b7d1211fd8f9a36d9fe1f50a0eca6f69.ppt

- Количество слайдов: 89

Where to from here ? ? The emerging electricity lines industry in New Zealand

Where to from here ? ? The emerging electricity lines industry in New Zealand

![[This slide added later] • This Presentation was made to the Small Line Company [This slide added later] • This Presentation was made to the Small Line Company](https://present5.com/presentation/b7d1211fd8f9a36d9fe1f50a0eca6f69/image-2.jpg) [This slide added later] • This Presentation was made to the Small Line Company Manager’s meeting in Wellington on Wednesday, 15 March 2000. • Please feel free to share this Presentation with your Board and senior managers, but restrict circulation to within that group. • Please forward any requests for this Presentation by external parties directly to me for consideration.

[This slide added later] • This Presentation was made to the Small Line Company Manager’s meeting in Wellington on Wednesday, 15 March 2000. • Please feel free to share this Presentation with your Board and senior managers, but restrict circulation to within that group. • Please forward any requests for this Presentation by external parties directly to me for consideration.

Discussion Topics Brief history of NZ industry Recent events in the NZ industry Present status of the NZ industry

Discussion Topics Brief history of NZ industry Recent events in the NZ industry Present status of the NZ industry

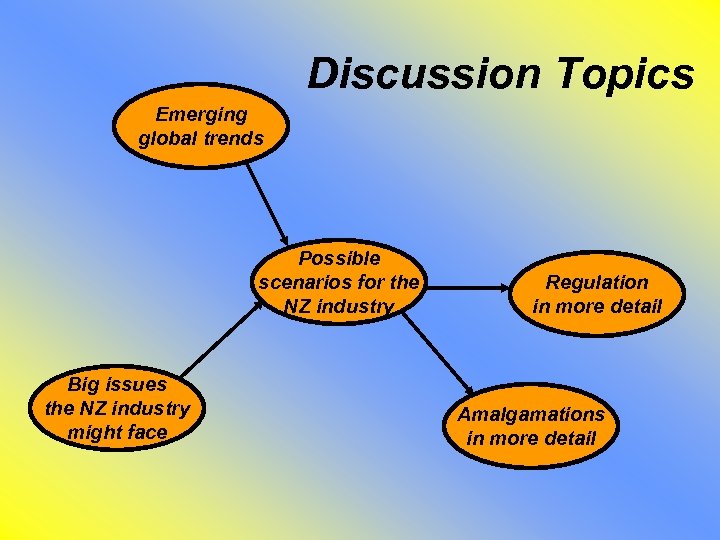

Discussion Topics Emerging global trends Possible scenarios for the NZ industry Big issues the NZ industry might face Regulation in more detail Amalgamations in more detail

Discussion Topics Emerging global trends Possible scenarios for the NZ industry Big issues the NZ industry might face Regulation in more detail Amalgamations in more detail

A brief history of the NZ industry

A brief history of the NZ industry

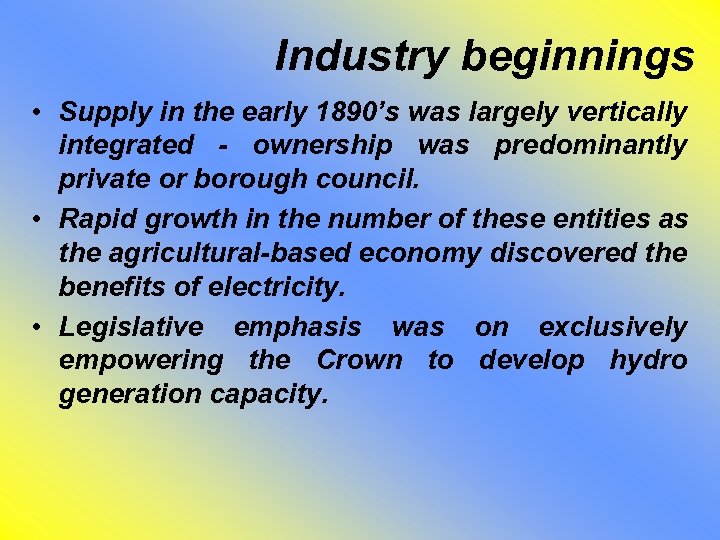

Industry beginnings • Supply in the early 1890’s was largely vertically integrated - ownership was predominantly private or borough council. • Rapid growth in the number of these entities as the agricultural-based economy discovered the benefits of electricity. • Legislative emphasis was on exclusively empowering the Crown to develop hydro generation capacity.

Industry beginnings • Supply in the early 1890’s was largely vertically integrated - ownership was predominantly private or borough council. • Rapid growth in the number of these entities as the agricultural-based economy discovered the benefits of electricity. • Legislative emphasis was on exclusively empowering the Crown to develop hydro generation capacity.

Steps toward unification • First step toward unified supply industry was the Electric Power Boards Act of 1918. • Provided for the establishment of bodies corporate elected by rate-payers to supply electricity within a licensed area. • However, two types of bodies emerged… • Electric Power Boards which tended to be in rural areas with undefined ownership. • Municipal Electricity Departments which tended to be in urban areas and were owned by Councils. • Key exception was the Auckland EPB, the only EPB in a major urban area.

Steps toward unification • First step toward unified supply industry was the Electric Power Boards Act of 1918. • Provided for the establishment of bodies corporate elected by rate-payers to supply electricity within a licensed area. • However, two types of bodies emerged… • Electric Power Boards which tended to be in rural areas with undefined ownership. • Municipal Electricity Departments which tended to be in urban areas and were owned by Councils. • Key exception was the Auckland EPB, the only EPB in a major urban area.

Further consolidation • Number of EPB’s and MED’s grew from 66 in 1919 to a peak of 94 in 1938. • Also saw the almost total decline of private electricity companies. • Crown had a virtual monopoly on generation, with all other capacity requiring the Minister’s approval. • Emergent structure was essentially vertically integrated, viz. . .

Further consolidation • Number of EPB’s and MED’s grew from 66 in 1919 to a peak of 94 in 1938. • Also saw the almost total decline of private electricity companies. • Crown had a virtual monopoly on generation, with all other capacity requiring the Minister’s approval. • Emergent structure was essentially vertically integrated, viz. . .

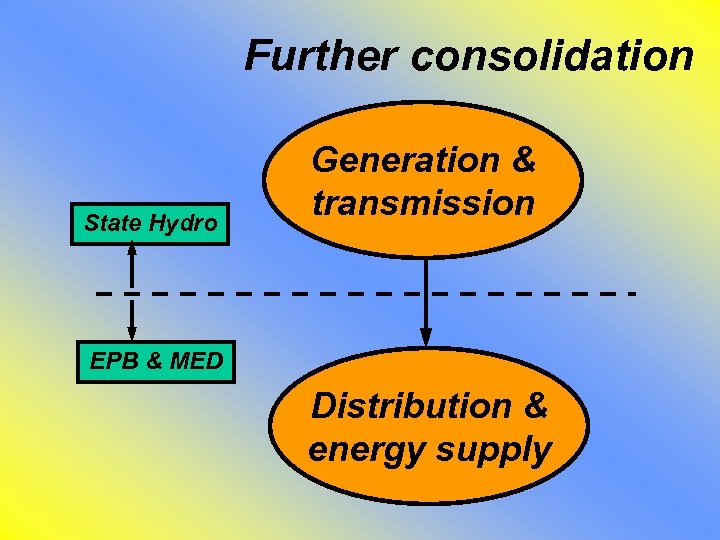

Further consolidation State Hydro Generation & transmission EPB & MED Distribution & energy supply

Further consolidation State Hydro Generation & transmission EPB & MED Distribution & energy supply

Rationalisation • First attempt was actually in 1921. • Minister tried to persuade the PN Borough to become an “inner area” of the MOEPB - took 75 years to resolve. • Rationalisation of the supply industry dominated Government’s energy thinking from 1945 to about 1973, with 3 significant investigations… • Electricity & Gas Consolidation Act 1956. • Stanton Commission of 1959. • Electricity Distribution Commission 1968.

Rationalisation • First attempt was actually in 1921. • Minister tried to persuade the PN Borough to become an “inner area” of the MOEPB - took 75 years to resolve. • Rationalisation of the supply industry dominated Government’s energy thinking from 1945 to about 1973, with 3 significant investigations… • Electricity & Gas Consolidation Act 1956. • Stanton Commission of 1959. • Electricity Distribution Commission 1968.

