e93bcd8bb0aec5652169473b0eba4a68.ppt

- Количество слайдов: 37

With you round the clock

BCV Who we are Germany Vaud Zurich Austria Bern Lausanne Lake Geneva Lausanne Geneva Italy France Geneva Switzerland 2

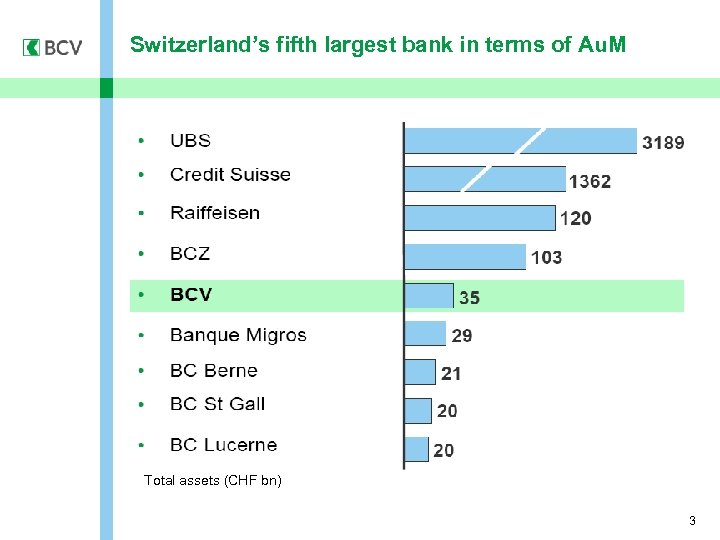

Switzerland’s fifth largest bank in terms of Au. M Total assets (CHF bn) 3

Four core businesses Retail banking Wealth management • 420, 000 customers • 425 employees • CHF 76 bn of Au. M> Corporate banking Trading • 2 out of 3 local SMEs • More than CHF 10 bn in loans • 75 traders • largest trading floor in French-speaking Switzerland 4

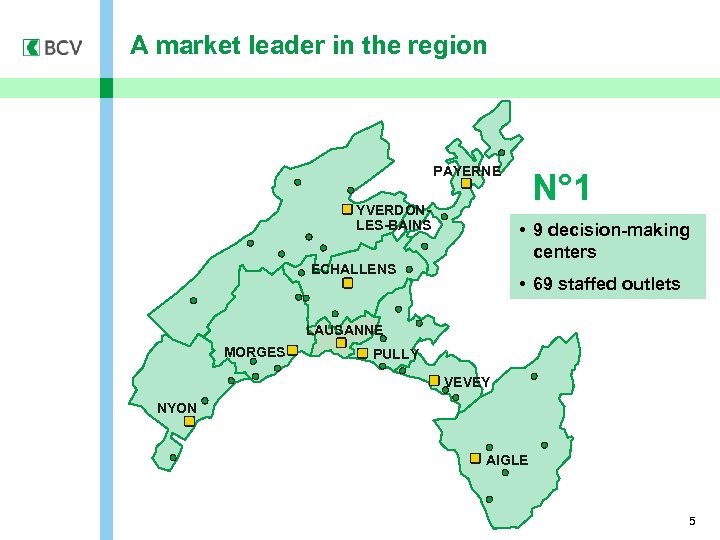

A market leader in the region PAYERNE YVERDONLES-BAINS N° 1 • 9 decision-making centers ECHALLENS • 69 staffed outlets LAUSANNE MORGES PULLY VEVEY NYON AIGLE 5

