54bee2e6f05c03a5fe65a95ab22e5993.ppt

- Количество слайдов: 67

Why India is Important for the European Fine Chemicals Industry Gautam Mahajan Inter-Link Services Private Limited Mahajan@interlinkindia. net +91 9810060368 1

Why India is Important for the European Fine Chemicals Industry Gautam Mahajan Inter-Link Services Private Limited Mahajan@interlinkindia. net +91 9810060368 1

Fine Chemicals Pharma Intermediates n Active Pharma Intermediates (API) n Contract biopharma n Agrochemical intermediates n Others n 2

Fine Chemicals Pharma Intermediates n Active Pharma Intermediates (API) n Contract biopharma n Agrochemical intermediates n Others n 2

The changing business dynamics in India • Europe and India: dynamics • Opportunities to invest in, sell to and buy from in India • India and China competition • Using India to balance supply constraints • The changing business dynamics in India • India Trade • The growth of the chemicals business and trends in India • Using India as a supply base for other countries 3

The changing business dynamics in India • Europe and India: dynamics • Opportunities to invest in, sell to and buy from in India • India and China competition • Using India to balance supply constraints • The changing business dynamics in India • India Trade • The growth of the chemicals business and trends in India • Using India as a supply base for other countries 3

First, we’ll discuss: • Europe and India: Dynamics • Opportunities to invest in, sell to and buy from in India • India and China competition • Using India to balance supply constraints 4

First, we’ll discuss: • Europe and India: Dynamics • Opportunities to invest in, sell to and buy from in India • India and China competition • Using India to balance supply constraints 4

Fine Chemicals: Market Size n n n US: € 17. 18 billion in 2005 € 23. 10 billion in 2011 est. Europe: € 8. 43 billion in 2005 € 10. 46 billion in 2009 est. India: >€ 1 billion 5

Fine Chemicals: Market Size n n n US: € 17. 18 billion in 2005 € 23. 10 billion in 2011 est. Europe: € 8. 43 billion in 2005 € 10. 46 billion in 2009 est. India: >€ 1 billion 5

EU Chemicals n n In 2004, 29% of EU chemicals exported compared to: 19% for the USA and 19% for Japan Only 18% of the EU chemicals demand was imported from the non-EU regions* *In 2003, India-China imports were 8%, estimated to increase to 30% in 200809 6

EU Chemicals n n In 2004, 29% of EU chemicals exported compared to: 19% for the USA and 19% for Japan Only 18% of the EU chemicals demand was imported from the non-EU regions* *In 2003, India-China imports were 8%, estimated to increase to 30% in 200809 6

European Fine Chemicals profitability under pressure Profitability eroding: n n Intense Asian competition New chemical entity (NCE) approvals rate reduced 7

European Fine Chemicals profitability under pressure Profitability eroding: n n Intense Asian competition New chemical entity (NCE) approvals rate reduced 7

Threats and Opportunities Globalisation n Higher Exports from Asia n India China Symbiosis n Asia driven acquisitions could be exit option n n offer services across the value chain 8

Threats and Opportunities Globalisation n Higher Exports from Asia n India China Symbiosis n Asia driven acquisitions could be exit option n n offer services across the value chain 8

Indian Fine Chemicals n Growing number of Indian suppliers: n n lower prices than American/European companies, often 50% compliant with current good manufacturing practices (c. GMP) n n 70 in India alone: second largest after USA in world intellectual property rights (IPR) 9

Indian Fine Chemicals n Growing number of Indian suppliers: n n lower prices than American/European companies, often 50% compliant with current good manufacturing practices (c. GMP) n n 70 in India alone: second largest after USA in world intellectual property rights (IPR) 9

Active Pharma Intermediates n n n Indian API 3 rd largest in world (€ 1. 6 bn in 2005) and will grow to € 3. 63 bn by 2010, CAGR 19. 3 % India will become second largest API manufacturer (overtake Italy) by 2010* * Italy's Chemical Pharmaceutical Generic Association (CPA) report 10

Active Pharma Intermediates n n n Indian API 3 rd largest in world (€ 1. 6 bn in 2005) and will grow to € 3. 63 bn by 2010, CAGR 19. 3 % India will become second largest API manufacturer (overtake Italy) by 2010* * Italy's Chemical Pharmaceutical Generic Association (CPA) report 10

Indian Advantage n n n n Low labour and environmental costs, Size and dynamism of its economy, Incentives provided by the Indian government, In long term, threatens dominance of China as top API producer R&D, Knowledge base & IPR Quality Cash rich: entering Europe 11

Indian Advantage n n n n Low labour and environmental costs, Size and dynamism of its economy, Incentives provided by the Indian government, In long term, threatens dominance of China as top API producer R&D, Knowledge base & IPR Quality Cash rich: entering Europe 11

Lower Costs n Lower Costs due to: n n Lower fixed (lower capital) Labor and Maintenance costs prevalent in Asia Lower overheads translates to 10. 0 percent of the expenditure incurred by North American/European manufacturing plants And Entering Europe 12

Lower Costs n Lower Costs due to: n n Lower fixed (lower capital) Labor and Maintenance costs prevalent in Asia Lower overheads translates to 10. 0 percent of the expenditure incurred by North American/European manufacturing plants And Entering Europe 12

Examples of Indian Acquisitions n Nicholas Piramal n n Avecia Pharmaceutical Pfizer, Inc. (Morpeth, UK) n $350 mn supply agreement with Pfizer n 7 year agreement for process development and scale-up services to Pfizer n Rhodia's (Paris) inhalation anesthetics business 13

Examples of Indian Acquisitions n Nicholas Piramal n n Avecia Pharmaceutical Pfizer, Inc. (Morpeth, UK) n $350 mn supply agreement with Pfizer n 7 year agreement for process development and scale-up services to Pfizer n Rhodia's (Paris) inhalation anesthetics business 13

Examples of Indian Acquisitions n n Shasun Drugs and Pharmaceuticals Rhodia Pharma Solutions Kemwell Pfizer Uppsala, Sweden contract API in Sept. ‘ 06 Dr Reddy Betapharm, Germany for € 450 mn United Phos crop protection chemicals co. Cequisa, Spain; Reposo, Argentine; Advanta seeds, Holland; Cropserve, S. Africa; AG Value, US and now a new € 111 m acquisition of Cerexagri in Europe announced 13 Nov ‘ 06 14

Examples of Indian Acquisitions n n Shasun Drugs and Pharmaceuticals Rhodia Pharma Solutions Kemwell Pfizer Uppsala, Sweden contract API in Sept. ‘ 06 Dr Reddy Betapharm, Germany for € 450 mn United Phos crop protection chemicals co. Cequisa, Spain; Reposo, Argentine; Advanta seeds, Holland; Cropserve, S. Africa; AG Value, US and now a new € 111 m acquisition of Cerexagri in Europe announced 13 Nov ‘ 06 14

Examples of Indian Acquisitions n Dishman Pharmaceuticals and Chemicals n n n Carbon. Gen and AMCIS, Switzerland for highpotency actives I 03 S, Ltd. ( ozone chemistry), Synprotec, a contract research company 15

