099a22399e119ea172bae3ff84e2d2ad.ppt

- Количество слайдов: 51

William H. Widen 1

William H. Widen 1

Secured Transactions Assignment 15 The Prototype Secured Transaction 2

Secured Transactions Assignment 15 The Prototype Secured Transaction 2

The Big Picture Part One: The Creditor-Debtor Relationship Chapter 1 -2: Creditors’ remedies Chapter 3: Creation and scope of security interests Chapter 4: Default Acceleration and Cure Chapter 5: The Prototypical Secured Transaction Part Two: The Creditor Third Party Relationship 3

The Big Picture Part One: The Creditor-Debtor Relationship Chapter 1 -2: Creditors’ remedies Chapter 3: Creation and scope of security interests Chapter 4: Default Acceleration and Cure Chapter 5: The Prototypical Secured Transaction Part Two: The Creditor Third Party Relationship 3

The Big Picture Part One: The Creditor-Debtor Relationship Chapter 1 -2: Creditors’ remedies Chapter 3: Creation and scope of security interests Chapter 4: Default Acceleration and Cure Chapter 5: The Prototypical Secured Transaction Part Two: The Creditor Third Party Relationship 4

The Big Picture Part One: The Creditor-Debtor Relationship Chapter 1 -2: Creditors’ remedies Chapter 3: Creation and scope of security interests Chapter 4: Default Acceleration and Cure Chapter 5: The Prototypical Secured Transaction Part Two: The Creditor Third Party Relationship 4

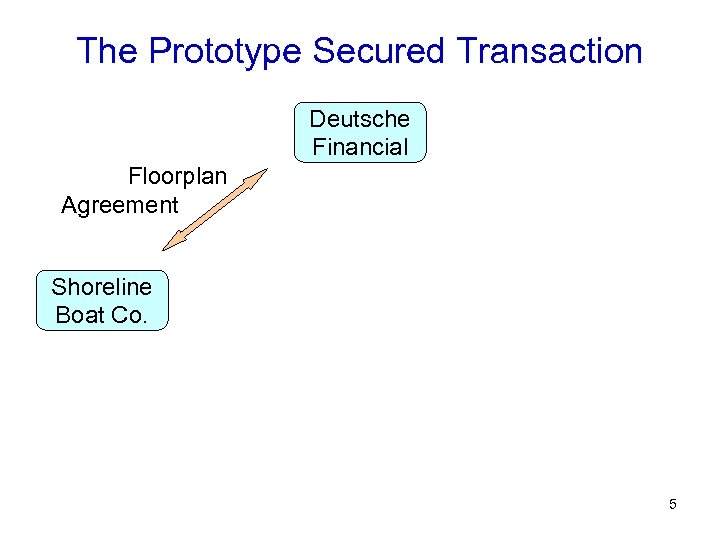

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. 5

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. 5

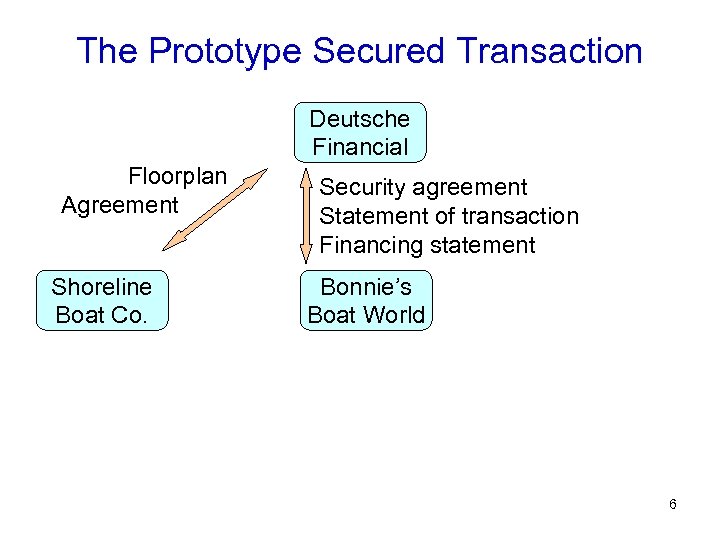

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. Security agreement Statement of transaction Financing statement Bonnie’s Boat World 6

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. Security agreement Statement of transaction Financing statement Bonnie’s Boat World 6

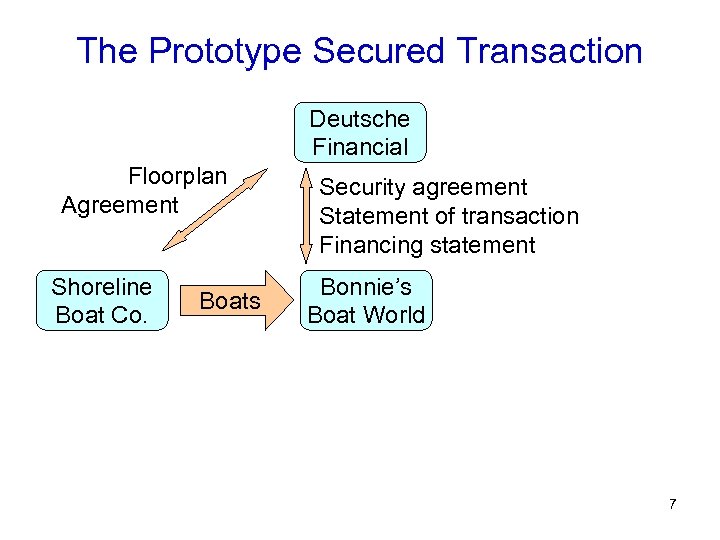

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. Boats Security agreement Statement of transaction Financing statement Bonnie’s Boat World 7

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. Boats Security agreement Statement of transaction Financing statement Bonnie’s Boat World 7

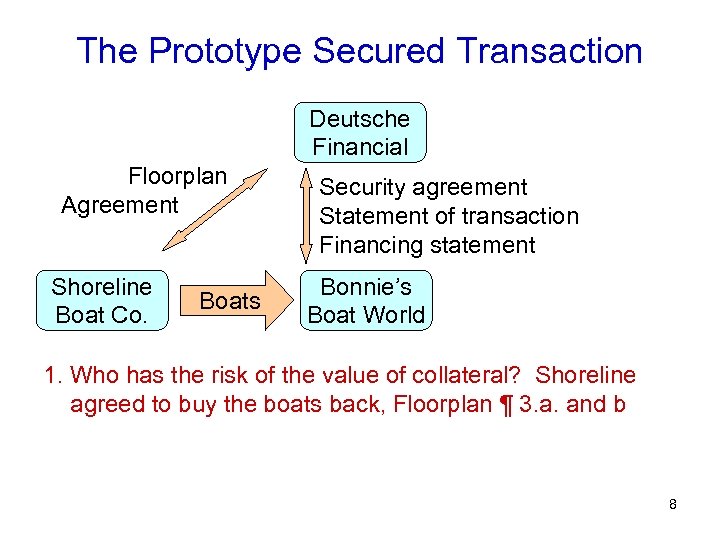

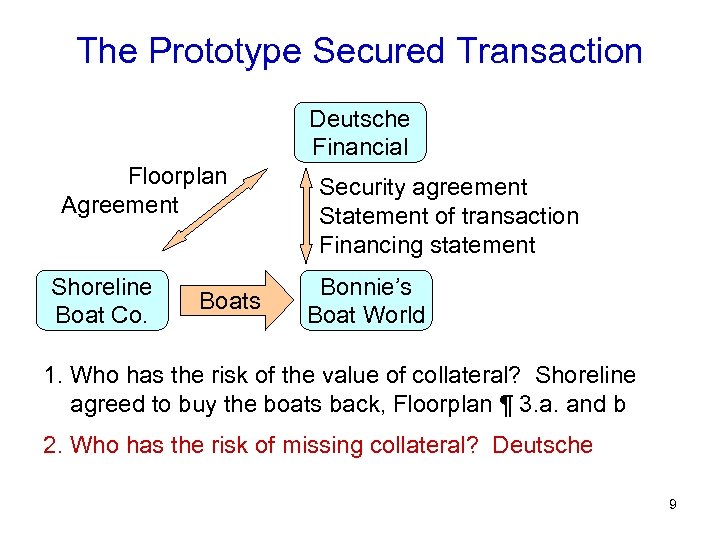

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. Boats Security agreement Statement of transaction Financing statement Bonnie’s Boat World 1. Who has the risk of the value of collateral? Shoreline agreed to buy the boats back, Floorplan ¶ 3. a. and b 8

