be2b225724dbbe713b6a48cf6f5ed145.ppt

- Количество слайдов: 29

Where has all the funding gone? Simon Deefholts Director, Global Shipping, HSBC Bank plc DATE: May 2010

Where has all the funding gone? Simon Deefholts Director, Global Shipping, HSBC Bank plc DATE: May 2010

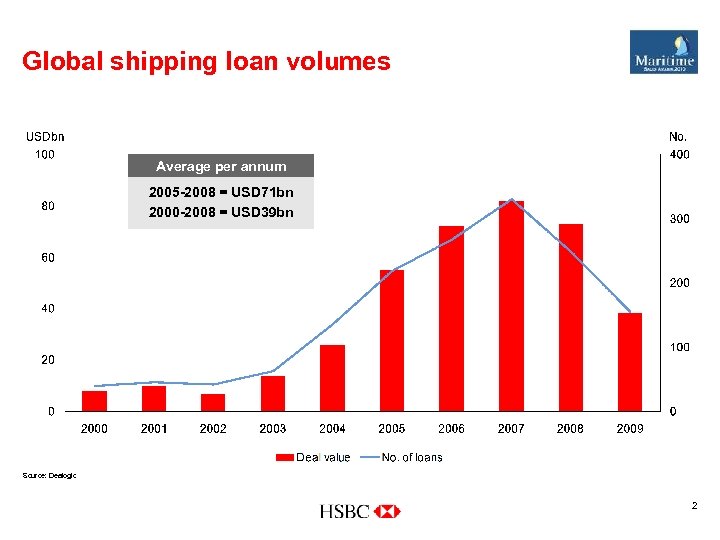

Global shipping loan volumes Average per annum 2005 -2008 = USD 71 bn 2000 -2008 = USD 39 bn Source: Dealogic 2

Global shipping loan volumes Average per annum 2005 -2008 = USD 71 bn 2000 -2008 = USD 39 bn Source: Dealogic 2

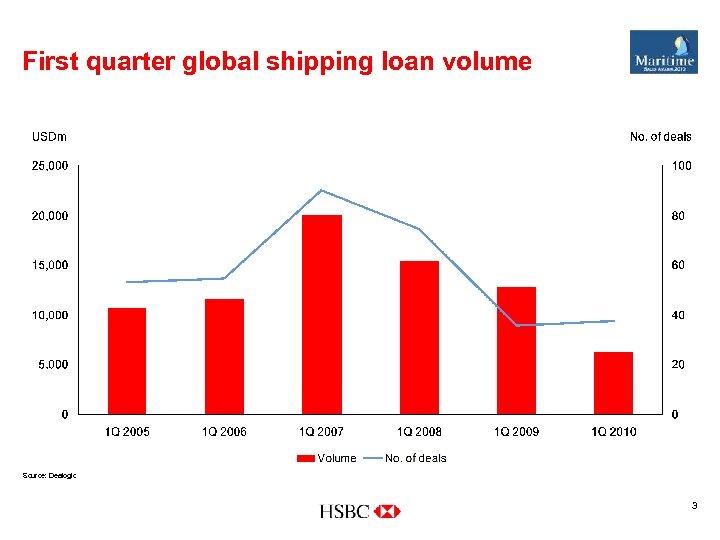

First quarter global shipping loan volume Source: Dealogic 3

First quarter global shipping loan volume Source: Dealogic 3

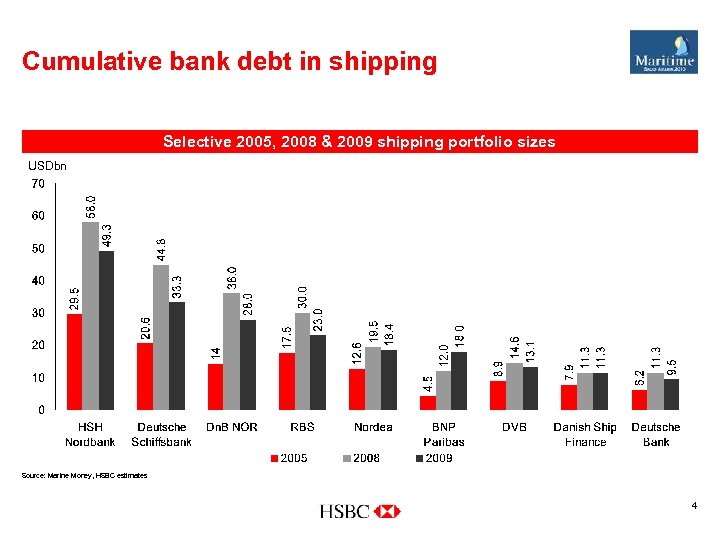

Cumulative bank debt in shipping Selective 2005, 2008 & 2009 shipping portfolio sizes USDbn Source: Marine Money, HSBC estimates 4

Cumulative bank debt in shipping Selective 2005, 2008 & 2009 shipping portfolio sizes USDbn Source: Marine Money, HSBC estimates 4

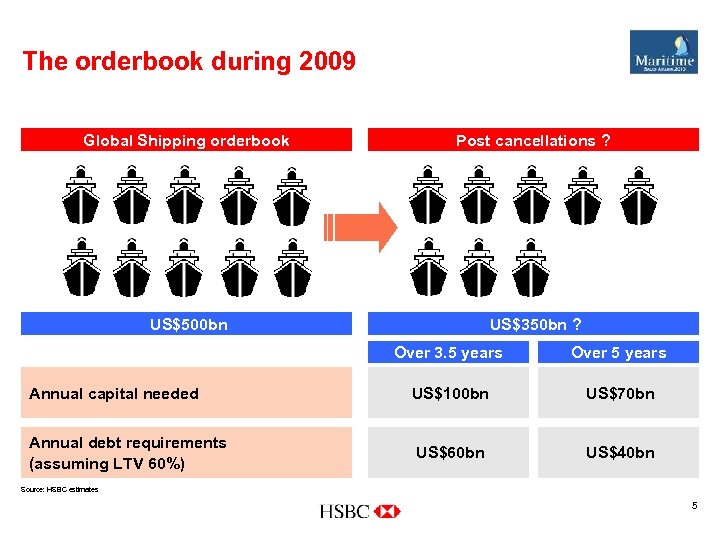

The orderbook during 2009 Global Shipping orderbook Post cancellations ? US$500 bn US$350 bn ? Over 3. 5 years Over 5 years Annual capital needed US$100 bn US$70 bn Annual debt requirements (assuming LTV 60%) US$60 bn US$40 bn Source: HSBC estimates 5

The orderbook during 2009 Global Shipping orderbook Post cancellations ? US$500 bn US$350 bn ? Over 3. 5 years Over 5 years Annual capital needed US$100 bn US$70 bn Annual debt requirements (assuming LTV 60%) US$60 bn US$40 bn Source: HSBC estimates 5

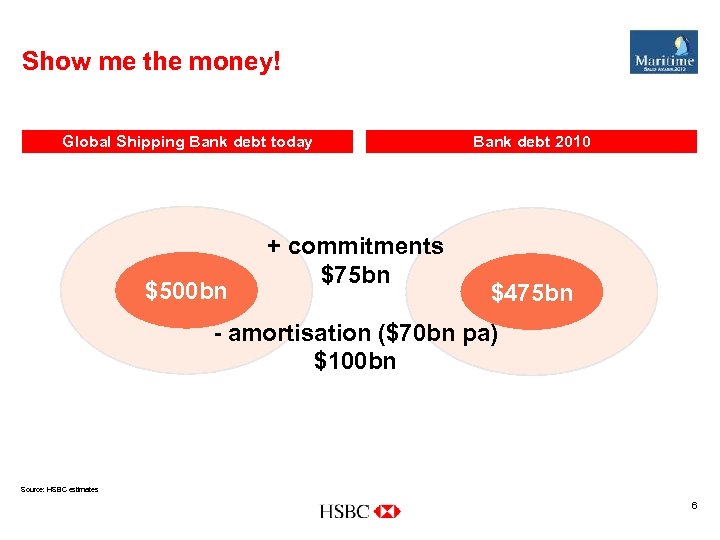

Show me the money! Global Shipping Bank debt today $500 bn + commitments $75 bn Bank debt 2010 $475 bn - amortisation ($70 bn pa) $100 bn Source: HSBC estimates 6

Show me the money! Global Shipping Bank debt today $500 bn + commitments $75 bn Bank debt 2010 $475 bn - amortisation ($70 bn pa) $100 bn Source: HSBC estimates 6

