cea7adf7c5a647932404c5eb3db86a66.ppt

- Количество слайдов: 27

What Every Utility Should Know About Check 21 Utility Payment Conference Presented by Jim Mills VP Business Development

Check 21 • • • What is Check 21? How does it work? Check 21 versus ACH Benefits of Check 21 Getting started

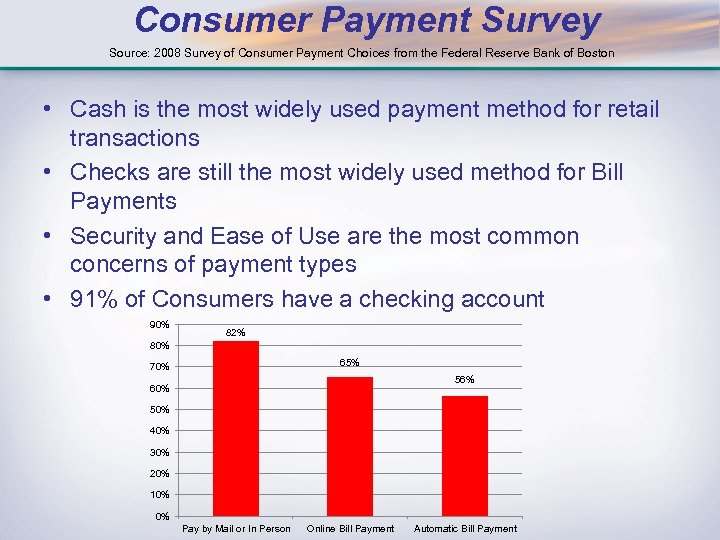

Consumer Payment Survey Source: 2008 Survey of Consumer Payment Choices from the Federal Reserve Bank of Boston • Cash is the most widely used payment method for retail transactions • Checks are still the most widely used method for Bill Payments • Security and Ease of Use are the most common concerns of payment types • 91% of Consumers have a checking account 90% 82% 80% 65% 70% 56% 60% 50% 40% 30% 20% 10% 0% Pay by Mail or In Person Online Bill Payment Automatic Bill Payment

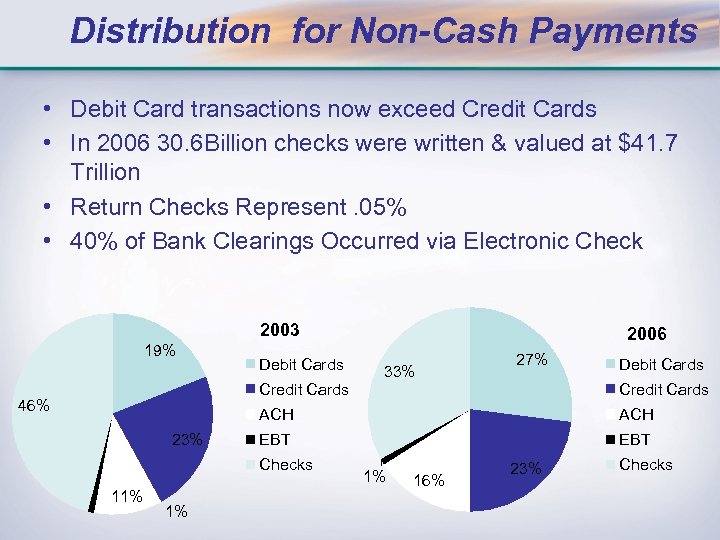

Distribution for Non-Cash Payments • Debit Card transactions now exceed Credit Cards • In 2006 30. 6 Billion checks were written & valued at $41. 7 Trillion • Return Checks Represent. 05% • 40% of Bank Clearings Occurred via Electronic Check 2003 19% Debit Cards 2006 33% 27% Debit Cards Credit Cards ACH 46% 23% Credit Cards ACH EBT Checks 11% 1% 1% 16% 23% Checks

Aren’t Checks Going Away? “One-third of all non-cash US payments are made by paper checks. ” “Checks are still the most popular form of payment used by consumers to pay bills” “Businesses pay 74% of their B 2 B payments by check. ”

Why was Check 21 Created? To Reduce Dependency on Physical Checks – Over 30 billion checks are written per year in US – September 11, 2001 – Planes were grounded – Checks could not clear – $47 B in Fed holdover

