3af05679d56a2881edab777dc2b50064.ppt

- Количество слайдов: 48

Wi$e. Up Financial Planning for Generations X and Y Success Metrics Nancy L. Granovsky, CFP® Professor & Extension Family Economics Specialist Texas Agri. Life Extension Service, The Texas A&M System ASEC Fall Partners Meeting Washington, DC October 22, 2008

Wi$e. Up Financial Planning for Generations X and Y Success Metrics Nancy L. Granovsky, CFP® Professor & Extension Family Economics Specialist Texas Agri. Life Extension Service, The Texas A&M System ASEC Fall Partners Meeting Washington, DC October 22, 2008

What is Wi$e. Up? • A financial education program for Gen X and Y women developed by the U. S. Department of Labor – Women’s Bureau. • Texas Agri. Life Extension of The Texas A&M System developed the curriculum, maintains the website and provides national program management.

What is Wi$e. Up? • A financial education program for Gen X and Y women developed by the U. S. Department of Labor – Women’s Bureau. • Texas Agri. Life Extension of The Texas A&M System developed the curriculum, maintains the website and provides national program management.

Why Wi$e. Up? • Gen X/Y women (especially those 22 -35) need information to guide their financial planning. • Gen X/Y women want to learn about financial planning in different ways. » Internet-based distance learning • Community-based educators need tools and curricula for outreach education.

Why Wi$e. Up? • Gen X/Y women (especially those 22 -35) need information to guide their financial planning. • Gen X/Y women want to learn about financial planning in different ways. » Internet-based distance learning • Community-based educators need tools and curricula for outreach education.

Wi$e. Up Scope and Content • Approach emphasizes action steps individuals can take. • Content is organized in learning modules around 8 basic content areas. • Gen e. Xperiences are incorporated.

Wi$e. Up Scope and Content • Approach emphasizes action steps individuals can take. • Content is organized in learning modules around 8 basic content areas. • Gen e. Xperiences are incorporated.

Wi$e. Up’s 8 Modules • • Money for Life Money Math Money Basics Credit in a Money World (Chapter 4) Savings Basics (Chapter 5) Insurance and Risk Management Becoming an Investor (Chapter 7) Achieving Financial Security

Wi$e. Up’s 8 Modules • • Money for Life Money Math Money Basics Credit in a Money World (Chapter 4) Savings Basics (Chapter 5) Insurance and Risk Management Becoming an Investor (Chapter 7) Achieving Financial Security

Gen e. Xperiences All I could think about was landing my first job. I wouldn’t have to worry about money! I could finally buy what I wanted, when I wanted, so I did. I filled my apartment with all the things I had been dreaming of, including a to-die-for new wardrobe. I wasn’t prepared when my apartment building burned down one day when I was at work, and I lost everything. Did I have renter’s insurance? No. . . I didn’t think it could happen in a million years! Now I tell everybody, “Don’t just think about today. Think about tomorrow. ”

Gen e. Xperiences All I could think about was landing my first job. I wouldn’t have to worry about money! I could finally buy what I wanted, when I wanted, so I did. I filled my apartment with all the things I had been dreaming of, including a to-die-for new wardrobe. I wasn’t prepared when my apartment building burned down one day when I was at work, and I lost everything. Did I have renter’s insurance? No. . . I didn’t think it could happen in a million years! Now I tell everybody, “Don’t just think about today. Think about tomorrow. ”

Wi$e. Up’s Implementation Options • Handbook alone for self-study. • Workshop Series with handbook. • Instructor’s CD-ROM and PPTs • Web Course with or without handbook. • www. wiseupwomen. org • Combination of workshops + Web course • Over 11, 000 across the U. S. have “Wi$ed. Up. ”

Wi$e. Up’s Implementation Options • Handbook alone for self-study. • Workshop Series with handbook. • Instructor’s CD-ROM and PPTs • Web Course with or without handbook. • www. wiseupwomen. org • Combination of workshops + Web course • Over 11, 000 across the U. S. have “Wi$ed. Up. ”

Other Program Components • Over 110 volunteer financial experts respond to participant questions; Q and A’s are posted to website. • Bi-monthly national teleconferences feature noted speakers and MP 3’s and transcripts are posted to website.

Other Program Components • Over 110 volunteer financial experts respond to participant questions; Q and A’s are posted to website. • Bi-monthly national teleconferences feature noted speakers and MP 3’s and transcripts are posted to website.

National Partners and Others • American Institute of Certified Public Accountants (AICPA) • Bi-monthly conference call speakers • Mentors • Financial Planning Association (FPA) • Financial Planning Perspectives posted • Mentors • Service providers/replicators

National Partners and Others • American Institute of Certified Public Accountants (AICPA) • Bi-monthly conference call speakers • Mentors • Financial Planning Association (FPA) • Financial Planning Perspectives posted • Mentors • Service providers/replicators

Do. L-WB Metrics • Strategic Goal: Improve the Status of Working Women • Outcome Goal: Better Earnings • Performance Goal: Increase Women’s Financial Security • Output Measures: number of participants, with annual increases.

Do. L-WB Metrics • Strategic Goal: Improve the Status of Working Women • Outcome Goal: Better Earnings • Performance Goal: Increase Women’s Financial Security • Output Measures: number of participants, with annual increases.

Reduce Debt • Intermediate Measures: % of participants who say they will reduce debt. • Outcome Measures: % of participants who reduce debt.

Reduce Debt • Intermediate Measures: % of participants who say they will reduce debt. • Outcome Measures: % of participants who reduce debt.

Increase Savings/Investments • Intermediate Measures: % of participants who say they will increase their savings/investments. • Outcome Measures: % of participants who do increase their savings/investments.

Increase Savings/Investments • Intermediate Measures: % of participants who say they will increase their savings/investments. • Outcome Measures: % of participants who do increase their savings/investments.

Wi$e. Up Assessments • Pre-assessment before each unit – Captures current status/practices • Post-assessment after each unit – Focuses on intentions/”plan to do” – Individuals can track their own intentions via “My Financial Roadmap” online • You won’t do what you can’t remember!

