9bed0a9e50b953bddeb20dcd088c7529.ppt

- Количество слайдов: 38

Who Makes Credit Card Mistakes? Nadia Massoud School of Business, University of Alberta, Canada Anthony Saunders Stern School, NYU, NY Barry Scholnick School of Business, University of Alberta, Canada Paper Presented at the FDIC 2006 Fall Workshop, Washington D. C. Preliminary – Please do not quote • Thanks to the anonymous Canadian deposit taking institution for providing the proprietary data. • Thanks also to FDIC Center for Financial Research (CFR) for Funding.

Who Makes Credit Card Mistakes? Nadia Massoud School of Business, University of Alberta, Canada Anthony Saunders Stern School, NYU, NY Barry Scholnick School of Business, University of Alberta, Canada Paper Presented at the FDIC 2006 Fall Workshop, Washington D. C. Preliminary – Please do not quote • Thanks to the anonymous Canadian deposit taking institution for providing the proprietary data. • Thanks also to FDIC Center for Financial Research (CFR) for Funding.

Campbell, JF, 2006 “Household Finance” • “Evidence …suggests that many households invest efficiently, but a minority make significant mistakes. This minority appears to be poorer and less well educated” Abstract from AFA Presidential Address (JF, 2006, p 1553) Massoud Saunders Scholnick 2

Campbell, JF, 2006 “Household Finance” • “Evidence …suggests that many households invest efficiently, but a minority make significant mistakes. This minority appears to be poorer and less well educated” Abstract from AFA Presidential Address (JF, 2006, p 1553) Massoud Saunders Scholnick 2

Campbell (2006, JF) Conclusion – “Poorer and Less Educated households are more likely to make (Investment) mistakes than wealthier and better educated households. This pattern reinforces the interpretation of nonstandard behavior as reflecting mistakes rather than nonstandard preferences. ” (p. 1590) Massoud Saunders Scholnick 3

Campbell (2006, JF) Conclusion – “Poorer and Less Educated households are more likely to make (Investment) mistakes than wealthier and better educated households. This pattern reinforces the interpretation of nonstandard behavior as reflecting mistakes rather than nonstandard preferences. ” (p. 1590) Massoud Saunders Scholnick 3

Less Education - More Mistakes • Equity Ownership (Campbell, 2006, Guiso, Sapienza and Zingales, 2005) • Portfolio Diversification (Campbell, 2006, Calvet et al, 2006) • Mortgage Refinancing (Campbell, 2006) Low Education Causing Mistakes is Different from “Nonstandard Preferences” (i. e. Psych/Behavioral Explanations) Massoud Saunders Scholnick 4

Less Education - More Mistakes • Equity Ownership (Campbell, 2006, Guiso, Sapienza and Zingales, 2005) • Portfolio Diversification (Campbell, 2006, Calvet et al, 2006) • Mortgage Refinancing (Campbell, 2006) Low Education Causing Mistakes is Different from “Nonstandard Preferences” (i. e. Psych/Behavioral Explanations) Massoud Saunders Scholnick 4

THIS PAPER 1. Measure Financial Mistakes in CREDIT CARD usage. 2. Who makes these Credit Card Mistakes? (Income, Education, etc) i. e. We ask the same question as Campbell, 2006 – but examine a different kind of mistake Massoud Saunders Scholnick 5

THIS PAPER 1. Measure Financial Mistakes in CREDIT CARD usage. 2. Who makes these Credit Card Mistakes? (Income, Education, etc) i. e. We ask the same question as Campbell, 2006 – but examine a different kind of mistake Massoud Saunders Scholnick 5

The Credit Card Debt Puzzle. . “conventional models cannot easily explain, for example, why so many people are borrowing on their credit cards, and simultaneously holding low yielding assets” Gross and Souleles QJE 2002 (p. 149) “Borrow High Lend Low” (BHLL) Zinman (2006) Massoud Saunders Scholnick 6

The Credit Card Debt Puzzle. . “conventional models cannot easily explain, for example, why so many people are borrowing on their credit cards, and simultaneously holding low yielding assets” Gross and Souleles QJE 2002 (p. 149) “Borrow High Lend Low” (BHLL) Zinman (2006) Massoud Saunders Scholnick 6

