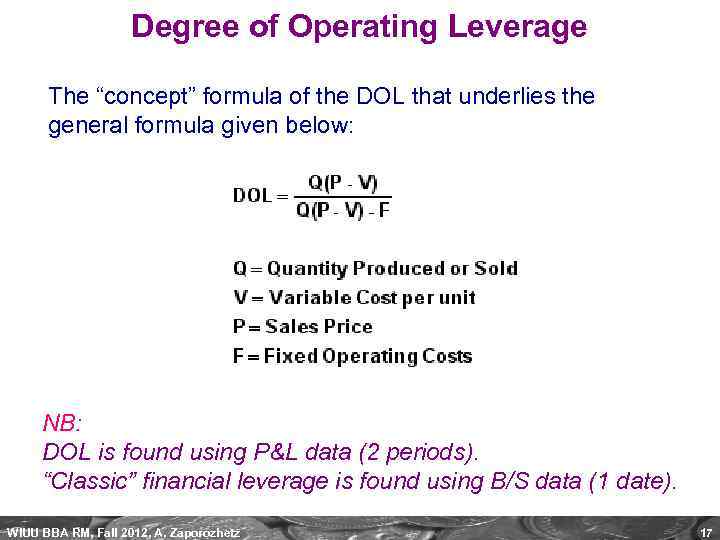

Degree of Operating Leverage The “concept” formula of the DOL that underlies the general formula given below: NB: DOL is found using P&L data (2 periods). “Classic” financial leverage is found using B/S data (1 date). WIUU BBA RM, Fall 2012, A. Zaporozhetz 17

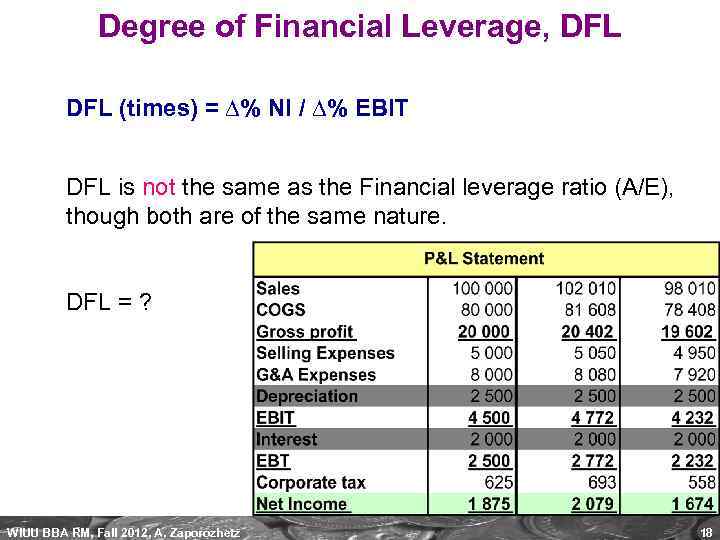

Degree of Financial Leverage, DFL (times) = ∆% NI / ∆% EBIT DFL is not the same as the Financial leverage ratio (A/E), though both are of the same nature. DFL = ? WIUU BBA RM, Fall 2012, A. Zaporozhetz 18

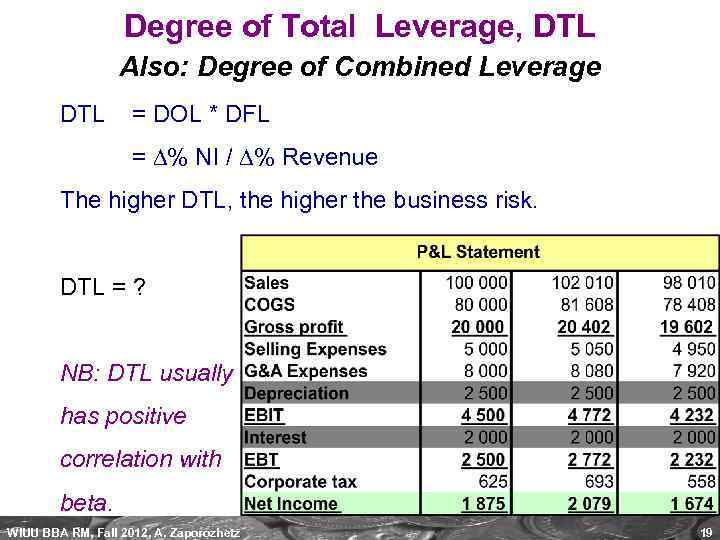

Degree of Total Leverage, DTL Also: Degree of Combined Leverage DTL = DOL * DFL = ∆% NI / ∆% Revenue The higher DTL, the higher the business risk. DTL = ? NB: DTL usually has positive correlation with beta. WIUU BBA RM, Fall 2012, A. Zaporozhetz 19

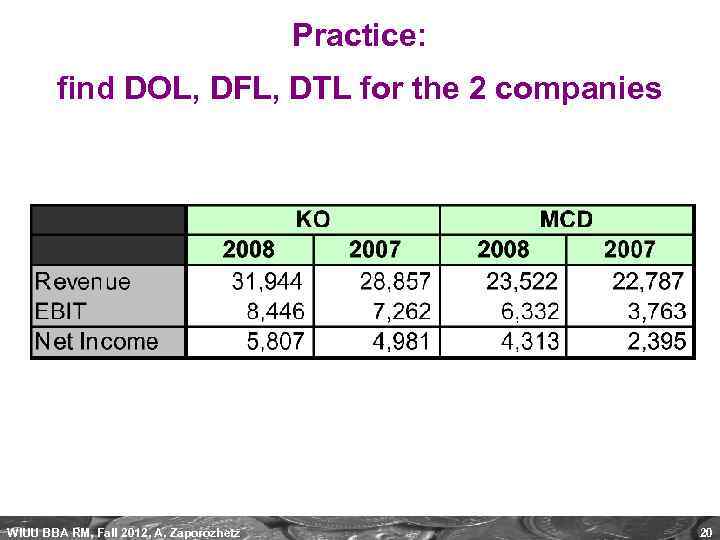

Practice: find DOL, DFL, DTL for the 2 companies WIUU BBA RM, Fall 2012, A. Zaporozhetz 20

RM_Sensitivity_Fall2012.ppt