Which would you do? • Take $1, 000 today. • OR • Take 1¢ that will double each day for 30 days?

Which would you do? • Take $1, 000 today. • OR • Take 1¢ that will double each day for 30 days?

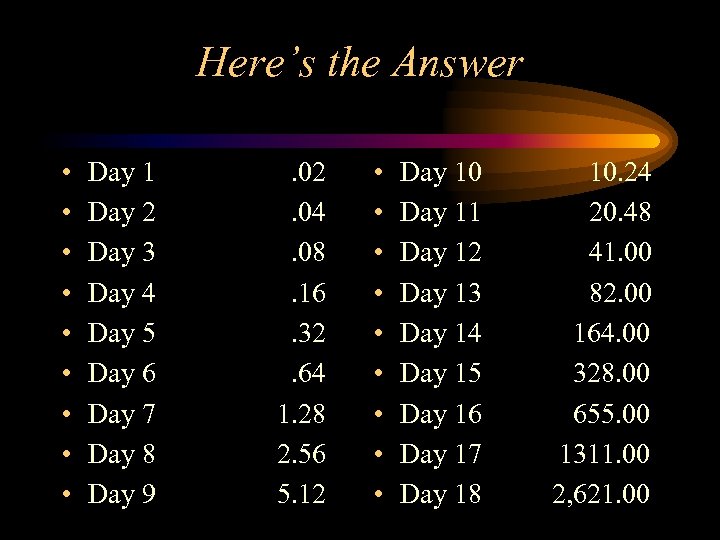

Here’s the Answer • • • Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7 Day 8 Day 9 . 02. 04. 08. 16. 32. 64 1. 28 2. 56 5. 12 • • • Day 10 Day 11 Day 12 Day 13 Day 14 Day 15 Day 16 Day 17 Day 18 10. 24 20. 48 41. 00 82. 00 164. 00 328. 00 655. 00 1311. 00 2, 621. 00

Here’s the Answer • • • Day 1 Day 2 Day 3 Day 4 Day 5 Day 6 Day 7 Day 8 Day 9 . 02. 04. 08. 16. 32. 64 1. 28 2. 56 5. 12 • • • Day 10 Day 11 Day 12 Day 13 Day 14 Day 15 Day 16 Day 17 Day 18 10. 24 20. 48 41. 00 82. 00 164. 00 328. 00 655. 00 1311. 00 2, 621. 00

at the end of 30 days. . . • $10, 737, 422

at the end of 30 days. . . • $10, 737, 422

SAVINGS & INVESTMENT Ag Business Management Spring 1999

SAVINGS & INVESTMENT Ag Business Management Spring 1999

Objectives • List the reasons for savings & investment. • Compare characteristics of various types of investments. • Explain the concept of interest. • Describe how investments can grow in value and calculate the future value of money.

Objectives • List the reasons for savings & investment. • Compare characteristics of various types of investments. • Explain the concept of interest. • Describe how investments can grow in value and calculate the future value of money.

Reasons for Savings Accounts • Retirement • Down payments • Business start up • Education

Reasons for Savings Accounts • Retirement • Down payments • Business start up • Education

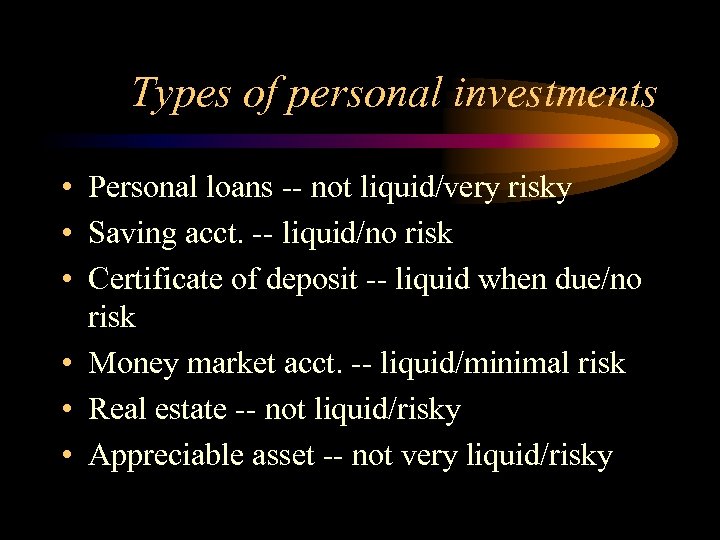

Types of personal investments • Personal loans -- not liquid/very risky • Saving acct. -- liquid/no risk • Certificate of deposit -- liquid when due/no risk • Money market acct. -- liquid/minimal risk • Real estate -- not liquid/risky • Appreciable asset -- not very liquid/risky