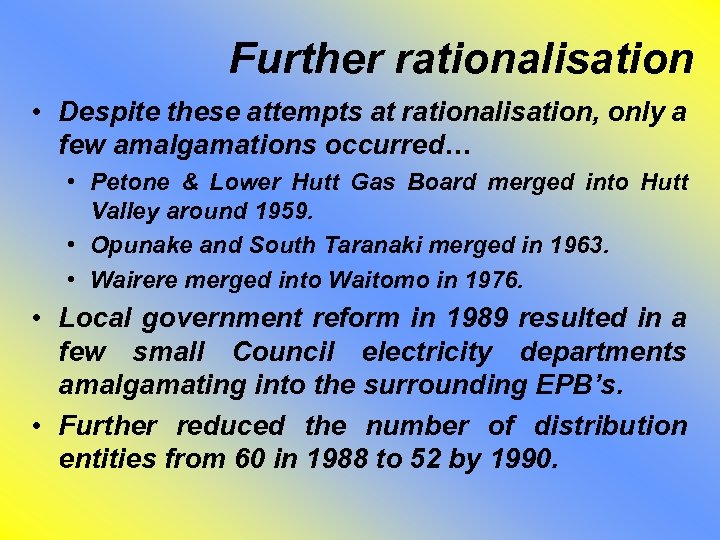

Further rationalisation • Despite these attempts at rationalisation, only a few amalgamations occurred… • Petone & Lower Hutt Gas Board merged into Hutt Valley around 1959. • Opunake and South Taranaki merged in 1963. • Wairere merged into Waitomo in 1976. • Local government reform in 1989 resulted in a few small Council electricity departments amalgamating into the surrounding EPB’s. • Further reduced the number of distribution entities from 60 in 1988 to 52 by 1990.

Further rationalisation • Despite these attempts at rationalisation, only a few amalgamations occurred… • Petone & Lower Hutt Gas Board merged into Hutt Valley around 1959. • Opunake and South Taranaki merged in 1963. • Wairere merged into Waitomo in 1976. • Local government reform in 1989 resulted in a few small Council electricity departments amalgamating into the surrounding EPB’s. • Further reduced the number of distribution entities from 60 in 1988 to 52 by 1990.

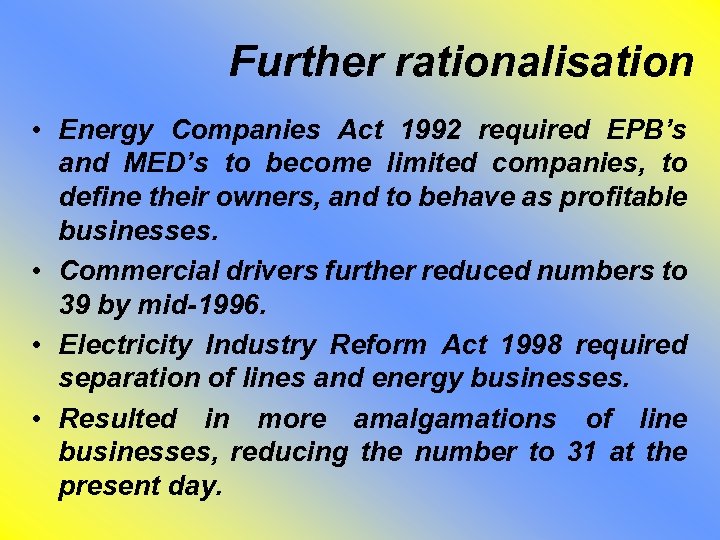

Further rationalisation • Energy Companies Act 1992 required EPB’s and MED’s to become limited companies, to define their owners, and to behave as profitable businesses. • Commercial drivers further reduced numbers to 39 by mid-1996. • Electricity Industry Reform Act 1998 required separation of lines and energy businesses. • Resulted in more amalgamations of line businesses, reducing the number to 31 at the present day.

Further rationalisation • Energy Companies Act 1992 required EPB’s and MED’s to become limited companies, to define their owners, and to behave as profitable businesses. • Commercial drivers further reduced numbers to 39 by mid-1996. • Electricity Industry Reform Act 1998 required separation of lines and energy businesses. • Resulted in more amalgamations of line businesses, reducing the number to 31 at the present day.

Present status of the NZ industry

Present status of the NZ industry

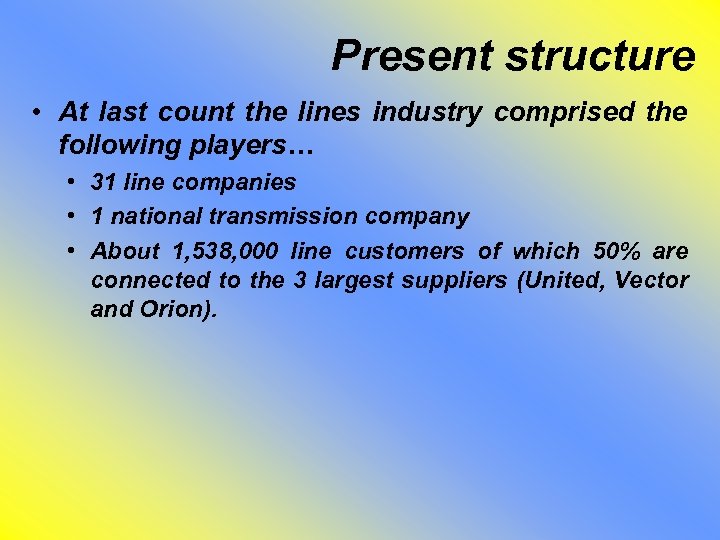

Present structure • At last count the lines industry comprised the following players… • 31 line companies • 1 national transmission company • About 1, 538, 000 line customers of which 50% are connected to the 3 largest suppliers (United, Vector and Orion).

Present structure • At last count the lines industry comprised the following players… • 31 line companies • 1 national transmission company • About 1, 538, 000 line customers of which 50% are connected to the 3 largest suppliers (United, Vector and Orion).

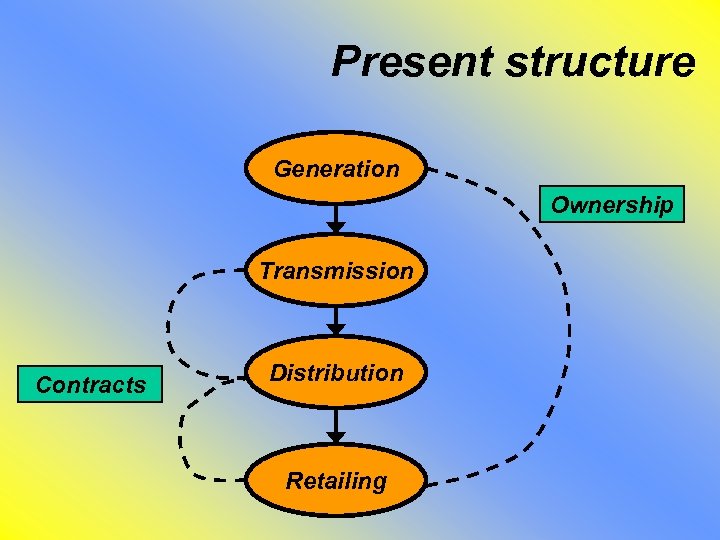

Present structure Generation Ownership Transmission Contracts Distribution Retailing

Present structure Generation Ownership Transmission Contracts Distribution Retailing

What is driving the NZ industry

What is driving the NZ industry

Industry drivers • Strong demands for secure supply. • Increasing focus on asset management practices. • Technology. • Consumer awareness. • Concern over recent profits. • Competition for investment funds. • Restrictions on land use and access. • Political intervention, including the present inquiry into the industry.

Industry drivers • Strong demands for secure supply. • Increasing focus on asset management practices. • Technology. • Consumer awareness. • Concern over recent profits. • Competition for investment funds. • Restrictions on land use and access. • Political intervention, including the present inquiry into the industry.

Comment • Politics will be a major driver of electricity lines industry - electricity always has been a bit of a political football, but it will probably be even more so now. • Previous National government had a very much laissez-faire approach. • Coalition government has demonstrated a very interventionist approach already in other sectors such as Social Welfare, Broadcasting, Workplace Insurance, Education and Health. • Very likely that the electricity sector will be subject to similar intervention.

Comment • Politics will be a major driver of electricity lines industry - electricity always has been a bit of a political football, but it will probably be even more so now. • Previous National government had a very much laissez-faire approach. • Coalition government has demonstrated a very interventionist approach already in other sectors such as Social Welfare, Broadcasting, Workplace Insurance, Education and Health. • Very likely that the electricity sector will be subject to similar intervention.

National government • • • Preference for private ownership. Strong dislike of Trusts. Desire for increased competition. Move toward price regulation. Preference for amalgamation.

National government • • • Preference for private ownership. Strong dislike of Trusts. Desire for increased competition. Move toward price regulation. Preference for amalgamation.

Coalition government • • Strong opposition to privatisation. Little concern for shareholder wealth. Opposed to utilities making profits. Strong preference for social objectives. Preference for vertical integration. Little regard for business costs. Failure to understand knowledge economy. Preference for government service provision as well as funding. • Aversion to high salaries. • Preference for ad-hoc intervention.

Coalition government • • Strong opposition to privatisation. Little concern for shareholder wealth. Opposed to utilities making profits. Strong preference for social objectives. Preference for vertical integration. Little regard for business costs. Failure to understand knowledge economy. Preference for government service provision as well as funding. • Aversion to high salaries. • Preference for ad-hoc intervention.

Emerging global trends & issues

Emerging global trends & issues

Comment • Many events in the NZ industry are mirrored by global utility events. • Time lag with some issues - NZ may either be a bit ahead or a bit behind. • May provide learning opportunities where we are a bit behind. • Key global issues are…

Comment • Many events in the NZ industry are mirrored by global utility events. • Time lag with some issues - NZ may either be a bit ahead or a bit behind. • May provide learning opportunities where we are a bit behind. • Key global issues are…

Key global issues • • Increasing competition in energy retailing. Increasing price regulation. Portfolio approach to investment. Separation of line & energy businesses. Integration of gas & electricity. Emergence of multi-utility businesses. Changing political climates and risks.

