697684d7cdcdf7f68ce0c413ccc56b85.ppt

- Количество слайдов: 55

Withholding u/s 195 - Key issues

Withholding u/s 195 - Key issues

Agenda 1 Overview 2 Analysis of Section 195 – Key Issues 3 Grossing up of taxes – Section 195 A 4 Other considerations 5 Key Takeaways 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 2

Agenda 1 Overview 2 Analysis of Section 195 – Key Issues 3 Grossing up of taxes – Section 195 A 4 Other considerations 5 Key Takeaways 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 2

Why discuss Section 195? ► Scope expanded in recent times – Finance Act, 2012 added Explanation 2 ► Retrospectively ► Extraterritorial – w. e. f. 1 April 1962 Operation ► Stringent consequences for all parties to the transaction ► Tax Department’s eye on international payments ► Nokia ► & Cairn Energy Revised Remittance Procedures (Rule 37 BB revamped) Note: Though amendment may have been ‘retrospective’ or ‘clarificatory’, it may be difficult to make a deductor liable for non-deduction in earlier years 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 3

Why discuss Section 195? ► Scope expanded in recent times – Finance Act, 2012 added Explanation 2 ► Retrospectively ► Extraterritorial – w. e. f. 1 April 1962 Operation ► Stringent consequences for all parties to the transaction ► Tax Department’s eye on international payments ► Nokia ► & Cairn Energy Revised Remittance Procedures (Rule 37 BB revamped) Note: Though amendment may have been ‘retrospective’ or ‘clarificatory’, it may be difficult to make a deductor liable for non-deduction in earlier years 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 3

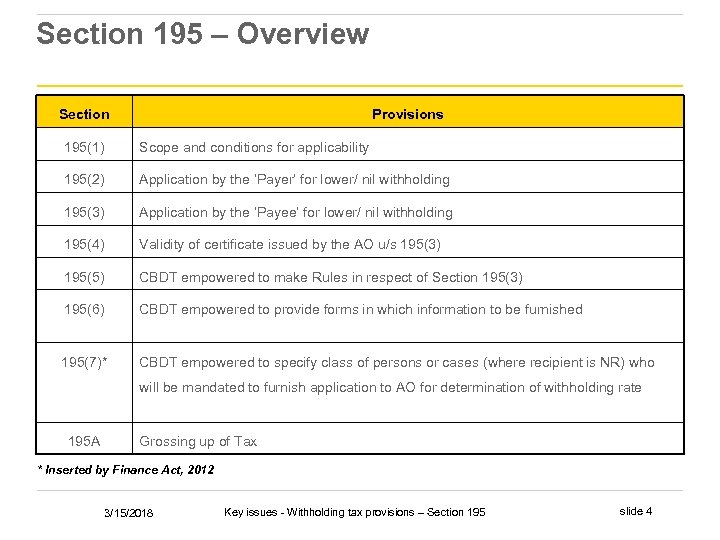

Section 195 – Overview Section Provisions 195(1) Scope and conditions for applicability 195(2) Application by the ‘Payer’ for lower/ nil withholding 195(3) Application by the ‘Payee’ for lower/ nil withholding 195(4) Validity of certificate issued by the AO u/s 195(3) 195(5) CBDT empowered to make Rules in respect of Section 195(3) 195(6) CBDT empowered to provide forms in which information to be furnished 195(7)* CBDT empowered to specify class of persons or cases (where recipient is NR) who will be mandated to furnish application to AO for determination of withholding rate 195 A Grossing up of Tax * Inserted by Finance Act, 2012 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 4

Section 195 – Overview Section Provisions 195(1) Scope and conditions for applicability 195(2) Application by the ‘Payer’ for lower/ nil withholding 195(3) Application by the ‘Payee’ for lower/ nil withholding 195(4) Validity of certificate issued by the AO u/s 195(3) 195(5) CBDT empowered to make Rules in respect of Section 195(3) 195(6) CBDT empowered to provide forms in which information to be furnished 195(7)* CBDT empowered to specify class of persons or cases (where recipient is NR) who will be mandated to furnish application to AO for determination of withholding rate 195 A Grossing up of Tax * Inserted by Finance Act, 2012 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 4

Analysis of Section 195 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 5

Analysis of Section 195 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 5

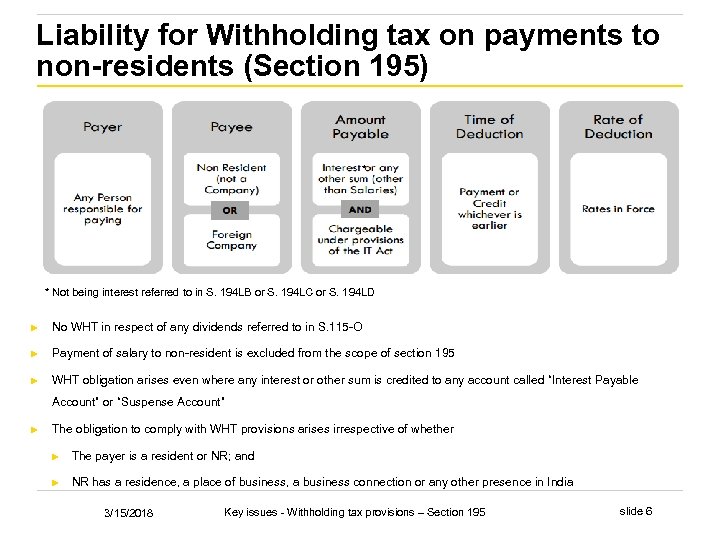

Liability for Withholding tax on payments to non-residents (Section 195) * * Not being interest referred to in S. 194 LB or S. 194 LC or S. 194 LD ► No WHT in respect of any dividends referred to in S. 115 -O ► Payment of salary to non-resident is excluded from the scope of section 195 ► WHT obligation arises even where any interest or other sum is credited to any account called “Interest Payable Account” or “Suspense Account” ► The obligation to comply with WHT provisions arises irrespective of whether ► The payer is a resident or NR; and ► NR has a residence, a place of business, a business connection or any other presence in India 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 6

Liability for Withholding tax on payments to non-residents (Section 195) * * Not being interest referred to in S. 194 LB or S. 194 LC or S. 194 LD ► No WHT in respect of any dividends referred to in S. 115 -O ► Payment of salary to non-resident is excluded from the scope of section 195 ► WHT obligation arises even where any interest or other sum is credited to any account called “Interest Payable Account” or “Suspense Account” ► The obligation to comply with WHT provisions arises irrespective of whether ► The payer is a resident or NR; and ► NR has a residence, a place of business, a business connection or any other presence in India 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 6

Section 195(1) – Scope and applicability 3/15/2018 Withholding tax provisions – Section 195 slide 7

Section 195(1) – Scope and applicability 3/15/2018 Withholding tax provisions – Section 195 slide 7

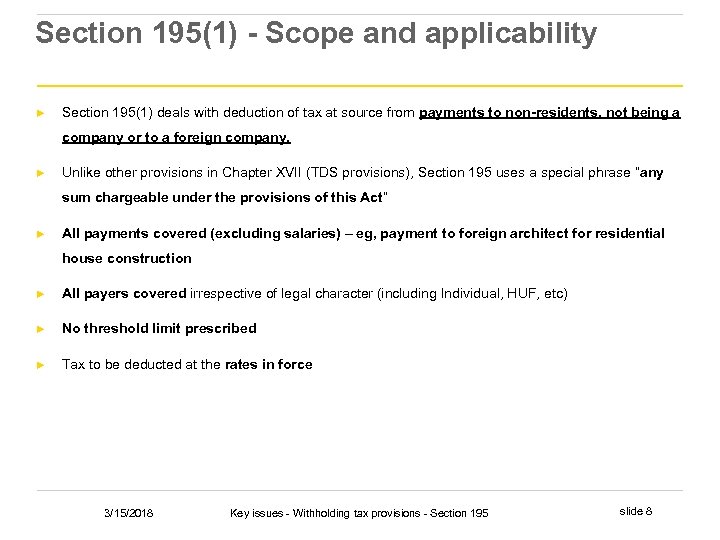

Section 195(1) - Scope and applicability ► Section 195(1) deals with deduction of tax at source from payments to non-residents, not being a company or to a foreign company, ► Unlike other provisions in Chapter XVII (TDS provisions), Section 195 uses a special phrase “any sum chargeable under the provisions of this Act” ► All payments covered (excluding salaries) – eg, payment to foreign architect for residential house construction ► All payers covered irrespective of legal character (including Individual, HUF, etc) ► No threshold limit prescribed ► Tax to be deducted at the rates in force 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 8

Section 195(1) - Scope and applicability ► Section 195(1) deals with deduction of tax at source from payments to non-residents, not being a company or to a foreign company, ► Unlike other provisions in Chapter XVII (TDS provisions), Section 195 uses a special phrase “any sum chargeable under the provisions of this Act” ► All payments covered (excluding salaries) – eg, payment to foreign architect for residential house construction ► All payers covered irrespective of legal character (including Individual, HUF, etc) ► No threshold limit prescribed ► Tax to be deducted at the rates in force 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 8

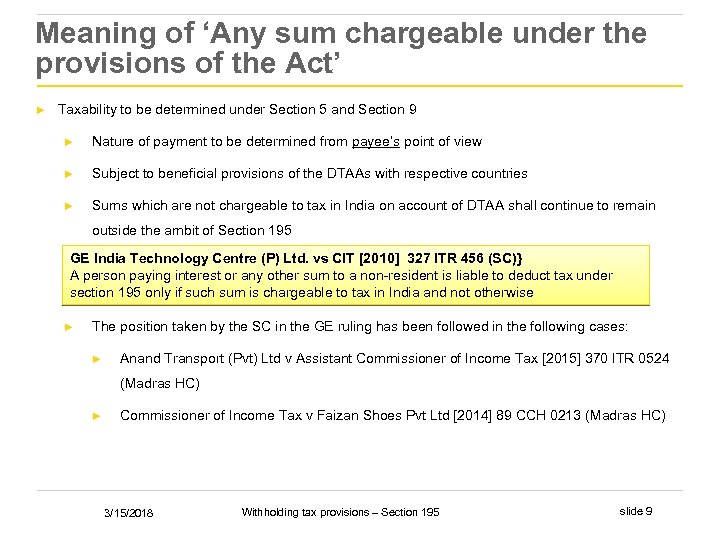

Meaning of ‘Any sum chargeable under the provisions of the Act’ ► Taxability to be determined under Section 5 and Section 9 ► Nature of payment to be determined from payee’s point of view ► Subject to beneficial provisions of the DTAAs with respective countries ► Sums which are not chargeable to tax in India on account of DTAA shall continue to remain outside the ambit of Section 195 GE India Technology Centre (P) Ltd. vs CIT [2010] 327 ITR 456 (SC)} A person paying interest or any other sum to a non-resident is liable to deduct tax under section 195 only if such sum is chargeable to tax in India and not otherwise ► The position taken by the SC in the GE ruling has been followed in the following cases: ► Anand Transport (Pvt) Ltd v Assistant Commissioner of Income Tax [2015] 370 ITR 0524 (Madras HC) ► Commissioner of Income Tax v Faizan Shoes Pvt Ltd [2014] 89 CCH 0213 (Madras HC) 3/15/2018 Withholding tax provisions – Section 195 slide 9

Meaning of ‘Any sum chargeable under the provisions of the Act’ ► Taxability to be determined under Section 5 and Section 9 ► Nature of payment to be determined from payee’s point of view ► Subject to beneficial provisions of the DTAAs with respective countries ► Sums which are not chargeable to tax in India on account of DTAA shall continue to remain outside the ambit of Section 195 GE India Technology Centre (P) Ltd. vs CIT [2010] 327 ITR 456 (SC)} A person paying interest or any other sum to a non-resident is liable to deduct tax under section 195 only if such sum is chargeable to tax in India and not otherwise ► The position taken by the SC in the GE ruling has been followed in the following cases: ► Anand Transport (Pvt) Ltd v Assistant Commissioner of Income Tax [2015] 370 ITR 0524 (Madras HC) ► Commissioner of Income Tax v Faizan Shoes Pvt Ltd [2014] 89 CCH 0213 (Madras HC) 3/15/2018 Withholding tax provisions – Section 195 slide 9

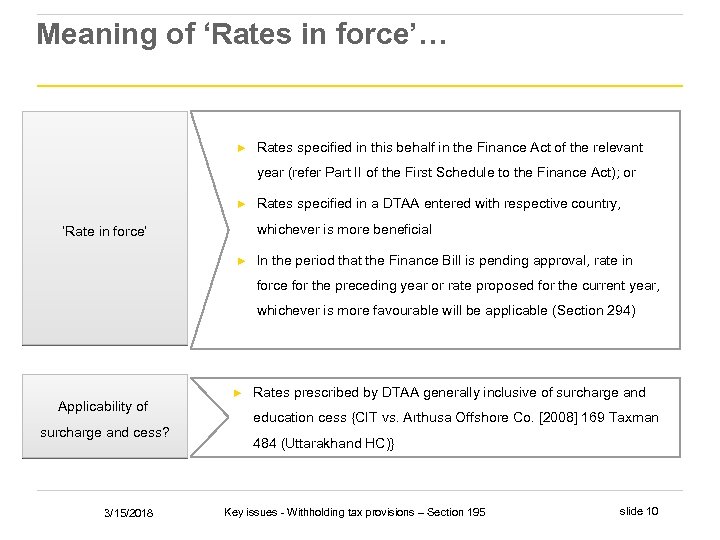

Meaning of ‘Rates in force’… ► Rates specified in this behalf in the Finance Act of the relevant year (refer Part II of the First Schedule to the Finance Act); or ► Rates specified in a DTAA entered with respective country, whichever is more beneficial ‘Rate in force’ ► In the period that the Finance Bill is pending approval, rate in force for the preceding year or rate proposed for the current year, whichever is more favourable will be applicable (Section 294) Applicability of surcharge and cess? 3/15/2018 ► Rates prescribed by DTAA generally inclusive of surcharge and education cess {CIT vs. Arthusa Offshore Co. [2008] 169 Taxman 484 (Uttarakhand HC)} Key issues - Withholding tax provisions – Section 195 slide 10

