955f93693e230b0913b5fca3b255c147.ppt

- Количество слайдов: 29

Wills, Trusts, APT’s & Stuff “Who me, worry? ” By Rick Kahler, MS, CFP™ Kahler Financial Group

Wills, Trusts, APT’s & Stuff “Who me, worry? ” By Rick Kahler, MS, CFP™ Kahler Financial Group

Another Estate Planning Seminar • • • How ‘bout them Bears? What’s happened to the Vikings? Is the stock market near a high? When will the real estate bubble burst? Will it be Hillary or Rudy in 2008?

Another Estate Planning Seminar • • • How ‘bout them Bears? What’s happened to the Vikings? Is the stock market near a high? When will the real estate bubble burst? Will it be Hillary or Rudy in 2008?

Let’s Talk About Anything… …except about death.

Let’s Talk About Anything… …except about death.

“OK, Kahler. . . I’ll Get Around To It…” …he never did

“OK, Kahler. . . I’ll Get Around To It…” …he never did

Why Do So Many Not Have Wills? • Four people I interviewed in four months – All had net worth’s of $1 million to $4 million – Most had a spouse and children None had a will

Why Do So Many Not Have Wills? • Four people I interviewed in four months – All had net worth’s of $1 million to $4 million – Most had a spouse and children None had a will

Why Don’t We Plan For Death? • • • Too much pain around death Money scripts…. . I don’t have enough to be worried about I’ll let those living figure it out Planning is too complicated or expensive

Why Don’t We Plan For Death? • • • Too much pain around death Money scripts…. . I don’t have enough to be worried about I’ll let those living figure it out Planning is too complicated or expensive

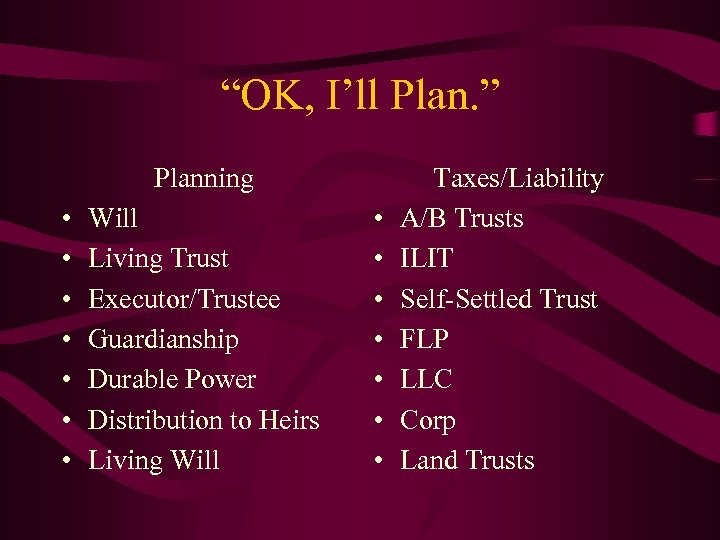

“OK, I’ll Plan. ” Planning • • Will Living Trust Executor/Trustee Guardianship Durable Power Distribution to Heirs Living Will • • Taxes/Liability A/B Trusts ILIT Self-Settled Trust FLP LLC Corp Land Trusts

“OK, I’ll Plan. ” Planning • • Will Living Trust Executor/Trustee Guardianship Durable Power Distribution to Heirs Living Will • • Taxes/Liability A/B Trusts ILIT Self-Settled Trust FLP LLC Corp Land Trusts

Understand the Terminology • Decedent – the guy who died • Executor – the person in charge of ‘executing’ the instructions of the will • Trustee – the person in charge of carrying out the instructions of a trust • Grantor, Settlor, Creator – the person who establishes a trust

Understand the Terminology • Decedent – the guy who died • Executor – the person in charge of ‘executing’ the instructions of the will • Trustee – the person in charge of carrying out the instructions of a trust • Grantor, Settlor, Creator – the person who establishes a trust

Understand the Terminology • Testamentary Trust – a trust created by a will at death • Probate – a public proceeding before a judge that governs the distribution of an estate passed by a will • Joint Tenancy – an interest in property where title automatically passes to the other owners • Tenants in common – an interest in property where title is passed only by a will

Understand the Terminology • Testamentary Trust – a trust created by a will at death • Probate – a public proceeding before a judge that governs the distribution of an estate passed by a will • Joint Tenancy – an interest in property where title automatically passes to the other owners • Tenants in common – an interest in property where title is passed only by a will

“OK, OK…What Should I Do? Get started, today.

