91bc582f67d5eebf6415741dbd60e2b8.ppt

- Количество слайдов: 18

Where Detection is Cutting Edge

Where Detection is Cutting Edge

“Over the next decade, $250 B in healthcare spending will shift from disease treatment to diagnosis” – Jeff Immelt, CEO GE

“Over the next decade, $250 B in healthcare spending will shift from disease treatment to diagnosis” – Jeff Immelt, CEO GE

Why Better Diagnostics Are Needed Imagine……………. . the blood bank used for your blood transfusion could better screen for newly infected HIV patients – 50, 000 new infections/ yr in US alone – 14 to 30 day period post infection before detectable . . your blood test could detect a cancer at a lower level (and earlier) than can be detected today • Better mainstream detection systems are needed to make this a reality • Sword is introducing a simple, sensitive detection system – Enhances tests in the research market today – Will enhance clinical diagnostics in near future 3

Why Better Diagnostics Are Needed Imagine……………. . the blood bank used for your blood transfusion could better screen for newly infected HIV patients – 50, 000 new infections/ yr in US alone – 14 to 30 day period post infection before detectable . . your blood test could detect a cancer at a lower level (and earlier) than can be detected today • Better mainstream detection systems are needed to make this a reality • Sword is introducing a simple, sensitive detection system – Enhances tests in the research market today – Will enhance clinical diagnostics in near future 3

Sword’s Next Generation Detection System All Diagnostic Tests Require a Detection System Sword is First Revolution in Mainstream Detection in 15 Years • Sword detection chemistry – Core patent issued October 2009 – Runs on large installed base of instruments – Joint product launch preparation underway with large instrumentation company • Provides key benefits… – Improved sensitivity for better detection of disease markers – Improved precision & accuracy for reducing misdiagnoses …without compromise in speed, performance or cost – Fast results – Comparable price to mainstream – Easily integrated into diagnostic instruments and tests 4

Sword’s Next Generation Detection System All Diagnostic Tests Require a Detection System Sword is First Revolution in Mainstream Detection in 15 Years • Sword detection chemistry – Core patent issued October 2009 – Runs on large installed base of instruments – Joint product launch preparation underway with large instrumentation company • Provides key benefits… – Improved sensitivity for better detection of disease markers – Improved precision & accuracy for reducing misdiagnoses …without compromise in speed, performance or cost – Fast results – Comparable price to mainstream – Easily integrated into diagnostic instruments and tests 4

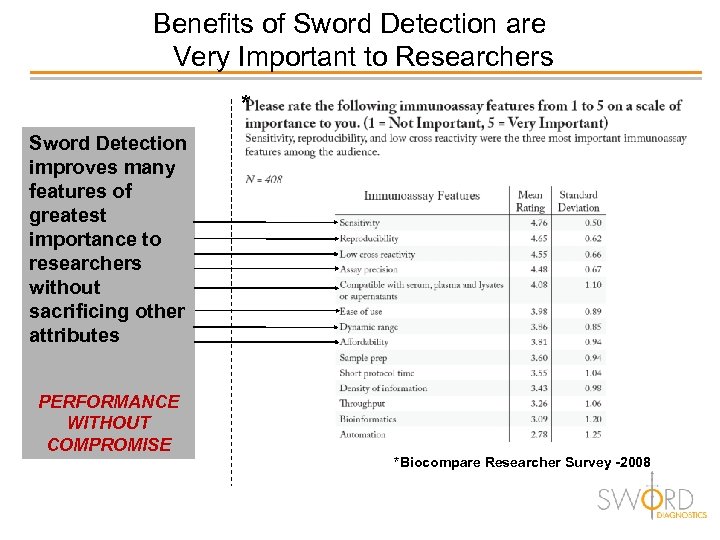

Benefits of Sword Detection are Very Important to Researchers * Sword Detection improves many features of greatest importance to researchers without sacrificing other attributes PERFORMANCE WITHOUT COMPROMISE *Biocompare Researcher Survey -2008

Benefits of Sword Detection are Very Important to Researchers * Sword Detection improves many features of greatest importance to researchers without sacrificing other attributes PERFORMANCE WITHOUT COMPROMISE *Biocompare Researcher Survey -2008

