6d61c63e951ed6c5d3a2202f48e983aa.ppt

- Количество слайдов: 99

What is a GRAT and What is This Talk All About? (Pages 1 – 3 of the Paper)

What is a GRAT and What is This Talk All About? (Pages 1 – 3 of the Paper)

What is a GRAT and What is This Talk All About? (Continued)

What is a GRAT and What is This Talk All About? (Continued)

Some of the Goals of This Talk

Some of the Goals of This Talk

Advantages of a GRAT (Pages 3 – 8 of the Paper)

Advantages of a GRAT (Pages 3 – 8 of the Paper)

Disadvantages of a GRAT (Pages 8 – 12 of the Paper)

Disadvantages of a GRAT (Pages 8 – 12 of the Paper)

Disadvantages of a GRAT (Continued)

Disadvantages of a GRAT (Continued)

Disadvantages of a GRAT (Continued)

Disadvantages of a GRAT (Continued)

Possible Structural Solutions to Address Certain Administrative and Certain Stewardship Disadvantages of a GRAT (Pages 12 – 14 of the Paper)

Possible Structural Solutions to Address Certain Administrative and Certain Stewardship Disadvantages of a GRAT (Pages 12 – 14 of the Paper)

Possible Structural Solutions to Address Certain Administrative and Certain Stewardship Disadvantages of a GRAT (Continued)

Possible Structural Solutions to Address Certain Administrative and Certain Stewardship Disadvantages of a GRAT (Continued)

Possible Structural Solutions to Address Certain Administrative and Certain Stewardship Disadvantages of a GRAT (Continued)

Possible Structural Solutions to Address Certain Administrative and Certain Stewardship Disadvantages of a GRAT (Continued)

Possible Solutions to Allow a GRAT to Leverage a GST Exemption: Is There a 5% Exception? (Pages 14 – 27 of the Paper)

Possible Solutions to Allow a GRAT to Leverage a GST Exemption: Is There a 5% Exception? (Pages 14 – 27 of the Paper)

Example: Using the Leverage of a GRAT to Indirectly Profit a GST Trust – Non-Skip Person Exception

Example: Using the Leverage of a GRAT to Indirectly Profit a GST Trust – Non-Skip Person Exception

Using the Leverage of a GRAT to Indirectly Profit a GST Trust – Non-Skip Person Exception

Using the Leverage of a GRAT to Indirectly Profit a GST Trust – Non-Skip Person Exception

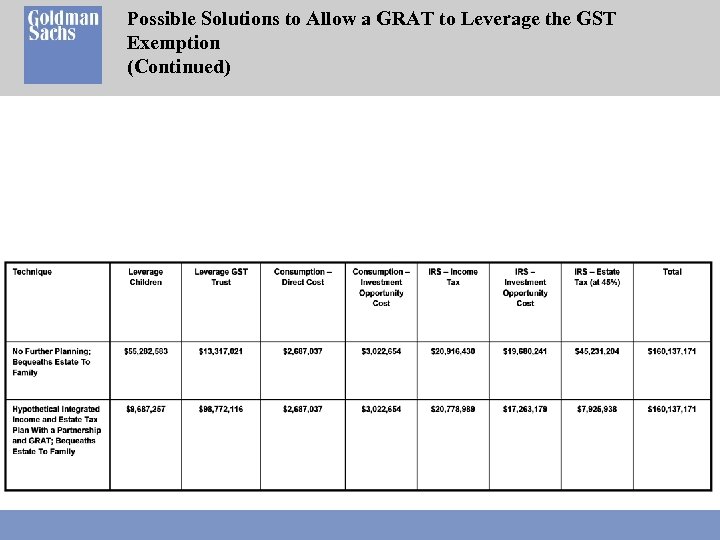

Possible Solutions to Allow a GRAT to Leverage the GST Exemption (Continued)

Possible Solutions to Allow a GRAT to Leverage the GST Exemption (Continued)

Possible Solutions to Allow a GRAT to Leverage the GST Exemption (Continued)

Possible Solutions to Allow a GRAT to Leverage the GST Exemption (Continued)

Possible Solutions to Allow a GRAT to Leverage the GST Exemption (Continued)

Possible Solutions to Allow a GRAT to Leverage the GST Exemption (Continued)

Possible Solutions to Increase the Likelihood of a Successful GRAT Even When the Investment Results of a Client’s Portfolio Are Flat or Decrease (Pages 27 – 63 of the Paper)

Possible Solutions to Increase the Likelihood of a Successful GRAT Even When the Investment Results of a Client’s Portfolio Are Flat or Decrease (Pages 27 – 63 of the Paper)