Key global issues • • Increasing competition in energy retailing. Increasing price regulation. Portfolio approach to investment. Separation of line & energy businesses. Integration of gas & electricity. Emergence of multi-utility businesses. Changing political climates and risks.

Price regulation • We will look later at how price regulation was applied in the UK in the 1990’s. • For now, we note that the price controls in 1995 and 1996 alone cost the distribution industry about £ 2 billion. • Recent events in Canada and the UK indicate that regulation is really starting to bite hard… • Trans. Alta’s sale of their lines business in Alberta to Utilicorp because of reduced allowable return. • United Utilities’ and Hyder’s sale of their energy businesses to off-set decreased line revenues (also because of competition).

Price regulation • We will look later at how price regulation was applied in the UK in the 1990’s. • For now, we note that the price controls in 1995 and 1996 alone cost the distribution industry about £ 2 billion. • Recent events in Canada and the UK indicate that regulation is really starting to bite hard… • Trans. Alta’s sale of their lines business in Alberta to Utilicorp because of reduced allowable return. • United Utilities’ and Hyder’s sale of their energy businesses to off-set decreased line revenues (also because of competition).

Increasing competition • Retailing is subject to increasingly tight margins. • Driving the industry toward vertical integration to obtain price stability, more so forward integration by the generators. • Happened here with the Big 4 generators. • Happened in the UK with Power. Gen and British Energy in particular. • Competition based on differentiation. • Almost choose energy retailer based on what other commodities are desired eg. Sky TV.

Increasing competition • Retailing is subject to increasingly tight margins. • Driving the industry toward vertical integration to obtain price stability, more so forward integration by the generators. • Happened here with the Big 4 generators. • Happened in the UK with Power. Gen and British Energy in particular. • Competition based on differentiation. • Almost choose energy retailer based on what other commodities are desired eg. Sky TV.

Portfolio approach • Began when US utilities facing lack-lustre domestic earnings took advantage of the privatisations in the UK, Argentina and Victoria. • Recent about-face in the US buy-up with Power. Gen buying Louisville Gas & Electric and actively seeking further US investments. • Sort of happening in NZ with AGL, but government policy is unlikely to see this become the norm.

Portfolio approach • Began when US utilities facing lack-lustre domestic earnings took advantage of the privatisations in the UK, Argentina and Victoria. • Recent about-face in the US buy-up with Power. Gen buying Louisville Gas & Electric and actively seeking further US investments. • Sort of happening in NZ with AGL, but government policy is unlikely to see this become the norm.

Separation • Separation of lines and energy was enforced by law in NZ about 18 months ago. • Fundamentally re-shaped the NZ industry. • UK industry is voluntarily separating energy from lines, providing the generators with opportunities to forward integrate and secure retail markets… • Power. Gen bought East Midland’s energy business. • British Energy have bought Hyder’s energy business, and are tipped to be a leading bidder for United Utilities energy business.

Separation • Separation of lines and energy was enforced by law in NZ about 18 months ago. • Fundamentally re-shaped the NZ industry. • UK industry is voluntarily separating energy from lines, providing the generators with opportunities to forward integrate and secure retail markets… • Power. Gen bought East Midland’s energy business. • British Energy have bought Hyder’s energy business, and are tipped to be a leading bidder for United Utilities energy business.

Separation • In the US, PG&E are expanding into energy businesses beyond their legacy market around San Francisco. • Key driver for them is moving into unregulated markets and prudently managing the down-side risks (a key strategy is backward integration into gas and coal). • Suggests that voluntary separation could have happened in NZ if retail competition intensified enough to make energy businesses unprofitable for anyone other than generators.

Separation • In the US, PG&E are expanding into energy businesses beyond their legacy market around San Francisco. • Key driver for them is moving into unregulated markets and prudently managing the down-side risks (a key strategy is backward integration into gas and coal). • Suggests that voluntary separation could have happened in NZ if retail competition intensified enough to make energy businesses unprofitable for anyone other than generators.

Integration • Began in NZ in 1959 when gas merged with electricity in the Hutt Valley, so the idea is certainly not new. • Certainly a major focus of retailers such as Contact, NGC and Fresh Start who have access to gas reserves. • Been a big focus of utilities such as SEEBoard (Beacon Gas) and TU (Lone Star Gas). • Less obvious is the integration of pipes and wires into combined businesses… • Powerco’s acquisition of Hawera Gas. • Southpower’s acquisition of Enerco.

Integration • Began in NZ in 1959 when gas merged with electricity in the Hutt Valley, so the idea is certainly not new. • Certainly a major focus of retailers such as Contact, NGC and Fresh Start who have access to gas reserves. • Been a big focus of utilities such as SEEBoard (Beacon Gas) and TU (Lone Star Gas). • Less obvious is the integration of pipes and wires into combined businesses… • Powerco’s acquisition of Hawera Gas. • Southpower’s acquisition of Enerco.

Multi-utilities • Privatisation in the UK appeared to kick this one off around 1990. • Two apparent strategies. • Penetration within a geographical area… • North West Water’s acquisition of NORWEB to become United Utilities. • Hyder’s acquisition of Welsh Water and SWALEC, and subsequent amalgamation of operations. • Extension beyond a geographical area… • Scottish Power’s acquisition of MANWEB and Southern Water.

Multi-utilities • Privatisation in the UK appeared to kick this one off around 1990. • Two apparent strategies. • Penetration within a geographical area… • North West Water’s acquisition of NORWEB to become United Utilities. • Hyder’s acquisition of Welsh Water and SWALEC, and subsequent amalgamation of operations. • Extension beyond a geographical area… • Scottish Power’s acquisition of MANWEB and Southern Water.

Multi-utilities • Uncommon in the US, Australia or NZ because water and waste assets tend to be owned by public bodies. • Some indication from the former government that water and waste assets in NZ could be privatised in the medium term. • Penetration into communications sector in urban areas… • United Utilities and Scottish. Power. • Texas Utilities • Downtown Utilities in Sydney, Melbourne and Brisbane.

Multi-utilities • Uncommon in the US, Australia or NZ because water and waste assets tend to be owned by public bodies. • Some indication from the former government that water and waste assets in NZ could be privatised in the medium term. • Penetration into communications sector in urban areas… • United Utilities and Scottish. Power. • Texas Utilities • Downtown Utilities in Sydney, Melbourne and Brisbane.

Political risk • Risk of ad-hoc political interference increasing the risks of investing in a jurisdiction. • This risk increases the β in the CAPM, requiring greater returns on capital to be made. • We probably now need to think of NZ as being “politically risky” in terms of utility investments. • One US utility with many global interests has already expressed reservations about investing in NZ.

Political risk • Risk of ad-hoc political interference increasing the risks of investing in a jurisdiction. • This risk increases the β in the CAPM, requiring greater returns on capital to be made. • We probably now need to think of NZ as being “politically risky” in terms of utility investments. • One US utility with many global interests has already expressed reservations about investing in NZ.

Where is it all going ? • Emerging global trend appears to be separation of lines and retailing. • Actually happening in the very broadest sense of regulated and unregulated businesses ie. separating the pipes and wires from competitive businesses. • Key drivers… • Increasing price regulation of pipes and wires businesses. • Decreasing margins in commodities such as electricity, gas and phone traffic.

Where is it all going ? • Emerging global trend appears to be separation of lines and retailing. • Actually happening in the very broadest sense of regulated and unregulated businesses ie. separating the pipes and wires from competitive businesses. • Key drivers… • Increasing price regulation of pipes and wires businesses. • Decreasing margins in commodities such as electricity, gas and phone traffic.

Where is it all going ? • Different drivers and competencies will be required in each business… • Regulated businesses will need to… • Ruthlessly control costs to deliver increasing returns. • Reduce costs beyond the scope of internal efficiencies, leading to further amalgamations. • Identify arbitrage opportunities, where individual regulatory jurisdictions will allow returns on funds greater than the global cost of capital.

Where is it all going ? • Different drivers and competencies will be required in each business… • Regulated businesses will need to… • Ruthlessly control costs to deliver increasing returns. • Reduce costs beyond the scope of internal efficiencies, leading to further amalgamations. • Identify arbitrage opportunities, where individual regulatory jurisdictions will allow returns on funds greater than the global cost of capital.

Where is it all going ? • Unregulated businesses will need to. . . • Prudently manage down-side risks associated with commodity trading. • Invest in markets where demand exceeds supply. • Control margins by investing in commodity sources, particularly up-stream gas, coal and water.

Where is it all going ? • Unregulated businesses will need to. . . • Prudently manage down-side risks associated with commodity trading. • Invest in markets where demand exceeds supply. • Control margins by investing in commodity sources, particularly up-stream gas, coal and water.

Big issues the NZ industry might face

Big issues the NZ industry might face

Big issues • • Foreign investment. Increased scrutiny. Price regulation. Further amalgamations.

Big issues • • Foreign investment. Increased scrutiny. Price regulation. Further amalgamations.