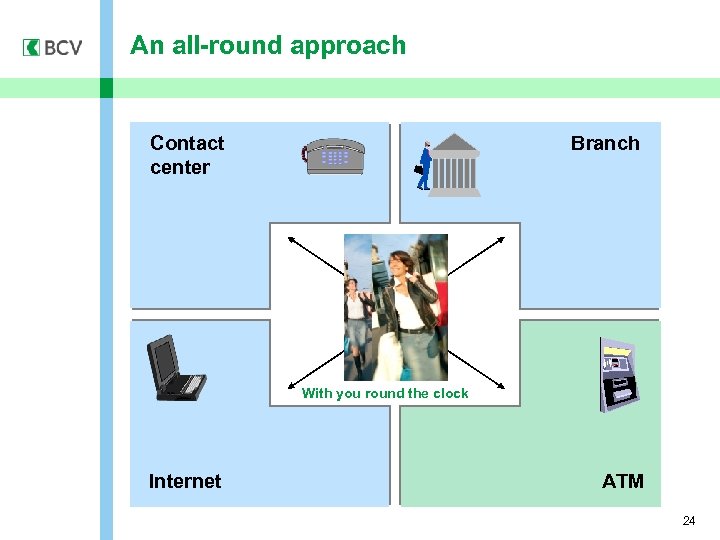

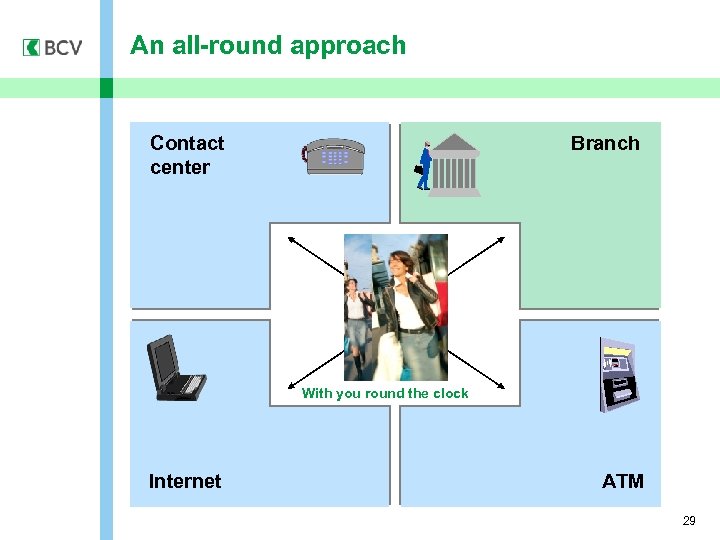

With you round the clock Our integrated multi-channel approach keeps us in constant contact with our customers 6

The importance of an integrated multi-channel approach Current consumer trends in banking People use branch offices less than before. Buying decisions are often initiated online. However, sales still tend to be closed in a branch office (high value-added). Our response We try to understand our customers’ preferences: • preferred channels • depends on which step of the process they’re at. We then define the role of each channel at each point in the process. Need for an integrated approach 7

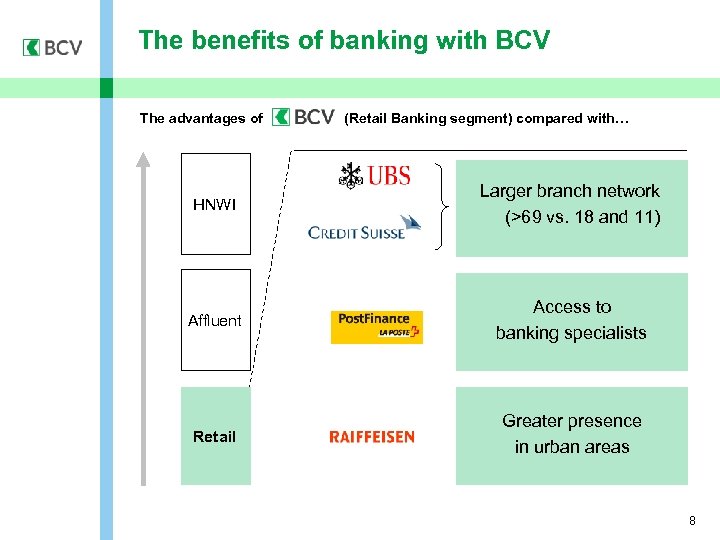

The benefits of banking with BCV The advantages of (Retail Banking segment) compared with… HNWI Larger branch network (>69 vs. 18 and 11) Affluent Access to banking specialists Retail Greater presence in urban areas 8

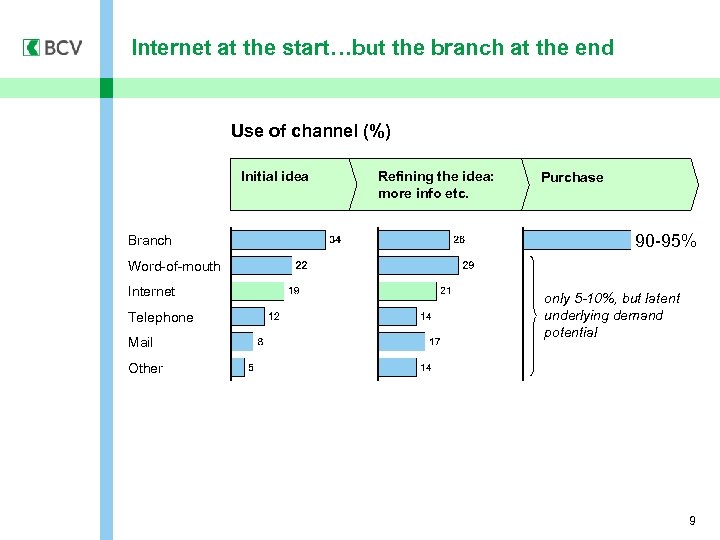

Internet at the start…but the branch at the end Use of channel (%) Initial idea Branch Refining the idea: more info etc. Purchase 90 -95% Word-of-mouth Internet Telephone Mail only 5 -10%, but latent underlying demand potential Other 9

