c1b0c78afb843ce2cff2092d23684df3.ppt

- Количество слайдов: 22

What’s your transition plan? Planning & financing post-secondary education for students with permanent disabilities

What’s your transition plan? Planning & financing post-secondary education for students with permanent disabilities

Why post-secondary? What do you expect from your post-secondary experience Improve your chances of getting a job? Increase your earning potential? Enhance your job opportunities? Increase your knowledge and skills? What do you want to do after you finish your education? Pick a program that you will find interesting

Why post-secondary? What do you expect from your post-secondary experience Improve your chances of getting a job? Increase your earning potential? Enhance your job opportunities? Increase your knowledge and skills? What do you want to do after you finish your education? Pick a program that you will find interesting

You need a career plan Planning doesn’t mean deciding what to do for the rest of your life If you’re in high school, the sooner you start planning, the more options you’ll have after graduation Do some research - contact the educational institution you are interested in and talk to a counselor Tap into resources such as OCCinfo, Edinfo and/or the booklet This is Your Life – a Career and Education Planning Guide – all available on the ALIS website www. alis. alberta. ca

You need a career plan Planning doesn’t mean deciding what to do for the rest of your life If you’re in high school, the sooner you start planning, the more options you’ll have after graduation Do some research - contact the educational institution you are interested in and talk to a counselor Tap into resources such as OCCinfo, Edinfo and/or the booklet This is Your Life – a Career and Education Planning Guide – all available on the ALIS website www. alis. alberta. ca

Making the transition You’re not alone! The jump to post-secondary studies can be tough, but there is help. An excellent reference is the “Transition Planning Guide for Students with Disabilities and their Families” available for download at www. alis. alberta. ca/disabilities Did you know? Students with permanent disabilities can take 40% or more of a full course load and be considered a full-time student

Making the transition You’re not alone! The jump to post-secondary studies can be tough, but there is help. An excellent reference is the “Transition Planning Guide for Students with Disabilities and their Families” available for download at www. alis. alberta. ca/disabilities Did you know? Students with permanent disabilities can take 40% or more of a full course load and be considered a full-time student

Where to Go? You have lots of post-secondary education options to consider Public Colleges Apprenticeship Programs Private Colleges Technical Schools Universities Private Vocational Schools Explore your interests and passions These could possibly turn into a career like the videos seen at www. alis. alberta. ca/disabilities

Where to Go? You have lots of post-secondary education options to consider Public Colleges Apprenticeship Programs Private Colleges Technical Schools Universities Private Vocational Schools Explore your interests and passions These could possibly turn into a career like the videos seen at www. alis. alberta. ca/disabilities

Where to Go? Technical Institutes Offer a variety of 1 -2 year certificate and diploma programs and 4 year applied degrees Co-ordinate most apprenticeship programs in Alberta Work with businesses to tailor programs to meet labour market demands Private Vocational Schools Short-term diploma programs that offer job-specific training Often focus on one sector (e. g. technology or administration) May provide extra job search support to graduating student Funded through student tuition

Where to Go? Technical Institutes Offer a variety of 1 -2 year certificate and diploma programs and 4 year applied degrees Co-ordinate most apprenticeship programs in Alberta Work with businesses to tailor programs to meet labour market demands Private Vocational Schools Short-term diploma programs that offer job-specific training Often focus on one sector (e. g. technology or administration) May provide extra job search support to graduating student Funded through student tuition

Where to Go? Apprentice Programs 60 designated trades and occupations in Alberta Programs range from 1 to 4 years in length Apprentices earn an income while learning a trade 80% on-the-job training and 20% classroom training You can begin apprenticeship in high school through the Registered Apprenticeship Program (RAP) Scholarships and financial assistance available for eligible apprentices Go to www. tradesecrets. gov. ab. cafor more information

Where to Go? Apprentice Programs 60 designated trades and occupations in Alberta Programs range from 1 to 4 years in length Apprentices earn an income while learning a trade 80% on-the-job training and 20% classroom training You can begin apprenticeship in high school through the Registered Apprenticeship Program (RAP) Scholarships and financial assistance available for eligible apprentices Go to www. tradesecrets. gov. ab. cafor more information