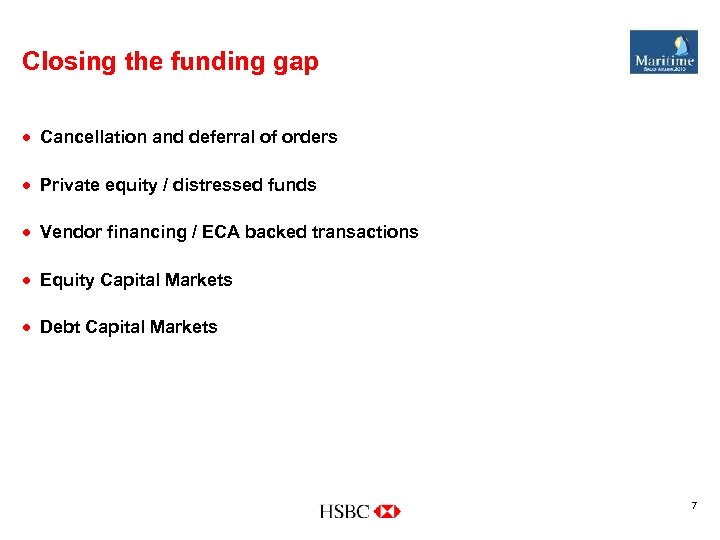

Closing the funding gap · Cancellation and deferral of orders · Private equity / distressed funds · Vendor financing / ECA backed transactions · Equity Capital Markets · Debt Capital Markets 7

Closing the funding gap · Cancellation and deferral of orders · Private equity / distressed funds · Vendor financing / ECA backed transactions · Equity Capital Markets · Debt Capital Markets 7

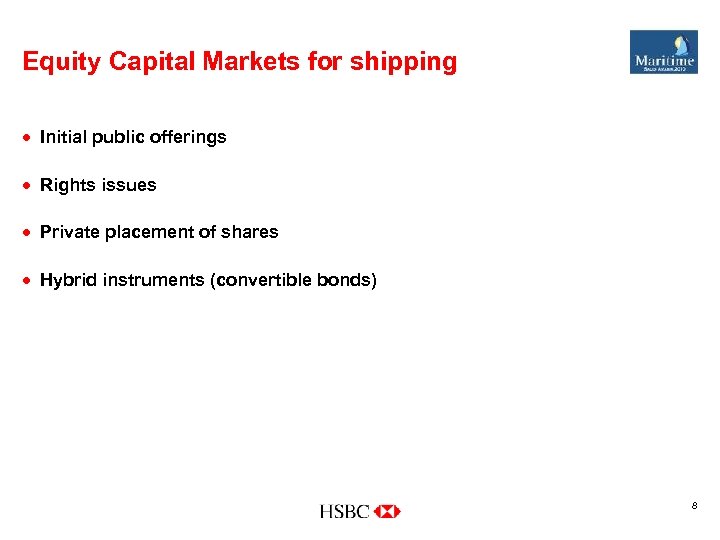

Equity Capital Markets for shipping · Initial public offerings · Rights issues · Private placement of shares · Hybrid instruments (convertible bonds) 8

Equity Capital Markets for shipping · Initial public offerings · Rights issues · Private placement of shares · Hybrid instruments (convertible bonds) 8

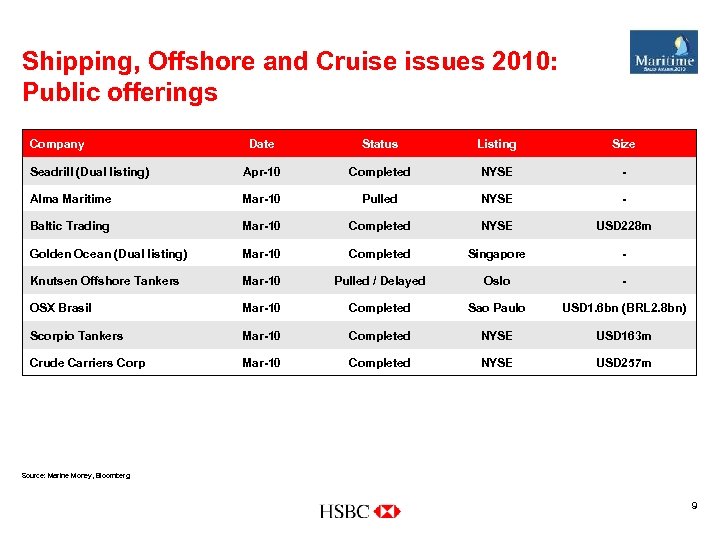

Shipping, Offshore and Cruise issues 2010: Public offerings Company Date Status Listing Size Seadrill (Dual listing) Apr-10 Completed NYSE - Alma Maritime Mar-10 Pulled NYSE - Baltic Trading Mar-10 Completed NYSE USD 228 m Golden Ocean (Dual listing) Mar-10 Completed Singapore - Knutsen Offshore Tankers Mar-10 Pulled / Delayed Oslo - OSX Brasil Mar-10 Completed Sao Paulo USD 1. 6 bn (BRL 2. 8 bn) Scorpio Tankers Mar-10 Completed NYSE USD 163 m Crude Carriers Corp Mar-10 Completed NYSE USD 257 m Source: Marine Money, Bloomberg 9

Shipping, Offshore and Cruise issues 2010: Public offerings Company Date Status Listing Size Seadrill (Dual listing) Apr-10 Completed NYSE - Alma Maritime Mar-10 Pulled NYSE - Baltic Trading Mar-10 Completed NYSE USD 228 m Golden Ocean (Dual listing) Mar-10 Completed Singapore - Knutsen Offshore Tankers Mar-10 Pulled / Delayed Oslo - OSX Brasil Mar-10 Completed Sao Paulo USD 1. 6 bn (BRL 2. 8 bn) Scorpio Tankers Mar-10 Completed NYSE USD 163 m Crude Carriers Corp Mar-10 Completed NYSE USD 257 m Source: Marine Money, Bloomberg 9

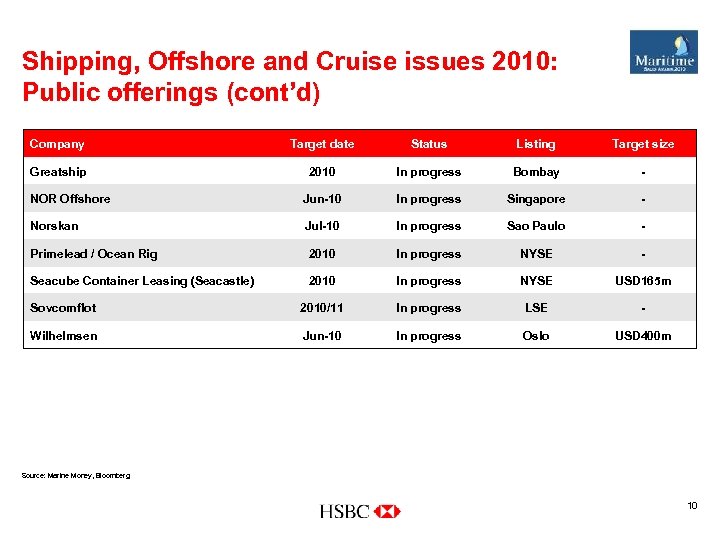

Shipping, Offshore and Cruise issues 2010: Public offerings (cont’d) Company Target date Status Listing Target size Greatship 2010 In progress Bombay - NOR Offshore Jun-10 In progress Singapore - Norskan Jul-10 In progress Sao Paulo - Primelead / Ocean Rig 2010 In progress NYSE - Seacube Container Leasing (Seacastle) 2010 In progress NYSE USD 165 m Sovcomflot 2010/11 In progress LSE - Wilhelmsen Jun-10 In progress Oslo USD 400 m Source: Marine Money, Bloomberg 10

Shipping, Offshore and Cruise issues 2010: Public offerings (cont’d) Company Target date Status Listing Target size Greatship 2010 In progress Bombay - NOR Offshore Jun-10 In progress Singapore - Norskan Jul-10 In progress Sao Paulo - Primelead / Ocean Rig 2010 In progress NYSE - Seacube Container Leasing (Seacastle) 2010 In progress NYSE USD 165 m Sovcomflot 2010/11 In progress LSE - Wilhelmsen Jun-10 In progress Oslo USD 400 m Source: Marine Money, Bloomberg 10

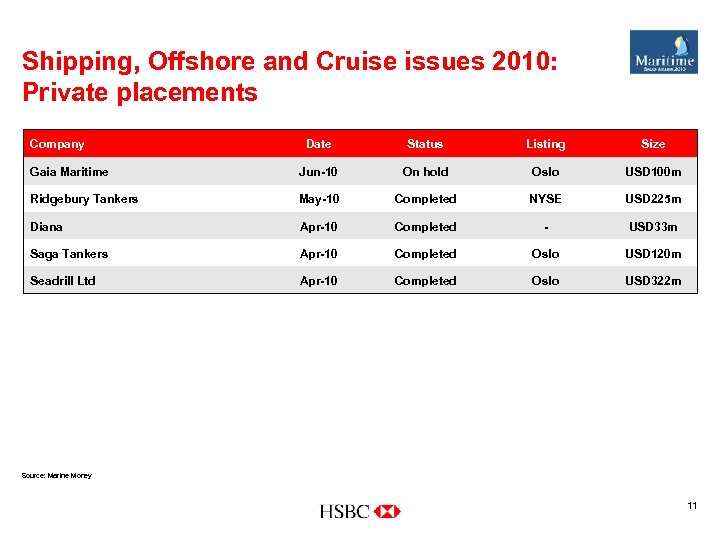

Shipping, Offshore and Cruise issues 2010: Private placements Company Date Status Listing Size Gaia Maritime Jun-10 On hold Oslo USD 100 m Ridgebury Tankers May-10 Completed NYSE USD 225 m Diana Apr-10 Completed - USD 33 m Saga Tankers Apr-10 Completed Oslo USD 120 m Seadrill Ltd Apr-10 Completed Oslo USD 322 m Source: Marine Money 11