Examples of Indian Acquisitions n Dishman Pharmaceuticals and Chemicals n n n Carbon. Gen and AMCIS, Switzerland for highpotency actives I 03 S, Ltd. ( ozone chemistry), Synprotec, a contract research company 15

Backward Integration in China n Indian producers backward–integrating in China n Example: Dishman has two projects: n n a $10 -million investment for producing quaternary compounds and intermediates and an API plant 16

Backward Integration in China n Indian producers backward–integrating in China n Example: Dishman has two projects: n n a $10 -million investment for producing quaternary compounds and intermediates and an API plant 16

Example: Matrix Labs Matrix Laboratories Concord Biotech specializing in fermentation and biocatalytic n backward-integrate into China, acquired a 58% stake in Mchem Group n 43% stake in Swiss API technology firm Explora Laboratories n Ventures with South Africa's Aspen Pharmacare n Belgium generics company Docpharma NV BUT n US generic drugmaker Mylan: € 573. 4 mn to acquire a 17 controlling stake in Matrix n

Example: Matrix Labs Matrix Laboratories Concord Biotech specializing in fermentation and biocatalytic n backward-integrate into China, acquired a 58% stake in Mchem Group n 43% stake in Swiss API technology firm Explora Laboratories n Ventures with South Africa's Aspen Pharmacare n Belgium generics company Docpharma NV BUT n US generic drugmaker Mylan: € 573. 4 mn to acquire a 17 controlling stake in Matrix n

Indian Companies setting up in Europe/America n Denisco n n n Nancy, France, API Dallas, Texas customer support office “Customers in North America face tight margins and fierce competitive pressure for time-to-market. Our ability to quickly, safely and efficiently produce pharmaceutical lab samples, and then rapidly ramp up for commercial-level volumes, will help lighten these pressures, ” said Venkat Ram, president of Denisco Chemicals. 18

Indian Companies setting up in Europe/America n Denisco n n n Nancy, France, API Dallas, Texas customer support office “Customers in North America face tight margins and fierce competitive pressure for time-to-market. Our ability to quickly, safely and efficiently produce pharmaceutical lab samples, and then rapidly ramp up for commercial-level volumes, will help lighten these pressures, ” said Venkat Ram, president of Denisco Chemicals. 18

Indian Companies setting up in Europe/America n n G Amphray in Holland now in Mexico Bilcare, India's largest research-based pharmaceuticals packaging company, has bought UK-based clinical trials services provider DHP in Sept. 2006 19

Indian Companies setting up in Europe/America n n G Amphray in Holland now in Mexico Bilcare, India's largest research-based pharmaceuticals packaging company, has bought UK-based clinical trials services provider DHP in Sept. 2006 19

Other Indian Companies Hikal, Jubilant Organosys, Matrix, and Suven have the benefit of the 'highskill and low-cost advantage' plus the leadership and financial muscle according to a Swiss Consultant 20

Other Indian Companies Hikal, Jubilant Organosys, Matrix, and Suven have the benefit of the 'highskill and low-cost advantage' plus the leadership and financial muscle according to a Swiss Consultant 20

Example: SST USA n n SST USA: “. . European-based producers still account for the majority of supplier base, producers from India and Japan now represent an important minority of the company's suppliers, " says Gary Vassallo, president of SST, who took over in March India makes up one-quarter of the 23 manufacturers represented by SST. 21

Example: SST USA n n SST USA: “. . European-based producers still account for the majority of supplier base, producers from India and Japan now represent an important minority of the company's suppliers, " says Gary Vassallo, president of SST, who took over in March India makes up one-quarter of the 23 manufacturers represented by SST. 21

Therefore, n Supplies from India and China forcing US and European companies to redefine their business models: "Apart from the issues of quality, speed, and value, the two key requisites for success are a position in India or China (a manufacturing subcontracting arrangement is good an affiliate company is better) and an attractive toolbox of technologies, " n Degussa custom manufacturing j. v. with Lynchem in China *says Pollak. 22

Therefore, n Supplies from India and China forcing US and European companies to redefine their business models: "Apart from the issues of quality, speed, and value, the two key requisites for success are a position in India or China (a manufacturing subcontracting arrangement is good an affiliate company is better) and an attractive toolbox of technologies, " n Degussa custom manufacturing j. v. with Lynchem in China *says Pollak. 22

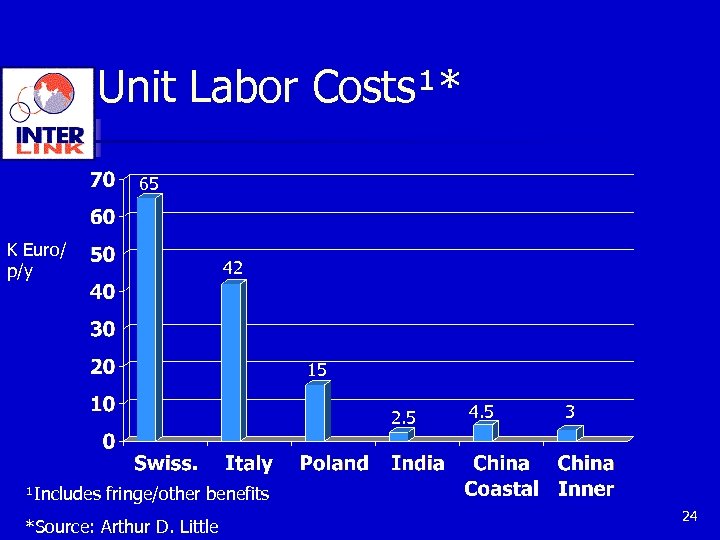

Fine Chemicals Economics n Fine chemicals production economics favor China and India based operations. Annual unit labor costs are a fraction of the West’s: € 3, 000 in India € 4, 000 -€ 6, 100 China n versus € 40, 400 in West Europe or n € 15, 300 in Poland, a good proxy for the Central and Eastern European region n 23

Fine Chemicals Economics n Fine chemicals production economics favor China and India based operations. Annual unit labor costs are a fraction of the West’s: € 3, 000 in India € 4, 000 -€ 6, 100 China n versus € 40, 400 in West Europe or n € 15, 300 in Poland, a good proxy for the Central and Eastern European region n 23

Unit Labor Costs¹* 65 K Euro/ p/y 42 15 2. 5 4. 5 3 ¹Includes fringe/other benefits *Source: Arthur D. Little 24

Unit Labor Costs¹* 65 K Euro/ p/y 42 15 2. 5 4. 5 3 ¹Includes fringe/other benefits *Source: Arthur D. Little 24

