fab4a4a7efdd01aafd52e8e7aaddaaf7.ppt

- Количество слайдов: 64

WIPA Training for AWICs – Session 3 May 6, 2015 1

WIPA Training for AWICs – Session 3 May 6, 2015 1

The CWIC’s Role in Health Care and Other Federal Benefits Counseling 2

The CWIC’s Role in Health Care and Other Federal Benefits Counseling 2

Transition to Financial Independence • Transition from dependence on public benefits to greater financial independence involves more than just monthly income. • Beneficiaries need and CWICs must provide information about the big picture – Social Security benefits, healthcare options, and other publicly-funded benefits. • Changes in one benefit can affect eligibility for other benefits – CWICs counsel on interaction. 3

Transition to Financial Independence • Transition from dependence on public benefits to greater financial independence involves more than just monthly income. • Beneficiaries need and CWICs must provide information about the big picture – Social Security benefits, healthcare options, and other publicly-funded benefits. • Changes in one benefit can affect eligibility for other benefits – CWICs counsel on interaction. 3

Barriers Beneficiaries Face • Beneficiaries believe they need to limit their earnings or risk everything • Each program has unique and complex rules • Beneficiaries fear losing critical healthcare benefits and other supports • Beneficiaries and other family members may each have benefits that affect each other • Work incentives in other federal benefit programs are not simple to understand • Beneficiaries also don’t understand what to save or report 4

Barriers Beneficiaries Face • Beneficiaries believe they need to limit their earnings or risk everything • Each program has unique and complex rules • Beneficiaries fear losing critical healthcare benefits and other supports • Beneficiaries and other family members may each have benefits that affect each other • Work incentives in other federal benefit programs are not simple to understand • Beneficiaries also don’t understand what to save or report 4

Supporting Beneficiaries in Assessing Health Care Needs and Options: Medicare, Medicaid, and Private Health Insurance 5

Supporting Beneficiaries in Assessing Health Care Needs and Options: Medicare, Medicaid, and Private Health Insurance 5

CWICs Must Know: Medicare • Entitlement and enrollment • Low income programs to help pay premiums when Medicare is primary payer • Interaction with employer group health plans • Effect of work at different times in the back-to-work process • Interaction with Medicaid and other insurances 6

CWICs Must Know: Medicare • Entitlement and enrollment • Low income programs to help pay premiums when Medicare is primary payer • Interaction with employer group health plans • Effect of work at different times in the back-to-work process • Interaction with Medicaid and other insurances 6

CWICs Must Know: Medicaid • Work incentives • Federal and state-specific rules for income and resources • Home and community-based waiver programs to keep people with disabilities in the community • Programs to purchase Medicaid if disabled and working • Other state and local insurance resources 7

CWICs Must Know: Medicaid • Work incentives • Federal and state-specific rules for income and resources • Home and community-based waiver programs to keep people with disabilities in the community • Programs to purchase Medicaid if disabled and working • Other state and local insurance resources 7

CWICs Must Know: Other Health Care Options • Veterans health care programs • Protections under the Consolidated Omnibus Budget Reconciliation Act (COBRA) and the Health Insurance Portability and Accountability Act (HIPAA) • The basics of private and employer health insurance coverage 8

CWICs Must Know: Other Health Care Options • Veterans health care programs • Protections under the Consolidated Omnibus Budget Reconciliation Act (COBRA) and the Health Insurance Portability and Accountability Act (HIPAA) • The basics of private and employer health insurance coverage 8

CWICs Must Explain: Health Coverage Options • Analyze complex scenarios using reference materials and technical assistance • Understand how different types of health plans interact • Assess the needs of beneficiaries and assist with decisions related to health care • Identify unmet needs and develop strategies for meeting those needs • Provide information about resolving disputed claims/appeals process • Make referrals for situations outside of the CWIC scope of work 9

CWICs Must Explain: Health Coverage Options • Analyze complex scenarios using reference materials and technical assistance • Understand how different types of health plans interact • Assess the needs of beneficiaries and assist with decisions related to health care • Identify unmet needs and develop strategies for meeting those needs • Provide information about resolving disputed claims/appeals process • Make referrals for situations outside of the CWIC scope of work 9

CWICs Must Explain: Medicare • CWICs must be able to explain to beneficiaries: – What Medicare is, including the differences between Part A, B, C and D – How to become entitled to Medicare, including enrollment periods and premiums – General services covered by the different parts of Medicare – Specific programs to help with Medicare costs – How to appeal an unfavorable Medicare decision 10

CWICs Must Explain: Medicare • CWICs must be able to explain to beneficiaries: – What Medicare is, including the differences between Part A, B, C and D – How to become entitled to Medicare, including enrollment periods and premiums – General services covered by the different parts of Medicare – Specific programs to help with Medicare costs – How to appeal an unfavorable Medicare decision 10

CWICs Must Explain: Medicare (Cont. ) • How work affects Medicare entitlement during: – Trial Work Period (TWP) – Extended Period of Eligibility (EPE) – Cessation or termination; • Also, Premium-HI for the Working Disabled; and • How health insurance from work interacts. 11

CWICs Must Explain: Medicare (Cont. ) • How work affects Medicare entitlement during: – Trial Work Period (TWP) – Extended Period of Eligibility (EPE) – Cessation or termination; • Also, Premium-HI for the Working Disabled; and • How health insurance from work interacts. 11

CWICs Must Find Out: EPMC • • When or if the Trial Work Period ended If benefits have (or should have) ceased or terminated If beneficiary reported past work When Social Security may terminate Medicare under the Extended Period of Medicare Coverage if beneficiary is still disabled and terminated from payments due to work 12

CWICs Must Find Out: EPMC • • When or if the Trial Work Period ended If benefits have (or should have) ceased or terminated If beneficiary reported past work When Social Security may terminate Medicare under the Extended Period of Medicare Coverage if beneficiary is still disabled and terminated from payments due to work 12

CWICs Must Find Out: EPMC (Cont. ) • If and when beneficiary needs to be prepared to pay Part B premiums • If the beneficiary is denied EXR due to medical improvement, Medicare will end • Premium-HI for the Working Disabled • When beneficiaries may enroll • When beneficiary must complete a new 24 -month Medicare Qualifying Period (MQP) and what options exist to provide coverage during MQP 13

