325232292979d02b441546647cd84c98.ppt

- Количество слайдов: 37

White Collar Fraud

White Collar Fraud

Check Fraud • Forgery • Counterfeiting • Altering Checks – (Payees, Amount, washing) • Forged Endorsements • Paperhanging • • • Kiting Checks Theft by checks Beating the bank Return item schemes Nigerian scams (419)

Check Fraud • Forgery • Counterfeiting • Altering Checks – (Payees, Amount, washing) • Forged Endorsements • Paperhanging • • • Kiting Checks Theft by checks Beating the bank Return item schemes Nigerian scams (419)

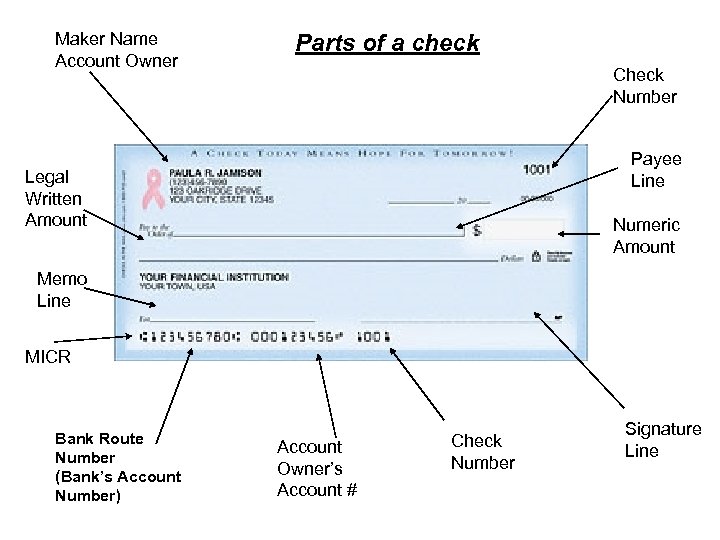

Maker Name Account Owner Parts of a check Check Number Payee Line Legal Written Amount Numeric Amount Memo Line MICR Bank Route Number (Bank’s Account Number) Account Owner’s Account # Check Number Signature Line

Maker Name Account Owner Parts of a check Check Number Payee Line Legal Written Amount Numeric Amount Memo Line MICR Bank Route Number (Bank’s Account Number) Account Owner’s Account # Check Number Signature Line

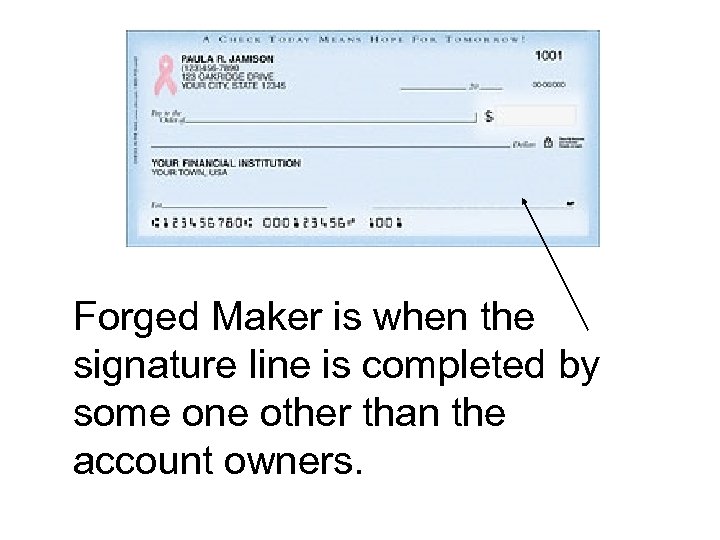

Check Fraud - Forgery • What is forgery? (Forged Maker) – A forgery is when a good check is stolen from the true owner and the owner of the accounts signature is forged (Faked)

Check Fraud - Forgery • What is forgery? (Forged Maker) – A forgery is when a good check is stolen from the true owner and the owner of the accounts signature is forged (Faked)

Forged Maker is when the signature line is completed by some one other than the account owners.

Forged Maker is when the signature line is completed by some one other than the account owners.

Check Fraud - Counterfeiting • What is a counterfeit check? – Counterfeiting can either mean wholly fabricating a check --using readily available desktop publishing equipment consisting of a personal computer, scanner, sophisticated software and high-grade laser printer -- or simply duplicating a check with advanced color photocopiers.