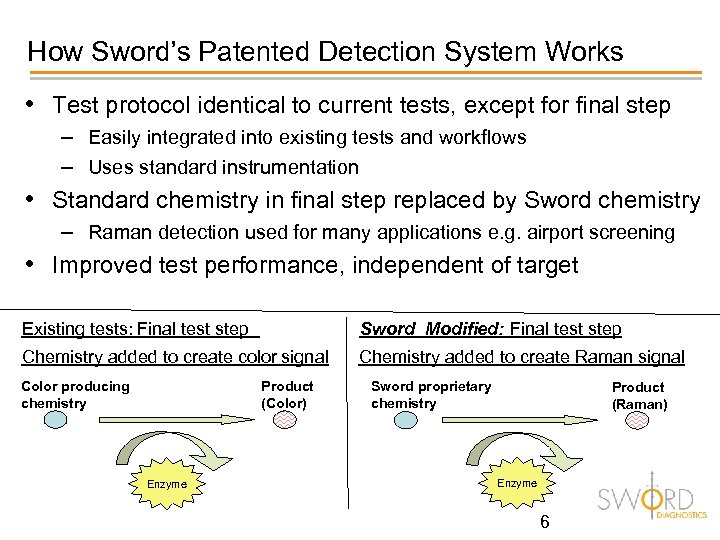

How Sword’s Patented Detection System Works • Test protocol identical to current tests, except for final step – Easily integrated into existing tests and workflows – Uses standard instrumentation • Standard chemistry in final step replaced by Sword chemistry – Raman detection used for many applications e. g. airport screening • Improved test performance, independent of target Existing tests: Final test step Sword Modified: Final test step Chemistry added to create color signal Chemistry added to create Raman signal Color producing chemistry Product (Color) Enzyme Sword proprietary chemistry Product (Raman) Enzyme 6

How Sword’s Patented Detection System Works • Test protocol identical to current tests, except for final step – Easily integrated into existing tests and workflows – Uses standard instrumentation • Standard chemistry in final step replaced by Sword chemistry – Raman detection used for many applications e. g. airport screening • Improved test performance, independent of target Existing tests: Final test step Sword Modified: Final test step Chemistry added to create color signal Chemistry added to create Raman signal Color producing chemistry Product (Color) Enzyme Sword proprietary chemistry Product (Raman) Enzyme 6

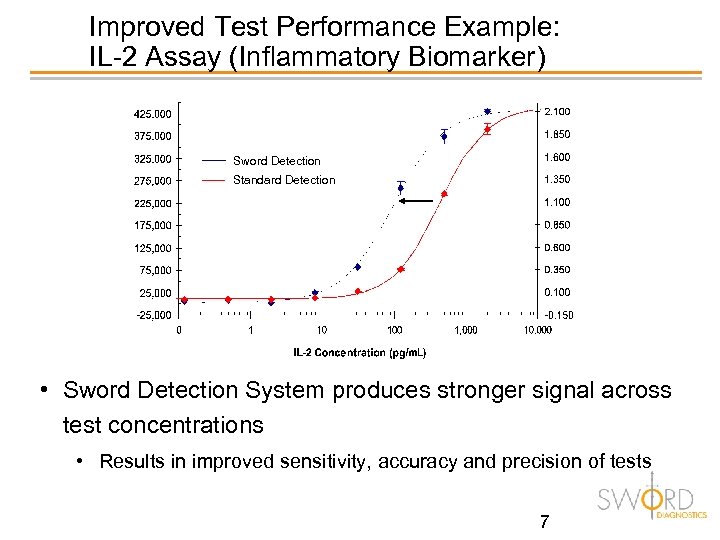

Improved Test Performance Example: IL-2 Assay (Inflammatory Biomarker) Sword Detection Standard Detection • Sword Detection System produces stronger signal across test concentrations • Results in improved sensitivity, accuracy and precision of tests 7

Improved Test Performance Example: IL-2 Assay (Inflammatory Biomarker) Sword Detection Standard Detection • Sword Detection System produces stronger signal across test concentrations • Results in improved sensitivity, accuracy and precision of tests 7