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. Boats Security agreement Statement of transaction Financing statement Bonnie’s Boat World 1. Who has the risk of the value of collateral? Shoreline agreed to buy the boats back, Floorplan ¶ 3. a. and b 8

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. Boats Security agreement Statement of transaction Financing statement Bonnie’s Boat World 1. Who has the risk of the value of collateral? Shoreline agreed to buy the boats back, Floorplan ¶ 3. a. and b 2. Who has the risk of missing collateral? Deutsche 9

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. Boats Security agreement Statement of transaction Financing statement Bonnie’s Boat World 1. Who has the risk of the value of collateral? Shoreline agreed to buy the boats back, Floorplan ¶ 3. a. and b 2. Who has the risk of missing collateral? Deutsche 9

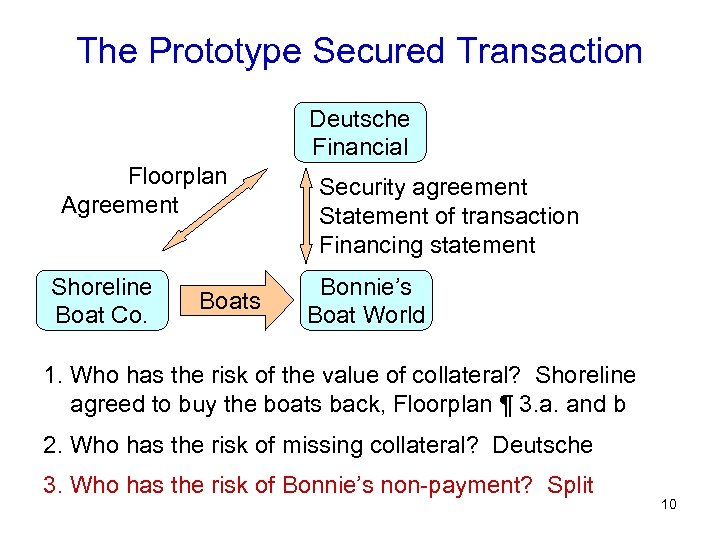

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. Boats Security agreement Statement of transaction Financing statement Bonnie’s Boat World 1. Who has the risk of the value of collateral? Shoreline agreed to buy the boats back, Floorplan ¶ 3. a. and b 2. Who has the risk of missing collateral? Deutsche 3. Who has the risk of Bonnie’s non-payment? Split 10

The Prototype Secured Transaction Deutsche Financial Floorplan Agreement Shoreline Boat Co. Boats Security agreement Statement of transaction Financing statement Bonnie’s Boat World 1. Who has the risk of the value of collateral? Shoreline agreed to buy the boats back, Floorplan ¶ 3. a. and b 2. Who has the risk of missing collateral? Deutsche 3. Who has the risk of Bonnie’s non-payment? Split 10

The Prototype Secured Transaction Deutsche Financial First State Bank Bonnie’s Boat World Gladys Homer Floorplan Agreement Shoreline Boat Co. Boats 1. Who has the risk of the value of collateral? Shoreline agreed to buy the boats back, Floorplan ¶ 3. a. and b 2. Who has the risk of missing collateral? Deutsche 3. Who has the risk of Bonnie’s non-payment? Split 11

The Prototype Secured Transaction Deutsche Financial First State Bank Bonnie’s Boat World Gladys Homer Floorplan Agreement Shoreline Boat Co. Boats 1. Who has the risk of the value of collateral? Shoreline agreed to buy the boats back, Floorplan ¶ 3. a. and b 2. Who has the risk of missing collateral? Deutsche 3. Who has the risk of Bonnie’s non-payment? Split 11

![Problem 15. 1, page 268 [Read problem] This is “field warehousing. ” Do you Problem 15. 1, page 268 [Read problem] This is “field warehousing. ” Do you](https://present5.com/presentation/099a22399e119ea172bae3ff84e2d2ad/image-12.jpg) Problem 15. 1, page 268 [Read problem] This is “field warehousing. ” Do you see any problems? 12

Problem 15. 1, page 268 [Read problem] This is “field warehousing. ” Do you see any problems? 12

![Problem 15. 1, page 268 [Read problem] This is “field warehousing. ” Do you Problem 15. 1, page 268 [Read problem] This is “field warehousing. ” Do you](https://present5.com/presentation/099a22399e119ea172bae3ff84e2d2ad/image-13.jpg) Problem 15. 1, page 268 [Read problem] This is “field warehousing. ” Do you see any problems? 13

Problem 15. 1, page 268 [Read problem] This is “field warehousing. ” Do you see any problems? 13

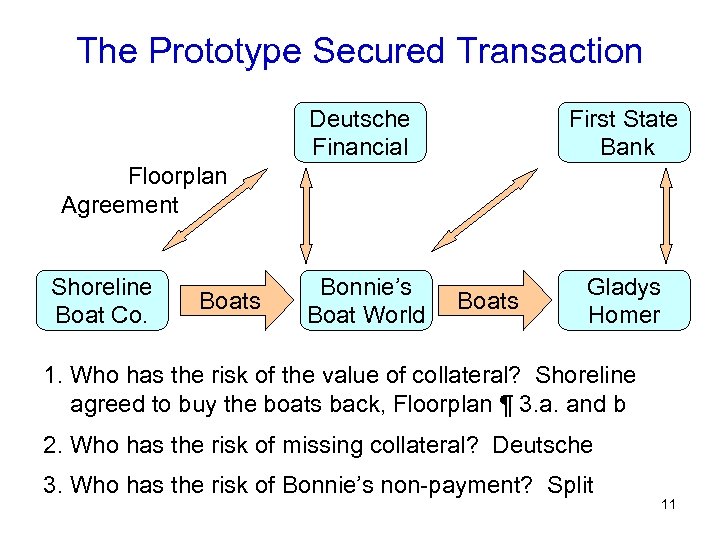

Problem 15. 1, page 268 The Great Salad Oil Swindle November 1963. 1. The oil is floating on top of water. 2. An underground pumping system moves the salad oil ahead of the floor checkers Tino De Angelis stands amid steamy clouds in his New Jersey refinery. 14

Problem 15. 1, page 268 The Great Salad Oil Swindle November 1963. 1. The oil is floating on top of water. 2. An underground pumping system moves the salad oil ahead of the floor checkers Tino De Angelis stands amid steamy clouds in his New Jersey refinery. 14

Problem 15. 1, page 268 The Great Salad Oil Swindle November 1963. 1. The oil is floating on top of water. 2. An underground pumping system moves the salad oil ahead of the floor checkers Tino De Angelis stands amid steamy clouds in his New Jersey refinery. 15

Problem 15. 1, page 268 The Great Salad Oil Swindle November 1963. 1. The oil is floating on top of water. 2. An underground pumping system moves the salad oil ahead of the floor checkers Tino De Angelis stands amid steamy clouds in his New Jersey refinery. 15

Problem 15. 1, page 268 The Great Salad Oil Swindle November 1963. 1. The oil is floating on top of water. 2. An underground pumping system moves the salad oil ahead of the floor checkers Tino De Angelis stands amid steamy clouds in his New Jersey refinery. 16

Problem 15. 1, page 268 The Great Salad Oil Swindle November 1963. 1. The oil is floating on top of water. 2. An underground pumping system moves the salad oil ahead of the floor checkers Tino De Angelis stands amid steamy clouds in his New Jersey refinery. 16