Shipping, Offshore and Cruise issues 2010: Private placements Company Date Status Listing Size Gaia Maritime Jun-10 On hold Oslo USD 100 m Ridgebury Tankers May-10 Completed NYSE USD 225 m Diana Apr-10 Completed - USD 33 m Saga Tankers Apr-10 Completed Oslo USD 120 m Seadrill Ltd Apr-10 Completed Oslo USD 322 m Source: Marine Money 11

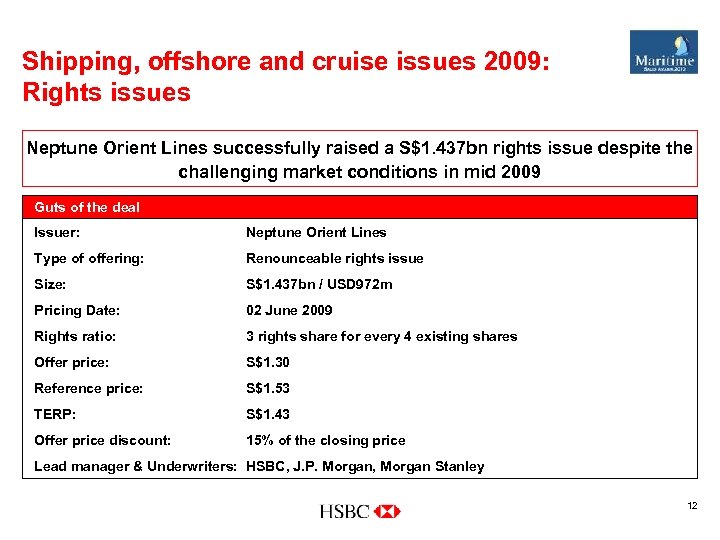

Shipping, offshore and cruise issues 2009: Rights issues Neptune Orient Lines successfully raised a S$1. 437 bn rights issue despite the challenging market conditions in mid 2009 Guts of the deal Issuer: Neptune Orient Lines Type of offering: Renounceable rights issue Size: S$1. 437 bn / USD 972 m Pricing Date: 02 June 2009 Rights ratio: 3 rights share for every 4 existing shares Offer price: S$1. 30 Reference price: S$1. 53 TERP: S$1. 43 Offer price discount: 15% of the closing price Lead manager & Underwriters: HSBC, J. P. Morgan, Morgan Stanley 12

Shipping, offshore and cruise issues 2009: Rights issues Neptune Orient Lines successfully raised a S$1. 437 bn rights issue despite the challenging market conditions in mid 2009 Guts of the deal Issuer: Neptune Orient Lines Type of offering: Renounceable rights issue Size: S$1. 437 bn / USD 972 m Pricing Date: 02 June 2009 Rights ratio: 3 rights share for every 4 existing shares Offer price: S$1. 30 Reference price: S$1. 53 TERP: S$1. 43 Offer price discount: 15% of the closing price Lead manager & Underwriters: HSBC, J. P. Morgan, Morgan Stanley 12

Debt Capital Markets for shipping: Horses for courses · Euro bond market · US bond market · Convertible bond market · NOK bond market · Islamic bond market 13

Debt Capital Markets for shipping: Horses for courses · Euro bond market · US bond market · Convertible bond market · NOK bond market · Islamic bond market 13

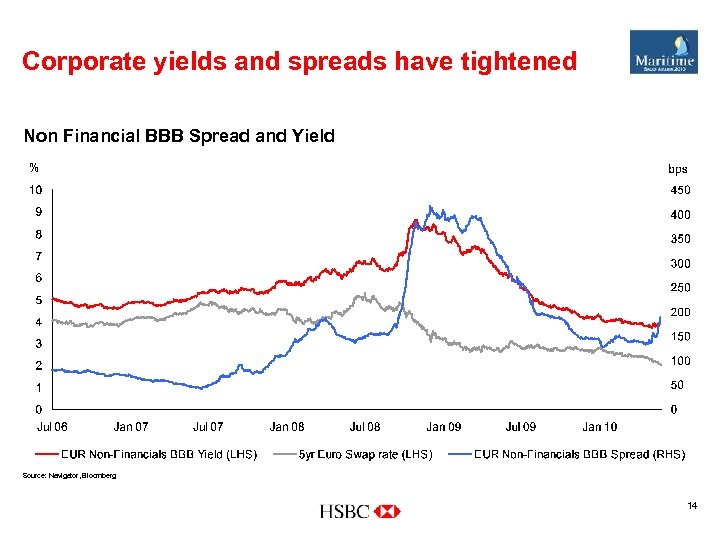

Corporate yields and spreads have tightened Non Financial BBB Spread and Yield Source: Navigator, Bloomberg 14

Corporate yields and spreads have tightened Non Financial BBB Spread and Yield Source: Navigator, Bloomberg 14

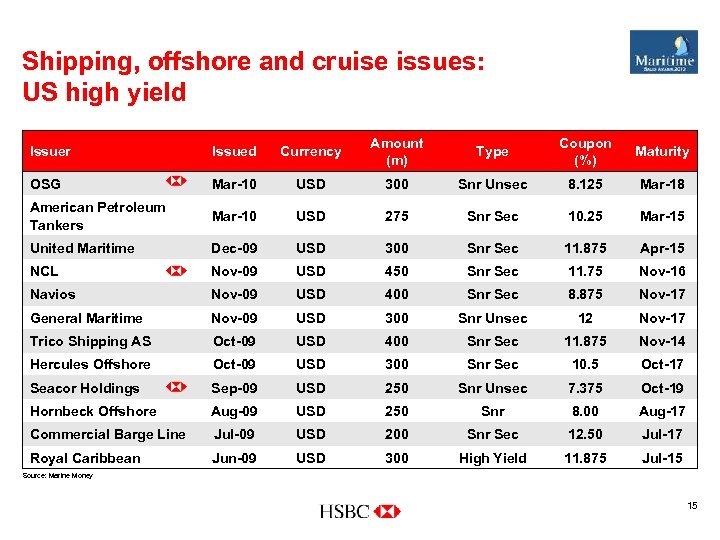

Shipping, offshore and cruise issues: US high yield Issuer Issued Currency Amount (m) Type Coupon (%) Maturity OSG Mar-10 USD 300 Snr Unsec 8. 125 Mar-18 American Petroleum Tankers Mar-10 USD 275 Snr Sec 10. 25 Mar-15 United Maritime Dec-09 USD 300 Snr Sec 11. 875 Apr-15 NCL Nov-09 USD 450 Snr Sec 11. 75 Nov-16 Navios Nov-09 USD 400 Snr Sec 8. 875 Nov-17 General Maritime Nov-09 USD 300 Snr Unsec 12 Nov-17 Trico Shipping AS Oct-09 USD 400 Snr Sec 11. 875 Nov-14 Hercules Offshore Oct-09 USD 300 Snr Sec 10. 5 Oct-17 Seacor Holdings Sep-09 USD 250 Snr Unsec 7. 375 Oct-19 Hornbeck Offshore Aug-09 USD 250 Snr 8. 00 Aug-17 Commercial Barge Line Jul-09 USD 200 Snr Sec 12. 50 Jul-17 Royal Caribbean Jun-09 USD 300 High Yield 11. 875 Jul-15 Source: Marine Money 15

Shipping, offshore and cruise issues: US high yield Issuer Issued Currency Amount (m) Type Coupon (%) Maturity OSG Mar-10 USD 300 Snr Unsec 8. 125 Mar-18 American Petroleum Tankers Mar-10 USD 275 Snr Sec 10. 25 Mar-15 United Maritime Dec-09 USD 300 Snr Sec 11. 875 Apr-15 NCL Nov-09 USD 450 Snr Sec 11. 75 Nov-16 Navios Nov-09 USD 400 Snr Sec 8. 875 Nov-17 General Maritime Nov-09 USD 300 Snr Unsec 12 Nov-17 Trico Shipping AS Oct-09 USD 400 Snr Sec 11. 875 Nov-14 Hercules Offshore Oct-09 USD 300 Snr Sec 10. 5 Oct-17 Seacor Holdings Sep-09 USD 250 Snr Unsec 7. 375 Oct-19 Hornbeck Offshore Aug-09 USD 250 Snr 8. 00 Aug-17 Commercial Barge Line Jul-09 USD 200 Snr Sec 12. 50 Jul-17 Royal Caribbean Jun-09 USD 300 High Yield 11. 875 Jul-15 Source: Marine Money 15

