49a962340ea129fd57baf0d9f5d4f030.ppt

- Количество слайдов: 53

What is MI? Understanding the Basics of Mortgage Insurance August 2014 © 2014 Genworth Financial, Inc. All rights reserved.

What is MI – The Basics Who Does Mortgage Insurance Insure? – Insures the LENDER not the borrower – MI required on conventional loans sold to Fannie Mae or Freddie Mac when *LTV is greater than 80% – FHA and VA loans are insured by HUD or the Veteran’s Administration – Different types of MI products are available – Investors/Lenders restrict the “type” of MI they allow – Every MI rate is filed as required by applicable state law – Genworth is an approved MI provider by Fannie Mae and Freddie Mac – MI is not life or credit life insurance *LTV is calculated by dividing the loan amount by lesser of the sales price or appraised value for a purchase or for a refinance use the loan amount divided by the appraised value August 2014 - What is MI? 2

How MI Helps Borrower Benefits – Less than 20% down – Average homebuyer can take up to 10 years to save the 20% down – MI can be cancelled in certain cases • MI is always cancelable by Lender but Investors may have certain requirements when it can be cancelled • Homeowners Protection Act requires that MI must be cancelled at 78%LTV unless Investor has parameters around defaulted situations – Tax deductible * – Affordable – Homeowner Assistance *For further information about the deductability of MI seek a tax professional August 2014 - What is MI? 3

MI Products Genworth Mortgage Insurance Products – Borrower paid Monthly and Zero Monthly (BPMI) – Borrower paid Standard Annual (Paid Monthly by borrower - remitted annually) – Borrower paid level Annual – Borrower or Lender Paid Split Premium – Borrower paid Single Premium/Non-Refundable – Lender Paid Single Premium Non-Refundable (LPMI) Genworth Offers Many Types of Mortgage Insurance Products But Investors Dictate What Type of MI They Will Allow August 2014 - What is MI? 4

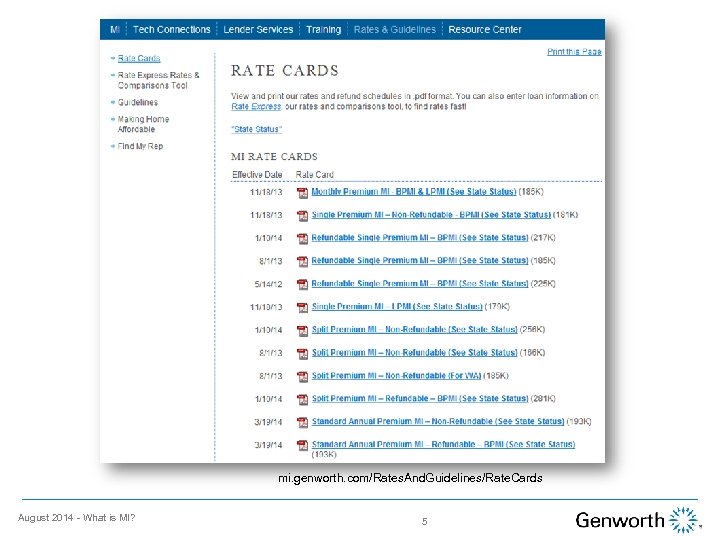

mi. genworth. com/Rates. And. Guidelines/Rate. Cards August 2014 - What is MI? 5

Product: Borrower Paid Monthly (BPMI) Monthly Premium MI – Is a payment option which features a coverage term of one month; premiums are remitted monthly. The premium rate shown is the annualized first year and renewal premium rate. To determine the monthly premium, multiply the premium rate by the loan amount and divide by 12. Borrower Paid – Non-refundable Renewal Premiums – For Constant Renewals: • The renewal premium rate is applied to the original loan balance for years 1 through 10. • For years 11 through term, the rate is reduced to 0. 20% or remains the same if the rate is less than 0. 20%. • Premium adjustments do not apply to the 11 th year rate through term. – – Lender Benefits Premium does not count against qualified mortgage (QM) points & fees 1 Simple to process and explain to borrower… payment embedded in PITI Commonly accepted – no investor restrictions Easier processing & lower monthly payments than FHA loans 1 Per the CFPB’s ATR/QM Small Entity Compliance Guide, monthly or annual PMI premiums are excluded from Points and Fees. The language can be found on page 38 of the guide which says the following: “Private mortgage insurance (PMI) premiums: Exclude monthly or annual PMI premiums. You may also exclude up-front PMI premiums if the premium is refundable on a prorated basis and a refund is automatically issued upon loan satisfaction. ” August 2014 - What is MI? 6

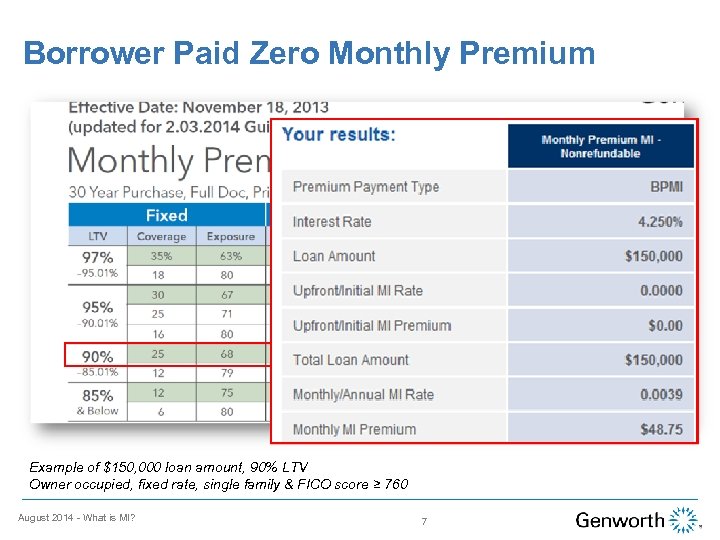

Borrower Paid Zero Monthly Premium Example of $150, 000 loan amount, 90% LTV Owner occupied, fixed rate, single family & FICO score ≥ 760 August 2014 - What is MI? 7

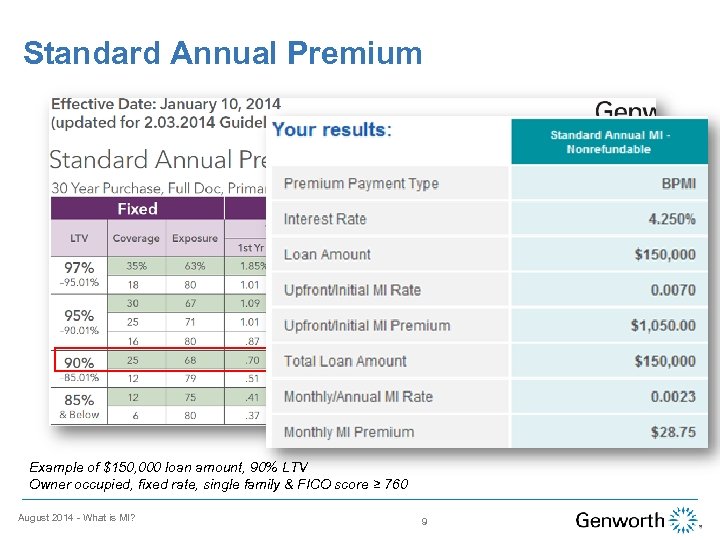

Product: Standard Annual Premium MI – Is a payment option that features an initial coverage term of twelve months; premiums are remitted annually. The rate is higher for the first year and reduced for the renewal years. Borrower Paid – Refundable and Non-refundable options - must meet QM test Renewal Premiums – For Constant Renewals: • The renewal premium rate is applied to the original loan balance for years 2 through 10. • For years 11 through term, the rate is reduced to 0. 20% or remains the same if the rate is less than 0. 25%. • Premium adjustments do not apply to the 11 th year rate through term. Lender Benefits • • • Premium does not count against qualified mortgage (QM) points & fees 1 Provide borrowers more ways to pay for MI Easier processing & lower monthly payments than FHA loans 1 Per the CFPB’s ATR/QM Small Entity Compliance Guide, monthly or annual PMI premiums are excluded from Points and Fees. The language can be found on page 38 of the guide which says the following: “Private mortgage insurance (PMI) premiums: Exclude monthly or annual PMI premiums. You may also exclude up-front PMI premiums if the premium is refundable on a prorated basis and a refund is automatically issued upon loan satisfaction. ” August 2014 - What is MI? 8

