779fc76b3cbf25b5843362924341d323.ppt

- Количество слайдов: 46

What’s It Worth? How Technology Companies are Valued Today Presented by: Frank G. E. Bollmann Standard & Poor’s Corporate Value Consulting May 18, 2002 Soup to Nuts 2002: Advanced Survival Strategies

What’s It Worth? How Technology Companies are Valued Today Presented by: Frank G. E. Bollmann Standard & Poor’s Corporate Value Consulting May 18, 2002 Soup to Nuts 2002: Advanced Survival Strategies

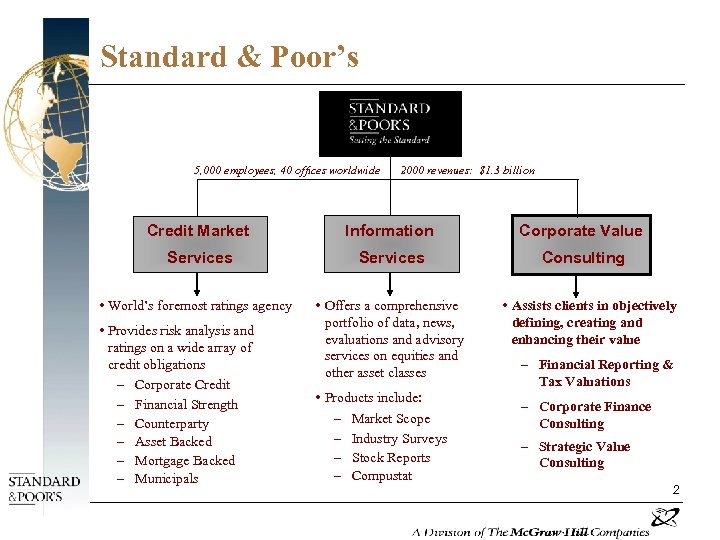

Standard & Poor’s 5, 000 employees, 40 offices worldwide 2000 revenues: $1. 3 billion Credit Market Information Corporate Value Services Consulting • World’s foremost ratings agency • Provides risk analysis and ratings on a wide array of credit obligations – Corporate Credit – Financial Strength – Counterparty – Asset Backed – Mortgage Backed – Municipals • Offers a comprehensive portfolio of data, news, evaluations and advisory services on equities and other asset classes • Products include: – Market Scope – Industry Surveys – Stock Reports – Compustat • Assists clients in objectively defining, creating and enhancing their value – Financial Reporting & Tax Valuations – Corporate Finance Consulting – Strategic Value Consulting 2

Standard & Poor’s 5, 000 employees, 40 offices worldwide 2000 revenues: $1. 3 billion Credit Market Information Corporate Value Services Consulting • World’s foremost ratings agency • Provides risk analysis and ratings on a wide array of credit obligations – Corporate Credit – Financial Strength – Counterparty – Asset Backed – Mortgage Backed – Municipals • Offers a comprehensive portfolio of data, news, evaluations and advisory services on equities and other asset classes • Products include: – Market Scope – Industry Surveys – Stock Reports – Compustat • Assists clients in objectively defining, creating and enhancing their value – Financial Reporting & Tax Valuations – Corporate Finance Consulting – Strategic Value Consulting 2

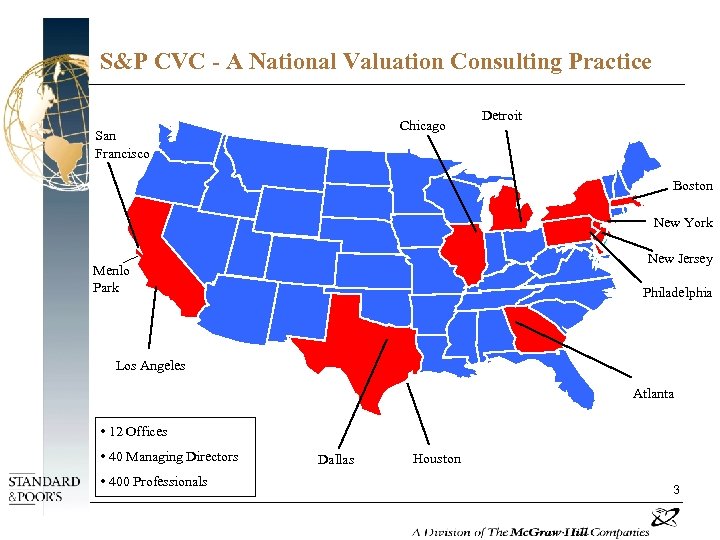

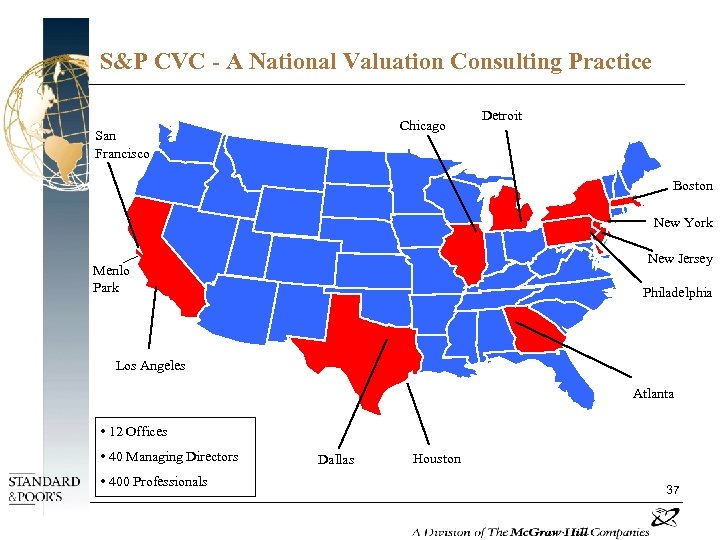

S&P CVC - A National Valuation Consulting Practice Chicago San Francisco Detroit Boston New York New Jersey Menlo Park Philadelphia Los Angeles Atlanta • 12 Offices • 40 Managing Directors • 400 Professionals Dallas Houston 3

S&P CVC - A National Valuation Consulting Practice Chicago San Francisco Detroit Boston New York New Jersey Menlo Park Philadelphia Los Angeles Atlanta • 12 Offices • 40 Managing Directors • 400 Professionals Dallas Houston 3

Overview l What is Value? l Valuation Approaches l Alternative Exit Strategies l Maximizing Value 4

Overview l What is Value? l Valuation Approaches l Alternative Exit Strategies l Maximizing Value 4

What is Value? l Market Value – Amount at which a property or a business would change hands between a willing seller and a willing buyer, when neither is acting under compulsion, and both have reasonable knowledge of the relevant facts l Investment Value – The value of business or property to a particular investor based upon their investment return requirements l Intrinsic Value – The value of business or property based upon an analysis of the underlying fundamental facts l Liquidation Value – The value of the assets of the business if sold piecemeal (orderly or forced disposition) l Strategic Value – The value of the business to a strategic buyer, including premiums for synergies and optimal management of assets 5

What is Value? l Market Value – Amount at which a property or a business would change hands between a willing seller and a willing buyer, when neither is acting under compulsion, and both have reasonable knowledge of the relevant facts l Investment Value – The value of business or property to a particular investor based upon their investment return requirements l Intrinsic Value – The value of business or property based upon an analysis of the underlying fundamental facts l Liquidation Value – The value of the assets of the business if sold piecemeal (orderly or forced disposition) l Strategic Value – The value of the business to a strategic buyer, including premiums for synergies and optimal management of assets 5

Market Value assumes: l Many buyers, many sellers l No abnormal pressure – Market value assumes that the property or business is exposed to the market for a reasonable period of time l Demand Supply Price – A market means that there are numerous buyers and sellers – In a perfect market no one buyer or seller can affect the price Quantity Reasonable knowledge of all the relevant facts – If a buyer or seller is not fully informed, the negotiators may not make a prudent decision

Market Value assumes: l Many buyers, many sellers l No abnormal pressure – Market value assumes that the property or business is exposed to the market for a reasonable period of time l Demand Supply Price – A market means that there are numerous buyers and sellers – In a perfect market no one buyer or seller can affect the price Quantity Reasonable knowledge of all the relevant facts – If a buyer or seller is not fully informed, the negotiators may not make a prudent decision

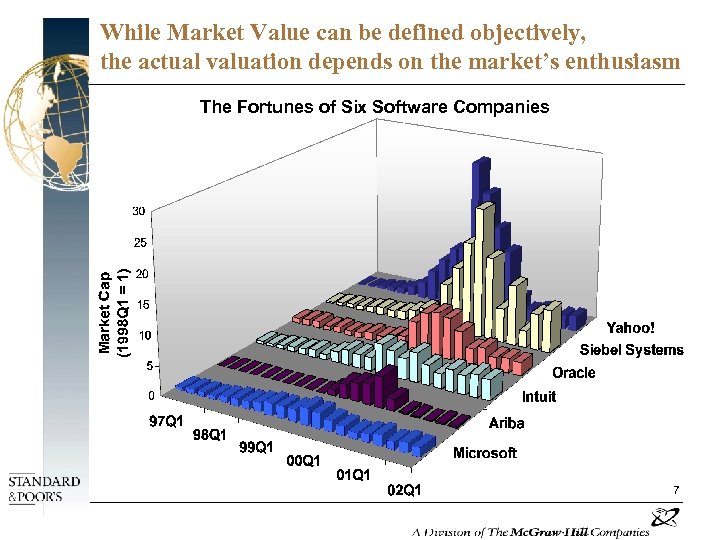

While Market Value can be defined objectively, the actual valuation depends on the market’s enthusiasm The Fortunes of Six Software Companies 7