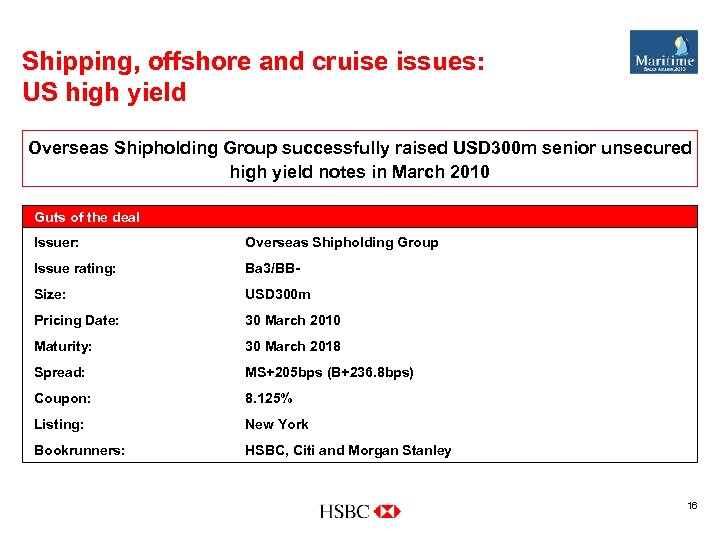

Shipping, offshore and cruise issues: US high yield Overseas Shipholding Group successfully raised USD 300 m senior unsecured high yield notes in March 2010 Guts of the deal Issuer: Overseas Shipholding Group Issue rating: Ba 3/BB- Size: USD 300 m Pricing Date: 30 March 2010 Maturity: 30 March 2018 Spread: MS+205 bps (B+236. 8 bps) Coupon: 8. 125% Listing: New York Bookrunners: HSBC, Citi and Morgan Stanley 16

Shipping, offshore and cruise issues: US high yield Overseas Shipholding Group successfully raised USD 300 m senior unsecured high yield notes in March 2010 Guts of the deal Issuer: Overseas Shipholding Group Issue rating: Ba 3/BB- Size: USD 300 m Pricing Date: 30 March 2010 Maturity: 30 March 2018 Spread: MS+205 bps (B+236. 8 bps) Coupon: 8. 125% Listing: New York Bookrunners: HSBC, Citi and Morgan Stanley 16

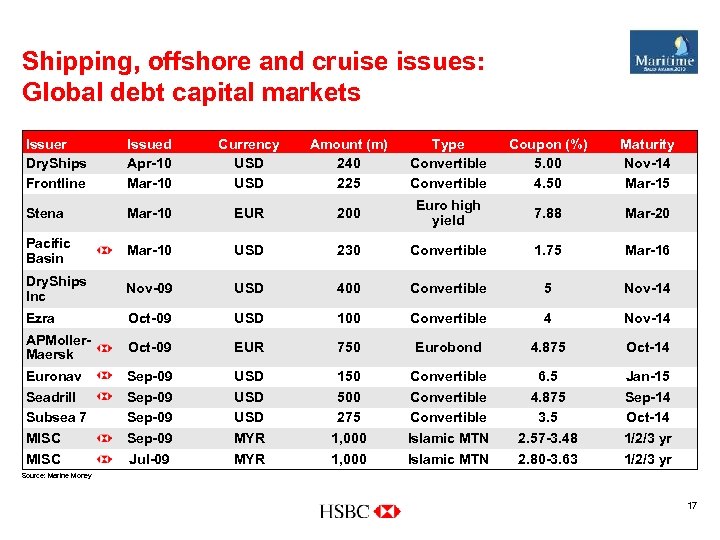

Shipping, offshore and cruise issues: Global debt capital markets Issuer Dry. Ships Frontline Issued Apr-10 Mar-10 Currency USD Amount (m) 240 225 Type Convertible Coupon (%) 5. 00 4. 50 Maturity Nov-14 Mar-15 Stena Mar-10 EUR 200 Euro high yield 7. 88 Mar-20 Pacific Basin Mar-10 USD 230 Convertible 1. 75 Mar-16 Dry. Ships Inc Nov-09 USD 400 Convertible 5 Nov-14 Ezra Oct-09 USD 100 Convertible 4 Nov-14 APMoller. Maersk Oct-09 EUR 750 Eurobond 4. 875 Oct-14 Euronav Seadrill Subsea 7 MISC Sep-09 Jul-09 USD USD MYR 150 500 275 1, 000 Convertible Islamic MTN 6. 5 4. 875 3. 5 2. 57 -3. 48 2. 80 -3. 63 Jan-15 Sep-14 Oct-14 1/2/3 yr Source: Marine Money 17

Shipping, offshore and cruise issues: Global debt capital markets Issuer Dry. Ships Frontline Issued Apr-10 Mar-10 Currency USD Amount (m) 240 225 Type Convertible Coupon (%) 5. 00 4. 50 Maturity Nov-14 Mar-15 Stena Mar-10 EUR 200 Euro high yield 7. 88 Mar-20 Pacific Basin Mar-10 USD 230 Convertible 1. 75 Mar-16 Dry. Ships Inc Nov-09 USD 400 Convertible 5 Nov-14 Ezra Oct-09 USD 100 Convertible 4 Nov-14 APMoller. Maersk Oct-09 EUR 750 Eurobond 4. 875 Oct-14 Euronav Seadrill Subsea 7 MISC Sep-09 Jul-09 USD USD MYR 150 500 275 1, 000 Convertible Islamic MTN 6. 5 4. 875 3. 5 2. 57 -3. 48 2. 80 -3. 63 Jan-15 Sep-14 Oct-14 1/2/3 yr Source: Marine Money 17

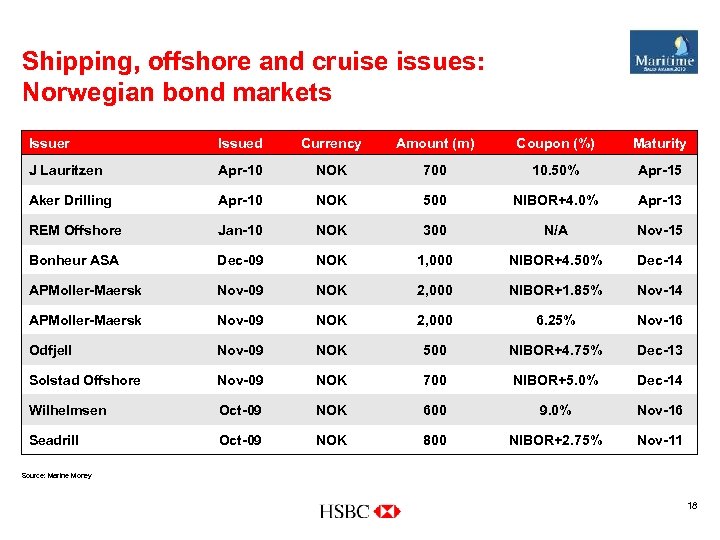

Shipping, offshore and cruise issues: Norwegian bond markets Issuer Issued Currency Amount (m) Coupon (%) Maturity J Lauritzen Apr-10 NOK 700 10. 50% Apr-15 Aker Drilling Apr-10 NOK 500 NIBOR+4. 0% Apr-13 REM Offshore Jan-10 NOK 300 N/A Nov-15 Bonheur ASA Dec-09 NOK 1, 000 NIBOR+4. 50% Dec-14 APMoller-Maersk Nov-09 NOK 2, 000 NIBOR+1. 85% Nov-14 APMoller-Maersk Nov-09 NOK 2, 000 6. 25% Nov-16 Odfjell Nov-09 NOK 500 NIBOR+4. 75% Dec-13 Solstad Offshore Nov-09 NOK 700 NIBOR+5. 0% Dec-14 Wilhelmsen Oct-09 NOK 600 9. 0% Nov-16 Seadrill Oct-09 NOK 800 NIBOR+2. 75% Nov-11 Source: Marine Money 18

Shipping, offshore and cruise issues: Norwegian bond markets Issuer Issued Currency Amount (m) Coupon (%) Maturity J Lauritzen Apr-10 NOK 700 10. 50% Apr-15 Aker Drilling Apr-10 NOK 500 NIBOR+4. 0% Apr-13 REM Offshore Jan-10 NOK 300 N/A Nov-15 Bonheur ASA Dec-09 NOK 1, 000 NIBOR+4. 50% Dec-14 APMoller-Maersk Nov-09 NOK 2, 000 NIBOR+1. 85% Nov-14 APMoller-Maersk Nov-09 NOK 2, 000 6. 25% Nov-16 Odfjell Nov-09 NOK 500 NIBOR+4. 75% Dec-13 Solstad Offshore Nov-09 NOK 700 NIBOR+5. 0% Dec-14 Wilhelmsen Oct-09 NOK 600 9. 0% Nov-16 Seadrill Oct-09 NOK 800 NIBOR+2. 75% Nov-11 Source: Marine Money 18