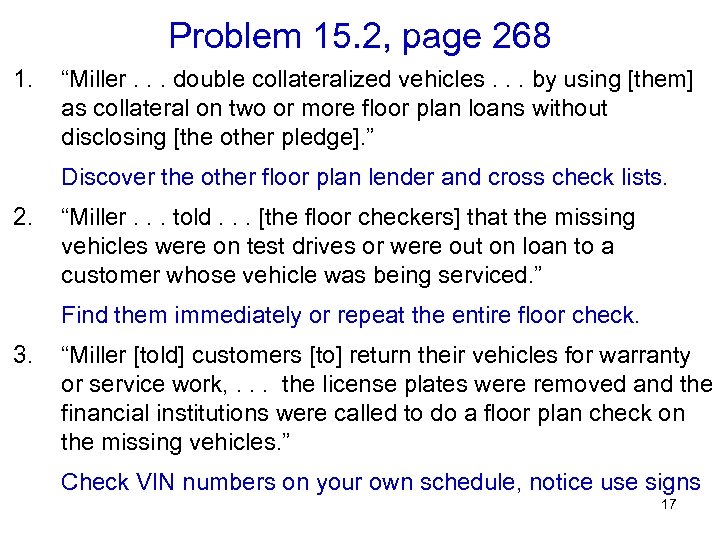

Problem 15. 2, page 268 1. “Miller. . . double collateralized vehicles. . . by using [them] as collateral on two or more floor plan loans without disclosing [the other pledge]. ” Discover the other floor plan lender and cross check lists. 2. “Miller. . . told. . . [the floor checkers] that the missing vehicles were on test drives or were out on loan to a customer whose vehicle was being serviced. ” Find them immediately or repeat the entire floor check. 3. “Miller [told] customers [to] return their vehicles for warranty or service work, . . . the license plates were removed and the financial institutions were called to do a floor plan check on the missing vehicles. ” Check VIN numbers on your own schedule, notice use signs 17

Problem 15. 2, page 268 1. “Miller. . . double collateralized vehicles. . . by using [them] as collateral on two or more floor plan loans without disclosing [the other pledge]. ” Discover the other floor plan lender and cross check lists. 2. “Miller. . . told. . . [the floor checkers] that the missing vehicles were on test drives or were out on loan to a customer whose vehicle was being serviced. ” Find them immediately or repeat the entire floor check. 3. “Miller [told] customers [to] return their vehicles for warranty or service work, . . . the license plates were removed and the financial institutions were called to do a floor plan check on the missing vehicles. ” Check VIN numbers on your own schedule, notice use signs 17

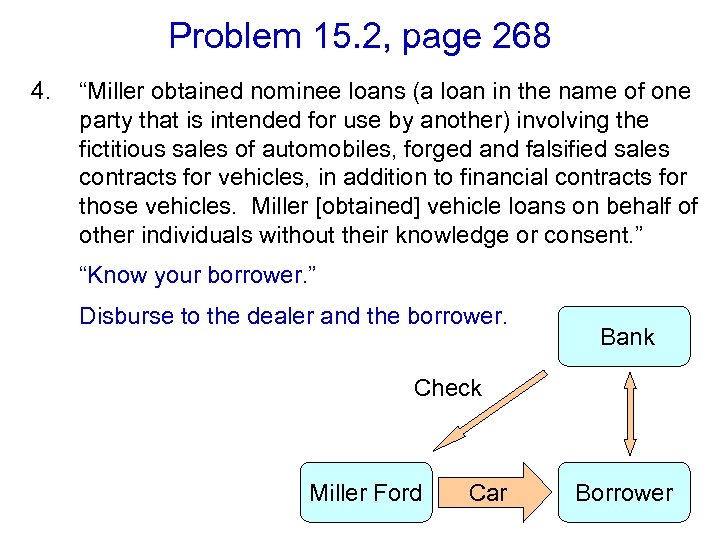

Problem 15. 2, page 268 4. “Miller obtained nominee loans (a loan in the name of one party that is intended for use by another) involving the fictitious sales of automobiles, forged and falsified sales contracts for vehicles, in addition to financial contracts for those vehicles. Miller [obtained] vehicle loans on behalf of other individuals without their knowledge or consent. ” “Know your borrower. ” Disburse to the dealer and the borrower. Bank Check Miller Ford Car Borrower 18

Problem 15. 2, page 268 4. “Miller obtained nominee loans (a loan in the name of one party that is intended for use by another) involving the fictitious sales of automobiles, forged and falsified sales contracts for vehicles, in addition to financial contracts for those vehicles. Miller [obtained] vehicle loans on behalf of other individuals without their knowledge or consent. ” “Know your borrower. ” Disburse to the dealer and the borrower. Bank Check Miller Ford Car Borrower 18

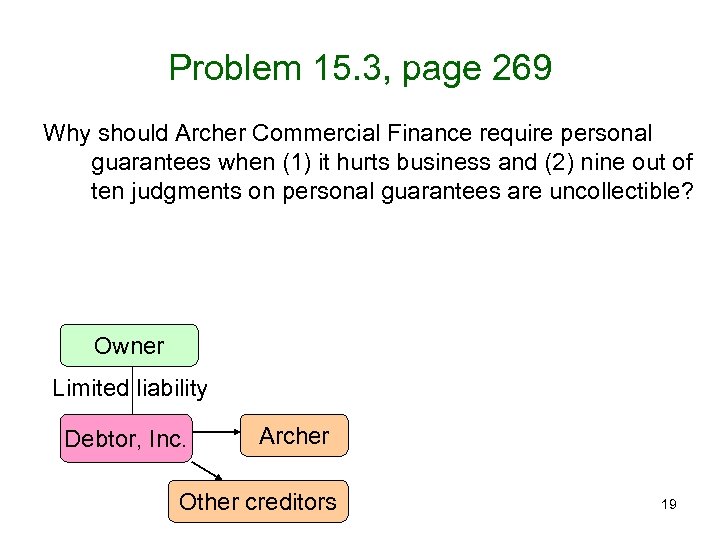

Problem 15. 3, page 269 Why should Archer Commercial Finance require personal guarantees when (1) it hurts business and (2) nine out of ten judgments on personal guarantees are uncollectible? Owner Limited liability Debtor, Inc. Archer Other creditors 19

Problem 15. 3, page 269 Why should Archer Commercial Finance require personal guarantees when (1) it hurts business and (2) nine out of ten judgments on personal guarantees are uncollectible? Owner Limited liability Debtor, Inc. Archer Other creditors 19

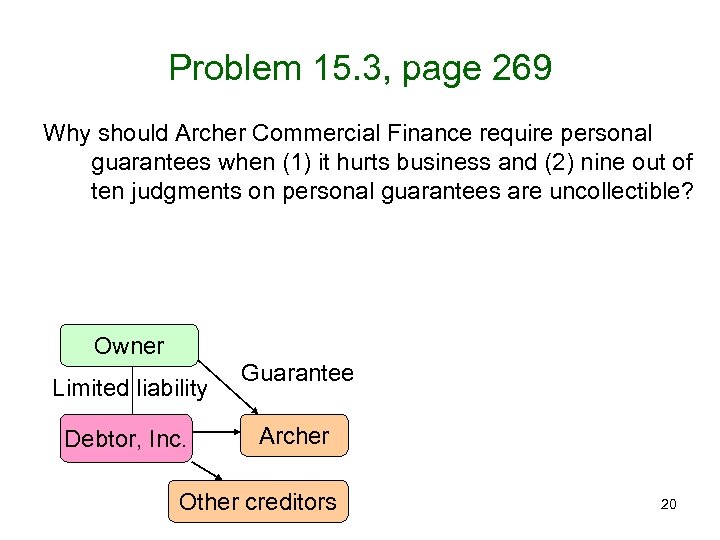

Problem 15. 3, page 269 Why should Archer Commercial Finance require personal guarantees when (1) it hurts business and (2) nine out of ten judgments on personal guarantees are uncollectible? Owner Limited liability Debtor, Inc. Guarantee Archer Other creditors 20