Meaning of ‘Rates in force’… ► Rates specified in this behalf in the Finance Act of the relevant year (refer Part II of the First Schedule to the Finance Act); or ► Rates specified in a DTAA entered with respective country, whichever is more beneficial ‘Rate in force’ ► In the period that the Finance Bill is pending approval, rate in force for the preceding year or rate proposed for the current year, whichever is more favourable will be applicable (Section 294) Applicability of surcharge and cess? 3/15/2018 ► Rates prescribed by DTAA generally inclusive of surcharge and education cess {CIT vs. Arthusa Offshore Co. [2008] 169 Taxman 484 (Uttarakhand HC)} Key issues - Withholding tax provisions – Section 195 slide 10

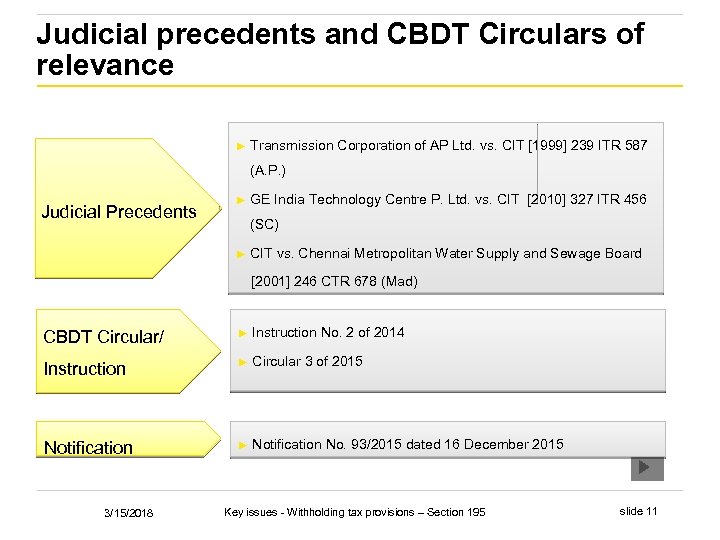

Judicial precedents and CBDT Circulars of relevance ► Transmission Corporation of AP Ltd. vs. CIT [1999] 239 ITR 587 (A. P. ) Judicial Precedents ► GE India Technology Centre P. Ltd. vs. CIT [2010] 327 ITR 456 (SC) ► CIT vs. Chennai Metropolitan Water Supply and Sewage Board [2001] 246 CTR 678 (Mad) CBDT Circular/ ► Instruction No. 2 of 2014 Instruction ► Circular 3 of 2015 Link Notification 3/15/2018 ► Notification No. 93/2015 dated 16 December 2015 Key issues - Withholding tax provisions – Section 195 slide 11

Judicial precedents and CBDT Circulars of relevance ► Transmission Corporation of AP Ltd. vs. CIT [1999] 239 ITR 587 (A. P. ) Judicial Precedents ► GE India Technology Centre P. Ltd. vs. CIT [2010] 327 ITR 456 (SC) ► CIT vs. Chennai Metropolitan Water Supply and Sewage Board [2001] 246 CTR 678 (Mad) CBDT Circular/ ► Instruction No. 2 of 2014 Instruction ► Circular 3 of 2015 Link Notification 3/15/2018 ► Notification No. 93/2015 dated 16 December 2015 Key issues - Withholding tax provisions – Section 195 slide 11

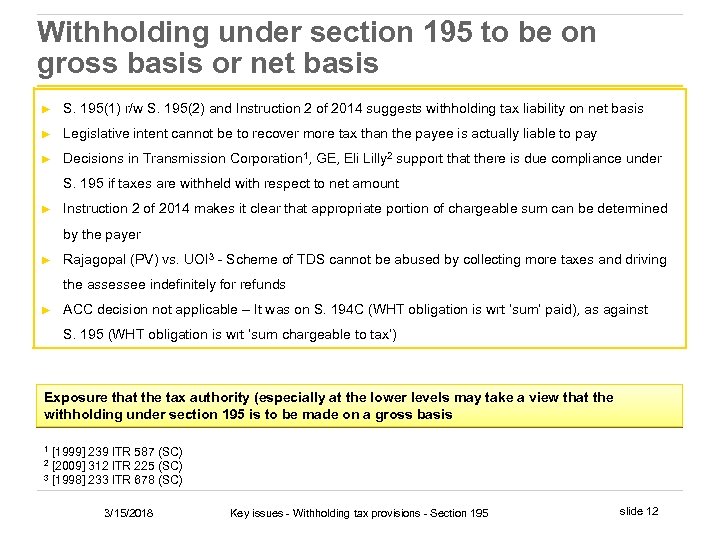

Withholding under section 195 to be on gross basis or net basis ► S. 195(1) r/w S. 195(2) and Instruction 2 of 2014 suggests withholding tax liability on net basis ► Legislative intent cannot be to recover more tax than the payee is actually liable to pay ► Decisions in Transmission Corporation 1, GE, Eli Lilly 2 support that there is due compliance under S. 195 if taxes are withheld with respect to net amount ► Instruction 2 of 2014 makes it clear that appropriate portion of chargeable sum can be determined by the payer ► Rajagopal (PV) vs. UOI 3 - Scheme of TDS cannot be abused by collecting more taxes and driving the assessee indefinitely for refunds ► ACC decision not applicable – It was on S. 194 C (WHT obligation is wrt ‘sum’ paid), as against S. 195 (WHT obligation is wrt ‘sum chargeable to tax’) Exposure that the tax authority (especially at the lower levels may take a view that the withholding under section 195 is to be made on a gross basis [1999] 239 ITR 587 (SC) [2009] 312 ITR 225 (SC) 3 [1998] 233 ITR 678 (SC) 1 2 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 12

Withholding under section 195 to be on gross basis or net basis ► S. 195(1) r/w S. 195(2) and Instruction 2 of 2014 suggests withholding tax liability on net basis ► Legislative intent cannot be to recover more tax than the payee is actually liable to pay ► Decisions in Transmission Corporation 1, GE, Eli Lilly 2 support that there is due compliance under S. 195 if taxes are withheld with respect to net amount ► Instruction 2 of 2014 makes it clear that appropriate portion of chargeable sum can be determined by the payer ► Rajagopal (PV) vs. UOI 3 - Scheme of TDS cannot be abused by collecting more taxes and driving the assessee indefinitely for refunds ► ACC decision not applicable – It was on S. 194 C (WHT obligation is wrt ‘sum’ paid), as against S. 195 (WHT obligation is wrt ‘sum chargeable to tax’) Exposure that the tax authority (especially at the lower levels may take a view that the withholding under section 195 is to be made on a gross basis [1999] 239 ITR 587 (SC) [2009] 312 ITR 225 (SC) 3 [1998] 233 ITR 678 (SC) 1 2 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 12

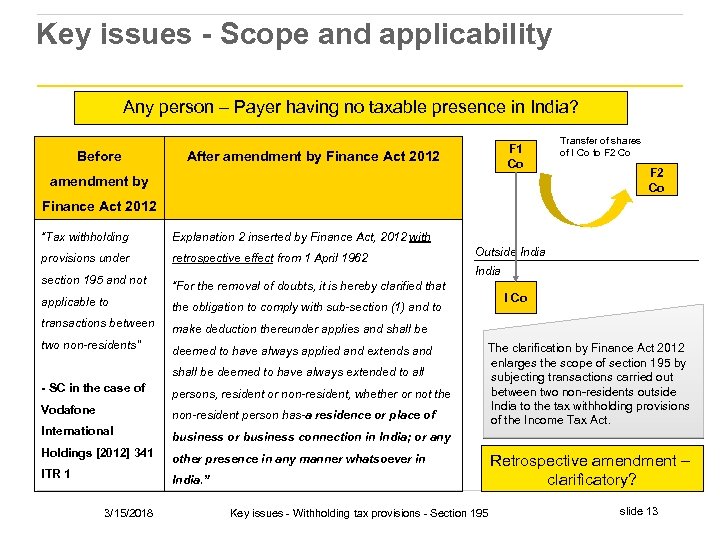

Key issues - Scope and applicability Any person – Payer having no taxable presence in India? Before F 1 Co After amendment by Finance Act 2012 amendment by Transfer of shares of I Co to F 2 Co Finance Act 2012 “Tax withholding Explanation 2 inserted by Finance Act, 2012 with provisions under retrospective effect from 1 April 1962 section 195 and not “For the removal of doubts, it is hereby clarified that applicable to the obligation to comply with sub-section (1) and to transactions between make deduction thereunder applies and shall be two non-residents” deemed to have always applied and extends and shall be deemed to have always extended to all - SC in the case of persons, resident or non-resident, whether or not the Vodafone non-resident person has-a residence or place of International I Co The clarification by Finance Act 2012 enlarges the scope of section 195 by subjecting transactions carried out between two non-residents outside India to the tax withholding provisions of the Income Tax Act. other presence in any manner whatsoever in ITR 1 India business or business connection in India; or any Holdings [2012] 341 Outside India. ” 3/15/2018 Key issues - Withholding tax provisions - Section 195 Retrospective amendment – clarificatory? slide 13

Key issues - Scope and applicability Any person – Payer having no taxable presence in India? Before F 1 Co After amendment by Finance Act 2012 amendment by Transfer of shares of I Co to F 2 Co Finance Act 2012 “Tax withholding Explanation 2 inserted by Finance Act, 2012 with provisions under retrospective effect from 1 April 1962 section 195 and not “For the removal of doubts, it is hereby clarified that applicable to the obligation to comply with sub-section (1) and to transactions between make deduction thereunder applies and shall be two non-residents” deemed to have always applied and extends and shall be deemed to have always extended to all - SC in the case of persons, resident or non-resident, whether or not the Vodafone non-resident person has-a residence or place of International I Co The clarification by Finance Act 2012 enlarges the scope of section 195 by subjecting transactions carried out between two non-residents outside India to the tax withholding provisions of the Income Tax Act. other presence in any manner whatsoever in ITR 1 India business or business connection in India; or any Holdings [2012] 341 Outside India. ” 3/15/2018 Key issues - Withholding tax provisions - Section 195 Retrospective amendment – clarificatory? slide 13

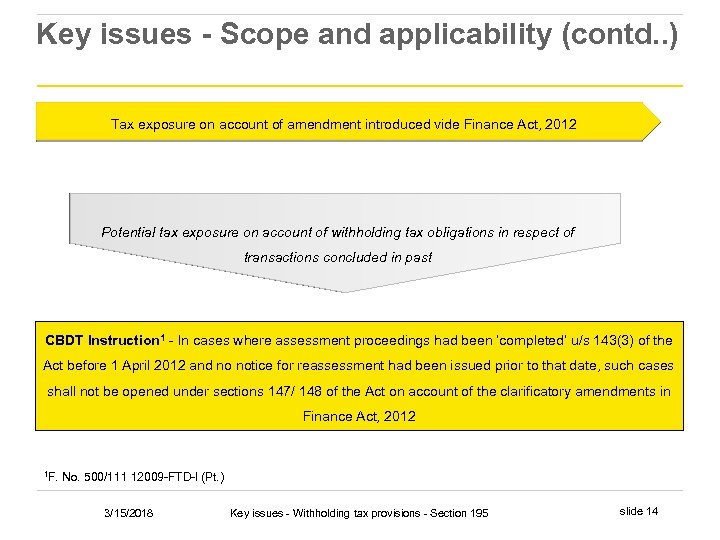

Key issues - Scope and applicability (contd. . ) Tax exposure on account of amendment introduced vide Finance Act, 2012 Potential tax exposure on account of withholding tax obligations in respect of transactions concluded in past CBDT Instruction 1 - In cases where assessment proceedings had been ‘completed’ u/s 143(3) of the Act before 1 April 2012 and no notice for reassessment had been issued prior to that date, such cases shall not be opened under sections 147/ 148 of the Act on account of the clarificatory amendments in Finance Act, 2012 1 F. No. 500/111 12009 -FTD-l (Pt. ) 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 14

Key issues - Scope and applicability (contd. . ) Tax exposure on account of amendment introduced vide Finance Act, 2012 Potential tax exposure on account of withholding tax obligations in respect of transactions concluded in past CBDT Instruction 1 - In cases where assessment proceedings had been ‘completed’ u/s 143(3) of the Act before 1 April 2012 and no notice for reassessment had been issued prior to that date, such cases shall not be opened under sections 147/ 148 of the Act on account of the clarificatory amendments in Finance Act, 2012 1 F. No. 500/111 12009 -FTD-l (Pt. ) 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 14

Key issues - Scope and applicability (contd. . ) ► At the time of credit/ payment No tax withholding required on mere accrual of income unless it is credited or paid. ► Tax withholding on ‘payments in kind’? Yes {Kanchanganga Sea Foods vs CIT [2004] 265 ITR 644 (AP)} ► Tax withholding on ‘inter-adjustment of dues’? Yes {J. B. Boda vs CBDT [1996] 223 ITR 271 (SC)} ► Royalty/ FTS payments taxable under DTAA - Time of withholding u/s 195(1)? Since royalty/ FTS becomes taxable under DTAA on payment basis, tax to be withheld at the time of payment {National Organic Chemicals Industries Ltd vs DCIT [2004] 96 TTJ 765 (Mumbai ITAT) & DCIT vs Uhde Gmbh [1996] 54 TTJ 355 (Mumbai ITAT)} ► Tax withholding on year-end provisions? In cases where it is possible to suggest that the right to receive amount has not been crystallized in favour of an identified person, there is no obligation to deduct tax at source. The obligation will need to be discharged as soon as the right is crystallized - conflicting decisions 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 15

