What is in a store for a smart tax payer ? Think Smart………… Act with smartness……… Enjoy the fruits of smart action…. .

What is in a store for a smart tax payer ? Think Smart………… Act with smartness……… Enjoy the fruits of smart action…. .

Invest in Tax Saving Schemes (Equity Linked Saving Schemes - ELSS) of Mutual Fund

Invest in Tax Saving Schemes (Equity Linked Saving Schemes - ELSS) of Mutual Fund

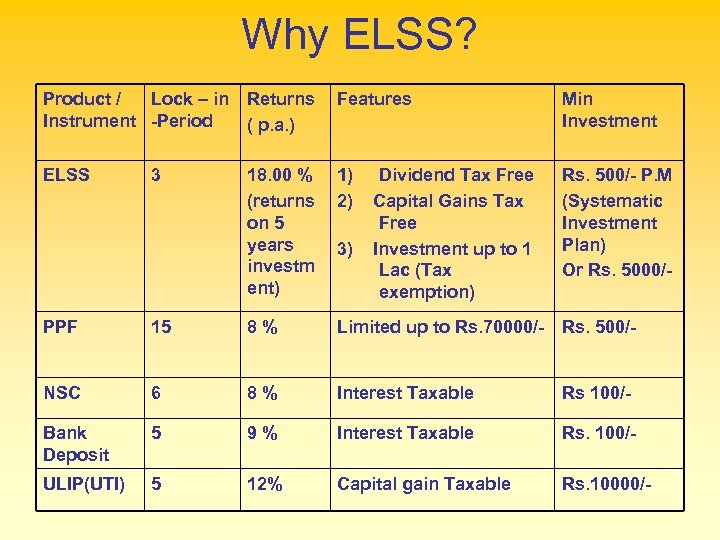

Why ELSS? Product / Lock – in Instrument -Period Returns ( p. a. ) Features Min Investment ELSS 18. 00 % (returns on 5 years investm ent) 1) 2) Rs. 500/- P. M (Systematic Investment Plan) Or Rs. 5000/- 3 3) Dividend Tax Free Capital Gains Tax Free Investment up to 1 Lac (Tax exemption) PPF 15 8% Limited up to Rs. 70000/- Rs. 500/- NSC 6 8% Interest Taxable Rs 100/- Bank Deposit 5 9% Interest Taxable Rs. 100/- ULIP(UTI) 5 12% Capital gain Taxable Rs. 10000/-

Why ELSS? Product / Lock – in Instrument -Period Returns ( p. a. ) Features Min Investment ELSS 18. 00 % (returns on 5 years investm ent) 1) 2) Rs. 500/- P. M (Systematic Investment Plan) Or Rs. 5000/- 3 3) Dividend Tax Free Capital Gains Tax Free Investment up to 1 Lac (Tax exemption) PPF 15 8% Limited up to Rs. 70000/- Rs. 500/- NSC 6 8% Interest Taxable Rs 100/- Bank Deposit 5 9% Interest Taxable Rs. 100/- ULIP(UTI) 5 12% Capital gain Taxable Rs. 10000/-