Check Fraud - Counterfeiting • What is a counterfeit check? – Counterfeiting can either mean wholly fabricating a check --using readily available desktop publishing equipment consisting of a personal computer, scanner, sophisticated software and high-grade laser printer -- or simply duplicating a check with advanced color photocopiers.

Check Fraud - Counterfeiting • Counterfeit checks can be determined by – Check stock (color and style of check) – Wrong maker information – No perforations on the check – Check Numbers – Printing on check

Check Fraud - Counterfeiting • Counterfeit checks can be determined by – Check stock (color and style of check) – Wrong maker information – No perforations on the check – Check Numbers – Printing on check

Check Fraud Altered Checks • What is an Altered check? – An altered check is a “good check” in which some piece of the information on the check has been changed.

Check Fraud Altered Checks • What is an Altered check? – An altered check is a “good check” in which some piece of the information on the check has been changed.

Check Fraud Altered Checks • What is an Altered Payee check? – An altered check is a “good check” in which the payee on the check has been changed. – A payee could be added – A payee may be deleted – The true payee could have been removed another name placed in the payee line.

Check Fraud Altered Checks • What is an Altered Payee check? – An altered check is a “good check” in which the payee on the check has been changed. – A payee could be added – A payee may be deleted – The true payee could have been removed another name placed in the payee line.

Check Fraud – Altered check • What is an Altered amount check? – An altered amount check is a “good check” in which the amount on the check has been changed.

Check Fraud – Altered check • What is an Altered amount check? – An altered amount check is a “good check” in which the amount on the check has been changed.

Check Fraud – Altered Check • What is a washed altered check? – A washed altered check is a “good check” in which a chemical has been used to remove the writing from the check and new information has been entered into on the check.

Check Fraud – Altered Check • What is a washed altered check? – A washed altered check is a “good check” in which a chemical has been used to remove the writing from the check and new information has been entered into on the check.

Check Fraud Altered Checks • How to determine an altered check? – Different ink – Different writing (Slant, pressure…) – Paper “feels weird” – Addition is apparent – Chemical agents

Check Fraud Altered Checks • How to determine an altered check? – Different ink – Different writing (Slant, pressure…) – Paper “feels weird” – Addition is apparent – Chemical agents

Check Fraud – Forged Endorsement • What is a forged endorsement fraud? – Forged endorsement fraud is when a “good check” is deposited / cashed by someone other than the intended payee.

Check Fraud – Forged Endorsement • What is a forged endorsement fraud? – Forged endorsement fraud is when a “good check” is deposited / cashed by someone other than the intended payee.

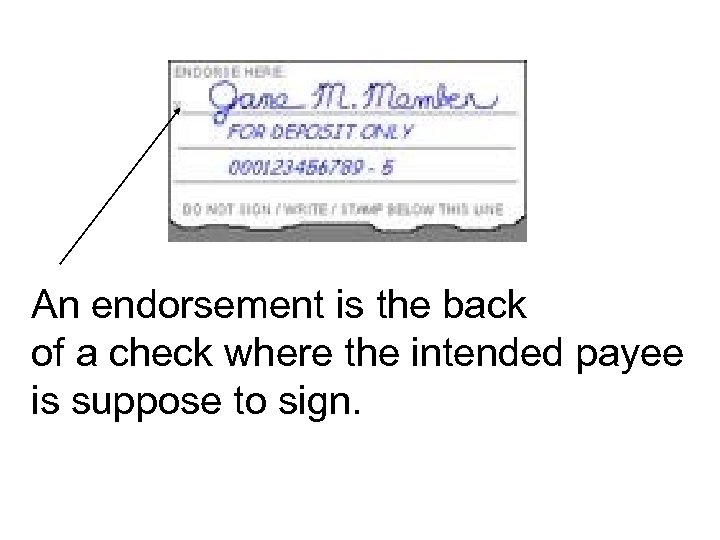

An endorsement is the back of a check where the intended payee is suppose to sign.

An endorsement is the back of a check where the intended payee is suppose to sign.

Check Fraud - Paperhanging • What is paperhanging? – Paperhanging is when someone writes checks off a closed account.

Check Fraud - Paperhanging • What is paperhanging? – Paperhanging is when someone writes checks off a closed account.

Check Fraud – Kiting Checks • Check Kiting is opening accounts at two or more institutions and using "the float time" of available funds to create fraudulent balances. This fraud has become easier in recent years due to new regulations requiring banks to make funds available sooner, combined with increasingly competitive banking practices.