The Check-21 Act’s Purpose “Check Clearing for the 21 st Century Act” or “Check-21 Act” PUBLIC LAW 108– 100—OCT. 28, 2003 117 STAT. 1177 Public Law 108– 100 108 th Congress “To facilitate check truncation by authorizing substitute checks, to foster innovation in the check collection system without mandating receipt of checks in electronic form, and to improve the overall efficiency of the Nation’s payments system, and for other purposes. ”

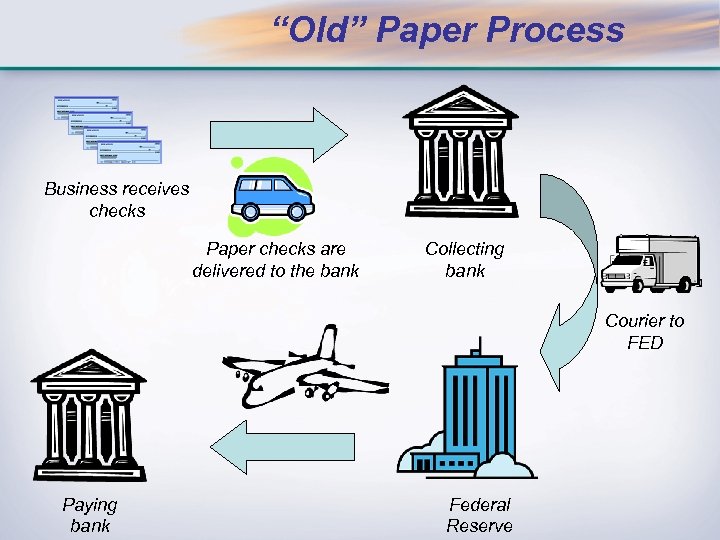

“Old” Paper Process Business receives checks Paper checks are delivered to the bank Collecting bank Courier to FED Paying bank Federal Reserve

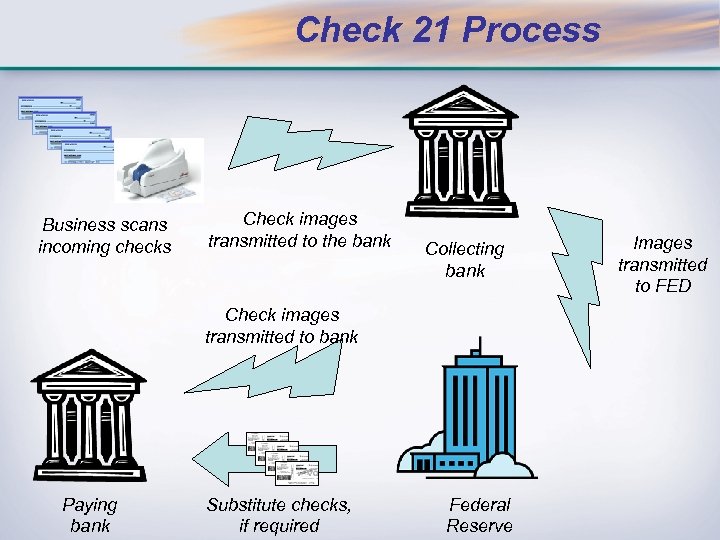

Check 21 Process Business scans incoming checks Check images transmitted to the bank Collecting bank Check images transmitted to bank Paying bank Substitute checks, if required Federal Reserve Images transmitted to FED