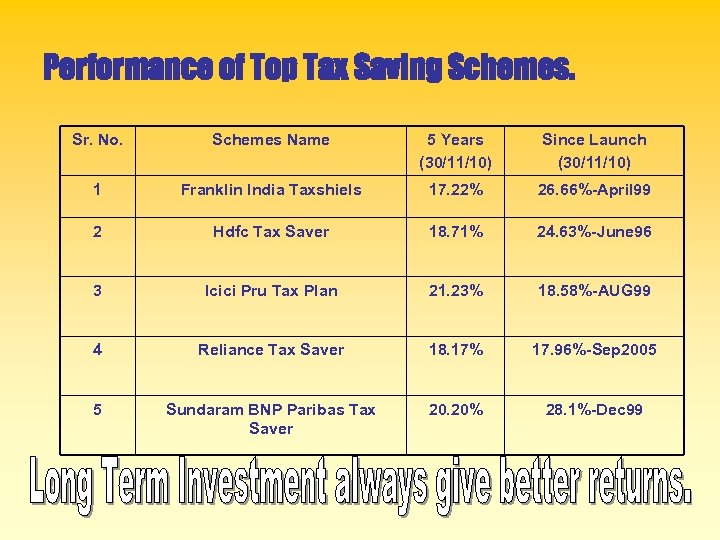

Performance of Top Tax Saving Schemes. Sr. No. Schemes Name 5 Years (30/11/10) Since Launch (30/11/10) 1 Franklin India Taxshiels 17. 22% 26. 66%-April 99 2 Hdfc Tax Saver 18. 71% 24. 63%-June 96 3 Icici Pru Tax Plan 21. 23% 18. 58%-AUG 99 4 Reliance Tax Saver 18. 17% 17. 96%-Sep 2005 5 Sundaram BNP Paribas Tax Saver 20. 20% 28. 1%-Dec 99

Performance of Top Tax Saving Schemes. Sr. No. Schemes Name 5 Years (30/11/10) Since Launch (30/11/10) 1 Franklin India Taxshiels 17. 22% 26. 66%-April 99 2 Hdfc Tax Saver 18. 71% 24. 63%-June 96 3 Icici Pru Tax Plan 21. 23% 18. 58%-AUG 99 4 Reliance Tax Saver 18. 17% 17. 96%-Sep 2005 5 Sundaram BNP Paribas Tax Saver 20. 20% 28. 1%-Dec 99

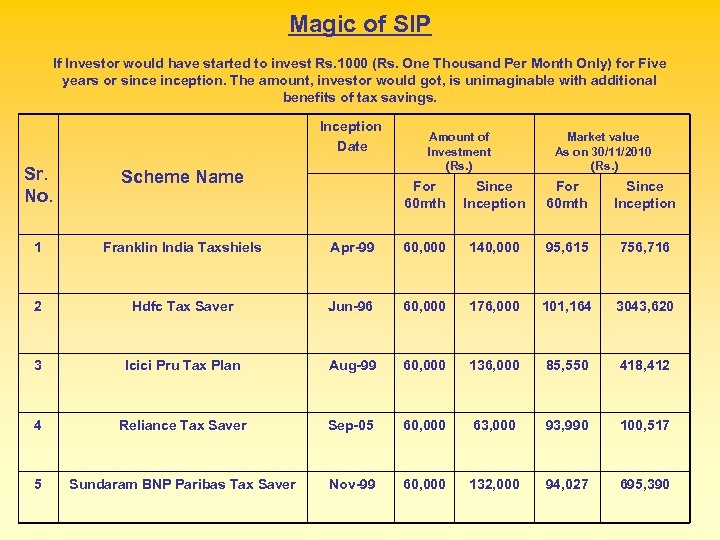

Magic of SIP If Investor would have started to invest Rs. 1000 (Rs. One Thousand Per Month Only) for Five years or sinception. The amount, investor would got, is unimaginable with additional benefits of tax savings. Inception Date Sr. No. Scheme Name 1 Franklin India Taxshiels 2 Amount of Investment (Rs. ) Market value As on 30/11/2010 (Rs. ) For 60 mth Since Inception Apr-99 60, 000 140, 000 95, 615 756, 716 Hdfc Tax Saver Jun-96 60, 000 176, 000 101, 164 3043, 620 3 Icici Pru Tax Plan Aug-99 60, 000 136, 000 85, 550 418, 412 4 Reliance Tax Saver Sep-05 60, 000 63, 000 93, 990 100, 517 5 Sundaram BNP Paribas Tax Saver Nov-99 60, 000 132, 000 94, 027 695, 390