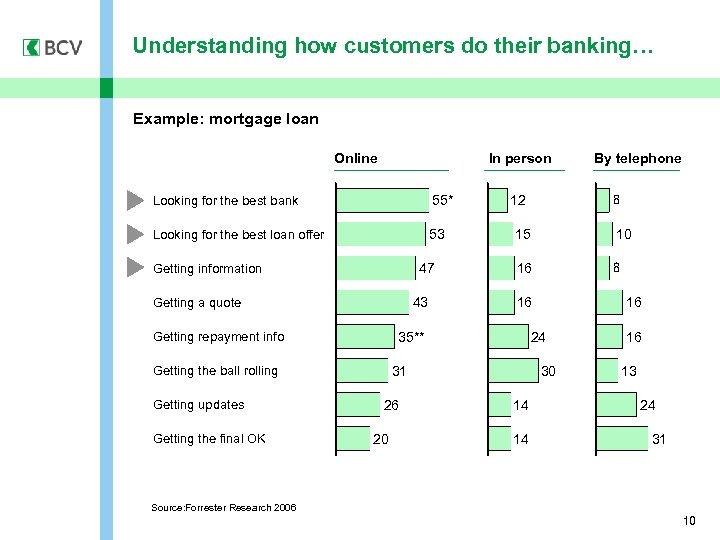

Understanding how customers do their banking… Example: mortgage loan Online In person Looking for the best bank 55* Looking for the best loan offer 53 47 Getting information 43 Getting a quote Getting the final OK 15 26 20 10 16 16 16 24 30 31 Getting the ball rolling Getting updates 12 35** Getting repayment info By telephone 14 14 16 13 24 31 Source: Forrester Research 2006 10

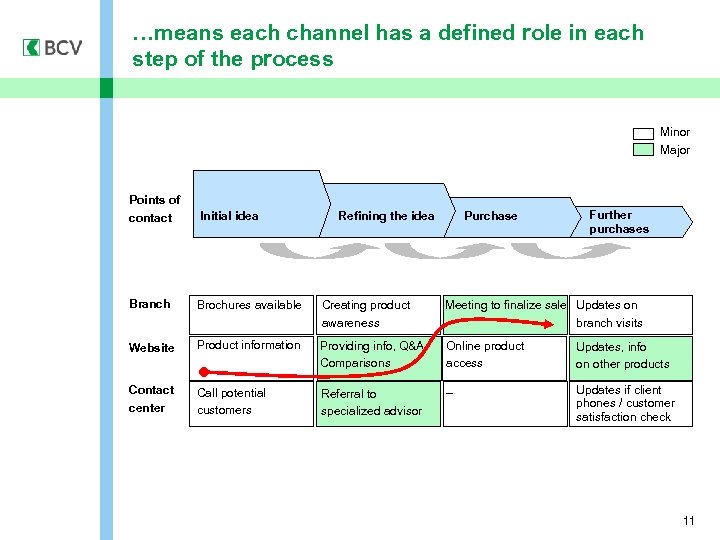

…means each channel has a defined role in each step of the process Minor Major Points of contact Initial idea Branch Brochures available Creating product awareness Meeting to finalize sale Updates on branch visits Website Product information Providing info, Q&A Comparisons Online product access Updates, info on other products Contact center Call potential customers Referral to specialized advisor – Updates if client phones / customer satisfaction check Refining the idea Purchase Further purchases 11

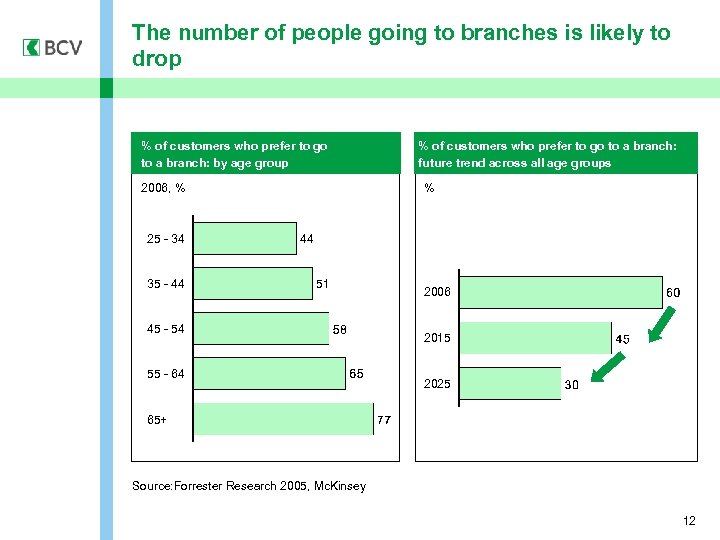

The number of people going to branches is likely to drop % of customers who prefer to go to a branch: by age group 2006, % 25 - 34 35 - 44 % of customers who prefer to go to a branch: future trend across all age groups % 44 51 45 - 54 55 - 64 2006 2015 2025 65+ Source: Forrester Research 2005, Mc. Kinsey 12