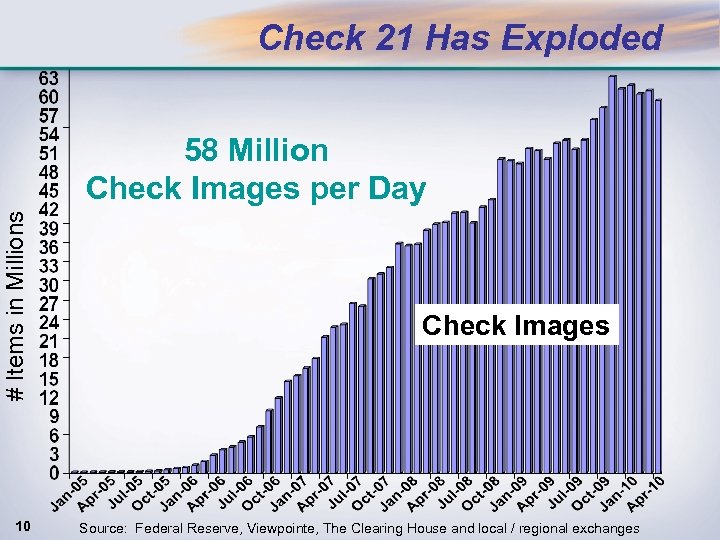

Check 21 Has Exploded # Items in Millions 58 Million Check Images per Day 10 Check Images Source: Federal Reserve, Viewpointe, The Clearing House and local / regional exchanges

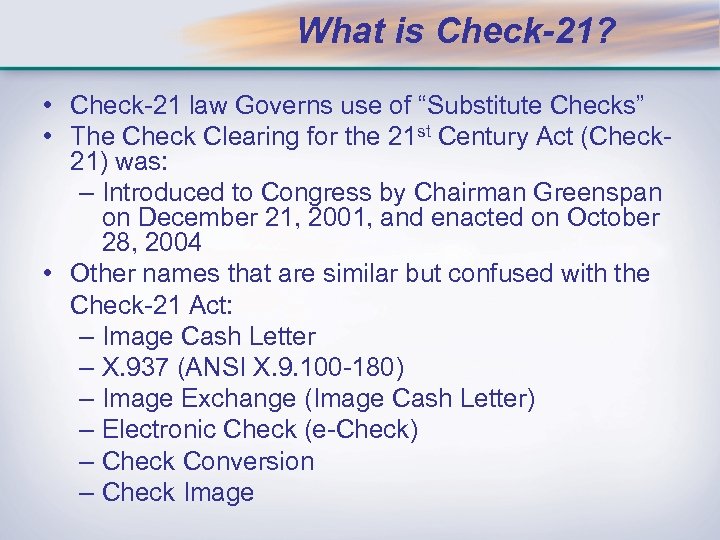

What is Check-21? • Check-21 law Governs use of “Substitute Checks” • The Check Clearing for the 21 st Century Act (Check 21) was: – Introduced to Congress by Chairman Greenspan on December 21, 2001, and enacted on October 28, 2004 • Other names that are similar but confused with the Check-21 Act: – Image Cash Letter – X. 937 (ANSI X. 9. 100 -180) – Image Exchange (Image Cash Letter) – Electronic Check (e-Check) – Check Conversion – Check Image