Key issues - Scope and applicability (contd. . ) ► At the time of credit/ payment No tax withholding required on mere accrual of income unless it is credited or paid. ► Tax withholding on ‘payments in kind’? Yes {Kanchanganga Sea Foods vs CIT [2004] 265 ITR 644 (AP)} ► Tax withholding on ‘inter-adjustment of dues’? Yes {J. B. Boda vs CBDT [1996] 223 ITR 271 (SC)} ► Royalty/ FTS payments taxable under DTAA - Time of withholding u/s 195(1)? Since royalty/ FTS becomes taxable under DTAA on payment basis, tax to be withheld at the time of payment {National Organic Chemicals Industries Ltd vs DCIT [2004] 96 TTJ 765 (Mumbai ITAT) & DCIT vs Uhde Gmbh [1996] 54 TTJ 355 (Mumbai ITAT)} ► Tax withholding on year-end provisions? In cases where it is possible to suggest that the right to receive amount has not been crystallized in favour of an identified person, there is no obligation to deduct tax at source. The obligation will need to be discharged as soon as the right is crystallized - conflicting decisions 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 15

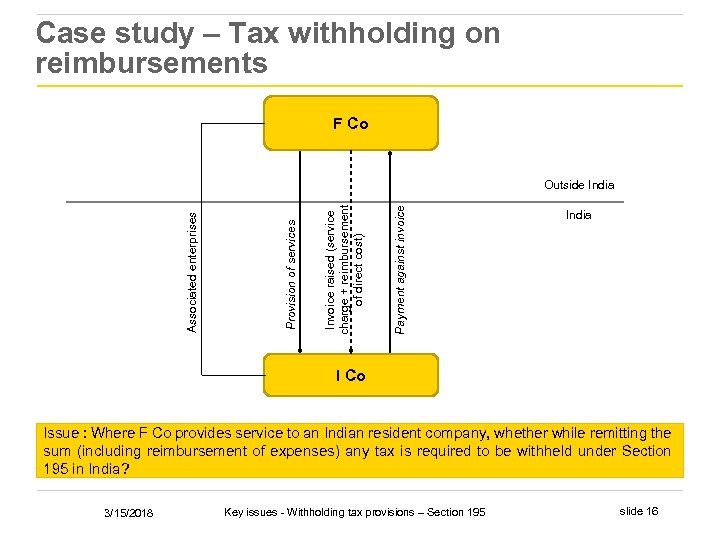

Case study – Tax withholding on reimbursements F Co Payment against invoice Invoice raised (service charge + reimbursement of direct cost) Provision of services Associated enterprises Outside India I Co Issue : Where F Co provides service to an Indian resident company, whether while remitting the sum (including reimbursement of expenses) any tax is required to be withheld under Section 195 in India? 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 16

Case study – Tax withholding on reimbursements F Co Payment against invoice Invoice raised (service charge + reimbursement of direct cost) Provision of services Associated enterprises Outside India I Co Issue : Where F Co provides service to an Indian resident company, whether while remitting the sum (including reimbursement of expenses) any tax is required to be withheld under Section 195 in India? 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 16

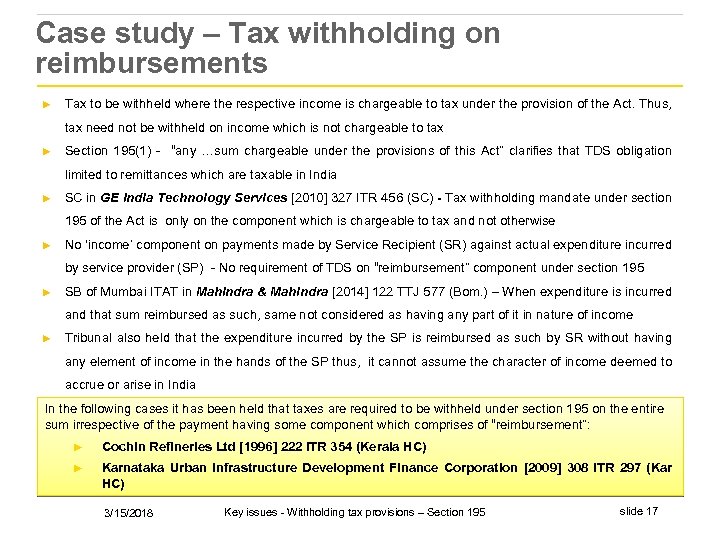

Case study – Tax withholding on reimbursements ► Tax to be withheld where the respective income is chargeable to tax under the provision of the Act. Thus, tax need not be withheld on income which is not chargeable to tax ► Section 195(1) - “any …sum chargeable under the provisions of this Act” clarifies that TDS obligation limited to remittances which are taxable in India ► SC in GE India Technology Services [2010] 327 ITR 456 (SC) - Tax withholding mandate under section 195 of the Act is only on the component which is chargeable to tax and not otherwise ► No ‘income’ component on payments made by Service Recipient (SR) against actual expenditure incurred by service provider (SP) - No requirement of TDS on “reimbursement” component under section 195 ► SB of Mumbai ITAT in Mahindra & Mahindra [2014] 122 TTJ 577 (Bom. ) – When expenditure is incurred and that sum reimbursed as such, same not considered as having any part of it in nature of income ► Tribunal also held that the expenditure incurred by the SP is reimbursed as such by SR without having any element of income in the hands of the SP thus, it cannot assume the character of income deemed to accrue or arise in India In the following cases it has been held that taxes are required to be withheld under section 195 on the entire sum irrespective of the payment having some component which comprises of “reimbursement”: ► Cochin Refineries Ltd [1996] 222 ITR 354 (Kerala HC) ► Karnataka Urban Infrastructure Development Finance Corporation [2009] 308 ITR 297 (Kar HC) 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 17

Case study – Tax withholding on reimbursements ► Tax to be withheld where the respective income is chargeable to tax under the provision of the Act. Thus, tax need not be withheld on income which is not chargeable to tax ► Section 195(1) - “any …sum chargeable under the provisions of this Act” clarifies that TDS obligation limited to remittances which are taxable in India ► SC in GE India Technology Services [2010] 327 ITR 456 (SC) - Tax withholding mandate under section 195 of the Act is only on the component which is chargeable to tax and not otherwise ► No ‘income’ component on payments made by Service Recipient (SR) against actual expenditure incurred by service provider (SP) - No requirement of TDS on “reimbursement” component under section 195 ► SB of Mumbai ITAT in Mahindra & Mahindra [2014] 122 TTJ 577 (Bom. ) – When expenditure is incurred and that sum reimbursed as such, same not considered as having any part of it in nature of income ► Tribunal also held that the expenditure incurred by the SP is reimbursed as such by SR without having any element of income in the hands of the SP thus, it cannot assume the character of income deemed to accrue or arise in India In the following cases it has been held that taxes are required to be withheld under section 195 on the entire sum irrespective of the payment having some component which comprises of “reimbursement”: ► Cochin Refineries Ltd [1996] 222 ITR 354 (Kerala HC) ► Karnataka Urban Infrastructure Development Finance Corporation [2009] 308 ITR 297 (Kar HC) 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 17

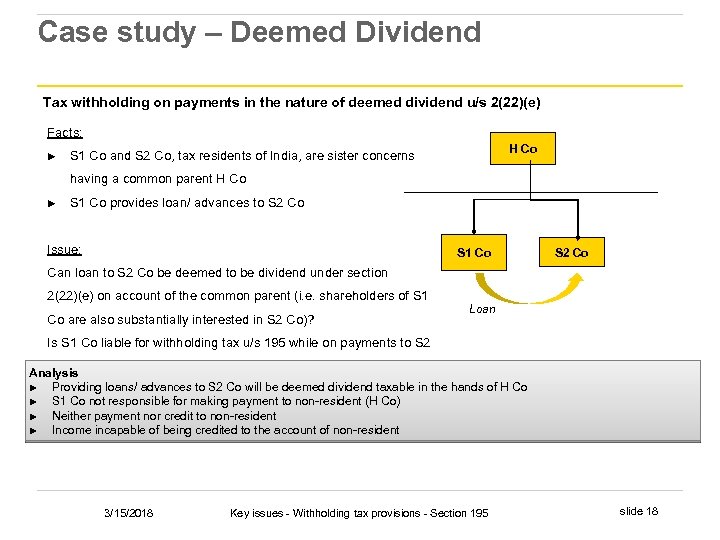

Case study – Deemed Dividend Tax withholding on payments in the nature of deemed dividend u/s 2(22)(e) Facts: ► H Co S 1 Co and S 2 Co, tax residents of India, are sister concerns having a common parent H Co ► S 1 Co provides loan/ advances to S 2 Co Issue: S 1 Co S 2 Co Can loan to S 2 Co be deemed to be dividend under section 2(22)(e) on account of the common parent (i. e. shareholders of S 1 Co are also substantially interested in S 2 Co)? Loan Is S 1 Co liable for withholding tax u/s 195 while on payments to S 2 Co? Analysis ► Providing loans/ advances to S 2 Co will be deemed dividend taxable in the hands of H Co ► S 1 Co not responsible for making payment to non-resident (H Co) ► Neither payment nor credit to non-resident ► Income incapable of being credited to the account of non-resident 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 18

Case study – Deemed Dividend Tax withholding on payments in the nature of deemed dividend u/s 2(22)(e) Facts: ► H Co S 1 Co and S 2 Co, tax residents of India, are sister concerns having a common parent H Co ► S 1 Co provides loan/ advances to S 2 Co Issue: S 1 Co S 2 Co Can loan to S 2 Co be deemed to be dividend under section 2(22)(e) on account of the common parent (i. e. shareholders of S 1 Co are also substantially interested in S 2 Co)? Loan Is S 1 Co liable for withholding tax u/s 195 while on payments to S 2 Co? Analysis ► Providing loans/ advances to S 2 Co will be deemed dividend taxable in the hands of H Co ► S 1 Co not responsible for making payment to non-resident (H Co) ► Neither payment nor credit to non-resident ► Income incapable of being credited to the account of non-resident 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 18

Way forward Practical considerations – Where a doubt arises as regards the applicability of Section 195 provisions to a particular payment, advisable to obtain clarity by ► Obtaining a lower or Nil withholding order from the AO ► Obtaining an advance ruling from the Authority for Advance rulings (would need to be evaluated having regard to the facts of each case) 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 19

Way forward Practical considerations – Where a doubt arises as regards the applicability of Section 195 provisions to a particular payment, advisable to obtain clarity by ► Obtaining a lower or Nil withholding order from the AO ► Obtaining an advance ruling from the Authority for Advance rulings (would need to be evaluated having regard to the facts of each case) 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 19

Section 195(2) - Application by the ‘Payer’ for Lower or Nil Withholding slide 20 3/15/2018 Key issues - Withholding tax provisions - Section 195

Section 195(2) - Application by the ‘Payer’ for Lower or Nil Withholding slide 20 3/15/2018 Key issues - Withholding tax provisions - Section 195

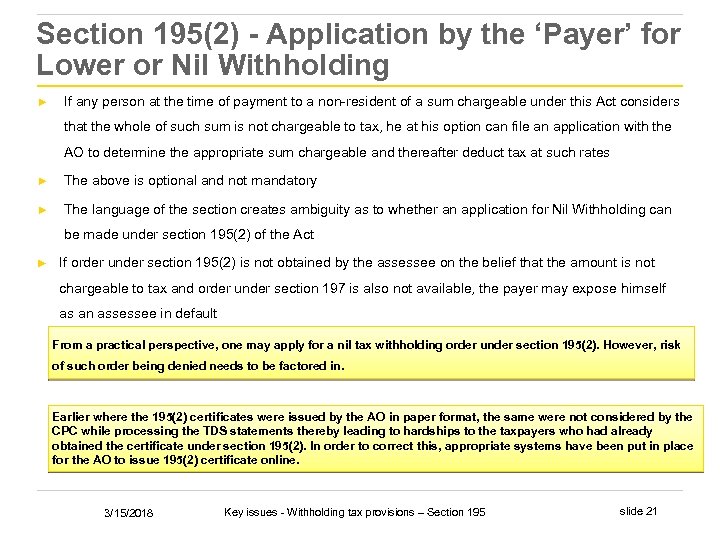

Section 195(2) - Application by the ‘Payer’ for Lower or Nil Withholding ► If any person at the time of payment to a non-resident of a sum chargeable under this Act considers that the whole of such sum is not chargeable to tax, he at his option can file an application with the AO to determine the appropriate sum chargeable and thereafter deduct tax at such rates ► The above is optional and not mandatory ► The language of the section creates ambiguity as to whether an application for Nil Withholding can be made under section 195(2) of the Act ► If order under section 195(2) is not obtained by the assessee on the belief that the amount is not chargeable to tax and order under section 197 is also not available, the payer may expose himself as an assessee in default From a practical perspective, one may apply for a nil tax withholding order under section 195(2). However, risk of such order being denied needs to be factored in. Earlier where the 195(2) certificates were issued by the AO in paper format, the same were not considered by the CPC while processing the TDS statements thereby leading to hardships to the taxpayers who had already obtained the certificate under section 195(2). In order to correct this, appropriate systems have been put in place for the AO to issue 195(2) certificate online. 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 21

Section 195(2) - Application by the ‘Payer’ for Lower or Nil Withholding ► If any person at the time of payment to a non-resident of a sum chargeable under this Act considers that the whole of such sum is not chargeable to tax, he at his option can file an application with the AO to determine the appropriate sum chargeable and thereafter deduct tax at such rates ► The above is optional and not mandatory ► The language of the section creates ambiguity as to whether an application for Nil Withholding can be made under section 195(2) of the Act ► If order under section 195(2) is not obtained by the assessee on the belief that the amount is not chargeable to tax and order under section 197 is also not available, the payer may expose himself as an assessee in default From a practical perspective, one may apply for a nil tax withholding order under section 195(2). However, risk of such order being denied needs to be factored in. Earlier where the 195(2) certificates were issued by the AO in paper format, the same were not considered by the CPC while processing the TDS statements thereby leading to hardships to the taxpayers who had already obtained the certificate under section 195(2). In order to correct this, appropriate systems have been put in place for the AO to issue 195(2) certificate online. 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 21