“OK, OK…What Should I Do? Get started, today.

Everyone Needs A Will • • • Guardianship Executor/Trustee Durable Power Distribution to Heirs Even If You Use A Living Trust

Everyone Needs A Will • • • Guardianship Executor/Trustee Durable Power Distribution to Heirs Even If You Use A Living Trust

Who Needs A Living Trust? • • • To Avoid Probate Your Final Distribution To Remains Private Faster Disposition Of Assets Don’t Mind Retitling All You Own real estate, a large estate, business

Who Needs A Living Trust? • • • To Avoid Probate Your Final Distribution To Remains Private Faster Disposition Of Assets Don’t Mind Retitling All You Own real estate, a large estate, business

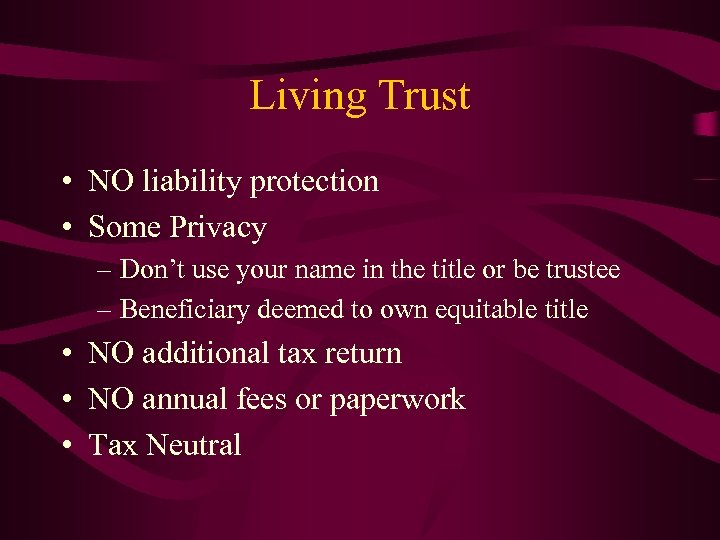

Living Trust • NO liability protection • Some Privacy – Don’t use your name in the title or be trustee – Beneficiary deemed to own equitable title • NO additional tax return • NO annual fees or paperwork • Tax Neutral

Living Trust • NO liability protection • Some Privacy – Don’t use your name in the title or be trustee – Beneficiary deemed to own equitable title • NO additional tax return • NO annual fees or paperwork • Tax Neutral

Do I Need To Worry About Taxes? • Will there be a chance your estate will be over $2, 000 when you die? • Don’t forget – Inheritances – life insurance policies

Do I Need To Worry About Taxes? • Will there be a chance your estate will be over $2, 000 when you die? • Don’t forget – Inheritances – life insurance policies

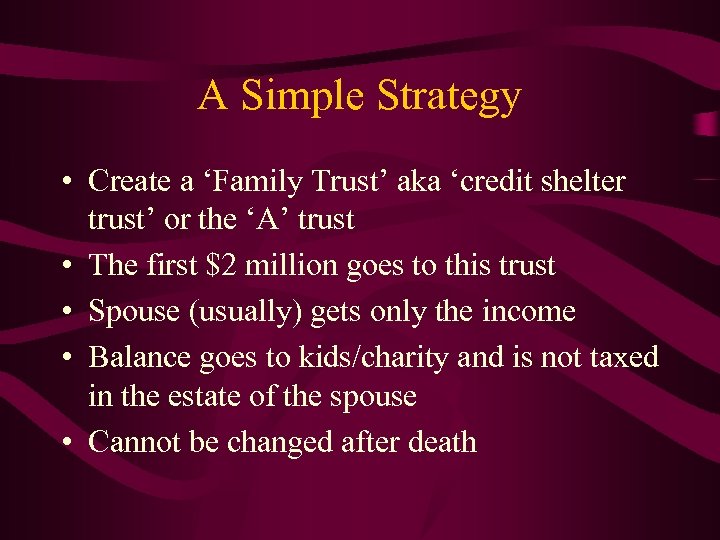

A Simple Strategy • Create a ‘Family Trust’ aka ‘credit shelter trust’ or the ‘A’ trust • The first $2 million goes to this trust • Spouse (usually) gets only the income • Balance goes to kids/charity and is not taxed in the estate of the spouse • Cannot be changed after death