CWICs Must Find Out: EPMC (Cont. ) • If and when beneficiary needs to be prepared to pay Part B premiums • If the beneficiary is denied EXR due to medical improvement, Medicare will end • Premium-HI for the Working Disabled • When beneficiaries may enroll • When beneficiary must complete a new 24 -month Medicare Qualifying Period (MQP) and what options exist to provide coverage during MQP 13

CWICs Must Explain: Interactions between Medicare and Veteran’s Benefits • Veterans under age 65 may have Medicare as an SSDI beneficiary as well as VA Health benefits – Veterans may choose which coverage to use, e. g. receive care at a VA facility or see a provider outside of the VA system – VA and Medicare have no coordination of benefits – beneficiaries responsible for Medicare premiums, deductibles and co-insurance – If VA allows services in a non-VA hospital, Medicare may pay for part not covered by VA – Veterans should carefully consider whether to decline or disenroll from Medicare Part B 14

CWICs Must Explain: Interactions between Medicare and Veteran’s Benefits • Veterans under age 65 may have Medicare as an SSDI beneficiary as well as VA Health benefits – Veterans may choose which coverage to use, e. g. receive care at a VA facility or see a provider outside of the VA system – VA and Medicare have no coordination of benefits – beneficiaries responsible for Medicare premiums, deductibles and co-insurance – If VA allows services in a non-VA hospital, Medicare may pay for part not covered by VA – Veterans should carefully consider whether to decline or disenroll from Medicare Part B 14

CWICs Must Explain: Insurance Interactions • Beneficiary may be covered through their own employment, under a parent’s health insurance, or a spouse’s employer-based plan – In some cases, Medicare will pay first; in others it will be secondary, for example: § Beneficiary under 65 and disabled, Medicare secondary if employer has 100+ employees § Beneficiary over 65 and working, Medicare secondary if employer has 20 or more employees • Employer pays first regardless of size if beneficiary eligible for renal Medicare • Other forms that pay first include: No fault insurance, Liability insurance, Black lung benefits, and worker’s compensation • Beneficiaries should consult the HR department at work about coordination of benefits with Medicare 15

CWICs Must Explain: Insurance Interactions • Beneficiary may be covered through their own employment, under a parent’s health insurance, or a spouse’s employer-based plan – In some cases, Medicare will pay first; in others it will be secondary, for example: § Beneficiary under 65 and disabled, Medicare secondary if employer has 100+ employees § Beneficiary over 65 and working, Medicare secondary if employer has 20 or more employees • Employer pays first regardless of size if beneficiary eligible for renal Medicare • Other forms that pay first include: No fault insurance, Liability insurance, Black lung benefits, and worker’s compensation • Beneficiaries should consult the HR department at work about coordination of benefits with Medicare 15

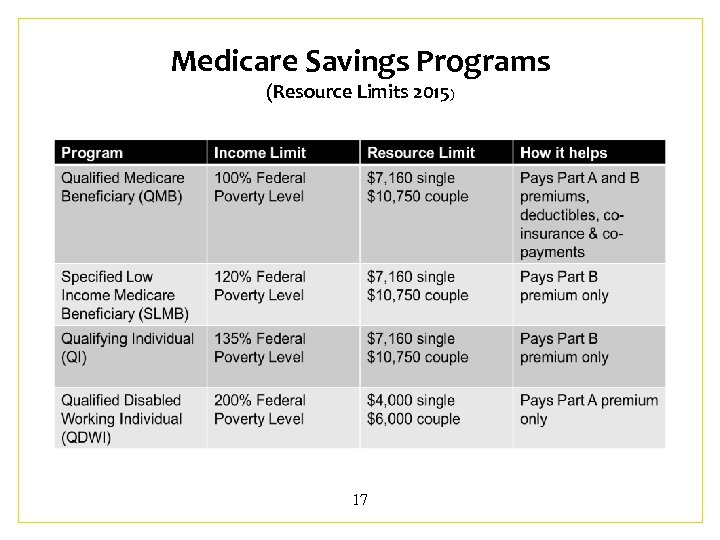

CWICs Must Explain: Medicare Savings Programs (MSP) MSP programs receive federal and state funding to help low-income Medicare beneficiaries with some or all of their Part A and B out-of-pocket expenses: – Mandated by federal law and regulated by federal government by Centers for Medicare and Medicaid (CMS) – Administered by the state (usually Medicaid agency) – Must have low income and resources – Coverage may pay for all or part of the Medicare premiums, deductibles and coinsurance – Beneficiaries apply in the same way they would apply for regular Medicaid – State shares data with Social Security; should stop deducting premium from Title II payment – States follow SSI exclusions in determining income and resources for eligibility, but the resource limits are much higher – States may use income rules that are less restrictive than SSI 16

CWICs Must Explain: Medicare Savings Programs (MSP) MSP programs receive federal and state funding to help low-income Medicare beneficiaries with some or all of their Part A and B out-of-pocket expenses: – Mandated by federal law and regulated by federal government by Centers for Medicare and Medicaid (CMS) – Administered by the state (usually Medicaid agency) – Must have low income and resources – Coverage may pay for all or part of the Medicare premiums, deductibles and coinsurance – Beneficiaries apply in the same way they would apply for regular Medicaid – State shares data with Social Security; should stop deducting premium from Title II payment – States follow SSI exclusions in determining income and resources for eligibility, but the resource limits are much higher – States may use income rules that are less restrictive than SSI 16

Medicare Savings Programs (Resource Limits 2015) 17

Medicare Savings Programs (Resource Limits 2015) 17

CWIC Role: Medicare Savings Programs (MSP) • Identify beneficiaries who could be eligible for an MSP • Recognize and verify eligibility for an MSP • Understand the effect of work on qualifying for an MSP • Explain to beneficiaries how their work goal will affect the MSP • Provide counseling and information to help beneficiaries make informed choices 18

CWIC Role: Medicare Savings Programs (MSP) • Identify beneficiaries who could be eligible for an MSP • Recognize and verify eligibility for an MSP • Understand the effect of work on qualifying for an MSP • Explain to beneficiaries how their work goal will affect the MSP • Provide counseling and information to help beneficiaries make informed choices 18