Problem 15. 3, page 269 Why should Archer Commercial Finance require personal guarantees when (1) it hurts business and (2) nine out of ten judgments on personal guarantees are uncollectible? Owner Limited liability Debtor, Inc. Guarantee Archer Other creditors 20

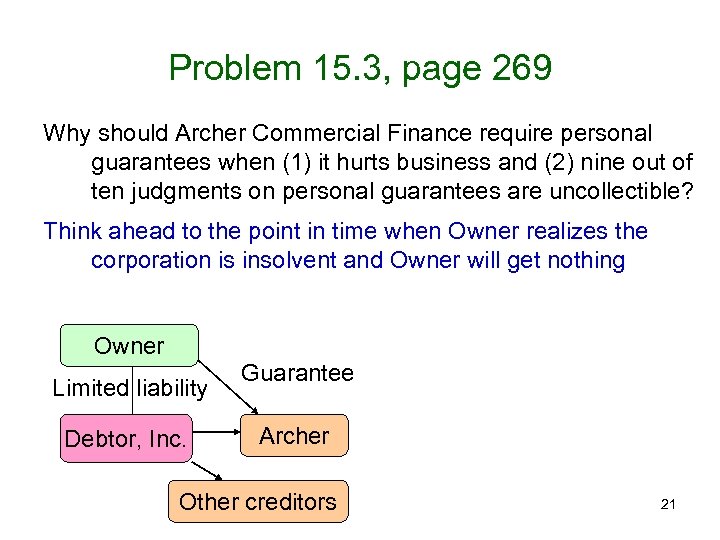

Problem 15. 3, page 269 Why should Archer Commercial Finance require personal guarantees when (1) it hurts business and (2) nine out of ten judgments on personal guarantees are uncollectible? Think ahead to the point in time when Owner realizes the corporation is insolvent and Owner will get nothing Owner Limited liability Debtor, Inc. Guarantee Archer Other creditors 21

Problem 15. 3, page 269 Why should Archer Commercial Finance require personal guarantees when (1) it hurts business and (2) nine out of ten judgments on personal guarantees are uncollectible? Think ahead to the point in time when Owner realizes the corporation is insolvent and Owner will get nothing Owner Limited liability Debtor, Inc. Guarantee Archer Other creditors 21

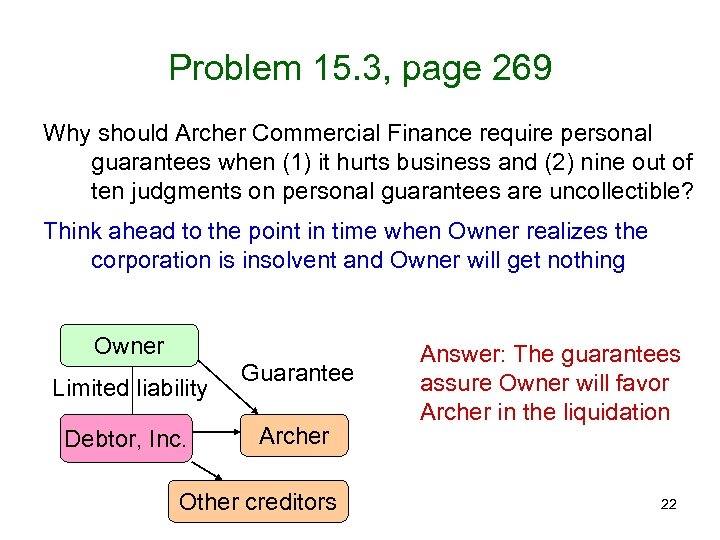

Problem 15. 3, page 269 Why should Archer Commercial Finance require personal guarantees when (1) it hurts business and (2) nine out of ten judgments on personal guarantees are uncollectible? Think ahead to the point in time when Owner realizes the corporation is insolvent and Owner will get nothing Owner Limited liability Debtor, Inc. Guarantee Archer Other creditors Answer: The guarantees assure Owner will favor Archer in the liquidation 22

Problem 15. 3, page 269 Why should Archer Commercial Finance require personal guarantees when (1) it hurts business and (2) nine out of ten judgments on personal guarantees are uncollectible? Think ahead to the point in time when Owner realizes the corporation is insolvent and Owner will get nothing Owner Limited liability Debtor, Inc. Guarantee Archer Other creditors Answer: The guarantees assure Owner will favor Archer in the liquidation 22

![Problem 15. 4, page 270 [Read problem] a. Does Deutsche have the right to Problem 15. 4, page 270 [Read problem] a. Does Deutsche have the right to](https://present5.com/presentation/099a22399e119ea172bae3ff84e2d2ad/image-23.jpg) Problem 15. 4, page 270 [Read problem] a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. If Bonnie surrenders the boats, what will Deutsche do? Seek deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 23

Problem 15. 4, page 270 [Read problem] a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. If Bonnie surrenders the boats, what will Deutsche do? Seek deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 23

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. If Bonnie surrenders the boats, what will Deutsche do? Seek deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 24

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. If Bonnie surrenders the boats, what will Deutsche do? Seek deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 24

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. If Bonnie surrenders the boats, what will Deutsche do? Seek deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 25

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. If Bonnie surrenders the boats, what will Deutsche do? Seek deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 25

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. Assume Bonnie has surrendered the boats. Should Deutsche seek a deficiency? How long can Bonnie keep the boats? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 26

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. Assume Bonnie has surrendered the boats. Should Deutsche seek a deficiency? How long can Bonnie keep the boats? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 26

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. Assume Bonnie has surrendered the boats. Should Deutsche seek a deficiency? Seek criminal prosecution? Ill. Rev. Stat. 9 -315. 01. It is unlawful for a debtor. . . who has a right of sale. . . and is to account to the secured party for the proceeds. . . to sell. . . and willfully and wrongfully fail to pay the secured party the amount of said proceeds due under the security agreement. Failure to pay such proceeds. . . within 10 days after the sale. . . is prima facia evidence of a willful and wanton failure to pay. [Such conduct is a Class 3 felony. ] 27

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. Assume Bonnie has surrendered the boats. Should Deutsche seek a deficiency? Seek criminal prosecution? Ill. Rev. Stat. 9 -315. 01. It is unlawful for a debtor. . . who has a right of sale. . . and is to account to the secured party for the proceeds. . . to sell. . . and willfully and wrongfully fail to pay the secured party the amount of said proceeds due under the security agreement. Failure to pay such proceeds. . . within 10 days after the sale. . . is prima facia evidence of a willful and wanton failure to pay. [Such conduct is a Class 3 felony. ] 27