Possible Solutions to Increase the Likelihood of a Successful GRAT Even When the Investment Results of a Client’s Portfolio Are Flat or Decrease (Continued)

Possible Solutions to Increase the Likelihood of a Successful GRAT Even When the Investment Results of a Client’s Portfolio Are Flat or Decrease (Continued)

Possible Solutions to Increase the Likelihood of a Successful GRAT Even When the Investment Results of a Client’s Portfolio Are Flat or Decrease (Continued)

Possible Solutions to Increase the Likelihood of a Successful GRAT Even When the Investment Results of a Client’s Portfolio Are Flat or Decrease (Continued)

Possible Solutions to Increase the Likelihood of a Successful GRAT Even When the Investment Results of a Client’s Portfolio Are Flat or Decrease (Continued)

Possible Solutions to Increase the Likelihood of a Successful GRAT Even When the Investment Results of a Client’s Portfolio Are Flat or Decrease (Continued)

Possible Solutions to Increase the Likelihood of a Successful GRAT Even When the Investment Results of a Client’s Portfolio Are Flat or Decrease (Continued)

Possible Solutions to Increase the Likelihood of a Successful GRAT Even When the Investment Results of a Client’s Portfolio Are Flat or Decrease (Continued)

Financial Engineering May Ameliorate Those Financial Concerns: What is a Call Option?

Financial Engineering May Ameliorate Those Financial Concerns: What is a Call Option?

Simplified Call Option Example

Simplified Call Option Example

Simplified Call Spread Option Example

Simplified Call Spread Option Example

Simplified Put Option Example

Simplified Put Option Example

What is a Put Spread Option?

What is a Put Spread Option?

Simplified Put Spread Option Example

Simplified Put Spread Option Example

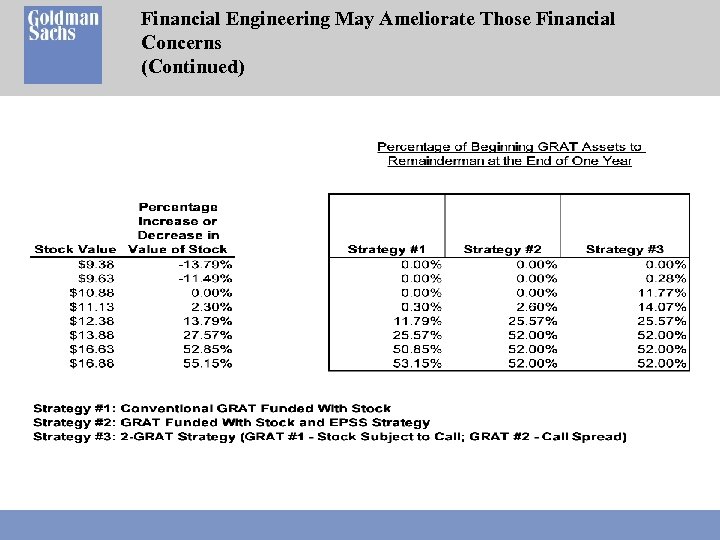

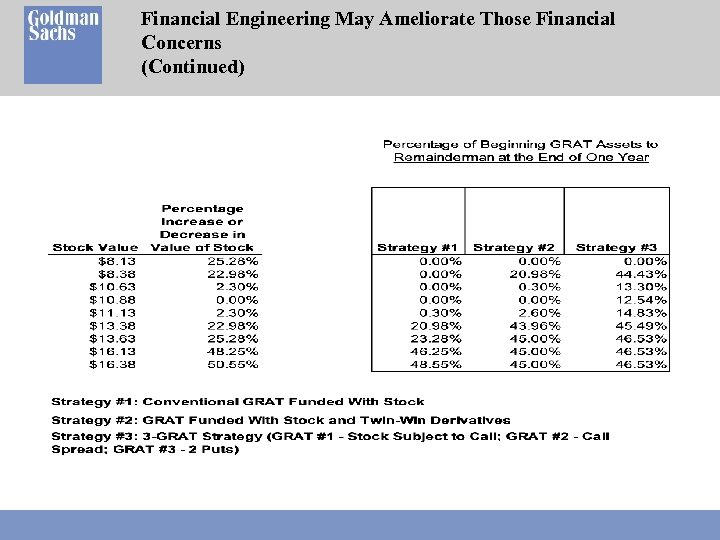

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Financial Engineering May Ameliorate Those Financial Concerns (Continued)

Using Private Intra-Family Derivatives to Hedge Grantor Trust Investments and to Transfer Wealth

Using Private Intra-Family Derivatives to Hedge Grantor Trust Investments and to Transfer Wealth