Wi$e. Up Assessments • Pre-assessment before each unit – Captures current status/practices • Post-assessment after each unit – Focuses on intentions/”plan to do” – Individuals can track their own intentions via “My Financial Roadmap” online • You won’t do what you can’t remember!

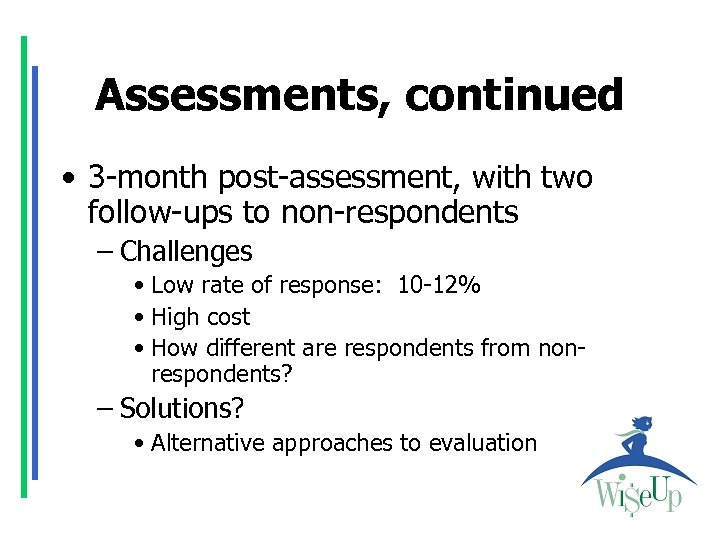

Assessments, continued • 3 -month post-assessment, with two follow-ups to non-respondents – Challenges • Low rate of response: 10 -12% • High cost • How different are respondents from nonrespondents? – Solutions? • Alternative approaches to evaluation

Assessments, continued • 3 -month post-assessment, with two follow-ups to non-respondents – Challenges • Low rate of response: 10 -12% • High cost • How different are respondents from nonrespondents? – Solutions? • Alternative approaches to evaluation

What We Are Learning Pre-Assessment Results Credit FY 08

What We Are Learning Pre-Assessment Results Credit FY 08

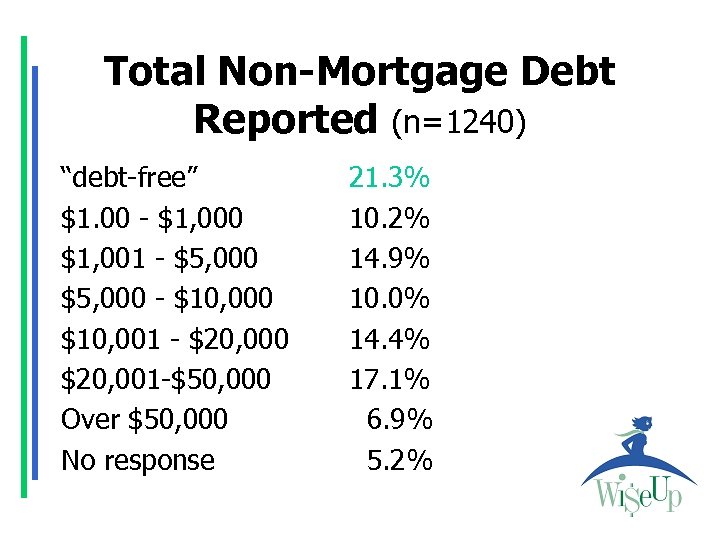

Total Non-Mortgage Debt Reported (n=1240) “debt-free” $1. 00 - $1, 000 $1, 001 - $5, 000 - $10, 000 $10, 001 - $20, 000 $20, 001 -$50, 000 Over $50, 000 No response 21. 3% 10. 2% 14. 9% 10. 0% 14. 4% 17. 1% 6. 9% 5. 2%

Total Non-Mortgage Debt Reported (n=1240) “debt-free” $1. 00 - $1, 000 $1, 001 - $5, 000 - $10, 000 $10, 001 - $20, 000 $20, 001 -$50, 000 Over $50, 000 No response 21. 3% 10. 2% 14. 9% 10. 0% 14. 4% 17. 1% 6. 9% 5. 2%

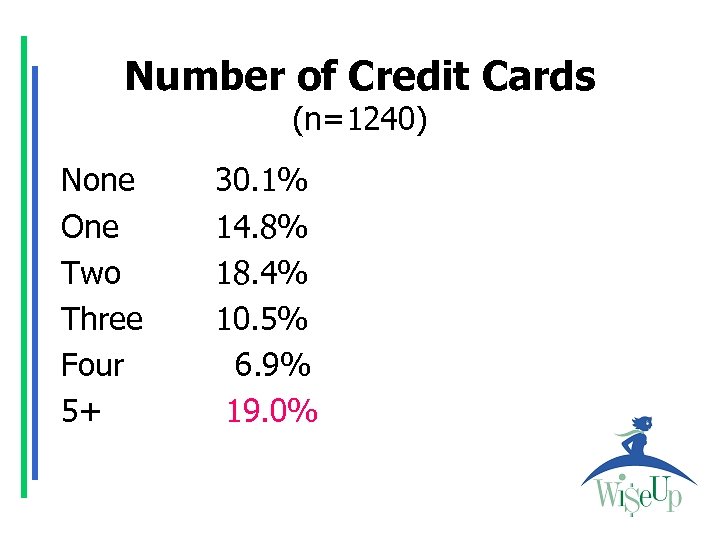

Number of Credit Cards (n=1240) None One Two Three Four 5+ 30. 1% 14. 8% 18. 4% 10. 5% 6. 9% 19. 0%

Number of Credit Cards (n=1240) None One Two Three Four 5+ 30. 1% 14. 8% 18. 4% 10. 5% 6. 9% 19. 0%