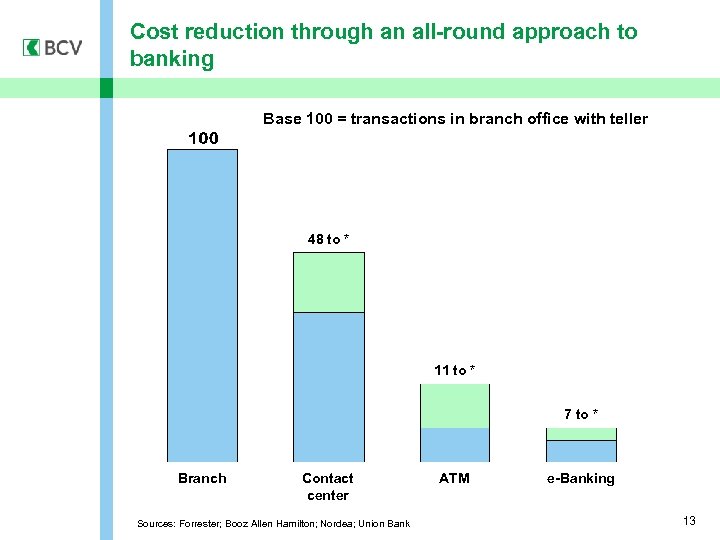

Cost reduction through an all-round approach to banking Base 100 = transactions in branch office with teller 48 to * 11 to * 7 to * Branch Contact center • Sources: Forrester; Booz Allen Hamilton; Nordea; Union Bank ATM e-Banking 13

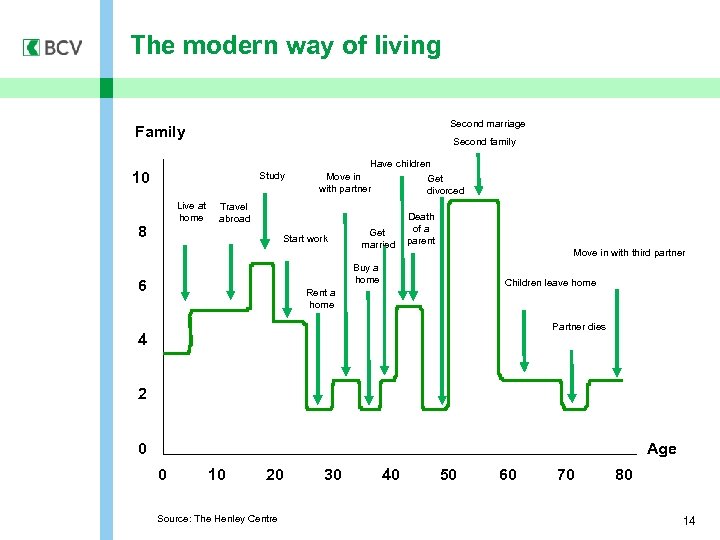

The modern way of living Second marriage Family Second family 10 Study Live at home 8 Have children Move in Get with partner divorced Travel abroad Start work Get married Death of a parent Move in with third partner Buy a home 6 Children leave home Rent a home Partner dies 4 2 0 Age 0 10 20 Source: The Henley Centre 30 40 50 60 70 80 14

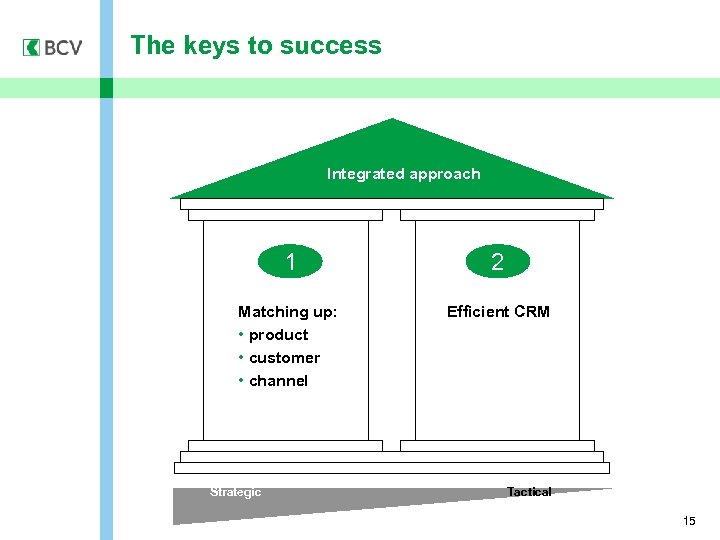

The keys to success Integrated approach 1 2 Matching up: • product • customer • channel Efficient CRM Strategic Tactical 15

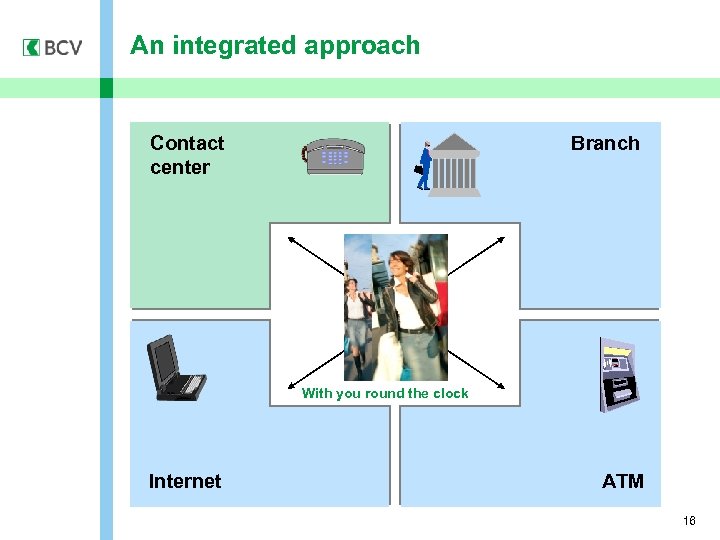

An integrated approach Contact center Branch With you round the clock Internet ATM 16