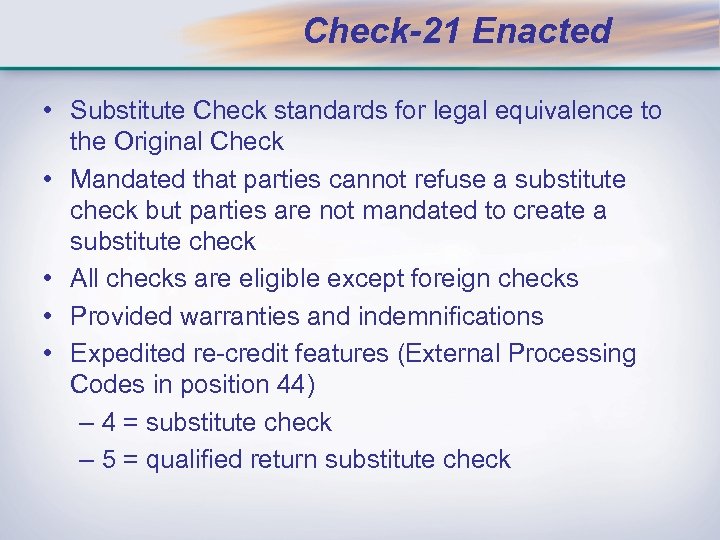

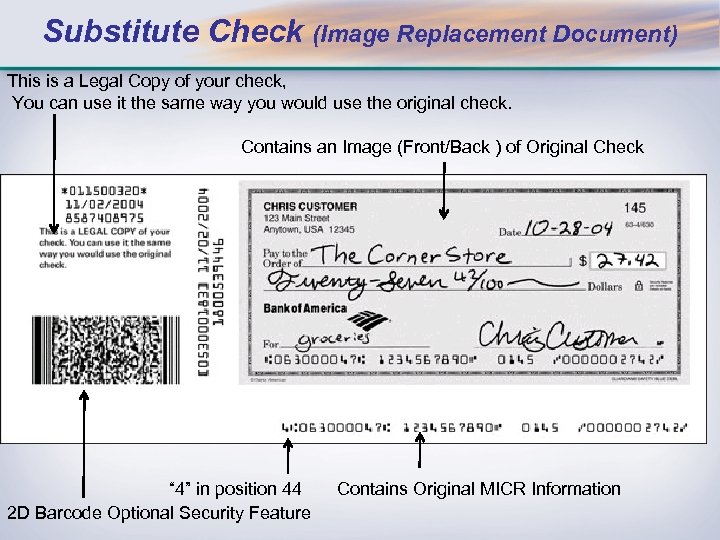

Check-21 Enacted • Substitute Check standards for legal equivalence to the Original Check • Mandated that parties cannot refuse a substitute check but parties are not mandated to create a substitute check • All checks are eligible except foreign checks • Provided warranties and indemnifications • Expedited re-credit features (External Processing Codes in position 44) – 4 = substitute check – 5 = qualified return substitute check

Substitute Check (Image Replacement Document) This is a Legal Copy of your check, You can use it the same way you would use the original check. Contains an Image (Front/Back ) of Original Check “ 4” in position 44 2 D Barcode Optional Security Feature Contains Original MICR Information

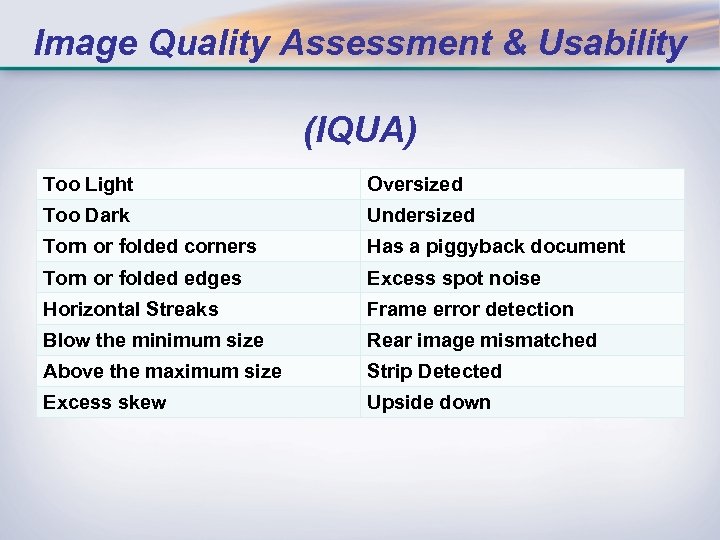

Image Quality Assessment & Usability (IQUA) Too Light Oversized Too Dark Undersized Torn or folded corners Has a piggyback document Torn or folded edges Excess spot noise Horizontal Streaks Frame error detection Blow the minimum size Rear image mismatched Above the maximum size Strip Detected Excess skew Upside down

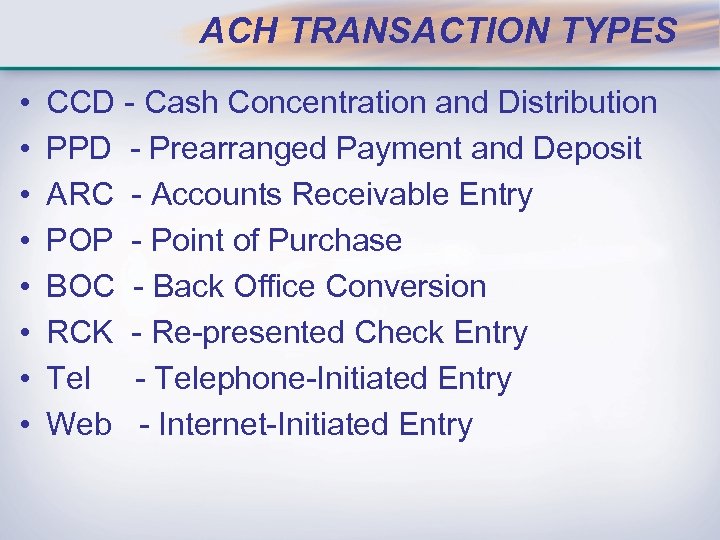

ACH TRANSACTION TYPES • • CCD - Cash Concentration and Distribution PPD - Prearranged Payment and Deposit ARC - Accounts Receivable Entry POP - Point of Purchase BOC - Back Office Conversion RCK - Re-presented Check Entry Tel - Telephone-Initiated Entry Web - Internet-Initiated Entry