While Market Value can be defined objectively, the actual valuation depends on the market’s enthusiasm The Fortunes of Six Software Companies 7

Approaches to Quantifying Value l Market Approach – Use multiple of revenues, earnings, or other performance metrics computed by comparing to actual trading activity (current market valuation) of public companies and recent transactions l Discounted Cash Flow (DCF) Approach – Future cash flows discounted to the present by some riskadjusted discount rate (weighted average cost of capital) l Hybrid Approach – Project future cash flows to value the company at a time in the future when there is the potential for an IPO l Replacement Cost Approach l Book Value Approach 8

Approaches to Quantifying Value l Market Approach – Use multiple of revenues, earnings, or other performance metrics computed by comparing to actual trading activity (current market valuation) of public companies and recent transactions l Discounted Cash Flow (DCF) Approach – Future cash flows discounted to the present by some riskadjusted discount rate (weighted average cost of capital) l Hybrid Approach – Project future cash flows to value the company at a time in the future when there is the potential for an IPO l Replacement Cost Approach l Book Value Approach 8

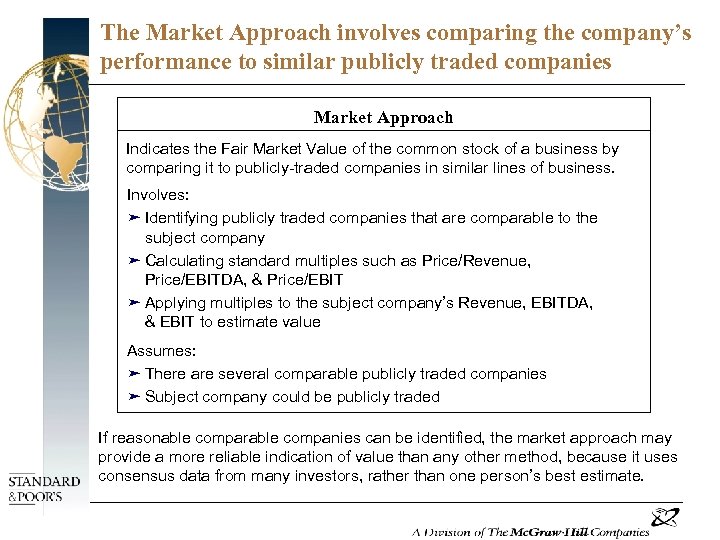

The Market Approach involves comparing the company’s performance to similar publicly traded companies Market Approach Indicates the Fair Market Value of the common stock of a business by comparing it to publicly-traded companies in similar lines of business. Involves: ä Identifying publicly traded companies that are comparable to the subject company ä Calculating standard multiples such as Price/Revenue, Price/EBITDA, & Price/EBIT ä Applying multiples to the subject company’s Revenue, EBITDA, & EBIT to estimate value Assumes: ä There are several comparable publicly traded companies ä Subject company could be publicly traded If reasonable comparable companies can be identified, the market approach may provide a more reliable indication of value than any other method, because it uses consensus data from many investors, rather than one person’s best estimate.

The Market Approach involves comparing the company’s performance to similar publicly traded companies Market Approach Indicates the Fair Market Value of the common stock of a business by comparing it to publicly-traded companies in similar lines of business. Involves: ä Identifying publicly traded companies that are comparable to the subject company ä Calculating standard multiples such as Price/Revenue, Price/EBITDA, & Price/EBIT ä Applying multiples to the subject company’s Revenue, EBITDA, & EBIT to estimate value Assumes: ä There are several comparable publicly traded companies ä Subject company could be publicly traded If reasonable comparable companies can be identified, the market approach may provide a more reliable indication of value than any other method, because it uses consensus data from many investors, rather than one person’s best estimate.

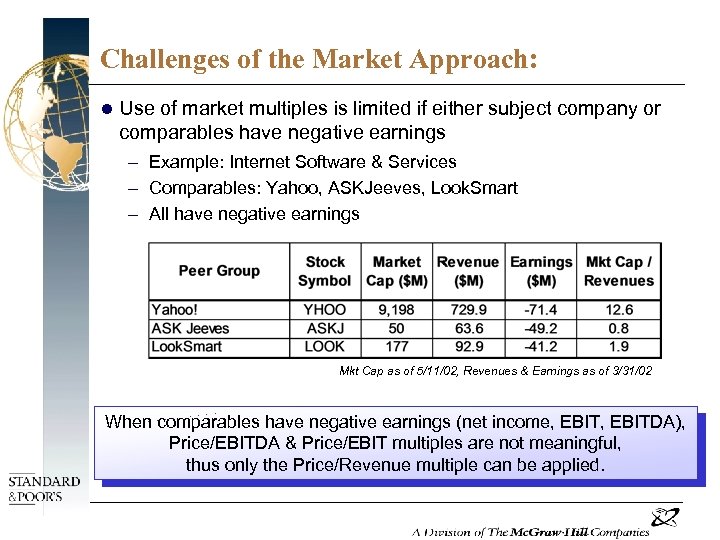

Challenges of the Market Approach: l Use of market multiples is limited if either subject company or comparables have negative earnings – Example: Internet Software & Services – Comparables: Yahoo, ASKJeeves, Look. Smart – All have negative earnings Mkt Cap as of 5/11/02, Revenues & Earnings as of 3/31/02 When comparables have negative earnings (net income, EBITDA), Price/EBITDA & Price/EBIT multiples are not meaningful, thus only the Price/Revenue multiple can be applied.

Challenges of the Market Approach: l Use of market multiples is limited if either subject company or comparables have negative earnings – Example: Internet Software & Services – Comparables: Yahoo, ASKJeeves, Look. Smart – All have negative earnings Mkt Cap as of 5/11/02, Revenues & Earnings as of 3/31/02 When comparables have negative earnings (net income, EBITDA), Price/EBITDA & Price/EBIT multiples are not meaningful, thus only the Price/Revenue multiple can be applied.

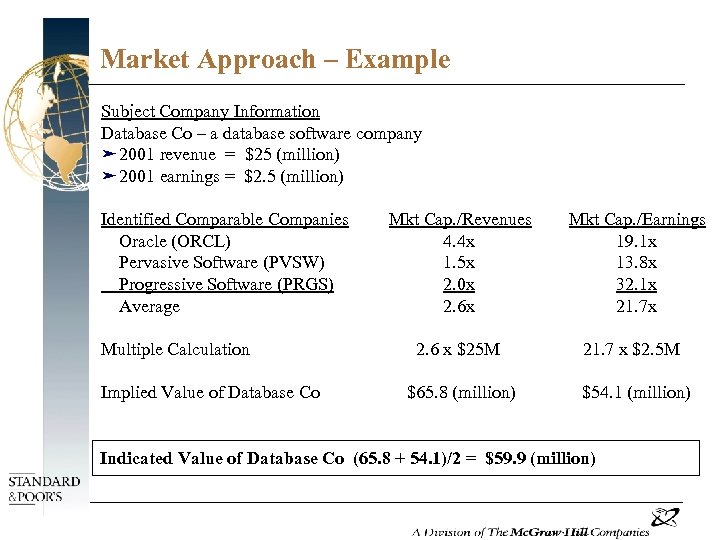

Market Approach – Example Subject Company Information Database Co – a database software company ä 2001 revenue = $25 (million) ä 2001 earnings = $2. 5 (million) Identified Comparable Companies Oracle (ORCL) Pervasive Software (PVSW) Progressive Software (PRGS) Average Multiple Calculation Implied Value of Database Co Mkt Cap. /Revenues 4. 4 x 1. 5 x 2. 0 x 2. 6 x $25 M $65. 8 (million) Mkt Cap. /Earnings 19. 1 x 13. 8 x 32. 1 x 21. 7 x $2. 5 M $54. 1 (million) Indicated Value of Database Co (65. 8 + 54. 1)/2 = $59. 9 (million)

Market Approach – Example Subject Company Information Database Co – a database software company ä 2001 revenue = $25 (million) ä 2001 earnings = $2. 5 (million) Identified Comparable Companies Oracle (ORCL) Pervasive Software (PVSW) Progressive Software (PRGS) Average Multiple Calculation Implied Value of Database Co Mkt Cap. /Revenues 4. 4 x 1. 5 x 2. 0 x 2. 6 x $25 M $65. 8 (million) Mkt Cap. /Earnings 19. 1 x 13. 8 x 32. 1 x 21. 7 x $2. 5 M $54. 1 (million) Indicated Value of Database Co (65. 8 + 54. 1)/2 = $59. 9 (million)

