9bbc2c9abd9b132b277b334f0be51f66.ppt

- Количество слайдов: 43

What is the difference between an HRA, HSA, and an FSA?

What Is Consumer Choice Health Care?

The Renewal Meeting • Why have my rates doubled in five years? • What type of health plan can stop the bleeding? • My employees have no understanding of the cost of health care.

“Consumerism” is Coming Late to the Healthcare Industry …It’s Out of Step With Our Emerging Economy • U. S. inflation in 2004 was 3%, while healthcare inflation was 12%. • “Employee health care costs will wipe out the equivalent of every penny of 2003 profitability for the company’s Consumer Products Division”, without major changes according to GE’s Chairman Jeffrey Immelt.

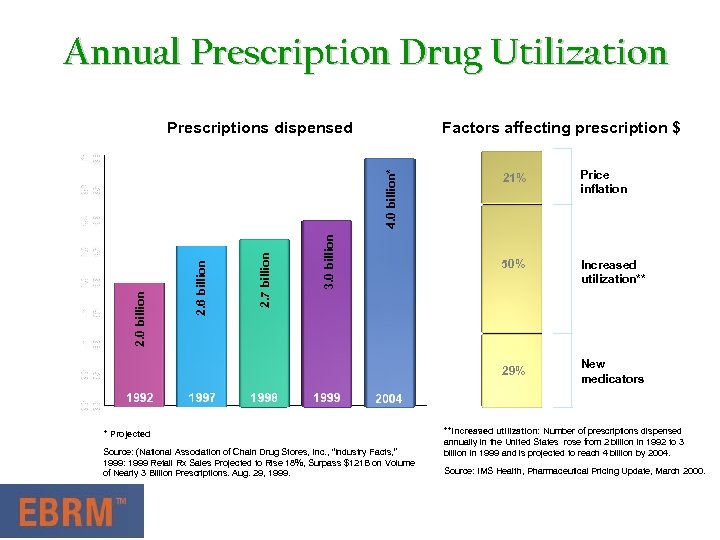

Annual Prescription Drug Utilization Factors affecting prescription $ 3. 0 billion 2. 7 billion 2. 6 billion 2. 0 billion 4. 0 billion* Prescriptions dispensed 21% Price inflation 50% Increased utilization** 29% * Projected Source: (National Association of Chain Drug Stores, Inc. , “Industry Facts, ” 1999: 1999 Retail Rx Sales Projected to Rise 18%, Surpass $121 B on Volume of Nearly 3 Billion Prescriptions. Aug. 29, 1999. New medicators **Increased utilization: Number of prescriptions dispensed annually in the United States rose from 2 billion in 1992 to 3 billion in 1999 and is projected to reach 4 billion by 2004. Source: IMS Health, Pharmaceutical Pricing Update, March 2000.

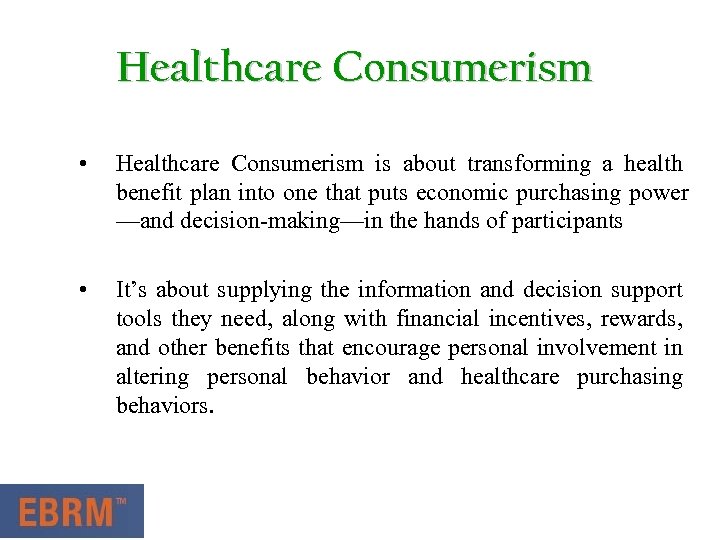

Healthcare Consumerism • Healthcare Consumerism is about transforming a health benefit plan into one that puts economic purchasing power —and decision-making—in the hands of participants • It’s about supplying the information and decision support tools they need, along with financial incentives, rewards, and other benefits that encourage personal involvement in altering personal behavior and healthcare purchasing behaviors.