Foreign investment • Foreign investment will very probably decline, for four key reasons… • Coalition government opposition to profits going offshore. • Halt to further privatisations of generation. • Movement of the electricity lines sector toward a low return - high risk position (perhaps more political risk than commercial risk). • Public perception that profit is bad and evil. • Having said that, NZ will still be closely watched by many foreign utilities such as Utilicorp, GPU, TU, and AGL.

Foreign investment • Foreign investment will very probably decline, for four key reasons… • Coalition government opposition to profits going offshore. • Halt to further privatisations of generation. • Movement of the electricity lines sector toward a low return - high risk position (perhaps more political risk than commercial risk). • Public perception that profit is bad and evil. • Having said that, NZ will still be closely watched by many foreign utilities such as Utilicorp, GPU, TU, and AGL.

Increased scrutiny • Likely to occur in two forms… • Increased scrutiny from special interest groups who know that the Government will take up their cause. • Possibly further increases in disclosure to government agencies - either more detail, or more often.

Increased scrutiny • Likely to occur in two forms… • Increased scrutiny from special interest groups who know that the Government will take up their cause. • Possibly further increases in disclosure to government agencies - either more detail, or more often.

Price regulation • Signaled by the former government. • Forms a significant part of the present inquiry. • Likely to occur in one form or another, and will very probably see a substantial reallocation of benefits from shareholders to customers. • Will be discussed in detail later on.

Price regulation • Signaled by the former government. • Forms a significant part of the present inquiry. • Likely to occur in one form or another, and will very probably see a substantial reallocation of benefits from shareholders to customers. • Will be discussed in detail later on.

Further amalgamations • Logical step for those lines companies that have exhausted internal cost savings. • Previous government was keen to see more amalgamations in order to reduce the industry cost base. • Exact stance of the Coalition on line company amalgamation is uncertain. • Will be discussed in detail later on.

Further amalgamations • Logical step for those lines companies that have exhausted internal cost savings. • Previous government was keen to see more amalgamations in order to reduce the industry cost base. • Exact stance of the Coalition on line company amalgamation is uncertain. • Will be discussed in detail later on.

Where might the NZ industry go

Where might the NZ industry go

Possible scenarios • • • Status-quo Walk shorts & sandals. Portfolio. Bare bones. Big brother.

Possible scenarios • • • Status-quo Walk shorts & sandals. Portfolio. Bare bones. Big brother.

Status-quo • Description… • Similar to the present industry. • Characterised by… • Much the same structure as at present. • May provide for line companies to resume energy retailing simply on a tit-for-tat basis from the Coalition government. • Tinkering with some peripheral legislation, such as the Workplace Insurance and the Employment Contracts. • No fundamental changes.

Status-quo • Description… • Similar to the present industry. • Characterised by… • Much the same structure as at present. • May provide for line companies to resume energy retailing simply on a tit-for-tat basis from the Coalition government. • Tinkering with some peripheral legislation, such as the Workplace Insurance and the Employment Contracts. • No fundamental changes.

Walk short & sandals • Description… • Return to the walk shorts & sandals days of the 1970’s. • Characterised by… • • • Focus on engineering excellence for its’ own sake. Possible loss of customer focus. Erosion of shareholder wealth. Lack of investor interest in industry. Probable departure of non-technical people.

Walk short & sandals • Description… • Return to the walk shorts & sandals days of the 1970’s. • Characterised by… • • • Focus on engineering excellence for its’ own sake. Possible loss of customer focus. Erosion of shareholder wealth. Lack of investor interest in industry. Probable departure of non-technical people.

Portfolio • Description • Lines businesses become investments within global portfolios that are bought and sold as returns and risks vary in relation to investor criteria. • Characterised by… • • • Clear focus on increasing earnings over time. Regular changes of ownership. Strong emphasis on cost control. Strong overseas presence. Possible increase in listed companies.

Portfolio • Description • Lines businesses become investments within global portfolios that are bought and sold as returns and risks vary in relation to investor criteria. • Characterised by… • • • Clear focus on increasing earnings over time. Regular changes of ownership. Strong emphasis on cost control. Strong overseas presence. Possible increase in listed companies.

Bare bones • Description • Price regulation that could cut deeply into overall cost structures. • Characterised by… • Tough price regulation. • Ruthless emphasis on cost control. • Probable exit of investors, similar to Trans. Alta’s decision to divest their lines business in Alberta. • Possible de-listing of listed lines companies. • Limited funds for reinvestment in networks. • Possible decline in supply reliability over the longterm due to limited funding.

Bare bones • Description • Price regulation that could cut deeply into overall cost structures. • Characterised by… • Tough price regulation. • Ruthless emphasis on cost control. • Probable exit of investors, similar to Trans. Alta’s decision to divest their lines business in Alberta. • Possible de-listing of listed lines companies. • Limited funds for reinvestment in networks. • Possible decline in supply reliability over the longterm due to limited funding.

Big brother • Description… • Tough information disclosure, possibly as a substitute for price regulation, possibly as well as. • Characterised by… • Extreme requirements for information disclosure, possibly including ad-hoc government intervention. • Possible focus on regulatory body rather than the electricity customer. • Significant resources dedicated to disclosure process.

Big brother • Description… • Tough information disclosure, possibly as a substitute for price regulation, possibly as well as. • Characterised by… • Extreme requirements for information disclosure, possibly including ad-hoc government intervention. • Possible focus on regulatory body rather than the electricity customer. • Significant resources dedicated to disclosure process.

Regulation in more detail

Regulation in more detail

Price regulation • Objective of regulation is to restrain profits and to maintain service levels in the absence of a competitive market. • Four main forms of regulation… • • Sliding scale Rate of return Price cap Discretionary

Price regulation • Objective of regulation is to restrain profits and to maintain service levels in the absence of a competitive market. • Four main forms of regulation… • • Sliding scale Rate of return Price cap Discretionary

Price regulation • Characteristics of a robust regulatory regime… • Allows fair, reasonable and sustainable returns to utility owners. • Provides consistent investment signals for both owners and managers. • Provides incentives for efficient operation. • Allows pass-through of unavoidable costs. • Risks should be symmetrical. • Protects customers from excessive profits. • Provides guaranteed minimum service standards (either directly or indirectly).

Price regulation • Characteristics of a robust regulatory regime… • Allows fair, reasonable and sustainable returns to utility owners. • Provides consistent investment signals for both owners and managers. • Provides incentives for efficient operation. • Allows pass-through of unavoidable costs. • Risks should be symmetrical. • Protects customers from excessive profits. • Provides guaranteed minimum service standards (either directly or indirectly).

Sliding scale • Popularised by the London gas companies around 1875, also adopted by the New York Telephone Company in 1896. • Adopts a series of ROR bands in which percentage adjustments to subsequent years revenues are made. • Generally has an intermediate band in which the full profit passes to the company. • Above the intermediate band, revenues are adjusted downward, whilst below the band revenues are allowed to be increased.

Sliding scale • Popularised by the London gas companies around 1875, also adopted by the New York Telephone Company in 1896. • Adopts a series of ROR bands in which percentage adjustments to subsequent years revenues are made. • Generally has an intermediate band in which the full profit passes to the company. • Above the intermediate band, revenues are adjusted downward, whilst below the band revenues are allowed to be increased.

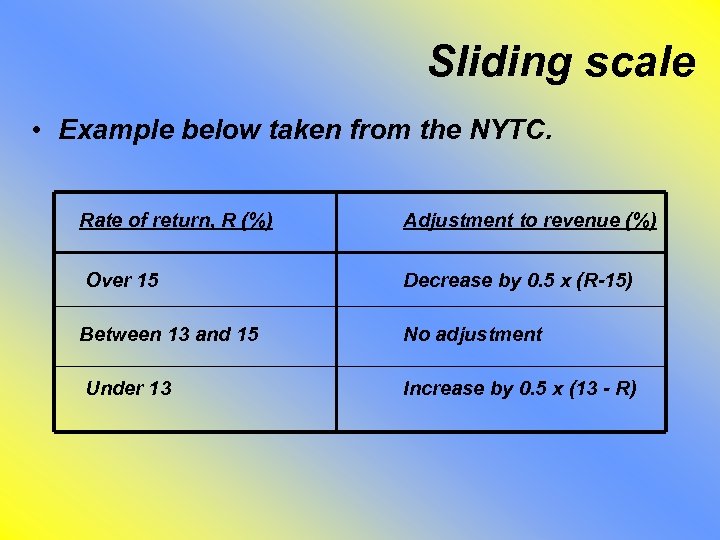

Sliding scale • Example below taken from the NYTC. Rate of return, R (%) Adjustment to revenue (%) Over 15 Decrease by 0. 5 x (R-15) Between 13 and 15 No adjustment Under 13 Increase by 0. 5 x (13 - R)

Sliding scale • Example below taken from the NYTC. Rate of return, R (%) Adjustment to revenue (%) Over 15 Decrease by 0. 5 x (R-15) Between 13 and 15 No adjustment Under 13 Increase by 0. 5 x (13 - R)

Rate of return • Developed around 1907 by Tom Edison and J. P. Morgan, who felt the industry would be better served by regulated geographical franchises rather than a free-for-all. • Still the predominant form of utility regulation in the US. • Provides for imprudent expenditure to be excluded from the rating base. • Huge legal battles with state regulatory commissions over what assets can be included in the rating base.

