5e958d9d7346da06ac7a45cb9b9351b8.ppt

- Количество слайдов: 60

What’s New In Washington and Baltimore… POHMS Annual Fall Conference November 3, 2011 John Akscin, Vice President and Customer Advocate

The Landscape is Changing Quickly…Will You?

Top 10 Things to Watch for in 2011 Accuracy of MC Fee Schedule PQRS Red Flag Rule Implementation of ACA Medicare Provisions EHR Incentive Oversight/Compliance E-Rx Prep for 2012 Prep HIPAA V-5010 CMS Rule on ACOs Advocacy SGR Reform Source: MGMA January 2011 3

4

Medicare Private Payors Market Based What Guidelines Solutions Cost Shifting 3 rd Party Players ACOs Regulatory 5

6

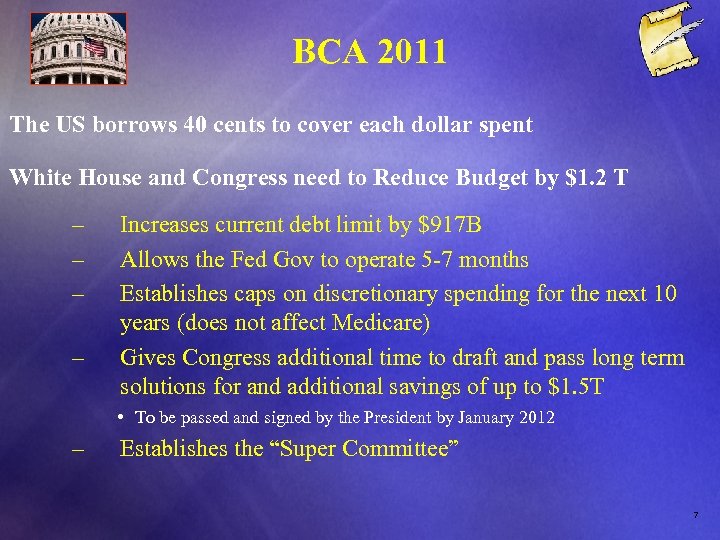

BCA 2011 The US borrows 40 cents to cover each dollar spent White House and Congress need to Reduce Budget by $1. 2 T – – Increases current debt limit by $917 B Allows the Fed Gov to operate 5 -7 months Establishes caps on discretionary spending for the next 10 years (does not affect Medicare) Gives Congress additional time to draft and pass long term solutions for and additional savings of up to $1. 5 T • To be passed and signed by the President by January 2012 – Establishes the “Super Committee” 7

Super Committee Congressional Joint Select Committee on Deficit Reduction Tasked with proposing legislation focused at reducing long-term debt another $1. 2 to $1. 5 T over the next 10 years Senate Republicans: Senator Jon Kyl (R-Ariz. ) Senator Pat Toomey (R-Pa. ) Senator Rob Portman (R-Ohio) Senate Democrats: Sen. Patty Murray (D-Wash. ) Sen. Max Baucus (D-Mont. ) Sen. John Kerry (D-Mass. ) House Democrats: Rep. Jim Clyburn (D-S. C. ) Rep. Chris Van Hollen (D-Md. ) Rep. Xavier Becerra (D-Calif. ) House Republicans: Rep. Jeb Hensarling (R-Texas) Rep. Dave Camp (R – Mich. ) Rep. Fred Upton (R-Mich. ) Target for completion…November 23 rd 8

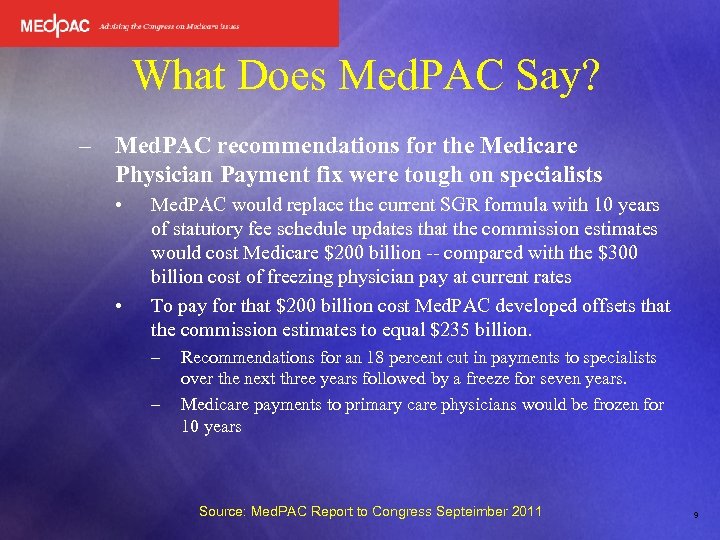

What Does Med. PAC Say? – Med. PAC recommendations for the Medicare Physician Payment fix were tough on specialists • • Med. PAC would replace the current SGR formula with 10 years of statutory fee schedule updates that the commission estimates would cost Medicare $200 billion -- compared with the $300 billion cost of freezing physician pay at current rates To pay for that $200 billion cost Med. PAC developed offsets that the commission estimates to equal $235 billion. – – Recommendations for an 18 percent cut in payments to specialists over the next three years followed by a freeze for seven years. Medicare payments to primary care physicians would be frozen for 10 years Source: Med. PAC Report to Congress Septeimber 2011 9

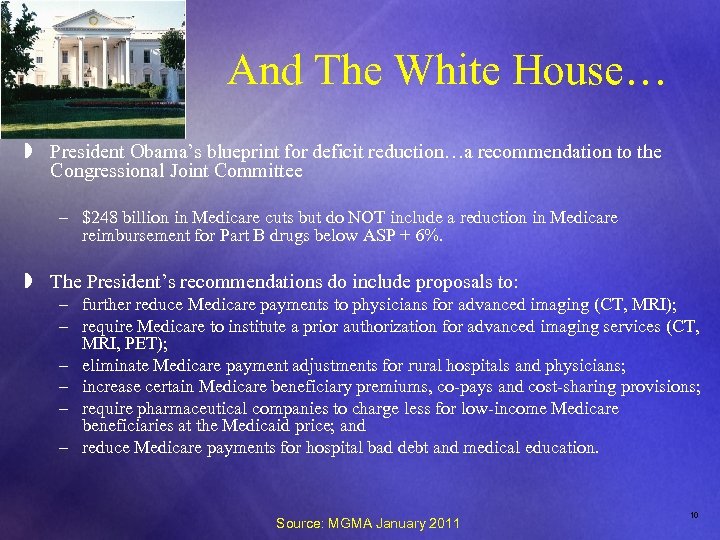

And The White House… » President Obama’s blueprint for deficit reduction…a recommendation to the Congressional Joint Committee – $248 billion in Medicare cuts but do NOT include a reduction in Medicare reimbursement for Part B drugs below ASP + 6%. » The President’s recommendations do include proposals to: – further reduce Medicare payments to physicians for advanced imaging (CT, MRI); – require Medicare to institute a prior authorization for advanced imaging services (CT, MRI, PET); – eliminate Medicare payment adjustments for rural hospitals and physicians; – increase certain Medicare beneficiary premiums, co-pays and cost-sharing provisions; – require pharmaceutical companies to charge less for low-income Medicare beneficiaries at the Medicaid price; and – reduce Medicare payments for hospital bad debt and medical education. Source: MGMA January 2011 10

