9ca9eb19368bc5eb3a81ffa3cd2fe410.ppt

- Количество слайдов: 44

Will We Have to Work Forever? Revised 2009

Will We Have to Work Forever? Revised 2009

Susan K. Morris, AFC Extension Educator, Family and Consumer Sciences Montgomery County “Educating People to Help Themselves”

Susan K. Morris, AFC Extension Educator, Family and Consumer Sciences Montgomery County “Educating People to Help Themselves”

Is a retirement plan really necessary?

Is a retirement plan really necessary?

Your Retirement Goals What’s your choice? Retire by age ? Work part-time? Travel? Buy a home in warmer climate? Reduce lifestyle? Maintain or increase current lifestyle?

Your Retirement Goals What’s your choice? Retire by age ? Work part-time? Travel? Buy a home in warmer climate? Reduce lifestyle? Maintain or increase current lifestyle?

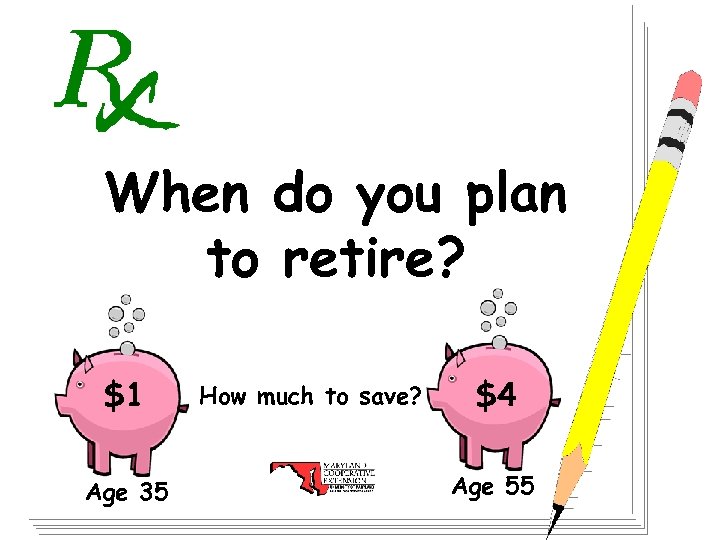

When do you plan to retire? $1 Age 35 How much to save? $4 Age 55

When do you plan to retire? $1 Age 35 How much to save? $4 Age 55

How long will your retirement last?

How long will your retirement last?

What will retirement cost?

What will retirement cost?

What are the sources of retirement income?

What are the sources of retirement income?

Sources of Retirement Income ü Social Security ü Company Retirement/Pension Plans ü Individual savings Tax deferred or taxable ü Part time work

Sources of Retirement Income ü Social Security ü Company Retirement/Pension Plans ü Individual savings Tax deferred or taxable ü Part time work

Social Security ¨ Contribute for 40 quarters ¨ Replacement rates between 59% and 24% depending on income earned ¨ Collect full benefits at designated retirement age

Social Security ¨ Contribute for 40 quarters ¨ Replacement rates between 59% and 24% depending on income earned ¨ Collect full benefits at designated retirement age

Full Retirement Age by Year of Birth Full Retirement Age 1937 & earlier 1938 1939 1940 1941 1942 1943 - 1954 1955 1956 1957 1958 1959 1960 & after 65 years, 2 months 65 years, 4 months 65 years, 6 months 65 years, 8 months 65 years, 10 months 66 years, 2 months 66 years, 4 months 66 years, 6 months 66 years, 8 months 66 years, 10 months 67 years

Full Retirement Age by Year of Birth Full Retirement Age 1937 & earlier 1938 1939 1940 1941 1942 1943 - 1954 1955 1956 1957 1958 1959 1960 & after 65 years, 2 months 65 years, 4 months 65 years, 6 months 65 years, 8 months 65 years, 10 months 66 years, 2 months 66 years, 4 months 66 years, 6 months 66 years, 8 months 66 years, 10 months 67 years

Check Social Security Records þSSA will automatically mail your statement of retirement, disability & survivor benefits 90 days before your birthday þUse “Requests for Earnings and Benefits Form” from Social Security office or call 1 -800 -772 -1213 or consult web site www. ssa. gov þSave IRS W-2 Forms

Check Social Security Records þSSA will automatically mail your statement of retirement, disability & survivor benefits 90 days before your birthday þUse “Requests for Earnings and Benefits Form” from Social Security office or call 1 -800 -772 -1213 or consult web site www. ssa. gov þSave IRS W-2 Forms