Existing Explanations for Credit Card Debt Puzzle (BHLL) 1. Rational - Precautionary Balances Zinman , 2006 Telyukova and Wright, 2006 • • • C Cards and Deposits not perfect substitutes. Need Deposit Balances to pay for things that will not accept Credit Cards. Therefore hold deposits and don’t fully pay down Credit Card Debt Massoud Saunders Scholnick 7

Existing Explanations for Credit Card Debt Puzzle (BHLL) 1. Rational - Precautionary Balances Zinman , 2006 Telyukova and Wright, 2006 • • • C Cards and Deposits not perfect substitutes. Need Deposit Balances to pay for things that will not accept Credit Cards. Therefore hold deposits and don’t fully pay down Credit Card Debt Massoud Saunders Scholnick 7

Behavioural Theories of BHLL 2. Self Control (Bertraut and Haliassos (2002), Haliassos and Reiter (2005), ) – hold Credit Card Balances to stop you spending MORE on Credit Cards – Accountant-Shopper Framework (Two Spouses in a household) Massoud Saunders Scholnick 8

Behavioural Theories of BHLL 2. Self Control (Bertraut and Haliassos (2002), Haliassos and Reiter (2005), ) – hold Credit Card Balances to stop you spending MORE on Credit Cards – Accountant-Shopper Framework (Two Spouses in a household) Massoud Saunders Scholnick 8

Behavioural Theories of BHLL (cont) 3. Hyperbolic Discounting (Laibson, Repetto and Tobacman, 2005) – Patient over long term; Impatient over Short term – therefore hold LT Assets and ST Credit Card debt. – More applicable to LT Assets (Houses, Stock Portfolio etc) not Demand Deposits Massoud Saunders Scholnick 9

Behavioural Theories of BHLL (cont) 3. Hyperbolic Discounting (Laibson, Repetto and Tobacman, 2005) – Patient over long term; Impatient over Short term – therefore hold LT Assets and ST Credit Card debt. – More applicable to LT Assets (Houses, Stock Portfolio etc) not Demand Deposits Massoud Saunders Scholnick 9

This Paper… Demographic Explanations for BHLL • • • Income Education Unemployment House Ownership Immigrant Same explanation as Campbell (2006) – but different financial mistakes (BHLL) Massoud Saunders Scholnick 10

This Paper… Demographic Explanations for BHLL • • • Income Education Unemployment House Ownership Immigrant Same explanation as Campbell (2006) – but different financial mistakes (BHLL) Massoud Saunders Scholnick 10

Our Data • Unique Proprietary Data Base • Single Canadian Deposit-Taking Institution • Confidentiality Agreement Massoud Saunders Scholnick 11

Our Data • Unique Proprietary Data Base • Single Canadian Deposit-Taking Institution • Confidentiality Agreement Massoud Saunders Scholnick 11

Our Proprietary Banking Data • ~100 000 Bank Consumers • 19 Months (Panel) • ~1. 5 Million person/month data points • Credit Card and Deposit Data • Taken Directly from Monthly Statements Massoud Saunders Scholnick 12

Our Proprietary Banking Data • ~100 000 Bank Consumers • 19 Months (Panel) • ~1. 5 Million person/month data points • Credit Card and Deposit Data • Taken Directly from Monthly Statements Massoud Saunders Scholnick 12

Matching Credit Card and Deposit Data Match (1) Credit Card Monthly Statement Data with (2) Deposit Account Monthly Statement Data Match using consumer Social Insurance (SIN) # and Name Massoud Saunders Scholnick 13

Matching Credit Card and Deposit Data Match (1) Credit Card Monthly Statement Data with (2) Deposit Account Monthly Statement Data Match using consumer Social Insurance (SIN) # and Name Massoud Saunders Scholnick 13

Demographic Data Our data has POSTAL CODE of each individual. (In Canada ~ 50 Households in each Postal Code) Match with Statistics Canada Census Data: Smallest Geog Area =Dissemination Area (DA). Approx 200 Households in each DA Massoud Saunders Scholnick 14