Overview Low Income Subsidy (LIS) • Federal assistance program (not administered by states, administered by CMS) – States provide CMS list Medicaid and MSP eligible(deemed eligible) – Social Security determines eligibility for those not Medicaid or MSPs eligible – Can be full or partial subsidy- based on income and resources (including spouse) – If no Medicaid, must meet income and resource test; not eligible if income above 150% FPL 19

Overview Low Income Subsidy (LIS) • Federal assistance program (not administered by states, administered by CMS) – States provide CMS list Medicaid and MSP eligible(deemed eligible) – Social Security determines eligibility for those not Medicaid or MSPs eligible – Can be full or partial subsidy- based on income and resources (including spouse) – If no Medicaid, must meet income and resource test; not eligible if income above 150% FPL 19

Determining Countable Income for LIS • Full LIS group #3 (below 135% FPL) and both Partial LIS groups require a determination of countable income • Use mostly SSI income rules (HI 03020. 030) – $20 GIE, $65 EIE, IRWE, ½ disregard, and BWE • IRWE – automatically deduct 16. 3% of gross wages if IRWE alleged, will use actual amount if higher • BWE – automatically deduct 25% of gross wages if BWE alleged, will use actual amount if higher 20

Determining Countable Income for LIS • Full LIS group #3 (below 135% FPL) and both Partial LIS groups require a determination of countable income • Use mostly SSI income rules (HI 03020. 030) – $20 GIE, $65 EIE, IRWE, ½ disregard, and BWE • IRWE – automatically deduct 16. 3% of gross wages if IRWE alleged, will use actual amount if higher • BWE – automatically deduct 25% of gross wages if BWE alleged, will use actual amount if higher 20

Determining Countable Resources for LIS • Resources: cash or other assets the individual owns that could convert to cash to be used for his or her support and maintenance • SSI resource exclusions used to determine LIS (HI 03030. 20), with some exceptions: – Non-liquid resource, other than real property – PASS whose sole purpose is to exclude income and resources in order to qualify for LIS – Transfer of assets is not an issue – $1, 500 deduction for burial expenses – Cash Surrender Value of a life insurance policy 21

Determining Countable Resources for LIS • Resources: cash or other assets the individual owns that could convert to cash to be used for his or her support and maintenance • SSI resource exclusions used to determine LIS (HI 03030. 20), with some exceptions: – Non-liquid resource, other than real property – PASS whose sole purpose is to exclude income and resources in order to qualify for LIS – Transfer of assets is not an issue – $1, 500 deduction for burial expenses – Cash Surrender Value of a life insurance policy 21

CWIC Role: Low Income Subsidy • Identify beneficiaries who could be eligible for a LIS • Identify beneficiaries who are currently eligible for a LIS and verify eligibility • Understand the effect of work on qualifying for LIS • Explain to beneficiaries how their work goal will affect LIS • Provide counseling and information to help beneficiaries make informed choices 22

CWIC Role: Low Income Subsidy • Identify beneficiaries who could be eligible for a LIS • Identify beneficiaries who are currently eligible for a LIS and verify eligibility • Understand the effect of work on qualifying for LIS • Explain to beneficiaries how their work goal will affect LIS • Provide counseling and information to help beneficiaries make informed choices 22

CWICs and Medicaid is a critical health insurance for people with disabilities. CWICs must be able to explain to beneficiaries: – What Medicaid is – How to apply for Medicaid – General services covered by Medicaid – How to appeal unfavorable Medicaid decisions – CWICs must be able to advise beneficiaries on the impact of work on their Medicaid eligibility 23

CWICs and Medicaid is a critical health insurance for people with disabilities. CWICs must be able to explain to beneficiaries: – What Medicaid is – How to apply for Medicaid – General services covered by Medicaid – How to appeal unfavorable Medicaid decisions – CWICs must be able to advise beneficiaries on the impact of work on their Medicaid eligibility 23

The Basics of Medicaid A health insurance program created in 1965, authorized by Title XIX of the Social Security Act Funded by a combination of federal and state funds Federal government (Centers for Medicare & Medicaid Services-CMS) set broad guidelines which states must follow in designing their Medicaid program Federal guidelines provide some flexibility (i. e. , who can be eligible and what medical services are covered) and, as a result, every state Medicaid program is different 24

The Basics of Medicaid A health insurance program created in 1965, authorized by Title XIX of the Social Security Act Funded by a combination of federal and state funds Federal government (Centers for Medicare & Medicaid Services-CMS) set broad guidelines which states must follow in designing their Medicaid program Federal guidelines provide some flexibility (i. e. , who can be eligible and what medical services are covered) and, as a result, every state Medicaid program is different 24

Basic Medicaid Eligibility Concepts • Medicaid was designed to provide medical services to certain groups of people who have low income & resources • Applicant must fall under one of the broad categories – People with disabilities, children, families, etc. • Federal laws establish, for each broad group, who can get Medicaid—known as Medicaid Eligibility Groups – States must provide Medicaid to Mandatory Eligibility Groups – States can choose to provide Medicaid to Optional Eligibility Groups 25

Basic Medicaid Eligibility Concepts • Medicaid was designed to provide medical services to certain groups of people who have low income & resources • Applicant must fall under one of the broad categories – People with disabilities, children, families, etc. • Federal laws establish, for each broad group, who can get Medicaid—known as Medicaid Eligibility Groups – States must provide Medicaid to Mandatory Eligibility Groups – States can choose to provide Medicaid to Optional Eligibility Groups 25