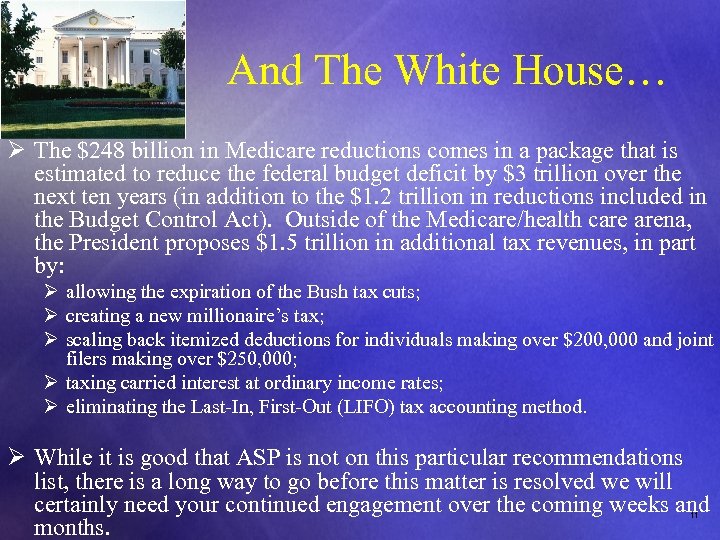

And The White House… Ø The $248 billion in Medicare reductions comes in a package that is estimated to reduce the federal budget deficit by $3 trillion over the next ten years (in addition to the $1. 2 trillion in reductions included in the Budget Control Act). Outside of the Medicare/health care arena, the President proposes $1. 5 trillion in additional tax revenues, in part by: Ø allowing the expiration of the Bush tax cuts; Ø creating a new millionaire’s tax; Ø scaling back itemized deductions for individuals making over $200, 000 and joint filers making over $250, 000; Ø taxing carried interest at ordinary income rates; Ø eliminating the Last-In, First-Out (LIFO) tax accounting method. Ø While it is good that ASP is not on this particular recommendations list, there is a long way to go before this matter is resolved we will certainly need your continued engagement over the coming weeks and months. 11

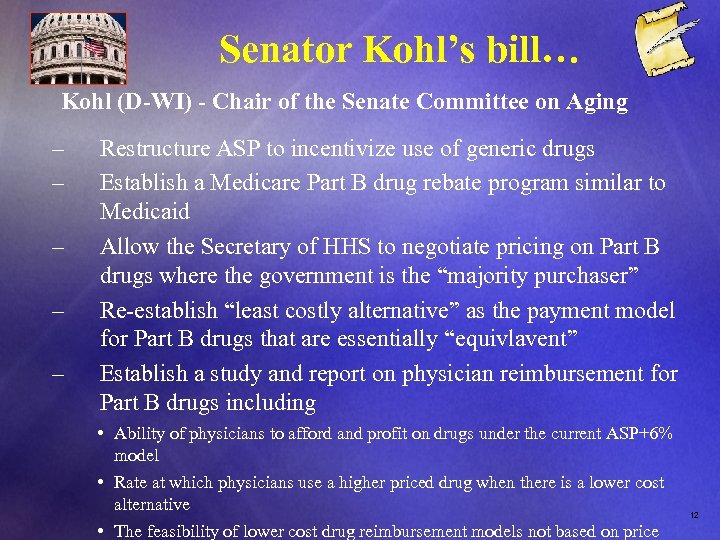

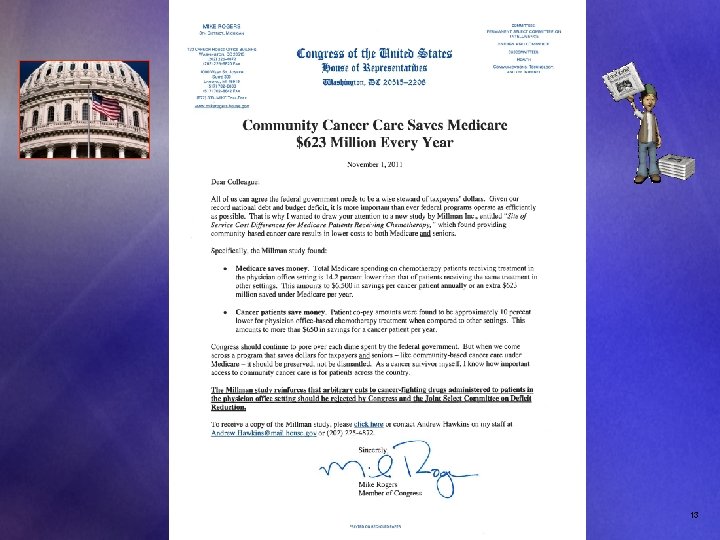

Senator Kohl’s bill… Kohl (D-WI) - Chair of the Senate Committee on Aging – – – Restructure ASP to incentivize use of generic drugs Establish a Medicare Part B drug rebate program similar to Medicaid Allow the Secretary of HHS to negotiate pricing on Part B drugs where the government is the “majority purchaser” Re-establish “least costly alternative” as the payment model for Part B drugs that are essentially “equivlavent” Establish a study and report on physician reimbursement for Part B drugs including • Ability of physicians to afford and profit on drugs under the current ASP+6% model • Rate at which physicians use a higher priced drug when there is a lower cost alternative • The feasibility of lower cost drug reimbursement models not based on price 12

13

What This Means to You… – – – For now, ASP+3% is back on the table If Congress does not provide a long term solution a provision reducing entitlement spending could be triggered affecting Medicare providers but not beneficiaries directly All spending will be fair game to the Super Committee including Part B drugs, physician payments and hospital payments 14

3. 5 Things You Should be Doing… 1. Work with your professional societies and associations in contacting Congress asking them to oppose any reductions in Medicare spending for Cancer Care 2. Key committees of jurisdiction submitted their recommendations on October 15 th. The work accelerates exponentially in order to hit the target of November 23 rd so be alert to advocacy efforts 3. Continue to stay tuned to MHS for periodic updates and information to stay informed 3. 5 Engage! 15

16

Drug Shortages

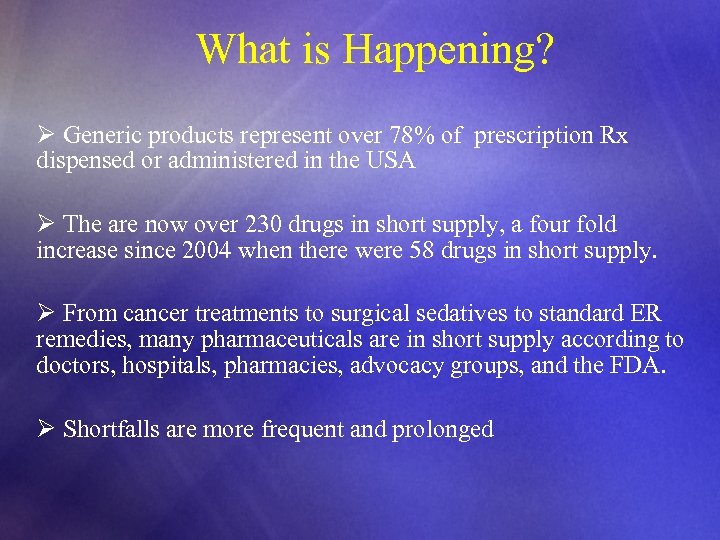

What is Happening? Ø Generic products represent over 78% of prescription Rx dispensed or administered in the USA Ø The are now over 230 drugs in short supply, a four fold increase since 2004 when there were 58 drugs in short supply. Ø From cancer treatments to surgical sedatives to standard ER remedies, many pharmaceuticals are in short supply according to doctors, hospitals, pharmacies, advocacy groups, and the FDA. Ø Shortfalls are more frequent and prolonged