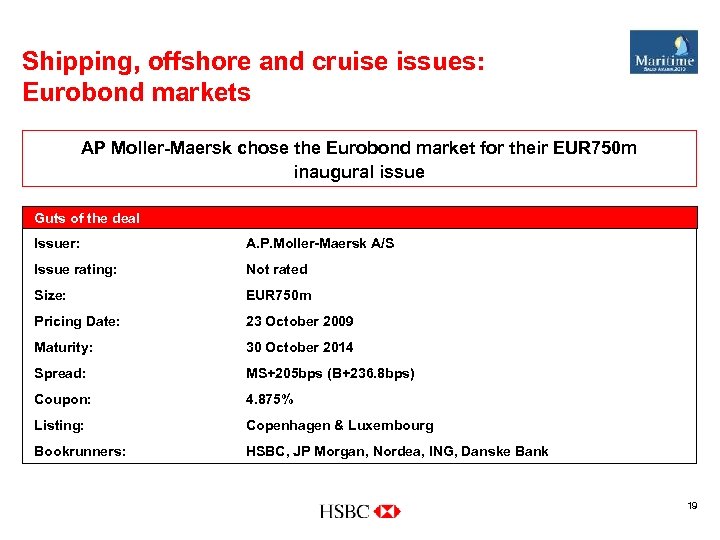

Shipping, offshore and cruise issues: Eurobond markets AP Moller-Maersk chose the Eurobond market for their EUR 750 m inaugural issue Guts of the deal Issuer: A. P. Moller-Maersk A/S Issue rating: Not rated Size: EUR 750 m Pricing Date: 23 October 2009 Maturity: 30 October 2014 Spread: MS+205 bps (B+236. 8 bps) Coupon: 4. 875% Listing: Copenhagen & Luxembourg Bookrunners: HSBC, JP Morgan, Nordea, ING, Danske Bank 19

Shipping, offshore and cruise issues: Eurobond markets AP Moller-Maersk chose the Eurobond market for their EUR 750 m inaugural issue Guts of the deal Issuer: A. P. Moller-Maersk A/S Issue rating: Not rated Size: EUR 750 m Pricing Date: 23 October 2009 Maturity: 30 October 2014 Spread: MS+205 bps (B+236. 8 bps) Coupon: 4. 875% Listing: Copenhagen & Luxembourg Bookrunners: HSBC, JP Morgan, Nordea, ING, Danske Bank 19

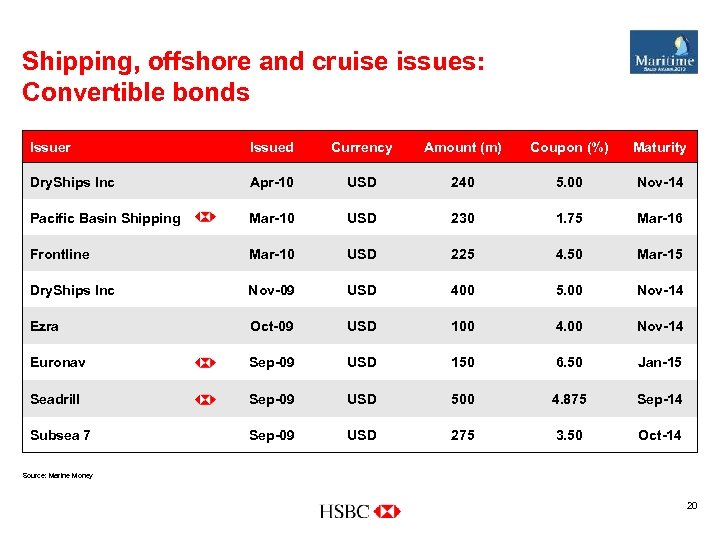

Shipping, offshore and cruise issues: Convertible bonds Issuer Issued Currency Amount (m) Coupon (%) Maturity Dry. Ships Inc Apr-10 USD 240 5. 00 Nov-14 Pacific Basin Shipping Mar-10 USD 230 1. 75 Mar-16 Frontline Mar-10 USD 225 4. 50 Mar-15 Dry. Ships Inc Nov-09 USD 400 5. 00 Nov-14 Ezra Oct-09 USD 100 4. 00 Nov-14 Euronav Sep-09 USD 150 6. 50 Jan-15 Seadrill Sep-09 USD 500 4. 875 Sep-14 Subsea 7 Sep-09 USD 275 3. 50 Oct-14 Source: Marine Money 20

Shipping, offshore and cruise issues: Convertible bonds Issuer Issued Currency Amount (m) Coupon (%) Maturity Dry. Ships Inc Apr-10 USD 240 5. 00 Nov-14 Pacific Basin Shipping Mar-10 USD 230 1. 75 Mar-16 Frontline Mar-10 USD 225 4. 50 Mar-15 Dry. Ships Inc Nov-09 USD 400 5. 00 Nov-14 Ezra Oct-09 USD 100 4. 00 Nov-14 Euronav Sep-09 USD 150 6. 50 Jan-15 Seadrill Sep-09 USD 500 4. 875 Sep-14 Subsea 7 Sep-09 USD 275 3. 50 Oct-14 Source: Marine Money 20

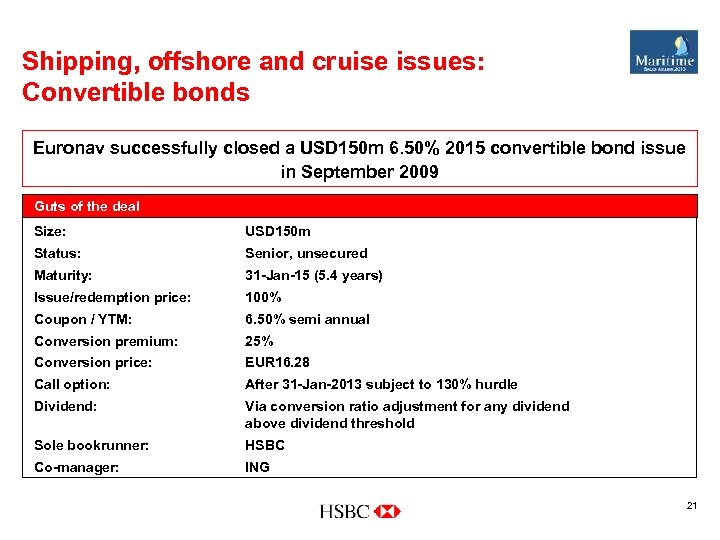

Shipping, offshore and cruise issues: Convertible bonds Euronav successfully closed a USD 150 m 6. 50% 2015 convertible bond issue in September 2009 Guts of the deal Size: USD 150 m Status: Senior, unsecured Maturity: 31 -Jan-15 (5. 4 years) Issue/redemption price: 100% Coupon / YTM: 6. 50% semi annual Conversion premium: 25% Conversion price: EUR 16. 28 Call option: After 31 -Jan-2013 subject to 130% hurdle Dividend: Via conversion ratio adjustment for any dividend above dividend threshold Sole bookrunner: HSBC Co-manager: ING 21

Shipping, offshore and cruise issues: Convertible bonds Euronav successfully closed a USD 150 m 6. 50% 2015 convertible bond issue in September 2009 Guts of the deal Size: USD 150 m Status: Senior, unsecured Maturity: 31 -Jan-15 (5. 4 years) Issue/redemption price: 100% Coupon / YTM: 6. 50% semi annual Conversion premium: 25% Conversion price: EUR 16. 28 Call option: After 31 -Jan-2013 subject to 130% hurdle Dividend: Via conversion ratio adjustment for any dividend above dividend threshold Sole bookrunner: HSBC Co-manager: ING 21

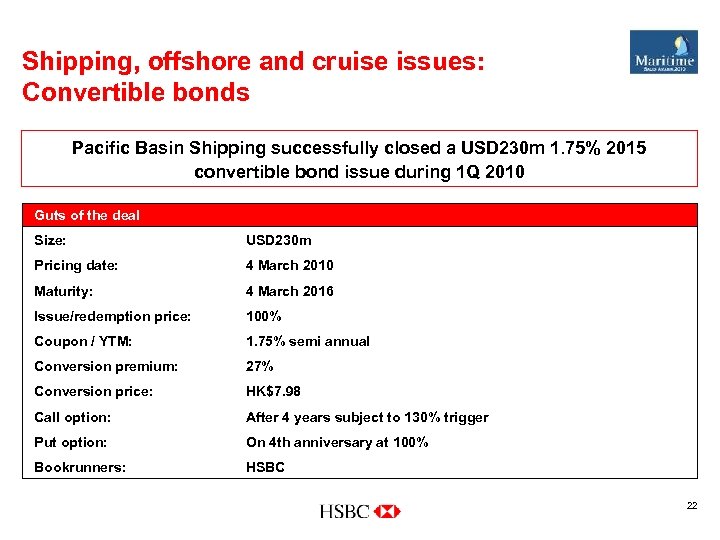

Shipping, offshore and cruise issues: Convertible bonds Pacific Basin Shipping successfully closed a USD 230 m 1. 75% 2015 convertible bond issue during 1 Q 2010 Guts of the deal Size: USD 230 m Pricing date: 4 March 2010 Maturity: 4 March 2016 Issue/redemption price: 100% Coupon / YTM: 1. 75% semi annual Conversion premium: 27% Conversion price: HK$7. 98 Call option: After 4 years subject to 130% trigger Put option: On 4 th anniversary at 100% Bookrunners: HSBC 22