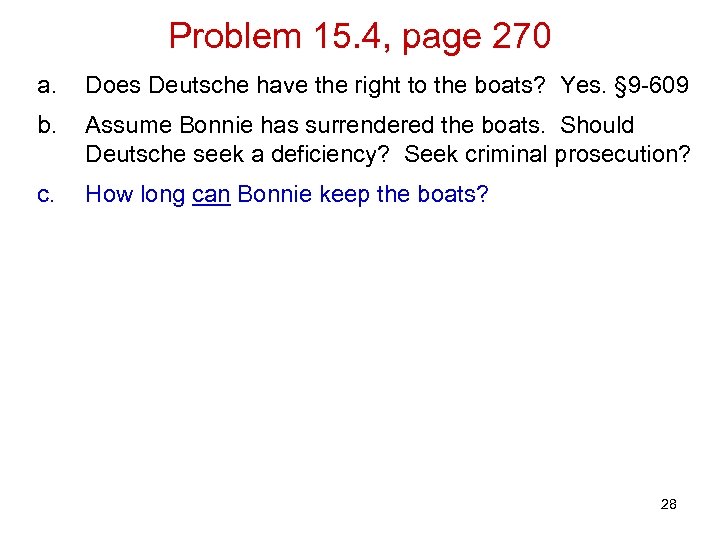

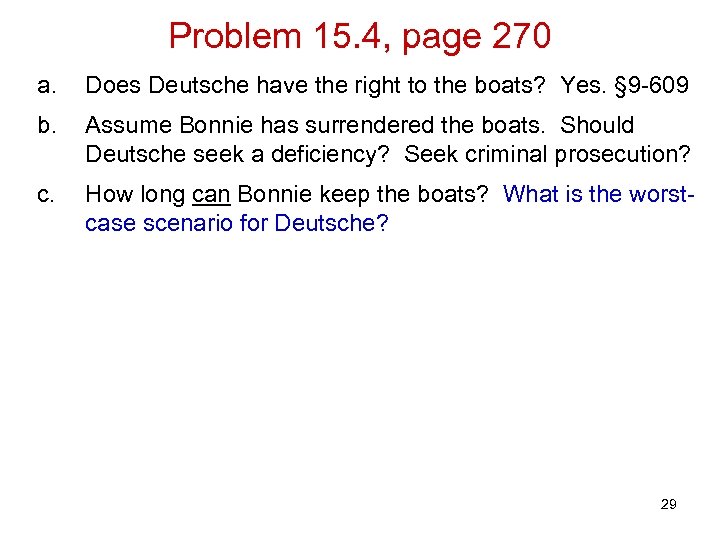

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. Assume Bonnie has surrendered the boats. Should Deutsche seek a deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 28

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. Assume Bonnie has surrendered the boats. Should Deutsche seek a deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 28

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. Assume Bonnie has surrendered the boats. Should Deutsche seek a deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? What is the worstcase scenario for Deutsche? 29

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. Assume Bonnie has surrendered the boats. Should Deutsche seek a deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? What is the worstcase scenario for Deutsche? 29

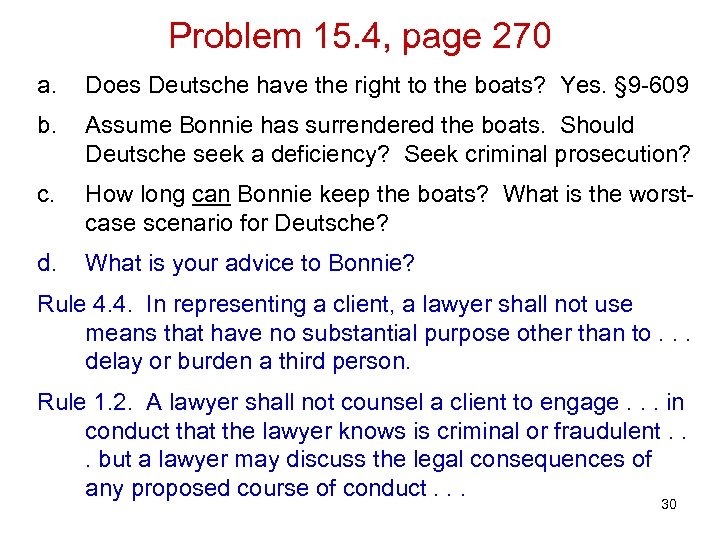

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. Assume Bonnie has surrendered the boats. Should Deutsche seek a deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? What is the worstcase scenario for Deutsche? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 30

Problem 15. 4, page 270 a. Does Deutsche have the right to the boats? Yes. § 9 -609 b. Assume Bonnie has surrendered the boats. Should Deutsche seek a deficiency? Seek criminal prosecution? c. How long can Bonnie keep the boats? What is the worstcase scenario for Deutsche? d. What is your advice to Bonnie? Rule 4. 4. In representing a client, a lawyer shall not use means that have no substantial purpose other than to. . . delay or burden a third person. Rule 1. 2. A lawyer shall not counsel a client to engage. . . in conduct that the lawyer knows is criminal or fraudulent. . . but a lawyer may discuss the legal consequences of any proposed course of conduct. . . 30

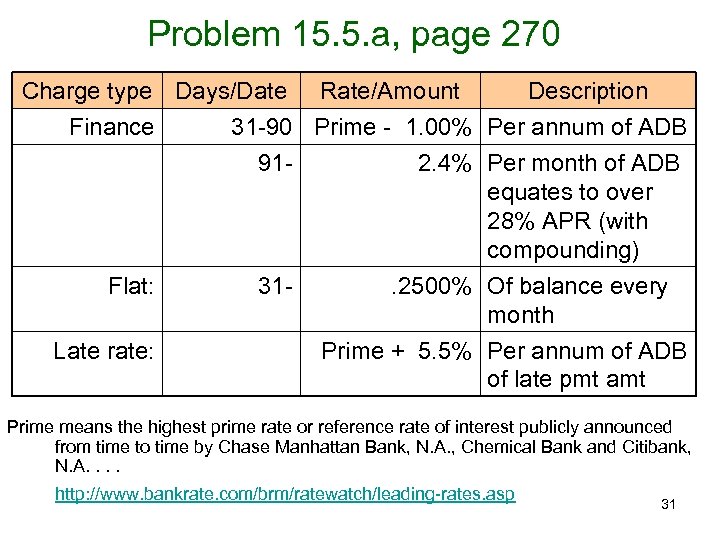

Problem 15. 5. a, page 270 Charge type Days/Date Rate/Amount Description Finance 31 -90 Prime - 1. 00% Per annum of ADB 91 - Flat: Late rate: 2. 4% Per month of ADB equates to over 28% APR (with compounding) 31 - . 2500% Of balance every month Prime + 5. 5% Per annum of ADB of late pmt amt Prime means the highest prime rate or reference rate of interest publicly announced from time to time by Chase Manhattan Bank, N. A. , Chemical Bank and Citibank, N. A. . http: //www. bankrate. com/brm/ratewatch/leading-rates. asp 31

Problem 15. 5. a, page 270 Charge type Days/Date Rate/Amount Description Finance 31 -90 Prime - 1. 00% Per annum of ADB 91 - Flat: Late rate: 2. 4% Per month of ADB equates to over 28% APR (with compounding) 31 - . 2500% Of balance every month Prime + 5. 5% Per annum of ADB of late pmt amt Prime means the highest prime rate or reference rate of interest publicly announced from time to time by Chase Manhattan Bank, N. A. , Chemical Bank and Citibank, N. A. . http: //www. bankrate. com/brm/ratewatch/leading-rates. asp 31

Problem 15. 5. b, page 270 Is BBW’s lease collateral? 32

Problem 15. 5. b, page 270 Is BBW’s lease collateral? 32

Problem 15. 5. b, page 270 Is BBW’s lease collateral? “Dealer grants Deutsche a security interest in all Dealer’s inventory, equipment, fixtures, accounts, contract rights, chattel paper, instruments, reserves, documents and general intangibles, whether now owned or hereafter acquired, all attachments, accessories, accessions, substitutions and replacements thereto and all proceeds thereof. ” 33

Problem 15. 5. b, page 270 Is BBW’s lease collateral? “Dealer grants Deutsche a security interest in all Dealer’s inventory, equipment, fixtures, accounts, contract rights, chattel paper, instruments, reserves, documents and general intangibles, whether now owned or hereafter acquired, all attachments, accessories, accessions, substitutions and replacements thereto and all proceeds thereof. ” 33

Problem 15. 5. b, page 270 Is BBW’s lease collateral? “Dealer grants Deutsche a security interest in all Dealer’s inventory, equipment, fixtures, accounts, contract rights, chattel paper, instruments, reserves, documents and general intangibles, whether now owned or hereafter acquired, all attachments, accessories, accessions, substitutions and replacements thereto and all proceeds thereof. ” 34