Retirement Plans Ø Company Retirement Plans Ø Salary Reduction Retirement Plans Ø Individual Retirement Accounts (Traditional or Roth) Ø Plans for the self-employed

Retirement Plans Ø Company Retirement Plans Ø Salary Reduction Retirement Plans Ø Individual Retirement Accounts (Traditional or Roth) Ø Plans for the self-employed

Which State Retirement System Are You Enrolled In? Ø Maryland State Retirement and Pension System Ø Optional Retirement Plans

Which State Retirement System Are You Enrolled In? Ø Maryland State Retirement and Pension System Ø Optional Retirement Plans

University Human Resources - UMCP David R. Rieger Assistant Director (301) 405 -5654 Rachel Nathan Benefits Service Counselor (301) 405 -8301 College of Information Studies (CLIS) College of Life Science (CLFS) Libraries (LIBR) Office of Extended Studies (EXST) Shady Grove (SGC) R. H. Smith School of Business (BMGT) ARHU (ARHU) University OIT (OIT) Stacy Sims Benefits Service Counselor (301) 405 -5657 Administrative Affairs (VPAA) Architecture (ARCH) CMPS (CMPS) President’s Office (PRES) Research & Grad School (VPR) School of Public Health (SPHL) SVPAAP (SVPAAP) Undergraduate Studies (UGST) Lidia Vogler Benefits Service Counselor (301) 405 -5658 BSOS (BSOS) Education (EDUC) Engineering (ENGR) Journalism (JOUR) Public Affairs (PUAF) Student Affairs (VPSA) Relations (VPUR) AGNR (AGNR)

University Human Resources - UMCP David R. Rieger Assistant Director (301) 405 -5654 Rachel Nathan Benefits Service Counselor (301) 405 -8301 College of Information Studies (CLIS) College of Life Science (CLFS) Libraries (LIBR) Office of Extended Studies (EXST) Shady Grove (SGC) R. H. Smith School of Business (BMGT) ARHU (ARHU) University OIT (OIT) Stacy Sims Benefits Service Counselor (301) 405 -5657 Administrative Affairs (VPAA) Architecture (ARCH) CMPS (CMPS) President’s Office (PRES) Research & Grad School (VPR) School of Public Health (SPHL) SVPAAP (SVPAAP) Undergraduate Studies (UGST) Lidia Vogler Benefits Service Counselor (301) 405 -5658 BSOS (BSOS) Education (EDUC) Engineering (ENGR) Journalism (JOUR) Public Affairs (PUAF) Student Affairs (VPSA) Relations (VPUR) AGNR (AGNR)

TAKE ADVANTAGE OF TAX DEFERMENT

TAKE ADVANTAGE OF TAX DEFERMENT

Contributions with pre-tax dollars lowers taxable income. Pre-Tax = After-Tax $1. 00 = 72¢ $1. 00 earned - 28¢ taxes = 72¢ to save

Contributions with pre-tax dollars lowers taxable income. Pre-Tax = After-Tax $1. 00 = 72¢ $1. 00 earned - 28¢ taxes = 72¢ to save

TAX DEFERRAL MAGIC • IRA • 403 b • 401 k • 457

TAX DEFERRAL MAGIC • IRA • 403 b • 401 k • 457

Are You Enrolled in a Supplemental Retirement Plan? Ø MD Supplemental Retirement Plan (administered by Nationwide) Ø Fidelity Investments Ø TIAA-CREF Ø 401(a) Match - $600

Are You Enrolled in a Supplemental Retirement Plan? Ø MD Supplemental Retirement Plan (administered by Nationwide) Ø Fidelity Investments Ø TIAA-CREF Ø 401(a) Match - $600

The Time Value of Money DID YOU KNOW? Save $5 a week until age 65 - Start at 20= $114, 282 - Start at 30= $49, 701 - Start at 40= $20, 606 may be a Today to start! good time

The Time Value of Money DID YOU KNOW? Save $5 a week until age 65 - Start at 20= $114, 282 - Start at 30= $49, 701 - Start at 40= $20, 606 may be a Today to start! good time

Maximize benefits from your Retirement Plans $ Begin contributions as soon as possible. $ Make maximum contributions allowed, if possible. $ Choose investments that pay high earnings

Maximize benefits from your Retirement Plans $ Begin contributions as soon as possible. $ Make maximum contributions allowed, if possible. $ Choose investments that pay high earnings

Individual Retirement Accounts l Tax-deferred retirement program l Must have earned income or alimony l Contribute up to *: $5, 000 in 2009 *Amount shown is for an individual. Amount doubles for a couple.