Using Private Intra-Family Derivatives to Hedge Grantor Trust Investments and to Transfer Wealth (Continued)

Using Private Intra-Family Derivatives to Hedge Grantor Trust Investments and to Transfer Wealth (Continued)

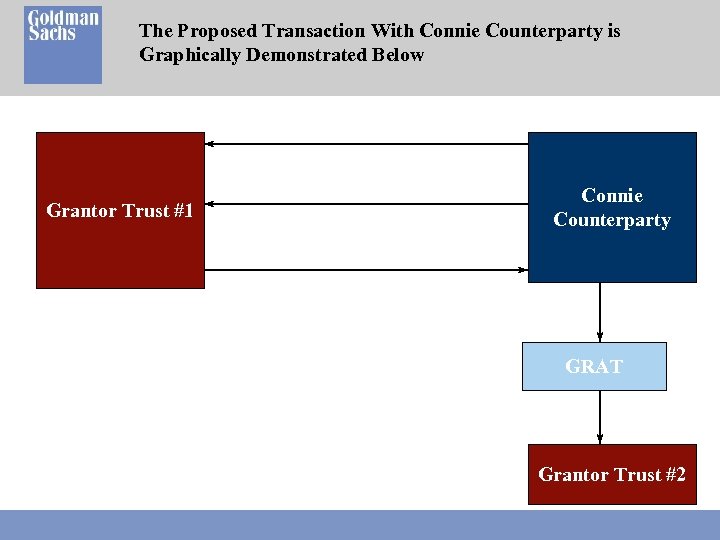

The Proposed Transaction With Connie Counterparty is Graphically Demonstrated Below Grantor Trust #1 Connie Counterparty GRAT Grantor Trust #2

The Proposed Transaction With Connie Counterparty is Graphically Demonstrated Below Grantor Trust #1 Connie Counterparty GRAT Grantor Trust #2

The Potential Outcomes of the Proposed Transaction With Connie Counterparty Are Shown In the Chart Below

The Potential Outcomes of the Proposed Transaction With Connie Counterparty Are Shown In the Chart Below

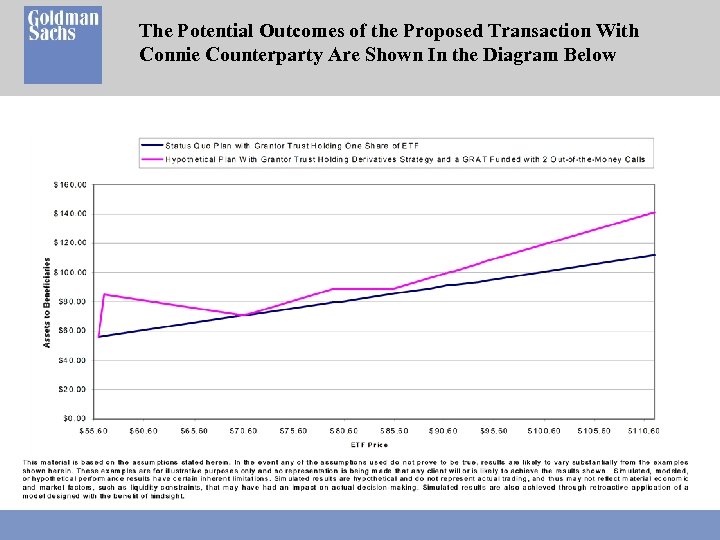

The Potential Outcomes of the Proposed Transaction With Connie Counterparty Are Shown In the Diagram Below

The Potential Outcomes of the Proposed Transaction With Connie Counterparty Are Shown In the Diagram Below

Example: Grantor of GRAT Enhances the Likelihood of Exceeding the Statutory Rate By Contributing a Derivative Which is the Result of a Private Intra-Family Transaction

Example: Grantor of GRAT Enhances the Likelihood of Exceeding the Statutory Rate By Contributing a Derivative Which is the Result of a Private Intra-Family Transaction

Transaction 1 (Traditional Investment GRAT, No Options): Sam Selfmade Purchases a Share of GE Common Stock for $32. 69 and Contributes it to GRAT #1

Transaction 1 (Traditional Investment GRAT, No Options): Sam Selfmade Purchases a Share of GE Common Stock for $32. 69 and Contributes it to GRAT #1