Sources of Information on Comparable Publicly Traded Companies l Compustat l 10 K's - 10 Q's l SDC l Analyst Reports l Bloomberg 12

Sources of Information on Comparable Publicly Traded Companies l Compustat l 10 K's - 10 Q's l SDC l Analyst Reports l Bloomberg 12

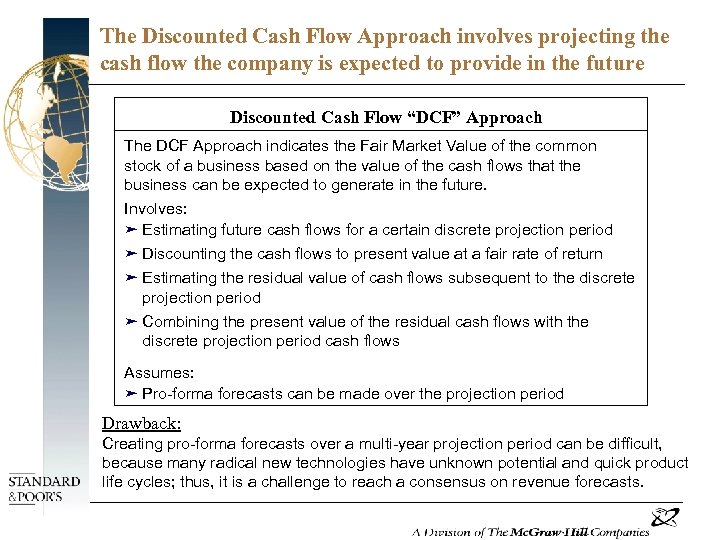

The Discounted Cash Flow Approach involves projecting the cash flow the company is expected to provide in the future Discounted Cash Flow “DCF” Approach The DCF Approach indicates the Fair Market Value of the common stock of a business based on the value of the cash flows that the business can be expected to generate in the future. Involves: ä Estimating future cash flows for a certain discrete projection period ä Discounting the cash flows to present value at a fair rate of return ä Estimating the residual value of cash flows subsequent to the discrete projection period ä Combining the present value of the residual cash flows with the discrete projection period cash flows Assumes: ä Pro-forma forecasts can be made over the projection period Drawback: Creating pro-forma forecasts over a multi-year projection period can be difficult, because many radical new technologies have unknown potential and quick product life cycles; thus, it is a challenge to reach a consensus on revenue forecasts.

The Discounted Cash Flow Approach involves projecting the cash flow the company is expected to provide in the future Discounted Cash Flow “DCF” Approach The DCF Approach indicates the Fair Market Value of the common stock of a business based on the value of the cash flows that the business can be expected to generate in the future. Involves: ä Estimating future cash flows for a certain discrete projection period ä Discounting the cash flows to present value at a fair rate of return ä Estimating the residual value of cash flows subsequent to the discrete projection period ä Combining the present value of the residual cash flows with the discrete projection period cash flows Assumes: ä Pro-forma forecasts can be made over the projection period Drawback: Creating pro-forma forecasts over a multi-year projection period can be difficult, because many radical new technologies have unknown potential and quick product life cycles; thus, it is a challenge to reach a consensus on revenue forecasts.

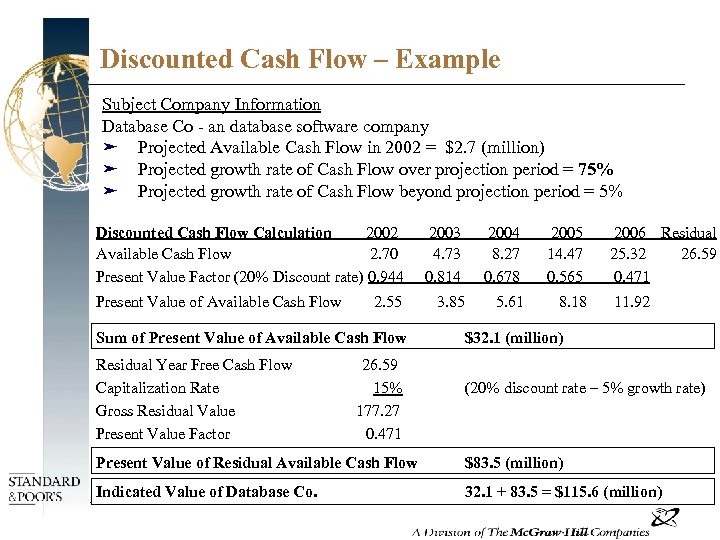

Discounted Cash Flow – Example Subject Company Information Database Co an database software company ä Projected Available Cash Flow in 2002 = $2. 7 (million) ä Projected growth rate of Cash Flow over projection period = 75% ä Projected growth rate of Cash Flow beyond projection period = 5% Discounted Cash Flow Calculation 2002 Available Cash Flow 2. 70 Present Value Factor (20% Discount rate) 0. 944 Present Value of Available Cash Flow 2. 55 Sum of Present Value of Available Cash Flow Residual Year Free Cash Flow Capitalization Rate Gross Residual Value Present Value Factor 26. 59 15% 177. 27 0. 471 2003 4. 73 0. 814 2004 8. 27 0. 678 2005 14. 47 0. 565 3. 85 5. 61 8. 18 2006 Residual 25. 32 26. 59 0. 471 11. 92 $32. 1 (million) (20% discount rate – 5% growth rate) Present Value of Residual Available Cash Flow $83. 5 (million) Indicated Value of Database Co. 32. 1 + 83. 5 = $115. 6 (million)

Discounted Cash Flow – Example Subject Company Information Database Co an database software company ä Projected Available Cash Flow in 2002 = $2. 7 (million) ä Projected growth rate of Cash Flow over projection period = 75% ä Projected growth rate of Cash Flow beyond projection period = 5% Discounted Cash Flow Calculation 2002 Available Cash Flow 2. 70 Present Value Factor (20% Discount rate) 0. 944 Present Value of Available Cash Flow 2. 55 Sum of Present Value of Available Cash Flow Residual Year Free Cash Flow Capitalization Rate Gross Residual Value Present Value Factor 26. 59 15% 177. 27 0. 471 2003 4. 73 0. 814 2004 8. 27 0. 678 2005 14. 47 0. 565 3. 85 5. 61 8. 18 2006 Residual 25. 32 26. 59 0. 471 11. 92 $32. 1 (million) (20% discount rate – 5% growth rate) Present Value of Residual Available Cash Flow $83. 5 (million) Indicated Value of Database Co. 32. 1 + 83. 5 = $115. 6 (million)

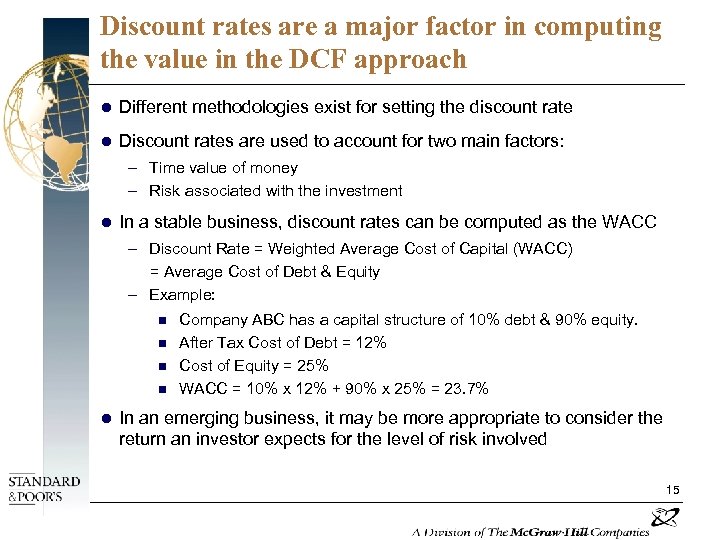

Discount rates are a major factor in computing the value in the DCF approach l Different methodologies exist for setting the discount rate l Discount rates are used to account for two main factors: – Time value of money – Risk associated with the investment l In a stable business, discount rates can be computed as the WACC – Discount Rate = Weighted Average Cost of Capital (WACC) = Average Cost of Debt & Equity – Example: n n l Company ABC has a capital structure of 10% debt & 90% equity. After Tax Cost of Debt = 12% Cost of Equity = 25% WACC = 10% x 12% + 90% x 25% = 23. 7% In an emerging business, it may be more appropriate to consider the return an investor expects for the level of risk involved 15

Discount rates are a major factor in computing the value in the DCF approach l Different methodologies exist for setting the discount rate l Discount rates are used to account for two main factors: – Time value of money – Risk associated with the investment l In a stable business, discount rates can be computed as the WACC – Discount Rate = Weighted Average Cost of Capital (WACC) = Average Cost of Debt & Equity – Example: n n l Company ABC has a capital structure of 10% debt & 90% equity. After Tax Cost of Debt = 12% Cost of Equity = 25% WACC = 10% x 12% + 90% x 25% = 23. 7% In an emerging business, it may be more appropriate to consider the return an investor expects for the level of risk involved 15