A Simple Strategy • Create a ‘Family Trust’ aka ‘credit shelter trust’ or the ‘A’ trust • The first $2 million goes to this trust • Spouse (usually) gets only the income • Balance goes to kids/charity and is not taxed in the estate of the spouse • Cannot be changed after death

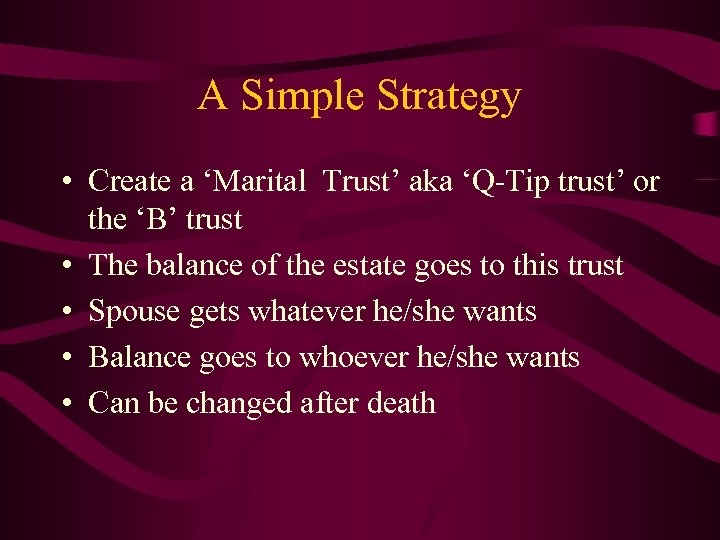

A Simple Strategy • Create a ‘Marital Trust’ aka ‘Q-Tip trust’ or the ‘B’ trust • The balance of the estate goes to this trust • Spouse gets whatever he/she wants • Balance goes to whoever he/she wants • Can be changed after death

A Simple Strategy • Create a ‘Marital Trust’ aka ‘Q-Tip trust’ or the ‘B’ trust • The balance of the estate goes to this trust • Spouse gets whatever he/she wants • Balance goes to whoever he/she wants • Can be changed after death

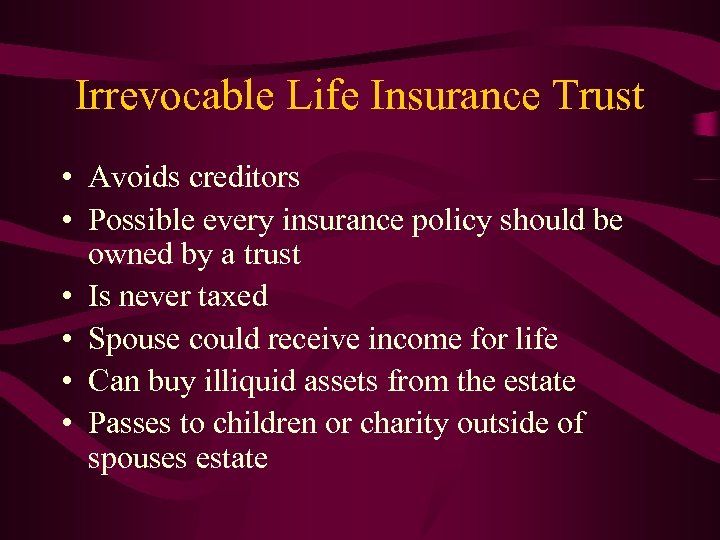

Irrevocable Life Insurance Trust • Avoids creditors • Possible every insurance policy should be owned by a trust • Is never taxed • Spouse could receive income for life • Can buy illiquid assets from the estate • Passes to children or charity outside of spouses estate

Irrevocable Life Insurance Trust • Avoids creditors • Possible every insurance policy should be owned by a trust • Is never taxed • Spouse could receive income for life • Can buy illiquid assets from the estate • Passes to children or charity outside of spouses estate