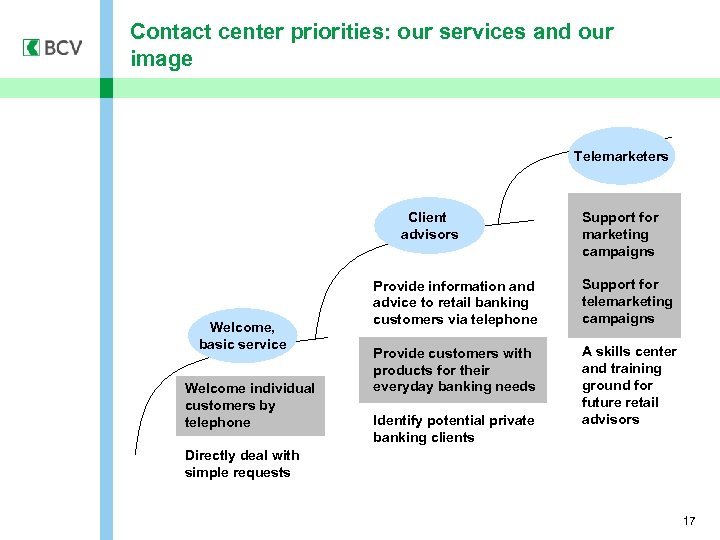

Contact center priorities: our services and our image Telemarketers Client advisors Welcome, basic service Welcome individual customers by telephone Support for marketing campaigns Provide information and advice to retail banking customers via telephone Support for telemarketing campaigns Provide customers with products for their everyday banking needs A skills center and training ground for future retail advisors Identify potential private banking clients Directly deal with simple requests 17

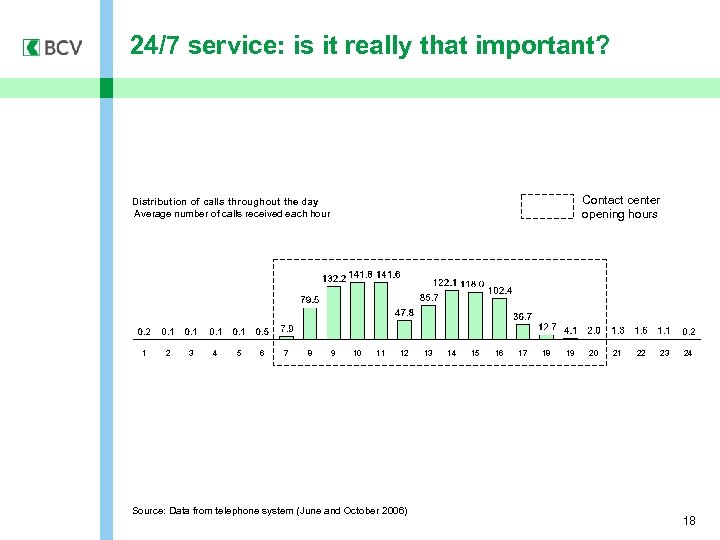

24/7 service: is it really that important? Contact center opening hours Distribution of calls throughout the day Average number of calls received each hour 1 2 3 4 5 6 7 8 9 10 11 12 Source: Data from telephone system (June and October 2006) 13 14 15 16 17 18 19 20 21 22 23 24 18

An all-round approach Contact center Branch With you round the clock Internet ATM 19

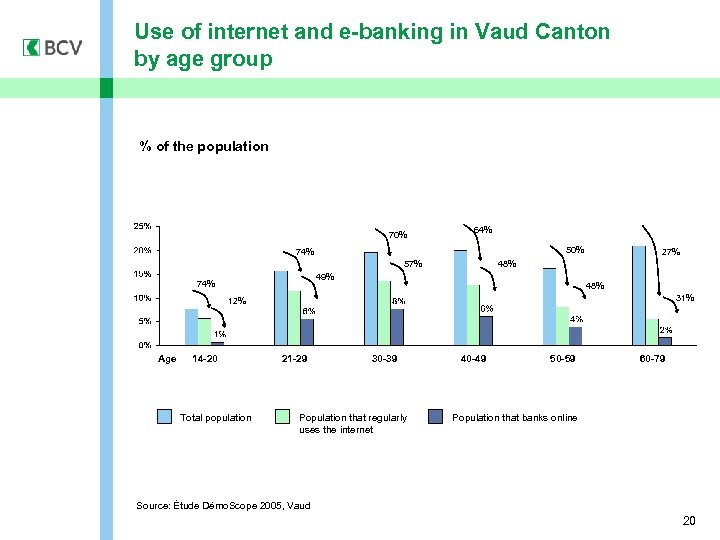

Use of internet and e-banking in Vaud Canton by age group % of the population 70% 64% 50% 74% 57% 49% 74% 27% 48% 31% 12% Age 14 -20 Total population 21 -29 30 -39 Population that regularly uses the internet 40 -49 50 -59 60 -79 Population that banks online Source: Étude Démo. Scope 2005, Vaud 20

