bbcf7ad2a1f81947b6108e41792385a5.ppt

- Количество слайдов: 31

What is the Stock Market, anyway? Introduction (or refresher) to the Georgia Stock Market Game

What is the Stock Market, anyway? Introduction (or refresher) to the Georgia Stock Market Game

$tock Market Quiz 1. Stocks are items found in the storeroom of a grocery store? 2. Only rich people invest in the stock market. 3. Most stocks on the stock market are sold by the United States Government? 4. If the stock market goes up 30% one year, it will fall by 30% in the next year? 5. Any stock that goes up in price must eventually come back down.

$tock Market Quiz 1. Stocks are items found in the storeroom of a grocery store? 2. Only rich people invest in the stock market. 3. Most stocks on the stock market are sold by the United States Government? 4. If the stock market goes up 30% one year, it will fall by 30% in the next year? 5. Any stock that goes up in price must eventually come back down.

6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U. S. government. 8. Stock markets are open on business days around the clock, around the world. 9. Sometimes companies buy their own stocks on the stock market. 10. It is hard to buy good stock today because all of the good Ones have already been purchased. 11. Buying stocks is a sure way to make money.

6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U. S. government. 8. Stock markets are open on business days around the clock, around the world. 9. Sometimes companies buy their own stocks on the stock market. 10. It is hard to buy good stock today because all of the good Ones have already been purchased. 11. Buying stocks is a sure way to make money.

12. Corporations sell new issues of stock on the New York Stock Exchange. 13. “Insider” stock trading means that trading stocks takes place inside a building. 14. People can buy stocks on the Internet. 15. When the stock market goes up, it causes the economy to grow. $

12. Corporations sell new issues of stock on the New York Stock Exchange. 13. “Insider” stock trading means that trading stocks takes place inside a building. 14. People can buy stocks on the Internet. 15. When the stock market goes up, it causes the economy to grow. $

What is the Stock Market? • The Stock Market is a market in which the public trades stocks it already owns.

What is the Stock Market? • The Stock Market is a market in which the public trades stocks it already owns.

How do I buy stock? • In “shares, ” or parts, of company ownership. • When you buy stock, you “share” a part of the company’s profits or bear some of its losses.

How do I buy stock? • In “shares, ” or parts, of company ownership. • When you buy stock, you “share” a part of the company’s profits or bear some of its losses.

Why would people invest in the Stock Market? • People usually buy stocks with their savings. They do so hoping that their stocks will increase in value, thus making their savings grow. (All investment decisions involve some risk. There is the always the risk that stock may not gain value or may even lose value. ) • People hope that their stocks will increase in value and help them to make more money. So many people are affected by the stock market that the federal government must regulate it even though the companies being traded are private institutions.

Why would people invest in the Stock Market? • People usually buy stocks with their savings. They do so hoping that their stocks will increase in value, thus making their savings grow. (All investment decisions involve some risk. There is the always the risk that stock may not gain value or may even lose value. ) • People hope that their stocks will increase in value and help them to make more money. So many people are affected by the stock market that the federal government must regulate it even though the companies being traded are private institutions.

What part of the federal government regulates the stock market? • The real “S. E. C. ” • a. k. a. The Securities and Exchange Commission

What part of the federal government regulates the stock market? • The real “S. E. C. ” • a. k. a. The Securities and Exchange Commission

The Language of Economics • Economize: To base decisions on an assessment of costs and benefits, choosing the best combination of costs and benefits among the alternatives. • Risk: The chance of losing money. Risk is the opposite of safety. • Saving: Setting aside some of today’s income for future spending.

The Language of Economics • Economize: To base decisions on an assessment of costs and benefits, choosing the best combination of costs and benefits among the alternatives. • Risk: The chance of losing money. Risk is the opposite of safety. • Saving: Setting aside some of today’s income for future spending.

How does economics relate to our study of the Middle East? • OIL! • Oil will be our primary example throughout our study of the stock market as we examine a product/company in the market which has a price that goes up and down based on many external factors. We will examine Iraq and Kuwait, major oil suppliers, and how their prices change based on war, government dissention, etc.

How does economics relate to our study of the Middle East? • OIL! • Oil will be our primary example throughout our study of the stock market as we examine a product/company in the market which has a price that goes up and down based on many external factors. We will examine Iraq and Kuwait, major oil suppliers, and how their prices change based on war, government dissention, etc.

REMEMBER: • Stock markets allow people to benefit from growth in private businesses. • No decision to save money is without cost or risk.

REMEMBER: • Stock markets allow people to benefit from growth in private businesses. • No decision to save money is without cost or risk.

Which of the following decisions will guarantee that a person will make money in the stock market? • (A) Buy the stock of a big company like IBM. • (B) Buy the stock of a small company like Starbucks Coffee. • (C) Purchase stocks after the stock market has dropped for two days in a row. • (D) None of these decisions will guarantee that an individual will make money in the stock market.