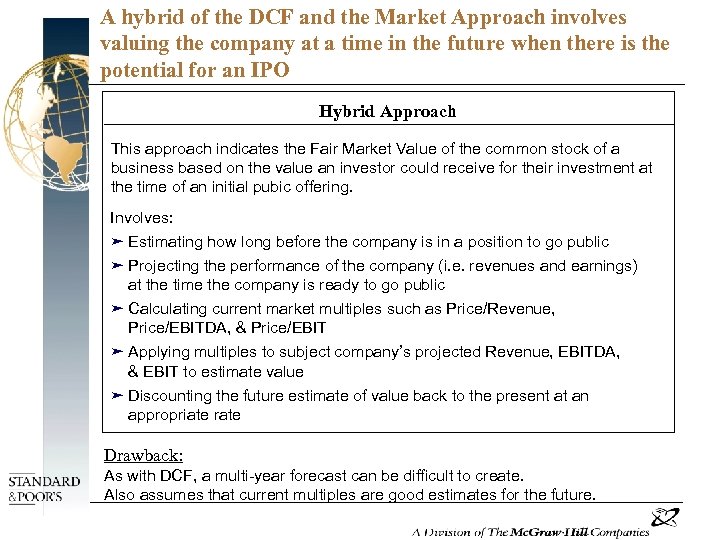

A hybrid of the DCF and the Market Approach involves valuing the company at a time in the future when there is the potential for an IPO Hybrid Approach This approach indicates the Fair Market Value of the common stock of a business based on the value an investor could receive for their investment at the time of an initial pubic offering. Involves: ä Estimating how long before the company is in a position to go public ä Projecting the performance of the company (i. e. revenues and earnings) at the time the company is ready to go public ä Calculating current market multiples such as Price/Revenue, Price/EBITDA, & Price/EBIT ä Applying multiples to subject company’s projected Revenue, EBITDA, & EBIT to estimate value ä Discounting the future estimate of value back to the present at an appropriate rate Drawback: As with DCF, a multi-year forecast can be difficult to create. Also assumes that current multiples are good estimates for the future.

A hybrid of the DCF and the Market Approach involves valuing the company at a time in the future when there is the potential for an IPO Hybrid Approach This approach indicates the Fair Market Value of the common stock of a business based on the value an investor could receive for their investment at the time of an initial pubic offering. Involves: ä Estimating how long before the company is in a position to go public ä Projecting the performance of the company (i. e. revenues and earnings) at the time the company is ready to go public ä Calculating current market multiples such as Price/Revenue, Price/EBITDA, & Price/EBIT ä Applying multiples to subject company’s projected Revenue, EBITDA, & EBIT to estimate value ä Discounting the future estimate of value back to the present at an appropriate rate Drawback: As with DCF, a multi-year forecast can be difficult to create. Also assumes that current multiples are good estimates for the future.

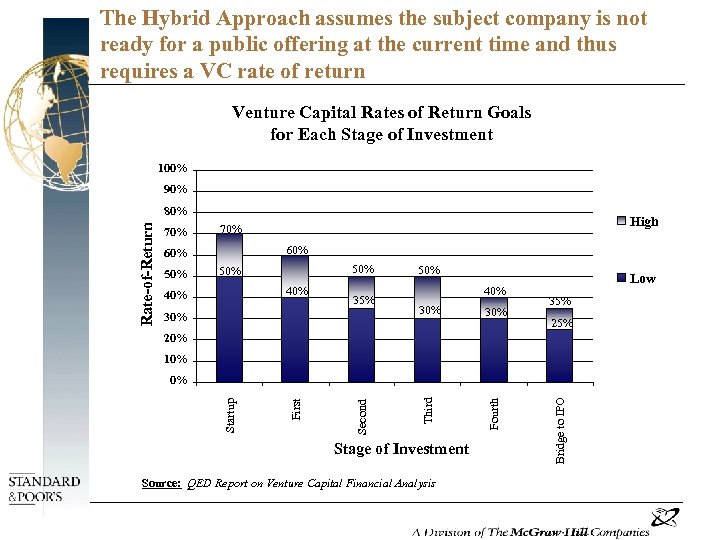

The Hybrid Approach assumes the subject company is not ready for a public offering at the current time and thus requires a VC rate of return Venture Capital Rates of Return Goals for Each Stage of Investment 100% 90% 60% 50% High 70% 50% 40% 35% 30% 50% 40% 30% Fourth 70% Third Rate-of-Return 80% Low 35% 20% 10% Stage of Investment Source: QED Report on Venture Capital Financial Analysis Bridge to IPO Second First Startup 0%

The Hybrid Approach assumes the subject company is not ready for a public offering at the current time and thus requires a VC rate of return Venture Capital Rates of Return Goals for Each Stage of Investment 100% 90% 60% 50% High 70% 50% 40% 35% 30% 50% 40% 30% Fourth 70% Third Rate-of-Return 80% Low 35% 20% 10% Stage of Investment Source: QED Report on Venture Capital Financial Analysis Bridge to IPO Second First Startup 0%

Definitions of stages of company development l “Startup” - companies, usually less than a year old, are involved in early product development and testing. l “First stage” - companies are performing market studies, testing prototypes, and perhaps manufacturing limited amounts of products. l “Second stage” - is usually considered to be when financing for initial expansion is provided. A viable product exists and a market for it has been established. Profits, if any, are not yet meaningful. l “Third stage” - should be experiencing a rapid ramp up in sales. Profit margins should be acceptable but internally generated cash is probably insufficient to meet expansion requirements. l “Fourth stage” - companies should be profitable and growing rapidly. Although capital may still be needed to fuel growth, much of the risk associated with early stage companies has been eliminated. Cash out may be only a year or two away. l “Bridge” or “Mezzanine” - rounds are sometimes done as the cash out time approaches to carry the company to the point that an initial public offering (IPO) can be completed. As a rule of thumb, mezzanine rounds are done within six months of a scheduled IPO.

Definitions of stages of company development l “Startup” - companies, usually less than a year old, are involved in early product development and testing. l “First stage” - companies are performing market studies, testing prototypes, and perhaps manufacturing limited amounts of products. l “Second stage” - is usually considered to be when financing for initial expansion is provided. A viable product exists and a market for it has been established. Profits, if any, are not yet meaningful. l “Third stage” - should be experiencing a rapid ramp up in sales. Profit margins should be acceptable but internally generated cash is probably insufficient to meet expansion requirements. l “Fourth stage” - companies should be profitable and growing rapidly. Although capital may still be needed to fuel growth, much of the risk associated with early stage companies has been eliminated. Cash out may be only a year or two away. l “Bridge” or “Mezzanine” - rounds are sometimes done as the cash out time approaches to carry the company to the point that an initial public offering (IPO) can be completed. As a rule of thumb, mezzanine rounds are done within six months of a scheduled IPO.

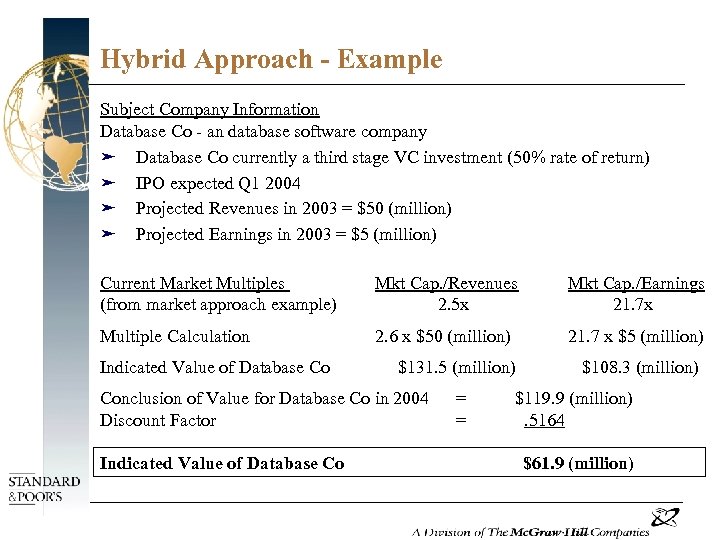

Hybrid Approach - Example Subject Company Information Database Co an database software company ä Database Co currently a third stage VC investment (50% rate of return) ä IPO expected Q 1 2004 ä Projected Revenues in 2003 = $50 (million) ä Projected Earnings in 2003 = $5 (million) Current Market Multiples (from market approach example) Mkt Cap. /Revenues 2. 5 x Mkt Cap. /Earnings 21. 7 x Multiple Calculation 2. 6 x $50 (million) 21. 7 x $5 (million) $131. 5 (million) $108. 3 (million) Indicated Value of Database Co Conclusion of Value for Database Co in 2004 Discount Factor Indicated Value of Database Co = = $119. 9 (million). 5164 $61. 9 (million)

Hybrid Approach - Example Subject Company Information Database Co an database software company ä Database Co currently a third stage VC investment (50% rate of return) ä IPO expected Q 1 2004 ä Projected Revenues in 2003 = $50 (million) ä Projected Earnings in 2003 = $5 (million) Current Market Multiples (from market approach example) Mkt Cap. /Revenues 2. 5 x Mkt Cap. /Earnings 21. 7 x Multiple Calculation 2. 6 x $50 (million) 21. 7 x $5 (million) $131. 5 (million) $108. 3 (million) Indicated Value of Database Co Conclusion of Value for Database Co in 2004 Discount Factor Indicated Value of Database Co = = $119. 9 (million). 5164 $61. 9 (million)