Magic of SIP If Investor would have started to invest Rs. 1000 (Rs. One Thousand Per Month Only) for Five years or sinception. The amount, investor would got, is unimaginable with additional benefits of tax savings. Inception Date Sr. No. Scheme Name 1 Franklin India Taxshiels 2 Amount of Investment (Rs. ) Market value As on 30/11/2010 (Rs. ) For 60 mth Since Inception Apr-99 60, 000 140, 000 95, 615 756, 716 Hdfc Tax Saver Jun-96 60, 000 176, 000 101, 164 3043, 620 3 Icici Pru Tax Plan Aug-99 60, 000 136, 000 85, 550 418, 412 4 Reliance Tax Saver Sep-05 60, 000 63, 000 93, 990 100, 517 5 Sundaram BNP Paribas Tax Saver Nov-99 60, 000 132, 000 94, 027 695, 390

Why invest in Tax Saving Schemes • Opportunity to benefit from the long term India Growth Story • 3 Years lock-in- provides mutual fund : * enough flexibility to take decision with long term horizon * freedom from short term liquidity concerns * potential to invest in fundamentally strog stocks which are likely to create long term value. * ability to create a stable portfolio with lower turnover could result in lower impact / transaction cost.

Why invest in Tax Saving Schemes • Opportunity to benefit from the long term India Growth Story • 3 Years lock-in- provides mutual fund : * enough flexibility to take decision with long term horizon * freedom from short term liquidity concerns * potential to invest in fundamentally strog stocks which are likely to create long term value. * ability to create a stable portfolio with lower turnover could result in lower impact / transaction cost.

Positive outlook for Equity • • India growth story intact at 8 -9 % GDP Sensex company growth above 15 % Favourable Demography Domestic Consumption story Less Dependant on Exports Less Vulnerable to global economy Strong outsourcing story – IT / Pharma

Positive outlook for Equity • • India growth story intact at 8 -9 % GDP Sensex company growth above 15 % Favourable Demography Domestic Consumption story Less Dependant on Exports Less Vulnerable to global economy Strong outsourcing story – IT / Pharma

Have you considered Inflation ? • As inflation rises, every rupee will buy a smaller percentage of the same product. • To protect the capital, investor should earn higher rate of returns than the rate of inflation • With rise in Inflation, purchasing power will be reduced to that extent

Have you considered Inflation ? • As inflation rises, every rupee will buy a smaller percentage of the same product. • To protect the capital, investor should earn higher rate of returns than the rate of inflation • With rise in Inflation, purchasing power will be reduced to that extent

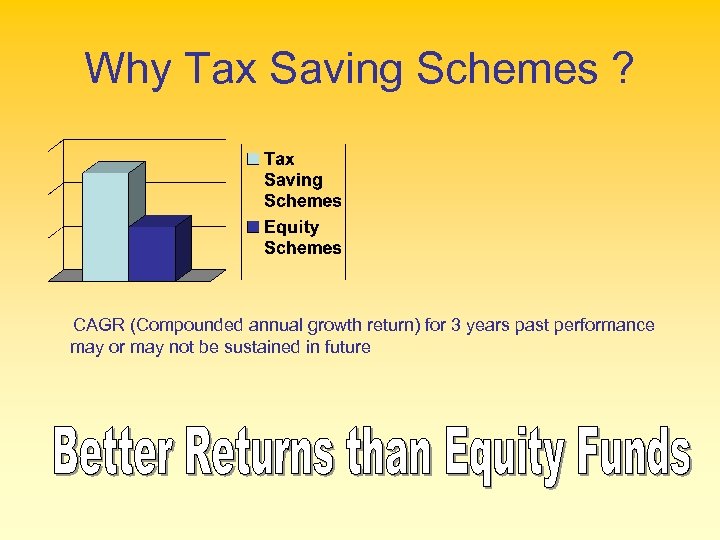

Why Tax Saving Schemes ? CAGR (Compounded annual growth return) for 3 years past performance may or may not be sustained in future

Why Tax Saving Schemes ? CAGR (Compounded annual growth return) for 3 years past performance may or may not be sustained in future

Why invest in equity funds ? * Better inflation adjusted returns from equity compared to alternative investment options. * Historical evidence in favour of equity * No long term capital gain on equity (above one year) * Indian growth story drive the market

Why invest in equity funds ? * Better inflation adjusted returns from equity compared to alternative investment options. * Historical evidence in favour of equity * No long term capital gain on equity (above one year) * Indian growth story drive the market