Two Basic Principles for Successful Consumerism 1. Must work for the Sickest Members, as well as the healthy 2. Must work for those not wanting to get involved in decision-making, as well as the “techies”

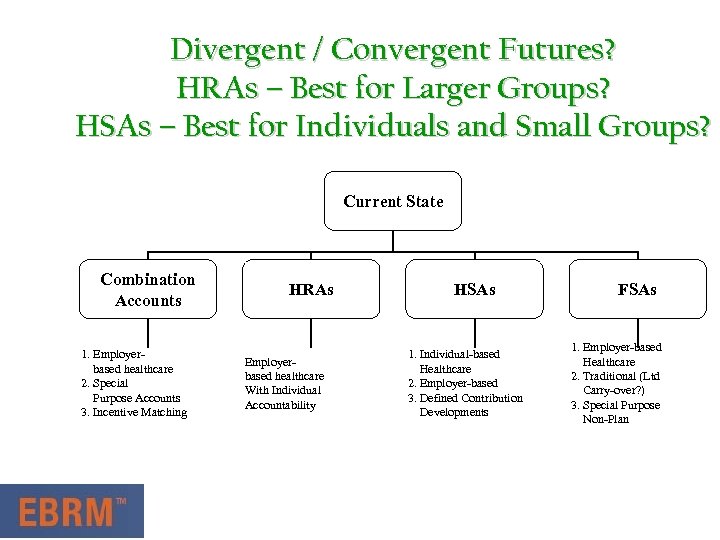

Divergent / Convergent Futures? HRAs – Best for Larger Groups? HSAs – Best for Individuals and Small Groups? Current State Combination Accounts 1. Employerbased healthcare 2. Special Purpose Accounts 3. Incentive Matching HRAs Employerbased healthcare With Individual Accountability HSAs 1. Individual-based Healthcare 2. Employer-based 3. Defined Contribution Developments FSAs 1. Employer-based Healthcare 2. Traditional (Ltd Carry-over? ) 3. Special Purpose Non-Plan

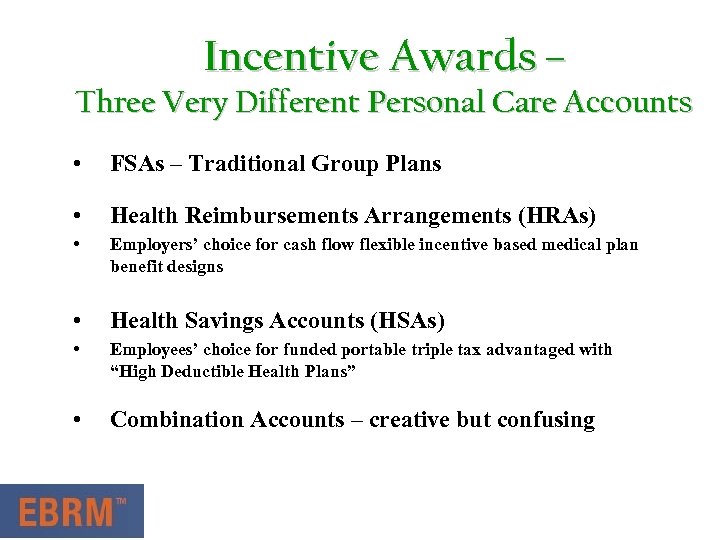

Incentive Awards – Three Very Different Personal Care Accounts • FSAs – Traditional Group Plans • Health Reimbursements Arrangements (HRAs) • Employers’ choice for cash flow flexible incentive based medical plan benefit designs • Health Savings Accounts (HSAs) • Employees’ choice for funded portable triple tax advantaged with “High Deductible Health Plans” • Combination Accounts – creative but confusing

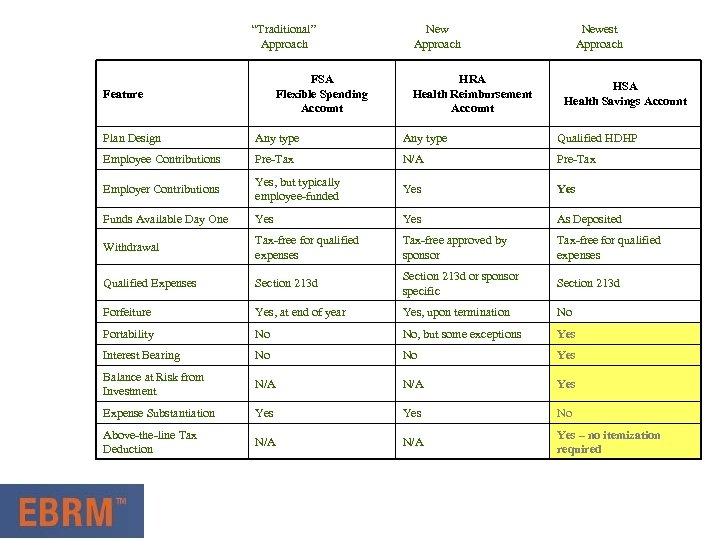

“Traditional” Approach FSA Flexible Spending Account Feature New Approach HRA Health Reimbursement Account Newest Approach HSA Health Savings Account Plan Design Any type Qualified HDHP Employee Contributions Pre-Tax N/A Pre-Tax Employer Contributions Yes, but typically employee-funded Yes Funds Available Day One Yes As Deposited Withdrawal Tax-free for qualified expenses Tax-free approved by sponsor Tax-free for qualified expenses Qualified Expenses Section 213 d or sponsor specific Section 213 d Forfeiture Yes, at end of year Yes, upon termination No Portability No No, but some exceptions Yes Interest Bearing No No Yes Balance at Risk from Investment N/A Yes Expense Substantiation Yes No Above-the-line Tax Deduction N/A Yes – no itemization required