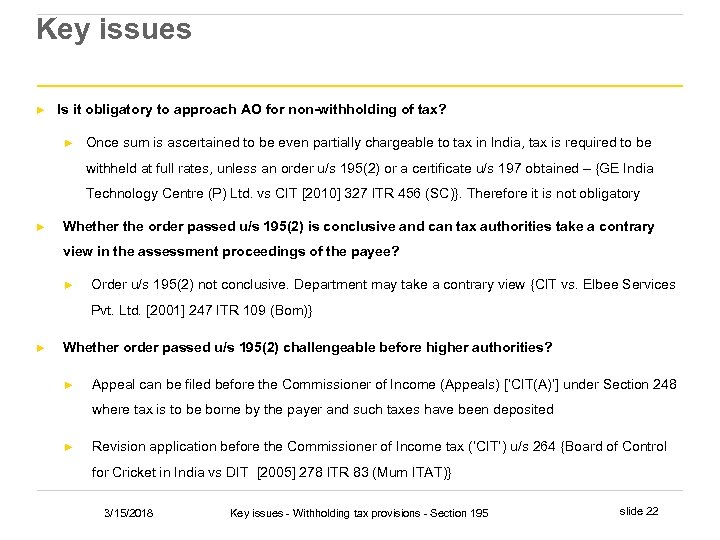

Key issues ► Is it obligatory to approach AO for non-withholding of tax? ► Once sum is ascertained to be even partially chargeable to tax in India, tax is required to be withheld at full rates, unless an order u/s 195(2) or a certificate u/s 197 obtained – {GE India Technology Centre (P) Ltd. vs CIT [2010] 327 ITR 456 (SC)}. Therefore it is not obligatory ► Whether the order passed u/s 195(2) is conclusive and can tax authorities take a contrary view in the assessment proceedings of the payee? ► Order u/s 195(2) not conclusive. Department may take a contrary view {CIT vs. Elbee Services Pvt. Ltd. [2001] 247 ITR 109 (Bom)} ► Whether order passed u/s 195(2) challengeable before higher authorities? ► Appeal can be filed before the Commissioner of Income (Appeals) [‘CIT(A)’] under Section 248 where tax is to be borne by the payer and such taxes have been deposited ► Revision application before the Commissioner of Income tax (‘CIT’) u/s 264 {Board of Control for Cricket in India vs DIT [2005] 278 ITR 83 (Mum ITAT)} 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 22

Key issues ► Is it obligatory to approach AO for non-withholding of tax? ► Once sum is ascertained to be even partially chargeable to tax in India, tax is required to be withheld at full rates, unless an order u/s 195(2) or a certificate u/s 197 obtained – {GE India Technology Centre (P) Ltd. vs CIT [2010] 327 ITR 456 (SC)}. Therefore it is not obligatory ► Whether the order passed u/s 195(2) is conclusive and can tax authorities take a contrary view in the assessment proceedings of the payee? ► Order u/s 195(2) not conclusive. Department may take a contrary view {CIT vs. Elbee Services Pvt. Ltd. [2001] 247 ITR 109 (Bom)} ► Whether order passed u/s 195(2) challengeable before higher authorities? ► Appeal can be filed before the Commissioner of Income (Appeals) [‘CIT(A)’] under Section 248 where tax is to be borne by the payer and such taxes have been deposited ► Revision application before the Commissioner of Income tax (‘CIT’) u/s 264 {Board of Control for Cricket in India vs DIT [2005] 278 ITR 83 (Mum ITAT)} 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 22

Key issues (contd. . ) ► ► Writ petition before the jurisdictional High Court Whether any time limit for passing order u/s 195(2)? ► No time limit {Blackwood Hodge (India) Pvt. Ltd. [1969] 81 ITR 807 (Cal)}; {Central Associated Pigment Ltd. [1971] 80 ITR 631 (Cal)} 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 23

Key issues (contd. . ) ► ► Writ petition before the jurisdictional High Court Whether any time limit for passing order u/s 195(2)? ► No time limit {Blackwood Hodge (India) Pvt. Ltd. [1969] 81 ITR 807 (Cal)}; {Central Associated Pigment Ltd. [1971] 80 ITR 631 (Cal)} 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 23

Section 195(3), (4), (5) - Application by the ‘Payee’ for Lower or Nil withholding slide 24 3/15/2018 Key issues - Withholding tax provisions - Section 195

Section 195(3), (4), (5) - Application by the ‘Payee’ for Lower or Nil withholding slide 24 3/15/2018 Key issues - Withholding tax provisions - Section 195

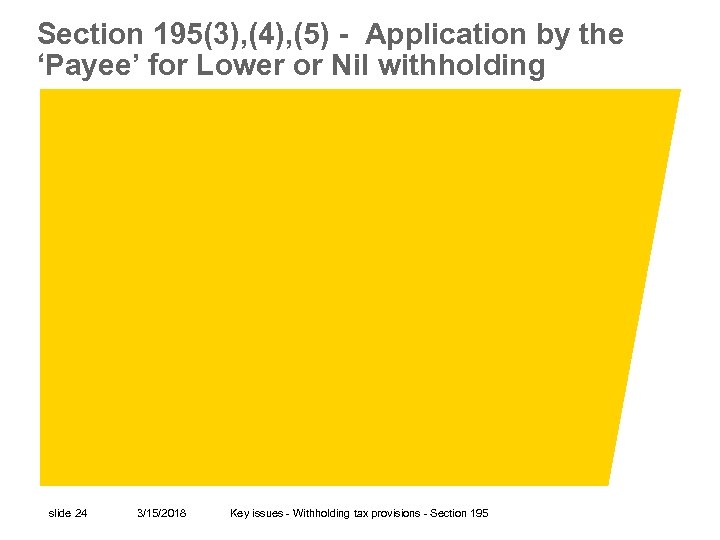

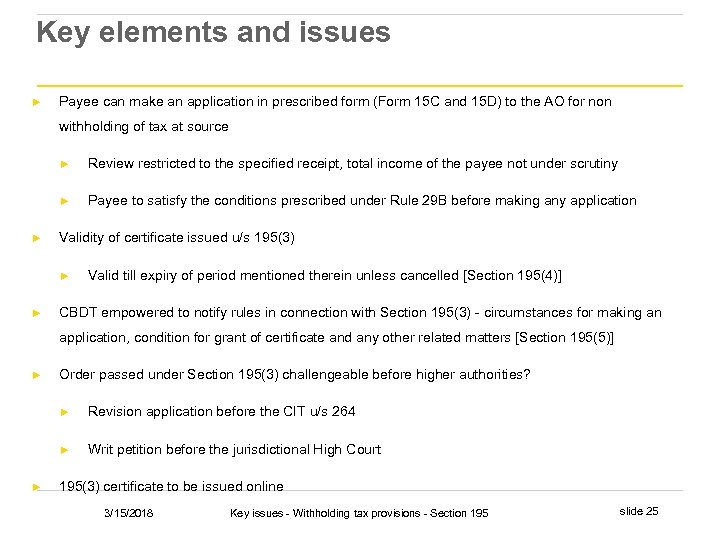

Key elements and issues ► Payee can make an application in prescribed form (Form 15 C and 15 D) to the AO for non withholding of tax at source ► ► ► Review restricted to the specified receipt, total income of the payee not under scrutiny Payee to satisfy the conditions prescribed under Rule 29 B before making any application Validity of certificate issued u/s 195(3) ► ► Valid till expiry of period mentioned therein unless cancelled [Section 195(4)] CBDT empowered to notify rules in connection with Section 195(3) - circumstances for making an application, condition for grant of certificate and any other related matters [Section 195(5)] ► Order passed under Section 195(3) challengeable before higher authorities? ► ► ► Revision application before the CIT u/s 264 Writ petition before the jurisdictional High Court 195(3) certificate to be issued online 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 25

Key elements and issues ► Payee can make an application in prescribed form (Form 15 C and 15 D) to the AO for non withholding of tax at source ► ► ► Review restricted to the specified receipt, total income of the payee not under scrutiny Payee to satisfy the conditions prescribed under Rule 29 B before making any application Validity of certificate issued u/s 195(3) ► ► Valid till expiry of period mentioned therein unless cancelled [Section 195(4)] CBDT empowered to notify rules in connection with Section 195(3) - circumstances for making an application, condition for grant of certificate and any other related matters [Section 195(5)] ► Order passed under Section 195(3) challengeable before higher authorities? ► ► ► Revision application before the CIT u/s 264 Writ petition before the jurisdictional High Court 195(3) certificate to be issued online 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 25

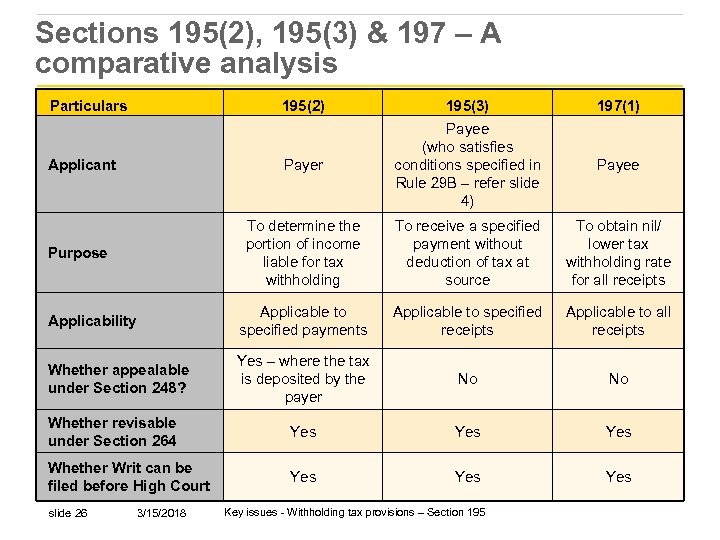

Sections 195(2), 195(3) & 197 – A comparative analysis Particulars 195(2) 195(3) 197(1) Applicant Payer Payee (who satisfies conditions specified in Rule 29 B – refer slide 4) Payee Purpose To determine the portion of income liable for tax withholding To receive a specified payment without deduction of tax at source To obtain nil/ lower tax withholding rate for all receipts Applicability Applicable to specified payments Applicable to specified receipts Applicable to all receipts Whether appealable under Section 248? Yes – where the tax is deposited by the payer No No Whether revisable under Section 264 Yes Yes Whether Writ can be filed before High Court Yes Yes slide 26 3/15/2018 Key issues - Withholding tax provisions – Section 195

Sections 195(2), 195(3) & 197 – A comparative analysis Particulars 195(2) 195(3) 197(1) Applicant Payer Payee (who satisfies conditions specified in Rule 29 B – refer slide 4) Payee Purpose To determine the portion of income liable for tax withholding To receive a specified payment without deduction of tax at source To obtain nil/ lower tax withholding rate for all receipts Applicability Applicable to specified payments Applicable to specified receipts Applicable to all receipts Whether appealable under Section 248? Yes – where the tax is deposited by the payer No No Whether revisable under Section 264 Yes Yes Whether Writ can be filed before High Court Yes Yes slide 26 3/15/2018 Key issues - Withholding tax provisions – Section 195

Section 195(6) - Certification for remittances slide 27 3/15/2018 Key issues - Withholding tax provisions - Section 195

Section 195(6) - Certification for remittances slide 27 3/15/2018 Key issues - Withholding tax provisions - Section 195

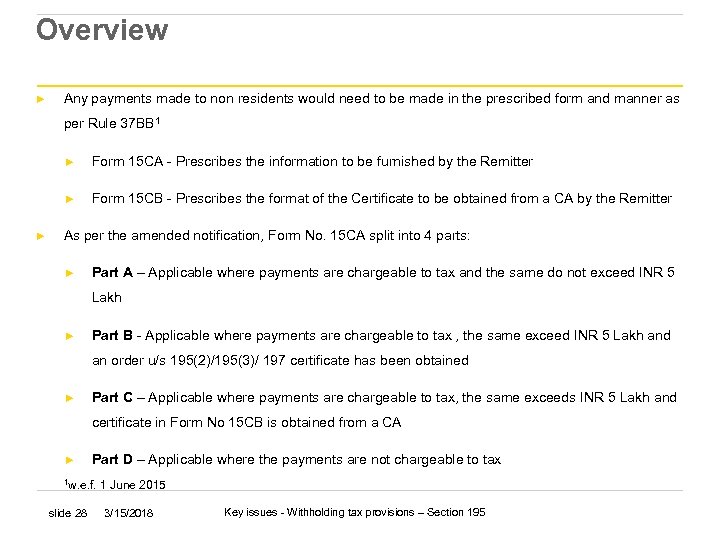

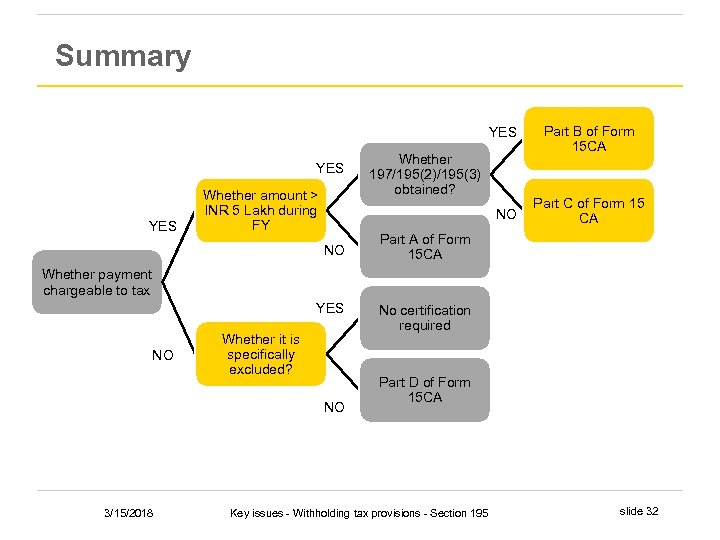

Overview ► Any payments made to non residents would need to be made in the prescribed form and manner as per Rule 37 BB 1 ► ► ► Form 15 CA - Prescribes the information to be furnished by the Remitter Form 15 CB - Prescribes the format of the Certificate to be obtained from a CA by the Remitter As per the amended notification, Form No. 15 CA split into 4 parts: ► Part A – Applicable where payments are chargeable to tax and the same do not exceed INR 5 Lakh ► Part B - Applicable where payments are chargeable to tax , the same exceed INR 5 Lakh and an order u/s 195(2)/195(3)/ 197 certificate has been obtained ► Part C – Applicable where payments are chargeable to tax, the same exceeds INR 5 Lakh and certificate in Form No 15 CB is obtained from a CA ► Part D – Applicable where the payments are not chargeable to tax 1 w. e. f. slide 28 1 June 2015 3/15/2018 Key issues - Withholding tax provisions – Section 195