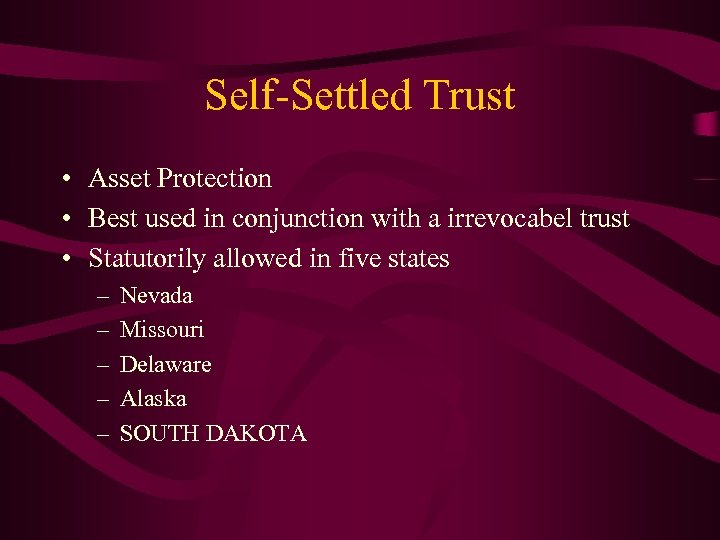

Self-Settled Trust • Asset Protection • Best used in conjunction with a irrevocabel trust • Statutorily allowed in five states – – – Nevada Missouri Delaware Alaska SOUTH DAKOTA

Self-Settled Trust • Asset Protection • Best used in conjunction with a irrevocabel trust • Statutorily allowed in five states – – – Nevada Missouri Delaware Alaska SOUTH DAKOTA

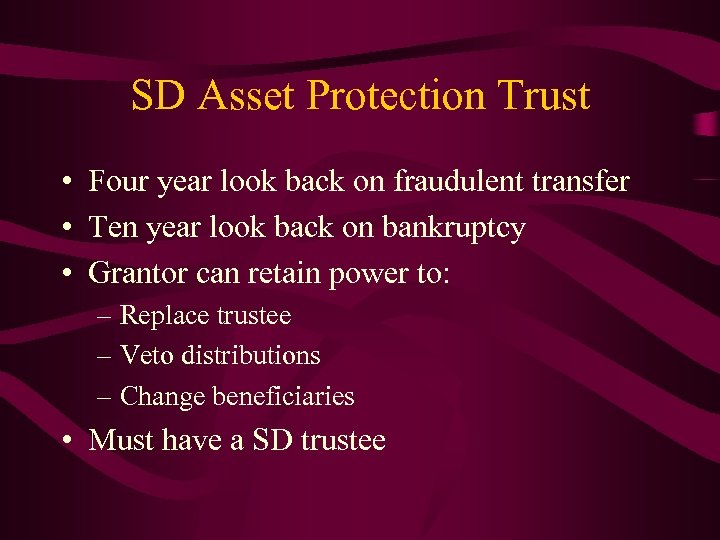

SD Asset Protection Trust • Four year look back on fraudulent transfer • Ten year look back on bankruptcy • Grantor can retain power to: – Replace trustee – Veto distributions – Change beneficiaries • Must have a SD trustee

SD Asset Protection Trust • Four year look back on fraudulent transfer • Ten year look back on bankruptcy • Grantor can retain power to: – Replace trustee – Veto distributions – Change beneficiaries • Must have a SD trustee

Family Limited Partnership (FLP) • • • Liability protection for limited partners No liability protection for general partners General partner usually a corporation Additional tax return Annual fees but no meeting Tax neutral

Family Limited Partnership (FLP) • • • Liability protection for limited partners No liability protection for general partners General partner usually a corporation Additional tax return Annual fees but no meeting Tax neutral

Family Limited Partnership (FLP) • General Partner is corporation – Receives a 1 to 10% interest – Shares of corp owned by parents • Limited Partners get 45 to 49% each – Typically owned by parents • Limited shares are gifted to kids by parents • General Partner controls FLP • Upon death, shares are valued at market which is typically 25 to 75% under asset value