Standard Annual Premium Example of $150, 000 loan amount, 90% LTV Owner occupied, fixed rate, single family & FICO score ≥ 760 August 2014 - What is MI? 9

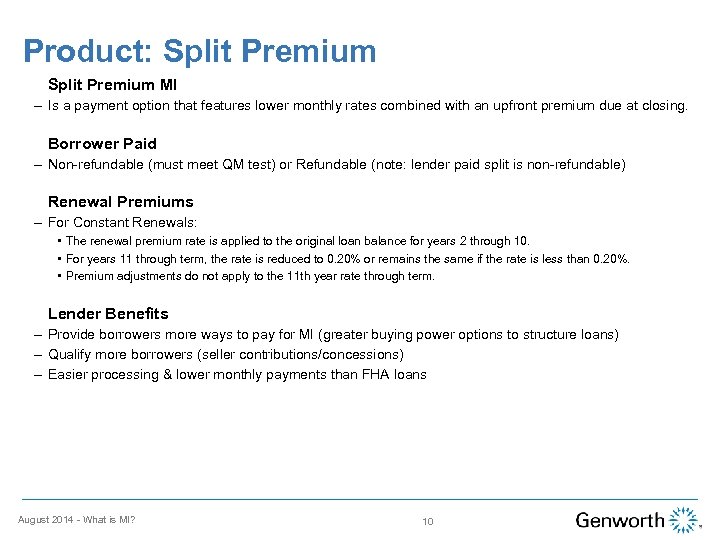

Product: Split Premium MI – Is a payment option that features lower monthly rates combined with an upfront premium due at closing. Borrower Paid – Non-refundable (must meet QM test) or Refundable (note: lender paid split is non-refundable) Renewal Premiums – For Constant Renewals: • The renewal premium rate is applied to the original loan balance for years 2 through 10. • For years 11 through term, the rate is reduced to 0. 20% or remains the same if the rate is less than 0. 20%. • Premium adjustments do not apply to the 11 th year rate through term. Lender Benefits – Provide borrowers more ways to pay for MI (greater buying power options to structure loans) – Qualify more borrowers (seller contributions/concessions) – Easier processing & lower monthly payments than FHA loans August 2014 - What is MI? 10

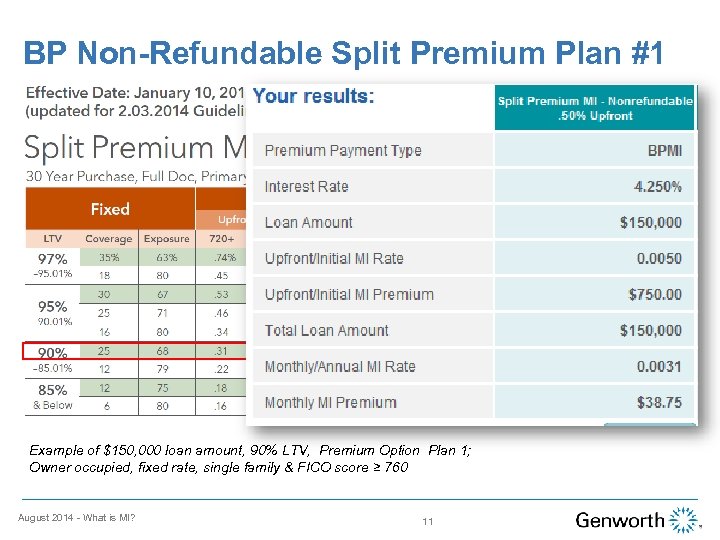

BP Non-Refundable Split Premium Plan #1 Example of $150, 000 loan amount, 90% LTV, Premium Option Plan 1; Owner occupied, fixed rate, single family & FICO score ≥ 760 August 2014 - What is MI? 11

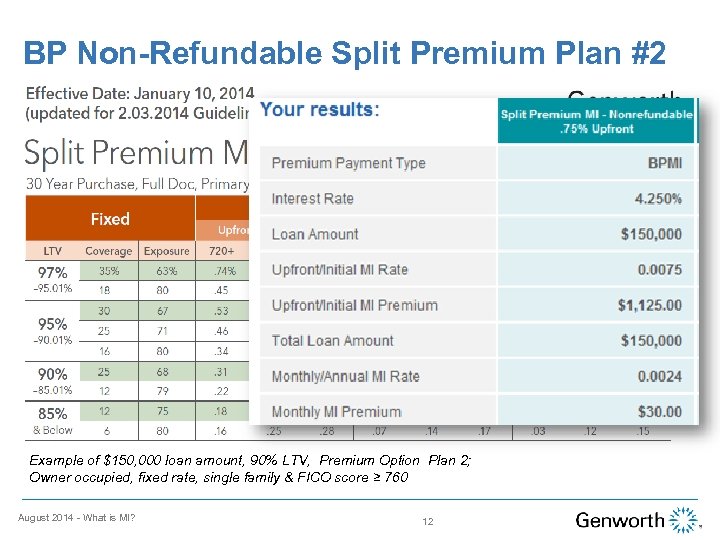

BP Non-Refundable Split Premium Plan #2 Example of $150, 000 loan amount, 90% LTV, Premium Option Plan 2; Owner occupied, fixed rate, single family & FICO score ≥ 760 August 2014 - What is MI? 12

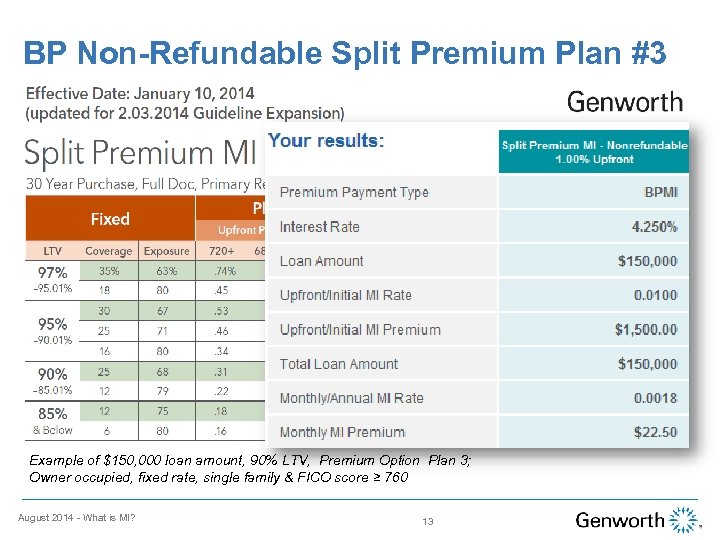

BP Non-Refundable Split Premium Plan #3 Example of $150, 000 loan amount, 90% LTV, Premium Option Plan 3; Owner occupied, fixed rate, single family & FICO score ≥ 760 August 2014 - What is MI? 13