How will I pay for it? Savings Family contributions / RESP Scholarships and Bursaries Jobs: part-time and summer Apprenticeship/Fellowship Programs Government Student Assistance Student Loan Products from lending institutions

How will I pay for it? Savings Family contributions / RESP Scholarships and Bursaries Jobs: part-time and summer Apprenticeship/Fellowship Programs Government Student Assistance Student Loan Products from lending institutions

Jobs It is expected that you work the summer before starting post-secondary and save about $360 a month – but, in special circumstances this requirement may be waived if you are unable to work because of a documented medical condition Part-time work during post-secondary may help cover some expenses Apprenticeship or Fellowship Programs Go to www. tradesecrets. org for more information

Jobs It is expected that you work the summer before starting post-secondary and save about $360 a month – but, in special circumstances this requirement may be waived if you are unable to work because of a documented medical condition Part-time work during post-secondary may help cover some expenses Apprenticeship or Fellowship Programs Go to www. tradesecrets. org for more information

Scholarships & Bursaries Scholarships are usually based on grades or other achievements Bursaries are usually based on demonstrated financial need Sources include government, your post-secondary school, community groups, and corporations Scholarship Connections www. alis. gov. ab. ca/scholarships

Scholarships & Bursaries Scholarships are usually based on grades or other achievements Bursaries are usually based on demonstrated financial need Sources include government, your post-secondary school, community groups, and corporations Scholarship Connections www. alis. gov. ab. ca/scholarships

Bank Student Loans Banks have financial programs for students, but there are key differences from government – sponsored loans The bank’s interest rate is not regulated and may be higher The loan is not interest-free while in school The loan may require a co-signer You will not have access to government's debt management tools if there is difficulty with repayment

Bank Student Loans Banks have financial programs for students, but there are key differences from government – sponsored loans The bank’s interest rate is not regulated and may be higher The loan is not interest-free while in school The loan may require a co-signer You will not have access to government's debt management tools if there is difficulty with repayment

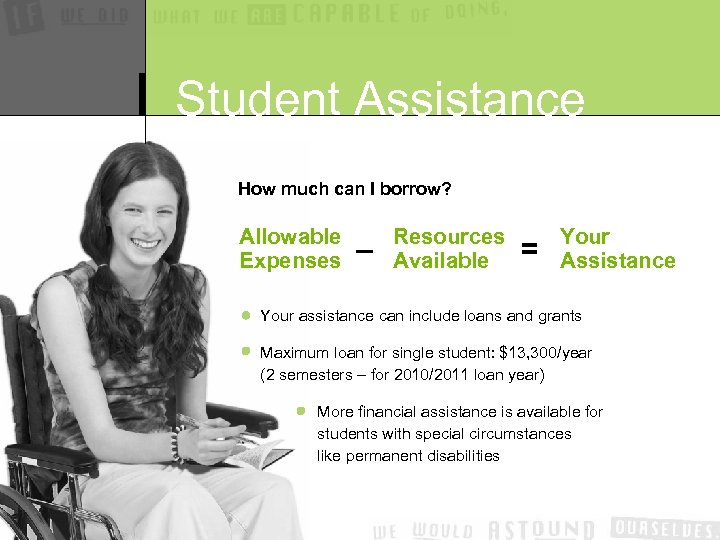

Student Assistance How much can I borrow? Allowable Expenses – Resources Available = Your Assistance Your assistance can include loans and grants Maximum loan for single student: $13, 300/year (2 semesters – for 2010/2011 loan year) More financial assistance is available for students with special circumstances like permanent disabilities

Student Assistance How much can I borrow? Allowable Expenses – Resources Available = Your Assistance Your assistance can include loans and grants Maximum loan for single student: $13, 300/year (2 semesters – for 2010/2011 loan year) More financial assistance is available for students with special circumstances like permanent disabilities