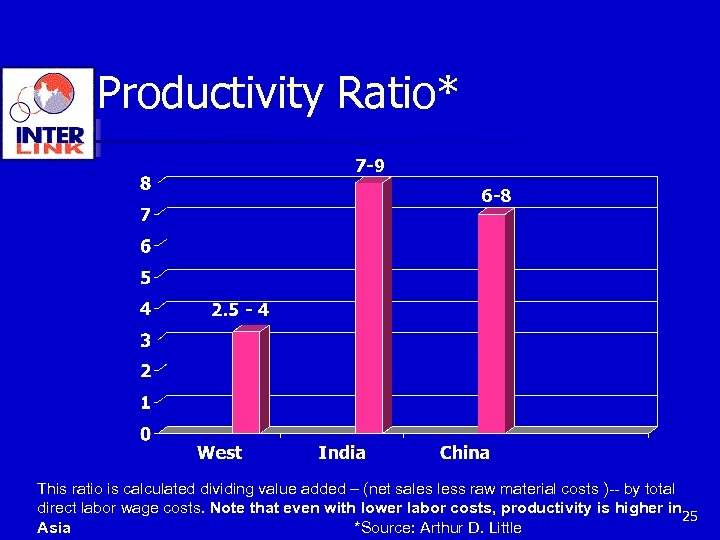

Productivity Ratio* 7 -9 6 -8 2. 5 - 4 This ratio is calculated dividing value added – (net sales less raw material costs )-- by total direct labor wage costs. Note that even with lower labor costs, productivity is higher in 25 Asia *Source: Arthur D. Little

Productivity Ratio* 7 -9 6 -8 2. 5 - 4 This ratio is calculated dividing value added – (net sales less raw material costs )-- by total direct labor wage costs. Note that even with lower labor costs, productivity is higher in 25 Asia *Source: Arthur D. Little

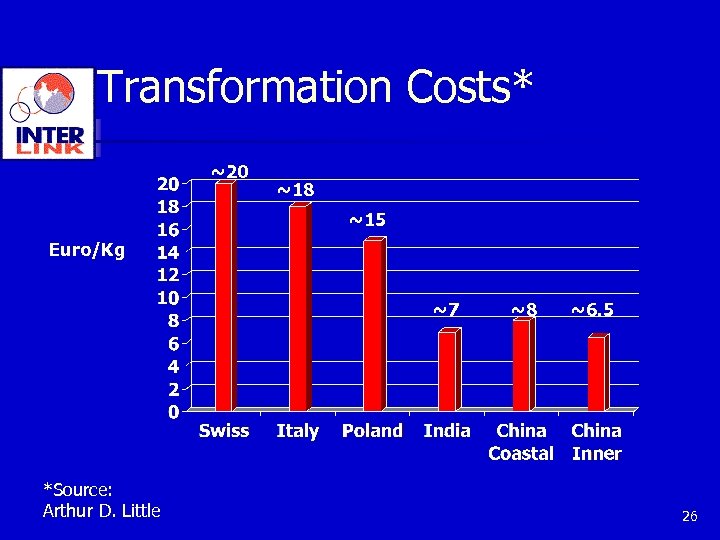

Transformation Costs* ~20 ~18 ~15 Euro/Kg ~7 *Source: Arthur D. Little ~8 ~6. 5 26

Transformation Costs* ~20 ~18 ~15 Euro/Kg ~7 *Source: Arthur D. Little ~8 ~6. 5 26

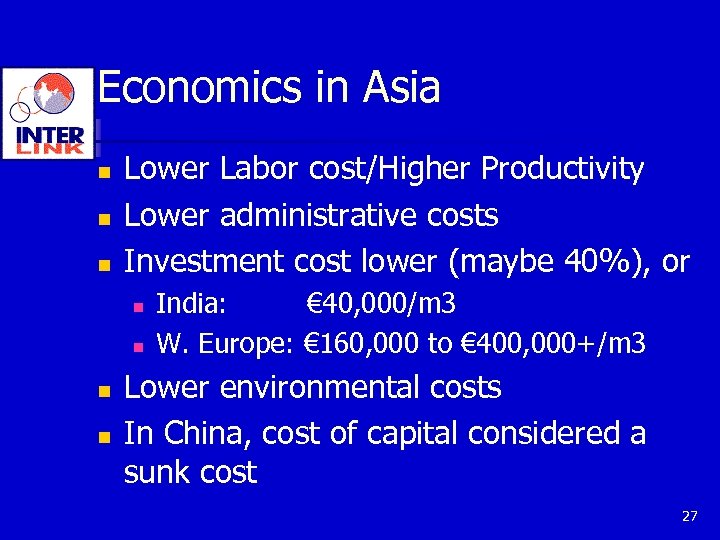

Economics in Asia n n n Lower Labor cost/Higher Productivity Lower administrative costs Investment cost lower (maybe 40%), or n n India: € 40, 000/m 3 W. Europe: € 160, 000 to € 400, 000+/m 3 Lower environmental costs In China, cost of capital considered a sunk cost 27

Economics in Asia n n n Lower Labor cost/Higher Productivity Lower administrative costs Investment cost lower (maybe 40%), or n n India: € 40, 000/m 3 W. Europe: € 160, 000 to € 400, 000+/m 3 Lower environmental costs In China, cost of capital considered a sunk cost 27

Economics in Asia n n n Raw materials maybe higher in India and China Higher solvent loss due to climate Higher energy costs Higher costs due to logistics, infrastructure and other inefficiencies Overall: Cost advantage of Asian suppliers increases with the complexity of the molecule, n n the longer and more complex the synthesis, and the higher the manpower and reactor volume requirements. 28

Economics in Asia n n n Raw materials maybe higher in India and China Higher solvent loss due to climate Higher energy costs Higher costs due to logistics, infrastructure and other inefficiencies Overall: Cost advantage of Asian suppliers increases with the complexity of the molecule, n n the longer and more complex the synthesis, and the higher the manpower and reactor volume requirements. 28

Economics But changing: n Higher inflation in India/China n Environmental costs catching up n Risks n n n Quality Supply chain disruption Communications Time Potential impact of REACH regulations That is why penetration has not been higher 29

Economics But changing: n Higher inflation in India/China n Environmental costs catching up n Risks n n n Quality Supply chain disruption Communications Time Potential impact of REACH regulations That is why penetration has not been higher 29

Conventional Solution Industry restructuring and consolidation in EU, n n n n Production restructuring Reduction of overcapacity More Imports Enhance quality Collaborate with Asian firms to maintain a stable position Confidentiality, reputation, documentation, product quality important Hitech segments such as contract biopharma, high potency active pharmaceutical ingredients (HPAPI) & Hazardous Chemistry Undervalued pharmaceutical intermediaries and API 30 are investment/consolidation opportunities

Conventional Solution Industry restructuring and consolidation in EU, n n n n Production restructuring Reduction of overcapacity More Imports Enhance quality Collaborate with Asian firms to maintain a stable position Confidentiality, reputation, documentation, product quality important Hitech segments such as contract biopharma, high potency active pharmaceutical ingredients (HPAPI) & Hazardous Chemistry Undervalued pharmaceutical intermediaries and API 30 are investment/consolidation opportunities

Opportunities for European Companies n n n Take advantage of Globalisation Acquire/update Asian companies Import from/Export to Asia Distribute in Europe, Asia and North America Use REACH regulations to advantage n n To import To buy time to restructure 31