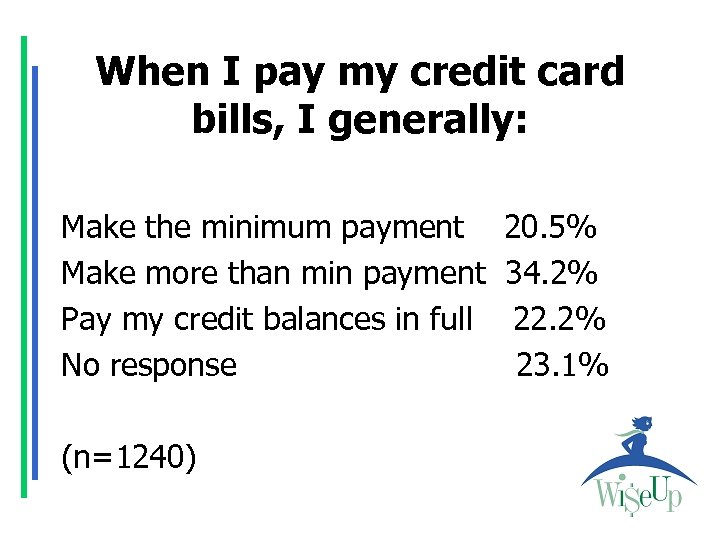

When I pay my credit card bills, I generally: Make the minimum payment Make more than min payment Pay my credit balances in full No response (n=1240) 20. 5% 34. 2% 22. 2% 23. 1%

When I pay my credit card bills, I generally: Make the minimum payment Make more than min payment Pay my credit balances in full No response (n=1240) 20. 5% 34. 2% 22. 2% 23. 1%

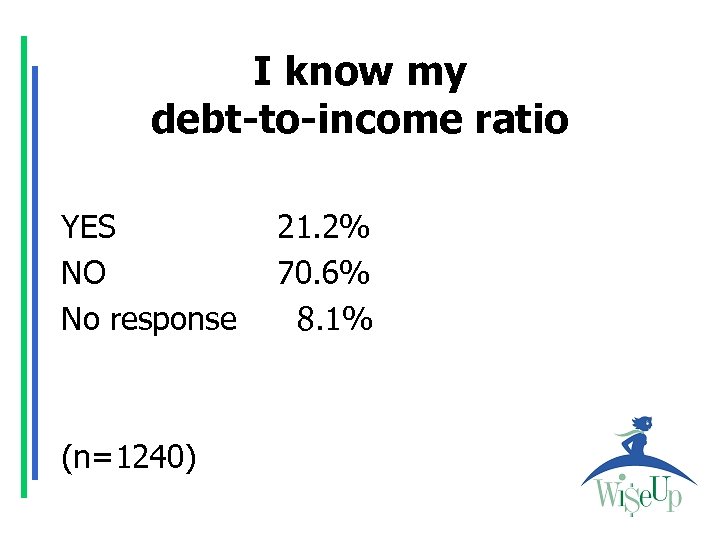

I know my debt-to-income ratio YES NO No response (n=1240) 21. 2% 70. 6% 8. 1%

I know my debt-to-income ratio YES NO No response (n=1240) 21. 2% 70. 6% 8. 1%

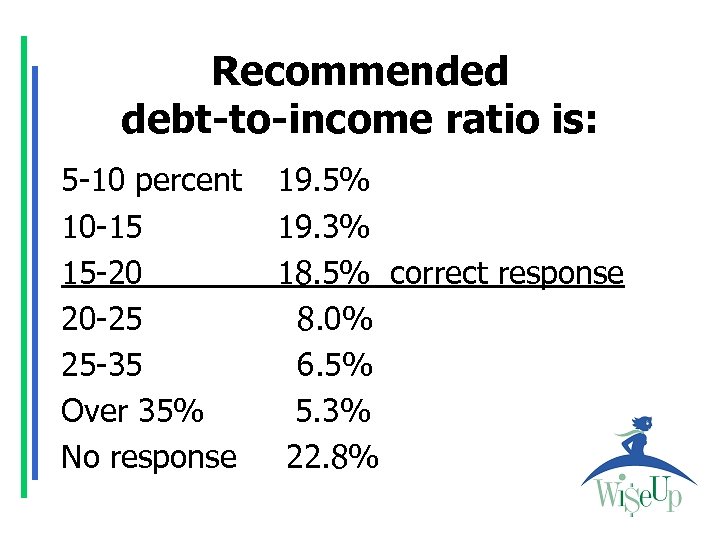

Recommended debt-to-income ratio is: 5 -10 percent 10 -15 15 -20 20 -25 25 -35 Over 35% No response 19. 5% 19. 3% 18. 5% correct response 8. 0% 6. 5% 5. 3% 22. 8%

Recommended debt-to-income ratio is: 5 -10 percent 10 -15 15 -20 20 -25 25 -35 Over 35% No response 19. 5% 19. 3% 18. 5% correct response 8. 0% 6. 5% 5. 3% 22. 8%

What We Are Learning Post-Assessment Results Credit FY 08

What We Are Learning Post-Assessment Results Credit FY 08

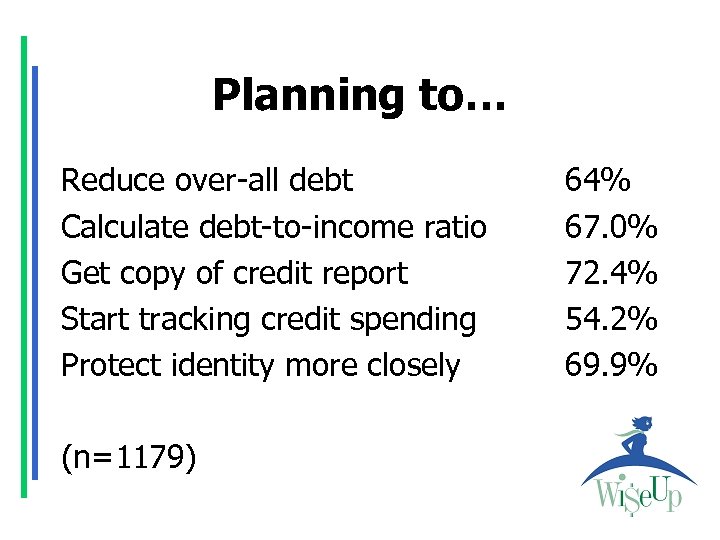

Planning to… Reduce over-all debt Calculate debt-to-income ratio Get copy of credit report Start tracking credit spending Protect identity more closely (n=1179) 64% 67. 0% 72. 4% 54. 2% 69. 9%