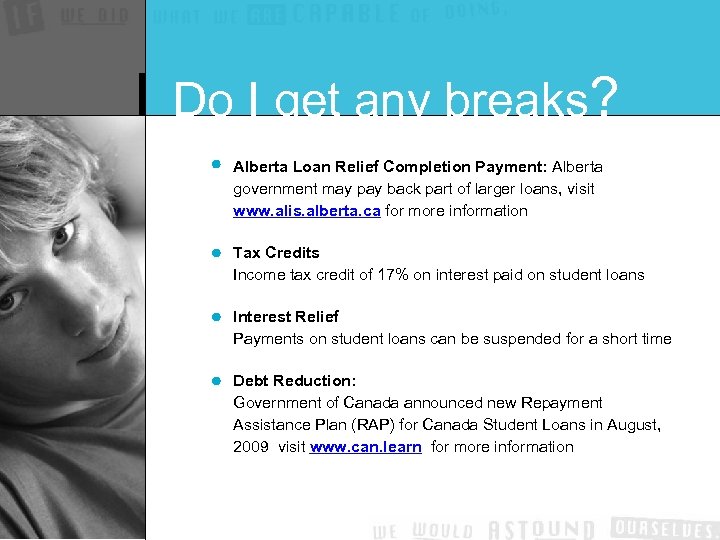

Do I get any breaks? Alberta Loan Relief Completion Payment: Alberta government may pay back part of larger loans, visit www. alis. alberta. ca for more information Tax Credits Income tax credit of 17% on interest paid on student loans Interest Relief Payments on student loans can be suspended for a short time Debt Reduction: Government of Canada announced new Repayment Assistance Plan (RAP) for Canada Student Loans in August, 2009 visit www. can. learn for more information

Do I get any breaks? Alberta Loan Relief Completion Payment: Alberta government may pay back part of larger loans, visit www. alis. alberta. ca for more information Tax Credits Income tax credit of 17% on interest paid on student loans Interest Relief Payments on student loans can be suspended for a short time Debt Reduction: Government of Canada announced new Repayment Assistance Plan (RAP) for Canada Student Loans in August, 2009 visit www. can. learn for more information

Alberta Student Loan Relief Program All students will be considered for Loan Relief Completion Payment at the completion of studies Go to www. alis. alberta. ca or call the Student Funding Contact Centre or more information

Alberta Student Loan Relief Program All students will be considered for Loan Relief Completion Payment at the completion of studies Go to www. alis. alberta. ca or call the Student Funding Contact Centre or more information

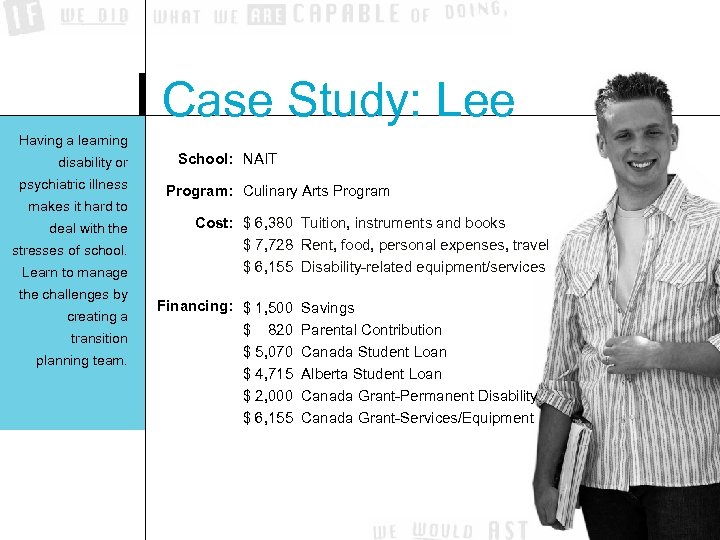

Case Study: Lee Having a learning disability or psychiatric illness makes it hard to deal with the stresses of school. Learn to manage the challenges by creating a transition planning team. School: NAIT Program: Culinary Arts Program Cost: $ 6, 380 Tuition, instruments and books $ 7, 728 Rent, food, personal expenses, travel $ 6, 155 Disability-related equipment/services Financing: $ 1, 500 $ 820 $ 5, 070 $ 4, 715 $ 2, 000 $ 6, 155 Savings Parental Contribution Canada Student Loan Alberta Student Loan Canada Grant-Permanent Disability Canada Grant-Services/Equipment