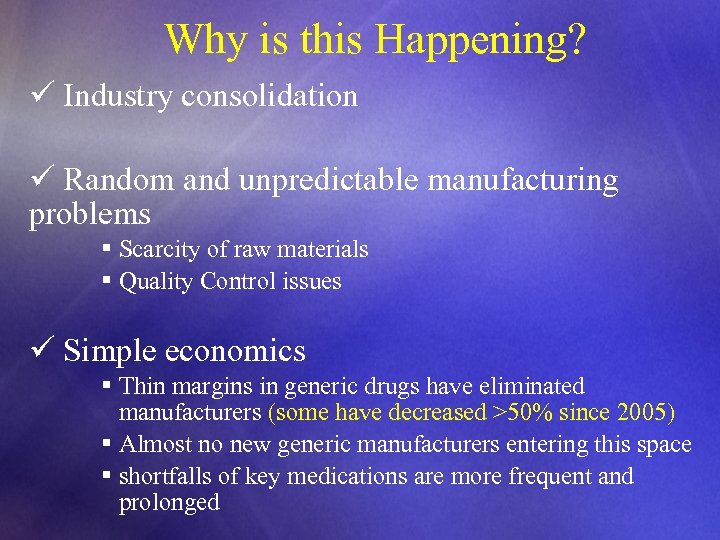

Why is this Happening? ü Industry consolidation ü Random and unpredictable manufacturing problems § Scarcity of raw materials § Quality Control issues ü Simple economics § Thin margins in generic drugs have eliminated manufacturers (some have decreased >50% since 2005) § Almost no new generic manufacturers entering this space § shortfalls of key medications are more frequent and prolonged

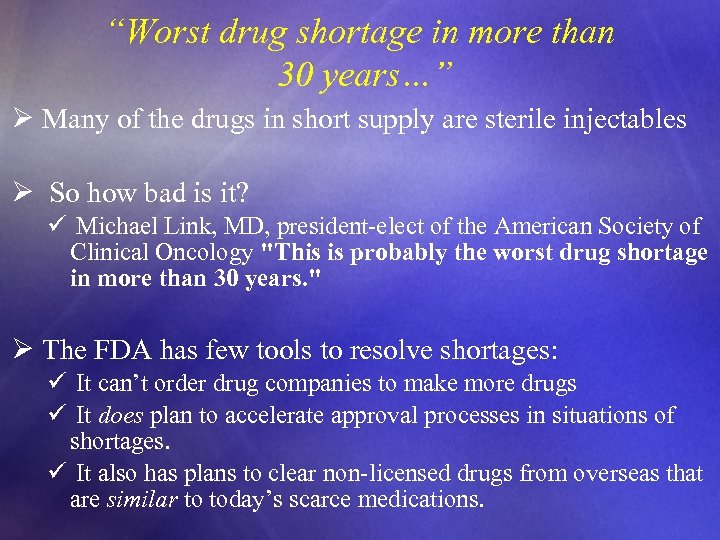

“Worst drug shortage in more than 30 years…” Ø Many of the drugs in short supply are sterile injectables Ø So how bad is it? ü Michael Link, MD, president-elect of the American Society of Clinical Oncology "This is probably the worst drug shortage in more than 30 years. " Ø The FDA has few tools to resolve shortages: ü It can’t order drug companies to make more drugs ü It does plan to accelerate approval processes in situations of shortages. ü It also has plans to clear non-licensed drugs from overseas that are similar to today’s scarce medications.

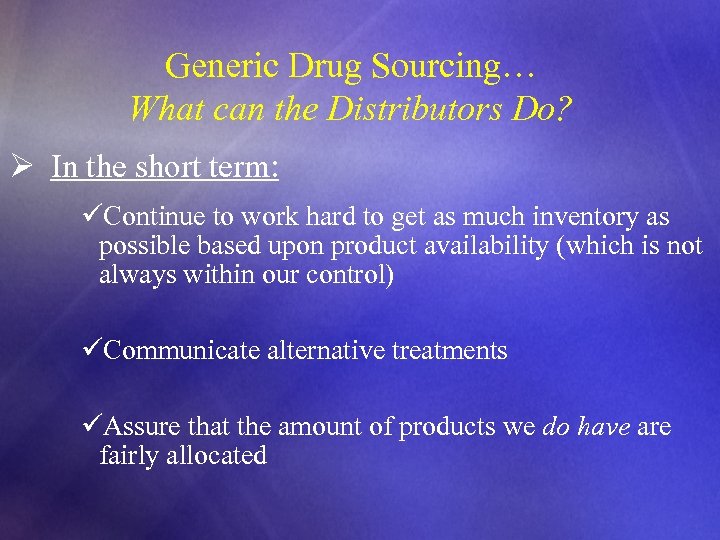

Generic Drug Sourcing… What can the Distributors Do? Ø In the short term: üContinue to work hard to get as much inventory as possible based upon product availability (which is not always within our control) üCommunicate alternative treatments üAssure that the amount of products we do have are fairly allocated

Staying Engaged with the Industry Ø In the mid term: ØThrough collaboration with HDMA, specialty distribution is continuing its advocacy efforts with professional associations including HDMA, ASCO, ASHP, ASA and the Institute for Safe Medicine Practices ØThis coalition recently held a drug shortage summit with the FDA to explore strategies to manage and mitigate product shortages ØASHP is finalizing a report to be available to coalition members ØHDMA is working on updating a report that was issued a few years ago on product availability

Finding Long Term Solutions Ø The Long term: ØFurther diversify supplier portfolios to better serve our customers and their patients ØIdentify and engage “secondary” suppliers for all key products that meet safety and credibility standards

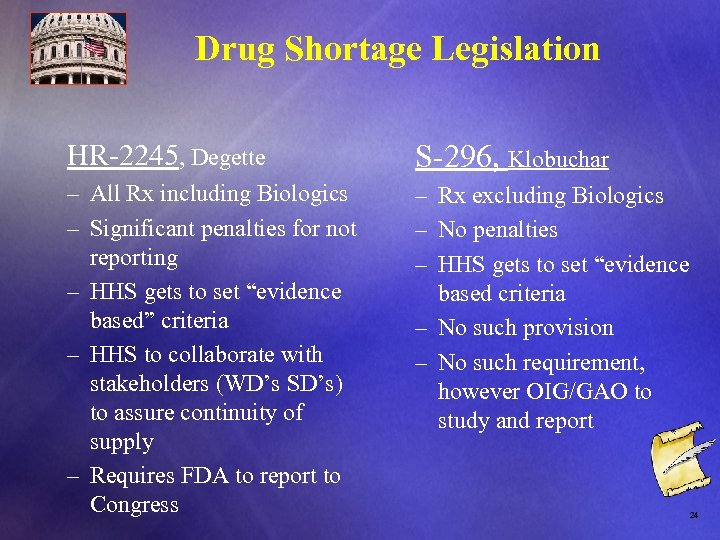

Drug Shortage Legislation HR-2245, Degette S-296, Klobuchar – All Rx including Biologics – Rx excluding Biologics – Significant penalties for not – No penalties reporting – HHS gets to set “evidence based criteria based” criteria – No such provision – HHS to collaborate with – No such requirement, stakeholders (WD’s SD’s) however OIG/GAO to to assure continuity of study and report supply – Requires FDA to report to Congress 24