Planning to… Reduce over-all debt Calculate debt-to-income ratio Get copy of credit report Start tracking credit spending Protect identity more closely (n=1179) 64% 67. 0% 72. 4% 54. 2% 69. 9%

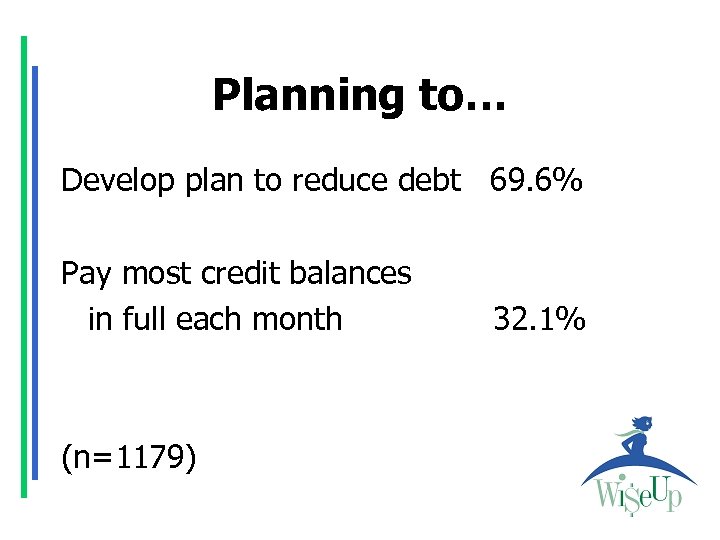

Planning to… Develop plan to reduce debt 69. 6% Pay most credit balances in full each month (n=1179) 32. 1%

Planning to… Develop plan to reduce debt 69. 6% Pay most credit balances in full each month (n=1179) 32. 1%

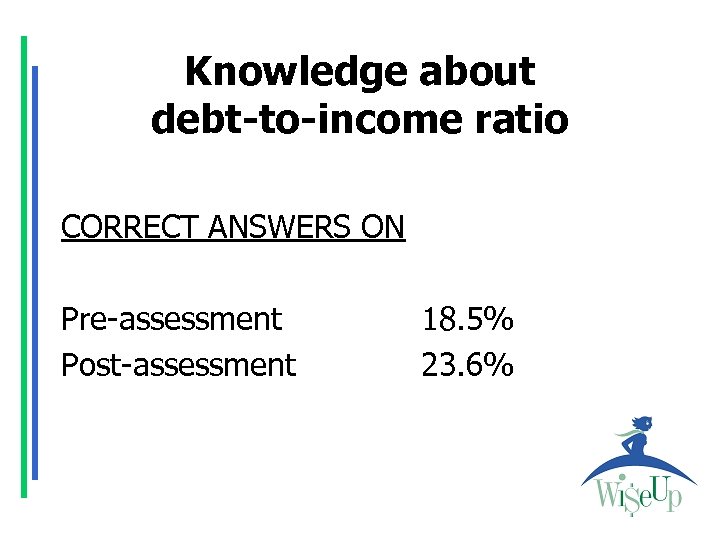

Knowledge about debt-to-income ratio CORRECT ANSWERS ON Pre-assessment Post-assessment 18. 5% 23. 6%

Knowledge about debt-to-income ratio CORRECT ANSWERS ON Pre-assessment Post-assessment 18. 5% 23. 6%

What We Are Learning 3 -Month Post-Assessment Results Credit FY 08

What We Are Learning 3 -Month Post-Assessment Results Credit FY 08

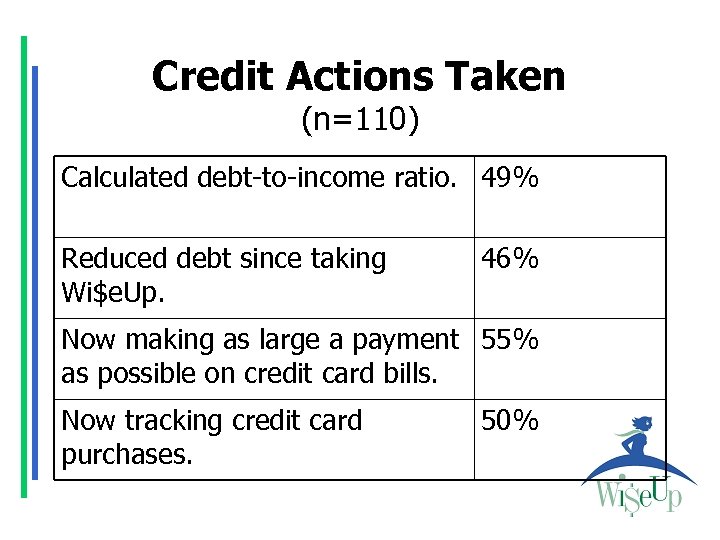

Credit Actions Taken (n=110) Calculated debt-to-income ratio. 49% Reduced debt since taking Wi$e. Up. 46% Now making as large a payment 55% as possible on credit card bills. Now tracking credit card purchases. 50%

Credit Actions Taken (n=110) Calculated debt-to-income ratio. 49% Reduced debt since taking Wi$e. Up. 46% Now making as large a payment 55% as possible on credit card bills. Now tracking credit card purchases. 50%