Demographic Data Our data has POSTAL CODE of each individual. (In Canada ~ 50 Households in each Postal Code) Match with Statistics Canada Census Data: Smallest Geog Area =Dissemination Area (DA). Approx 200 Households in each DA Massoud Saunders Scholnick 14

Matching Bank and Census Data • Using Postal Code, we can EXACLY MATCH Each Bank Consumer with appropriate DA Census Data (Average from ~200 Households) • • • Income Unemployment Education Home Ownership Immigrant Massoud Saunders Scholnick 15

Matching Bank and Census Data • Using Postal Code, we can EXACLY MATCH Each Bank Consumer with appropriate DA Census Data (Average from ~200 Households) • • • Income Unemployment Education Home Ownership Immigrant Massoud Saunders Scholnick 15

US Zip Code vs. Can Post Code US Census by ZIP Code (5 Digit) Available for 28 785 ZIP CODES Average: >10 000 people per Zip Code Canada Census by Post Code (6 Digit) DA Available for ~ 200 Households (~ 600 people) Massoud Saunders Scholnick 16

US Zip Code vs. Can Post Code US Census by ZIP Code (5 Digit) Available for 28 785 ZIP CODES Average: >10 000 people per Zip Code Canada Census by Post Code (6 Digit) DA Available for ~ 200 Households (~ 600 people) Massoud Saunders Scholnick 16

Methodology • Credit Card Mistakes are our Dependent Variables – THREE different kinds of Credit Card Mistakes (i. e. 3 Different models) • Demographic Data (Income, Education etc) are our Independent Variables Massoud Saunders Scholnick 17

Methodology • Credit Card Mistakes are our Dependent Variables – THREE different kinds of Credit Card Mistakes (i. e. 3 Different models) • Demographic Data (Income, Education etc) are our Independent Variables Massoud Saunders Scholnick 17

DEFINING MISTAKES (Dep Vars) • • Zinman (2006) Framework “Borrow High Lend Low” (BHLL). Unadjusted Wedge= min [Credit Card Debt, Demand Deposits] Unadjusted COST= max[0, Unadjusted Wedge*(r_card-r_dep)] Massoud Saunders Scholnick 18

DEFINING MISTAKES (Dep Vars) • • Zinman (2006) Framework “Borrow High Lend Low” (BHLL). Unadjusted Wedge= min [Credit Card Debt, Demand Deposits] Unadjusted COST= max[0, Unadjusted Wedge*(r_card-r_dep)] Massoud Saunders Scholnick 18

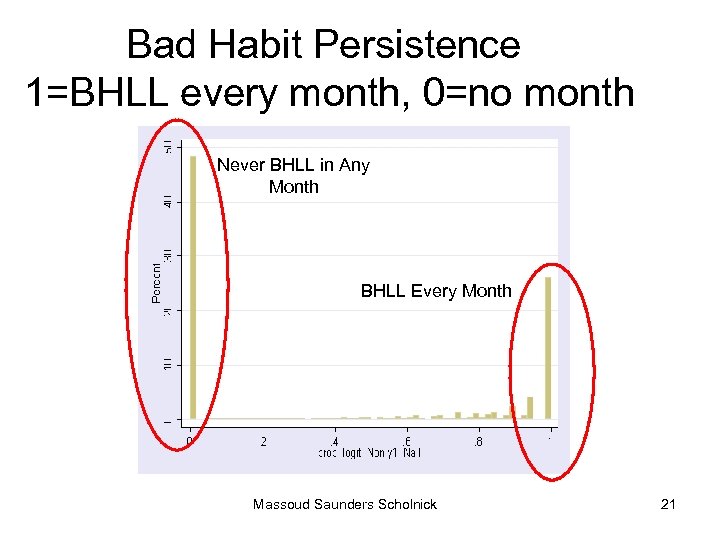

Our First Measure of Mistakes • “Bad Habit Persistence” Rational Expectations Theory: Agents should not make REPEATED mistakes Test BHLL every month. Stronger test than just a single month (we have 19 months data) Our Measure: What proportion of months do you BHLL Massoud Saunders Scholnick 19