Opportunities for European Companies n n n Take advantage of Globalisation Acquire/update Asian companies Import from/Export to Asia Distribute in Europe, Asia and North America Use REACH regulations to advantage n n To import To buy time to restructure 31

Acquire/Update Indian Companies n n Degussa long-term agreement Hikal Solvay Pharma got FDA approval for Bavla facility n Expanded its facilities in Naroda, India, for c. GMP manufacture of quaternary ammonium and phosphonium compounds and certain bulk drugs. 32

Acquire/Update Indian Companies n n Degussa long-term agreement Hikal Solvay Pharma got FDA approval for Bavla facility n Expanded its facilities in Naroda, India, for c. GMP manufacture of quaternary ammonium and phosphonium compounds and certain bulk drugs. 32

Acquire/Update Indian Companies n n n Albany Molecular Research USA expanding Indian R&D center, + scale-up lab for APIs and intermediates. Aceto Corporation USA (a distributor) to buy or build its pharma quality assurance, and analytical labs, and to be Indian logistics center. Sigma-Aldrich Corporation USA building a manufacturing plant in Bangalore 33

Acquire/Update Indian Companies n n n Albany Molecular Research USA expanding Indian R&D center, + scale-up lab for APIs and intermediates. Aceto Corporation USA (a distributor) to buy or build its pharma quality assurance, and analytical labs, and to be Indian logistics center. Sigma-Aldrich Corporation USA building a manufacturing plant in Bangalore 33

Galaxy Surfactants Ltd. 34

Galaxy Surfactants Ltd. 34

The changing business dynamics in India • Europe and India: dynamics • Opportunities to invest in, sell to and buy from in India • India and China competition • Using India to balance supply constraints • The changing business dynamics in India • India Trade • The growth of the chemicals business and trends in India • Using India as a supply base for other countries 35

The changing business dynamics in India • Europe and India: dynamics • Opportunities to invest in, sell to and buy from in India • India and China competition • Using India to balance supply constraints • The changing business dynamics in India • India Trade • The growth of the chemicals business and trends in India • Using India as a supply base for other countries 35

India n n Purchasing power parity 3 rd largest in world of € 3 trillion 10 th largest GDP at > € 600 bn (2006) 2 nd fastest growing major economy, with a GDP growth rate of 8. 9% (1 st quarter 2006– 2007) Growth in industrial output of 11. 4% for September 2006 and 12. 7% for the year 36

India n n Purchasing power parity 3 rd largest in world of € 3 trillion 10 th largest GDP at > € 600 bn (2006) 2 nd fastest growing major economy, with a GDP growth rate of 8. 9% (1 st quarter 2006– 2007) Growth in industrial output of 11. 4% for September 2006 and 12. 7% for the year 36

Growth in other Industries n n n Car sales up 22% in September Indian Engineering & Construction industry 8. 5% CAGR in 5 years, increasing rapidly Manufacturing to grow from € 39 bn in 2003 to € 242 bn in 2015 Telephones grew from 14. 5 million in 1997 to 120 million in 2006 IT industry has had 29% CAGR in 5 years 37

Growth in other Industries n n n Car sales up 22% in September Indian Engineering & Construction industry 8. 5% CAGR in 5 years, increasing rapidly Manufacturing to grow from € 39 bn in 2003 to € 242 bn in 2015 Telephones grew from 14. 5 million in 1997 to 120 million in 2006 IT industry has had 29% CAGR in 5 years 37

India n n n India: FTA with Thailand Trading partner status Asean Working on EU special relation NAFTA? India as a base for value added marketing into Asia and Middle East/Africa India as a source of manufactured goods, not just services and knowledge (and R&D) 38

India n n n India: FTA with Thailand Trading partner status Asean Working on EU special relation NAFTA? India as a base for value added marketing into Asia and Middle East/Africa India as a source of manufactured goods, not just services and knowledge (and R&D) 38

India – Sustained High Growth n India adds: n n n By 2050, 1/3 of global economic growth from India n n € 36 billion in incremental output (around a tenth of the levels of the US) to world Annual contribution will rise to € 282 billion by 2025 and € 1. 8 trillion by 2050 India and China together will account for 2/3 India's economic growth will bring several benefits to Western economies n n n R&D facilities in India will help reduce costs and improve productivity Low cost geography and its scientific talent pool, India will provide value added services, globally Special Economic Zones to give distinct thrust to exports – Tax benefits, export incentives etc. 39

India – Sustained High Growth n India adds: n n n By 2050, 1/3 of global economic growth from India n n € 36 billion in incremental output (around a tenth of the levels of the US) to world Annual contribution will rise to € 282 billion by 2025 and € 1. 8 trillion by 2050 India and China together will account for 2/3 India's economic growth will bring several benefits to Western economies n n n R&D facilities in India will help reduce costs and improve productivity Low cost geography and its scientific talent pool, India will provide value added services, globally Special Economic Zones to give distinct thrust to exports – Tax benefits, export incentives etc. 39