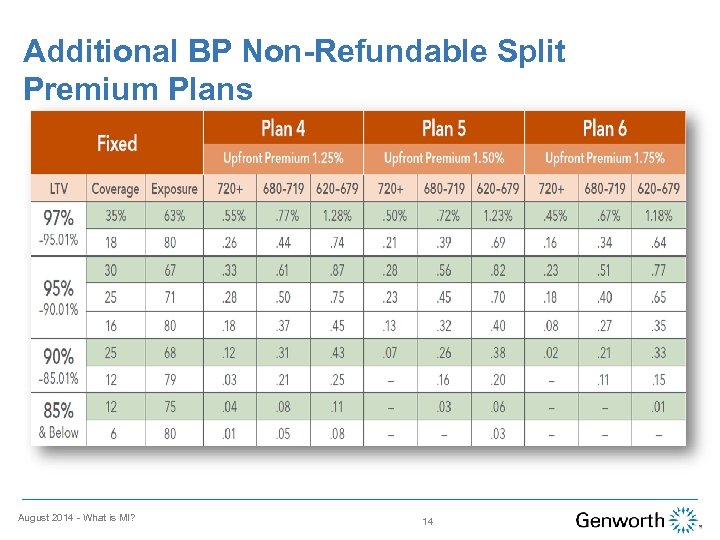

Additional BP Non-Refundable Split Premium Plans August 2014 - What is MI? 14

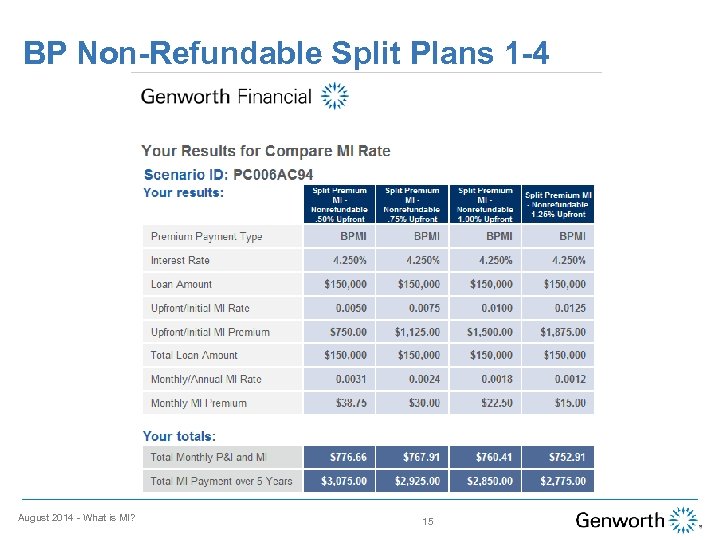

BP Non-Refundable Split Plans 1 -4 August 2014 - What is MI? 15

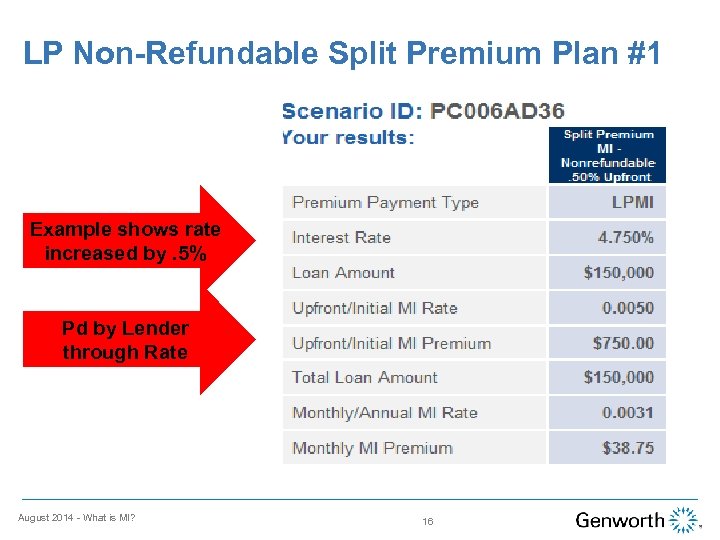

LP Non-Refundable Split Premium Plan #1 Example shows rate increased by. 5% Pd by Lender through Rate August 2014 - What is MI? 16

Product: Singles Borrower Paid – Provides coverage until the loan amortizes to 78% of the original value, unless previously cancelled. (Must meet QM test) Lender Paid – Single premium lender paid options one–time premium coverage for the life of the loan. – Non-refundable only – See secondary for pricing Lender Benefits – Qualify more borrowers – Reduce expenses – underwrite & process one loan – LPMI: premium does not count against qualified mortgage (QM) points & fees Reminder: For BPMI non-refundable, the borrower may still get a refund if cancelled subject to HPA. August 2014 - What is MI? 17

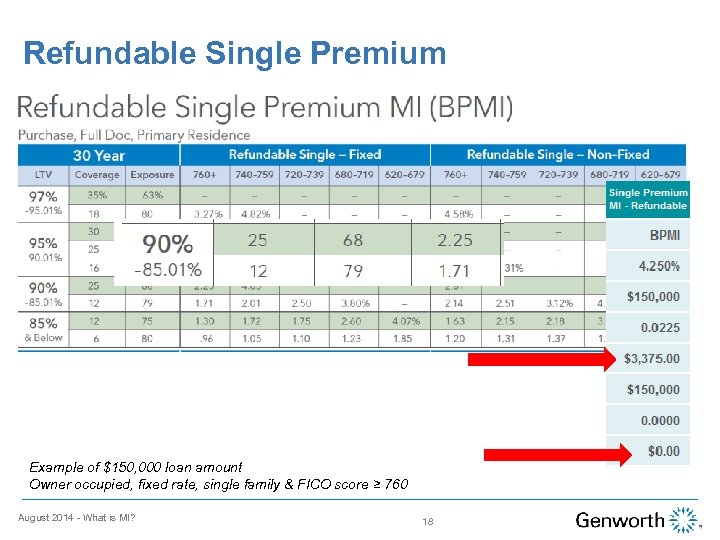

Refundable Single Premium Example of $150, 000 loan amount Owner occupied, fixed rate, single family & FICO score ≥ 760 August 2014 - What is MI? 18

Coverage and Exposure Coverage – Percentage of risk the MI company has – Fannie Mae and Freddie Mac have coverage requirements – Most investors follow Fannie/Freddie guidelines for MI coverage – Lenders must ensure the required MI coverage is in force on the loan to deliver it Exposure – The amount of risk the lender has – Most investors follow “exposure” requirements of Fannie Mae and Freddie Mac – Determining “exposure” is not part of the credit underwriting of the mortgage – Ensuring proper MI coverage is! August 2014 - What is MI? 19