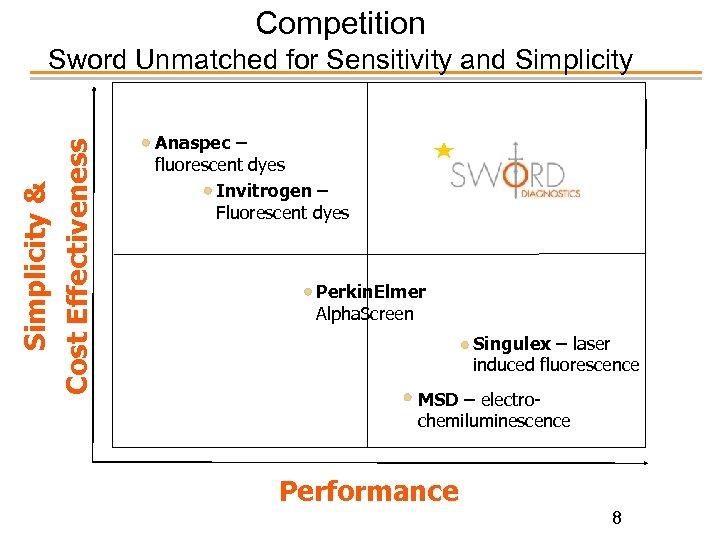

Competition Cost Effectiveness Simplicity & Sword Unmatched for Sensitivity and Simplicity Anaspec – fluorescent dyes Invitrogen – Fluorescent dyes Perkin. Elmer Alpha. Screen Singulex – laser induced fluorescence MSD – electrochemiluminescence Performance 8

Competition Cost Effectiveness Simplicity & Sword Unmatched for Sensitivity and Simplicity Anaspec – fluorescent dyes Invitrogen – Fluorescent dyes Perkin. Elmer Alpha. Screen Singulex – laser induced fluorescence MSD – electrochemiluminescence Performance 8

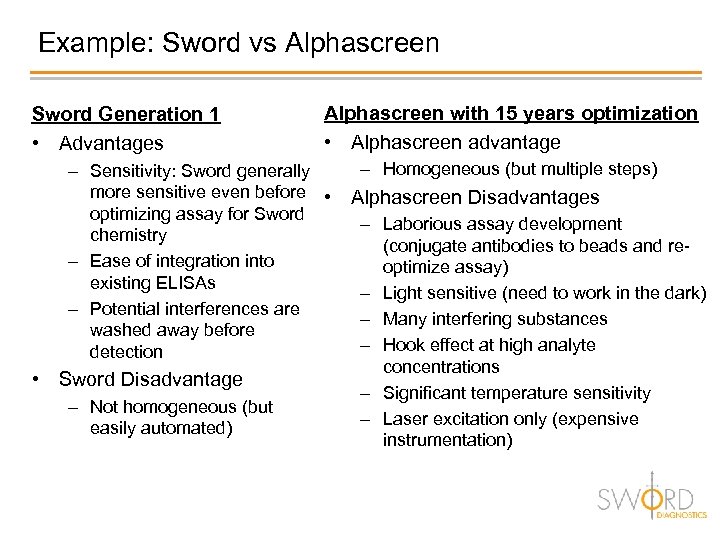

Example: Sword vs Alphascreen Sword Generation 1 • Advantages Alphascreen with 15 years optimization • Alphascreen advantage – Sensitivity: Sword generally more sensitive even before • optimizing assay for Sword chemistry – Ease of integration into existing ELISAs – Potential interferences are washed away before detection • Sword Disadvantage – Not homogeneous (but easily automated) – Homogeneous (but multiple steps) Alphascreen Disadvantages – Laborious assay development (conjugate antibodies to beads and reoptimize assay) – Light sensitive (need to work in the dark) – Many interfering substances – Hook effect at high analyte concentrations – Significant temperature sensitivity – Laser excitation only (expensive instrumentation)

Example: Sword vs Alphascreen Sword Generation 1 • Advantages Alphascreen with 15 years optimization • Alphascreen advantage – Sensitivity: Sword generally more sensitive even before • optimizing assay for Sword chemistry – Ease of integration into existing ELISAs – Potential interferences are washed away before detection • Sword Disadvantage – Not homogeneous (but easily automated) – Homogeneous (but multiple steps) Alphascreen Disadvantages – Laborious assay development (conjugate antibodies to beads and reoptimize assay) – Light sensitive (need to work in the dark) – Many interfering substances – Hook effect at high analyte concentrations – Significant temperature sensitivity – Laser excitation only (expensive instrumentation)