Types of personal investments • Personal loans -- not liquid/very risky • Saving acct. -- liquid/no risk • Certificate of deposit -- liquid when due/no risk • Money market acct. -- liquid/minimal risk • Real estate -- not liquid/risky • Appreciable asset -- not very liquid/risky

Treasury Bills • Liquid when due/not risky • Short-term • Maximum maturity = 1 year • Minimum investment = $10, 000

Treasury Bills • Liquid when due/not risky • Short-term • Maximum maturity = 1 year • Minimum investment = $10, 000

Treasury Notes • Liquid when due/not risky • minimum $5, 000 investment 3 years or less • minimum $1, 000 investment 4 - 10 years

Treasury Notes • Liquid when due/not risky • minimum $5, 000 investment 3 years or less • minimum $1, 000 investment 4 - 10 years

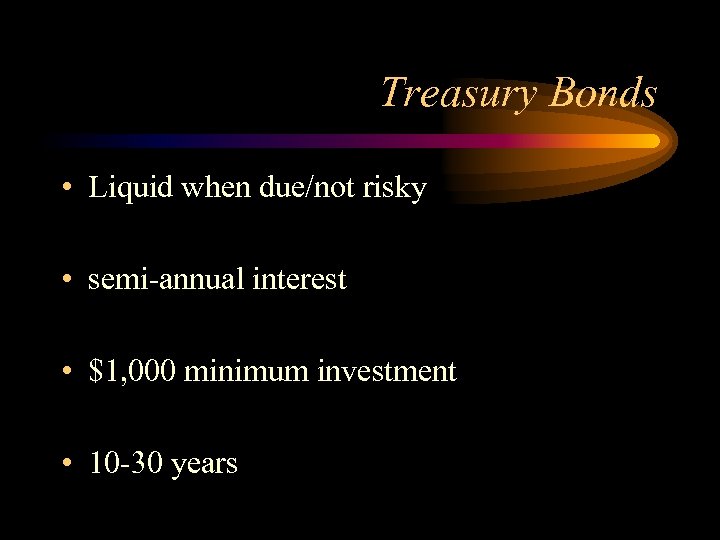

Treasury Bonds • Liquid when due/not risky • semi-annual interest • $1, 000 minimum investment • 10 -30 years

Treasury Bonds • Liquid when due/not risky • semi-annual interest • $1, 000 minimum investment • 10 -30 years

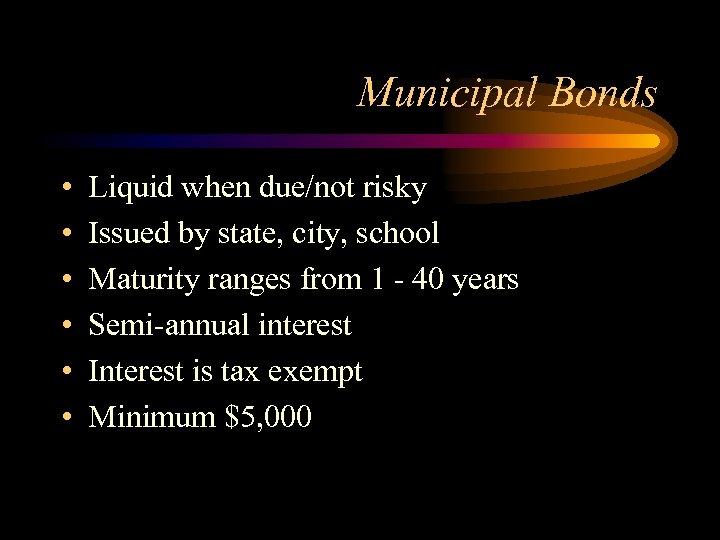

Municipal Bonds • • • Liquid when due/not risky Issued by state, city, school Maturity ranges from 1 - 40 years Semi-annual interest Interest is tax exempt Minimum $5, 000