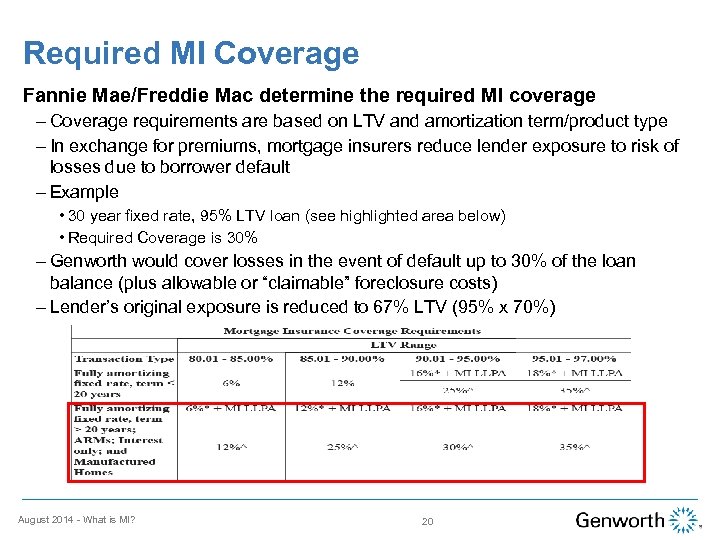

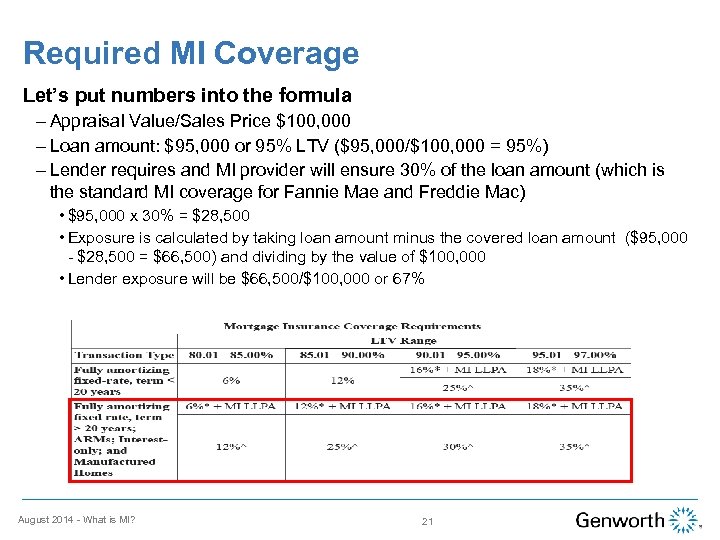

Required MI Coverage Fannie Mae/Freddie Mac determine the required MI coverage – Coverage requirements are based on LTV and amortization term/product type – In exchange for premiums, mortgage insurers reduce lender exposure to risk of losses due to borrower default – Example • 30 year fixed rate, 95% LTV loan (see highlighted area below) • Required Coverage is 30% – Genworth would cover losses in the event of default up to 30% of the loan balance (plus allowable or “claimable” foreclosure costs) – Lender’s original exposure is reduced to 67% LTV (95% x 70%) August 2014 - What is MI? 20

Required MI Coverage Let’s put numbers into the formula – Appraisal Value/Sales Price $100, 000 – Loan amount: $95, 000 or 95% LTV ($95, 000/$100, 000 = 95%) – Lender requires and MI provider will ensure 30% of the loan amount (which is the standard MI coverage for Fannie Mae and Freddie Mac) • $95, 000 x 30% = $28, 500 • Exposure is calculated by taking loan amount minus the covered loan amount ($95, 000 - $28, 500 = $66, 500) and dividing by the value of $100, 000 • Lender exposure will be $66, 500/$100, 000 or 67% August 2014 - What is MI? 21

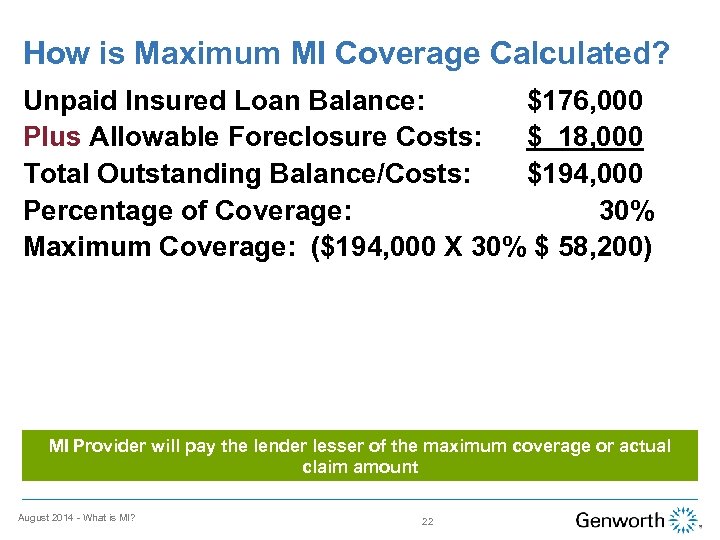

How is Maximum MI Coverage Calculated? Unpaid Insured Loan Balance: $176, 000 Plus Allowable Foreclosure Costs: $ 18, 000 Total Outstanding Balance/Costs: $194, 000 Percentage of Coverage: 30% Maximum Coverage: ($194, 000 X 30% $ 58, 200) MI Provider will pay the lender lesser of the maximum coverage or actual claim amount August 2014 - What is MI? 22

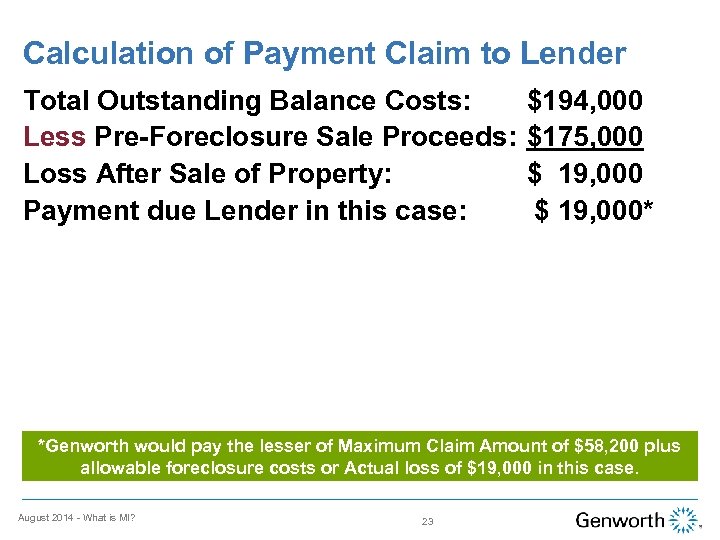

Calculation of Payment Claim to Lender Total Outstanding Balance Costs: Less Pre-Foreclosure Sale Proceeds: Loss After Sale of Property: Payment due Lender in this case: $194, 000 $175, 000 $ 19, 000* *Genworth would pay the lesser of Maximum Claim Amount of $58, 200 plus allowable foreclosure costs or Actual loss of $19, 000 in this case. August 2014 - What is MI? 23

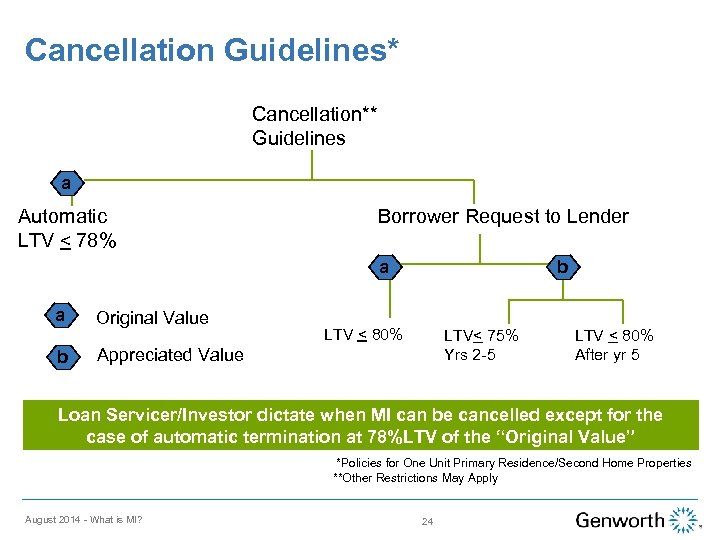

Cancellation Guidelines* Cancellation** Guidelines a Automatic LTV < 78% Borrower Request to Lender a a b Original Value b LTV < 80% LTV< 75% Yrs 2 -5 Appreciated Value LTV < 80% After yr 5 Loan Servicer/Investor dictate when MI can be cancelled except for the case of automatic termination at 78%LTV of the “Original Value” *Policies for One Unit Primary Residence/Second Home Properties **Other Restrictions May Apply August 2014 - What is MI? 24

Cancellation Guidelines* MI cannot be cancelled without authorization from the Servicer – HPA (Homeowners Protection Act) law went into effect on July 29, 1999 • Applies to single family residential loans closed on or after July 29, 1999 – Cancellation at 80% or LTV • Borrower may request to cancel MI when the loan reaches 80% of the original property value based on the initial amortization schedule or actual balance (in the event of curtailment). – Automatic Termination at 78% LTV • Servicers must cancel MI when the LTV reaches 78% based on the initial amortization schedule. * * Additional requirements/restrictions may apply - check with the loan servicer for requirements August 2014 - What is MI? 25