Problem 15. 5. b, page 270 Is BBW’s lease collateral? “Dealer grants Deutsche a security interest in all Dealer’s inventory, equipment, fixtures, accounts, contract rights, chattel paper, instruments, reserves, documents and general intangibles, whether now owned or hereafter acquired, all attachments, accessories, accessions, substitutions and replacements thereto and all proceeds thereof. ” 34

Problem 15. 5. b, page 270 Is BBW’s lease collateral? “Dealer grants Deutsche a security interest in all Dealer’s inventory, equipment, fixtures, accounts, contract rights, chattel paper, instruments, reserves, documents and general intangibles, whether now owned or hereafter acquired, all attachments, accessories, accessions, substitutions and replacements thereto and all proceeds thereof. ” Are BBW’s bank accounts collateral? 35

Problem 15. 5. b, page 270 Is BBW’s lease collateral? “Dealer grants Deutsche a security interest in all Dealer’s inventory, equipment, fixtures, accounts, contract rights, chattel paper, instruments, reserves, documents and general intangibles, whether now owned or hereafter acquired, all attachments, accessories, accessions, substitutions and replacements thereto and all proceeds thereof. ” Are BBW’s bank accounts collateral? 35

Problem 15. 5. b, page 270 Is BBW’s lease collateral? “Dealer grants Deutsche a security interest in all Dealer’s inventory, equipment, fixtures, accounts, contract rights, chattel paper, instruments, reserves, documents and general intangibles, whether now owned or hereafter acquired, all attachments, accessories, accessions, substitutions and replacements thereto and all proceeds thereof. ” Are BBW’s bank accounts collateral? 36

Problem 15. 5. b, page 270 Is BBW’s lease collateral? “Dealer grants Deutsche a security interest in all Dealer’s inventory, equipment, fixtures, accounts, contract rights, chattel paper, instruments, reserves, documents and general intangibles, whether now owned or hereafter acquired, all attachments, accessories, accessions, substitutions and replacements thereto and all proceeds thereof. ” Are BBW’s bank accounts collateral? 36

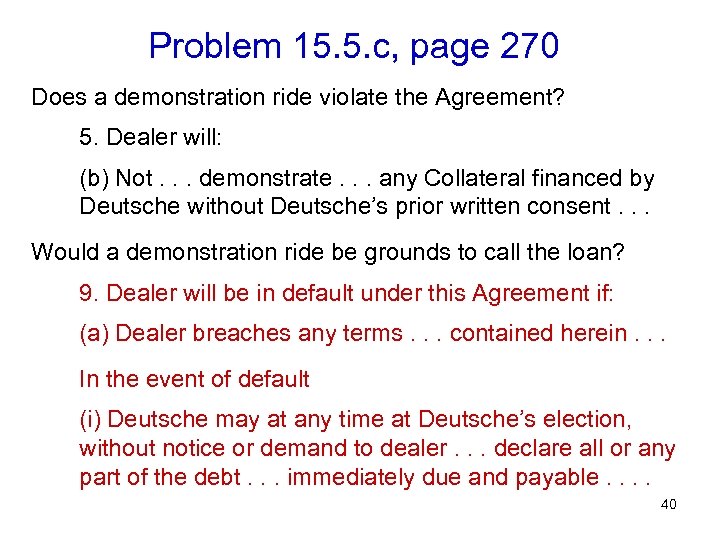

Problem 15. 5. c, page 270 Does a demonstration ride violate the Agreement? 5. Dealer will: (b) Not. . . demonstrate. . . any Collateral financed by Deutsche without Deutsche’s prior written consent. . . Would a demonstration ride be grounds to call the loan? 9. Dealer will be in default under this Agreement if: (a) Dealer breaches any terms. . . contained herein. . . In the event of default (i) Deutsche may at any time at Deutsche’s election, without notice or demand to dealer. . . declare all or any part of the debt. . . immediately due and payable. . 37

Problem 15. 5. c, page 270 Does a demonstration ride violate the Agreement? 5. Dealer will: (b) Not. . . demonstrate. . . any Collateral financed by Deutsche without Deutsche’s prior written consent. . . Would a demonstration ride be grounds to call the loan? 9. Dealer will be in default under this Agreement if: (a) Dealer breaches any terms. . . contained herein. . . In the event of default (i) Deutsche may at any time at Deutsche’s election, without notice or demand to dealer. . . declare all or any part of the debt. . . immediately due and payable. . 37

Problem 15. 5. c, page 270 Does a demonstration ride violate the Agreement? 5. Dealer will: (b) Not. . . demonstrate. . . any Collateral financed by Deutsche without Deutsche’s prior written consent. . . Would a demonstration ride be grounds to call the loan? 9. Dealer will be in default under this Agreement if: (a) Dealer breaches any terms. . . contained herein. . . In the event of default (i) Deutsche may at any time at Deutsche’s election, without notice or demand to dealer. . . declare all or any part of the debt. . . immediately due and payable. . 38

Problem 15. 5. c, page 270 Does a demonstration ride violate the Agreement? 5. Dealer will: (b) Not. . . demonstrate. . . any Collateral financed by Deutsche without Deutsche’s prior written consent. . . Would a demonstration ride be grounds to call the loan? 9. Dealer will be in default under this Agreement if: (a) Dealer breaches any terms. . . contained herein. . . In the event of default (i) Deutsche may at any time at Deutsche’s election, without notice or demand to dealer. . . declare all or any part of the debt. . . immediately due and payable. . 38

Problem 15. 5. c, page 270 Does a demonstration ride violate the Agreement? 5. Dealer will: (b) Not. . . demonstrate. . . any Collateral financed by Deutsche without Deutsche’s prior written consent. . . Would a demonstration ride be grounds to call the loan? 9. Dealer will be in default under this Agreement if: (a) Dealer breaches any terms. . . contained herein. . . In the event of default (i) Deutsche may at any time at Deutsche’s election, without notice or demand to dealer. . . declare all or any part of the debt. . . immediately due and payable. . 39

Problem 15. 5. c, page 270 Does a demonstration ride violate the Agreement? 5. Dealer will: (b) Not. . . demonstrate. . . any Collateral financed by Deutsche without Deutsche’s prior written consent. . . Would a demonstration ride be grounds to call the loan? 9. Dealer will be in default under this Agreement if: (a) Dealer breaches any terms. . . contained herein. . . In the event of default (i) Deutsche may at any time at Deutsche’s election, without notice or demand to dealer. . . declare all or any part of the debt. . . immediately due and payable. . 39

Problem 15. 5. c, page 270 Does a demonstration ride violate the Agreement? 5. Dealer will: (b) Not. . . demonstrate. . . any Collateral financed by Deutsche without Deutsche’s prior written consent. . . Would a demonstration ride be grounds to call the loan? 9. Dealer will be in default under this Agreement if: (a) Dealer breaches any terms. . . contained herein. . . In the event of default (i) Deutsche may at any time at Deutsche’s election, without notice or demand to dealer. . . declare all or any part of the debt. . . immediately due and payable. . 40

Problem 15. 5. c, page 270 Does a demonstration ride violate the Agreement? 5. Dealer will: (b) Not. . . demonstrate. . . any Collateral financed by Deutsche without Deutsche’s prior written consent. . . Would a demonstration ride be grounds to call the loan? 9. Dealer will be in default under this Agreement if: (a) Dealer breaches any terms. . . contained herein. . . In the event of default (i) Deutsche may at any time at Deutsche’s election, without notice or demand to dealer. . . declare all or any part of the debt. . . immediately due and payable. . 40