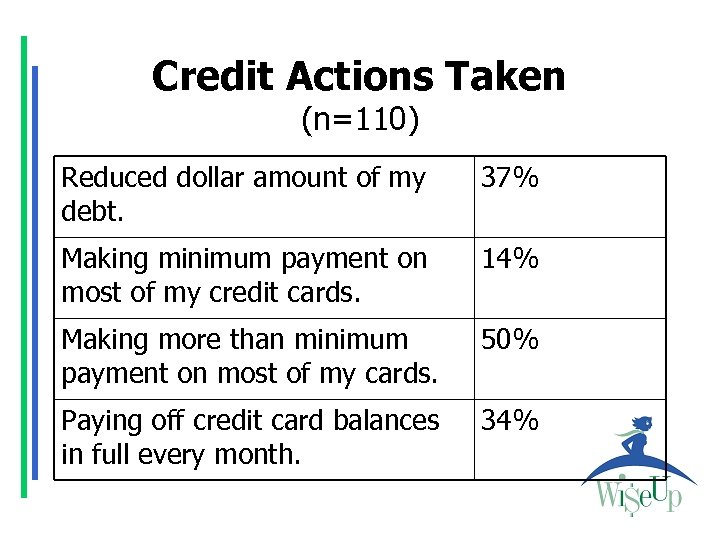

Credit Actions Taken (n=110) Reduced dollar amount of my debt. 37% Making minimum payment on most of my credit cards. 14% Making more than minimum payment on most of my cards. 50% Paying off credit card balances in full every month. 34%

Credit Actions Taken (n=110) Reduced dollar amount of my debt. 37% Making minimum payment on most of my credit cards. 14% Making more than minimum payment on most of my cards. 50% Paying off credit card balances in full every month. 34%

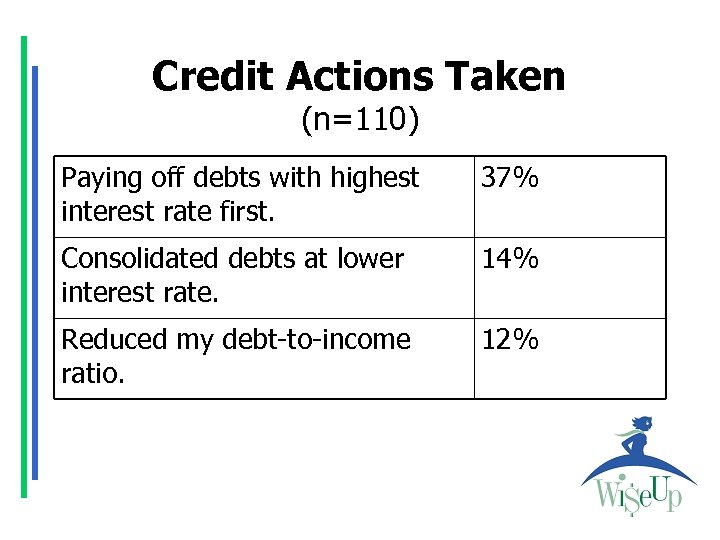

Credit Actions Taken (n=110) Paying off debts with highest interest rate first. 37% Consolidated debts at lower interest rate. 14% Reduced my debt-to-income ratio. 12%

Credit Actions Taken (n=110) Paying off debts with highest interest rate first. 37% Consolidated debts at lower interest rate. 14% Reduced my debt-to-income ratio. 12%

What We Are Learning 3 -Month Post-Assessment Results Savings/Investments FY 08

What We Are Learning 3 -Month Post-Assessment Results Savings/Investments FY 08

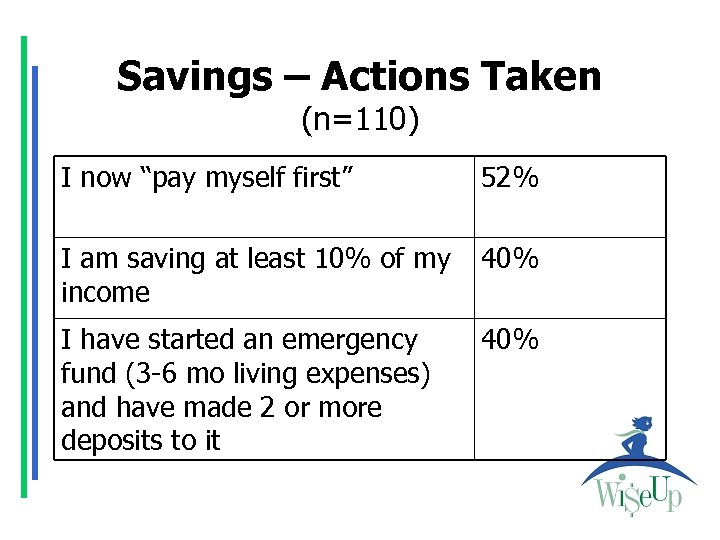

Savings – Actions Taken (n=110) I now “pay myself first” 52% I am saving at least 10% of my income 40% I have started an emergency fund (3 -6 mo living expenses) and have made 2 or more deposits to it 40%

Savings – Actions Taken (n=110) I now “pay myself first” 52% I am saving at least 10% of my income 40% I have started an emergency fund (3 -6 mo living expenses) and have made 2 or more deposits to it 40%

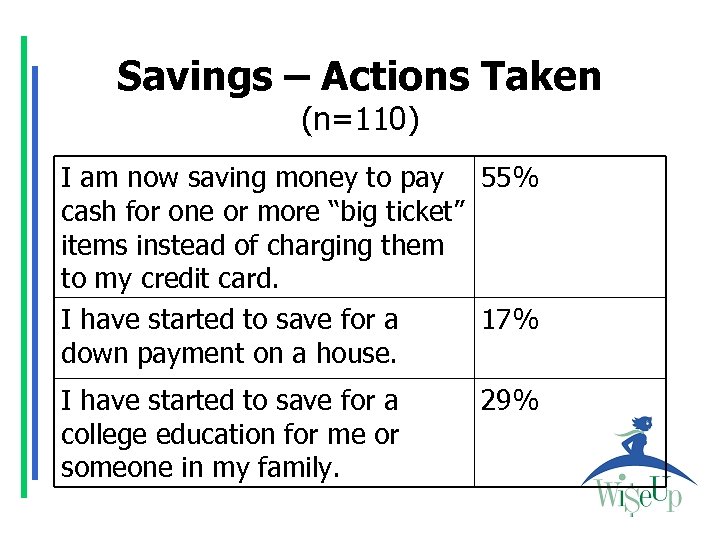

Savings – Actions Taken (n=110) I am now saving money to pay 55% cash for one or more “big ticket” items instead of charging them to my credit card. I have started to save for a 17% down payment on a house. I have started to save for a college education for me or someone in my family. 29%