Resources Genworth Rate Cards Qualified Mortgage (QM) Info Rate Express℠ Tool and Mobile App Genworth Underwriting Guidelines August 2014 - What is MI? 26

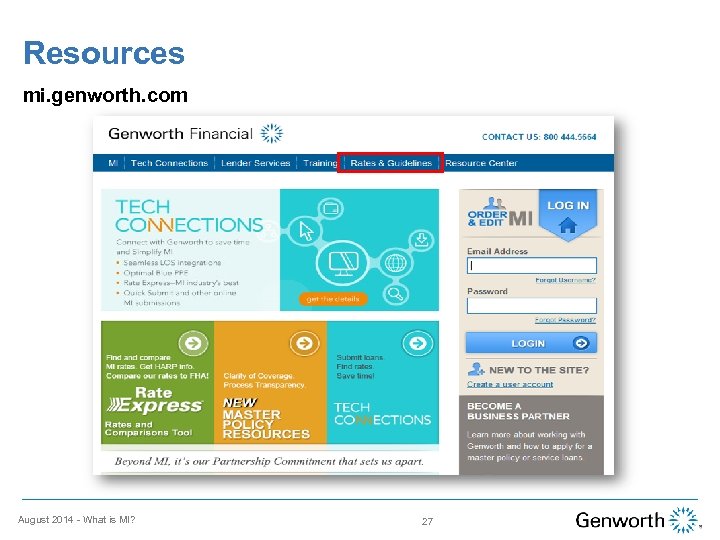

Resources mi. genworth. com August 2014 - What is MI? 27

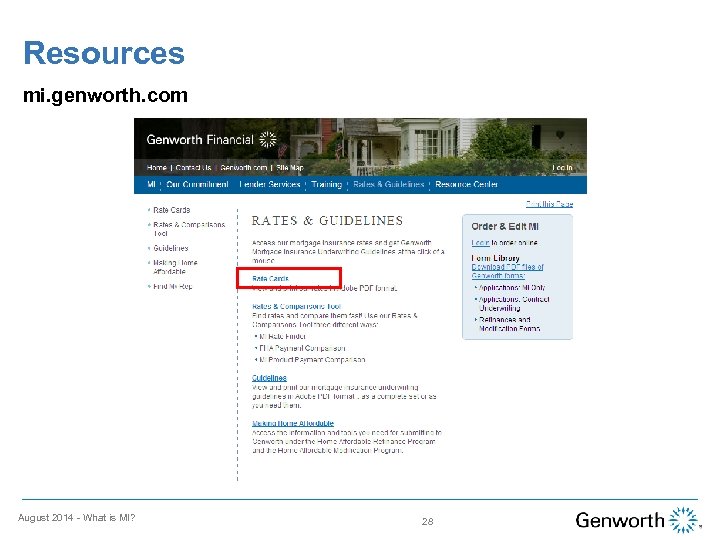

Resources mi. genworth. com August 2014 - What is MI? 28

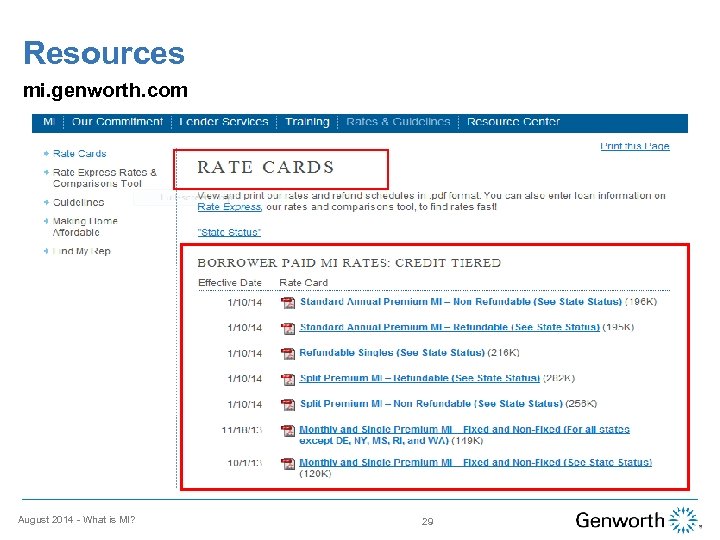

Resources mi. genworth. com August 2014 - What is MI? 29

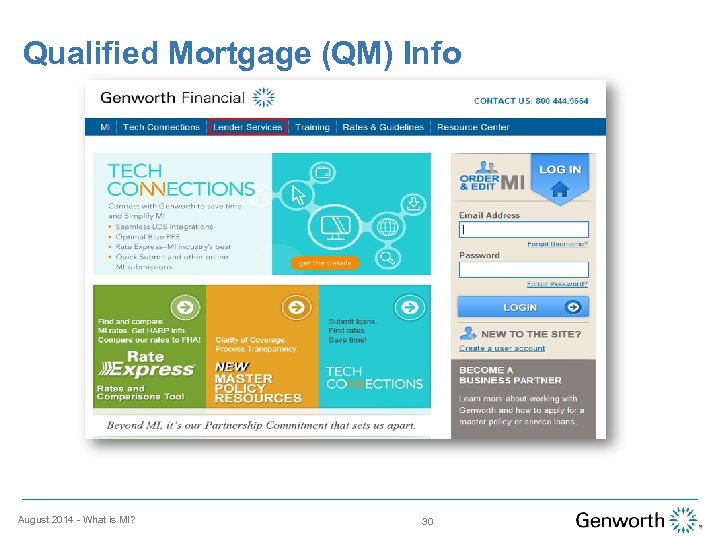

Qualified Mortgage (QM) Info August 2014 - What is MI? 30

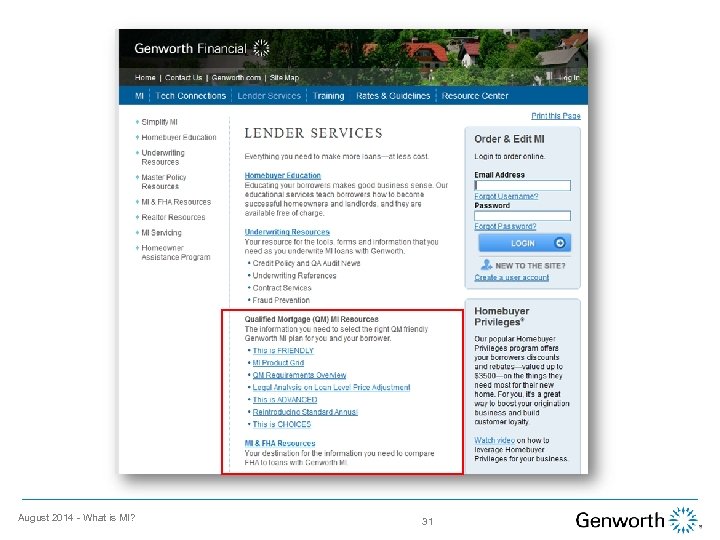

August 2014 - What is MI? 31

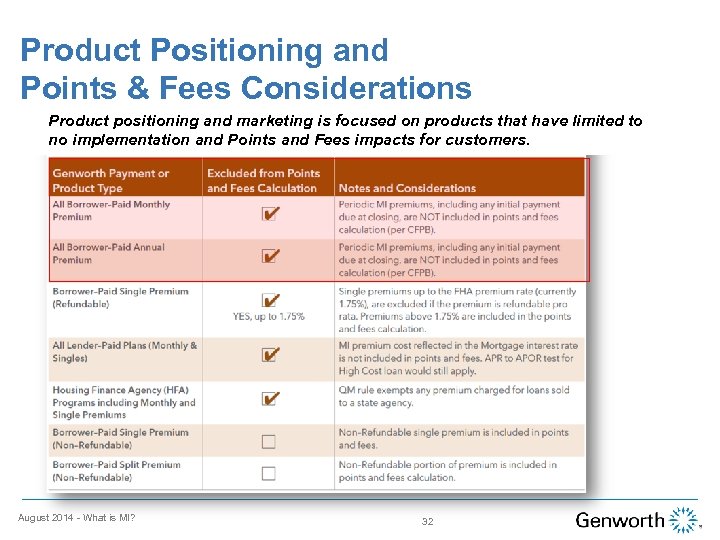

Product Positioning and Points & Fees Considerations Product positioning and marketing is focused on products that have limited to no implementation and Points and Fees impacts for customers. August 2014 - What is MI? 32