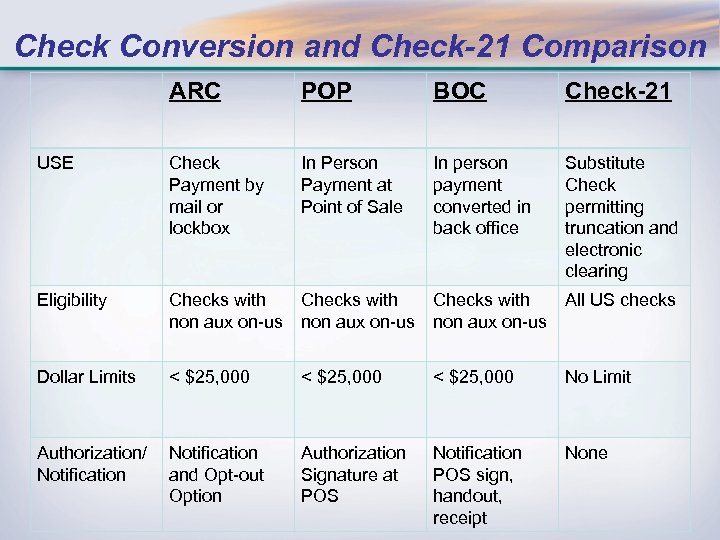

Check Conversion and Check-21 Comparison ARC POP BOC Check-21 USE Check Payment by mail or lockbox In Person Payment at Point of Sale In person payment converted in back office Substitute Check permitting truncation and electronic clearing Eligibility Checks with All US checks non aux on-us Dollar Limits < $25, 000 No Limit Authorization/ Notification and Opt-out Option Authorization Signature at POS Notification POS sign, handout, receipt None

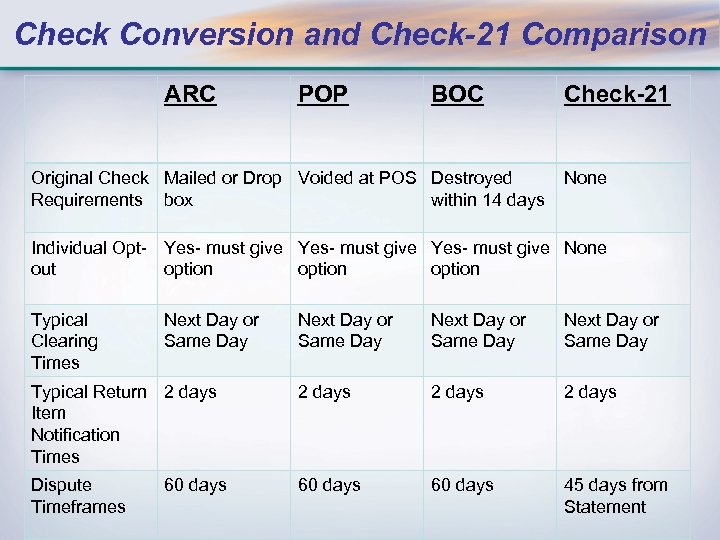

Check Conversion and Check-21 Comparison ARC POP BOC Original Check Mailed or Drop Voided at POS Destroyed Requirements box within 14 days Check-21 None Individual Opt- Yes- must give None out option Typical Clearing Times Next Day or Same Day Typical Return 2 days Item Notification Times 2 days Dispute Timeframes 60 days 45 days from Statement 60 days