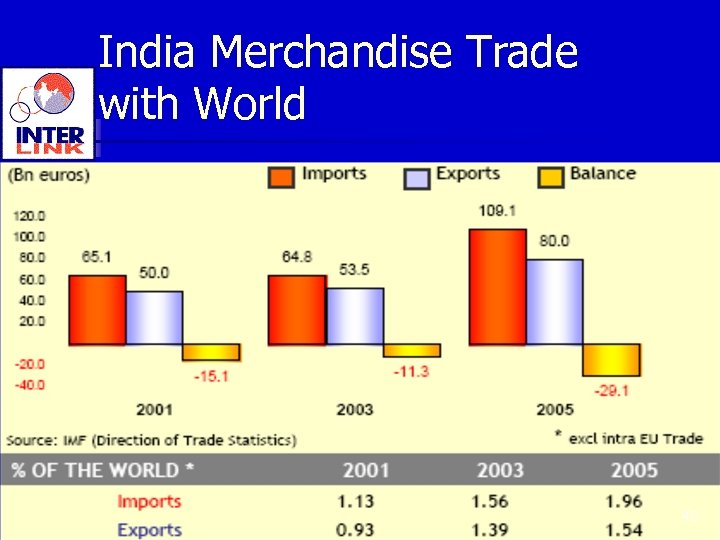

India Merchandise Trade with World 40

India Merchandise Trade with World 40

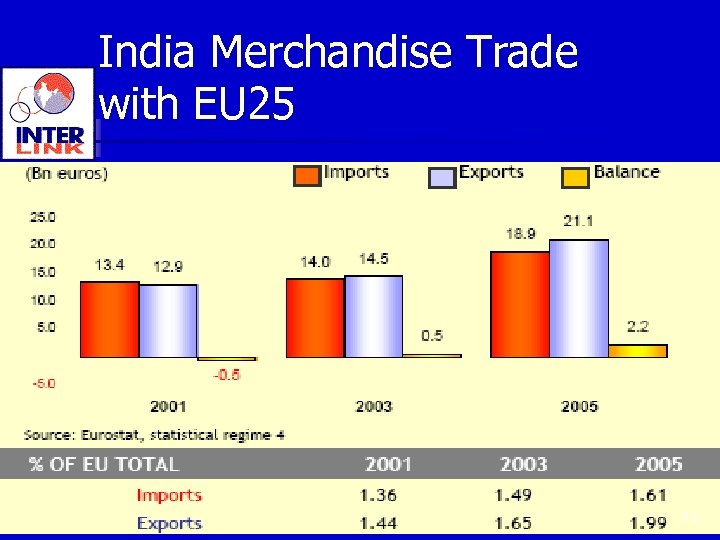

India Merchandise Trade with EU 25 41

India Merchandise Trade with EU 25 41

Indo EU Trade Total 2 way trade expected to be € 80 BN in 2011 n EU-India trade has grown from € 4. 4 billion in 1980 to € 40 billion in 2005 n Trade with the EU represents more than 20% of Indian's exports and import and n EU is India's largest trading partner n The EU is also India's largest source of foreign direct investment. However, India accounts for just 1. 8% of total EU trade. India attracts only 0. 3% of the EU's world-wide investments n 42

Indo EU Trade Total 2 way trade expected to be € 80 BN in 2011 n EU-India trade has grown from € 4. 4 billion in 1980 to € 40 billion in 2005 n Trade with the EU represents more than 20% of Indian's exports and import and n EU is India's largest trading partner n The EU is also India's largest source of foreign direct investment. However, India accounts for just 1. 8% of total EU trade. India attracts only 0. 3% of the EU's world-wide investments n 42

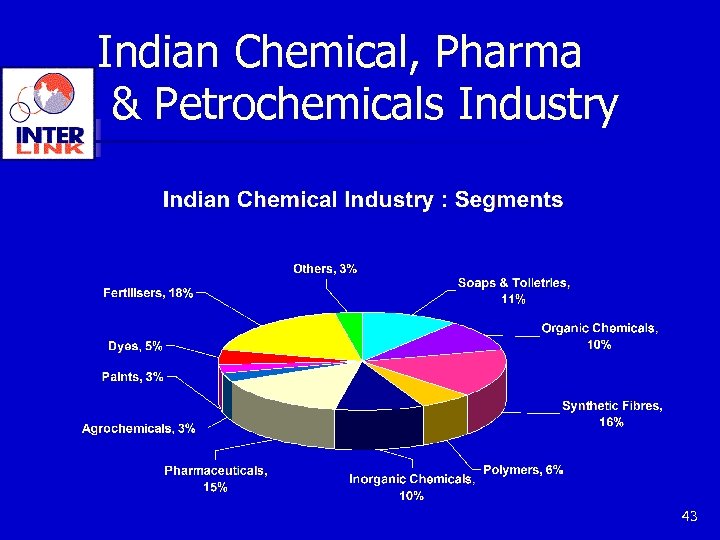

Indian Chemical, Pharma & Petrochemicals Industry 43

Indian Chemical, Pharma & Petrochemicals Industry 43

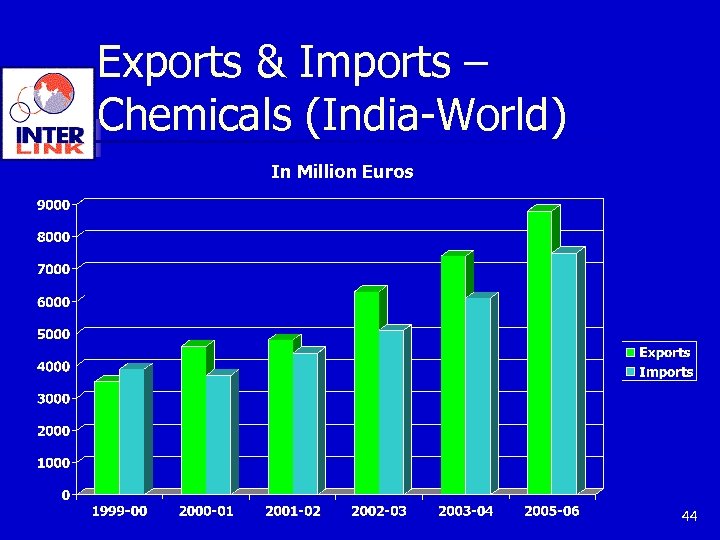

Exports & Imports – Chemicals (India-World) In Million Euros 44

Exports & Imports – Chemicals (India-World) In Million Euros 44

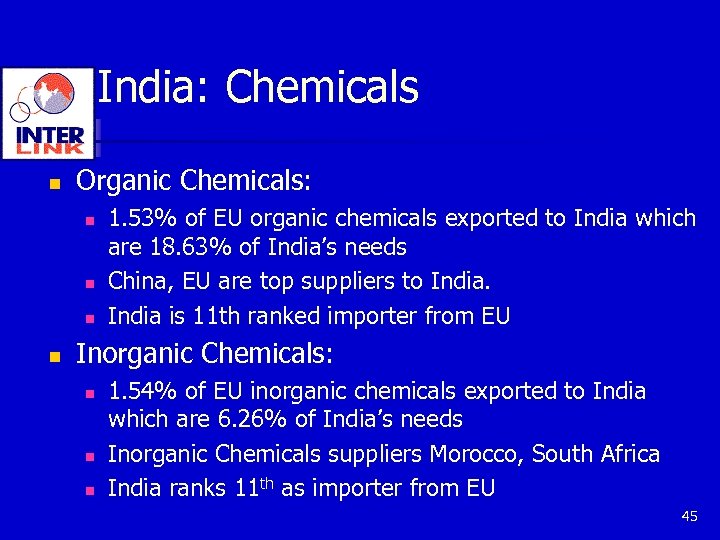

India: Chemicals n Organic Chemicals: n n 1. 53% of EU organic chemicals exported to India which are 18. 63% of India’s needs China, EU are top suppliers to India is 11 th ranked importer from EU Inorganic Chemicals: n n n 1. 54% of EU inorganic chemicals exported to India which are 6. 26% of India’s needs Inorganic Chemicals suppliers Morocco, South Africa India ranks 11 th as importer from EU 45

India: Chemicals n Organic Chemicals: n n 1. 53% of EU organic chemicals exported to India which are 18. 63% of India’s needs China, EU are top suppliers to India is 11 th ranked importer from EU Inorganic Chemicals: n n n 1. 54% of EU inorganic chemicals exported to India which are 6. 26% of India’s needs Inorganic Chemicals suppliers Morocco, South Africa India ranks 11 th as importer from EU 45