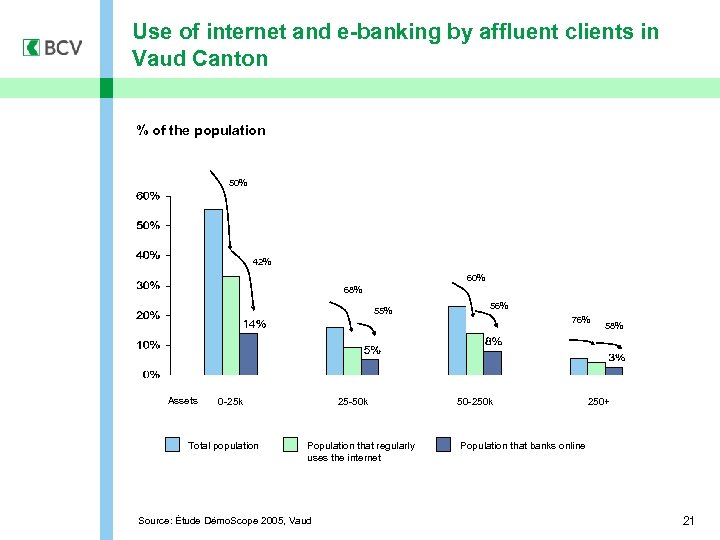

Use of internet and e-banking by affluent clients in Vaud Canton % of the population 50% 42% 60% 68% 55% Assets 0 -25 k Total population 25 -50 k Population that regularly uses the internet Source: Étude Démo. Scope 2005, Vaud 56% 76% 50 -250 k 58% 250+ Population that banks online 21

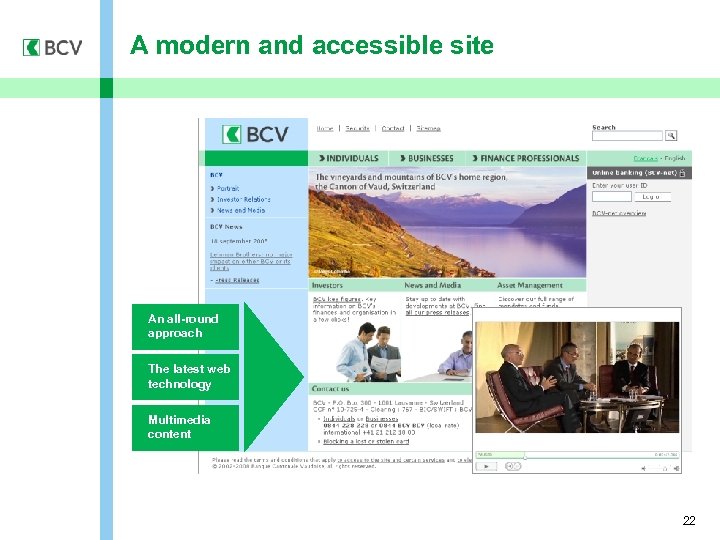

A modern and accessible site An all-round approach The latest web technology Multimedia content 22

The first bank on Second Life 23

An all-round approach Contact center Branch With you round the clock Internet ATM 24

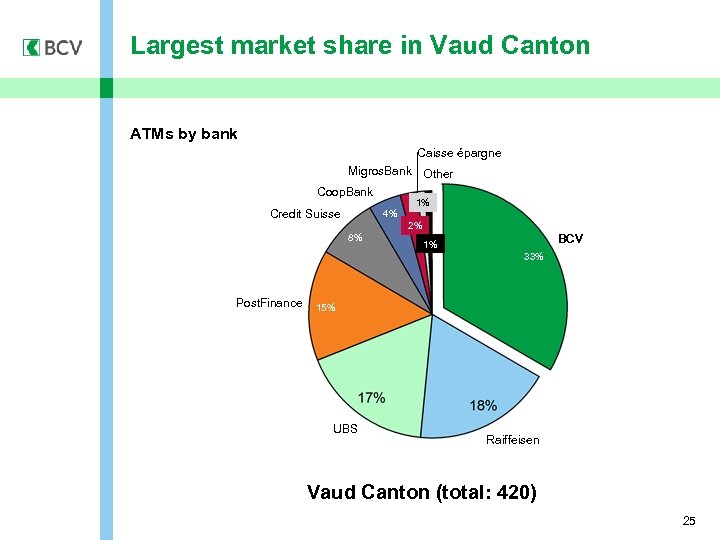

Largest market share in Vaud Canton ATMs by bank Caisse épargne Migros. Bank Other Coop. Bank Credit Suisse 4% 1% 2% 8% BCV 1% 33% Post. Finance 15% UBS Raiffeisen Vaud Canton (total: 420) 25