Rate of return • Developed around 1907 by Tom Edison and J. P. Morgan, who felt the industry would be better served by regulated geographical franchises rather than a free-for-all. • Still the predominant form of utility regulation in the US. • Provides for imprudent expenditure to be excluded from the rating base. • Huge legal battles with state regulatory commissions over what assets can be included in the rating base.

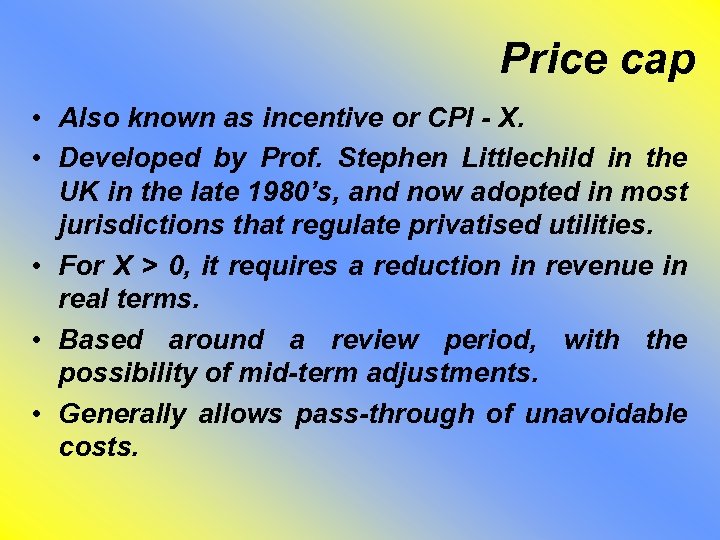

Price cap • Also known as incentive or CPI - X. • Developed by Prof. Stephen Littlechild in the UK in the late 1980’s, and now adopted in most jurisdictions that regulate privatised utilities. • For X > 0, it requires a reduction in revenue in real terms. • Based around a review period, with the possibility of mid-term adjustments. • Generally allows pass-through of unavoidable costs.

Price cap • Also known as incentive or CPI - X. • Developed by Prof. Stephen Littlechild in the UK in the late 1980’s, and now adopted in most jurisdictions that regulate privatised utilities. • For X > 0, it requires a reduction in revenue in real terms. • Based around a review period, with the possibility of mid-term adjustments. • Generally allows pass-through of unavoidable costs.

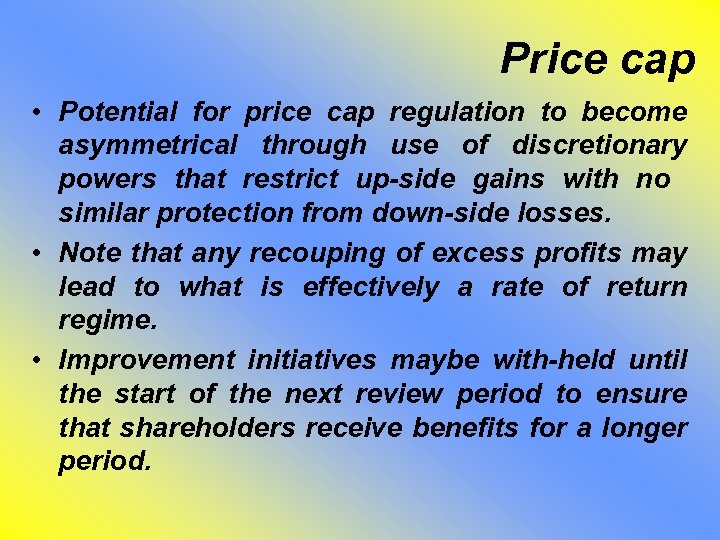

Price cap • Potential for price cap regulation to become asymmetrical through use of discretionary powers that restrict up-side gains with no similar protection from down-side losses. • Note that any recouping of excess profits may lead to what is effectively a rate of return regime. • Improvement initiatives maybe with-held until the start of the next review period to ensure that shareholders receive benefits for a longer period.

Price cap • Potential for price cap regulation to become asymmetrical through use of discretionary powers that restrict up-side gains with no similar protection from down-side losses. • Note that any recouping of excess profits may lead to what is effectively a rate of return regime. • Improvement initiatives maybe with-held until the start of the next review period to ensure that shareholders receive benefits for a longer period.

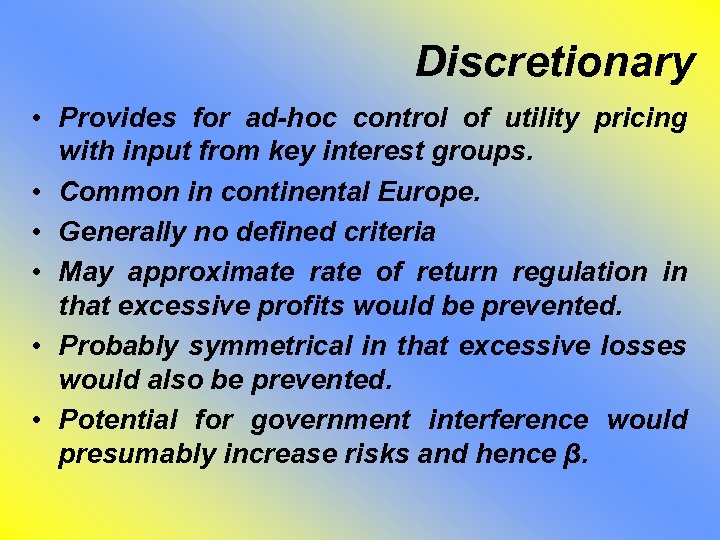

Discretionary • Provides for ad-hoc control of utility pricing with input from key interest groups. • Common in continental Europe. • Generally no defined criteria • May approximate rate of return regulation in that excessive profits would be prevented. • Probably symmetrical in that excessive losses would also be prevented. • Potential for government interference would presumably increase risks and hence β.

Discretionary • Provides for ad-hoc control of utility pricing with input from key interest groups. • Common in continental Europe. • Generally no defined criteria • May approximate rate of return regulation in that excessive profits would be prevented. • Probably symmetrical in that excessive losses would also be prevented. • Potential for government interference would presumably increase risks and hence β.

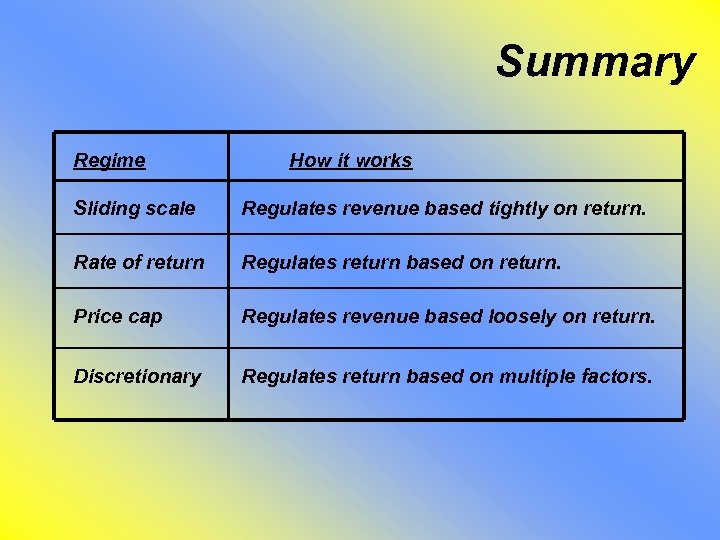

Summary Regime How it works Sliding scale Regulates revenue based tightly on return. Rate of return Regulates return based on return. Price cap Regulates revenue based loosely on return. Discretionary Regulates return based on multiple factors.

Summary Regime How it works Sliding scale Regulates revenue based tightly on return. Rate of return Regulates return based on return. Price cap Regulates revenue based loosely on return. Discretionary Regulates return based on multiple factors.