Which of the following decisions will guarantee that a person will make money in the stock market? • (A) Buy the stock of a big company like IBM. • (B) Buy the stock of a small company like Starbucks Coffee. • (C) Purchase stocks after the stock market has dropped for two days in a row. • (D) None of these decisions will guarantee that an individual will make money in the stock market.

If a company starts purchasing its own stock, what are the company leaders attempting to do? • (A) To raise company profits • (B) To increase company expenses • (C) To show that the company believes the price is too low • (D) To confuse the Securities and Exchange Commission

If a company starts purchasing its own stock, what are the company leaders attempting to do? • (A) To raise company profits • (B) To increase company expenses • (C) To show that the company believes the price is too low • (D) To confuse the Securities and Exchange Commission

What is your Stock Market IQ? Stock Market QUIZ

What is your Stock Market IQ? Stock Market QUIZ

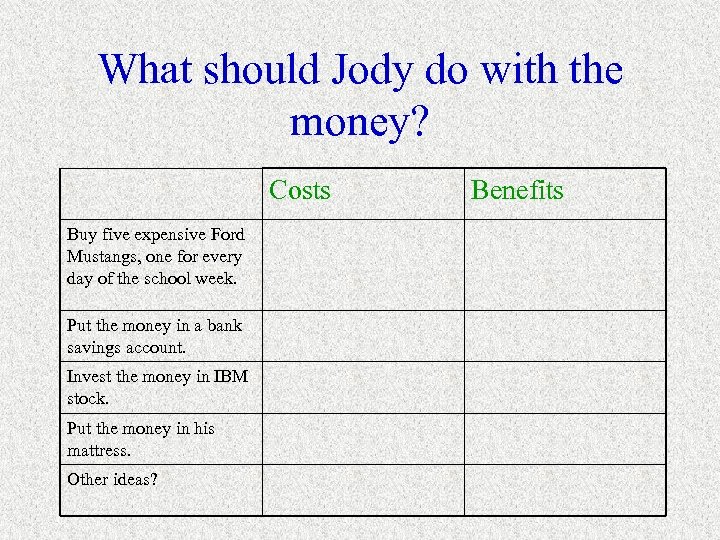

Uncle Mort’s Money An exercise in costs vs. benefits

Uncle Mort’s Money An exercise in costs vs. benefits

What should Jody do with the money? Costs Buy five expensive Ford Mustangs, one for every day of the school week. Put the money in a bank savings account. Invest the money in IBM stock. Put the money in his mattress. Other ideas? Benefits

What should Jody do with the money? Costs Buy five expensive Ford Mustangs, one for every day of the school week. Put the money in a bank savings account. Invest the money in IBM stock. Put the money in his mattress. Other ideas? Benefits

What are markets? • The process through which buyers and sellers exchange with one another.

What are markets? • The process through which buyers and sellers exchange with one another.

What is a Stock Exchange? • A Stock Exchange is one of the organized stock markets with a centralized trading floor. In this market, auction-type trading allows traders to sell stocks to the highest bidder or buy stocks from the lowest supplier. These markets consist of the New York Stock Exchange(NYSE) and the American Stock Exchange (AMEX), both of which are located in New York City.

What is a Stock Exchange? • A Stock Exchange is one of the organized stock markets with a centralized trading floor. In this market, auction-type trading allows traders to sell stocks to the highest bidder or buy stocks from the lowest supplier. These markets consist of the New York Stock Exchange(NYSE) and the American Stock Exchange (AMEX), both of which are located in New York City.

What about the Nasdaq? • NASDAQ= National Association of Securities Dealers Automated Quotation • The Nasdaq Stock Market is an electronic marketplace where buyers and sellers get together via computer and hundreds of thousands of miles of high speed data lines. More than 5, 000 companies list on Nasdaq’s computerized market. Nasdaq is not actually an exchange because it doesn’t have a central floor.

What about the Nasdaq? • NASDAQ= National Association of Securities Dealers Automated Quotation • The Nasdaq Stock Market is an electronic marketplace where buyers and sellers get together via computer and hundreds of thousands of miles of high speed data lines. More than 5, 000 companies list on Nasdaq’s computerized market. Nasdaq is not actually an exchange because it doesn’t have a central floor.

How do I find out how stock is doing in certain markets or exchanges? • • • Your phone! Newspapers TV news Internet Stock Market Game website

How do I find out how stock is doing in certain markets or exchanges? • • • Your phone! Newspapers TV news Internet Stock Market Game website

What about a Stockbroker? • A broker who accepts orders to buy and sell stock and then transfers those orders to other people who complete them is a stock broker. • In the Georgia Stock Market Game, you will have an online broker. • The broker gets commission (a percentage) of your trade. In the game we will play, there is a 2% broker fee for each transaction.

What about a Stockbroker? • A broker who accepts orders to buy and sell stock and then transfers those orders to other people who complete them is a stock broker. • In the Georgia Stock Market Game, you will have an online broker. • The broker gets commission (a percentage) of your trade. In the game we will play, there is a 2% broker fee for each transaction.

“Today on Wall Street…” • “Wall Street” is an actual street name in New York City which is also frequently used to refer to the market for stocks.