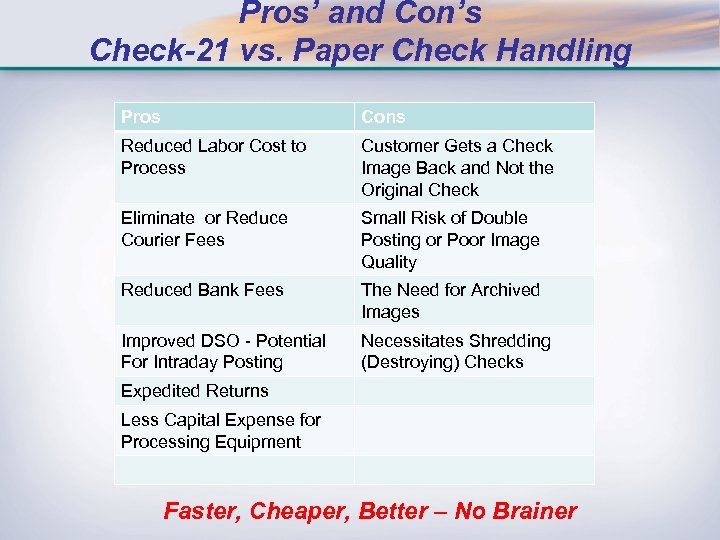

Pros’ and Con’s Check-21 vs. Paper Check Handling Pros Cons Reduced Labor Cost to Process Customer Gets a Check Image Back and Not the Original Check Eliminate or Reduce Courier Fees Small Risk of Double Posting or Poor Image Quality Reduced Bank Fees The Need for Archived Images Improved DSO - Potential For Intraday Posting Necessitates Shredding (Destroying) Checks Expedited Returns Less Capital Expense for Processing Equipment Faster, Cheaper, Better – No Brainer

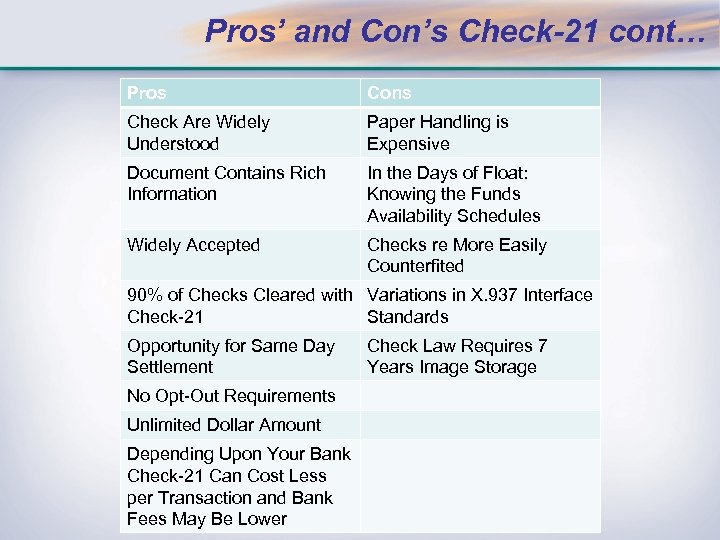

Pros’ and Con’s Check-21 cont… Pros Cons Check Are Widely Understood Paper Handling is Expensive Document Contains Rich Information In the Days of Float: Knowing the Funds Availability Schedules Widely Accepted Checks re More Easily Counterfited 90% of Checks Cleared with Variations in X. 937 Interface Check-21 Standards Opportunity for Same Day Settlement No Opt-Out Requirements Unlimited Dollar Amount Depending Upon Your Bank Check-21 Can Cost Less per Transaction and Bank Fees May Be Lower Check Law Requires 7 Years Image Storage