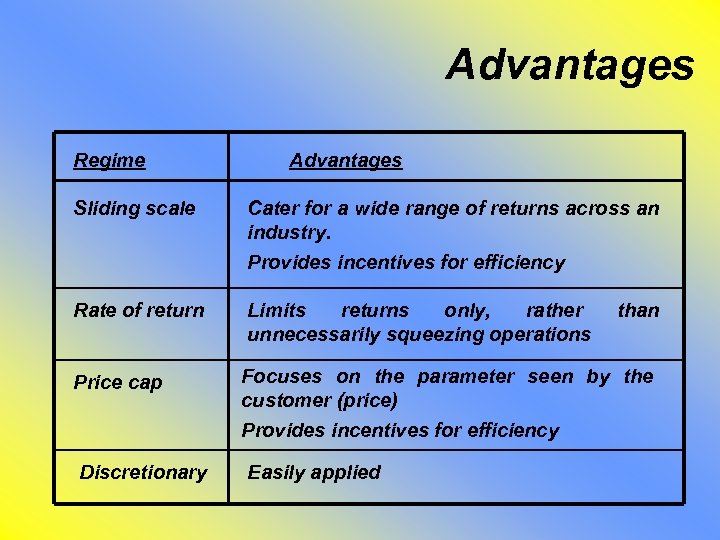

Advantages Regime Advantages Sliding scale Cater for a wide range of returns across an industry. Provides incentives for efficiency Rate of return Limits returns only, rather unnecessarily squeezing operations Price cap Focuses on the parameter seen by the customer (price) Provides incentives for efficiency Discretionary Easily applied than

Advantages Regime Advantages Sliding scale Cater for a wide range of returns across an industry. Provides incentives for efficiency Rate of return Limits returns only, rather unnecessarily squeezing operations Price cap Focuses on the parameter seen by the customer (price) Provides incentives for efficiency Discretionary Easily applied than

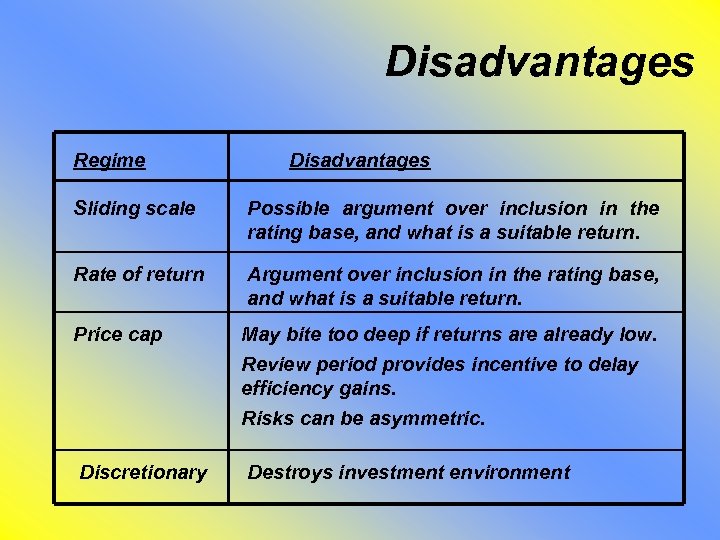

Disadvantages Regime Disadvantages Sliding scale Possible argument over inclusion in the rating base, and what is a suitable return. Rate of return Argument over inclusion in the rating base, and what is a suitable return. Price cap May bite too deep if returns are already low. Review period provides incentive to delay efficiency gains. Risks can be asymmetric. Discretionary Destroys investment environment

Disadvantages Regime Disadvantages Sliding scale Possible argument over inclusion in the rating base, and what is a suitable return. Rate of return Argument over inclusion in the rating base, and what is a suitable return. Price cap May bite too deep if returns are already low. Review period provides incentive to delay efficiency gains. Risks can be asymmetric. Discretionary Destroys investment environment

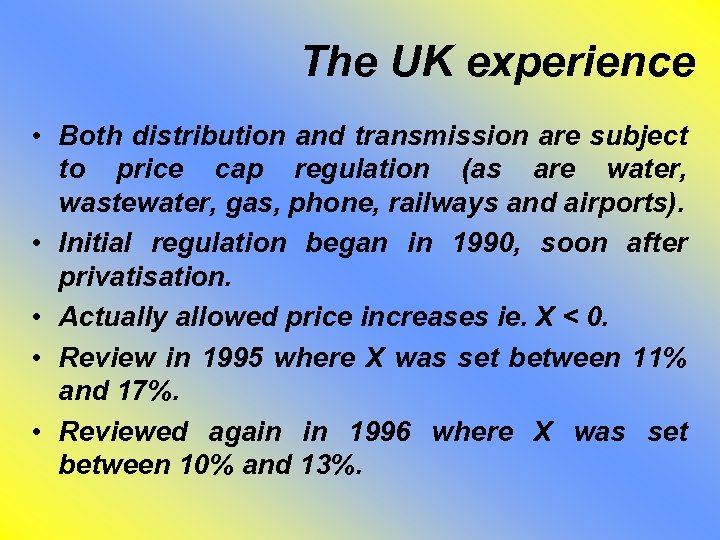

The UK experience • Both distribution and transmission are subject to price cap regulation (as are water, wastewater, gas, phone, railways and airports). • Initial regulation began in 1990, soon after privatisation. • Actually allowed price increases ie. X < 0. • Review in 1995 where X was set between 11% and 17%. • Reviewed again in 1996 where X was set between 10% and 13%.

The UK experience • Both distribution and transmission are subject to price cap regulation (as are water, wastewater, gas, phone, railways and airports). • Initial regulation began in 1990, soon after privatisation. • Actually allowed price increases ie. X < 0. • Review in 1995 where X was set between 11% and 17%. • Reviewed again in 1996 where X was set between 10% and 13%.

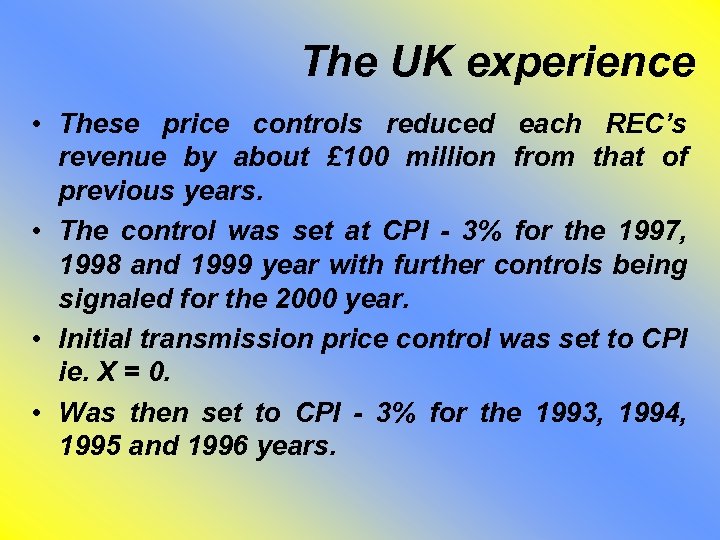

The UK experience • These price controls reduced each REC’s revenue by about £ 100 million from that of previous years. • The control was set at CPI - 3% for the 1997, 1998 and 1999 year with further controls being signaled for the 2000 year. • Initial transmission price control was set to CPI ie. X = 0. • Was then set to CPI - 3% for the 1993, 1994, 1995 and 1996 years.

The UK experience • These price controls reduced each REC’s revenue by about £ 100 million from that of previous years. • The control was set at CPI - 3% for the 1997, 1998 and 1999 year with further controls being signaled for the 2000 year. • Initial transmission price control was set to CPI ie. X = 0. • Was then set to CPI - 3% for the 1993, 1994, 1995 and 1996 years.

The UK experience • Set to CPI - 20% for 1997. • Set to CPI - 4% for the 1998, 1999 and 2000 years, with further controls being signaled.

The UK experience • Set to CPI - 20% for 1997. • Set to CPI - 4% for the 1998, 1999 and 2000 years, with further controls being signaled.

Making it work in NZ • NZ industry differs from many other regulatory jurisdictions in that there is a wide mix of ownership demanding vastly different returns on capital. • Applying a single regulatory CPI - X regime could prove disastrous, and would need to be done on a case-by-case basis. • Case in point would be an efficient Trust-owned lines business from which a low return is demanded.

Making it work in NZ • NZ industry differs from many other regulatory jurisdictions in that there is a wide mix of ownership demanding vastly different returns on capital. • Applying a single regulatory CPI - X regime could prove disastrous, and would need to be done on a case-by-case basis. • Case in point would be an efficient Trust-owned lines business from which a low return is demanded.

Making it work in NZ • Uniform CPI - X could reduce funds available for re-investment in supply security rather than merely reducing profits, thereby jepodising the very customers that regulation was intended to protect. • Issues to be resolved could include… • Deciding how to group lines companies into X bands (or whether it should even be individually). • Deciding what X to apply to each band. • Deciding on a suitable review period, and what midterm adjustments would be permissible. • Definition of pass-through costs eg. Transpower.

Making it work in NZ • Uniform CPI - X could reduce funds available for re-investment in supply security rather than merely reducing profits, thereby jepodising the very customers that regulation was intended to protect. • Issues to be resolved could include… • Deciding how to group lines companies into X bands (or whether it should even be individually). • Deciding what X to apply to each band. • Deciding on a suitable review period, and what midterm adjustments would be permissible. • Definition of pass-through costs eg. Transpower.

Making it work in NZ • Rate of return regulation could have merit by restricting returns to WACC on ODV. • Could provide an incentive for efficient reinvestment in supply, especially if imprudently spent funds were excluded from the rating base. • Conversely, there is no incentive to improve operational efficiencies, as these become passthrough costs. • Reduce attractiveness of external investment in companies by restricting earnings growth.

Making it work in NZ • Rate of return regulation could have merit by restricting returns to WACC on ODV. • Could provide an incentive for efficient reinvestment in supply, especially if imprudently spent funds were excluded from the rating base. • Conversely, there is no incentive to improve operational efficiencies, as these become passthrough costs. • Reduce attractiveness of external investment in companies by restricting earnings growth.

Making it work in NZ • Sliding scale with a fixed review period may have merits in that wide-ranging returns could be addressed. • Specifically, companies whose return is much less than WACC could be allowed to increase revenue to maintain their capital base. • Would provide incentives for efficiency gains, but only up to a point. • Would require clear definition of the rating base, however the ODV process should address that issue.