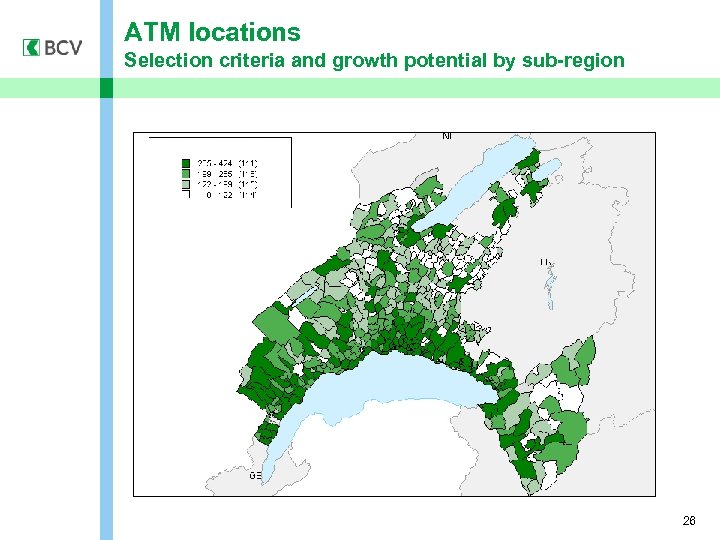

ATM locations Selection criteria and growth potential by sub-region 26

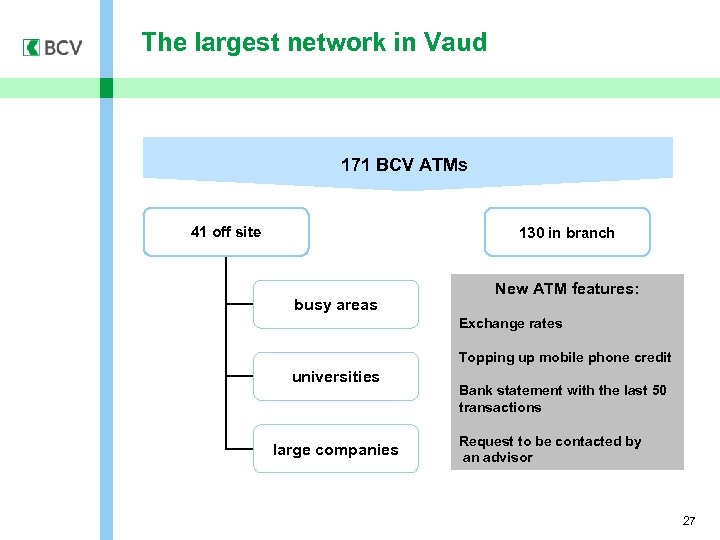

The largest network in Vaud 171 BCV ATMs 41 off site 130 in branch busy areas New ATM features: Exchange rates Topping up mobile phone credit universities large companies Bank statement with the last 50 transactions Request to be contacted by an advisor 27

An innovative project for completely automated banking booths 28

An all-round approach Contact center Branch With you round the clock Internet ATM 29

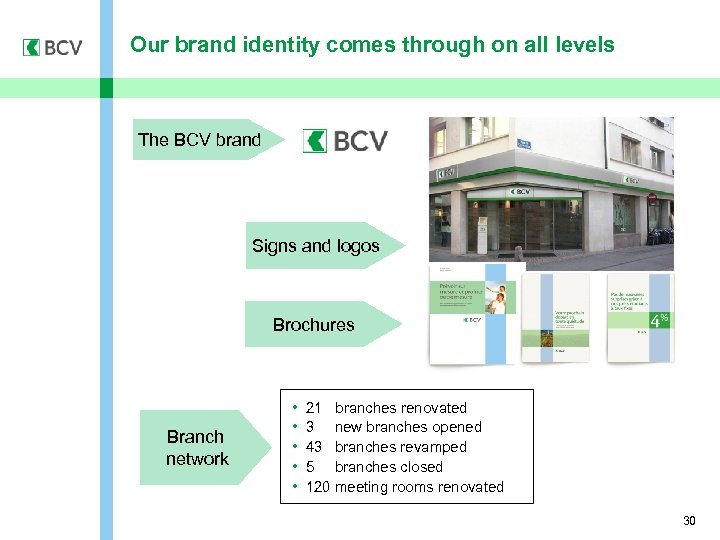

Our brand identity comes through on all levels The BCV brand Signs and logos Brochures Branch network • • • 21 branches renovated 3 new branches opened 43 branches revamped 5 branches closed 120 meeting rooms renovated 30