Full Replacement HSAs and HRAs Are Very Different • HSA – A law, with specific requirements and benefit design requirements Most TAX ADVANTAGED vehicle ever created ******************************* • HRAs – No Law, this is a regulatory creation based upon an IRS ruling. Most FLEXIBLE vehicle ever created

HRA’s Consist Of… Ø The Reimbursement Account Ø Individual Responsibility Gap Ø Health Insurance Policy

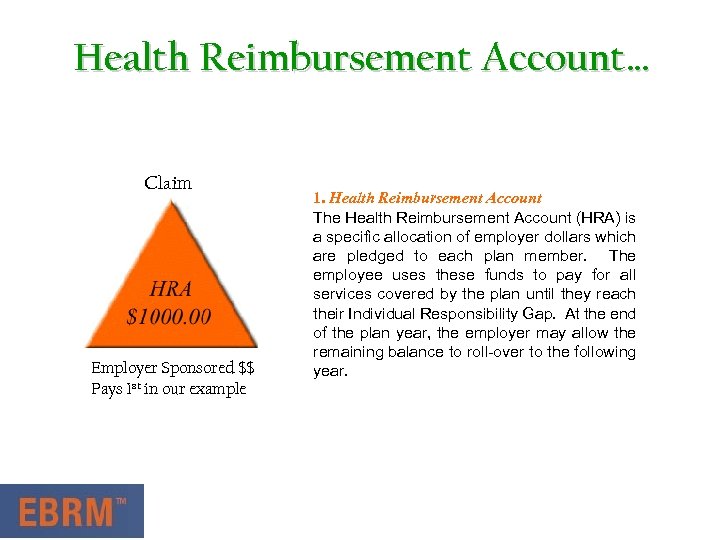

Health Reimbursement Account… Claim Employer Sponsored $$ Pays 1 st in our example 1. Health Reimbursement Account The Health Reimbursement Account (HRA) is a specific allocation of employer dollars which are pledged to each plan member. The employee uses these funds to pay for all services covered by the plan until they reach their Individual Responsibility Gap. At the end of the plan year, the employer may allow the remaining balance to roll-over to the following year.

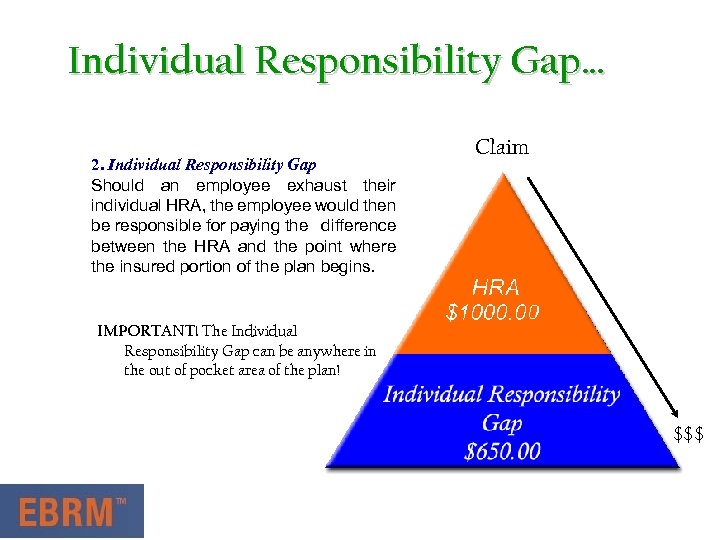

Individual Responsibility Gap… 2. Individual Responsibility Gap Should an employee exhaust their individual HRA, the employee would then be responsible for paying the difference between the HRA and the point where the insured portion of the plan begins. Claim IMPORTANT! The Individual Responsibility Gap can be anywhere in the out of pocket area of the plan! $$$