Active management allows the company to minimize risk and optimize value, showing greater potential l Traditional valuation methods consider a single route to value or a few scenarios. – Dismisses uncertainty too quickly – Ignores management’s ability to switch paths depending on how the future unfolds l Real Options Valuation recognizes that management can learn about and adapt to changing conditions. – Provides a more complete, realistic view of the future, which often justifies a higher valuation – A dynamic roadmap shows how to manage the investment – when to kill it, when to accelerate investment, when to go for broke – 27% of CFO’s “always” or “almost always” incorporate real options when evaluating strategic investment projects* *Source: Graham and Harvey, “The theory and practice of corporate finance: evidence from the field”, Journal of Financial Economics vol. 60 (2001) pp. 187 -243. 20

Active management allows the company to minimize risk and optimize value, showing greater potential l Traditional valuation methods consider a single route to value or a few scenarios. – Dismisses uncertainty too quickly – Ignores management’s ability to switch paths depending on how the future unfolds l Real Options Valuation recognizes that management can learn about and adapt to changing conditions. – Provides a more complete, realistic view of the future, which often justifies a higher valuation – A dynamic roadmap shows how to manage the investment – when to kill it, when to accelerate investment, when to go for broke – 27% of CFO’s “always” or “almost always” incorporate real options when evaluating strategic investment projects* *Source: Graham and Harvey, “The theory and practice of corporate finance: evidence from the field”, Journal of Financial Economics vol. 60 (2001) pp. 187 -243. 20

Alternative Exit Strategies l Options for raising capital include: – Venture Capital – Being acquired – IPO l Market value is based on: – – Willing seller Willing buyer Neither under compulsion Both with knowledge of the relevant facts 21

Alternative Exit Strategies l Options for raising capital include: – Venture Capital – Being acquired – IPO l Market value is based on: – – Willing seller Willing buyer Neither under compulsion Both with knowledge of the relevant facts 21

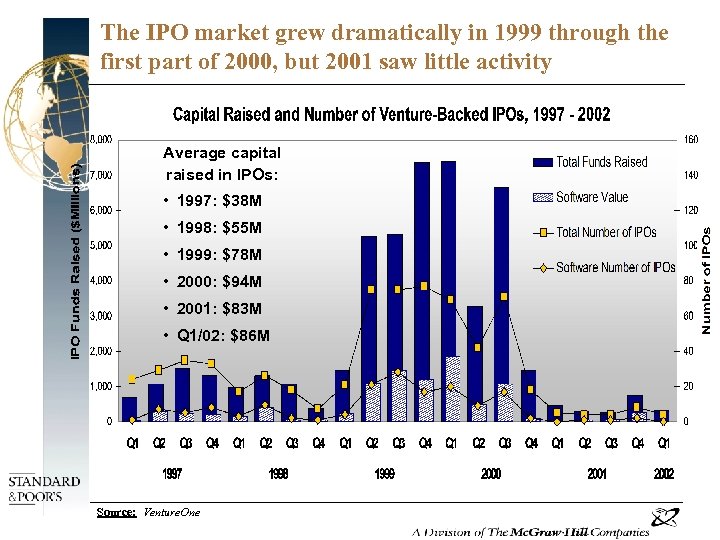

The IPO market grew dramatically in 1999 through the first part of 2000, but 2001 saw little activity Average capital raised in IPOs: • 1997: $38 M • 1998: $55 M • 1999: $78 M • 2000: $94 M • 2001: $83 M • Q 1/02: $86 M Source: Venture. One

The IPO market grew dramatically in 1999 through the first part of 2000, but 2001 saw little activity Average capital raised in IPOs: • 1997: $38 M • 1998: $55 M • 1999: $78 M • 2000: $94 M • 2001: $83 M • Q 1/02: $86 M Source: Venture. One

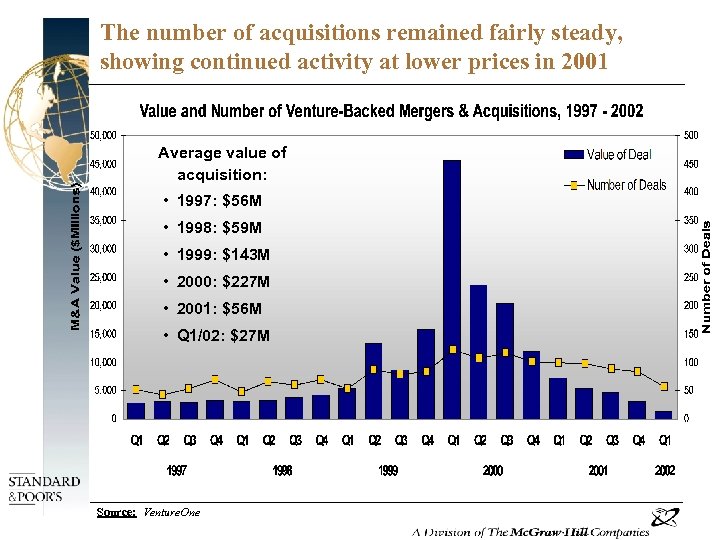

The number of acquisitions remained fairly steady, showing continued activity at lower prices in 2001 Average value of acquisition: • 1997: $56 M • 1998: $59 M • 1999: $143 M • 2000: $227 M • 2001: $56 M • Q 1/02: $27 M Source: Venture. One

The number of acquisitions remained fairly steady, showing continued activity at lower prices in 2001 Average value of acquisition: • 1997: $56 M • 1998: $59 M • 1999: $143 M • 2000: $227 M • 2001: $56 M • Q 1/02: $27 M Source: Venture. One

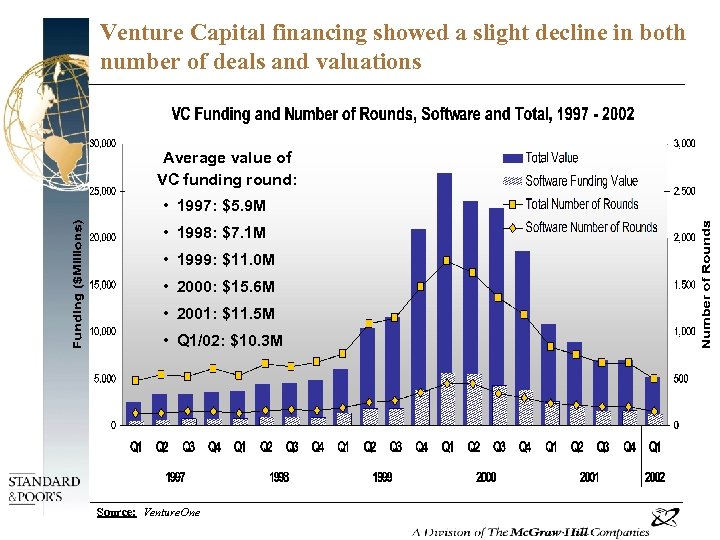

Venture Capital financing showed a slight decline in both number of deals and valuations Average value of VC funding round: • 1997: $5. 9 M • 1998: $7. 1 M • 1999: $11. 0 M • 2000: $15. 6 M • 2001: $11. 5 M • Q 1/02: $10. 3 M Source: Venture. One

Venture Capital financing showed a slight decline in both number of deals and valuations Average value of VC funding round: • 1997: $5. 9 M • 1998: $7. 1 M • 1999: $11. 0 M • 2000: $15. 6 M • 2001: $11. 5 M • Q 1/02: $10. 3 M Source: Venture. One

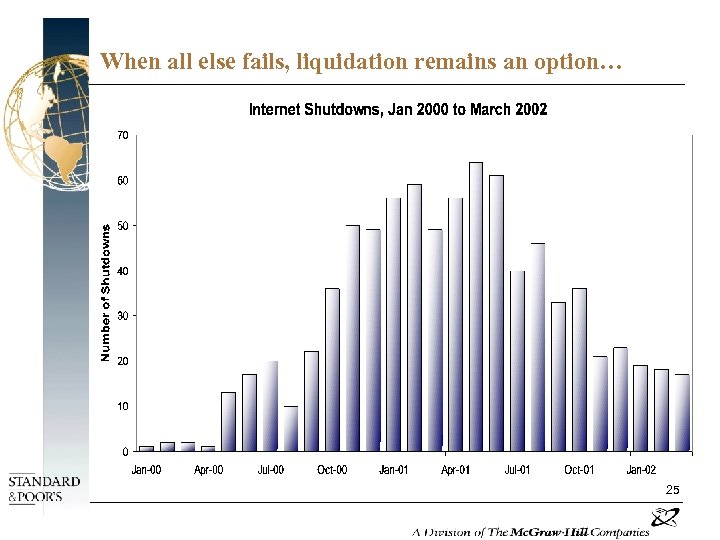

When all else fails, liquidation remains an option… 25

When all else fails, liquidation remains an option… 25

Value depends on the conditions surrounding the sale l Value as part of a going concern – This terminology implies the property is to be valued in place as part of the business. This value is alternatively called value-in-use. Value-in-use considers all of the costs involved in putting the property in place including freight, handling, installation, testing and debugging. It may also include turnkey costs or the entrepreneurial effort to manage the above process. l Value as part of an assemblage – This terminology considers that assembled assets not currently in production may have a greater value than if liquidated piecemeal. l Value as part of an orderly liquidation – If there is no opportunity to sell the assets on an assembled basis then this premise would assume piecemeal sale which would negate asset incorporation costs. l Value as part of a forced liquidation – If the assets must be sold piecemeal and if there will be less than normal exposure to the market, then this premise is appropriate. 26