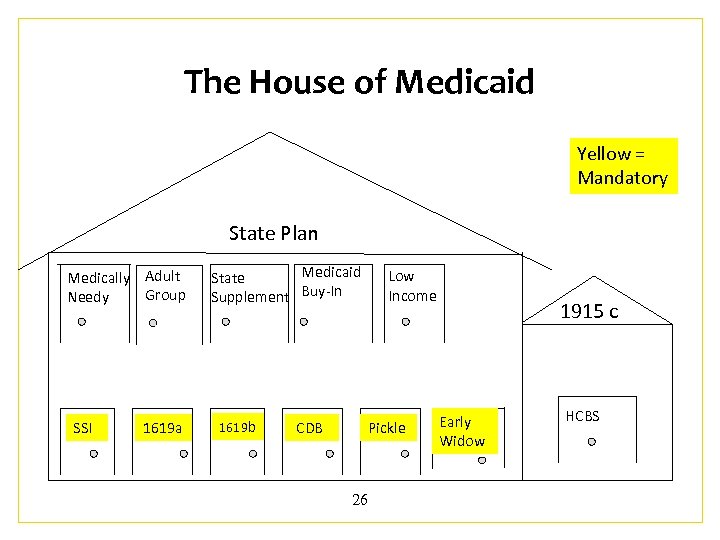

The House of Medicaid Yellow = Mandatory State Plan Medically Adult Group Needy SSI 1619 a Medicaid State Supplement Buy-In 1619 b CDB Low Income Pickle 26 1915 c Early Widow HCBS

The House of Medicaid Yellow = Mandatory State Plan Medically Adult Group Needy SSI 1619 a Medicaid State Supplement Buy-In 1619 b CDB Low Income Pickle 26 1915 c Early Widow HCBS

Mandatory Medicaid Groups • Receiving a SSI cash benefit with earnings (if any) under SGA (1611 status) • 1619(a): receiving SSI cash benefit, earnings above SGA • 1619(b): not receiving SSI cash benefit due to earned income, meet other eligibility criteria • Not all states use SSI eligibility rules. 209(b) states use at least one eligibility requirement that is more stringent than other states 27

Mandatory Medicaid Groups • Receiving a SSI cash benefit with earnings (if any) under SGA (1611 status) • 1619(a): receiving SSI cash benefit, earnings above SGA • 1619(b): not receiving SSI cash benefit due to earned income, meet other eligibility criteria • Not all states use SSI eligibility rules. 209(b) states use at least one eligibility requirement that is more stringent than other states 27

Mandatory Medicaid Groups Continued CDB: Lost eligibility for SSI, 1619 a, or 1619 b status due to increase in or receipt of Social Security Childhood Disability Beneficiary (CDB), Would be eligible for SSI, 1619 a, or 1619 b if not for the receipt or increase in CDB benefit Pickle Eligibility: Had SSI and Title II in at least 1 month; and lost the SSI due to receipt of or increase in Title II, would be SSI eligible if the countable “frozen Title II amount” plus any other countable income is less than the current day Federal Benefit Rate (FBR) Early Widower(s): Lost SSI or state supplement benefit due to mandatory application for and receipt of Title II benefits, Not yet eligible for Medicare Part A, At least age 50 but under 65; and Would continue to be eligible for SSI or state supplement if they were not receiving the Title II benefits 28

Mandatory Medicaid Groups Continued CDB: Lost eligibility for SSI, 1619 a, or 1619 b status due to increase in or receipt of Social Security Childhood Disability Beneficiary (CDB), Would be eligible for SSI, 1619 a, or 1619 b if not for the receipt or increase in CDB benefit Pickle Eligibility: Had SSI and Title II in at least 1 month; and lost the SSI due to receipt of or increase in Title II, would be SSI eligible if the countable “frozen Title II amount” plus any other countable income is less than the current day Federal Benefit Rate (FBR) Early Widower(s): Lost SSI or state supplement benefit due to mandatory application for and receipt of Title II benefits, Not yet eligible for Medicare Part A, At least age 50 but under 65; and Would continue to be eligible for SSI or state supplement if they were not receiving the Title II benefits 28

Optional Medicaid Eligibility Groups Medically Needy: State sets income standard, if beneficiary accrues/incurs sufficient medical expenses to bring their income below the income standard Adult Group: New category under Affordable Care Act State Supplement Eligible: Beneficiaries with countable income over FBR but countable income falls below state’s limit Medicaid Buy-In (name differs by state): People with disabilities who work can buy into Medicaid in most states—each state uses different rules Low-income: Aged or disabled with income up to 100% of FPL Home and Community-Based Services (HCBS) Waiver Eligible: Meet targeted disability group of waiver and require institutional level of care. HCBS waivers pay for services to keep individual out of a nursing home. 29

Optional Medicaid Eligibility Groups Medically Needy: State sets income standard, if beneficiary accrues/incurs sufficient medical expenses to bring their income below the income standard Adult Group: New category under Affordable Care Act State Supplement Eligible: Beneficiaries with countable income over FBR but countable income falls below state’s limit Medicaid Buy-In (name differs by state): People with disabilities who work can buy into Medicaid in most states—each state uses different rules Low-income: Aged or disabled with income up to 100% of FPL Home and Community-Based Services (HCBS) Waiver Eligible: Meet targeted disability group of waiver and require institutional level of care. HCBS waivers pay for services to keep individual out of a nursing home. 29

CWIC Role in Medicaid Counseling • Identify the type of Medicaid and verify eligibility group • Analyze how earnings will impact current Medicaid eligibility and discuss alternatives • Communicate requirements for reporting earnings • Follow up to ensure that the reporting process is complete and eligibility is maintained, if necessary 30

CWIC Role in Medicaid Counseling • Identify the type of Medicaid and verify eligibility group • Analyze how earnings will impact current Medicaid eligibility and discuss alternatives • Communicate requirements for reporting earnings • Follow up to ensure that the reporting process is complete and eligibility is maintained, if necessary 30

Example: Healthcare Counseling • Sally, 22 years old, and has Cerebral Palsy. She is in her senior year of college. • $820. 00 per month in CDB. • Spend-down for Medicaid $100. 00/month • Job goal: Teacher making $24 -30, 000. 00/year • Needs 4 hours/day home health care—not covered through employer-sponsored insurance (cost: $1, 500. 00/month) This may increase once she is employed 31

Example: Healthcare Counseling • Sally, 22 years old, and has Cerebral Palsy. She is in her senior year of college. • $820. 00 per month in CDB. • Spend-down for Medicaid $100. 00/month • Job goal: Teacher making $24 -30, 000. 00/year • Needs 4 hours/day home health care—not covered through employer-sponsored insurance (cost: $1, 500. 00/month) This may increase once she is employed 31

CWIC Role: Advising on Healthcare Options • Sally’s spend-down will increase • Does state have Medicaid buy-in? If not, – Potential tax savings? Health Savings Account (HSA); or – PASS as long-range plan to reach vocational goal and retain Medicaid? – Medicaid waiver services? • Interactions with employer-sponsored coverage? 32