Individual Retirement Accounts l Tax-deferred retirement program l Must have earned income or alimony l Contribute up to *: $5, 000 in 2009 *Amount shown is for an individual. Amount doubles for a couple.

Traditional Individual Retirement Accounts l Fully deductible from income taxes if no retirement plan at work. OR l May be partially or fully deductible, based on Adjusted Gross Income.

Traditional Individual Retirement Accounts l Fully deductible from income taxes if no retirement plan at work. OR l May be partially or fully deductible, based on Adjusted Gross Income.

Deductible IRA Income Limits Year Joint Return Individual Return 2009 $89, 000 -$109, 000 $55, 000 -$65, 000 (married filing jointly) $166, 000 -176, 000 (only one is an active participant) For 2010 and beyond, check with IRS publications for IRA income limits.

Deductible IRA Income Limits Year Joint Return Individual Return 2009 $89, 000 -$109, 000 $55, 000 -$65, 000 (married filing jointly) $166, 000 -176, 000 (only one is an active participant) For 2010 and beyond, check with IRS publications for IRA income limits.

Deductible IRA Contributions Reduce taxable income Report on 1040 tax form

Deductible IRA Contributions Reduce taxable income Report on 1040 tax form

Traditional Non-deductible IRA Contributions File IRS Form 8606 with Federal Tax return Retain copy permanently

Traditional Non-deductible IRA Contributions File IRS Form 8606 with Federal Tax return Retain copy permanently

Roth IRA Contributions made with after-tax dollars No mandatory age for withdrawals No mandatory age limit for contributions Contributions (after-tax dollars) always available for withdrawal without penalty

Roth IRA Contributions made with after-tax dollars No mandatory age for withdrawals No mandatory age limit for contributions Contributions (after-tax dollars) always available for withdrawal without penalty

Investing in IRAs Don’t have $5, 000 all at once? Consider making automatic monthly payments from a checking account or through payroll deduction.

Investing in IRAs Don’t have $5, 000 all at once? Consider making automatic monthly payments from a checking account or through payroll deduction.

Timing IRA Contributions § Make contributions as early in year as possible § You can make previous year’s contribution until April 15 th, but tell account custodian it is for the previous year

Timing IRA Contributions § Make contributions as early in year as possible § You can make previous year’s contribution until April 15 th, but tell account custodian it is for the previous year

u. Accounts can be held in any bank, credit union, mutual fund company, and/or brokerage firm. u. Investments can be reallocated. u. Invest for high return.

u. Accounts can be held in any bank, credit union, mutual fund company, and/or brokerage firm. u. Investments can be reallocated. u. Invest for high return.

Transferring Your Money • IRA Direct Transfers • Rollover Transfers

Transferring Your Money • IRA Direct Transfers • Rollover Transfers

Other IRA Transfers Employer plan to employer plan Employer plan to rollover IRA

Other IRA Transfers Employer plan to employer plan Employer plan to rollover IRA

How much have you currently set aside for retirement?

How much have you currently set aside for retirement?

Estimating the Amount to Save $ Retirement income goal $ Social Security and Pension income $ Additional income needed $ Value of assets currently owned $ Revised amount to save

Estimating the Amount to Save $ Retirement income goal $ Social Security and Pension income $ Additional income needed $ Value of assets currently owned $ Revised amount to save

Retirement Calculators

Retirement Calculators

Do your own “Ball Park E$timate” for retirement planning http: //www. choosetosave. org/ballpark/

Do your own “Ball Park E$timate” for retirement planning http: //www. choosetosave. org/ballpark/

Retirement Planning Has Changed! $ More self-directed $ $ No “guarantees” Living longer Portable plans Inflation & taxation

Retirement Planning Has Changed! $ More self-directed $ $ No “guarantees” Living longer Portable plans Inflation & taxation

Think of retirement as a vacation -- take half as much baggage and twice as much money!

Think of retirement as a vacation -- take half as much baggage and twice as much money!

Now. . . What are your questions? Your input is very valuable to us! Please take a moment to complete the evaluation form.

Now. . . What are your questions? Your input is very valuable to us! Please take a moment to complete the evaluation form.

Will We Have to Work Forever? Revised 2009

Will We Have to Work Forever? Revised 2009