Case Study: Lee Having a learning disability or psychiatric illness makes it hard to deal with the stresses of school. Learn to manage the challenges by creating a transition planning team. School: NAIT Program: Culinary Arts Program Cost: $ 6, 380 Tuition, instruments and books $ 7, 728 Rent, food, personal expenses, travel $ 6, 155 Disability-related equipment/services Financing: $ 1, 500 $ 820 $ 5, 070 $ 4, 715 $ 2, 000 $ 6, 155 Savings Parental Contribution Canada Student Loan Alberta Student Loan Canada Grant-Permanent Disability Canada Grant-Services/Equipment

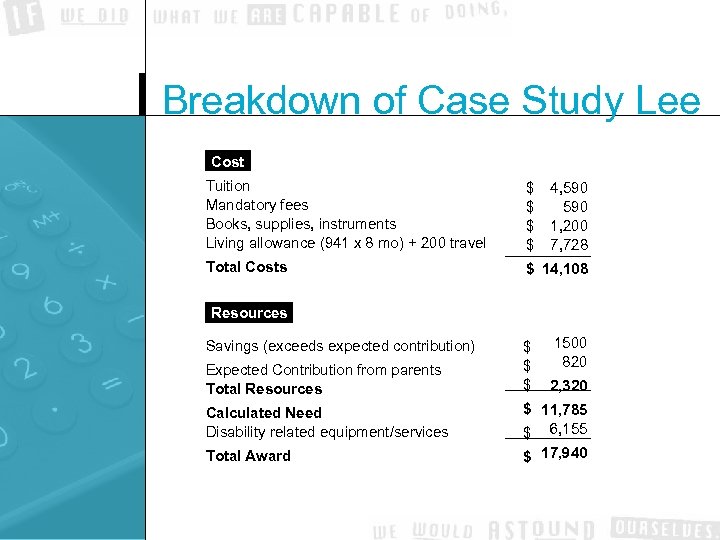

Breakdown of Case Study Lee Cost Tuition Mandatory fees Books, supplies, instruments Living allowance (941 x 8 mo) + 200 travel $ $ Total Costs $ 14, 108 Resources : Savings (exceeds expected contribution) 4, 590 1, 200 7, 728 1500 820 Expected Contribution from parents Total Resources $ $ $ Calculated Need Disability related equipment/services $ 11, 785 $ 6, 155 Total Award $ 17, 940 2, 320

Breakdown of Case Study Lee Cost Tuition Mandatory fees Books, supplies, instruments Living allowance (941 x 8 mo) + 200 travel $ $ Total Costs $ 14, 108 Resources : Savings (exceeds expected contribution) 4, 590 1, 200 7, 728 1500 820 Expected Contribution from parents Total Resources $ $ $ Calculated Need Disability related equipment/services $ 11, 785 $ 6, 155 Total Award $ 17, 940 2, 320

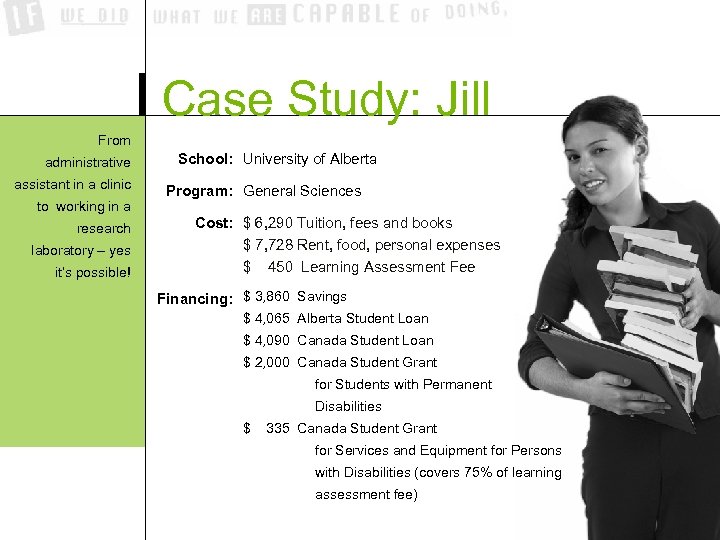

Case Study: Jill From administrative assistant in a clinic to working in a research laboratory – yes it’s possible! School: University of Alberta Program: General Sciences Cost: $ 6, 290 Tuition, fees and books $ 7, 728 Rent, food, personal expenses $ 450 Learning Assessment Fee Financing: $ 3, 860 Savings $ 4, 065 Alberta Student Loan $ 4, 090 Canada Student Loan $ 2, 000 Canada Student Grant for Students with Permanent Disabilities $ 335 Canada Student Grant for Services and Equipment for Persons with Disabilities (covers 75% of learning assessment fee)