Check Fraud – Kiting Checks • Check Kiting is opening accounts at two or more institutions and using "the float time" of available funds to create fraudulent balances. This fraud has become easier in recent years due to new regulations requiring banks to make funds available sooner, combined with increasingly competitive banking practices.

Signs of bad checks • • • The check lacks perforations. The check number is either missing or does not change. The check number is low (like 101 up to 400) on personal checks or (like 1001 up to 1500) on business checks. (90% of bad checks are written on accounts less than one year old. ) The type of font used to print the customer's name looks visibly different from the font used to print the address. Additions to the check (i. e. phone numbers) have been written by hand. The customer's address is missing.

Signs of bad checks • • • The check lacks perforations. The check number is either missing or does not change. The check number is low (like 101 up to 400) on personal checks or (like 1001 up to 1500) on business checks. (90% of bad checks are written on accounts less than one year old. ) The type of font used to print the customer's name looks visibly different from the font used to print the address. Additions to the check (i. e. phone numbers) have been written by hand. The customer's address is missing.

Signs of bad checks • The address of the bank is missing. • There are stains or discolorations on the check possibly caused by erasures or alterations. • The numbers printed along the bottoms of the check (called Magnetic Ink Character Recognition, or MICR, coding) is shiny. Real magnetic ink is dull and non glossy in appearance. • The MICR encoding at the bottom of the check does not match the check number. • The MICR numbers are missing. • Check is torn up and taped back together.

Signs of bad checks • The address of the bank is missing. • There are stains or discolorations on the check possibly caused by erasures or alterations. • The numbers printed along the bottoms of the check (called Magnetic Ink Character Recognition, or MICR, coding) is shiny. Real magnetic ink is dull and non glossy in appearance. • The MICR encoding at the bottom of the check does not match the check number. • The MICR numbers are missing. • Check is torn up and taped back together.

Signs of bad checks • The MICR coding does not match the bank district and the routing symbol in the upper right-hand corner of the check. • The name of the payee appears to have been printed by a typewriter. Most payroll, expenses, and dividend checks are printed via computer. • The word VOID appears across the check. • Notations appear in the memo section listing "load, " "payroll, " or "dividends. " Most legitimate companies have separate accounts for these functions, eliminating a need for such notations. • The check lacks an authorized signature.

Signs of bad checks • The MICR coding does not match the bank district and the routing symbol in the upper right-hand corner of the check. • The name of the payee appears to have been printed by a typewriter. Most payroll, expenses, and dividend checks are printed via computer. • The word VOID appears across the check. • Notations appear in the memo section listing "load, " "payroll, " or "dividends. " Most legitimate companies have separate accounts for these functions, eliminating a need for such notations. • The check lacks an authorized signature.

Check Fraud – Theft by Check • Theft by check is committed when an individual receives product or services from a “bad check”. • A “bad check” is defined as a check that is not paid by the financial institution. (the bank)

Check Fraud – Theft by Check • Theft by check is committed when an individual receives product or services from a “bad check”. • A “bad check” is defined as a check that is not paid by the financial institution. (the bank)

Check Fraud – Beating the Bank • What is beating the bank? – Beating the bank is a term used when someone tries to use the float on a check in order to get cash or services on funds that are excepted on an account.

Check Fraud – Beating the Bank • What is beating the bank? – Beating the bank is a term used when someone tries to use the float on a check in order to get cash or services on funds that are excepted on an account.

Check Fraud – Return item schemes • What is a return item scheme? – A return item scheme is when an account holder deposits one or more “bad checks” and removes the funds from their account prior to the checks being returned.

Check Fraud – Return item schemes • What is a return item scheme? – A return item scheme is when an account holder deposits one or more “bad checks” and removes the funds from their account prior to the checks being returned.

Check Fraud – Nigerian Scams • What is Nigerian Scams? – A Nigerian scam is an email, or fax request from someone in Nigeria or other country that offers extraordinary amount of money for very little work. The victims of this scam never make money and many victims are out several thousands of dollars. – (also called a 419 for the section of Nigerian Law being broken)

Check Fraud – Nigerian Scams • What is Nigerian Scams? – A Nigerian scam is an email, or fax request from someone in Nigeria or other country that offers extraordinary amount of money for very little work. The victims of this scam never make money and many victims are out several thousands of dollars. – (also called a 419 for the section of Nigerian Law being broken)

Check Fraud – Nigerian Scams http: //www. crimes-ofpersuasion. com/Crimes/Business/nigerian. htm

Check Fraud – Nigerian Scams http: //www. crimes-ofpersuasion. com/Crimes/Business/nigerian. htm

Credit Card Fraud • Stolen Credit Cards • Counterfeiting cards • Duplicating Cards

Credit Card Fraud • Stolen Credit Cards • Counterfeiting cards • Duplicating Cards

Credit Card Fraud • What is a stolen credit card? – A stolen credit card is when a legitimate credit card is stolen from the legitimate owner of the card and used by the unapproved party.