CWIC Role: Advising on Healthcare Options • Sally’s spend-down will increase • Does state have Medicaid buy-in? If not, – Potential tax savings? Health Savings Account (HSA); or – PASS as long-range plan to reach vocational goal and retain Medicaid? – Medicaid waiver services? • Interactions with employer-sponsored coverage? 32

Providing Effective Counseling on Other Federal Benefit Programs and Associated Work Incentives Temporary Assistance for Needy Families (TANF) Supplemental Nutrition Assistance Program (SNAP) Federal Housing Assistance Program (HUD) Unemployment Insurance Program Workers’ Compensation Benefits for Veterans with Disabilities Individual Development Accounts (IDAs) 33

Providing Effective Counseling on Other Federal Benefit Programs and Associated Work Incentives Temporary Assistance for Needy Families (TANF) Supplemental Nutrition Assistance Program (SNAP) Federal Housing Assistance Program (HUD) Unemployment Insurance Program Workers’ Compensation Benefits for Veterans with Disabilities Individual Development Accounts (IDAs) 33

TANF Background & Purpose • TANF - Created in 1996 under the Personal Responsibility and Work Opportunities Act – Replaced Aid to Families with Dependent Children (AFDC) – Shift from long-term support to transitional support • Purpose of TANF is to help low income families by providing: – Temporary income – Help going to work • Federal program administered by states – Few federal requirements – States have lots of flexibility in designing program 34

TANF Background & Purpose • TANF - Created in 1996 under the Personal Responsibility and Work Opportunities Act – Replaced Aid to Families with Dependent Children (AFDC) – Shift from long-term support to transitional support • Purpose of TANF is to help low income families by providing: – Temporary income – Help going to work • Federal program administered by states – Few federal requirements – States have lots of flexibility in designing program 34

TANF and SSI Interactions • Those receiving SSI may not be included in the TANF financial assistance unit • Many states have programs to help TANF recipients apply for SSI. If single parent becomes eligible for SSI, the child-only unit will be: – Exempt from 60 -month time limit (child only TANF) – The parent (no longer TANF eligible) won’t have to meet work requirements 35

TANF and SSI Interactions • Those receiving SSI may not be included in the TANF financial assistance unit • Many states have programs to help TANF recipients apply for SSI. If single parent becomes eligible for SSI, the child-only unit will be: – Exempt from 60 -month time limit (child only TANF) – The parent (no longer TANF eligible) won’t have to meet work requirements 35

TANF and SSDI Interactions • SSDI generally not excluded from assistance unit – States may vary on how it is counted – TANF generally counts all SSDI as unearned income – Dependents of SSDI beneficiaries often get Social Security Dependent benefits (may be over income for TANF) 36

TANF and SSDI Interactions • SSDI generally not excluded from assistance unit – States may vary on how it is counted – TANF generally counts all SSDI as unearned income – Dependents of SSDI beneficiaries often get Social Security Dependent benefits (may be over income for TANF) 36

TANF Income-Related Work Incentives • Some states provide entire TANF grant (benefit) if income below limit, other states adjust TANF grant amount based on family’s income • Almost all states exempt a certain portion of wages or work expenses from income tests – significant state variance • Most states provide or pay for all or part of child care needed to reach work goal. • Clothing allowance, vehicle repair reimbursement, and travel mileage reimbursement are examples of some incentives available to help TANF recipients overcome barriers to employment 37

TANF Income-Related Work Incentives • Some states provide entire TANF grant (benefit) if income below limit, other states adjust TANF grant amount based on family’s income • Almost all states exempt a certain portion of wages or work expenses from income tests – significant state variance • Most states provide or pay for all or part of child care needed to reach work goal. • Clothing allowance, vehicle repair reimbursement, and travel mileage reimbursement are examples of some incentives available to help TANF recipients overcome barriers to employment 37

SNAP Background and Purpose • • A program of the US Department of Agriculture Formerly known as Food Stamps Federal program with basic rules/some state flexibility Basic eligibility criteria: – Income, resources below limit (20% deduction from earned income) – Meet work requirement • Special exceptions for people with disabilities (Ex: no work requirement) 38

SNAP Background and Purpose • • A program of the US Department of Agriculture Formerly known as Food Stamps Federal program with basic rules/some state flexibility Basic eligibility criteria: – Income, resources below limit (20% deduction from earned income) – Meet work requirement • Special exceptions for people with disabilities (Ex: no work requirement) 38

SNAP Work Incentives and Income Deductions • 20% deduction off of earned income • Standard deduction: Amount depends on size of the household • Dependent care deduction (necessary for work, training, or education) • Medical expenses (non-reimbursed) of more than $35 per month for elderly or disabled • Court ordered child support payments to non-household members • A portion of shelter and utility costs 39

SNAP Work Incentives and Income Deductions • 20% deduction off of earned income • Standard deduction: Amount depends on size of the household • Dependent care deduction (necessary for work, training, or education) • Medical expenses (non-reimbursed) of more than $35 per month for elderly or disabled • Court ordered child support payments to non-household members • A portion of shelter and utility costs 39

SNAP Exceptions • Income limit exceptions for people with disabilities – No income test if all members of household receive SSI – Elderly/disabled households only have to meet the net income standard – Funds set aside in a PASS are excluded from income • Resource limit exceptions for people with disabilities – Resource limit is $3, 250 if person with a disability (or person over 60) is in the household – Resources of SSI eligible individual doesn’t count 40

SNAP Exceptions • Income limit exceptions for people with disabilities – No income test if all members of household receive SSI – Elderly/disabled households only have to meet the net income standard – Funds set aside in a PASS are excluded from income • Resource limit exceptions for people with disabilities – Resource limit is $3, 250 if person with a disability (or person over 60) is in the household – Resources of SSI eligible individual doesn’t count 40

Housing & Urban Development (HUD) Subsidies • Offers low income people a safe and affordable place to live • Public Housing Authorities (PHAs) • Three main types – Public Housing – Tenant-Based Section 8 (Housing Choice Voucher) – Project-Based Section 8 Rental Assistance • Also: Supportive Housing for the Elderly and Persons with Disabilities, Housing Opportunities for People with AIDS (HOPWA), Other project-based subsidies 41