Family Limited Partnership (FLP) • General Partner is corporation – Receives a 1 to 10% interest – Shares of corp owned by parents • Limited Partners get 45 to 49% each – Typically owned by parents • Limited shares are gifted to kids by parents • General Partner controls FLP • Upon death, shares are valued at market which is typically 25 to 75% under asset value

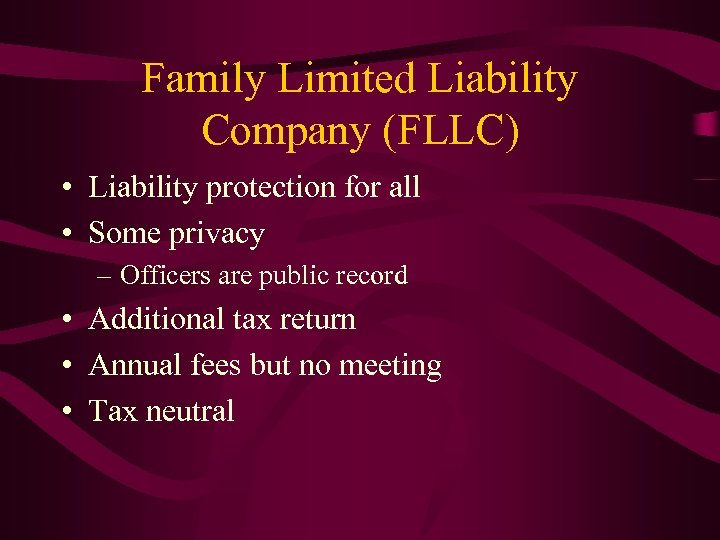

Family Limited Liability Company (FLLC) • Liability protection for all • Some privacy – Officers are public record • Additional tax return • Annual fees but no meeting • Tax neutral

Family Limited Liability Company (FLLC) • Liability protection for all • Some privacy – Officers are public record • Additional tax return • Annual fees but no meeting • Tax neutral

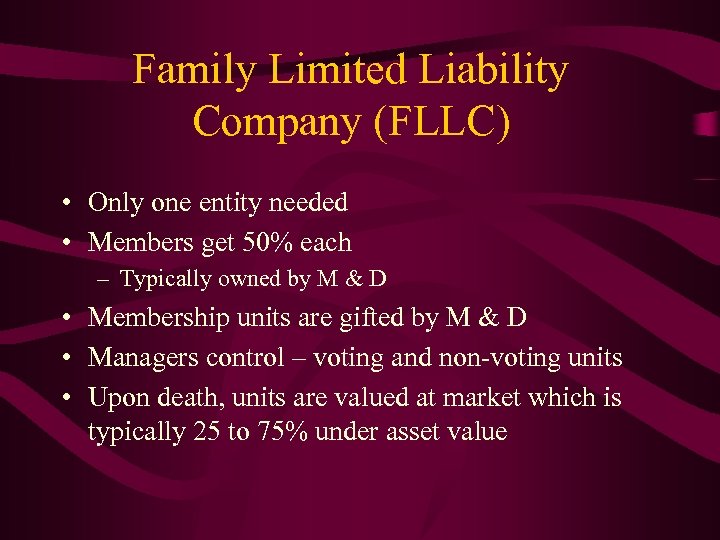

Family Limited Liability Company (FLLC) • Only one entity needed • Members get 50% each – Typically owned by M & D • Membership units are gifted by M & D • Managers control – voting and non-voting units • Upon death, units are valued at market which is typically 25 to 75% under asset value

Family Limited Liability Company (FLLC) • Only one entity needed • Members get 50% each – Typically owned by M & D • Membership units are gifted by M & D • Managers control – voting and non-voting units • Upon death, units are valued at market which is typically 25 to 75% under asset value