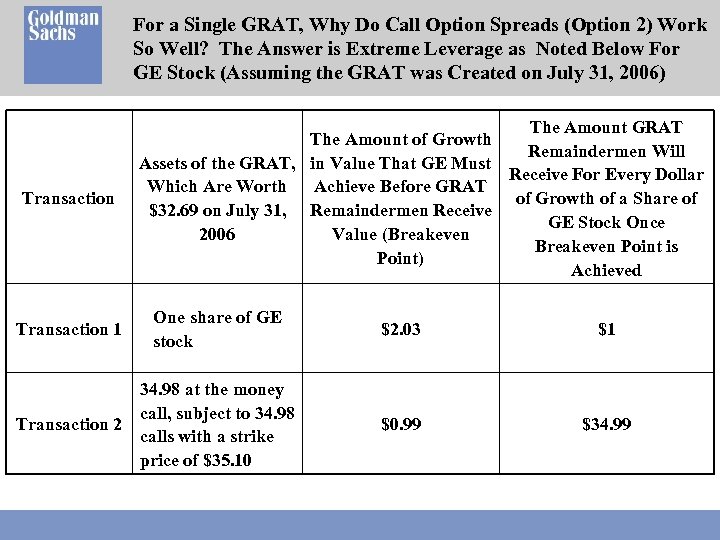

For a Single GRAT, Why Do Call Option Spreads (Option 2) Work So Well? The Answer is Extreme Leverage as Noted Below For GE Stock (Assuming the GRAT was Created on July 31, 2006) Transaction 1 The Amount GRAT The Amount of Growth Remaindermen Will Assets of the GRAT, in Value That GE Must Receive For Every Dollar Which Are Worth Achieve Before GRAT of Growth of a Share of $32. 69 on July 31, Remaindermen Receive GE Stock Once 2006 Value (Breakeven Point is Point) Achieved One share of GE stock 34. 98 at the money call, subject to 34. 98 Transaction 2 calls with a strike price of $35. 10 $2. 03 $1 $0. 99 $34. 99

For a Single GRAT, Why Do Call Option Spreads (Option 2) Work So Well? The Answer is Extreme Leverage as Noted Below For GE Stock (Assuming the GRAT was Created on July 31, 2006) Transaction 1 The Amount GRAT The Amount of Growth Remaindermen Will Assets of the GRAT, in Value That GE Must Receive For Every Dollar Which Are Worth Achieve Before GRAT of Growth of a Share of $32. 69 on July 31, Remaindermen Receive GE Stock Once 2006 Value (Breakeven Point is Point) Achieved One share of GE stock 34. 98 at the money call, subject to 34. 98 Transaction 2 calls with a strike price of $35. 10 $2. 03 $1 $0. 99 $34. 99

Refinements of the Technique

Refinements of the Technique

Refinements of the Technique (Continued)

Refinements of the Technique (Continued)

Refinements of the Technique (Continued)

Refinements of the Technique (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Pages 79 – 85 of the Paper)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Pages 79 – 85 of the Paper)

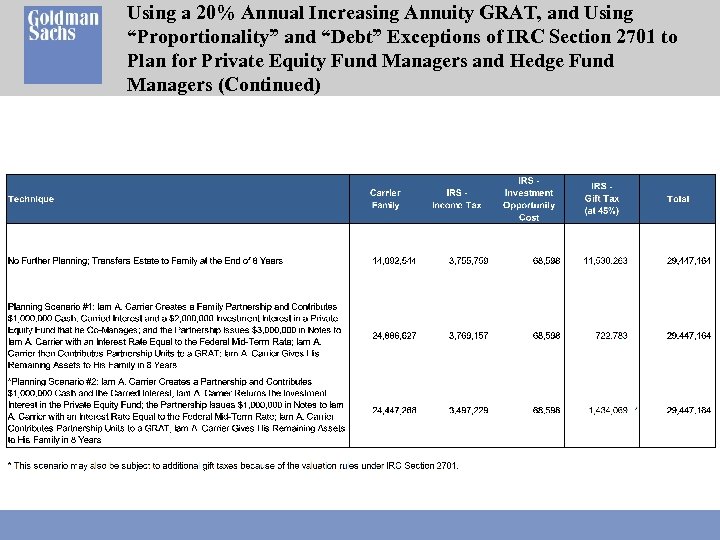

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued) Scenario #1: Hypothetical Transaction #2

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued) Scenario #1: Hypothetical Transaction #2

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued) Scenario #2: Hypothetical Transaction #2

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued) Scenario #2: Hypothetical Transaction #2

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Using a 20% Annual Increasing Annuity GRAT, and Using “Proportionality” and “Debt” Exceptions of IRC Section 2701 to Plan for Private Equity Fund Managers and Hedge Fund Managers (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Pages 85 - 91 of the Paper)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Pages 85 - 91 of the Paper)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)

Possible Solutions to Locking in the Gains of a Successful GRAT or Managing an Underwater GRAT Without Commuting the GRAT (Continued)