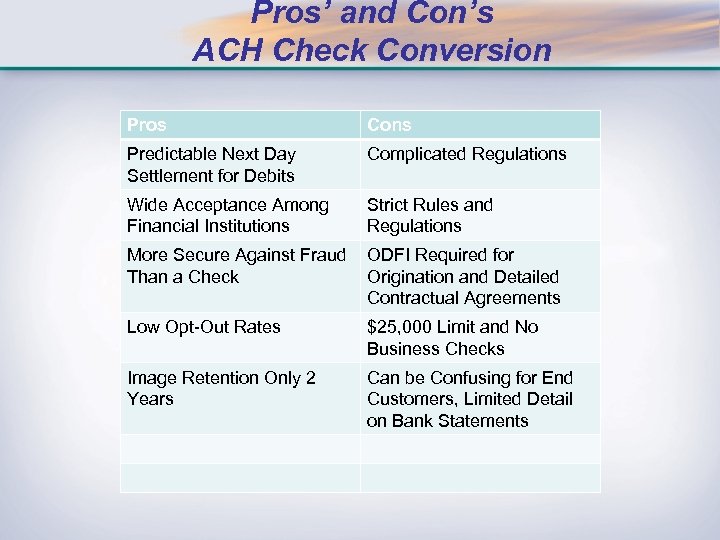

Pros’ and Con’s ACH Check Conversion Pros Cons Predictable Next Day Settlement for Debits Complicated Regulations Wide Acceptance Among Financial Institutions Strict Rules and Regulations More Secure Against Fraud Than a Check ODFI Required for Origination and Detailed Contractual Agreements Low Opt-Out Rates $25, 000 Limit and No Business Checks Image Retention Only 2 Years Can be Confusing for End Customers, Limited Detail on Bank Statements

Benefits of Check-21 • Eliminate daily trips to the bank • Faster funds availability • Later cutoff times • Reduce errors and deposit prep time • Identify fraud sooner • Eliminate accounts at multiple banks by consolidating electronically • Consolidate deposits from multiple locations

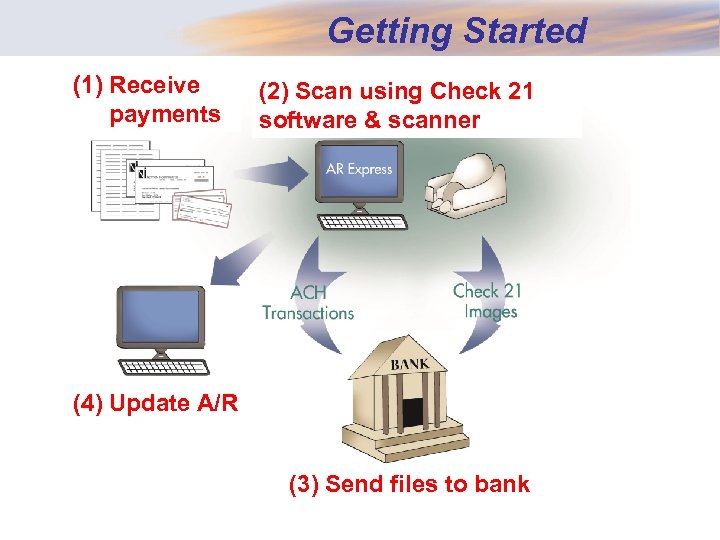

Getting Started (1) Receive payments (2) Scan using Check 21 software & scanner (4) Update A/R (3) Send files to bank

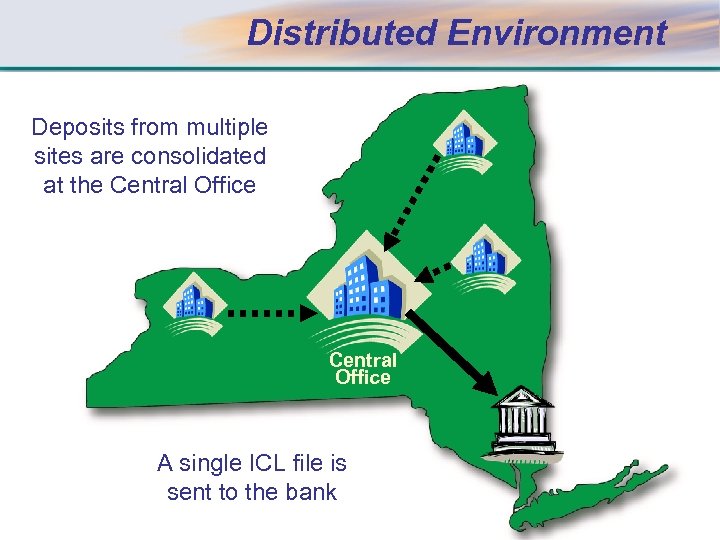

Distributed Environment Deposits from multiple sites are consolidated at the Central Office A single ICL file is sent to the bank