Shipping, offshore and cruise issues: Convertible bonds Pacific Basin Shipping successfully closed a USD 230 m 1. 75% 2015 convertible bond issue during 1 Q 2010 Guts of the deal Size: USD 230 m Pricing date: 4 March 2010 Maturity: 4 March 2016 Issue/redemption price: 100% Coupon / YTM: 1. 75% semi annual Conversion premium: 27% Conversion price: HK$7. 98 Call option: After 4 years subject to 130% trigger Put option: On 4 th anniversary at 100% Bookrunners: HSBC 22

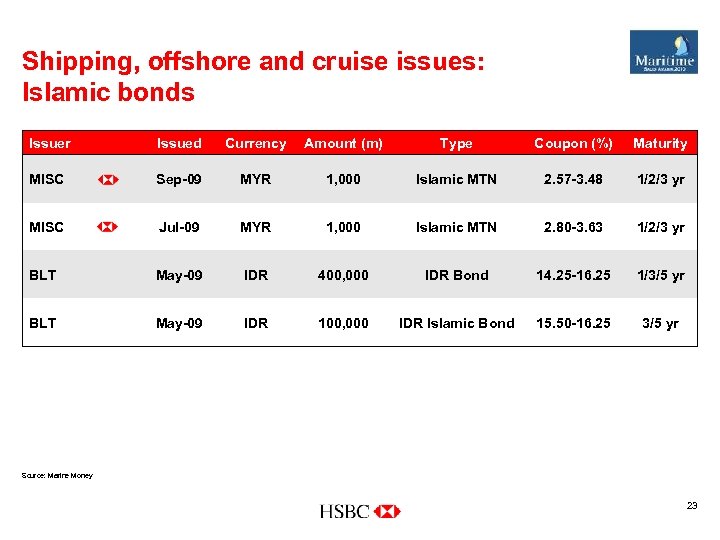

Shipping, offshore and cruise issues: Islamic bonds Issuer Issued Currency Amount (m) Type Coupon (%) Maturity MISC Sep-09 MYR 1, 000 Islamic MTN 2. 57 -3. 48 1/2/3 yr MISC Jul-09 MYR 1, 000 Islamic MTN 2. 80 -3. 63 1/2/3 yr BLT May-09 IDR 400, 000 IDR Bond 14. 25 -16. 25 1/3/5 yr BLT May-09 IDR 100, 000 IDR Islamic Bond 15. 50 -16. 25 3/5 yr Source: Marine Money 23

Shipping, offshore and cruise issues: Islamic bonds Issuer Issued Currency Amount (m) Type Coupon (%) Maturity MISC Sep-09 MYR 1, 000 Islamic MTN 2. 57 -3. 48 1/2/3 yr MISC Jul-09 MYR 1, 000 Islamic MTN 2. 80 -3. 63 1/2/3 yr BLT May-09 IDR 400, 000 IDR Bond 14. 25 -16. 25 1/3/5 yr BLT May-09 IDR 100, 000 IDR Islamic Bond 15. 50 -16. 25 3/5 yr Source: Marine Money 23

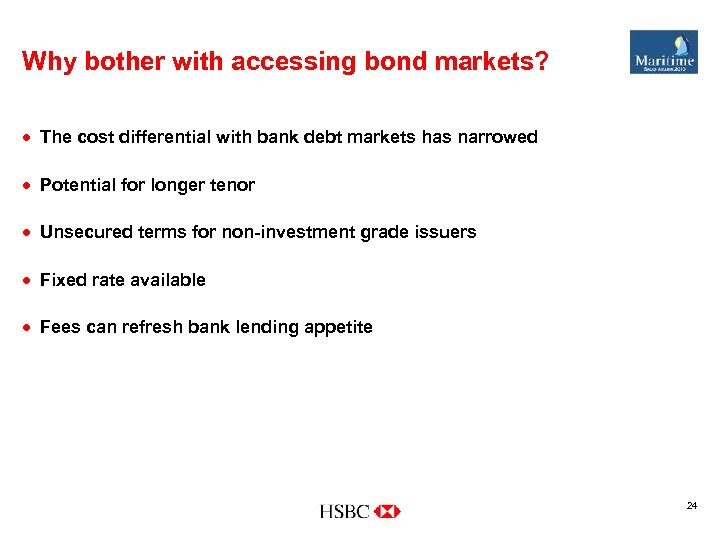

Why bother with accessing bond markets? · The cost differential with bank debt markets has narrowed · Potential for longer tenor · Unsecured terms for non-investment grade issuers · Fixed rate available · Fees can refresh bank lending appetite 24

Why bother with accessing bond markets? · The cost differential with bank debt markets has narrowed · Potential for longer tenor · Unsecured terms for non-investment grade issuers · Fixed rate available · Fees can refresh bank lending appetite 24

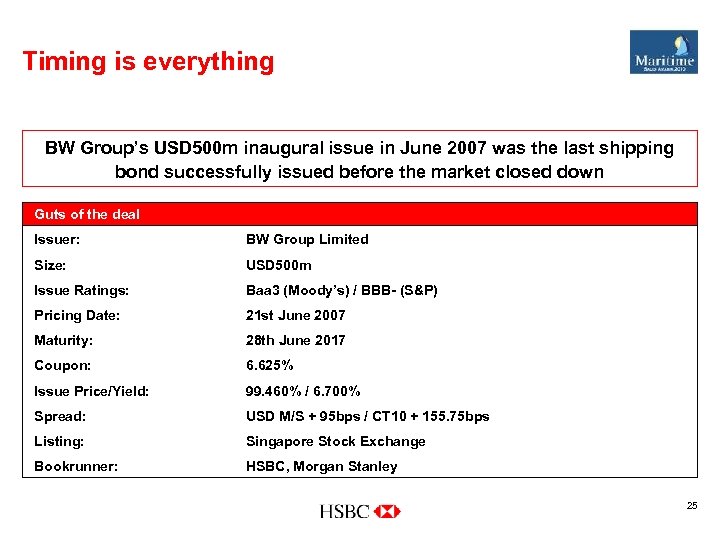

Timing is everything BW Group’s USD 500 m inaugural issue in June 2007 was the last shipping bond successfully issued before the market closed down Guts of the deal Issuer: BW Group Limited Size: USD 500 m Issue Ratings: Baa 3 (Moody’s) / BBB- (S&P) Pricing Date: 21 st June 2007 Maturity: 28 th June 2017 Coupon: 6. 625% Issue Price/Yield: 99. 460% / 6. 700% Spread: USD M/S + 95 bps / CT 10 + 155. 75 bps Listing: Singapore Stock Exchange Bookrunner: HSBC, Morgan Stanley 25

Timing is everything BW Group’s USD 500 m inaugural issue in June 2007 was the last shipping bond successfully issued before the market closed down Guts of the deal Issuer: BW Group Limited Size: USD 500 m Issue Ratings: Baa 3 (Moody’s) / BBB- (S&P) Pricing Date: 21 st June 2007 Maturity: 28 th June 2017 Coupon: 6. 625% Issue Price/Yield: 99. 460% / 6. 700% Spread: USD M/S + 95 bps / CT 10 + 155. 75 bps Listing: Singapore Stock Exchange Bookrunner: HSBC, Morgan Stanley 25

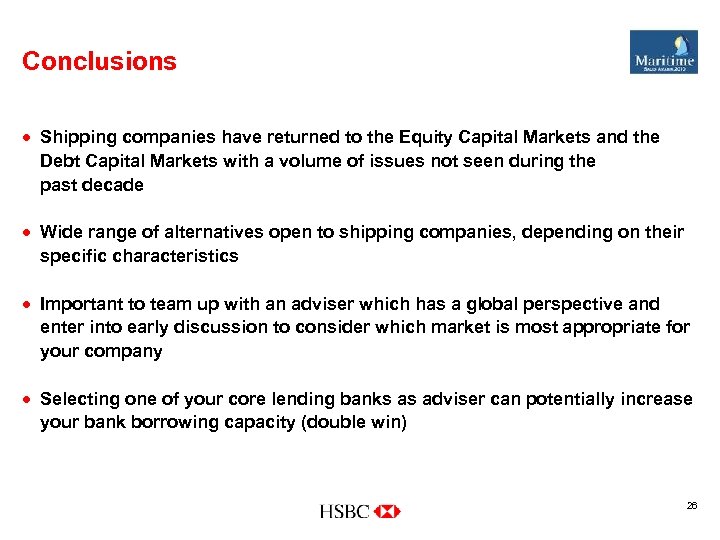

Conclusions · Shipping companies have returned to the Equity Capital Markets and the Debt Capital Markets with a volume of issues not seen during the past decade · Wide range of alternatives open to shipping companies, depending on their specific characteristics · Important to team up with an adviser which has a global perspective and enter into early discussion to consider which market is most appropriate for your company · Selecting one of your core lending banks as adviser can potentially increase your bank borrowing capacity (double win) 26