Overview ► Any payments made to non residents would need to be made in the prescribed form and manner as per Rule 37 BB 1 ► ► ► Form 15 CA - Prescribes the information to be furnished by the Remitter Form 15 CB - Prescribes the format of the Certificate to be obtained from a CA by the Remitter As per the amended notification, Form No. 15 CA split into 4 parts: ► Part A – Applicable where payments are chargeable to tax and the same do not exceed INR 5 Lakh ► Part B - Applicable where payments are chargeable to tax , the same exceed INR 5 Lakh and an order u/s 195(2)/195(3)/ 197 certificate has been obtained ► Part C – Applicable where payments are chargeable to tax, the same exceeds INR 5 Lakh and certificate in Form No 15 CB is obtained from a CA ► Part D – Applicable where the payments are not chargeable to tax 1 w. e. f. slide 28 1 June 2015 3/15/2018 Key issues - Withholding tax provisions – Section 195

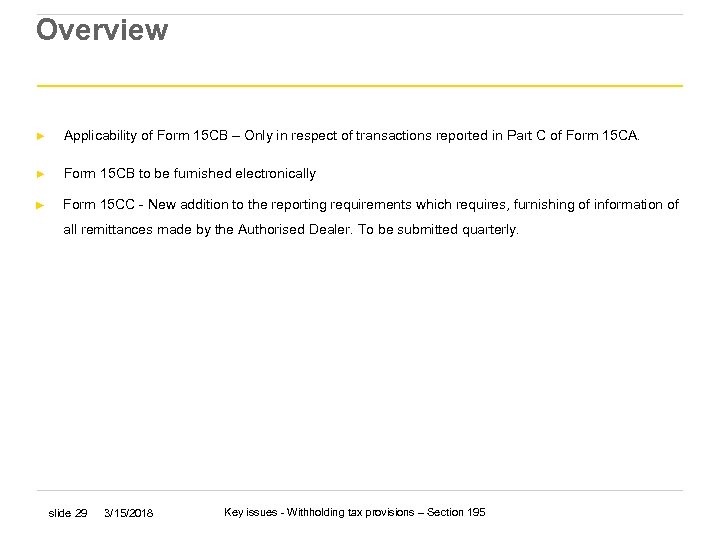

Overview ► Applicability of Form 15 CB – Only in respect of transactions reported in Part C of Form 15 CA. ► Form 15 CB to be furnished electronically ► Form 15 CC - New addition to the reporting requirements which requires, furnishing of information of all remittances made by the Authorised Dealer. To be submitted quarterly. slide 29 3/15/2018 Key issues - Withholding tax provisions – Section 195

Overview ► Applicability of Form 15 CB – Only in respect of transactions reported in Part C of Form 15 CA. ► Form 15 CB to be furnished electronically ► Form 15 CC - New addition to the reporting requirements which requires, furnishing of information of all remittances made by the Authorised Dealer. To be submitted quarterly. slide 29 3/15/2018 Key issues - Withholding tax provisions – Section 195

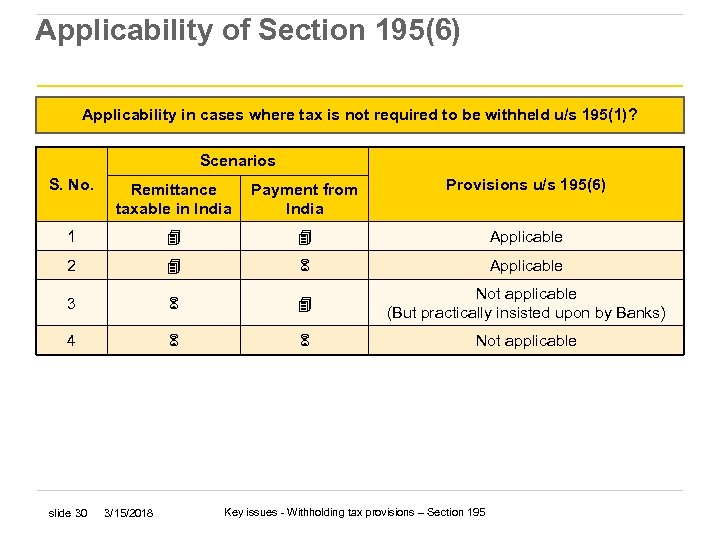

Applicability of Section 195(6) Applicability in cases where tax is not required to be withheld u/s 195(1)? Scenarios S. No. Remittance taxable in India Payment from India Provisions u/s 195(6) 1 4 4 Applicable 2 4 6 Applicable 3 6 4 Not applicable (But practically insisted upon by Banks) 4 6 6 Not applicable slide 30 3/15/2018 Key issues - Withholding tax provisions – Section 195

Applicability of Section 195(6) Applicability in cases where tax is not required to be withheld u/s 195(1)? Scenarios S. No. Remittance taxable in India Payment from India Provisions u/s 195(6) 1 4 4 Applicable 2 4 6 Applicable 3 6 4 Not applicable (But practically insisted upon by Banks) 4 6 6 Not applicable slide 30 3/15/2018 Key issues - Withholding tax provisions – Section 195

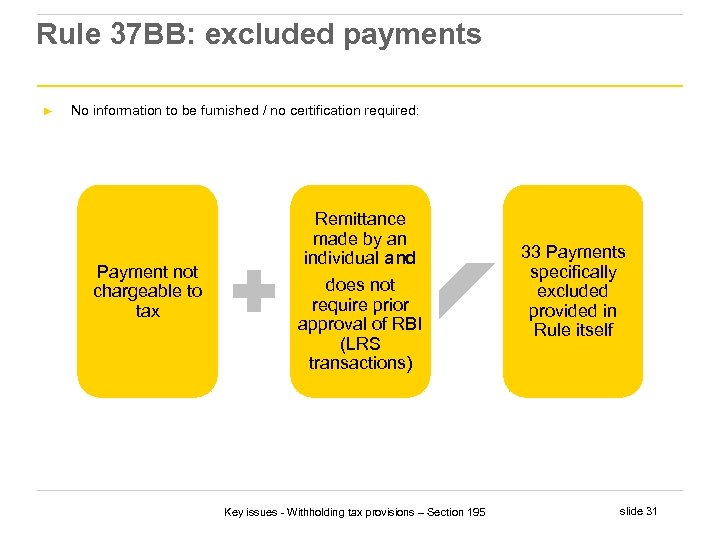

Rule 37 BB: excluded payments ► No information to be furnished / no certification required: Payment not chargeable to tax Remittance made by an individual and does not require prior approval of RBI (LRS transactions) Key issues - Withholding tax provisions – Section 195 33 Payments specifically excluded provided in Rule itself slide 31

Rule 37 BB: excluded payments ► No information to be furnished / no certification required: Payment not chargeable to tax Remittance made by an individual and does not require prior approval of RBI (LRS transactions) Key issues - Withholding tax provisions – Section 195 33 Payments specifically excluded provided in Rule itself slide 31

Summary YES NO YES Whether amount > INR 5 Lakh during FY NO Part B of Form 15 CA Part C of Form 15 CA Whether 197/195(2)/195(3) obtained? Part A of Form 15 CA Whether payment chargeable to tax YES NO Whether it is specifically excluded? NO 3/15/2018 No certification required Part D of Form 15 CA Key issues - Withholding tax provisions - Section 195 slide 32

Summary YES NO YES Whether amount > INR 5 Lakh during FY NO Part B of Form 15 CA Part C of Form 15 CA Whether 197/195(2)/195(3) obtained? Part A of Form 15 CA Whether payment chargeable to tax YES NO Whether it is specifically excluded? NO 3/15/2018 No certification required Part D of Form 15 CA Key issues - Withholding tax provisions - Section 195 slide 32

Section 195 A - Grossing-up of taxes 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 33

Section 195 A - Grossing-up of taxes 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 33

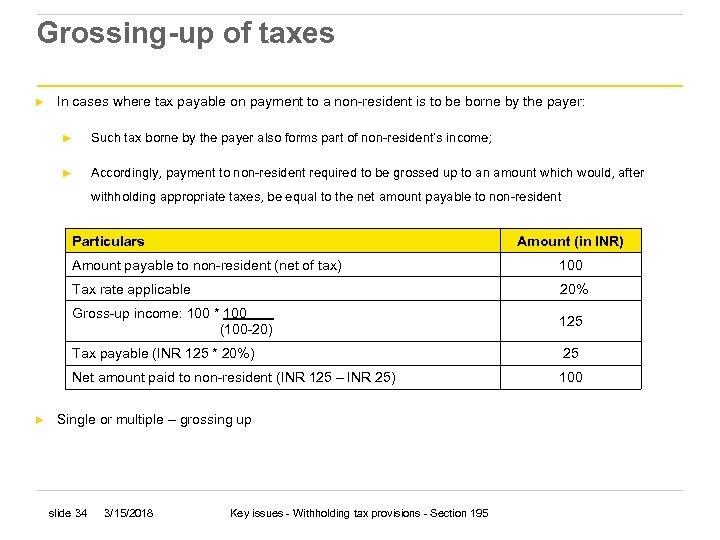

Grossing-up of taxes ► In cases where tax payable on payment to a non-resident is to be borne by the payer: ► Such tax borne by the payer also forms part of non-resident’s income; ► Accordingly, payment to non-resident required to be grossed up to an amount which would, after withholding appropriate taxes, be equal to the net amount payable to non-resident Particulars Amount (in INR) Amount payable to non-resident (net of tax) Tax rate applicable 20% Gross-up income: 100 * 100. (100 -20) 125 Tax payable (INR 125 * 20%) 25 Net amount paid to non-resident (INR 125 – INR 25) ► 100 Single or multiple – grossing up slide 34 3/15/2018 Key issues - Withholding tax provisions - Section 195

Grossing-up of taxes ► In cases where tax payable on payment to a non-resident is to be borne by the payer: ► Such tax borne by the payer also forms part of non-resident’s income; ► Accordingly, payment to non-resident required to be grossed up to an amount which would, after withholding appropriate taxes, be equal to the net amount payable to non-resident Particulars Amount (in INR) Amount payable to non-resident (net of tax) Tax rate applicable 20% Gross-up income: 100 * 100. (100 -20) 125 Tax payable (INR 125 * 20%) 25 Net amount paid to non-resident (INR 125 – INR 25) ► 100 Single or multiple – grossing up slide 34 3/15/2018 Key issues - Withholding tax provisions - Section 195

Other related considerations 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 35

Other related considerations 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 35

Tax Residency Certificate ► Section 90(4) provides that in order to avail benefits of tax treaty, non-residents are required to obtain a Tax Residency Certificate (TRC) from the relevant authority in its country ► TRC would be sufficient evidence for substantiating tax residency in a country ► Section 90(5) provides specific details which are required to be mentioned in the TRC provided by the relevant authority ► Rule 21 AB specifies prescribed particulars for S. 90(5) ► Documents substantiating particulars to be maintained by the non-resident ► Details not covered in TRC be mentioned in Form 10 F ► Form 10 F is a self-declaration by the non-resident ► In November 2013, vide Notification No. 86/2013, Cyprus had been specified as notified jurisdictional area under Section 94 A ► Payments made to a Cypriot resident on which tax is deductible at source under the Act are subject to withholding tax at least at the rate of 30% ► T Rajkumar v Union of India ([2016] 68 Taxmann. com 182 (Madras HC) 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 36

Tax Residency Certificate ► Section 90(4) provides that in order to avail benefits of tax treaty, non-residents are required to obtain a Tax Residency Certificate (TRC) from the relevant authority in its country ► TRC would be sufficient evidence for substantiating tax residency in a country ► Section 90(5) provides specific details which are required to be mentioned in the TRC provided by the relevant authority ► Rule 21 AB specifies prescribed particulars for S. 90(5) ► Documents substantiating particulars to be maintained by the non-resident ► Details not covered in TRC be mentioned in Form 10 F ► Form 10 F is a self-declaration by the non-resident ► In November 2013, vide Notification No. 86/2013, Cyprus had been specified as notified jurisdictional area under Section 94 A ► Payments made to a Cypriot resident on which tax is deductible at source under the Act are subject to withholding tax at least at the rate of 30% ► T Rajkumar v Union of India ([2016] 68 Taxmann. com 182 (Madras HC) 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 36