What Else… – HHS Kathleen Sebelius hosts hearings on Gray Market – House E&C Health Sub-Com testimony – FDA one day workshop – Congressman Elijah Cummings, D-MD launches investigations of Gray Market and 5 regional distributors for price gouging – Significant penalties for not reporting – HHS preparing to set “evidence based” criteria – HHS to collaborate with stakeholders (WD’s SD’s) to assure continuity of supply – Premier Healthcare Alliance Report on Gray Market – Require FDA to report to Congress on solutions – Renewed discussion of Federal pedigree legislation is imminent 25

The Executive Order… – Direct FDA to broaden reporting of potential shortages of certain prescription drugs; – Require FDA to expand its current efforts to expedite review of new manufacturing sites, drug suppliers, and manufacturing changes; – Direct FDA to work with the Dept. of Justice to example reports of price gouging. 26

The President Also… – Sent a letter to manufacturers reminding them of their legal responsibilities to report discontinuation of certain drugs to the FDA and encourages companies to voluntarily notify FDA about potential shortages in cases where notification is not required. – Indicated support for increasing staffing at FDA’s Drug Shortages Program to address the increased workload for additional notifications – Released two reports examining drug shortages (ASPE and FDA) 27

Be Careful Out There… FSenator Michael Bennett (D-CO) sends letter to Margaret Hamburg üDrug pedigree tracking is critical to watch dog effort ü“Grey market” schemes are worrisome FOIG action catches Maryland physician for “introducing miss-branded drugs into intrastate commerce” üPhysician plead guilty üCriminal investigation discovered this “cancer doctor” üPurchased >$200, 000 in drugs from an illegal European distributor üBilled the government (Fed and State) almost $800, 000 for these drugs administered to patients in the clinic’s infusion center v. Remember…if the deal is too good to be true…it probably is! 28

29

30

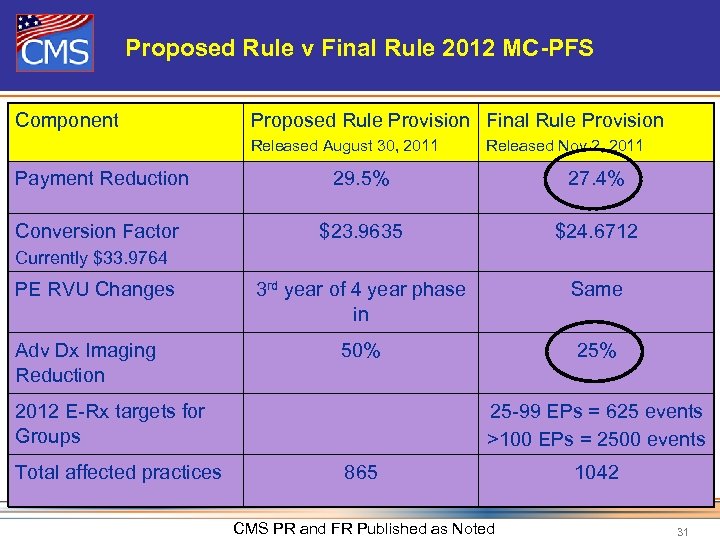

Proposed Rule v Final Rule 2012 MC-PFS Component Proposed Rule Provision Final Rule Provision Released August 30, 2011 Released Nov 2, 2011 Payment Reduction 29. 5% 27. 4% Conversion Factor $23. 9635 $24. 6712 3 rd year of 4 year phase in Same 50% 25% Currently $33. 9764 PE RVU Changes Adv Dx Imaging Reduction 2012 E-Rx targets for Groups Total affected practices 25 -99 EPs = 625 events >100 EPs = 2500 events 865 CMS PR and FR Published as Noted 1042 31

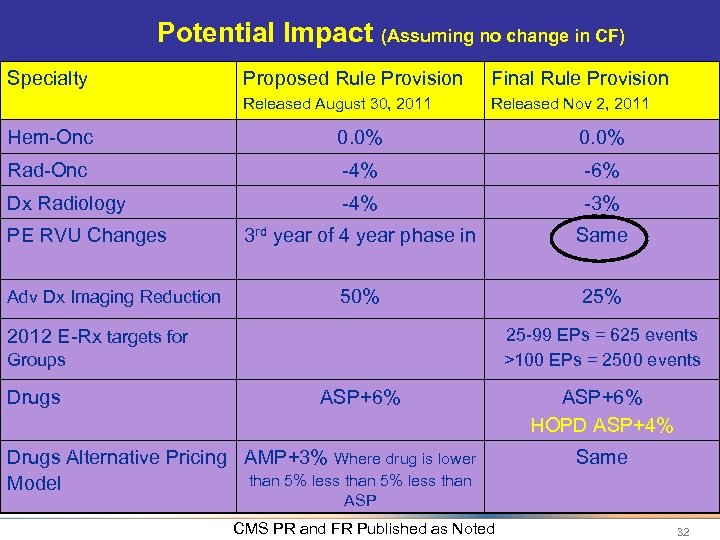

Potential Impact (Assuming no change in CF) Specialty Proposed Rule Provision Final Rule Provision Released August 30, 2011 Released Nov 2, 2011 Hem-Onc 0. 0% Rad-Onc -4% -6% Dx Radiology -4% -3% 3 rd year of 4 year phase in Same 50% 25% PE RVU Changes Adv Dx Imaging Reduction 25 -99 EPs = 625 events >100 EPs = 2500 events 2012 E-Rx targets for Groups Drugs ASP+6% Drugs Alternative Pricing AMP+3% Where drug is lower than 5% less than Model ASP+6% HOPD ASP+4% Same ASP CMS PR and FR Published as Noted 32

Proposed Rule 2012 MC-PFS FImpact to specialties as projected by CMS without a CF change üHem-Onc = 0% üRheumatology = 0% üUrology = 0% üGastroenterology = 0% üDermatology = 0% üRad Onc = - 4% üDx Imaging = - 4% *2012 is year 3 of the 4 year phase in of RVU changes 33 33

34

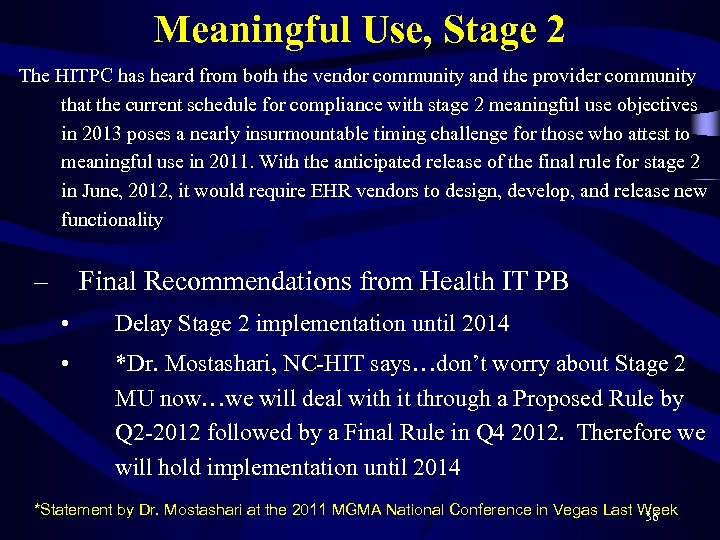

Meaningful Use, Stage 2 The HITPC has heard from both the vendor community and the provider community that the current schedule for compliance with stage 2 meaningful use objectives in 2013 poses a nearly insurmountable timing challenge for those who attest to meaningful use in 2011. With the anticipated release of the final rule for stage 2 in June, 2012, it would require EHR vendors to design, develop, and release new functionality – Final Recommendations from Health IT PB • Delay Stage 2 implementation until 2014 • *Dr. Mostashari, NC-HIT says…don’t worry about Stage 2 MU now…we will deal with it through a Proposed Rule by Q 2 -2012 followed by a Final Rule in Q 4 2012. Therefore we will hold implementation until 2014 *Statement by Dr. Mostashari at the 2011 MGMA National Conference in Vegas Last Week 36