Case Study: Jill From administrative assistant in a clinic to working in a research laboratory – yes it’s possible! School: University of Alberta Program: General Sciences Cost: $ 6, 290 Tuition, fees and books $ 7, 728 Rent, food, personal expenses $ 450 Learning Assessment Fee Financing: $ 3, 860 Savings $ 4, 065 Alberta Student Loan $ 4, 090 Canada Student Loan $ 2, 000 Canada Student Grant for Students with Permanent Disabilities $ 335 Canada Student Grant for Services and Equipment for Persons with Disabilities (covers 75% of learning assessment fee)

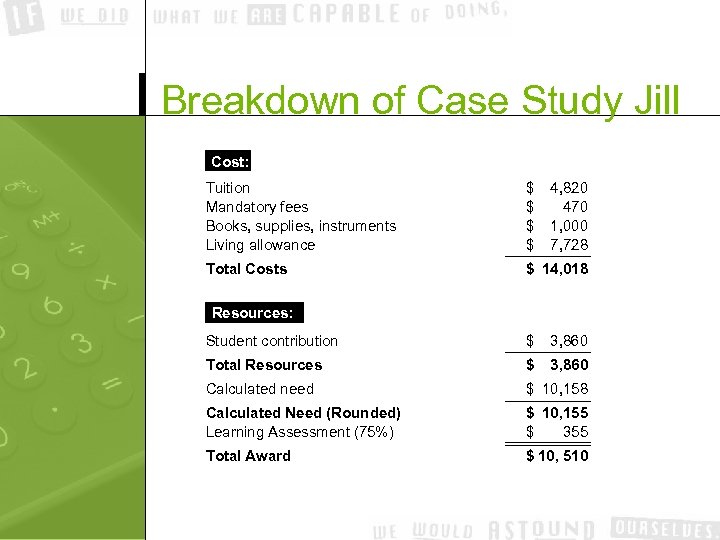

Breakdown of Case Study Jill Cost: Tuition Mandatory fees Books, supplies, instruments Living allowance $ $ 4, 820 470 1, 000 7, 728 Total Costs $ 14, 018 Resources: Student contribution $ 3, 860 Total Resources $ 3, 860 Calculated need $ 10, 158 Calculated Need (Rounded) Learning Assessment (75%) $ 10, 155 $ 355 Total Award $ 10, 510

Breakdown of Case Study Jill Cost: Tuition Mandatory fees Books, supplies, instruments Living allowance $ $ 4, 820 470 1, 000 7, 728 Total Costs $ 14, 018 Resources: Student contribution $ 3, 860 Total Resources $ 3, 860 Calculated need $ 10, 158 Calculated Need (Rounded) Learning Assessment (75%) $ 10, 155 $ 355 Total Award $ 10, 510