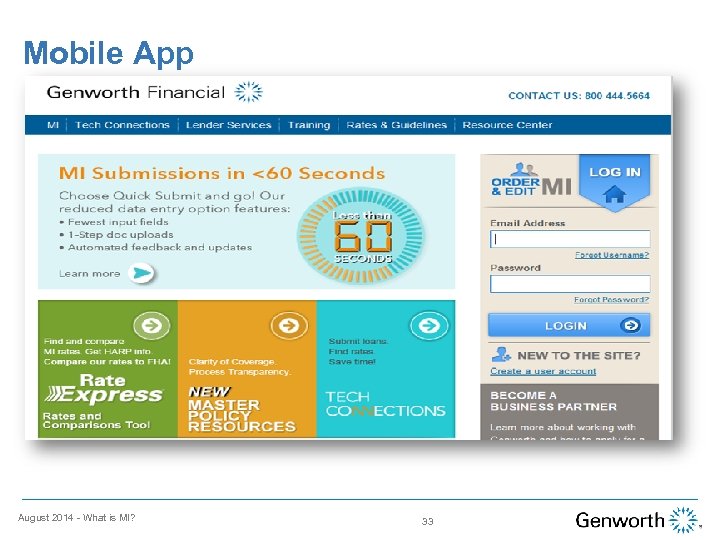

Mobile App August 2014 - What is MI? 33

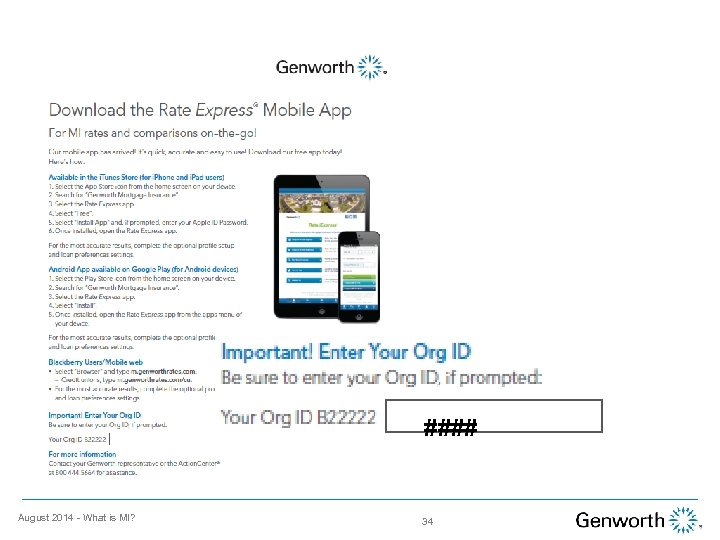

#### August 2014 - What is MI? 34

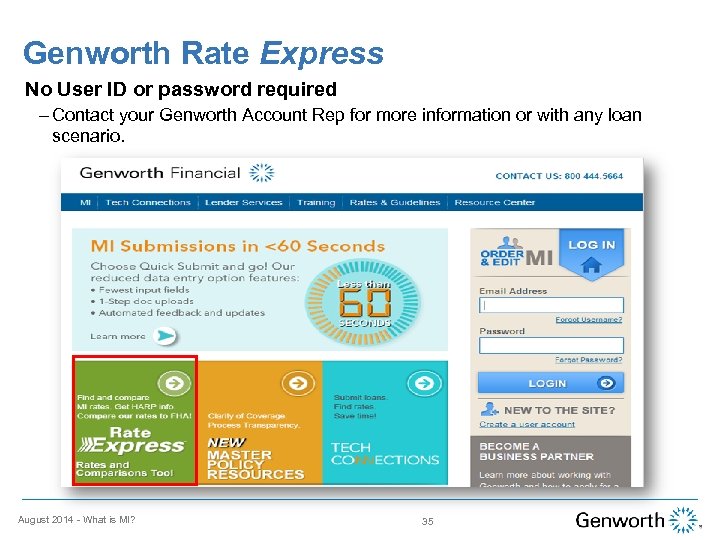

Genworth Rate Express No User ID or password required – Contact your Genworth Account Rep for more information or with any loan scenario. August 2014 - What is MI? 35

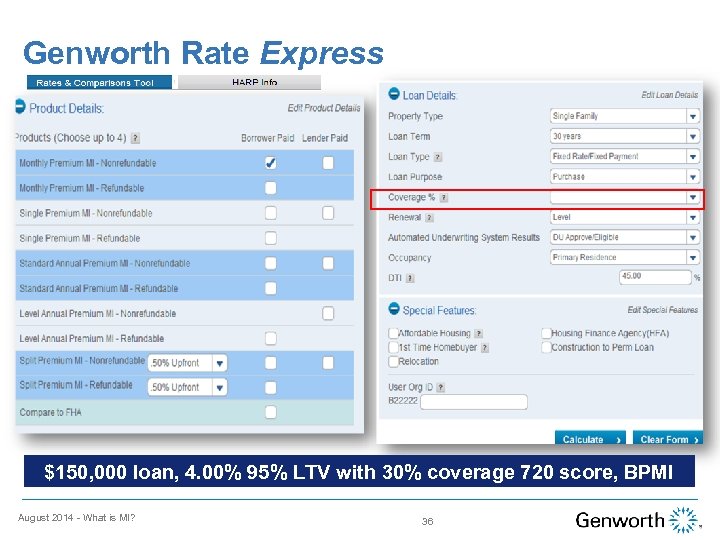

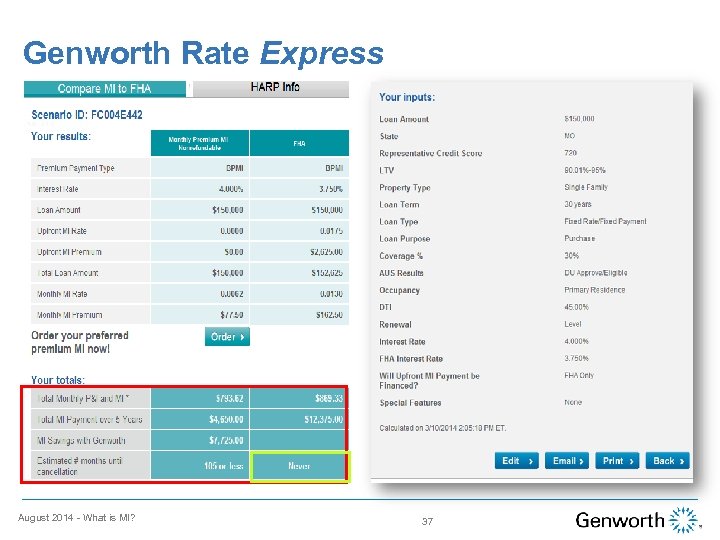

Genworth Rate Express $150, 000 loan, 4. 00% 95% LTV with 30% coverage 720 score, BPMI August 2014 - What is MI? 36