Our First Measure of Mistakes • “Bad Habit Persistence” Rational Expectations Theory: Agents should not make REPEATED mistakes Test BHLL every month. Stronger test than just a single month (we have 19 months data) Our Measure: What proportion of months do you BHLL Massoud Saunders Scholnick 19

Model 1. Repeated BHLL • Our Data: 19 Months • Estimate if BHLL for each consumer for each month. • If BHLL = 1, if NOT BHLL = 0. • Proportion of Months that each Consumer BHLLs Massoud Saunders Scholnick 20

Model 1. Repeated BHLL • Our Data: 19 Months • Estimate if BHLL for each consumer for each month. • If BHLL = 1, if NOT BHLL = 0. • Proportion of Months that each Consumer BHLLs Massoud Saunders Scholnick 20

Bad Habit Persistence 1=BHLL every month, 0=no month Never BHLL in Any Month BHLL Every Month Massoud Saunders Scholnick 21

Bad Habit Persistence 1=BHLL every month, 0=no month Never BHLL in Any Month BHLL Every Month Massoud Saunders Scholnick 21

Second Measures of Mistakes Repeated BHLL (as in 1 above) adjusted for Precautionary Balances* (*As defined in Zinman, 2006 and Telyukova and Wright, 2006 and Telyukova 2006) • Assume that Credit Cards and Deposits are NOT perfect substitutes. • Assume that its Rational for Consumers Hold “Excess” Deposits for Precautionary Reasons Massoud Saunders Scholnick 22

Second Measures of Mistakes Repeated BHLL (as in 1 above) adjusted for Precautionary Balances* (*As defined in Zinman, 2006 and Telyukova and Wright, 2006 and Telyukova 2006) • Assume that Credit Cards and Deposits are NOT perfect substitutes. • Assume that its Rational for Consumers Hold “Excess” Deposits for Precautionary Reasons Massoud Saunders Scholnick 22

Measuring “Precautionary” Balances • We assume a “Value at Risk” Framework • How much $$ do you have to hold in deposits in case of large future shocks? • We assume a confidence level of 1 standard deviation of deposits (measured over 19 months) Massoud Saunders Scholnick 23

Measuring “Precautionary” Balances • We assume a “Value at Risk” Framework • How much $$ do you have to hold in deposits in case of large future shocks? • We assume a confidence level of 1 standard deviation of deposits (measured over 19 months) Massoud Saunders Scholnick 23

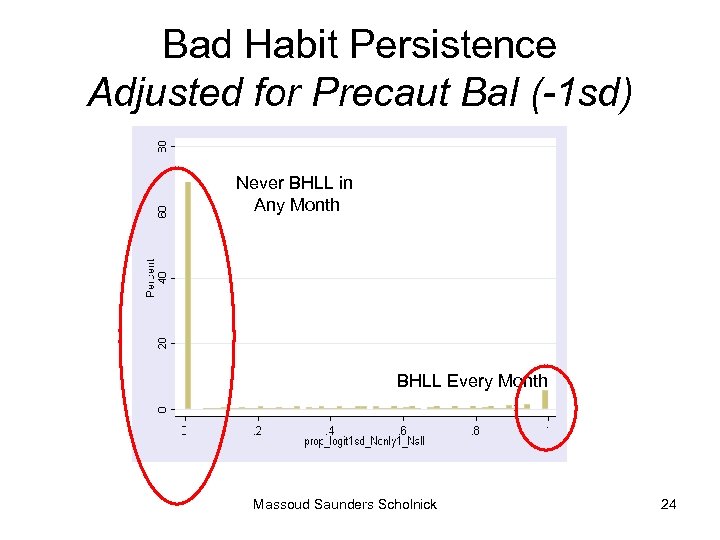

Bad Habit Persistence Adjusted for Precaut Bal (-1 sd) Never BHLL in Any Month BHLL Every Month Massoud Saunders Scholnick 24

Bad Habit Persistence Adjusted for Precaut Bal (-1 sd) Never BHLL in Any Month BHLL Every Month Massoud Saunders Scholnick 24