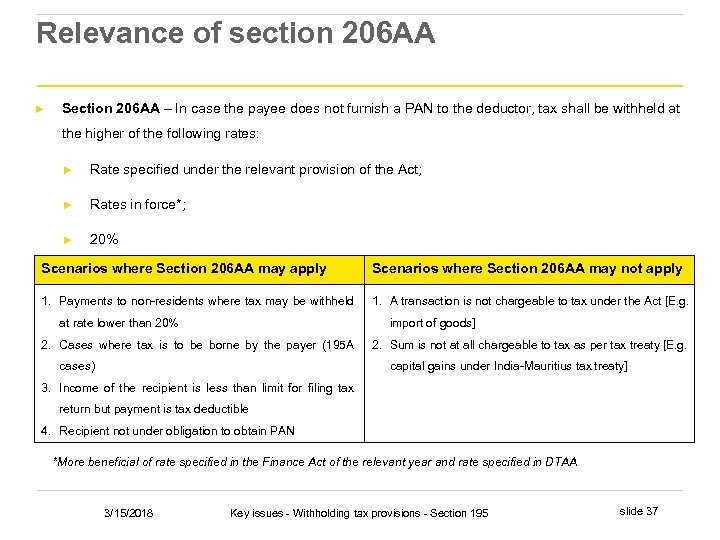

Relevance of section 206 AA ► Section 206 AA – In case the payee does not furnish a PAN to the deductor, tax shall be withheld at the higher of the following rates: ► Rate specified under the relevant provision of the Act; ► Rates in force*; ► 20% Scenarios where Section 206 AA may apply Scenarios where Section 206 AA may not apply 1. Payments to non-residents where tax may be withheld 1. A transaction is not chargeable to tax under the Act [E. g. at rate lower than 20% import of goods] 2. Cases where tax is to be borne by the payer (195 A cases) 2. Sum is not at all chargeable to tax as per tax treaty [E. g. capital gains under India-Mauritius tax treaty] 3. Income of the recipient is less than limit for filing tax return but payment is tax deductible 4. Recipient not under obligation to obtain PAN *More beneficial of rate specified in the Finance Act of the relevant year and rate specified in DTAA 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 37

Relevance of section 206 AA ► Section 206 AA – In case the payee does not furnish a PAN to the deductor, tax shall be withheld at the higher of the following rates: ► Rate specified under the relevant provision of the Act; ► Rates in force*; ► 20% Scenarios where Section 206 AA may apply Scenarios where Section 206 AA may not apply 1. Payments to non-residents where tax may be withheld 1. A transaction is not chargeable to tax under the Act [E. g. at rate lower than 20% import of goods] 2. Cases where tax is to be borne by the payer (195 A cases) 2. Sum is not at all chargeable to tax as per tax treaty [E. g. capital gains under India-Mauritius tax treaty] 3. Income of the recipient is less than limit for filing tax return but payment is tax deductible 4. Recipient not under obligation to obtain PAN *More beneficial of rate specified in the Finance Act of the relevant year and rate specified in DTAA 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 37

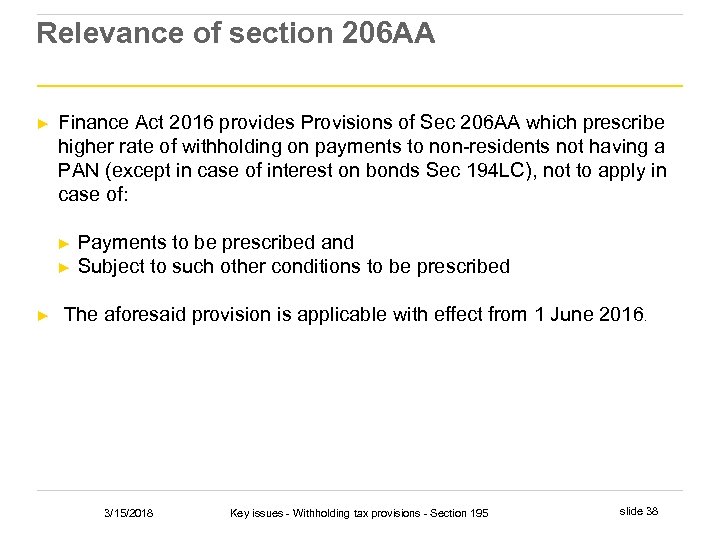

Relevance of section 206 AA ► Finance Act 2016 provides Provisions of Sec 206 AA which prescribe higher rate of withholding on payments to non-residents not having a PAN (except in case of interest on bonds Sec 194 LC), not to apply in case of: ► ► ► Payments to be prescribed and Subject to such other conditions to be prescribed The aforesaid provision is applicable with effect from 1 June 2016. 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 38

Relevance of section 206 AA ► Finance Act 2016 provides Provisions of Sec 206 AA which prescribe higher rate of withholding on payments to non-residents not having a PAN (except in case of interest on bonds Sec 194 LC), not to apply in case of: ► ► ► Payments to be prescribed and Subject to such other conditions to be prescribed The aforesaid provision is applicable with effect from 1 June 2016. 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 38

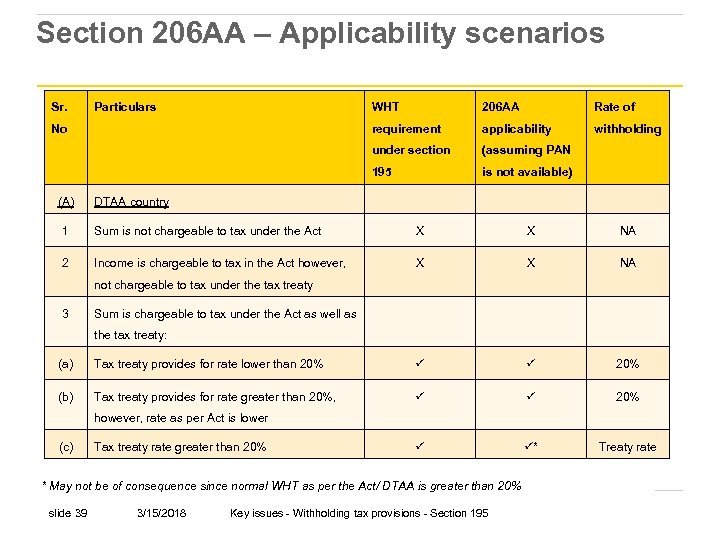

Section 206 AA – Applicability scenarios Sr. Particulars WHT applicability withholding under section (assuming PAN 195 (A) Rate of requirement No 206 AA is not available) DTAA country 1 Sum is not chargeable to tax under the Act X X NA 2 Income is chargeable to tax in the Act however, X X NA not chargeable to tax under the tax treaty 3 Particulars Sum is chargeable to tax under the Act as well as the tax treaty: (a) Tax treaty provides for rate lower than 20% (b) Tax treaty provides for rate greater than 20%, 20% * Treaty rate however, rate as per Act is lower (c) Tax treaty rate greater than 20% * May not be of consequence since normal WHT as per the Act/ DTAA is greater than 20% slide 39 3/15/2018 Key issues - Withholding tax provisions - Section 195

Section 206 AA – Applicability scenarios Sr. Particulars WHT applicability withholding under section (assuming PAN 195 (A) Rate of requirement No 206 AA is not available) DTAA country 1 Sum is not chargeable to tax under the Act X X NA 2 Income is chargeable to tax in the Act however, X X NA not chargeable to tax under the tax treaty 3 Particulars Sum is chargeable to tax under the Act as well as the tax treaty: (a) Tax treaty provides for rate lower than 20% (b) Tax treaty provides for rate greater than 20%, 20% * Treaty rate however, rate as per Act is lower (c) Tax treaty rate greater than 20% * May not be of consequence since normal WHT as per the Act/ DTAA is greater than 20% slide 39 3/15/2018 Key issues - Withholding tax provisions - Section 195

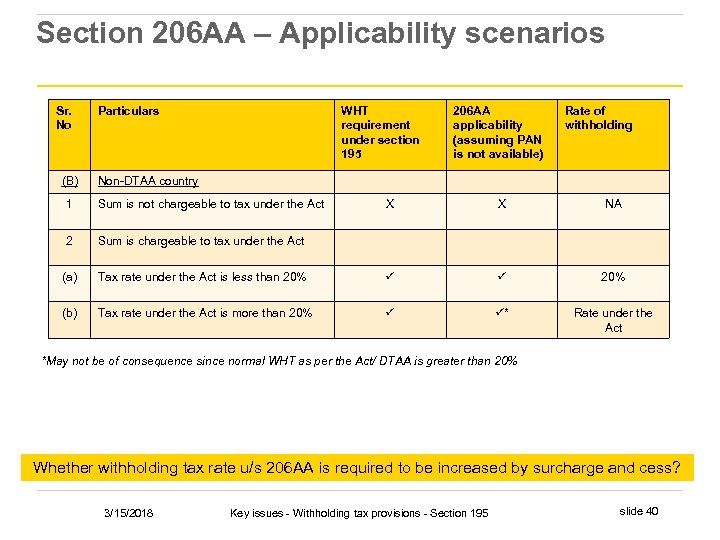

Section 206 AA – Applicability scenarios Sr. No (B) Particulars WHT requirement under section 195 206 AA applicability (assuming PAN is not available) Rate of withholding Non-DTAA country 1 Sum is not chargeable to tax under the Act X X NA 2 Sum is chargeable to tax under the Act (a) Tax rate under the Act is less than 20% (b) Tax rate under the Act is more than 20% * Rate under the Act *May not be of consequence since normal WHT as per the Act/ DTAA 20% # May not be of consequence normal WHT as per the Act/ DTAA is greater than 20% Whether withholding tax rate u/s 206 AA is required to be increased by surcharge and cess? 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 40

Section 206 AA – Applicability scenarios Sr. No (B) Particulars WHT requirement under section 195 206 AA applicability (assuming PAN is not available) Rate of withholding Non-DTAA country 1 Sum is not chargeable to tax under the Act X X NA 2 Sum is chargeable to tax under the Act (a) Tax rate under the Act is less than 20% (b) Tax rate under the Act is more than 20% * Rate under the Act *May not be of consequence since normal WHT as per the Act/ DTAA 20% # May not be of consequence normal WHT as per the Act/ DTAA is greater than 20% Whether withholding tax rate u/s 206 AA is required to be increased by surcharge and cess? 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 40

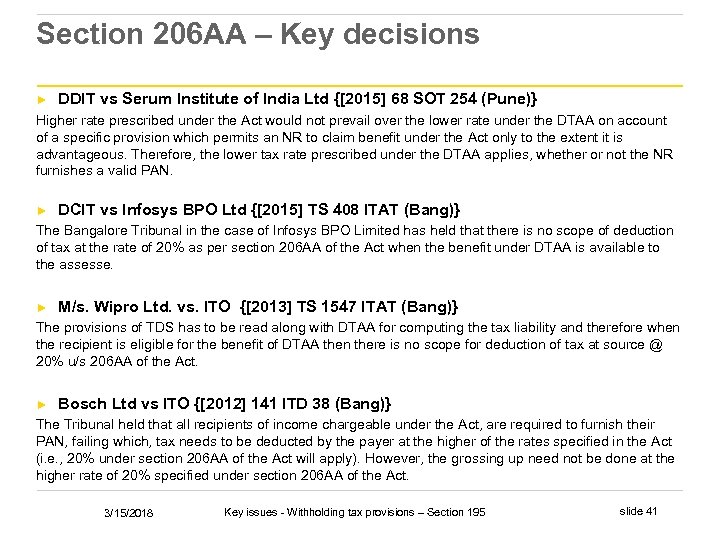

Section 206 AA – Key decisions ► DDIT vs Serum Institute of India Ltd {[2015] 68 SOT 254 (Pune)} Higher rate prescribed under the Act would not prevail over the lower rate under the DTAA on account of a specific provision which permits an NR to claim benefit under the Act only to the extent it is advantageous. Therefore, the lower tax rate prescribed under the DTAA applies, whether or not the NR furnishes a valid PAN. ► DCIT vs Infosys BPO Ltd {[2015] TS 408 ITAT (Bang)} The Bangalore Tribunal in the case of Infosys BPO Limited has held that there is no scope of deduction of tax at the rate of 20% as per section 206 AA of the Act when the benefit under DTAA is available to the assesse. ► M/s. Wipro Ltd. vs. ITO {[2013] TS 1547 ITAT (Bang)} The provisions of TDS has to be read along with DTAA for computing the tax liability and therefore when the recipient is eligible for the benefit of DTAA then there is no scope for deduction of tax at source @ 20% u/s 206 AA of the Act. ► Bosch Ltd vs ITO {[2012] 141 ITD 38 (Bang)} The Tribunal held that all recipients of income chargeable under the Act, are required to furnish their PAN, failing which, tax needs to be deducted by the payer at the higher of the rates specified in the Act (i. e. , 20% under section 206 AA of the Act will apply). However, the grossing up need not be done at the higher rate of 20% specified under section 206 AA of the Act. 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 41

Section 206 AA – Key decisions ► DDIT vs Serum Institute of India Ltd {[2015] 68 SOT 254 (Pune)} Higher rate prescribed under the Act would not prevail over the lower rate under the DTAA on account of a specific provision which permits an NR to claim benefit under the Act only to the extent it is advantageous. Therefore, the lower tax rate prescribed under the DTAA applies, whether or not the NR furnishes a valid PAN. ► DCIT vs Infosys BPO Ltd {[2015] TS 408 ITAT (Bang)} The Bangalore Tribunal in the case of Infosys BPO Limited has held that there is no scope of deduction of tax at the rate of 20% as per section 206 AA of the Act when the benefit under DTAA is available to the assesse. ► M/s. Wipro Ltd. vs. ITO {[2013] TS 1547 ITAT (Bang)} The provisions of TDS has to be read along with DTAA for computing the tax liability and therefore when the recipient is eligible for the benefit of DTAA then there is no scope for deduction of tax at source @ 20% u/s 206 AA of the Act. ► Bosch Ltd vs ITO {[2012] 141 ITD 38 (Bang)} The Tribunal held that all recipients of income chargeable under the Act, are required to furnish their PAN, failing which, tax needs to be deducted by the payer at the higher of the rates specified in the Act (i. e. , 20% under section 206 AA of the Act will apply). However, the grossing up need not be done at the higher rate of 20% specified under section 206 AA of the Act. 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 41

Consequences of non-compliance slide 42 3/15/2018 Key issues - Withholding tax provisions – Section 195

Consequences of non-compliance slide 42 3/15/2018 Key issues - Withholding tax provisions – Section 195