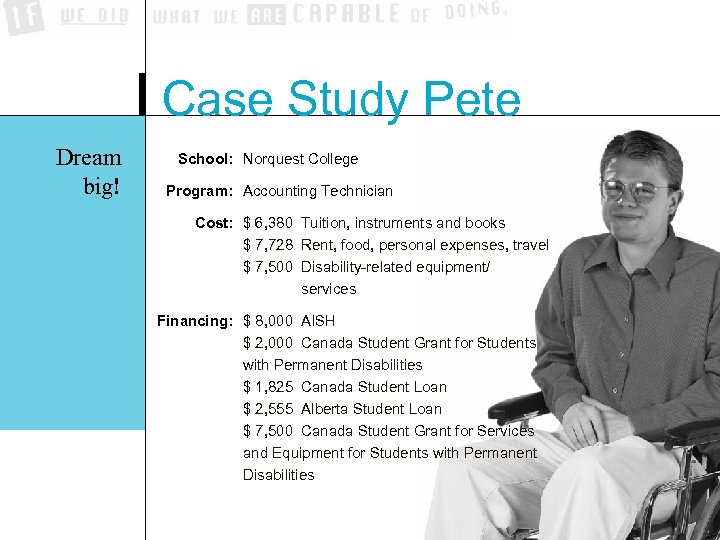

Case Study Pete Dream big! School: Norquest College Program: Accounting Technician Cost: $ 6, 380 Tuition, instruments and books $ 7, 728 Rent, food, personal expenses, travel $ 7, 500 Disability-related equipment/ services Financing: $ 8, 000 AISH $ 2, 000 Canada Student Grant for Students with Permanent Disabilities $ 1, 825 Canada Student Loan $ 2, 555 Alberta Student Loan $ 7, 500 Canada Student Grant for Services and Equipment for Students with Permanent Disabilities

Case Study Pete Dream big! School: Norquest College Program: Accounting Technician Cost: $ 6, 380 Tuition, instruments and books $ 7, 728 Rent, food, personal expenses, travel $ 7, 500 Disability-related equipment/ services Financing: $ 8, 000 AISH $ 2, 000 Canada Student Grant for Students with Permanent Disabilities $ 1, 825 Canada Student Loan $ 2, 555 Alberta Student Loan $ 7, 500 Canada Student Grant for Services and Equipment for Students with Permanent Disabilities

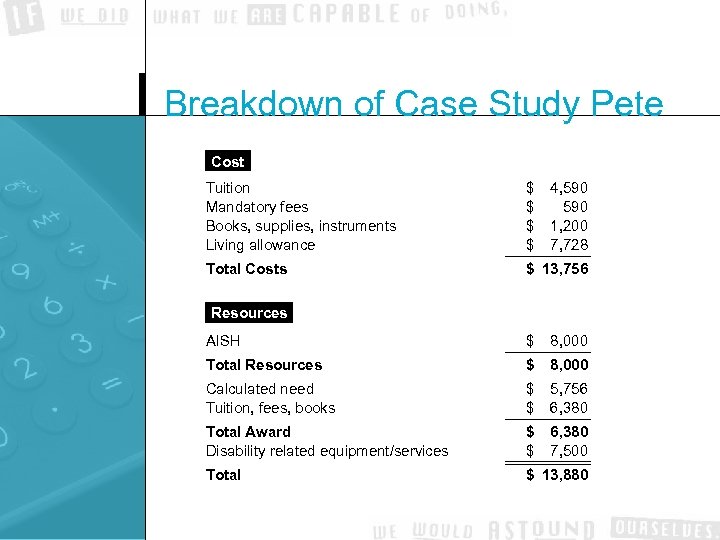

Breakdown of Case Study Pete Cost Tuition Mandatory fees Books, supplies, instruments Living allowance $ $ 4, 590 1, 200 7, 728 Total Costs $ 13, 756 Resources AISH $ 8, 000 Total Resources $ 8, 000 Calculated need Tuition, fees, books $ $ 5, 756 6, 380 Total Award Disability related equipment/services $ $ 6, 380 7, 500 Total $ 13, 880

Breakdown of Case Study Pete Cost Tuition Mandatory fees Books, supplies, instruments Living allowance $ $ 4, 590 1, 200 7, 728 Total Costs $ 13, 756 Resources AISH $ 8, 000 Total Resources $ 8, 000 Calculated need Tuition, fees, books $ $ 5, 756 6, 380 Total Award Disability related equipment/services $ $ 6, 380 7, 500 Total $ 13, 880

Getting Help www. alis. alberta. ca, click on Students Finance www. canlearn. ca Student Funding Contact Centre in Edmonton 427– 3722 or toll free in Canada 1 -800 -222 -6485 Career Information Hotline: 1 -800 -661 -3753 Alberta Service Centres/Canada-Alberta Service Centres High School Guidance Counsellors, disability service coordinator, or financial aid office at post-secondary educational institutions

Getting Help www. alis. alberta. ca, click on Students Finance www. canlearn. ca Student Funding Contact Centre in Edmonton 427– 3722 or toll free in Canada 1 -800 -222 -6485 Career Information Hotline: 1 -800 -661 -3753 Alberta Service Centres/Canada-Alberta Service Centres High School Guidance Counsellors, disability service coordinator, or financial aid office at post-secondary educational institutions

Thank you! QUESTIONS?

Thank you! QUESTIONS?