Value depends on the conditions surrounding the sale l Value as part of a going concern – This terminology implies the property is to be valued in place as part of the business. This value is alternatively called value-in-use. Value-in-use considers all of the costs involved in putting the property in place including freight, handling, installation, testing and debugging. It may also include turnkey costs or the entrepreneurial effort to manage the above process. l Value as part of an assemblage – This terminology considers that assembled assets not currently in production may have a greater value than if liquidated piecemeal. l Value as part of an orderly liquidation – If there is no opportunity to sell the assets on an assembled basis then this premise would assume piecemeal sale which would negate asset incorporation costs. l Value as part of a forced liquidation – If the assets must be sold piecemeal and if there will be less than normal exposure to the market, then this premise is appropriate. 26

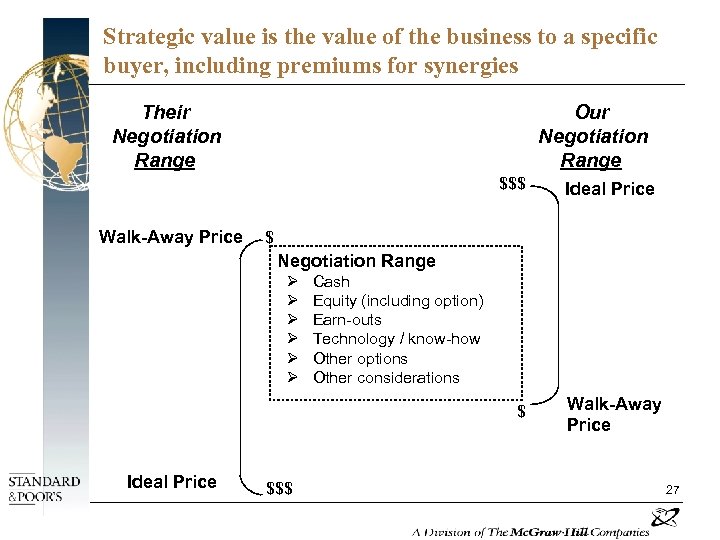

Strategic value is the value of the business to a specific buyer, including premiums for synergies Their Negotiation Range Our Negotiation Range $$$ Walk-Away Price Ideal Price $ Negotiation Range Ø Ø Ø Cash Equity (including option) Earn-outs Technology / know-how Other options Other considerations $ Ideal Price $$$ Walk-Away Price 27

Strategic value is the value of the business to a specific buyer, including premiums for synergies Their Negotiation Range Our Negotiation Range $$$ Walk-Away Price Ideal Price $ Negotiation Range Ø Ø Ø Cash Equity (including option) Earn-outs Technology / know-how Other options Other considerations $ Ideal Price $$$ Walk-Away Price 27

Maximizing Value l External Factors: – Industry Attractiveness – IPO Window l Internal Factors: – – – Clearly defined strategy Right management Critical mass – roll-ups, & acquisitions Historic success Appropriate compensation system to attract and retain valuable employees – Effective information system – Business advisors – Legal Counsel, Investment Bank and Auditor 28

Maximizing Value l External Factors: – Industry Attractiveness – IPO Window l Internal Factors: – – – Clearly defined strategy Right management Critical mass – roll-ups, & acquisitions Historic success Appropriate compensation system to attract and retain valuable employees – Effective information system – Business advisors – Legal Counsel, Investment Bank and Auditor 28

Other, more qualitative measures still drive much of the valuation for early-stage companies l Patronage – Valuation is influenced by the relationships and reputation a company develops with partners, customers, and the marketplace in general (example: Internet company’s stock price jumps when they are “legitimized” through the announcement of a relationship with an industry leader like Microsoft or Intel). l Employees – The value of a software company is more than ever represented in the intellectual capacity, creativity, and energy of its employees. As many companies downsize, “reengineer”, cut benefits, demand more creativity, and shift programming jobs overseas, the motivation for the best and brightest programmers will be entrepreneurial motivation. l Flexibility – Speed, creativity, and the ability to customize increasingly are valued over efficiency

Other, more qualitative measures still drive much of the valuation for early-stage companies l Patronage – Valuation is influenced by the relationships and reputation a company develops with partners, customers, and the marketplace in general (example: Internet company’s stock price jumps when they are “legitimized” through the announcement of a relationship with an industry leader like Microsoft or Intel). l Employees – The value of a software company is more than ever represented in the intellectual capacity, creativity, and energy of its employees. As many companies downsize, “reengineer”, cut benefits, demand more creativity, and shift programming jobs overseas, the motivation for the best and brightest programmers will be entrepreneurial motivation. l Flexibility – Speed, creativity, and the ability to customize increasingly are valued over efficiency

Conclusions l “Value is in the eye of the beholder” l The bar to IPO has been raised l M&A deals may be easier, since you deal with an educated audience only l Investors of all kinds demand solid fundamentals – No more “exotic” multiples – Focus on income and revenue l The gap between traditional valuation approaches and the market is closing 30

Conclusions l “Value is in the eye of the beholder” l The bar to IPO has been raised l M&A deals may be easier, since you deal with an educated audience only l Investors of all kinds demand solid fundamentals – No more “exotic” multiples – Focus on income and revenue l The gap between traditional valuation approaches and the market is closing 30

Contact Information Frank G. E. Bollmann Glen N. Kernick Director Phone (650) 688 8668 Frank_Bollmann@sandp. com Director Phone (650) 688 8673 Glen_Kernick@sandp. com Standard & Poor’s Corporate Value Consulting 68 Willow Road Menlo Park, CA 94025 31

Contact Information Frank G. E. Bollmann Glen N. Kernick Director Phone (650) 688 8668 Frank_Bollmann@sandp. com Director Phone (650) 688 8673 Glen_Kernick@sandp. com Standard & Poor’s Corporate Value Consulting 68 Willow Road Menlo Park, CA 94025 31

Additional Detail on S&P CVC l Background on Standard & Poor’s CVC l Overview of CVC Services 32

Additional Detail on S&P CVC l Background on Standard & Poor’s CVC l Overview of CVC Services 32

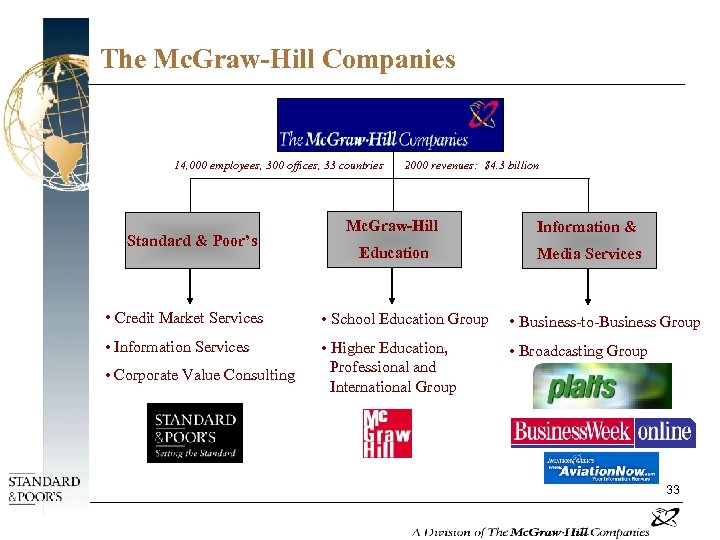

The Mc. Graw-Hill Companies 14, 000 employees, 300 offices, 33 countries Standard & Poor’s 2000 revenues: $4. 3 billion Mc. Graw-Hill Information & Education Media Services • Credit Market Services • School Education Group • Business to Business Group • Information Services • Higher Education, Professional and International Group • Broadcasting Group • Corporate Value Consulting 33

The Mc. Graw-Hill Companies 14, 000 employees, 300 offices, 33 countries Standard & Poor’s 2000 revenues: $4. 3 billion Mc. Graw-Hill Information & Education Media Services • Credit Market Services • School Education Group • Business to Business Group • Information Services • Higher Education, Professional and International Group • Broadcasting Group • Corporate Value Consulting 33