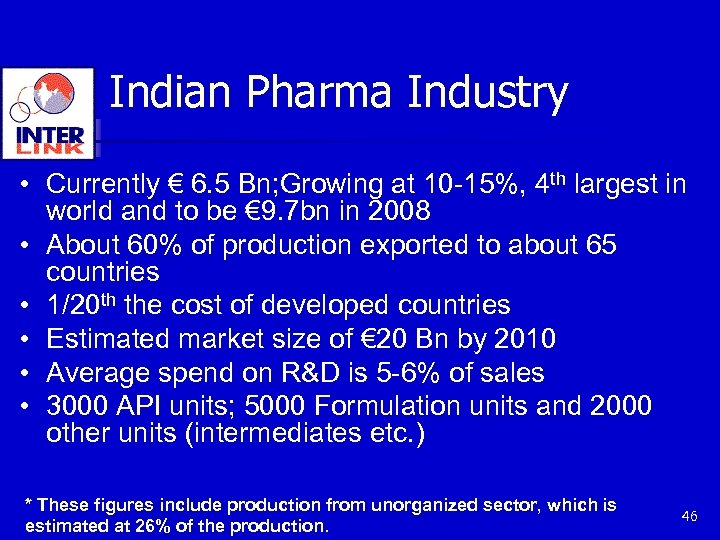

Indian Pharma Industry • Currently € 6. 5 Bn; Growing at 10 -15%, 4 th largest in world and to be € 9. 7 bn in 2008 • About 60% of production exported to about 65 countries • 1/20 th the cost of developed countries • Estimated market size of € 20 Bn by 2010 • Average spend on R&D is 5 -6% of sales • 3000 API units; 5000 Formulation units and 2000 other units (intermediates etc. ) * These figures include production from unorganized sector, which is estimated at 26% of the production. 46

Indian Pharma Industry • Currently € 6. 5 Bn; Growing at 10 -15%, 4 th largest in world and to be € 9. 7 bn in 2008 • About 60% of production exported to about 65 countries • 1/20 th the cost of developed countries • Estimated market size of € 20 Bn by 2010 • Average spend on R&D is 5 -6% of sales • 3000 API units; 5000 Formulation units and 2000 other units (intermediates etc. ) * These figures include production from unorganized sector, which is estimated at 26% of the production. 46

Indian Pharma Industry § Exports are over € 3. 8 billion. § India among top five bulk drug makers. § Indian owned companies are 65% increased from § § 25% Exports growing by 20% Medicinal plants trade > € 725 M. 170 biotechnology companies in R&D and manufacture of genomic drugs, business growing exponentially. Sequencing genes and delivering genomic information for big Pharmaceutical companies is the next boom industry in India. 47

Indian Pharma Industry § Exports are over € 3. 8 billion. § India among top five bulk drug makers. § Indian owned companies are 65% increased from § § 25% Exports growing by 20% Medicinal plants trade > € 725 M. 170 biotechnology companies in R&D and manufacture of genomic drugs, business growing exponentially. Sequencing genes and delivering genomic information for big Pharmaceutical companies is the next boom industry in India. 47

Indian Pharma Industry n n India's bulk drug and pharmaceutical industry grown into a highly sophisticated one, meeting the International standards of Production, Technology and Quality Control The progress of the Drug industry has rendered the country self-sufficient in National Health Care, has reversed the trend of Indian foreign trade profile from a predominantly importing country to a highly visible exporter to global marketing 48

Indian Pharma Industry n n India's bulk drug and pharmaceutical industry grown into a highly sophisticated one, meeting the International standards of Production, Technology and Quality Control The progress of the Drug industry has rendered the country self-sufficient in National Health Care, has reversed the trend of Indian foreign trade profile from a predominantly importing country to a highly visible exporter to global marketing 48

Indian Pharma Industry n n Indian pharmaceutical companies: filed 104 out of 251 new Drug Master Filings made in the US in April- June 2006, largest number of DMFs by any country India has largest contract research business in pharma industry (2005: $100 -120 Mn) and growing at 20 -25 per cent per year. About 35 per cent is new drug discovery and 65 per cent is in clinical trials. Cost saving for a multinational company moving R&D to India is 30 -50% Indian domestic Pharma companies are going global with a direct presence in multinational locations in the 49

Indian Pharma Industry n n Indian pharmaceutical companies: filed 104 out of 251 new Drug Master Filings made in the US in April- June 2006, largest number of DMFs by any country India has largest contract research business in pharma industry (2005: $100 -120 Mn) and growing at 20 -25 per cent per year. About 35 per cent is new drug discovery and 65 per cent is in clinical trials. Cost saving for a multinational company moving R&D to India is 30 -50% Indian domestic Pharma companies are going global with a direct presence in multinational locations in the 49

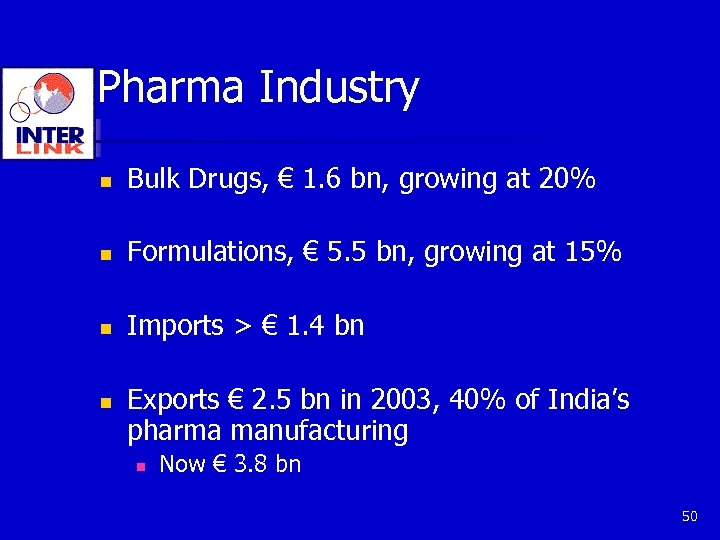

Pharma Industry n Bulk Drugs, € 1. 6 bn, growing at 20% n Formulations, € 5. 5 bn, growing at 15% n Imports > € 1. 4 bn n Exports € 2. 5 bn in 2003, 40% of India’s pharma manufacturing n Now € 3. 8 bn 50

Pharma Industry n Bulk Drugs, € 1. 6 bn, growing at 20% n Formulations, € 5. 5 bn, growing at 15% n Imports > € 1. 4 bn n Exports € 2. 5 bn in 2003, 40% of India’s pharma manufacturing n Now € 3. 8 bn 50

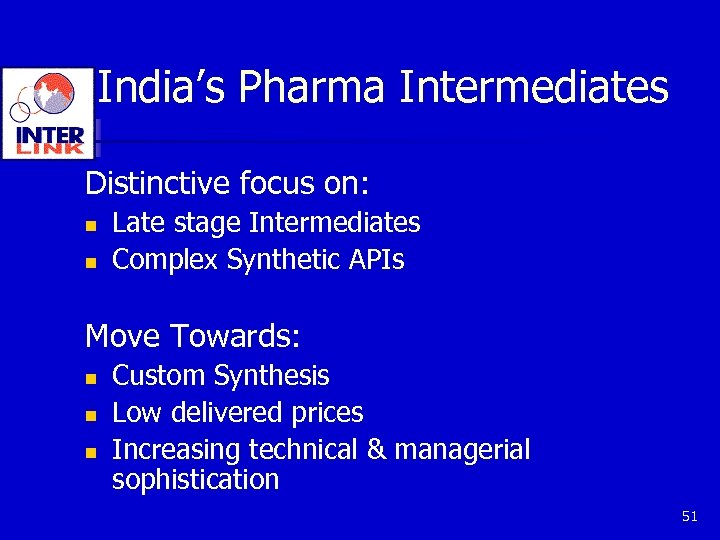

India’s Pharma Intermediates Distinctive focus on: n n Late stage Intermediates Complex Synthetic APIs Move Towards: n n n Custom Synthesis Low delivered prices Increasing technical & managerial sophistication 51