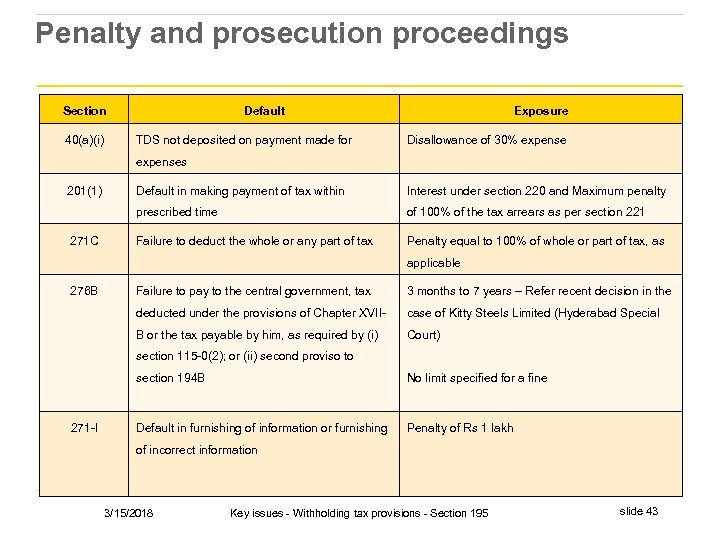

Penalty and prosecution proceedings Section 40(a)(i) Default TDS not deposited on payment made for Exposure Disallowance of 30% expenses 201(1) Interest under section 220 and Maximum penalty prescribed time 271 C Default in making payment of tax within of 100% of the tax arrears as per section 221 Failure to deduct the whole or any part of tax Penalty equal to 100% of whole or part of tax, as applicable 276 B Failure to pay to the central government, tax 3 months to 7 years – Refer recent decision in the deducted under the provisions of Chapter XVII- case of Kitty Steels Limited (Hyderabad Special B or the tax payable by him, as required by (i) Court) section 115 -0(2); or (ii) second proviso to section 194 B 271 -I No limit specified for a fine Default in furnishing of information or furnishing Penalty of Rs 1 lakh of incorrect information 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 43

Penalty and prosecution proceedings Section 40(a)(i) Default TDS not deposited on payment made for Exposure Disallowance of 30% expenses 201(1) Interest under section 220 and Maximum penalty prescribed time 271 C Default in making payment of tax within of 100% of the tax arrears as per section 221 Failure to deduct the whole or any part of tax Penalty equal to 100% of whole or part of tax, as applicable 276 B Failure to pay to the central government, tax 3 months to 7 years – Refer recent decision in the deducted under the provisions of Chapter XVII- case of Kitty Steels Limited (Hyderabad Special B or the tax payable by him, as required by (i) Court) section 115 -0(2); or (ii) second proviso to section 194 B 271 -I No limit specified for a fine Default in furnishing of information or furnishing Penalty of Rs 1 lakh of incorrect information 3/15/2018 Key issues - Withholding tax provisions - Section 195 slide 43

Key takeaways 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 44

Key takeaways 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 44

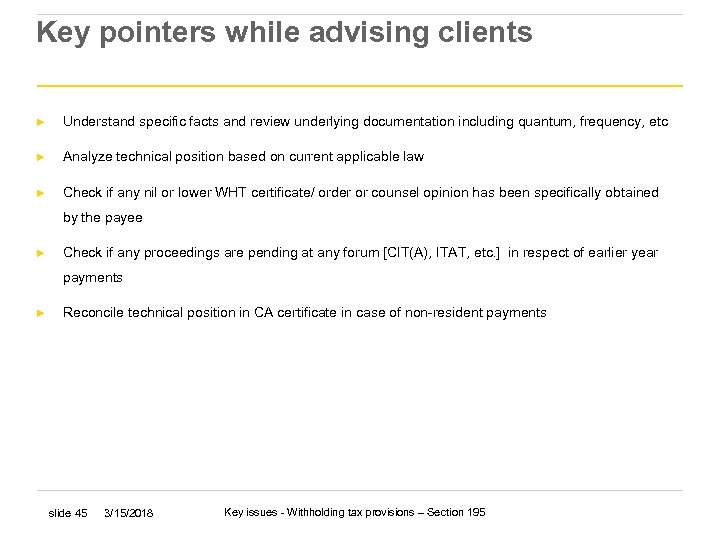

Key pointers while advising clients ► Understand specific facts and review underlying documentation including quantum, frequency, etc ► Analyze technical position based on current applicable law ► Check if any nil or lower WHT certificate/ order or counsel opinion has been specifically obtained by the payee ► Check if any proceedings are pending at any forum [CIT(A), ITAT, etc. ] in respect of earlier year payments ► Reconcile technical position in CA certificate in case of non-resident payments slide 45 3/15/2018 Key issues - Withholding tax provisions – Section 195

Key pointers while advising clients ► Understand specific facts and review underlying documentation including quantum, frequency, etc ► Analyze technical position based on current applicable law ► Check if any nil or lower WHT certificate/ order or counsel opinion has been specifically obtained by the payee ► Check if any proceedings are pending at any forum [CIT(A), ITAT, etc. ] in respect of earlier year payments ► Reconcile technical position in CA certificate in case of non-resident payments slide 45 3/15/2018 Key issues - Withholding tax provisions – Section 195

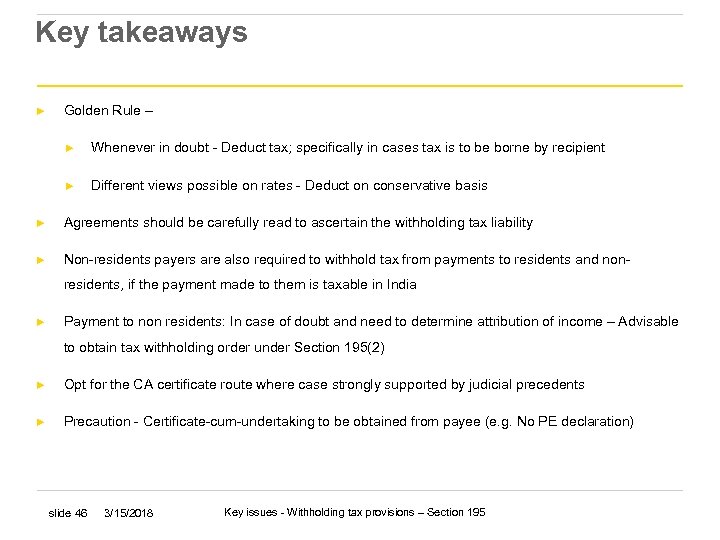

Key takeaways ► Golden Rule – ► Whenever in doubt - Deduct tax; specifically in cases tax is to be borne by recipient ► Different views possible on rates - Deduct on conservative basis ► Agreements should be carefully read to ascertain the withholding tax liability ► Non-residents payers are also required to withhold tax from payments to residents and nonresidents, if the payment made to them is taxable in India ► Payment to non residents: In case of doubt and need to determine attribution of income – Advisable to obtain tax withholding order under Section 195(2) ► Opt for the CA certificate route where case strongly supported by judicial precedents ► Precaution - Certificate-cum-undertaking to be obtained from payee (e. g. No PE declaration) slide 46 3/15/2018 Key issues - Withholding tax provisions – Section 195

Key takeaways ► Golden Rule – ► Whenever in doubt - Deduct tax; specifically in cases tax is to be borne by recipient ► Different views possible on rates - Deduct on conservative basis ► Agreements should be carefully read to ascertain the withholding tax liability ► Non-residents payers are also required to withhold tax from payments to residents and nonresidents, if the payment made to them is taxable in India ► Payment to non residents: In case of doubt and need to determine attribution of income – Advisable to obtain tax withholding order under Section 195(2) ► Opt for the CA certificate route where case strongly supported by judicial precedents ► Precaution - Certificate-cum-undertaking to be obtained from payee (e. g. No PE declaration) slide 46 3/15/2018 Key issues - Withholding tax provisions – Section 195

Thank You

Thank You

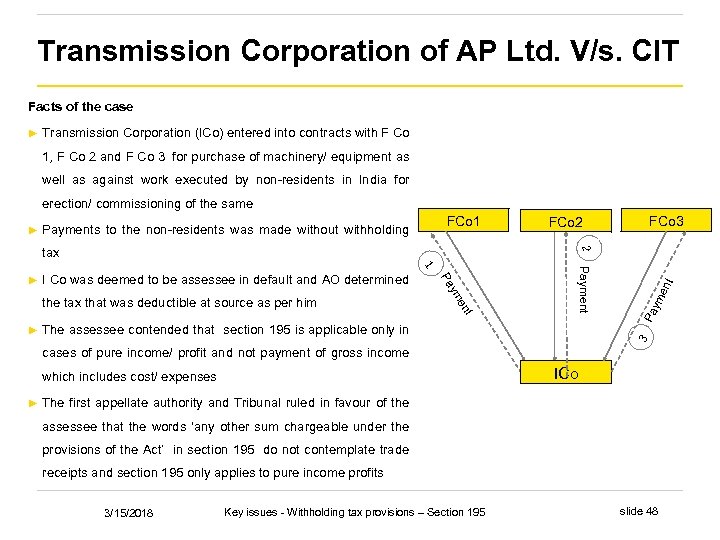

Transmission Corporation of AP Ltd. V/s. CIT Facts of the case ► Transmission Corporation (ICo) entered into contracts with F Co 1, F Co 2 and F Co 3 for purchase of machinery/ equipment as well as against work executed by non-residents in India for erection/ commissioning of the same FCo 1 Payments to the non-residents was made without withholding t The assessee contended that section 195 is applicable only in 3 ► ym en ym Pa the tax that was deductible at source as per him Payment 1 I Co was deemed to be assessee in default and AO determined en t 2 tax ► FCo 3 FCo 2 Pa ► cases of pure income/ profit and not payment of gross income ICo which includes cost/ expenses ► The first appellate authority and Tribunal ruled in favour of the assessee that the words ‘any other sum chargeable under the provisions of the Act’ in section 195 do not contemplate trade receipts and section 195 only applies to pure income profits 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 48

Transmission Corporation of AP Ltd. V/s. CIT Facts of the case ► Transmission Corporation (ICo) entered into contracts with F Co 1, F Co 2 and F Co 3 for purchase of machinery/ equipment as well as against work executed by non-residents in India for erection/ commissioning of the same FCo 1 Payments to the non-residents was made without withholding t The assessee contended that section 195 is applicable only in 3 ► ym en ym Pa the tax that was deductible at source as per him Payment 1 I Co was deemed to be assessee in default and AO determined en t 2 tax ► FCo 3 FCo 2 Pa ► cases of pure income/ profit and not payment of gross income ICo which includes cost/ expenses ► The first appellate authority and Tribunal ruled in favour of the assessee that the words ‘any other sum chargeable under the provisions of the Act’ in section 195 do not contemplate trade receipts and section 195 only applies to pure income profits 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 48

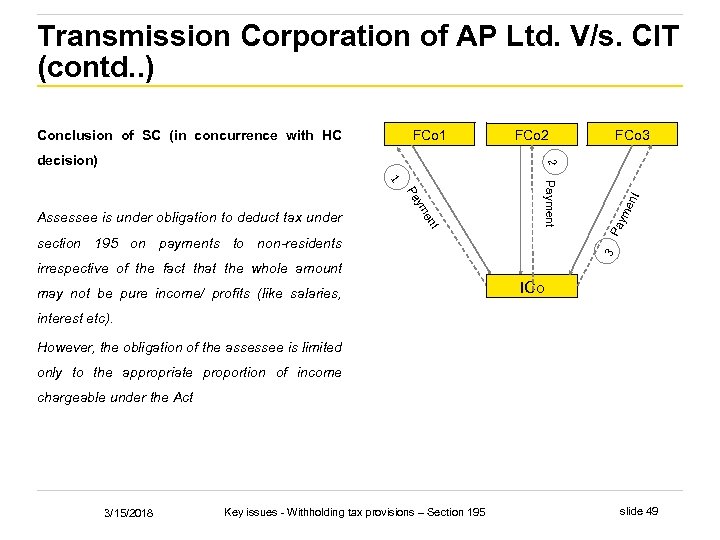

Transmission Corporation of AP Ltd. V/s. CIT (contd. . ) FCo 1 Conclusion of SC (in concurrence with HC FCo 3 FCo 2 t en ym 3 section 195 on payments to non-residents Pa Pa Payment 1 Assessee is under obligation to deduct tax under t 2 decision) irrespective of the fact that the whole amount may not be pure income/ profits (like salaries, ICo interest etc). However, the obligation of the assessee is limited only to the appropriate proportion of income chargeable under the Act 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 49

Transmission Corporation of AP Ltd. V/s. CIT (contd. . ) FCo 1 Conclusion of SC (in concurrence with HC FCo 3 FCo 2 t en ym 3 section 195 on payments to non-residents Pa Pa Payment 1 Assessee is under obligation to deduct tax under t 2 decision) irrespective of the fact that the whole amount may not be pure income/ profits (like salaries, ICo interest etc). However, the obligation of the assessee is limited only to the appropriate proportion of income chargeable under the Act 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 49