Third Measure of Mistakes Consumer is Delinquent or Overlimit on Credit Card – but still has deposits that could pay outstanding Credit Card debt. • Delinquent – don’t pay minimum balance • Overlimit – Charge over preset limit • Very Costly to be delinquent and overlimit – pay fee AND impacts future credit rating. Massoud Saunders Scholnick 25

Third Measure of Mistakes Consumer is Delinquent or Overlimit on Credit Card – but still has deposits that could pay outstanding Credit Card debt. • Delinquent – don’t pay minimum balance • Overlimit – Charge over preset limit • Very Costly to be delinquent and overlimit – pay fee AND impacts future credit rating. Massoud Saunders Scholnick 25

Model 3: • BHLL AND Delinquent / Overlimit • Measure: Multiply two (0, 1) measures • (Delinq/overlimit=1, else=0) * BHLL • Measure = 1 if both delinq/olimit AND BHLL • Measure for every month (not proportion of months – i. e. don’t look at repeat errors) Massoud Saunders Scholnick 26

Model 3: • BHLL AND Delinquent / Overlimit • Measure: Multiply two (0, 1) measures • (Delinq/overlimit=1, else=0) * BHLL • Measure = 1 if both delinq/olimit AND BHLL • Measure for every month (not proportion of months – i. e. don’t look at repeat errors) Massoud Saunders Scholnick 26

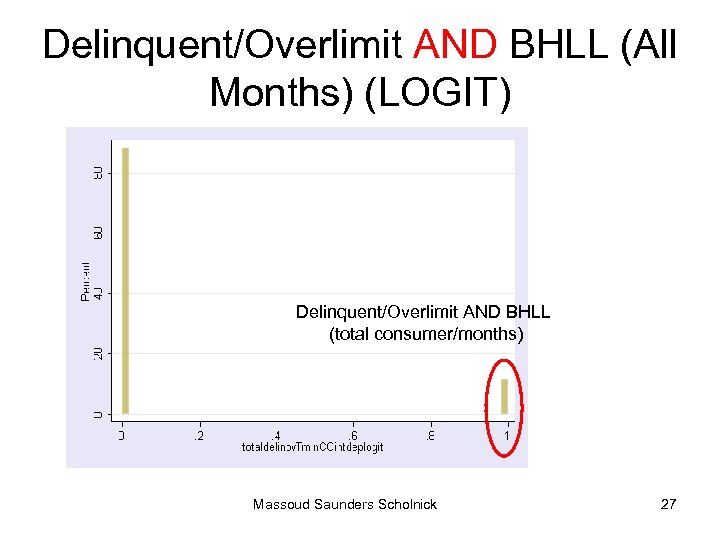

Delinquent/Overlimit AND BHLL (All Months) (LOGIT) Delinquent/Overlimit AND BHLL (total consumer/months) Massoud Saunders Scholnick 27

Delinquent/Overlimit AND BHLL (All Months) (LOGIT) Delinquent/Overlimit AND BHLL (total consumer/months) Massoud Saunders Scholnick 27

Independent (Demographic) Variables 1. Ln(Average Income) 2. Unemployment Rate % 3. Education 1. % High School 2. % Some Post Secondary Education 3. % University Grad 4. Own Home % 5. Immigrant 1. Developed Countries 2. LDCs Massoud Saunders Scholnick 28

Independent (Demographic) Variables 1. Ln(Average Income) 2. Unemployment Rate % 3. Education 1. % High School 2. % Some Post Secondary Education 3. % University Grad 4. Own Home % 5. Immigrant 1. Developed Countries 2. LDCs Massoud Saunders Scholnick 28

Fico (Beacon) Score • Created by Independent Credit Bureau • Includes data from ALL Debt Accounts (not just Credit Cards) • Based on Lagged Data • Include as control for Banks ex ante assessment of credit risk Massoud Saunders Scholnick 29

Fico (Beacon) Score • Created by Independent Credit Bureau • Includes data from ALL Debt Accounts (not just Credit Cards) • Based on Lagged Data • Include as control for Banks ex ante assessment of credit risk Massoud Saunders Scholnick 29