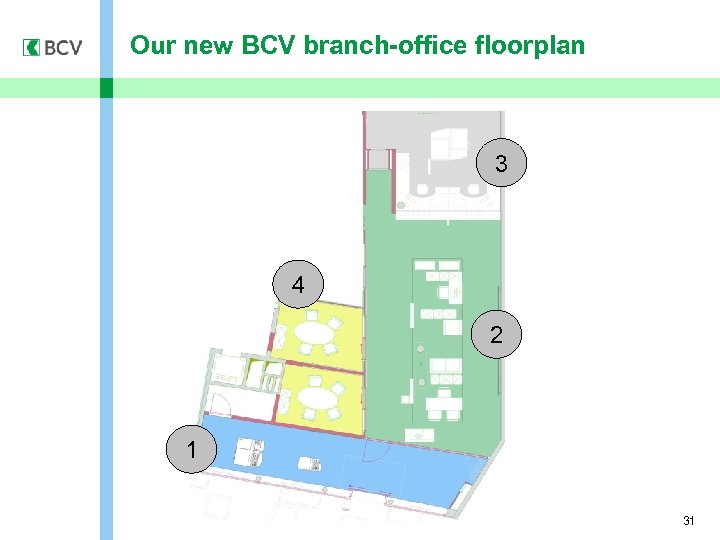

Our new BCV branch-office floorplan 3 4 2 1 31

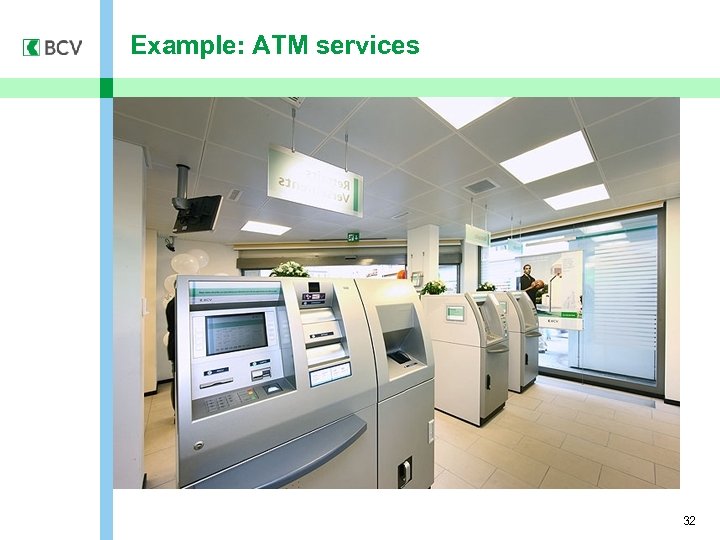

Example: ATM services 32

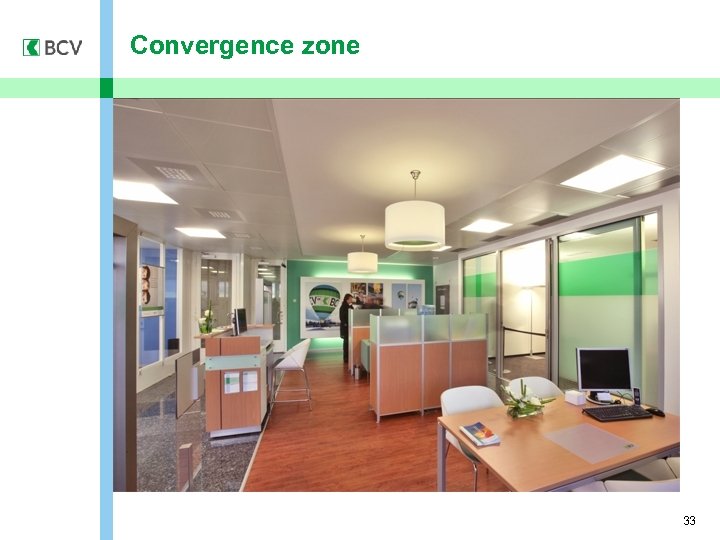

Convergence zone 33

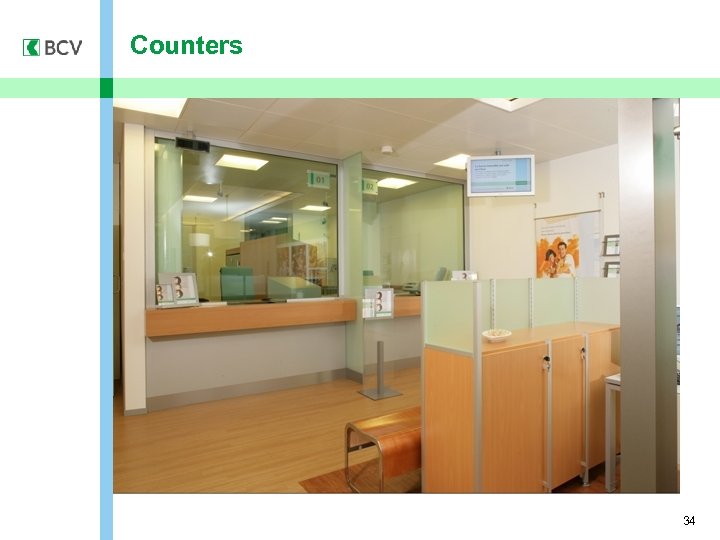

Counters 34

Meeting rooms 35

Our new ‘mini’ branches 36

With you round the clock Our integrated multi-channel approach keeps us in constant contact with our customers 37

e93bcd8bb0aec5652169473b0eba4a68.ppt