Savings – Actions Taken (n=110) I am now saving money to pay 55% cash for one or more “big ticket” items instead of charging them to my credit card. I have started to save for a 17% down payment on a house. I have started to save for a college education for me or someone in my family. 29%

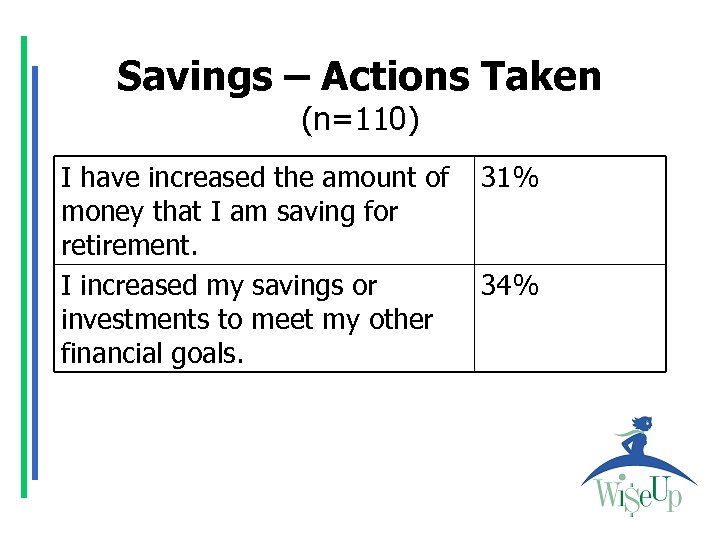

Savings – Actions Taken (n=110) I have increased the amount of money that I am saving for retirement. I increased my savings or investments to meet my other financial goals. 31% 34%

Savings – Actions Taken (n=110) I have increased the amount of money that I am saving for retirement. I increased my savings or investments to meet my other financial goals. 31% 34%

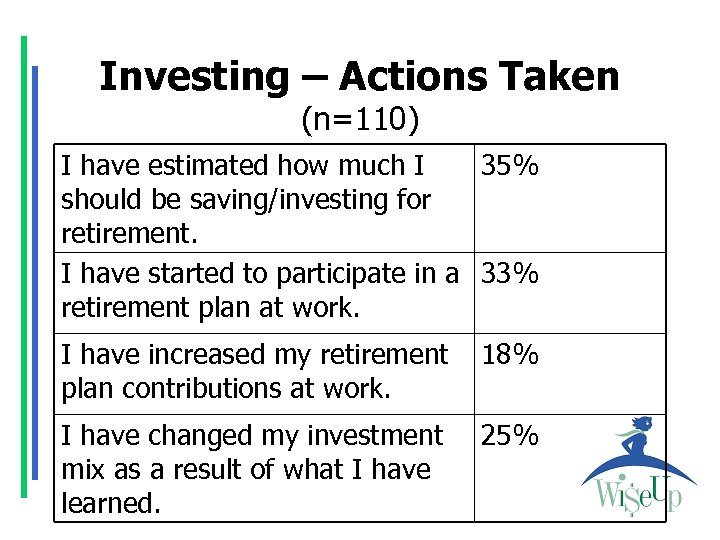

Investing – Actions Taken (n=110) I have estimated how much I 35% should be saving/investing for retirement. I have started to participate in a 33% retirement plan at work. I have increased my retirement plan contributions at work. 18% I have changed my investment mix as a result of what I have learned. 25%

Investing – Actions Taken (n=110) I have estimated how much I 35% should be saving/investing for retirement. I have started to participate in a 33% retirement plan at work. I have increased my retirement plan contributions at work. 18% I have changed my investment mix as a result of what I have learned. 25%

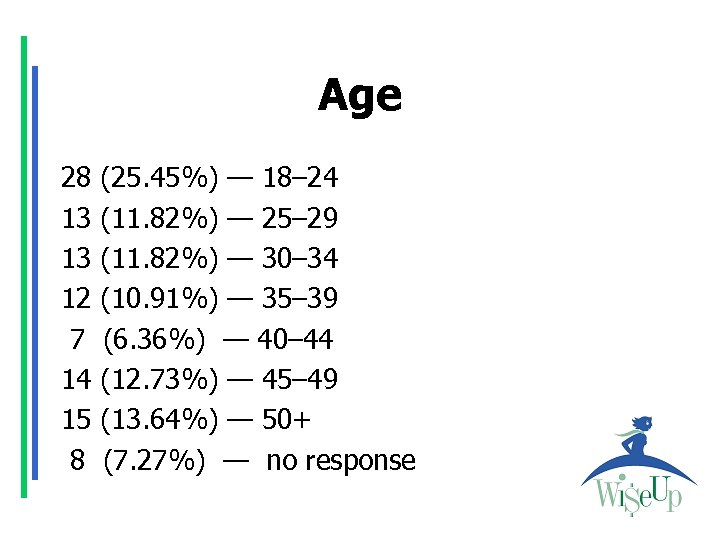

Age 28 13 13 12 7 14 15 8 (25. 45%) — 18– 24 (11. 82%) — 25– 29 (11. 82%) — 30– 34 (10. 91%) — 35– 39 (6. 36%) — 40– 44 (12. 73%) — 45– 49 (13. 64%) — 50+ (7. 27%) — no response