Genworth Rate Express August 2014 - What is MI? 37

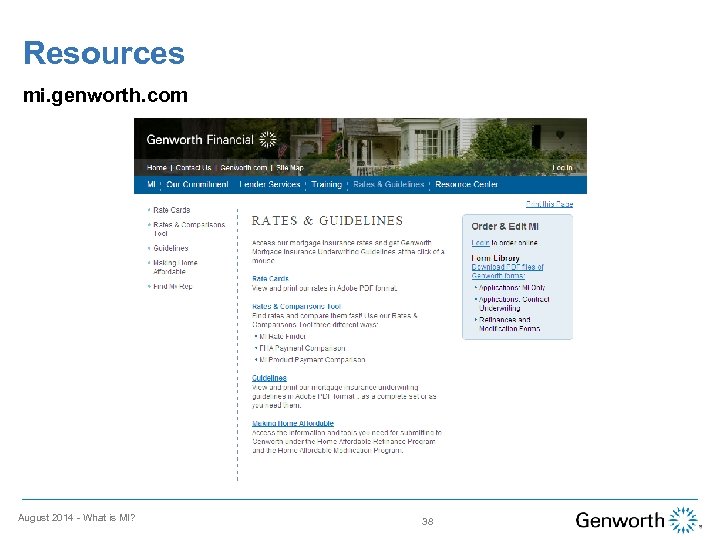

Resources mi. genworth. com August 2014 - What is MI? 38

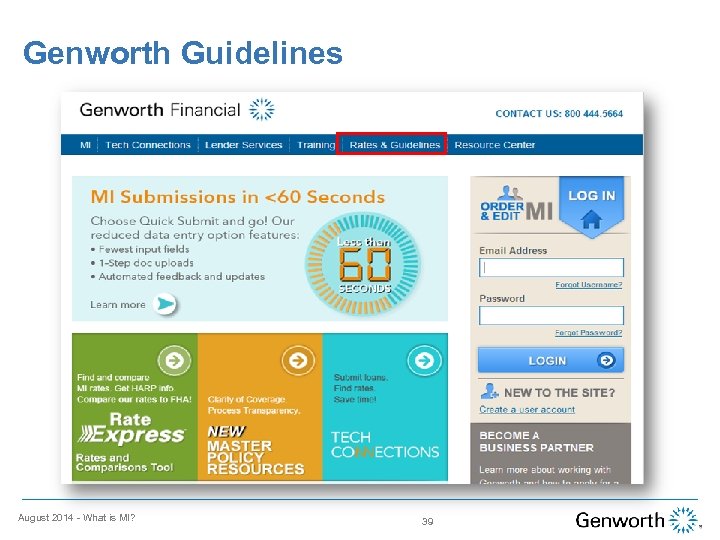

Genworth Guidelines August 2014 - What is MI? 39

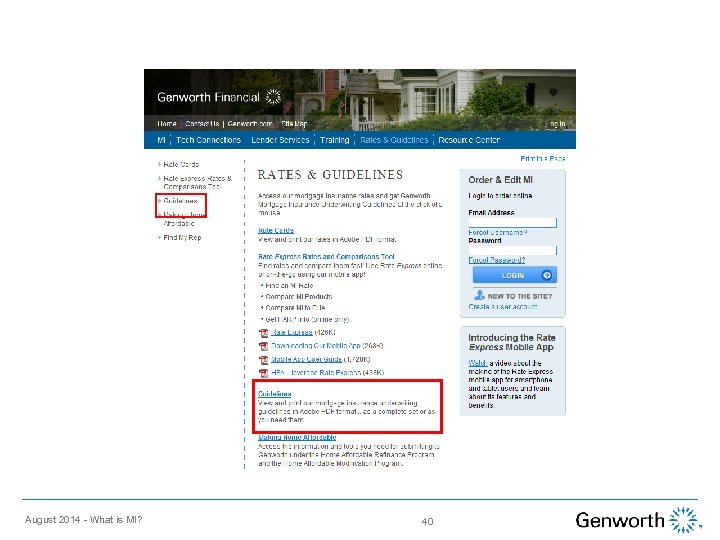

August 2014 - What is MI? 40

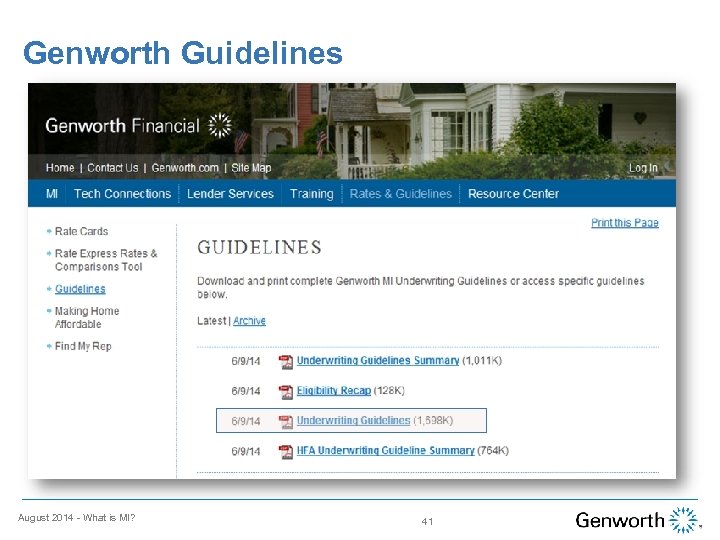

Genworth Guidelines August 2014 - What is MI? 41

Genworth Guidelines Genworth Mortgage Insurance National Eligibility and Guidelines August 2014 - What is MI? 42

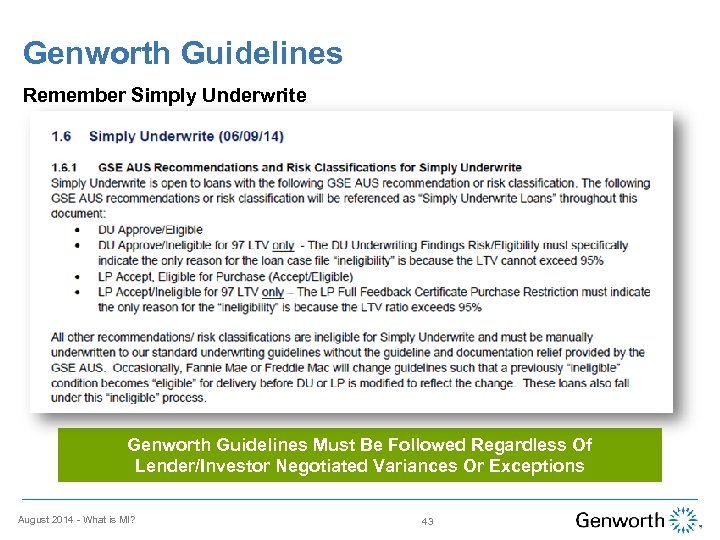

Genworth Guidelines Remember Simply Underwrite Genworth Guidelines Must Be Followed Regardless Of Lender/Investor Negotiated Variances Or Exceptions August 2014 - What is MI? 43