India’s Pharma Intermediates Distinctive focus on: n n Late stage Intermediates Complex Synthetic APIs Move Towards: n n n Custom Synthesis Low delivered prices Increasing technical & managerial sophistication 51

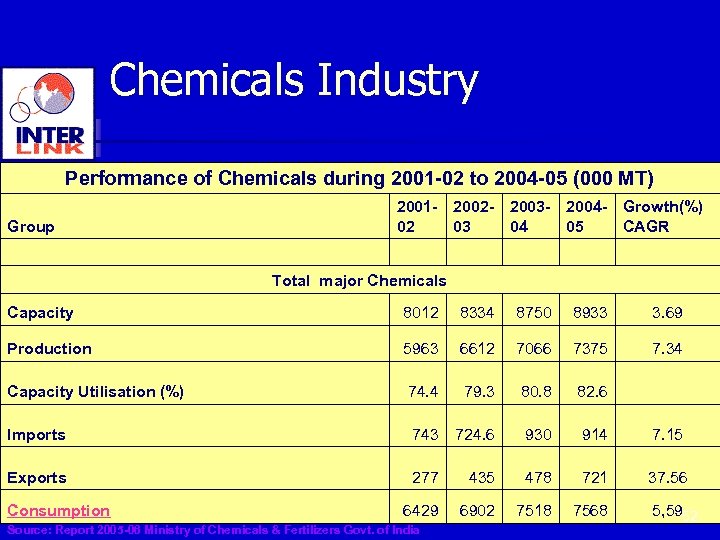

Chemicals Industry Performance of Chemicals during 2001 -02 to 2004 -05 (000 MT) Group 2001 - 2002 - 2003 - 2004 - Growth(%) 02 03 04 05 CAGR Total major Chemicals Capacity 8012 8334 8750 8933 3. 69 Production 5963 6612 7066 7375 7. 34 Capacity Utilisation (%) 74. 4 79. 3 80. 8 82. 6 Imports 743 724. 6 930 914 7. 15 Exports 277 435 478 721 37. 56 6429 6902 7518 7568 Consumption Source: Report 2005 -06 Ministry of Chemicals & Fertilizers Govt. of India 5, 5952

Chemicals Industry Performance of Chemicals during 2001 -02 to 2004 -05 (000 MT) Group 2001 - 2002 - 2003 - 2004 - Growth(%) 02 03 04 05 CAGR Total major Chemicals Capacity 8012 8334 8750 8933 3. 69 Production 5963 6612 7066 7375 7. 34 Capacity Utilisation (%) 74. 4 79. 3 80. 8 82. 6 Imports 743 724. 6 930 914 7. 15 Exports 277 435 478 721 37. 56 6429 6902 7518 7568 Consumption Source: Report 2005 -06 Ministry of Chemicals & Fertilizers Govt. of India 5, 5952

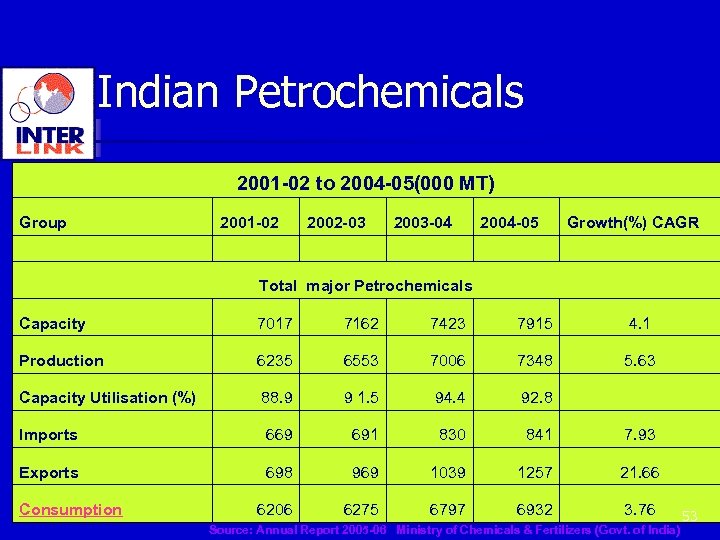

Indian Petrochemicals 2001 -02 to 2004 -05(000 MT) Group 2001 -02 2002 -03 2003 -04 2004 -05 Growth(%) CAGR Total major Petrochemicals Capacity 7017 7162 7423 7915 4. 1 Production 6235 6553 7006 7348 5. 63 Capacity Utilisation (%) 88. 9 9 1. 5 94. 4 92. 8 Imports 669 691 830 841 7. 93 Exports 698 969 1039 1257 21. 66 6206 6275 6797 6932 3. 76 Consumption Source: Annual Report 2005 -06 Ministry of Chemicals & Fertilizers (Govt. of India) 53

Indian Petrochemicals 2001 -02 to 2004 -05(000 MT) Group 2001 -02 2002 -03 2003 -04 2004 -05 Growth(%) CAGR Total major Petrochemicals Capacity 7017 7162 7423 7915 4. 1 Production 6235 6553 7006 7348 5. 63 Capacity Utilisation (%) 88. 9 9 1. 5 94. 4 92. 8 Imports 669 691 830 841 7. 93 Exports 698 969 1039 1257 21. 66 6206 6275 6797 6932 3. 76 Consumption Source: Annual Report 2005 -06 Ministry of Chemicals & Fertilizers (Govt. of India) 53

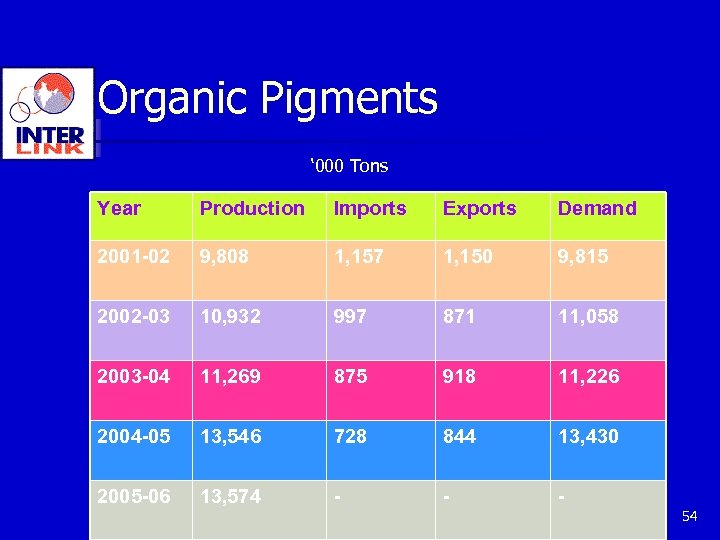

Organic Pigments ‘ 000 Tons Year Production Imports Exports Demand 2001 -02 9, 808 1, 157 1, 150 9, 815 2002 -03 10, 932 997 871 11, 058 2003 -04 11, 269 875 918 11, 226 2004 -05 13, 546 728 844 13, 430 2005 -06 13, 574 - - - 54