Making it work in NZ • Sliding scale with a fixed review period may have merits in that wide-ranging returns could be addressed. • Specifically, companies whose return is much less than WACC could be allowed to increase revenue to maintain their capital base. • Would provide incentives for efficiency gains, but only up to a point. • Would require clear definition of the rating base, however the ODV process should address that issue.

Amalgamation in more detail

Amalgamation in more detail

Comment • Hot topic - has been for quite a few years, and probably will be for the next few years. • Just about everybody has spoken to their immediate neighbors and beyond to attempt amalgamations of various sorts. • Reasonably safe to say that the limiting factor has been the 3 P’s. … • Personalities (mainly Directors and Trustees). • Politics (local body). • Parochialism (community pressure).

Comment • Hot topic - has been for quite a few years, and probably will be for the next few years. • Just about everybody has spoken to their immediate neighbors and beyond to attempt amalgamations of various sorts. • Reasonably safe to say that the limiting factor has been the 3 P’s. … • Personalities (mainly Directors and Trustees). • Politics (local body). • Parochialism (community pressure).

Different levels • Three key levels of amalgamation… • Strategic alliance. • Joint management. • Merged ownership. • Essential precursor is extracting all internal efficiencies first, which most NZ lines companies have now done. • Some have investigated the Strategic Alliance approach, with the general conclusion being that the benefits are very minimal. • Activity mainly focusing on Joint Management.

Different levels • Three key levels of amalgamation… • Strategic alliance. • Joint management. • Merged ownership. • Essential precursor is extracting all internal efficiencies first, which most NZ lines companies have now done. • Some have investigated the Strategic Alliance approach, with the general conclusion being that the benefits are very minimal. • Activity mainly focusing on Joint Management.

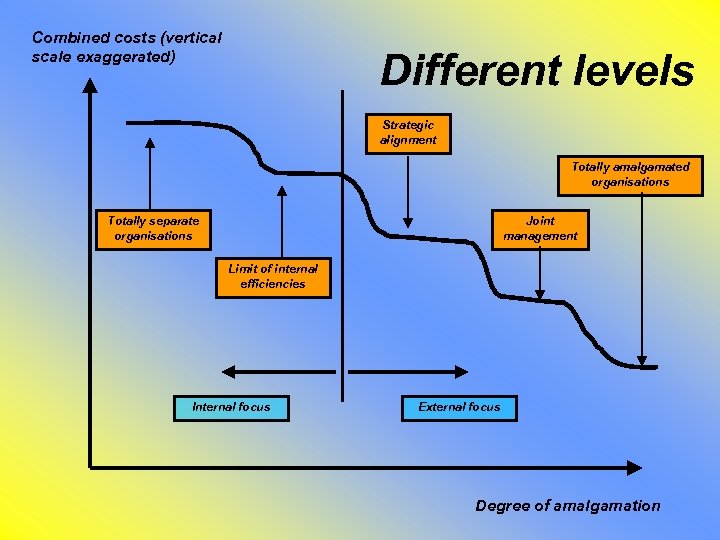

Combined costs (vertical scale exaggerated) Different levels Strategic alignment Totally amalgamated organisations Totally separate organisations Joint management Limit of internal efficiencies Internal focus External focus Degree of amalgamation

Combined costs (vertical scale exaggerated) Different levels Strategic alignment Totally amalgamated organisations Totally separate organisations Joint management Limit of internal efficiencies Internal focus External focus Degree of amalgamation

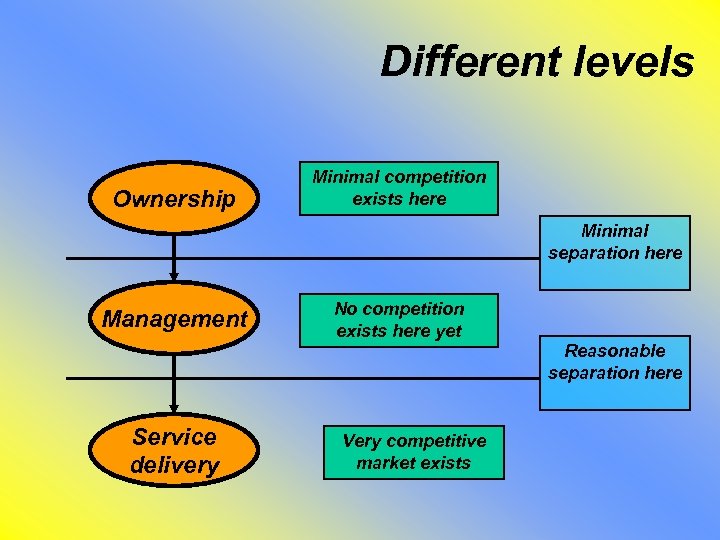

Different levels • Activities occur at 3 reasonably distinct levels in the utility industry… • Ownership • Management • Service delivery • Key feature is contestability. . . • Most maintenance and construction work is contestable, with the outcome being lower costs. • Some ownership is contestable, with the outcome being increased earnings. • Management is also contestable in theory, with the outcome being lower costs and higher earnings.

Different levels • Activities occur at 3 reasonably distinct levels in the utility industry… • Ownership • Management • Service delivery • Key feature is contestability. . . • Most maintenance and construction work is contestable, with the outcome being lower costs. • Some ownership is contestable, with the outcome being increased earnings. • Management is also contestable in theory, with the outcome being lower costs and higher earnings.

Different levels Ownership Minimal competition exists here Minimal separation here Management No competition exists here yet Reasonable separation here Service delivery Very competitive market exists

Different levels Ownership Minimal competition exists here Minimal separation here Management No competition exists here yet Reasonable separation here Service delivery Very competitive market exists

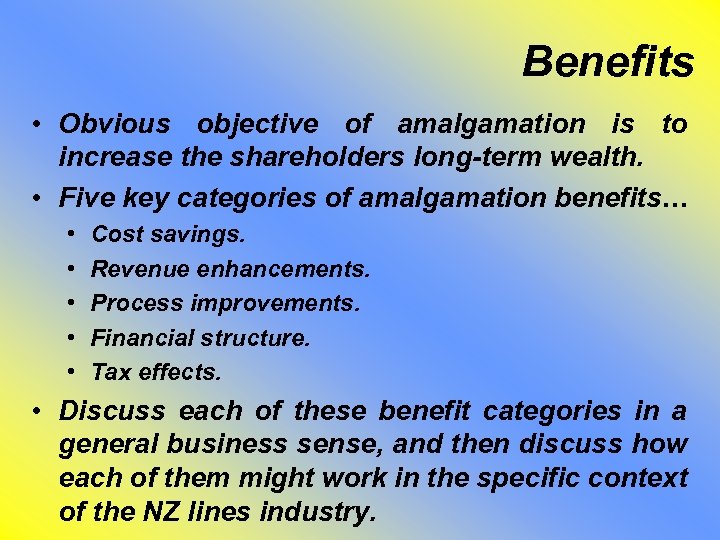

Benefits • Obvious objective of amalgamation is to increase the shareholders long-term wealth. • Five key categories of amalgamation benefits… • • • Cost savings. Revenue enhancements. Process improvements. Financial structure. Tax effects. • Discuss each of these benefit categories in a general business sense, and then discuss how each of them might work in the specific context of the NZ lines industry.

Benefits • Obvious objective of amalgamation is to increase the shareholders long-term wealth. • Five key categories of amalgamation benefits… • • • Cost savings. Revenue enhancements. Process improvements. Financial structure. Tax effects. • Discuss each of these benefit categories in a general business sense, and then discuss how each of them might work in the specific context of the NZ lines industry.

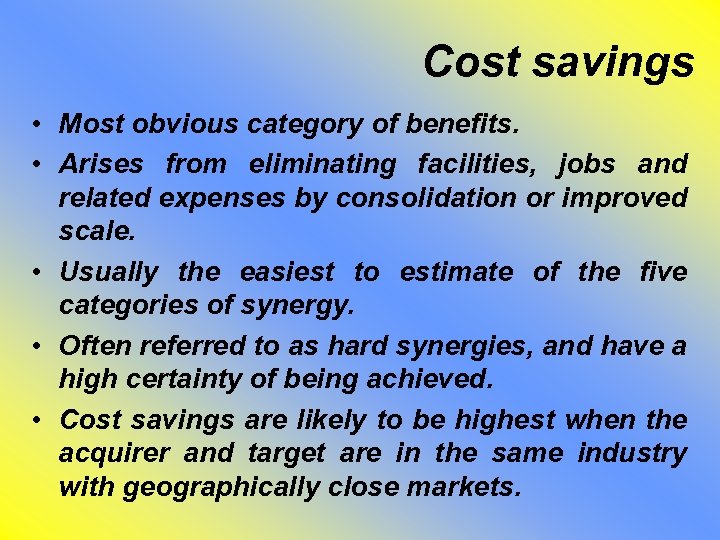

Cost savings • Most obvious category of benefits. • Arises from eliminating facilities, jobs and related expenses by consolidation or improved scale. • Usually the easiest to estimate of the five categories of synergy. • Often referred to as hard synergies, and have a high certainty of being achieved. • Cost savings are likely to be highest when the acquirer and target are in the same industry with geographically close markets.