Credit Card Fraud • What is a stolen credit card? – A stolen credit card is when a legitimate credit card is stolen from the legitimate owner of the card and used by the unapproved party.

Credit Card Fraud • What is a Counterfeited credit card? – A counterfeit credit card is when some one completely makes a new credit card with the victim’s information but another person’s name on the front of the card.

Credit Card Fraud • What is a Counterfeited credit card? – A counterfeit credit card is when some one completely makes a new credit card with the victim’s information but another person’s name on the front of the card.

Credit card fraud • What is a duplicated credit card? – A duplicated credit card is a when the victim’s information from a legitimate card is lifted by some means, and that information is used to make unauthorized purchases.

Credit card fraud • What is a duplicated credit card? – A duplicated credit card is a when the victim’s information from a legitimate card is lifted by some means, and that information is used to make unauthorized purchases.

Credit Card fraud • http: //www. theksbwchannel. com/news/270 9698/detail. html • http: //www. engadget. com/2005/03/29/bew are-phony-atm-facades/

Credit Card fraud • http: //www. theksbwchannel. com/news/270 9698/detail. html • http: //www. engadget. com/2005/03/29/bew are-phony-atm-facades/

ID Theft Fraud • What is ID theft? – ID theft is when someone’s personal information, identity, is used without their permission to commit fraud. • Check fraud • Credit card fraud

ID Theft Fraud • What is ID theft? – ID theft is when someone’s personal information, identity, is used without their permission to commit fraud. • Check fraud • Credit card fraud

ID theft fraud • Checking account ID theft fraud – A criminal opens a checking account using the victim’s personal information and commits bank fraud therefore tarnishing the victims name and keeping themselves out of the loop.

ID theft fraud • Checking account ID theft fraud – A criminal opens a checking account using the victim’s personal information and commits bank fraud therefore tarnishing the victims name and keeping themselves out of the loop.

ID theft fraud • Credit card ID theft fraud – A criminal uses a victim’s personnal information to open a credit card in the victim’s name. The criminal maxes out the credit card, and do not make payments. This in turn messes up the victims credit.

ID theft fraud • Credit card ID theft fraud – A criminal uses a victim’s personnal information to open a credit card in the victim’s name. The criminal maxes out the credit card, and do not make payments. This in turn messes up the victims credit.