Organic Pigments ‘ 000 Tons Year Production Imports Exports Demand 2001 -02 9, 808 1, 157 1, 150 9, 815 2002 -03 10, 932 997 871 11, 058 2003 -04 11, 269 875 918 11, 226 2004 -05 13, 546 728 844 13, 430 2005 -06 13, 574 - - - 54

Indian Specialty & Fine Chemicals Market n n n n n Indian Specialty & Fine Chemicals Industry > € 4 Billion/Year Will be one of top-two exporters in low cost countries 2002: Exports valued at € 1. 6 Billion Growing @15%-20% annually Manufacturing hub for technology – intensive production Better than China in product quality & R&D facilities Specialty chemicals as antioxidants, food additives, and pigments Pharmaceutical and Agrochemical Industries consume more than 70% of the fine chemicals produced Performance chemicals being developed in India. Growing demand from manufacturers of products such as sunscreens and Biocides Manufacturing for Fine & Specialty chemicals shifting from developed countries to developing countries such as India. 55

Indian Specialty & Fine Chemicals Market n n n n n Indian Specialty & Fine Chemicals Industry > € 4 Billion/Year Will be one of top-two exporters in low cost countries 2002: Exports valued at € 1. 6 Billion Growing @15%-20% annually Manufacturing hub for technology – intensive production Better than China in product quality & R&D facilities Specialty chemicals as antioxidants, food additives, and pigments Pharmaceutical and Agrochemical Industries consume more than 70% of the fine chemicals produced Performance chemicals being developed in India. Growing demand from manufacturers of products such as sunscreens and Biocides Manufacturing for Fine & Specialty chemicals shifting from developed countries to developing countries such as India. 55

Why India is Important for the European Fine Chemicals Industry The changing business dynamics in India The growth of the fine chemicals business and trends in India: Knowledge and R&D base Opportunities to invest in, sell to and buy from in India and China competition Using India to balance supply constraints Using India as a supply base for other countries 56

Why India is Important for the European Fine Chemicals Industry The changing business dynamics in India The growth of the fine chemicals business and trends in India: Knowledge and R&D base Opportunities to invest in, sell to and buy from in India and China competition Using India to balance supply constraints Using India as a supply base for other countries 56

Confused European Dynamics* n n n Some European Companies: Growing Others: On the Fence And Some: Exiting Understand React to Change Cos. Trading at Low Multiples Few Customers for Used Plants * Marc Hannebert 57

Confused European Dynamics* n n n Some European Companies: Growing Others: On the Fence And Some: Exiting Understand React to Change Cos. Trading at Low Multiples Few Customers for Used Plants * Marc Hannebert 57

European Growth Drivers n n n Generics New Molecules (R&D) Speed of Generisation India is great at these 58

European Growth Drivers n n n Generics New Molecules (R&D) Speed of Generisation India is great at these 58

Who is your Customer? Taking Pharma Intermediate Cos. as an example: n Consumer n Final Drug Producer n Some one else n Insurance Companies? Provide Value Added solution to end Customer Move down and up Value Chain, convert commodities to specialties through soft factors (Roger La. Force) 59

Who is your Customer? Taking Pharma Intermediate Cos. as an example: n Consumer n Final Drug Producer n Some one else n Insurance Companies? Provide Value Added solution to end Customer Move down and up Value Chain, convert commodities to specialties through soft factors (Roger La. Force) 59

Lessons n n European Fine Chemicals Cos. have Customer Base Change Production Base to India n n Source Contract Buy someone Use India for R&D: REACH labs in India 60

Lessons n n European Fine Chemicals Cos. have Customer Base Change Production Base to India n n Source Contract Buy someone Use India for R&D: REACH labs in India 60

Lessons n n n Build Global Strategy: USA, Asia, and the world Understand react to change Try to Europeanise India n Upgrade n n As economy grows Insurance companies 61

Lessons n n n Build Global Strategy: USA, Asia, and the world Understand react to change Try to Europeanise India n Upgrade n n As economy grows Insurance companies 61

Lessons Indian Companies n Use Production & R&D base to your advantage n Get closer to Customer n n Buy someone close to the customer, or with a customer base Buy a distribution co. Manage expensive European logistics Globalise: Backward/Forward Integration n Indianise Europe 62

Lessons Indian Companies n Use Production & R&D base to your advantage n Get closer to Customer n n Buy someone close to the customer, or with a customer base Buy a distribution co. Manage expensive European logistics Globalise: Backward/Forward Integration n Indianise Europe 62

Drivers in India n n India low Cost Driven by Government to deliver low cost health care solutions to the poor n n Low cost/affordable drugs Avoid Insurance company syndrome n n Lobby of people vs. Lobby of insurance companies/drug companies n Example: AIDS drugs 63

Drivers in India n n India low Cost Driven by Government to deliver low cost health care solutions to the poor n n Low cost/affordable drugs Avoid Insurance company syndrome n n Lobby of people vs. Lobby of insurance companies/drug companies n Example: AIDS drugs 63

India and Specialties n n Opportunity for European companies to sell For Indian companies to develop low cost alternatives 64

India and Specialties n n Opportunity for European companies to sell For Indian companies to develop low cost alternatives 64

We conclude, India is important: n n n Very cheap source of fine chemicals Growing & important R&D centre Growing market for European companies to tap India is Entering Europe Growing competitor Opportunity for European manufacturers to relocate and source from India and to sell in India n n Sub contract Or source and sell through specialists like Azelis 65

We conclude, India is important: n n n Very cheap source of fine chemicals Growing & important R&D centre Growing market for European companies to tap India is Entering Europe Growing competitor Opportunity for European manufacturers to relocate and source from India and to sell in India n n Sub contract Or source and sell through specialists like Azelis 65

Therefore, understanding India, build a Global Strategy n Used to be in many industries: “What is your China Strategy? ” It is not only that but your Indian and Asian strategy, and your Global strategy Ignore India at your own risk! 66

Therefore, understanding India, build a Global Strategy n Used to be in many industries: “What is your China Strategy? ” It is not only that but your Indian and Asian strategy, and your Global strategy Ignore India at your own risk! 66

THANK YOU Gautam Mahajan Inter-Link Services Pvt. Ltd. K 185 Sarai Jullena New Delhi 110025 mahajan@interlinkindia. com +91 98100 60368, Fax +91 11 26929055 67

THANK YOU Gautam Mahajan Inter-Link Services Pvt. Ltd. K 185 Sarai Jullena New Delhi 110025 mahajan@interlinkindia. com +91 98100 60368, Fax +91 11 26929055 67