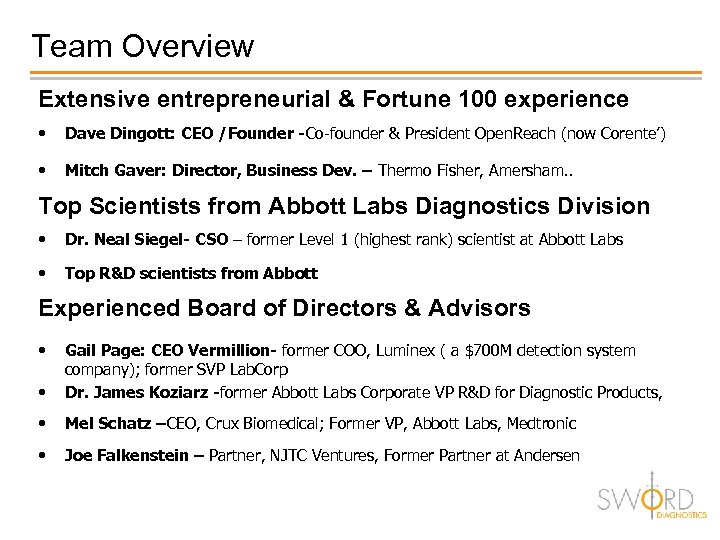

Team Overview Extensive entrepreneurial & Fortune 100 experience • Dave Dingott: CEO /Founder -Co-founder & President Open. Reach (now Corente’) • Mitch Gaver: Director, Business Dev. – Thermo Fisher, Amersham. . Top Scientists from Abbott Labs Diagnostics Division • Dr. Neal Siegel- CSO – former Level 1 (highest rank) scientist at Abbott Labs • Top R&D scientists from Abbott Experienced Board of Directors & Advisors • • Gail Page: CEO Vermillion- former COO, Luminex ( a $700 M detection system company); former SVP Lab. Corp Dr. James Koziarz -former Abbott Labs Corporate VP R&D for Diagnostic Products, • Mel Schatz –CEO, Crux Biomedical; Former VP, Abbott Labs, Medtronic • Joe Falkenstein – Partner, NJTC Ventures, Former Partner at Andersen

Team Overview Extensive entrepreneurial & Fortune 100 experience • Dave Dingott: CEO /Founder -Co-founder & President Open. Reach (now Corente’) • Mitch Gaver: Director, Business Dev. – Thermo Fisher, Amersham. . Top Scientists from Abbott Labs Diagnostics Division • Dr. Neal Siegel- CSO – former Level 1 (highest rank) scientist at Abbott Labs • Top R&D scientists from Abbott Experienced Board of Directors & Advisors • • Gail Page: CEO Vermillion- former COO, Luminex ( a $700 M detection system company); former SVP Lab. Corp Dr. James Koziarz -former Abbott Labs Corporate VP R&D for Diagnostic Products, • Mel Schatz –CEO, Crux Biomedical; Former VP, Abbott Labs, Medtronic • Joe Falkenstein – Partner, NJTC Ventures, Former Partner at Andersen

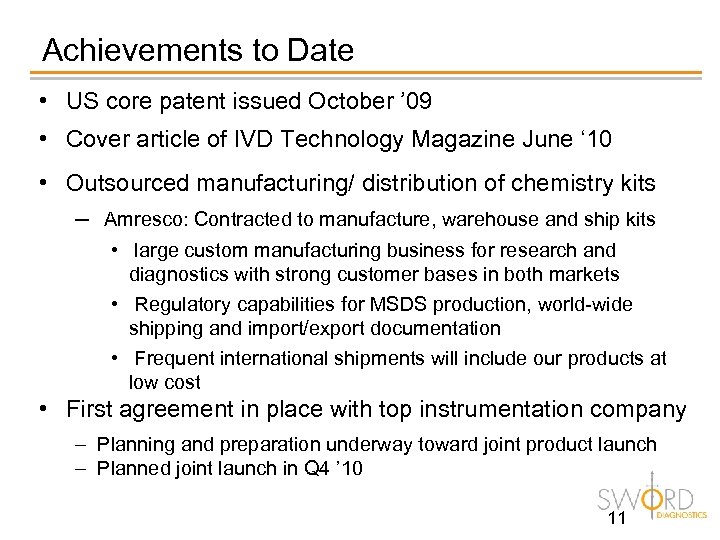

Achievements to Date • US core patent issued October ’ 09 • Cover article of IVD Technology Magazine June ‘ 10 • Outsourced manufacturing/ distribution of chemistry kits – Amresco: Contracted to manufacture, warehouse and ship kits • large custom manufacturing business for research and diagnostics with strong customer bases in both markets • Regulatory capabilities for MSDS production, world-wide shipping and import/export documentation • Frequent international shipments will include our products at low cost • First agreement in place with top instrumentation company – Planning and preparation underway toward joint product launch – Planned joint launch in Q 4 ’ 10 11