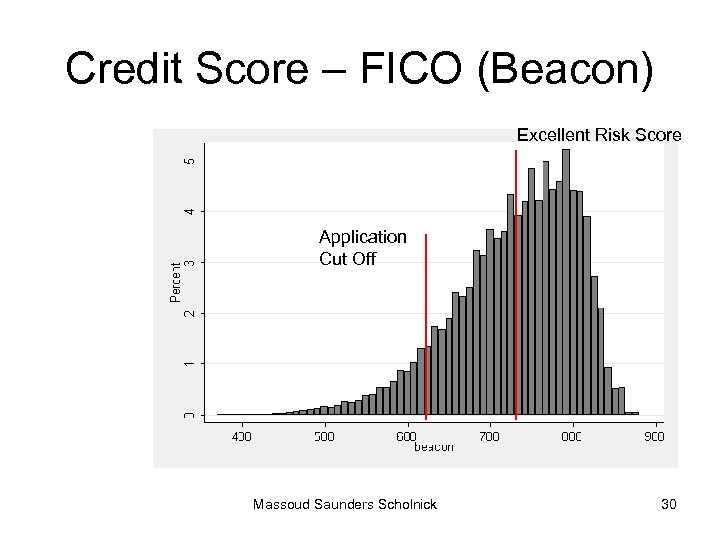

Credit Score – FICO (Beacon) Excellent Risk Score Application Cut Off Massoud Saunders Scholnick 30

Credit Score – FICO (Beacon) Excellent Risk Score Application Cut Off Massoud Saunders Scholnick 30

RESULTS Massoud Saunders Scholnick 31

RESULTS Massoud Saunders Scholnick 31

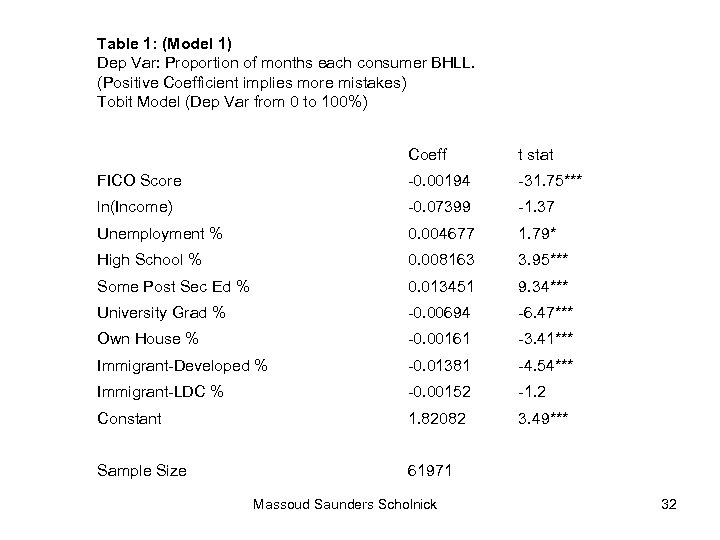

Table 1: (Model 1) Dep Var: Proportion of months each consumer BHLL. (Positive Coefficient implies more mistakes) Tobit Model (Dep Var from 0 to 100%) Coeff t stat FICO Score -0. 00194 -31. 75*** ln(Income) -0. 07399 -1. 37 Unemployment % 0. 004677 1. 79* High School % 0. 008163 3. 95*** Some Post Sec Ed % 0. 013451 9. 34*** University Grad % -0. 00694 -6. 47*** Own House % -0. 00161 -3. 41*** Immigrant-Developed % -0. 01381 -4. 54*** Immigrant-LDC % -0. 00152 -1. 2 Constant 1. 82082 3. 49*** Sample Size 61971 Massoud Saunders Scholnick 32