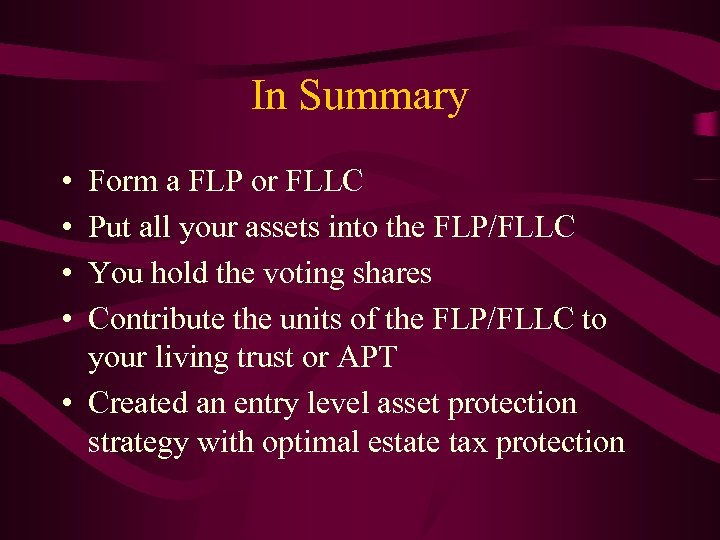

In Summary • • Form a FLP or FLLC Put all your assets into the FLP/FLLC You hold the voting shares Contribute the units of the FLP/FLLC to your living trust or APT • Created an entry level asset protection strategy with optimal estate tax protection

In Summary • • Form a FLP or FLLC Put all your assets into the FLP/FLLC You hold the voting shares Contribute the units of the FLP/FLLC to your living trust or APT • Created an entry level asset protection strategy with optimal estate tax protection

Asset Protection Fundamentals • Own nothing in your own name • Use a variety of entities – Trusts, LLCs, Corps, FLPs • In a variety of states

Asset Protection Fundamentals • Own nothing in your own name • Use a variety of entities – Trusts, LLCs, Corps, FLPs • In a variety of states

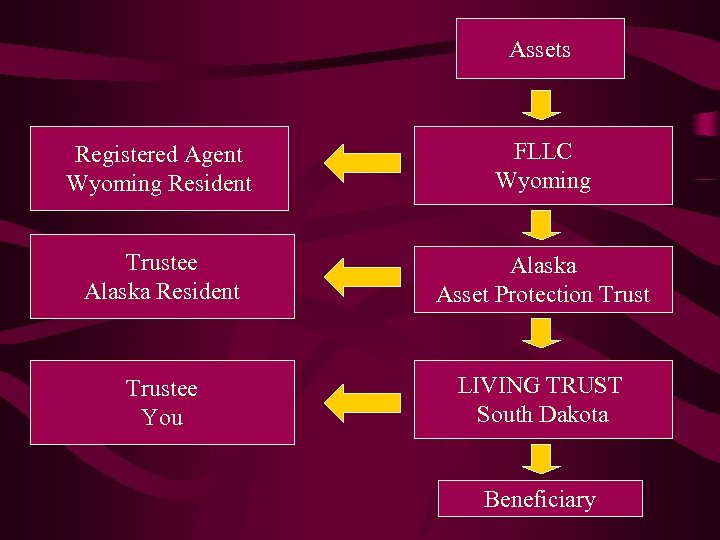

Assets Registered Agent Wyoming Resident FLLC Wyoming Trustee Alaska Resident Alaska Asset Protection Trustee You LIVING TRUST South Dakota Beneficiary

Assets Registered Agent Wyoming Resident FLLC Wyoming Trustee Alaska Resident Alaska Asset Protection Trustee You LIVING TRUST South Dakota Beneficiary

This Is Just The Beginning • • • Don’t try this at home The devil is in the details Educate yourself Use an attorney Use an accountant

This Is Just The Beginning • • • Don’t try this at home The devil is in the details Educate yourself Use an attorney Use an accountant

Our 30 Years of Experience Runs Deep • • • Operate multiple businesses With over 40 employees Instruct nationally and internationally Columnist for 10 years Several financial and real estate degrees – CFP™, Ch. FC, CCIM, GAA – Masters in Wealth Management

Our 30 Years of Experience Runs Deep • • • Operate multiple businesses With over 40 employees Instruct nationally and internationally Columnist for 10 years Several financial and real estate degrees – CFP™, Ch. FC, CCIM, GAA – Masters in Wealth Management

Our Broad Experience Means: • • We give you tried applications, not theory You learn from our experiences We see the bigger picture We know the answers to the questions you don’t ask • You get better, more balanced advice.

Our Broad Experience Means: • • We give you tried applications, not theory You learn from our experiences We see the bigger picture We know the answers to the questions you don’t ask • You get better, more balanced advice.