Housing & Urban Development (HUD) Subsidies • Offers low income people a safe and affordable place to live • Public Housing Authorities (PHAs) • Three main types – Public Housing – Tenant-Based Section 8 (Housing Choice Voucher) – Project-Based Section 8 Rental Assistance • Also: Supportive Housing for the Elderly and Persons with Disabilities, Housing Opportunities for People with AIDS (HOPWA), Other project-based subsidies 41

Annual Income, Exclusions, & Deductions • Annual Income: income before any exclusions or deductions apply – No resource limit, but includes income derived from assets or percentage of value • Exclusions include: – Earnings for children under 18 – Amount excluded under a PASS – Incremental earnings/benefits from participation in qualifying state or local employment training program • Deductions include: – $400 for household that includes a person with a disability 42

Annual Income, Exclusions, & Deductions • Annual Income: income before any exclusions or deductions apply – No resource limit, but includes income derived from assets or percentage of value • Exclusions include: – Earnings for children under 18 – Amount excluded under a PASS – Incremental earnings/benefits from participation in qualifying state or local employment training program • Deductions include: – $400 for household that includes a person with a disability 42

Earned Income Disregard (EID) • Applies to all tenants in Public Housing Programs and to tenants with disabilities in four additional types of Housing Subsidy Programs. – 100% of earned income is disregarded in calculating rental liability for first 12 months of employment – 50% of earned income is disregarded next 12 months – Certain requirements and restrictions exist – The disallowance of increased income is limited to a lifetime 48 -month period. – Can only be used to disregard earned income of family member with disability in four additional programs. 43

Earned Income Disregard (EID) • Applies to all tenants in Public Housing Programs and to tenants with disabilities in four additional types of Housing Subsidy Programs. – 100% of earned income is disregarded in calculating rental liability for first 12 months of employment – 50% of earned income is disregarded next 12 months – Certain requirements and restrictions exist – The disallowance of increased income is limited to a lifetime 48 -month period. – Can only be used to disregard earned income of family member with disability in four additional programs. 43

Individual Savings Account • Applicable to Individuals in Public Housing • PHA will deposit the total amount that would have been calculated as increased tenant resulting from increased earned income into an interest-bearing savings account. • Tenant family may only withdraw moneys from account for: – Purchasing a home; – Paying the education costs of a family member; – Moving from public or assisted housing; – Expenses approved by PHA to promote self-sufficiency • If family moves, PHA pays the family any balance in the account, minus any amounts owed to the PHA. 44

Individual Savings Account • Applicable to Individuals in Public Housing • PHA will deposit the total amount that would have been calculated as increased tenant resulting from increased earned income into an interest-bearing savings account. • Tenant family may only withdraw moneys from account for: – Purchasing a home; – Paying the education costs of a family member; – Moving from public or assisted housing; – Expenses approved by PHA to promote self-sufficiency • If family moves, PHA pays the family any balance in the account, minus any amounts owed to the PHA. 44

Family Self Sufficiency Account • Available in public housing or those with Housing Choice Vouchers – Two components: case management and escrow account. Opportunities for education, job training, and counseling, and services such as child care and transportation assistance. – PHAs deposit funds into account. The amount of the contribution depends on family's original income level. § When family successfully completes the program, family receives full amount. § Family receives no funds if program is not successfully completed. 45

Family Self Sufficiency Account • Available in public housing or those with Housing Choice Vouchers – Two components: case management and escrow account. Opportunities for education, job training, and counseling, and services such as child care and transportation assistance. – PHAs deposit funds into account. The amount of the contribution depends on family's original income level. § When family successfully completes the program, family receives full amount. § Family receives no funds if program is not successfully completed. 45

CWIC Role in HUD Programs • Myriad of federal housing programs make this a complex area for benefits counseling • CWICS must learn about the basic programs outlined in the manual • Take that knowledge and learn about all of the programs locally • Build relationships with housing staff • Verify housing subsidies and work incentives in use • Communicate the reporting process to beneficiaries • Advocate for the use of the work incentive programs • Offer pro-active information about the ability, in some cases, to save toward school, buying their own home, or opening their own business. • Use the Benefits Summary and Analysis (BS&A) and Work Incentives Plan (WIP) to project immediate and long-term benefits and impact to the beneficiary’s housing situation 46

CWIC Role in HUD Programs • Myriad of federal housing programs make this a complex area for benefits counseling • CWICS must learn about the basic programs outlined in the manual • Take that knowledge and learn about all of the programs locally • Build relationships with housing staff • Verify housing subsidies and work incentives in use • Communicate the reporting process to beneficiaries • Advocate for the use of the work incentive programs • Offer pro-active information about the ability, in some cases, to save toward school, buying their own home, or opening their own business. • Use the Benefits Summary and Analysis (BS&A) and Work Incentives Plan (WIP) to project immediate and long-term benefits and impact to the beneficiary’s housing situation 46

Unemployment Insurance • Provides temporary and partial replacement of income to eligible individuals who lose their jobs due to no fault of their own. • Program goals: – to prevent individuals from experiencing severe financial hardships; and – to provide time for individuals to find work again. • Unemployment Insurance is not means-tested…it is insurance! 47

Unemployment Insurance • Provides temporary and partial replacement of income to eligible individuals who lose their jobs due to no fault of their own. • Program goals: – to prevent individuals from experiencing severe financial hardships; and – to provide time for individuals to find work again. • Unemployment Insurance is not means-tested…it is insurance! 47

UI Eligibility Criteria • • Sufficient amount of recent work in covered employment Lost their job “through no-fault of their own” Actively seeking employment Available for work and able to work Willing to accept a suitable position when one is offered Meet the state specific eligibility requirements Have no disqualifying factors 48

UI Eligibility Criteria • • Sufficient amount of recent work in covered employment Lost their job “through no-fault of their own” Actively seeking employment Available for work and able to work Willing to accept a suitable position when one is offered Meet the state specific eligibility requirements Have no disqualifying factors 48