Table 1: (Model 1) Dep Var: Proportion of months each consumer BHLL. (Positive Coefficient implies more mistakes) Tobit Model (Dep Var from 0 to 100%) Coeff t stat FICO Score -0. 00194 -31. 75*** ln(Income) -0. 07399 -1. 37 Unemployment % 0. 004677 1. 79* High School % 0. 008163 3. 95*** Some Post Sec Ed % 0. 013451 9. 34*** University Grad % -0. 00694 -6. 47*** Own House % -0. 00161 -3. 41*** Immigrant-Developed % -0. 01381 -4. 54*** Immigrant-LDC % -0. 00152 -1. 2 Constant 1. 82082 3. 49*** Sample Size 61971 Massoud Saunders Scholnick 32

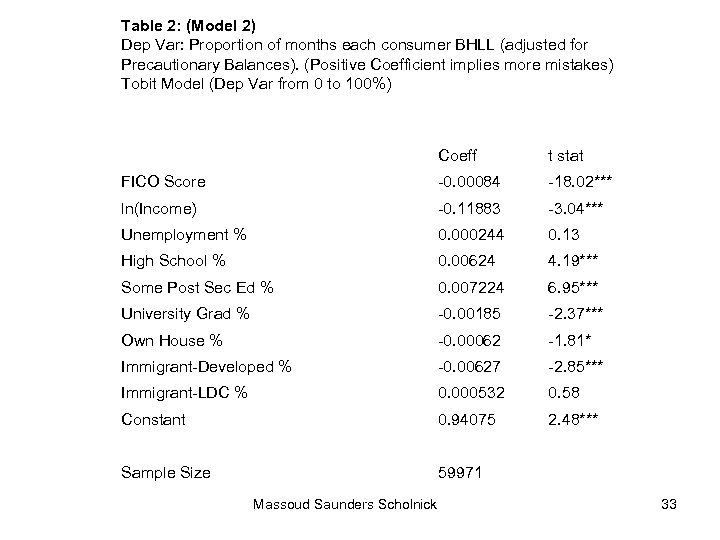

Table 2: (Model 2) Dep Var: Proportion of months each consumer BHLL (adjusted for Precautionary Balances). (Positive Coefficient implies more mistakes) Tobit Model (Dep Var from 0 to 100%) Coeff t stat FICO Score -0. 00084 -18. 02*** ln(Income) -0. 11883 -3. 04*** Unemployment % 0. 000244 0. 13 High School % 0. 00624 4. 19*** Some Post Sec Ed % 0. 007224 6. 95*** University Grad % -0. 00185 -2. 37*** Own House % -0. 00062 -1. 81* Immigrant-Developed % -0. 00627 -2. 85*** Immigrant-LDC % 0. 000532 0. 58 Constant 0. 94075 2. 48*** Sample Size 59971 Massoud Saunders Scholnick 33

Table 2: (Model 2) Dep Var: Proportion of months each consumer BHLL (adjusted for Precautionary Balances). (Positive Coefficient implies more mistakes) Tobit Model (Dep Var from 0 to 100%) Coeff t stat FICO Score -0. 00084 -18. 02*** ln(Income) -0. 11883 -3. 04*** Unemployment % 0. 000244 0. 13 High School % 0. 00624 4. 19*** Some Post Sec Ed % 0. 007224 6. 95*** University Grad % -0. 00185 -2. 37*** Own House % -0. 00062 -1. 81* Immigrant-Developed % -0. 00627 -2. 85*** Immigrant-LDC % 0. 000532 0. 58 Constant 0. 94075 2. 48*** Sample Size 59971 Massoud Saunders Scholnick 33