Age 28 13 13 12 7 14 15 8 (25. 45%) — 18– 24 (11. 82%) — 25– 29 (11. 82%) — 30– 34 (10. 91%) — 35– 39 (6. 36%) — 40– 44 (12. 73%) — 45– 49 (13. 64%) — 50+ (7. 27%) — no response

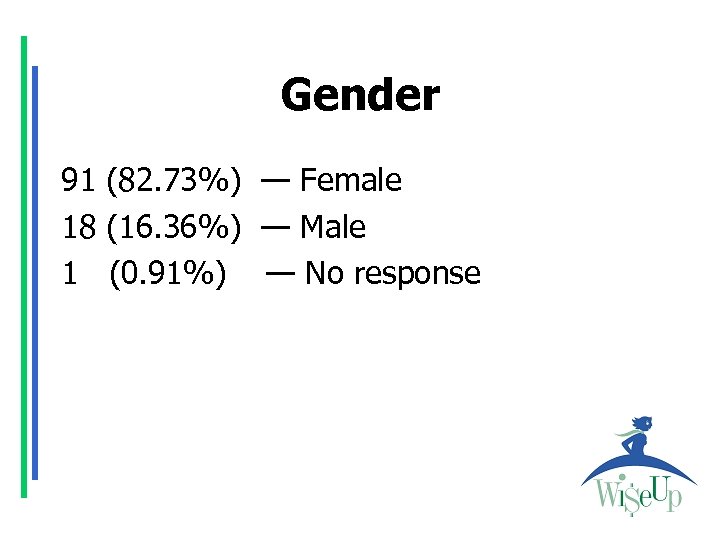

Gender 91 (82. 73%) — Female 18 (16. 36%) — Male 1 (0. 91%) — No response

Gender 91 (82. 73%) — Female 18 (16. 36%) — Male 1 (0. 91%) — No response

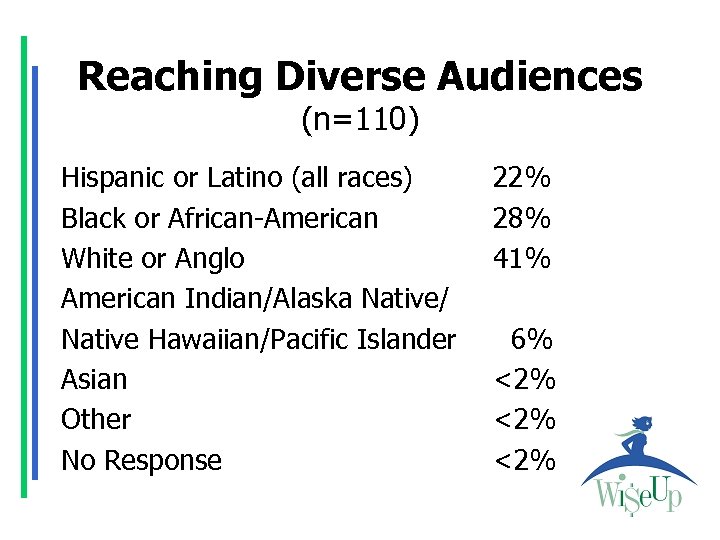

Reaching Diverse Audiences (n=110) Hispanic or Latino (all races) Black or African-American White or Anglo American Indian/Alaska Native/ Native Hawaiian/Pacific Islander Asian Other No Response 22% 28% 41% 6% <2% <2%

Reaching Diverse Audiences (n=110) Hispanic or Latino (all races) Black or African-American White or Anglo American Indian/Alaska Native/ Native Hawaiian/Pacific Islander Asian Other No Response 22% 28% 41% 6% <2% <2%

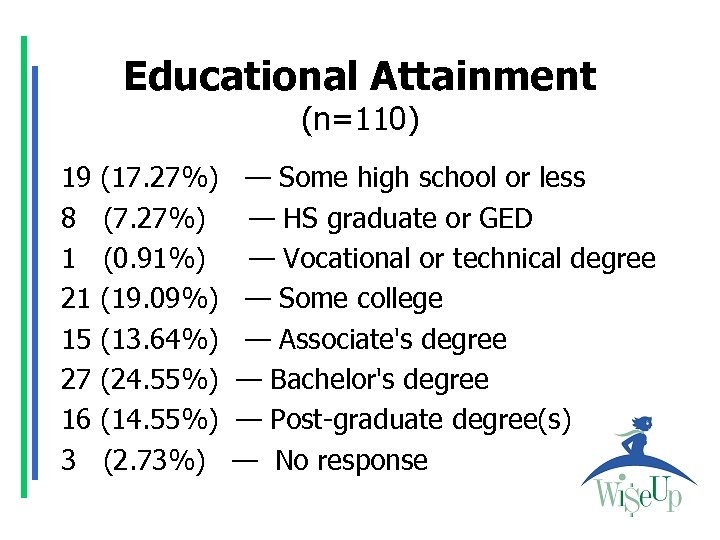

Educational Attainment (n=110) 19 8 1 21 15 27 16 3 (17. 27%) (0. 91%) (19. 09%) (13. 64%) (24. 55%) (14. 55%) (2. 73%) — Some high school or less — HS graduate or GED — Vocational or technical degree — Some college — Associate's degree — Bachelor's degree — Post-graduate degree(s) — No response

Educational Attainment (n=110) 19 8 1 21 15 27 16 3 (17. 27%) (0. 91%) (19. 09%) (13. 64%) (24. 55%) (14. 55%) (2. 73%) — Some high school or less — HS graduate or GED — Vocational or technical degree — Some college — Associate's degree — Bachelor's degree — Post-graduate degree(s) — No response