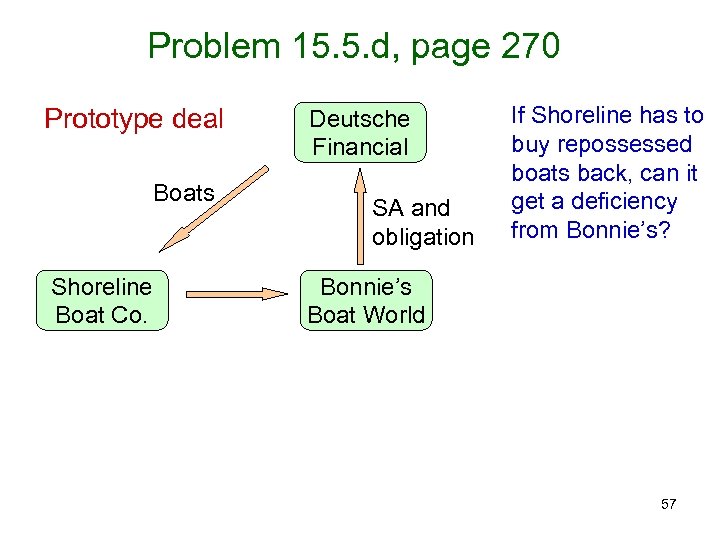

Problem 15. 5. d, page 270 Prototype deal Boats Shoreline Boat Co. Deutsche Financial SA and obligation If Shoreline has to buy repossessed boats back, can it get a deficiency from Bonnie’s? Bonnie’s Boat World 57

Problem 15. 5. d, page 270 Prototype deal Boats Shoreline Boat Co. Deutsche Financial SA and obligation If Shoreline has to buy repossessed boats back, can it get a deficiency from Bonnie’s? Bonnie’s Boat World 57

Problem 15. 5. d, page 270 Prototype deal Boats Shoreline Boat Co. Deutsche Financial SA and obligation If Shoreline has to buy repossessed boats back, can it get a deficiency from Bonnie’s? Bonnie’s Boat World “ 10. Dealer agrees that the purchase of any Collateral by a vendor, as provided in any agreement between Deutsche and the vendor, is a commercially reasonable disposition and private sale of such Collateral under the Uniform Commercial Code. . ” 58

Problem 15. 5. d, page 270 Prototype deal Boats Shoreline Boat Co. Deutsche Financial SA and obligation If Shoreline has to buy repossessed boats back, can it get a deficiency from Bonnie’s? Bonnie’s Boat World “ 10. Dealer agrees that the purchase of any Collateral by a vendor, as provided in any agreement between Deutsche and the vendor, is a commercially reasonable disposition and private sale of such Collateral under the Uniform Commercial Code. . ” 58

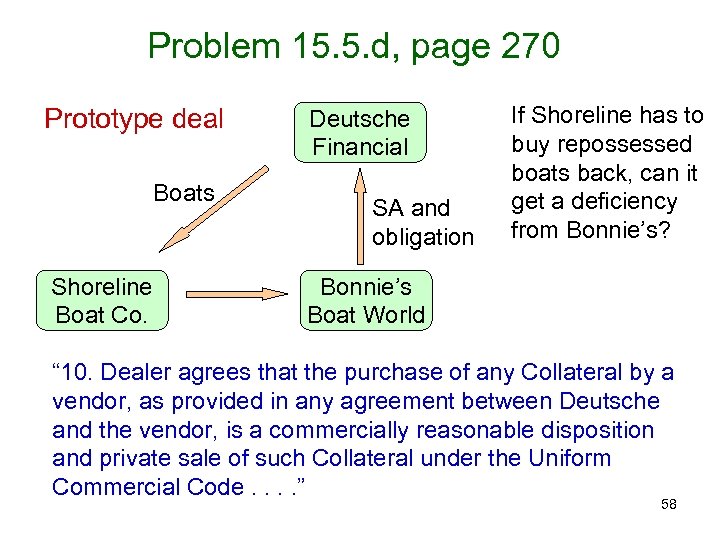

Problem 15. 5. d, page 270 Prototype deal UCC sale for “the total unpaid balance” Shoreline Boat Co. Deutsche Financial Repo Bonnie’s Boat World “ 10. Dealer agrees that the purchase of any Collateral by a vendor, as provided in any agreement between Deutsche and the vendor, is a commercially reasonable disposition and private sale of such Collateral under the Uniform Commercial Code. . ” 59

Problem 15. 5. d, page 270 Prototype deal UCC sale for “the total unpaid balance” Shoreline Boat Co. Deutsche Financial Repo Bonnie’s Boat World “ 10. Dealer agrees that the purchase of any Collateral by a vendor, as provided in any agreement between Deutsche and the vendor, is a commercially reasonable disposition and private sale of such Collateral under the Uniform Commercial Code. . ” 59

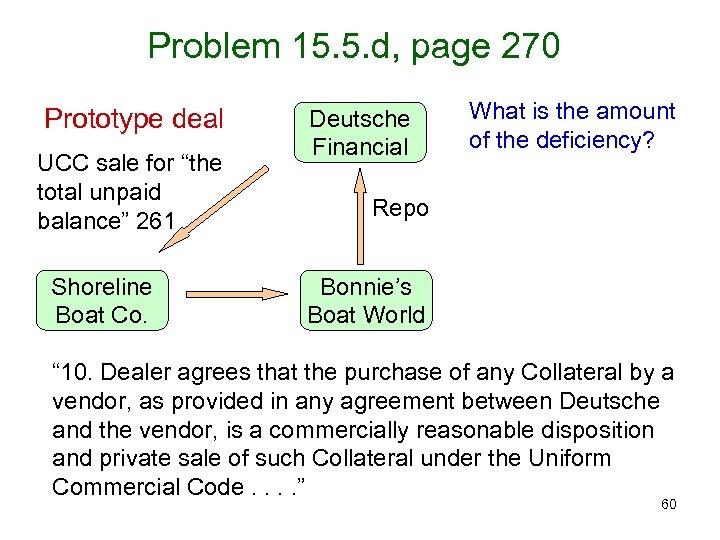

Problem 15. 5. d, page 270 Prototype deal UCC sale for “the total unpaid balance” 261 Shoreline Boat Co. Deutsche Financial What is the amount of the deficiency? Repo Bonnie’s Boat World “ 10. Dealer agrees that the purchase of any Collateral by a vendor, as provided in any agreement between Deutsche and the vendor, is a commercially reasonable disposition and private sale of such Collateral under the Uniform Commercial Code. . ” 60

Problem 15. 5. d, page 270 Prototype deal UCC sale for “the total unpaid balance” 261 Shoreline Boat Co. Deutsche Financial What is the amount of the deficiency? Repo Bonnie’s Boat World “ 10. Dealer agrees that the purchase of any Collateral by a vendor, as provided in any agreement between Deutsche and the vendor, is a commercially reasonable disposition and private sale of such Collateral under the Uniform Commercial Code. . ” 60

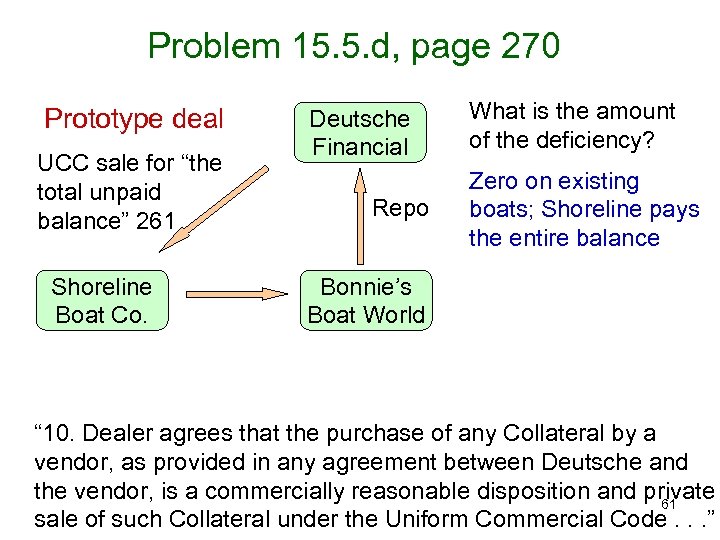

Problem 15. 5. d, page 270 Prototype deal UCC sale for “the total unpaid balance” 261 Shoreline Boat Co. Deutsche Financial Repo What is the amount of the deficiency? Zero on existing boats; Shoreline pays the entire balance Bonnie’s Boat World “ 10. Dealer agrees that the purchase of any Collateral by a vendor, as provided in any agreement between Deutsche and the vendor, is a commercially reasonable disposition and private 61 sale of such Collateral under the Uniform Commercial Code. . . ”