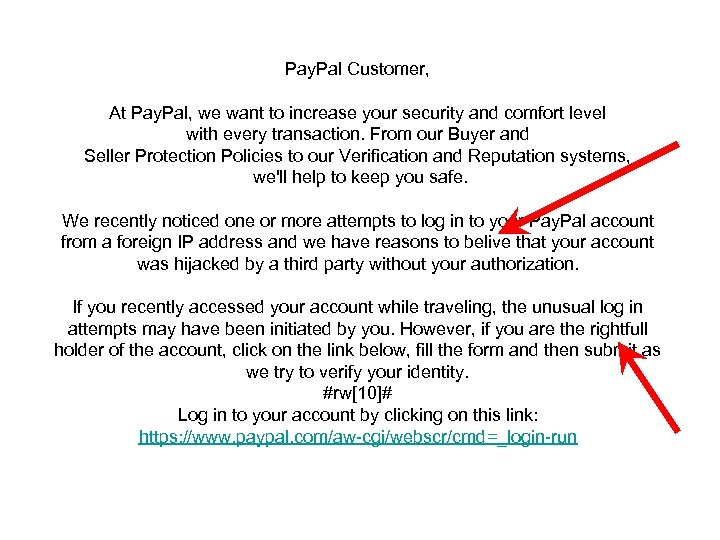

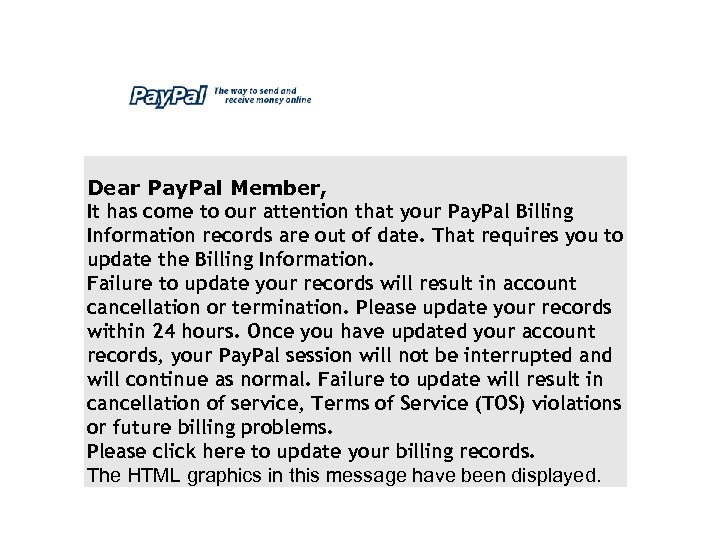

Credit card fraud • What is a Phishing scams? – Phishing scams are emails that appear to be from a legitimate source in which when you connect to the web link on the email, you are transferred to a criminal web site and they ask for your personal information.

Credit card fraud • What is a Phishing scams? – Phishing scams are emails that appear to be from a legitimate source in which when you connect to the web link on the email, you are transferred to a criminal web site and they ask for your personal information.

Pay. Pal Customer, At Pay. Pal, we want to increase your security and comfort level with every transaction. From our Buyer and Seller Protection Policies to our Verification and Reputation systems, we'll help to keep you safe. We recently noticed one or more attempts to log in to your Pay. Pal account from a foreign IP address and we have reasons to belive that your account was hijacked by a third party without your authorization. If you recently accessed your account while traveling, the unusual log in attempts may have been initiated by you. However, if you are the rightfull holder of the account, click on the link below, fill the form and then submit as we try to verify your identity. #rw[10]# Log in to your account by clicking on this link: https: //www. paypal. com/aw-cgi/webscr/cmd=_login-run

Pay. Pal Customer, At Pay. Pal, we want to increase your security and comfort level with every transaction. From our Buyer and Seller Protection Policies to our Verification and Reputation systems, we'll help to keep you safe. We recently noticed one or more attempts to log in to your Pay. Pal account from a foreign IP address and we have reasons to belive that your account was hijacked by a third party without your authorization. If you recently accessed your account while traveling, the unusual log in attempts may have been initiated by you. However, if you are the rightfull holder of the account, click on the link below, fill the form and then submit as we try to verify your identity. #rw[10]# Log in to your account by clicking on this link: https: //www. paypal. com/aw-cgi/webscr/cmd=_login-run

Dear Pay. Pal Member, It has come to our attention that your Pay. Pal Billing Information records are out of date. That requires you to update the Billing Information. Failure to update your records will result in account cancellation or termination. Please update your records within 24 hours. Once you have updated your account records, your Pay. Pal session will not be interrupted and will continue as normal. Failure to update will result in cancellation of service, Terms of Service (TOS) violations or future billing problems. Please click here to update your billing records. The HTML graphics in this message have been displayed.

Dear Pay. Pal Member, It has come to our attention that your Pay. Pal Billing Information records are out of date. That requires you to update the Billing Information. Failure to update your records will result in account cancellation or termination. Please update your records within 24 hours. Once you have updated your account records, your Pay. Pal session will not be interrupted and will continue as normal. Failure to update will result in cancellation of service, Terms of Service (TOS) violations or future billing problems. Please click here to update your billing records. The HTML graphics in this message have been displayed.

Other Fraud • Online banking fraud – A criminal accesses a victim’s computer via the internet and gains complete access to all information on their computer.

Other Fraud • Online banking fraud – A criminal accesses a victim’s computer via the internet and gains complete access to all information on their computer.

Other Fraud • ACH fraud – ACH fraud is when a criminal uses a victim’s personal account to make electronic payment to some other account or bank. • Wire Fraud – Wire fraud is when a criminal uses a victim’s personal accounts to make a wire transfer to another bank.

Other Fraud • ACH fraud – ACH fraud is when a criminal uses a victim’s personal account to make electronic payment to some other account or bank. • Wire Fraud – Wire fraud is when a criminal uses a victim’s personal accounts to make a wire transfer to another bank.