Achievements to Date • US core patent issued October ’ 09 • Cover article of IVD Technology Magazine June ‘ 10 • Outsourced manufacturing/ distribution of chemistry kits – Amresco: Contracted to manufacture, warehouse and ship kits • large custom manufacturing business for research and diagnostics with strong customer bases in both markets • Regulatory capabilities for MSDS production, world-wide shipping and import/export documentation • Frequent international shipments will include our products at low cost • First agreement in place with top instrumentation company – Planning and preparation underway toward joint product launch – Planned joint launch in Q 4 ’ 10 11

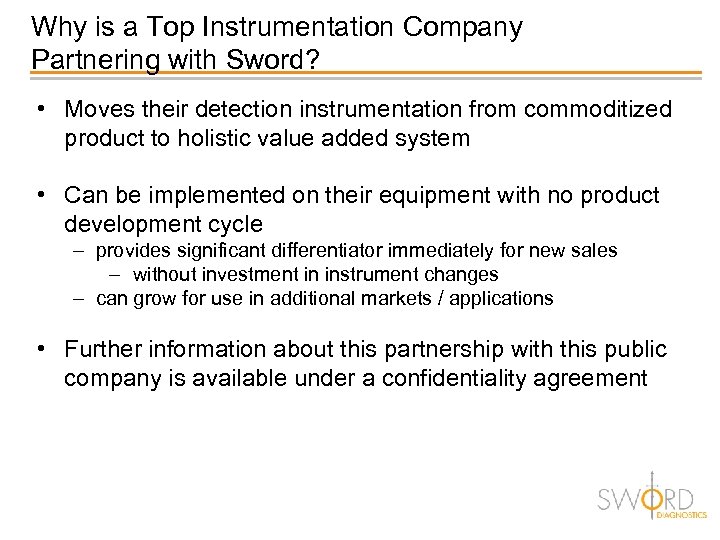

Why is a Top Instrumentation Company Partnering with Sword? • Moves their detection instrumentation from commoditized product to holistic value added system • Can be implemented on their equipment with no product development cycle – provides significant differentiator immediately for new sales – without investment in instrument changes – can grow for use in additional markets / applications • Further information about this partnership with this public company is available under a confidentiality agreement

Why is a Top Instrumentation Company Partnering with Sword? • Moves their detection instrumentation from commoditized product to holistic value added system • Can be implemented on their equipment with no product development cycle – provides significant differentiator immediately for new sales – without investment in instrument changes – can grow for use in additional markets / applications • Further information about this partnership with this public company is available under a confidentiality agreement

Likely Terms for Joint Partnership • Co-marketing of Sword chemistry to its existing and future customer base – Joint development of applications data, support packages, & marketing collateral – Lead sharing, joint sales calls, trade shows, seminars, and promotions – Sword to certify and promote its detection chemistry on their instruments – Sword sells reagent kits and supports reagent sales – Benefit to Instrumentation Company: • Market differentiator of innovative detection reagents for their instruments generating increased sales • Referral revenue

Likely Terms for Joint Partnership • Co-marketing of Sword chemistry to its existing and future customer base – Joint development of applications data, support packages, & marketing collateral – Lead sharing, joint sales calls, trade shows, seminars, and promotions – Sword to certify and promote its detection chemistry on their instruments – Sword sells reagent kits and supports reagent sales – Benefit to Instrumentation Company: • Market differentiator of innovative detection reagents for their instruments generating increased sales • Referral revenue

Attractive Business Model • Recurring revenue stream – Chemistry kit consumables (high recurring margins) – Licensing revenue (ongoing revenue stream) • Proven business model for detection systems – Licenses for research-use only • Licensees are large suppliers to research market – Applications ready to become diagnostics require additional license – Similar revenue model to Luminex, a successful Nasdaq listed detection system company 14