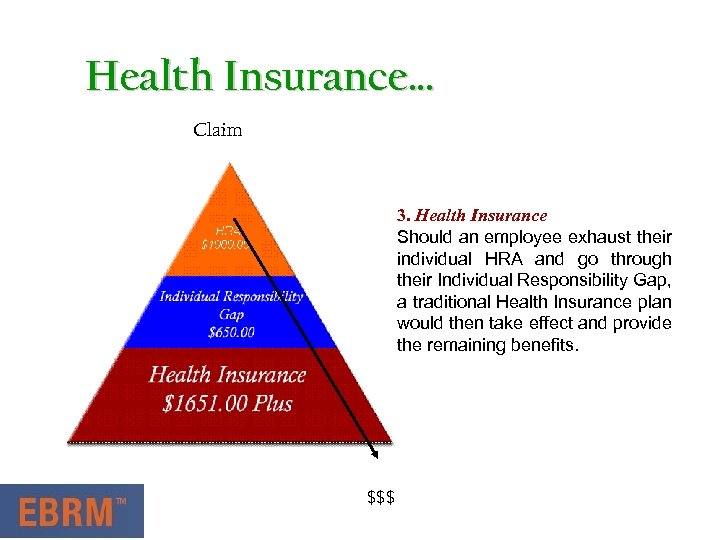

Health Insurance… Claim 3. Health Insurance Should an employee exhaust their individual HRA and go through their Individual Responsibility Gap, a traditional Health Insurance plan would then take effect and provide the remaining benefits. $$$

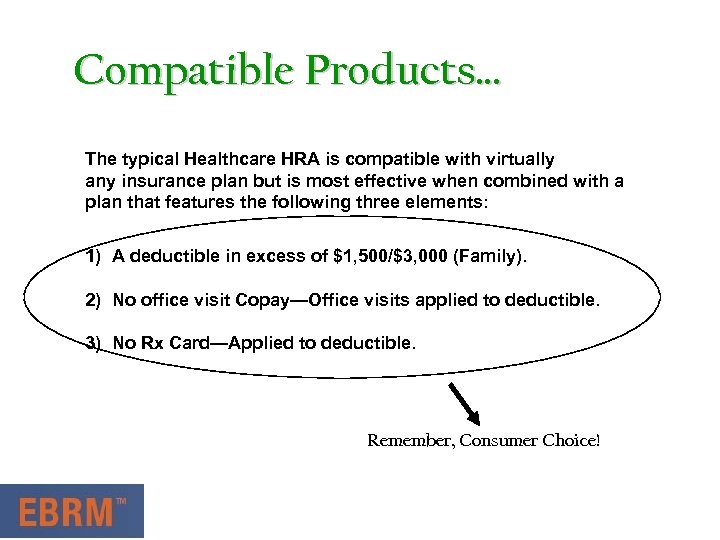

Compatible Products… The typical Healthcare HRA is compatible with virtually any insurance plan but is most effective when combined with a plan that features the following three elements: 1) A deductible in excess of $1, 500/$3, 000 (Family). 2) No office visit Copay—Office visits applied to deductible. 3) No Rx Card—Applied to deductible. Remember, Consumer Choice!

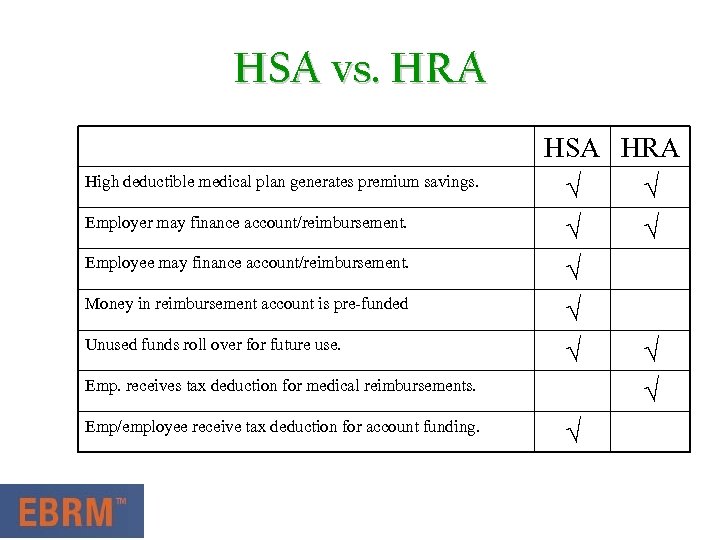

HSA vs. HRA High deductible medical plan generates premium savings. Employer may finance account/reimbursement. Employee may finance account/reimbursement. Money in reimbursement account is pre-funded Unused funds roll over for future use. Emp. receives tax deduction for medical reimbursements. Emp/employee receive tax deduction for account funding. HSA HRA √ √ √ √ √

An Introduction to Health Savings Accounts Agenda • • What is a Health Savings Account (HSA)? HSA Eligibility and Contributions HSA Distributions Other Matters

What is a Health Savings Account (HSA)? • A Health Savings Account, or HSA, is an account that can receive contributions on a tax-favored basis on behalf of an eligible individual and allows tax-free distributions used to pay for qualified medical expenses

Eligibility • An eligible individual is: • Covered under a high-deductible health plan (HDHP); – Not covered by another health plan that is not an HDHP – Not enrolled in Medicare (generally, younger than age 65) and – Not claimed as a dependent