Conclusions · Shipping companies have returned to the Equity Capital Markets and the Debt Capital Markets with a volume of issues not seen during the past decade · Wide range of alternatives open to shipping companies, depending on their specific characteristics · Important to team up with an adviser which has a global perspective and enter into early discussion to consider which market is most appropriate for your company · Selecting one of your core lending banks as adviser can potentially increase your bank borrowing capacity (double win) 26

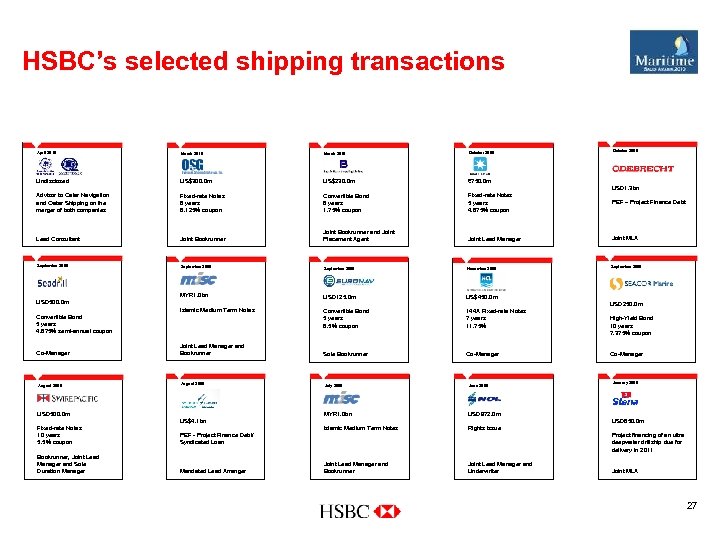

HSBC’s selected shipping transactions October 2009 April 2010 March 2010 October 2009 Undisclosed US$300. 0 m US$230. 0 m € 750. 0 m Advisor to Qatar Navigation and Qatar Shipping on the merger of both companies Fixed-rate Notes 8 years 8. 125% coupon Convertible Bond 6 years 1. 75% coupon Fixed-rate Notes 5 years 4. 875% coupon PEF – Project Finance Debt Lead Consultant Joint Bookrunner and Joint Placement Agent Joint Lead Manager Joint MLA September 2009 November 2009 MYR 1. 0 bn USD 125. 0 m US$450. 0 m Islamic Medium Term Notes Convertible Bond 5 years 6. 5% coupon 144 A Fixed-rate Notes 7 years 11. 75% Sole Bookrunner Co-Manager USD 1. 3 bn USD 500. 0 m Convertible Bond 5 years 4. 875% semi-annual coupon Co-Manager August 2009 Joint Lead Manager and Bookrunner August 2009 September 2009 USD 250. 0 m July 2009 June 2009 MYR 1. 0 bn Co-Manager January 2009 USD 972. 0 m Islamic Medium Term Notes High-Yield Bond 10 years 7. 375% coupon Rights Issue USD 500. 0 m US$4. 1 bn Fixed-rate Notes 10 years 5. 5% coupon PEF - Project Finance Debt/ Syndicated Loan Bookrunner, Joint Lead Manager and Sole Duration Manager Mandated Lead Arranger USD 850. 0 m Project financing of an ultra deepwater drillship due for delivery in 2011 Joint Lead Manager and Bookrunner Joint Lead Manager and Underwriter Joint MLA 27

HSBC’s selected shipping transactions October 2009 April 2010 March 2010 October 2009 Undisclosed US$300. 0 m US$230. 0 m € 750. 0 m Advisor to Qatar Navigation and Qatar Shipping on the merger of both companies Fixed-rate Notes 8 years 8. 125% coupon Convertible Bond 6 years 1. 75% coupon Fixed-rate Notes 5 years 4. 875% coupon PEF – Project Finance Debt Lead Consultant Joint Bookrunner and Joint Placement Agent Joint Lead Manager Joint MLA September 2009 November 2009 MYR 1. 0 bn USD 125. 0 m US$450. 0 m Islamic Medium Term Notes Convertible Bond 5 years 6. 5% coupon 144 A Fixed-rate Notes 7 years 11. 75% Sole Bookrunner Co-Manager USD 1. 3 bn USD 500. 0 m Convertible Bond 5 years 4. 875% semi-annual coupon Co-Manager August 2009 Joint Lead Manager and Bookrunner August 2009 September 2009 USD 250. 0 m July 2009 June 2009 MYR 1. 0 bn Co-Manager January 2009 USD 972. 0 m Islamic Medium Term Notes High-Yield Bond 10 years 7. 375% coupon Rights Issue USD 500. 0 m US$4. 1 bn Fixed-rate Notes 10 years 5. 5% coupon PEF - Project Finance Debt/ Syndicated Loan Bookrunner, Joint Lead Manager and Sole Duration Manager Mandated Lead Arranger USD 850. 0 m Project financing of an ultra deepwater drillship due for delivery in 2011 Joint Lead Manager and Bookrunner Joint Lead Manager and Underwriter Joint MLA 27

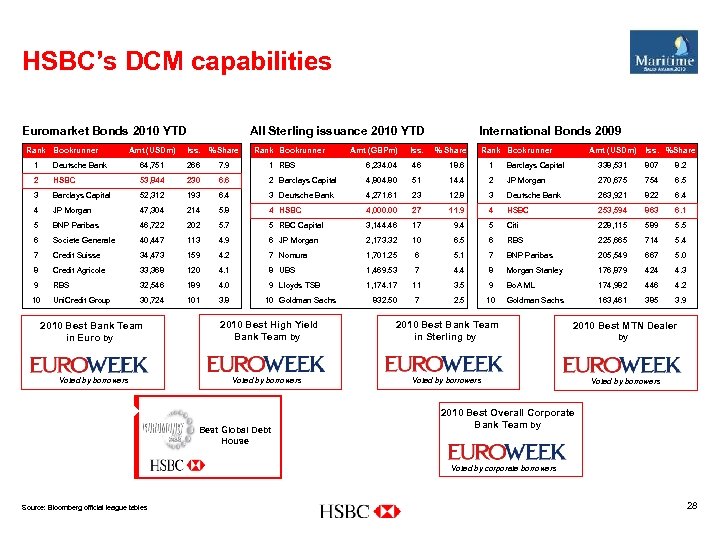

HSBC’s DCM capabilities Euromarket Bonds 2010 YTD Rank Bookrunner All Sterling issuance 2010 YTD Amt (USDm) Iss. %Share Amt (GBPm) Iss. % Share 1 Deutsche Bank 64, 751 266 7. 9 1 RBS 6, 234. 04 46 18. 6 1 Barclays Capital 338, 531 807 8. 2 2 HSBC 53, 844 230 6. 6 2 Barclays Capital 4, 804. 80 51 14. 4 2 JP Morgan 270, 675 754 6. 5 3 Barclays Capital 52, 312 193 6. 4 3 Deutsche Bank 4, 271. 61 23 12. 8 3 Deutsche Bank 263, 921 822 6. 4 4 JP Morgan 47, 304 214 5. 8 4 HSBC 4, 000. 00 27 11. 9 4 HSBC 253, 594 863 6. 1 5 BNP Paribas 46, 722 202 5. 7 5 RBC Capital 3, 144. 46 17 9. 4 5 Citi 228, 115 589 5. 5 6 Societe Generale 40, 447 113 4. 9 6 JP Morgan 2, 173. 32 10 6. 5 6 RBS 225, 665 714 5. 4 7 Credit Suisse 34, 473 159 4. 2 7 Nomura 1, 701. 25 6 5. 1 7 BNP Paribas 205, 549 667 5. 0 8 Credit Agricole 33, 368 120 4. 1 8 UBS 1, 469. 53 7 4. 4 8 Morgan Stanley 176, 879 424 4. 3 9 RBS 32, 546 189 4. 0 9 Lloyds TSB 1, 174. 17 11 3. 5 9 Bo. A ML 174, 982 446 4. 2 10 Uni. Credit Group 30, 724 101 3. 8 832. 50 7 2. 5 10 Goldman Sachs 163, 461 385 3. 9 2010 Best Bank Team in Euro by Voted by borrowers Rank Bookrunner International Bonds 2009 10 Goldman Sachs 2010 Best High Yield Bank Team by Voted by borrowers Best Global Debt House Rank Bookrunner Amt (USDm) Iss. %Share 2010 Best Bank Team in Sterling by 2010 Best MTN Dealer Voted by borrowers by 2010 Best Overall Corporate Bank Team by Voted by corporate borrowers Source: Bloomberg official league tables 28