Attractive Business Model • Recurring revenue stream – Chemistry kit consumables (high recurring margins) – Licensing revenue (ongoing revenue stream) • Proven business model for detection systems – Licenses for research-use only • Licensees are large suppliers to research market – Applications ready to become diagnostics require additional license – Similar revenue model to Luminex, a successful Nasdaq listed detection system company 14

Commercialization Plans • Near term sales to do-it-yourselfers in research market • 40% of research market – Sword will exploit partner brand – Dramatic decrease in customer acquisition cost • Leverage instrumentation partnership for next phase partnership with kit manufacturers – 60% of research market –Instrumentation partner facilitating next step • Additional opportunities in clinical diagnostics market –Longer sales cycle/ later stage • Additional applications of Sword’s IP creates market opportunity of $1. 7 B 15

Commercialization Plans • Near term sales to do-it-yourselfers in research market • 40% of research market – Sword will exploit partner brand – Dramatic decrease in customer acquisition cost • Leverage instrumentation partnership for next phase partnership with kit manufacturers – 60% of research market –Instrumentation partner facilitating next step • Additional opportunities in clinical diagnostics market –Longer sales cycle/ later stage • Additional applications of Sword’s IP creates market opportunity of $1. 7 B 15

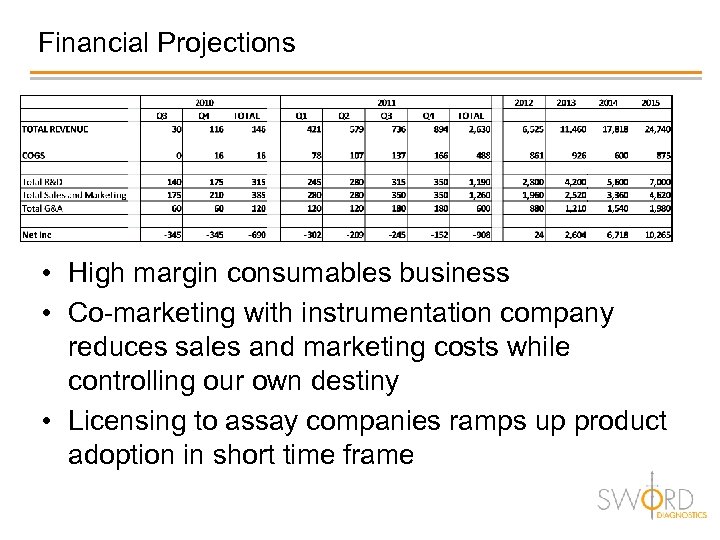

Financial Projections • High margin consumables business • Co-marketing with instrumentation company reduces sales and marketing costs while controlling our own destiny • Licensing to assay companies ramps up product adoption in short time frame

Financial Projections • High margin consumables business • Co-marketing with instrumentation company reduces sales and marketing costs while controlling our own destiny • Licensing to assay companies ramps up product adoption in short time frame

Funding Status • $7 M raised to date – NJTC Ventures, Calvert Group, Heartland Angels, others. . • Currently raising $1 M • Funds for joint launch of product with strategic partner • Commercialization 17

Funding Status • $7 M raised to date – NJTC Ventures, Calvert Group, Heartland Angels, others. . • Currently raising $1 M • Funds for joint launch of product with strategic partner • Commercialization 17

Strategy Creates Strong Exit Opportunities • Sword positioned to build sizable platform company over next few years based on comparable companies in space • Opportunity also exists to exit at earlier inflection point • Precedent valuations strong in either case – Lumigen (Acquired ‘ 06 by Beckman, 2 transactions, $210 M at 7 X revenue) – Bio. Veris (Acquired ‘ 07 by Roche; $600 M at 25 X revenue) – Luminex ($650 M market cap; 7 X Revenue) 18

Strategy Creates Strong Exit Opportunities • Sword positioned to build sizable platform company over next few years based on comparable companies in space • Opportunity also exists to exit at earlier inflection point • Precedent valuations strong in either case – Lumigen (Acquired ‘ 06 by Beckman, 2 transactions, $210 M at 7 X revenue) – Bio. Veris (Acquired ‘ 07 by Roche; $600 M at 25 X revenue) – Luminex ($650 M market cap; 7 X Revenue) 18