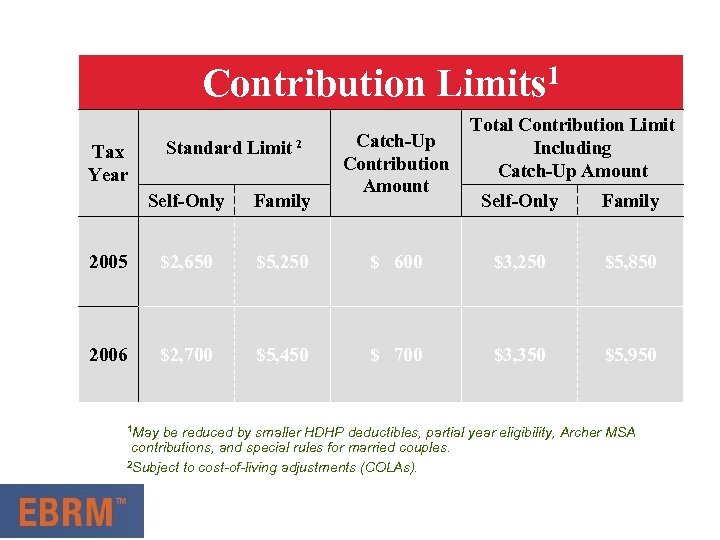

Contribution Limits 1 Standard Limit 2 Tax Year Self-Only Family 2005 $2, 650 $5, 250 2006 $2, 700 $5, 450 1 May Catch-Up Contribution Amount Total Contribution Limit Including Catch-Up Amount Self-Only Family $ 600 $3, 250 $5, 850 $ 700 $3, 350 $5, 950 be reduced by smaller HDHP deductibles, partial year eligibility, Archer MSA contributions, and special rules for married couples. 2 Subject to cost-of-living adjustments (COLAs).

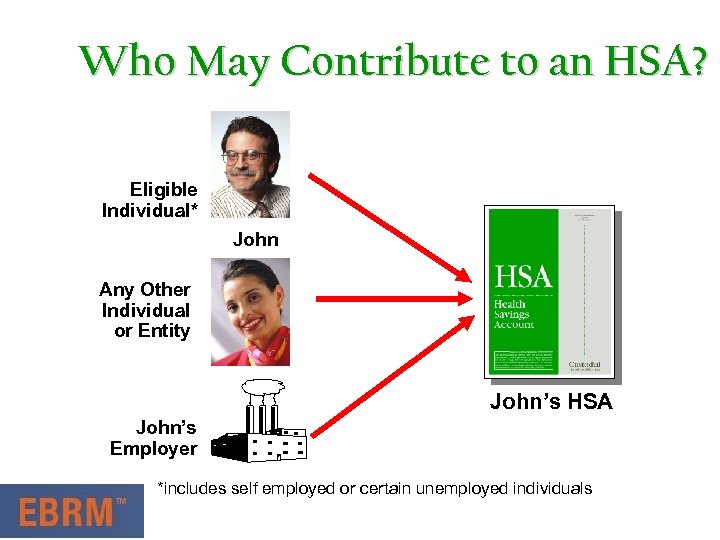

Who May Contribute to an HSA? Eligible Individual* John Any Other Individual or Entity John’s HSA John’s Employer *includes self employed or certain unemployed individuals

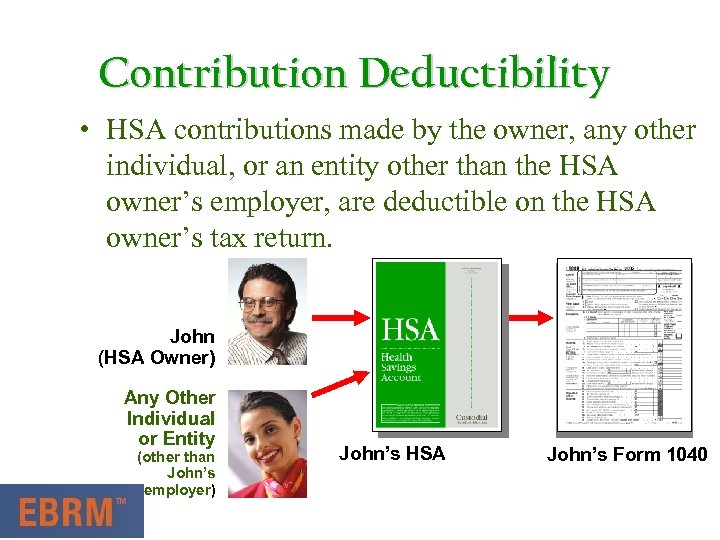

Contribution Deductibility • HSA contributions made by the owner, any other individual, or an entity other than the HSA owner’s employer, are deductible on the HSA owner’s tax return. John (HSA Owner) Any Other Individual or Entity (other than John’s employer) John’s HSA John’s Form 1040