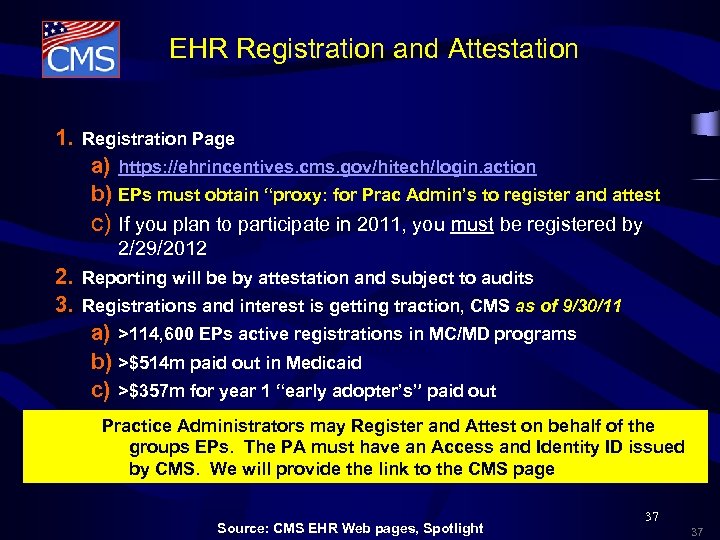

EHR Registration and Attestation 1. Registration Page a) https: //ehrincentives. cms. gov/hitech/login. action b) EPs must obtain “proxy: for Prac Admin’s to register and attest c) If you plan to participate in 2011, you must be registered by 2/29/2012 2. Reporting will be by attestation and subject to audits 3. Registrations and interest is getting traction, CMS as of 9/30/11 a) >114, 600 EPs active registrations in MC/MD programs b) >$514 m paid out in Medicaid c) >$357 m for year 1 “early adopter’s” paid out Practice Administrators may Register and Attest on behalf of the groups EPs. The PA must have an Access and Identity ID issued by CMS. We will provide the link to the CMS page Source: CMS EHR Web pages, Spotlight 37 37

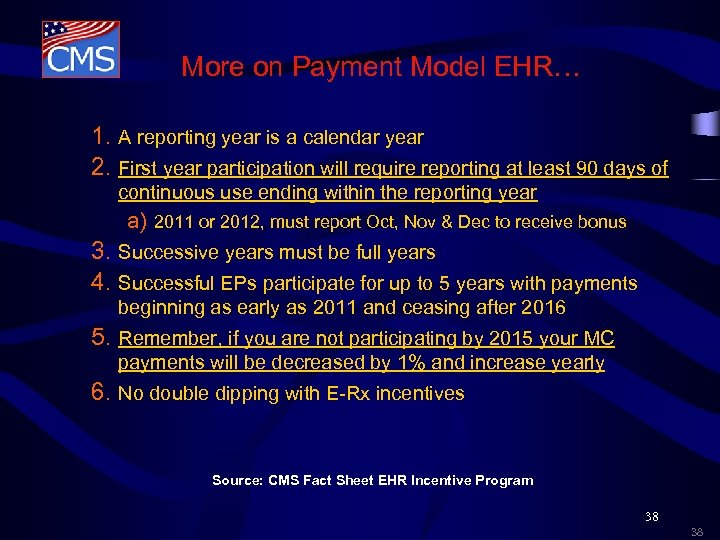

More on Payment Model EHR… 1. A reporting year is a calendar year 2. First year participation will require reporting at least 90 days of continuous use ending within the reporting year a) 2011 or 2012, must report Oct, Nov & Dec to receive bonus 3. Successive years must be full years 4. Successful EPs participate for up to 5 years with payments beginning as early as 2011 and ceasing after 2016 5. Remember, if you are not participating by 2015 your MC payments will be decreased by 1% and increase yearly 6. No double dipping with E-Rx incentives Source: CMS Fact Sheet EHR Incentive Program 38 38

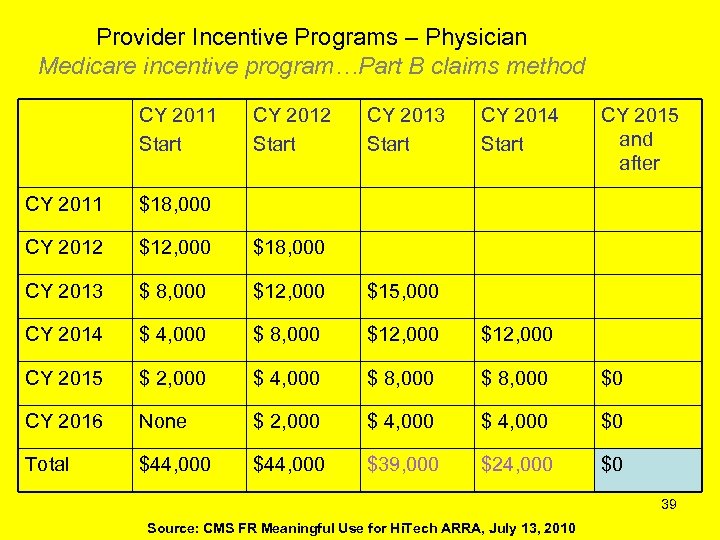

Provider Incentive Programs – Physician Medicare incentive program…Part B claims method CY 2011 Start CY 2012 Start CY 2013 Start CY 2014 Start CY 2015 and after CY 2011 $18, 000 CY 2012 $12, 000 $18, 000 CY 2013 $ 8, 000 $12, 000 $15, 000 CY 2014 $ 4, 000 $ 8, 000 $12, 000 CY 2015 $ 2, 000 $ 4, 000 $ 8, 000 $0 CY 2016 None $ 2, 000 $ 4, 000 $0 Total $44, 000 $39, 000 $24, 000 $0 39 Source: CMS FR Meaningful Use for Hi. Tech ARRA, July 13, 2010

40

41 41

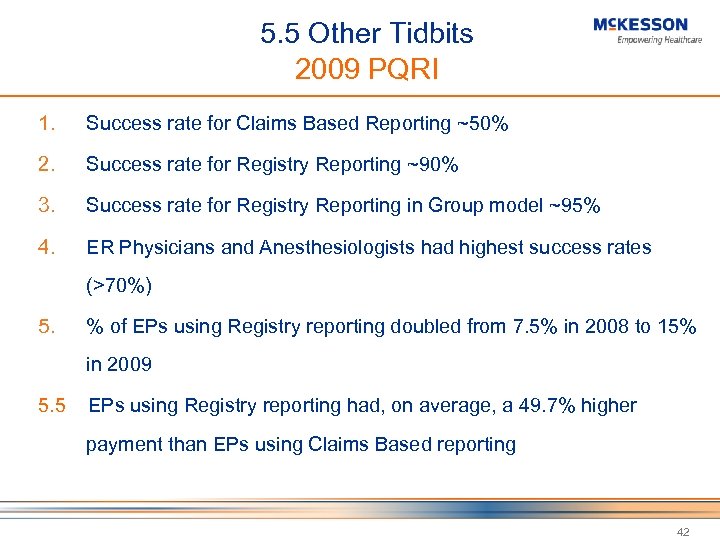

5. 5 Other Tidbits 2009 PQRI 1. Success rate for Claims Based Reporting ~50% 2. Success rate for Registry Reporting ~90% 3. Success rate for Registry Reporting in Group model ~95% 4. ER Physicians and Anesthesiologists had highest success rates (>70%) 5. % of EPs using Registry reporting doubled from 7. 5% in 2008 to 15% in 2009 5. 5 EPs using Registry reporting had, on average, a 49. 7% higher payment than EPs using Claims Based reporting 42