“Today on Wall Street…” • “Wall Street” is an actual street name in New York City which is also frequently used to refer to the market for stocks.

More vocabulary and key points… • Mutual fund: collection of stocks over time (usually a long-term investment) • Preferred stock: “safe stock” --less risky than “common stock” traded on the market • Remember that RISK can equal REWARD, but RISK can also equal LOSS. • The market is driven by two things: FEAR and GREED!

More vocabulary and key points… • Mutual fund: collection of stocks over time (usually a long-term investment) • Preferred stock: “safe stock” --less risky than “common stock” traded on the market • Remember that RISK can equal REWARD, but RISK can also equal LOSS. • The market is driven by two things: FEAR and GREED!

The Stock Market Game • Game takes place • Groups are given $100, 000 of “pretend money” to invest. • Transactions are made and research can be done at the game’s website, http: //www. gcee. org *Click on “Play the Stock Market Game” on the right and you are ready to begin! • Each team is given a User. ID and a password to enter the game and make transactions.

The Stock Market Game • Game takes place • Groups are given $100, 000 of “pretend money” to invest. • Transactions are made and research can be done at the game’s website, http: //www. gcee. org *Click on “Play the Stock Market Game” on the right and you are ready to begin! • Each team is given a User. ID and a password to enter the game and make transactions.

What CAN I do in this game? • You CAN invest for ten weeks in common stocks, mutual funds, or preferred stocks online in the game. • You CAN use very risky strategies to try to win this game that you would not be likely to use in “real life” with “real” money! • You CAN win lots of college scholarship money and other prizes if you place among the state winners in this competition.

What CAN I do in this game? • You CAN invest for ten weeks in common stocks, mutual funds, or preferred stocks online in the game. • You CAN use very risky strategies to try to win this game that you would not be likely to use in “real life” with “real” money! • You CAN win lots of college scholarship money and other prizes if you place among the state winners in this competition.

What CAN’T I do in this game? • You CAN’T hold on to all of your money without investing any of it. There is actually a 5% savings fee if you don’t use your money in this game. • You CAN’T buy or sell stock without the majority of your team’s consent. • You CAN’T buy stock that costs less than $5 a share.

What CAN’T I do in this game? • You CAN’T hold on to all of your money without investing any of it. There is actually a 5% savings fee if you don’t use your money in this game. • You CAN’T buy or sell stock without the majority of your team’s consent. • You CAN’T buy stock that costs less than $5 a share.

What MUST I do? • You MUST buy “round lots” of shares (100’s). • “ 3 x 3 x 3 rule” added last year… – You must make 1 st buy within 3 weeks – You must own at least 3 stocks (or mutual funds) at the end of competition – You must hold 3 different companies for at least 3 weeks at a time at some point throughout the competition.

What MUST I do? • You MUST buy “round lots” of shares (100’s). • “ 3 x 3 x 3 rule” added last year… – You must make 1 st buy within 3 weeks – You must own at least 3 stocks (or mutual funds) at the end of competition – You must hold 3 different companies for at least 3 weeks at a time at some point throughout the competition.

Will you be checking on me? • I will be checking rankings weekly and updating them in the hallway, but I will not be checking the 3 x 3 x 3 rule. That is your responsibility to implement. If you win the competition, the judges will look over your portfolio to be sure that you followed this rule! • We will be doing weekly activities in class to monitor your learning about the stock market through this competition.

Will you be checking on me? • I will be checking rankings weekly and updating them in the hallway, but I will not be checking the 3 x 3 x 3 rule. That is your responsibility to implement. If you win the competition, the judges will look over your portfolio to be sure that you followed this rule! • We will be doing weekly activities in class to monitor your learning about the stock market through this competition.

So how do I win? • The value of the portfolio=the winning team! Last year’s winning team in the state made $1. 4 million! • Play with a high risk strategy, but don’t end up being a “Pig!”

So how do I win? • The value of the portfolio=the winning team! Last year’s winning team in the state made $1. 4 million! • Play with a high risk strategy, but don’t end up being a “Pig!”

Stock Market Nicknames: • “Bear market” refers to a time where stock market prices are falling as a whole. • “Bull market” refers to a time where stock market prices are rising overall. • “Pigs” are people who try to make a lot of money short-term in the market and end up getting slaughtered!

Stock Market Nicknames: • “Bear market” refers to a time where stock market prices are falling as a whole. • “Bull market” refers to a time where stock market prices are rising overall. • “Pigs” are people who try to make a lot of money short-term in the market and end up getting slaughtered!

What can we do to get ready for the upcoming competition? • Begin researching companies you might be interested in investing in (look up ticker symbols). • Look online for annual reports. • Check the value of companies that interest you online, in the paper, or on the news daily. • Discuss possible investments with your group.

What can we do to get ready for the upcoming competition? • Begin researching companies you might be interested in investing in (look up ticker symbols). • Look online for annual reports. • Check the value of companies that interest you online, in the paper, or on the news daily. • Discuss possible investments with your group.