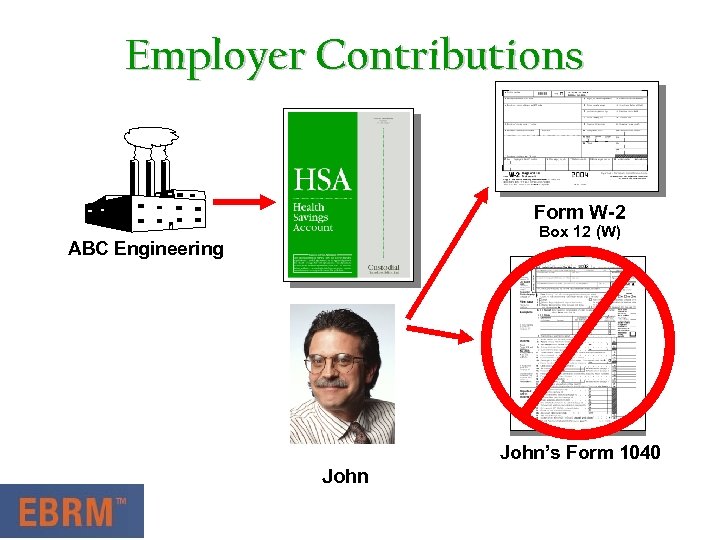

Employer Contributions • Reported on employee’s Form W-2 – Not subject to FICA, FUTA, or RRTA – Not deductible on employee’s Form 1040 • Comparable contributions to “comparable participating employees” – Same amount, or – Same percentage

Employer Contributions Form W-2 Box 12 (W) ABC Engineering John’s Form 1040 John

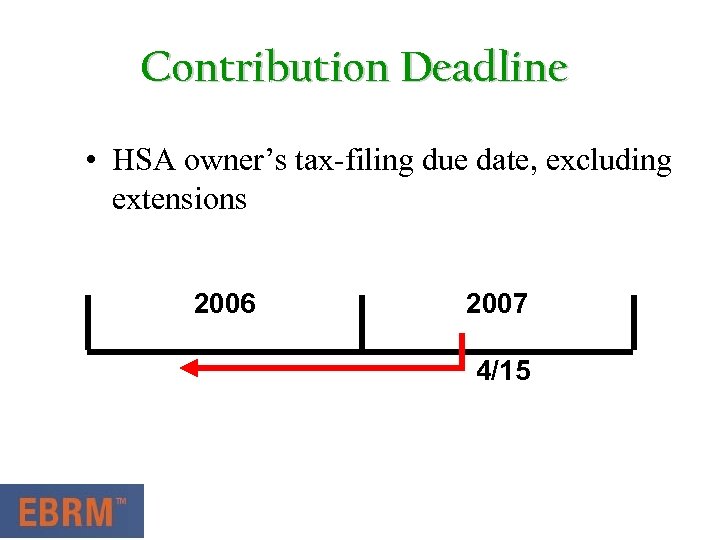

Contribution Deadline • HSA owner’s tax-filing due date, excluding extensions 2006 2007 4/15

HSA Distributions • An HSA owner can take distributions any time • Financial organizations and employers are not required to verify any HSA distribution • An HSA owner may use checks, or debit, credit, or stored value cards to take qualified HSA distributions • A financial organization may contractually restrict distribution frequency and minimum amounts

HSA Distributions • Tax free if used to pay for qualified medical expenses • Tax and 10 percent penalty tax apply to nonqualified distributions • Some exceptions to the penalty tax

Exceptions to the Penalty Tax • Distributions for the following reasons will avoid the 10 percent penalty tax: – Death – Disability – Attainment of age 65* *A financial organization is responsible for tracking the ages of its HSA owners and can rely on the birth date as provided by the HSA owner.

Eligible Individuals • Distributions used to pay for the following individuals’ qualified medical expenses are tax free: – HSA owner – His/her spouse – Dependents

Qualified Medical Expenses • Same as IRC 213(d) definition for itemized deductions* • Must be incurred after an HSA is established, earlier expenses are nonqualified • No age restriction • Cannot be used to pay health insurance premiums, some exceptions apply *Qualified medical expenses paid for with an HSA distribution are not eligible for a tax deduction.

Unanswered Questions • HSA contributions may not be deductible on certain state income tax returns

15 Minute HSA Overview 1. Health Savings Accounts – Legislative and Regulatory Basics 2. Consumerism in Healthcare – Why are We Doing This? 3. Carrier Experience – Does It Work?

Consumerism in Healthcare – Why are We Doing This?