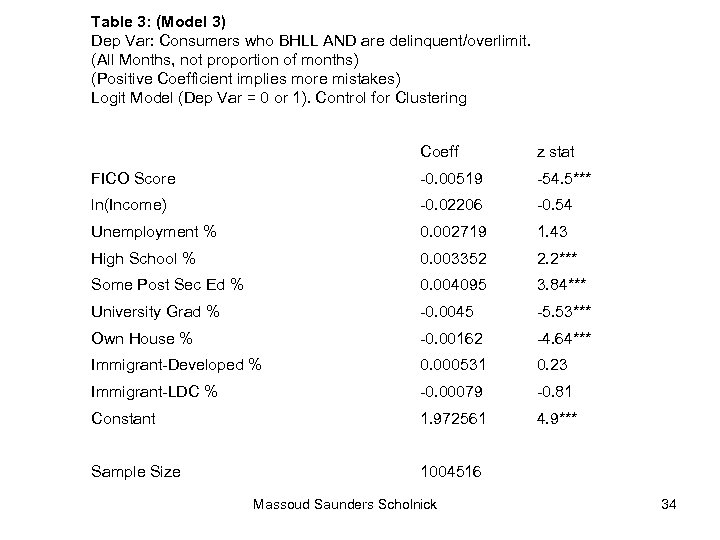

Table 3: (Model 3) Dep Var: Consumers who BHLL AND are delinquent/overlimit. (All Months, not proportion of months) (Positive Coefficient implies more mistakes) Logit Model (Dep Var = 0 or 1). Control for Clustering Coeff z stat FICO Score -0. 00519 -54. 5*** ln(Income) -0. 02206 -0. 54 Unemployment % 0. 002719 1. 43 High School % 0. 003352 2. 2*** Some Post Sec Ed % 0. 004095 3. 84*** University Grad % -0. 0045 -5. 53*** Own House % -0. 00162 -4. 64*** Immigrant-Developed % 0. 000531 0. 23 Immigrant-LDC % -0. 00079 -0. 81 Constant 1. 972561 4. 9*** Sample Size 1004516 Massoud Saunders Scholnick 34

Table 3: (Model 3) Dep Var: Consumers who BHLL AND are delinquent/overlimit. (All Months, not proportion of months) (Positive Coefficient implies more mistakes) Logit Model (Dep Var = 0 or 1). Control for Clustering Coeff z stat FICO Score -0. 00519 -54. 5*** ln(Income) -0. 02206 -0. 54 Unemployment % 0. 002719 1. 43 High School % 0. 003352 2. 2*** Some Post Sec Ed % 0. 004095 3. 84*** University Grad % -0. 0045 -5. 53*** Own House % -0. 00162 -4. 64*** Immigrant-Developed % 0. 000531 0. 23 Immigrant-LDC % -0. 00079 -0. 81 Constant 1. 972561 4. 9*** Sample Size 1004516 Massoud Saunders Scholnick 34

Who Makes LESS mistakes • University Grad (All 3 models – all *** ) • Own House (All 3 models) • Immigrant-Developed Countries (2 models) • High Income (1 model) Massoud Saunders Scholnick 35

Who Makes LESS mistakes • University Grad (All 3 models – all *** ) • Own House (All 3 models) • Immigrant-Developed Countries (2 models) • High Income (1 model) Massoud Saunders Scholnick 35

Who Makes MORE mistakes • High School Only (All 3 models – all ***) • Some Post Sec (All 3 models - all ***) • Unemployed (1 model) Massoud Saunders Scholnick 36

Who Makes MORE mistakes • High School Only (All 3 models – all ***) • Some Post Sec (All 3 models - all ***) • Unemployed (1 model) Massoud Saunders Scholnick 36

Implications 1. Demographics Matter 2. Education Really Matters • Sign Changes: University = Less Mistakes, High School/Some Pst Sec = More Mistakes • Highly significant (***): across all 3 types of mistake, and all 3 levels of education Massoud Saunders Scholnick 37

Implications 1. Demographics Matter 2. Education Really Matters • Sign Changes: University = Less Mistakes, High School/Some Pst Sec = More Mistakes • Highly significant (***): across all 3 types of mistake, and all 3 levels of education Massoud Saunders Scholnick 37

Implications for Theory • Same argument as Campbell (2006 JF) • Demographic Explanation (especially education) reflects “non-standard Behaviour” NOT “non-standard Preferences” • i. e. Behavioral Explanations based on nonstandard preferences need to explain why mistakes occur in some demographic groups, and not others. Massoud Saunders Scholnick 38

Implications for Theory • Same argument as Campbell (2006 JF) • Demographic Explanation (especially education) reflects “non-standard Behaviour” NOT “non-standard Preferences” • i. e. Behavioral Explanations based on nonstandard preferences need to explain why mistakes occur in some demographic groups, and not others. Massoud Saunders Scholnick 38