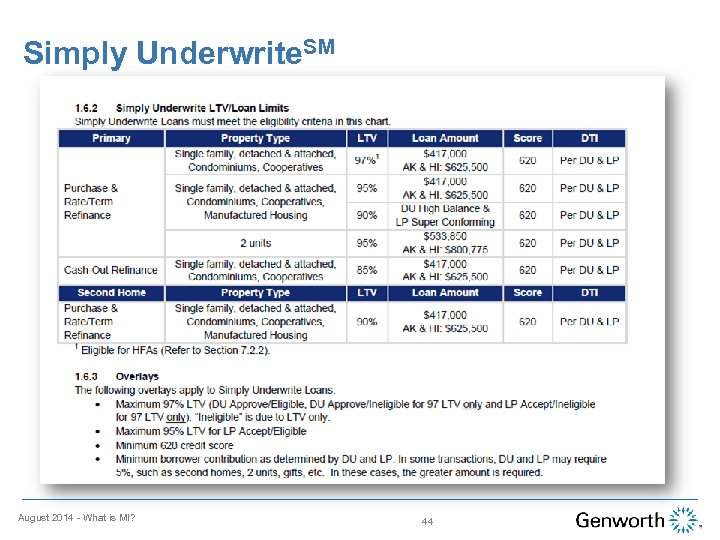

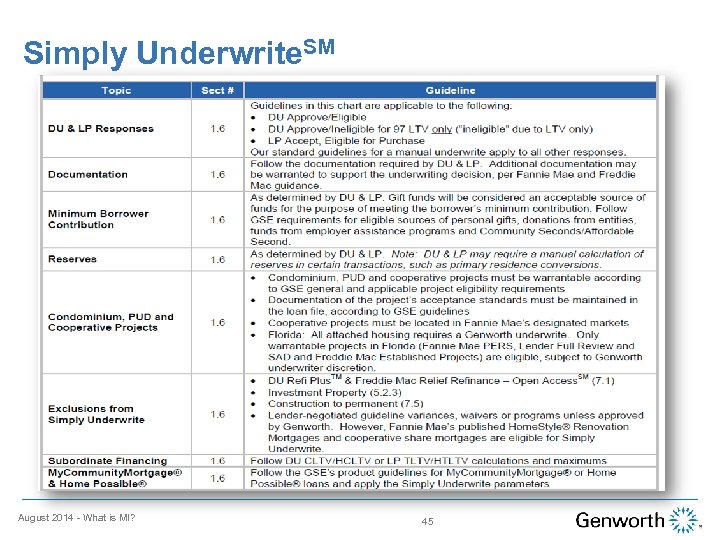

Simply Underwrite. SM August 2014 - What is MI? 44

Simply Underwrite. SM August 2014 - What is MI? 45

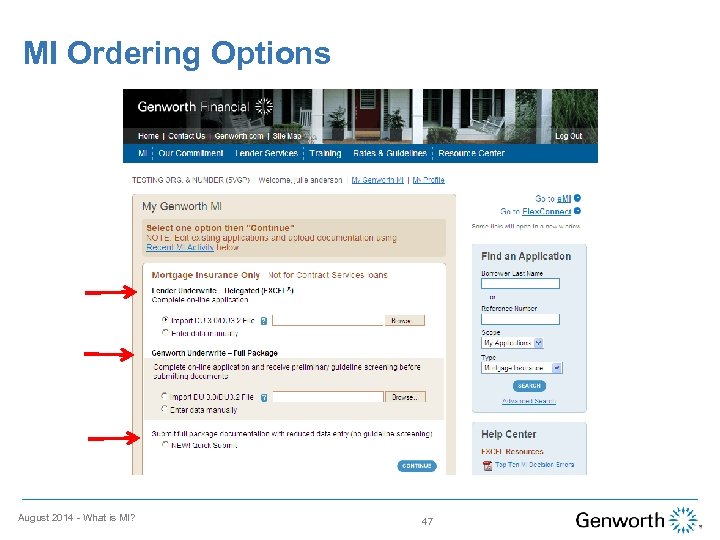

MI Ordering Options Genworth Underwrite Genworth’s Delegated Underwriting August 2014 - What is MI? 46

MI Ordering Options August 2014 - What is MI? 47

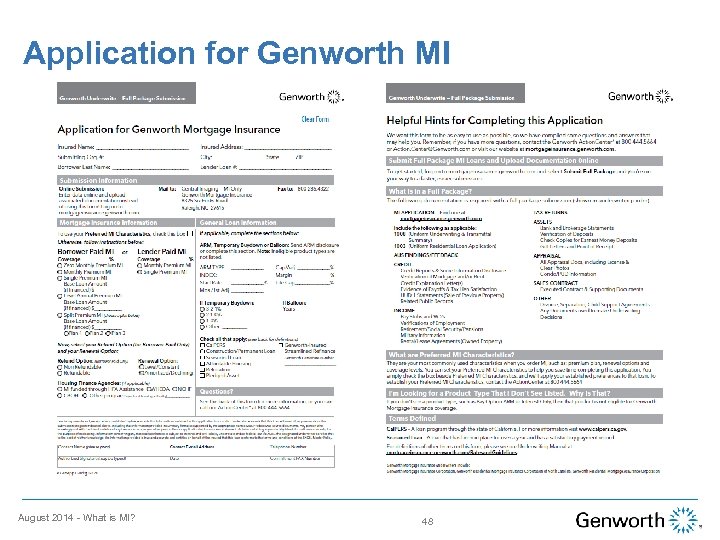

Application for Genworth MI August 2014 - What is MI? 48

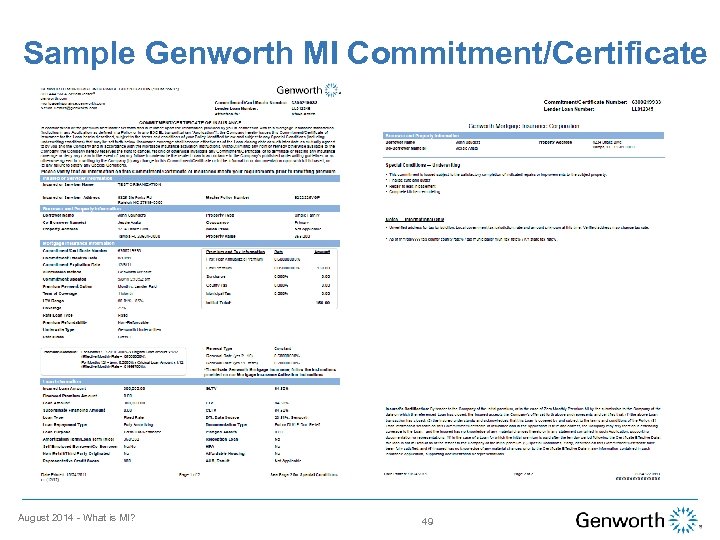

Sample Genworth MI Commitment/Certificate August 2014 - What is MI? 49

Genworth Action. Center® For additional information on MI underwriting, MI servicing, premium billing, technical assistance and general inquires contact the Genworth Action. Center. 800 444. 5664 action. center@genworth. com http: //www. mortgageinsurance. genworth. com/ August 2014 - What is MI? 50

Genworth Underwriting Resources mi. genworth. com/Lender. Services/Underwriting August 2014 - What is MI? 51

Additional Resources GENWORTH RESOURCES Action Center: 800 444. 5664 Your Local Genworth Underwriting Manager Your Genworth Account Executive or Manager August 2014 - What is MI? 52

Legal Disclaimer Genworth Mortgage Insurance is happy to provide you with these training materials. While we strive for accuracy, we also know that any discussion of laws and their application to particular facts is subject to individual interpretation, change, and other uncertainties. Our training is not intended as legal advice, and is not a substitute for advice of counsel. You should always check with your own legal advisors for interpretations of legal and compliance principles applicable to your business. GENWORTH EXPRESSLY DISCLAIMS ANY AND ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING WITHOUT LIMITATION WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE, WITH RESPECT TO THESE MATERIALS AND THE RELATED TRAINING. IN NO EVENT SHALL GENWORTH BE LIABLE FOR ANY DIRECT, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES OF ANY KIND WHATSOEVER WITH RESPECT TO THE TRAINING AND THE MATERIALS. Desktop Underwriter ® or DU® are registered trademarks of Fannie Mae Loan Prospector ® or LP ® are registered trademarks of Freddie Mac Excel® is a registered trademark of Genworth August 2014 - What is MI? 53

49a962340ea129fd57baf0d9f5d4f030.ppt