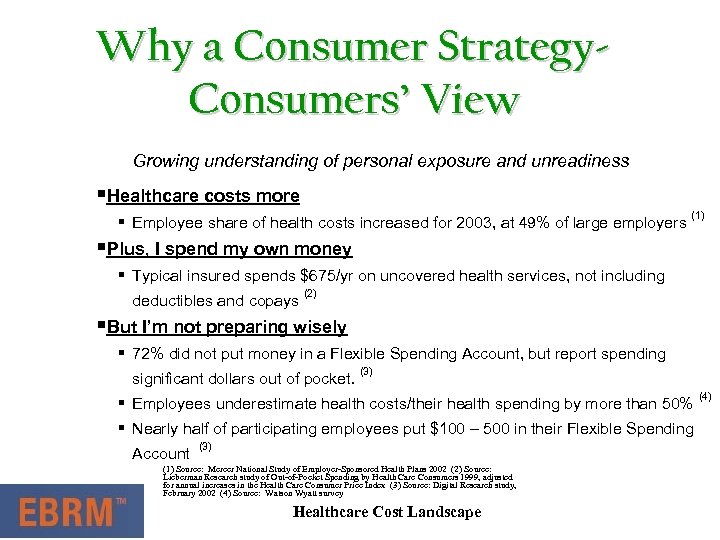

Why a Consumer Strategy. Consumers’ View Growing understanding of personal exposure and unreadiness §Healthcare costs more § Employee share of health costs increased for 2003, at 49% of large employers (1) §Plus, I spend my own money § Typical insured spends $675/yr on uncovered health services, not including deductibles and copays (2) §But I’m not preparing wisely § 72% did not put money in a Flexible Spending Account, but report spending significant dollars out of pocket. (3) § Employees underestimate health costs/their health spending by more than 50% § Nearly half of participating employees put $100 – 500 in their Flexible Spending Account (3) (1) Source: Mercer National Study of Employer-Sponsored Health Plans 2002 (2) Source: Lieberman Research study of Out-of-Pocket Spending by Health Care Consumers 1999, adjusted for annual increases in the Health Care Consumer Price Index (3) Source: Digital Research study, February 2002 (4) Source: Watson Wyatt survey Healthcare Cost Landscape (4)

Why a Consumer Strategy. Consumers’ View §I need help § 85% of employees expect their employer to provide prenegotiated savings on non-covered services. § 88% would like to know their physician’s background when purchasing a non-covered service § 94% would like to know in advance what their costs will be when purchasing a non-covered service. (3)

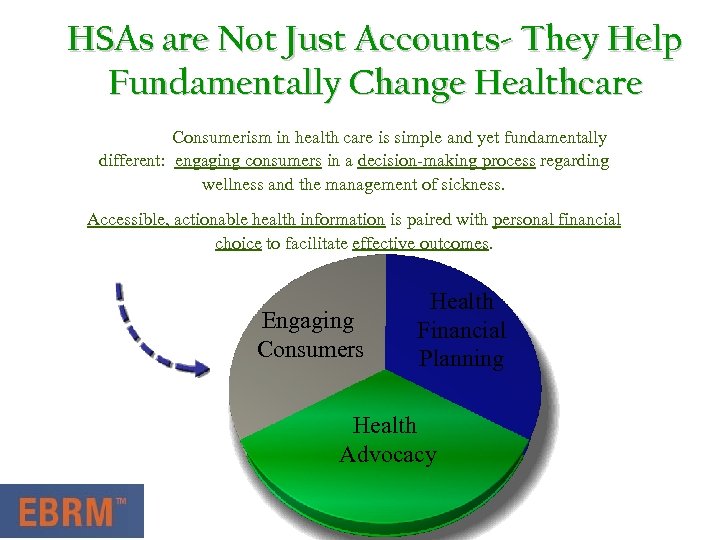

HSAs are Not Just Accounts- They Help Fundamentally Change Healthcare Consumerism in health care is simple and yet fundamentally different: engaging consumers in a decision-making process regarding wellness and the management of sickness. Accessible, actionable health information is paired with personal financial choice to facilitate effective outcomes. Engaging Consumers Health Financial Planning Health Advocacy

A Consumer Strategy. The Power of Engagement Q: Consumerism in Healthcare – Why are We Doing This? Answer: HSAs are not about changing how we finance healthcare… HSAs are about improving healthcare.

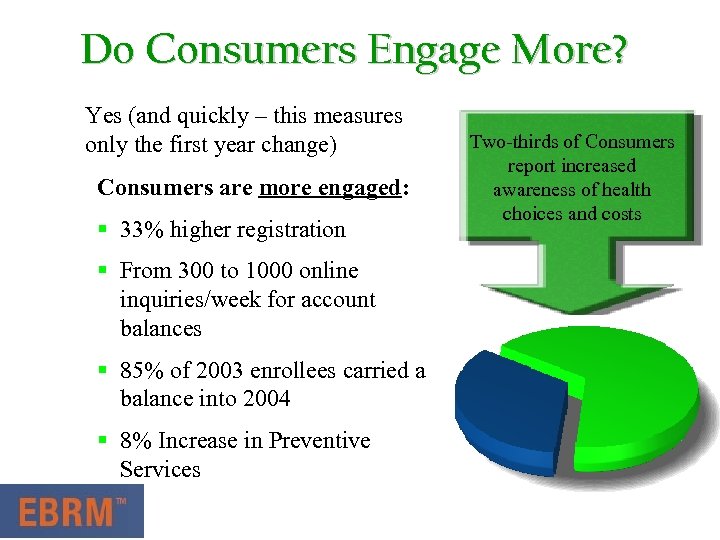

Do Consumers Engage More? Yes (and quickly – this measures only the first year change) Consumers are more engaged: § 33% higher registration § From 300 to 1000 online inquiries/week for account balances § 85% of 2003 enrollees carried a balance into 2004 § 8% Increase in Preventive Services Two-thirds of Consumers report increased awareness of health choices and costs