THANK YOU

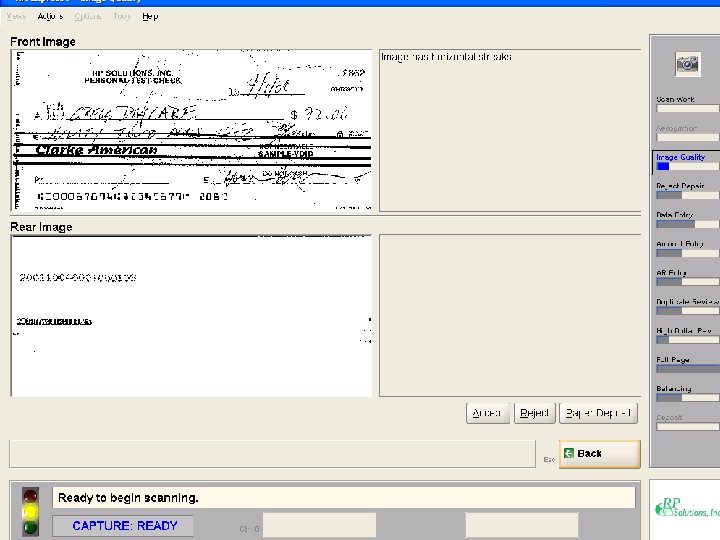

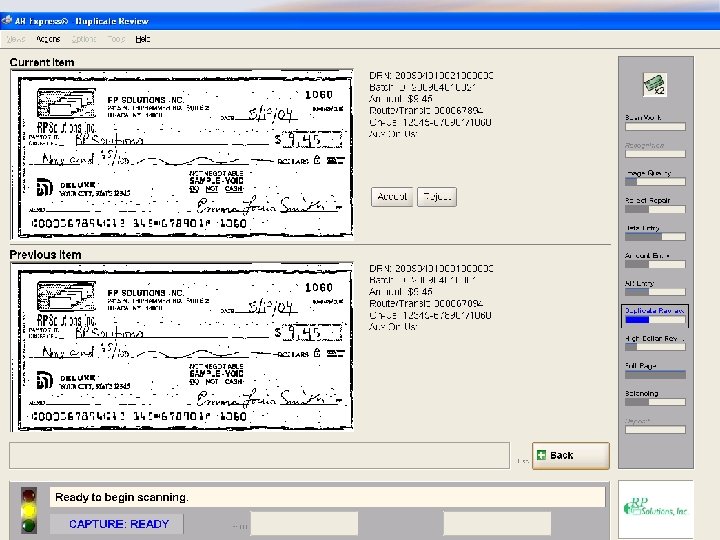

REFERENCES References • • • Argento, M. D. , Stanton, J. R. , Bachelder, E. L. , & Stewart, D. C. (2007, December). The 2007 Federal Reserve Payment Study. Federal Reserve Bank of Boston. Check Clearing for the 21 st Century Act, Public Law 108 -100 117 Stat. 1177 U. S. C. § H. R. 1474 (Oct 28, 2003). The Continuous progress of Check-21 -enabled Services. (2010, July). Retrieved from Federal Reserve Bank of Atlanta website: http: //www. frbservices. org ECCHO. (n. d. ). ECCHO [Substitute Checks: Development of Processing and Quality Standards]. Retrieved August 10, 2010, from http: //eccho. org/check 21_resource. php Foster, K. , Meijer, E. , Schuh, S. , & Zabek, M. (2010, January). The 2008 Survey of Consumer Payment Choices. 2008 -2010 Federal Reserve Bank of Boston. Johnson, D. (2008, January). Check Conversion and Check-21 Comparison Grid. Ithaca NY: RP Solutions. Rasche, C. (2010, May). First Federal weathers CHeck-21 ripple effect on check adjustments (Federal Reserve Bank of Atlanta, Ed. ). Retrieved from http: //www. frbservices. org/ RP Solutions. (2009). Expert. RPS (Version 2. 04) [Computer software]. Duplicate Check Detection Screenshot, IQUA Screenshot: RP Solutions. Sabasteanski, C. (2004, March). Transformation in the Check Industry. FISC Solutions. 2002 Electronic Payments Review and Buyers Guide: Vols. Pages 10 -21. - Understanding the ACH Network: An ACH Primer. (2002). (Original work published 2002)

cea7adf7c5a647932404c5eb3db86a66.ppt