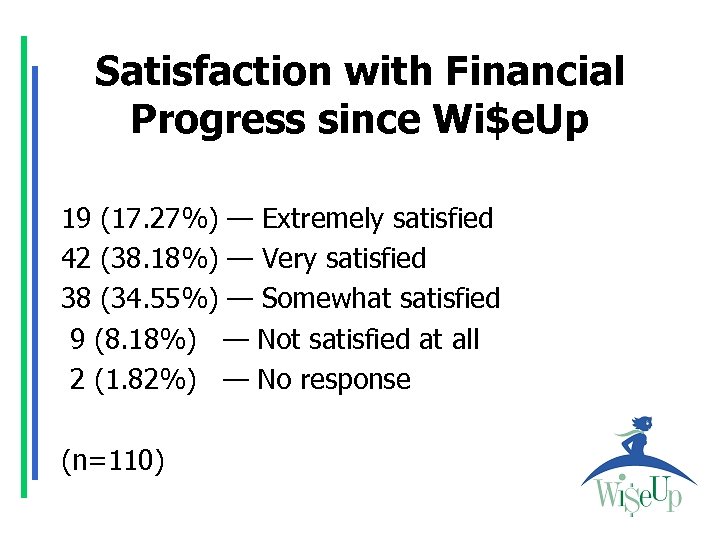

Satisfaction with Financial Progress since Wi$e. Up 19 (17. 27%) — Extremely satisfied 42 (38. 18%) — Very satisfied 38 (34. 55%) — Somewhat satisfied 9 (8. 18%) — Not satisfied at all 2 (1. 82%) — No response (n=110)

Satisfaction with Financial Progress since Wi$e. Up 19 (17. 27%) — Extremely satisfied 42 (38. 18%) — Very satisfied 38 (34. 55%) — Somewhat satisfied 9 (8. 18%) — Not satisfied at all 2 (1. 82%) — No response (n=110)

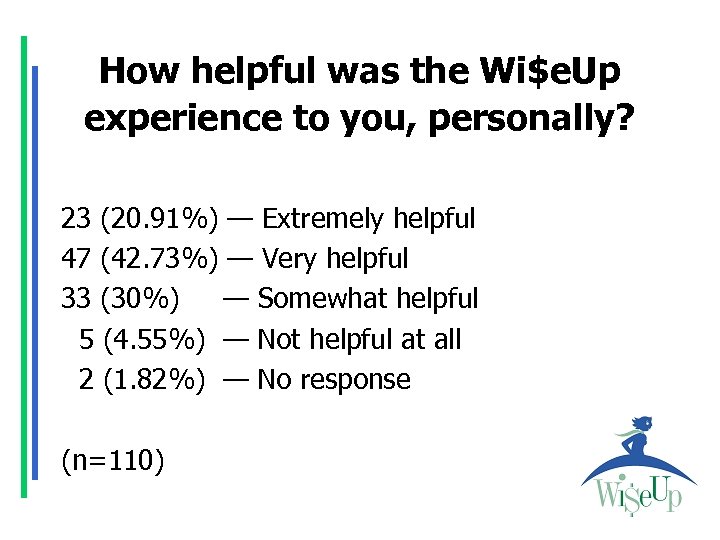

How helpful was the Wi$e. Up experience to you, personally? 23 (20. 91%) — Extremely helpful 47 (42. 73%) — Very helpful 33 (30%) — Somewhat helpful 5 (4. 55%) — Not helpful at all 2 (1. 82%) — No response (n=110)

How helpful was the Wi$e. Up experience to you, personally? 23 (20. 91%) — Extremely helpful 47 (42. 73%) — Very helpful 33 (30%) — Somewhat helpful 5 (4. 55%) — Not helpful at all 2 (1. 82%) — No response (n=110)

What they wrote… • I have started to pay more attention to my bill statements and understanding my bills. • I am satisfied with my financial progress throughout using Wi$e. Up because it has help me to manage my money and save it for important uses.

What they wrote… • I have started to pay more attention to my bill statements and understanding my bills. • I am satisfied with my financial progress throughout using Wi$e. Up because it has help me to manage my money and save it for important uses.

What they wrote… • I could be doing better, but I have not taken any action. • I want to stay with your program & re-take the course. • The most important benefit of the program is helping you save money a quicker faster way.

What they wrote… • I could be doing better, but I have not taken any action. • I want to stay with your program & re-take the course. • The most important benefit of the program is helping you save money a quicker faster way.

What they wrote… • The courses made me actually put numbers down for goals. That was very helpful. • The most important benefit of being involved in the Wise. Up program is that it helps you better to situate all of your financial needs in a better and more organized way. It also helps you to save your money in a manageable way and for beneficial reasons.

What they wrote… • The courses made me actually put numbers down for goals. That was very helpful. • The most important benefit of being involved in the Wise. Up program is that it helps you better to situate all of your financial needs in a better and more organized way. It also helps you to save your money in a manageable way and for beneficial reasons.

Benefits mentioned. . • Income to debt ratio information. • Actually seeing my "debt to income ratio". • The benefits of starting early! • I learned a good amount of information about financial responsibilities that I did not know.

Benefits mentioned. . • Income to debt ratio information. • Actually seeing my "debt to income ratio". • The benefits of starting early! • I learned a good amount of information about financial responsibilities that I did not know.

Insights mentioned. . • All women should participate, regardless of age. • It'll help women be aware of financial options and ways to help themselves. • It's a course everyone should take.

Insights mentioned. . • All women should participate, regardless of age. • It'll help women be aware of financial options and ways to help themselves. • It's a course everyone should take.

Would you recommend Wi$e. Up to others? 104 (94. 55%) — Yes 4 (3. 64%) — No 2 (1. 81%) — No response (n=110)

Would you recommend Wi$e. Up to others? 104 (94. 55%) — Yes 4 (3. 64%) — No 2 (1. 81%) — No response (n=110)

Thank You…. . • Nancy Granovsky, CFP® • n-granovsky@tamu. edu • 2251 TAMU Texas A&M University College Station, TX 77843 -2251 • Websites: http: //fcs. tamu. edu http: //wiseupwomen. org • TEL: 979 -845 -1869

Thank You…. . • Nancy Granovsky, CFP® • n-granovsky@tamu. edu • 2251 TAMU Texas A&M University College Station, TX 77843 -2251 • Websites: http: //fcs. tamu. edu http: //wiseupwomen. org • TEL: 979 -845 -1869