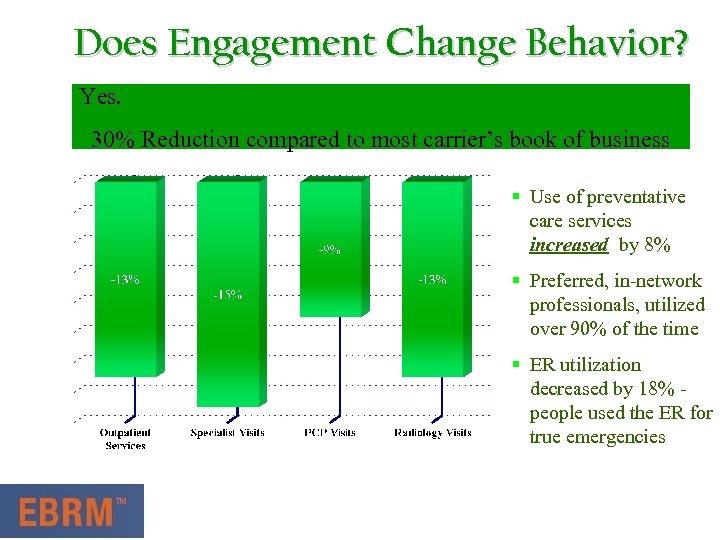

Does Engagement Change Behavior? Yes. 30% Reduction compared to most carrier’s book of business § Use of preventative care services increased by 8% § Preferred, in-network professionals, utilized over 90% of the time § ER utilization decreased by 18% people used the ER for true emergencies

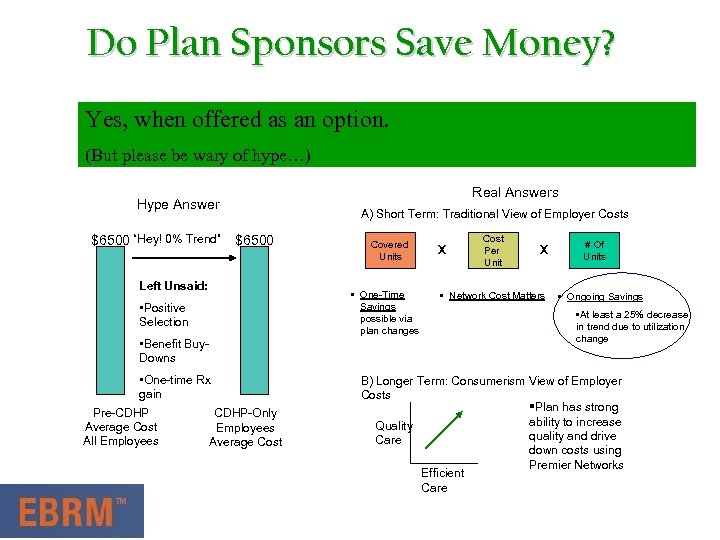

Do Plan Sponsors Save Money? Yes, when offered as an option. (But please be wary of hype…) Real Answers Hype Answer $6500 “Hey! 0% Trend” A) Short Term: Traditional View of Employer Costs $6500 Left Unsaid: • Positive Selection • Benefit Buy. Downs • One-time Rx gain Pre-CDHP-Only Average Cost Employees All Employees Average Cost Covered Units • One-Time Savings possible via plan changes X Cost Per Unit X • Network Cost Matters # Of Units • Ongoing Savings • At least a 25% decrease in trend due to utilization change B) Longer Term: Consumerism View of Employer Costs §Plan has strong ability to increase Quality quality and drive Care down costs using Premier Networks Efficient Care

Are Customers Satisfied? Yes … and satisfaction grows as consumers engage more • Enrollment and satisfaction cuts across employee type, industry – Plan 2004 slice enrollment averages are highest among CDHP players – High Plan adoption seen in manufacturing, financial services, retail and more • Consumers report increased awareness of health choices and costs – Two-thirds said that they are more aware of costs, more actively involved in choices l Satisfaction is high – 90%+ satisfaction ratings of customer service, enrollment materials – 87% overall satisfaction is at or above industry benchmarks – Follows inverse sine distribution relative to length of time from enrollment period, which means that follow-up post-enrollment communication needs to be carefully utilized • … and the consistent, persistent negative feedback is… – …that most consumers prefer to be called ‘members’ and not ‘consumers’

Questions & Answers

9bbc2c9abd9b132b277b334f0be51f66.ppt