Cost savings • Most obvious category of benefits. • Arises from eliminating facilities, jobs and related expenses by consolidation or improved scale. • Usually the easiest to estimate of the five categories of synergy. • Often referred to as hard synergies, and have a high certainty of being achieved. • Cost savings are likely to be highest when the acquirer and target are in the same industry with geographically close markets.

Cost savings • Forms the majority of synergies, under the following broad categories… • • Governance Management Planning Operations Fault restoration Maintenance Network assets Facilities.

Cost savings • Forms the majority of synergies, under the following broad categories… • • Governance Management Planning Operations Fault restoration Maintenance Network assets Facilities.

Revenue enhancements • Possible for an amalgamated business to achieve a higher revenue growth than either business could have achieved independently. • Primary means would be applying a targets premium product to the acquirer’s distribution channel. • Very difficult to estimate - many external factors such as customer response to new products or services. • Consider evaluating but probably exclude from the final synergy estimate.

Revenue enhancements • Possible for an amalgamated business to achieve a higher revenue growth than either business could have achieved independently. • Primary means would be applying a targets premium product to the acquirer’s distribution channel. • Very difficult to estimate - many external factors such as customer response to new products or services. • Consider evaluating but probably exclude from the final synergy estimate.

Revenue enhancements • Unlikely that an amalgamated lines business could increase revenues beyond what the two separate businesses could have unless some cross-boundary connection allows a premium to be charged for alternative supplies. • Not to be confused with acquisition of a highgrowth target (which would increase revenues regardless of any acquisition). • Price regulation will very likely be a key revenue issue.

Revenue enhancements • Unlikely that an amalgamated lines business could increase revenues beyond what the two separate businesses could have unless some cross-boundary connection allows a premium to be charged for alternative supplies. • Not to be confused with acquisition of a highgrowth target (which would increase revenues regardless of any acquisition). • Price regulation will very likely be a key revenue issue.

Process improvements • Creates synergy by transferring best practice and core competencies between the acquirer and the target. • Acquirer may be seeking the targets processes, procedures and controls rather than their products or markets. • Acquirer may also identify an undervalued business that can be enhanced by the acquirer’s processes and procedures. • Consider evaluating but probably exclude from the final synergy estimate.

Process improvements • Creates synergy by transferring best practice and core competencies between the acquirer and the target. • Acquirer may be seeking the targets processes, procedures and controls rather than their products or markets. • Acquirer may also identify an undervalued business that can be enhanced by the acquirer’s processes and procedures. • Consider evaluating but probably exclude from the final synergy estimate.

Process improvements • Unlikely that any one lines business has processes superior enough to merit acquiring them solely for that reason. • Generally high level of communication between lines companies at operational levels has meant that best practice is generally discussed and shared openly.

Process improvements • Unlikely that any one lines business has processes superior enough to merit acquiring them solely for that reason. • Generally high level of communication between lines companies at operational levels has meant that best practice is generally discussed and shared openly.

Financial structure • Capital restructuring to lower the overall WACC can be undertaken independently of any amalgamation, hence should not be used to justify an amalgamation. • It may be possible to take advantage of a targets more favorable cost of debt. • May also be possible to pool working capital and surplus cash. • Probably should be included in the synergy estimate if benefits can be calculated accurately enough.

Financial structure • Capital restructuring to lower the overall WACC can be undertaken independently of any amalgamation, hence should not be used to justify an amalgamation. • It may be possible to take advantage of a targets more favorable cost of debt. • May also be possible to pool working capital and surplus cash. • Probably should be included in the synergy estimate if benefits can be calculated accurately enough.

Financial structure • Previously stated that amalgamations should not be used as a justification for financial restructuring if the opportunity already exists. • Cost of lines business equity varies minimally throughout NZ, however use of debt financing has created a noticeable spread in WACC. • May be possible to create some synergy through refinancing at the lower WACC (in reality, it may lower a debt financing rate by a fraction of a percent).

Financial structure • Previously stated that amalgamations should not be used as a justification for financial restructuring if the opportunity already exists. • Cost of lines business equity varies minimally throughout NZ, however use of debt financing has created a noticeable spread in WACC. • May be possible to create some synergy through refinancing at the lower WACC (in reality, it may lower a debt financing rate by a fraction of a percent).

Tax effects • Often difficult to assess, but generally fall into two broad categories… • One-off tax costs such as capital and transfer duties, or the inability to carry forward tax losses. • On-going tax costs. • Goal is to obtain a lower tax rate for the amalgamated business. • Global acquisitions may provide opportunities to move tax liabilities to low-tax jurisdictions. • Definitely evaluate and include in the final synergy estimate.

Tax effects • Often difficult to assess, but generally fall into two broad categories… • One-off tax costs such as capital and transfer duties, or the inability to carry forward tax losses. • On-going tax costs. • Goal is to obtain a lower tax rate for the amalgamated business. • Global acquisitions may provide opportunities to move tax liabilities to low-tax jurisdictions. • Definitely evaluate and include in the final synergy estimate.

Tax effects • Obviously little opportunity for exploiting low tax jurisdictions in the global sense. • Unlikely that the amalgamated business would achieve a more favorable tax position. • One-off tax issues can be very significant, especially if capital repayments to shareholders are involved. • Best seek specialist tax advice very early in the process to identify the tax implications of each amalgamation option.

Tax effects • Obviously little opportunity for exploiting low tax jurisdictions in the global sense. • Unlikely that the amalgamated business would achieve a more favorable tax position. • One-off tax issues can be very significant, especially if capital repayments to shareholders are involved. • Best seek specialist tax advice very early in the process to identify the tax implications of each amalgamation option.

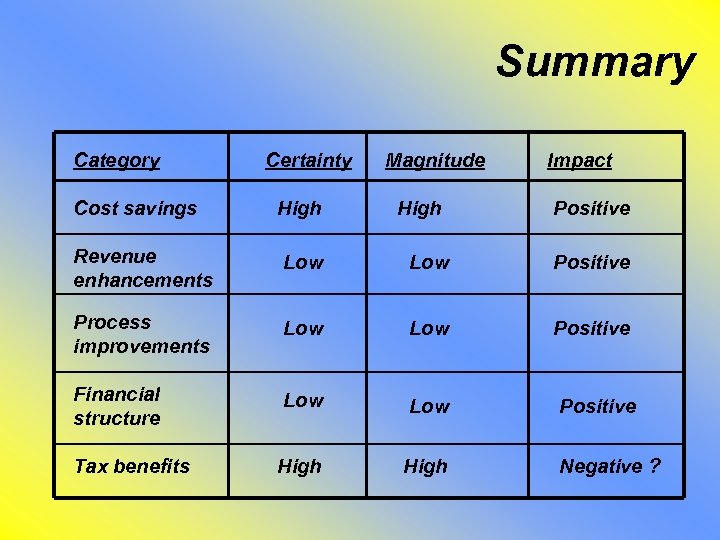

Summary Category Certainty Magnitude High Impact Cost savings High Positive Revenue enhancements Low Positive Process improvements Low Positive Financial structure Low Positive Tax benefits High Negative ?

Summary Category Certainty Magnitude High Impact Cost savings High Positive Revenue enhancements Low Positive Process improvements Low Positive Financial structure Low Positive Tax benefits High Negative ?

Concluding remarks

Concluding remarks

Concluding remarks • Industry has seen significant change over the last few years, probably as much as in the previous century. • More change is very likely in the immediate term, some of which may make more sense politically than commercially. • Some changes may provide opportunities for well-placed lines businesses to move ahead. • The only certainty is more change !!!

Concluding remarks • Industry has seen significant change over the last few years, probably as much as in the previous century. • More change is very likely in the immediate term, some of which may make more sense politically than commercially. • Some changes may provide opportunities for well-placed lines businesses to move ahead. • The only certainty is more change !!!

![[This slide added later] • Utility Consultants has a wide range of slide shows [This slide added later] • Utility Consultants has a wide range of slide shows](https://present5.com/presentation/b7d1211fd8f9a36d9fe1f50a0eca6f69/image-88.jpg) [This slide added later] • Utility Consultants has a wide range of slide shows covering many topical areas of utility management, including strategy, regulation, investment banking, asset management and risk management. • To see the full range of slide shows available, visit our web site by picking the link on the following page then picking Slide Shows on the blue navigation bar (at the left).

[This slide added later] • Utility Consultants has a wide range of slide shows covering many topical areas of utility management, including strategy, regulation, investment banking, asset management and risk management. • To see the full range of slide shows available, visit our web site by picking the link on the following page then picking Slide Shows on the blue navigation bar (at the left).

![[This slide added later] Phone us on (07) 854 -6541 Pick here to email [This slide added later] Phone us on (07) 854 -6541 Pick here to email](https://present5.com/presentation/b7d1211fd8f9a36d9fe1f50a0eca6f69/image-89.jpg) [This slide added later] Phone us on (07) 854 -6541 Pick here to email us Pick here to visit us

[This slide added later] Phone us on (07) 854 -6541 Pick here to email us Pick here to visit us