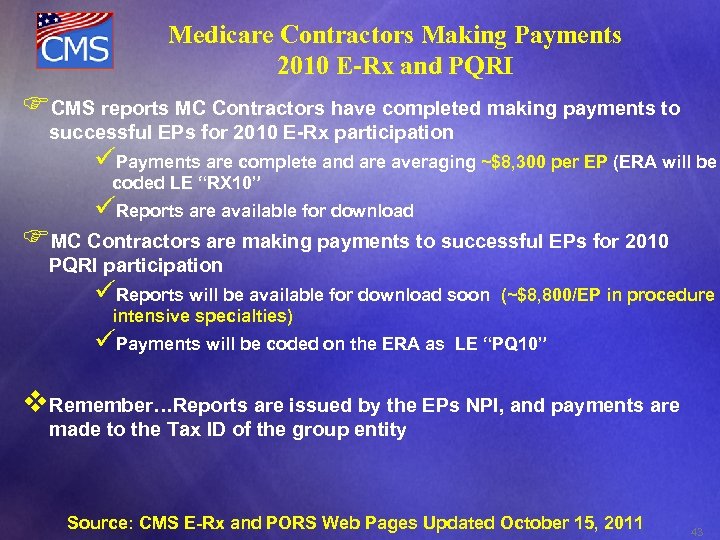

Medicare Contractors Making Payments 2010 E-Rx and PQRI FCMS reports MC Contractors have completed making payments to successful EPs for 2010 E-Rx participation üPayments are complete and are averaging ~$8, 300 per EP (ERA will be coded LE “RX 10” üReports are available for download FMC Contractors are making payments to successful EPs for 2010 PQRI participation üReports will be available for download soon (~$8, 800/EP in procedure intensive specialties) üPayments will be coded on the ERA as LE “PQ 10” v. Remember…Reports are issued by the EPs NPI, and payments are made to the Tax ID of the group entity Source: CMS E-Rx and PORS Web Pages Updated October 15, 2011 43

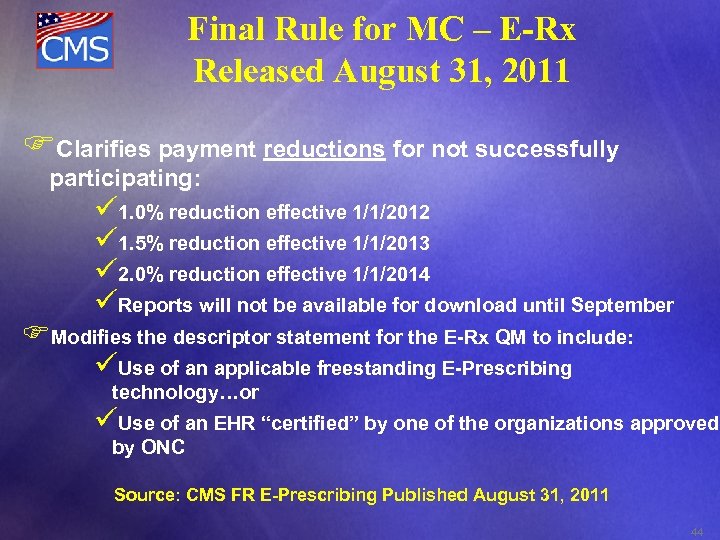

Final Rule for MC – E-Rx Released August 31, 2011 FClarifies payment reductions for not successfully participating: ü 1. 0% reduction effective 1/1/2012 ü 1. 5% reduction effective 1/1/2013 ü 2. 0% reduction effective 1/1/2014 üReports will not be available for download until September FModifies the descriptor statement for the E-Rx QM to include: üUse of an applicable freestanding E-Prescribing technology…or üUse of an EHR “certified” by one of the organizations approved by ONC Source: CMS FR E-Prescribing Published August 31, 2011 44

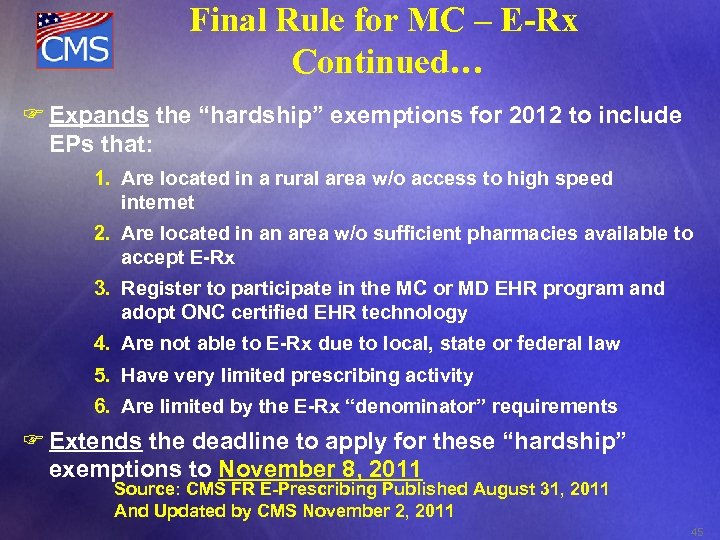

Final Rule for MC – E-Rx Continued… F Expands the “hardship” exemptions for 2012 to include EPs that: 1. Are located in a rural area w/o access to high speed internet 2. Are located in an area w/o sufficient pharmacies available to accept E-Rx 3. Register to participate in the MC or MD EHR program and adopt ONC certified EHR technology 4. Are not able to E-Rx due to local, state or federal law 5. Have very limited prescribing activity 6. Are limited by the E-Rx “denominator” requirements F Extends the deadline to apply for these “hardship” exemptions to November 8, 2011 Source: CMS FR E-Prescribing Published August 31, 2011 And Updated by CMS November 2, 2011 45