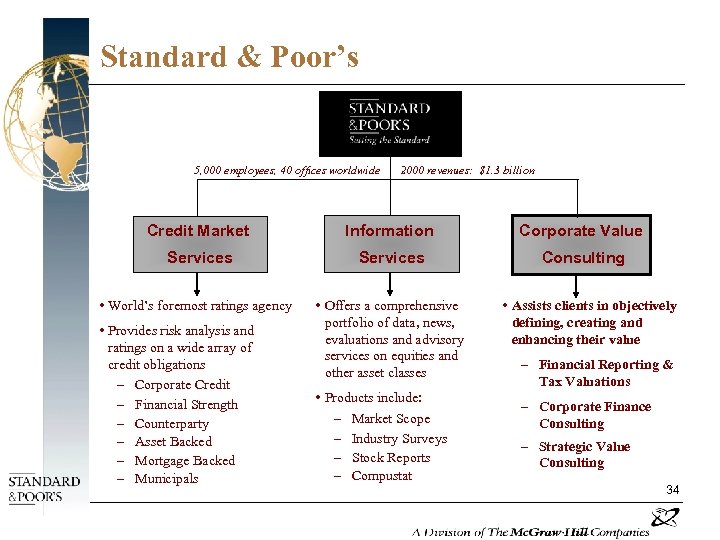

Standard & Poor’s 5, 000 employees, 40 offices worldwide 2000 revenues: $1. 3 billion Credit Market Information Corporate Value Services Consulting • World’s foremost ratings agency • Provides risk analysis and ratings on a wide array of credit obligations – Corporate Credit – Financial Strength – Counterparty – Asset Backed – Mortgage Backed – Municipals • Offers a comprehensive portfolio of data, news, evaluations and advisory services on equities and other asset classes • Products include: – Market Scope – Industry Surveys – Stock Reports – Compustat • Assists clients in objectively defining, creating and enhancing their value – Financial Reporting & Tax Valuations – Corporate Finance Consulting – Strategic Value Consulting 34

Standard & Poor’s 5, 000 employees, 40 offices worldwide 2000 revenues: $1. 3 billion Credit Market Information Corporate Value Services Consulting • World’s foremost ratings agency • Provides risk analysis and ratings on a wide array of credit obligations – Corporate Credit – Financial Strength – Counterparty – Asset Backed – Mortgage Backed – Municipals • Offers a comprehensive portfolio of data, news, evaluations and advisory services on equities and other asset classes • Products include: – Market Scope – Industry Surveys – Stock Reports – Compustat • Assists clients in objectively defining, creating and enhancing their value – Financial Reporting & Tax Valuations – Corporate Finance Consulting – Strategic Value Consulting 34

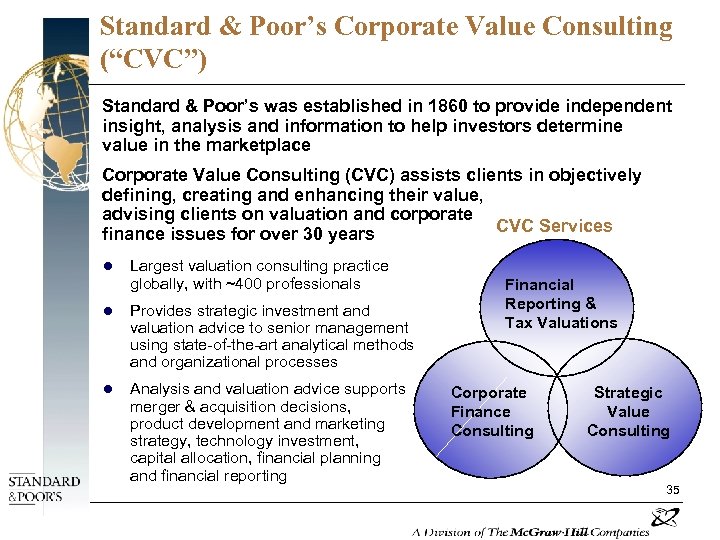

Standard & Poor’s Corporate Value Consulting (“CVC”) Standard & Poor’s was established in 1860 to provide independent insight, analysis and information to help investors determine value in the marketplace Corporate Value Consulting (CVC) assists clients in objectively defining, creating and enhancing their value, advising clients on valuation and corporate CVC Services finance issues for over 30 years l Largest valuation consulting practice globally, with ~400 professionals l Provides strategic investment and valuation advice to senior management using state-of-the-art analytical methods and organizational processes l Analysis and valuation advice supports merger & acquisition decisions, product development and marketing strategy, technology investment, capital allocation, financial planning and financial reporting Financial Reporting & Tax Valuations Corporate Finance Consulting Strategic Value Consulting 35

Standard & Poor’s Corporate Value Consulting (“CVC”) Standard & Poor’s was established in 1860 to provide independent insight, analysis and information to help investors determine value in the marketplace Corporate Value Consulting (CVC) assists clients in objectively defining, creating and enhancing their value, advising clients on valuation and corporate CVC Services finance issues for over 30 years l Largest valuation consulting practice globally, with ~400 professionals l Provides strategic investment and valuation advice to senior management using state-of-the-art analytical methods and organizational processes l Analysis and valuation advice supports merger & acquisition decisions, product development and marketing strategy, technology investment, capital allocation, financial planning and financial reporting Financial Reporting & Tax Valuations Corporate Finance Consulting Strategic Value Consulting 35

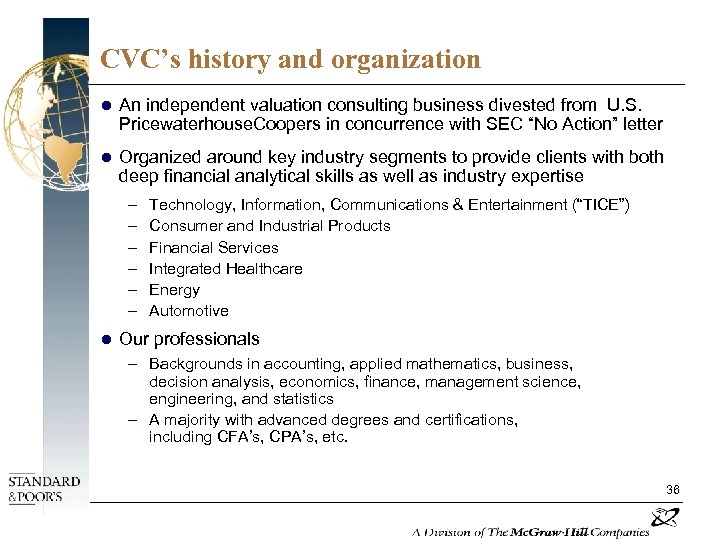

CVC’s history and organization l An independent valuation consulting business divested from U. S. Pricewaterhouse. Coopers in concurrence with SEC “No Action” letter l Organized around key industry segments to provide clients with both deep financial analytical skills as well as industry expertise – – – l Technology, Information, Communications & Entertainment (“TICE”) Consumer and Industrial Products Financial Services Integrated Healthcare Energy Automotive Our professionals – Backgrounds in accounting, applied mathematics, business, decision analysis, economics, finance, management science, engineering, and statistics – A majority with advanced degrees and certifications, including CFA’s, CPA’s, etc. 36

CVC’s history and organization l An independent valuation consulting business divested from U. S. Pricewaterhouse. Coopers in concurrence with SEC “No Action” letter l Organized around key industry segments to provide clients with both deep financial analytical skills as well as industry expertise – – – l Technology, Information, Communications & Entertainment (“TICE”) Consumer and Industrial Products Financial Services Integrated Healthcare Energy Automotive Our professionals – Backgrounds in accounting, applied mathematics, business, decision analysis, economics, finance, management science, engineering, and statistics – A majority with advanced degrees and certifications, including CFA’s, CPA’s, etc. 36

S&P CVC - A National Valuation Consulting Practice Chicago San Francisco Detroit Boston New York New Jersey Menlo Park Philadelphia Los Angeles Atlanta • 12 Offices • 40 Managing Directors • 400 Professionals Dallas Houston 37

S&P CVC - A National Valuation Consulting Practice Chicago San Francisco Detroit Boston New York New Jersey Menlo Park Philadelphia Los Angeles Atlanta • 12 Offices • 40 Managing Directors • 400 Professionals Dallas Houston 37

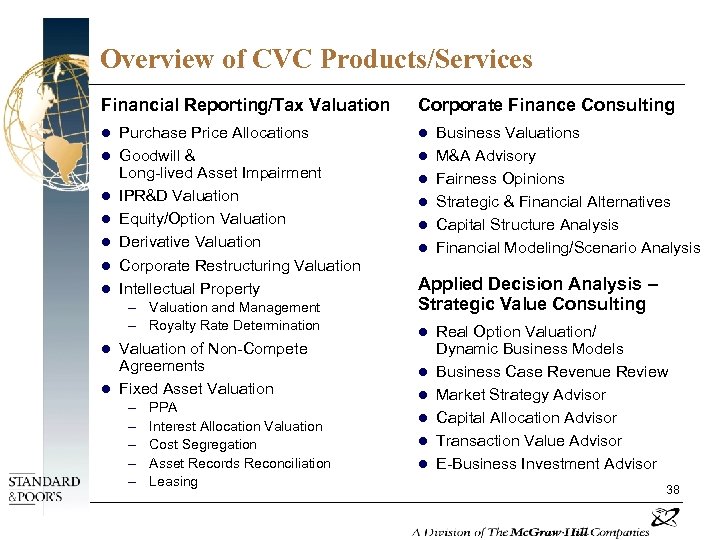

Overview of CVC Products/Services Financial Reporting/Tax Valuation l l l l Purchase Price Allocations Goodwill & Long-lived Asset Impairment IPR&D Valuation Equity/Option Valuation Derivative Valuation Corporate Restructuring Valuation Intellectual Property – Valuation and Management – Royalty Rate Determination Valuation of Non-Compete Agreements l Fixed Asset Valuation Corporate Finance Consulting l l l Applied Decision Analysis – Strategic Value Consulting l l – – – PPA Interest Allocation Valuation Cost Segregation Asset Records Reconciliation Leasing Business Valuations M&A Advisory Fairness Opinions Strategic & Financial Alternatives Capital Structure Analysis Financial Modeling/Scenario Analysis l l l Real Option Valuation/ Dynamic Business Models Business Case Revenue Review Market Strategy Advisor Capital Allocation Advisor Transaction Value Advisor E-Business Investment Advisor 38