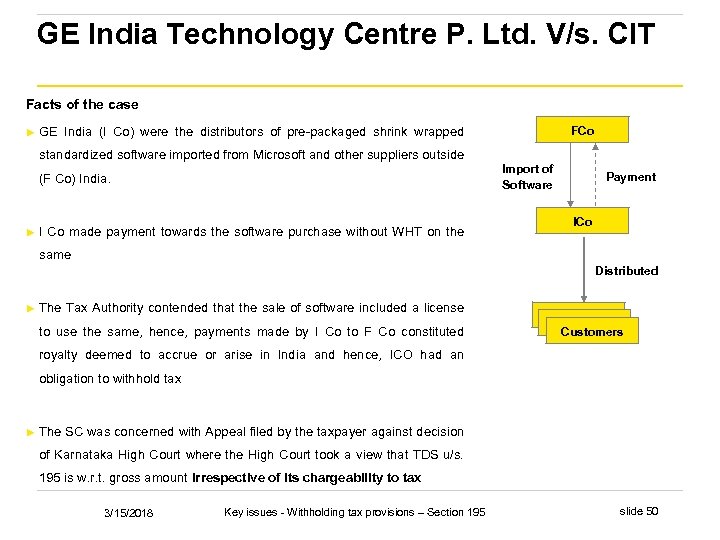

GE India Technology Centre P. Ltd. V/s. CIT Facts of the case ► standardized software imported from Microsoft and other suppliers outside (F Co) India. ► FCo GE India (I Co) were the distributors of pre-packaged shrink wrapped I Co made payment towards the software purchase without WHT on the Import of Software Payment ICo same Distributed ► The Tax Authority contended that the sale of software included a license to use the same, hence, payments made by I Co to F Co constituted Customers royalty deemed to accrue or arise in India and hence, ICO had an obligation to withhold tax ► The SC was concerned with Appeal filed by the taxpayer against decision of Karnataka High Court where the High Court took a view that TDS u/s. 195 is w. r. t. gross amount irrespective of its chargeability to tax 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 50

GE India Technology Centre P. Ltd. V/s. CIT Facts of the case ► standardized software imported from Microsoft and other suppliers outside (F Co) India. ► FCo GE India (I Co) were the distributors of pre-packaged shrink wrapped I Co made payment towards the software purchase without WHT on the Import of Software Payment ICo same Distributed ► The Tax Authority contended that the sale of software included a license to use the same, hence, payments made by I Co to F Co constituted Customers royalty deemed to accrue or arise in India and hence, ICO had an obligation to withhold tax ► The SC was concerned with Appeal filed by the taxpayer against decision of Karnataka High Court where the High Court took a view that TDS u/s. 195 is w. r. t. gross amount irrespective of its chargeability to tax 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 50

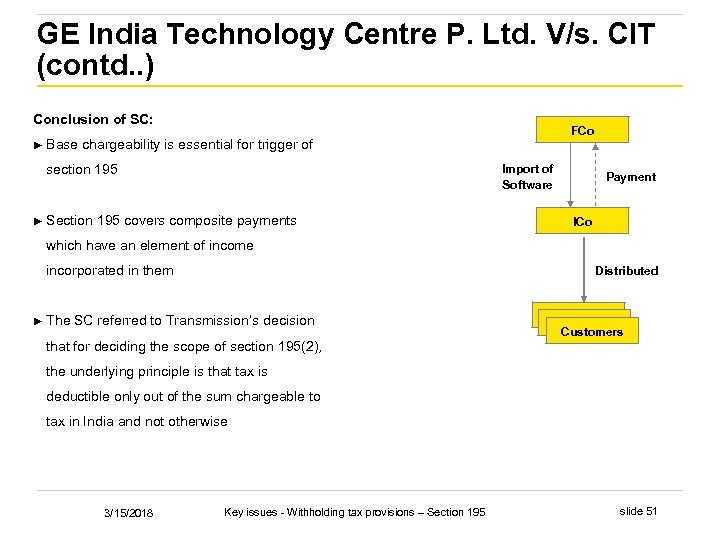

GE India Technology Centre P. Ltd. V/s. CIT (contd. . ) Conclusion of SC: ► Base chargeability is essential for trigger of section 195 ► FCo Import of Software Section 195 covers composite payments Payment ICo which have an element of income incorporated in them ► Distributed The SC referred to Transmission’s decision that for deciding the scope of section 195(2), Customers the underlying principle is that tax is deductible only out of the sum chargeable to tax in India and not otherwise 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 51

GE India Technology Centre P. Ltd. V/s. CIT (contd. . ) Conclusion of SC: ► Base chargeability is essential for trigger of section 195 ► FCo Import of Software Section 195 covers composite payments Payment ICo which have an element of income incorporated in them ► Distributed The SC referred to Transmission’s decision that for deciding the scope of section 195(2), Customers the underlying principle is that tax is deductible only out of the sum chargeable to tax in India and not otherwise 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 51

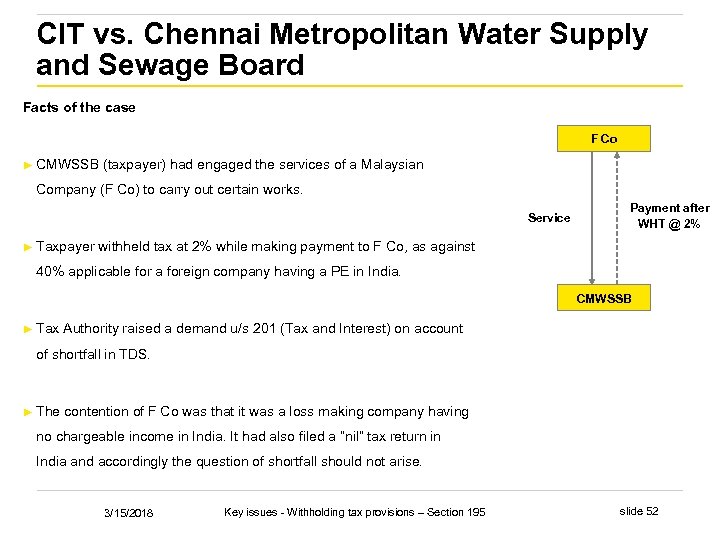

CIT vs. Chennai Metropolitan Water Supply and Sewage Board Facts of the case F Co ► CMWSSB (taxpayer) had engaged the services of a Malaysian Company (F Co) to carry out certain works. Service ► Payment after WHT @ 2% Taxpayer withheld tax at 2% while making payment to F Co, as against 40% applicable for a foreign company having a PE in India. CMWSSB ► Tax Authority raised a demand u/s 201 (Tax and Interest) on account of shortfall in TDS. ► The contention of F Co was that it was a loss making company having no chargeable income in India. It had also filed a “nil” tax return in India and accordingly the question of shortfall should not arise. 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 52

CIT vs. Chennai Metropolitan Water Supply and Sewage Board Facts of the case F Co ► CMWSSB (taxpayer) had engaged the services of a Malaysian Company (F Co) to carry out certain works. Service ► Payment after WHT @ 2% Taxpayer withheld tax at 2% while making payment to F Co, as against 40% applicable for a foreign company having a PE in India. CMWSSB ► Tax Authority raised a demand u/s 201 (Tax and Interest) on account of shortfall in TDS. ► The contention of F Co was that it was a loss making company having no chargeable income in India. It had also filed a “nil” tax return in India and accordingly the question of shortfall should not arise. 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 52

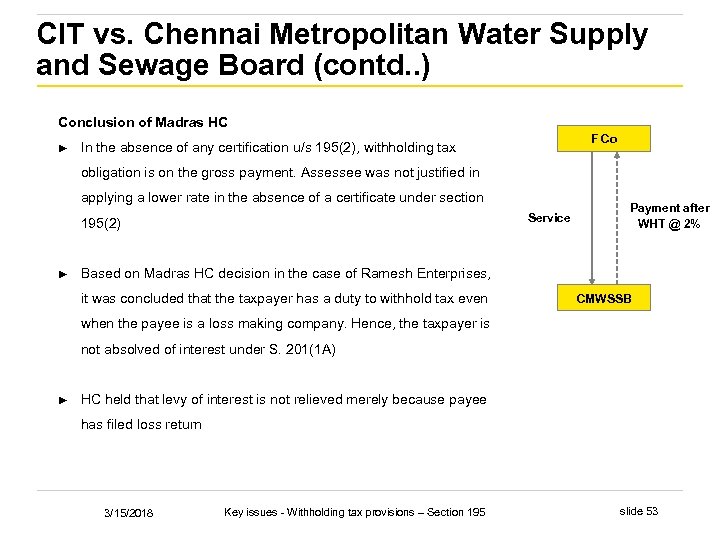

CIT vs. Chennai Metropolitan Water Supply and Sewage Board (contd. . ) Conclusion of Madras HC ► F Co In the absence of any certification u/s 195(2), withholding tax obligation is on the gross payment. Assessee was not justified in applying a lower rate in the absence of a certificate under section Service 195(2) ► Payment after WHT @ 2% Based on Madras HC decision in the case of Ramesh Enterprises, it was concluded that the taxpayer has a duty to withhold tax even CMWSSB when the payee is a loss making company. Hence, the taxpayer is not absolved of interest under S. 201(1 A) ► HC held that levy of interest is not relieved merely because payee has filed loss return 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 53

CIT vs. Chennai Metropolitan Water Supply and Sewage Board (contd. . ) Conclusion of Madras HC ► F Co In the absence of any certification u/s 195(2), withholding tax obligation is on the gross payment. Assessee was not justified in applying a lower rate in the absence of a certificate under section Service 195(2) ► Payment after WHT @ 2% Based on Madras HC decision in the case of Ramesh Enterprises, it was concluded that the taxpayer has a duty to withhold tax even CMWSSB when the payee is a loss making company. Hence, the taxpayer is not absolved of interest under S. 201(1 A) ► HC held that levy of interest is not relieved merely because payee has filed loss return 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 53

Instruction No. 2 of 2014 Circular dt. 26 th Feb 2014 Clarifications sought: ► Whether tax withholding is required on the whole sum being remitted to a non-resident or only with reference to the portion of remittance representing the sum chargeable to tax in India, particularly if no application has been made by the tax payer to determine the sum on which tax is required to be withheld ►The CBDT after examining the matter in light if the decisions in the case of GE, Transmission Corporation and Chennai Metropolitan Water Supply and Sewage Board has directed the subordinate Indian Tax Authority as follows: ► Withholding tax liability of the payer is only with respect to the sum chargeable to tax Act ► In a case where proceedings are initiated against the payer for failure to withhold taxes under the provisions of the ITL, the tax authority shall determine the appropriate proportion of the sum chargeable to tax which will be his tax liability and the tax payer will be treated as an assessee in default only with respect to such appropriate proportion ► The appropriate proportion will depend on the nature and facts of the case and will need to be determined by the tax authority only after taking into account the nature of remittances, income component therein or any other fact relevant to such determination ► In respect of remittances such as those for composite contracts or capital gains income, payers may determine their withholding tax liability only with respect to the chargeable portion of the remittance 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 54

Instruction No. 2 of 2014 Circular dt. 26 th Feb 2014 Clarifications sought: ► Whether tax withholding is required on the whole sum being remitted to a non-resident or only with reference to the portion of remittance representing the sum chargeable to tax in India, particularly if no application has been made by the tax payer to determine the sum on which tax is required to be withheld ►The CBDT after examining the matter in light if the decisions in the case of GE, Transmission Corporation and Chennai Metropolitan Water Supply and Sewage Board has directed the subordinate Indian Tax Authority as follows: ► Withholding tax liability of the payer is only with respect to the sum chargeable to tax Act ► In a case where proceedings are initiated against the payer for failure to withhold taxes under the provisions of the ITL, the tax authority shall determine the appropriate proportion of the sum chargeable to tax which will be his tax liability and the tax payer will be treated as an assessee in default only with respect to such appropriate proportion ► The appropriate proportion will depend on the nature and facts of the case and will need to be determined by the tax authority only after taking into account the nature of remittances, income component therein or any other fact relevant to such determination ► In respect of remittances such as those for composite contracts or capital gains income, payers may determine their withholding tax liability only with respect to the chargeable portion of the remittance 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 54

CBDT Circular No. 3 of 2015 dated 12 th Feb 2015 Issue under consideration: “Disallowance regarding ‘other sum chargeable’ under section 40(a)(i) is triggered when the deductor fails to withhold tax as per provisions of section 195 of the Act. Doubts have been raised about the interpretation of the term ‘other sum chargeable’ i. e. whether this term refers to the whole sum being remitted or only the portion representing the sum chargeable to income-tax under relevant provisions of the Act. ” ► Paragraph 3 of the Circular reiterates the contents of Instruction 2 of 2014 ► Paragraph 4 of the Circular states that: “As disallowance of amount under section 40(a)(i) of the Act in case of a deductor is interlinked with the sum chargeable under the Act as mentioned in section 195 of the Act …, the Central Board of Direct Taxes, …hereby clarifies that for the purpose of making disallowance of ‘other sum chargeable’ under section 40(a)(i) of the Act, the appropriate portion of the sum which is chargeable to tax under the Act shall form basis of such disallowance and shall be the same as determined by the Assessing Officer …for the purpose of sub-section (1) of section 195 of the Act as per Instruction No. 2/2014 dated 26. 02. 2014 of CBDT. Further, where determination of ‘other sum chargeable; has been made under …section 195 of the Act, such a determination will form the basis for disallowance, if any, under section 40(a)(i) of the Act. ” 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 55

CBDT Circular No. 3 of 2015 dated 12 th Feb 2015 Issue under consideration: “Disallowance regarding ‘other sum chargeable’ under section 40(a)(i) is triggered when the deductor fails to withhold tax as per provisions of section 195 of the Act. Doubts have been raised about the interpretation of the term ‘other sum chargeable’ i. e. whether this term refers to the whole sum being remitted or only the portion representing the sum chargeable to income-tax under relevant provisions of the Act. ” ► Paragraph 3 of the Circular reiterates the contents of Instruction 2 of 2014 ► Paragraph 4 of the Circular states that: “As disallowance of amount under section 40(a)(i) of the Act in case of a deductor is interlinked with the sum chargeable under the Act as mentioned in section 195 of the Act …, the Central Board of Direct Taxes, …hereby clarifies that for the purpose of making disallowance of ‘other sum chargeable’ under section 40(a)(i) of the Act, the appropriate portion of the sum which is chargeable to tax under the Act shall form basis of such disallowance and shall be the same as determined by the Assessing Officer …for the purpose of sub-section (1) of section 195 of the Act as per Instruction No. 2/2014 dated 26. 02. 2014 of CBDT. Further, where determination of ‘other sum chargeable; has been made under …section 195 of the Act, such a determination will form the basis for disallowance, if any, under section 40(a)(i) of the Act. ” 3/15/2018 Key issues - Withholding tax provisions – Section 195 slide 55