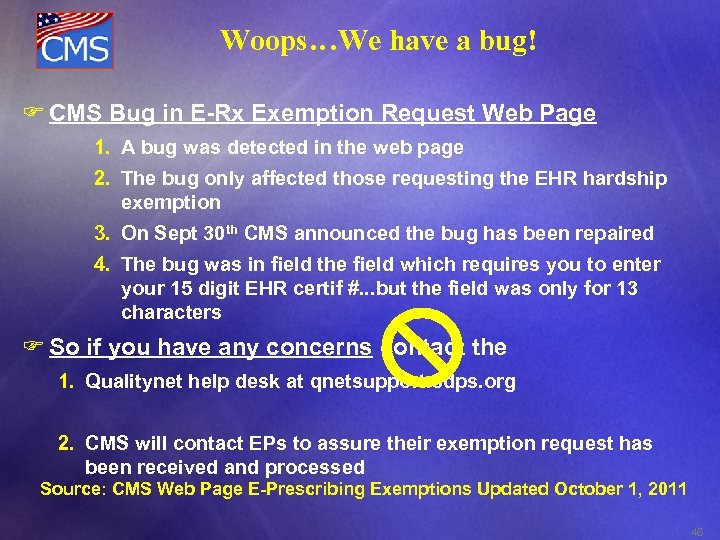

Woops…We have a bug! F CMS Bug in E-Rx Exemption Request Web Page 1. A bug was detected in the web page 2. The bug only affected those requesting the EHR hardship exemption 3. On Sept 30 th CMS announced the bug has been repaired 4. The bug was in field the field which requires you to enter your 15 digit EHR certif #. . . but the field was only for 13 characters F So if you have any concerns contact the 1. Qualitynet help desk at qnetsupport. sdps. org 2. CMS will contact EPs to assure their exemption request has been received and processed Source: CMS Web Page E-Prescribing Exemptions Updated October 1, 2011 46

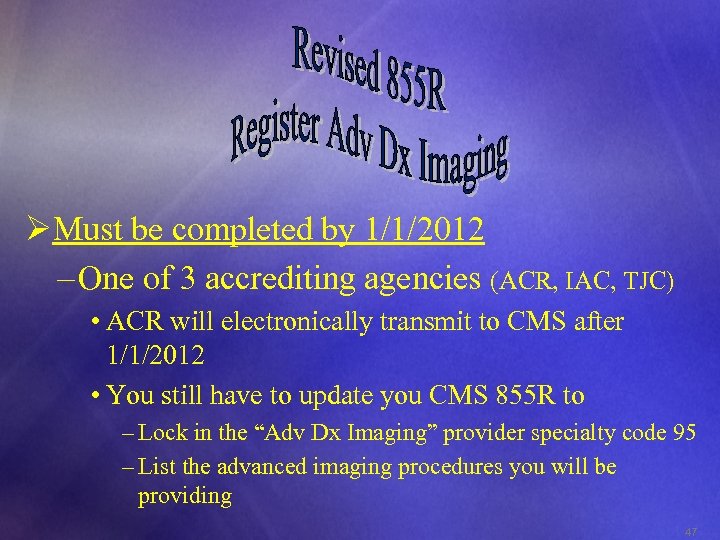

ØMust be completed by 1/1/2012 – One of 3 accrediting agencies (ACR, IAC, TJC) • ACR will electronically transmit to CMS after 1/1/2012 • You still have to update you CMS 855 R to – Lock in the “Adv Dx Imaging” provider specialty code 95 – List the advanced imaging procedures you will be providing 47

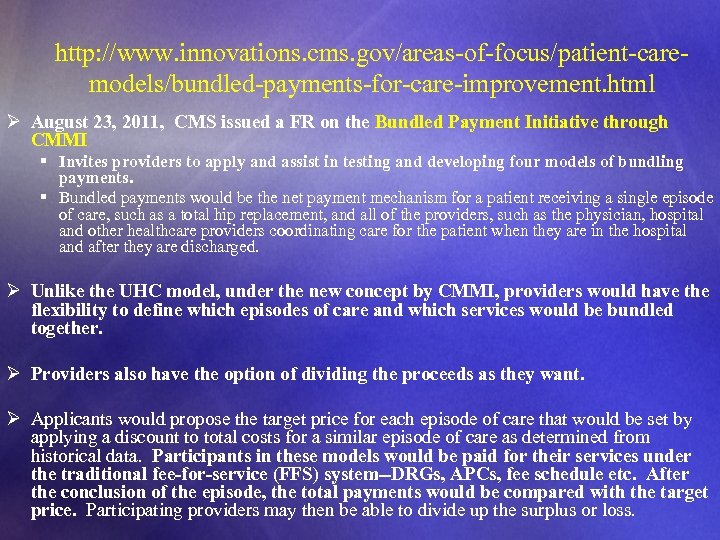

http: //www. innovations. cms. gov/areas-of-focus/patient-caremodels/bundled-payments-for-care-improvement. html Ø August 23, 2011, CMS issued a FR on the Bundled Payment Initiative through CMMI § Invites providers to apply and assist in testing and developing four models of bundling payments. § Bundled payments would be the net payment mechanism for a patient receiving a single episode of care, such as a total hip replacement, and all of the providers, such as the physician, hospital and other healthcare providers coordinating care for the patient when they are in the hospital and after they are discharged. Ø Unlike the UHC model, under the new concept by CMMI, providers would have the flexibility to define which episodes of care and which services would be bundled together. Ø Providers also have the option of dividing the proceeds as they want. Ø Applicants would propose the target price for each episode of care that would be set by applying a discount to total costs for a similar episode of care as determined from historical data. Participants in these models would be paid for their services under the traditional fee-for-service (FFS) system--DRGs, APCs, fee schedule etc. After the conclusion of the episode, the total payments would be compared with the target price. Participating providers may then be able to divide up the surplus or loss.

49

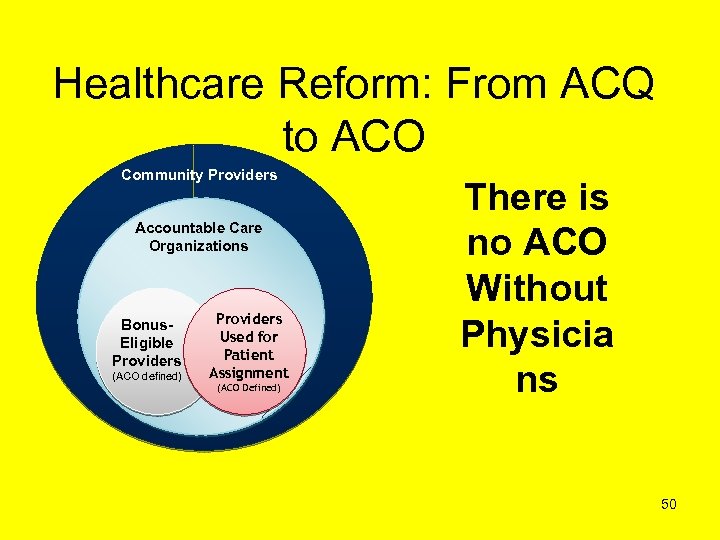

Healthcare Reform: From ACQ to ACO Community Providers Accountable Care Organizations Bonus. Eligible Providers (ACO defined) Providers Used for Patient Assignment (ACO Defined) There is no ACO Without Physicia ns 50

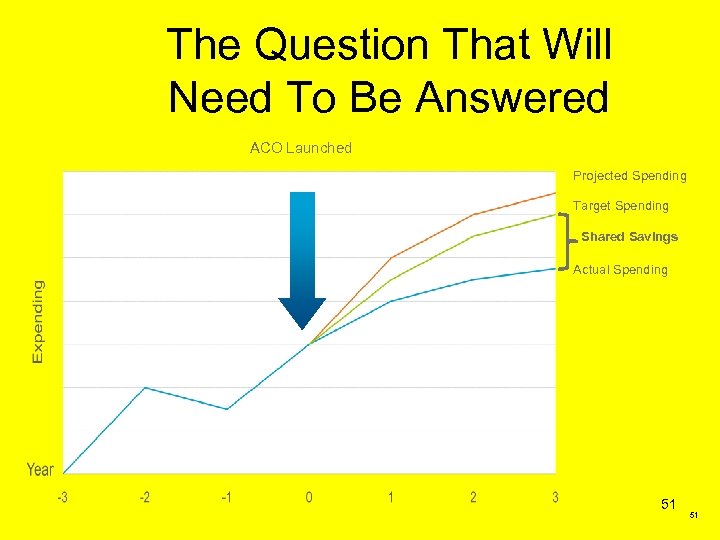

The Question That Will Need To Be Answered ACO Launched Projected Spending Target Spending Shared Savings Actual Spending 51 51