Overview of CVC Products/Services Financial Reporting/Tax Valuation l l l l Purchase Price Allocations Goodwill & Long-lived Asset Impairment IPR&D Valuation Equity/Option Valuation Derivative Valuation Corporate Restructuring Valuation Intellectual Property – Valuation and Management – Royalty Rate Determination Valuation of Non-Compete Agreements l Fixed Asset Valuation Corporate Finance Consulting l l l Applied Decision Analysis – Strategic Value Consulting l l – – – PPA Interest Allocation Valuation Cost Segregation Asset Records Reconciliation Leasing Business Valuations M&A Advisory Fairness Opinions Strategic & Financial Alternatives Capital Structure Analysis Financial Modeling/Scenario Analysis l l l Real Option Valuation/ Dynamic Business Models Business Case Revenue Review Market Strategy Advisor Capital Allocation Advisor Transaction Value Advisor E-Business Investment Advisor 38

Financial Reporting and Tax Valuations CVC offers a broad range of valuation services to meet the most sophisticated financial reporting, tax and regulatory needs l Purchase Price Allocations (FAS 141) l Goodwill & Long-Lived Asset Impairment Analyses (FAS 142/121) l In-Process Research & Development (FAS 86 and Others) l Employee Stock Option Valuations (FAS 123) l Derivative Securities Valuation (FAS 133) l Fixed Asset Valuations l Intellectual Property/Asset Management 39

Financial Reporting and Tax Valuations CVC offers a broad range of valuation services to meet the most sophisticated financial reporting, tax and regulatory needs l Purchase Price Allocations (FAS 141) l Goodwill & Long-Lived Asset Impairment Analyses (FAS 142/121) l In-Process Research & Development (FAS 86 and Others) l Employee Stock Option Valuations (FAS 123) l Derivative Securities Valuation (FAS 133) l Fixed Asset Valuations l Intellectual Property/Asset Management 39

Corporate Finance Consulting CVC provides clients with objective, ongoing advisory assistance related to major corporate finance issues l Business Valuations l Fairness Opinions l Strategic and Financial Alternatives Consulting l Financial Modeling/Scenario Analyses l Merger & Acquisition Advisory 40

Corporate Finance Consulting CVC provides clients with objective, ongoing advisory assistance related to major corporate finance issues l Business Valuations l Fairness Opinions l Strategic and Financial Alternatives Consulting l Financial Modeling/Scenario Analyses l Merger & Acquisition Advisory 40

Applied Decision Analysis (ADA) – Strategic Value Consulting ADA professionals help companies maximize the value of their strategic investments – from R&D, to acquisitions l Real Options Analysis – Develop a dynamic roadmap that shows how to manage an investment – when to kill it, when to accelerate investment, when to go for broke l Market Strategy Advisor – Provide accurate customer models that help clients maximize the return on their product development investments l Business Case Revenue Review – Improve the credibility of revenue forecasts l Capital Allocation Advisor – Help clients allocate capital or constrained resources for across competing company needs (e. g. R&D portfolios or e-business initiatives), prioritizing, valuing and managing initiatives to maximize value l Transaction Value Advisor – Deliver the insight and management roadmaps that clients need to confidently pursue deal-making opportunities, and to know when to walk away 41

Applied Decision Analysis (ADA) – Strategic Value Consulting ADA professionals help companies maximize the value of their strategic investments – from R&D, to acquisitions l Real Options Analysis – Develop a dynamic roadmap that shows how to manage an investment – when to kill it, when to accelerate investment, when to go for broke l Market Strategy Advisor – Provide accurate customer models that help clients maximize the return on their product development investments l Business Case Revenue Review – Improve the credibility of revenue forecasts l Capital Allocation Advisor – Help clients allocate capital or constrained resources for across competing company needs (e. g. R&D portfolios or e-business initiatives), prioritizing, valuing and managing initiatives to maximize value l Transaction Value Advisor – Deliver the insight and management roadmaps that clients need to confidently pursue deal-making opportunities, and to know when to walk away 41

CVC provides a full range of service offerings to support partnering and transaction decisions Transaction Services l Valuation Consulting and Financial Modeling l Negotiation Support l License-In, License-Out Support l M&A Advisory: Buy-Side and Sell-Side Transaction Support l Bidding Strategy l Capital Structure Analysis l Royalty Rate Analysis l RFP Support l IP Valuation (patents, trademarks, copyrights, trade secrets) l Fairness Opinions 42

CVC provides a full range of service offerings to support partnering and transaction decisions Transaction Services l Valuation Consulting and Financial Modeling l Negotiation Support l License-In, License-Out Support l M&A Advisory: Buy-Side and Sell-Side Transaction Support l Bidding Strategy l Capital Structure Analysis l Royalty Rate Analysis l RFP Support l IP Valuation (patents, trademarks, copyrights, trade secrets) l Fairness Opinions 42

What distinguishes CVC? l Breadth of service capabilities l Pw. C heritage-superior knowledge of accounting and tax rules l Industry expertise l Thought leadership on valuation and corporate finance issues l Scale – Largest valuation practice in U. S. – Professionals with diverse backgrounds, experiences and skill-sets – Rapid mobilization of resources (local delivery through 12 offices in key U. S. cities, and access to S&P global network) l Access to S&P information services (research and analysts) 43

What distinguishes CVC? l Breadth of service capabilities l Pw. C heritage-superior knowledge of accounting and tax rules l Industry expertise l Thought leadership on valuation and corporate finance issues l Scale – Largest valuation practice in U. S. – Professionals with diverse backgrounds, experiences and skill-sets – Rapid mobilization of resources (local delivery through 12 offices in key U. S. cities, and access to S&P global network) l Access to S&P information services (research and analysts) 43

Selected Clients 44

Selected Clients 44

Additional CVC Technology Clients – – – – – Acuson Adaptec Air. Touch Communications Alta. Vista Amazon. Com Apple Ariba Atmel AT&T Broadcast. com Cisco Systems CMP Media Compaq Computer Creative Technology Cypress Semiconductor Documentum Ericsson Excite@Home – – – – – Hewlett-Packard Hyperion Solutions IBM Informix Infoseek JDS Uniphase Kana Communications Lantronix Leap Wireless International Lucent Technologies Micron Technology, Inc. Microsoft Corporation Miller Freeman, Inc. Network Associates Nortel Networks Nokia Open. TV PC-Tel, Inc – – – – – Polycom Prodigy Qualcomm Quantum Redback Networks SAIC – Bellcore Research Seagate Technology Siebel Systems Sony Electronics Sun Microsystems TCI Telstra Corporation The Walt Disney Company Thomson Multimedia Vignette VLSI Technology Xerox Yahoo 45

Additional CVC Technology Clients – – – – – Acuson Adaptec Air. Touch Communications Alta. Vista Amazon. Com Apple Ariba Atmel AT&T Broadcast. com Cisco Systems CMP Media Compaq Computer Creative Technology Cypress Semiconductor Documentum Ericsson Excite@Home – – – – – Hewlett-Packard Hyperion Solutions IBM Informix Infoseek JDS Uniphase Kana Communications Lantronix Leap Wireless International Lucent Technologies Micron Technology, Inc. Microsoft Corporation Miller Freeman, Inc. Network Associates Nortel Networks Nokia Open. TV PC-Tel, Inc – – – – – Polycom Prodigy Qualcomm Quantum Redback Networks SAIC – Bellcore Research Seagate Technology Siebel Systems Sony Electronics Sun Microsystems TCI Telstra Corporation The Walt Disney Company Thomson Multimedia Vignette VLSI Technology Xerox Yahoo 45

Contact Information Frank G. E. Bollmann Glen N. Kernick Director Phone (650) 688 8668 Frank_Bollmann@sandp. com Director Phone (650) 688 8673 Glen_Kernick@sandp. com Standard & Poor’s Corporate Value Consulting 68 Willow Road Menlo Park, CA 94025 46

Contact Information Frank G. E. Bollmann Glen N. Kernick Director Phone (650) 688 8668 Frank_Bollmann@sandp. com Director Phone (650) 688 8673 Glen_Kernick@sandp. com Standard & Poor’s Corporate Value Consulting 68 Willow Road Menlo Park, CA 94025 46