Challenges CWICs Encounter with Unemployment Insurance: “able to work” • In some cases, UI staff state that an Social Security disability beneficiary has "proved" that they are unable to work and UI is denied based on the "assumption" that they are not eligible. A review of state statutes does not substantiate this, but a beneficiary may face this when filing a claim. • Some states have language in their state code to eliminate this problem. • If denied on the basis of “not able to work" because of disability, the beneficiary should file an appeal. 49

Challenges CWICs Encounter with Unemployment Insurance: “able to work” • In some cases, UI staff state that an Social Security disability beneficiary has "proved" that they are unable to work and UI is denied based on the "assumption" that they are not eligible. A review of state statutes does not substantiate this, but a beneficiary may face this when filing a claim. • Some states have language in their state code to eliminate this problem. • If denied on the basis of “not able to work" because of disability, the beneficiary should file an appeal. 49

Interaction Between UI and Disability Benefits • • UI is considered to be unearned income No impact on the Title II disability cash benefit All but $20 counted against SSI If UI causes the SSI recipient to lose eligibility, the recipient moves into suspension, rather than into 1619 B. • Unemployment Insurance IS a work incentive! Similar to Expedited Reinstatement, UI provides a safety net for those who are concerned about what happens if they lose their job after Social Security cash benefits end 50

Interaction Between UI and Disability Benefits • • UI is considered to be unearned income No impact on the Title II disability cash benefit All but $20 counted against SSI If UI causes the SSI recipient to lose eligibility, the recipient moves into suspension, rather than into 1619 B. • Unemployment Insurance IS a work incentive! Similar to Expedited Reinstatement, UI provides a safety net for those who are concerned about what happens if they lose their job after Social Security cash benefits end 50

CWIC Role and UI • Verify receipt of payment and length of eligibility period before offering specific advisement • Understand state-specific rules • Advocate by providing information and resources, ex: “able to work, ” appeals process, etc. • Consider all sources of income in family- Ex: spouse of SSI recipient receives UI (Ripple effect) • Facilitate connections with supports and services to return to work 51

CWIC Role and UI • Verify receipt of payment and length of eligibility period before offering specific advisement • Understand state-specific rules • Advocate by providing information and resources, ex: “able to work, ” appeals process, etc. • Consider all sources of income in family- Ex: spouse of SSI recipient receives UI (Ripple effect) • Facilitate connections with supports and services to return to work 51

CWICs Must Understand: Workers’ Compensation (WC) • Provides medical treatment for work-related injury/illness • Provides cash payments that partially replace lost wages • Other Public Disability Benefits (PDB) – Periodic benefit payment – Paid under a Federal, State, or local law or plan – Paid to worker’s who have a temporary or permanent disability 52

CWICs Must Understand: Workers’ Compensation (WC) • Provides medical treatment for work-related injury/illness • Provides cash payments that partially replace lost wages • Other Public Disability Benefits (PDB) – Periodic benefit payment – Paid under a Federal, State, or local law or plan – Paid to worker’s who have a temporary or permanent disability 52

WC/PDB Details • Usually affected by work • May reduce SSDI payments to worker or dependent family members (some states have reverse offset) • Total of SSDI and WC/PDB cannot exceed 80% of current average earnings before becoming disabled • Treated as unearned income for SSI purposes • May offer resources for rehabilitation • Beneficiary over age 62 may wish to switch to early retirement, because there is no WC/PDB offset 53

WC/PDB Details • Usually affected by work • May reduce SSDI payments to worker or dependent family members (some states have reverse offset) • Total of SSDI and WC/PDB cannot exceed 80% of current average earnings before becoming disabled • Treated as unearned income for SSI purposes • May offer resources for rehabilitation • Beneficiary over age 62 may wish to switch to early retirement, because there is no WC/PDB offset 53

CWICs Must Understand: Veterans Benefits • The Veterans Benefits Administration (VBA) oversees all of the federal benefit programs available to veterans and their family members. The programs include monetary benefits such as Disability Compensation and Disability Pension as well as vocational rehabilitation services, educational assistance, life insurance, home loans programs, and other special services. • Disability compensation: paid to veterans who are disabled by an injury or disease that was incurred or aggravated during active military service. (service-connected) – an entitlement program; not means-tested • Disability Pension: needs-based benefit paid to a veteran because of permanent and total nonservice-connected (NSC) disability, or a surviving spouse or child because of a wartime veteran’s nonserviceconnected death. 54

CWICs Must Understand: Veterans Benefits • The Veterans Benefits Administration (VBA) oversees all of the federal benefit programs available to veterans and their family members. The programs include monetary benefits such as Disability Compensation and Disability Pension as well as vocational rehabilitation services, educational assistance, life insurance, home loans programs, and other special services. • Disability compensation: paid to veterans who are disabled by an injury or disease that was incurred or aggravated during active military service. (service-connected) – an entitlement program; not means-tested • Disability Pension: needs-based benefit paid to a veteran because of permanent and total nonservice-connected (NSC) disability, or a surviving spouse or child because of a wartime veteran’s nonserviceconnected death. 54

CWICs Must Explain: VA Benefits, Employment and Social Security • Disability Compensation: not affected by earned income. Could affect disability rating • Disability Pension: all income is counted. Includes Title II but not SSI. Self-employment income may be reduced by operating expenses. Reduced dollar for dollar • Title II: Social Security does not count Veterans Administration (VA) benefits paid under Title 38 U. S. C. This exclusion covers both the Disability Compensation and Disability Pension programs • SSI: eligibility for SSI or the SSI payment amount would be affected by receipt of VA disability benefits (unearned income). SSI disregards any portion of Disability Compensation payment that is a VA Aid and Attendance Allowance or Housebound Allowance or unusual medical expenses. $20. 00 General Income Exclusion does not apply (if Veteran’s assistance based on need). 55

CWICs Must Explain: VA Benefits, Employment and Social Security • Disability Compensation: not affected by earned income. Could affect disability rating • Disability Pension: all income is counted. Includes Title II but not SSI. Self-employment income may be reduced by operating expenses. Reduced dollar for dollar • Title II: Social Security does not count Veterans Administration (VA) benefits paid under Title 38 U. S. C. This exclusion covers both the Disability Compensation and Disability Pension programs • SSI: eligibility for SSI or the SSI payment amount would be affected by receipt of VA disability benefits (unearned income). SSI disregards any portion of Disability Compensation payment that is a VA Aid and Attendance Allowance or Housebound Allowance or unusual medical expenses. $20. 00 General Income Exclusion does not apply (if Veteran’s assistance based on need). 55