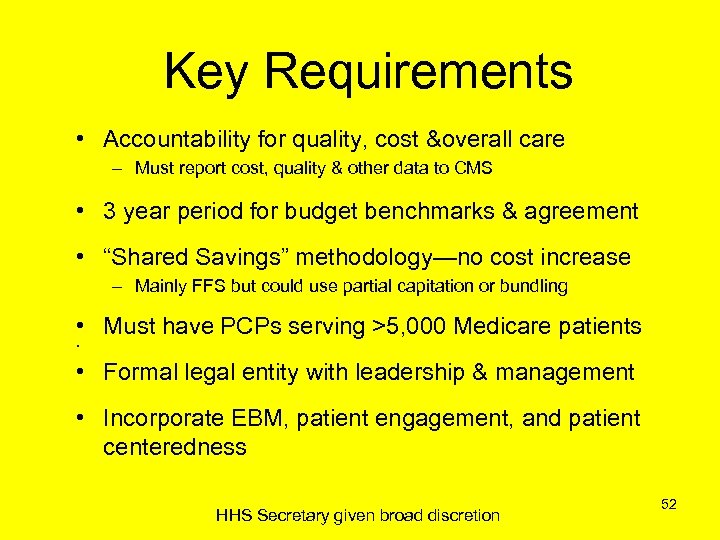

Key Requirements • Accountability for quality, cost &overall care – Must report cost, quality & other data to CMS • 3 year period for budget benchmarks & agreement • “Shared Savings” methodology—no cost increase – Mainly FFS but could use partial capitation or bundling • Must have PCPs serving >5, 000 Medicare patients • • Formal legal entity with leadership & management • Incorporate EBM, patient engagement, and patient centeredness HHS Secretary given broad discretion 52

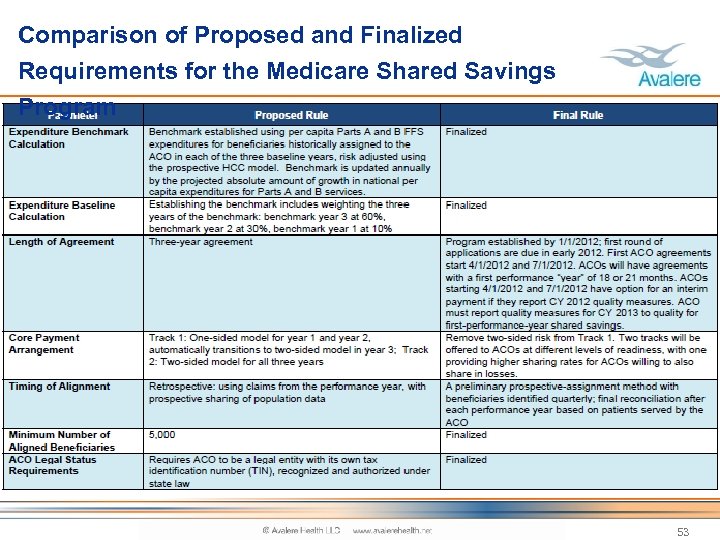

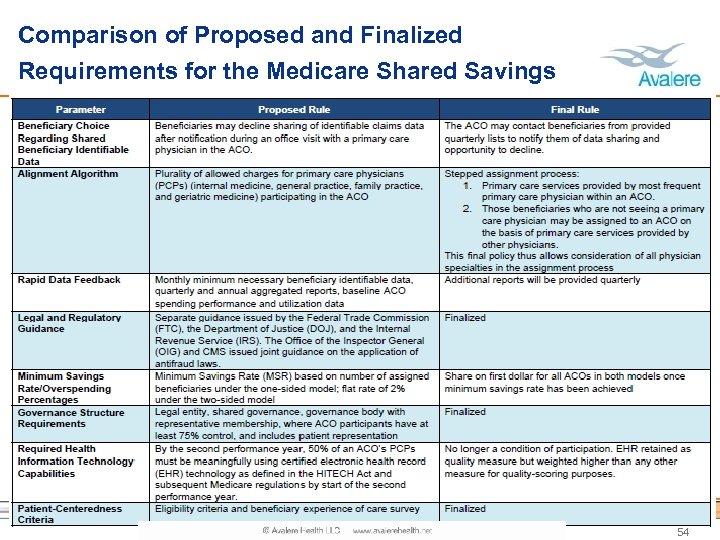

Comparison of Proposed and Finalized Requirements for the Medicare Shared Savings Program 53

Comparison of Proposed and Finalized Requirements for the Medicare Shared Savings Program 54

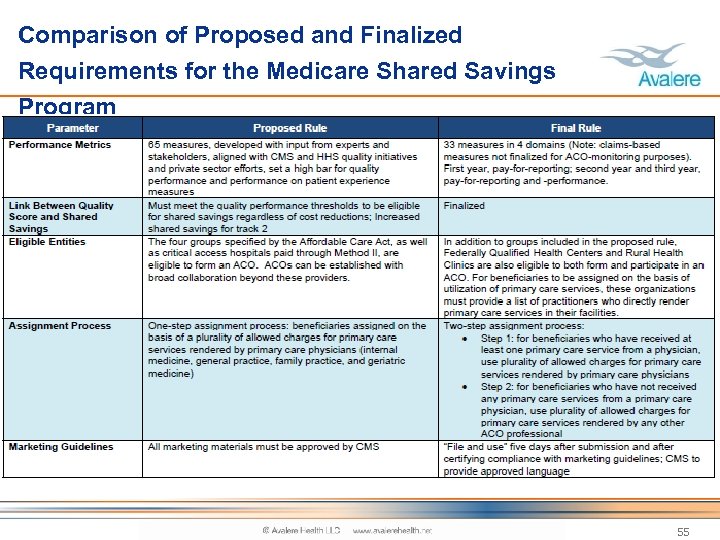

Comparison of Proposed and Finalized Requirements for the Medicare Shared Savings Program 55

The Bottom Line… • The ACO game is in the early stages of definition – Keep options open and remain independent while the dust settles – Some specialties are likely to have additional value-based options with Medicare before all is done • Potential pilot initiatives (demonstrations) through CMI • Value-based reimbursement generally depends on… – The ability to deliver and document high quality, cost effective care is vital regardless of whether one joins and ACO or remains independent – Success requires scale, investment and changes in practice 56 governance and practice patterns

The Bottom Line (cont. ) • Relative to hospitals – Hospitals need physicians more than physicians need hospitals – Hospitals are high cost providers/are targets of budget legislation – Physician employment in the past failed and is likely to fail again – Research shows that hospital centric ACO's failed to save money, and more importantly, did not make money • PGP Demonstration, 5 years • 4 out of 10 received a payment bonus – Winners split $29. 4 m • Only 2 hit bonus all 5 years – Marshfield…$15. 8 m – University of Michigan Faculty Medical Group…$5. 3 m 57

58

Akscin’s 5. 5 Pearls of Wisdom For Success Engage Focus Address Develop Measure Celebrate ! 59

The Picture is Clearer… The Future is Now!

5e958d9d7346da06ac7a45cb9b9351b8.ppt