Problem 15. 5. d, page 270 Prototype deal UCC sale for “the total unpaid balance” 261 Shoreline Boat Co. Deutsche Financial Repo What is the amount of the deficiency? Zero on existing boats; Shoreline pays the entire balance Bonnie’s Boat World “ 10. Dealer agrees that the purchase of any Collateral by a vendor, as provided in any agreement between Deutsche and the vendor, is a commercially reasonable disposition and private 61 sale of such Collateral under the Uniform Commercial Code. . . ”

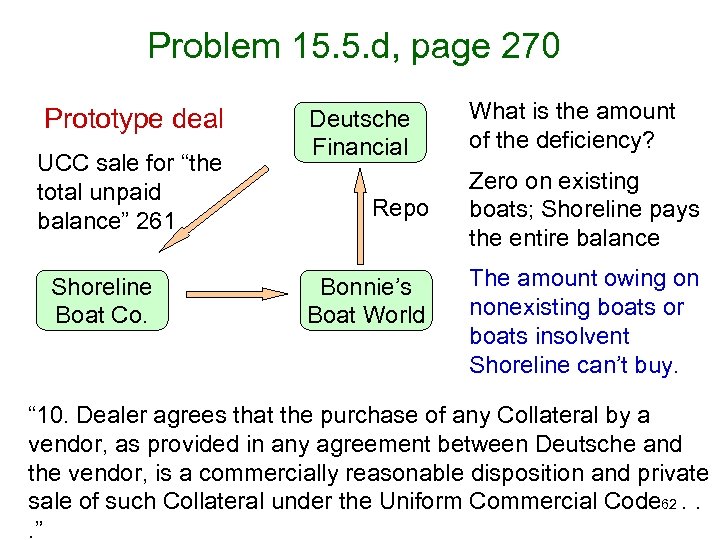

Problem 15. 5. d, page 270 Prototype deal UCC sale for “the total unpaid balance” 261 Shoreline Boat Co. Deutsche Financial Repo Bonnie’s Boat World What is the amount of the deficiency? Zero on existing boats; Shoreline pays the entire balance The amount owing on nonexisting boats or boats insolvent Shoreline can’t buy. “ 10. Dealer agrees that the purchase of any Collateral by a vendor, as provided in any agreement between Deutsche and the vendor, is a commercially reasonable disposition and private sale of such Collateral under the Uniform Commercial Code 62. . ”

Problem 15. 5. d, page 270 Prototype deal UCC sale for “the total unpaid balance” 261 Shoreline Boat Co. Deutsche Financial Repo Bonnie’s Boat World What is the amount of the deficiency? Zero on existing boats; Shoreline pays the entire balance The amount owing on nonexisting boats or boats insolvent Shoreline can’t buy. “ 10. Dealer agrees that the purchase of any Collateral by a vendor, as provided in any agreement between Deutsche and the vendor, is a commercially reasonable disposition and private sale of such Collateral under the Uniform Commercial Code 62. . ”

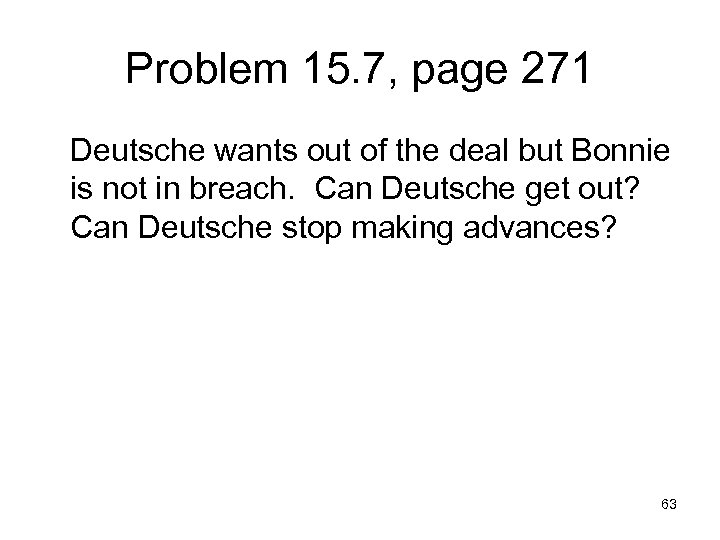

Problem 15. 7, page 271 Deutsche wants out of the deal but Bonnie is not in breach. Can Deutsche get out? Can Deutsche stop making advances? 63

Problem 15. 7, page 271 Deutsche wants out of the deal but Bonnie is not in breach. Can Deutsche get out? Can Deutsche stop making advances? 63

Problem 15. 7, page 271 “ 12. . Either party may terminate this Agreement at any time by written notice received by the other party. If Deutsche terminates this Agreement, Dealer agrees that if Dealer: (a) is not in default hereunder, 30 days prior notice of termination is reasonable and sufficient (although this provision shall not be construed to mean that shorter periods may not, in particular circumstances, also be reasonable and sufficient). . . Dealer will not be relieved from any obligation to Deutsche arising out of Deutsche’s advances or commitments made before the effective termination date of this Agreement. Deutsche will retain all of its rights, interests and remedies hereunder until Dealer has paid all Dealer’s debts to Deutsche. 64

Problem 15. 7, page 271 “ 12. . Either party may terminate this Agreement at any time by written notice received by the other party. If Deutsche terminates this Agreement, Dealer agrees that if Dealer: (a) is not in default hereunder, 30 days prior notice of termination is reasonable and sufficient (although this provision shall not be construed to mean that shorter periods may not, in particular circumstances, also be reasonable and sufficient). . . Dealer will not be relieved from any obligation to Deutsche arising out of Deutsche’s advances or commitments made before the effective termination date of this Agreement. Deutsche will retain all of its rights, interests and remedies hereunder until Dealer has paid all Dealer’s debts to Deutsche. 64

Problem 15. 7, page 271 “ 2. . Dealer acknowledges that Deutsche may then elect to terminate Dealer’s financing program. . . and cease making additional advances to Dealer. Any termination for that reason, however, will not accelerate the maturities of advances previously made, unless Dealer shall otherwise be in default of this Agreement. ” 65

Problem 15. 7, page 271 “ 2. . Dealer acknowledges that Deutsche may then elect to terminate Dealer’s financing program. . . and cease making additional advances to Dealer. Any termination for that reason, however, will not accelerate the maturities of advances previously made, unless Dealer shall otherwise be in default of this Agreement. ” 65

![Problem 15. 7, page 271 “ 2. [Dealer can reject a S of T]. Problem 15. 7, page 271 “ 2. [Dealer can reject a S of T].](https://present5.com/presentation/099a22399e119ea172bae3ff84e2d2ad/image-50.jpg) Problem 15. 7, page 271 “ 2. [Dealer can reject a S of T]. . . Dealer acknowledges that Deutsche may then elect to terminate Dealer’s financing program. . . and cease making additional advances [when? ] to Dealer. Any termination for that reason, however, will not accelerate the maturities of advances previously made, unless Dealer shall otherwise be in default of this Agreement. ” 66

Problem 15. 7, page 271 “ 2. [Dealer can reject a S of T]. . . Dealer acknowledges that Deutsche may then elect to terminate Dealer’s financing program. . . and cease making additional advances [when? ] to Dealer. Any termination for that reason, however, will not accelerate the maturities of advances previously made, unless Dealer shall otherwise be in default of this Agreement. ” 66

Problem 15. 7, page 271 What if Deutsche wants to send a really expensive Statement of Transaction to percipitate a rejection? 67

Problem 15. 7, page 271 What if Deutsche wants to send a really expensive Statement of Transaction to percipitate a rejection? 67