CWIC Role in Advising Veterans • CWICs must: – Verify the benefits received through the VA for both veterans and family members. Know eligibility criteria and encourage Veterans to apply if potentially eligible. – Understand how employment affects each benefit, and potential effect on disability rating – Communicate the interactions between Social Security disability benefits and VA benefits (including compensated work therapy) – Advise on how to properly report and document employment to both Social Security and VA 56

CWIC Role in Advising Veterans • CWICs must: – Verify the benefits received through the VA for both veterans and family members. Know eligibility criteria and encourage Veterans to apply if potentially eligible. – Understand how employment affects each benefit, and potential effect on disability rating – Communicate the interactions between Social Security disability benefits and VA benefits (including compensated work therapy) – Advise on how to properly report and document employment to both Social Security and VA 56

Individual Development Accounts (IDAs) • Special savings accounts for individuals and families with low incomes: – Participants save earned income on a regular basis in a special account – Savings earmarked for purchase of a specific asset – Matching funds provided to grow the savings, and acquire an economic asset for the long term. • Federal vs. non-federal IDAs: treated differently by the SSI program 57

Individual Development Accounts (IDAs) • Special savings accounts for individuals and families with low incomes: – Participants save earned income on a regular basis in a special account – Savings earmarked for purchase of a specific asset – Matching funds provided to grow the savings, and acquire an economic asset for the long term. • Federal vs. non-federal IDAs: treated differently by the SSI program 57

Asset Goals AFI or TANF Federal IDAs: – Acquire a first home – Access higher education or training – Start or support a new or existing small business 58

Asset Goals AFI or TANF Federal IDAs: – Acquire a first home – Access higher education or training – Start or support a new or existing small business 58

Social Security Disability Program Rules Promoting Participation in AFI IDAs • Participating in an AFI IDA – or any IDA - has no negative impact on eligibility or payment of benefits for Title II beneficiaries • SSI: funds set aside in an AFI IDA are NOT counted as either income or resources in determining (1) eligibility and (2) payment amount. – IDA disbursement for qualified asset purchases (home, education, self-employment) excluded – Emergency withdrawals are considered loans and therefore not counted as income – SSI program rules allow for deducting AFI and TANF earnings contributions directly from countable earnings or net earnings from self-employment 59

Social Security Disability Program Rules Promoting Participation in AFI IDAs • Participating in an AFI IDA – or any IDA - has no negative impact on eligibility or payment of benefits for Title II beneficiaries • SSI: funds set aside in an AFI IDA are NOT counted as either income or resources in determining (1) eligibility and (2) payment amount. – IDA disbursement for qualified asset purchases (home, education, self-employment) excluded – Emergency withdrawals are considered loans and therefore not counted as income – SSI program rules allow for deducting AFI and TANF earnings contributions directly from countable earnings or net earnings from self-employment 59

IDAs and PASS: Promotes self-sufficiency through employment. In some cases this may mean a PASS to save for and purchase assets needed for work. In other cases, it may mean using a PASS to pay for services or supports needed to work. IDA: Promotes self-sufficiency through accumulating savings & acquiring assets that grow in value over time. While employment outcome is not required, IDAs support assets that help people prepare for and go to work! 60

IDAs and PASS: Promotes self-sufficiency through employment. In some cases this may mean a PASS to save for and purchase assets needed for work. In other cases, it may mean using a PASS to pay for services or supports needed to work. IDA: Promotes self-sufficiency through accumulating savings & acquiring assets that grow in value over time. While employment outcome is not required, IDAs support assets that help people prepare for and go to work! 60

CWIC Role: Facilitating the Use of IDAs 1. Identifying and researching the details of the IDA programs available in each state 2. Building relationships and partnerships with the IDA grantees 3. Identifying ideal candidates for IDA Participation 4. Providing adequate information and supporting beneficiaries to consider IDAs as a valuable option to help them meet their goals 5. Supporting beneficiary participation in IDAs and financial literacy training over time 61

CWIC Role: Facilitating the Use of IDAs 1. Identifying and researching the details of the IDA programs available in each state 2. Building relationships and partnerships with the IDA grantees 3. Identifying ideal candidates for IDA Participation 4. Providing adequate information and supporting beneficiaries to consider IDAs as a valuable option to help them meet their goals 5. Supporting beneficiary participation in IDAs and financial literacy training over time 61

Benefits Counseling Other Federal Benefits • CWICs must provide information about the impact of earnings on ALL other Federal programs to beneficiaries. They must: – Know the federal requirements – Know the state-specific details • Verify benefits before offering specific advisement 62

Benefits Counseling Other Federal Benefits • CWICs must provide information about the impact of earnings on ALL other Federal programs to beneficiaries. They must: – Know the federal requirements – Know the state-specific details • Verify benefits before offering specific advisement 62

Strategies for CWIC Success • Get to know an expert in the local administering office • Find the online program rules policy manual and use it as a reference often • Share programmatic information • Communicate the myths & mishaps to beneficiaries • Offer proactive information • Discuss issues in the BS&A and the WIP 63

Strategies for CWIC Success • Get to know an expert in the local administering office • Find the online program rules policy manual and use it as a reference often • Share programmatic information • Communicate the myths & mishaps to beneficiaries • Offer proactive information • Discuss issues in the BS&A and the WIP 63

Benefits Counseling: The Big Picture • Informed choice – Present options – Emphasis on outcome – Look at “bottom line”: better off financially? – Holistic counseling: putting the pieces together – Ripple effect: consider whole family – Options other than public benefits • Proactive Counseling- identify critical transition points: – When there will be a change in a benefit – How this change will affect other benefits – What protections are available if a change in employment occurs 64

Benefits Counseling: The Big Picture • Informed choice – Present options – Emphasis on outcome – Look at “bottom line”: better off financially? – Holistic counseling: putting the pieces together – Ripple effect: consider whole family – Options other than public benefits • Proactive Counseling- identify critical transition points: – When there will be a change in a benefit – How this change will affect other benefits – What protections are available if a change in employment occurs 64