HSBC’s DCM capabilities Euromarket Bonds 2010 YTD Rank Bookrunner All Sterling issuance 2010 YTD Amt (USDm) Iss. %Share Amt (GBPm) Iss. % Share 1 Deutsche Bank 64, 751 266 7. 9 1 RBS 6, 234. 04 46 18. 6 1 Barclays Capital 338, 531 807 8. 2 2 HSBC 53, 844 230 6. 6 2 Barclays Capital 4, 804. 80 51 14. 4 2 JP Morgan 270, 675 754 6. 5 3 Barclays Capital 52, 312 193 6. 4 3 Deutsche Bank 4, 271. 61 23 12. 8 3 Deutsche Bank 263, 921 822 6. 4 4 JP Morgan 47, 304 214 5. 8 4 HSBC 4, 000. 00 27 11. 9 4 HSBC 253, 594 863 6. 1 5 BNP Paribas 46, 722 202 5. 7 5 RBC Capital 3, 144. 46 17 9. 4 5 Citi 228, 115 589 5. 5 6 Societe Generale 40, 447 113 4. 9 6 JP Morgan 2, 173. 32 10 6. 5 6 RBS 225, 665 714 5. 4 7 Credit Suisse 34, 473 159 4. 2 7 Nomura 1, 701. 25 6 5. 1 7 BNP Paribas 205, 549 667 5. 0 8 Credit Agricole 33, 368 120 4. 1 8 UBS 1, 469. 53 7 4. 4 8 Morgan Stanley 176, 879 424 4. 3 9 RBS 32, 546 189 4. 0 9 Lloyds TSB 1, 174. 17 11 3. 5 9 Bo. A ML 174, 982 446 4. 2 10 Uni. Credit Group 30, 724 101 3. 8 832. 50 7 2. 5 10 Goldman Sachs 163, 461 385 3. 9 2010 Best Bank Team in Euro by Voted by borrowers Rank Bookrunner International Bonds 2009 10 Goldman Sachs 2010 Best High Yield Bank Team by Voted by borrowers Best Global Debt House Rank Bookrunner Amt (USDm) Iss. %Share 2010 Best Bank Team in Sterling by 2010 Best MTN Dealer Voted by borrowers by 2010 Best Overall Corporate Bank Team by Voted by corporate borrowers Source: Bloomberg official league tables 28

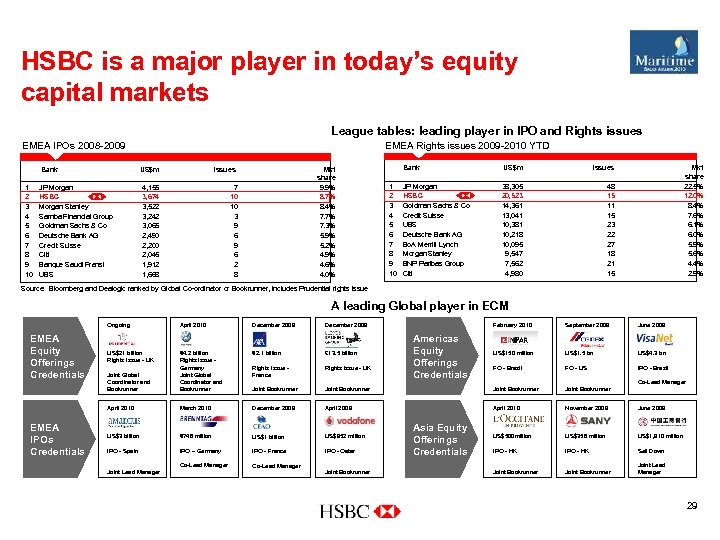

HSBC is a major player in today’s equity capital markets League tables: leading player in IPO and Rights issues EMEA IPOs 2008 -2009 Bank 1 2 3 4 5 6 7 8 9 10 EMEA Rights issues 2009 -2010 YTD US$m Issues 4, 155 3, 674 3, 522 3, 242 3, 065 2, 490 2, 200 2, 045 1, 912 1, 668 7 10 10 3 9 6 2 8 JP Morgan HSBC Morgan Stanley Samba Financial Group Goldman Sachs & Co Deutsche Bank AG Credit Suisse Citi Banque Saudi Fransi UBS Mkt share 9. 9% 8. 7% 8. 4% 7. 7% 7. 3% 5. 9% 5. 2% 4. 9% 4. 6% 4. 0% Bank 1 2 3 4 5 6 7 8 9 10 US$m JP Morgan HSBC Goldman Sachs & Co Credit Suisse UBS Deutsche Bank AG Bo. A Merrill Lynch Morgan Stanley BNP Paribas Group Citi Issues 48 15 11 15 23 22 27 18 21 15 38, 305 20, 523 14, 361 13, 041 10, 381 10, 218 10, 095 9, 547 7, 562 4, 980 Mkt share 22. 5% 12. 0% 8. 4% 7. 6% 6. 1% 6. 0% 5. 9% 5. 6% 4. 4% 2. 9% Source: Bloomberg and Dealogic ranked by Global Co-ordinator or Bookrunner, includes Prudential rights issue A leading Global player in ECM Ongoing EMEA IPOs Credentials December 2009 US$21 billion Rights Issue - UK € 2. 1 billion £ 13. 5 billion Rights Issue France Rights Issue - UK Joint Global Coordinator and Bookrunner € 4. 2 billion Rights Issue Germany Joint Global Coordinator and Bookrunner Joint Bookrunner April 2010 EMEA Equity Offerings Credentials April 2010 March 2010 US$3 billion IPO - Spain September 2009 June 2009 US$150 million US$1. 5 bn US$4. 3 bn FO - Brazil FO - US IPO - Brazil Joint Bookrunner December 2009 April 2010 November 2009 June 2009 € 748 million US$1 billion US$952 million US$500 million US$356 million US$1, 910 million IPO – Germany IPO - France IPO - Qatar IPO - HK Sell Down Co-Lead Manager Joint Lead Manager February 2010 Co-Lead Manager Joint Bookrunner Joint Lead Manager Joint Bookrunner Americas Equity Offerings Credentials Asia Equity Offerings Credentials Co-Lead Manager 29

HSBC is a major player in today’s equity capital markets League tables: leading player in IPO and Rights issues EMEA IPOs 2008 -2009 Bank 1 2 3 4 5 6 7 8 9 10 EMEA Rights issues 2009 -2010 YTD US$m Issues 4, 155 3, 674 3, 522 3, 242 3, 065 2, 490 2, 200 2, 045 1, 912 1, 668 7 10 10 3 9 6 2 8 JP Morgan HSBC Morgan Stanley Samba Financial Group Goldman Sachs & Co Deutsche Bank AG Credit Suisse Citi Banque Saudi Fransi UBS Mkt share 9. 9% 8. 7% 8. 4% 7. 7% 7. 3% 5. 9% 5. 2% 4. 9% 4. 6% 4. 0% Bank 1 2 3 4 5 6 7 8 9 10 US$m JP Morgan HSBC Goldman Sachs & Co Credit Suisse UBS Deutsche Bank AG Bo. A Merrill Lynch Morgan Stanley BNP Paribas Group Citi Issues 48 15 11 15 23 22 27 18 21 15 38, 305 20, 523 14, 361 13, 041 10, 381 10, 218 10, 095 9, 547 7, 562 4, 980 Mkt share 22. 5% 12. 0% 8. 4% 7. 6% 6. 1% 6. 0% 5. 9% 5. 6% 4. 4% 2. 9% Source: Bloomberg and Dealogic ranked by Global Co-ordinator or Bookrunner, includes Prudential rights issue A leading Global player in ECM Ongoing EMEA IPOs Credentials December 2009 US$21 billion Rights Issue - UK € 2. 1 billion £ 13. 5 billion Rights Issue France Rights Issue - UK Joint Global Coordinator and Bookrunner € 4. 2 billion Rights Issue Germany Joint Global Coordinator and Bookrunner Joint Bookrunner April 2010 EMEA Equity Offerings Credentials April 2010 March 2010 US$3 billion IPO - Spain September 2009 June 2009 US$150 million US$1. 5 bn US$4. 3 bn FO - Brazil FO - US IPO - Brazil Joint Bookrunner December 2009 April 2010 November 2009 June 2009 € 748 million US$1 billion US$952 million US$500 million US$356 million US$1, 910 million IPO – Germany IPO - France IPO - Qatar IPO - HK Sell Down Co-Lead Manager Joint Lead Manager February 2010 Co-Lead Manager Joint Bookrunner Joint Lead Manager Joint Bookrunner Americas Equity Offerings Credentials Asia Equity Offerings Credentials Co-Lead Manager 29