Municipal Bonds • • • Liquid when due/not risky Issued by state, city, school Maturity ranges from 1 - 40 years Semi-annual interest Interest is tax exempt Minimum $5, 000

Mutual Funds • Semi-liquid/semi-risky • Pool of money from many individuals • Invested by professional money manager – equity funds - stock/industry, public utilities – fixed-income - corporate securities, gov agen – Balanced -combination of stocks & bonds

Mutual Funds • Semi-liquid/semi-risky • Pool of money from many individuals • Invested by professional money manager – equity funds - stock/industry, public utilities – fixed-income - corporate securities, gov agen – Balanced -combination of stocks & bonds

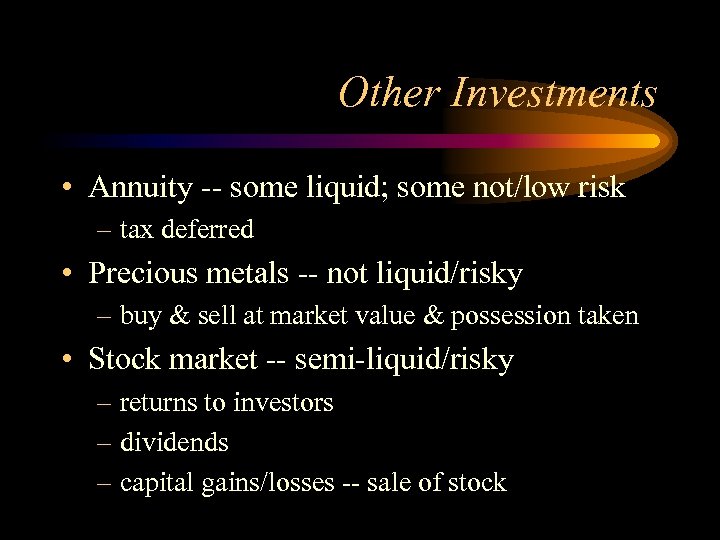

Other Investments • Annuity -- some liquid; some not/low risk – tax deferred • Precious metals -- not liquid/risky – buy & sell at market value & possession taken • Stock market -- semi-liquid/risky – returns to investors – dividends – capital gains/losses -- sale of stock

Other Investments • Annuity -- some liquid; some not/low risk – tax deferred • Precious metals -- not liquid/risky – buy & sell at market value & possession taken • Stock market -- semi-liquid/risky – returns to investors – dividends – capital gains/losses -- sale of stock

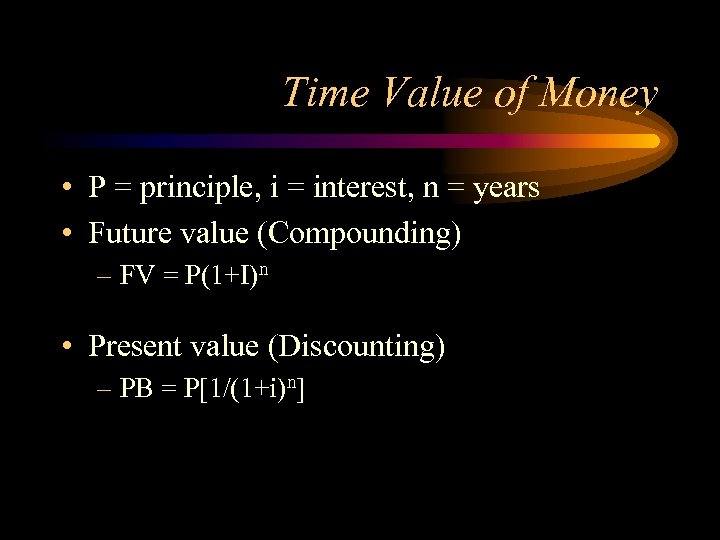

Time Value of Money • P = principle, i = interest, n = years • Future value (Compounding) – FV = P(1+I)n • Present value (Discounting) – PB = P[1/(1+i)n]

Time Value of Money • P = principle, i = interest, n = years • Future value (Compounding) – FV = P(1+I)n • Present value (Discounting) – PB = P[1/(1+i)n]